Top 28 Companies in Pharmaceutical Clinical Trials

The pharmaceutical clinical trials industry plays an indispensable role across the global healthcare spectrum. Made of numerous companies, their primary responsibility involves conducting research, managing clinical trials, and ensuring the safety and efficacy of medical treatments. These corporations frequently collaborate with pharmaceutical and medical device manufacturers, healthcare organizations, and research institutes. As innovation intensifies and international healthcare challenges elevate, the pharmaceutical clinical trials industry is set to register unprecedented expansion, while contributing towards the introduction of advanced medical treatments and therapies.

Top 28 Pharmaceutical Clinical Trials Companies

- Website: parexel.com

- Headquarters: Newton, Massachusetts, United States

- Founded: 1982

- Headcount: 10001+

- Latest funding type: Acquired

Parexel is a global company that offers services and solutions in the clinical research and healthcare industry. They provide expertise in various areas such as clinical trial management, regulatory outsourcing, medical monitoring, and consulting. They work with pharmaceutical companies, medical device manufacturers, and other healthcare organizations to support the development and advancement of new medicines and therapies.

2. Worldwide Clinical Trials

- Website: worldwide.com

- Headquarters: Research Triangle Park, North Carolina, United States

- Founded: 1986

- Headcount: 1001-5000

Worldwide.com is a global company specializing in clinical trial services and real-world evidence. With over 35 years of experience, they offer a range of services including clinical monitoring, data management, drug safety, patient recruitment, and project management. They focus on therapeutic areas such as cardiovascular, metabolic, neuroscience, oncology, and rare diseases. Their innovative lab services and personalized approach make them a trusted partner in the pharmaceutical industry.

- Website: medpace.com

- Headquarters: Cincinnati, Ohio, United States

- Founded: 1992

- Latest funding type: Ipo

Medpace is a full-service Contract Research Organization (CRO) that accelerates the advancement of safe and effective medical therapeutics. With a global reach, Medpace offers a wide range of services including clinical trial management, patient recruitment, and drug safety monitoring.

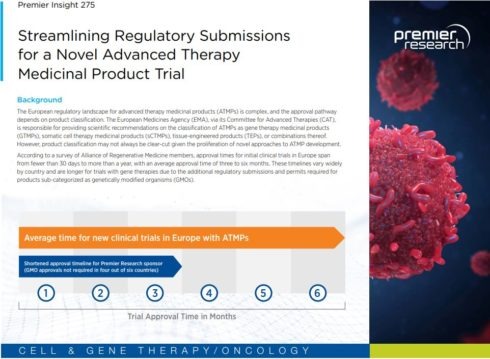

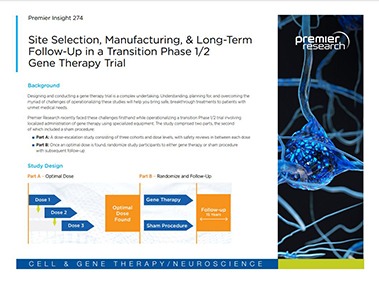

4. Premier Research

- Website: premier-research.com

- Headquarters: Morrisville, North Carolina, United States

- Founded: 1989

- Latest funding type: Series Unknown

Premier Research is a clinical research organization that helps innovative biotech and specialty pharma companies transform ideas and breakthrough science into new medical treatments. They offer a range of services, including product development consulting, global regulatory consulting, nonclinical studies, quality assurance, and project management.

5. Novotech

- Website: novotech-cro.com

- Headquarters: Sydney, Nsw, Australia

- Founded: 1996

- Latest funding type: Debt Financing

Novotech is a leading Asia Pacific biotech specialist CRO that offers cost competitive solutions for clinical research. They provide a full range of services including medical and regulatory consulting, patient recruitment, site selection, and clinical operations. With expertise in infectious diseases, vaccines, and biometrics, Novotech offers high-quality research and data management. They have a large homogenous population and locations in various countries.

6. Clinipace

- Website: clinipace.com

- Founded: 2003

- Headcount: 501-1000

Clinipace is a global CRO that specializes in clinical research and development. They provide personalized solutions to biotech and pharmaceutical companies, offering expertise in clinical technology, analytics, regulatory and strategic product development. With a focus on collaboration and control, Clinipace guides their clients through the entire clinical development program.

7. Crown Bioscience

- Website: crownbio.com

- Headquarters: San Diego, California, United States

- Founded: 2006

Crown Bioscience is a Contract Research Organization (CRO) that empowers customers to improve human health. They engage scientific talent, uphold quality standards, and pursue innovation to accelerate and de-risk drug development. Their services include biomarker discovery, efficacy testing, DMPK, and pharmacology.

8. Veeda Clinical Research Limited

- Website: veedacr.com

- Headquarters: Ahmedabad, Gujarat, India

- Founded: 2004

- Latest funding type: Private Equity

Veeda Clinical Research is a company that provides quality research solutions for sponsors and regulatory authorities. They conduct early phase clinical trials in healthy volunteers and patients, specializing in ophthalmology trials. Additionally, they offer bioequivalence and bioavailability studies, drug discovery and development services, clinical endpoint phase III studies, and safety monitoring services.

9. Quanticate

- Website: quanticate.com

- Headquarters: Hitchin, Hertfordshire, United Kingdom

- Founded: 1994

- Headcount: 201-500

Quanticate is a global biometric Clinical Research Organization (CRO) offering statistical and data expertise. They help pharmaceutical and biotech companies bring their drugs to market by providing fast and reliable access to expert biometric teams. Their services include biostatistics, statistical programming, clinical data management, and biostatistical consultancy.

10. Nucleus Network

- Website: nucleusnetwork.com.au

- Headquarters: Melbourne, Victoria, Australia

Nucleus Network is a company that offers clinical research services focusing on early phase and vaccine trials. They provide state-of-the-art facilities, experienced staff, and innovative approaches to help pharmaceutical and biotech companies accelerate their drug development processes.

11. Richmond Pharmacology

- Website: richmondpharmacology.com

- Headquarters: London, London, United Kingdom

- Founded: 2001

- Headcount: 51-200

Richmond Pharmacology is a Clinical Research Organisation that conducts early phase clinical trials in a wide range of medical conditions with patients and healthy volunteers. They work with international pharmaceutical and biotech organizations to drive innovation in the field of clinical research.

12. Integrium, LLC

- Website: integrium.com

- Headquarters: Tustin, California, United States

- Founded: 1998

Integrium is a full-service Clinical Proof of Concept (PoC) firm specializing in various therapeutic areas, including cardiovascular, metabolic disease, and dermatology research. We assist pharmaceutical companies in designing and executing clinical trials to achieve their objectives on time and with expected quality. With cutting-edge technology and unparalleled services, we play a crucial role in advancing new medical advancements. Our team of experts works collaboratively with clients, investigators, and vendors to ensure the successful implementation of clinical trials.

13. Mithra Biotechnology Inc.

- Website: mithracro.com

- Headquarters: 新北市 New Taipei City, Taiwan, Taiwan

- Founded: 1988

MithraCro is a biotechnology company specializing in pharmaceutical analysis services, with expertise in bioequivalence testing, clinical trial services, drug metabolism research, and protein analysis.

14. Pearl Therapeutics

- Website: devprobiopharma.com

- Headquarters: Morristown, New Jersey, United States

- Founded: 2020

- Headcount: 11-50

DevPro Biopharma is a clinical research and development accelerator that specializes in transforming molecules into medicines. They offer comprehensive services to assist in the development of pharmaceutical products.

15. Almac Group

- Website: almacgroup.com

- Headquarters: Craigavon, County Armagh, United Kingdom

- Founded: 1968

- Headcount: 5001-10000

- Latest funding type: Grant

Almac Group provides a range of services in the pharmaceutical industry, including storage and distribution, product launch and distribution, API development and manufacture, clinical trial assays, genomic services, clinical testing, and clinical supply chain management. They offer flexible solutions to meet the needs of their clients and ensure the successful launch and distribution of pharmaceutical products. Almac Group is committed to exceptional quality and customer satisfaction.

16. 4B Technologies, Ltd

- Website: 4btechnologies.com

- Headquarters: 苏州市, Jiangsu, China

- Founded: 2017

- Latest funding type: Series B

4B Technologies is a biopharmaceutical company with a leadership team composed of elite professionals from various fields. They are dedicated to developing innovative and effective treatments for neurological diseases.

17. TechnoDerma Medicines

- Website: tkskin.com

- Headquarters: Xuzhou, Jiangsu, China

- Founded: 2014

- Latest funding type: Series A

Techonderma Medicines, Inc. is a private clinical-stage biopharmaceutical company focused on developing innovative therapies for various skin conditions.

- Website: caidya.com

Caidya is a clinical research organization (CRO) that offers personalized services and expertise in various therapeutic areas. They specialize in conducting regional or multinational studies using efficient operational models, local market knowledge, and advanced technologies. Caidya is committed to transparency, clinical development expertise, and personalized experiences for their clients.

19. Novum Pharmaceutical Research Services

- Website: novumprs.com

- Headquarters: Pittsburgh, Pennsylvania, United States

- Founded: 1972

Novum is a global clinical research organization (CRO) with a focus on delivering high-quality research outcomes and exceptional customer satisfaction. With nearly fifty years of experience, Novum offers a comprehensive suite of services in early clinical development, bioanalytical testing, and phase II-IV clinical trial management. The company's dedicated and skilled team, extensive training programs, and global resources enable efficient project optimization and streamline timelines and budgets.

20. PharPoint Research, Inc.

- Website: pharpoint.com

- Headquarters: Durham, North Carolina, United States

- Founded: 2007

PharPoint Research provides drug development solutions to clients of all sizes. Contact us to speak with a representative about how PharPoint can help with your current or upcoming study needs.

21. NC Coast Clinical Research Initiative

- Website: nccoastclinicalresearch.com

- Headquarters: United States

- Founded: 2012

NC Coast Clinical Research is a consortium of 60+ CROs and 100+ clinical research support companies, providing comprehensive integrated drug development, laboratory and lifecycle management services.

22. Quinta-analytica

- Website: quinta.cz

- Headquarters: Praha 10, Hlavni Mesto Praha, Czechia

- Founded: 1997

Quinta is an innovative and trusted world leader in pharmaceutical analysis, R&D, and clinical testing in both human and veterinary medicinal products.

23. LINK Medical Research

- Website: linkmedical.eu

- Headquarters: Oslo, Oslo, Norway

- Founded: 1995

LINK Medical Research is a leading contract research organization (CRO) in Northern Europe. They offer a strategic partnership and provide highly competent teams and evidence-based documentation for superior clinical outcomes. From early phase development to post-marketing, they offer expert guidance through every stage of product development. With a well-integrated local presence in the Nordics, UK, and Germany, they make the journey to market simple and cost-effective.

24. Medlab Clinical Ltd

- Website: medlab.co

- Headquarters: Botany, New South Wales, Australia

Medlab.co is a company that specializes in drug delivery technology. They have a proprietary NanoCelle® platform with 57 patents worldwide. They offer partnering opportunities, clinical trials, and a range of products. Medlab.co is committed to transforming medicine and improving patient outcomes.

25. Clexio Biosciences

- Website: clexio.com

- Headquarters: Petach Tikva, Israel, Israel

- Founded: 2018

Clexio Biosciences is a multi-asset company dedicated to developing novel therapies for patients suffering from neurological and psychiatric conditions.

26. Suzhou Abogen Biosciences

- Website: abogenbio.com

- Headquarters: 苏州市, 江苏省, China

- Founded: 2019

- Latest funding type: Series C

Abogenbio is a biotechnology company focused on innovative drug development and research. With a team culture of openness and collaboration, we strive to bring hope and healing to patients through the creation of groundbreaking medicines. We are dedicated to fostering a fearless and accountable environment where partners can thrive and pave the way for a brighter future.

27. Abond CRO Inc.

- Website: abondcro.com

- Headquarters: Allendale, Michigan, United States

- Founded: 1974

ABOND is a full-service CRO that offers consulting, clinical operations, data management, and statistical analysis. Our commitment to honesty, focus, and responsibility sets us apart. We provide reliable outcomes and are always answerable for our work.

28. Novatek Pharmaceuticals

- Website: novatekpharmaceuticals.com

Novatek Pharmaceuticals Inc. is a startup based in Houston, TX that provides scientific guidance and conducts clinical research for immunomodulatory drugs related to cancers and infectious diseases. They are currently raising Series A for clinical trials and pipeline development.

Want to find more pharmaceutical clinical trials companies?

If you want to find more companies that offer comprehensive clinical trial services and research solutions you can do so with Inven . This list was built with Inven and there are hundreds of companies like these globally.

With Inven you'll also get to know the company's:

- Ownership: Which of these are private equity backed? Which are family-owned?

- Contact data: Who are the owners and CEO's? What are their emails and phone numbers?

- Financials: How do these companies perform financially? What are their revenues and profit margins?

...and a lot more!

Find companies 10x faster with Inven

Keep on reading

More articles.

Find the right market research agencies, suppliers, platforms, and facilities by exploring the services and solutions that best match your needs

list of top MR Specialties

Browse all specialties

Browse Companies and Platforms

by Specialty

by Location

Browse Focus Group Facilities

Manage your listing

Follow a step-by-step guide with online chat support to create or manage your listing.

About Greenbook Directory

IIEX Conferences

Discover the future of insights at the Insight Innovation Exchange (IIEX) event closest to you

IIEX Virtual Events

Explore important trends, best practices, and innovative use cases without leaving your desk

Insights Tech Showcase

See the latest research tech in action during curated interactive demos from top vendors

Stay updated on what’s new in insights and learn about solutions to the challenges you face

Greenbook Future list

An esteemed awards program that supports and encourages the voices of emerging leaders in the insight community.

Insight Innovation Competition

Submit your innovation that could impact the insights and market research industry for the better.

Find your next position in the world's largest database of market research and data analytics jobs.

For Suppliers

Directory: Renew your listing

Directory: Create a listing

Event sponsorship

Get Recommended Program

Digital Ads

Content marketing

Ads in Reports

Podcasts sponsorship

Run your Webinar

Host a Tech Showcase

Future List Partnership

All services

Dana Stanley

Greenbook’s Chief Revenue Officer

Top Pharmaceutical Market Research Firms for Prescription Medicines

What are pharmaceutical market research companies.

Pharmaceutical market research companies provide services to help pharma, healthcare, and related industries gain insights into how to best market in today's complex healthcare landscape. They inform on marketing for prescription and over-the-counter (OTC) drugs, vaccines, and other pharma products as well as some medical devices.

The top pharmaceutical market research companies offer market research services related to prescription medicines and certain types of healthcare marketing. These vendors conduct research projects for prescription drug development and marketing needs, and their services go hand-in-hand with overarching pharmaceutical research, healthcare research, and other niche aspects of pharma research.

Learn more about pharma market research.

Featured Experts in Top Pharmaceutical Market Research Firms for Prescription Medicines

Learning Resources

in Experts in Market Research on Prescription Medicines

Service or Speciality

Advanced Analytics

Advertising Agencies

Advertising Effectiveness

Advertising Research - General

Africa / Middle East

African-American

Agile Research

Agriculture / Agribusiness

Alcoholic Beverages

Apparel / Clothing / Textiles

Artificial Intelligence / AI-Powered Platforms

Association Membership

Attitude & Usage Research

Automated Market Research Platforms

B2B Research - General

Banking - Commercial

Banking - Retail

Biotechnology

Brainstorming / Facilitation

Brand / product / service launch

Brand / product / service repositioning

Brand Equity

Brand Image Tracking

Brand Loyalty / Satisfaction

Brand Positioning

Bulletin Boards

Business Insights

Business Intelligence Software

Business-to-Business

CATI - Computer-Aided Telephone Interviewing

CX - Customer Experience

CX Benchmark Studies

Candy / Confectionery

Cannabis / CBD

Car Clinics

Casinos / Gambling

Central America

Central Location

Chemical Industry

College Students

Communications

Communications Strategy Research

Computer Hardware

Computer Software

Concept Development

Concept Optimization

Concept Testing

Conjoint Analysis / Trade-off/Choice Modeling

Construction Industry

Consultation

Consumer Durables

Consumer Research - General

Consumer Services

Consumer Trends

Convention / Tradeshow

Copy Testing - Traditional Media

Corporate Image/Identity Research

Cosmetics / Beauty Aids

Credit Cards

Cross-Tabulation Systems

Customer Loyalty / Value

Customer Satisfaction

Data Analysis

Data Integration

Data Mining

Data Processing

Data Visualization & Dashboards

Demographic Analysis

Doctors / Physicians

Eastern Europe & Russia

Electronics

Employee Experience & Satisfaction

Entertainment Industry

Environment & Sustainability

Ethnic Groups

Ethnography / Observational Research

Executives / Professionals

Exercise & Fitness

Field Services

Financial Industry

Financial Services Professionals

Focus Group Facility

Focus Group Facility - Non-Traditional

Focus Group Recruiting

Focus Groups

Focus Groups - International

Focus Groups - Pop-Up

Foods / Nutrition

Forecasting & Predictive Analytics

Foreign Language

Fragrance Industry

Full Service

Gaming / Gamers

General - Healthcare

Generation X

Generation Y / Millennials

Generation Z

Global Capabilities

Global, multinational branding

HMOs / Managed Care

High Net Worth

High Technology

Hispanic / Latino

Home Use Tests

Hospital Personnel

Hospital Purchasing Agents

Hospitals / Nursing Homes

Household Products/Services

Hybrid / Mixed Methodology

Idea Generation

Implicit Association

In-Depth (IDI) / One-on-One

In-Depth / One-on-One

Industrial & Manufacturing

International / Multi-country

International Consumer Market Research

Internet of Things (IoT)

Investment Banking

Journey Mapping

Knowledge Management Systems

Lawn & Garden

Legal / Lawyers

Low Incidence

Mall Intercept

Market & Competitive Intelligence

Market Opportunity Evaluation

Market Segmentation

Market Simulation

Media Industry

Media Market Research

Medical / Health Care

Medical / Healthcare Professionals

Mobile Surveys

Mock Juries

Moderator Services

Movies / Streaming / TV

Multi-Country Studies

Multicultural

Music Tests

Mystery Shopping

NPS Measurement

New Products

Nurses / Nurse Practitioners

Online - Qualitative

Online - Quantitative

Online Communities - MROC

Online Diaries / Journals / Blogs

Online Panels

Packaged Goods

Packaging Development

Packaging Testing

Payments & Incentives

Personal Care Items

Pet Owners / Foods / Supplies

Pharmaceutical - OTC Medicines

Pharmaceutical - Prescription Medicines

Pharmacists

Post-Launch Tracking

Prediction Markets

Preventive Healthcare

Price / Pricing

Price Elasticity

Problem Detection / Dissatisfaction

Product Development

Product Market Research

Product Optimization

Product Testing

Professionals / Executives

Proprietary Panels

Psychographic Research

Psychological / Motivational Research

Purchase Behavior

Qualitative

Qualitative Research

Qualitative Services - General

Quantitative Research

Quick Service Restuarants (QSR)

Recruiting Research

Restaurants / Food Service

Retail Industry

Sample & Recruiting

Secondary Research / Desk Research

Segmentation

Semiotics Research and Analysis

Seniors / Mature

Sensory Research

Sentiment Analysis

Service Quality Needs & Measurement

Shopper Insights

Smart Products

Social Listening & Analytics

South America

Southeast Asia & India

Statistical Analysis

Store Audits

Strategic Research

Surgical Products / Medical Devices

Survey Programming

Survey Recruiting

Syndicated / Published Reports

Taste Test Facility

Teenagers / Youth

Telecommunications

Text Chat / SMS / IM Sessions

Tracking Research

Trademark / Trademark Infringement

Translation Services

Upper Income / Affluent

Usability Lab

User Testing

Utilities / Energy

Veterinarians

Video Conferencing

Video Management Platforms

Video Recording

Website Analysis / Web Analytics

Website Usability / UX

Western Europe

Atlanta (GA)

Boston (MA--NH)

Charlotte (NC--SC)

Chicago (IL--IN--WI)

Cincinnati (OH--KY--IN)

Cleveland (OH)

Connecticut

Massachusetts

Miami-Fort Lauderdale (FL)

New Hampshire

New York (NY--NJ--CT)

Orlando (FL)

Pennsylvania

Philadelphia (PA--NJ--DE--MD)

San Antonio (TX)

South Carolina

St. Louis (MO--IL)

Toronto (ON)

Vendor type

Data & Analytics

Data Collection

International

Panels / Communities

Qualitative Consultant

Software & Technology

Support Services

Business Designation

HIPAA Compliant

Minority-Owned Business

Women-Owned Business

Clear filters ( 0 )

Related Specialties

Interviews with Healthcare Professionals

Moderating with Medical & Healthcare Professionals

Healthcare & Medical [market sector expertise]

OTC Medicines [market sector expertise]

Preventive Healthcare [market sector expertise]

Compare Experts in Market Research on Prescription Medicines

Miami, Florida

SOCIAL MEDIA

Save to my lists

Featured expert

Recommended by Clients

Based on 3 ratings

CASA Demographics

Largest Nationwide Qualitative Panel of Hispanic and Asian-American Segments / Multilingual Recruitment, Moderation & Analysis / Decades of Expertise

Why choose CASA Demographics

Decades of Qual Expertise

Diverse 546,000+ US Panel

Truly Nationwide Reach

MBA & PhD-led Researchers

Multilingual Moderation

Learn more about CASA Demographics

New York, New York

We’re the only B2B research company that solves the challenges of today’s insights leaders by connecting them with verified business expertise.

Why choose NewtonX

100% ID-Verified

1.1 billion reach

140 industries globally

Niche audiences

Custom recruiting

Learn more about NewtonX

Perryville, Missouri

Pinnacle Research Group, LLC

Pinnacle Research Group is a think-tank of highly educated, forward-thinking professionals who combine psychological theory with real world insight.

Why choose Pinnacle Research Group, LLC

Passionately Curious

Expertise Exploring Why

Fresh Perspective

Dedication to Excellence

Seasoned Researchers

Learn more about Pinnacle Research Group, LLC

SIS International Research

SIS International Research, founded in 1984, is a leading full-service Market Research and Market Intelligence firm.

Why choose SIS International Research

Global Coverage

Full Service Capabilities

B2B & Industrial Research

Healthcare Research

Strategy Consulting

Learn more about SIS International Research

Hoboken, New Jersey

SKIM is a global insights agency helping leading companies thrive by understanding decision making.

Why choose SKIM

Price&Portfolio Strategy

Decision Journey Mapping

Decades of Comm Research

Conjoint Analysis

Learn more about SKIM

Newark, New Jersey

APLUSA's US division is a full-service firm with core strengths in segmentation, demand forecasting, chart data innovations, and hybrid qualitative

Why choose APLUSA

Real-world data

Global presence

Oncology expertise

Demand forecasting

Learn more about APLUSA

Cincinnati, Ohio

The Directions Group

The Directions Group is a strategic insights firm helping businesses grow, innovate, and differentiate themselves through integrated intelligence.

Why choose The Directions Group

Lead with Intelligence

Learn more about The Directions Group

Philadelphia, Pennsylvania

Research/strategic consulting - specialization: segmentation, opportunity assessment, forecasting/pricing, positioning, brand strategy & customer exp

Learn more about NAXION

Stamford, Connecticut

Fletcher Knight, Inc.

Fletcher Knight is a leading global brand strategy and innovation consulting firm.

Why choose Fletcher Knight, Inc.

Creative Led Research

Breakthrough Insights

Inspirational Ideas

Rigourous Strategy

Learn more about Fletcher Knight, Inc.

Yardley, Pennsylvania

Olson Research Group

Olson Research offers qualitative and quantitative market research services with unique access to more than 2.4 million HEALTHCARE DECISION MAKERS.

Why choose Olson Research Group

Access to healthcare

Experienced PMs

In-house programming

Recruiting expertise

Precise targeting

Learn more about Olson Research Group

Mexico City, Mexico

IVP Latina / Inter-View Partners

Inter-View Partners (IVP) is an independent group of fieldwork providers, high quality fielding in over 9 countries and various world regions.

Why choose IVP Latina / Inter-View Partners

ONE-STOP-SHOP

QUAL TO QUANT

FIELD NETWORK

SWIFT SERVICE

Learn more about IVP Latina / Inter-View Partners

Boston, Massachusetts

Northern Light Single Point

Custom-built enterprise knowledge management platform that seamlessly integrates full-text search of all your research resources.

Learn more about Northern Light Single Point

Toronto, Ontario, Canada

Human Branding Inc.

Human Branding uses Applied Anthropology Thinking™ to go deeper beneath the surface to better understand human behavior. Named Top 10 MR firm 2023!

Why choose Human Branding Inc.

Deep Humanistic Insights

Decode Human Behavior

Game-changing Results

Behavior Science Experts

Health & Wellness Experts

Learn more about Human Branding Inc.

Chicago, Illinois

Fieldwork Network

Our specialties include local and country-wide recruiting, managing and facilitating Mock Juries, Medical / Medical Device, and Global Research.

Why choose Fieldwork Network

Recruit local & national

Expert On-line Platform

Dedicated Proj Mgmt

50 countries & counting!

Over 40 years experience

Learn more about Fieldwork Network

Atlanta, Georgia

CMI is your research and data enablement partner that develops strategies and innovations to power top Fortune 500 companies.

Why choose CMI

Data Enablement

30+ Years Experience

Custom Solutions

Learn more about CMI

Sign Up for Updates

Get the latest updates from top market research, insights, and analytics experts delivered weekly to your inbox

I agree to receive emails with insights-related content from Greenbook. I understand that I can manage my email preferences or unsubscribe at any time and that Greenbook protects my privacy under the General Data Protection Regulation.*

Your guide for all things market research and consumer insights

Create a New Listing

Manage My Listing

Find Companies

Find Focus Group Facilities

Tech Showcases

GRIT Report

Expert Channels

Get in touch

Marketing Services

Future List

Publish With Us

Privacy policy

Cookie policy

Terms of use

Copyright © 2024 New York AMA Communication Services, Inc. All rights reserved. 234 5th Avenue, 2nd Floor, New York, NY 10001 | Phone: (212) 849-2752

- Partner with Us

- Patient Support

- Latest News

- Media Contacts

- Investors Home

- Events and Presentations

- Investors Resources

- Contract Manufacturing

- Medical Information

- South Africa and Sub-Saharan Africa

- New Zealand

- Belgium (French)

- Belgium (Dutch)

- Bosnia & Herzegovina

- Czech Republic

- Netherlands

- Switzerland (German)

- Switzerland (French)

- United Kingdom

- Puerto Rico

- Saudi Arabia

- United Arab Emirates

- Canada (English)

- Canada (French)

- United States

Please enter a valid search term

We find answers that make life better for patients and our world.

Meeting the needs of patients—and the needs of our time., it’s more than what we discover. it’s how we deliver., putting science to work to solve the challenges people face every day..

Can We Find Cures Faster?

Learn how AbbVie researchers find and advance ideas that have the potential to cure.

We solve the tough challenges.

By working closely with patients and physicians, we solve the real, complex challenges they’re facing right now, first with science and support.

Our science: First, faster, and for patients

At AbbVie, our R&D teams are chasing bold goals.

Tenacity is the anchor of solving any real challenge. It's what keeps you there, keeps you trying, keeps you driven to find that answer.

We find the answers together .

We make investments that empower our people and strengthen our partnerships.

We are recognized on a number of “Best of” lists related to diversity, leadership and engagement, as well as for corporate responsibility practices.

Grow and fulfill your unique potential in our supportive environment that champions collaboration. AbbVie offers functional training, global events, leadership programs and more.

250+ active external innovation partners to conduct groundbreaking science to discover and develop transformational medicines.

Explore opportunities

If you thrive as part of a diverse, collaborative team—we’re ready for you.

We invest in creating better futures.

Our focus and capabilities address tough challenges that lead to improved lives.

AbbVie Reports Second-Quarter 2024 Financial Results

Get the latest information about abbvie.

We make an impact that lasts.

Leading with purpose, we are willing to make the tough choices that deliver a lasting impact to patients, their families and our employees.

Environmental, Social & Governance

See how we're creating positive impact for generations to come.

AbbVie’s Positions & Views

- Sustainability

- News Center

Unless otherwise specified, all product names appearing in this internet site are trademarks owned by or licensed to AbbVie Inc., its subsidiaries or affiliates. No use of any AbbVie trademark, trade name, or trade dress in this site may be made without the prior written authorization of AbbVie Inc., except to identify the product or services of the company.

Copyright © 2024 AbbVie Inc. North Chicago, Illinois, U.S.A.

- Accessibility Statement

- Terms of Use

- Privacy Notice

- Consumer Health Data Privacy Notice

- Cookie Settings

You are about to leave the AbbVie website

The product-specific site Internet site that you have requested is intended for the residents of a particular country or countries, as noted on that site. As a result, the site may contain information on pharmaceuticals that are not approved in other countries or region. If you are a resident of a country other than those to which the site is directed, please return to AbbVie.com or contact your local AbbVie affiliate to obtain the appropriate product information for your country of residence. The Internet site that you have requested may not be optimized to your screen size. Do you wish to continue to this product-specific site?

Top 10 largest clinical research organizations

We take a look at the 10 biggest contract research organizations in the pharma sector in 2022.

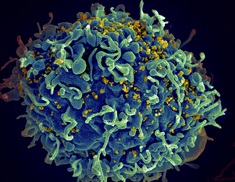

The drug discovery process is complex. The clinical stage is particularly resource-intensive, something that has led to the rise in demand for contract research organizations (CROs) that can support drug manufacturers at each stage of the process, from discovery to approval. The core activities a CRO can provide include (but are not limited to) clinical trial management, data research and project management.

Despite an initial downturn at the start of the pandemic, Covid-19 created a spike in the number of clinical trials taking place due to the need for vaccines and drugs to tackle the virus. In the coming years, we expect the rise of technologies that enable decentralized clinical trials to help expand the market share of CROs.

Currently the global CRO services market is projected to grow from US$73.38 bn to $163.48 bn by 2029. Here Pharma IQ takes a look at the 10 biggest CROs in pharma today.

Founded in 1982, IQVIA is an American multinational company formed through the merger of Quintiles, a leading provider of product development and integrated healthcare services, and IMS Health, a global information and technology services company. The latter has enabled company to have a strong focus on digital solutions and analytics. In 2017, Quintiles IMS rebranded to IQVIA.

Laboratory Corporation of America Holdings, also known as Labcorp, is an American company that operates one of the largest clinical laboratory networks in the world. In an average week Labcorp processes tests on more than 3 million patient specimens. In 2020 the company earned revenue in excess of $14 bn.

Syneos Health

Founded in 1999, Syneos Health was created following the merger of two biopharmaceutical companies: INC Research and inVentive health. Today it has offices in more than 110 countries and offers services as a CRO as well as consultancy.

Founded in 1985 as a one-person consultancy firm, Pharmaceutical Product Development (PPD) is a global contract research organization that provides drug development, lab and lifecycle management services. In 2020 the company made US$4.7bn and the following year it became part of Thermo Fisher Scientific.

Headquartered in Dublin, Icon provides strategic management and support for clinical development from the compound selection stage through to clinical trials. Its services include clinical trials management, biometric activities, investigator recruitment and outcomes research.

Parexel was founded in 1982 and acquired by private equity firm Pamplona Capital in 2017 in a deal worth $5 bn. In 2021 it was bought by EQT Private Equity and Goldman Sachs Asset Management. The company conducts clinical trials and operates in more than 50 countries. It makes around $3 bn in revenue annually.

Charles River Laboratories

Founded in 1947, today this company specializes in cell and gene therapies as well as lab services for the pharmaceutical, medical device and biotech industries. As of 2021 it operates more than 90 facilities in 20 countries and has an annual revenue of $3.54 bn.

Award-winning MedPace has offices on six continents, with headquarters in Ohio where it has a clinical research campus and a number of clinical and bioanalytical laboratories. It provides clinical trial services for Phase I-IV studies in the biotech, pharma and medical device industries. Its revenue has been growing steadily year- on-year and is currently almost $1 bn.

CTI Clinical Trial and Consulting Services

This organization was founded in 1999 to provide clinical trial services and bring new drugs to market. It operates in more than 60 countries and since its inception has contributed to the approval of more than 150 new drugs and medical devices around the world.

WuXi AppTec

Founded in 2000 in Shanghai, WuXi AppTec is the newest company in our top 10. It provides services across the entire development cycle including small molecule R&D and manufacturing, biologics R&D and manufacturing, cell and gene therapy. It currently operates in 18 locations across China, Iceland and the US.

Quick links

- How to improve the success rate of clinical trials

- Webinar: The technology enabling decentralized clinical trials

- The challenges of handling and delivering highly potent oncology drugs

Get exclusive access to member-only articles, reports, videos, interviews, webinars and other premium content from industry experts and thought leaders by signing up to Pharma IQ here .

Upcoming Events

Digit pharma & health 2024.

September 10 - 12, 2024 Hilton Düsseldorf

Temperature Control and Logistics North America Summit

September 10 - 12, 2024 Falls Church, VA

AI for Pharma & Healthcare

24 - 26 September, 2024 Amsterdam Marriott Hotel

SmartLab Exchange Europe

February 25 - 26, 2025 Novotel Amsterdam City, Netherlands

Pharma Contract Manufacturing

08 - 10 April, 2025 Berlin

SmartLab Exchange USA 2025

08 - 09 April, 2025 Le Méridien, Fort Lauderdale, Florida, USA

Subscribe to our Free Newsletter

Insights from the world’s foremost thought leaders delivered to your inbox.

Latest Webinars

Pharma iq's power list 2022: in conversation with pharma's top leaders.

2022-10-18 02:00 PM - 03:00 PM BST

A post-pandemic 3D view of the patient and supply journey

2022-06-01 04:30 PM - 05:30 PM CET

Discover how targeted radiotherapy induced toxicity can be identified with imaging

2022-04-28 01:00 PM - 02:00 PM EST

RECOMMENDED

FIND CONTENT BY TYPE

- Infographics

Pharma IQ COMMUNITY

- Advertise With Us

- User Agreement

- Cookie Policy

- Become a Member Today

- Pharma IQ App

ADVERTISE WITH US

Reach Pharmaceuticals & Biotechnology professionals through cost-effective marketing opportunities to deliver your message, position yourself as a thought leader, and introduce new products, techniques and strategies to the market.

JOIN THE Pharma IQ COMMUNITY

Join Pharma & Biotech today and interact with a vibrant network of professionals, keeping up to date with the industry by accessing our wealth of articles, videos, live conferences and more.

Pharma IQ, a division of IQPC

Careers With IQPC | Contact Us | About Us | Cookie Policy

Become a Member today!

PLEASE ENTER YOUR EMAIL TO JOIN FOR FREE

Already an IQPC Community Member? Sign in Here or Forgot Password Sign up now and get FREE access to our extensive library of reports, infographics, whitepapers, webinars and online events from the world’s foremost thought leaders.

We respect your privacy, by clicking 'Subscribe' you will receive our e-newsletter, including information on Podcasts, Webinars, event discounts, online learning opportunities and agree to our User Agreement. You have the right to object. For further information on how we process and monitor your personal data click here . You can unsubscribe at any time.

Top 15 Clinical Research Companies: Leaders in Medical Innovation

What’s on this page:

In the healthcare industry, the number of contract research organizations in the US has reached 2,823 in 2023. This marks a subtle but significant increase of 0.9% compared to the previous year.

This increase signals a vital trend: the growing complexity of finding the best clinical research companies in a crowded field. These organizations aren’t just businesses; they’re important in advancing medicine and developing drugs and therapies.

With such an important task, choosing the right company becomes essential. In this guide, we’ve looked closely at many companies along with their strengths and weaknesses and made a list of the top clinical research organizations.

By the end, you’ll know which company is the best fit for your needs.

Quick List of Top 15 Clinical Research Companies

Here is a quick overview of the best companies of clinical research:

- IQVIA: Best for data-driven insights and advanced analytics in healthcare research.

- ICON: Best for comprehensive clinical development services and therapeutic expertise.

- Parexel: Best for global biopharmaceutical services, emphasizing regulatory and clinical trial excellence.

- Syneos Health: Best for integrated biopharmaceutical solutions and clinical-commercial capabilities.

- PPD: Best for drug development services with innovative, technology-enhanced trial strategies.

- Labcorp: Best for comprehensive clinical testing and diagnostics services with global reach.

- Medpace: Best for expertise in clinical research and regulatory affairs for pharmaceutical companies.

- Charles River Laboratories: Best for preclinical research and development services, including animal testing and research models.

- PRA Health Sciences: Best for clinical trial expertise and integrated solutions for biopharmaceutical development.

- AdvanCell: Best for innovative cell and tissue-based research solutions for life science industries.

- Dynata: Best for data-driven insights and market research services for informed decision-making.

- Covance: Best for end-to-end drug development solutions, from preclinical to post-marketing.

- MedNet: Best for technology solutions and eClinical platforms for streamlined clinical trials.

- Fisher Clinical Services Inc: Best for global logistics and supply chain services for clinical trial materials.

- Worldwide Clinical Trials: Best for specialized CRO offering personalized clinical research solutions.

3 Best Clinical Research Organizations: Comparison Chart

Here’s a comparison table to highlight the key features and differences among the best companies of clinical research. This table aims to provide a quick overview of each company’s unique strengths and areas of expertise in the pharmaceutical and healthcare research sector.

| Data-driven insights, advanced analytics | Healthcare research, Data analytics | Technology-driven healthcare research services | |

| Comprehensive clinical development, expertise | Clinical development, Therapeutic research | Clinical trial and development services | |

| Regulatory expertise, clinical trial excellence | Biopharmaceutical services | Global clinical trial management |

3 Top Clinical Research Organization List For Advanced Medical Discoveries

Now, we’ll explore the top clinical research organizations (CROs) dedicated to advancing medical discoveries. Let’s jump into the details of these exceptional organizations.

IQVIA is a global leader in clinical research and healthcare data analytics. They play a crucial role in the medical field by providing comprehensive data, advanced analytics, and expert insights. This helps pharmaceutical and healthcare companies make smarter, more effective decisions.

Why is IQVIA among the best? Their strength lies in their vast database and advanced technology, which enable them to analyze complex healthcare data efficiently. This leads to a better understanding of diseases, more effective treatments, and faster drug development.

IQVIA’s work is essential because it speeds up the process of bringing new medicines to the market, ultimately benefiting patients worldwide. In short, IQVIA is a key catalyst in advancing global healthcare.

About IQVIA

- Founding Team: Dennis Gillings

- Founding Year: 1982

- Company Size: 86,000

Features of IQVIA

IQVIA, a prominent player in the life sciences sector, is dedicated to advancing healthcare through connected intelligence. Here are some key features of IQVIA in the world of clinical research:

Innovative Clinical Development

IQVIA is reimagining clinical development by intelligently connecting data, technology, and analytics. This approach leads to faster decision-making and reduced risk, enabling the delivery of life-changing therapies more quickly.

Efficient Payment Systems for Clinical Trials

They have simplified the process of paying sites involved in clinical trials. IQVIA offers the capability to make payments within 30 days, even in challenging locations. This significantly reduces the administrative burden of managing clinical trial payments by up to 90%.

Decentralized Trials Expertise

The company has conducted over 500 studies in more than 75 countries, covering over 30 indications using decentralized trial methodologies. This demonstrates their capability in managing complex, multinational clinical trials.

Global Reach and Impact

With a presence in various regions, including Australia, New Zealand, the Middle East, and Africa, IQVIA’s global footprint allows it to drive healthcare innovations worldwide.

AI and Technology Integration

The company is at the forefront of integrating AI and other technologies in healthcare. Their Healthcare-grade AI promises precision, speed, scale, trust, and reliability, essential for advancing health and improving patient outcomes.

- Extensive, reliable healthcare data enhances market research quality.

- Utilizes AI and machine learning for advanced healthcare insights.

- Specialized focus yields a deep understanding of healthcare dynamics.

- Broad international presence enables diverse and large-scale studies.

- Offers advanced tools for insightful healthcare data analysis.

- Advanced tools can be challenging to use without training.

- Handling sensitive health data raises privacy and security issues.

Our Review of IQVIA

IQVIA, a prominent player in the healthcare and life sciences industry, presents a mixed bag of strengths and weaknesses. On the positive side, we appreciate IQVIA’s extensive expertise in data analytics and healthcare consulting.

Their comprehensive research and analysis have undoubtedly driven valuable insights and innovations in the sector. Moreover, their global presence allows for diverse perspectives and access to critical healthcare data.

However, we must also acknowledge some shortcomings. IQVIA’s services can be prohibitively expensive for smaller organizations, limiting accessibility. Additionally, the sheer volume of data can sometimes lead to information overload, making it challenging to extract actionable insights.

ICON is a prominent company in the field of clinical research, playing a significant role in advancing medical science. They specialize in designing and conducting clinical trials for new medicines and treatments.

The work of ICON is crucial because they help determine the safety and effectiveness of these potential medical breakthroughs. They are considered one of the best in clinical research due to their high standards of accuracy, reliability, and ethical practices.

ICON’s expertise ensures that the clinical trials they manage are conducted efficiently and effectively, leading to faster approval of new treatments. This directly impacts patient care, as it allows quicker access to new, potentially life-saving medicines.

In essence, ICON’s contribution is vital in driving forward medical innovations.

- Founding Team: John Climax and Ronan Lambe

- Founding Year: 1990

- Company Size: 41,160

Features of ICON

Here are some of the key features of ICON in clinical research:

Diverse Clinical and Scientific Operations

ICON offers a wide range of clinical and scientific operations services, ensuring comprehensive support for various aspects of clinical trials. This includes everything from study design to execution and data analysis.

Decentralized Clinical Trial Solutions

They provide end-to-end services, operational models, and technology to deliver customized solutions for decentralized clinical trials. This approach is increasingly important in today’s clinical research landscape, offering flexibility and efficiency.

Specialized Therapeutic Areas

ICON has expertise across multiple therapeutic areas including cardiovascular, central nervous system, endocrine & metabolic disorders, infectious diseases, internal medicine & immunology, oncology, and more. This broad expertise allows them to handle a wide range of clinical research projects.

Innovative Solutions for Biotech

ICON provides full-service outsourcing and flexible support customized to the specific needs of biotech companies. This includes due diligence and asset valuation, which are critical for biotech firms navigating the complex landscape of drug development.

Advanced Medical Imaging Solutions

Their expert medical imaging solutions support all stages of clinical research, improving decision-making, increasing efficiency, and reducing trial costs.

- Decades of expertise ensure high-quality clinical research.

- Offers wide-reaching capabilities for multi-regional clinical studies.

- Deep understanding of global regulations enhances compliance and efficiency.

- Invests in new technologies for more efficient trial processes.

- Broad range of specialties contributes to comprehensive service offerings.

- Managing multi-regional trials can lead to logistical challenges.

- Rapid growth may strain resources and affect service quality.

Our Review of ICON

When we researched ICON, we found both commendable aspects and areas for improvement. On the positive side, we appreciate their commitment to clinical research and their global presence, which allows for diverse study options. Their experienced team and advanced technology contribute to reliable data collection and analysis.

However, there are some drawbacks to consider. We have noticed occasional delays in project timelines, which can be frustrating. Additionally, the cost of their services tends to be on the higher side, making it a potential barrier for smaller research endeavors.

Parexel is a globally recognized company in clinical research, known for its important role in developing new medical treatments. They are one of the biggest clinical research organizations. Parexel conducts clinical trials, crucial steps in testing the safety and effectiveness of new drugs.

The work of Parexel is essential because it bridges the gap between medical research and the availability of new treatments to patients. One of the reasons they stand out as one of the best in this field is their rigorous approach to research.

Their commitment to quality and their global network also enables diverse and large-scale studies, setting them apart from others in the field. These strengths allow Parexel to deliver reliable and valuable data, accelerating the process of bringing new, effective medicines to the market.

Simply put, Parexel is a key player in transforming medical research into real-world health solutions.

About Parexel

- Founding Team: Josef von Rickenbach and Anne B. Sayigh

- Company Size: 18,900

Features of Parexel

Parexel, a global biopharmaceutical services organization, offers a range of features in clinical research. Here are some key aspects of their approach:

Patient-Centric Approach

Parexel emphasizes a patient-first strategy in their clinical trials. This approach results in deeper and more relevant insights for trial design and execution. This ensures that the trials are more aligned with patient needs and experiences.

Innovative Trial Designs

Parexel employs innovative trial designs to optimize trials for maximum impact. This includes advanced modeling and simulation to predict drug effects ahead of time, which can save time, money, and resources.

Regulatory Compliance and Market Access

Parexel designs studies and endpoints with market access in mind, ensuring that they satisfy global regulations. This approach helps in getting treatments to patients safely and quickly.

Patient Advocacy and Engagement

The company includes patient advocates in their council, using their experiences to improve trial designs. This inclusion demonstrates their commitment to understanding and incorporating patient perspectives in clinical research.

Focus on Speed and Precision

Parexel aims to design neuroscience trials with speed and precision, utilizing the right experts and specializations. This focus is crucial in delivering effective treatments on time.

- Provides advanced technology and analytics for efficient data management.

- Extensive network provides global insights with regional knowledge.

- Expertise in navigating complex regulatory environments worldwide.

- Broad experience across various therapeutic areas ensures versatile solutions.

- Focuses on patient engagement for more effective trial outcomes.

- Rapid expansion can lead to challenges in resource management.

- Concentration in specific areas could pose risks in market shifts.

Our Review of Parexel

Parexel is a notable player in the field of clinical research and pharmaceutical services. We’ve thoroughly analyzed their offerings and found both strengths and areas that need improvement.

On the positive side, Parexel excels in its commitment to innovation and technology. We appreciate their continuous efforts to simplify clinical trials and drug development processes, making them more efficient.

However, we also noticed some downsides. Communication with clients could be more transparent, with clearer updates on project progress. Additionally, there’s room for improvement in terms of ensuring consistency in service quality across different projects.

Other 12 Companies of Clinical Research

In the world of clinical research, beyond the well-known names, there are 12 other companies making significant contributions. Let’s explore their vital role in advancing healthcare.

1. Syneos Health

Syneos Health helps develop medicines by managing clinical trials for new drugs. They’re essential because they ensure medicines are safe and effective. Syneos Health stands out in clinical research for its comprehensive services and global reach, making drug development smoother and faster.

About Syneos Health

- Founding Team: Colin Shannon

- Founding Year: 1980

- Company Size: 28,000

PPD is a group that tests new drugs to see if they’re good and safe. This is crucial for getting new treatments to people. They stand out for their thorough research and global reach.

- Founding Team: Fred Eshelman

- Founding Year: 1985

- Company Size: 40,000+3

Labcorp does important tests and research for health. They’re needed because they help find out if new treatments are good. They’re among the best for their big labs and fast results.

About Labcorp

- Founding Team: Matthew Benger

- Founding Year: 1978

- Company Size: 75,5000

Medpace focuses on making sure new health treatments are safe. This is key for better medicine. They’re a top choice because of their focus on quality and detail in research.

About Medpace

- Founding Team: August Troendle

- Founding Year: 1992

- Company Size: 5,400

5. Charles River Laboratories

Charles River Laboratories tests drugs and does research to help pets and people stay healthy. They’re essential for safe, new treatments. Their expertise makes them a leader in the field.

About Charles River Laboratories

- Founding Team: Henry Foster

- Founding Year: 1947

- Company Size: 21,400

6. PRA Health Science

PRA Health Science works on finding out if new medicines are safe. This helps everyone get better treatments. They’re known for their excellent research and care in studies.

About PRA Health Science

- Founding Year: 1976

- Company Size: 17,000+

7. AdvanCell

AdvanCell specializes in new treatments, checking if they’re safe and working. Their work is vital for progress in medicine. They’re recognized for their innovation in research.

About AdvanCell

- Founding Team: Andrew Adamovich

Dynata gathers data for health studies. They’re needed for understanding what works in healthcare. They’re a top name for their accurate and wide-reaching data collection.

About Dynata

- Founding Team: Mike Petrullo

- Founding Year: 1940

- Company Size: 5000-10000

Covance helps with drug tests and research to fight diseases. Their role is key for new treatments. They’re celebrated for their comprehensive services and global impact.

About Covance

- Founding Team: Fred Cummings

- Founding Year: 1981

- Company Size: 50,000

MedNet provides software for managing clinical trials. This helps in making research easier and faster. They’re among the best for their tech solutions in research.

About MedNet

- Founding Team: John “Rob” Robertson

- Founding Year: 1996

- Company Size: 51-200

11. Fisher Clinical Services Inc.

Fisher Clinical Services Inc. manages the logistics of clinical trials, ensuring that treatments are tested efficiently. Their work is crucial for the progress of medicine, and they are renowned for their reliability and global network.

About Fisher Clinical Services Inc.

- Founding Team: John Pickering

- Founding Year: 1989

12. Worldwide Clinical Trials

Worldwide Clinical Trials conducts essential research to evaluate new medical treatments. Their work is critical for advancing healthcare. They are distinguished by their global expertise and commitment to innovation in clinical research.

About Worldwide Clinical Trials

- Founding Team: Neal Cutler

- Founding Year: 1986

- Company Size: 3,147

What To Consider When Choosing the Best Clinical Research Companies?

Choosing the right clinical research company (CRC) is crucial for the success of any clinical trial. Here’s a detailed guide on what to consider:

Expertise and Specialization

Always ensure the CRC has expertise in your specific therapeutic area. Companies with experience in similar drug trials or medical devices can better navigate the complexities of your project.

Regulatory Compliance

The CRC must adhere to regulatory guidelines like FDA (US) , EMA (Europe), and others. Check their track record in meeting these standards to avoid compliance issues.

Reputation and Track Record

You should research the company’s history. Look for testimonials, case studies, and reviews from past clients. A company with a strong reputation is likely to deliver quality results.

Project Management Capabilities

Effective project management is key. Assess their ability to manage timelines, budgets, and communication. A CRC that provides transparent, regular updates is preferable.

Patient Recruitment Strategies

Patient recruitment can be challenging. Evaluate their strategies for participant recruitment and retention. Consider their demographic reach and methods for ensuring a diverse participant pool.

Data Management and Analysis

The CRC should have strong systems for data collection, management, and analysis. Ask about their use of Electronic Data Capture (EDC) systems and how they handle data security and confidentiality.

Cost and Financial Terms

Get a clear understanding of the cost structure. Consider the value for money rather than just the lowest cost. Ensure there are no hidden fees and clarify what is included in the quoted price.

How Heartbeat AI Can Help You Get the Best List of Clinical Research Organizations?

Heartbeat AI, with its advanced features, can significantly assist in identifying the best list of clinical research organizations (CROs). Here’s how its various features contribute to this process:

Data Analysis and Processing

Heartbeat AI excels in analyzing vast amounts of data. When it comes to selecting CROs, it can process and analyze information from numerous sources, including past performance records, clinical trial reports, and regulatory compliance data. This thorough analysis helps in identifying CROs with a proven track record of success and reliability.

Machine Learning Algorithms

These algorithms enable Heartbeat AI to learn from historical data and improve its recommendations over time. By understanding trends and patterns in the successful execution of clinical trials, it can better predict which CROs are likely to meet your specific needs.

Predictive Analytics

Heartbeat AI uses predictive models to forecast future trends and outcomes based on historical data. This can be invaluable in predicting the success rate of CROs in upcoming projects, thus aiding in making more informed choices.

Customization and Personalization

The AI can be customized to your specific requirements. If you’re focusing on a specific therapeutic area or clinical trial phase, Heartbeat AI can prioritize specialized CROs in these fields.

Real-time Data Updates

The healthcare and pharmaceutical landscapes are constantly changing. Heartbeat AI’s ability to integrate and analyze real-time data ensures that the recommendations are based on the most current information available.

Integration with External Databases

Heartbeat AI can integrate with various external databases and platforms. This enables it to pull in comprehensive information about CROs from diverse sources, enhancing the accuracy of its recommendations.

Claim $500 of Free Data

Summing up, we’ve explored the best clinical research companies, diving into their features, strengths, weaknesses, and more. Clinical research is vital in healthcare; it’s key for advancing medical knowledge and developing new treatments.

With this guide, you’re equipped to find the right clinical research company that meets your specific needs. Whether it’s for innovative therapies, drug development, or medical advancements, choosing the right partner is crucial. This guide serves as a valuable resource to help you make an informed decision in the complex world of clinical research.

Frequently Asked Question

What services do companies of clinical research offer.

Clinical research organizations offer a wide range of services, including protocol development, patient recruitment, data collection and analysis, regulatory compliance, and more.

What is the role of a clinical research coordinator?

A clinical research coordinator is responsible for managing various aspects of a clinical trial, including patient recruitment, data collection, and ensuring compliance with protocols.

What is informed consent in clinical research?

Informed consent is the process by which participants in a clinical trial are fully informed about the study’s purpose, risks, and benefits. They voluntarily agree to participate based on this information.

- Health, Pharma & Medtech ›

- Pharmaceutical Products & Market

Pharmaceutical research and development (R&D) – statistics & facts

The rise of r&d investment, why do companies invest in r&d, the characteristics of the r&d pipeline, key insights.

Detailed statistics

Total global pharmaceutical R&D spending 2014-2028

Top 50 pharmaceutical companies - Rx sales and R&D spending 2023

Pharmaceuticals: cost of drug development in the U.S. since 1975

Editor’s Picks Current statistics on this topic

Industry & Market

Top pharma companies worldwide 2024, by size of R&D pipeline

U.S. pharma industry R&D spending as a percent of total revenues 1990-2023

R&D cost to develop new pharmaceutical compounds 2010-2020

Further recommended statistics

- Premium Statistic Total global pharmaceutical R&D spending 2014-2028

- Premium Statistic R&D spending growth worldwide on pharmaceuticals 2015-2028

- Premium Statistic Growth rate of R&D spending in pharmaceutical industry by major region 2007-2023

- Premium Statistic Number of drugs in the R&D pipeline worldwide 2001-2024

- Basic Statistic Pharma companies worldwide with active R&D pipelines 2001-2024

- Basic Statistic Projected most valuable R&D projects based on net present value 2023

Total global pharmaceutical R&D spending 2014-2028

Total global spending on pharmaceutical research and development from 2014 to 2028 (in billion U.S. dollars)

R&D spending growth worldwide on pharmaceuticals 2015-2028

Global growth in total pharmaceutical R&D spending from 2015 to 2028

Growth rate of R&D spending in pharmaceutical industry by major region 2007-2023

Annual growth of pharmaceutical R&D spending in Europe, the U.S., and China between 2009 and 2023

Number of drugs in the R&D pipeline worldwide 2001-2024

Total number of drugs in the R&D pipeline worldwide from 2001 to 2024

Pharma companies worldwide with active R&D pipelines 2001-2024

Total number of pharmaceutical companies with active R&D pipelines worldwide from 2001 to 2024

Projected most valuable R&D projects based on net present value 2023

Selected top pharmaceutical R&D projects based on net present value (NPV) as of December 2023 (in billion U.S. dollars)

R&D performance by company

- Premium Statistic R&D spending share of top pharmaceutical companies 2023

- Basic Statistic Top pharmaceutical companies in R&D spending growth 2022

- Basic Statistic Top 50 global pharmaceutical and biotech companies by R&D intensity in 2022

- Premium Statistic Top pharma companies worldwide 2024, by size of R&D pipeline

- Premium Statistic Distribution of pharmaceutical R&D companies by region 2023 vs. 2024

R&D spending share of top pharmaceutical companies 2023

R&D spending as revenue share of leading 10 pharmaceutical companies in 2023

Top pharmaceutical companies in R&D spending growth 2022

World's top 50 pharmaceutical and biotechnology companies based on R&D spending growth in 2022

Top 50 global pharmaceutical and biotech companies by R&D intensity in 2022

World's top 50 pharmaceutical and biotechnology companies based on R&D intensity in 2022

Top pharma companies worldwide 2024, by size of R&D pipeline

Leading 15 pharmaceutical companies worldwide by size of R&D pipeline as of 2024

Distribution of pharmaceutical R&D companies by region 2023 vs. 2024

Distribution of pharmaceutical R&D companies worldwide as of 2023 and 2024, by country

Characteristics of R&D pipeline

- Basic Statistic Top therapeutic categories worldwide 2024, by number of R&D products

- Premium Statistic Worldwide top diseases 2024, by number of active drugs

- Basic Statistic Worldwide top origins for pipeline drugs by number of active drugs 2024

- Basic Statistic Worldwide pipeline drugs by delivery route share 2023 vs. 2024

- Basic Statistic Worldwide top drug producing mechanisms of action by number of active compounds 2024

Top therapeutic categories worldwide 2024, by number of R&D products

Leading 15 therapeutic categories worldwide by number of R&D products as of 2024

Worldwide top diseases 2024, by number of active drugs

Leading 15 diseases worldwide by number of active drugs as of 2024

Worldwide top origins for pipeline drugs by number of active drugs 2024

Leading 15 origins of drugs in R&D pipeline worldwide by number of active drugs as of 2024

Worldwide pipeline drugs by delivery route share 2023 vs. 2024

Percentage of drugs in R&D pipeline worldwide by delivery route as of 2023 and 2024

Worldwide top drug producing mechanisms of action by number of active compounds 2024

Leading 15 mechanisms of action in R&D pipeline drugs worldwide by number of active compounds as of 2024

Duration, cost and ROI

- Basic Statistic Average length of a clinical trial cycle 2014-2022

- Basic Statistic Rate of return on biopharma R&D late stage pipeline 2013-2023

- Premium Statistic Average R&D cost to develop new biopharma compound 2013-2023

- Premium Statistic Average peak sales forecast per new biopharmaceutical asset 2013-2023

Average length of a clinical trial cycle 2014-2022

Average length of a clinical trial cycle from 2014 to 2022 (in years)

Rate of return on biopharma R&D late stage pipeline 2013-2023

Rate of return on biopharmaceutical late-stage R&D pipeline from 2013 to 2023

Average R&D cost to develop new biopharma compound 2013-2023

Average cost to develop a compound for biopharma companies from 2013 to 2023 (in billion U.S. dollars)

Average peak sales forecast per new biopharmaceutical asset 2013-2023

Projected average peak sales for each new biopharmaceutical asset from 2013 to 2023 (in million U.S. dollars)

Outsourced R&D

- Basic Statistic CRO market size worldwide forecast 2032

- Premium Statistic Leading global contract research organizations based on revenue 2023

- Premium Statistic CDMO market size worldwide forecast 2023-2033

- Basic Statistic Top pharma contract development and manufacturing companies 2022

CRO market size worldwide forecast 2032

Global contract research organization (CRO) market in 2022 and a forecast for 2032 (in billion U.S. dollars)

Leading global contract research organizations based on revenue 2023

Leading global contract research organizations (CROs) based on 2023 revenue (in million U.S. dollars)

CDMO market size worldwide forecast 2023-2033

Contract development and manufacturing organization (CDMO) market forecast worldwide from 2023 to 2033 (in billion U.S. dollars)

Top pharma contract development and manufacturing companies 2022

Leading 10 contract development and manufacturing organizations (CDMOs) based on revenue in 2022 (in billion U.S. dollars)

Public opinion/knowledge

- Basic Statistic Willingness to pay more taxes for additional medical research - U.S. adults 2019-2023

- Basic Statistic View of health research as a problem or solution for rising costs - U.S. adults 2020

- Basic Statistic Importance to support private investments in medical research by government 2022

- Premium Statistic U.S. approval of pharma companies' COVID-19 vaccine development handling 2021

- Basic Statistic Share of U.S. adults who could name a medical or health research entity 2024

- Basic Statistic Participation in clinical trials recommended by a doctor among U.S. adults 2021

Willingness to pay more taxes for additional medical research - U.S. adults 2019-2023

Would you be willing to pay $1 per week more in taxes if you were certain that all of the money would be spent on additional medical research?

View of health research as a problem or solution for rising costs - U.S. adults 2020

When it comes to rising health care costs, would you say research to improve health is part of the problem or part of the solution?

Importance to support private investments in medical research by government 2022

How important is it for the federal government to support incentives for private sector investment in new treatments and cures?

U.S. approval of pharma companies' COVID-19 vaccine development handling 2021

Percentage of U.S. adults who approve of how pharmaceutical companies handled COVID-19 vaccine development as of 2021

Share of U.S. adults who could name a medical or health research entity 2024

Percentage of adults in the United States who could name a medical or health research entity as of 2024

Participation in clinical trials recommended by a doctor among U.S. adults 2021

How likely would you be to participate in a clinical trial recommended by your doctor?

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

What can we help you find?

We believe research is the will to conquer the impossible and that science will lead the way.

The journey to discovery is guided by science — and inspired by patients

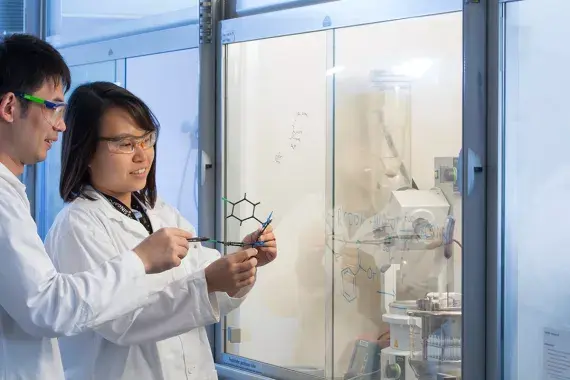

Every day our scientists, from all backgrounds and disciplines, work together to use the power of leading-edge science to save and improve lives.

Watch now: Merck Research Laboratories

Our research in action

People employed in R&D

Invested in R&D in 2023

Publications by our scientists

Our areas of focus

We follow the science and apply our expertise on core therapeutic areas where we have the greatest potential to help save and improve lives.

Our team of researchers and scientists are pushing the boundaries of cancer research to discover more effective anticancer therapies.

Our work in oncology

Vaccines are one of the greatest public health success stories — and we’ve been discovering, developing, supplying and delivering vaccines to help prevent disease for over 130 years.

Our work in vaccines

Infectious diseases

Our focus has always been on the prevention and treatment of diseases that threaten people and communities around the world.

Our work in infectious diseases

Cardio-metabolic disorders

We have a long history of making an impact in cardio-metabolic disorders, such as type 2 diabetes and cardiovascular disease.

Our work in cardio-metabolic disorders

We’re at the forefront of research, seeking to translate scientific discoveries into treatments for people with immune-mediated inflammatory disorders.

Our work in immunology

Neuroscience

We're tackling the complexities and therapeutic challenges of some of the most devastating neurological disorders.

Our work in neuroscience

We have a proud legacy of turning breakthrough science into medicines and vaccines that save and improve lives around the world.

Check out our pipeline

Publications

As part of our commitment to unparalleled research, our scientists and postdoctoral research fellows are encouraged to be active members of the scientific community.

Explore our publications

Clinical trials

Our progress is due in large part to the important and tough scientific questions we set out to answer with our clinical trials.

Learn about clinical trials

Business development & licensing

With a robust pipeline and portfolio fueled by both our own discoveries and external innovation, we know that collaborations are critical to advancing bold science.

Collaborate with us

Discovery & development

Journey of a molecule

Creating a medicine or vaccine is a journey — from the lab to patients.

Meet our scientists

Innovation is fueled by diverse expertise and backgrounds. Learn more about our R&D leaders pushing scientific boundaries at Merck.

Dean Li Executive vice president and president, Merck Research Laboratories

Eliav Barr Senior vice president, head of global clinical development and chief medical officer

George Addona Senior vice president and head, discovery, preclinical development and translational medicine

Where we work

Research based on innovation is at the core of who we are and what we do. It starts with the capabilities and expertise at our facilities, but we're open to collaboration anywhere the science leads us.

South San Francisco

Visit all of our R&D locations

Read our R&D stories

What is One Pipeline?