- Book a Demo

- Segmentation research

- Shopper Insights

- Customer Experience

- Customer journey mapping

- Brand positioning and differentiation

- Ad and creative testing

- Proposition development

- Product testing

- Concept testing

- Usage and attitude surveys

- Inclusive by design

- Social and consumer research expertise

- All articles

- Online Qual

- Market Research

- Strategic Thinking

How to conduct customer segmentation market research?

Qualitative research enables you to understand your customer base in detail, to explore the feelings and beliefs that lie behind their decisions and behaviour, and to identify the factors that are most likely to differentiate the different customer groups that you would like to target.

Brand research: what, why and how

Regardless of how much time you spend developing a brand strategy and planning your brand identity down to the last detail, all that matters, in the end, is consumer perceptions. In this article we explore different types of brand research, as well as the multiple methods you can choose to accomplish your brand research objectives.

Featured Stories

- Concept Testing: Turning your idea into a valuable asset

- Usage and attitude research: what is it and why do you need it?

- Mapping customer journeys: The role of qualitative market research

- How to build a powerful customer insight strategy

- Using Projective Techniques in Online Qual

- All resources

- How to Guides

- Webinars & Videos

- Together™ Help Centre

- Free Templates

Designed for use with our online qual research platform Together™, our activity templates include a range of activities, from warm-ups and ice-breakers, to deep cultural immersion projects and concept testing.

Conducting research with diverse and multi-cultural consumers

To deeply understand diverse and multi-cultural audiences requires deep expertise and an enabling approach. This guide contains the principles and approaches Further’s award-winning research team use to gather and activate insight and evidence for greater inclusion and equality.

Featured Content

- Understanding the male grooming category

- Using insight to develop a disruptive insurance proposition

- DEMO - An introduction to Further's Online Qual Platform Together™

- Research Briefing Template

- 10 essential tips for analysis and reporting

- Essential Guide to Mobile Ethnography

- Consumer Understanding

- Brand and Communications

- Innovation and NPD

- Case studies

- There are no suggestions because the search field is empty.

7 core skills for project management in market research

One of the most important attributes for a research project manager to have would be the ability to execute any project with an unwavering view of the research objectives and how to best achieve them.

In order to deliver the best results, a market research project must be planned, scoped, and executed carefully. Ultimately, it is the research project manager who ensures that everyone (and everything, including all team members) stay on track. Project managers ensure that everyone has focus and remains accountable for their agreed responsibilities to guarantee the project's success.

Project managers are found in practically every industry and company, from financial services and software engineering to marketing and product development. The market research industry is no exception. Managing a successful research project depends on the inputs and outputs of dozens of elements.

If you are looking for your next challenge, to progress in your team, or just to hone your skills as a research project manager, then the following seven skills are must-haves:

1) Ask questions & challenge assumptions

Most market research projects involve many, many moving parts. A good research project manager must understand both the high-level details and the more granular aspects of any brief. You can’t come by this knowledge passively: it’s critical to seek it out by asking questions in order to identify assumptions that might turn into future problems.

A big part of project management is thinking about the possible risks and challenges which might arise on a project – by pre-empting these, you can mitigate the risks and hopefully avoid them altogether.

A good framework for structuring questions is to think about the:

- what,

- when,

- Who / how many, and,

The what : fundamentally, what are we doing this study for? What are its aims and objectives? A client briefing is key from a project manager's perspective, more detail is always preferred over less. If you haven't got a client briefing document - you're welcome to download have ours!

The how. In research terms, this is the methodology (quantitative or qualitative). Examples: In-Depth Interviews (IDIs), surveys, or research communities.

The when. When must the project be delivered? There will be multiple milestones to think about and plan within a research project, such as briefing, design, fieldwork, analysis, reporting, and debrief. All of these aspects must be meticulously documented and planned out.

The who / how many . Who are we looking to speak to for this research, who is our target audience? What are the participant recruitment and screening requirements?

How much . What is the project budget? How does this translate in terms of allocation of cost for different aspects of the work, different tasks within the business (direct vs indirect costs) etc. If this hasn’t been thought about, it should!

2) Develop and document research project goals

The more granular you can be with milestones and outcomes, the better.

There’s the overarching research objective, but you should have subgoals within all aspects of the project, and these subgoals or milestones should always be written down and accessible to all relevant parties.

Documenting goals keeps things organized

Once you have a goal and its subset of milestones, it can be much easier to plan a work-back towards achieving the goal. Teams that have this information understand what they’re working toward, and how far they may be to achieving the goal.

Documenting goals allows for better project analysis

A market research project can be a complex beast. Reimagining it as a series of related and interconnected goals can help give it a shape, and allow you to find areas to improve. For example, if you notice that one team happens to have a disproportionate amount of goals piled up in one week, you’ve identified a potential bottleneck ahead of time.

Documenting goals create reusable templates

Your next project might benefit from reusing parts of a previous goal structure that worked well. This time-saving approach isn’t possible if you don’t have a good record of your goals!

3) Budgeting

A massively important part of the project management function is resource planning and budgeting.

Laissez faire attitudes can creep into many stages of the study, such as the all too common “As long as it gets delivered and the client happy, it’s okay!”

Projects need to be understood and scoped in terms of their financial performance, usually expressed as direct and net costs.

- Direct (gross) costs – what external costs need to be paid? Usually, these are to third parties such as recruiters or freelancers, but could also include costs such as equipment, venue hire, or travel expenses.

- Net costs – the cost of internal staff time. These are not as easy to measure as direct costs unless a business maintains timesheets (few do). However, by keeping an accurate track of time you can identify patterns around profitability.

Three budgeting tips:

1. Always request a formal set of costs from suppliers.

When doing this, include the full scope of the what, who, how, when—so they can tell you the ‘how much.’ If you have a firm and clear scope agreed with your client and they then try and change it, you have room to push back. But if you don’t, your agency may be forced to absorb any extra costs.

2. Negotiate preferred rates.

Look at how much you are spending with your suppliers and how much work goes their way.

3. Set up a costing or budget sheet for all projects.

This internal document lays out the charge to the client, and the budgeted direct costs. All of these costs ideally have been confirmed in a request for costs at the proposal stage. You then are clear on how much you have to work with for discussions with suppliers.

4) Be diligent and steadfast regarding sampling and screening

The biggest risk to the success of your research project (and the one with the biggest impact on cost recruitment.

To keep your project and budget on track it is imperative that recruitment goals are documented in writing, explained, discussed and understood.

The most common project management slips are in ‘who and how many’ (which impacts cost), and ‘when’ (which impacts cost and resource planning). If you speak to the wrong people the end result will be the wrong insight and more time will be wasted on finding replacement participants. If recruitment goes wrong thanks to incorrect specifications, the entire project may be derailed.

Your sample sources and screening criteria are the two key elements in preventing a recruitment mishap.

Keeping this under control involves:

- A thorough client briefing

- A form statement of work from the client

- An unbroken chain of communication and understanding for all involved teams

- Skill #2 (documentation of goals) is paramount! Write everything down and spend extra time making sure that everything is clear.

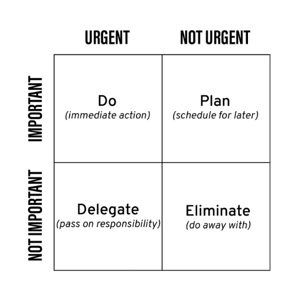

5) Always have a Plan B (and C… and D…)

Contingency plans are an absolute necessity for any project manager. Thinking about the possible risks and challenges associated with market research projects is half the battle. You must also have a clear response and approach to when (inevitably) you experience a setback.

Much of this comes with experience, but common pitfalls include:

- Scope creep. Someone wants just one extra thing. Someone makes a backchannel promise to look at X. One thing leads to another and it starts to snowball. Your original scope is now somehow 20% bigger.

- Underestimating the difficultly of the recruitment target. Using panels can be faster (and cheaper) than recruiting via a fieldwork agency but may not be right for all projects, consider this when building screeners and briefing your recruitment agencies or asking them for costs. Remember certain specs may be harder, faster, or slower than first assumed.

- Data protection and privacy. The world is increasingly more digital. Market research can make use of brilliant technology, but those technologies can come with their own set of challenges.

- Real life timing. Holiday periods or other events can throw a wrench into things if you’re not careful.

6) Communication skills

Thinking about your typical research project lifecycle, there are often large numbers of people involved:

- the client,

- client team,

- researchers,

- project managers,

- fieldwork execs,

- interviewing staff,

- 3 rd party suppliers,

- And more (the list can be quite long).

With all these different people involved, it is important that teams talk to each other and that correct and necessary information is communicated at the various stages.

Sharpening your skills in various aspects of communication will help with navigating this maze.

Asynchronous communication

When you all can’t speak at the same time, there are many ways to keep the conversation going.

- Email is the most common. Avoid creating massive chains with everyone copied. Make use of highlighting or bolding to get key points across. Try to include specific next steps.

- Video messages. An often underused tool, short video messages can be way more effective than a long, dry email. Tools like Loom make creating and sending them easy.

Synchronous communication

Synchronous communication is a fancy term for a real-time call or a meeting. Making sure that meetings have clear agendas, goals, and boundaries makes all the difference. Avoid inviting people to a call who do not need to be there (a recording can be shared afterward).

Someone should always be taking meeting notes, and these notes should be reviewed and formatted in a consistent manner before being widely shared.

7) Expectation management

People are full of assumptions and preconceived notions. This goes for both internal and external stakeholders.

If you’re not explicit in what is expected of them or what to expect, they will absolutely invent an expectation. And if the project doesn’t meet that expectation, well, that’s when things can get tough.

If you’ve asked the right questions and have been documenting properly, expectations are much easier to manage. Clear communication, strong and thorough briefs, and making sure everyone in the chain signals understanding: these tactics will help make sure everyone is on the same page.

8) Have a knack for insights and data storytelling

Market research outputs must be actionable insights for clients, and those insights come from the intelligent capture, interpretation and analysis of data.

As the project manager, you are often a gatekeeper of information and an important quality assurance checkpoint. While you may not be the person in charge of the research study itself, you will touch most things that happen internally and get passed over to external clients.

Therefore, having an eye for insights and how to tell a story from data can elevate the entire project, as you can often take the role of:

- Simplify findings and data-points into key takeaways (e.g. for an executive summary)

- Be an extra set of eyes on the data before it changes hands

- Express the more technical (yet important) aspects of market research in client-friendly terms

Launch an online qual market research project with Further

The article above was inspired by the market research project managers here at Further. They are the beating heart of our organization. Whether you need help with study design, onboarding, platform training, or maximizing data management, we can ensure optimum respondent engagement, high-quality deliverables, and more insightful results.

We make it as easy as possible for you to DIY programme our platform, but it is a lot easier for us to program and optimize your study guide and let you take it from there. We offer you the option to manage your project yourself or to have one of our experienced project managers guide you, your clients, and your respondents through the entire process.

Our tutorials or live training are a fast and effective way for you and your clients to become more familiar with our platform. Check out our help centre here.

Learn more about how we can help with online qual market research here.

Topics: Market Research , Project management

ARTICLE CONTENTS

Ask & challenge assumptions

Develop and document research project goals

Be diligent and steadfast regarding sampling and screening

Always have a Plan B (and C... and D...)

Communication skills

Expectation management

Have a knack for insights and data storytelling

Launch an online qual market research project with Further

Discover our platform and services

Platform-only.

The insight platform for online qual, research communities, digital diaries, ethnography and more.

Services & Support

A range of expert research services and resources to help you deliver your projects with ease, speed and reach.

Human insight with impact; leveraging our academic and industry experts to uncover insight, create impact and make confident decisions.

You may also like…

Do you make it easy for customers (and potential customers) to engage with your brand? Are your products and services answering the key needs of your market?

Published 28 Oct 2021 6 minutes -->

Concept testing is a research method that involves asking customers questions about your product or service before launching it. It helps determine whether or not your target audience would be ...

Published 29 Sep 2021 7 minutes -->

We were amazed at the level of insight we achieved in just a week. Further opened our eyes to new ways of researching and understanding our staff

We helped Conde Nast International define a new global mission and vision statement

Further really understood the brief and were extremely proactive. We are now very confident that we’re taking the right products and proposition to market.

We helped this insuretech startup tailor their customer value proposition for the UK market ahead of a planned launch

Further's expert team pushed us to clarify our assumptions and to think harder about how to communicate the value of our products and services

We helped Keyhouse enter a new market and understand what target users of their case management software needed and how to position their offer

Working with Further was a refreshing and eye-opening experience…...the qualityof their output which was excellent.

We helped Unicef generate insights to support the development of a mass market, sustainable fundraising product.

Strategically, Further’s insights provided clear and directional answers that will guide us through our next phase of growth

We helped Zwift understand users and non-users needs and wants so they could prioritise their innovation pipeline

We helped Chilly’s leadership team consider new ways to understand and co-create with their customers’

%20(1).webp)

We helped disruptive pet insurance company Waggel develop customer personas and map out the current and intended customer journey.

Browse our site, download our resources, request a demo of our platform or speak to one of our experts

@ Copyright Further 2024

Further is a division of Youmeus Limited

© Copyright Further 2024

- Contact sales

Start free trial

A Beginner’s Guide to Market Research

Business creates goods or services and delivers them to a market that buys or uses them for a fee. Everyone’s happy! That’s the way it’s supposed to work, but anyone who has tried to make a living in the real world has experienced the complexities inherent in such a simple formula. There are many variables to consider in marketing , but let’s just focus on the marketplace and the research required to understand it.

The market can be a small or vastly large group of people who need goods and services. They’ve got money in their pockets and businesses are looking to have them use it to purchase their product or service. But that’s a very general sketch of a process that requires a lot more specifics.

How does a business gather the data they need to understand the needs and wants of the market, and who they should be targeting when developing ideas, advertising and marketing projects ? That’s not so easy—especially from the perspective of a cubicle.

There’s a world outside the office and businesses need to know it intimately if they’re to offer something that the world wants. Whether it’s a delicious meal or a product people don’t even know that they want yet, this process starts with market research.

What Is Market Research?

Market research is shorthand for talking about an organized effort to gather information about customers. It’s a way to profile and target people to know what they desire or what they need, so businesses can exploit that and produce it to their satisfaction. Market research is a relatively young discipline. It began to be conceptualized and practiced in the 1930s, and it grew out of the boom in radio in the United States at that time. Advertisers learned that listener demographics were crucial to companies that sponsored different programs.

Market research is a cornerstone on which a business strategy is built, market research being about specific markets while the larger business strategy is about the process of marketing. Market research is fundamental to keeping businesses competitive as it analyzes the needs, size and competitors in the marketplace, so companies can make strategic decisions.

Related: 10 Marketing Tips for Small Businesses That Cost $0

Types of Market Research

There are various techniques to market research. Some are qualitative and use focus groups, in-depth interviews and ethnography, while others are quantitative, which involve customer surveys and analysis of secondary data.

Primary research is when the effectiveness of sales, existing business practices, quality of service and communications are monitored and reported on. This helps the business understand the competition and evaluate a strategic business plan to take advantage of the market.

Secondary research uses data that has already been published and is collected in a new database to help with situation analysis. From this, businesses can develop strategies for benchmarking and targeting specific market segments.

Why Market Research Is Important

Market research is important for the obvious reason that without it, a company is firing blindly into the void. You can create a great product or service, but without knowing who to sell it to it will whither on the vine and die.

Related: How to Plan a Successful Product Launch

There might have been a time when market research wasn’t as necessary when there was less competition and so customers could find your product or service. But that time has long since passed. The more knowledge a company has about the market and the customer’s needs within that market, the more likely it’ll have success.

There are many reasons why businesses should conduct market research. It helps to identify problem areas in your business. You can’t resolve a problem until you first know what it is.

Customer Satisfaction

It’s not just about selling products and services. Market research is also important in that it helps increase customer satisfaction. That means businesses retain more customers and their brand is less likely to be tarnished by false steps and miscalculations. By using tools like surveys for customer feedback , you’re also going to understand the needs of your existing customer base. It’ll help you to know why they’ve chosen your company over your competitors, which will allow you to better serve them.

Campaign Effectiveness

Using market research is one way to help marketing campaigns be more effective. It identifies new business opportunities and then designs the best marketing push to capture the target audience. This is a sure-fire method of increasing sales, which is the backbone of business success.

Knowledge of Competitors

There’s also the benefit of having a bead on what your competitors are up to in the marketplace. It can be used to evaluate your progress but also what your competitors are up to and how they are expanding or not in the market. Knowing what your competitors are up to will offer insight into how you want to strategically place yourself in the market to stay ahead of them.

Market research is also a way to reduce and often avoid loss. If you know the landscape well before you launch a product or service, you will be aware of hurdles to clear and problems to avoid. You’ll also have a better idea of the risks involved in bringing something to market and therefore be able to work on solutions for those risks if they in fact arise.

Related: Free Risk Tracking Template

Business Opportunities Revealed

Then there are the business opportunities that arise from market research. These are new areas that a business might have been ignorant of before and now can exploit for greater market penetration and profits. It will also highlight areas where the business can expand and increase its customer base. New customers can also be discovered through market research, further expanding the company’s reach. Gap analysis is one method that can be used to evaluate how well a service is performing versus its potential.

Set Targets for Growth

Another reason for businesses to conduct market research is that it allows them to set achievable targets for growth, sales and product development. It provides businesses with information that helps with the decision-making process about services and effective product development strategies.

How to Conduct Market Research

There are many ways to get the data you need for market research. Some of them include starting with a business’ own employees. They’re in the front with customers and can offer valuable insight.

Customers can be tapped with comment cards that ask basic questions. Talking to your existing customer base through the web, email, snail mail, telephone surveys or in-person with focus groups is one of the best ways to know what they want and need. You can also track what customers are buying and not buying from you through documentation and records. Be sure to get a firm grasp of your fundamental digital marketing metrics .

In terms of secondary sources, there are resources such as the census bureau, the local chamber of commerce, the department of commerce, libraries, trade and professional organizations and publications.

The process of conducting market research follows these six steps.

1. Define Your Buyer

Before you can sell something, you must know who you’re selling to. What’s their age, gender, location, what do they do for a living, how big is their family, what’s their income, etc? The more data you can get, the better targeted your marketing campaign will be.

Now that you have a profile, you want to find a representative sample of those targeted customers to understand their characteristics, challenges and buying habits through focus groups, surveys, phone interviews, etc.

Related: The Importance of Customer Development for Startups

2. Choose Which Buyers to Survey

When gathering customers for your surveys, you’ll want to get a group that represents each buyer persona you have come up with. It’s good to have a mix of people but you can choose one person if you think that’s best.

Make sure whoever you choose is someone who has recently interacted with you and your competitor and even those who are not interested in purchasing from either. This widens the lens and gives you a more accurate view of the marketplace.

3. Engage the Participants

For the data collected to be accurate and usable, you must engage the participants, whether they’re the ideal panel or not. Try to get a list of customers who made recent purchases.

There are also those customers who purchased from competitors or were close to choosing your product or service but didn’t. You can reach out to participants on social media, leverage your existing network or create an incentive to participate.

4. Prepare Questions

Once you have a group, you must do your due diligence and have targeted questions that have been worked on to get the most out of the audience and help you with the problem at hand, otherwise, you’re wasting everyone’s time.

You want the discussion to be natural and conversational, not scripted. However, it should include a short backgrounder, followed by a short response from the audience on their opinion or problems with the product or service. Then, take a deep dive into buyer researched potential solutions (make this interactive, following up and interjecting more specific queries). Wind down with decisions from the group, and close by opening up for questions and thanking the people there.

5. Know Your Competitors

They’re doing the same thing as you, so the more you understand them and how they act, the better you can respond and exploit areas that they’re not exploring. Also, competition is complicated. It can be a whole company or a division within that you’re competing with. But you must list the competitors and always be aware of them.

6. Summarize Your Findings

Now comes the time to crunch the numbers and look for common threads that run through the data you collected. It can be overwhelming at first, all that information, which is why it’s wise to boil the work down to the essential findings. These make actionable points.

Break your final report into sections: background, participants, executive summary for the main points, awareness of the common questions, consideration for the themes you uncovered, how the group came to decide, and finally an action plan on how to move forward with the information you gathered.

Market research is a project, and projects need tools to manage them. ProjectManager is a cloud-based project management software that has a robust dashboard that can collect, crunch and deliver the market research you gather in easy-to-read and share charts and graphs. Plus it features task management tools like Kanban boards and task lists to keep the project moving forward. See how it can help you make sense of your market research today by taking this free 30-day trial.

Deliver your projects on time and under budget

Start planning your projects.

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![market research in project management → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

What is a Competitive Analysis — and How Do You Conduct One?

![market research in project management SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

20+ Tools & Resources for Conducting Market Research

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![market research in project management How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![market research in project management 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![market research in project management 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- +91 882 625 4440

- [email protected]

Top Insights For Project Management In Market Research

The most important role of a project manager is to organize and execute the project with a demonstrated view to achieving the project’s objectives. In order to achieve effective results, it’s important to carefully plan, organize and execute the market research project. Eventually, project manager is the one who ensures that everyone and everything is on track. They also ensure that everyone has a focus and remains accountable for their roles and responsibilities.

Key Insights For Project Management

Managing a market research project depends on tons of research elements. If you are planning to execute an effective market research project , then the following top insights are essential:

Define Questions and Assumptions

Market research projects include many touchpoints. It’s important for a project manager to understand all the aspects in-depth, and keep track of all the possible risks and challenges that might appear on a project.

To understand all the aspects of a project, here are some key points that you should strictly consider such as:

- Ask about the client’s aims and objectives. Try to gain more insights into the purpose of the project.

- What would be the research methodology (such as Quantitative or Qualitative)?

- When should the project be delivered? It’s important in order to plan it in an effective way, such as designing, organizing, analyzing, and reporting.

- Who would be the target audience? What are the screening criteria and the participant requirements?

Develop Project Goals

Now, once you are clear with the goal and the method to achieve it, the next step is to organize it effectively. Allocate all the information to the team members to let them understand the way to work for the project. Developing research project goals results in better project analysis. It also results in finding the areas for improvement.

Resourcing, Planning, and Budgeting are the most important subjects of a project. The research project needs to be understood and specified on the basis of financial performance(expressed as gross cost and net cost).

Gross costs – What are the external costs that need to be paid? These costs are usually paid to third parties such as freelancers or recruiters, but it can also include equipment cost or transportation expenses(if any).

Net costs – What is the cost of internal staff time? Net costs are basically the direct costs that few companies maintain to track profitability.

Always Have An Alternative Plan

We might be familiar with the quote “If plan A doesn’t work, the alphabet has 25 more letters”. This is absolutely relevant for any project manager. Just having track of possible risks and challenges is not the end of the battle, you need to be ready with the backup. For example, recruitment of panels can be faster and cheaper than the third-party panel, but this methodology may not be right for all projects. So, it’s important to have an alternative plan to achieve effective results.

Conclave Research – Your Next Research Project Partner

Our highly trained and experienced team of project managers is always available for our clients and work with precision throughout the whole project to make sure that the client’s expectations are met and succeeded at every stage of the project. With a streamlined bid-to-launch process, we provide accurate and competitive pricing. We take pride in the capabilities of our team of experts to monitor and control any anomalies during fielding. Through effective communication, deep understanding, and meticulous project oversight, Conclave Research ensures you the best results from every research project.

Connect with us today…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

- Enhancing Data Collection, Processing, and Precision Insights with AI

- How to leverage and implement open-end questions

- The Power of Effective Survey Programming for market research projects

- The Future of Data Processing: Exploring the Latest Trends and Techniques

- Role of Survey Programming In Market Research

Recent Comments

- February 2022

- January 2022

- December 2021

- November 2021

- Data Collection Blog

- Market Research Consultant

- Online Survey Programming Blog

- Project Management Blog

- Uncategorized

- Qualitative Research

- Quantitative Research

- Strategic Stewardship & Consulting

- Brand Development

- Future Forecasting

- Brand Experience Strategy

- Stakeholder Workshops

- Sensory Science

- Advertising

- Brand Research

- Product Development

- Customer Experience

- Brand Health Score

- Insights Assessment

- Healthcare Experience (Hx) Index

- System 1 Research Methods

- System 2 Research Methods

- Case Studies

Three Project Management Tips for Market Research

- Select a Topic

- Market Research

- Consumer Insights

- Research Methods

- CPG Market Research

- System 1 Methodology

- System 2 Methodology

Stay up to date

Search the blog.

Anna Plaisance

With multiple projects underway, it can be difficult to prioritize tasks, manage workloads and meet deadlines while staying within budget. Here at MDRG , we juggle an average of 15-20 fast-paced, custom qualitative and quantitative market research projects at any given time. That's why we have a project manager — the gate keeper of all our projects!

Deadlines missed, unorganized processes and not meeting profit margins: these are some of the risks you take when you don’t have a project manager. Quality research — and, therefore, happy clients — doesn’t happen by accident. They are a result of carefully planned projects committed to end-to-end quality control.

That’s why we’ve crafted three tips to consider for the optimal outcome when managing your team’s market research projects:

Plan, develop and scope research needs ahead of time. Like many industries, market research opportunities start in the proposal phase. By taking the time to properly prepare and plan, you set your team up for success should you (hopefully) win the work. This includes first gathering details on:

- Research objectives and methodology

- Target audience and sample plan

- Timeframes and milestones

- Nuanced logistics

- Overall expectations

You also need to carefully consider which partners and/or platforms will help best in achieving your goals. Then, you can begin to estimate the overall budget. At MDRG, we estimate hard costs paid to external vendors and soft costs based on hourly estimates for specific tasks (i.e., questionnaire development, programming, analysis, etc.). Once you’ve properly scoped the project, you can sit back and relax until the work begins.

Track progress over the duration of a project and flag potential risks. Once a project begins, project managers should schedule an internal kick-off to set expectations and align with the team on overall deliverables, timing and budget that were scoped during the proposal phase. As the research progresses, a good project manager should frequently schedule check-ins and reviews with the team to ensure certain milestones are being met in a timely, cost-effective and quality manner. As such, part of this is identifying and flagging potential risks – and escalating problems when necessary. After all, collaboration is key to problem solving!

Bonus tip: As you problem solve, document any areas of opportunity that can be adopted as a formal process for efficiency moving forward.

Consider a project and/or time management tool that will work best for your needs. To our last couple points, using project and/or time management tools can help you achieve overall project success. Project management tools – such as Asana, Smartsheets or Hive (our personal favorite) to name a few – are a great resource for keeping track of even the smallest project details and deadlines. As mentioned, part of MDRG’s scoping process is to estimate internal hours and then track actual hours as projects progress. In order to do so, our team inputs weekly timesheets into Hive that the project manager can easily pull hours from to check against the budget. We suggest that you identify and compile a list of what’s important to your company. Then you can formally vet tools against the checklist so you can choose project/time management software that works best for your needs!

At MDRG, we’re dedicated to the quality of our work, and we hope that these tips can help to ensure that your next market research project is successful!

Submit a Comment

Get latest articles directly in your inbox, stay up to date.

- Core Competencies

- How We Do It

(504) - 821 - 1910

Write a brief description of your company or services here. keep it short but make it interesting enough to make user want more.

Important Links

- Default HubSpot Blog

+123 456 7890

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.

How Smallpdf did it: Smallpdf ran an on-page survey for a couple of weeks and received 1,000 replies. They learned that many of their users were administrative assistants, students, and teachers.

Next, they used the survey results to create simple user personas like this one for admins:

Who are they? Administrative Assistants.

What is their main goal? Creating Word documents from a scanned, hard-copy document or a PDF where the source file was lost.

What is their main barrier to achieving it? Converting a scanned PDF doc to a Word file.

💡Pro tip: Smallpdf used Hotjar Surveys to run their user persona survey. Our survey tool helped them avoid the pitfalls of guesswork and find out who their users really are, in their own words.

You can design a survey and start running it in minutes with our easy-to-use drag and drop builder. Customize your survey to fit your needs, from a sleek one-question pop-up survey to a fully branded questionnaire sent via email.

We've also created 40+ free survey templates that you can start collecting data with, including a user persona survey like the one Smallpdf used.

2. Conduct observational research

Observational research involves taking notes while watching someone use your product (or a similar product).

Overt vs. covert observation

Overt observation involves asking customers if they’ll let you watch them use your product. This method is often used for user testing and it provides a great opportunity for collecting live product or customer feedback .

Covert observation means studying users ‘in the wild’ without them knowing. This method works well if you sell a type of product that people use regularly, and it offers the purest observational data because people often behave differently when they know they’re being watched.

Tips to do it right:

Record an entry in your field notes, along with a timestamp, each time an action or event occurs.

Make note of the users' workflow, capturing the ‘what,’ ‘why,’ and ‘for whom’ of each action.

Don’t record identifiable video or audio data without consent. If recording people using your product is helpful for achieving your research goal, make sure all participants are informed and agree to the terms.

Don’t forget to explain why you’d like to observe them (for overt observation). People are more likely to cooperate if you tell them you want to improve the product.

💡Pro tip: while conducting field research out in the wild can wield rewarding results, you can also conduct observational research remotely. Hotjar Recordings is a tool that lets you capture anonymized user sessions of real people interacting with your website.

Observe how customers navigate your pages and products to gain an inside look into their user behavior . This method is great for conducting exploratory research with the purpose of identifying more specific issues to investigate further, like pain points along the customer journey and opportunities for optimizing conversion .

With Hotjar Recordings you can observe real people using your site without capturing their sensitive information

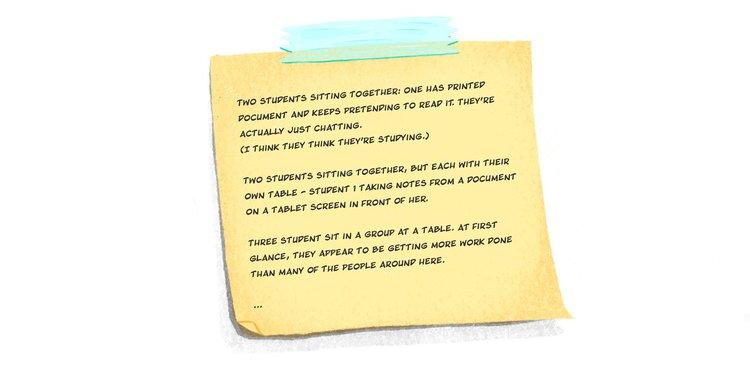

How Smallpdf did it: here’s how Smallpdf observed two different user personas both covertly and overtly.

Observing students (covert): Kristina Wagner, Principle Product Manager at Smallpdf, went to cafes and libraries at two local universities and waited until she saw students doing PDF-related activities. Then she watched and took notes from a distance. One thing that struck her was the difference between how students self-reported their activities vs. how they behaved (i.e, the self-reporting bias). Students, she found, spent hours talking, listening to music, or simply staring at a blank screen rather than working. When she did find students who were working, she recorded the task they were performing and the software they were using (if she recognized it).

Observing administrative assistants (overt): Kristina sent emails to admins explaining that she’d like to observe them at work, and she asked those who agreed to try to batch their PDF work for her observation day. While watching admins work, she learned that they frequently needed to scan documents into PDF-format and then convert those PDFs into Word docs. By observing the challenges admins faced, Smallpdf knew which products to target for improvement.

“Data is really good for discovery and validation, but there is a bit in the middle where you have to go and find the human.”

3. Conduct individual interviews

Interviews are one-on-one conversations with members of your target market. They allow you to dig deep and explore their concerns, which can lead to all sorts of revelations.

Listen more, talk less. Be curious.

Act like a journalist, not a salesperson. Rather than trying to talk your company up, ask people about their lives, their needs, their frustrations, and how a product like yours could help.

Ask "why?" so you can dig deeper. Get into the specifics and learn about their past behavior.

Record the conversation. Focus on the conversation and avoid relying solely on notes by recording the interview. There are plenty of services that will transcribe recorded conversations for a good price (including Hotjar!).

Avoid asking leading questions , which reveal bias on your part and pushes respondents to answer in a certain direction (e.g. “Have you taken advantage of the amazing new features we just released?).

Don't ask loaded questions , which sneak in an assumption which, if untrue, would make it impossible to answer honestly. For example, we can’t ask you, “What did you find most useful about this article?” without asking whether you found the article useful in the first place.

Be cautious when asking opinions about the future (or predictions of future behavior). Studies suggest that people aren’t very good at predicting their future behavior. This is due to several cognitive biases, from the misguided exceptionalism bias (we’re good at guessing what others will do, but we somehow think we’re different), to the optimism bias (which makes us see things with rose-colored glasses), to the ‘illusion of control’ (which makes us forget the role of randomness in future events).

How Smallpdf did it: Kristina explored her teacher user persona by speaking with university professors at a local graduate school. She learned that the school was mostly paperless and rarely used PDFs, so for the sake of time, she moved on to the admins.

A bit of a letdown? Sure. But this story highlights an important lesson: sometimes you follow a lead and come up short, so you have to make adjustments on the fly. Lean market research is about getting solid, actionable insights quickly so you can tweak things and see what works.

💡Pro tip: to save even more time, conduct remote interviews using an online user research service like Hotjar Engage , which automates the entire interview process, from recruitment and scheduling to hosting and recording.

You can interview your own customers or connect with people from our diverse pool of 200,000+ participants from 130+ countries and 25 industries. And no need to fret about taking meticulous notes—Engage will automatically transcribe the interview for you.

4. Analyze the data (without drowning in it)

The following techniques will help you wrap your head around the market data you collect without losing yourself in it. Remember, the point of lean market research is to find quick, actionable insights.

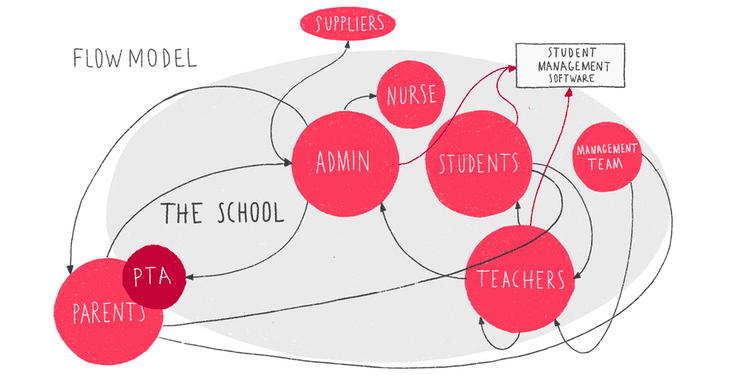

A flow model is a diagram that tracks the flow of information within a system. By creating a simple visual representation of how users interact with your product and each other, you can better assess their needs.

You’ll notice that admins are at the center of Smallpdf’s flow model, which represents the flow of PDF-related documents throughout a school. This flow model shows the challenges that admins face as they work to satisfy their own internal and external customers.

Affinity diagram

An affinity diagram is a way of sorting large amounts of data into groups to better understand the big picture. For example, if you ask your users about their profession, you’ll notice some general themes start to form, even though the individual responses differ. Depending on your needs, you could group them by profession, or more generally by industry.

We wrote a guide about how to analyze open-ended questions to help you sort through and categorize large volumes of response data. You can also do this by hand by clipping up survey responses or interview notes and grouping them (which is what Kristina does).

“For an interview, you will have somewhere between 30 and 60 notes, and those notes are usually direct phrases. And when you literally cut them up into separate pieces of paper and group them, they should make sense by themselves.”

Pro tip: if you’re conducting an online survey with Hotjar, keep your team in the loop by sharing survey responses automatically via our Slack and Microsoft Team integrations. Reading answers as they come in lets you digest the data in pieces and can help prepare you for identifying common themes when it comes time for analysis.

Hotjar lets you easily share survey responses with your team

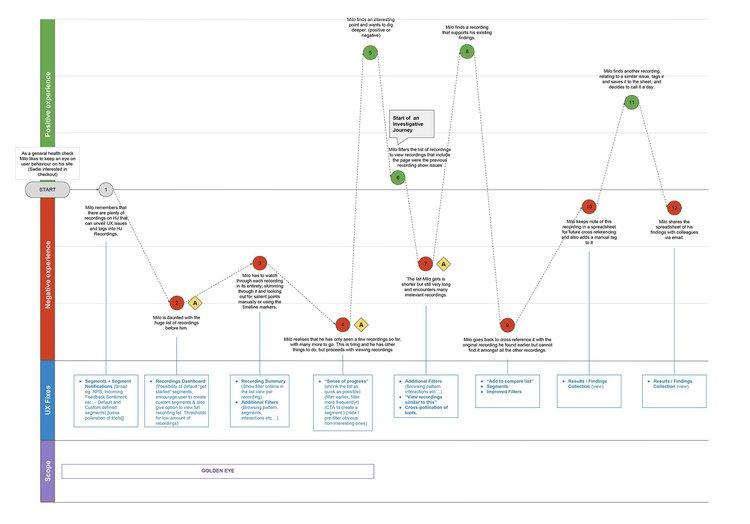

Customer journey map

A customer journey map is a diagram that shows the way a typical prospect becomes a paying customer. It outlines their first interaction with your brand and every step in the sales cycle, from awareness to repurchase (and hopefully advocacy).

The above customer journey map , created by our team at Hotjar, shows many ways a customer might engage with our tool. Your map will be based on your own data and business model.

📚 Read more: if you’re new to customer journey maps, we wrote this step-by-step guide to creating your first customer journey map in 2 and 1/2 days with free templates you can download and start using immediately.

Next steps: from research to results

So, how do you turn market research insights into tangible business results? Let’s look at the actions Smallpdf took after conducting their lean market research: first they implemented changes, then measured the impact.

Implement changes

Based on what Smallpdf learned about the challenges that one key user segment (admins) face when trying to convert PDFs into Word files, they improved their ‘PDF to Word’ conversion tool.

We won’t go into the details here because it involves a lot of technical jargon, but they made the entire process simpler and more straightforward for users. Plus, they made it so that their system recognized when you drop a PDF file into their ‘Word to PDF’ converter instead of the ‘PDF to Word’ converter, so users wouldn’t have to redo the task when they made that mistake.

In other words: simple market segmentation for admins showed a business need that had to be accounted for, and customers are happier overall after Smallpdf implemented an informed change to their product.

Measure results

According to the Lean UX model, product and UX changes aren’t retained unless they achieve results.

Smallpdf’s changes produced:

A 75% reduction in error rate for the ‘PDF to Word’ converter

A 1% increase in NPS

Greater confidence in the team’s marketing efforts

"With all the changes said and done, we've cut our original error rate in four, which is huge. We increased our NPS by +1%, which isn't huge, but it means that of the users who received a file, they were still slightly happier than before, even if they didn't notice that anything special happened at all.”

Subscribe to fresh and free monthly insights.

Over 50,000 people interested in UX, product, digital empathy, and beyond, receive our newsletter every month. No spam, just thoughtful perspectives from a range of experts, new approaches to remote work, and loads more valuable insights. If that floats your boat, why not become a subscriber?

I have read and accepted the message outlined here: Hotjar uses the information you provide to us to send you relevant content, updates and offers from time to time. You can unsubscribe at any time by clicking the link at the bottom of any email.

Market research (or marketing research) is any set of techniques used to gather information and better understand a company’s target market. This might include primary research on brand awareness and customer satisfaction or secondary market research on market size and competitive analysis. Businesses use this information to design better products, improve user experience, and craft a marketing strategy that attracts quality leads and improves conversion rates.

David Darmanin, one of Hotjar’s founders, launched two startups before Hotjar took off—but both companies crashed and burned. Each time, he and his team spent months trying to design an amazing new product and user experience, but they failed because they didn’t have a clear understanding of what the market demanded.

With Hotjar, they did things differently . Long story short, they conducted market research in the early stages to figure out what consumers really wanted, and the team made (and continues to make) constant improvements based on market and user research.

Without market research, it’s impossible to understand your users. Sure, you might have a general idea of who they are and what they need, but you have to dig deep if you want to win their loyalty.

Here’s why research matters:

Obsessing over your users is the only way to win. If you don’t care deeply about them, you’ll lose potential customers to someone who does.

Analytics gives you the ‘what’, while research gives you the ‘why’. Big data, user analytics , and dashboards can tell you what people do at scale, but only research can tell you what they’re thinking and why they do what they do. For example, analytics can tell you that customers leave when they reach your pricing page, but only research can explain why.

Research beats assumptions, trends, and so-called best practices. Have you ever watched your colleagues rally behind a terrible decision? Bad ideas are often the result of guesswork, emotional reasoning, death by best practices , and defaulting to the Highest Paid Person’s Opinion (HiPPO). By listening to your users and focusing on their customer experience , you’re less likely to get pulled in the wrong direction.

Research keeps you from planning in a vacuum. Your team might be amazing, but you and your colleagues simply can’t experience your product the way your customers do. Customers might use your product in a way that surprises you, and product features that seem obvious to you might confuse them. Over-planning and refusing to test your assumptions is a waste of time, money, and effort because you’ll likely need to make changes once your untested business plan gets put into practice.

Lean User Experience (UX) design is a model for continuous improvement that relies on quick, efficient research to understand customer needs and test new product features.

Lean market research can help you become more...

Efficient: it gets you closer to your customers, faster.

Cost-effective: no need to hire an expensive marketing firm to get things started.

Competitive: quick, powerful insights can place your products on the cutting edge.

As a small business or sole proprietor, conducting lean market research is an attractive option when investing in a full-blown research project might seem out of scope or budget.

There are lots of different ways you could conduct market research and collect customer data, but you don’t have to limit yourself to just one research method. Four common types of market research techniques include surveys, interviews, focus groups, and customer observation.

Which method you use may vary based on your business type: ecommerce business owners have different goals from SaaS businesses, so it’s typically prudent to mix and match these methods based on your particular goals and what you need to know.

1. Surveys: the most commonly used

Surveys are a form of qualitative research that ask respondents a short series of open- or closed-ended questions, which can be delivered as an on-screen questionnaire or via email. When we asked 2,000 Customer Experience (CX) professionals about their company’s approach to research , surveys proved to be the most commonly used market research technique.

What makes online surveys so popular?

They’re easy and inexpensive to conduct, and you can do a lot of data collection quickly. Plus, the data is pretty straightforward to analyze, even when you have to analyze open-ended questions whose answers might initially appear difficult to categorize.

We've built a number of survey templates ready and waiting for you. Grab a template and share with your customers in just a few clicks.

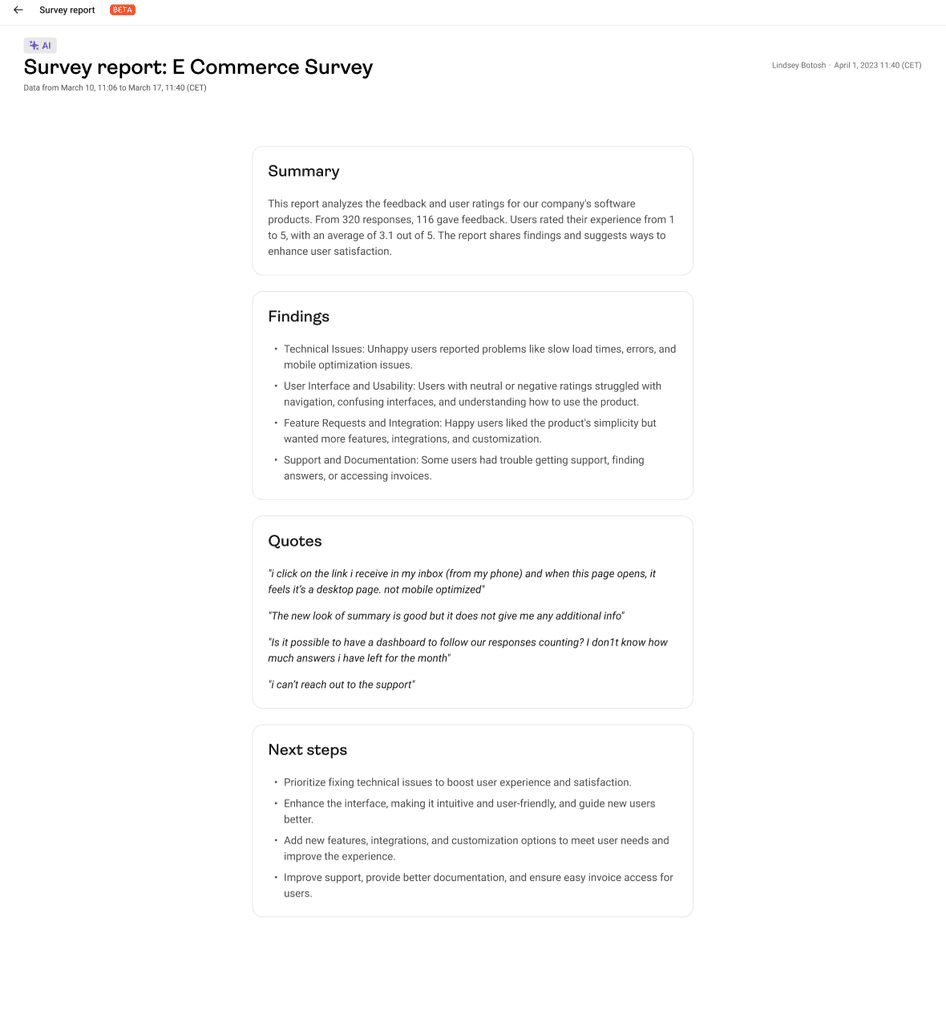

💡 Pro tip: you can also get started with Hotjar AI for Surveys to create a survey in mere seconds . Just enter your market research goal and watch as the AI generates a survey and populates it with relevant questions.

Once you’re ready for data analysis, the AI will prepare an automated research report that succinctly summarizes key findings, quotes, and suggested next steps.

An example research report generated by Hotjar AI for Surveys

2. Interviews: the most insightful

Interviews are one-on-one conversations with members of your target market. Nothing beats a face-to-face interview for diving deep (and reading non-verbal cues), but if an in-person meeting isn’t possible, video conferencing is a solid second choice.

Regardless of how you conduct it, any type of in-depth interview will produce big benefits in understanding your target customers.

What makes interviews so insightful?

By speaking directly with an ideal customer, you’ll gain greater empathy for their experience , and you can follow insightful threads that can produce plenty of 'Aha!' moments.

3. Focus groups: the most unreliable

Focus groups bring together a carefully selected group of people who fit a company’s target market. A trained moderator leads a conversation surrounding the product, user experience, or marketing message to gain deeper insights.

What makes focus groups so unreliable?

If you’re new to market research, we wouldn’t recommend starting with focus groups. Doing it right is expensive , and if you cut corners, your research could fall victim to all kinds of errors. Dominance bias (when a forceful participant influences the group) and moderator style bias (when different moderator personalities bring about different results in the same study) are two of the many ways your focus group data could get skewed.

4. Observation: the most powerful

During a customer observation session, someone from the company takes notes while they watch an ideal user engage with their product (or a similar product from a competitor).

What makes observation so clever and powerful?

‘Fly-on-the-wall’ observation is a great alternative to focus groups. It’s not only less expensive, but you’ll see people interact with your product in a natural setting without influencing each other. The only downside is that you can’t get inside their heads, so observation still isn't a recommended replacement for customer surveys and interviews.

The following questions will help you get to know your users on a deeper level when you interview them. They’re general questions, of course, so don’t be afraid to make them your own.

1. Who are you and what do you do?

How you ask this question, and what you want to know, will vary depending on your business model (e.g. business-to-business marketing is usually more focused on someone’s profession than business-to-consumer marketing).

It’s a great question to start with, and it’ll help you understand what’s relevant about your user demographics (age, race, gender, profession, education, etc.), but it’s not the be-all-end-all of market research. The more specific questions come later.

2. What does your day look like?

This question helps you understand your users’ day-to-day life and the challenges they face. It will help you gain empathy for them, and you may stumble across something relevant to their buying habits.

3. Do you ever purchase [product/service type]?

This is a ‘yes or no’ question. A ‘yes’ will lead you to the next question.

4. What problem were you trying to solve or what goal were you trying to achieve?

This question strikes to the core of what someone’s trying to accomplish and why they might be willing to pay for your solution.

5. Take me back to the day when you first decided you needed to solve this kind of problem or achieve this goal.

This is the golden question, and it comes from Adele Revella, Founder and CEO of Buyer Persona Institute . It helps you get in the heads of your users and figure out what they were thinking the day they decided to spend money to solve a problem.

If you take your time with this question, digging deeper where it makes sense, you should be able to answer all the relevant information you need to understand their perspective.

“The only scripted question I want you to ask them is this one: take me back to the day when you first decided that you needed to solve this kind of problem or achieve this kind of a goal. Not to buy my product, that’s not the day. We want to go back to the day that when you thought it was urgent and compelling to go spend money to solve a particular problem or achieve a goal. Just tell me what happened.”

— Adele Revella , Founder/CEO at Buyer Persona Institute

Bonus question: is there anything else you’d like to tell me?

This question isn’t just a nice way to wrap it up—it might just give participants the opportunity they need to tell you something you really need to know.

That’s why Sarah Doody, author of UX Notebook , adds it to the end of her written surveys.

“I always have a last question, which is just open-ended: “Is there anything else you would like to tell me?” And sometimes, that’s where you get four paragraphs of amazing content that you would never have gotten if it was just a Net Promoter Score [survey] or something like that.”

What is the difference between qualitative and quantitative research?

Qualitative research asks questions that can’t be reduced to a number, such as, “What is your job title?” or “What did you like most about your customer service experience?”

Quantitative research asks questions that can be answered with a numeric value, such as, “What is your annual salary?” or “How was your customer service experience on a scale of 1-5?”

→ Read more about the differences between qualitative and quantitative user research .

How do I do my own market research?

You can do your own quick and effective market research by

Surveying your customers

Building user personas

Studying your users through interviews and observation

Wrapping your head around your data with tools like flow models, affinity diagrams, and customer journey maps

What is the difference between market research and user research?

Market research takes a broad look at potential customers—what problems they’re trying to solve, their buying experience, and overall demand. User research, on the other hand, is more narrowly focused on the use (and usability ) of specific products.

What are the main criticisms of market research?

Many marketing professionals are critical of market research because it can be expensive and time-consuming. It’s often easier to convince your CEO or CMO to let you do lean market research rather than something more extensive because you can do it yourself. It also gives you quick answers so you can stay ahead of the competition.

Do I need a market research firm to get reliable data?

Absolutely not! In fact, we recommend that you start small and do it yourself in the beginning. By following a lean market research strategy, you can uncover some solid insights about your clients. Then you can make changes, test them out, and see whether the results are positive. This is an excellent strategy for making quick changes and remaining competitive.

Net Promoter, Net Promoter System, Net Promoter Score, NPS, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.

Related articles

6 traits of top marketing leaders (and how to cultivate them in yourself)