Response of Pakistan’s economic growth to macroeconomic variables: an asymmetric analysis

- Research Article

- Published: 23 December 2022

- Volume 30 , pages 36557–36572, ( 2023 )

Cite this article

- Hafiz M. Sohail ORCID: orcid.org/0000-0002-7885-5549 1 ,

- Mirzat Ullah ORCID: orcid.org/0000-0002-7715-0352 2 ,

- Kazi Sohag 2 &

- Faheem Ur Rehman ORCID: orcid.org/0000-0003-1517-0611 3

2314 Accesses

3 Citations

Explore all metrics

This study examines the impact of several important macroeconomic variables such as quality of education, infrastructure development, foreign direct investment inflow, and green energy transitions on economic growth. We analyzed annual time series data sample for estimation of the above macroeconomic indicators during 1990 to 2020. We use nonlinear auto-regressive distributive lag model (NARDL) approach to detect the short-term and long-term effects of undermentioned macroeconomic variables on economic growth of Pakistan. The results primarily reveal that the quality education, foreign direct investment inflow, and infrastructure development are playing a significant positive role in the economic growth of Pakistan. Similarly, in short term the foreign direct investment inflow, infrastructure, and green energy transition coefficients are significantly positive related to sustainable development goals. However, the education found as unsubstantial as contributive as other variables. Moreover, the Granger causality and structural break estimations are employed to estimate the causal association between the selected parameters and unexpected change over the economy. The estimated outcomes find the unidirectional causality from education and green energy transition towards economic growth, where education is found within relation to infrastructure. Additionally, bidirectional causal relationship is found between FDI and infrastructure towards economic growth which shows that the increase in foreign investment has the potential to boost the economic growth. Finally, all the estimated indexes are considered as important sources towards the economic growth.

Similar content being viewed by others

The dynamics of public spending on sustainable green economy: role of technological innovation and industrial structure effects

Towards green economy and sustainable development in Bangladesh: assessing the role of social and environmental indicators

Exploring the potential role of higher education and ICT in China on green growth

Avoid common mistakes on your manuscript.

Introduction

The current transition towards green economy is affecting the world economies and dynamics. Given the considerable hydrocarbon dependency, we scrutinize the key aspects among sustainable development goals (SDGs) that have the potential to make remarkable change in the developing economies especially the case of Pakistan. As other developing economies: Pakistan is adopting the United Nations (UN) endorsed campaign of green transition of 17 SDGs. The UN Agenda-2030 for SDGs intends to solve the current environmental challenges of the twenty-first century in the interests of citizens. The sustainable development efforts are considered to contribute to economic growth without affecting the green environment of the society. It is indispensable to address interconnected pillars of economic growth through supportive policies to attain sustainable economic growth. Sustainable development objectives include providing quality education, building resilient infrastructure, promoting of clean energy transition especially the use of natural gases, and inviting foreign investments to boost the domestic economic growth.

The education at both levels industry and society are very important in the way to build green environment and make economic growth. The demand for edification is one of the most critical human assets since it can increase productivity in allocation with resources. In contrast, it has been observed by Seetanah ( 2009 ) that education fosters economic development and increases human livelihoods by boosting the quality of the workforce, promoting democratization, better life, decreasing fertility, and boosting equality. According to the United Nations Research Institute for Social Development, economic sustainability comprises healthy living, education, access to products, and socio-economic achievement (Armeanu et al. 2018 ; Beets 2005 ; Johnston 1998 ; Schwab 2018 ). The current study reveals that improving education in society can contribute to economic growth in long run. Moreover, there is an association between transportation infrastructures and energy consumption by examining the economic growth. To create sustainable environment the study reveals that the economic growth is veiled in creating less CO 2 emission and energy consumption. In adopting the green energy, the study uses the adaptation of natural gas, which is considered as crucial clean energy source as comparison with other petrochemicals such as petroleum and coal. The increase in natural gas consumption is predicted to enhance Pakistan’s environmental quality and allow the country to maintain its economic performance. Apergis and Payne ( 2010a ) examined that natural gas can minimize CO 2 emissions. IEA ( 2016 ) reported the adaptation of natural gas consumption from 2012 to 2030 that use of natural gas in the power sector will rise by 2.2% and in industry can boost by an average of 1.7% per year. It is expected that converting power and industrial sector form petroleum into natural gas the Pakistan can save 17% CO 2 emission and economy can grow with the same ratio (Sadiqa et al. 2022 ).

Achieving targeted economic growth is one of the critical challenges of government policymakers in case of developing countries like Pakistan. The prevailing concern for all economies is to sustain the economy (Shabbir 2013 ). According to UN Agenda-2030 the SDG-8 support the sustained, inclusive, and sustainable economic growth; productive employment; and clean environment for all. According to the World Business Council for Sustainable Development, companies may meet human desires by inventing the modern technologies, improving efficiency, creating jobs, and ensuring that solutions are accessible to a broad range of people (Carree et al. 2007 ). For measuring economic growth, current study has adopted the same proxy used by (I. Khan et al. 2021 ; Omri 2013 ). Yusuf et al. ( 2020 ) documented that most economies aspire to attract foreign direct investment ( FDI ) because of its recognized benefits as a catalyst for economic growth. Likewise, this research looks at the empirical association between FDI and economic growth in Pakistan, as well as the factors that influence FDI into the Pakistani economy.

As a result, this study focused to develop a theoretical and statistical solution to the question: do the goals of the UN Agenda-2030 of SDGs impact the economy of Pakistan? This study aims to develop and test the models to determine the association between education (SDG-4), FDI (SDG-17.3), infrastructure and technology (SDG-9), clean energy (SDG-7), and sustainable economic growth (SDG-8) in Pakistan (Fig. 1 ). This research study examines the impact of sustainable development goal indexes (SDGs) include the levels of quality education, resilient infrastructure, clean energy transition proxied by use of natural gases, and foreign direct investments on domestic economic growth of Pakistan (Fig. 2 ). These SDGs are selected form current stream of United Nations Agenda-2030 of green energy transitions. This paper contributes to existing efforts for economic growth narrative in several ways like introducing new statistical measurement of nonlinear auto-regressive distributed lag (NARDL) model which is considered as most superior to the conventionally used auto-regressive distributed lag (ARDL) model. This model has the potential to predict the effects of the explanatory variable in domain of both positive and negative shocks on the outcome variable (Neog and Yadava 2020 ). Additionally, the existing literature studied toured the impacts of energy consumption on economic growth with the conventional ARDL linear modeling methods which only assessed the impacts of external shocks related to consumption of energy on the nation’s GDP (Sohail et al. 2022 ).

Source : Author’s calculations

Conceptual framework of the study.

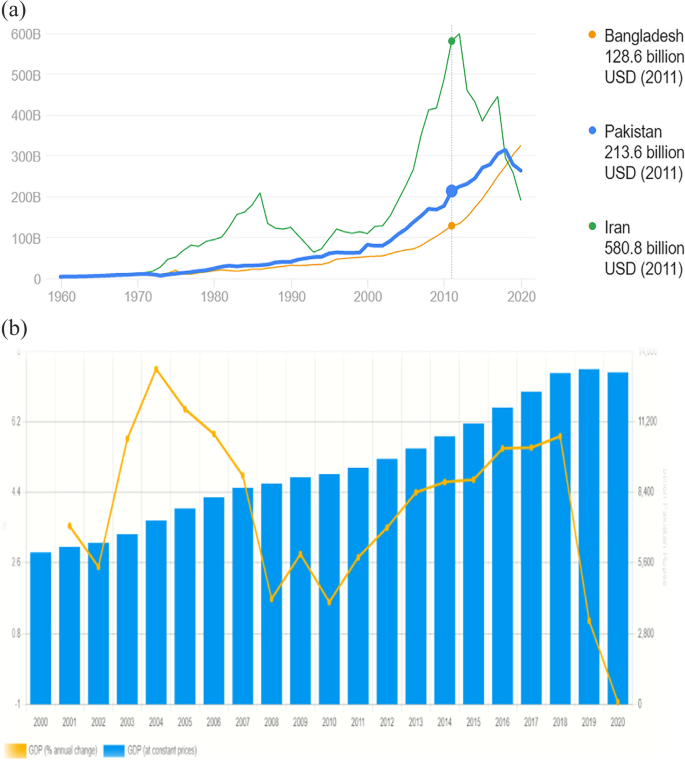

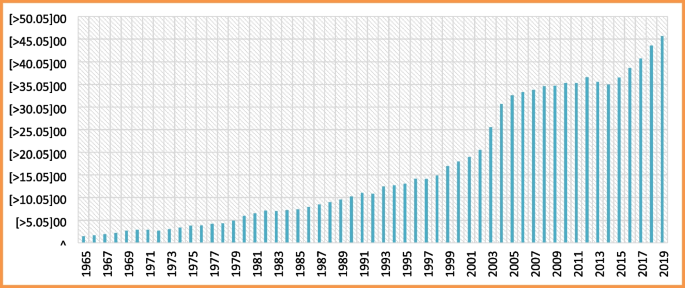

Source : Author’s calculations. b Historical trending in the economic growth of Pakistan. Source : Author’s calculations

a Trend in the economic growth of Pakistan with respect to Bangladesh and Iran economies.

In line with the above discussion, this research study aimed several specific goals. First , we assess the economic impact of inclusive and equitable quality education to encourage possibilities for lifelong learning. Second , we assess the impact and enactment of the global partnership to invite more foreign direct investment to home country on economic growth. Third , we analyze the effect of resilient infrastructure, sustainable industrialization, and foster innovation on economic growth. Finally , we determine the effect of affordable, reliable, sustainable, and modern energy on economic growth. This study is different from previous studies in several ways, where we focused on each category of SDG impact on national economy. We mainly focused on the SDGs which are included in UN agenda, where the member developing countries are UN suggestions. Most important, the impact of such SDGs was used in our study, for example, the long-run effect of education on national economy. The government subsidizes and spends more on higher education to produce skill full labors where the impact of such spending is negative on economic growth, which is against the previous research studies and opposing the general theoretical support. This impact is very true to current economic situation of Pakistan. There are several reasons like citizens are getting the stipend and scholarships for higher studies and leave the country. On the other hand, government failed to provide jobs to graduates so skillful labors are contributing negative to economic growth in the long term. Additionally, the FDI inflow into the developing economy has vast substantial impact of economic growth. In this study we used several statistical estimations like VECM and NARDL to find out the enactment of the global partnership on economic growth proxied by FDI inflow.

The remaining manuscript is set as follows: a historical overview of Pakistan’s economy is presented in the “ Overview of Pakistan economy ” section, review of literature is summarized in the “ Literature review ” section, whereas the methodology and empirical results are covered in the “ Methodology and data source ” and “ Empirical analysis ” sections, respectively. Finally, the “ Conclusion and policy implications ” section presents the conclusion and policy implications.

Overview of Pakistan economy

Pakistan stands in developing economy with GDP of $264 billion. In comparison with other geographic economies the Pakistan economy grew up with many challenges and experience serious issues. Pakistan has recurrently experienced economic and financial crises, including rampant inflation, trade deficits, depleted foreign reserves, and currency depreciation. The economy confronted with a mixture of overpopulation, terrorism, bad governance, and low literacy level.

The two most serious threats to the country’s low GDP are the accumulation of rising inflation and a payment crisis triggered by a mixture of global and regional elements (Tehsin et al. 2017 ). Similarly, the pandemic (COVID-19) has exacerbated, and Pakistan’s foreign exchange reserves plummeted to multiyear low (Pakistan 2021 ).

Over a given time period, this secures the difference between a country’s exchange of goods and services, as well as net transactions such as overseas aid. A persistently high deficit may result in a surplus of a country’s currency in the foreign exchange market, reducing the currency’s value. This is one of the reasons why the Pakistani rupee (PKR) has plummeted (Khan et al. 2022 ). To overcome all the issues Pakistan requests to IMF bailout package and, additionally, borrow from other countries like China, Saudi Arabia, and USA. The Pakistan’s economy experienced significant regime changes, during every regime the level of uncertainty changed for the trade effected, and this is the main issue faced to the economy. The volatility behavior of Pakistan economy is divided in four major phases. First was the phase where it is generally agreed that Pakistan had economic progress during the 1960s (Looney 2004 ). However, at the same time the defense spending throughout the late 1960s slowed the country’s economic growth and caused it to stagnate (Looney 1991 ). During 1958–1973, increased defense spending harmed economic growth, particularly during the conflicts with neighbor country in 1965 and 1971 (Looney 1994 ).

The second phase of economic expansion emerged in 1980s, with the most significant annual GDP growth of 10.2% reported in 1980 and a yearly growth rate of 6.1% over 10 years of 6.1% on average (Tehsin et al. 2017 ). Despite this progress in economic development, Pakistan may perhaps be not maintained it until miliarial administration. Similarly, following the previous regime the military acquired the country administration and several structural changes were enabled, accepted globalization, and welcomed international trade and investment; Pakistan’s economy progressed toward sustainable economic growth. This was the era from 2000 to 2007 during which the economy grew at a rapid pace (Amjad and Awais 2016 ). Based on the lessons learned during the miliarial administration, it can be predicted that the social and economic consequences of another effort at economic development will manifest themselves in the structure of extreme right-wing violence in society. Ultimately, due to the worldwide coronavirus outbreak, Pakistan’s GDP growth fell to 1.9% in 2019, down from a decade-high of 5.8% the previous year when the new elected administration took the charge. The economy grew, ranging from 7.0 to 7.5% in the final years of the miliarial administration, primarily due to advances in the recital of the service sector (Looney 2009 ). The final phase could be considered in economy favor to reduce the country’s large budget deficits and excessive public debt caused by the prior newly elected democratic administration have act as poor economic management (Looney 2004 ). According to Looney, the miliarial administration did not adhere to the effective governance indicators set forth by the World Bank (Looney 2004 ). These include political freedoms, the efficiency of government, and anti-corruption (Kaufmann et al. 2011 ).

Literature review

This part includes a detailed assessment of previous work that has been done in context of economic growth, development in education, green energy transition, foreign direct investment, and infrastructure development. This part will assist the readers in fully understanding the bridge and connection between SDGs and the economic growth of Pakistan. The following is a review of the literature on each domain subject.

- Economic growth

In the perspective of economic growth of Pakistan, it has been facing number of challenges like high fiscal deficit and low investment, rising rate of poverty and unemployment, and heavy external and domestic debts. For success of any economy, it depends upon stable, efficient, and active government financial structure. To support the ongoing economic projects, Sohail et al. ( 2022 ) examined that the economy has been facing the lowest growth rate among South Asian countries since 1990. They concluded that the exogenous factors could enhance the current low growth and award a development in economy. Additionally, the economy of Pakistan has been facing a large spillover effect of war on terror, internal instability that is promoted by frenemies and hostile neighbors (Sadiqa et al. 2022 ). Endogenous mishandling of energy crises started from 1990 and which is the result of poor economic management, governance, and institutional framework. Yusuf et al. ( 2020 ) concluded that the economy needs to improve the political stability for promotion of investment form of domestic and foreign investors and suggested the openness to international trade and private foreign investment. It created untenably large lags in policy formulation and implementation (Sohail et al. 2022 ). Nazir et al. ( 2021 ) documented that the manufacturing sector contributed its share in economic growth and played a key role. They examined that Pakistan due to this sector progressed from its status as a low-income to a lower middle-income country. It helps the nation to achieve the objective of poverty reduction. In the current scenario, Pakistan needs to significantly increase foreign direct investments, as well as national saving, to overcome the budgetary issue and to address the domestic and external debt burden.

Education and economic growth

Pakistan’s literacy rate is substantially lower as comparison with other developing countries. The literacy rate is being significantly higher for males with high difference than for females, and for the females, the educational levels are much lower. Sustainable development goal comprises the ensuring of inclusive and quality education and promoting lifelong learning opportunities for all (Seetanah 2009 ). Similarly, Kingdon ( 2007 ) stated that the education quality in Pakistan is different from other developing countries and needs a serious attention; it is concluded that certain economies with a high educational level (for example, Taiwan) also have a thriving economy. Self and Grabowski ( 2004 ) examined the determinants of education on economic development, that the educational attainment is accountable for fluctuations in a financial product. Their study also demonstrated educational levels which are related to each other. Chowdhury ( 2022 ) investigated the internationalization of education on economic growth; the main findings revealed significant disparities between education levels in terms of their effect on economic growth. The tertiary education does not appear to have a causal effect on development. They examined the association between level of education and economic growth and conclude that when the population is separated into groups based on the gender of the individuals then education has a significant causal effect on the nation’s economic growth in the long term. Many other experts have concentrated their efforts on investigating the relationship between education and the economic prosperity of a country, but in developing economies, this is considered as first time to examine the effect of education on economic growth.

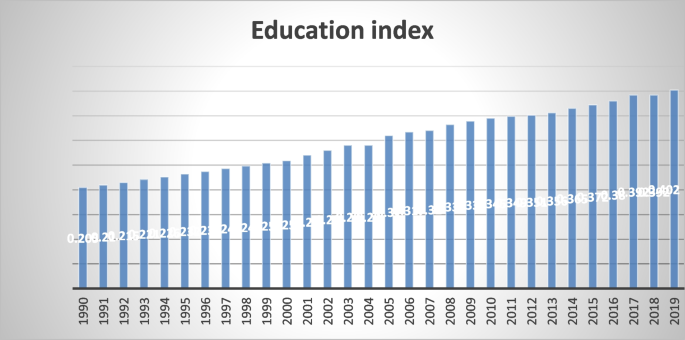

Lin ( 2003 ) studied the association of economic growth, education, and technical progress and confirmed the long-run association of parameters. Hassan and Rafaz ( 2017 ) study the association between gender’s education and economic growth in Pakistan. Using OLS regression and data spanning the years 1990 to 2016, the results reveal that increasing female education, female labor force participation, education expenditure, and fertility rate by 1% resulted in a 9.6% rise in Pakistan’s gross domestic product (GDP). Hanif and Arshed ( 2016 ) employed three indices for educational level in the SAARC countries to determine that higher education enrollment has the most significant impact on growth. Saeed and Awan ( 2020 ) attempted that the technical improvement has a significant impact on Pakistan economy and suggested the positive association between research and development and innovations and those discoveries can help to increase the pace of GDP growth. Yasmin et al. ( 2021 ) employed a generalized method of moments (GMM) to investigate the link between economic growth and several factors such as education, poverty, and unemployment in Pakistan. Educational attainment and trade expansion both have a favorable impact on the economy, whereas joblessness has an adverse influence on the determination of economic expansion, according to the conclusions of the research. Despite the fact that each researcher took a distinct strategy to their investigation, the outcomes appear to be comparable. The question is if the connection between educational factors and economic growth in Pakistan has altered over time, and whether there are any other factors that are associated with these variables. As a result, explanation and specificity of the association between education and economic growth may be regarded valuable information. A trend of education is shown by Fig. 3 .

Trend in education including primary, secondary, and higher education (1990–2019).

Foreign direct investment and economic growth

The theoretic basics of the foreign direct investment ( FDI ) to economic growth is founded on the neoclassical and endogenous growth models. Chanegriha et al. ( 2020 ) deliberate that the FDI has an optimistic effect on economic growth by growing investment level. However, in the endogenous growth models the FDI increases total economic growth in host countries by familiarizing new inputs, technologies, and products; augmenting managers and labor skills; and increasing local competition. Ciftci and Durusu-Ciftci ( 2021 ) studied that the FDI inflows for the host countries have several advantages, such as creating new business areas and human capital enhancement, lessening the market power of present firms, being a catalyst for domestic capital stock, and tax revenues in respect to other types of financial capital.

Ahmad et al. ( 2022 ) investigated the Chinese FDI flow into Pakistan. They documented a massive increase after the groundbreaking of Belt and Road Initiative (BRI) and China-Pakistan Economic Corridor (CPEC). According to the Chinese government, investments in Pakistan increased from $695.9 million in 2014 to $1002.9 million in 2020. Similarly, Abdouli and Omri ( 2021 ) conducted an empirical study to investigate the association between FDI and GDP. They suggested that they would have a significant impact on Pakistan’s economic growth. Thereby, FDI provides a number of benefits to the host country, including the formation of new jobs, technical progress, resource optimization, and competitive merchandise. According to these figures, Chinese investment accounted for an average of 43.8 percent of total FDI . Murshed et al. ( 2022 ) claimed that FDI puts stress on local firms to innovate and develop technologically, which may explain why developing countries welcome FDI . With FDI assistance, Pakistan’s economy is poised to close the savings-investment gap. This FDI creates new job opportunities, technology transfer, increased productivity, and contest. Benefits like these encourage developing economies like Pakistan to adopt FDI -friendly policies.

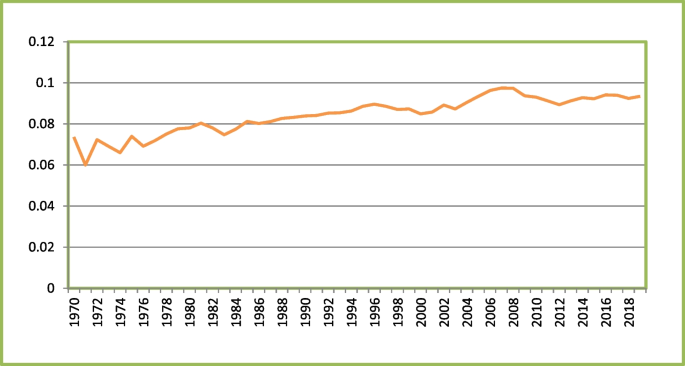

Hamid et al. ( 2022 ) scrutinized the impact of FDI and imports on economic growth; they discovered a dual-directional relationship between output and FDI and imports. The findings support the assertion of output growth caused by FDI and imports. Ulucak and Erdogan ( 2022 ) investigated the ambiguous environmental effects of FDI inflows. They demonstrated the negative environmental consequences of hosting FDI , which indicates that as FDI flows into host countries, environment protection tends to worsen. Similarly, according to Wang et al. ( 2022 ), pollution halo effect highpoints the optimistic environmental significances of FDI . In this respect, these FDI are supposed to be immersed in tidy industries within the host nations, thereby plummeting the possibility of FDI making contributions to augmented CO 2 emissions. Khan et al. ( 2020 ) studied the FDI inflows and CO 2 emission nexus, applied data of BRICS countries from 1986 to 2016, highlighted the harmful environmental effects of FDI inflows, and documented that higher FDI inflows contribute to higher emissions of CO 2 . Furthermore, the country-specific results revealed that, with the exception of Russia, the pollution haven hypothesis holds true for the other BRICS nations. Moreover, Fig. 4 presents the trend of FDI in Pakistan.

Trend in foreign direct index inflow to Pakistan.

Infrastructure and economic growth

The sustainable development goal in UN Agenda-2030 is to create resilient infrastructure, promote inclusive and sustainable industrialization, and inspire innovation. Reliable infrastructure is required to connect supply chains and efficiently move products and services across the borders (Sohail et al., 2021 ). Construction of infrastructure links households throughout urban regions, helps in flow of trading commodities, provide quick access to quality healthcare facilities, and award access to educational opportunities. Infrastructure plays a significant role in connecting markets by transporting products and consumers of an economy (Brons et al. 2014 ). As a result, efficient transportation methods allow contractors to deliver their goods and services to the market on time while also facilitating the movement of people to the most relevant occupations in demand. A good telecommunication infrastructure allows for a rapid flow of information, which improves the country’s overall economic efficiency (Rehman et al. 2022 ; Schwab 2018 ). Because of their connection, air and road transportation stimulate a broader range of activities. The authors also provided proof for a significant optimistic reaction of passenger-kilometer due to favorable change in earning (Rehman and Sohag 2022 ; Marazzo et al. 2010 ). It has been estimated that an increase of 1% in air passenger traffic results in a rise of 0.943% in the gross domestic product (Hu et al. 2015 ). Figure 5 shows the trends of infrastructure in Pakistan.

Trend in infrastructure including rail lines, container, air, and rail passengers (1985–2019).

Natural gas consumption and economic growth

The purpose to ensure access to affordable, reliable, sustainable, and modern energy for all depicts that sustainable goal is included in UN Agenda-2030. Natural gas is considered a reliable source of green energy transition. In this research study we are considering that the natural gas is a significant energy supply for almost every economy of the country, more specifically the developing country like Pakistan. Natural gas is used to generate the country’s total national output. Additionally, it is a cleaner and environmentally friendly resource of energy in comparison to other petrochemical or coal. Increasing the natural gas consumption level in Pakistan is expected to advance the country’s environmental quality, and will allow the government to maintain its economic performance (Sohail et al. 2022 ). One effective option for achieving energy structure optimization is transitioning from coal to low-carbon energy sources (Li et al. 2019b ). Compared to coal and oil, natural gas usage produces much fewer CO 2 emissions per unit of energy (Solarin and Shahbaz 2015 ).

Natural gas has been considered as a low-carbon and environmentally friendly among all other energy sources; it can significantly reduce air pollution (Xiao et al. 2016 ). Increased NGC can contribute to the achievement of the twin dividend, i.e., economic growth and emission reduction (Feng et al. 2015 ). Because natural gas is one of the energy input variables at the micro-level, the price of natural gas will directly influence the use and production of all industries, particularly the secondary industry, which is one of the most energy-intensive industries. Promotion and exploitation of natural gas as an industrial material in factories and as a household commodity could significantly impact the way people live and produce, especially when compared to other alternative energy sources, remarkably price, and accessibility. Much academic research has been undertaken on the causality relationship between NGC and economic growth, most of which have been conducted at the national level and compared the results of other countries. For example, the research from 67 nations over the period 1992–2005 revealed that NGC and economic growth were linked in a two-way causal manner both in the short and long terms (Apergis and Payne 2010b ). Among G7 member countries, there were three types of causality between NGC and economic growth (unidirectional causality, reverse causality, and bidirectional causality) (Apergis and Payne 2010b ), the first being the most common (Ozturk and Al-Mulali 2015 ). The evidence from the Gulf Cooperation Countries throughout the period 1980–2012 demonstrated that NGC was beneficial to long-term economic growth. Depending on the outcomes of their research, different experts have come to different conclusions about the connection between natural gas use and economic development.

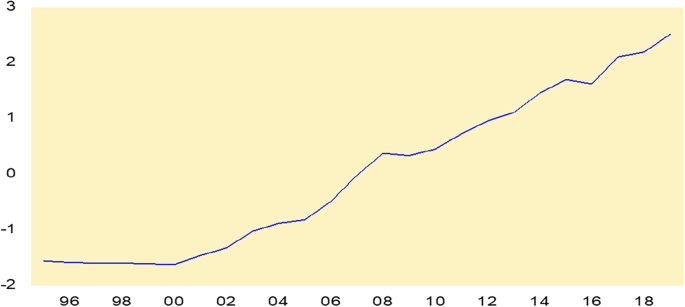

As a result, while numerous studies have established that NGC has a favorable effect on economic growth (Ozturk and Al-Mulali 2015 ), others have claimed that economic growth has a detrimental impact on NGC (Sari et al. 2008 ). Furthermore, there was a mismatch among regions regarding the association between NGC and economic growth (Fatai et al. 2004 ). In this aspect, the association between NGC and economic growth was statistically insignificant in Australia and New Zealand. According to the findings from different OPEC member countries, there were growth, conservation, and neutrality correlations between NGC and economic development, in other OPEC member countries. It was shown that the association between NGC and economic growth differed significantly between China and Japan. In China, there was no evidence of indirect causality, whereas in Japan, there was evidence of two-way causality (Sari et al. 2008 ). Finally, trend in natural gas consumption in Pakistan is shown in Fig. 6 .

Source: Author’s calculations

Trend in natural gas consumption.

Methodology and data source

To estimate the growing stream of Pakistan economy, in the consideration of UN Agenda-2030 of green transition SDGs, we analyze that a long period contains three-decade annual time series data for the SDG’s indexes from period 1990 to 2020. Further, we apply the principal component analysis and vector error correction model vector auto-regression method advanced by Antonakakis and Gabauer ( 2017 ). VECM econometric techniques are used to investigate the statistical significance of considered SDG’s indexes to study the effect both in long and short terms. From the UN Agenda-2030 of green transition SDGs, we are considering the five most vulnerable variables along with indexes to examine the affect in most effective way. These indexes are education index ( EDI ), foreign direct investment ( FDI ), infrastructure index ( INFRI ), and natural gas consumption ( NGC ). For batter examination we are considering the GDP per capita as the proxy of economic growth ( EG ).

Estimation process

We scrutinized the influence of four SDGs on economic growth along with the indexes. Hence, a statistical tool called principal component analysis (PCA) can minimize the number of variables in a multivariate data set. The foremost benefit of this approach is that it permits the variance to keep the input data’s maximum informative value intact while simultaneously minimizing the dimensions (Tripathi and Singal 2019 ). PCA is a well-accepted approach for selecting independent variables and removing duplicate or strongly correlated parameters commonly used in economic estimations. Using the PCA estimations this method to identify the variation within an extensive collection of associated variables are proposed by (Jolliffe 1972 ).

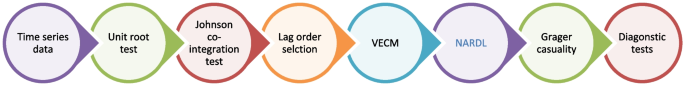

However, the empirical investigation starts with determining the sequence of the variables’ integration (Fig. 7 ). This sequence is critical because ARDL methods can accept variables incorporated at level or at first difference, but not at second difference. This model has a single disadvantage: it cannot be used if the parameters are integrated at the I (2) (Ibrahim 2015 ).

Estimation strategy.

Vector error correction model

Here is the long-run association among the series I (1); it is, therefore, the VECM approach that estimates the long-run and short-run association among the selected variables (Tran 2018 ). Additionally, for better representation of causal association between the time series variables this study used Granger causality techniques (Rossi and Wang 2019 ). This current study analyzes the causal association between selected indexes of SDGs such as education (EDI), foreign direct investment (FDI), infrastructure (INFRI), and green energy transition (NGC) and check the impact on economic growth (EG).

Nonlinear cointegration results

PESARAN et al. ( 2001 ) examined the cointegration analysis to deliver the proof of a linear relation between dependent variables. The NARDL is a nonlinear stretched form of usual ARDL model to study the effect of both short run and long run. For the conceivable asymmetric effects, this model is practical for investigation in the short and the long run. Similarly, the present study employs the estimation of nonlinear auto-regressive distributive lag (NARDL) model developed for the first time by Shin et al. ( 2014 ). By using this modern statistical model the presence of an association between levels of education, infrastructure, FDI inflow, and natural gas consumptions in Pakistan is investigated. Using NARDL in this study have several advantages over other techniques like it reduces the characteristic supposition in the cointegration analysis that all selected variables necessarily be integrated of the same order with excluding the second difference I (2) variables. Additionally, as studied by Li et al. ( 2019a ), it examines the potential cointegration, so that it evades neglecting any association which is not evident in an existing established linear setting. Similarly, Economou ( 2019 ) documented that the NARDL estimator allows to discriminate the existence of linear cointegration, nonlinear cointegration, and lack of cointegration. The present study is using the NARDL model that covers the optimistic and pessimistic partial sums and also the short- and long-run effects on economic growth. Furthermore, as Pakistan have witnessed sever crisis in 1998, 2008, and 2019, structural-break test is very vital for the current study. The study utilized unit root test against the alternative of trend stationary process with a structural breakpoint both in intercept and slope is based on the analysis. Thus, using an error correction model the NARDL model studies the resultant equations for

where EG t is the economic growth in Pakistan in year t ; EDI t shows the education index in year t ; FDI t presents the foreign direct investment inflow in year t ; INFRI t stands for the infrastructure index in year t ; NGC t shows the natural gas consumption in year t ; \({\hat{e} }_{t-1}\) shows the error correction term; α 1 , α ij \(\left(i\right)\) , and β 1 are the parameters; and \({\varepsilon }_{\mathrm{log}egit},{\varepsilon }_{\mathrm{log}ediit},{\varepsilon }_{\mathrm{log}fdiit},{\varepsilon }_{\mathrm{log}infriit}, \mathrm{and }{\varepsilon }_{\mathrm{log}ngcit}\) are the white noise disturbance terms that may be correlated with each other. The rank of cointegration in VECM designates the total cointegrating vector. For instance, the number of rank (2) specifies that the linear combination of two nonstationary repressor variables will become stationary. A significant negative sign of the e t − 1, also called the error correction model (ECM) parameter, displays that any variation in the short-run association between the independent variable and dependent variable will set up a significant long-run association between them.

Empirical analysis

This study used the augmented Dickey Fuller (ADF) estimation proposed by Dickey and Fuller ( 1979 ) and PP (Phillips and Perron 1988 ) tests for conformation of integration level among the selected variables; the results are presented in Table 1 . The outcome shows that all the other variables are integrated at level I (1). The exact order of integration level guides to apply the VECM estimation technique (Pradhan and Bagchi 2013 ). In above econometric equation we estimate the structural break to estimate an unexpected economic change over the study time frame in the parameters of regression model; such estimation enables us to measure the unreliability and forecasting errors of the estimation model used in our study. The empirical results of structural break-ZA are shown in Table 2 . The results show that the structural breaks, i.e., 2003, 2005, 2007, 2008, 2009, 2010, 2012, and 2013, are founded in the selected variables such as EG , EDI , FDI , INFRI , and NGC . Most of the breaks are started from 2003 to 2012. This break may happen due to financial crisis shocks of Pakistan.

Prior to the application of Johansen cointegration test, it is imperative to confirm the long-run association among the selected parameters; we have to select the lag order by utilizing the VAR approach for I (1) variables (Nielsen 2001 ). The number of lag selection criteria has been applied in previous studies such as Akaike Information Criterion, Hannan-Quinn Information Criterion, Modified Ranking LR test statistics, Schwartz Information Criterion, and Final Prediction Error. In Table 3 , many tests confirm a (1) lag length.

At the moment, the cointegration test is used to determine whether there are any long-run equilibrium relationships between the four variables EDI , FDI , INFRI and NGC and economic growth. This employs the maximum likelihood ratio test and examines two test statistics trace statistics and leading eigenvalue statistics. The result of the Johansen cointegration rank test is shown in Table 4 , which indicates that there are two cointegrating vectors at 5% levels of significance (i.e., the null hypothesis of no cointegration is forbidden for a rank of 0 and less than or equal to 2). This indicates that there is a long-run association between the four variables. The favorable results in Table 4 require the modeling of VECM and not a vector auto-regressive (VAR) model as stated in the model selection process.

In Table 5 , both long-term and short-term coefficients were obtained through the VECM. The long-term coefficients of EDI , FDI , INFRI , and NGC are statically significant. Additionally, the study established that the education index has a favorable effect on economic growth in nine remittance-receiving countries. At a 1% significance level, this optimistic effect of education on economic development is highly noteworthy. The coefficient of EDI implies that increasing the EDI by 1% increases economic growth by 0.08 percent. Our results are the same as the recent study on nine selected remittance-receiving countries exposed (Zaman et al. 2021 ). In comparison, other studies showed that increasing educational levels boosts economic growth (Habibi and Zabardast 2020 ; Hanushek and Woessmann 2020 ; Kousar et al. 2020 ). Likewise, numerous studies have also demonstrated a beneficial correlation between education spending and economic growth (Glewwe et al. 2014 ; Jalil and Idrees 2013 ). These research findings corroborate our findings, indicating the existence of a noteworthy long-term optimistic link between economic expansion and education.

The FDI coefficient affirms that a 1% augmentation in FDI will boost economic growth by 0.504 percent. A 1-percent drop in FDI will conversely influence economic growth with the same quantity. Modern studies examining the relation between FDI influx and economic growth indicated that FDI inflow increases economic growth (e Ali et al. 2021 ). Similarly, other studies reported that FDI increased economic progress in the long run (Saleem and Shabbir 2020 ; Tiwari and Mutascu 2011 ).

In addition, the VECM model’s long-run fallout shows that INFRI (infrastructure index) also leads to an essential positive connection in the direction of economic growth at a 1% significance level. The coefficient of INFRI increases by 1%; economic growth will also augment by 0.757, respectively. The outcomes logically aligned with Mohanty and Bhanumurthy ( 2019 ) and C. Wang et al. ( 2020 ) showed a significant positive association between economic growth and infrastructure. Another study conducted in India also authenticated our results that increasing infrastructure enhances economic growth (Mohanty and Bhanumurthy 2019 ; Chakamera and Alagidede 2018 ).

Finally, the selected VECM model shows that NGC also helpfully manipulates the economic growth in the chosen country. As NGC is raised by 1%, it boosts economic enlargement by 0.460%, while declining NGC by 1% will move down economic growth with the identical percent in the case of Pakistan. This positive bond between NGC and economic expansion is highly noteworthy at a 1% significance level. Our consequences are associated with the recent study by Sohail et al. ( 2022 ) and previous studies (Apergis and Payne 2010b ; Shahbaz et al. 2013 ; Solarin and Ozturk 2016 ) showing that economic growth can be improved with the increase of NGC .

In the second part of Table 6 , the error correction term ( CointEq1 , CointEq2 ) is significant. It has a negative sign, which means that the series are cointegrated and go together toward long-term equilibrium (Mahadevan and Asafu-Adjaye 2007 ). The negative response is required for balancing the EG series in the long term. As the error correction term is adverse and significant, we have causality in at least one direction. The short-run consequences of the nominated VECM model display that FDI inflow has an essential positive connection with economic growth, indicating that a 1% increase in FDI inflow will enhance economic growth by 0.315 percent in the short run.

During the short-run term, EDI has a significant pessimistic association with economic growth, which means that increasing education by 1% reduces economic expansion by 0.460 percent. INFRI has a considerable positive link with economic increase in the short run. In the near run, a 1% increase in INFRI boosts economic growth by 0.149 percent and vice versa. NGC demonstrated a substantial negative link with economic intensification in the short run, indicating that a 1% increase in NGC causes economic growth to decelerate by 0.321 percent. The R 2 value is close to 1 ( R 2 = 0.835). It can be said that the interpretation is consistent. This result supports the result obtained from the cointegration test. Therefore, the comments made for this equation are consistent as well.

The advance methodology was introduced by Shin et al. ( 2014 ) to examine the time series data for nonlinear and significant relationship. The results from NARDL are estimated in Table 7 , where we follow the estimation from Shin et al. ( 2014 ). We examined that there is cointegrated and significant association between economic growth and education, natural gas, and infrastructure. Additionally, we extend the model to check the short-run and long-run asymmetries. The level of significance is examined at every model from 1 to 3. In this study we employed the structural break to estimate an unexpected economic change throughout in our study timeline. In line with this, we have proposed our estimation as basic model for economic growth ( EG ), model 2 represents the secondary economic growth ( EG-S ), model 3 the primary growth ( EG-P ), and model 4 indicates the tertiary economic growth ( EG-T ) for making such supposition we follow (Shin et al. 2014 ). Additionally, the economic growth is based on cointegration consequences and VECM is organized to recognize the path of causality. The results from short-run NARDL represent that education and infrastructure have no effect on secondary and tertiary economic growth ( EG-S ; EG-T ). However, in the long run the education has significant and positive impact over primary economic growth ( EG-P ). Similarly, in all models the FDI has vital role in determination of economic growth at every level. Moreover, the consumption of natural gas impacts in the long term and in the long run.

The consequences of Granger causality are presented in Table 8 . The outcome shows the unidirectional causality from EDI to economic growth ( EDI ≥ EG ), natural gas to economic growth ( NGC ≥ GCF ), and EDI to infrastructure ( EDI ≥ INFRI ).

Bidirectional causality is found between economic growth and FDI ( EG < = > FDI ) and economic growth and infrastructure ( EG < = > INFRI ). Bidirectional causality implies that when one parameter is increased, the other parameter also increases. When the parameters are exchanged, the parameters reinforce one another and become self-reinforcing. As a result, the policymaker would have an easier time dealing with this circumstance (Kónya 2006 ). However, if this is not the case, the study must incorporate more variables, and policy formation becomes more complicated (Riman and Akpan 2010 ). In summary, EDI has a noteworthy consequence on economic growth in Pakistan, owing to its bidirectional causation.

To check the result health of this study, we also report some problem-solving tests (Sohail et al. 2022 ) such as LM test, White test, and Jarque–Bera test. The results are provided in Table 9 and confirmed the model’s strength on the relationship among EDI , FDI , INFRI , NGC , and Pakistan economy.

Conclusion and policy implications

In adaptation of green energy transition and responding to the United Nation Agenda-2030 of sustainable development goal initiation, this research study focused with the impact of sustainable development goals (SDGs) on economic growth of Pakistan. More specifically, we examined the association of several important SDGs on economic growth with regards to previously missing links of sustainable economic development. Interestingly, this study is considering several new dimensions through the influence of SDGs: firstly the education (SDG-4) which is found in opposing to the theoretical approaches, secondly the foreign direct investment (SDG-17) which is found to more contributive to national economy, thirdly infrastructure and technological development (SDG-9) which is found as an important factor to boost the economy, and lastly the clean and green energy of increasing usage of natural gas (SDG-7) on the economy of Pakistan. Specifically, this research study provides help to the policymakers to overcome several permanent issues faced to the economy like the authorities should review the current policies regarding equitable quality education and lifelong learning opportunities to make it more contributive to the economic growth. Additionally , the economy needs more friendly policies to attract more FID inflow. Moreover , the policymakers should provide attention over the existing infrastructure to make it more sustainable business environment for industrialization and foster innovation. Finally , the usage of natural gas is considered more affordable and sustainable environmentally friendly in account of national economy.

We examined the impact several substantial SDGs that has potential to influence the economic for long time period historical data starting from 1990 to 2020. The structural break estimation indicates that there is presence of unexpected growth in several years. In line with this, we used the VECM and NARDL estimation techniques, where we found that the long-term coefficients of education, FDI inflow, and usage of natural gas impact the economy. We determined that FDI inflow and infrastructure are the most potent goals for Pakistan. Similarly, usage of natural gas and education are found contributions to economic growth. The consequences of asymmetric probing are stimulating, which confirmed the mi x outcomes regarding short-term and long-term asymmetries. The short-run and long-run results obtained from NARDL are significant and interesting in the case of developing economy. The government needed to motivate more FDI inflow to improve the infrastructure, and shell also improves education system at different level. Similarly, the adaptation of natural gas is creating a favorable environment. Collectively with the finding of four SDGs, all indicators are essential.

Recommendation and policy implications

The authorities need to imply more appealing policies to attract more foreign investment inflow. The existing policies related to quality education especially in the long term need to be revised to obtain the projected goals. The infrastructure that builds with aim of sustainable development can provide gateway to expansion for business operations. While the usage of natural gas is deemed as more clean energy source in comparison to oil and coal, the production level is to be increased, which could result in increasing of economic growth. This study can be extended to examine the relationship among sustainable development goals by analyzing the influence of other SDGs towards economic growth for other developing economies with fresh date data set.

Availability of data and materials

The data sets used during the current study are available from the corresponding author on reasonable request.

Ethical approval.

Not applicable.

Abdouli M, Omri A (2021) Exploring the nexus among FDI inflows, environmental quality, human capital, and economic growth in the Mediterranean region. J Knowl Econ 12(2):788–810

Google Scholar

Ahmad MS, Szczepankiewicz EI, Yonghong D, Ullah F, Ullah I, Loopesco WE (2022) Does Chinese foreign direct investment (FDI) stimulate economic growth in Pakistan? An application of the autoregressive distributed lag (ARDL bounds) testing approach. Energies 15(6):2050

Amjad R, Awais N (2016) Pakistan’s productivity performance and TFP trends 1980–2015: cause for real concern

Antonakakis, N., & Gabauer, D. (2017). Refined measures of dynamic connectedness based on TVP-VAR.

Apergis N, Payne J (2010a) Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Appl Energy 38(1):656–660

Apergis N, Payne JE (2010b) Natural gas consumption and economic growth: a panel investigation of 67 countries. Appl Energy 87(8):2759–2763

Armeanu DŞ, Vintilă G, Gherghina ŞC (2018) Empirical study towards the drivers of sustainable economic growth in EU-28 countries. Sustainability 10(1):4

Beets SD (2005) Understanding the demand-side issues of international corruption. J Bus Ethics 57(1):65–81

Brons M, Kalantzis F, Maincent E, Arnoldus P (2014) Infrastructure in the EU: developments and impact on growth. DG ECFIN, Occasional Paper, 203

Carree M, Van Stel A, Thurik R, Wennekers S (2007) The relationship between economic development and business ownership revisited. Entrep Reg Dev 19(3):281–291

Chakamera C, Alagidede P (2018) The nexus between infrastructure (quantity and quality) and economic growth in Sub Saharan Africa. Int Rev Appl Econ 32(5):641–672

Chanegriha M, Stewart C, Tsoukis C (2020) Testing for causality between FDI and economic growth using heterogeneous panel data. J Int Trade Econ Dev 29(5):546–565

Chowdhury MB (2022) Internationalisation of education and its effect on economic growth and development. The World Economy 45(1):200–219

Ciftci C, Durusu-Ciftci D (2021) Economic freedom, foreign direct investment, and economic growth: the role of sub-components of freedom. J Int Trade Econ Dev 1–22

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Ali MS, Khan UU, Parveen S (2021) The relationship between financial development and foreign direct investment and its impact on economic growth of Pakistan. iRASD J Econ 3(1):27–37

Economou F (2019) Economic freedom and asymmetric crisis effects on FDI inflows: the case of four South European economies. Res Int Bus Financ 49:114–126

Fatai K, Oxley L, Scrimgeour FG (2004) Modelling the causal relationship between energy consumption and GDP in New Zealand, Australia, India, Indonesia, The Philippines and Thailand. Math Comput Simul 64(3):431–445. https://doi.org/10.1016/S0378-4754(03)00109-5

Article Google Scholar

Feng K, Davis SJ, Sun L, Hubacek K (2015) Drivers of the US CO 2 emissions 1997–2013. Nat Commun 6(1):1–8

Glewwe P, Maiga E, Zheng H (2014) The contribution of education to economic growth: a review of the evidence, with special attention and an application to Sub-Saharan Africa. World Dev 59:379–393

Habibi F, Zabardast MA (2020) Digitalization, education and economic growth: a comparative analysis of Middle East and OECD countries. Technol Soc 63:101370

Hamid I, Alam MS, Kanwal A, Jena PK, Murshed M, Alam R (2022) Decarbonization pathways: the roles of foreign direct investments, governance, democracy, economic growth, and renewable energy transition. Environ Sci Pollut Res 1–16.

Hanif N, Arshed N (2016) Relationship between school education and economic growth: SAARC countries. Int J Econ Financ Issues 6(1):294–300

Hanushek EA, Woessmann L (2020) Education, knowledge capital, and economic growth. Econ Educ 171–182

Hassan SA, Rafaz N (2017) The role of female education in economic growth of Pakistan: a time series analysis from 1990–2016. International Journal of Innovation and Economic Development 3(5):83–93

Hu Y, Xiao J, Deng Y, Xiao Y, Wang S (2015) Domestic air passenger traffic and economic growth in China: evidence from heterogeneous panel models. J Air Transp Manag 42:95–100

Ibrahim MH (2015) Oil and food prices in Malaysia: a nonlinear ARDL analysis. Agricultural and Food Economics 3(1):1–14

IEA (2016) International Energy Agency. In: OECd/IEa

Jalil A, Idrees M (2013) Modeling the impact of education on the economic growth: evidence from aggregated and disaggregated time series data of Pakistan. Econ Model 31:383–388

Johnston M (1998) Fighting systemic corruption: social foundations for institutional reform. The European Journal of Development Research 10(1):85–104

Jolliffe IT (1972) Discarding variables in a principal component analysis. I: Artificial data. Journal of the Royal Statistical Society: Series C (Applied Statistics) 21(2):160–173

Kaufmann D, Kraay A, Mastruzzi M (2011) The Worldwide Governance Indicators (WGI) project. Retrieved April, 21, 2012

Khan I, Hou F, Zakari A, Tawiah VK (2021) The dynamic links among energy transitions, energy consumption, and sustainable economic growth: a novel framework for IEA countries. Energy 222:119935

Khan NM, Ahmad M, Cao K, Ali I, Liu W, Rehman H, ..., Ahmed T (2022) Developing a new bursting liability index based on energy evolution for coal under different loading rates. Sustainability 14(3):1572

Khan ZU, Ahmad M, Khan A (2020) On the remittances-environment led hypothesis: empirical evidence from BRICS economies. Environ Sci Pollut Res 27(14):16460–16471

Kingdon GG (2007) The progress of school education in India. Oxf Rev Econ Policy 23(2):168–195

Kónya L (2006) Exports and growth: Granger causality analysis on OECD countries with a panel data approach. Econ Model 23(6):978–992

Kousar S, Batool SA, Batool SS, Zafar M (2020) Do government expenditures on education and health lead toward economic growth? Evidence from Pakistan. Journal of Research & Reflections in Education (JRRE) 14(1)

Li K, Cursio JD, Sun Y, Zhu Z (2019a) Determinants of price fluctuations in the electricity market: a study with PCA and NARDL models. Economic research-Ekonomska istraživanja 32(1):2404–2421

Li Z-G, Cheng H, Gu T-Y (2019b) Research on dynamic relationship between natural gas consumption and economic growth in China. Struct Chang Econ Dyn 49:334–339

Lin T-C (2003) Education, technical progress, and economic growth: the case of Taiwan. Econ Educ Rev 22(2):213–220

Looney R (2004) Failed economic take-offs and terrorism in Pakistan: conceptualizing a proper role for US assistance. Asian Surv 44(6):771–793

Looney R (2009) Failed take-off: an assessment of Pakistan’s October 2008 economic crisis

Looney RE (1991) Defense expenditures and economic performance in South Asia: tests of causality and interdependence. Confl Manag Peace Sci 11(2):37–67

Looney RE (1994) Budgetary dilemmas in Pakistan: costs and benefits of sustained defense expenditures. Asian Surv 34(5):417–429

Mahadevan R, Asafu-Adjaye JJEP (2007) Energy consumption, economic growth and prices: a reassessment using panel VECM for developed and developing countries. 35(4):2481–2490

Marazzo M, Scherre R, Fernandes E (2010) Air transport demand and economic growth in Brazil: a time series analysis. Transportation Research Part e: Logistics and Transportation Review 46(2):261–269

Mohanty RK, Bhanumurthy NR (2019) Analyzing the dynamic relationships between physical infrastructure, financial development and economic growth in India. Asian Economic Journal 33(4):381–403

Murshed M, Nurmakhanova M, Al-Tal R, Mahmood H, Elheddad M, Ahmed R (2022) Can intra-regional trade, renewable energy use, foreign direct investments, and economic growth mitigate ecological footprints in South Asia? Energy Sources, Part B: Economics, Planning, and Policy 1–26

Nazir MS, Abdalla AN, Sohail H, Tang Y, Rashed GI, Chen W (2021) Optimal planning and investment of multi-renewable power generation and energy storage system capacity. J Electr Syst 17(2)

Neog Y, Yadava AK (2020) Nexus among CO 2 emissions, remittances, and financial development: a NARDL approach for India. Environ Sci Pollut Res 27(35):44470–44481

CAS Google Scholar

Nielsen B (2001) Order determination in general vector autoregressions

Omri A (2013) CO 2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Economics 40:657–664

Ozturk I, Al-Mulali U (2015) Natural gas consumption and economic growth nexus: panel data analysis for GCC countries. Renew Sustain Energy Rev 51:998–1003

Pakistan SBO (2021) https://www.daynews.tv/2021/11/24/sbp-releases-annual-report-on-the-state-of-pakistans-economy/ . Retrieved from

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Pradhan RP, Bagchi TP (2013) Effect of transportation infrastructure on economic growth in India: the VECM approach. Res Transp Econ 38(1):139–148

Rehman FU, Sohag K (2022) Does transport infrastructure spur export diversification and sophistication in G-20 economies? An application of CS-ARDL. Appl Econ Lett. https://doi.org/10.1080/13504851.2022.2083554

Rehman FU, Islam MM, Sohag K (2022) Does infrastructural development allure foreign direct investment? The role of Belt and Road Initiatives. International Journal of Emerging Markets, (ahead-of-print). https://doi.org/10.1108/IJOEM-03-2022-0395

Riman BH, Akpan ES (2010) Causality between poverty, health expenditure and health status: evidence from Nigeria using VECM. Eur J Econ Finance Adm Sci 27:120–128

Rossi B, Wang Y (2019) Vector autoregressive-based Granger causality test in the presence of instabilities. Stand Genomic Sci 19(4):883–899

Sadiqa BA, Zaman K, Rehman FU, Nassani AA, Haffar M, Abro MMQ (2022) Evaluating race-to-the-top/bottom hypothesis in high-income countries: controlling emissions cap trading, inbound FDI, renewable energy demand, and trade openness. Environ Sci Pollut Res 1–14

Saeed F, Awan AG (2020) Does technological advancement really affects economic growth of Pakistan. Global Journal of Management, Social Sciences and Humanities 6(2)

Saleem, H., & Shabbir, M. S. (2020). The short-run and long-run dynamics among FDI, trade openness and economic growth: using a bootstrap ARDL test for co-integration in selected South Asian countries. South Asian Journal of Business Studies .

Sari R, Ewing BT, Soytas U (2008) The relationship between disaggregate energy consumption and industrial production in the United States: an ARDL approach. Energy Economics 30(5):2302–2313

Schwab K (2018) The global competitiveness report 2018. Paper presented at the World Economic Forum

Seetanah B (2009) The economic importance of education: evidence from Africa using dynamic panel data analysis. J Appl Econ 12(1):137–157

Self S, Grabowski R (2004) Does education at all levels cause growth? India, a case study. Econ Educ Rev 23(1):47–55

Shabbir S (2013) Does external debt affect economic growth: evidence from developing countries. Retrieved from

Shahbaz M, Lean HH, Farooq A (2013) Natural gas consumption and economic growth in Pakistan. Renew Sustain Energy Rev 18:87–94

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. Festschrift in honor of Peter Schmidt. Springer, Berlin, pp 281–314

Sohail HM, Li Z, Murshed M, Alvarado R, Mahmood H (2022) An analysis of the asymmetric effects of natural gas consumption on economic growth in Pakistan: a non-linear autoregressive distributed lag approach. Environ Sci Pollut Res 29(4):5687–5702

Sohail HM, Zatullah M, Li Z (2021) Effect of foreign direct investment on bilateral trade: experience from asian emerging economies. SAGE Open 11(4):21582440211054490

Solarin SA, Ozturk I (2016) The relationship between natural gas consumption and economic growth in OPEC members. Renew Sustain Energy Rev 58:1348–1356

Solarin SA, Shahbaz M (2015) Natural gas consumption and economic growth: the role of foreign direct investment, capital formation and trade openness in Malaysia. Renew Sustain Energy Rev 42:835–845

Tehsin M, Khan AA, Sargana T-U-H (2017) CPEC and sustainable economic growth for Pakistan. Pakistan Vision 18(2):102–118

Tiwari AK, Mutascu M (2011) Economic growth and FDI in Asia: a panel-data approach. Economic Analysis and Policy 41(2):173–187

Tran N (2018) The long-run analysis of monetary policy transmission channels on inflation: a VECM approach. Journal of the Asia Pacific Economy 23(1):17–30

Tripathi M, Singal SK (2019) Use of principal component analysis for parameter selection for development of a novel water quality index: a case study of river Ganga India. Ecol Ind 96:430–436

Ulucak R, Erdogan S (2022) The effect of nuclear energy on the environment in the context of globalization: consumption vs production-based CO 2 emissions. Nucl Eng Technol 54(4):1312–1320

Wang C, Lim MK, Zhang X, Zhao L, Lee PT-W (2020) Railway and road infrastructure in the Belt and Road Initiative countries: estimating the impact of transport infrastructure on economic growth. Transportation Research Part a: Policy and Practice 134:288–307

Wang Q, Wang X, Li R (2022) Does urbanization redefine the environmental Kuznets curve. An empirical analysis of 134

Xiao B, Niu D, Guo X (2016) Can natural gas-fired power generation break through the dilemma in China? A system dynamics analysis. J Clean Prod 137:1191–1204

Yasmin N, Safdar N, Yasmin F, Khatoon S (2021) Education, poverty, and unemployment: a way forward to promote sustainable economic growth in Pakistan. Journal of Contemporary Issues in Business Government 27(06)

Yusuf AM, Abubakar AB, Mamman SO (2020) Relationship between greenhouse gas emission, energy consumption, and economic growth: evidence from some selected oil-producing African countries. Environ Sci Pollut Res 27(13):15815–15823

Zaman S, Wang Z, Zaman Q, u. (2021) Exploring the relationship between remittances received, education expenditures, energy use, income, poverty, and economic growth: fresh empirical evidence in the context of selected remittances receiving countries. Environ Sci Pollut Res 28(14):17865–17877. https://doi.org/10.1007/s11356-020-11943-1

Download references

This paper was supported by the National Social Science Foundation of China (21&ZD184).

Author information

Authors and affiliations.

School of Economics & Management, South China Normal University, Guangzhou, 510631, China

Hafiz M. Sohail

Graduate School of Economics and Management, Ural Federal University, Mira 19, 620002, Yekaterinburg, Russia

Mirzat Ullah & Kazi Sohag

Business School, NingboTech University, Ningbo, 315100, Zhejiang, China

Faheem Ur Rehman

You can also search for this author in PubMed Google Scholar

Contributions

H. M. S. conceptualized, conducted the econometric analysis, and write of chapter introduction. M. Z. U. conceptualized, conducted the econometric analysis, and conduct overall study, with writing of conclusions and recommendations. K. S. reviewed the literature, discussed the findings, and edited the entire draft. F. U. R. supervised the entire study and drafting.

Corresponding author

Correspondence to Faheem Ur Rehman .

Ethics declarations

Consent to participate, consent for publication, competing interests.

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Sohail, H.M., Ullah, M., Sohag, K. et al. Response of Pakistan’s economic growth to macroeconomic variables: an asymmetric analysis. Environ Sci Pollut Res 30 , 36557–36572 (2023). https://doi.org/10.1007/s11356-022-24677-z

Download citation

Received : 01 June 2022

Accepted : 06 December 2022

Published : 23 December 2022

Issue Date : March 2023

DOI : https://doi.org/10.1007/s11356-022-24677-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Sustainable development goal indexes

- Time series analysis

- VECM, NARDL

JEL Classification

- Find a journal

- Publish with us

- Track your research

The World Bank In Pakistan

Pakistan has important strategic endowments and development potential. The increasing proportion of Pakistan’s youth provides the country with a potential demographic dividend and a challenge to provide adequate services and employment.

Poverty reduction has slowed amid recent shocks, as economic growth has remained volatile and slow. Pakistan made significant progress towards reducing poverty between 2001 and 2018 with the expansion of off-farm economic opportunities and increased inflow of remittances. However, rapid poverty reduction has not fully translated into improved socio-economic conditions, as human capital outcomes have remained poor, with high levels of stunting at 38 percent and learning poverty at 78 percent. Critical constraints, including persistent fiscal and current account deficits, protectionist trade policies, unproductive agriculture, a difficult business environment, a heavy state presence in the economy, and a financially unsustainable energy sector, have remained unaddressed, leading to slow and volatile growth. Progress with poverty reduction has recently slowed amid macroeconomic instability, the COVID-19 pandemic, and the catastrophic 2022 floods. The estimated lower-middle income poverty rate is 40.1 percent (US$3.65/day 2017 PPP) for the year 2023-24, virtually the same as the poverty rate in 2018, but with 7 million more Pakistanis living below the poverty line.

Pakistan experienced heavy monsoon rains in 2022 leading to catastrophic and unprecedented flooding with enormous human and economic impacts. Roughly 33 million people were impacted, and many permanently displaced. More than 13,000 kilometers of roads were destroyed, 2.2 million houses damaged, around 3.8 million hectares of crops were flooded, and an estimated 1.2 million livestock were killed. Limited access to input and output markets and temporary disruptions to supply chains subsequently drove up food prices and added to existing price pressures resulting from reduced agricultural yields and the global rise of food prices. The Government’s Post-Disaster Needs Assessment estimated that the need for rehabilitation and reconstruction is at US$16.3 billion.

Pakistan has made recent progress towards macroeconomic stabilization, but risks remain extremely high and faster growth will require substantial reform. Real GDP growth contracted by 0.2 percent y-o-y in fiscal year FY23, after growing by 6.2 percent in FY22 and 5.8 percent in FY21. Accumulated economic imbalances, including high fiscal deficits and increasing debt, depleted Pakistan’s policy buffers resulting in high vulnerability to the catastrophic floods, high world commodity prices, and tight global financing conditions. Repeated delays in implementing the International Monetary Fund (IMF) Extended Fund Facility (EFF) program and the associated decline in external financing inflows saw foreign reserves fall to critically low levels, amid high inflation and sharp currency depreciation. Following the expiry of the incomplete EFF program, a nine-month Stand-By Arrangement (SBA) was approved by the IMF, with staff level agreement reached on its final review in March 2024. Under the SBA, exchange rate flexibility was restored, import controls were eased with some recovery in foreign exchange reserves and economic growth, and new measures were introduced to contain the FY24 fiscal deficit. Nonetheless, risks remain high. Short-term stability depends on remaining on track with the SBA, continued fiscal restraint, and new external financing inflows. Robust economic recovery over the medium term will require the steadfast implementation of much broader fiscal and economic reforms.

Economic activity is expected to remain subdued, with real GDP growth estimated at 1.8 percent in FY24, reflecting continued tight macroeconomic policy, import controls, high inflation, and continued policy uncertainty. Output growth is expected to increase to around 2.5 percent over FY25-26, remaining below potential. Poverty reduction is projected to stall with the poverty rate at around 40 percent in the medium term, owing to weak growth, limited increase in real labor incomes, and persistently high food and energy inflation. Inflation is projected to remain elevated at 26.0 percent in FY24 due to higher domestic energy prices, with little respite for poor and vulnerable households with depleted savings and lower real incomes. With high base effects and lower projected global commodity prices, inflation is expected to moderate over the medium-term. With continued import controls, the CAD is expected to remain low at 0.7 percent of GDP in FY24 and to further narrow to 0.6 percent of GDP in FY25 and FY26. The fiscal deficit is projected to widen to 8.0 percent of GDP due to higher interest payments but gradually decline as fiscal consolidation takes hold and interest payments fall over time.

The Government continues to face a challenging macroeconomic environment while maintaining progress towards macroeconomic stabilization and critical structural reforms. Significant downside risks include: i) policy uncertainty, which may undermine a coherent and timely policy response; ii) worsening external conditions, including unforeseen increases in global commodity prices and interest rates; and iii) risks associated with large domestic and external financing needs, especially in the context banking sector liquidity constraints. To manage these risks, it will be critical to adhere to sound overall economic management and buttress market sentiment, including through articulating and effectively implementing a clear strategy for economic recovery; constraining fiscal expenditures to the extent possible and carefully targeting any new expenditures; maintaining a tight monetary stance and flexible exchange rate; and remaining on-track with critical structural reforms, including those in the energy sector.

Last Updated: Apr 02, 2024

The Country Partnership Strategy (CPS) for Pakistan for FY2015-20 is structured to help the country tackle the most difficult—but potentially transformational—areas to reach the twin goals of poverty reduction and shared prosperity.

The Pakistan team continues to engage with stakeholders on the next Country Partnership Framework (CPF). The CPF will draw from several analytical works, including Pakistan Systematic Country Diagnostic: Leveling the Playing Field , and the recently published Country Climate Development Report and Country Economic Memorandum .

The four results areas of the current CPS are:

Transforming the energy sector: WBG interventions are supporting improved performance of the energy sector by supporting reforms and investments in the power sector to reduce load shedding, expand low-cost generation supply, improve transmission, improve governance and cut losses.

Supporting private sector development: A mix of budget support, investments and analytical work supports improvements in Pakistan’s investment climate, in overall competitiveness, agricultural markets and productivity, and skills development.

Reaching out to the underserved, neglected, and poor: Investments support financial inclusion, micro, small and medium enterprises (MSMEs), women and youth (including through enrollment outcomes), fragile provinces/regions and poorer districts, social protection, and resilience and adaptation to the impact of climate change.

Accelerating improvements in service delivery: At the federal and provincial levels the Bank supports increasing revenues to fund services and setting more ambitious stretch targets for areas that are not producing change fast enough (especially education and health). At a provincial level, this involves support to better service delivery in cities.

Cross cutting themes for the program include women’s economic empowerment, climate change and resilience, and regional economic connectivity.The WBG has fourth-largest portfolio of $14.7 billion in Pakistan ($10.7bn IDA, $3.8bn IBRD, $0.2mn in Trust funds and co-financings). The portfolio is supporting reforms and investments to strengthen institutions, particularly in fiscal management and human development. Partnerships are being strengthened at provincial levels, focusing on multi-sectoral initiatives in areas such as children's nutrition, education and skills, irrigated agriculture, tourism, disaster risk management, and urban development. Clean energy, and social/financial inclusion, both remain major priorities.

ENHANCING DISASTER RESILIENCE

Being one of the most vulnerable countries to climate change Pakistan is recurrently affected by catastrophes, including the unprecedented 2022 floods which affected an estimated 33 million people and resulted in US$14.9 billion in damages and US$15.2 billion in economic losses . Pakistan’s economy continues to suffer chronic strain from prevailing and likely future threats of hazards. Since the 2005 Pakistan earthquake, which led to nearly 73,000 deaths and caused damages to over 570,000 houses, the Bank has been supporting the Government of Pakistan in shifting to an anticipatory risk management approach. Initially, the Bank provided technical assistance to the government to highlight physical and fiscal risks from hazards, including risk assessments of federal and provincial capitals. In parallel, the Bank also used grant resources to build the capacity of Provincial Disaster Management Authority of Balochistan.

Following the floods of 2014, at the request of Government of Pakistan, the World Bank prepared the US$125 million IDA-funded Disaster and Climate Resilience Improvement Project (DCRIP) to support the restoration of flood protection infrastructure and strengthen government capacity to manage disasters and climate variability in Punjab. The project was successfully concluded in November 2021,achieving its intended development objectives and surpassing the targets for several key results indicators. DCRIP directly benefitted more than 8 million people, half of which are women. The project also repurposed US$7 million to support the Government of Punjab in the pandemic emergency response through procurement of personal protection and healthcare equipment.

In 2016, the Bank also prepared and delivered the US$100 million IDA-funded Sindh Resilience Project (SRP) to mitigate flood and drought risks in selected areas, and strengthen Government of Sindh's capacity to manage natural disasters. About 5.75 million people across the province have benefitted from project interventions till date. The drought mitigation component of the project, comprising construction of small groundwater recharge dams, has already started generating strong development impacts for the target communities. In 2021, the Bank approved an additional financing of US$200 million to scale up the small groundwater recharge dams component and set up an emergency rescue service for Sindh.

The Bank has also prepared and delivered the US$188 million IDA-funded Pakistan Hydromet and Climate Services Project which aims to strengthen Pakistan’s public-sector delivery of reliable and timely hydro-meteorological services and enhance community resilience to shocks. The Contingent Emergency Response Component (CERC) was activated under this project to disburse US$150 million in response to the 2022 floods to provide cash assistance to 1.3 million flood affected families.