Market Validation: Step-By-Step Guide (+Popular Methods)

What’s market validation in SaaS, and why is it important?

If you’re looking for the answers to these questions, we’ve got you covered! This article also introduces popular market validation methods and explains how product teams can develop a solid validation plan!

Let’s get right to it!

- Market validation helps you answer the question of whether there are enough potential customers who are willing to pay for your product.

- Market research focuses on wider market trends early in the product development cycle, while market validation focuses on the specific product and its market potential after the ideation stage.

- Validating the market for your product reduces the risk of developing a product that’s not profitable, increases investor confidence, and helps teams use scarce resources well.

- Customer interviews are a great source of qualitative feedback about customer needs and expectations.

- Online surveys are great for collecting customer insights at scale.

- Competitive analysis can tell you how successful other similar products are, while industry reports can indicate trends in customer demand.

- Keyword research and Google Trends analysis can reveal what kinds of problems customers are trying to solve.

- Fake door testing is a cost-effective and quick way to test demand.

- Prototype tests are good not only for market validation but also for usability testing.

- Beta testing is your chance to test the product in real-life conditions while still minimizing risk.

- Start the market validation process by lining up your hypothesis and research questions.

- It might be a good idea to hire a market research company to ensure reliable and unbiased results.

- Once you have the results, define the target market and target user personas.

- Next, validate the product idea using a range of methods.

- Your prototypes will gradually turn into your minimum viable product (MVP). Launch it and use customer feedback and data analytics to further refine it and add value.

- Userpilot is a product growth platform with advanced feedback and analytics functionality. Book the demo to see how it can help you with market validation.

What is market validation?

Market validation is the process of confirming the demand for a product or service within the target market before committing resources to its development.

The process is very similar to product idea validation and helps you answer one key question: Are there enough potential customers who are willing to pay for the product?

What is the difference between market research and market validation?

Market research and market validation are two related concepts but they take place at different stages of the product development process and, more importantly, serve different purposes.

Research happens in the early stage of the product development cycle, often before the product concept is fully shaped. Validation , on the other hand, happens after the ideation stage, when you have a clear idea of what you’re trying to build.

Market research focuses on the wider market situation. Its aim is to collect data about the target market, competitors, customer pain points, needs and wants , and industry trends to guide future product development.

In contrast, market validation focuses on the market trends only in the context of the specific product and its goal is to verify if it’s viable.

Why is it important to conduct market validation?

Market validation is essential for product success for a number of reasons.

To start with, it confirms that the product solves a genuine customer problem . This reduces the risk of developing a product that won’t be profitable, which is the main cause of product failure. This could boost the investor confidence in the product and the morale of the product team.

During the development stage, it helps teams allocate resources in the most optimal way to secure the best ROI.

What’s more, market validation gives you insights into customer perception of the product and allows you to capture the voice of prospective customers , which you can use to shape your marketing efforts and product messaging.

And it’s a great opportunity to start building relationships with early adopters and recruit beta testers.

Common market validation methods to use

Which market validation methods can you use to authenticate your business idea? Let’s look at a few popular choices.

Customer interviews

In-depth interviews of target customers or focus groups are a great source of qualitative data about customer needs and expectations.

Their main advantage is flexibility. During the interview, you can adjust your questioning and follow up on customer ideas in a way that’s not possible when conducting surveys.

The main downside of interviews is that they’re time-consuming and tricky to arrange, so they’re not very practical for large studies.

In contrast to interviews, online surveys are great for collecting customer insights at scale.

Designing and triggering in-app surveys is dead easy. You can use them to target a specific user segment and use it to pick their brains on the new feature or product you’re planning to develop.

Market validation research

Some market research techniques can also be used for market validation. Here are a few examples:

- Competitive analysis – if your established competitors don’t offer a similar product or feature, it might be an indication that there’s no demand for it in the particular market.

- Industry reports – just like competitive analysis, they can tell you what’s selling and what’s not.

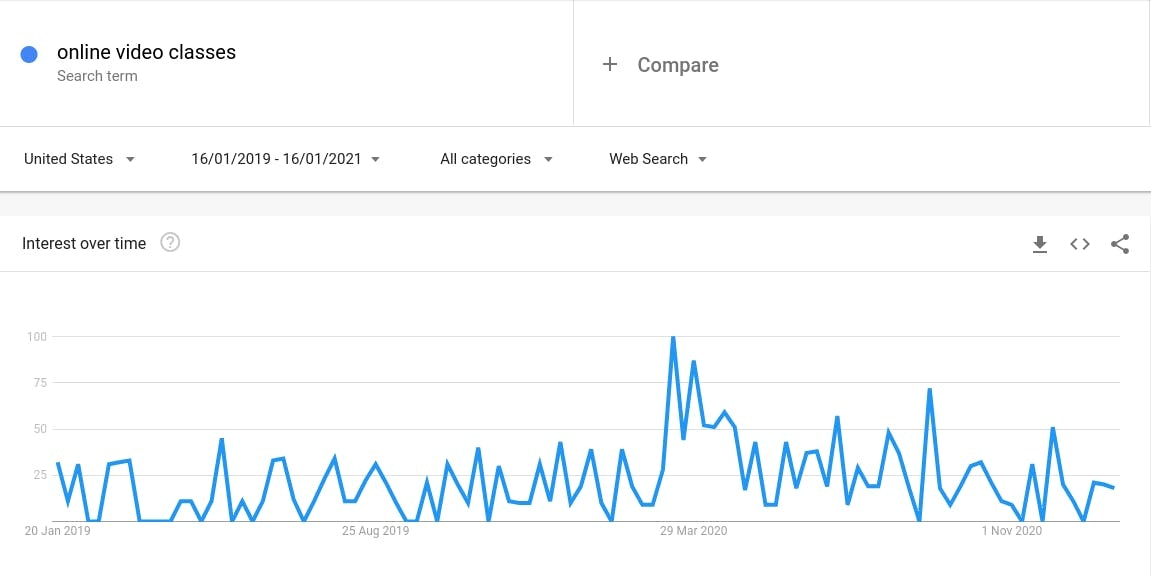

- Keyword research and Google Trends analysis – high search volume for terms related to the product could be an indication of high demand.

Fake door testing

Fake door testing is a popular lean market validation method.

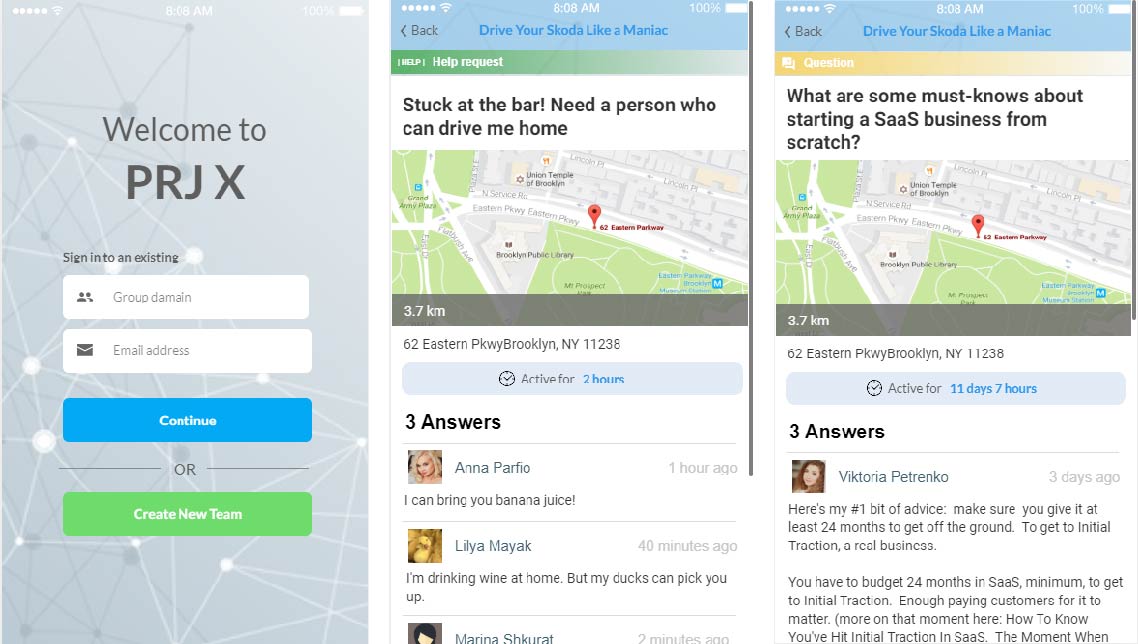

First, you make your users believe that the feature already exists, for example, by adding it to the UI and driving engagement with in-app messages, like in this hypothetical Asana example.

By tracking user engagement, you can tell how much interest they have in the new functionality.

Of course, once they click on the feature, they’ll know they’ve been tricked, so you’ll have to explain that it was a test. For instance, you could trigger a modal like the one below.

Prototype testing

Fake door tests are a kind of prototype test. In this case, it’s a very low-fidelity prototype.

If the response to the test is positive, you create more realistic prototypes and carry on testing them iteratively.

These could be wireframes, videos, or animations. You could also do a Wizard of Oz experiment and make it look like a fully functional product while doing all the work manually behind the scenes. Or hack existing products to develop the functionality of the final product and make users believe the product is ready.

Each iteration not only validates your idea and the design but is also a learning opportunity that increases the chance of launching a strong MVP.

Beta testing

Beta testing is often the ultimate stage before the MVP launch. It’s the final opportunity to test the product with real users and in real-life conditions but with limited exposure to risk.

How can you recruit beta testers?

Start with your power users . They are the most successful and loyal customers so they make good testers, and they will be delighted to get early access to the new feature or product. You can identify them by using product analytics and survey data.

Then, simply trigger a modal to invite them to take part in the test.

What are the steps in the market validation process?

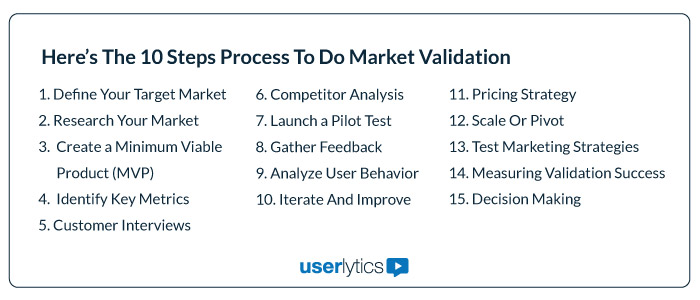

The market validation process consists of 6 key steps. Let’s have a quick look at each of them.

1. Determine market validation goals and hypothesis

The process starts by defining your research goals and developing hypotheses. Basically, you try to list all the questions you need to answer.

Here are some examples of research questions:

- What is the feature, product, or service?

- Which customer problems does it solve?

- Are there other similar products?

- How successful are they?

- What is the target market?

- Who are the prospective customers?

- Are there enough potential users?

- Are they ready to pay for the product? How much?

- Is it financially viable?

2. Research the market to gauge market demand

Once you have the research questions lined up, it’s time for market research.

There are lots of different techniques that you can use here, like competitive analysis or studying market trends.

The process is not easy though. For starters, it requires expertise that only large enterprise-level organizations can have at their disposal. That’s why hiring a market research company might be a good shot to ensure unbiased and valid research results.

3. Identify the target market of your business idea

Market research should give you the insights necessary to identify your target market and the target audience.

Use them to develop target user personas of your product, focusing on their JTBDs , pain points , and desires. Applying a template like the one below will give structure to persona mapping.

4. Validate product ideas through multiple methods

Once you identify the target market, it’s time to validate the product idea.

Using a range of techniques and methods will help you ensure that the results are reliable and valid. For example, you could run fake door tests and prototype tests and use surveys and interviews to collect user feedback.

5. Develop the minimum viable product

As you’re running subsequent tests, your prototypes will be getting more and more complex. At some point, you will reach a stage where you have a functional product. That’s your minimum viable product, or the MVP for short.

The idea behind the MVP isn’t to launch a ready product. It only needs basic functionality – enough to satisfy the key user needs and communicate the value proposition of the product.

Your MVP won’t be enough to cross the chasm and captivate the imagination of the majority of your target user base. However, it should be good enough for innovators and early adopters . That’s all you need at this stage.

6. Iterate the MVP by collecting customer feedback

When you launch your MVP, collect customer feedback and track user in-app behavior.

Use the insights to iterate on the previous version to iron out the kinks and keep adding value, just like you did with prototype testing.

As you keep testing and improving the product , it’s going to be more and more appealing to wider audiences beyond early customers.

What is an example of market validation?

Let’s imagine that you’re a product manager developing an analytics platform. You come up with an idea of a feature that leverages AI to enhance the analysis process.

While AI solutions are taking other sectors by storm, your market research reveals no competing analytics tools offer such functionality.

You start the validation by running a fake door test. In this way, you can test the demand without investing any resources.

The results are optimistic, so you iterate on the idea and develop more and more advanced prototypes. Once the MVP is ready, you first dark launch it and carry out beta tests to further refine it.

Finally, you launch it on Product Hunt to attract the attention of early adopters.

Best practices when conducting market validation tests

- Make your users commit – in your validation interviews, tell users the product is ready and ask them to commit to the purchase. This is the ultimate test of their interest. In this way, you could also get your first paying customers.

- Validate with the right audience – innovators and early adopters are only a small part of your target user population. Most money comes from the early and late majority categories of adopters , so make sure to test the product with a representative sample .

- Recruit beta testers early on – as you’re testing different prototype versions, keep recruiting beta testers for when the product is ready. For example, ask users to sign up at the end of the fake door test.

- Stay open to critical feedback – to avoid bias seek diverse perspectives and test to encourage research participants to provide honest opinions, even if they don’t align with your initial assumptions.

- Keep your surveys brief – to get higher response rates, limit your surveys to no more than 2 questions. Include both quantitative and qualitative questions, but don’t make them compulsory to answer.

Proper market validation helps organizations ensure that they’re developing the right solutions for the right audience in the right markets.

This reduces the risk of wasting resources on developing products or features that the market doesn’t need. Ultimately, it increases the chances of building a successful product.

If you want to see how you can use Userpilot for market validation, book the demo!

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Get The Insights!

The fastest way to learn about Product Growth,Management & Trends.

The coolest way to learn about Product Growth, Management & Trends. Delivered fresh to your inbox, weekly.

The fastest way to learn about Product Growth, Management & Trends.

You might also be interested in ...

What is a customer profile template steps and examples.

Aazar Ali Shad

Feature Rollout: What Is It and How to Conduct It? (+Best Practices)

Saffa Faisal

How to Launch a Successful Feature Release?

Integrations

What's new?

Prototype Testing

Live Website Testing

Feedback Surveys

Interview Studies

Card Sorting

Tree Testing

In-Product Prompts

Participant Management

Automated Reports

Templates Gallery

Choose from our library of pre-built mazes to copy, customize, and share with your own users

Browse all templates

Financial Services

Tech & Software

Product Designers

Product Managers

User Researchers

By use case

Concept & Idea Validation

Wireframe & Usability Test

Content & Copy Testing

Feedback & Satisfaction

Content Hub

Educational resources for product, research and design teams

Explore all resources

Question Bank

Research Maturity Model

Guides & Reports

Help Center

Future of User Research Report

The Optimal Path Podcast

User Research

Feb 10, 2021 • 24 minutes read

How market validation justifies new product investment

Learn how market validation justifies product investment with key insights from product leaders at airfocus and eDreams.

Ryan Williams

You’ve got a brilliant idea for a new product. You know how to make it. So nothing’s standing in your way, right? But, before you start, ask yourself: how am I sure that people are going to use and pay for this product?

To answer this question, we spoke to Malte Scholz , Head of Product and CEO at airfocus, and Martín Burgener , Product Director at eDreams, who gave us their insights on market validation.

In this article, we’ll look at:

- A definition of market validation

- Why companies need to do market validation

- A step-by-step process for conducting market validation research

- Key market validation methods

- A real-life example from eDreams

Market validation: Quick overview

Market validation is an essential step in the product development process between having a new product concept and starting the process to create it. As the name suggests, market validation involves researching potential users of a new product to gauge how viable the product or business idea would be in the target market.

Market validation can be used when developing a startup idea centered around an innovative new product, launching a new product within an existing business, or developing a new feature to add to current products.

Why you should do market validation

Undertaking a market validation project is hugely beneficial for two main reasons:

Avoiding big product failures

- Helping to secure and justify funding for product development

Developing products takes a lot of time and financial investment. So, when those products are created and launched but fail to attract users in the market, the sunk cost can be significant.

Market validation helps to avoid these negative situations by making sure you understand your users, and that you’re not building a product which no one wants or needs.

Everything starts and ends with the product. We can do as great sales and marketing as we want, but if we don’t get the product right, we’ll fail.

Malte Scholz , Head of Product and CEO at airfocus

To look at it a different way, market validation research also helps you to create a better product by more accurately fulfilling users’ pain points. During the market validation process, you’ll gain an understanding of your users’ needs and pains. These insights will inform a product team on what products or features will best bring value to users.

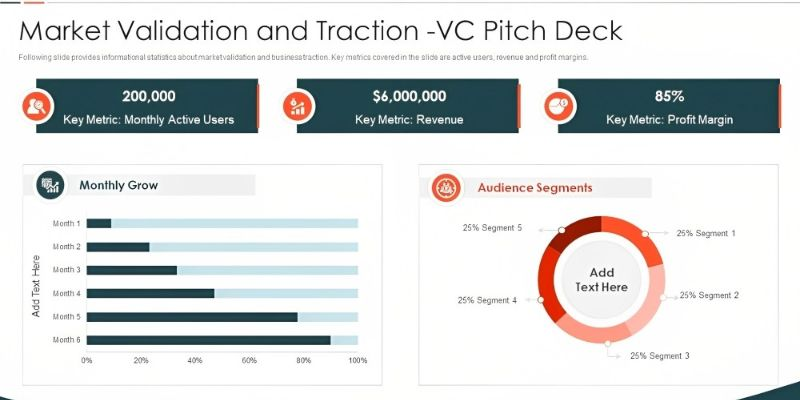

Secure funding

The reality of developing new products is that it costs money. By undertaking a market validation process, the viability of the product’s success can be more accurately determined. This makes investment in its development far easier to acquire and to justify in the eyes of stakeholders.

A startup will likely have a short window of time after founding and before initial funding becomes necessary to continue growing.

A team within an existing company will have to justify the cost of the new product before it’s given a green light from the company’s management.

Even a solo entrepreneur creating a product on their own will have bills to pay and limited hours in a day. So before they invest their time into building the product, market validation can assure them of their product’s viability for success—or it can help them avoid spending months on a product unlikely to succeed.

Our company succeeds when we nail the product, and that’s why product validation and product-market fit are so essential to us.

In each of these scenarios, investing time and money into a product is an enormous risk. So, before resources can be allotted into development, market validation helps to justify the investment by confirming the existence of a target market willing to buy the product.

How to do market validation: The process

The process of running a market validation test can vary a lot, depending on your resources, the type of product you’re developing, your industry, and the demographics of your users. But, there is a solid framework in which most market validation processes can work.

A standard market validation plan includes:

- Writing down assumptions

- Creating the test

- Finding research participants

- Conducting, then analyzing, the results

Step 1 - Write down assumptions

Only with a goal and a hypothesis, or assumption, in mind can you start the market validation process. After all, this process is about testing assumptions relating to market viability with real users of your product.

Start by writing down the assumptions you want to test first. The best place to start is the assumptions that are the most critical to the overall success of the product.

My boss here at eDreams has an example: If you build a chair, and one of the screws is not strong enough, then the whole chair will break. So you first have to test the screw itself.

Martín Burgener , Product Director at eDreams

Some examples of vital assumptions to test could be:

- There’s demand in the market for this product

- Our target demographic will want to use the product

- The product will solve the needs of its users

- Our pricing model suits our target customers

Step 2 - Create the test

Once you know which assumptions you want to test, you'll need to choose a research method that best tests your assumptions. The most common market validation methods are customer interviews and surveys. We'll look into these methods and more in the section on Market validation methods below.

In this step, you also want to be creating the test itself. For interviews and surveys, you can now put together the right research questions to ask the participants.

Once you’ve created the questions, it’s good practice to put it through a dry run. For this, you should simply ask someone to go through the test with you. At this stage, representative users aren’t important, as you’re just testing if the test itself will make sense in the real experiment.

Step 3 - Find research participants

An essential part of any type of research is recruiting research participants.

First off, these participants need to be representative of the actual users you’ll be targeting for your product. Without representative test users, the feedback you’ll get will be biased in unrealistic directions.

You may need to offer incentives to convince people to take your experiment. If you require the participants to be physically present, then you may also want to cover their travel costs. For other experiments, you could offer a free trial of your product once it’s released.

There are a number of ways to recruit participants for your market validation test, from using your personal network to posting on social media, and from using existing product users to employing guerrilla testing methods. This article on recruiting research participants goes into detail on each of these methods.

Step 4 - Conduct and review the experiment

At this point, you are ready to actually run the experiments. You know the assumptions you want to test, you’ve chosen an ideal method of conducting the test, and you’ve recruited enough participants to get useful feedback.

A key piece of wisdom here is that being proven wrong is not the same as failing. As Martín explains, market validation is about proving your assumptions wrong time and time again until you get the idea right:

If we think about the products eDreams have been working on, roughly 70-85% of all tests we do result in a fail. And that’s for a company that is product-led and has been making digital products for 12 years.

It’s important to see failure as part of a successful experiment rather than something negative itself. Having assumptions being proven wrong is inevitable, so the better mindset is to consider them a regular part of testing.

This also fits as part of broader advice: stay humble. Product teams should never assume they really know what users need and want. Keeping a mindset of humility, and assuming you never already know the answer, means always listening to the customer.

It all goes back to: be humble and learn more than explain.

Market validation is not a one-off test. Rather, it’s a process that should continue all through product development . Humility during this process can not only help product teams to stay positive in the face of setbacks but nearly always leads to better product development.

Market validation methods

There are a number of market validation methods that can be used, and each has its benefits and drawbacks. It’s important to make sure you use the right methods, and often that means using a combination of multiple methods to get a more complete view of the market.

To us, it’s not a one-structured approach to validating the market. It’s a lot of things that come together, like data collected from user interviews, usage data, experiments, MVP data.

Below, we’ll take a look at some of the more popular market validation methods:

- Surveys and interviews

- Building an MVP

Prototype testing

Usability testing.

- SEO methods

Surveys and customer interviews

Running customer interviews and surveys is a popular and effective way of doing market validation tests, largely due to the qualitative data gained from customers’ feedback. These market validation methods of research are very flexible, allowing you to learn about your users from many different angles.

With a survey or questionnaire, you get the benefit of a huge volume of responses, while interviews allow you to dig deeper into people’s feedback and uncover their true problems.

There’s always quantitative stuff you can do, like statistics and market analysis. But, at the end of the day, the most important part is to get qualitative feedback by talking to people.

Involving a Customer Advisory Board (CAB) takes this process a step even further. CABs are a group of users who meet with a company regularly to offer feedback and advice on their product development. They help product teams to challenge biases and assumptions of what users need and want, and are invaluable in more deeply validating a new product.

Maze’s rapid testing platform allows for a variety of validation tests to get insights early in the product development cycle. Learn more .

Minimum viable product

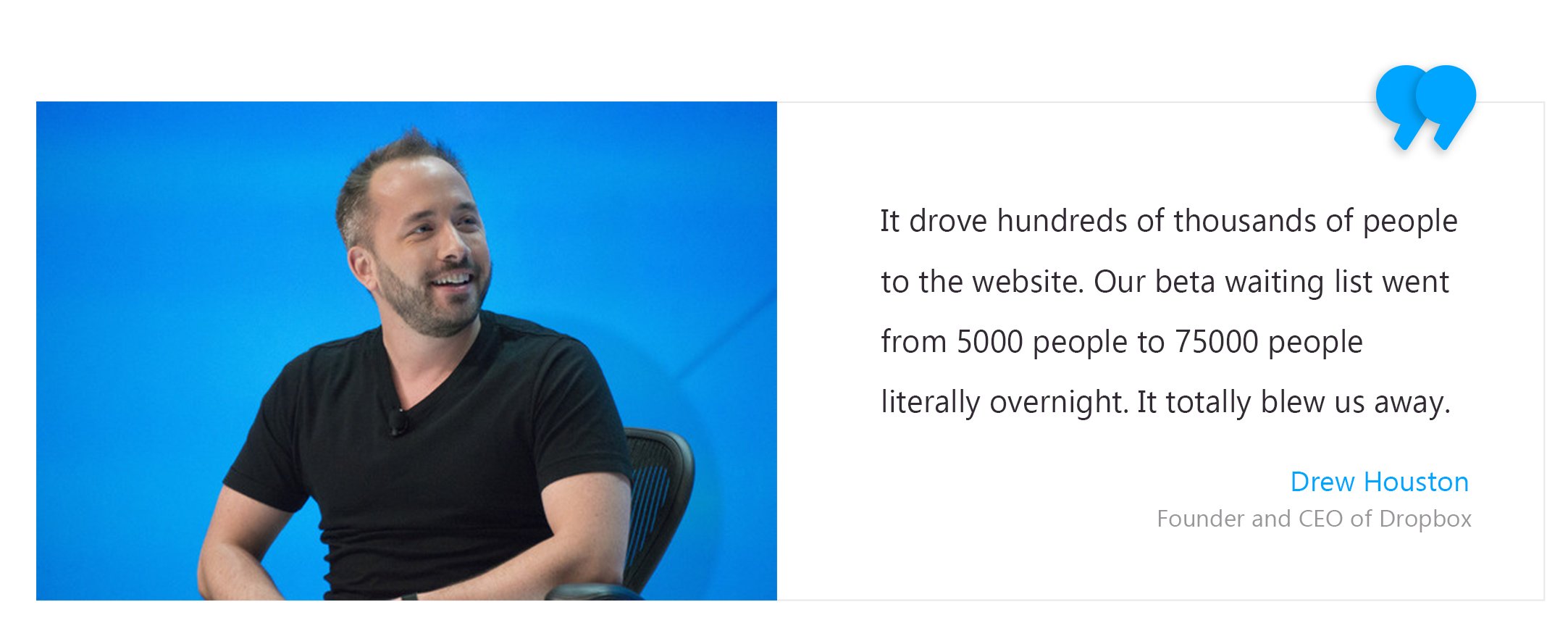

A Minimum viable product (MVP) is the most basic version of your intended product, that still offers value to the user.

MVPs are often used for market validation to test the level of interest users have in the product and how they interact with the product itself. If users show continued use of the MVP, then it justifies investing in creating the fully-fledged version of the product itself. It also allows you to get feedback from your target audience and detect any major issues with how they’re using it.

The choice of whether or not to create an MVP often comes down to what it takes to create it. If you’re creating your company’s flagship product, then it makes a lot of sense to make an MVP to start bringing in revenue while the product is still being built. For additional products, if it’s going to take a year to create even the MVP version of your product, and you’re aiming for a lean process, then it may be better first to validate user interest in the product in other ways.

Sometimes it’s cheaper to build something than to test it with surveys. Some products are not hard to build, so they’re cheaper and faster than spending weeks testing. So it depends on the risk of assuming things and what it would cost you by failing.

A common argument against creating an MVP is the time and financial investment it requires to build. A workaround solution, which still allows for lean market validation, is Wizard of Oz testing. "We sometimes do what we call “Wizard of Oz”. This is where the user thinks the site is doing something, but really there’s a person behind doing it. It’s not a long-lasting solution, but it allows us to measure and validate if the value is there. Then we say, okay it makes sense to build an API because there’s a market there," explains Martín.

This tactic allows you to offer a service to your users without having to build a product to do it automatically. The main drawback is that it does require you to have staff on-hand who can pick up these tasks. However, if this feature is a paid one, the cost of the employee can be offset by the income of the feature itself.

Prototyping can function as an invaluable tool for market validation, primarily because having a working version of your intended product allows for more robust product testing.

Allowing test users to interact with a prototype version of your product can unlock better insights into what works and what doesn’t. It means people aren’t imagining a product explained to them in words. Instead, they get to actually use the product, and better imagine themselves using it outside of the test.

Read more about prototype testing .

Having a prototype also allows for usability testing. When undertaken with test users working on a real, albeit early-stage product, usability testing tools can give vital early feedback on the product’s design and UX, helping to create a better product down the line.

Usability testing is about getting users to interact with your digital product by completing pre-determined tasks while taking note of their decisions and reactions. This type of testing lets you see if your product is easy to understand and use for prospective customers.

“At eDreams, we have what we call Wednesday Labs. We invite 6 people to our offices and we present a new project for them to navigate and test if they can get from A to B. That’s more qualitative than quantitative, but it allows us to test many things,” says Martín.

Move forward with the right ideas

Learn what your users’ problems and needs are and validate your concepts and ideas before starting development.

Market validation can benefit from usability testing because it allows potential users of the product to interact with it, while also giving their thoughts on the product itself and helping you to identify issues with ease of use and functionality.

Maze's usability testing features allow you to test ease of use and validate product ideas with your target audience rapidly. Learn more here .

This method is particularly useful if you’re conducting market validation for a new feature on an existing, proven product. You can include the new feature within the digital product the user is already aware of and test their responses to the new feature.

Search engine results and Google Trends

An easy way to gauge possible user interest in your product is by taking a look at online search results. This method involves seeing how many people are searching for particular phrases online each month with tools like Semrush or Ahrefs .

For example, let’s say your product idea is to create an online learning platform for people with autism. You could search for “e-learning” and “online video classes” to gauge the popularity of your industry and product, and then “online video classes for people with autism” to see how many people are already looking for your product.

The benefits of this method are that it’s a very quick and cheap method which gives you a general idea of the existing market interest in your product. You can even geolocalize results to see if there are countries with particular interest.

Another similar method is looking at Google Trends . This free tool allows you to see search patterns over time for particular keywords. While tools like Ahrefs and Semrush give numerical search volumes, Trends shows how search intent changes over a given period of time. For example, the Trends graph below shows a clear spike in interest for “online video classes,” coinciding with the start of lockdown measures imposed due to the 2020 Coronavirus pandemic. Seeing that your proposed product is steadily gaining in interest can help to validate it.

Google Trends results for "online video classes"

A/B testing paid ads

Finally, another market validation method is to A/B test online ads highlighting different aspects of your product. The point here is to see how much your users value particular product features, which can give insights on where future product development should focus.

Martín explains: "We sometimes do fake ads for Search Engine Marketing (SEM) tests. We compare a campaign that says 'The cheapest flights' and another that says 'The cheapest flights with free cancellation'. When you click, you get to the normal eDreams page, so if you see that the click-through rate is better for the second one, you see there’s value for 'free cancellation'."

This method can be used in tandem with others. For example, if you are running a Wizard of Oz test for a proposed new feature, then online ads can simultaneously be run to highlight the new feature. If there’s a clearly higher click-through rate for the ads with the new feature, then it validates the development of the feature as a digital product.

Market validation example: eDreams

For eDreams , market validation was essential while they were working on a project focused on offering flexible flight tickets. This came with several assumptions. They first tested if their target customers valued free cancellation on their tickets at all. While in theory, it seems like an obvious advantage for travelers, the assumption still needs to be tested.

After conducting market validation tests, they found that despite it being a big trend in their industry, customers didn’t initially see the value of flexible tickets. “We tested if people valued flexibility. The first reaction from people was ‘I’m paying this because I want to go to Rome, why would I want to cancel?’ So, it took us a lot of iterations and work to get people to understand the value of flexibility, like if your boss doesn’t approve your holidays, or if you get sick, or if there’s a worldwide pandemic,” said Martín.

eDreams worked to better explain the value of the flexible tickets and found that, with the correct context, explanation, and phrasing, these potential customers were indeed very receptive to the idea and did value flexible tickets.

These results are interesting and indicative of the value of market validation. Asking open-ended questions and listening to customers allowed eDreams to see that there was value in offering flexible tickets, but that it was unlikely to be successful in the way they initially planned to present it to customers.

Read on more usability testing implementation examples .

Continue reading

How to test marketing messaging: Validating claims with users before launch

Inside Maze

How to position your startup: A peek into our process and advice from positioning expert Hema Padhu

How to Perform Market Validation: A Step-by-Step Guide

It's essential to validate product ideas before investing time and money. Learn how to perform market validation and the user research methods that make it work.

How does that saying go, something like If wishes were business ideas, we would all have a few Fortune 500 companies under our belt ? Okay, perhaps I made that up, but maybe it should be a saying. After all, how often have you come up with an idea and thought it wasn't practicable, only to see it come to market some months later from somebody else? Or you don't know if your great idea is feasible, so you move on and forget about it? Or someone else thinks it's pie-in-the-sky, so you scuttle your idea off to the Dead Ideas folder on your computer?

Yet some ideas are clear winners. How can you tell which brilliant idea for a new product or feature is worth pursuing and which might not be as valuable or need more tweaking? Market validation research is a vital step between ideation and creation that can answer that question before you invest too much time or resources into it.

Let's take a deeper look at what exactly market validation is, why it's essential for companies before investing in ideas, when and how to conduct market validation research , and the methodologies that can help you get the market validation your idea or product needs to succeed.

What is market validation research?

Market validation is the process of testing a new product idea for viability to determine whether a product or feature is needed in your target market. Simply put, does the public have an appetite for your product? It is a crucial step to take between product concept ideation and product creation.

By testing the practicality and feasibility of a new product with the target market before investing time and resources into its development, you will have a better sense of what your users' needs are and whether and confidence in whether (or not) your product will fulfill those needs.

Market validation research can also help garner buy-in for your product or idea. Early validation will allow stakeholders—internal team members or external funders—to be confident in bringing your concept to market. Further, market validation research can allow you to tweak and hone your idea to better address any unmet needs or pain points your users may have.

Market validation is generally accomplished by identifying the buyers or users of your product in your target market and then interviewing or surveying them for direct feedback about their needs and pain points.

Why is market validation a vital early step in the development process?

Having what feels like a wholly intuitive and ingenious idea can often motivate moving fast to push it into development. However, anyone who's worked in product management has probably had the unfortunate experience of discovering that what sounded terrific in a product dev meeting doesn't stand up under real-world scrutiny. Why?

- Perhaps your target market would like your idea but not enough to pay for it

- Maybe it's not as big of a problem for your market base as your team supposes

- Maybe your target users would love your idea, but their companies don't find it to be a value add for their budgets

- Perhaps your users have already figured out an easy way to resolve the issue your product is addressing

By conducting market validation research before investing in the development of a new product, your company can help justify buy-in and funding for the product while avoiding the waste of a product failing to meet expectations.

The real-world value of market validation research is that it will help you uncover the blind spots you or your team may have when evaluating your ideas, unearth pain points for your target market that you might have glanced over, and help to finetune your thinking before an idea moves into development. After all, running market validation research and finding out your idea is a clunker is much less expensive than developing and marketing an idea that underperforms expectations.

What research methodologies are used in market validation?

Many methodologies can be employed for market validation research, each representing advantages and disadvantages. Some lean towards quantitative data to provide a high-level understanding of the market, while others are more qualitative and can give you an idea of what users in your target market feel and think about the product. When choosing which methodologies might be best for your product, the goal is to employ multiple methods to give you a richer and more complex view of the market. First, let's look at the most common methods.

Surveys, focus groups, and interviews

Depending on whether the questions you ask your subjects are open or close-ended, surveys, focus groups, and in-depth interviews can give you both qualitative and quantitative data directly from your target market of users.

Additionally, each method provides the flexibility to learn in-depth feedback directly from interview subjects and gather data that can give valuable direction to your project. Surveys offer the opportunity to collect large amounts of data at one time. Focus groups and interviews can allow you to drill down quickly when you discover specific pain points your target users experience.

Observational research

In observational research, you have your testers interact directly with your product and take note of their actions, behaviors, frustrations, holdups, habits, and pain points, often without giving them much direction. This is often helpful information for products with a less tech-savvy market base. It can also be beneficial if you've run alpha and beta testing and find disparate data from your two user groups.

Usability testing

Which leads us to usability testing . Like observational research, usability testing requires observing how users interact with your product following a determined set of steps while you watch and record their reactions and issues.

When users can directly interact with and comment on your product in an observational setting, you can assess how easy to use your product is, how useful the functionality might be, and how receptive your test market is to changes you've made.

Building out a minimum viable product (MVP)

Developing the minimum viable product (MVP) would be one of the last steps of market validation you and your team might take. That's because an MVP is your product's basic, physical version that can still offer usefulness to your users. However, producing one can represent a significant outlay of resources and costs—both in time and financial investments—so not every project or company will find building an MVP practical.

If you are working on a first product, rather than a new feature, say, it could be sensible to produce an MVP early. Not only will this allow you to have a basic version of your product to market validate with test consumers, but you can also begin making revenue from an early version while fine tuning your product.

A/B Testing

One way to evaluate how much value a new feature for an existing product might add is by running A/B testing ads designed to test how many click-throughs you get for one idea compared to another. For example, suppose we were thinking about adding a feature to our verified research participant database that offered AI to complement traditional surveys. In that case, we could set up an SEM test with a campaign that offers "Verified research participants tailored to your needs" and compare it to another campaign offering "Verified research participant recruiting powered by AI insights."

By comparing the number of click-throughs each ad garners, we could have constructive insights into whether there's a desire or value in adding AI to our product. You can also tailor the landing page the ads take a user to garner even more validation of a product's potential value based on clicks, impressions, and conversions to compare results from each.

Prototype testing

Prototype testing can be a valuable tool in your market validation toolbelt for allowing test users the means to have meaningful interactions with your product. For usability testing, having a prototype available for users to interact with can give you keen insight into how the product works in real-life settings, possible UX/UI issues, timely feedback on design issues before full development, and a better understanding of how your users interact with your product.

Utilizing SEO results and Google Trends

One of the simplest ways to begin market validation is to use free/low-cost tools your organization likely already has access to. Just like you'd check your SEO results frequently after you launch a new project, you can also utilize them before building your product to gauge what your user base's interests, needs, and pain points are by using Google Trends and SEO tools like Semrush , MOZ Pro , or Ahrefs .

By investigating how often particular keywords and terms associated with your product are being searched, you can get an easy view of what your user base needs and where your product does or doesn't meet those needs and monitor growth in interest over time and location.

The market validation step-by-step guide

Step 1 – define goals, assumptions, hypotheses, and target customer.

- Define your goals clearly

- Identify your target market

- Highlight any untested assumptions

- Identify unmet needs your customer base may have

- Define your unique value props

- Develop your hypotheses

The first step is to identify your goals for your product. Having a clear view of what you expect to accomplish, you can then clarify any plans that may still be assumptions that need to be verified.

Next, clearly define your target market for yourself. This will help you move on to the next step, which is documenting your hypotheses about the function of your product, how you will produce it, the pricing model, and so on.

Once you have a handle on your target consumers, define your unique value propositions, what makes your product useful, necessary, or unique, and how it meets your users' unmet needs. When you have a keen understanding of these things, you'll clearly understand what you will need to test with market validation research.

Step 2 - Assess the market size and share/competitive landscape

Next, get a fuller idea of your market size, the share that you think you could reasonably capture with your idea, and who your competitors in the market are.

Start broadly by researching the industry, its annual spending, and how your unique value props may disrupt that.

Utilize SEO search volume tools to better understand the demand for your product and how you can best capitalize on that demand to make your product stand out against competitors.

Step 3 - Perform customer validation research

Your next step involves getting into the nitty gritty and performing customer validation research that will give you actionable insights into what your target market segment needs–their pain points- and how your product can potentially alleviate these needs.

This will often involve conducting interviews with your target market by finding research participants to conduct interviews, holding focus groups, or gathering data via online surveys. You're looking to answer a few basic questions at this stage. That is:

- What are the pain points or unserved needs your market segment is encountering?

- What are their motivations and preferences?

- How are your competitors' products leaving these needs unmet?

- What are the workarounds they've developed to try to meet these needs themselves?

- Are they able to solve this/these problems?

- What is their level of satisfaction with the products they currently use?

- Would your product be useful as a solution?

- Are there any assumptions or hypotheses you originally created that need user feedback?

- Is there a feasible monetization of your solution for their needs?

When beginning this kind of research, you'll also need to look at what success means for your product by clearly defining your success criteria. First, understand what user responses will define success for your product or idea. Do this by looking at what percentage of respondents experience specific pain points, what percentage find your product idea to be a viable solution for their particular problem or problems, and what percentage would realistically pay for your product to solve their problems.

Next, analyze the data that you've gathered. Go back to the list of hypotheses and assumptions you created. You may need to revise your original assumptions. This could also be where you realize there isn't realistically a market for your product or idea, and that's okay, too. Ask yourself, if this isn't the solution our market base is looking for, what is? Work to improve what you have to offer, and then you can revisit test market validation again.

Step 4 – Test your product

Once you have a reasonably strong idea that your idea could be a solution, you can move forward in market validation testing and research that takes more investment, such as prototyping or creating an MVP. After that, you'll want to move on to testing your product.

First, test your product with focus groups or interviewees who can give you granular data about how the product works and what might need to be finetuned. Utilize test groups who will realistically be real-world users to get a fair and representative idea of how your product will function in the marketplace. Then, utilize these insights to tweak and adjust your product as necessary.

Next, it often makes sense to conduct alpha testing for your product with internal employees in a controlled setting that will allow you to check for issues, identify bugs or quirks, and address them before making your product public.

Finally, you can perform beta testing by releasing your product to a small, limited set of external users, with the goal being to identify problems, glitches, or UX issues before a wider release.

Ultimately, don't we all just need a little validation?

We all understand the value of having our ideas validated in our personal lives. With new products and features, validation is a meaningful way of proving market value, gaining buy-in, and providing a bridge between ideation and development.

The goal for market validation is about more than building a Fortune 500 company overnight, unfortunately. However, if that's a vision you have for your future, taking the proper steps when taking a new product, startup, or feature to market is a small step toward achieving that. Instead, market validation research is a process that can help you make the best use of your resources and determine whether your product or idea is ready to push into development so that your company continues to produce the best version of every product it offers.

Subscribe to Research Works Newsletter

Receive a monthly review of UXR industry news, researcher interviews, and innovative recruiting tips straight to your inbox.

Webinar: Why User Research Is Crucial For Validating Product Market Fit

In this webinar, we delve into why it is critical for companies to validate product market fit by conducting user research prior to investing...

8 Key Steps to help find Participants for User Testing

Participant recruitment tactics, screening advice, marketing channels and five other aspects to consider when you want to find participants for user...

Screener Survey Guide: How to Screen for Unmoderated Studies

Screener surveys are an important tool for research participant recruitment. We have a guide to help you create effective screeners for unmoderated...

Market Validation: 7 Steps to Success + 3 Things to Avoid

Market validation is key for any business that’s serious about success.

Here, we provide an in-depth look at the essential steps to validate your product’s market potential . We’ll cover the fundamentals of market validation and equip you with the know-how to guide you through the process so you can validate your business idea.

What is market validation?

Market validation (aka business validation) verifies the potential success of a product or service. It’s a process of researching target markets , understanding customer needs, and testing the product or service with potential customers.

It’s like taking a product for a test drive and seeing if it runs smoothly! Through market analysis , surveys, focus groups, interviews, and competitive analysis , market validation can help you uncover the key data points you need for smart decision-making.

Why is market validation important?

Market validation uncovers data that helps determine if it’s worth investing your resources in a new venture or not. It helps you understand the market’s potential for your product and its demand. Whether doing research for a business plan , start-up , or launching in a new market , the business validation process is used to help:

- Assess the competitive landscape

- Identify customer needs

- See if your product or service can meet those needs

- Determine if your product is viable and profitable

All in all, market validation is a must for any business that wants to succeed.

Ten market validation examples

Market Research

Use a market research tool to understand the size, demographics , and trends of the market you want to target. This type of research can help companies determine the potential demand for their product or service and identify areas of opportunity.

Online Surveys

Surveys can be used to gather feedback on products or services from potential customers. Questions may include how customers currently solve the problem you aim to address, how important the problem is to them, what features they would like to see, and how much they would be willing to pay.

Competitor Analysis

Competitive analysis frameworks help you understand how a product stacks up against similar offerings from competitors. This process helps companies identify areas of improvement and develop strategies to gain an edge over the competition.

Focus Groups

Focus groups enable further testing of a product or service by gathering groups of potential customers to discuss the offering in detail. This type of research can reveal customer needs, desires, and preferences.

Usability Testing

Usability testing allows companies to evaluate the effectiveness of their product. It involves having real customers use the product, then give feedback on their experience. Usability testing can reveal the features that work well and those in need of improvement.

A/B Testing

A/B testing compares different versions of a product or service to see which is most effective. It involves running two versions of the product or service simultaneously. Results are then compared to determine which version is most successful.

Customer Interviews

Interviews reveal insights into the customer experience by asking consumers about their needs, pain points and gathering product feedback. This helps companies understand what people truly want and need, which can, in turn, enable them to develop better products.

Social Media Monitoring

Social media monitoring can uncover customer conversations about a product or service. By monitoring what’s being said about products or brands in a market, those wishing to enter it can spot potential threats and opportunities to consider.

User Experience Research

Companies can use user experience research to evaluate how users interact with their products. This type of research can reveal areas of improvement and help companies understand how people use their products.

Beta Testing

Companies can use beta testing to test their product in a real-world environment. Beta tests involve having a group of people use the product, and providing feedback on their experience. It can help companies identify issues and make improvements before launching the product.

Three market validation mistakes to avoid

Pursuing the wrong ‘type’ of validation is something that even seasoned entrepreneurs and companies can fall victim to. Not all market validation is created equal, so I’ve outlined four key market validation mishaps to help you avoid the trap that is ‘fake validation.’

Validating your business idea with the wrong type of customers

Don’t be afraid to approach target customers for feedback by soliciting customers who are either too big or small for your market entry point. If your early customers are different from those you wish to target in the long term, it’s important to validate your idea at both ends of the market. If you fail to do this, it can impact short and long-term results; or put you on the wrong path altogether.

To this end, you must always ensure you have the right type, and variety of consumers validating your product.

Validating your idea without considering future international expansion

If you launch in the U.S and only do market validation in the U.S., you limit the potential for international success by performing limited domestic validation. International customers may have a completely different set of problems to solve; there could be regulatory nuances or rival firms that require a bigger consideration.

Always keep long-term goals in mind; if international expansion or new territories form part of your long-term plan, consider this when going through the market validation process.

Seeking feedback from peers or industry connections

Market validation shouldn’t always be comfortable. One could argue it’s most effective when feedback isn’t quite as complimentary as you’d hoped for. I’ll explain. Whether we look at the start-up scene in Tel Aviv or Silicon valley, for example, it’s easy to be sucked in by praise and positive feedback from those in your market.

Start Your Market Validation with Similarweb Today

Market validation in seven steps, 1: identify the problem.

- Research the needs of the customer base

- Identify unmet customer needs

- Identify what challenges customers face

2: Refine the idea

- Consider how to solve the problem

- Brainstorm solutions

- Evaluate potential solutions

3: Conduct surveys

- Develop survey questions to test the idea

- Send surveys to a targeted customer sample

- Analyze survey results

4: Identify potential customers

- Research customer demographics

- Identify potential customer segments

- Analyze customer profiles

Understand Your Audience with Similarweb from Similarweb on Vimeo .

5: Analyze the competition

- Research the competitive landscape

- Identify competitive advantages

- Analyze competitive pricing

6: Create a prototype

- Design a prototype that meets customer needs

- Test the prototype with potential customers

- Gather customer feedback

7: Analyze market potential

- Calculate the size of the customer base

- Estimate potential market share

- Analyze market trends and potential growth

After the initial work is done, it’s important to monitor your results and how they change over time. Similarweb Digital Research Intelligence can help you track competitors, consumers, and a market with ease.

How Similarweb helps with market validation

If you’re looking to validate a business idea, Similarweb can help with steps 4, 5, and 7 of the market validation process. Here, I’ll show you how to use it to understand the competitive landscape, learn more about a target audience , and gain valuable insights into your target market .

Market validation example: customer research

As we’ve discussed, there are lots of ways you can research customers for market validation. When you need to find and understand audience behavior fast, there’s no better way than through Similarweb’s suite of market intelligence tools.

From researching audience demographics , such as gender, age, and geographies , to seeing target audience interests and cross-browsing behaviors (the other sites or mobile apps they visit), Similarweb can help you comprehensively analyze an audience in minutes.

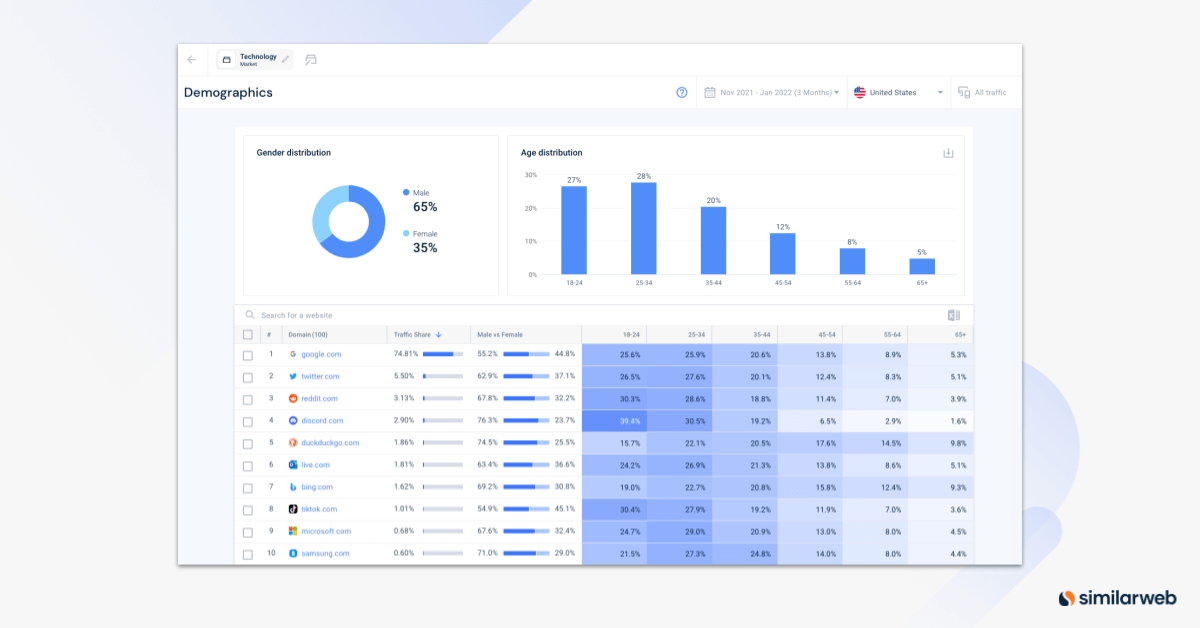

Here you can see the demographics for the Top 100 sites in the US tech sector over a 3-month period. Here, we see a split of website visitors, with 65% being male vs 35% female. The average age group is made up of 25-34-year-olds, which accounts for 28% of website visitors during this period. Further analysis can be done on any site, for any period or location.

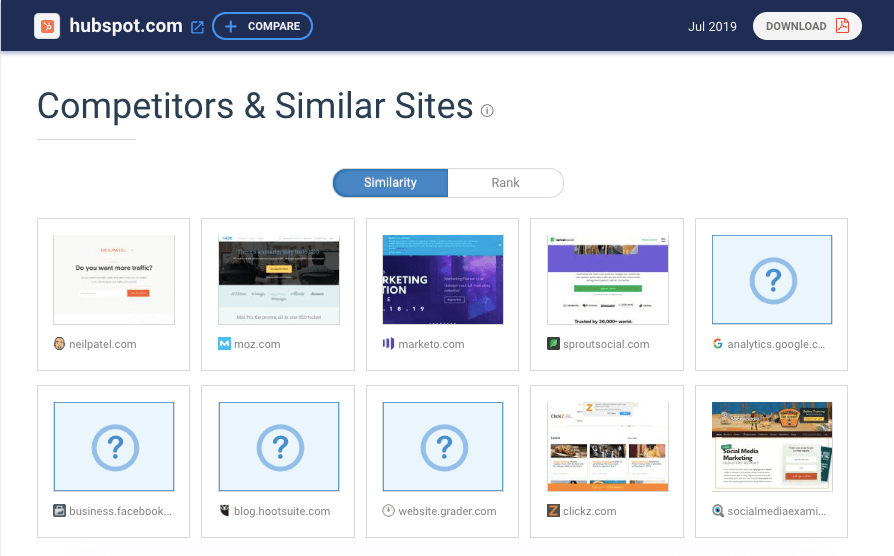

Market validation example: competitive research

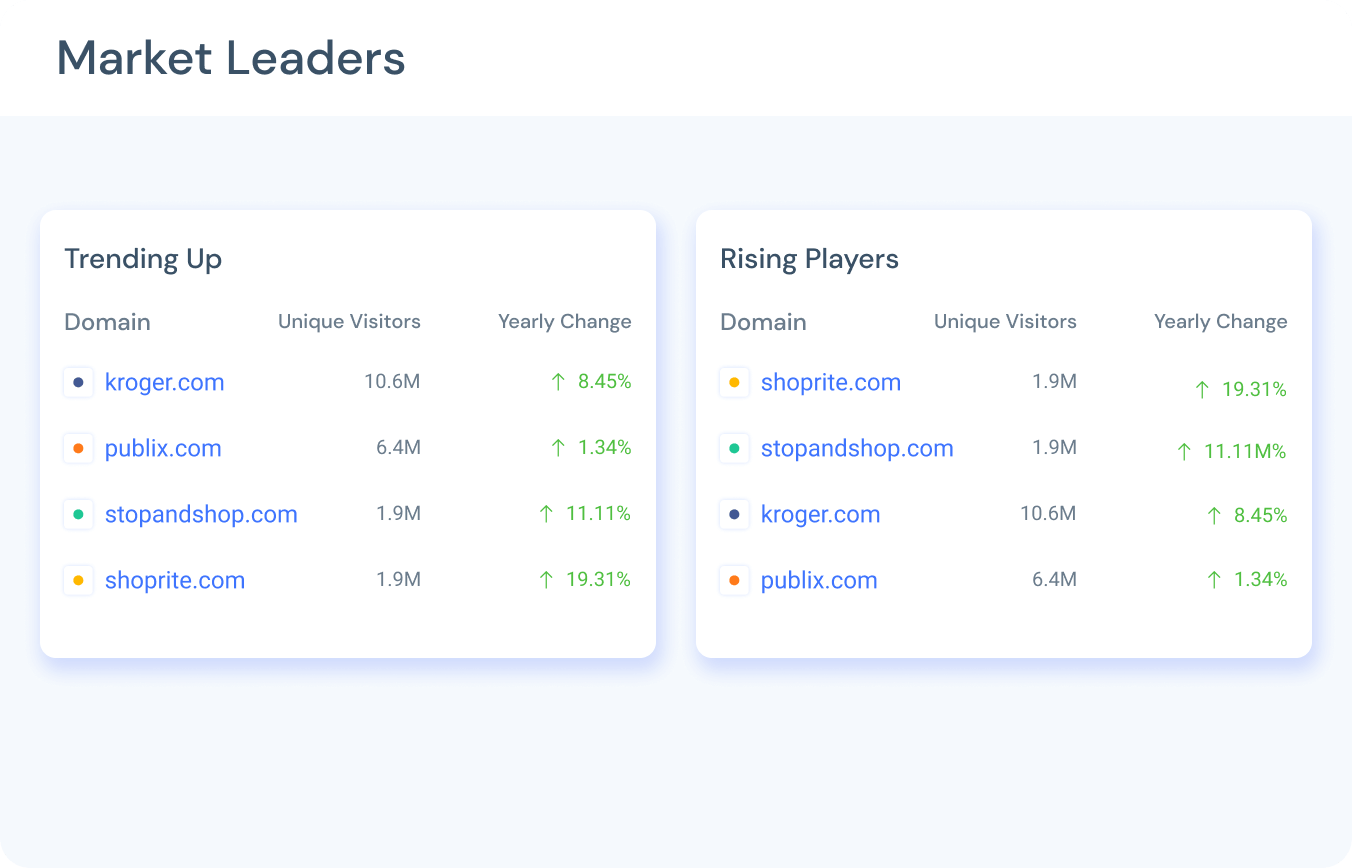

Where competitive intelligence is concerned, Similarweb is a powerhouse of a tool you need in your arsenal. Let’s say you want to enter a new market: you need to know who the key players and emerging disruptors are. This is point zero, it’s fundamental data you need to start any competitive analysis process.

First, I’m using Similarweb Industry Analysis to identify my market leaders and emerging players.

Now that I have my list of competitors to analyze, let’s take a look at the competitive analysis process.

To show you how easy it is, I’ve created a quick clip of our competitive analysis in action. In under a minute, I’ve used it to discover:

- Who the major competitors in a market are

- Which traffic channels are most effective in this market

- Generated a list of the right referral partners and advertisers in this space

- Copies of creative materials being used in competitor advertisements

- Discovered what content and pages are the most popular in this market

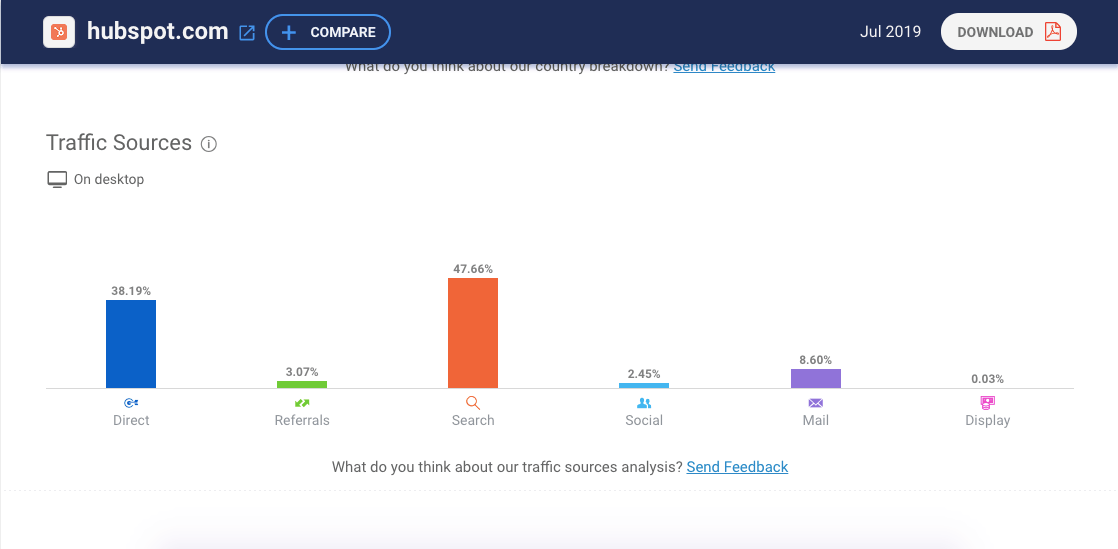

- The highest volume search terms in the industry

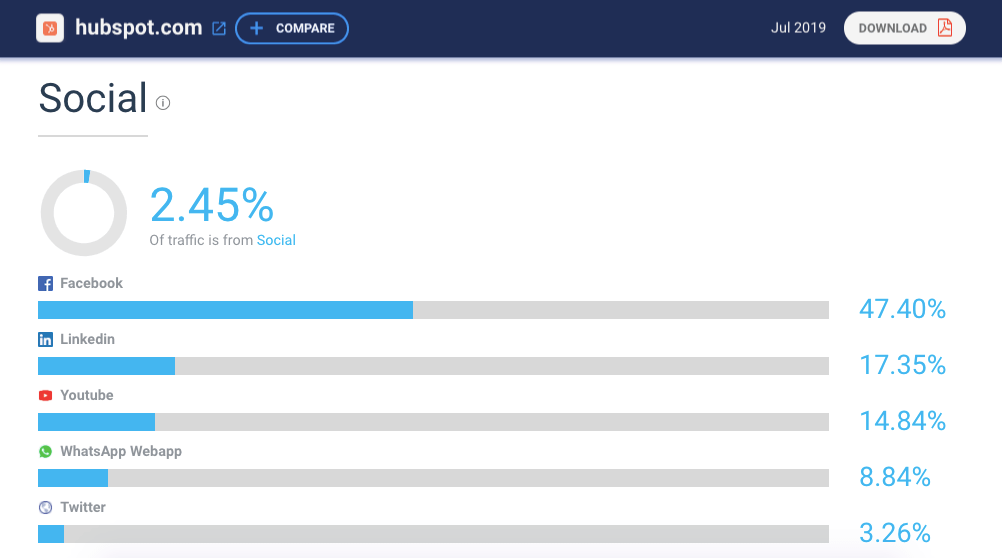

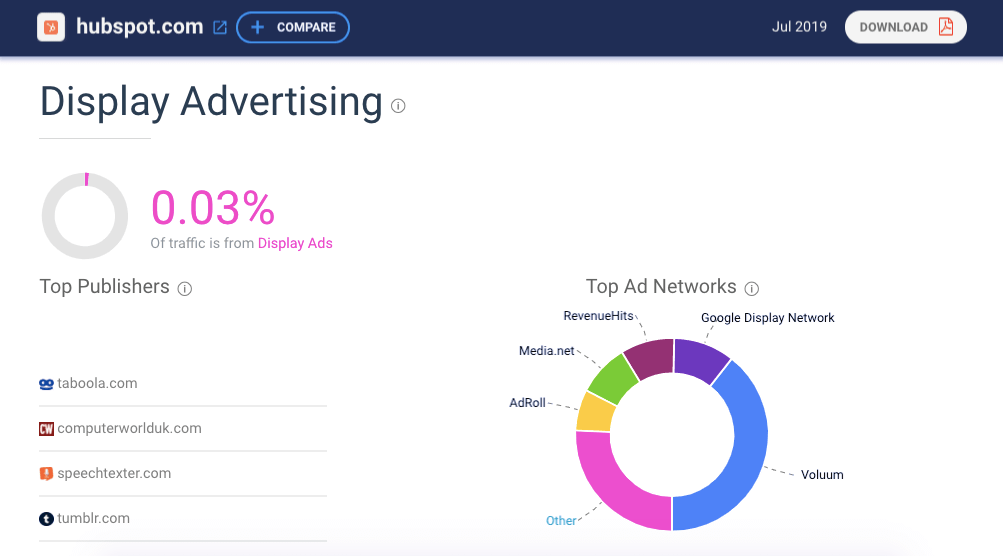

Here, we can see an overview of key traffic and engagement metrics for a chosen competitor. This includes things like total visits to its site, a link to any mobile apps it has, and a full breakdown of which channels its traffic comes from. I can quickly compare these stats against key rivals in the market, to see who is winning or losing traffic; and helping me identify which companies I’m going to analyze in more detail.

Market validation example: market research

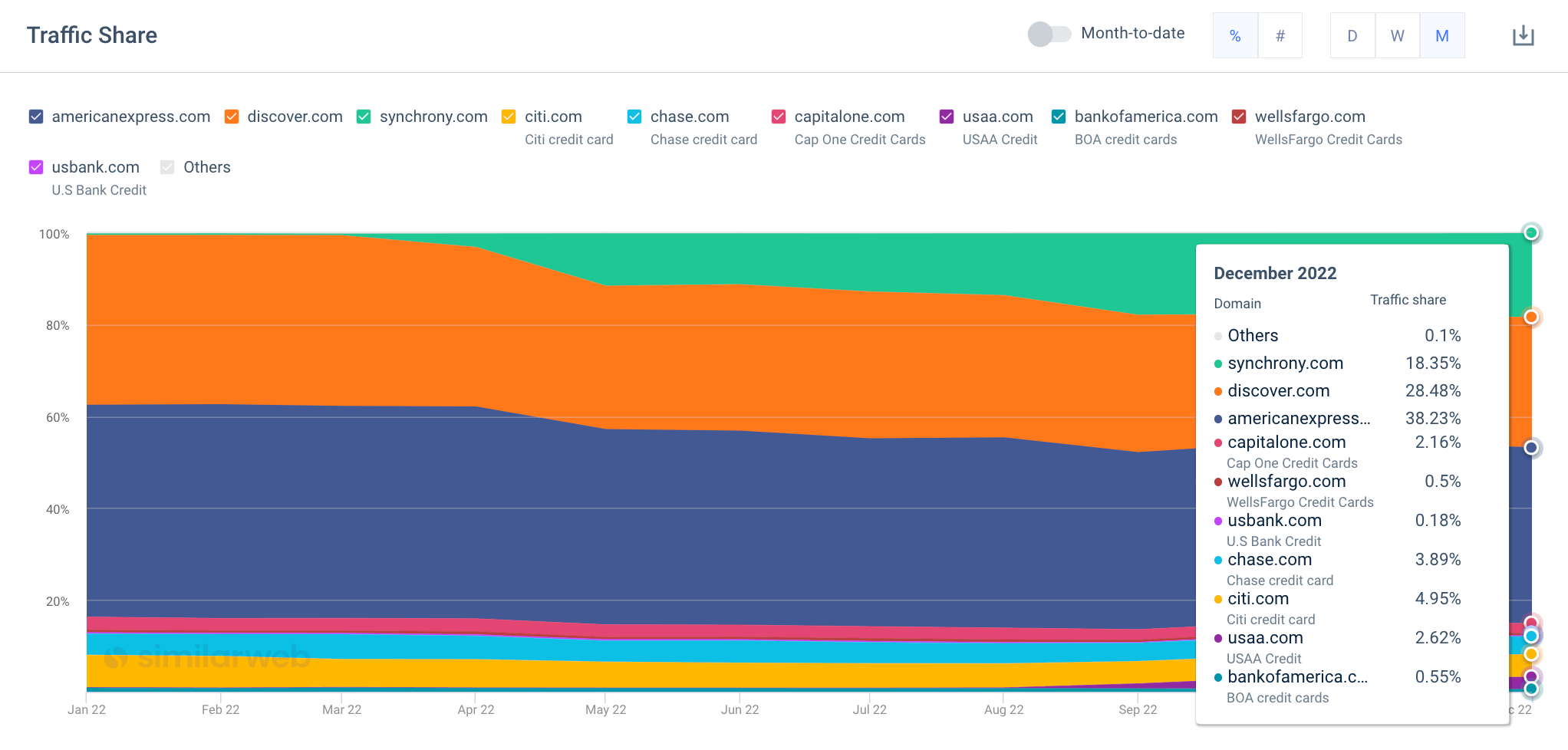

Market validation requires you to calculate the market size, estimate your potential market share , analyze market trends . Similarweb lets you do this quickly, with dynamic data sets that represent the market as it stands today. Instead of relying on outdated market reports, you can cut to the chase and use modern digital analytics to get the most accurate picture of the market at any point in time.

With a metric known as traffic share , we can estimate the potential market size by showing the total reachable audience you have or could have with a product or service.

The best insights are dynamic in nature. They appear to show shifts, sometimes unexpectedly or can indicate growth and changing behaviors as the year progresses.

Helpful: Read more about how to size a market .

Market validation is the only way to determine whether it’s worth investing more time and resources into a new product or service. In seven steps, you’ll have the intel you need to know if your idea is worth pursuing, or not.

Similarweb makes market validation faster and easier. By helping you quickly understand the market, its key players, and consumers; get a handle on the size of the opportunity, you can get the answers you need to make data-driven decisions about launching a new product or entering a new market fast.

What is market validation? Market validation is the process of gathering consumer feedback to determine the potential success or failure of an offering in the marketplace.

What are some methods of market validation? Market validation can be done through surveys, focus groups, interviews, product testing, and analysis of customer behavior and preferences.

How can market validation help a company? Market validation can help a company assess the viability of a product or service before investing significant resources into it. It can also help a company determine if their product or service is meeting customer needs.

When should market validation be conducted? Market validation should be conducted at the beginning of the product development process and throughout the life cycle of the product or service.

What are the benefits of market validation? The benefits of market validation include gaining insight into customer needs and preferences, reducing the risk of failure, and increasing the chances of success. Market validation can also help companies better understand their target audience and fine-tune their offering to better meet their needs.

What can market validation tell us about our customers? Market validation can provide an in-depth understanding of customer needs, preferences, and behaviors. It can give businesses insight into how customers perceive their product or service, what they are looking for in a product, and what they value most. With this information, companies can better tailor their offerings to meet customer needs and maximize success.

Related Posts

From AI to Buy: The Role of Artificial Intelligence in Retail

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Industry Research: The Data-Backed Approach

Wondering what similarweb can do for you.

Here are two ways you can get started with Similarweb today!

- Integrations

- Learning Center

Market Validation

What is market validation.

Market validation is the process of presenting a concept for a product to its target market and learn from those prospective buyers whether or not the idea is worth pursuing.

This process typically takes place early-on in the conception stage, before any significant investment has been made in developing the product.

The two most common approaches to market validation are:

- Interview people in the target market, such as the buyer and user personas.

- Send out surveys to these personas.

The key is that market validation research must include direct contact and feedback from people in the product’s intended market.

Why is Market Validation so Important?

There are many reasons why an organization conducts market validation before committing to the development of a new product or service. Here are some of the key benefits:

It helps secure funding and resources.

For an existing organization, the product management team would need to present its executive staff with evidence of market validation before execs green light the project and allow the product manager to begin assigning a budget, development time, marketing tasks, etc.

For an entrepreneur seeking funding for a new product idea, venture capitalists and other types of investors required evidence of market validation before agreeing to fund the entrepreneur’s company.

Beyond its ability to help teams secure resources to bring their product concept to reality, it’s an inexpensive way to uncover problems with your product idea.

When an organization comes up with an idea internally for a new feature or an entirely new product, the idea might at first seem viable, even ingenious.

But until that product team subjects its idea to a true test—for example, conducting customer validation interviews to learn whether or not they would be interested in the product—the team could be missing the following major flaws in the idea:

- Target users don’t need a standalone solution to solve the problem your product concept addresses and they’ve already discovered a simple and inexpensive workaround that they’re satisfied with.

- The consensus is while they like the idea, they don’t think it’s important enough to pay for.

- The companies in your target industries don’t allow enough budget for your solution.

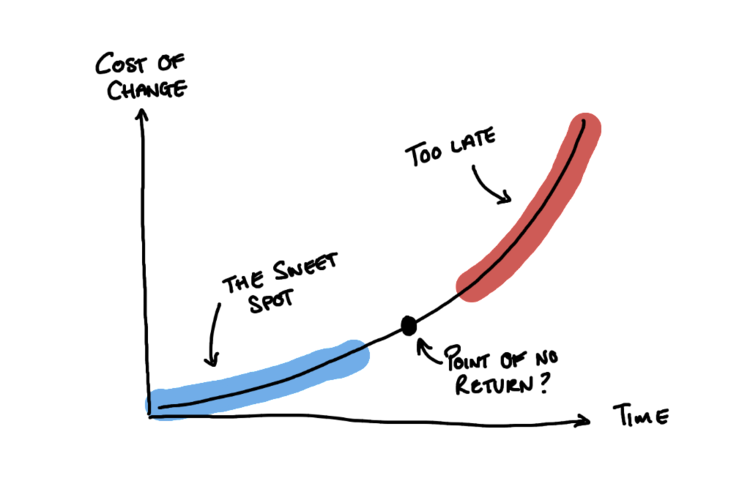

For these reasons, even a good idea can fail to achieve the all-important objective of product-market fit . The more development work your team has done before you discover whether your product will fail in the market, the more expensive that failure will be.

The value of market validation is that your organization can uncover those problems before committing any significant time or resources to a product concept. That makes this the most inexpensive way to learn that an idea isn’t worth pursuing.

How do you Conduct One-on-One Interviews for Market Validation?

The market validation process varies by company. It’ll also vary by industry and the type of user persona the product team is seeking feedback from. Different demographics will have their own preferred methods of communication.

Here is an outline of the broad steps you will want to take:

1. Prepare a clear and simple explanation of your product concept.

Develop a straightforward and easy-to-grasp description of the product concept that you can quickly share in your customer interviews.

Part of this step will also include thinking through some key details such as:

- Who are your customers

- What specific problem you believe they have

- How the product would solve that problem.

Answering these questions will also help you with the next step, which is figuring out which people to interview.

2. Find your ideal interview subjects.

Now it’s time to build a list of people to interview. If you know people in the target market for your product concept, you can start with them. That’s a quick way to begin compiling feedback.The downside to this approach is that these interview subjects will be more subjective and biased than you need from your interview subjects.

As you broaden your search for target personas to interview, it’s important to communicate let what the target persona will gain in exchange for giving you their time.

For example, explain that if they agree to speak with you about your product concept, you’ll either invite them to be among the beta-testers of the product or they’ll receive the product for free for an extended period of time after the launch.

3. Create your interview questions.

This is an important step because the way you frame your questions can have a strong influence on how your target users perceive your product concept.

We recommend you focus your questions not on your product but on the problems facing your target users and how they currently deal with those problems today. Use open-ended questions. They let your interview subjects answer the topics in their own words.

For more guidance on interviewing, read our blog post on how to create customer interview questions .

4. Conduct the interviews.

You can generate viable market-validation findings from only a handful of in-depth interviews, assuming you have identified the right people to speak with. The more interviews, the greater the sample size, the better. That way you can see the broad patterns or even discover new problems for these personas that you hadn’t considered.

We recommend a single product manager lead these interviews because typically the product manager will have the deepest knowledge in the organization about the target persona, the market, and other important strategic details. But if you have lined up too many interviews for a single person to conduct—a high-quality problem to have—you can also share the responsibility with another product manager or even a product marketing manager.

It is very important, though, to make sure everyone running a market validation interview starts with the same questions. Then eventually each conversation will take its own path. That’s okay. But you need to make sure that each interview also yields answers to the same questions, so your team can intelligently analyze the data.

5. Make sense of the data.

After you’ve conducted all of your interviews, pull together the details of each to help you answer the key question:

Did the market validate my product concept as viable and worth investing in?

Look for patterns in the answers, such as:

- Your product solves a large enough problem that the market would pay to resolve it.

- Your target users haven’t found another solution yet to this problem.

- The industries you are targeting with this product concept do indeed have a budget to spend on addressing such issues.

If you find a trend of answers like these, congratulations, you might have a market-validated product concept! At this point, you’ll want to summarize this data in an easy-to-understand format. This can help you earn approval and enthusiasm from your executive team, your company’s other stakeholders across departments, and investors.

Market validation: no product development should begin without it

Many organizations are so enthusiastic about their revolutionary product idea that, in their rush to bring it to market before another company beats them to it, they skip the market validation process and jump straight into product development.

However, there might be a good reason that a competitor hasn’t already developed a similar concept. It might not have a large enough total addressable market. Perhaps most target users view the product as a “nice to have” but not worth paying for. Those users might already have another solution to the problem—one that doesn’t require any product. Or maybe the market has seen several failed solutions and is now unwilling to give a new product a try.

Your organization shouldn’t spend a significant amount of time or money developing a product that would fail. To ensure this doesn’t happen, you should always conduct market-validation research early-on in the concept stage of any new product. Uncover any problems before they become costly development mistakes!

Try ProductPlan Free for 14 Days

Share on mastodon.

- UX Consulting

- Industry Spotlight

- Competitor Differentiation

- Moderated Testing

- Unmoderated Testing

- Quantitative Testing

- Website Usability Testing

- Mobile App Testing

- Prototype Testing

- Accessibility Testing

- Multi-Channel Testing

- Branching Logic

- Participant Recruitment

- Private Label

- Think Aloud

- Content Testing

- Information Architecture

- Surveys & Quant Usability Testing

- Advanced Methodologies

- X-Second Test

- AI UX Analysis

- ULX Benchmarking Score

- Sentiment Analysis Tools

- Video Analysis Tools

- System Usability Scale

- BioSensor Tracking

- Whitepapers

- Case Studies

- Press Releases

- Help/FAQ Clients

- Help/FAQ Testers

- Get Paid to Test

- > Client Login

- > Tester Login

How to Do Market Validation – The Ultimate Guide

In this blog post, you will find: 1. What Is Market Validation? 2. Why Is Market Validation Important? 3. How To Do Market Validation? 4. What Is Lean Market Validation? 5. Conclusion – Key Takeaways

Launching a new product is no easy task -much can be lost between conception and reality. Companies today invest heavily in market research and intelligence, a distribution strategy, and a myriad of aspects that will ensure their new creation lands in the hands of their ideal customers.

However, there is one critical step that can save firms millions of dollars and help them gauge the feasibility of a product: Market validation. This is where dreams meet reality, and where brilliant concepts meet the verdict of the market.

In this blog post, we dive deep into what market validation is, why it matters, and most importantly, how to do it right.

What Is Market Validation?

Market validation, often referred to as product or market validation, is the process of testing and confirming the feasibility and demand for a product or service in the marketplace.

It is a critical step for entrepreneurs, startups, and businesses to determine whether their business or product idea is likely to succeed before investing significant resources.

Market validation involves collecting data and feedback from potential customers, target audiences, or relevant stakeholders to assess the viability and attractiveness of a business concept.

With market validation, you can answer the following critical questions:

- Is there a market need? Market validation aims to identify if there is a genuine problem or need that your product or service can address.

- Is there demand? It seeks to determine whether there is sufficient interest and demand for your offering within the target market.

- Is your solution viable? Market validation assesses if your proposed solution is practical, feasible, and likely to meet the identified needs.

- Can it be profitable? It evaluates the potential for profitability by examining pricing, cost structures, and market size.

Market validation typically involves a range of activities, such as conducting surveys, interviews, focus groups, and pilot tests. It may also include analyzing industry trends, competitive landscapes, and economic conditions.

The process helps entrepreneurs and businesses gather essential insights that guide decision-making, refine their business plans, and make informed choices about resource allocation, market entry, and product development.

Why Is Market Validation Important?

Market validation is a critical process for any company of any size. It helps reduce the risks associated with bringing a new product or service to prospective customers.

It provides valuable data and helps gain feedback on your product concept to make adjustments, pivot business ideas, or even decide not to proceed if the evidence suggests it’s not viable.

Conducting market validation tests can increase the likelihood of building a product that has a higher chance of success in the marketplace and turning prospects into paying customers -whether it’s a startup idea or a big company effort.

How to Do Market Validation?

Whether you’re a seasoned entrepreneur or just getting started, the principles of market validation will empower you to transform your concepts into thriving realities.

In this sense, the market validation process must be thorough and include critical variables and steps for it to be successful.

1. Define Your Target Market

Identify the specific group of people or businesses that your product or service is intended for. Understanding your target audience is crucial for effective validation.

To define your target market effectively when conducting a market validation test, start by thoroughly understanding your product or service. What problem does it solve? What are its features and benefits? What are its unique selling points (USPs)?

Then, do a segmentation. Divide the broader market into smaller, more manageable segments. Consider factors like demographics –age, gender, location– psychographics –lifestyle, values– and behavior –buying habits and brand loyalty. Segmentation helps you focus your efforts on the most promising groups.

Finally, create buyer personas for each segment. A buyer persona is a fictional representation of your ideal customer within a specific segment. It includes demographic information, pain points, goals, and preferences.

2. Research Your Market

Conduct thorough market research to gain insights into your target market. This includes analyzing market size, market demand, growth potential, competition, and current trends. You can use tools like surveys, online research, or industry reports to gather data.

Also, Clearly define the boundaries of your target market. Specify the geographic region, customer demographics, and any other relevant criteria that make up your market.

Collect data from multiple sources, including government statistics, industry reports, market research firms, and online databases. Look for data that is specific to your defined market boundaries and estimate the Total Addressable Market (TAM).

TAM represents the entire market for your product or service if there were no limitations or competition.

3. Create a Minimum Viable Product (MVP)

Develop a simplified version of your product or service, known as a Minimum Viable Product (MVP). The MVP should have enough features to test your core value proposition.