Things you buy through our links may earn Vox Media a commission.

Here Are Some Insane Slides From SoftBank’s Presentation Explaining (?) How It Will Fix WeWork

“So this time, the earnings results announcement is not good at all,” said SoftBank CEO Masayoshi Son at the start of the company’s quarterly earnings call on Wednesday . It’s hard to see how he could have said anything else, given the whole thing where SoftBank poured billions of dollars into WeWork because Son thought Adam Neumann was a genius, and then paid billions more to get Neumann to go away.

This was never going to be an easy presentation. Fortunately, he had slides .

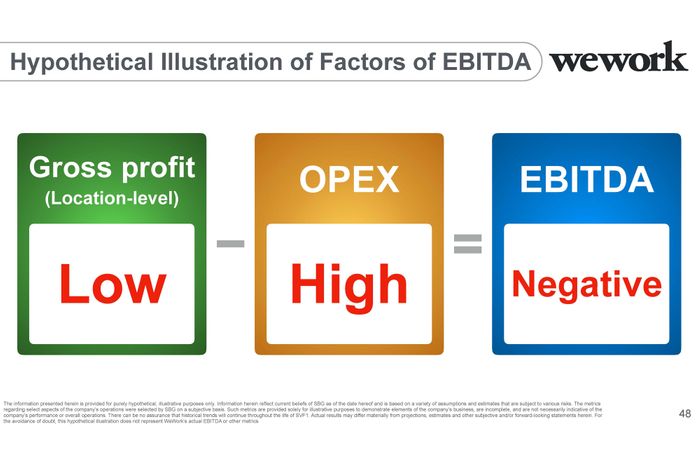

For example, here is a slide explaining that when WeWork’s expenses exceed its revenues, it loses money:

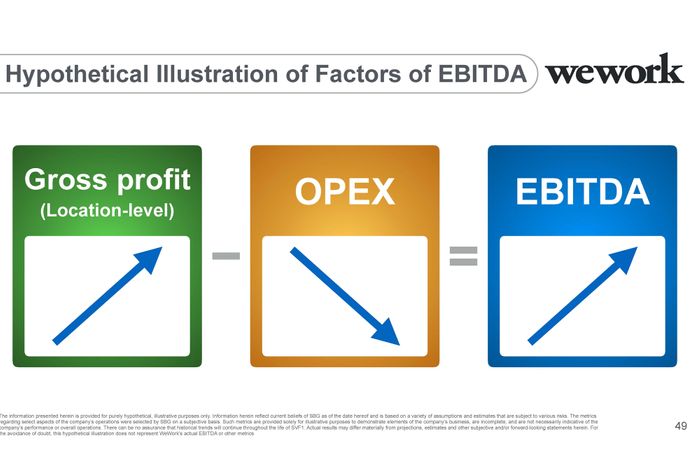

And here is one explaining that SoftBank’s plan to fix that problem is to increase revenues and reduce expenses:

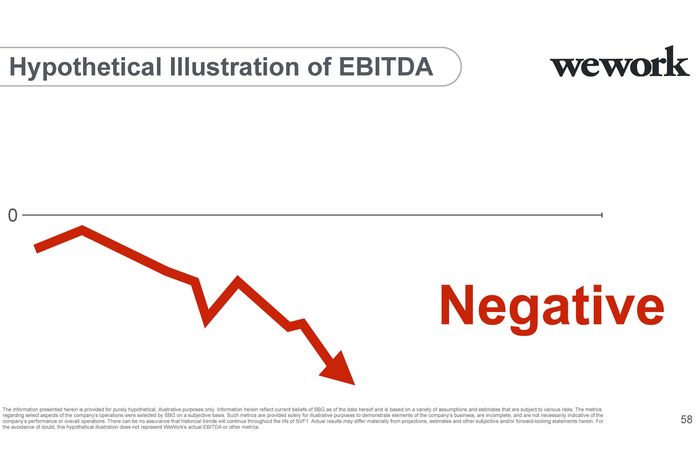

Here is a slide explaining that WeWork tends to lose money:

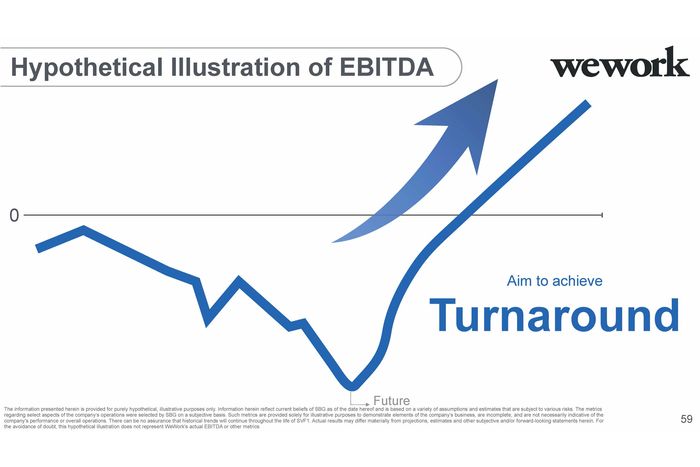

And here is a slide explaining how nice it would be if WeWork made money:

But my absolute favorite slide is this one, showing that while SoftBank has a market capitalization of $82 billion, they have good reason to think the company’s assets (such as its interests in WeWork, Sprint, Chinese internet giant Alibaba, and the Japanese wireless carrier also called SoftBank) are worth $206 billion, after subtracting its debts.

Here’s what Son, SoftBank’s legendary founder, had to say about this chart:

SoftBank market value peaked at about 2000, when the Internet bubble burst, but we exceeded actually this time in terms of shareholder value. So from financial results perspective, it was terrible in the last three months. But shareholder value, which is the most important [key performance indicator] for us, is the biggest in our corporate history.

The valuations presented here are not crazy. You can quibble with some assumptions, but for the most part, SoftBank’s assets are holdings in other publicly traded companies, so the value of what SoftBank owns is mostly not a matter of opinion. But Son does not explore an obvious follow-up question: If this chart you have shown us is right, then why does the stock market treat your company as being worth $120 billion less than the sum of its parts?

One obvious answer is that the stock market expects him to take the profits from successful investments like Alibaba and pour them into shitty investments like WeWork.

Classically, if a conglomerate’s market capitalization is less than the total value of its businesses, the right thing to do is break it up. What this chart says is, if you bought SoftBank, fired Son, and sold the company off for parts, you’d make a profit of $120 billion. Private investors in WeWork (including SoftBank) became convinced that Adam Neumann was a massive liability, but this chart shows the stock market literally telling us that Masayoshi Son’s leadership is an intangible asset worth over negative $100 billion to SoftBank.

So maybe Adam Neumann isn’t the only charismatic founder-CEO who needs to be paid to go away.

- the top line

- adam neumann

Most Viewed Stories

- Andrew Huberman’s Mechanisms of Control

- Have We Already Found Alien Life?

- Trump vs. Biden Polls: Joe Has Finally Stopped the Bleeding

- Is Trump Really Making Big Gains With Black and Latino Voters?

- How Did a College Hooper Become Diddy’s Alleged Drug Mule?

- Who’s the Trump VP Pick? Latest Odds for Every Shortlist Candidate.

Editor’s Picks

Most Popular

- Andrew Huberman’s Mechanisms of Control By Kerry Howley

- Have We Already Found Alien Life? By Jeff Wise

- Trump vs. Biden Polls: Joe Has Finally Stopped the Bleeding By Ed Kilgore

- Is Trump Really Making Big Gains With Black and Latino Voters? By Ed Kilgore

- How Did a College Hooper Become Diddy’s Alleged Drug Mule? By Matt Stieb

- Who’s the Trump VP Pick? Latest Odds for Every Shortlist Candidate. By Margaret Hartmann

What is your email?

This email will be used to sign into all New York sites. By submitting your email, you agree to our Terms and Privacy Policy and to receive email correspondence from us.

Sign In To Continue Reading

Create your free account.

Password must be at least 8 characters and contain:

- Lower case letters (a-z)

- Upper case letters (A-Z)

- Numbers (0-9)

- Special Characters (!@#$%^&*)

As part of your account, you’ll receive occasional updates and offers from New York , which you can opt out of anytime.

The Best Slides From SoftBank’s WeWork-Focused Earnings Report

Morning Markets: SoftBank’s earnings report wasn’t great as the bill from WeWork’s implosion came due. However, SoftBank has a plan for the future and it’s here to explain it to you.

We’ll start with my (Alex’s) take and then see what Sophia has to say.

I want to be very clear upfront that I love SoftBank’s latest slideshow. I say that with no malice, no sarcasm, nothing. I mean it.

Subscribe to the Crunchbase Daily

The deck came out as part of the Japanese conglomerate’s earnings report that we touched on yesterday , the same report that detailed the cost of WeWork’s stumble and quick staunching . SoftBank’s Masayoshi Son has expressed public contrition about the investment but appears optimistic about not only the broader Vision Fund portfolio ( more here ) but also the chances of WeWork to work out.

You can see the argument in the slides, which you can read in entirety here . I recommend it. For the time-strapped, I’ve included the best (from our view) in terms of their bald honesty, simple distillation of business truths, and optimism. Those are three of my favorite things, so perhaps it isn’t a huge surprise that I dig what SoftBank presented.

Without further ado, let’s PowerPoint.

Let’s start with some WeWork-related slides. Here’s a piece of the deck detailing an issue that WeWork had heading into its IPO:

That chart is valid, honest, and correctly color-coded to represent increasingly negative EBITDA, something that WeWork has generated oceans of through time.

Why did the company generate so much negative EBITDA? Fundamentally WeWork was a low gross-margin business that had high operating costs, leading to sharply negative adjusted profit. SoftBank spells this out:

Fact-check? True.

To solve the issues SoftBank intends to boost profit while limiting operating expenses. That’s a good recipe frankly, and probably the only way that WeWork can survive. To pull that off, SoftBank details three moves, namely stopping the build-out of new coworking spaces, “cost reduction,” and the “sort[ing] out [of] unprofitable business[es].”

The result of which the company hopes will lead to this sort of result:

I don’t raise that chart merely to underline how much I enjoy it. The rising gross profit line forms the crux of SoftBank’s argument regarding turning WeWork around. Later, the company shows the impact of lowering operating expenses against rising gross profit:

What’s the result? The flip of our first chart:

Other Brilliance

This column is supposed to be short, pithy, and useful. In that spirit let’s limit ourselves to just three more slides.

The first of our final three details a business concept that I’ve actually tried to explain using words to little effect. Sometimes images are better than words, something that pains me to admit as a writer. Still, this is a slide I intend on saving and using later on (though with FCF swapped out):

For our penultimate chart, an image from the middle of an argument about the future of the value of AI-related companies, using historical Internet trends paired with market cap data to make a point about growth. The argument in the following chart is easy to grok: Internet traffic (use) and Internet company market cap (resulting value) have risen in tandem.

And, as the amount of data stored in the world goes up (magenta line, right chart) the value of AI companies will rise (green line, right chart). This probably isn’t untrue. But what makes the chart fun is that this is the sort of thing you see from companies at Y Combinator, brimming with enthusiasm for the future. You don’t usually get this sort of stoked-ness from folks who might have another $100 billion to invest in short order.

Finally, the best slide of all. Son and SoftBank and the Vision Fund aren’t going to let the WeWork fiasco slow them done. Instead, it’s Damn the torpedos, full speed ahead!

Sophia’s Take

First of all, I am also a fan of the honesty in this slideshow. I don’t want to give SoftBank too much credit for doing what they’re supposed to do (i.e. not lying to their shareholders), but I do appreciate that they don’t mince words, perhaps best illustrated with this slide:

Kudos for not calling it the “WeWork opportunity.”

Anyway, I found the slides mentioned above interesting as well, but it was also useful to see what SoftBank had planned for turning WeWork around. Much of what’s in a slide that Alex summarized above, which confirms earlier reporting by various news outlets.

The first point seemingly confirms earlier reporting by the Financial Times that WeWork planned on scaling back in some areas (FT reported that it would be China, India and Latin America, and the company would focus on U.S., European, and Japanese operations).

The second point we’ve known was coming, we just don’t know how big it’s coming. Layoffs , that is. WeWork’s new executive chairman Marcelo Claure said in an all-hands meeting that there would be layoffs, but he was unsure how many people would be cut. News reports indicate that it could be up to 4,000 people of WeWork’s approximately 15,000-person company. In what other way SoftBank intends on cutting costs besides slashing the headcount is unclear. Maybe they’ll cut perks as well.

The third point makes a lot of sense — WeWork needs to get rid of its unprofitable businesses if it ever wants to turn a profit. According to Crunchbase, WeWork has acquired 18 companies to date ( more here on the company’s old acquisition methods). That’s a lot for startup, especially one that’s burning cash like WeWork. It’d be more helpful to see what parts of the business SoftBank was considering reducing or cutting, but that’s for another slideshow.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

You may also like

How To Scale Your Startup Sustainably Rather Than Chase Growth At All Costs

Ventures must focus on profitable core products for financial stability and longevity, writes guest author Greg Waisman of global payments platform...

![softbank wework investor presentation Illustration of pandemic pet pampering. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/03/Pets-2-470x352.jpg)

Old Dogs Can Inspire New Business Models

As furry friends age, their people face the prospect of costly vet bills, chronic health conditions to manage, and constant worry about their...

The AI Gold Rush: How Startups Can Stake Their Claim In A Competitive Frontier

No One Gushes About Govtech, But It Can Produce Some Nice Returns

Which Overlooked Startup Sectors Will Be Powerful Investments In 2024?

The 10 Biggest Rounds Of February: Epic Games Leads The List Thanks To House Of Mouse Investment

5 Interesting Startup Deals You May Have Missed In February

67.1k followers.

Find the right companies, identify the right contacts, and connect with decision-makers with an all-in-one prospecting solution.

Check out SoftBank CEO Masayoshi Son's wildly optimistic slides about turning WeWork profitable

- SoftBank published its financials for the July to September quarter on Wednesday, posting a big loss thanks to the poor performance of its investments in WeWork and Uber.

- CEO Masayoshi Son is known for giving idiosyncratic presentations filled with expressive images, wild graphs, and inspirational quotes.

- He didn't disappoint during his financial presentation on Wednesday.

- Visit Business Insider's homepage for more stories.

SoftBank CEO Masayoshi Son, the man overseeing the $100 billion Vision Fund, has something of a reputation for wild pitch decks. In 2010, he famously laid out a 300-year vision over a set of slides full of inspirational quotes and whimsical musings on the nature of love.

The Japanese magnate and investor hasn't disappointed with his latest set of slides.

In a financial presentation for SoftBank's July-to-September quarter on Wednesday, Son directly acknowledged the financial damage wrought by his firm's multi-billion dollar bet on office-sharing firm WeWork, describing it as the "WeWork problem."

SoftBank's financials indicated that its combined loss on the value of its WeWork shares came to $8.2 billion.

WeWork was headed to IPO and worth an estimated $47 billion, but experienced a disastrous few months after reporters scrutinized its governance, business model, and the behaviour of cofounder Adam Neumann. The firm cancelled its IPO, and Neumann stepped down as CEO. SoftBank took control of the firm in October in a $9.5 billion rescue package.

But Son, per his presentation, is optimistic SoftBank can turn the firm around.

Here are the key slides. You can see Son's full presentation here .

Masayoshi Son opened his presentation by acknowledging the WeWork fiasco. "We are actually in a rough sea," he said.

He showed a picture of a rough sea to make his point.

The rough sea is overlaid with headlines in Japanese about SoftBank and WeWork.

Son said: "There [is a lot of] media coverage here and there, especially in the past two months. 'SoftBank may go bankrupt. Vision Fund is a big negative. Uber is in terrible share price after the IPO. WeWork may go bankrupt. And SoftBank is actually putting further money into this company so that it can go bankrupt altogether so that all the aggressive investment activity has been failed.' Such coverage... In a sense, it may be true."

Son took on the elephant in the room — SoftBank's bet on WeWork and how much it cost the company

"My judgment in investment was not right in many ways, so I regret [that] in many ways," he said.

He dug into how much SoftBank lost on WeWork

Its combined loss on its WeWork shares was $8.2 billion across the Vision Fund and SoftBank Group.

After questions about how highly WeWork was valued, Son showed this slide explaining the Vision Fund's valuation process

SoftBank's aggressive approach to valuations has raised eyebrows. WeWork, for example, was valued at $47 billion at its peak. And one of SoftBank's executives once said the office-sharing firm could be worth $100 billion .

According to SoftBank's financials, it's actually now worth around $8 billion.

Son acknowledged that WeWork is a massively loss-making business, pointing to its low gross profits and high operating costs...

...but he has a plan

But check out the small print. It reads: "There can be no assurance that the strategy of SBG set forth herein will be successful."

But if it is successful, here's how he thinks WeWork's profits will look

One Twitter user, described the slide thus: "Masa is a goddamn comic genius... this gold from from his latest deck."

—Ezra Seeing Ghosts Rapoport (@HFBondsTrader) November 6, 2019

...again, it comes with small print

It reads: "This hypothetical illustration is provided solely for illustrative purposes, reflects the current beliefs of SBG as of the date hereof, and is based on a variety of assumptions and estimates...

"Accordingly, actual results may differ materially from the hypothetical illustration presented herein. For the avoidance of doubt, this illustration does not reflect actual results or metrics from the company."

Once gross profit and those massive operating expenses are sorted out, Son anticipates profitability

Look at that hockey stick!

And after this turnaround plan, it will be back to calm seas

Son said: "We don't see any rough sea. It's just the gentle waves in the sea."

- Main content

- Find a Location

WeWork announces completion of $1.5 billion funding from SoftBank Group; Board and governance changes become effective

NEW YORK & TOKYO—The We Company (“WeWork” or the “Company”) and SoftBank Group Corp. (“SoftBank”) today announced that WeWork has received $1.5 billion in funding, which was an acceleration of the existing payment obligation, approved by WeWork’s shareholders at $11.60 per share. In connection with the completion of the $1.5 billion funding from SoftBank, several governance changes became effective today, including the reconstitution of the WeWork Board of Directors.

As previously announced, the $1.5 billion payment and governance changes are part of an agreement with WeWork that has now been approved by WeWork shareholders, under which SoftBank will provide significant funding to the Company. The financing package includes $5 billion in new debt financing.

“The $1.5 billion in funding that WeWork received today from SoftBank positions the Company for the future and underlines SoftBank’s steadfast belief in the business,” said Marcelo Claure, Executive Chairman of the Board of Directors of WeWork. “WeWork is leading the innovation of a multi-trillion dollar industry, and this financing package enables the company to accelerate the path to profitability and free cash flow generation. I want to thank management, the entire WeWork team, our members, landlords and communities around the world for their continued support and dedication.”

Claure added, “SoftBank’s high-conviction investment comes with operational support as well as improved governance. With our expanded Board seats we anticipate appointing two additional directors in the near future.”

Pursuant to the previously announced agreement with WeWork and completion of the accelerated $1.5 billion payment commitment, several governance changes are effective immediately. The Board of WeWork has been reconstituted to include 10 members, initially consisting of:

∙ Five directors designated by either SoftBank or SoftBank Vision Fund, including Ron Fisher, Marcelo Claure, Steven Langman, and two others to be named at a later date; ∙ Two directors designated by existing investors Benchmark Capital and Hony Capital, who are Bruce Dunlevie and John Zhao, respectively; ∙ “Two directors not affiliated with WeWork, who are Jeff Sine and Mark Schwartz; and ∙ One director from the Special Committee of the Board, Lew Frankfort.

Other governance changes, which became effective today include:

∙ Marcelo Claure today has been appointed Executive Chairman of the Board. ∙ Adam Neumann has become a Board observer, and the Board has received voting control over his shares.

About The SoftBank Group

The SoftBank Group is a global technology player that aspires to drive the Information Revolution. The SoftBank Group is comprised of the holding company SoftBank Group Corp. (TOKYO: 9984) and its global portfolio of companies, which includes advanced telecommunications, Internet services, AI, smart robotics, IoT and clean energy technology providers. In September 2016, Arm Limited, the world’s leading semiconductor IP company, joined the SoftBank Group. SoftBank Group Corp. is invested in the SoftBank Vision Fund, which plans to invest up to $100 billion in the global businesses and technologies that the SoftBank Vision Fund believes will enable the next stage of the Information Revolution. To learn more, please visit https://group.softbank/en/ .

About WeWork

WeWork provides members around the world with space, community, and services through both physical and virtual offerings. Its mission is to create a world where people work to make a life, not just a living. As of Q2 2019, WeWork had 528 locations in over 111 cities and 29 countries. Our 527,000 memberships represent global enterprises across multiple industries, including 38% of the Global Fortune 500. We are committed to providing our members around the world with a better day at work for less.

SoftBank Contacts [email protected] +81 3 6889 2300

Ben Spicehandler / Emily Claffey / Hannah Dunning Sard Verbinnen & Co 212.687.8080

WeWork Contacts Gwen Rocco / Erin Clark [email protected]

Joele Frank / Meaghan Repko Joele Frank, Wilkinson Brimmer Katcher 212.355.4449

Related articles

- Share full article

Advertisement

Supported by

WeWork Reaches a Debt Restructuring Deal With SoftBank

The agreement will reduce the unprofitable office space company’s debt, giving it more financial breathing room.

By Vikas Bajaj

WeWork, the struggling office space company, said on Friday that it had reached a deal with SoftBank and other investors to significantly reduce its debt and secure new financing.

The agreement would cancel or convert into equity about $1.5 billion of the company’s debt, reducing WeWork’s total debt to less than $2.4 billion, the company said. In addition, the company will have until 2027 to repay $1.9 billion of its remaining debt, or two years later than those debts are currently set to mature.

The deal culminates a tumultuous ride for WeWork, once regarded by venture capitalists as one of the most valuable and promising start-ups. The company, founded by Adam Neumann and backed by SoftBank, sought to shake up the humdrum world of commercial real estate by leasing trendy office space on a short-term basis to large corporations, small businesses and individuals.

But that business model never quite lived up to the grand visions of Mr. Neumann and Masayoshi Son, the founder and top executive at SoftBank. In September 2019, the company scrapped an initial public offering, Mr. Neumann stepped down as chief executive, and SoftBank spent billions to keep the firm going.

The pandemic leveled another big blow, greatly reducing the demand for office space. WeWork has spent the past few years cutting costs by renegotiating and terminating leases with commercial landlords, making progress toward becoming a sustainable business. But the company remains unprofitable and carries a large debt.

The deal announced on Friday will greatly reduce that debt, increase the cash on WeWork’s balance sheet by $290 million and give the company access to $475 million in new financing commitments. In a statement, WeWork said it was “ideally positioned to capture tailwinds of the global shift towards flex from traditional office.”

WeWork’s shareholders will get to vote on the terms of the debt restructuring, and the company will also seek approval from bondholders.

After an initial gain on the announcement, the company’s stock price ended slightly lower on Friday, at less than 98 cents. Its shares traded at more than $8 in late 2021 after WeWork went public by merging with a special purpose acquisition company .

WeWork said it had notified the Securities and Exchange Commission that it would be late in filing its annual report because of its debt deal. The company said it would aim to file the report by March 31.

Vikas Bajaj , an assistant editor in the Business section, was previously a member of the editorial board and a correspondent based in Mumbai, India. Before that, he covered housing and financial markets from New York. More about Vikas Bajaj

- Work & Careers

- Life & Arts

Become an FT subscriber

Limited time offer save up to 40% on standard digital.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital.

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- Everything in Print

- Everything in Premium Digital

The new FT Digital Edition: today’s FT, cover to cover on any device. This subscription does not include access to ft.com or the FT App.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

SoftBank to invest additional $2 billion in WeWork - sources

Reporting by Angela Moon and Greg Roumeliotis in New York; Additional reporting by Sonam Rai in Bengelaru and Sam Nussey in Tokyo; Editing by Jim Finkle, Dan Grebler and Christopher Cushing

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Oil stays near five-month highs as tighter supply looms

Oil prices stayed near five-month highs on Monday as markets expected tighter supply due to OPEC+ cuts and after attacks on Russian refineries, while Chinese manufacturing data supported a stronger demand outlook.

More From Forbes

Why adam neumann’s reported $500 million wework bid could easily fail.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

AUSTIN, TEXAS - JANUARY 19: Israeli-American businessman Adam Neumann speaks during The Israeli ... [+] American Council (IAC) 8th Annual National Summit on January 19, 2023 in Austin, Texas. (Photo by Shahar Azran/Getty Images)

Adam Neumann — cofounder of WeWork — wants to buy the co-working space provider out of bankruptcy — bidding “more than $500 million,” according to the Wall Street Journal .

Here are three reasons a bid from Neumann could face long odds:

- Neumann’s worthless WeWork equity gives him less power in the bankruptcy than creditors.

- Neumann’s past statements about financial backers have raised questions.

- Neumann’s prior role at WeWork — which pumped up the company’s value to $47 billion prior to the company’s November 2023 bankruptcy — makes his return unpalatable to investors.

“As we’ve said previously, WeWork is an extraordinary company and it's no surprise we receive expressions of interest from third parties on a regular basis,” a WeWork spokesperson wrote in an email.

“Our Board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company. WeWork remains intensely focused on finishing the important work we began back in November, and believe we will emerge from Chapter 11 in the second quarter as a financially strong and profitable company,” concluded the statement.

WeWork’s Journey From $47 Billion To Bankruptcy

WeWork operates an inherently risky business. Specifically, the company signs short-term agreements to rent out desks in nicely appointed offices while taking out long-term leases with office landlords.

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024.

The risk of this business model became more apparent during the pandemic. People canceled their desk rental deals with WeWork and did their work from home with help from videoconferencing platforms like Zoom. Yet the pandemic did not relieve WeWork of its obligations to make the long-term lease payments.

WeWork tried to restructure those obligations. That did not work so the company filed for bankruptcy on Nov. 6, 2023 — which sent the company’s value down 99.91% from its peak valuation of $47 billion. “WeWork has a strong foundation, a dynamic business, and a bright future,” CEO David Tolley said in a company statement I included in a November 2023 report on Forbes .

“Now is the time for us to pull the future forward by aggressively addressing our legacy leases and dramatically improving our balance sheet. We remain committed to investing in our products, services, and world-class team of employees to support our community,” Tolley added.

How Did WeWork’s Valuation Reach $47 Billion?

The office desk renting service could not have risen to $47 billion in value without the astounding sales skills of Neumann or the willingness of SoftBank’s Masayoshi Son to invest more than $10 billion in WeWork.

Once WeWork filed for an IPO, investor scrutiny of its sub-optimal management and cash immolating business model led to Neumann’s departure. From there, the Covid-19 pandemic reduced demand for WeWork’s short-term desk rentals — without relieving the company of its long-term lease obligations.

Here are the key events in WeWork’s timeline:

- Idea launch. In 2010, Neumann and Miguel McKelvey came up with the idea of leasing — rather than buying — office space and renting desks short-term to freelancers, small businesses and larger corporations, the Times noted.

- Geographic expansion. WeWork opened its first such office in lower Manhattan — expanding to locations in San Francisco, Los Angeles, Seattle, Tel Aviv and London, the Times wrote.

- Early 2019: $47 billion valuation. SoftBank’s billions of dollars helped propel WeWork’s private valuation to this level at the start of 2019, noted the Times .

- IPO implosion sends Neumann out the door. In August 2019, WeWork — then Manhattan’s largest private tenant — filed for an IPO. The company’s prospectus revealed “governance issues at the company and huge losses.” That September, WeWork shelved its IPO and “Neumann departed as CEO soon thereafter,” the Times reported.

- Softbank lifeline. Enormous losses meant the company needed a new source of money. In October 2019, SoftBank “provided a lifeline that valued the company at $7 billion,” noted the Times .

- New CEO and SPAC merger. In February 2020, real estate executive Sandeep Mathrani took over as WeWork CEO. Despite the rise of people working from home during the pandemic, Mathrani was able to lead WeWork through an October 2021 merger with a special-purpose acquisition company, according to the Times .

- Tolley steps in as CEO. In May 2023, Mathrani left after reportedly growing frustrated with SoftBank. Tolley stepped in as WeWork’s interim CEO and became full-time CEO in October, the Times reported.

- Reverse stock split and going concern warning. In mid-August 2023, WeWork announced a 1-for-40 reverse stock split to meet NYSE listing requirements, while disclosing “substantial doubt” about its ability to stay in business, according to a company statement.

By November 2023 when WeWork made its bankruptcy filing, the company was leasing millions of square feet of office space in 777 worldwide locations. WeWork had $15 billion worth of assets and carried debts of $18.6 billion. The company owed nearly “$100 million in unpaid rent and lease termination fees to various real-estate companies and property owners,” the Journal wrote.

Neumann’s Bid For WeWork

Back in November, Neumann was disappointed by the bankruptcy filing and optimistic about the company’s future. On March 26, Neumann bid more than $500 million for WeWork.

“It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before,” Neumann said in a statement obtained by CNBC . “I believe that, with the right strategy and team, a reorganization will enable WeWork to emerge successfully.”

Even amid the company fallout, Neumann wasn't suffering financially. He “collected tens of millions of dollars when he left the company in 2019, saw a further $770 million windfall when WeWork went public via SPAC in October 2021, and retained “now-worthless stock which was once a further $722 million,” CNBC reported.

What’s more, Neumann had since moved on to a new venture called Flow — a version of WeWork for residential renters. With $350 million from venture capital firm Andreessen Horowitz, Flow was valued at $1 billion last November, CNBC reported.

Not much is known about Neumann’s supposed bid for WeWork. He “recently submitted an offer to buy the bankrupt co-working company for more than $500 million, according to people familiar with the matter,” the Journal reported.

Details of the financing for Neumann’s proposed deal were limited. In February 2024, “Neumann’s lawyers sent a letter to WeWork’s advisers saying he was joining with Dan Loeb’s Third Point hedge fund and other investors in exploring a bid for the company,” noted the Journal .

In the letter, Neumann blamed WeWork management for an inability to seek options for financial support and a failure to provide the information he needed to submit a bid since he approached the company in December 2023, according to the Journal .

WeWork told parties interested in bidding for the business that the company “plans to hand control over to its creditors after it restructures itself into a more profitable business,” the Journal reported earlier.

Impediments To An Adam Neumann WeWork Bid

Neumann faces considerable impediments to buying WeWork. One of the biggest challenges is his lack of power in the bankruptcy negotiations.

His WeWork equity is worthless and he is vying for the company against creditors who have more power because they are higher on the liquidation ladder . In bankruptcy, lenders and other creditors get proceeds from asset sales before common shareholders — who often receive nothing from proceedings.

Neumann also strikes me as facing credibility challenges when it comes to his claims about financial backing. CNBC spoke with investors who shared their skepticism about his WeWork bid. Here are summaries of their comments:

- Investment firm Rithm Capital. Rithm is interested in financing Neumann’s bid — yet the firm’s involvement “remains preliminary and the diligence process is at an extremely early stage,” CNBC noted.

- Dan Loeb’s Third Point exaggerated interest. Neumann’s February letter cited Third Point as “providing financing,” noted CNBC . Third Point quickly denied Neumann’s claim and “is not involved in any offer,” according to anonymous sources interviewed by CNBC .

- Baupost Group interest exaggerated. Baupost “also was floated as a potential financing source months earlier but didn’t join Neumann’s latest bid,” CNBC noted. The Financial Times first reported Baupost was not involved.

WeWork and Neumann declined to comment on this report, according to CNBC .

Neumann’s bid is out of sync with what WeWork is doing and would require him to come up with enough money to repay creditors. When Neumann made his offer in early March, WeWork had yet to present a viable path for exiting bankruptcy.

The company was “instead focused on moving through the bankruptcy proceedings in New Jersey,” noted CNBC . WeWork has “said it is running low on cash and its lawyers have said they are in negotiations with lenders to finance its continuing restructuring efforts,” the Journal noted.

Moreover, Neumann would first need to repay secured creditors who are first in line for repayment. “Those creditors have shown no indication that they are weighing Neumann’s bid,” one person told CNBC .

My take: Neumann may want to restore his reputation with a successful bid for WeWork. However, there could be a big gap between his personal ambition and his ability to revive the company.

- Editorial Standards

- Reprints & Permissions

Adam Neumann is trying to buy back WeWork

- Adam Neumann submitted a bid to buy back WeWork, the Wall Street Journal reported.

- The WeWork cofounder has been trying to regain control of the company since parting ways five years ago.

- The flexible office provider filed for bankruptcy in November 2023.

WeWork cofounder Adam Neumann is trying to regain control of the bankrupt flexible office company.

Neumann has submitted a bid to buy WeWork for more than $500 million, The Wall Street Journal reported Monday.

The move comes after an attorney for Neumann and his new real estate company Flow Global sent a letter to WeWork's lawyers detailing efforts to buy back the company last month.

A spokesperson for Flow Global on Monday confirmed to Business Insider that several groups were involved in the WeWork offer, which was made earlier this month.

"Two weeks ago, a coalition of half a dozen financing partners — whose identities are known to WeWork and its advisors — submitted a potential bid for substantially more than The Wall Street Journal reported without contacting us," a representative for Flow said.

An attorney who has represented Flow Global did not respond to Business Insider's request for comment.

Neumann has met with WeWork several times since December to discuss the possibility of purchasing or financing it, the letter said.

The February letter from Neumann's attorney said he was partnering with capital providers that included Dan Loeb's Third Point. The hedge fund told Bloomberg at the time that it was only in preliminary talks with Neumann and Flow and hadn't committed to a deal.

Neumann parted ways with WeWork in fall 2019, after would-be investors in the company's failed initial public offering balked at his eccentric leadership style and the company's financial outlook.

In February 2020, WeWork's main investor, SoftBank, installed a commercial real estate veteran as CEO. He embarked on a multi-year cost-cutting effort, ridding WeWork of superfluous businesses that accumulated under Neumann, reducing headcount, and axing expensive leases.

But the pandemic undercut the turnaround, as downtowns emptied and white-collar employees, especially in the US, failed to return to their offices five days a week. Saddled with long-term leases WeWork couldn't shed and less office demand than predicted, the company filed for Chapter 11 bankruptcy in November 2023.

Now, Neumann wants back in. Sources familiar with the situation told the Journal it wasn't immediately clear how Neumann would foot the $500 million bill.

Neumann did not immediately respond to Business Insider's request for comment.

"As we've said previously, WeWork is an extraordinary company and it's no surprise we receive expressions of interest from third parties on a regular basis," WeWork said in a statement to Business Insider. "Our Board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company. WeWork remains intensely focused on finishing the important work we began back in November, and believe we will emerge from Chapter 11 in the second quarter as a financially strong and profitable company."

March 25, 2024: This story has been updated to include a statement from Flow Global's spokesperson and more context about WeWork's history.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

Adam Neumann wants WeWork back—and he’s reportedly launched an offer of more than $500 million to get it

Adam Neumann is determined to prevent WeWork’s demise. Reports indicate he has assembled a $500 million financing package to salvage his old co-working venture from collapse.

Neumann has kept himself busy since his ousting from the office-sharing company , launching real estate business Flow in 2022 with a reported valuation of $1 billion .

Now, according to the Wall Street Journal , Neumann and several partners have submitted a bid to purchase WeWork for more than $500 million, citing people familiar with the matter.

A spokesman for Flow told Bloomberg that Neumann’s proposed purchase price for WeWork is considerably higher than $500 million, saying: “Two weeks ago, a coalition of half a dozen financing partners—whose identities are known to WeWork and its advisors—submitted a potential bid for substantially more than the Wall Street Journal reported.”

It is unconfirmed how Neumann will finance the acquisition, and representatives for Flow did not respond to Fortune’s request for comment.

WeWork is assessing its options having filed for bankruptcy in the U.S. in November , listing nearly $19 billion dollar of debts.

The New York–based company revealed in a Chapter 11 filing it had $15 billion in assets, adding that it had struck a restructuring agreement with creditors representing roughly 92% of its secured notes.

A subsequent restructuring in the wake of the filing remains the company’s focus in light of Neumann’s offer, WeWork told Fortune .

“As we’ve said previously, WeWork is an extraordinary company and it’s no surprise we receive expressions of interest from third parties on a regular basis,” a spokesman said.

“Our board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company.

“WeWork remains intensely focused on finishing the important work we began back in November, and believe we will emerge from Chapter 11 in the second quarter as a financially strong and profitable company.”

The return of Neumann at WeWork

The potential return of Neumann to the corner office at WeWork—the company he founded in 2010—may prompt mixed reactions among staff.

The former CEO stepped down in 2019 citing scrutiny of his leadership as a “distraction” for the company after a stock exchange listing went awry over questions around finances and governance.

Neumann, who had built the company to a valuation of $47 billion within a decade, was also paid eye-watering sums upon his exit , namely a $185 million noncompete agreement, a $106 million settlement payment, and $578 million received for shares sold by Neumann to longtime investor SoftBank.

And while Neumann is worth approximately $2.3 billion according to Bloomberg , the 2019 IPO fumble meant many staffers’ stock options were rendered worthless .

On top of that, the company once known for its lavish parties and mini summer camps cut 2,000 roles after it withdrew its IPO—leading many to question Neumann’s leadership while he was still at the helm.

For his part, Neumann has offered commentary but never apologized since his departure.

In 2021, his first public interview since leaving the company, Neumann told the New York Times DealBook Summit he had many regrets about his exit from the company and the subsequent decisions made to get the business back on track.

Regarding the job losses after his departure, he said: “I did not expect it, I didn’t want it, I feel tremendous regret for it even though it happened after I stepped down and it happened because the company is changing directions.”

Neumann, who said he remained silent in the years after stepping down to allow the business to take center stage, has more recently leveled criticism at those who took over after him.

In November, upon hearing the news of the business’s bankruptcy, Neumann said: “It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before.

“I believe that, with the right strategy and team, a reorganization will enable WeWork to emerge successfully.”

It seems Neumann, at least, believes he might be the man for the job.

Latest in Finance

- 0 minutes ago

Coinbase CFO Alesia Haas on the strategic role of finance chiefs and why she’s ‘bullish on AI’

Future of Finance: Coinbase’s Alesia Haas on why Ethereum isn’t a security and the crypto industry rebuilding trust after the FTX ‘travesty’

Avian influenza spreads to dairy herds in Michigan and Idaho, expert ‘wouldn’t be surprised if there are infections in cows in Europe too’

Momentum trading just had its best quarter in over 20 years thanks to bets like Nvidia. Here’s why Wall Street is on edge

Young people in India are more likely to be unemployed if they’re educated, says International Labour Organization

Older office buildings ‘will be stranded,’ says Morgan Stanley: ‘They simply don’t have long-term cash flow growth potential’

Most popular.

Do turmeric supplements really treat pain, boost mood, and improve allergies? Experts say they work best for 2 conditions

Don’t brush right after you eat. Dentists say there’s one thing you should do after every meal that’s better for oral—and overall—health

Ford is slashing two-thirds of employees at its F-150 Lightning plant as its ambitious electric-car plans sputter

A woman purchased a vacant Hawaiian lot for about $22,000. She was surprised to see a $500,000 home was built on it by mistake

Ozempic maker Novo Nordisk facing pressure as study finds $1,000 appetite suppressant can be made for just $5

- International edition

- Australia edition

- Europe edition

WeWork co-founder Adam Neumann bids to buy it back for more than $500m

Former CEO of shared office space rental company has reportedly been in talks with investors

- Business live – latest updates

Adam Neumann, the ousted co-founder of WeWork , has tabled a bid worth more than $500m (£395m) in an attempt to regain control of the long troubled shared office space rental company that he launched in 2010.

Flow, Neumann’s property company, said on Monday that it had submitted a potential bid for WeWork with a “coalition of half a dozen financing partners”. The Wall Street Journal, which first reported Neumann’s offer, said it was tabled at more than $500m.

“WeWork is an extraordinary company and it’s no surprise we receive expressions of interest from third parties on a regular basis,” WeWork said in a statement shared with Reuters.

“Our board and our advisers review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company,” it added.

It said it remained focused on restructuring efforts, after filing Chapter 11 bankruptcy in the US in November as high interest rates, and falling demand for office space because of home working, took their toll. WeWork added that its turnaround plans would help it emerge as a “financially strong and profitable company”.

Last month it emerged that Neumann had been trying for months to meet the company – which was once valued at $47bn – to negotiate a deal to buy it outright, or provide it with debt financing.

Lawyers representing Neumann’s new venture, Flow Global, sent a letter to WeWork advisers in February, reportedly suggesting he was exploring a joint bid for the company with investors including the US hedge fund Third Point.

Third Point later told Reuters it had held “only preliminary conversations” with Neumann, and had not made any financial commitments towards a potential deal.

Neumann was once tipped to join the ranks of the world’s richest people, with a personal fortune of $14bn from the planned flotation of WeWork in 2019.

During its ascendence, the company invested heavily in acquiring a series of long-term leases in some of the world’s most expensive real estate markets, amassing nearly 800 locations across 39 countries.

after newsletter promotion

But investors, already sceptical of the company’s near-$50bn valuation, were ultimately put off by terms of the stock listing, including demands that each of Neumann’s shares should carry 20 times the votes of ordinary stock, and that his wife should have a say in selecting his successor should he die.

The IPO was eventually postponed, and Neumann later quit as chief executive, as a series of increasingly damaging allegations about his personal conduct and eccentric lifestyle came to light.

The executive “would convince employees to take shots of pricey Don Julio tequila, work 20-hour days [and] attend 2am meetings”, according to the New York Times . “He would convince them to smoke marijuana at work, dance to Journey around a fire in the woods on weekend excursions, smoke more pot [and] drink more tequila.”

Neumann has since returned to leadership, and announced plans for the property venture Flow – focused on branded apartments targeting millennial rentals – in 2022. Despite scheduling a 2023 launch, its business plan has yet to be made public, leaving its website still claiming it is “coming soon” .

Adam Neumann seeks to buy WeWork back five years after his ousting as CEO

SoftBank paid WeWork lenders almost $1.5bn before bankruptcy filing

WeWork co-founder says anticipated bankruptcy filing ‘disappointing’

WeWork, once a $47bn firm, files for bankruptcy after accruing $2.9bn debt

WeWork bankruptcy: shared office provider expected to try and renegotiate Australian leases

WeWork plans to file for bankruptcy over massive debt pile and losses

WeWork has ‘substantial doubt’ it can stay in business

WeWork mugs for $500: 10 of the strangest merch items from companies that crashed

Adam Neumann’s latest big idea? To become America’s biggest landlord

Wework founder bounces back with $1bn property project flow, most viewed.

- Press Releases

SOFTBANK AND WEWORK ANNOUNCE JOINT VENTURE TO TRANSFORM WORKSPACE IN JAPAN

About the softbank group, about wework.

A subsidiary of SoftBank Group Corp. (SBG) and SoftBank Corp., a subsidiary of SBG and a telecom operating company in Japan, will contribute to the joint venture.

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.

COMMENTS

The 43rd Annual General Meeting of Shareholders Jun. 21, 2023. SoftBank Group Corp.'s archive of earnings results briefings, shareholders' meetings and investor briefings. Download details of our quarterly financial results, earnings and investor briefing presentations, videos, investor call transcripts and more.

Private investors in WeWork (including SoftBank) became convinced that Adam Neumann was a massive liability, but this chart shows the stock market literally telling us that Masayoshi Son's ...

October 22, 2019. NEW YORK & TOKYO—The We Company ("WeWork" or the "Company") and SoftBank Group Corp. (or "SoftBank") today announced an agreement under which SoftBank commits to provide significant funding to the Company. This includes $5 billion in new financing and the launching of a tender offer by SoftBank of up to $3 ...

The spectacular implosion of WeWork, which has inspired books, podcasts and a TV show, were among the most expensive SoftBank bets that soured after the firm raised Vision Fund 1 (VF1) - a $100 ...

In an investor presentation this week, Mr. Son thanked Mr. Claure for addressing challenges at Sprint and WeWork, but said that since SoftBank's business model was evolving, it made sense to ...

The Best Slides From SoftBank's WeWork-Focused Earnings Report. Alex Wilhelm Sophia Kunthara. November 7, 2019. Morning Markets: SoftBank's earnings report wasn't great as the bill from WeWork's implosion came due. However, SoftBank has a plan for the future and it's here to explain it to you. We'll start with my (Alex's) take and ...

SoftBank CEO Masayoshi Son, the man overseeing the $100 billion Vision Fund, has something of a reputation for wild pitch decks. In 2010, he famously laid out a 300-year vision over a set of ...

NEW YORK & TOKYO—The We Company ("WeWork" or the "Company") and SoftBank Group Corp. ("SoftBank") today announced that WeWork has received $1.5 billion in funding, which was an acceleration of the existing payment obligation, approved by WeWork's shareholders at $11.60 per share. In connection with the completion of the $1.5 billion funding from SoftBank, several […]

WeWork Inc. (NYSE: WE), a leading global flexible space provider, today announced that Saurabh Jalan, Partner at SoftBank Group International ("SBGI"), has joined WeWork's Board of Directors. Jalan will bring his extensive experience working with global technology platforms to WeWork's Board of Directors. Additionally, the Board has appointed WeWork CEO Sandeep Mathrani to the position ...

WeWork Inc. (NYSE: WE), the leading global flexible space provider, today announced that Alex Clavel, Chief Executive Officer of SoftBank Group International ("SBGI"), has joined WeWork's Board of Directors, effective August 9, 2022. Mr. Clavel succeeds Michel Combes, the former Chief Executive Officer of SBGI, who had served on WeWork's Board since October 2020. Mr. Clavel has ...

At WeWork, we promise to treat your data with respect and will not share your information with any third party. You can unsubscribe to any of the investor alerts you are subscribed to by visiting the 'unsubscribe' section below. If you experience any issues with this process, please contact us for further assistance.

WeWork, the struggling office space company, said on Friday that it had reached a deal with SoftBank and other investors to significantly reduce its debt and secure new financing.. The agreement ...

SoftBank Group Corp.'s investor relations website - Here you can access all SoftBank Group Corp.'s investor-related information, including recent filings, ... [Presentation materials] Earnings Investor Briefing for Q3 FY2023. IR News. IR Calendar FY2023 (Apr. 2023 - Mar. 2024) Feb. 8, 2024.

Existing Payment Obligation: Acceleration of SoftBank's April 2020 $1.5 billion payment obligation at $11.60 per share, expected to be completed 7 days post-signing, subject to WeWork shareholder approval; Tender Offer: The launch of a tender offer worth up to $3 billion to all non-SoftBank shareholders at a price of $19.19 per share, expected to commence in the fourth quarter of 2019, with ...

Masayoshi Son, SoftBank's billionaire founder, vowed on Tuesday to "double down" on its investment in WeWork as he confirmed plans for a $9.5bn rescue that will hand up to $1.7bn to Adam ...

SoftBank Group agreed to spend more than $10 billion to take over WeWork on Tuesday, doubling down on an ill-fated investment and giving a near $1.7 billion payoff to the U.S. office-space sharing ...

In these tumultuous times, SoftBank, WeWork's largest investor, was critical to its survival. SoftBank provided WeWork with a large financial bailout. This decision was meant to restore WeWork's ...

"SoftBank will continue to act in the best long-term interests of our investors," the Japanese company said in a statement. WeWork shares have fallen about 98.5% so far this year.

Investor Presentation A copy of the investor presentation can be found here. ... Morrison & Foerster LLP is acting as legal counsel to SoftBank Group. About WeWork WeWork was founded in 2010 with the vision to create environments where people and companies come together and do their best work. Since opening our first location in New York City ...

SoftBank Group Corp <9984.T> will inject another $2 billion in WeWork Cos Inc this year, bringing the Japanese conglomerate's total investment in the office space provider to more than $10 billion ...

WeWork tried to restructure those obligations. That did not work so the company filed for bankruptcy on Nov. 6, 2023 — which sent the company's value down 99.91% from its peak valuation of $47 ...

In February 2020, WeWork's main investor, SoftBank, installed a commercial real estate veteran as CEO. He embarked on a multi-year cost-cutting effort, ridding WeWork of superfluous businesses ...

Investor Relations. IR News. IR Calendar ... "This agreement is the result of all parties coming to the table for the sake of doing what is best for the future of WeWork. SoftBank and WeWork have spent the past year transforming the WeWork business and executing on our plan towards profitability. ... presentations and other information ...

Adam Neumann is determined to prevent WeWork's demise. Reports indicate he has assembled a $500 million financing package to salvage his old co-working venture from collapse. Neumann has kept ...

Business of Software Conference Follow. Softbank Investor Presentation November 2019 discussing the progress of SoftBank. The value of SoftBank's business is underpinned by the value of Alibaba, Sprint and ARM Holdings. The SoftBank Vision Fund and in particular its stake in WeWork has performed disastrously but overall the value of the entity ...

Last modified on Tue 26 Mar 2024 22.30 EDT. Adam Neumann, the ousted co-founder of WeWork, has tabled a bid worth more than $500m (£395m) in an attempt to regain control of the long troubled ...

Investor Relations. IR News. IR Calendar. Events and Presentations ... TOKYO and NEW YORK, July 18, 2017 — The SoftBank Group and WeWork Companies ("WeWork") today announced a joint venture that will bring WeWork's transformational platform of space, community, and services for companies of all sizes — including creators, entrepreneurs ...

Adam Neumann has submitted a bid of more than $500 million to buy back WeWork, the office-sharing company he co-founded and propelled to a $47 billion valuation before it fell into bankruptcy, a ...