- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Demystifying Assignment of Lease: Your Go-To Guide

LegalGPS : July 29, 2023 at 8:17 AM

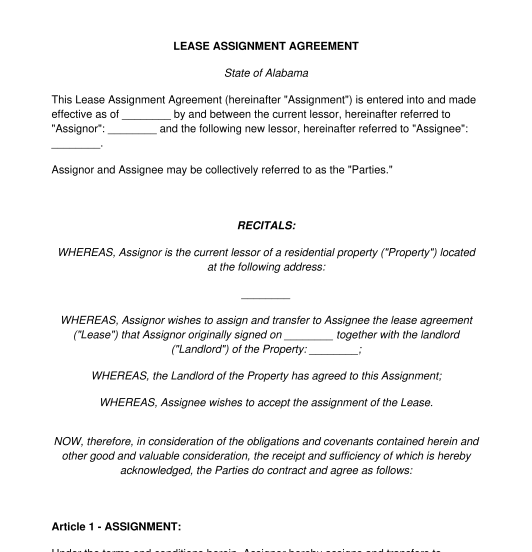

When you’re talking about property leasing, it’s important to understand that there are a lot of terms and concepts that you may have never heard before. One of them is the assignment of lease, which refers to a situation where a tenant transfers their rights and responsibilities under the lease agreement to another party.

What is an Assignment of Lease, and why is it so crucial?

An Assignment of Lease is a term you may have heard thrown around, especially if you're involved in rental properties. It’s a pretty important document. But what exactly is it? Well, in simple terms, an Assignment of Lease is an agreement where the original tenant of a property transfers their leases and all of its rights and obligations to a new tenant. Now, you might be wondering, "When would this scenario ever occur?"

Let's imagine you're a tenant who signed a three-year lease for an office space. However, two years in, you need to relocate due to unprecedented growth of your business. Instead of breaking the lease, you might choose to assign your lease to another business looking for office space. This means that you, as the original tenant, no longer have any obligations under the lease. The new tenant is now responsible for paying rent and complying with all of the terms of the previously signed agreement.

Now that you understand, let's get into the step-to-step guide on how to create an Assignment of Lease!

Steps to Write an Assignment of Lease

Creating a thorough Assignment of Lease agreement doesn't need to be an overwhelming task. Simply follow these steps to ensure your agreement is both comprehensive and legally binding:

Step 1: Identify the Parties

The information of each party should be included. For the existing tenant (the assignor), make sure to include:

Full legal name or business name

Postal mailing address

Phone number and email address

Do the same for the new tenant (the assignee). Make sure all the information is up-to-date and accurate to avoid any unnecessary confusion or disputes. For example, if the assignor is a business, make sure they have updated their mailing address with the post office to reflect their new building location. If a party has multiple addresses, be sure to list them all.

Step 2: Specify the Lease

This section requires exact information from the original lease agreement, including:

Property address and description

Lease start and end date

A reference to the original lease agreement (for instance, a sentence like "the lease agreement dated...")

Remember to include a copy of the original lease as an attachment to ensure the assignee understands the terms they're adhering to. If not already included in the original lease agreement, be sure to add the following information: Description of rental property, Lease term (how long the lease is good for), Rent amount, and Security deposit amount.

Step 3: Detail the Assignment

State that the assignor is transferring all their interests and obligations in the lease to the assignee. Here, write something like:

"The Assignor hereby assigns, transfers, and conveys to the Assignee all of the Assignor's rights, title, and interest in and to the Lease, together with all the Assignor's obligations, liabilities, and duties under the Lease."

This means that the assignor is transferring all of their interests and obligations in the lease to the assignee. This includes any future rent payments, repairs and maintenance responsibilities, notices of default by either party, and so on.

Step 4: Landlord's Consent

Many leases require the landlord's consent to assign the lease. The assignor should request written consent from the landlord and include a clause like:

"The assignment of the lease is not valid unless and until the landlord provides written consent."

This is followed by a place for the landlord to affirm consent by signing or initialing. This is important because the landlord can elect to withhold consent and the assignment will not be valid. If this is the case, you may need to provide additional consideration for your landlord's assent (for example, an increase in rent).

Step 5: Assignee Acceptance

Include a statement in which the new tenant agrees to the assignment and the terms of the lease. It may look like:

"The Assignee hereby accepts this assignment, assumes all duties and responsibilities under the Lease, and agrees to perform all of the Assignor's obligations under the Lease."

You need to do this because the new tenant needs to have an affirmative acceptance of the assignment in order for it to be valid. This is typically done through a letter from the assignee stating that they agree to perform all of your obligations under the lease.

Step 6: Signature and Date

Every binding legal document needs a date and a signature. Make sure that there is a proper place for the assignor and the assignee to sign and print their names, with a line for the date.

By following these clear, actionable steps, you'll be able to construct an effective Assignment of Lease agreement. Remember, every situation is unique, so adjust the template as necessary, being sure to include all relevant details.

Clear so far? Great! Now, let's focus on the tips to draft a perfect Assignment of Lease.

Tips to Draft a Perfect Assignment of Lease

Accurate Dates: Be sure to include the date when this agreement will take effect. Precision avoids any confusion about durations, when the assignee takes over, or when the assignor's obligations end.

Clear Terms: This document should restate the terms of the original lease. The assignee needs a clear understanding of what they're stepping into. Bit ambiguous? Think of it like this: the assignee should be able to step into the assignor's shoes comfortably.

Specify Rent Terms: Stating the rent amount, due dates, and method of payment in the assignment helps create a record of the agreed-upon rent terms, ensuring no misunderstanding arises in the future.

Specify the Term: The assignment should state how long the new lease lasts. For example, if the original lease is for one year, then the assignee will assume only a one-year term.

Specify Other Conditions: If there are other conditions in place—such as tenant improvements or utility allowances—then specify these too.

An assignment of lease doesn't have to be a formidable task to overcome. With a cautious and considered approach, these documents can be a smooth and seamless part of managing a successful lease transition.

Our contract templates can offer you even more support, empowering you towards crafting an excellent and individualised Assignment of Lease ready for your task. So why not take your next step towards leasing success and check them out today? Click here to get started!

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

Subleases and Assignments by Tenants & Related Legal Concerns

Some landlords allow a tenant to sublet their unit to a third party, while others do not. If you are considering this option, you should check your lease or rental agreement to make sure that it is permitted. Even if it is not explicitly prohibited, you should get your landlord’s permission in advance to minimize future disputes.

How a Sublease Works

A subtenant is not a co-tenant and does not have a direct relationship with your landlord. As their “landlord,” you can (and should) require them to pay rent directly to you and evict them if they fail to follow through. This differs from a co-tenant, who can be evicted only by your landlord. If you decide to evict your subtenant, you will need to follow the same procedures that would be required of a landlord. A month-to-month rental agreement may be better for a subtenant arrangement than a lease. Any agreement should clearly state the amount of the rent, the length of the tenancy, and any security deposit that may be required.

A tenant will usually need their landlord’s permission before subletting their unit, but some state or local laws may prevent landlords from unreasonably denying subleases.

You should be aware that any benefits that you give your subtenant must fit within the overall rules that the landlord imposes for the property and the people who live there. Even though the subtenant did not sign your lease with the landlord, its terms apply to them as well.

You should make sure that you are confident about the subtenant’s financial situation and ability to comply with the terms of the sublease and the landlord’s rules. If they fail to pay rent or damage the property, you will be on the hook to the landlord for all of your own rent and the cost of any repairs. In extreme situations, such as criminal activity by your subtenant, the landlord may evict you in order to remove the subtenant. You also may face an eviction if you get into a dispute with your subtenant. If they refuse to leave when you return, for example, it may be easier for the landlord to simply evict both of you.

Can a Subtenant Turn Into a Tenant?

A subtenant can turn into a tenant if the landlord and you start acting as though the subtenant is a co-tenant. The most common issue here is who receives rent from the subtenant. If they start paying the landlord rather than you, they will have a strong argument that they are the landlord’s tenant. To prevent your subtenant from gaining the rights of a co-tenant, you should make sure that they pay rent to you, and then you can send it to the landlord.

Assigning a Lease

While assignments are often discussed together with subleases, they should not be confused. An assignment transfers the rest of your lease to a new tenant, and it usually happens when you want to move out before the lease is over. While a sublease makes you the landlord of the subtenant, an assignment makes the assignee a tenant of your landlord. All of the terms of your existing agreement with the landlord most likely will apply to the assignee. (There is an exception if the agreement contains a personal term, such as handling errands for the landlord in exchange for reduced rent.) The original tenant, the assignee, and the landlord all will need to sign the assignment document for it to become valid.

The original tenant will remain liable for rent that the assignee does not pay unless the landlord agrees otherwise.

Assignments can be risky because the original tenant remains on the hook to the landlord for all of the remaining rent if the assignee fails to pay it. This essentially makes the original tenant a guarantor for the rent, so it may be more appealing to try to terminate the lease early and let the next tenant start a new lease. Sometimes, however, you can work around this default rule and get the landlord’s consent to take you off the hook for any rent that the assignee does not pay.

Vacation Rentals (Airbnb)

Many tenants try to earn extra money by listing a home as a short-term vacation rental on websites like Airbnb. You should make sure that your lease permits this type of rental, since you may face eviction if you use Airbnb without your landlord’s authorization. You should get any ensuing agreement with your landlord in writing. It should cover issues such as how much of your unit will be leased to the short-term renter, how often you can list on Airbnb, and financial considerations such as any amount of the Airbnb rent that the landlord receives.

In addition to getting your landlord’s permission, you will want to make sure that listing your home for a short-term vacation rental complies with any zoning or land use laws in your area. You must comply with any restrictions in these laws, even if your landlord does not require it.

Finally, you may want to purchase renters’ insurance, while being aware that it may not cover people in a vacation rental. Some insurance companies are extremely reluctant to provide policies to people who plan to list on Airbnb or similar services.

Last reviewed October 2023

Landlord - Tenant Law Center Contents

- Landlord - Tenant Law Center

- Choosing a Place to Rent & Legal and Financial Concerns

- Understanding Leases and Rental Agreements & Their Legal Implications

- Changing a Lease or Rental Agreement

- Rent Rules and the Legal Rights & Obligations of Tenants

- Security Deposit Rules & Tenants' Legal Rights

- Inspecting a Rental Property Before Signing a Lease

- Co-Tenants' Legal Rights & Obligations on a Lease

- Subleases and Assignments by Tenants & Related Legal Concerns

- Major Repairs to Rental Property & Tenants' Legal Options

- Minor Repairs to Rental Property & Tenants' Legal Options

- Improvements, Alterations, and Fixtures on Rental Property

- Tenants' Legal Rights to Privacy

- Injuries to Tenants on Rental Property & Related Legal Claims

- Environmental Hazards on Rental Property & Enforcing Tenants' Legal Rights

- Inadequate Security at Rental Property & Tenants' Legal Options

- Terminating a Lease of Rental Property & Related Legal Rights and Obligations

- Abandoning Personal Property When Leaving a Rental Unit

- Recovering a Security Deposit When Leaving a Rental Unit

- Resolving Disputes With Your Landlord Without a Lawyer

- Responding to Legal Notices Terminating a Tenancy

- The Eviction Legal Process for Tenants

- Working With a Tenants' Rights Lawyer

- Tenants' Legal Rights & Duties — FAQs

- Landlords' Legal Rights & Duties

- Housing Discrimination Law

- Eviction Laws and Forms: 50-State Survey

- Find a Landlord Tenant Lawyer

Related Areas

- Consumer Protection Law Center

- Civil Rights and Discrimination Legal Center

- Foreclosure Law Center

- Animal and Dog Law Center

- Related Areas

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Connect with an agent

A realtor.com coordinator will connect you with a local agent in minutes.

A local real estate agent can answer questions, give guidance, and schedule home tours.

By proceeding, you consent to receive calls and texts at the number you provided, including marketing by autodialer and prerecorded and artificial voice, and email, from Realtor.com and others Persons who may contact you include real estate professionals such as agents and brokers, mortgage professionals such as lenders and mortgage brokers, realtor.com and its affiliates, insurers or their agents, and those who may be assisting any of the foregoing. about your inquiry and other home-related matters, but not as a condition of any purchase. More You also agree to our Terms of Use, and to our Privacy Policy regarding the information relating to you. Msg/data rates may apply. This consent applies even if you are on a corporate, state or national Do Not Call list.

A Realtor.com coordinator will call you shortly

What’s next.

- A coordinator will ask a few questions about your home buying or selling needs.

- You’ll be introduced to an agent from our real estate professional network.

To connect right away, call (855) 650-5492

( Getty Images )

What Is a Leasehold Property? A Rental That Lasts … and Lasts

Most people know the difference between renting and owning a home, but there’s a third category that many are not familiar with, called a leasehold property. That’s where you lease (or rent) property, but for far longer than a tenant’s standard one- or two-year time frame.

Contracts for leaseholds, in contrast, last for a minimum of 40 years—and up to 120 years! Yeah, that’s a long, long time, almost certainly far past the point that you’ll get to enjoy the place. So what’s the deal with this long-haul lease?

What is a leasehold property?

Leaseholds are very common in other countries, especially in Europe, where you might see the terms “leasehold” and “freehold” on listings. A freehold agreement is similar to the type of standard home purchase that we have in America; once you’ve paid off the debt, you own the property and the land. Whereas when you sign a leasehold agreement, it’s as if you own the house for only a fixed period of time but you never own the land it is built on—and eventually the house reverts back to the land owner.

What does leasehold mean? How a leasehold property works

In leasehold or freehold arrangements, the property owner (also called the freeholder) grants the leaseholder the right to live on the property for a specified span of time. To hold up his end of the bargain, the lessee will have to make a down payment—only it’s far less than the typical 20% down required for a standard home purchase in the United States.

After that, the leaseholder pays rent (it’s sometimes called ground rent) every month, like your typical tenant.

Since leaseholders commit to renting a property for such a long span of time, they have one clear advantage over more temporary tenants in that they can have their way with home improvements.

Leaseholders can renovate to their heart’s content, build additions, or even erect whole new buildings on the land (and rent those units out to tenants of their own choosing).

At the end of the lease, however, unless the contract stipulates otherwise or a longer lease is negotiated, the property or land reverts back to the owner, improvements and all.

Leaseholds are more common for commercial property where malls and other businesses can be built on the land, but they also exist for residential purposes, such as houses and condos.

While properties with leaseholds are fairly rare in the United States, they be found, particularly in New York, Florida, and Hawaii.

Leaseholds make particular sense on islands or in beach communities, where land is limited and at a premium. In Maui, for example, leasehold or freehold estates were more commonly created in condo developments during the 1970s and 1980s (many of which are at the point where the lease is running out).

Benefits of a leasehold property

Leasehold properties come with a few noteworthy benefits for the potential owner. For one, they’re usually less expensive than purchasing the same land outright.

You can also sell your leasehold to someone else without the property owner’s permission or involvement; the more time left on the lease, the more valuable it is.

“Sometimes, leasehold properties can be a sweet deal,” says Powell Berger , a Hawaii real estate expert. But a freehold lease also comes with some major downsides.

“For most home buyers, leasehold property is a bad option, because you really don’t build equity,” Berger explains. “Mention ‘leasehold property’ ownership to most Hawaii residents, and you’re likely to be met with stern warnings.”

Yet Berger also notes that leaseholds can be ideal if you’re buying the condo to use as rental property to rake in a steady revenue from the lease’s ground rent as a landlord .

“The cost of owning the unit is low, and the rental income it produces can generate a good return on the ground rent over the long haul of the lease,” he says.

Leasehold interests are also good for seniors on a fixed income. Under a short-term lease, the rent can be raised every year. But with a leasehold interest, the rates could stay the same for decades.

With a lower down payment than a freehold property would require, becoming a freeholder could be the ideal arrangement for older people looking to downsize.

Of course, as with any real estate transaction, you’ll want to carefully weigh the pros and cons of a leasehold property and consult a real estate agent before you sign on the dotted line.

But for some people, this leasehold gray area between renting and buying could be the perfect ticket to kicking back on a patch of paradise without the hassles that true homeownership often entails.

Lisa Johnson Mandell is an award-winning writer who covers lifestyle, entertainment, real estate, design, and travel. Find her on ReallyRather.com

- Related Articles

Share this Article

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Lease Assignment Agreement

Rating: 4.9 - 137 votes

A Lease Assignment Agreement is a short document that allows for the transfer of interest in a residential or commercial lease from one tenant to another. In other words, a Lease Assignment Agreement is used when the original tenant wants to get out of a lease and has someone lined up to take their place.

Within a Lease Assignment Agreement, there is not that much information included, except the basics: names and identifying information of the parties, assignment start date, name of landlord, etc. The reason these documents are not more robust is because the original lease is incorporated by reference , all the time. What this means is that all of the terms in the original lease are deemed to be included in the Lease Assignment Agreement.

A Lease Assignment Agreement is different than a Sublease Agreement because the entirety of the lease interest is being transferred in an assignment. With a sublease, the original tenant is still liable for everything, and the sublease may be made for less than the entire property interest. A Lease Assignment transfers the whole interest and puts the new tenant in place of the old one.

The one major thing to be aware of with a Lease Assignment Agreement is that in most situations, the lease will require a landlord's explicit consent for an assignment. The parties should, therefore, be sure the landlord agrees to an assignment before filling out this document.

How to use this document

This Lease Assignment Agreement will help set forth all the required facts and obligations for a valid lease assignment . This essentially means one party (called the Assignor ) will be transferring their rights and obligations as a tenant (including paying rent and living in the space) to another party (called the Assignee ).

In this document, basic information is listed , such as old and new tenant names, the landlord's name, the address of the property, the dates of the lease, and the date of the assignment.

Information about whether or not the Assignor will still be liable in case the Assignee doesn't fulfill the required obligations is also included.

Applicable law

Lease Agreements in the United States are generally subject to the laws of the individual state and therefore, so are Lease Assignment Agreements.

The Environmental Protection Agency governs the disclosure of lead-based paint warnings in all rentals in the States. If a lead-based paint disclosure has not been included in the lease, it must be included in the assignment. Distinct from that, however, required disclosures and lease terms will be based on the laws of the state, and sometimes county, where the property is located.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: Tenants and Subtenants Obligations under a Sublease Agreement

Other names for the document:

Assignment Agreement for Commercial Lease, Assignment of Commercial Lease, Assignment of Lease, Assignment of Residential Lease, Assignment Agreement for Lease

Country: United States

Housing and Real Estate - Other downloadable templates of legal documents

- Security Deposit Return Letter

- Rent Payment Plan Letter

- Residential Lease Agreement

- Sublease Agreement

- Tenant Maintenance Request Letter

- Rent Receipt

- Late Rent Notice

- Notice of Intent to Vacate

- Roommate Agreement

- Quitclaim Deed

- Parking Space Lease Agreement

- Short-Term Lease Agreement

- Tenant Security Deposit Return Request

- Termination of Tenancy Letter

- Change of Rent Notice

- Complaint Letter to Landlord

- Lease Amendment Agreement

- Notice of Lease Violation

- Consent to Sublease

- Eviction Notice

- Other downloadable templates of legal documents

- Contract Management

Supplier Management

Savings Management

- Data & Security

FAQ’s

oboloo Articles

Navigating the world of lease assignment agreements: what you need to know.

Are you planning to lease a property but need to transfer the lease to someone else? Or are you interested in taking over an existing lease for your business or personal use? If so, then understanding the world of Lease Assignment Agreements is crucial. A Lease Assignment Agreement allows for the transfer of a tenant’s rights and obligations under their existing lease agreement. However, navigating this process can be complex and overwhelming without proper information and guidance. In this blog post, we’ll provide you with everything you need to know about Lease Assignment Agreements – from what they are and their different types to their benefits and risks. So let’s dive in!

What is a lease assignment agreement?

A lease assignment agreement is a legal document that allows a tenant to transfer their lease rights and obligations to another party . This means that the new tenant takes over the existing lease, including any remaining time on it, and assumes all responsibilities outlined in the original agreement .

This type of agreement is commonly used when a tenant needs to move out before their lease expires or when someone wants to take over an existing lease for business purposes. The landlord must agree to this transfer by signing off on the Lease Assignment Agreement .

It’s important to note that a Lease Assignment Agreement differs from subletting because in subleasing, the original tenant still retains some control over the property while in an assignment, they give up all rights and responsibilities.

A Lease Assignment Agreement can be beneficial for both parties involved – as long as everything is clearly defined and agreed upon beforehand.

What are the different types of lease assignment agreements?

When it comes to lease assignment agreements , there are different types that you should be aware of. The most common ones include the following:

1. Absolute Assignment: This type of lease assignment agreement involves the transfer of all rights and interests in a leased property from one party (the assignor) to another (the assignee). The assignee takes over all obligations and responsibilities related to the lease .

2. Sublease Agreement: A sublease agreement is an arrangement where the original tenant sublets their space to a new tenant for a portion or entirety of the remaining term on their lease. In this case, both parties must agree with any changes made regarding rent, utilities, maintenance expenses etc.

3. Partial Assignment: This occurs when only part of the leased property’s rights and interest is transferred from one party to another. The partial assignment does not release the assignor from their obligation towards future liabilities under the original terms agreed upon in leasing contract .

4. Assumption Agreement: In this type of lease assignment agreement, one party agrees to take responsibility for fulfilling obligations owed by another party if they default on payment or other obligations specified in leasing contract .

Understanding these various types will help you make informed decisions about which option suits your needs best before signing any legal documents associated with Lease Assignment Agreements

What are the benefits of a lease assignment agreement?

A lease assignment agreement is a legal document that allows a tenant to transfer their leasehold interest in a property to another party. This type of agreement offers several benefits for both the tenant and the new assignee.

Firstly, for tenants looking to exit their lease early, an assignment agreement can help avoid hefty penalties or fees imposed by landlords for breaking a lease . By assigning their lease to another party, tenants can fulfill their contractual obligations while also finding someone else to take over their remaining rent payments .

On the other hand, assignees benefit from being able to acquire an existing lease without having to go through lengthy negotiations with landlords. Additionally, they may be able to secure more favorable terms than if they were starting from scratch on a new rental agreement .

For landlords, allowing assignments can reduce vacancy periods and ensure consistent cash flow as new tenants move in seamlessly when old ones leave. It also saves time and resources since there is no need for extensive screening of prospective tenants.

A well-executed lease assignment agreement presents numerous advantages for all parties involved in the transaction.

What are the risks of a lease assignment agreement?

Entering into a lease assignment agreement comes with its own set of risks that both the assignor and assignee should consider before signing on the dotted line . One of the biggest risks is liability for any outstanding rent payments or damages to the property.

If the original tenant fails to pay rent or causes damage to the property, then both parties could be held responsible under the terms of some lease assignment agreements. This means that even if you are not directly at fault, you could still end up facing legal action for unpaid rent or repairs.

Another potential risk is losing control over who occupies your leased space. In some cases, landlords may require approval before allowing a new tenant to assume a lease agreement . If this approval isn’t granted and you’ve already assigned your lease to someone else without permission, then both parties could face eviction as a result.

There’s always a risk involved in giving up your rights as an original tenant when you sign onto an assignment agreement. You’ll be relinquishing control over how long your business stays in one location and what happens once it moves out – which can impact everything from future expansion plans to overall financial stability.

How to prepare for a lease assignment agreement?

Preparing for a lease assignment agreement is an important step in ensuring a smooth and successful transfer of your lease rights to another party. Here are some steps you should take to prepare for the process:

1. Review your current lease agreement: Before entering into a lease assignment agreement, it’s essential to review your existing lease terms carefully. Ensure that you understand all clauses related to assignments, subletting or transfers.

2. Communicate with the landlord: Contacting your landlord early on can help avoid any misunderstandings later on during the process. You may need their approval before assigning the lease, so keep them informed throughout.

3. Identify potential assignees: Determine who you want to assign the lease too and ensure they meet all necessary requirements set out by both the landlord and existing lease agreement .

4. Negotiate terms with assignee: Once you’ve identified potential assignees, negotiate terms such as rent payments and security deposits if needed.

5. Draft an Assignment Agreement: Work with legal counsel or use online resources like templates from professional associations where possible, ensuring that all parties agree upon its contents before finalizing it.

Preparing well for a Lease Assignment Agreement can be complex depending on various factors involved but following these steps will help make it easier and more manageable !

How to execute a lease assignment agreement?

Executing a lease assignment agreement is the final step in transferring your lease to a new tenant. Before you sign on the dotted line, make sure you have all your ducks in a row.

Firstly, review the terms of your existing lease and ensure that they are clear and concise. This includes any clauses regarding subletting or assigning the lease. You should also check for any restrictions that may prevent you from assigning the lease without landlord approval.

Next, identify potential tenants who may be interested in taking over your lease. Once you’ve found someone suitable, it’s time to negotiate terms with them directly or through an attorney.

Once both parties agree on terms such as rent payments and security deposits, it’s time to draft up an assignment agreement document. This document should include details about both parties involved along with signatures from each party acknowledging their understanding of its contents.

Submit this executed agreement along with other necessary documents such as consent forms from landlords and financial statements to complete the transfer process smoothly.

To sum it up, a lease assignment agreement is an essential document that plays a crucial role in transferring the rights and obligations of the lessee to another party. As we have discussed in this article, there are different types of lease assignment agreements with benefits and risks involved.

To navigate the world of lease assignment agreements successfully, one must prepare adequately by reviewing the original lease agreement thoroughly and seeking legal advice if necessary. Proper execution of the agreement is also crucial to ensure that all parties understand their responsibilities.

Understanding how a lease assignment agreement works can help you make informed decisions when dealing with leases. Whether you’re a landlord or tenant looking to transfer your interests in a property, always remember to be cautious and seek professional guidance throughout the process.

Want to find out more about procurement?

Access more blogs, articles and FAQ's relating to procurement

The smarter way to have full visibility & control of your suppliers

Contract Management

Partnerships

Charities/Non-Profits

Service Status

Release Notes

Feel free to contact us here. Our support team will get back to you as soon as possible

Sustainability

This residential lease assignment is between , an individual (the " Original Tenant ") and an individual (the " New Tenant ").

On or about , the Original Tenant and (the " Landlord ") entered into a lease agreement (the " Lease ").

The Lease covers the property located at , , , and more particularly described as follows: (the " Premises ").

Under section of the Lease, the Original Tenant is permitted to assign its interest in the Lease, with the consent of the Landlord.

The Original Tenant wishes to assign to the New Tenant's his or her rights in, and delegate all of his or her obligations under, the Lease, and the New Tenant wishes to accept this assignment.

The parties therefore agree as follows:

1. ASSIGNMENT.

The Original Tenant assigns to the New Tenant of all his or her rights in, and delegates to the New Tenant all of his or her obligations under, the Lease. This transfer will become effective as of (the " Effective Date "), and will continue until the present term of the Lease ends.

2. ASSUMPTION OF RIGHTS AND DUTIES.

After the Effective Date, the New Tenant shall assume all rights and duties under the Lease, including the obligation to pay rent under the Lease when it is due. The Original Tenant will have no further obligations under the Lease The Original Tenant will remain bound to the Landlord under the Lease, notwithstanding the assignment . However, the Original Tenant remains responsible for obligations accruing before the Effective Date.

3. REIMBURSEMENT.

On or before the Effective Date, the New Tenant shall pay to the Original Tenant, which is the sum of:

- (a) the security deposit held by the Landlord under the Lease; and

- (b) the rent or other deposits paid in advance by the Original Tenant for any period after the effective date of this assignment.

4. INDEMNIFICATION.

- (a) The Original Tenant shall indemnify the New Tenant from all damages, liabilities, expenses, claims, or judgments (including interest and reasonable attorneys' fees) (collectively, "Claims" ) arising out of the Original Tenant's failure to perform his or her obligations under the Lease before the Effective Date.

- (b) The New Tenant shall indemnify the Original Tenant from all Claims relating to the Lease, except if those costs arise from the Original Tenant's failure to perform his or her duties under the Lease before the Effective Date.

- (c) The New Tenant shall indemnify the Original Tenant from all Claims attributable to the acts or omissions of the New Tenant or his or her agents, contractors, or employees with respect to the Premises or any activities on the Premises. This indemnification will survive the termination of the Lease and this assignment.

5. CONTINUING EFFECTIVENESS OF LEASE.

This assignment is made on the understanding that all other terms of the Lease remain in full effect, including the prohibition against further assignments and subleases without the Landlord's express written consent.

6. ORIGINAL TENANT'S REPRESENTATIONS.

The Original Tenant represents that he or she:

- (a) has the power and authority to enter into and carry out this assignment;

- (b) has not previously assigned his or her rights under the Lease;

- (c) is the lawful and sole owner of the interests assigned under this assignment;

- (d) the interests assigned under this assignment are free from all encumbrances;

- (e) except for the Landlord and the Original Tenant, there are no parties in possession or occupancy of the Premises or any part of them, and there are no parties with possessory rights on the Premises or any part of them; and

- (f) has performed all obligations and made all required payments under the Lease.

7. CONDITION OF PREMISES.

The New Tenant has examined and inspected the Premises and accepts them "as is" and in its present condition with all faults. Except as provided in this assignment, the Original Tenant makes no representations, covenants, or guaranties about the status, nature, or condition of the Lease or the Premises.

8. INTERPRETATION .

In interpreting the language of this assignment, the parties shall be treated as having drafted this assignment after meaningful negotiations. The language in this assignment will be construed as to its fair meaning and not strictly for or against either party.

9. GOVERNING LAW .

- (a) Choice of Law. The laws of the state of govern this assignment (without giving effect to its conflicts of law principles).

- (b) Choice of Forum. Both parties consent to the personal jurisdiction of the state and federal courts in County, .

10. AMENDMENTS.

No amendment to this assignment will be effective unless it is in writing and signed by a party or its authorized representative.

11. COUNTERPARTS; ELECTRONIC SIGNATURES.

- (a) Counterparts. The parties may execute this agreement in any number of counterparts, each of which is an original but all of which constitute one and the same instrument.

- (b) Electronic Signatures . This agreement, agreements ancillary to this agreement, and related documents entered into in connection with this agreement are signed when a party's signature is delivered by facsimile, email, or other electronic medium. These signatures must be treated in all respects as having the same force and effect as original signatures.

12. SEVERABILITY.

If any one or more of the provisions contained in this assignment is, for any reason, held to be invalid, illegal, or unenforceable in any respect, that invalidity, illegality, or unenforceability will not affect any other provisions of this assignment, but this assignment will be construed as if those invalid, illegal, or unenforceable provisions had never been contained in it, unless the deletion of those provisions would result in such a material change so as to cause completion of the transactions contemplated by this assignment to be unreasonable.

13. NOTICES.

- (a) Writing; Permitted Delivery Methods . Each party giving or making any notice, request, demand, or other communication required or permitted by this assignment shall give that notice in writing and use one of the following types of delivery, each of which is a writing for purposes of this assignment: personal delivery, mail (registered or certified mail, postage prepaid, return-receipt requested), nationally recognized overnight courier (fees prepaid), facsimile, or email.

- (b) Addresses. A party shall address notices under this section to a party at the following addresses:

- If to the Original Tenant:

- If to the New Tenant:

- (c) Effectiveness. A notice is effective only if the party giving notice complies with subsections (a) and (b) and if the recipient receives the notice.

14. WAIVER.

No waiver of a breach, failure of any condition, or any right or remedy contained in or granted by the provisions of this assignment will be effective unless it is in writing and signed by the party waiving the breach, failure, right, or remedy. No waiver of any breach, failure, right, or remedy will be deemed a waiver of any other breach, failure, right, or remedy, whether or not similar, and no waiver will constitute a continuing waiver, unless the writing so specifies.

15. ENTIRE AGREEMENT.

This agreement constitutes the final agreement of the parties. It is the complete and exclusive expression of the parties' agreement about the subject matter of this agreement. All prior and contemporaneous communications, negotiations, and agreements between the parties relating to the subject matter of this agreement are expressly merged into and superseded by this agreement. The provisions of this agreement may not be explained, supplemented, or qualified by evidence of trade usage or a prior course of dealings. Neither party was induced to enter this agreement by, and neither party is relying on, any statement, representation, warranty, or agreement of the other party except those set forth expressly in this agreement. Except as set forth expressly in this agreement, there are no conditions precedent to this agreement's effectiveness.

16. HEADINGS.

The descriptive headings of the sections and subsections of this assignment are for convenience only, and do not affect this agreement's construction or interpretation.

17. EFFECTIVENESS.

This assignment will become effective when all parties have signed it. The date this assignment is signed by the last party to sign it (as indicated by the date associated with that party's signature) will be deemed the date of this assignment.

18. NECESSARY ACTS; FURTHER ASSURANCES.

Each party shall use all reasonable efforts to take, or cause to be taken, all actions necessary or desirable to consummate and make effective the transactions this assignment contemplates or to evidence or carry out the intent and purposes of this assignment.

[SIGNATURE PAGE FOLLOWS]

Each party is signing this agreement on the date stated opposite that party's signature.

ORIGINAL TENANT

[PAGE BREAK HERE]

LANDLORD'S CONSENT AND RELEASE

As Landlord under the Lease, I hereby consent to this assignment of the Lease, and to the New Tenant's assumption of the Original Tenant's obligations under the Lease, including the obligation to pay rent when it is due. As of the Effective Date, I release the Original Tenant from all liability for obligations (including rent payments) under the Lease. However, the Original Tenant remains primarily obligated as tenant under the Lease and I do not waive or relinquish any rights under the Lease against either the Original Tenant or the New Tenant.

Attach a copy of the Lease as Exhibit A

Free Assignment of Residential Lease Template

Simplify lease transfers with an assignment of residential lease agreement. with the landlord's approval, smoothly transfer your lease responsibilities to a new tenant while documenting the arrangement comprehensively..

Complete your document with ease

What's an assignment of residential lease?

Related templates

Assignment of Agreement

Transfer work responsibilities efficiently with an assignment of agreement. Facilitate a smooth transition from one party to another.

Assignment of Commercial Lease

Transfer your commercial lease to a new tenant smoothly. Create an assignment of a commercial lease to clearly articulate the new tenant's rights, responsibilities, and obligations.

Cohabitation Agreement

Step into a new chapter of your life securely with a cohabitation agreement. Start your commitment on the right track with your significant other.

Land Co-ownership Agreement

Define the rights and responsibilities of a property owner with a land co-ownership agreement. Safeguard investments and clarify land usage guidelines.

Landlord Consent to Assignment

Facilitate lease transfers with a landlord consent to assignment form. Provide tenant and landlord information, along with the rental property address, and grant permission for the lease transfer easily.

Landlord Consent to Sublease

Obtain approval from the landlord to sublet a space with a sublease agreement. Use our template to clearly lay out the lease terms, obligations of the new tenant, payment, and other essential details.

Primary tabs

Leasehold is a kind of property interest . A lease between a landlord and a tenant creates both a contractual interest and a property interest, the property interest here is called leasehold.

Leasehold is the presumption in the law that the lessee and lessor of the lease are protected even the lease is silent in some areas. For example, the landlord must make sure the real estate be habitable . Even if this is not included in the lease, if the real estate becomes inhabitable, the landlord offends the tenant’s leasehold. The tenant can sue the landlord and ask for remedies. However, if the lease specifically alters the presumed interests, the lessee and lessor should follow the lease.

[Last updated in July of 2020 by the Wex Definitions Team ]

- landlord & tenant

- wex definitions

Leasehold Mortgage vs. Assignment of Lease

More Articles

- 1. Foreclosure Right of Redemption & Tenant's Rights in Maryland

- 2. How to Get Out of a Timeshare That Has a Mortgage Attached

- 3. What Does "Encumbrances" Mean in Real Estate?

Although leasehold mortgages and assignments of lease are both legal processes relating to property leases, they’re actually very different. A leasehold mortgage is a loan placed on a piece of leased land, usually used by developers for construction projects. An assignment of lease transfers an unexpired lease to someone else, who then takes over the rental payments.

A leasehold mortgage is a loan taken out on a piece of property that is owned by someone else, while an assignment of lease transfers the lease on a property to someone else.

Mortgage Leases and Leasehold Mortgages

Generally, when someone wants to purchase a property, that property is financed using a mortgage. For commercial property buyers, though, mortgage lending isn’t quite as straightforward. There are various types of commercial mortgages, and one of those is a leasehold mortgage .

With a leasehold mortgage, a commercial real estate investor can obtain financing for a building based on the land that person is leasing. Common in real estate development, this type of mortgage gives the developer the funds necessary to put a building on land that is leased, based on the assumption that once construction is finished it will begin generating the income necessary to make it worth it for the property owner.

Assignment of Lease

If you own a home and want to get rid of it, you must either bring in a renter or sell it to someone else. With a lease, though, you can turn over the lease to someone else, provided your landlord is OK with it. This is done through the use of an assignment of lease , which gets you out of an unexpired lease by letting you transfer it to someone else.

Unlike a leasehold mortgage, an assignment of lease is not only a process, but it’s also a title document that both parties must read and sign. This type of arrangement comes in handy if your business fails to become profitable and must close, yet you have a remaining lease on your space. It may also be an option if your business grows so quickly that you need a larger space and therefore must move before your lease expires.

Leasehold Mortgage Versus Lease Assignment

Although leasehold mortgages and lease assignments are different by nature, they also have something in common. They refer to various activities that can take place based on a lease . While leasehold mortgage financing requires taking out a loan, though, a lease assignment is merely transferring an agreement from one party to another.

One similarity between the two is that they both refer to leases, which means property owners may have a stake in the outcome. With a leasehold mortgage, the borrower must have permission to take out such a mortgage – a permission that is usually conveyed as part of a commercial ground lease . With an assignment of lease, the landlord must sign off on the transfer before it can be finalized.

Approvals for Leasehold Mortgages

Getting a leasehold mortgage isn’t just a matter of heading to a bank and asking. The borrower will need to be able to prove that he has the right to request this type of loan . Usually, this starts by looking at the lease and finding the section specific to mortgages on the leased property.

Most commercial ground leases will state that the lessee must provide written notice to the lessor of an impending request to obtain financing for the property. That notice should include contact information for the potential mortgage lender, and the lender should verify that the lease allows a tenant to borrow money from the type of lending institution the borrower has approached.

Approvals for Lease Assignments

A tenant can’t simply turn a lease over to someone else. Obviously, the landlord will have a say in the situation and likely will want to clear the new tenant before approving the transfer. The landlord’s permission is usually granted in the form of a legal document known as the License to Assign .

The landlord’s approval may not be the only thing you’ll need to secure before you can complete an assignment of lease. On your lease agreement, check the section called Alienation , which should detail circumstances in which your landlord can refuse to allow you to assign your lease to someone else. If you fail to go through the landlord approval process, your landlord could later revoke the lease assignment.

Defining a Ground Lease

Before you can establish a mortgage leasehold interest in a property, you first must have the rights to lease the space. Leasehold mortgages are most commonly seen with ground leases, which are commercial leases issued to a tenant who wants to develop property on a lot. The property owner permits the developer to erect a building on that land with the understanding that once development is complete, the land and all the improvements revert back to the owner of that land.

Property owners agree to leasehold mortgages because once development is complete, the owner can then sell the property at a profit. It’s a small price to pay to allow someone to lease the property during the construction phase in order to recoup some money at the end of it. However, it can be risky for the property owner if the person leasing the property stops paying the lease or the leasehold mortgage payment and there’s no one around to pay the rent.

Leasehold Mortgage Foreclosures

If you own a property and stop paying your mortgage, the bank will eventually foreclose. But if you stop making payments on your leasehold mortgage, things get a little more complicated. Someone else owns that property, and that person expects a lease to continue to be paid even if the loan goes bad.

A lender can foreclose on the borrower’s interest in a property , but that same lender likely won’t want to continue to make the rent on that property, even if the owner expects it. Since commercial leases can sometimes run for multiple years, this obligation is something a lender definitely needs to think about. It’s important that agreements be written in a way that the lender doesn’t expressly assume the lease in the event of a foreclosure.

Assignment of Lease Versus Subletting

If you think assignment of lease sounds a lot like subletting , you’re right. But there’s a very specific difference between the two. With an assignment of lease, you are stepping out of the situation and setting up a direct relationship between the new tenant and your previous landlord. With subletting, your relationship with your landlord continues, but you introduce a new relationship between you and a third-party tenant who now pays the rent.

While both processes require legal documentation, subletting puts the agreement between the original tenant and the person who will be staying in the rented property. As with an assignment of lease, though, you’ll need to make sure you have your landlord’s approval before the new person moves in. But neither assignment of lease nor subletting require that you involve a lender, as in the case of leasehold mortgage financing.

Liabilities of Assignments of Lease

As with any type of mortgage lease, when you have a lease on a property, the liability falls on you if you fail to make mortgage payments or you damage the building in some way. When you shift the lease via a legal document, though, this liability goes with it. This only applies if the landlord releases that liability , though, so it’s important to make sure that’s part of your documentation.

Although you may be able to escape liability for what the transferee does to the rental space, there’s one area where liability will probably be unavoidable. If your transferee exits the lease before your original term is up, your landlord will probably come right back to you to fix the issues. Your Assignment of Lease document should detail what will happen in this event, including your right to reoccupy the premises if you choose.

Benefits of a Ground Lease

You may have never heard of these ground leases before, but they’ve definitely happened all around you. Large chain retailers like Whole Foods and Starbucks use ground leases to build new locations on already-owned land, often in situations where they rest alongside other shops and restaurants in a retail strip.

Businesses often choose ground leases with leaseholder mortgages because they can access a property without having to make a considerable down payment. They simply need to obtain leasehold mortgage financing and they can start building. For larger corporations, this is as much a benefit as a slowly growing small business since it keeps capital free for them to spend on other expenses, such as building costs.

Subordinated Ground Lease

When a landlord agrees to a ground lease, often that means agreeing to take a subordinated position if the tenant defaults on her leasehold mortgage. This means your landlord is agreeing that if you don’t make your payments, the property itself acts as collateral. As a result, the landlord may increase rent payments for tenants in order to compensate for that risk.

An unsubordinated ground lease, on the other hand, accounts for any mortgage lease issues by stating that if you don’t pay your rent or your mortgage payments, the property owner takes a top role legally. You may have a tougher time getting a bank to agree to take a lower priority than the landlord and because of this inconvenience, generally, you’ll find the rent is lower to compensate for it.

Leasehold Improvements Versus Leasehold Mortgages

Another term that can be confused with leasehold mortgages is something called leasehold improvements , which can be done without the loan and subsequent mortgage leasehold interest involved in a leasehold mortgage. A leasehold improvement simply refers to adjustments a tenant makes to a property that apply specifically to the internal contents , such as paint, new flooring or upgraded lighting fixtures. This is different from the building improvements that are handled by a landlord and apply specifically to common areas, elevators and other nonrentable areas of a building.

Unlike leasehold mortgages, leasehold improvements don’t involve taking out a loan . The owner may provide a particular amount of money for such improvements, called a Tenant Improvement Allowance. Landlords may also be willing to discount rent or provide money through something called a Building Standard Allowance. In other cases, the landlord himself pays for the improvements in something called a Turnkey Job, which is generally done prior to move-in but can be done while you’re occupying the space, with sufficient notice each time before entering the unit.

Liabilities of Leasehold Mortgages

Before taking a mortgage leasehold interest stake in a property, a lessee will also want to reduce his own liability. If there is a casualty during the time this loan is in place, the developer may find it difficult to get access to the insurance proceeds necessary to repair any damages that were suffered. For that reason, many property owners will employ an escrow agent to hold the funds so that they’re guaranteed to only be used for damage-related costs.

If there’s an injury or another incident on your property during the time you hold a lease, local laws will determine where responsibility falls. Landlord-tenant law covers such a situation, and often landlords have insurance to protect against these types of claims. Although you, as the developer, have a responsibility to keep your worksite safe, the landlord is responsible for ensuring common areas are maintained and proper signage is posted when a hazard exists on site.

- USLegal: Leasehold Mortgage Law and Legal Definition

- JDSupra: When a Lender Forecloses on a Leasehold Interest

- White and Williams LLP: Leasehold Financing: Key Issues for Mortgage Lenders

- What Is A Ground Lease? | Massimo CRE Coach

- LawDepot: What Type of Leases Do You Have?

- Sherin and Lodgen: Why a Leasehold Mortgage?

- FindLaw: Liability for Tenant Injuries and Insurance for Landlords

Stephanie Faris has written about finance for entrepreneurs and marketing firms since 2013. She spent nearly a year as a ghostwriter for a credit card processing service and has ghostwritten about finance for numerous marketing firms and entrepreneurs. Her work has appeared on The Motley Fool, MoneyGeek, Ecommerce Insiders, GoBankingRates, and ThriveBy30.

Related Articles

Foreclosure right of redemption & tenant's rights in maryland, how to get out of a timeshare that has a mortgage attached, what does "encumbrances" mean in real estate, do insurance rates go up if you rent part of your house, can a joint owner mortgage a property without consent of the other owner, mortgage contingency vs. commitment, can a co-owner of real property rent without the others permission, equity vs. refinance tips, tax implications of owning a residential rental property, how to sell an easement, what is a leasehold estate, what is an assignment of trust deed.

Zacks Research is Reported On:

Zacks Investment Research

is an A+ Rated BBB

Accredited Business.

Copyright © 2024 Zacks Investment Research

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm.

Visit performance for information about the performance numbers displayed above.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.

Assignment Of Leases And Rents

Jump to Section

What is an assignment of leases and rents.

The assignment of leases and rents, also known as the assignment of leases rents and profits, is a legal document that gives a mortgage lender right to any future profits that may come from leases and rents when a property owner defaults on their loan. This document is usually attached to a mortgage loan agreement.

Assignment of leases and rents allows lenders to a degree of financial protection in case a loan default occurs. This document is an agreement made between a borrower and a lender of mortgage loans. It often details an exact amount the lender will be entitled to if a default happens.

Common Sections in Assignments Of Leases And Rents

Below is a list of common sections included in Assignments Of Leases And Rents. These sections are linked to the below sample agreement for you to explore.

Assignment Of Leases And Rents Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.9 10 d368735dex109.htm ASSIGNMENT OF LEASES AND RENTS , Viewed October 4, 2021, View Source on SEC .

Who Helps With Assignments Of Leases And Rents?

Lawyers with backgrounds working on assignments of leases and rents work with clients to help. Do you need help with an assignment of leases and rents?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of leases and rents. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

Meet some of our Assignment Of Leases And Rents Lawyers

Jonathan M.

Owner and operator of Meek Law Firm, PC. Meek Law Firm provides comprehensive business law representation, precise and informed representation for real estate transactions in the commercial and residential markets of North and South Carolina and efficient succession and estate planning for business owners and individuals.

Graduated UF Law 1977. 40 years experience in Family Law/Divorce and Prenuptial Agreements. Rated "AV Preeminent" By Martindale Hubble, the oldest lawyer rating firm in the USA. Top 5% of attorneys in Florida as reviewed by Judges and other Lawyers (not client reviews). Personal prompt service and easy to contact--available 24/7. Good negotiator and very personable. My clients are my priority.

https://www.tgravelylaw.com/

~ Charles Kramer - Technology, Contracts and Intellectual Property Attorney ~ www.linkedin.com/in/charleskramer I am a New York corporate and technology attorney. My experience includes: - representing high-tech companies (including software, military, manufacturing and computer game companies) in connection with negotiating and drafting (1) toolkit, enterprise, Saas, PaaS and other complex agreements and licenses with companies around the world; (2) joint-venture, sales, publishing and distribution agreements; and (3) general corporate agreements. - 5 years as General Counsel of a software company (and many more years representing it as outside counsel); - 3 years as an associate in the Wall Street law firm of Lord, Day & Lord (then the oldest law firm in New York City practicing under the same name); and - speaking at conferences on legal issues including at the annual Game Developers Conference and Miller Freeman's Digital Video Conference. I am comfortable working in areas where the technology -- and the related law -- are new. My recent work includes working as a contract attorney (extended on a month-by-month basis) as American counsel for a publicly traded Swiss industrial corporation with responsibility for drafting form contracts for its planned "industrial internet of things" digital services. Accordingly I am comfortable working in a corporate environment using modern collaboration tools. Charles Kramer (917) 512-2721 (voice, voicemail, text)

Joe provides premium legal services to both individuals and businesses throughout the Commonwealth. Experience litigating civil and criminal matters, as well as drafting/negotiation transactional issues involving contracts, real estate, business formation, estate planning and more. Prior to entering private law practice, Joe worked for two decades in financial industry including regulatory and compliance for both national and regional banks and investment firms.

Driven attorney with a knack for alternative dispute resolution, real estate, corporate law, immigration, and basic estate planning, with superb people skills and high emotional intelligence, and for working smart and efficiently, as well as time and financial management skills to deliver excellent legal work and solutions to legal issues. Seasoned with 20+ years of law firm and legal experience (real estate/corporate).

Brittany T.

Brittany is an experienced attorney specializing in transactional and complex contract matters including but not limited to SaaS development and product implementation, technology/data agreements, licensing, and compliance. She has over 7 years of experience providing strategic legal advice to individuals and business clients of all sizes, from start-ups to large corporations. Brittany has a strong understanding of the legal issues related to technology and software and is well-versed in drafting and negotiating contracts ranging from software licenses to data sharing agreements. She is a highly-skilled negotiator and is adept at finding creative solutions to challenging legal issues.

Find the best lawyer for your project

How it works.

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Real Estate lawyers by top cities

- Austin Real Estate Lawyers

- Boston Real Estate Lawyers

- Chicago Real Estate Lawyers

- Dallas Real Estate Lawyers

- Denver Real Estate Lawyers

- Houston Real Estate Lawyers

- Los Angeles Real Estate Lawyers

- New York Real Estate Lawyers

- Phoenix Real Estate Lawyers

- San Diego Real Estate Lawyers

- Tampa Real Estate Lawyers

Assignment Of Leases And Rents lawyers by city

- Austin Assignment Of Leases And Rents Lawyers

- Boston Assignment Of Leases And Rents Lawyers

- Chicago Assignment Of Leases And Rents Lawyers

- Dallas Assignment Of Leases And Rents Lawyers

- Denver Assignment Of Leases And Rents Lawyers

- Houston Assignment Of Leases And Rents Lawyers

- Los Angeles Assignment Of Leases And Rents Lawyers

- New York Assignment Of Leases And Rents Lawyers

- Phoenix Assignment Of Leases And Rents Lawyers

- San Diego Assignment Of Leases And Rents Lawyers

- Tampa Assignment Of Leases And Rents Lawyers

related contracts

- Addendum to Lease

- ALTA Statement

- Apartment Lease

- Apartment Rental Agreement

- Assignment of Lease

- Boundary Line Agreement

- Brokerage Agreement

- Building Contract

- Building Lease

- Business Office Lease Agreement

other helpful articles

- How much does it cost to draft a contract?

- Do Contract Lawyers Use Templates?

- How do Contract Lawyers charge?

- Business Contract Lawyers: How Can They Help?

- What to look for when hiring a lawyer

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Legal Services

- Brain Injury

- Cerebral Palsy

- Child Birth

- General Medical Negligence

- Misdiagnosis Of Cancer

- Wrongful Birth

- Bridging Loans

- Freehold and Leasehold to Buy and Sell

- Purchases and Sales of Business Premises

- Transfers/Assignments of Existing Leases

- Children Advice

- Cohabitation Agreements

- Collaborative Law

- Divorce and Separation

- Domestic Violence

- Financial Arrangements

- Inheritance Act Claims

- Pre and Post Nuptial Agreements

- Property Claims for Unmarried Couples

- Business Visas

- Relationship and Family Visas

- Refusals and Appeals

- Settlement Visas

- Student Visas

- UK Citizenship

- Visitor Visas

- Bills of Costs

- Costs Budgeting and Management

- Costs Negotiations and Advice

- Costs Training and Seminars

- Court of Protection

- Group Litigation

- Points of Dispute

- Replies to Points of Dispute

- Solicitor and Client Disputes

- Auction Sales and Purchases

- Buying a House

- Lease Extensions

- Lifetime Mortgages (Equity Release)

- Remortgaging

- Selling a House

- Transfer of Equity

- Contentious Probate

- Court of Protection Applications

- Declarations of Trust

- Estate Planning

- Inheritance Tax Advice

- Powers of Attorney

Further Information

- Accreditations

- Free Online Enquiry

- News, Events and Articles

Assignment Of A Lease: Everything You Need To Know! 📃

Sep 04, 2023 | Shakeel Mir

There are are plenty of reasons why you might want to exit your commercial lease early. Perhaps your current premises are no longer suitable for the needs of your growing business, or maybe your business is in financial difficulty and you need to find a lease with more favourable terms.

There are also plenty of options when it comes to deciding how to exit a lease before the specified end date. Some of the most common include: assignment of a lease, which involves passing the lease onto another business; terminating the lease, with the help of a break clause if your contract contains one; or subletting your premises and adopting the role of landlord yourself.

Unfortunately, exiting a lease early is not always a simple process. A lease is a legal contract, and if you break it your landlord could take you to court. Opting to pursue a process such as assigning the lease to a new tenant can make exiting a lease early possible, but there are many factors that should be considered before beginning this process.

If you are thinking of trying to leave your lease early, it is advisable to obtain independent legal advice from an appropriately experienced commercial property solicitor before taking any action.

If you require legal advice or assistance on getting out of a commercial lease please call us on 0800 086 2929 , email [email protected] or complete our Free Online Enquiry Form .

In addition to office meetings, we also offer remote meetings via telephone and video conferencing software so can assist you wherever you are based.

What is assignment of a lease?

The process of assignment of a lease is essentially selling the lease to a third party (the “assignee”).

If you are a commercial property tenant, your contract likely contains a clause that allows you to assign your lease to a new tenant. To do this, you will need to find a potential new tenant yourself. Your landlord will expect this new tenant to meet the same expectations they originally set for you, and you will probably need their consent before the assignment can be completed.

While your landlord cannot reasonably withhold their consent for the assignment, they are under no obligation to give their consent if the new tenant doesn’t meet the terms set out in your contract – so it’s wise to be picky yourself about the tenant you select.

There are likely to be restrictions around when and if you can assign your lease specified in your contract. Some common restrictions include not allowing lease assignments if the contract is for a short period, and not allowing the lease to be assigned if the lease is ending within a few years.

Once a lease as been assigned, the assignee will become the new tenant and will be responsible for ensuring compliance with all of the tenant’s obligations in the lease.

What checks will a landlord make before permitting assignment of a lease?

Financial status

Your landlord will want to see evidence – usually in the form of business bank account statements – that the new tenant is in a strong financial position

Statements from previous landlords that the tenant has leased property from will be required to show that the tenant is reliable and doesn’t have a history of missing payments or otherwise neglecting their responsibilities as a tenant

Proposed use of the premises

Your landlord will probably be looking for a new tenant to intend to use the premises in broadly the same way as you have done in the past as the lease will specify what use is allowed.

Likelihood of requesting alterations to the building

As above, your landlord will require advanced notice of any alterations the new tenant may wish to make to the premises, and in some cases written permission in the form of a Licence to Alter will be required. It is likely that they may withhold their consent for assigning the lease to any tenant intending to make large-scale changes depending upon the type of premises involved.

What liabilities will you have when assigning a lease?

It is important to recognise that the assignment of a lease to a new tenant does not automatically exempt you from all liabilities related to that tenancy going forwards. In fact, once the lease assignment is complete you can still be liable should the new tenant miss any payments or otherwise break the terms of their contract.

Exactly what you will be liable for depends on when your lease began. If your lease began before January 1996 you will remain liable for all payments by any subsequent tenants – even if the lease is assigned several more times after you. This is called “privity of contract”.

For leases that began after January 1996, you will be required to sign an Authorised Guarantee Agreement . This means you guarantee payments for the next tenant, but not any further tenants.

Landlords can only claim payments of rent within six months of the money being due, and only after full notice has already been served to the former tenant.

What does lease assignment cost?

On the other hand, if the rent under the new lease is below the market rate, the new tenant may instead want to pay you a premium. If this is the case, you’ll need to make a decision on whether to charge VAT – or “opt to tax” – something that’s worth getting professional advice on.

A final charge to be considered is the cost of this advice. It is highly recommended to involve your solicitor when opting to pursue a lease assignment so as not to inadvertently break the terms of your contract and leave yourself open to court action. You should therefore also factor solicitors’ fees into your calculations when considering the cost of exiting your lease.

How to get out of a commercial lease – what are the alternatives?

Assignment of a lease is not the only way to get out of a commercial lease and depending on your circumstances and the contract you have with your current landlord, it may not always be the best option.

Some alternative ways to get out of a commercial lease early include:

Using a break clause