How Zara’s strategy made her the queen of fast fashion

Table of contents, here’s what you’ll learn from zara's strategy study:.

- How to come up with disruptive ideas for your industry.

- How finding the right people is more important than developing the best strategy.

- How best to address the sustainability question.

Zara is a privately held multinational clothing retail chain with a focus on fast fashion. It was founded by Amancio Ortega in 1975 and it’s the largest company of the Inditex group.

Amancio Ortega was Inditex’s Chairman until 2011 and Zara’s CEO until 2005. The current CEO of Zara is Óscar García Maceiras and Marta Ortega Pérez, daughter of the founder, is the current Chairwoman of Inditex.

Zara's market share and key statistics:

- Brand value of $25,4 billion in 2022

- Net sales of $19,6 billion in 2021

- 1,939 stores worldwide in 2021

- Over 4 billion annual visits to its website

- Inditex employee count of 165,042 in 2021

{{cta('ba277e9c-bdee-47b7-859b-a090f03f4b33')}}

Humble beginnings: How did Zara start?

Most people date Zara’s birth to 1975, when Amancio Ortega and Rosalia Mera, his then-wife, opened the first shop. But, it’s impossible to study the company’s first steps, its initial competitive advantage, and strategic approach by starting at that point in time.

When the first Zara shop opened, Amancio Ortega already had 22 years of industry experience, ten years as a clever and hard-working employee, and 12 years as a business owner. Rosalia Mera also had 20 years of industry experience.

As an employee , Ortega worked in the clothing industry, first as a gofer and then as a delivery boy. He quickly demonstrated great talent for recognizing fabrics, understanding and serving customers, and making sound business suggestions. Soon, he decided to use his insights to develop his own business instead of his boss’s.

As a business owner , he started GOA Confecciones in 1963, along with his siblings, his wife, and a close friend. They started with a humble workshop making women’s quilted dressing gowns, following a trend at the time Amancio had noticed. Within ten years, that workshop had grown to support a workforce of 500 people.

And then, the couple opened the first Zara shop.

Zara’s competitive positioning strategy in its first year

The opening of the first Zara shop in 1975 wasn’t just a new store to sell clothes. It was the final big move of a carefully planned vertical integration strategy.

To understand how the strategy was formulated , we need to understand Amancio’s first steps. His first business, GOA Confecciones, was a manufacturing business. He was supplying small stores and businesses with his products, and he wasn’t in contact with the end customer.

That brought two challenges:

- A lack of insight into market trends and no direct consumer feedback about preferences.

- Very low-profit margins compared to the 70-80% profit margin of retailers.

Amancio developed several ideas to improve distribution and get a direct relationship with the final purchaser. And he was always updating his factories with the latest technological advancements to offer the highest quality of products at the lowest possible price. But he was missing one essential part to reap the benefits of his distribution practices: a store .

So, in 1972 he opened one under the brand name Sprint . An experiment that quickly proved unsuccessful and, seven years later, was shut down. Although it’s unknown the extent to which Amancio put his ideas to the test, Sprint was a private masterclass in the retail world that gave Amancio insights that would later turn Zara into a global success.

Despite Sprint’s failure, Amancio didn’t abandon the idea of opening his own store mainly because he believed that his advanced production model was vulnerable and the rise of a competitor who could replicate and improve his system was imminent.

Adding a store to his vertical integration strategy would have a twofold effect:

- The store would operate as a direct feedback source. The company would be able to test design ideas before going into mass production while simultaneously getting an accurate pulse of the needs, tastes, and fancies of the customers. The store would simultaneously reduce risk and increase opportunity spotting.

- The company would have reduced operating costs as a retailer. Since the group would control all aspects of the process (from manufacturing to distribution to selling), it would solve key retail challenges with stocking. The savings would then be passed on to the customer. The store would have an operational competitive advantage and become a potential cash cow for the company.

The idea was to claim his spot in prime commercial areas (a core and persistent strategic move for Zara) and target the rising middle class. The market conditions were tough, though, with many family-owned businesses losing their customer base, giant players owning a huge market share, and Benetton’s franchising shops stealing great shop locations and competent potential managers.

So the first Zara store had these defining characteristics that made it the successful final piece of Amancio’s strategy:

- It was located near the factory = delivery of products was optimized

- It was in the city’s commercial heart = more expensive, but with access to affluence

- It was located in the city where Ortegas had the most customer experience = knowing thy customer

- It was visibly attractive = expensive, but a great marketing trick

Amancio’s team lacked experience and expertise in one key factor: display window designing . The display window was a massive differentiator and had to be bold and attractive. So, Amancio hired Jordi Bernadó, a designer with innovative ideas whose work transformed display windows and the sales process.

The Zara shop was a success, laying the foundations for the international expansion of the Inditex group.

Key Takeaway #1: Challenge your industry’s conventional wisdom to create a disruptive strategy

Disrupting an industry isn’t an easy task nor a frequent occurrence.

To do it successfully, you need to:

- Understand the prominent business mode of your industry and the forces that contributed to its development.

- Challenge the assumptions behind it and design a radically different business model.

- Develop ample space for experimentation and failures.

The odds of instantly conquering the industry might be low (otherwise, someone would have already done it), but you’ll end up with out-of-the-box ideas and a higher sensitivity to potential disruptors in your competitive arena.

Recommended reading: How To Write A Strategic Plan + Example

How Zara’s supply chain strategy is at the core of its business strategy

According to many analysts, the Zara supply chain strategy is its most important innovative component.

Amancio Ortega and other senior members of the group disagree. Nevertheless, the Inditex logistics strategy is extraordinarily efficient and plays a crucial role in sustaining its competitive advantage. Most companies in the clothing retail industry take an average of 4-8 weeks between inception and putting the product on the shelf. The group achieves the same in an average of two weeks. That’s nothing short of extraordinary.

Let’s see how Zara developed its logistics and business strategy.

Innovative logistics: how Zara’s supply chain evolved

The logistics methods developed by companies are highly dependent on external factors.

Take, for example, infrastructure. In the early days of Zara, when it was expanding through Spain, the company considered using trains as a transportation system. However, the schedule couldn’t keep up with Zara’s needs, which had the goal of distributing products twice a week to its shops. So transportation by road was the only way.

However, when efficiency is a high priority, it shapes logistics processes more than anything else.

And for Zara, efficient logistics was – and still is – of the highest priority.

Initially, leadership tried outsourcing logistics, but the experiment failed and the company assigned a member of the house with a thorough knowledge of the company's operating philosophy to take charge of the project. The tactic of entrusting important big projects to employees imbued with the company’s philosophy became a defining characteristic.

So, one of Zara’s early strategic decisions was that each shop would make orders twice a week. Since the first store was opened, the company has had the shortest stock rotation times in the industry. That’s what drove the development of its logistics methods. The whole strategy behind Zara relied on quick production and distribution. And the proximity of manufacturing and distribution was essential for the model to work. So Zara had these two centers in the same place.

Even when the brand was expanding around the world, its logistics center remained in Arteixo, Spain, despite being a less-than-ideal location for international distribution. At some point, the growth of the brand, and Inditex as a whole, outpaced Arteixo’s capacity, and the decentralization question came up.

The debate was tough among leadership, but the arguments were strong. Decentralization was necessary because of:

- Safety and security. If there was a fire or any other crippling disaster there (especially on a distribution day), then the company would face serious troubles on multiple fronts.

- Arteixo’s limitations. The company’s center in Arteixo was reaching its capacity limits.

So the company decided to decentralize the manufacturing and distribution of its brands.

Initially, the group made the decision to place differentiated logistics centers where the management of its chain of stores was based, i.e. Bershka would have a different logistics center than Pull&Bear, although they were both part of the Inditex Group. That idea emerged after Massimo Dutti and Stradivarius became part of Inditex. Those brands already had that geographical structure, and since the group integrated them successfully into its strategy and logistics model, it made sense to follow the same pattern with its other brands.

Besides, the proximity of the distribution centers to the headquarters of each brand allowed them to consolidate them based on the growth strategy and purpose of each brand (more on this later).

But just a few years after that, the group decided to build another production center for Zara that forced specialization between the two Zara centers. The specialization was based on location, i.e. each center would manufacture products that would stock the shelves of stores in specific locations.

Zara’s supply chain strategy is so successful because it’s constantly evolving as the group adapts to external circumstances and its internal needs. And just like its iconic fashion, the company always stays ahead of the logistics curve.

Zara’s business strategy transcends its logistics innovations

Zara’s business strategy relies on four key pillars:

- Flexibility of supply

- Instant absorption of market demand

- Response speed

- Technological innovation

Zara is the only brand in the Inditex group that is concerned with manufacturing. It’s the first brand in the clothing sector with a complete vertical organization. And the production model requires the adoption or development of the latest technological innovations.

This requirement is counterintuitive in the clothing sector.

Most people believe that making big investments in a market as mature as clothing is a bad idea. But the Zara production model is very capital and labor intensive. The technological edge derived from that investment gave the company, in the early days, the capability to manufacture over 50% of its own products while maintaining an extremely high stock rotation frequency.

Zara might be one of the best logistics companies in the world, but that particular excellence is a supporting factor, or at least a highly contributing factor, to its successful business strategy.

Zara’s business strategy is so much more than its supply chain strategy.

The company created the “fast fashion” term and industry. When other companies were manufacturing their collections once per season, Zara was adapting its collection to suit what people asked for on a weekly basis. The idea was to offer fashionable items at a fair price and faster than everybody else.

Part of its cost-cutting strategic priority was its marketing strategy. Zara didn’t – and still doesn’t – advertise like the rest of the clothing industry. Its marketing strategy starts with choosing the location of the stores and ends with advertising that the sales period has started. In the early years of the brand’s expansion, Amancio would visit potential store locations himself and choose the site to build the Zara shop.

The price was never an issue. If the location was in a commercial center, Zara would build its store there no matter how high the cost was because the company expected to recoup it quickly with increased sales.

Zara’s marketing is its own stores.

The strategy of Zara and her Inditex sisters

Despite Zara’s success (or because of it), Amancio Ortega created – or bought – multiple other brands that he included in the Inditex group, each one with a specific purpose.

- Zara was targeting middle-class women.

- Pull&Bear was targeting young people under twenty-five years old with casual clothing.

- Bershka was targeting rebel teens, especially girls, with hip-hop-style clothing.

- Massimo Dutti was targeting both sexes with more affluence.

- Stradivarius was competing with Bershka, giving Inditex two major brands in the teenage market.

- Oysho was concentrating on women's lingerie.

- Zara Home manufactures home textiles and decor.

Pull&Bear was initially targeting young males between the ages of 14 and 28. Later it extended to young females of the same age and focused on selling leisure and sports clothing. It has the slowest stock turnaround time in the group.

Bershka’s target group was girls between 13 and 23 years of age with highly individualized tastes. Prices were low, but the quality average. Almost a fiasco in the beginning, it underwent a successful strategic turnaround becoming today one of the biggest growth opportunities for the group. And out of all the Inditex chains, Bershka has the most creative designs.

Massimo Dutti was the first retail brand Amancio bought and didn’t create himself. Its strategy is very different from Zara, producing high-quality products and selling them at a high price. It’s an extension of the group’s offer to the higher end of the price spectrum in the fashion industry. It’s also the only Inditex chain brand that advertises regularly.

Stradivarius was the second acquired brand, with the purchase being a defensive move. The chain shares the same target group with Bershka, making it, to this day, a direct competitor.

Oysho started as an underwear and lingerie company. Its product lines evolved to include comfortable night and homewear along with swimwear and a very young children’s line. The brand’s strategy was aggressive from its conception, opening 286 stores in its first six years of existence.

Zara Home is the youngest brand in the Group and the only one outside the clothing sector, though still in the fashion industry. It was launched with the least confidence and with immense prior research. An experiment to extend the Zara brand beyond clothing, it was based on the conservative view that Zara could extend its product categories only to textile items for the home. But it turned out that customers were more accepting of Zara Home selling a wide variety of domestic items. So the brand made a successful strategic pivot.

Key Takeaway #2: The right people are more important than the best strategy

It might not be obvious in the story, but a key reason for Zara's and Inditex’s success has been the people behind them.

For example, a vast number of people in various positions from inside the group claim that Inditex cannot be understood without Amancio Ortega. Additionally, major projects like the development of Zara’s logistics systems and the group's international expansion had such a success precisely because of the people in charge of them.

Zara’s radically different model was a breakthrough because:

- Its leadership had a clear vision and a real strategy to execute it.

- People with a deep understanding of the company’s philosophy led Its largest projects.

Sustainability: Zara’s strategy to make fast fashion sustainable

Building a sustainable business in the fast fashion industry is a tough nut to crack.

To achieve it, Inditex has made sustainability a cornerstone of its business model. Its strategy revolves around the values of collaboration , transparency, and innovation . The group’s ambition is to make a positive impact with a vision of prosperity for the planet and its people by transforming its value chain and industry.

Inditex’s sustainability commitments and strategy to achieve them

Inditex has developed a sustainability roadmap that extends up to 2040 with ambitious goals. Specifically, it has committed to

- 100% consumption of renewable energy in all of its facilities by 2022 (report pending).

- 100% of its cotton to originate from more sustainable sources by 2023.

- 100% of its man-made cellulosic fibers to originate from more sustainable sources by 2023.

- Zero waste from its facilities by 2023.

- 100% elimination of single-use plastic for customers by 2023.

- 100% collection of packaging material for recycling or reuse by 2023.

- 100% of its polyester to originate from more sustainable sources by 2025.

- 100% of its linen to originate from sustainable sources by 2025.

- 25% reduction of water consumption in its supply chain by 2025.

- Net zero emissions by 2040.

The group’s commitments extend beyond environmental issues to how its manufacturing and supplying partners conduct their business . To bring its strategy to fruition, it has set up a new governance and management structure.

The Board of Directors is responsible for approving Inditex’s sustainability strategy. The Sustainability Committee oversees and controls all the proposals around the social, environmental, health, and safety impact of the group’s products, while the Ethics Committee makes sure operations are compliant with the rules of conduct. There is also a Social Advisory Board that includes external independent experts that advises Inditex on sustainability issues.

Finally, Javier Losada, previously the group’s Chief Sustainability Officer and now promoted to Chief Operations Officer, will be leading the sustainability transformation of the group. Javier Losada first joined Inditex back in 1993 and ascended its rank to reach the C-suite.

Inditex is dedicated to its commitment to reducing its environmental impact and seems to be headed in the right direction. The only question is whether it’s fast enough.

Key Takeaway #3: Integrating sustainability with business strategy is a present-day necessity

Governments and international bodies around the world are implementing more stringent environmental regulations, forcing companies to commit to ambitious goals and developing a realistic strategy to achieve them.

The companies that are impacted the least are those that always had sustainability as a high priority .

From the companies that require significant changes in their operations to comply with the new regulations, only those who integrate sustainability into their business strategy and model will succeed.

Why is Zara so successful?

Zara is the biggest Spanish clothing retailer in the world based on sales value. Its success is due to its fast fashion strategy that is based on a strong supply chain and quick market feedback loops.

Zara's customer-centric approach places a strong emphasis on understanding and responding to customer needs and preferences. This is reflected in the company's product design, marketing, and customer service strategies.

Zara made fashionable clothes accessible to the middle class.

Zara’s vision guides its future

Zara's vision, as part of the Inditex Group, is to create a sustainable fashion industry by promoting responsible consumption and production, respecting the environment and people, and contributing to the communities in which it operates.

The company aims to offer the latest fashion trends to its customers at accessible prices while continuously innovating and improving its operations and processes.

Growth by numbers (Inditex)

How Zara became the undisputed king of fast fashion?

Zara is one of the biggest international apparel brands. Zara invites customers from around 93 markets to its organization of 2000+ stores in upscale markets on the planet’s biggest urban communities. With these stores, Zara generates 18 billion Euros annually.

The brand has been fruitful in keeping up its central goal to give quick and reasonable designs in the world of fashion. Zara’s way to deal with configuration is firmly connected to its clients. This story is about how Zara became the undisputed king of Fast fashion.

Fashion is the imitation of a given example and satisfies the demand for social adaptation. . . . The more an article becomes subject to rapid changes of fashion, the greater the demand for cheap products of its kind. — Georg Simmel, “Fashion” (1904)

History of Zara: The Long Story Cut Short

Amancio Ortega launched the first Zara store in 1975 in Central Street in downtown A Coruna, Galicia, Spain. The main Store included low-value look-a-like designs of famous and better-quality dress styles. The store ended up being a triumph and Ortega Began opening more Zara stores throughout Spain.

During the 1980s, Ortega began changing the plan, assembling and dissemination cycle to diminish lead times and respond to new patterns in a snappier manner in what they called “Moment Fashions”.

In 1980 the company started its international expansion through Porto, Portugal in the 1990s, with Mexico in 1992. Since then Ortega has continued to grow and create brands such as Pull & Bear, Bershka , and Oysho . It has acquired groups like Massimo Dutti and Stradivarius . Even though these brands have been contributors to their parent group Inditex’s success, Zara is still the principal growth driver.

Zara’s Customer-driven Value Chain

Product line-up:.

Unlike other Inditex chains, Zara has focused on manufacturing fashion-sensitive products internally. The latest designs were continuously in production as per changing customer’s preferences. Many competitors were producing just a few thousand SKUs whereas Zara was producing several hundred of thousands of SKUs in a year. These SKUs varied as per color, size, and fabric.

Zara’s designs are not dependent on design maestros. Instead, its designers carefully observe the catwalk trends and try to implement them for the mass market. The design team continuously creates variations in a particular season. Thereafter expanding on successful designs.

Fast Supply Chain:

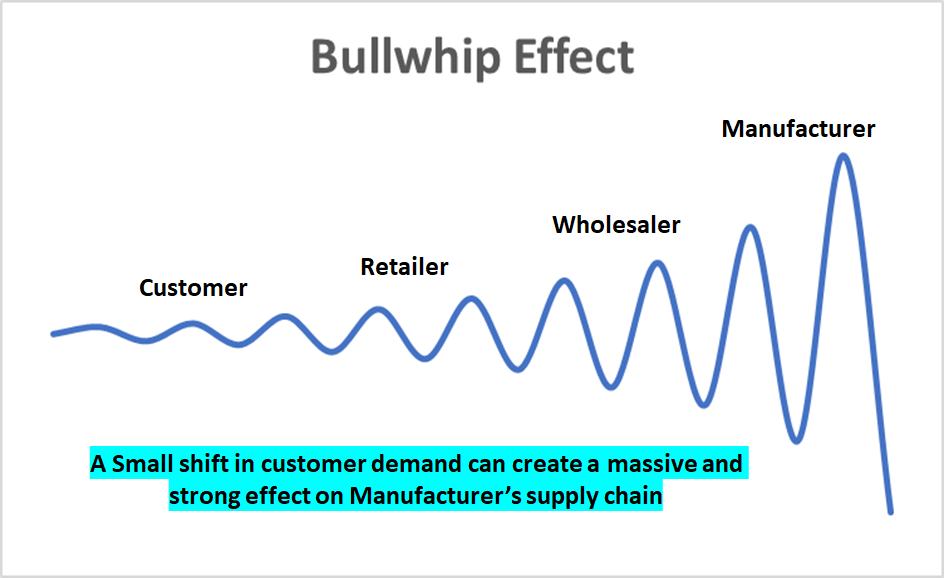

Zara’s flexible supply chain allows it to dispatch new ranges to shops two times per week from its central distribution center that is an approximately 400,000-square-meter facility located in Arteixo, Spain. This kind of business system called vertical integration eliminated the need for local warehouses. The strategy here was to reduce the “bullwhip effect”. Let’s see what the bullwhip effect is:

The bullwhip effect is a distribution channel phenomenon in which demand forecasts yield supply chain inefficiencies. It refers to increasing swings in inventory in response to shifts in consumer demand as one moves further up the supply chain. Wikipedia

It was a matter of a few weeks and a new design was on the shelf for the customers. Isn’t cool? These designs of clothes and accessories were quickly moved to fancy stores in prime locations but at a cheap price. This strategy has attracted a lot of fashion yet money conscious customers.

We want our customers to understand that if they like something, they must buy it now because it won’t be in the shops the following week. It is all about creating a climate of scarcity and opportunity. Luis Blanc, one of the former Inditex’s international directors

Zara’s Retailing Strategy

Zara instead of focusing on improving its manufacturing efficiency focused on improving its retail strategy. This retailing strategy was about following fashion trends quickly even it means there is an unmet demand. As was previously discussed, this also helped Zara in creating a FOMO for its products. The two components of its retailing strategy were dependent on its upstream operations: Merchandizing and Stores.

Read: The Torchbearers of Sustainable Fashion

Merchandising.

Merchandising is the promotion of goods and/or services that are available for retail sale. It includes the determination of quantities, setting prices for goods and services, creating display designs, developing marketing strategies, and establishing discounts or coupons. Investopedia

- Zara placed emphasis on the freshness of its designs. It wanted to create a sense of exclusivity. It never focused on creating bulk items of one design. Zara had confidence in its fast supply chain of twice a week shipment to the store with the latest designs. Thre quarter of its merchandise gets replaced in just a month. How about that?

The success of your business is based in principle on the idea of offering the latest fashions at low prices, in turn creating a formula for cutting costs: an integrated business in which it is manufactured, distributed, and sold. Amancio Ortega

Fun Fact : An average customer visits a Zara store 17 times in a year where the number is 3-4 times for its competitors.

- Zara understood the importance of store locations very well. Zara prices are not expensive but its store location and design made its products look expensive. The brand wanted its customers to have a premium feel at a reasonable price.

We invest in prime locations. We place great care in the presentation of our storefronts. That is how we project our image. We want our clients to enter a beautiful store, where they are offered the latest fashions. Luis Blanc, one of the former Inditex’s international directors

Store Operations

Zara has stores in most upscale markets and shopping centers in the world. You name it and they have a store there. Champs Elysées in Paris, Regent Street in London, and Fifth Avenue in New York to name a few. As per its latest annual report the value of these properties is valued at almost 8 billion Euros. But the way these stores are managed is a strategy to learn for all retailers.

- We all love grand stores with a lot of variety. Zara has emphasized on creating a grand image of its stores. Imagine a big store at a posh location. How much impressed you would be. The average size of Zara stores has continuously increased over the years. In 2001 the average store size was 910 sq.m whereas in 2018 the size has more than doubled.

Zara’s average store size has increased by 50%: from 1,452m2 in 2012 to 2,184m2 in 2018. That growth has been driven by new store openings – larger flagship stores – as well as the fact that many of the new openings have entailed the absorption of one or more older, smaller units in the same catchment area. Inditex Annual Report

- Zara has tried to standardize the in-store experience with its store window displays and interior presentations. As the season progresses, Zara consistently evolves its interior themes, color schemes, and product placements. All these ideas come from the central team in Spain and regional teams implement with necessary region-based adaptations. So much so that the uniforms of the staff were selected twice in a season by a store manager from the latest collection.

Anti-Marketing Approach of Zara

Zara has able to maintain profitability ~13% whereas its major competitor like H&M is at 6% . This has been possible not only because of its efficient supply chain we discussed above but also because of its no advertising or limited advertising policy.

This is what makes Zara really one of a kind. The organization just spends about 0.3% of deals on promoting and does not have a lot of advertising to discuss. The usual trend in the industry is to spend 3.5% on advertising. Zara never shows its clothes at expensive fashion shows also. It first shows its designs at stores directly. But why does not Zara believe in advertising? There are primarily two reasons:

- First, as we discussed it saves Zara a lot of money. So much so that it has now one of the highest profitability.

- Second, it brings exclusivity and prevents overexposure of a design. Customers feel like if they purchase a shirt at Zara, five others won’t have that equivalent shirt at work or school.

Read: Viral Marketing over the Long-Haul ft. Burger King

Zara is a perfect case study to learn the perfect operations strategy, perfect marketing strategy, perfect pricing strategy, and whatnot. It’s all strategies are so perfect. It is also a perfect example to understand how a traditional brand is evolving itself with time to stay relevant.

As per its annual report , In 2018, Zara launched its global online store, marking a milestone in its commitment to having all of its brands available online worldwide by 2020. Zara continued to earn global accolades for its collections and initiatives, its integrated shopping experience, and its commitment to sustainability, with over 90 million garments put on sale under the Join Life label.

Zara is just not a brand of fast fashion. Its much more than that now. And that’s why it’s actually the true king of fast fashion.

Interested in reading our Advanced Strategy Stories . Check out our collection.

Also check out our most loved stories below

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

Why do some companies succeed consistently while others fail?

What is Adjacency Expansion strategy? How Nike has used it over the decades to outperform its competition and venture into segments other than shoes?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Microsoft – How to Be Cool by Making Others Cool

Microsoft CEO Satya Nadella said, “You join here, not to be cool, but to make others cool.” We decode the strategy powered by this statement.

A marketing aggregator, business story teller, freelancer. I'm pursuing my PGPM, and is a 2nd year marketing student at MDI.

Related Posts

Revolutionizing Supply Chain Planning with AI: The Future Unleashed

Is AI the death knell for traditional supply chain management?

Merchant-focused Business & Growth Strategy of Shopify

Business, Growth & Acquisition Strategy of Salesforce

Hybrid Business Strategy of IBM

Strategy Ingredients that make Natural Ice Cream a King

Investing in Consumer Staples: Profiting from Caution

Storytelling: The best strategy for brands

How Acquisitions Drive the Business Strategy of New York Times

Rely on Annual Planning at Your Peril

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

How does DoorDash make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend Print delivery

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

Brought to you by:

ZARA: Fast Fashion

By: Pankaj Ghemawat, Jose Luis Nueno Iniesta

Focuses on Inditex, an apparel retailer from Spain, which has set up an extremely quick response system for its ZARA chain. Instead of predicting months before a season starts what women will want to…

- Length: 35 page(s)

- Publication Date: Apr 1, 2003

- Discipline: Strategy

- Product #: 703497-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

- Supplements

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Focuses on Inditex, an apparel retailer from Spain, which has set up an extremely quick response system for its ZARA chain. Instead of predicting months before a season starts what women will want to wear, ZARA observes what's selling and what's not and continuously adjusts what it produces and merchandises on that basis. Powered by ZARA's success, Inditex has expanded into 39 countries, making it one of the most global retailers in the world. But in 2002, it faces important questions concerning its future growth.

Apr 1, 2003 (Revised: Dec 21, 2006)

Discipline:

Harvard Business School

703497-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Zara's Secret for Fast Fashion

by Kasra Ferdows, Michael A. Lewis and Jose A.D. Machuca

Editor's note: With some 650 stores in 50 countries, Spanish clothing retailer Zara has hit on a formula for supply chain success that works by defying conventional wisdom. This excerpt from a recent Harvard Business Review profile zeros in on how Zara's supply chain communicates, allowing it to design, produce, and deliver a garment in fifteen days.

In Zara stores, customers can always find new products—but they're in limited supply. There is a sense of tantalizing exclusivity, since only a few items are on display even though stores are spacious (the average size is around 1,000 square meters). A customer thinks, "This green shirt fits me, and there is one on the rack. If I don't buy it now, I'll lose my chance."

Such a retail concept depends on the regular creation and rapid replenishment of small batches of new goods. Zara's designers create approximately 40,000 new designs annually, from which 10,000 are selected for production. Some of them resemble the latest couture creations. But Zara often beats the high-fashion houses to the market and offers almost the same products, made with less expensive fabric, at much lower prices. Since most garments come in five to six colors and five to seven sizes, Zara's system has to deal with something in the realm of 300,000 new stock-keeping units (SKUs), on average, every year.

This "fast fashion" system depends on a constant exchange of information throughout every part of Zara's supply chain—from customers to store managers, from store managers to market specialists and designers, from designers to production staff, from buyers to subcontractors, from warehouse managers to distributors, and so on. Most companies insert layers of bureaucracy that can bog down communication between departments. But Zara's organization, operational procedures, performance measures, and even its office layouts are all designed to make information transfer easy.

Zara's single, centralized design and production center is attached to Inditex (Zara's parent company) headquarters in La Coruña. It consists of three spacious halls—one for women's clothing lines, one for men's, and one for children's. Unlike most companies, which try to excise redundant labor to cut costs, Zara makes a point of running three parallel, but operationally distinct, product families. Accordingly, separate design, sales, and procurement and production-planning staffs are dedicated to each clothing line. A store may receive three different calls from La Coruña in one week from a market specialist in each channel; a factory making shirts may deal simultaneously with two Zara managers, one for men's shirts and another for children's shirts. Though it's more expensive to operate three channels, the information flow for each channel is fast, direct, and unencumbered by problems in other channels—making the overall supply chain more responsive.

In each hall, floor to ceiling windows overlooking the Spanish countryside reinforce a sense of cheery informality and openness. Unlike companies that sequester their design staffs, Zara's cadre of 200 designers sits right in the midst of the production process. Split among the three lines, these mostly twentysomething designers—hired because of their enthusiasm and talent, no prima donnas allowed—work next to the market specialists and procurement and production planners. Large circular tables play host to impromptu meetings. Racks of the latest fashion magazines and catalogs fill the walls. A small prototype shop has been set up in the corner of each hall, which encourages everyone to comment on new garments as they evolve.

The physical and organizational proximity of the three groups increases both the speed and the quality of the design process. Designers can quickly and informally check initial sketches with colleagues. Market specialists, who are in constant touch with store managers (and many of whom have been store managers themselves), provide quick feedback about the look of the new designs (style, color, fabric, and so on) and suggest possible market price points. Procurement and production planners make preliminary, but crucial, estimates of manufacturing costs and available capacity. The cross-functional teams can examine prototypes in the hall, choose a design, and commit resources for its production and introduction in a few hours, if necessary.

Zara is careful about the way it deploys the latest information technology tools to facilitate these informal exchanges. Customized handheld computers support the connection between the retail stores and La Coruña. These PDAs augment regular (often weekly) phone conversations between the store managers and the market specialists assigned to them. Through the PDAs and telephone conversations, stores transmit all kinds of information to La Coruña—such hard data as orders and sales trends and such soft data as customer reactions and the "buzz" around a new style. While any company can use PDAs to communicate, Zara's flat organization ensures that important conversations don't fall through the bureaucratic cracks.

Once the team selects a prototype for production, the designers refine colors and textures on a computer-aided design system. If the item is to be made in one of Zara's factories, they transmit the specs directly to the relevant cutting machines and other systems in that factory. Bar codes track the cut pieces as they are converted into garments through the various steps involved in production (including sewing operations usually done by subcontractors), distribution, and delivery to the stores, where the communication cycle began.

The constant flow of updated data mitigates the so-called bullwhip effect—the tendency of supply chains (and all open-loop information systems) to amplify small disturbances. A small change in retail orders, for example, can result in wide fluctuations in factory orders after it's transmitted through wholesalers and distributors. In an industry that traditionally allows retailers to change a maximum of 20 percent of their orders once the season has started, Zara lets them adjust 40 percent to 50 percent. In this way, Zara avoids costly overproduction and the subsequent sales and discounting prevalent in the industry.

Excerpted with permission from "Rapid-Fire Fulfillment," Harvard Business Review , Vol. 82, No.11, November 2004.

[ Order the full article ]

Kasra Ferdows is the Heisley Family Professor of Global Manufacturing at Georgetown University's McDonough School of Business in Washington DC.

Michael A. Lewis is a professor of operations and supply management at the University of Bath School of Management in the UK.

Jose A.D. Machuca is a professor of operations management at the University of Seville in Spain.

For Fast Response, Have Extra Capacity on Hand

The Secret of Zara’s Success: A Culture of Customer Co-creation

Zara is one of the world’s most successful fashion retail brands – if not the most successful one. With its dramatic introduction of the concept of “fast fashion” retail since it was founded in 1975 in Spain, Zara aspires to create responsible passion for fashion amongst a broad spectrum of consumers, spread across different cultures and age groups. There are many factors that have contributed to the success of Zara but one of its key strengths, which has played a strong role in it becoming a global fashion powerhouse as it is today, is its ability to put customers first. Zara is obsessed with its customers, and they have defined the company and the brand’s culture right from the very beginning.

The Zara brand offers men and women’s clothing, children’s clothing (Zara Kids), shoes and accessories. The sub-brand Zara TRF offers trendier and sometimes edgier items to younger women and teenagers.

The Zara brand story

Zara was founded by Amancio Ortega and Rosalía Mera in 1975 as a family business in downtown Galicia in the northern part of Spain. Its first store featured low-priced lookalike products of popular, higher-end clothing and fashion. Amancio Ortega named Zara as such because his preferred name Zorba was already taken. In the next 8 years, Zara’s approach towards fashion and its business model gradually generated traction with the Spanish consumer. This led to the opening of 9 new stores in the biggest cities of Spain.

In 1985, Inditex was incorporated as a holding company, which laid the foundations for a distribution system capable of reacting to shifting market trends extremely quickly. Ortega created a new design, manufacturing, and distribution process that could reduce lead times and react to new trends in a quicker way, which he called “instant fashion”. This was driven by heavy investments in information technology and utilising groups instead of individual designers for the critical “design” element.

In the next decade, Zara began aggressively expanding into global markets, which included Portugal, New York (USA), Paris (France), Mexico, Greece, Belgium, Sweden, Malta, Cyprus, Norway and Israel. Today, there is hardly a developed country without a Zara store. Zara now has 2,264 stores strategically located in leading cities across 96 countries. It is no surprise that Zara, which started off as a small store in Spain, is now the world’s largest fast fashion retailer and is the flagship brand of Inditex. Its founder, Amancio Ortega, is the sixth richest man in the world according to Forbes magazine.

Today, Inditex is the world’s largest fashion group with more than 174,000 employees operating more than 7,400 stores in 202 markets worldwide including 49 online markets. The revenues of Inditex was USD 23.4 billion in 2019. The other fashion brands in the Inditex portfolio are:

Zara Home: Home goods and decoration objects founded in 2003. Operating in 183 markets, 70 of them with stores.

Pull & Bear: Casual laid-back clothing and accessories for the young founded in 1991. Operates in 185 markets, 75 of them with stores.

Massimo Dutti: High end clothing and accessories for cosmopolitan men and women acquired in 1995. Operates 186 markets, 74 of them with stores.

Bershka: Blends urban styles and modern fashion for young women and men founded in 1998. Operates in 185 markets, 74 of them with stores.

Stradivarius: Casual and feminine clothes for young women acquired in 1999. Operates 180 markets, 67 of them with stores.

Oysho: Lingerie, casual outerwear, lounge wear and original accessories founded in 2001. Operating in 176 markets, 58 of them with stores.

Uterqüe: High-quality fashion accessories at attractive prices founded in 2008. Operating in 158 markets, 17 of them with stores.

Apart from fashion brands, Amancio Ortega has also set up a global real estate investment fund, Pontegadea Inversiones, which manages corporate offices across 9 countries including United States (Seattle), Britain (London), France (Paris), Canada, Italy, South Korea. These corporate properties house large companies including Facebook, Amazon and Apple, and prestigious luxury and retail brands.

The Zara brand strategy

In 2019, Zara was ranked 29th on global brand consultancy Interbrand’s list of best global brands. Its core values are found in four simple terms: beauty, clarity, functionality and sustainability.

The secret to Zara’s success has largely being driven by its ability to keep up with rapidly changing fashion trends and showcase it in its collections with very little delay. From the very beginning, Zara found a significant gap in the market that few clothing brands had effectively addressed. This was to keep pace with latest fashion trends, but offer clothing collections that are a combination of high quality and yet, are affordable. The brand keeps a close watch on how fashion is changing and evolving every day across the world. Based on latest styles and trends, it creates new designs and puts them into stores in a week or two. In stark comparison, most other fashion brands would take close to six months to get new designs and collections into the market.

It is through this strategic ability of introducing new collections based on latest trends in a rapid manner that enabled Zara to beat other competitors. It quickly became the people’s favourite brand, especially with those who want to keep up with fashion trends. Founder Amancio Ortega is famously known for his views on clothes as a perishable commodity. According to him, people should love to use and wear clothes for a short while and then they should throw them away, just like yogurt, bread or fish, rather than store them in cupboards.

The media often quotes that the brand produces “freshly baked clothes”, which survive fashion trends for less than a month or two. Zara concentrates on three areas to effectively “bake” its fresh fashions:

Shorter lead times (and more fashionable clothes): Shorter lead times allow Zara to ensure that its stores stock clothes that customers want at that time (e.g. specific spring/ summer or autumn/ winter collections, recent trend that is catching up, sudden popularity of an item worn by a celebrity/ socialite/ actor/ actress, latest collection of a top designer etc.). While many retailers try to forecast what customers might buy months in the future, Zara moves in step with its customers and offers them what they want to buy at a given point in time.

Lower quantities (through scarce supply): By reducing the quantity manufactured for a particular style, Zara not only reduces its exposure to any single product but also creates artificial scarcity. Similar to the principle that applies to all fashion items (and more specifically luxury), the lesser the availability, the more desirable an object becomes. Another benefit of producing lower quantities is that if a style does not generate traction and suffers from poor sales, there is not a high volume to be disposed of. Zara only has two time-bound sales a year rather than constant markdowns, and it discounts a very small proportion of its products, approximately half compared to its competitors, which is a very impressive feat.

More styles: Rather than producing more quantities per style, Zara produces more styles, roughly 12,000 a year. Even if a style sells out very quickly, there are new styles waiting to take up the space. This means more choices and higher chance of getting it right with the consumer.

Zara only allows its designs to remain on the shop floor for three to four weeks. This practice pushes consumers to keep visiting the brand’s stores because if they were just a week late, all the clothes of a particular style or trend would be gone and replaced with a new trend. At the same time, this constant refreshing of the lines and styles carried by its stores also entices customers to visit its shops more frequently.

In the following sections, the key components of Zara’s winning formula in the fashion retailing industry are illustrated.

Customer co-creation: Zara’s principal designer is the customer

Zara’s unrelenting focus on the customer is at the core of the brand’s success and the heights it has achieved today. There was a fascinating story around how Zara co-creates its products leveraging its customers’ input. In 2015, a lady named Miko walked into a Zara store in Tokyo and asked the store assistant for a pink scarf, but the store did not have any pink scarves. The same happened almost simultaneously for Michelle in Toronto, Elaine in San Francisco, and Giselle in Frankfurt, who all walked into Zara stores and asked for pink scarves. They all left the stores without any scarves – an experience many other Zara fans encountered globally in different Zara stores over the next few days.

7 days later, more than 2,000 Zara stores globally started selling pink scarves. 500,000 pink scarves were dispatched – to be exact. They sold out in 3 days. How did such lightning fast stocking of pink scarves happen?

Customer insights are the holy grail of modern business, and the more companies know about their customers, the better they can innovate and compete. But it can prove challenging to have the right insights, at the right time, and have access to them consistently over time. One of the secrets to Zara’s success includes using Radio Frequency Identification Technology (RFID) in its stores. The brand uses cutting-edge systems to track the location of garments instantly and makes those most in demand rapidly available to customers. Additionally, it helps to reduce inventory costs, provides greater flexibility to launch new designs, and allows fulfillment of online orders with stock from stores nearest to the delivery location thereby reducing delivery costs.

Another secret of Zara’s success is that the brand trains and empowers its store employees and managers to be particularly sensitive to customer needs and wants, and how customers enact them on the shop floors. Zara empowers its sales associates and store managers to be at the forefront of customer research – they intently listen and note down customer comments, ideas for cuts, fabrics or a new line, and keenly observe new styles that its customers are wearing that have the potential to be converted into unique Zara styles. In comparison, traditional daily sales reports can hardly provide such a dynamic updated picture of the market. The Zara empire is built on two basic rules: “to give customers what they want”, and “get it to them faster than anyone else”.

Due to Zara’s competitive customer research capabilities, its product offerings across its stores globally reflect unique customer needs and wants in terms of physical, climate or cultural differences. It offers smaller sizes in Japan, special women’s clothes in Arab countries, and clothes of different seasonality in South America. These differences in product offerings across countries are greatly facilitated by the frequent interactions between Zara’s local store managers and its creative team.

In the fashion world, a trend starts small, but develops fast. Zara employees are trained to listen, watch and be attentive to even the smallest seismographic signals from their customers, which can be an initial sign that a new trend is taking shape. Zara knows that the quicker it can respond, the more likely it is to succeed in supplying the right fashion merchandise at the right time across its global retail chain. Zara has set up sophisticated technology driven systems, which enable information to travel quickly from the stores back to its headquarters in Arteixo in Spain, enabling decision makers to act fast and respond effectively to a developing trend. Its design teams regularly visit university campuses; nightclubs and other venues to observe what young fashion leaders are wearing. In its headquarters, the design team uses flat-screen monitors linked by webcam to offices in Shanghai, Tokyo and New York (the leading cities for fashion trends), which act as trend spotters. The ‘Trends’ team never goes to fashion shows but tracks bloggers and listens closely to the brand’s customers.

The fact that Zara’s designers and customers are inextricably linked is a crucial part of the brand strategy. Specialist teams receive constant feedback on the decisions its customers are making at every Zara store, which continuously inspires the Zara creative team.

Zara’s super-efficient supply chain

Zara’s highly responsive, vertically integrated supply chain enables the export of garments 24 hours, 365 days of the year, resulting in the shipping of new products to stores twice a week. After products are designed, they take around 10 to 15 days to reach the stores. All clothing items are processed through the distribution center in Spain, where new items are inspected, sorted, tagged, and loaded into trucks. In most cases, clothing items are delivered to stores within 48 hours. This vertical integration allows Zara to retain control over areas like dyeing and processing and have fabric-processing capacity available on-demand to provide the correct fabrics for new styles according to customer preferences. It also eliminates the need for warehouses and helps reduce the impact of demand fluctuations. Zara produces over 450 million items and launches around 12,000 new designs annually, so the efficiency of the supply chain is critical to ensure that this constant refreshment of store level collections goes off smoothly and efficiently.

Here are some of the characteristics of Zara’s supply chain that highlight the reasons behind its success:

Frequency of customer insights collection: Trend information flows daily into a database at head office, which is used by designers to create new lines and modify existing ones.

Standardization of product information: Zara warehouses have standardised product information with common definitions, allowing quick and accurate preparation of designs with clear manufacturing instructions.

Product information and inventory management: By effectively managing thousands of fabric, trim and design specifications and their physical inventory, Zara is capable of designing a garment with available stock of required raw materials.

Procurement strategy: Around two-thirds of fabrics are undyed and are purchased before designs are finalized so as to obtain savings through demand aggregation.

Manufacturing approach: Zara uses a “make and buy” approach – it produces the more fashionable and riskier items (which need testing and piloting) in Spain, and outsources production of more standard designs with more predictable demand to Morocco, Turkey and Asia to reduce production cost. The more fashionable and riskier items (which are around half of its merchandise) are manufactured at a dozen company-owned factories in Spain (Galicia), northern Portugal and Turkey. Clothes with longer shelf life (i.e. the one with more predictable demand patterns), such as basic T-shirts, are outsourced to low cost suppliers, mainly in Asia. Even when manufacturing in Europe, Zara manages to keep its costs down by outsourcing the assembly workshops and leveraging the informal economy of mothers and grandmothers.

Distribution management: Zara’s state-of-the-art distribution facility functions with minimal human intervention. Optical reading devices sort out and distribute more than 60,000 items of clothing an hour.

In addition to these supply chain efficiencies, Zara can also modify existing items in as little as two weeks. Shortening the product life cycle means greater success in meeting consumer preferences. If a design does not sell well within a week, it is withdrawn from shops, further orders are canceled and a new design is pursued. Zara closely monitors changes in customer preferences towards fashion. It has a range of basic designs that are carried over from year to year, but some in-vogue, high fashion, inspired by latest trends items can stay on the shelves for less than four weeks, which encourages Zara fans to make repeat visits. An average high-street store in Spain expects customers to visit thrice a year, but for Zara, the expectation is that customers should visit around 17 times in a year.

This expectation for such a high frequency of repeat visits is evidence of Zara’s confidence that it is keeping on top of changing consumer needs and preferences and is helping them shape their ideas, opinions and taste for fashion. In reality, Zara is also helping in giving birth to new trends through its stores or even helping in extending the longevity of some seasonal styles by offering affordable lines.

Sustainability at the core of Zara’s operations

Sustainability has been a hot topic in business for the last decade and is now quickly becoming a must-have hygiene factor for companies that want to resonate with and win the loyalty of its global customers. For Inditex, this means having a commitment to people and the environment.

Commitment to people: Inditex ensures that its employees have a shared vision of value built on sustainability through professional development, equality and diversity and volunteering. It also ensures that its suppliers have fundamental rights at work and by initiating continuous improvement programs for them. Inditex also spends over USD 50 million annually on social and community programmes and initiatives. For example, its “for&from” programme which started in 2002 has enabled the social integration of people with physical and mental disabilities, by providing over 200 stable employment opportunities across 15 stores.

Commitment to environment: Being in a business where it taps on natural resources to create its products, Inditex makes efforts to ensure that the environmental impact of its business complies with UNSDGs (United Nations Sustainable Developmental Goals). Inditex has pledged to only sell sustainable clothes by 2025 and that all cotton, linen and polyester sold will be organic, sustainable or recycled. The company also runs Join Life, a scheme which helps consumers identify clothes made with more environmentally friendly materials like organic cotton and recycled polyester.

Additionally, Inditex takes wide-ranging measures to protect biodiversity, reduce its consumption of water, energy and other resources, avoid waste, and combat climate change. For example, it has outlined a Global Water Management Strategy, specifically committing to zero discharge of hazardous chemicals. It has also been expanding its waste reduction programme through which customers can drop off their used clothing, footwear and accessories at collection points in 2,299 stores in 46 markets today.

Zara’s culture: The word “impossible” does not exist

Zara has a very entrepreneurial culture, and employs lots of young talent who quickly climb through the ranks of the company. Zara promotes approximately two-thirds of its store managers from within and generally experiences low turnover. The brand has no fear in giving responsibility to young people and the culture encourages risk-taking (as long as learning happens) and fast implementation (the mantra of fashion).

Top management gives its store managers full liberty and control over their store’s operations and performance with clearly set cost, profit and growth targets with a fixed and variable compensation scheme. The variable component amounts to up to half of the total compensation – making store level employees heavily incentive-driven.

In addition, once an employee is selected for promotion, his or her store develops a comprehensive training program for that individual with the human resources department, which is followed up by periodic supplemental training – reflecting Zara’s commitment to talent development. The organizational structure is also flat with only a few managerial layers.

Customers are the most important source of information for Zara, but like any other fashion brand, Zara also employs trend analysts, customer insights experts, and retains some of the best talents in the fashion world. The creative team of Zara comprises of over 200 professionals. They all embody and enact the corporate philosophy that the word “impossible” does not exist in Zara.

For example, while many companies struggle with long lead times in discussions and decision making, Zara gets around this challenge by getting various business functions to sit together at the headquarters and also by encouraging a culture (through structures and processes) where people continuously talk to each other. The sales and marketing teams who receive trend feedback talk regularly with designers and merchandisers. It is important that there is constant two-way communication so that sales and marketing teams can talk about new lines to customers and designers / merchandisers have a strong visibility of customers’ needs and preferences enacted at a store level. The production scheduling is also closely coordinated so that there is no time wasted on approvals. The design team structure is very flat and focuses on careful interpretation of catwalk trends that are suitable for the mass market – the Zara customer. The design and product development teams, who are based in Spain, work closely to produce 1,000 new styles every month.

Besides being customer centric, another important reason why Zara’s employee strategy is so successful is the fact that it empowers its staff to make decisions based on data. Zara has no chief designer. All its designers are given unparalleled independence in approving products and campaigns, based on daily data feeds indicating which styles are popular.

Due to the unwavering focus on the customer, the entire business model is designed in such a way that the pattern of needs for the finished goods dictate the terms of the production process to follow, instead of having the raw materials determine the nature of the production process – something that is very rare in multinational companies of similar scale.

In sum, the entire brand culture is extremely customer-centric, which has been and continues to be a significant contributor to Zara’s success.

The Zara brand communication strategy

Zara has used almost a zero advertising and endorsement policy throughout its entire existence, preferring to invest a percentage of its revenues in opening new stores instead. It spends a meager 0.3 per cent of sales on advertising compared to an average of 3.5 per cent by competitors. The brand’s founder Amancio has never spoken to the media nor has in any way advertised Zara. This is indeed the mark of a truly successful brand where customers appreciate and desire the brand, which is over and above product level benefits but strongly driven by the brand experience.

Instead of advertising, Zara uses its store location and store displays as key elements of its marketing strategy. By choosing to be in the most prominent locations in a city, Zara ensures very high customer traffic for its stores. Its window displays, which showcase the most outstanding pieces in the collection, are also a powerful communication tool designed by a specialized team. A lot of time and effort is spent designing the window displays to be artistic and attention grabbing. According to Zara’s philosophy of fast fashion, the window displays are constantly changed. This strategy goes down to how the employees dress as well – all Zara employees are required to wear Zara clothes while working in the stores, but these “uniforms” vary across different Zara stores to reflect socio-economic differences in the regions they were located. This effectively communicates Zara’s focus on the mass market, yet another detail that reflects its close attention on the customer.

To tap into the emerging e-commerce trend, Zara launched its online boutique in September 2010. The website was initially available in Spain, the UK, Portugal, Italy, Germany and France, and was extended to Austria, Ireland, the Netherlands, Belgium and Luxembourg. Over the next 3 years, the online store became available in the United States, Russia, Canada, Mexico, Romania, and South Korea. In 2017, Zara’s online store launched in Singapore, Malaysia, Thailand, Vietnam and India. More recently in March 2018, the brand launched online in Australia and New Zealand. Today, its online store is available in 66 countries. As of 2019, online sales grew to constitute 14% of Zara’s total global sales.

As a fast fashion retailer, Zara is definitely aware of the power of e-commerce and has built up a successful online presence and high-quality customer experience.

Zara’s future brand and business challenges

Charting a new digital strategy in the COVID-19 crisis: With its primarily offline shopping experience, Zara has been hard hit by global store closures amid the COVID-19 crisis in 2020, with sales falling 44% year-on-year in Q1 2020 and the company reporting a net loss of USD 482 million. Inditex has announced that it will be closing between 1,000 to 1,200 stores worldwide, focusing on smaller ones in Asia and Europe. While online sales have been encouraging – Zara’s online sales for Q1 2020 grew 50% – it is not enough to mitigate the damage.

Amancio Ortega plans to spend USD 1.1 billion scaling up its digital strategy and online capabilities by 2022 and a further USD 2 billion in stores to improve integration between online and offline for faster deliveries and real-time tracking of products. Its goal is for online sales to constitute at least 25% of total sales. To achieve this goal, Zara will need to think of new ways to engage its customers digitally, not just through its online store, but through online communities and social media.

Mobile commerce: Zara woke up late to the potential of mobile commerce and needs to catch up fast with competitors. Different forms of market analysis strongly point towards a scenario wherein spends on mobile commerce will overtake desktop based ecommerce by 2021. On an average, most brands currently get about 15-20% of their website traffic via mobile devices and this is growing rapidly. With the deluge of investments planned in the mobile commerce space and Zara’s competitors already having an advantage on the mobile front, Zara needs to quickly make mobile shopping not only an effortless experience but also a delightful one.

Price is not an advantage anymore: Offering the latest fashion lines at affordable prices continues to be a strategic advantage for Zara, but cannot continue to be the only one. Across the world, and closer to home in Europe, competitors are cutting prices and refining their business models to cut the competitive advantage that Zara has. Swedish fast fashion retailer H&M, which is placed #30 just behind Zara on Interbrand’s list, launched an online store in Spain in 2014 to take own Zara in its home turf. Again in its home market, it now faces increasing competition from brands like Mango, which cut prices and started focusing on fashion segments in which Zara enjoyed popularity. In addition to H&M and Mango, other competitors like Gap and Topshop are all fighting for a share of the fast fashion retail market pie. Also with the rise of e- and m-commerce, the number of indirect competitors has mushroomed. We now have online fashion aggregators that bring in multiple brands under one single online platform and cut through borders and price segments. Some examples of such aggregators who are doing well include Lyst, Farfetch, Spring and Yoox Net-a-Porter.

For Zara to effectively compete and maintain its strategic advantage, the focus needs to shift away from price but towards quality. Even today the Zara brand enjoys high levels of appeal, which is evident by the serpentine queues outside its stores when it launches in new markets. There is a need for Zara to start investing in building a strong brand positioning and aggressively communicate it. Additionally, Zara needs to adopt, imbibe and leverage social media and digital platforms in its advertising and communication strategies deeper going forward.

Need for marketing strategy to evolve: As discussed above, Zara does not engage in advertising and instead uses its store locations as a marketing strategy. However, brand communication is crucial in attracting new customers to the brand to support its growth. Without advertisements, Zara relies heavily on word of mouth or social media. This causes the perception of potential customers towards Zara to be heavily shaped by family and friends, which may not be accurate. In addition, Zara’s social media platforms such as Facebook and YouTube exists merely as a feed for updates rather than a platform that consumers can interact with. Its videos on YouTube are also seeing very low viewership in comparison with its follower count, which is not ideal as videos are a powerful medium for brands in the fashion industry. This is a gap that Zara needs to plug immediately as the reach and impact of social media marketing gets stronger. As Zara’s target customer segments start using more social and digital platforms for communication and for sharing their lives, it is important for Zara to have a strong presence on such platforms.

Family business planning and succession: With various technological and business disruptions in the past decade, leadership in the 21st century will be influenced by constant change, geopolitical volatility, and economic and political uncertainty. For Zara’s first 36 years in business, the brand has been controlled by its founder Amancio Ortega, who is currently 85 years old. In 2011, Ortega passed the chairman title on to Pablo Isla, Zara’s Deputy CEO since 2005.

Succession is currently taking place at Inditex and generational transfer will empower the next generation in one of the wealthiest business families in the world. Pablo Isla, chairman of Inditex since 2011, steps down in April 2022, and 37-year-old Marta Ortega will take over as chair in the company that her father Amancio Ortega started with his ex-wife Rosalia in 1975 in Galicia, Spain. Marta Ortega is the youngest of Amancio Ortega’s three children.

Marta Ortega will become a non-executive chair, and will head the Inditex group, the portfolio of companies including supervision of strategic operations. She has been with Inditex for over 15 years, starting out working in a Zara store at King’s Road in London, and as an assistant at the portfolio brand Bershka. In recent years, Marta Ortega has been involved in strategy, brand building and fashion proposals for the Inditex portfolio of brands.

Marta Ortega will not be involved in daily management of the financial performance to shield her and the family from too much public exposure. Amancio Ortega has always been known for appearing less in public and avoiding any media exposure. His photo did not appear in the Inditex annual report until 2000. Marta Ortega seems to be more open to media interviews and public appearance, and granted her first interview with Wall Street Journal in August 2021.

Óscar García Maceiras will be appointed CEO of Inditex in April 2022 and will run the daily business. He joined Inditex in March 2021 and is currently general secretary of Inditex and secretary of the board.

The sharing of executive powers between the chair and the CEO to enhance corporate governance has historically been less common in the corporate world in Spain but is often seen in Europe and elsewhere. Inditex will therefore return to dual leadership in April 2022 with Marta Ortega as chair and García Maceiras as CEO, the very same structure that ran for six years with Amancio Ortega as chairman and Pablo Isla as CEO until 2011.

Despite working at Inditex for over 15 years, Marta Ortega Pérez does not hold an office. Her father, Amancio Ortega, never had an office either and always preferred to work in an open space in the fashion design department to be close to teams around him.

To effectively manage the above changes, Zara’s next generation leadership needs to step up to the succession planning challenge by being resilient in staying true to the brand promise to consistently produce “freshly baked clothes” for its fashion-forward consumers, and by balancing both short-term (profitability) and long-term goals (growing the business and reaching more consumers).

More importantly, despite Zara’s global reach and consequent product standardization, it needs to constantly find new ways to serve local fashion needs and preferences of its consumers across the globe. This will be a challenge for the brand’s leadership in the next decade.

Conclusion: Take Zara’s cue and listen to your customers

The Zara brand was born with a keen eye on its customer – its ability to understand, predict and deliver on its customers’ preferences for trendy fashion at affordable prices. In addition to its effective supply chain, the brand’s ability to have its customers co-create designs is unique and provides it with a competitive advantage. Most fashion trends often start unexpectedly, originate from uncommon places and grow out of nowhere. With reference to the pink scarf trend mentioned above, it could have been that Hollywood actress Scarlett Johansson had worn a pink scarf to a charity gala the evening before in Los Angeles, or golf star Michelle Wie had showcased a pink scarf at a celebrity tournament in Asia. The fact that Zara was able to quickly jump on to this trend and provide hundreds of customers with the pink scarves they desperately wanted to buy.

In a world swamped with Big Data, and yet more collected at an even more rapid pace than before, brands still need to be careful and observant. Big Data does not provide answers to all business challenges, and it may be too hyped to be considered as the Holy Grail.

One of the secrets behind Zara’s global success is the culture and the respect for the fact that no one is a better, authentic trendsetter than the customer himself or herself – and this philosophy needs to be continually reflected in all its business strategies going forward.

So, why not consult your customers for a start? Zara always does.

Follow Martin Roll on LinkedIn >>

Insights links

About the author: Martin Roll – Business & Brand Strategist

Read about Uniqlo: Uniqlo – The Strategy Behind The Global Japanese Fast Fashion Retail Brand

Read about Forever 21: Forever 21 – Fast Fashion Retail Brand With An Edge

Read about Charles & Keith: Charles & Keith – A Truly Successful Asian Global Fast Fashion Retail Brand

Read more: Insights & Articles

Sign up for updates on Business, Brands & Leadership

Related Articles

- Korean Wave (Hallyu) - The Rise of Korea's Cultural Economy & Pop Culture

- Brand Naming Toolkit - Techniques And Insights

- The Essential Features of a Global Asian Brand

- Strategy And Succession in Family Business - Charting The Future

- Banyan Tree - Branded Paradise From Asia

NEW Book Release