Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

9 Financial Advisor Resume Examples - Here's What Works In 2024

The financial advisor career path can be both stable and rewarding, especially if you have an affinity for numbers and data entry. this guide discusses three financial advisor resume templates and provides tips on writing your resume, along with highlighting strong action verbs and skills to include..

The vast number of estates and personal accounts within the finance industry require a steady influx of financial advisors who are adept with numbers and client management. The field is expected to hold at a growth rate of four percent through 2029, according to the Bureau of Labor Statistics, with a median income just shy of $90,000 in 2020. Financial advisors help clients manage their accounts, and should have a current understanding of the various types of financial accounts clients could be enrolled in. As you’ll be dealing with individual clients on a one-to-one basis, it also helps to have a working knowledge of Customer Relationship Management (CRM) software. Since you’ll be working with numbers, having a mathematics background is useful - though it’s worth noting that financial advising software can handle all of the heavy lifting in that department. Being detail oriented and accurate are therefore the best traits for financial advisors. Read on to take a close look at three financial advisor resume templates and review industry-based tips to build your own resume with. At the bottom, we’ve listed key action verbs and skills you should include to attract the attention of hiring managers and get past automatic screeners.

Financial Advisor Resume Templates

Jump to a template:

- Financial Advisor

- Financial Aid Advisor

- Entry Level Financial Advisor

- Portfolio Manager

Jump to a resource:

- Keywords for Financial Advisor Resumes

Financial Advisor Resume Tips

- Action Verbs to Use

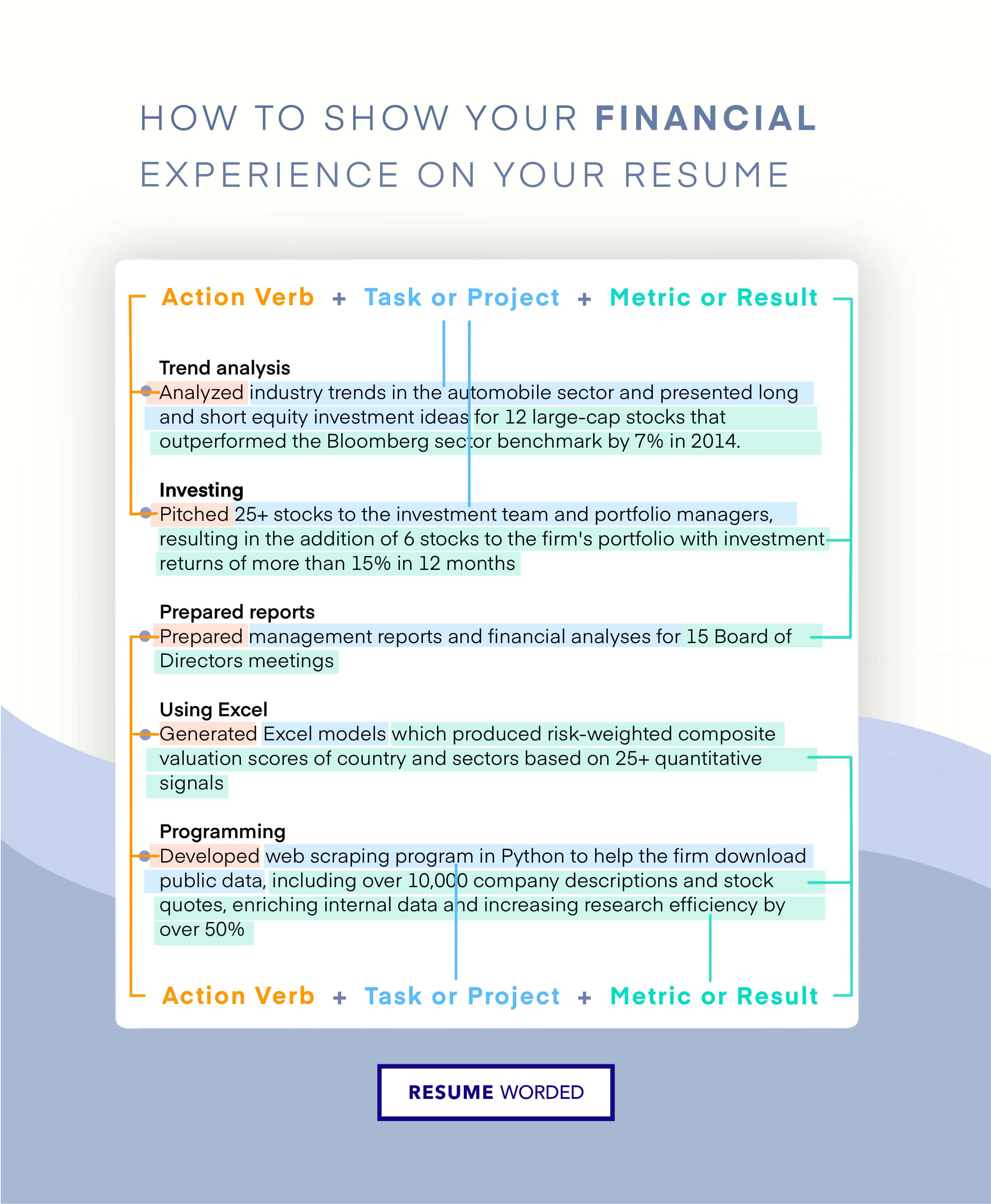

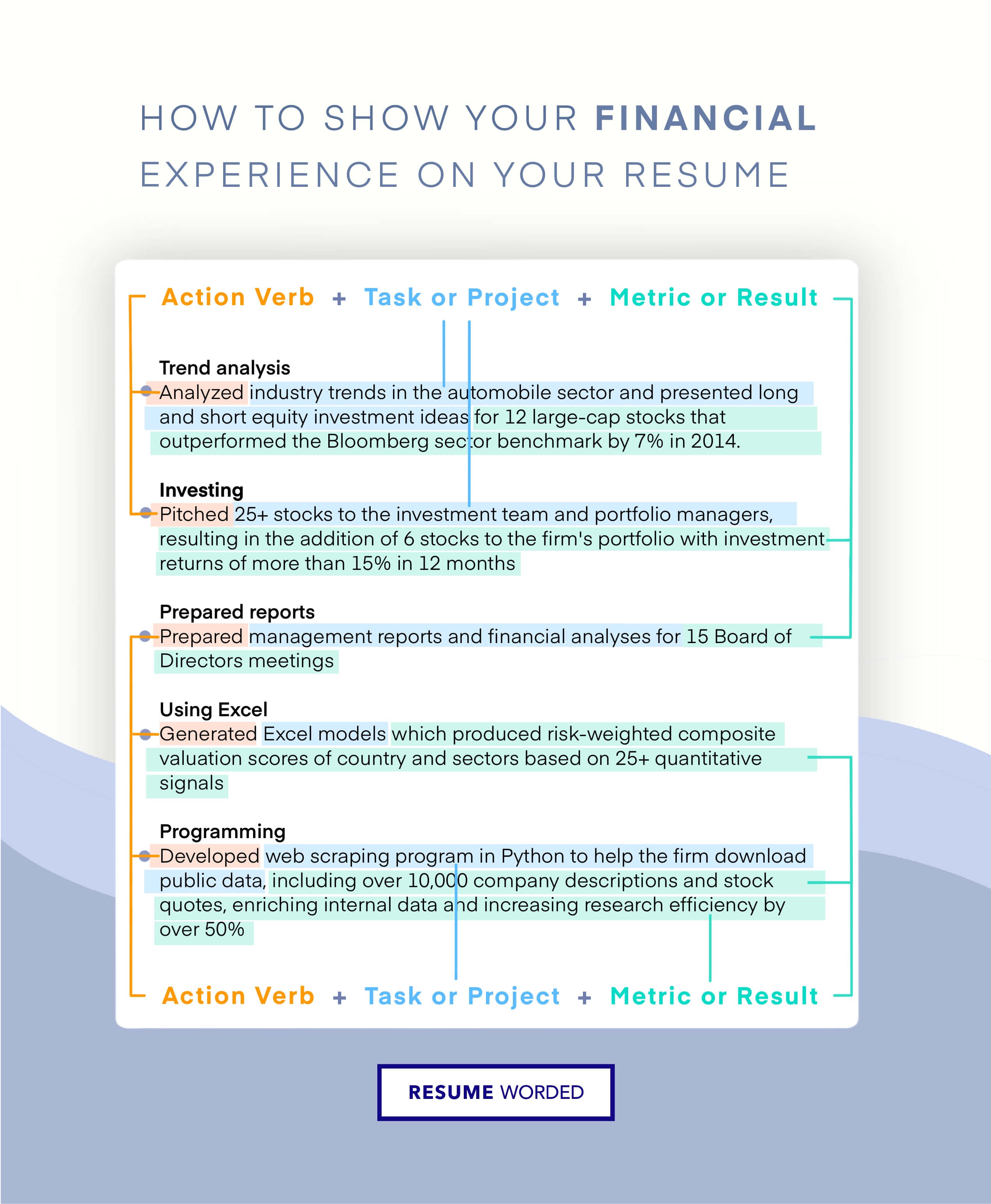

- Bullet Points on Financial Advisor Resumes

- Related Finance Resumes

Get advice on each section of your resume:

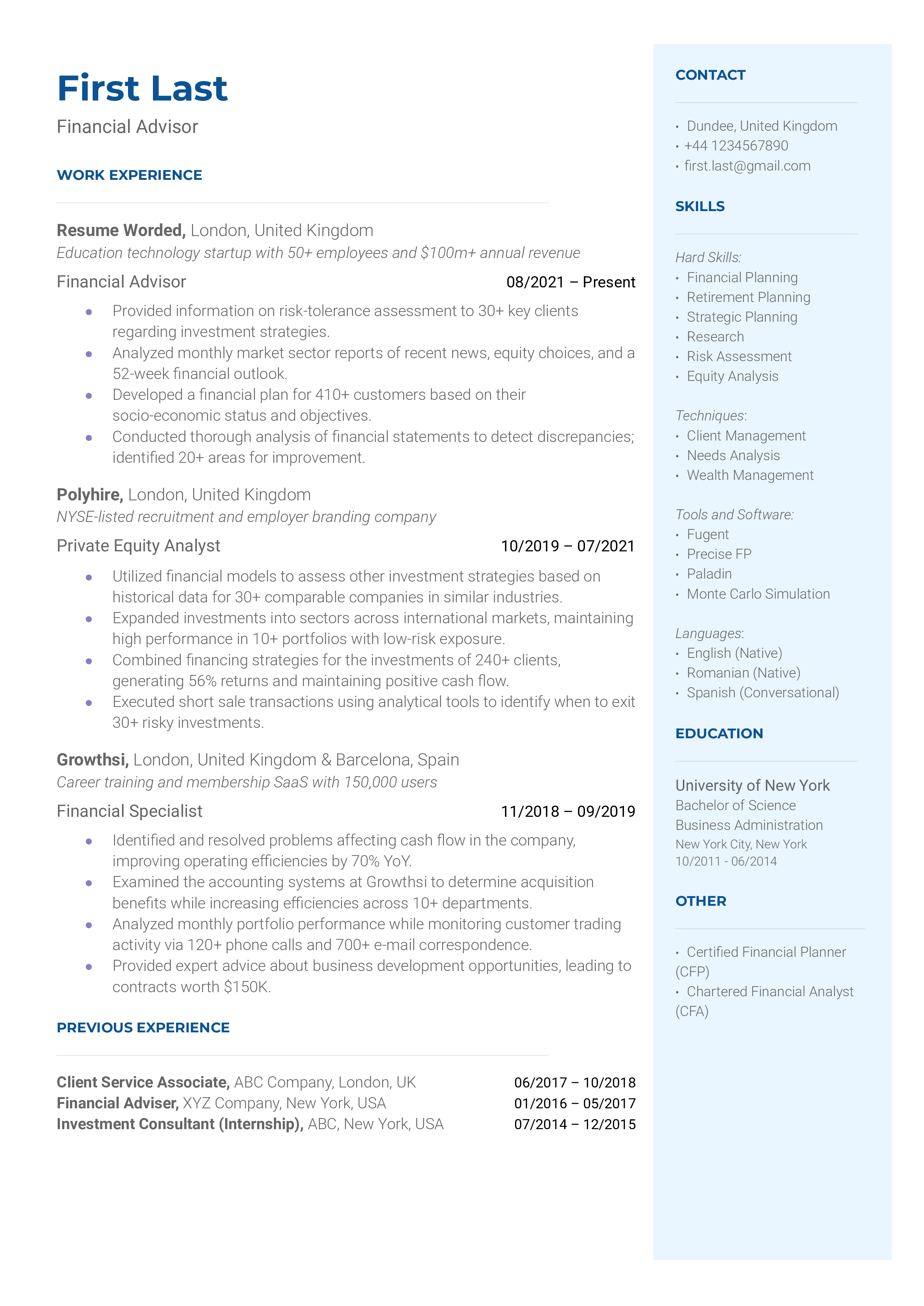

Template 1 of 9: Financial Advisor Resume Example

As a financial advisor, you play a crucial role in helping clients make informed decisions about their financial future. The industry constantly evolves with new regulations and investment opportunities, so companies are seeking well-rounded, knowledgeable candidates. Resumes are particularly important in this field, as they serve as your first impression and demonstrate your expertise in managing finances. In today's competitive job market, hiring managers are looking for financial advisors who can stay ahead of trends and adapt to changing market conditions. Your resume should showcase your proficiency in financial planning, as well as your ability to build strong client relationships and communicate complex financial information effectively.

We're just getting the template ready for you, just a second left.

Tips to help you write your Financial Advisor resume in 2024

highlight relevant certifications.

As a financial advisor, having the right certifications can set you apart from other candidates. Make sure to list any certifications you hold, such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations, as these demonstrate your commitment to continued education and industry expertise.

Showcase your interpersonal skills

Financial advisors need strong interpersonal skills to build trust with clients and effectively communicate financial strategies. Use your resume to highlight achievements that demonstrate your ability to collaborate, build rapport, and empathize with clients, such as a high client satisfaction rate or successful team projects.

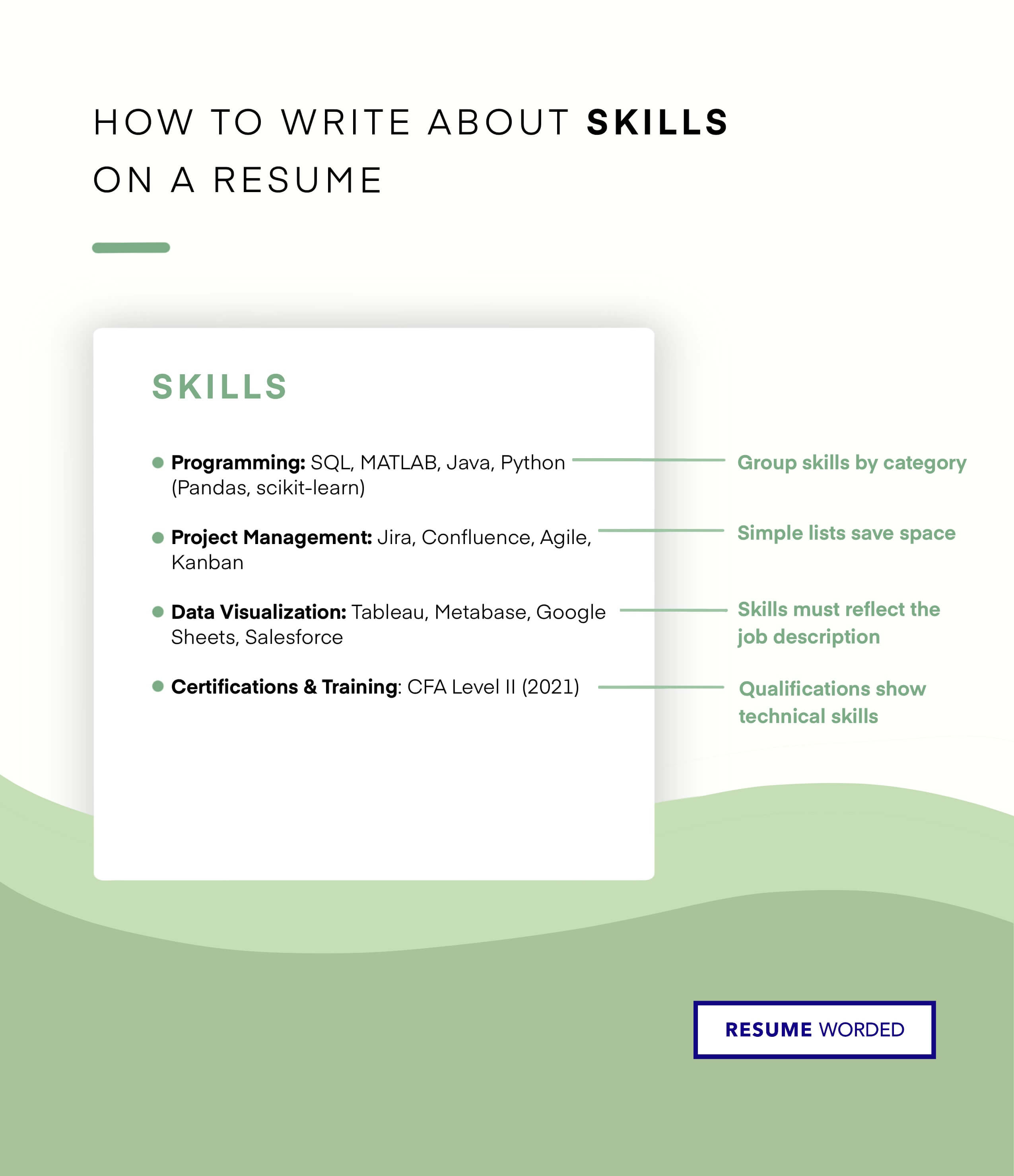

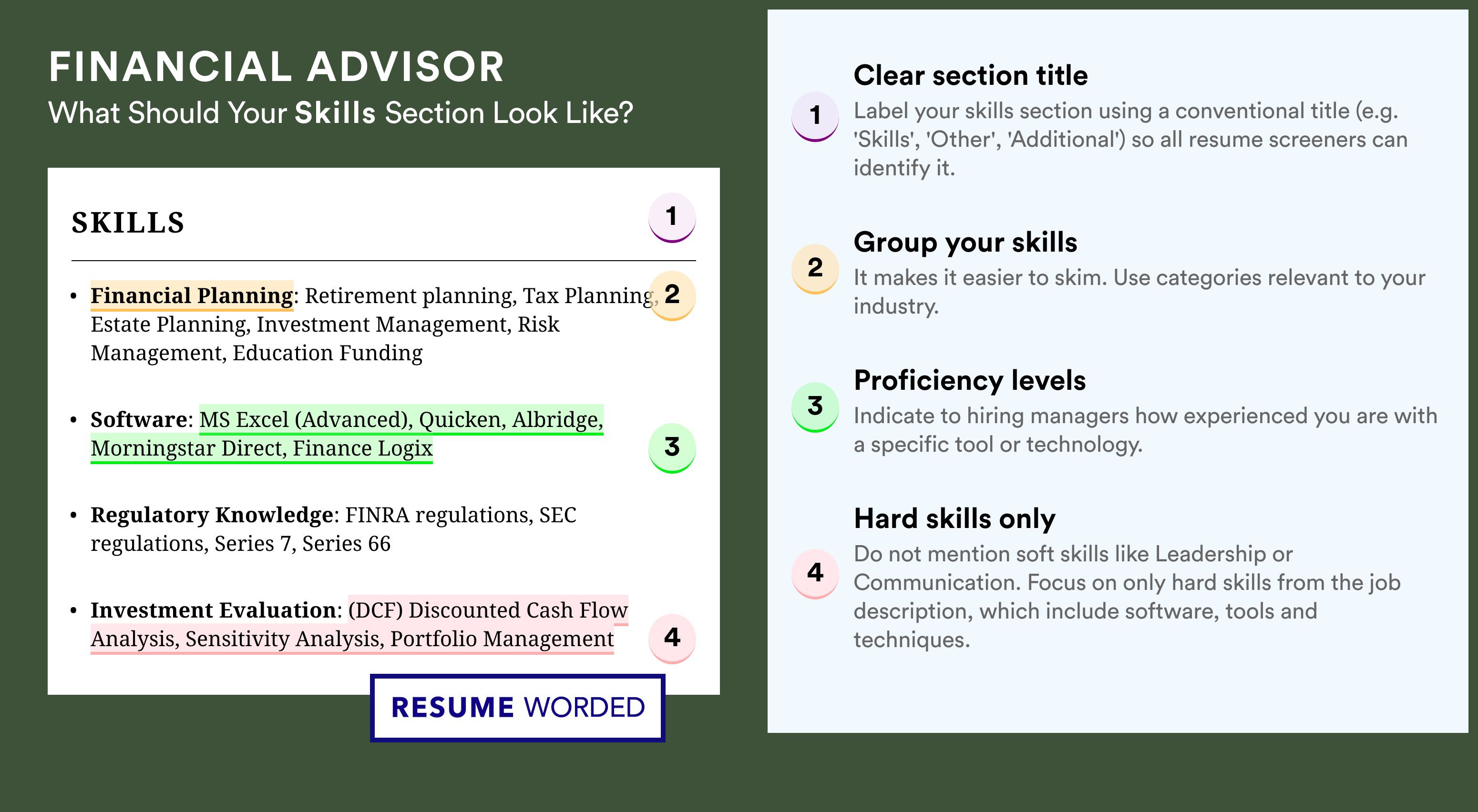

Skills you can include on your Financial Advisor resume

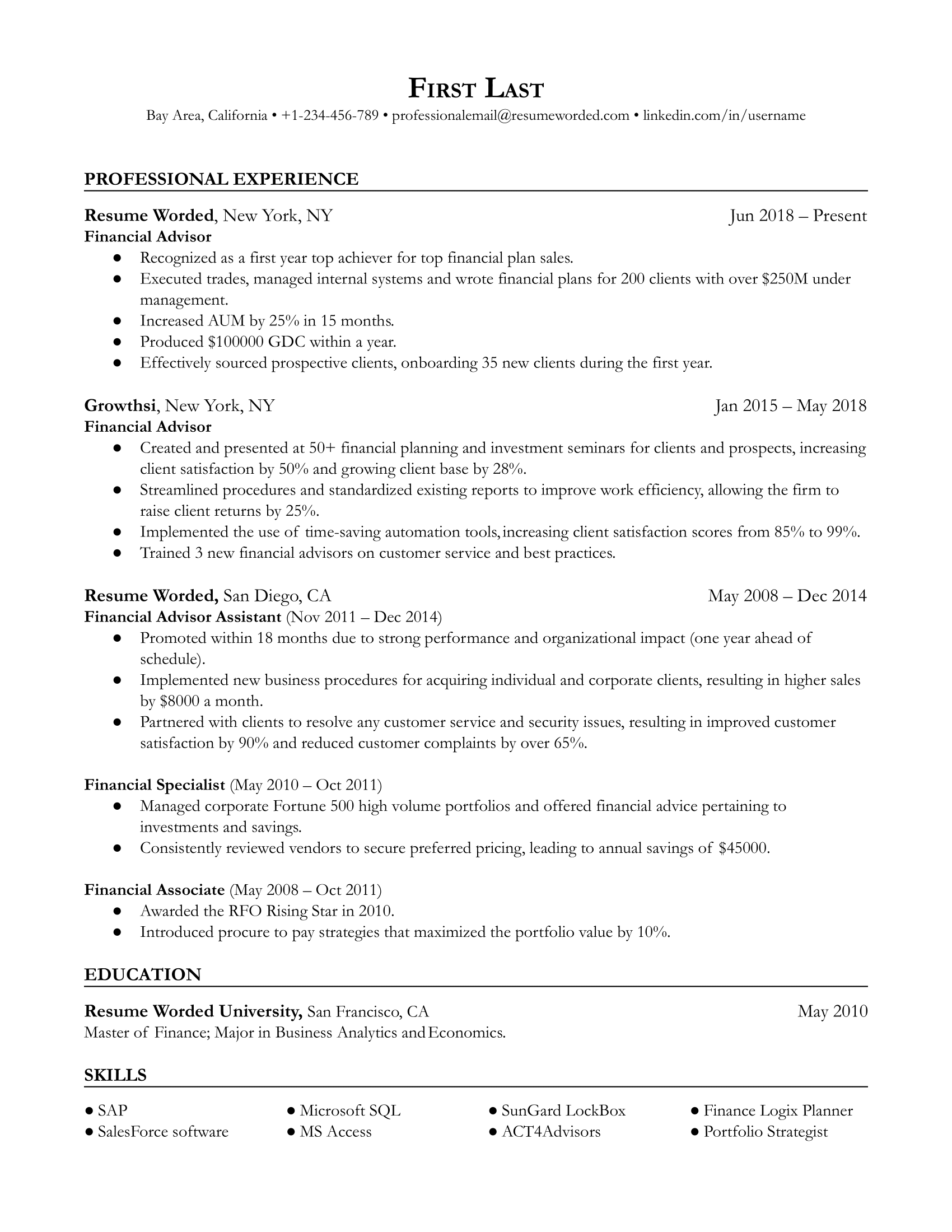

Template 2 of 9: financial advisor resume example.

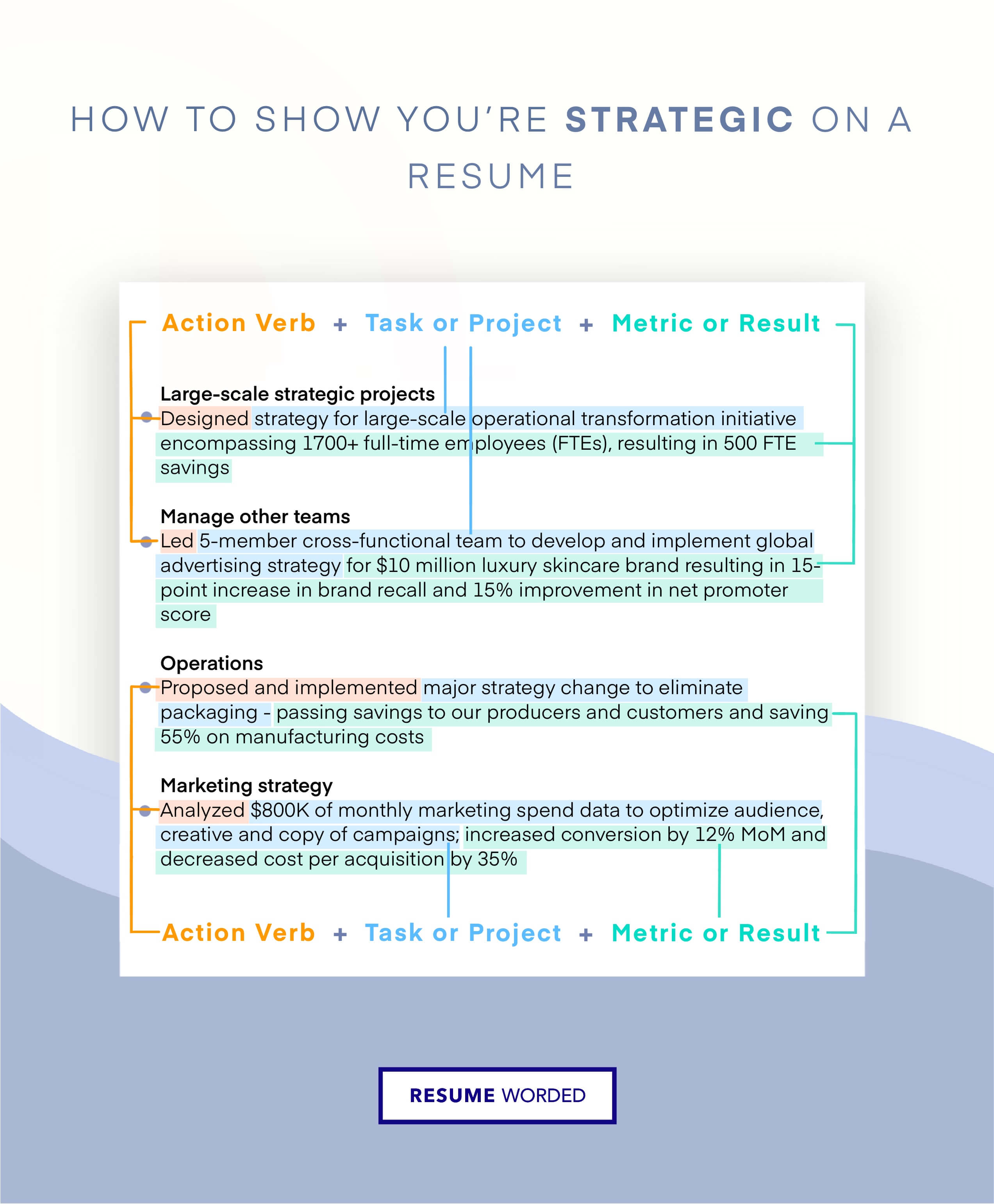

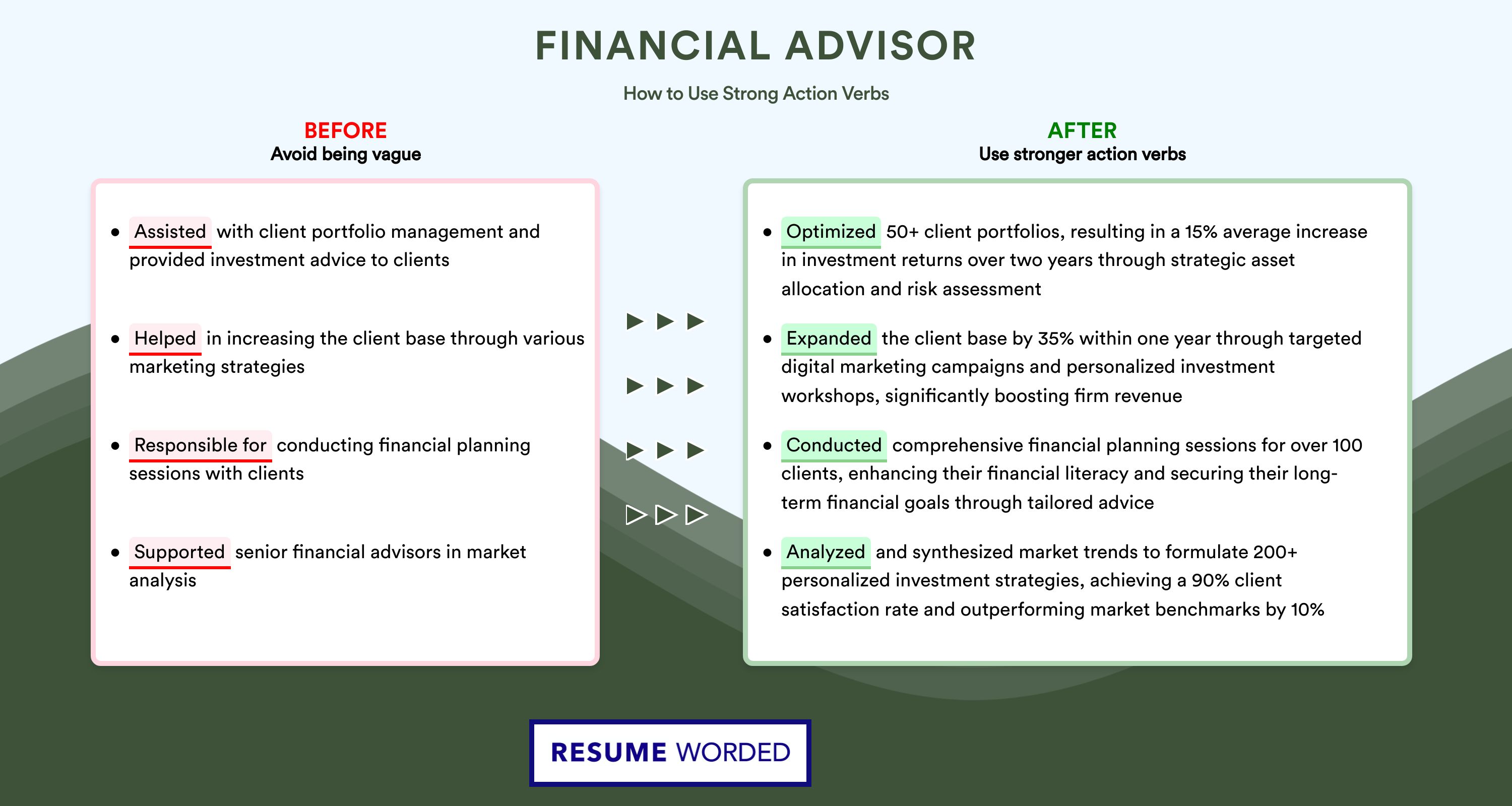

As financial advisors are expected to have experience conducting numerous tasks, you should aim to reference a selection of accomplishments from your past employers. Additionally, showing instances where you’ve been promoted early or recognized with awards is a quick method of indicating your capabilities.

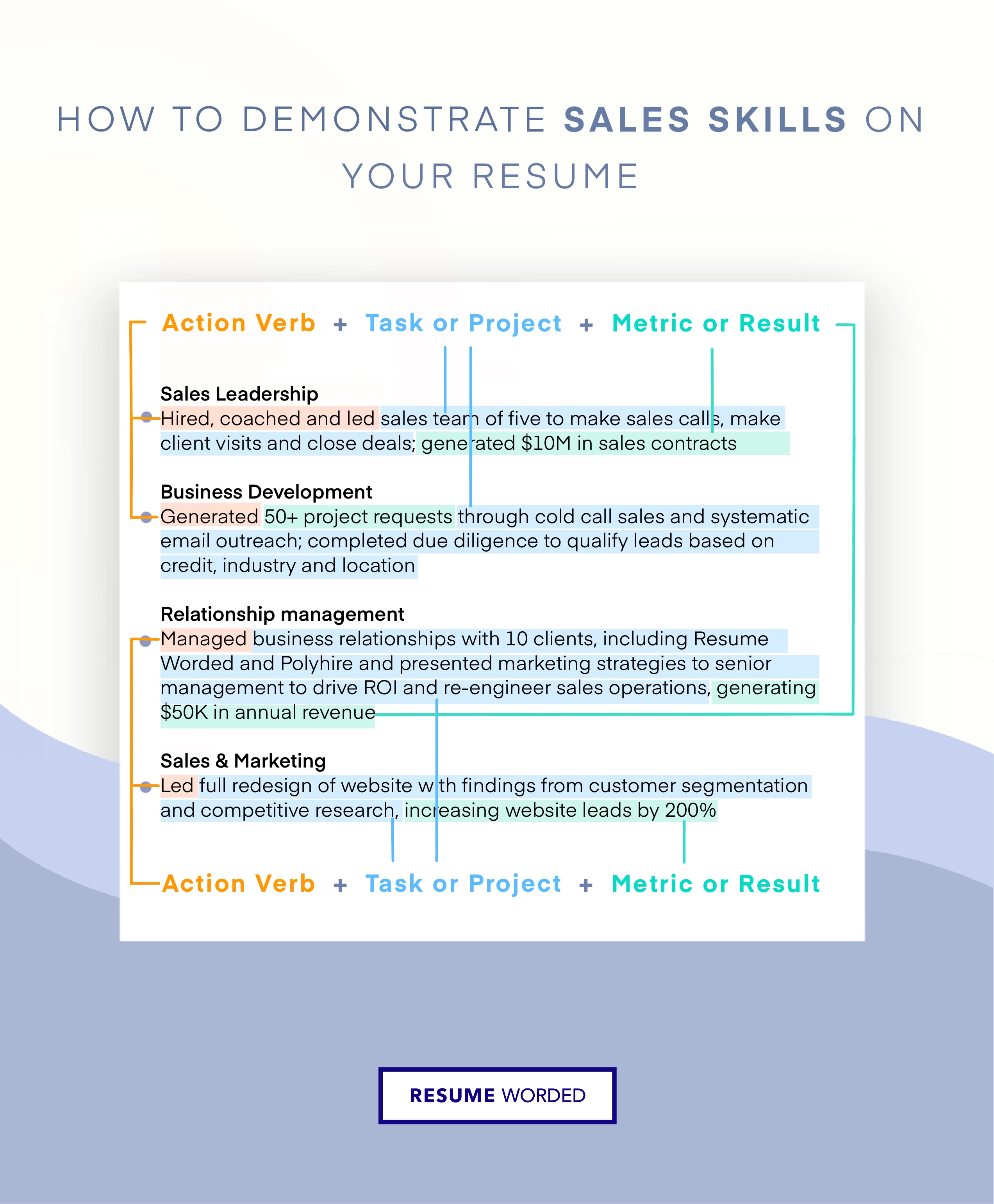

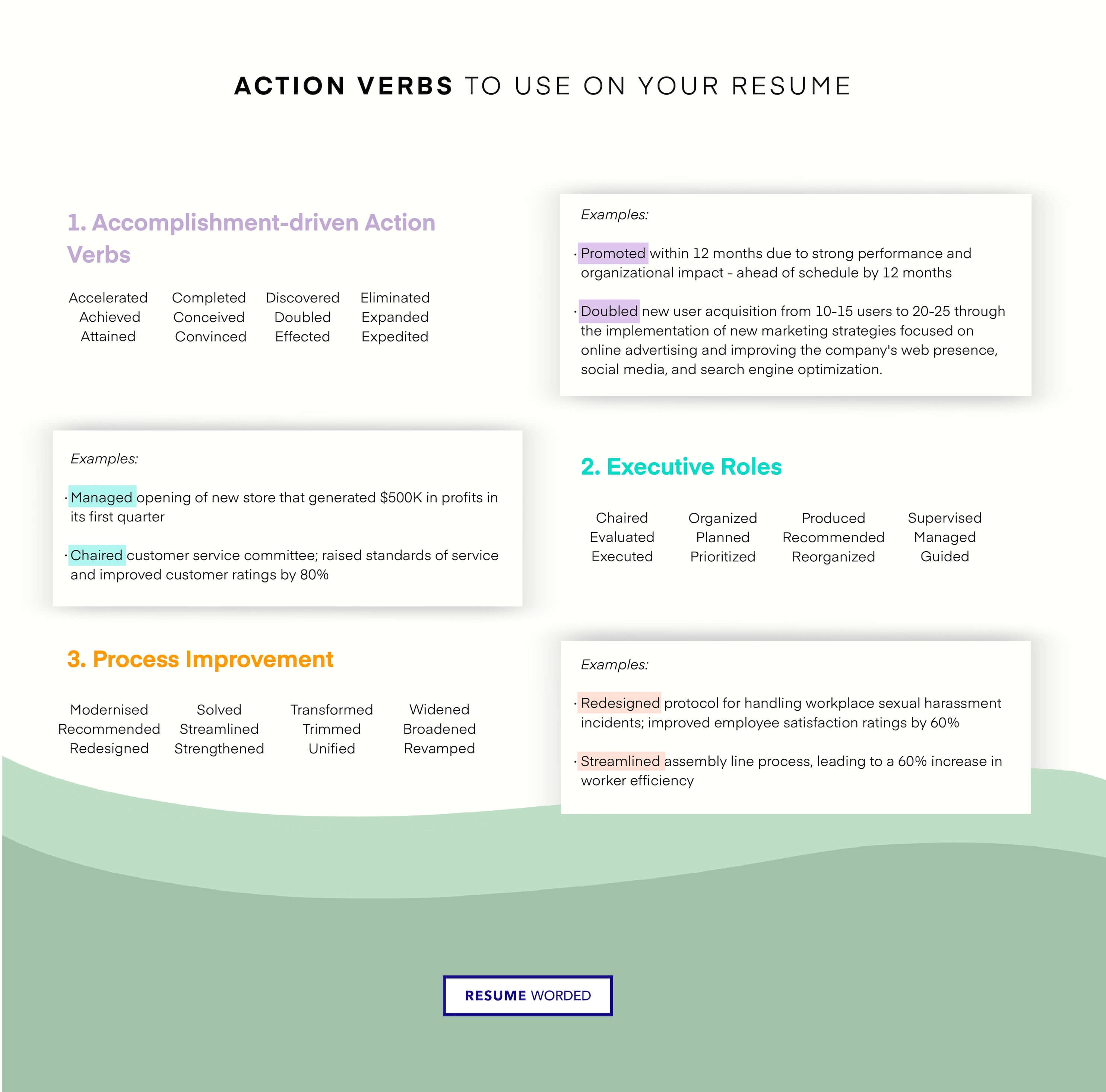

Wide use of relevant verbs which stress financial abilities

Financial advisors handle a variety of different tasks, so it's good to include a range of appropriate action verbs in your bullet pointed accomplishments. For example, you may have "produced", "sourced", "executed", or "increased" for previous employers, each of which tells hiring managers that you have an understanding of the work involved in financial advising positions.

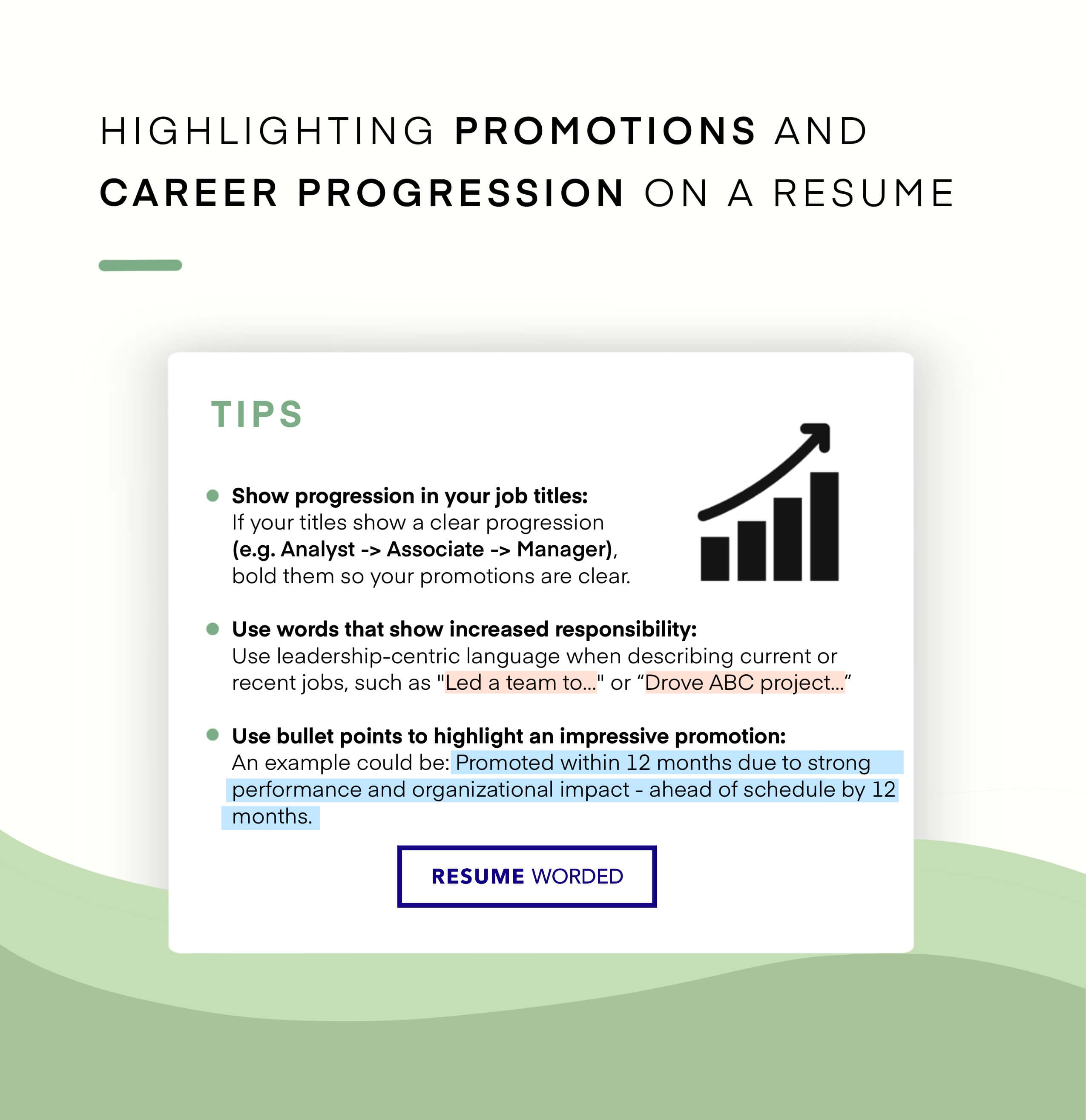

Shows promotions within past companies, all in the financial industry

Few accomplishments are as impressive to hiring managers as rapid promotions. If you have been promoted within a company before, particularly for financial advising positions, you should include your promotions and, if relevant, the amount of time it took you to be promoted (i.e. “Promoted within 18 months”). This demonstrates proven competency.

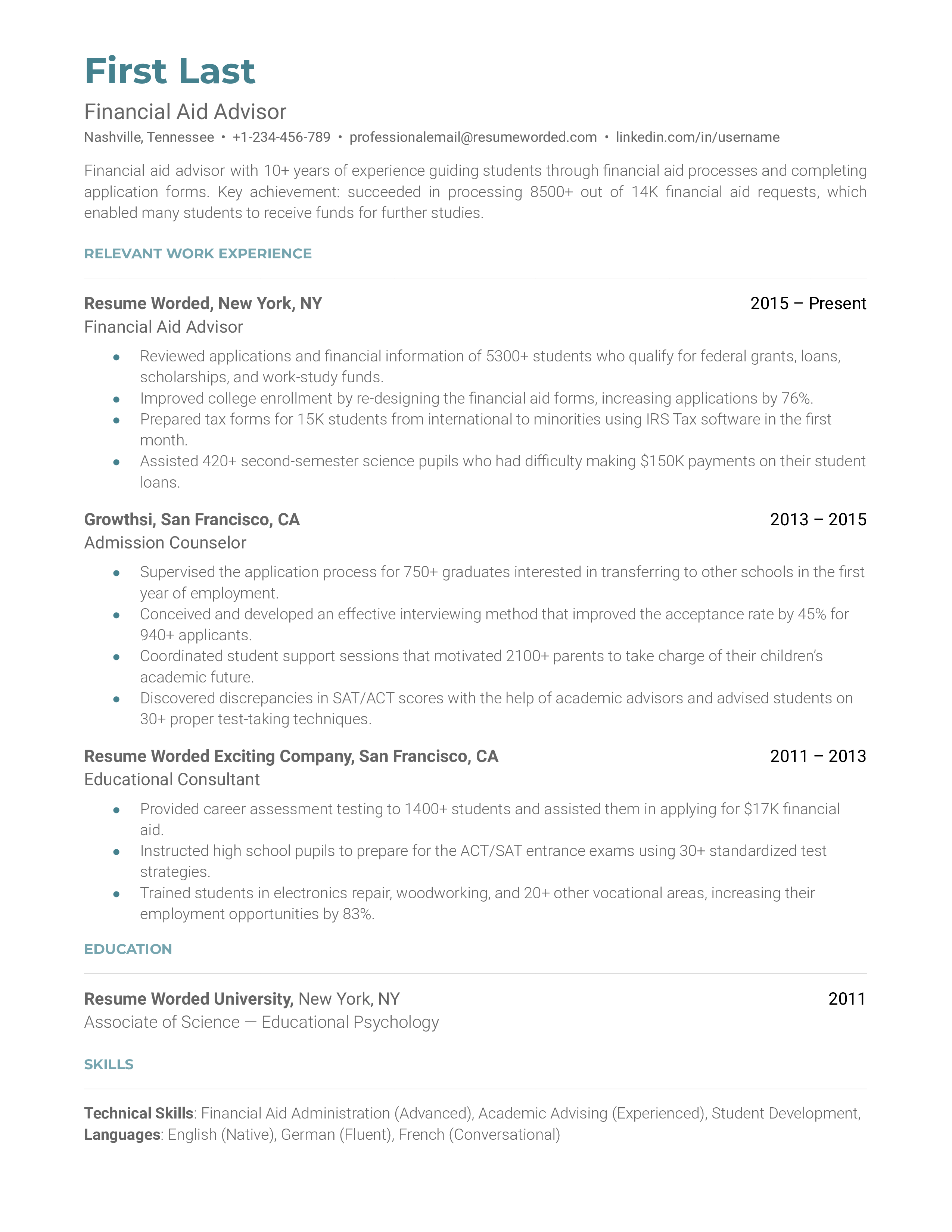

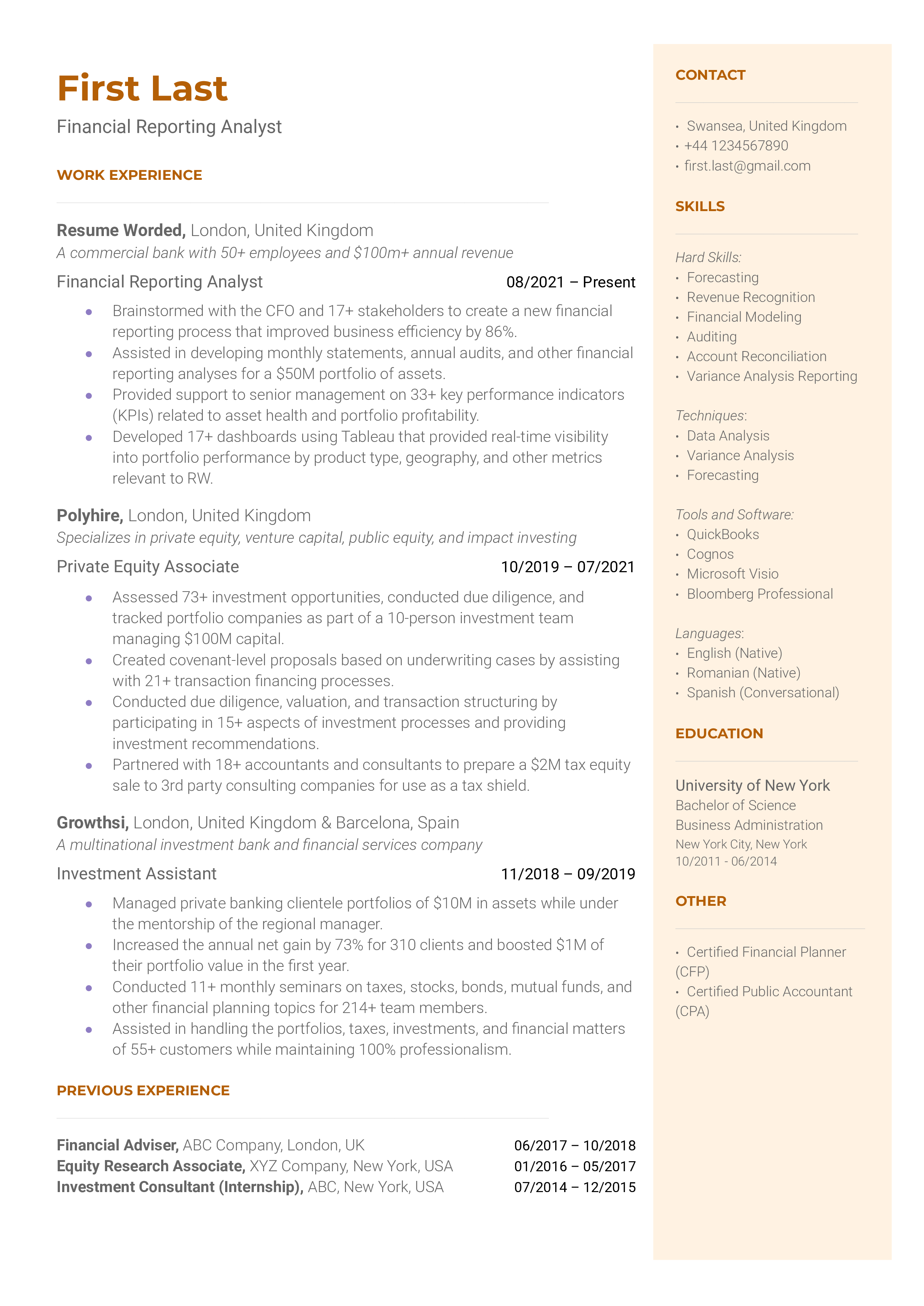

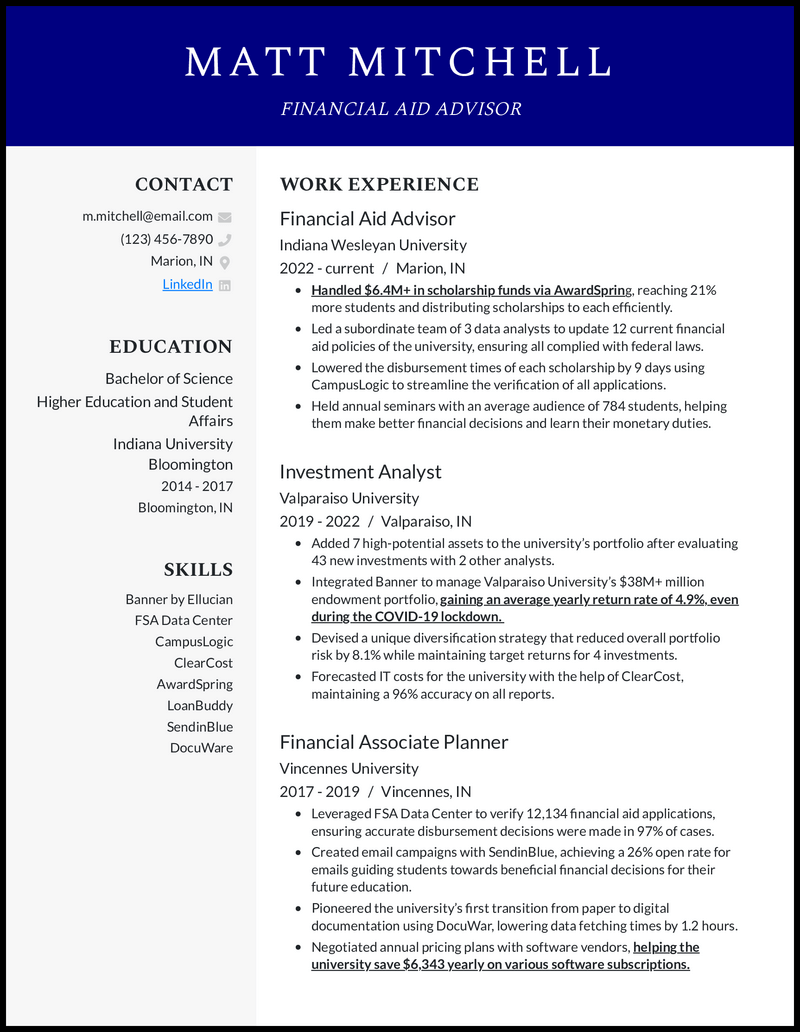

Template 3 of 9: Financial Aid Advisor Resume Example

As a Financial Aid Advisor, you play a crucial role in assisting students and their families in navigating the financial aspects of higher education. The industry has evolved rapidly in recent years, with a growing emphasis on technology and data analysis to streamline processes and improve financial aid outcomes. Employers in this field value attention to detail, strong communication skills, and a deep understanding of financial aid regulations. A well-crafted resume is essential for showcasing your expertise and demonstrating your ability to adapt to this changing landscape. Crafting a targeted resume that highlights your skills and achievements specific to financial aid advising will help you stand out to potential employers. Make sure to emphasize any certifications, professional development, or relevant experience that demonstrate your commitment to the field and your readiness for new challenges.

Tips to help you write your Financial Aid Advisor resume in 2024

highlight financial aid-specific knowledge.

As a Financial Aid Advisor, you'll need to demonstrate your in-depth understanding of financial aid regulations, policies, and procedures. Include any relevant certifications, such as NASFAA credentials, and mention specific knowledge areas like the FAFSA, state grants, and scholarship opportunities.

Showcase customer service and communication skills

Strong communication and customer service skills are vital for a Financial Aid Advisor, as you'll be working directly with students and families. Highlight any experience you have in customer service or student support roles, and emphasize your ability to explain complex financial information in easy-to-understand terms.

Skills you can include on your Financial Aid Advisor resume

Template 4 of 9: financial aid advisor resume example.

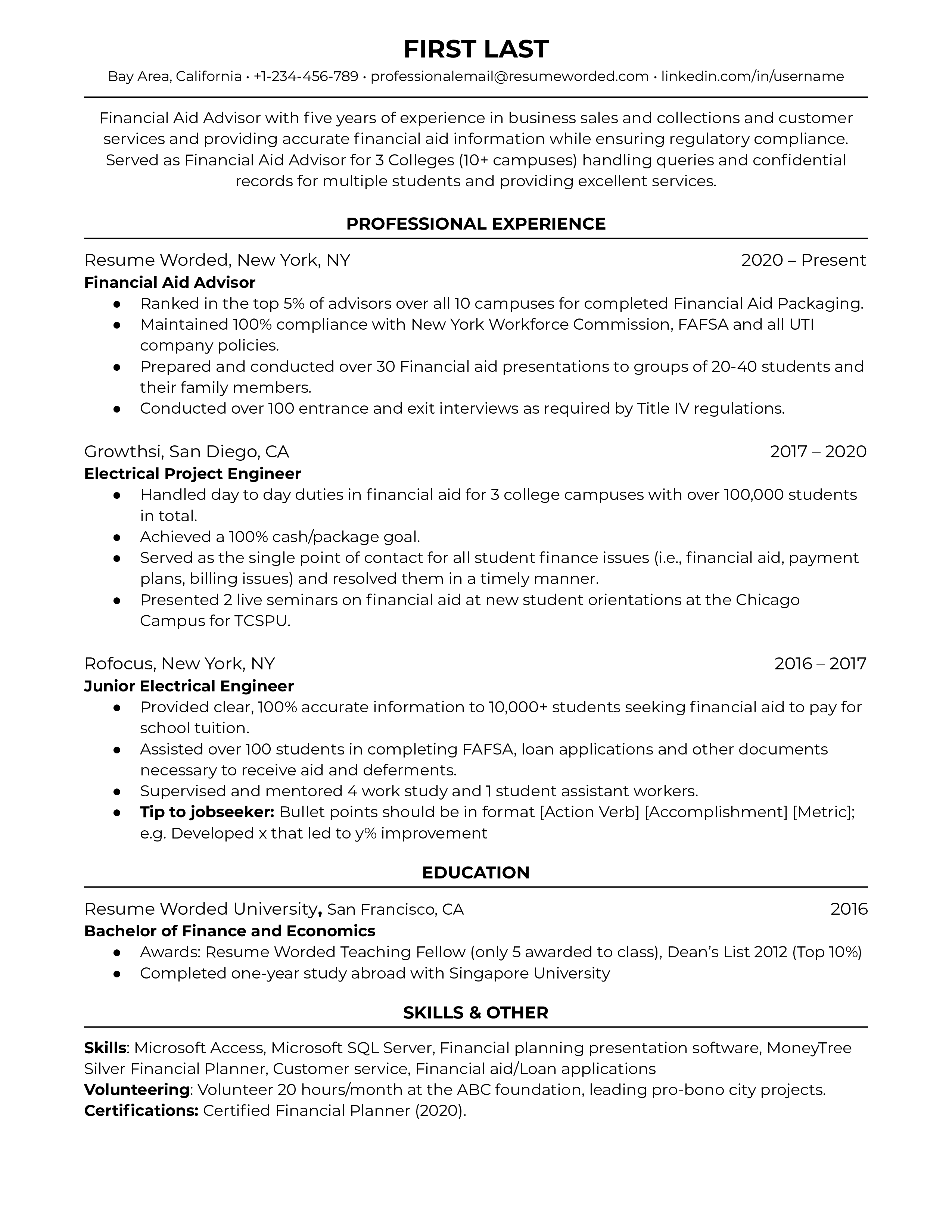

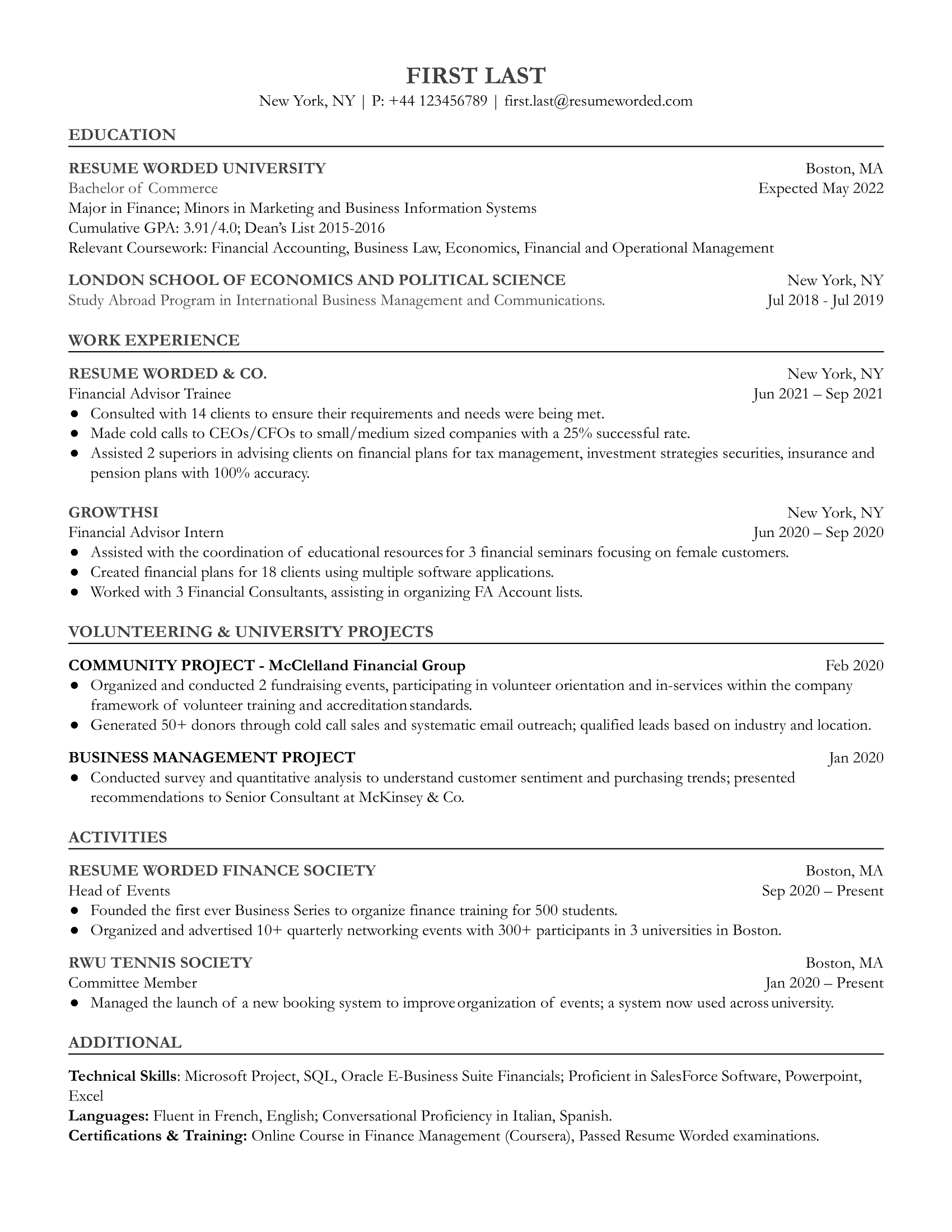

Financial aid advisors work specifically in academic settings, meaning you’ll need to have (or build) an understanding of student loans, scholarships, and grants. As with all financial advisor resumes, you should rely on quantitative values in your bullet points, and include any volunteering you’ve done.

Use of numerical values, with accomplishments pertaining to financial advisory

Since financial advising is based on numerical data, it makes sense that every one of your bullet points should include a numerical value where possible. If you can indicate how much you increased or reduced a value by, or what percentage of your reports were in compliance, it shows you know your field.

Include relevant extra-curriculars to supplement work experience

Pro bono and volunteer activities for community organizations or companies are important to include as it shows that your passion for financial advising extends beyond the workday. Aim to bolster the inclusion by clarifying how much time you volunteer each week/month, or how long you’ve been volunteering with the organization.

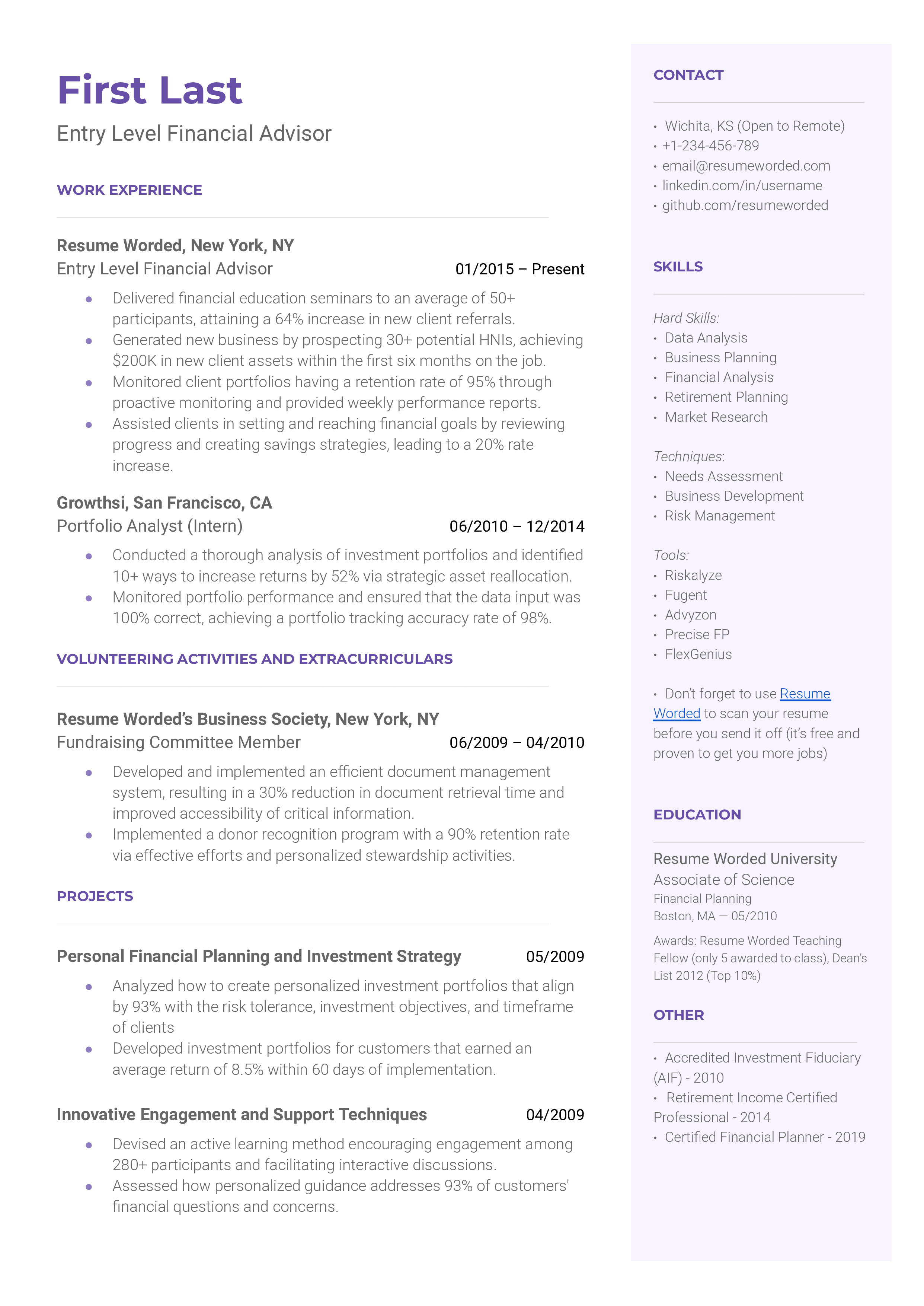

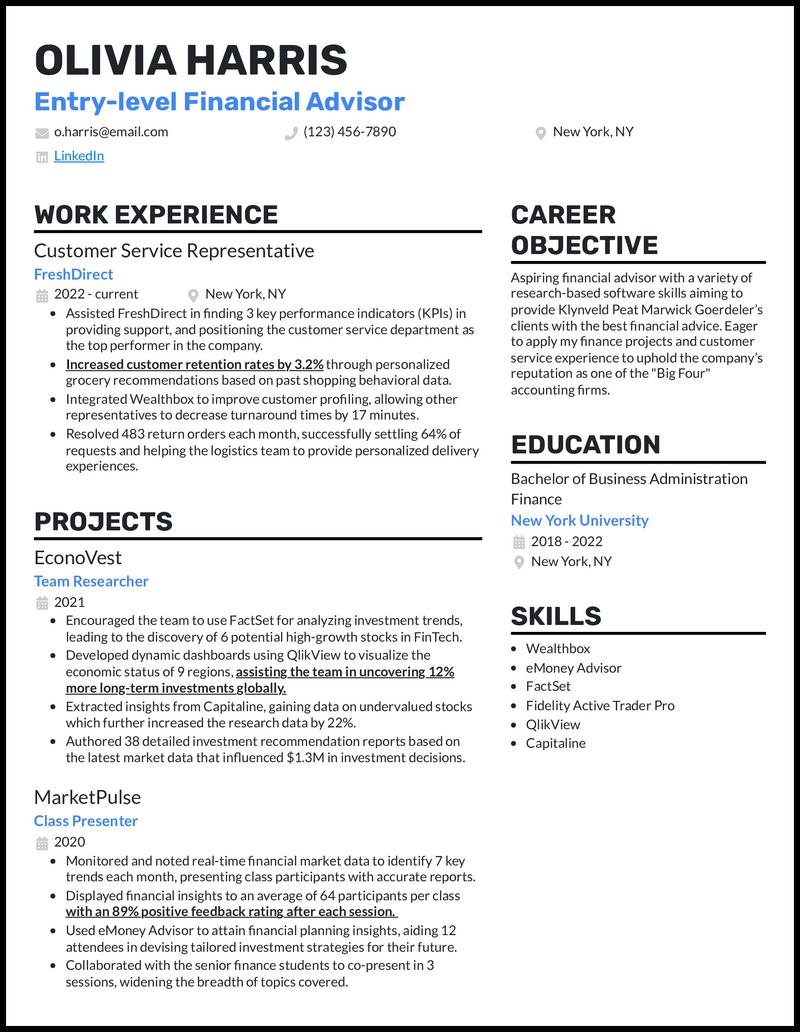

Template 5 of 9: Entry Level Financial Advisor Resume Example

As an entry-level financial advisor, you're aiming to help people manage their finances effectively. This field has seen an increase in demand for personalised, tech-enabled services. Thus, firms are looking for candidates who can not only understand complex financial concepts but also build relationships, and navigate financial tech platforms. When preparing your resume, focus on showcasing the skills that set you apart in these areas, while keeping it concise and impactful. A great resume should capture your ability to excel in financial analysis and client management, even at the start of your career.

Tips to help you write your Entry Level Financial Advisor resume in 2024

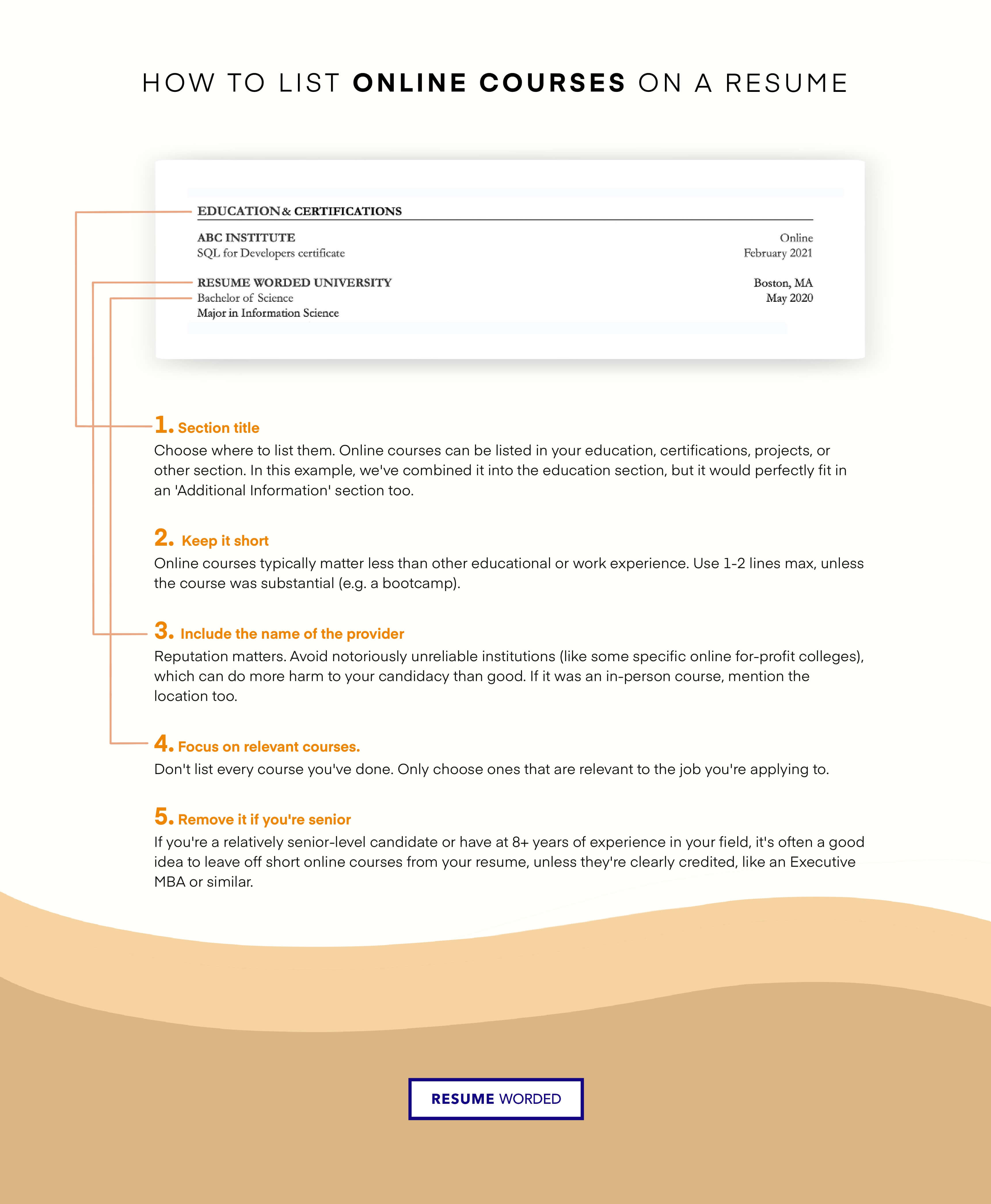

highlight relevant coursework and certifications.

Since you're at the entry level, you may not have lots of job experience to share. However, you can show your financial aptitude by highlighting relevant coursework or certifications. This could include classes in economics, financial management, or even data analysis. Any certification you've earned, like a CFP or CFA, should also be prominently displayed.

Show your tech savviness

In this digitized world, you'll likely be handling clients' portfolios online and using different financial tech platforms. You should include any experience or skills you have with financial software like QuickBooks, Excel, or even coding languages like Python.

Skills you can include on your Entry Level Financial Advisor resume

Template 6 of 9: entry level financial advisor resume example.

Entry level financial advisors can indicate their proficiency in the position by ensuring that their bullet points include relevant skills and their technical skills are listed separately. Additionally, you should list your program name and coursework to emphasize your academic training.

Includes financial advisor skills

While entry level financial advisors may not have a lot of field experience, you can still show you know the position by including your background with relevant skills like consulting, advising, and creating financial plans. You should also include a skills bank at the top or bottom of your resume to list your technical skills.

Relevant coursework is listed

Financial advising generally requires a four year degree, and you should include your program name when you list it. It also helps to specify your strongest courses (such as Financial and Operational Management or Financial Accounting) to indicate to hiring managers that you are educated in those fields.

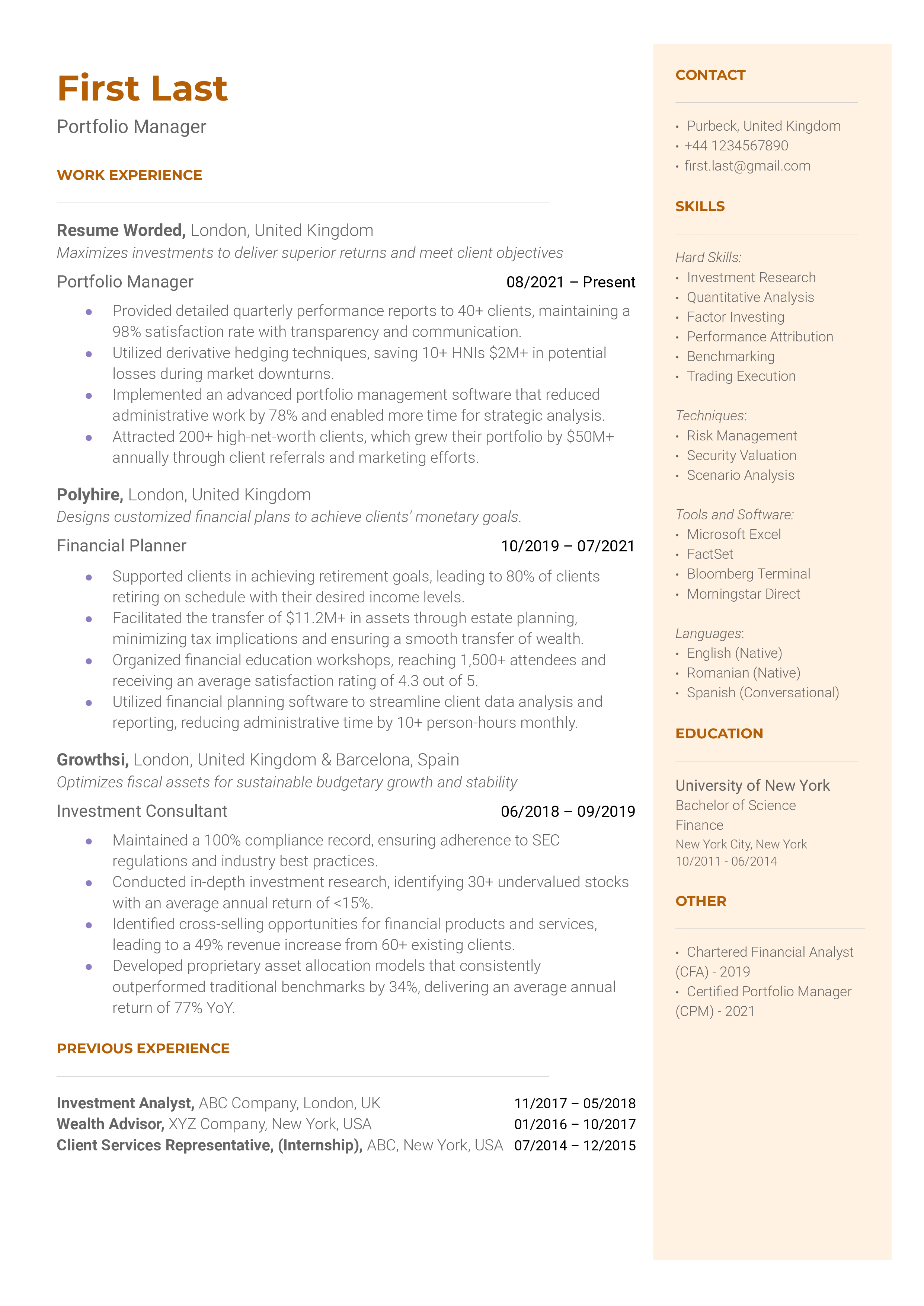

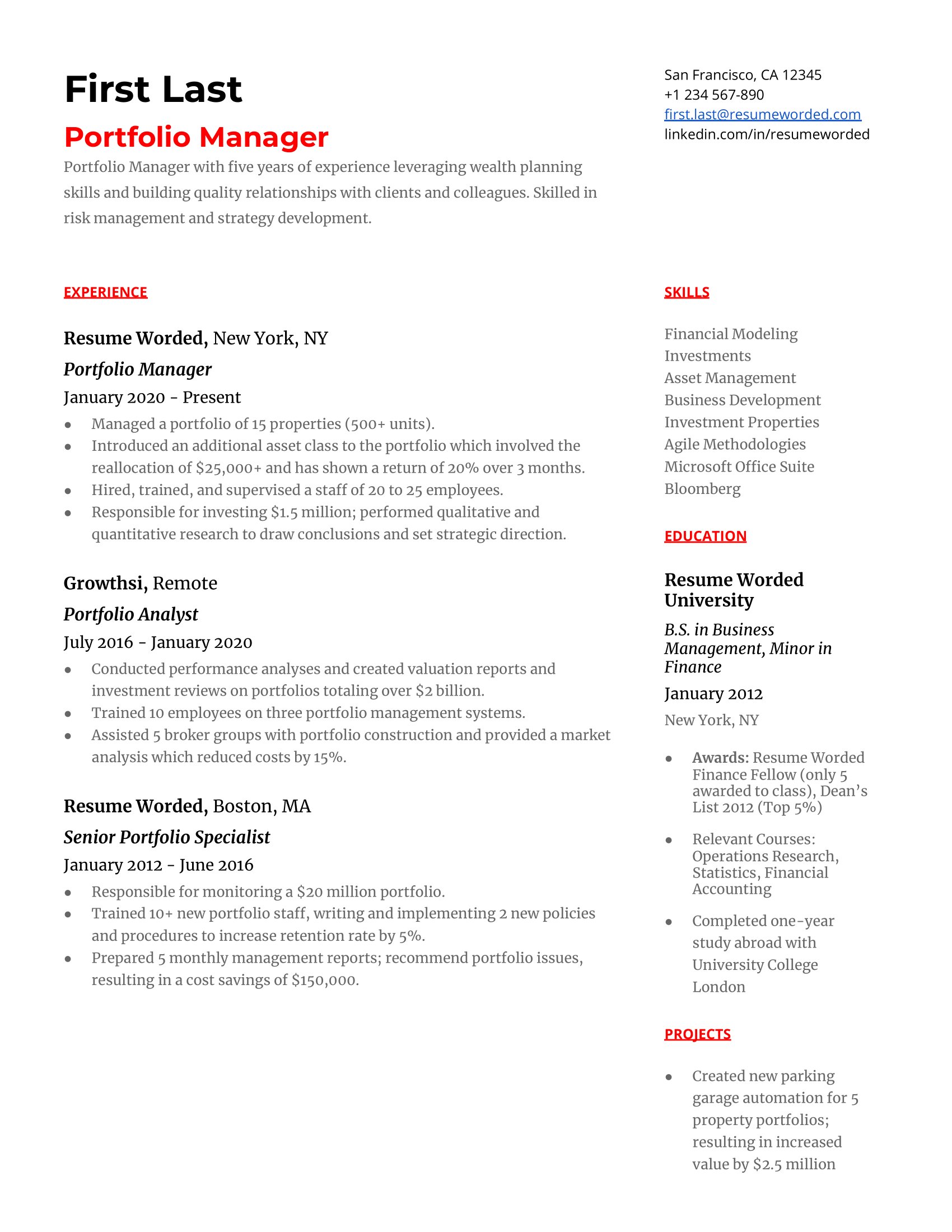

Template 7 of 9: Portfolio Manager Resume Example

As a Portfolio Manager, your role involves a lot of strategic decision-making, so it's important to showcase your ability to make informed, successful investment choices. It's not all about finance knowledge - soft skills are increasingly valued in this field, with a trend towards a more client-focused approach. When you're writing your resume, remember that your goal is to illustrate your potential value to prospective employers. It's a balancing act between demonstrating your financial acumen and highlighting your ability to build relationships with clients and teams. Over the last few years, there's been a shift in the industry, with more emphasis on ESG (Environmental, Social, and Governance) investing. This means it's essential to demonstrate any experience or interest in this area. Use your resume to paint a picture of yourself as a forward-thinking Portfolio Manager who's in tune with industry trends and prepared to adapt.

Tips to help you write your Portfolio Manager resume in 2024

show evidence of strategic decision-making.

Portfolio Managers aren't just expected to manage investments, they're expected to make strategic decisions that benefit their clients financially. In your work history, provide examples of when you have strategically allocated resources, implemented investment strategies, or enhanced Portfolio performance.

Highlight your ESG investing experience

Given the growing emphasis on ESG investing, it's important to show any involvement in this area. Whether it's through professional experience, training, or personal interest, make sure to include any ESG-related knowledge or skills in your resume.

Skills you can include on your Portfolio Manager resume

Template 8 of 9: portfolio manager resume example.

A portfolio manager is a finance and investment professional who is responsible for managing and trading an investment fund's assets. They oversee the investment strategy and manage day-to-day fund trading. They may manage portfolios for large corporations to individual investor groups. Portfolio managers can take different approaches to managing investments. However, they are always responsible for overseeing, securing, and ideally, creating profitable investment portfolios for others. To become a portfolio manager, you’ll need a strong background in finance and trading. You will need a minimum of bachelor's degree in finance or business, though a master’s degree can help you land this job more easily. Additionally, hiring managers will look for candidates with previous experience in finance and risk management, in roles such as a financial analyst or investment consultant. It’s important that aspiring portfolio managers showcase certain skills, such as knowledge of the stock market and trading principles, investment forecasting, portfolio analysis, and more.

Show your experience helping clients meet their financial goals

Whether the client is a company or individual investor, one of the most important things for portfolio managers to know is how to effectively communicate and perform for their clients. You should highlight any experience you have communicating and effectively meeting client desires.

Highlight relevant skills to portfolio management

Portfolio managers need several hard skills to be successful, such as investment analysts, risk management techniques, and financial modeling. On your resume, it’s important to list these skills, and also how you have used them successfully in previous roles or scenarios.

Template 9 of 9: Portfolio Manager Resume Example

Portfolio managers oversee investment portfolios for individuals and companies. They’re tasked with choosing the right types of assets for their clients’ needs and making prudent investment decisions based on available data. To become a portfolio manager, use your resume to emphasize a strong background in investment as well as financial analysis.

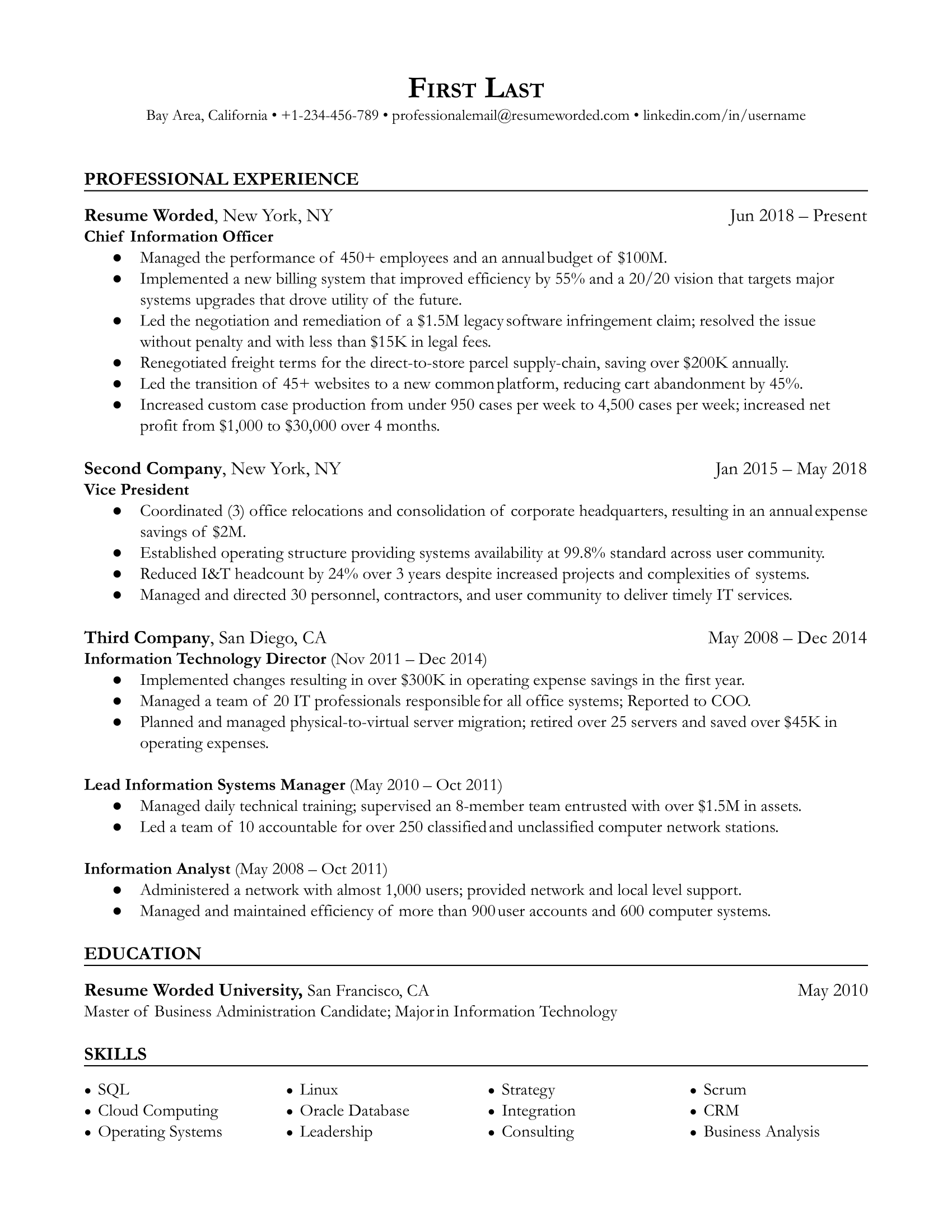

Effective use of skills section

Being a portfolio manager usually requires some hard skills such as financial modeling, asset management, and investment. Use your skills section to highlight these abilities as well as any technical skills that might be relevant (e.g. Python, MATLAB, or other technical skills).

Use strong action verbs to make past accomplishments stand out

Portfolio manager roles are senior positions that often go to more experienced candidates. If you want the job, your resume should show a track record of successful portfolios that you’ve managed. Using strong action verbs such as “introduced”, “conducted”, or “trained” shows that you played an active role in your past achievements.

We spoke with hiring managers from top financial firms like JPMorgan Chase, Bank of America, and Morgan Stanley to gather their best tips for creating a financial advisor resume that stands out. Here's what they shared:

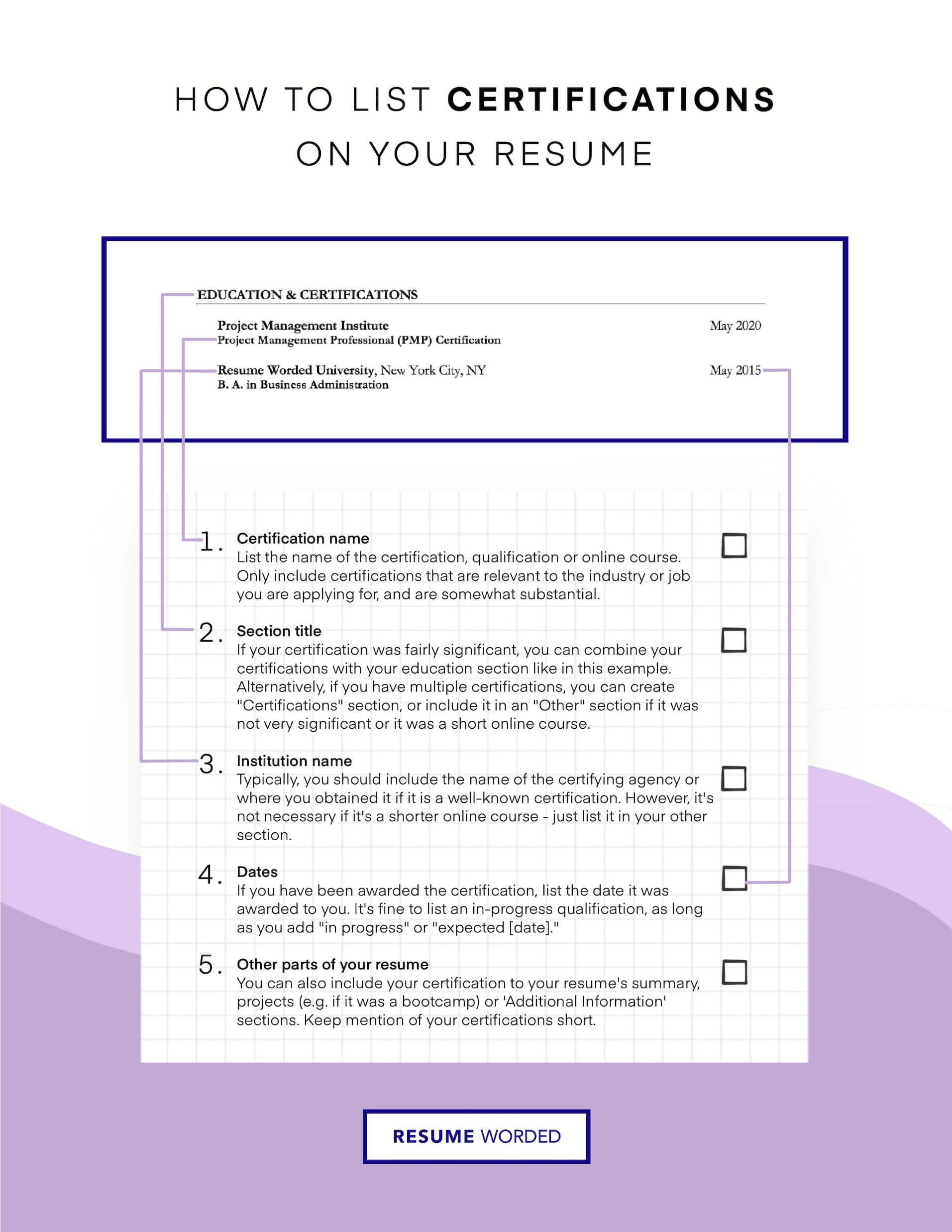

Highlight your certifications and licenses

Make sure to prominently feature your relevant certifications and licenses, such as:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Series 7 and Series 66 licenses

Hiring managers look for these to quickly assess if you meet the basic qualifications. Don't make them hunt for this info. For example:

Certifications: - Certified Financial Planner (CFP), 2019 - Series 7 and 66 FINRA licenses, 2017

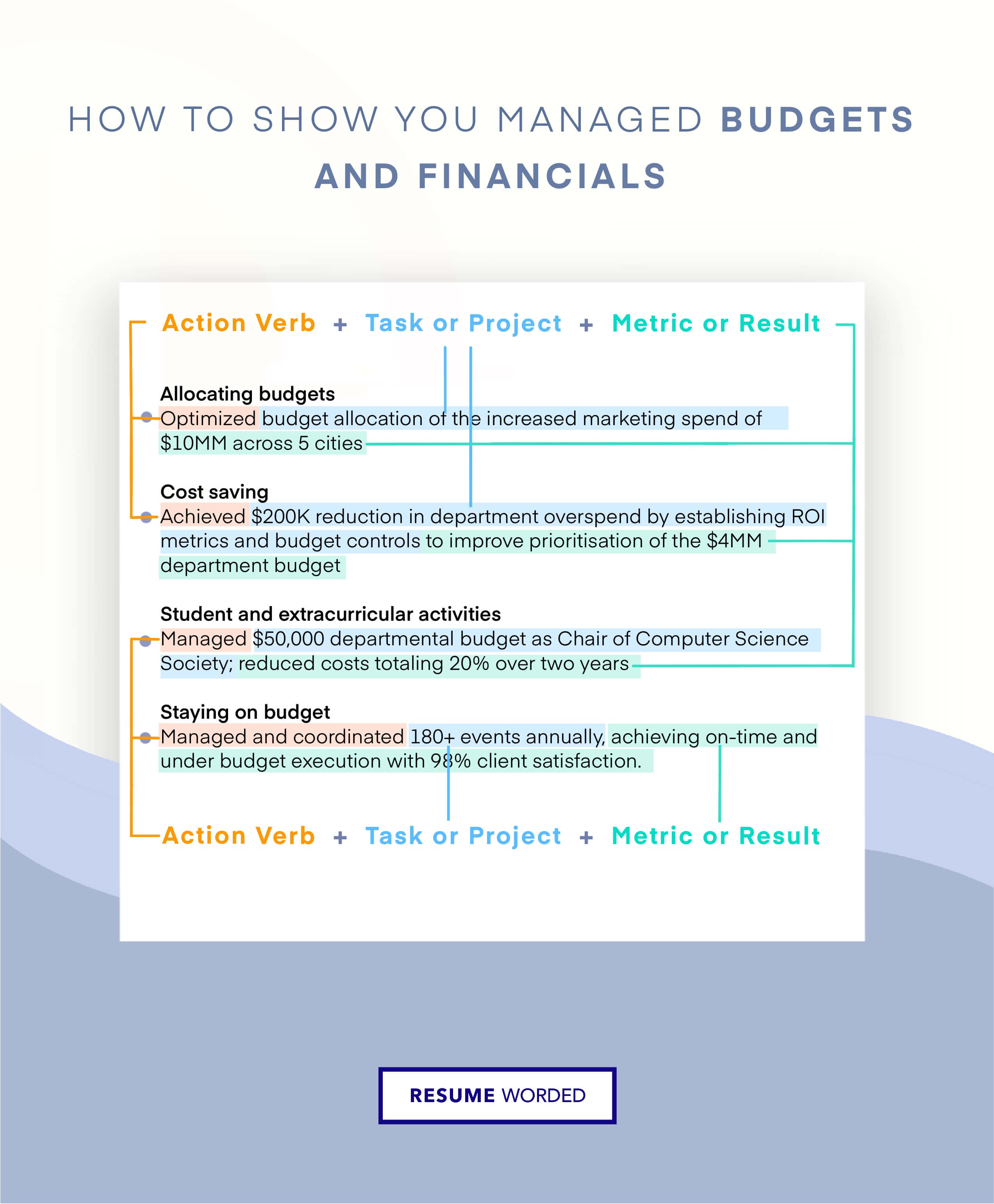

Quantify your achievements with data

When describing your accomplishments, use hard numbers to paint a clear picture of your impact. Weak resumes make vague claims like:

- Helped grow client base and assets under management

Instead, get specific with details like:

- Grew client base by 20% and assets under management by $10M in 2 years

- Achieved 95% client retention rate through proactive relationship management

- Rebalanced portfolio of 50+ clients to align with financial goals and risk tolerance

Show progression and increased responsibility

Hiring managers want to see growth and advancement in your career. Emphasize how you've taken on more responsibility over time. Compare these two work experience examples:

- Financial Advisor, XYZ Firm, 2015-2020 - Provided investment advice and financial planning to clients - Managed client portfolios and asset allocation

- Senior Financial Advisor, XYZ Firm, 2018-2020 - Led team of 5 advisors managing $500M in client assets - Developed and implemented new training program that reduced onboarding time by 30% Financial Advisor, XYZ Firm, 2015-2018 - Managed portfolio of 200 high-net-worth clients with over $200M in assets - Increased AUM by 15% through proactive prospecting and referrals

The second shows a clear progression in roles, responsibilities, and scope.

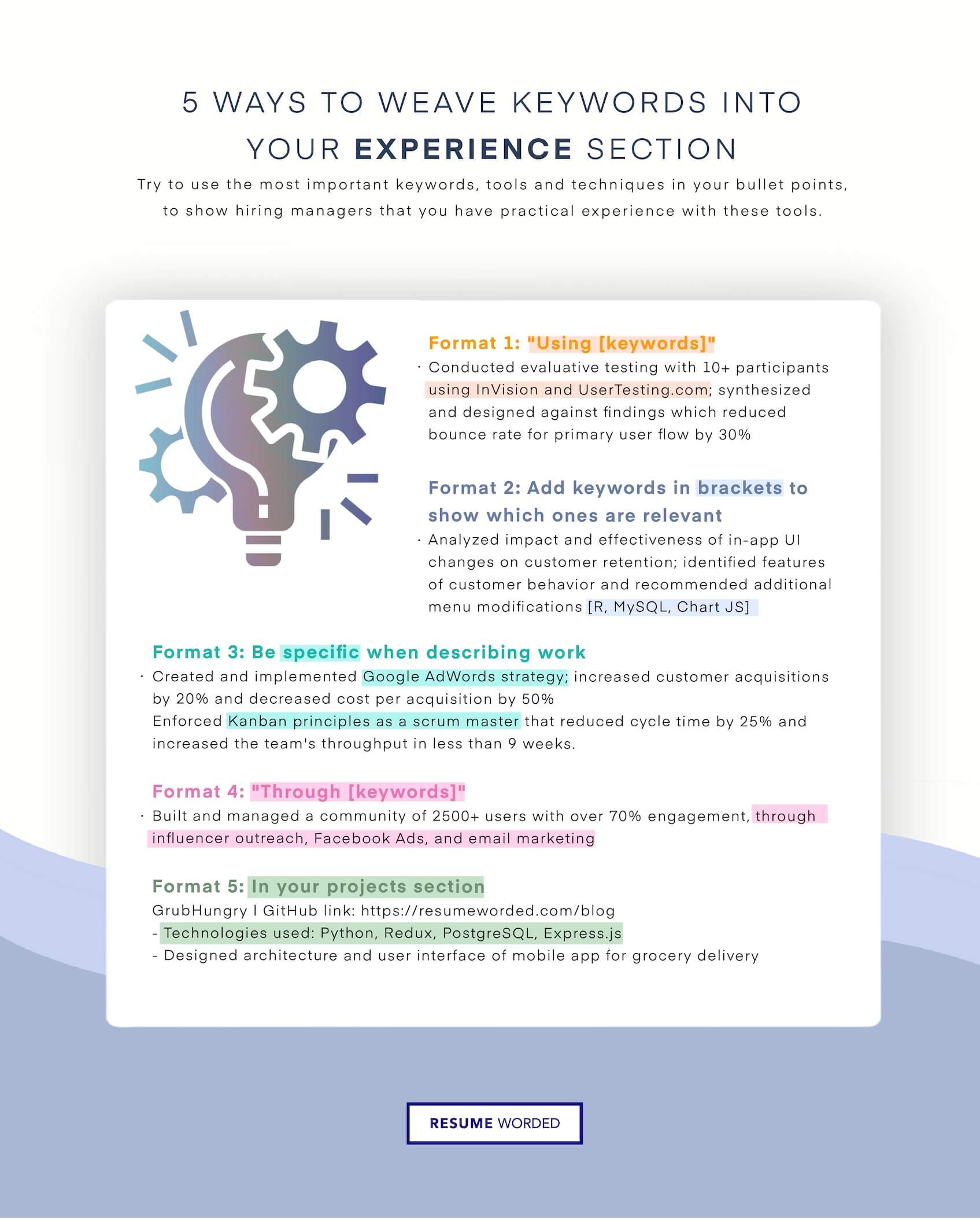

Tailor your skills to the job description

Read the job posting carefully and mirror the language it uses in the skills section of your resume. For instance, if it mentions skills like:

- Retirement planning

- Tax optimization strategies

- Estate planning

Make sure to include them prominently, with specific examples of how you've applied these skills. Avoid simply listing generic skills like 'financial analysis' or 'client service' without connecting them to the role.

Highlight your client relationship skills

Succeeding as a financial advisor is about more than just technical analysis. It's critical to demonstrate your 'soft skills' in areas like:

- Relationship building

- Communication

- Problem-solving

- Emotional intelligence

Work these into your bullets, for example:

Built trusted relationships with clients through active listening, empathy, and responsiveness to concerns. Maintained 95%+ client satisfaction scores.

Add relevant volunteer and industry activities

Hiring managers like to see involvement and leadership outside of your primary job. Include things like:

- Membership and leadership roles in industry associations

- Volunteer work, especially in financial literacy education

- Teaching, mentoring, or public speaking engagements

For example:

- Board Member, CFA Society of New York, 2019-Present

- Volunteer Financial Coach, Neighborhood Economic Development Center, 2017-2020

This shows your passion, initiative, and commitment to your profession and community.

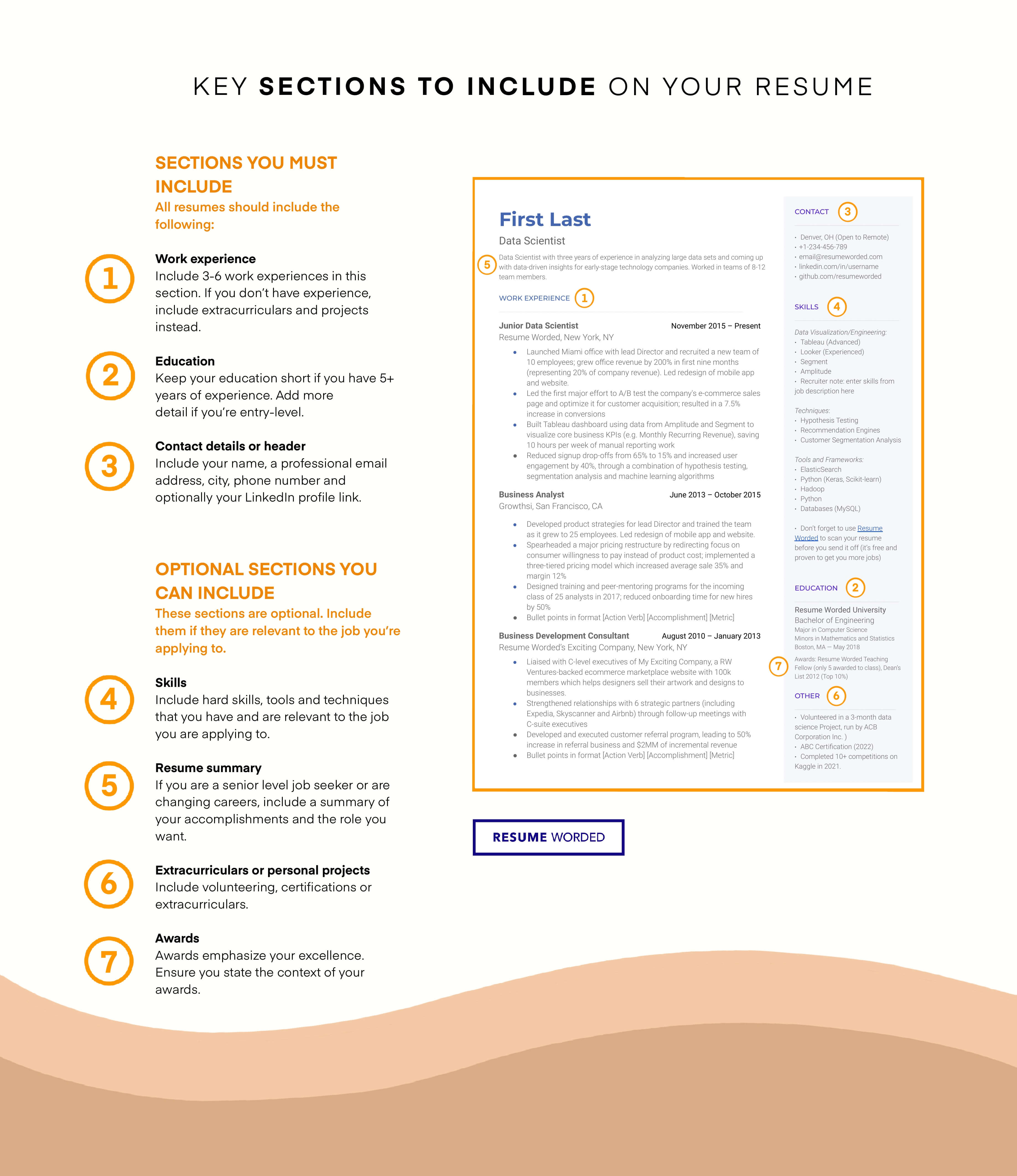

Writing Your Financial Advisor Resume: Section By Section

header, 1. put your name front and center.

Your name should be the most prominent element in your header, typically in a larger font than the rest of your resume. This makes it easy for hiring managers to remember who you are and quickly find your resume in a stack of applications.

Here's an example of how to format your name in your resume header:

- John D. Smith, CFP

Avoid nicknames or unprofessional email addresses like:

- Johnny Smith

- [email protected]

2. Include key certifications

As a Financial Advisor, certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) demonstrate your expertise and commitment to the field. Including these after your name can catch a hiring manager's attention and set you apart from other candidates.

John Smith, CFP, CFA

However, avoid listing irrelevant or outdated certifications that don't directly apply to the Financial Advisor role, such as:

- Certified Public Accountant (CPA) from 1995

- Notary Public

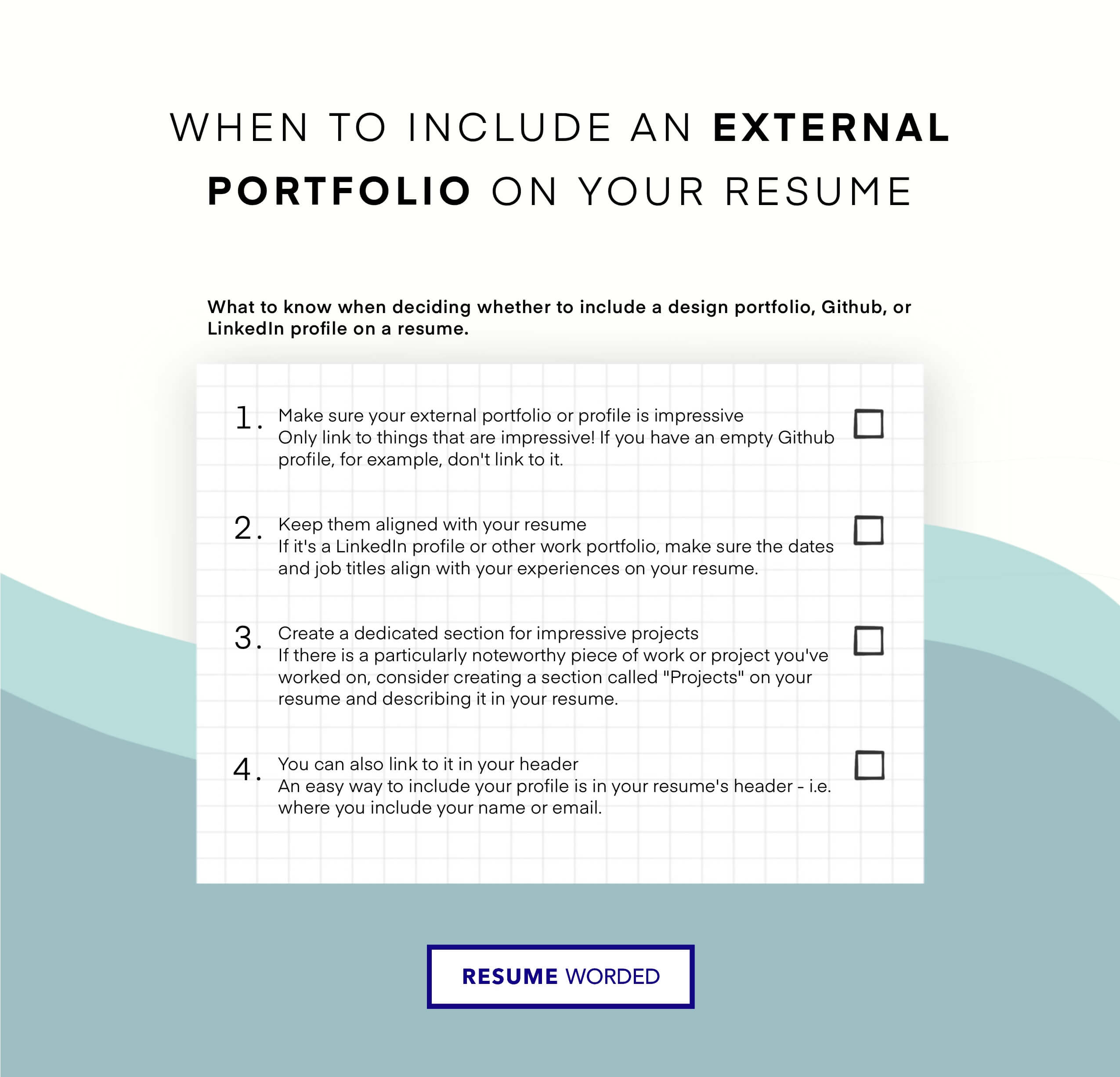

3. Streamline your contact details

While your header should make it easy for employers to contact you, avoid cluttering it with too many details. Include your phone number, professional email address, and LinkedIn profile URL. You may choose to include your city and state, but a full mailing address is no longer necessary.

Here's a clean, professional format for your contact details:

[email protected] | 555-123-4567 | linkedin.com/in/johnsmith | New York, NY

Keep your header concise by excluding unnecessary information like:

- Multiple phone numbers

- Full mailing address with street, city, state, and zip code

- Links to personal websites or social media profiles unrelated to your professional brand

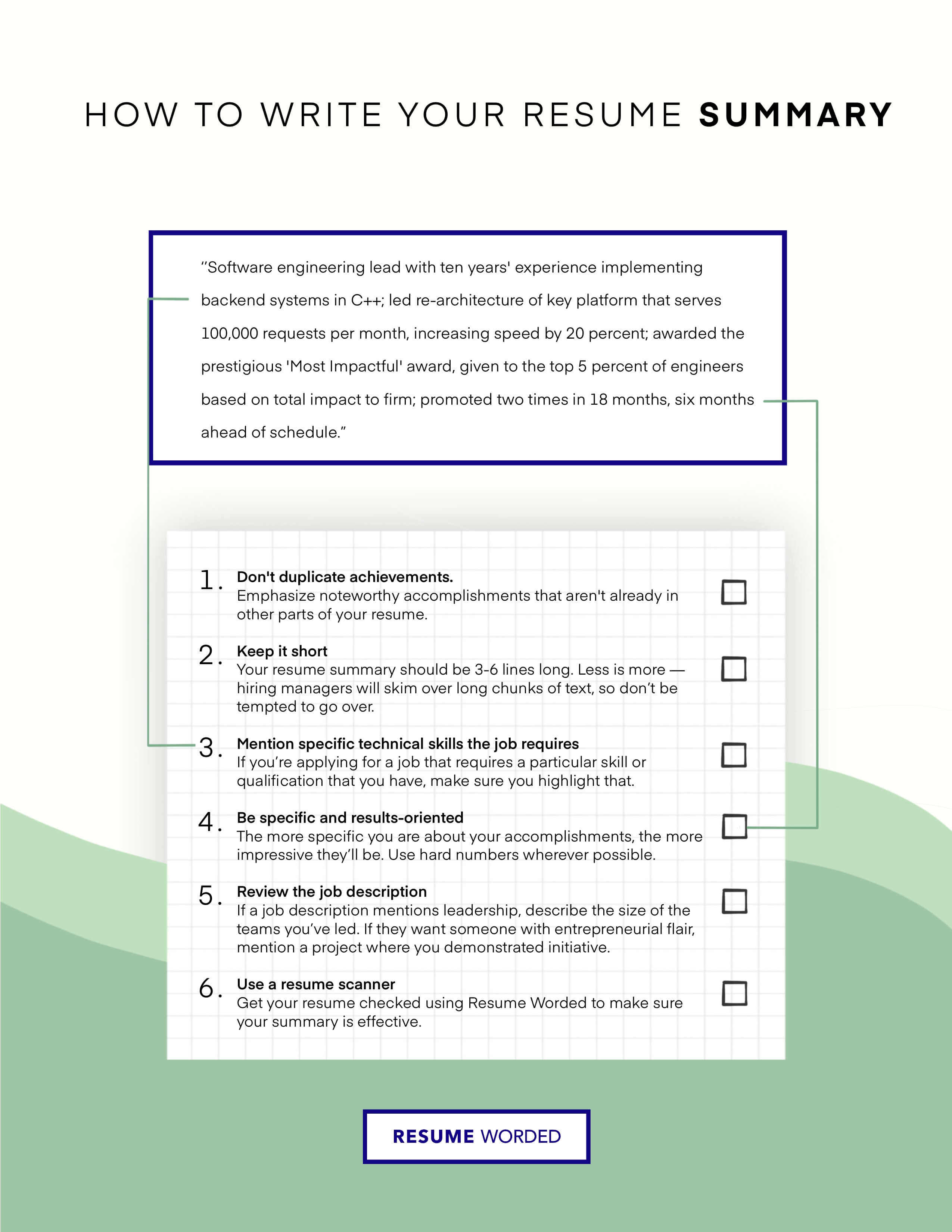

Summary

A resume summary, also known as a professional summary or summary statement, is an optional section that appears at the top of your resume, just below your contact information. While it's not a mandatory component, a well-written summary can effectively showcase your most relevant qualifications and help you stand out from other candidates. It's particularly useful if you're a career changer or an experienced professional looking to highlight your expertise.

When crafting your summary, focus on your key strengths, accomplishments, and the value you can bring to the role. Tailor it to the specific financial advisor position you're targeting and avoid using generic or vague statements. Remember, your goal is to capture the hiring manager's attention and encourage them to read the rest of your resume.

To learn how to write an effective resume summary for your Financial Advisor resume, or figure out if you need one, please read Financial Advisor Resume Summary Examples , or Financial Advisor Resume Objective Examples .

1. Highlight your relevant experience and certifications

As a financial advisor, your experience and certifications play a crucial role in demonstrating your expertise and credibility. In your summary, showcase your most relevant qualifications and achievements that align with the requirements of the position you're seeking.

For example, instead of simply stating that you're a 'hardworking financial advisor,' highlight specific accomplishments or certifications:

- CFA charterholder with 5+ years of experience in wealth management and financial planning

- Series 7 and 66 licensed financial advisor with a proven track record of growing client portfolios by an average of 15% annually

By providing concrete details about your background, you give the hiring manager a clear understanding of your capabilities and the value you can bring to their organization.

2. Tailor your summary to the specific role and company

One of the most common mistakes job seekers make is using a generic, one-size-fits-all summary that fails to address the specific requirements of the position they're applying for. To make your summary more impactful, tailor it to the financial advisor role and the company you're targeting.

Start by carefully reviewing the job description and identifying the key skills, qualifications, and experiences the employer is looking for. Then, incorporate those elements into your summary, using language that mirrors the job posting.

For instance, if the job description emphasizes financial planning and wealth management, your summary might look something like this:

Certified Financial Planner (CFP) with 7+ years of experience in comprehensive financial planning and wealth management. Skilled in developing customized investment strategies, retirement planning, and risk management. Proven ability to build long-term client relationships and consistently exceed client expectations.

3. Quantify your achievements and impact

To make your summary more compelling and memorable, quantify your achievements whenever possible. Using specific numbers, percentages, or dollar amounts helps to contextualize your accomplishments and demonstrates the tangible impact you've made in your previous roles.

Compare the following examples:

- Experienced financial advisor with a strong background in portfolio management and client relations

- Accomplished financial advisor with 10+ years of experience managing portfolios totaling $50M+ and maintaining a 95% client retention rate

By quantifying your achievements, you provide the hiring manager with a clear understanding of the scale and scope of your contributions, making your summary more impactful and persuasive.

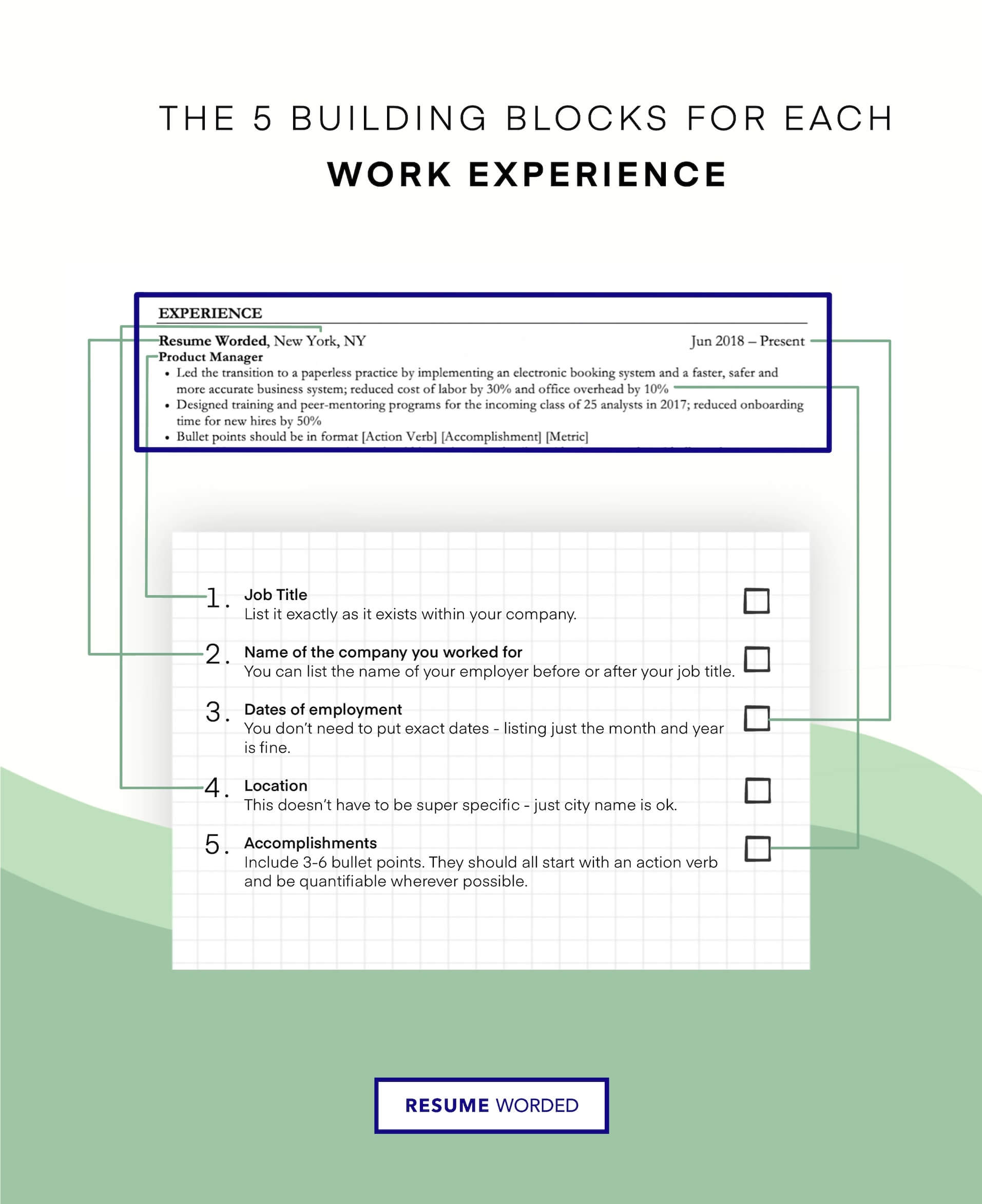

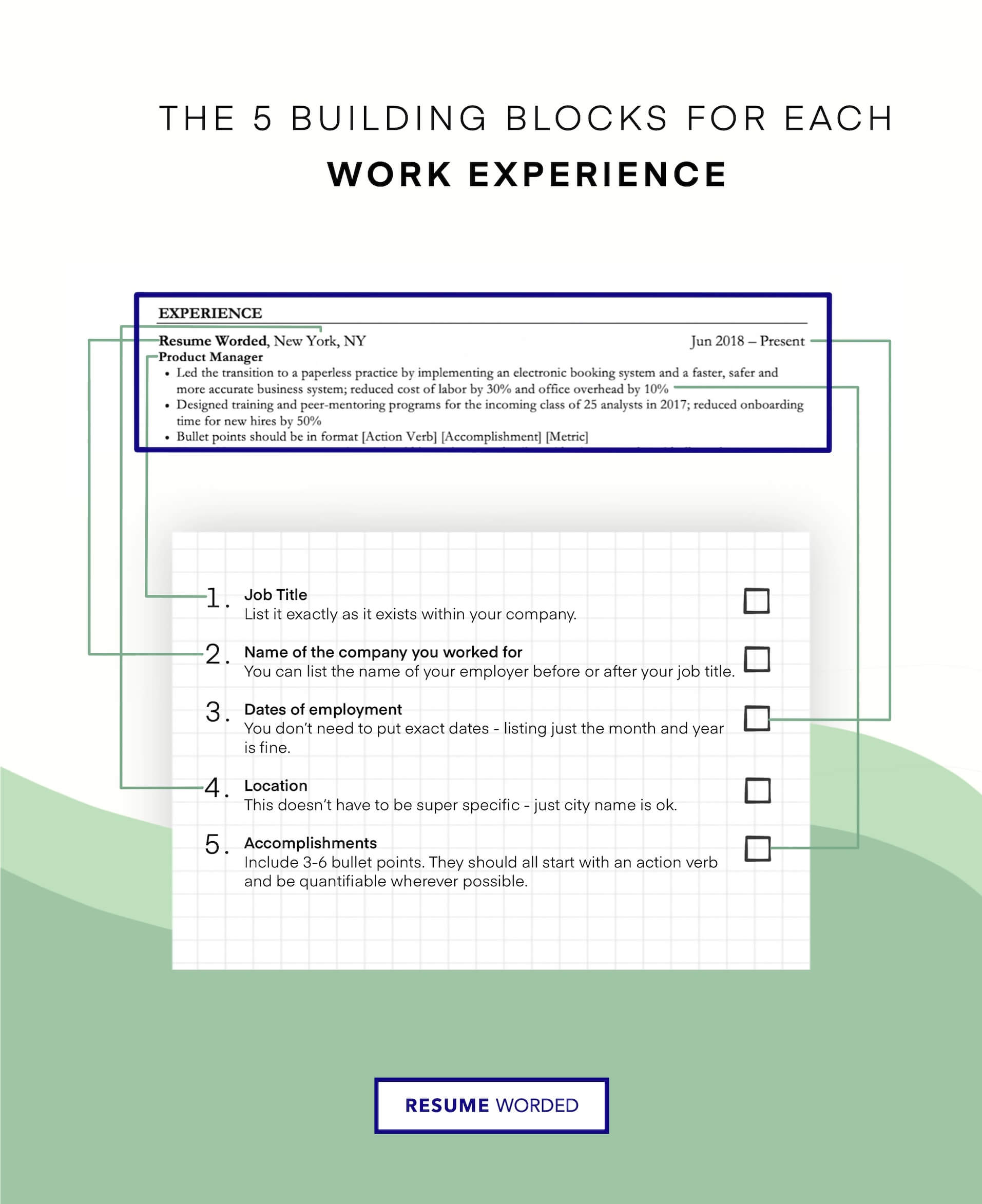

Experience

Your work experience section is the heart of your resume. It's where you show hiring managers how you've applied your skills to make an impact for previous employers. For financial advisors, this section is especially important because it's where you can demonstrate your ability to drive results and grow your client base.

In this section, we'll break down the key steps you need to follow to craft a compelling work experience section that will catch the eye of hiring managers and help you land your next financial advisor role.

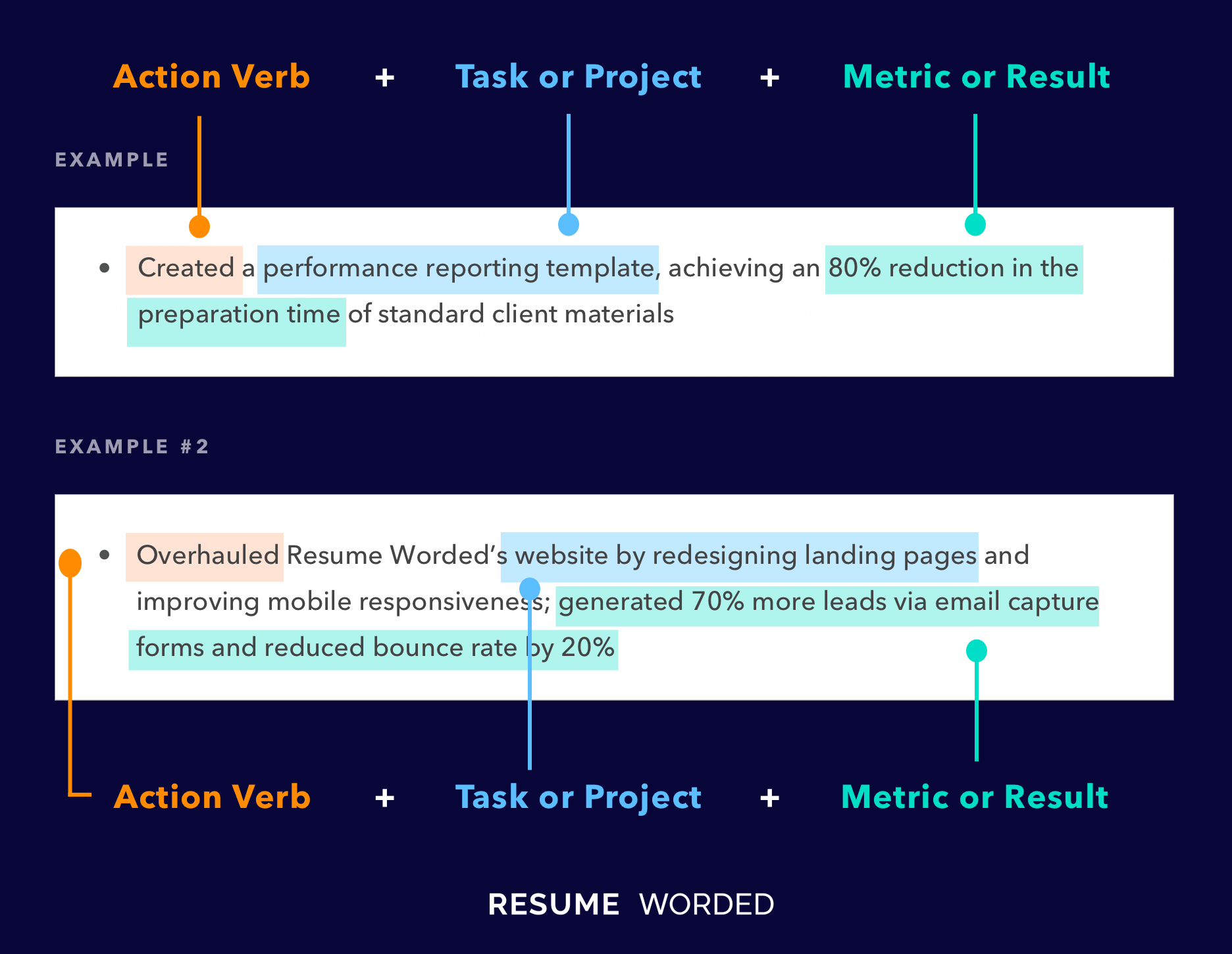

1. Quantify your achievements with metrics

When describing your past roles, don't just list your responsibilities. Instead, focus on the results you achieved and quantify them with metrics whenever possible. This will give hiring managers a clear picture of the value you can bring to their organization.

Here are some examples of how to incorporate metrics into your bullet points:

- Grew client base by 25% in 2 years by implementing targeted marketing campaigns and leveraging referral network

- Managed portfolio of 150+ clients with $50M+ in total assets under management

- Increased average client account size by 30% through strategic financial planning and investment recommendations

If you don't have access to specific metrics, you can still use numbers to convey the scope of your work, like this:

- Conducted 50+ client meetings per month to review financial plans and investment strategies

Not sure if your bullet points are showcasing your achievements effectively? Try running your resume through Score My Resume . It will analyze your resume based on criteria hiring managers care about and give you actionable tips to improve it.

2. Highlight your client management skills

As a financial advisor, your ability to attract and retain clients is crucial to your success. Make sure your work experience section showcases your client management skills and the strategies you've used to build strong relationships.

Instead of simply stating that you "managed client relationships," provide specific examples of how you did it:

- Managed client relationships and provided financial advice

A more effective bullet point would look like this:

- Built and maintained relationships with high-net-worth individuals through regular communication, in-depth financial planning sessions, and personalized investment strategies

Other ways to highlight your client management skills include mentioning client retention rates, client satisfaction scores, or specific feedback you received from clients.

Remember, the key is to focus on the actions you took and the results you achieved. Use strong, industry-specific verbs like "advised," "recommended," "analyzed," and "implemented" to make your bullet points more impactful.

3. Showcase your expertise with industry-specific tools

Financial advisors use a variety of tools and technologies to analyze investments, create financial plans, and manage client portfolios. Mentioning your proficiency with these tools can help you stand out from other candidates and demonstrate your industry expertise.

Utilized Bloomberg Terminal to monitor market trends, analyze investment opportunities, and make data-driven recommendations to clients

Other industry-specific tools you may want to mention include:

- CRM software (e.g., Salesforce, Redtail)

- Financial planning software (e.g., MoneyGuidePro, eMoney Advisor)

- Portfolio management platforms (e.g., Morningstar, Envestnet)

When mentioning these tools, try to provide context around how you used them to drive results or improve processes.

Not sure if you're using the right keywords in your resume? Try running it through Targeted Resume . It will analyze your resume against a specific job description and highlight any missing skills or keywords, so you can tailor your resume for each application.

4. Demonstrate career progression and leadership

Hiring managers want to see that you've progressed in your career and taken on increasing levels of responsibility. If you've earned promotions or held leadership roles, make sure to highlight them in your work experience section.

One way to do this is by listing your positions in reverse-chronological order, with your most recent (and typically most senior) position at the top. For example:

XYZ Financial Services Senior Financial Advisor (2018-Present) - Led team of 5 junior advisors and provided mentorship and guidance to help them reach their goals - Managed $100M+ in client assets and consistently exceeded quarterly revenue targets Financial Advisor (2015-2018) - Built book of business from scratch and grew AUM to $50M+ within 3 years - Developed and implemented financial plans for 100+ clients

By showing your progression and highlighting your leadership experience, you demonstrate your ability to take on more responsibility and drive results at a higher level.

If you have a promotion on your resume, consider bolding your job titles to make your career progression stand out even more. Recruiters often scan for job titles first, so this can be an effective way to catch their attention.

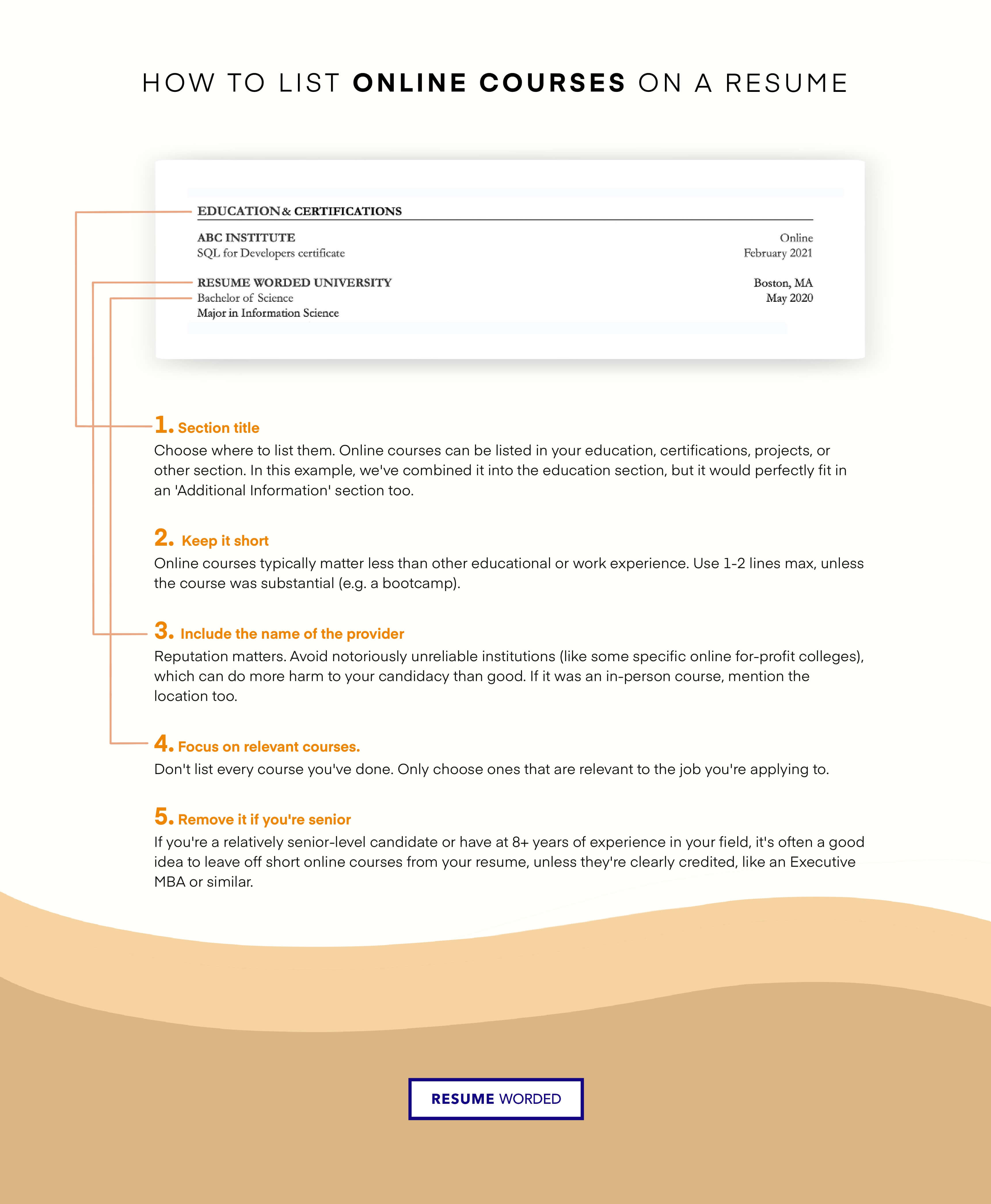

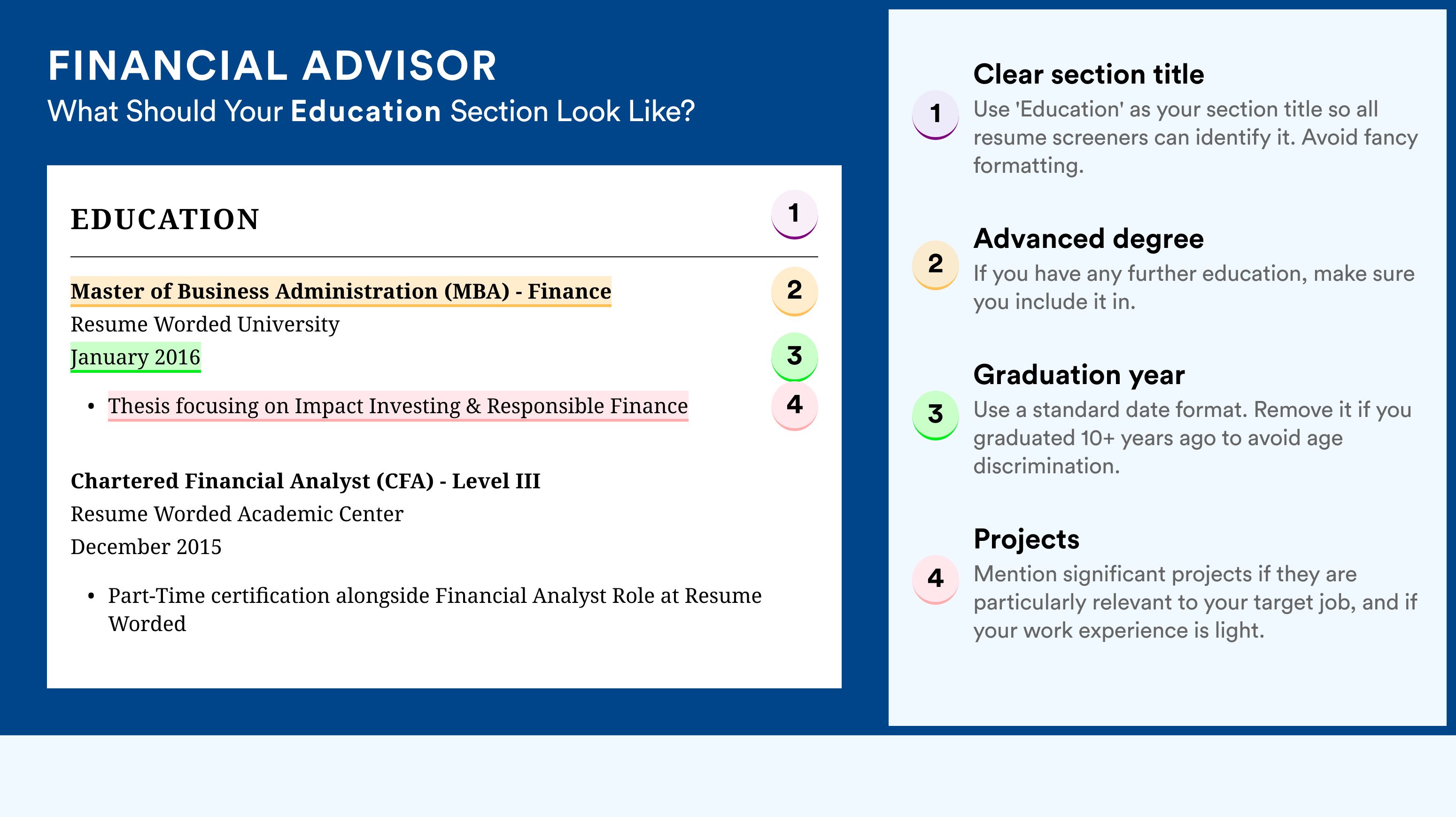

Education

Your education section is a crucial part of your financial advisor resume. It shows employers that you have the necessary knowledge and qualifications to succeed in the role. Here are some key tips to help you write a strong education section that will impress hiring managers.

1. List your degrees in reverse chronological order

Start with your most recent degree first, and work your way backwards. This helps employers quickly see your highest level of education.

Here's an example of how to list your degrees:

Master of Business Administration (MBA), XYZ University, 2018 Bachelor of Science in Finance, ABC College, 2014

2. Include relevant coursework and honors

If you're a recent graduate or have taken courses that are particularly relevant to financial advising, consider listing them under your degree. This can help show employers that you have specific knowledge and skills that will be valuable in the role.

- Relevant Coursework: Investment Analysis, Portfolio Management, Financial Planning

- Honors: Magna Cum Laude, Dean's List (Fall 2016, Spring 2017)

3. Keep it short and sweet for senior roles

If you are a senior financial advisor with years of experience, you don't need to go into great detail about your education. Employers will be more interested in your professional accomplishments.

A bad example would be:

Bachelor of Arts in Economics, XYZ University, 1985-1989 Relevant Coursework: Microeconomics, Macroeconomics, Statistics, Calculus Honors: Dean's List (Fall 1986, Spring 1988)

Instead, keep it concise like this:

B.A. Economics, XYZ University

Action Verbs For Financial Advisor Resumes

The action verbs on the left are among the most effective for the financial advisor field. Aim to utilize these action verbs at the beginning of your bullet points, which should each describe an accomplishment and include a numerical value for best effect. Don’t overuse any single verb, though where one is appropriate in multiple instances, it can help to reiterate it up to two times. Remember that financial advisors perform a spectrum of duties and try to indicate the breadth of your responsibilities when listing your accomplishments.

- Restructured

- Implemented

- Streamlined

For a full list of effective resume action verbs, visit Resume Action Verbs .

Action Verbs for Financial Advisor Resumes

Skills for financial advisor resumes.

While financial advisors perform a variety of tasks, hiring managers are looking for specific skills to be referenced in your resume. On the left, we’ve listed the most applicable skills for the financial advisor industry. As a financial advisor, part of your work may involve giving presentations to clients, meaning providing an initial summary may be called for. One way to incorporate your skills is to include a short summary at the top of your resume, as this both gives you the opportunity to highlight them and shows your aptitude for summarization. You should also include these skills in the body of your resume to help support your capacity as a financial advisor. Lastly, a skills bank that lists your technical skills and the tools you’re familiar with will complete the picture.

- Financial Analysis

- Financial Advisory

- Investments

- Financial Planning

- Financial Services

- Portfolio Management

Risk Management

- Business Development

- Corporate Finance

- Life Insurance

- Wealth Management

- Retirement Planning

- Retail Banking

- Business Strategy

- Strategic Planning

- Microsoft Access

- Customer Service

- Project Management

- Business Planning

- Marketing Strategy

How To Write Your Skills Section On a Financial Advisor Resumes

You can include the above skills in a dedicated Skills section on your resume, or weave them in your experience. Here's how you might create your dedicated skills section:

Skills Word Cloud For Financial Advisor Resumes

This word cloud highlights the important keywords that appear on Financial Advisor job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more 'important' it is.

How to use these skills?

Resume bullet points from financial advisor resumes.

You should use bullet points to describe your achievements in your Financial Advisor resume. Here are sample bullet points to help you get started:

Analyzed brand's pricing, advertising and distribution data and identified seasonal trends and white space by integrating consumer insights; recommended strategic changes in portfolio and marketing plan to C-suite executives, reversing sales slump (+6.5%)

Formulated implementation plans for transactions in collaboration with senior members of trading, sales, compliance and legal teams; generated annual profits of $10+ million

Built complete investment pitch books for 4 deals at advanced stages and liaised with 12 prospective international co-investors

Developed web scraping program in Python to help the firm download public data, including over 10,000 company descriptions and stock quotes, enriching internal data and increasing research efficiency by over 50%

Developed a sell-side ideas pitch book of acquisition targets for a ~$650MM bedding company

For more sample bullet points and details on how to write effective bullet points, see our articles on resume bullet points , how to quantify your resume and resume accomplishments .

Other Finance Resumes

C-level and executive.

Reporting Analyst

- Bookkeeper Resume Guide

- Investment Banking Resume Guide

- Financial Analyst Resume Guide

- Accountant Resume Guide

- Equity Research Resume Guide

- C-Level and Executive Resume Guide

Financial Advisor Resume Guide

- Procurement Resume Guide

- Auditor Resume Guide

- Financial Controller Resume Guide

- Risk Management Resume Guide

- Accounts Payable Resume Guide

- Internal Audit Resume Guide

- Purchasing Manager Resume Guide

- Loan Processor Resume Guide

- Finance Director Resume Guide

- Credit Analyst Resume Guide

- Collections Specialist Resume Guide

- Finance Executive Resume Guide

- VP of Finance Resume Guide

- Claims Adjuster Resume Guide

- Payroll Specialist Resume Guide

- Cost Analyst Resume Guide

- M&A Resume Guide

- Financial Advisor Resume Example

- Financial Aid Advisor Resume Example

- Entry Level Financial Advisor Resume Example

- Portfolio Manager Resume Example

- Tips for Financial Advisor Resumes

- Skills and Keywords to Add

- Sample Bullet Points from Top Resumes

- All Resume Examples

- Financial Advisor CV Examples

- Financial Advisor Cover Letter

- Financial Advisor Interview Guide

- Explore Alternative and Similar Careers

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 8 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 8 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

3 Financial Advisor Resume Examples Working for 2024

Financial Advisor Resume

Financial aid advisor resume.

- Entry Level Financial Advisor Resume

- Write Your Financial Advisor Resume

You’re passionate about helping others succeed financially. Investments are strategized, financial assessments are completed, and insurance plans are recommended successfully with you as an advisor.

Are you in need of some guidance to make a cover letter and a top-notch resume?

While you can easily manage a portfolio of accounts, creating a stellar one-page resume that blows hiring managers away can feel more challenging. That’s why we’ve created our financial advisor resume examples to help guide you to success.

or download as PDF

Why this resume works

- Your financial advisor resume doesn’t need to start with a finance job either. A customer service representative will work just fine as long as you show your contribution to improving customer satisfaction. Remember to mention how you’ve made regional and international trades to highlight your expertise in understanding global economics and trade.

- Handling funds in an investment company can differ vastly from a university, hence, ensure that you state every aspect of not just providing returns on a portfolio or disbursing scholarship funds, but also guiding students in general for their future education.

Entry-Level Financial Advisor Resume

- Even if it’s only as a presenter or researcher, mention how you’ve used skills like FactSet and eMoney Advisor to gain financial insights and help others make investment strategies. Finish things off with an actual work experience where you’ve interacted with customers in any way.

Related resume examples

- Finance manager

- Financial analyst

- Investment banking

- Loan officer

Tailor Your Financial Advisor Resume for Each Job’s Description

If you were planning an investment strategy for a client, you’d want to understand their current and future financial needs to achieve the right goals. You’ll also want to account for each company’s specific needs while writing your resume.

Start by reviewing the job description to identify the qualifications each company is seeking. Is a company trying to improve its pricing strategy? Then, your abilities in market analysis and forecasting will be important to emphasize. Take a similar tailored approach to each resume you submit.

Need some ideas?

15 best financial advisor skills

- Risk Management

- Pricing Strategies

- Forecasting

- Market Analysis

- Morningstar Direct

- Portfolio Management

- Financial Modeling

- Investopedia

- Retirement Planning

- Asset Management

- Client Relations

- Equity Analysis

Your financial advisor work experience bullet points

When a business or client puts their money in your hands, they’ll want to know you’ll achieve positive results.

The best way for financial advisors to optimize for success is by including actionable bullet points describing previous work achievements. Each example should be backed by a number, such as how you boosted ROI, to showcase the exact impact you had.

Here are some excellent metrics for financial advisors to use.

- Portfolio growth: One of the most significant signs of success for advisors is growing client portfolios with optimal investments and management year over year.

- Portfolio volatility: The more you reduce risk, the better chance companies or clients will want to work with you.

- Report accuracy: The data you gather during market analysis is crucial to making informed monetary decisions, so showcasing accuracy is always a great idea.

- Client retention: It’s unlikely clients stay with a financial advisor who isn’t getting them great results, so showcasing how you create a great experience for them will stand out.

See what we mean?

- Conducted 2,413 risk tolerance assessments with Riskalyze, tailoring regional investment strategies to align with client expectations, reducing portfolio volatility by 3.9%.

- Designed 62 custom financial models, each addressing unique client needs and leading to a 14% increase in client investment commitments.

- Forecasted IT costs for the university with the help of Clear Cost, maintaining a 96% accuracy on all reports.

- Integrated Wealthbox to improve customer profiling, allowing other representatives to decrease turnaround times by 17 minutes.

9 active verbs to start your financial advisor work experience bullet points

3 tips to write an impactful financial advisor resume without much experience.

- While completing an economics, finance, or related degree, you likely achieved much that contributed to your skill set. Therefore, listing achievements like how you used Tableau to reach 65% more effective conclusions during a financial forecasting project will help you stand out.

- Even if you haven’t worked in a financial advisory role, other jobs will still have transferable skills. For example, you could write about the cash handling and accurate account management skills you gained as a bank teller.

- Your hobbies & interests can also show relevant abilities for inexperienced financial advisors. For example, you could write about how you volunteered for a homeless shelter for two years and optimized spending to provide more blankets and beds for those in need.

3 Tips to Bolster Your Financial Advisor Resume When You’re Experienced

- You’re probably very passionate about what your financial work accomplishes. However, keeping these examples to relevant one-sentence descriptions is still important to allow hiring managers to easily pick up on your key financial modeling and analysis skills.

- Financial processes are always being updated with new GAAP standards and changes in the market. Therefore, listing your most recent experiences first is essential to showcase how you optimize for compliance and portfolio growth based on today’s needs.

- It can be easy to have your resume get disorganized when you have a lot of portfolio and asset management experience. Using a well-spaced resume template with clear headers and an easily readable 12-14 point font will ensure your top achievements, like decreasing investment risks by 32%, grab attention.

Think of your resume like you’re presenting a few key market indicators to supervisors after analysis. To make decisions easy, you’ll want to limit your resume to three or four jobs that are most recent and relevant to your current risk analysis and asset management skills.

A resume objective works well when you don’t have much financial advisory experience. For example, you could write about how you’ll apply your two years of experience as a data entry associate to ensure client portfolio data is managed accurately.

Aim to connect your cover letter to the company’s mission and how your top financial advisory skills fit in. For example, while applying to a retirement planning firm, you could write about how you have a deep passion for using your investment planning and wealth management skills to help others achieve a healthy and happy financial future.

Financial Advisor Job Description [Updated for 2024]

In the modern world of finance, the role of a financial advisor has become incredibly significant.

As the financial landscape evolves, the demand for skilled professionals who can navigate, enhance, and secure our financial future grows ever greater.

But let’s delve deeper: What’s truly expected from a financial advisor?

Whether you are:

- A job seeker trying to grasp the core of this role,

- A hiring manager drafting the perfect candidate profile,

- Or simply fascinated by the intricacies of financial advising,

You’ve landed on the right page.

Today, we present a customizable financial advisor job description template, designed for effortless posting on job boards or career sites.

Let’s dive right into it.

Financial Advisor Duties and Responsibilities

Financial Advisors provide clients with expertise and advice on financial matters, making recommendations for ways to best utilize their money.

The role involves researching the marketplace and advising clients on products and services available, ensuring they are aware of and understand those that best meet their needs.

They have the following duties and responsibilities:

- Assess the financial needs of individuals and help them with decisions on investments (such as stocks and bonds), tax laws, and insurance decisions

- Provide strategic advice across a variety of financial products and services (debt management, cash management, insurance coverage, investments)

- Plan for the short and long term financial goals of their clients

- Assist clients in making informed decisions about their money and investments

- Monitor clients’ accounts and determine if changes are needed to improve account performance or accommodate life changes, such as getting married or having children

- Guide clients through financial self-analysis, including goal setting and advice to reach those goals

- Research and present new investment strategies and opportunities

- Manage and update client portfolios in response to life changes or economic trends

- Comply with all industry rules and regulations

- Monitor economic and financial trends to ensure they are providing the best advice and services to the client.

Financial Advisor Job Description Template

We are seeking a skilled Financial Advisor to provide financial guidance to clients in order to help them accomplish their financial goals.

The responsibilities of the Financial Advisor include assessing the financial needs of individuals, providing sound financial advice, and guiding clients on short and long-term investment opportunities.

The ideal candidate has a solid understanding of financial planning strategies, tax laws, and investment opportunities.

Responsibilities

- Assess client’s overall financial picture, understand their needs and develop a solid financial plan

- Guide clients towards a profitable and secure financial decision

- Keep abreast of new industry’s trends and research market to back up financial consulting

- Oversee the course of the financial plan and update it, if necessary, to ensure profits

- Liaise with providers, solicitors, valuers, and other professionals

Qualifications

- Proven work experience as a Financial Advisor, Financial Planner or similar role

- Ability to analyze market’s financial data and to provide appropriate data-based advice

- Strong communication skills

- A strong sense of discretion and confidentiality

- Professional certification (e.g. CFP) is a plus

- BSc degree in Finance, Accounting or relevant field

- Health insurance

- Dental insurance

- Retirement plan

- Paid time off

- Professional development opportunities

Additional Information

- Job Title: Financial Advisor

- Work Environment: Office setting with options for remote work. Some travel may be required for client consultations.

- Reporting Structure: Reports to the Financial Services Manager.

- Salary: Salary is based upon candidate experience and qualifications, as well as market and business considerations.

- Pay Range: $60,000 minimum to $120,000 maximum

- Location: [City, State] (specify the location or indicate if remote)

- Employment Type: Full-time

- Equal Opportunity Statement: We are an equal opportunity employer and value diversity at our company. We do not discriminate on the basis of race, religion, color, national origin, gender, sexual orientation, age, marital status, veteran status, or disability status.

- Application Instructions: Please submit your resume and a cover letter outlining your qualifications and experience to [email address or application portal].

What Does a Financial Advisor Do?

Financial Advisors work for individuals, businesses, or organizations, providing expert advice on how to manage their finances effectively.

They can also operate as independent consultants.

They analyze their client’s financial situation, including income, expenses, investments, insurance, and long-term goals to develop a comprehensive financial plan.

Their job includes educating clients about various investment options and potential risks, and advising them on current or future market trends.

Financial Advisors help clients implement their financial plan and regularly review and adjust it to accommodate life changes or shifting financial goals.

They may also specialize in areas such as retirement planning, estate planning, or risk management.

They are responsible for building and maintaining client relationships, understanding their financial goals and needs, and providing tailored advice to help them achieve those goals.

In addition to these roles, they are also expected to stay updated on economic and financial news and regulations.

Financial Advisor Qualifications and Skills

Financial Advisors should possess a blend of technical knowledge, interpersonal skills, and industry expertise to provide clients with sound financial guidance, including:

- Strong financial and analytical skills to assess financial data, recognize trends and devise tailored strategies for clients.

- Excellent communication skills to explain complex financial concepts to clients in simple, clear terms and to ensure they understand the financial plans or products being proposed.

- Superb interpersonal skills to build trust with clients and foster long-term relationships.

- Proficiency in financial planning software and tools to aid in the analysis of financial situations and the development of financial plans.

- Problem-solving abilities to identify financial challenges or issues that a client may be facing and devise appropriate solutions.

- Ethical judgement and high levels of integrity to handle sensitive financial information and provide honest and ethical advice to clients.

- A thorough understanding of the financial market, including investment products, insurance, retirement planning, tax laws, and more.

Financial Advisor Experience Requirements

Financial advisors typically begin their career paths with a bachelor’s degree in a finance-related field.

Entry-level financial advisor candidates may have 1 to 2 years of experience, typically gained through internships or part-time roles in financial planning or investment firms.

Those who’ve been in the industry for more than 3 years are often seasoned professionals who have honed their skills in roles such as Financial Analyst, Investment Associate, or other finance-related positions.

Financial advisors with more than 5 years of experience often have a well-established clientele and a track record of successful financial planning.

They may have also taken on leadership roles, supervising junior advisors or even managing a team.

Many firms require their financial advisors to hold specific certifications, such as the Certified Financial Planner (CFP) designation, which further attests to their expertise and experience.

Apart from these, financial advisors also need to have a deep understanding of financial laws and regulations, excellent communication skills, and the ability to build strong relationships with clients.

They also need to keep abreast of the latest trends and developments in finance to provide the best advice to their clients.

Financial Advisor Education and Training Requirements

Financial Advisors typically have a bachelor’s degree in finance, economics, business, or a related field.

They must have a strong understanding of financial laws, tax regulations, and financial planning principles.

It is also important for them to be familiar with different types of investment products and strategies, such as mutual funds, stocks, bonds, and real estate investments.

Many employers prefer Financial Advisors to have a master’s degree in finance or a related field, particularly for more senior roles.

Some Financial Advisors may also pursue a Doctor of Business Administration (DBA) degree to further specialize in financial management.

In addition to their degree, Financial Advisors are often required to obtain licenses or certifications, such as the Certified Financial Planner (CFP) certification or the Chartered Financial Analyst (CFA) designation.

These certifications require passing exams and meeting certain experience and ethical requirements.

Continuing education is also important for Financial Advisors, as it allows them to stay up-to-date with changes in financial laws and regulations, as well as new investment products and strategies.

Many Financial Advisors also attend professional development seminars and workshops to improve their skills and knowledge.

Prior to providing financial advice, Financial Advisors may need to register with regulatory bodies, depending on the services they provide and the jurisdiction in which they operate.

This often includes passing a comprehensive examination and fulfilling ongoing education requirements.

Financial Advisor Salary Expectations

A Financial Advisor earns an average salary of $88,890 (USD) per year.

The actual earnings can vary based on factors such as years of experience, specific skills, certifications, location, and the company employing the advisor.

Financial Advisor Job Description FAQs

What skills does a financial advisor need.

Financial Advisors should possess strong analytical, mathematical, and problem-solving skills.

They should be able to assess a client’s financial situation and provide effective solutions to meet their financial goals.

Excellent interpersonal and communication skills are also crucial, as they deal with clients on a regular basis.

Familiarity with financial planning software and understanding of financial laws and regulations are also necessary.

Do Financial Advisors need a degree?

Financial Advisors typically need a bachelor’s degree in finance, economics, business, or a related field.

However, higher-level positions may require a master’s degree in business administration (MBA) or finance.

Additionally, they need to get licensed and certified which usually require passing certain exams.

What should you look for in a Financial Advisor resume?

A Financial Advisor’s resume should highlight their education in finance or a related field, and any relevant certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

Look for experience in financial planning, investment management, and customer service.

Additionally, their resume should demonstrate strong analytical, problem-solving, and communication skills.

What qualities make a good Financial Advisor?

A good Financial Advisor is trustworthy and demonstrates a high level of integrity as they will be handling sensitive financial information.

They should be patient and have excellent listening skills to understand clients’ financial needs and goals.

A good Financial Advisor is also proactive, staying updated with the latest financial trends and market conditions.

Is it difficult to hire Financial Advisors?

Hiring Financial Advisors can be challenging due to the specific skills and certifications required for the role.

Additionally, because they handle sensitive financial matters, it’s crucial to find someone trustworthy with a strong track record.

However, with a clear job description, competitive compensation, and a thorough interview process, it’s possible to find a good fit for the role.

And there you have it.

Today, we’ve demystified what it really means to be a financial advisor .

It’s not just about managing money.

It’s about shaping financial futures, one investment strategy at a time.

With our comprehensive financial advisor job description template and real-world examples, you’re all set to make your mark.

But why stop there?

Take the plunge with our job description generator . It’s your next step towards crafting impeccable job listings or refining your resume to brilliance.

Every financial decision is a step towards a secure future.

Let’s shape that future. Together.

Reasons to Become a Financial Advisor (Conquer the Cash Chess!)

How to Become a Financial Advisor (Complete Guide)

Disadvantages of Being a Financial Advisor (Stressful Stock Situations)

Job Trendsetters: The Most Popular Careers of the Moment

The Eccentric Economy: Exploring the World’s Weirdest Jobs

AI’s Incomplete Reach: Jobs That Rely on Human Depth

Stressful Beyond Words: Jobs That Challenge Every Fiber!

The Editorial Team at InterviewGuy.com is composed of certified interview coaches, seasoned HR professionals, and industry insiders. With decades of collective expertise and access to an unparalleled database of interview questions, we are dedicated to empowering job seekers. Our content meets real-time industry demands, ensuring readers receive timely, accurate, and actionable advice. We value our readers' insights and encourage feedback, corrections, and questions to maintain the highest level of accuracy and relevance.

Similar Posts

![financial advisor job description for resume Agriculture Equipment Operator Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/03/agriculture-equipment-operator-job-description-768x512.webp)

Agriculture Equipment Operator Job Description [Updated for 2024]

![financial advisor job description for resume Biologist Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/biologist-job-description-768x512.webp)

Biologist Job Description [Updated for 2024]

![financial advisor job description for resume 3D Application Support Specialist Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/03/3d-application-support-specialist-job-description-768x512.webp)

3D Application Support Specialist Job Description [Updated for 2024]

![financial advisor job description for resume Criminal Analyst Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/criminal-analyst-job-description-768x512.webp)

Criminal Analyst Job Description [Updated for 2024]

![financial advisor job description for resume Operations Specialist Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/operations-specialist-job-description-768x512.webp)

Operations Specialist Job Description [Updated for 2024]

![financial advisor job description for resume Mental Health Technician Job Description [Updated for 2024]](https://interviewguy.com/wp-content/uploads/2024/02/mental-health-technician-job-description-768x512.webp)

Mental Health Technician Job Description [Updated for 2024]

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Job Descriptions

- Banking and Financial Services Job Descriptions

Financial Advisor Job Description

Financial advisors advise clients on investments, taxes, estate planning, college savings accounts, insurance, mortgages, and retirement. They are also known as personal financial advisors, financial planners, financial advisers, financial service advisors, and investment advisers.

Try Betterteam

Post your jobs to 100+ job boards

- Reach over 250 million candidates.

- Get candidates in hours, not days.

Financial Advisor Job Description Template

We are looking to hire a financial advisor to join our team. You will spend your day talking to clients about their financial objectives and risk tolerance and then recommend an appropriate financial planning strategy. To excel in this tightly regulated role you should already have the appropriate licenses and deep knowledge of all the latest financial products on the market.

Financial Advisor Responsibilities:

- Talking to clients to determine their expenses, income, insurance coverage, financial objectives, tax status, risk tolerance, or other information needed to develop a financial plan.

- Answering client questions about financial plans and strategies and giving financial advice.

- Advising strategies for clients in insurance coverage, investment planning, cash management, and other areas to help them reach financial objectives.

- Reviewing client accounts and plans on a regular basis to understand if life or economic changes, situational concerns, or financial performance necessitate changes in their plan.

- Analyzing financial data received from clients to develop strategies for meeting clients' financial goals.

- Preparing or interpreting financial document summaries, investment performance reports, and income projections for clients.

- Implementing financial plans or referring clients to professionals who can help them.

- Managing and updating client portfolios.

- Contacting clients regularly to discover changes in their financial status.

- Building and maintaining your client base.

Financial Advisor Requirements:

- Bachelor's degree in business, finance, or related field.

- 1-2 years of sales experience.

- Must have current FINRA Series 7 and 63 Securities Registration (66 or 65 preferred).

- Life and health license.

- Valid driver’s license.

- Knowledge of mutual funds, securities, and insurance industries.

- Proficient in Word, Excel, Outlook, and PowerPoint.

- Comfortable using a computer for various tasks.

- Experience providing quality financial advice.

Related Articles:

Financial advisor interview questions, financial manager job description, financial manager interview questions, financial analyst job description, financial analyst interview questions.

- Career Blog

Financial Advisor: Job Description, Salary, and Skills

As we navigate through life, we inevitably come across crucial moments where our financial health is at stake. Whether it’s buying a home, planning for retirement, or simply building a rainy day fund, it’s essential to have sound financial advice.

This is where financial advisors come in. A financial advisor is a professional who assists clients in managing their finances through various financial products and services.

Definition of financial advisor

A financial advisor is a person who offers financial guidance to clients. This may include investment advice, insurance planning, retirement planning, tax planning, and other financial services. Financial advisors may work independently or as part of a firm.

Importance of financial advisors

Financial advisors play a vital role in helping individuals manage their finances. They provide valuable expertise and guidance, which can help clients make informed decisions about their money. Financial advisors can also help clients create and implement a long-term financial plan, which can lead to greater financial stability and security.

Target audience

This article is intended for anyone exploring a career in financial advising or looking to hire a financial advisor. Whether you are a recent graduate, mid-career professional, or retiree, this article will provide valuable insights and information about the world of financial advising.

We also hope that this article will be useful for individuals seeking guidance from a financial advisor. By understanding the job description, salary, and required skills of a financial advisor, clients can make more informed decisions about the type of advisor they wish to work with and the services they need.

Job Description of a Financial Advisor

A financial advisor is a professional who helps individuals and organizations make informed decisions about their financial investments. Financial advisors work with clients to create a customized financial plan that meets their specific needs and goals. They provide financial advice and guidance in areas such as investments, retirement planning, tax management, and estate planning.

Duties and Responsibilities

The primary duties and responsibilities of a financial advisor include:

- Conducting financial analysis and assessing clients’ financial goals, risk tolerance, and investment preferences

- Developing a personalized financial plan that meets clients’ objectives

- Recommending investment portfolios, including stocks, bonds, and mutual funds

- Providing guidance on tax implications and strategies to minimize taxes

- Monitoring and adjusting clients’ investment portfolios to ensure they remain aligned with their financial objectives and risk tolerance

- Educating clients on financial planning principles and investment strategies

- Maintaining records of clients’ financial plans and investment portfolios

Qualifications

To become a financial advisor, candidates should possess the following qualifications:

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Knowledge of financial planning principles and investment strategies

- Familiarity with investment products, such as stocks, bonds, and mutual funds

Education and Training Requirements

Most financial advisors hold a bachelor’s degree in finance, accounting, economics, or a related field. In addition to a degree, financial advisors typically complete training and professional development courses to stay abreast of financial trends and regulations. Continuing education courses are also required in many states to maintain professional licenses and certifications.

Certifications and Licenses

Financial advisors must hold certain licenses and certifications to practice. These include:

- Series 7: This license enables financial advisors to sell securities products such as stocks, bonds, and mutual funds.

- Series 65 or Series 66: These licenses allow financial advisors to provide investment advice and manage client assets.

- Certified Financial Planner (CFP): This certification demonstrates expertise in financial planning, including retirement planning, tax management, and estate planning.

- Chartered Financial Analyst (CFA): This certification indicates advanced expertise in investment analysis and portfolio management.

A career as a financial advisor can be rewarding, challenging, and financially lucrative. However, the job requires strong communication skills, knowledge of financial planning principles, and the ability to build strong client relationships. It also requires obtaining the relevant licenses and certifications, as well as ongoing education and training to stay current with financial trends and regulations.

Types of Financial Advisors

When it comes to managing finances and investments, there are different types of financial advisors you can seek assistance. Here are the three most common types of financial advisors:

Independent Financial Advisor

As the name suggests, an independent financial advisor (IFA) is someone who operates independently of any financial institution. They have the freedom to offer clients a broad range of financial products and services without being tied to a specific company or brand. This means that IFAs can give impartial advice to clients based on their unique financial situation and objectives.

IFAs usually work on a fee-only basis, which means they earn their income through charging clients for their services. They can provide various services such as financial planning, investment management, retirement planning, tax planning, and estate planning. An IFA must hold the necessary licenses and certifications to work independently.

Broker-Dealer Personal Financial Advisor

A broker-dealer personal financial advisor is someone who works for a brokerage firm or a bank. They help clients purchase and sell securities such as stocks, bonds, and mutual funds. They earn commissions on the securities sold to clients. Broker-dealers also offer financial planning services and can provide advice on investments, retirement planning, and estate planning.

Broker-dealer personal financial advisors are regulated by the Financial Industry Regulatory Authority (FINRA). They must pass exams and hold necessary licenses to operate.

Insurance Personal Financial Advisor

An insurance personal financial advisor provides advice on insurance-related matters such as life, health, and disability insurance. They can also offer advice on long-term care insurance and annuities. Many insurance advisors are professionals who work on behalf of insurance companies or brokerage firms. They earn commissions on the insurance policies sold to clients.

An insurance personal financial advisor must hold the necessary licenses to operate. They may also hold additional licenses to offer financial planning services and investment advice.

The type of financial advisor that works best for you may depend on your needs and preferences. It is important to find an advisor who is qualified and experienced in the areas you need help with. Whether you choose an independent financial advisor, broker-dealer personal financial advisor, or insurance personal financial advisor, they can help you manage your finances and achieve your financial goals.

Career Opportunities

As a financial advisor, there are a wide range of career opportunities available, each with their own unique set of job duties and responsibilities.

Job Outlook and Growth Projections

The job outlook for financial advisors is quite positive, with the Bureau of Labor Statistics projecting a 15% growth rate for the profession between 2016 and 2026. This growth is largely due to an aging population and the increasing need for retirement planning and long-term financial management.

Furthermore, with the rise of digital technologies, online financial planning services are becoming more popular, allowing advisors to reach a wider client base and work more efficiently.

Areas of Specialization

Financial advisors may choose to specialize in a particular area of finance, such as retirement planning, estate planning, tax planning, or investment management. Specializing in a specific area can allow advisors to provide more tailored services to their clients and develop a stronger reputation in their field.

Another area of specialization is working with specific types of clients, such as high-net-worth individuals, small business owners, or young families. By focusing on a specific clientele, advisors can build expertise in the unique financial challenges and goals that these clients face.

Salary Information

Financial advisors can earn a very competitive salary, with the median annual salary for the profession being around $89,160 according to the Bureau of Labor Statistics. This varies depending on a variety of factors, such as experience, location, and the type of clients or specialties served.

In addition to base salary, financial advisors may also receive bonuses, commissions, or performance-based incentives based on meeting certain targets or exceeding client expectations.

Financial advising can be a highly rewarding career with a positive job outlook and potential for growth and specialization. However, it does require a strong skill set and a commitment to ongoing learning and development in order to provide the best possible services to clients.

Essential Skills of a Financial Advisor

To be a successful financial advisor, one must possess a combination of essential skills. These critical skills will enable them to provide high-quality financial advice and services to their clients. Here are the five essential skills:

Communication skills

Effective communication is essential in the financial advisory field. Financial advisors must be able to communicate complex financial information clearly and concisely to their clients. This communication should be in language clients can understand, and the advisor should be able to explain the implications of the financial advice. Financial advisors must also be great listeners to understand their clients’ specific financial needs.

Analytical skills

Analytical skills involve the interpretation and evaluation of financial data, such as investment performance, ratios, and market trends. Financial advisors must be able to analyze and interpret financial information to provide valuable insights to their clients. These skills enable an advisor to determine which investments and products are suitable for each client and develop a customized financial plan.

Sales skills

Financial advisors need strong sales skills to grow their business and market their services effectively. They must be able to communicate their value proposition, provide compelling advice, and build trust with their clients. They also need to keep up to date with trends and changes in the financial industry to provide suitable advice.

Time-management skills