Challenges, Prospects and Role of Insurance on Economic Growth in Bangladesh

IIUM Journal of Case Studies in Management: Vol.11, No.1: 20-27, 2020

8 Pages Posted: 6 Apr 2020

Mohammad Ali

Bangladesh University of Professionals

Date Written: March 11, 2020

This paper aims to review the role of insurance on economic growth and to analyse challenges and prospects of insurance sector in Bangladesh. Based on the secondary data, this research critically reviews the previous studies to find the contribution of insurance on economic growth and prospects as well as challenges of insurance sector in the context of Bangladesh. Insurance has significant contribution on economic growth of a country that facilitates to create a strong capital base and gain economic independency. The study found that the key problems of this sector are deficiency of publicity, lack of qualified human resource, dearth of marketing policies, absence of business ethics, legal complexities, unskilled agents, poor IT support, insufficient return on investment, lack of transparency, lack of public awareness and traditional management. Therefore, initiating innovative marketing strategies, attracting and retaining talent, developing talent, increasing awareness, adapting information technology (IT), avoiding harmful competition, increasing return on investment, offering diversifies and attracting packages, adapting dynamic management style and implementing effective insurance policy are suggested to overcome the challenges of this sector.

Keywords: Insurance, economic growth, prospects, challenges and Bangladesh

JEL Classification: G22

Suggested Citation: Suggested Citation

Mohammad Ali (Contact Author)

Bangladesh university of professionals ( email ).

Mirpur-12 Cantonment 463 Dhaka, Dhaka 1216 Bangladesh

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, economic growth ejournal.

Subscribe to this fee journal for more curated articles on this topic

Development Economics: Macroeconomic Issues in Developing Economies eJournal

Emerging markets economics: macroeconomic issues & challenges ejournal, political economy - development: domestic development strategies ejournal.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Existing Insurance Laws of Bangladesh: Challenges & Ways out

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Investigative Stories

- Entertainment

- Life & Living

- Tech & Startup

- Rising Star

- Star Literature

- Daily Star Books

- Roundtables

- Star Holiday

- weekend read

- Environment

- Supplements

- Brand Stories

- Law & Our Rights

Most Viewed

GTV newsroom editor’s body recovered from Hatirjheel Lake

Enforced disappearance: Govt sets up inquiry commission

Justice Zubayer Rahman Chowdhury appointed BJSC chairman

Modi’s 2021 visit: 200 sued for killing madrasa student in Ctg

Why the insurance sector of Bangladesh needs reshaping

The contribution of the insurance sector to the GDP is measured by a ratio popularly known as penetration ratio – a ratio of premium to GDP. The penetration ratio in Bangladesh, currently at only 0.46 percent, is very low compared to the global standards. Lack of awareness about insurance is often stated as the reason behind the meagre penetration ratio, but there are many other addressable issues in the sector.

Bangladesh has 81 insurance companies, of which 35 companies deal with life insurance and 46 with non-life insurance. The question about whether our economy needs so many insurance companies is moot. The answer is a no, and it's a no-brainer. India, for example, has only 57 insurance companies, and Malaysia has only 25. Allowing such a large number of insurance companies to operate in Bangladesh was completely unjustified. A good number of companies were given licences based on political considerations; they were permitted not because they were needed for the economy, but because they were beneficial to some influential people. If an economy has more insurance companies than it needs, companies are bound to perform poorly and resort to anomalies due to undue competition.

For all latest news, follow The Daily Star's Google News channel.

The progress of a country's insurance sector can be understood by looking at its claim settlement ratio. This ratio refers to the percentage of claims that the insurance company settles in a year compared to the total number of claims received. If the ratio is high, it means more claims have been settled. So, what are the claim settlement ratios of the insurance companies in Bangladesh?

Historical data show that it was about 54 percent in 1973-1990, which rose to nearly 73 percent during 1991-08, and to 78 percent during 2009-2019. However, this rate dropped dramatically to 68 percent in 2021 from 88 percent in 2020. In contrast, the global claim settlement ratio is 98 percent on average. Even in India, the average claim settlement ratio is 98 percent. One could argue that the recent deterioration of this ratio in Bangladesh may be due to the pandemic. But what about the historical low settlement ratios?

Many factors can be attributed to such low claim settlement ratios. There are allegations that insurers delay the settlement of claims when some policies mature. In some cases, if clients are not influential, their claims are not settled properly. A large number of insurance companies have to compete for the same number of clients with almost similar products and services. Some companies fail to invest their funds appropriately to generate the required return, while other companies face investment losses. Besides, corruption, financial irregularities and embezzlement in some companies resulted in a serious liquidity crisis. The regulatory authority has repeatedly failed to ensure the accountability of such companies; lack of monitoring and supervision allows them to continue operating with many anomalies.

Furthermore, the lack of professionalism of agents has created a negative mindset towards the entire sector. Incomplete information is often provided by agents to policyholders. In many cases, policyholders do not look at the terms and conditions of policies; rather they depend on what the agents say. In such cases, the agents can exaggerate the benefits of policies. When the policies mature, the policyholders find a huge gap between the promise and the reality.

On the other hand, the rising income inequality has kept a large proportion of the population outside insurance coverage. A paradoxical situation has emerged in the country: the rich have the ability to manage risks personally and have insurance policies. But the poor who face many risks do not have insurance policies that can be attributed not only to the lack of awareness, but also to the economic factors creating their inability to buy the policies.

There is also a mismatch between the demand for and supply of the products and services. Before launching any product, there should be a survey on prospective customers so that the supplier can understand its latent demand and design it accordingly. But in our country, most of the time, products and services are launched without serious market investigation.

The negligence to the overall sector is evident from the setting up of the Insurance Development and Regulatory Authority (IDRA) only in 2010, although this sector has been operating in the country in parallel with the banking sector since independence. The IDRA does not have an adequate workforce to regulate the insurance sector properly. In addition, there is also doubt about its autonomy in taking corrective measures against the insurance companies involved in various irregularities and financial scams.

But the insurance market is crucial for sustaining the country's economic growth. To utilise this opportunity, the lack of trust and irregularities in this sector has to be mitigated. Timely claim settlements are a must-do to create trust. It is also crucial to design diversified products and services according to the customers' demand. The liquidity constraint has to be minimised by prudential use of funds. The regulatory authority needs to monitor the insurance companies rigorously and punish companies that break the law. Such actions will also create a ripple effect, and pressurise other companies to work within the regulatory framework.

Dr Md Main Uddin is professor and former chairman of the Department of Banking and Insurance at the University of Dhaka. He can be reached at [email protected]

গুমবিরোধী আন্তর্জাতিক সনদে যুক্ত হলো বাংলাদেশ

গুমবিরোধী আন্তর্জাতিক সনদে যুক্ত হয়েছে বাংলাদেশ। অন্তর্বর্তী সরকারের প্রধান উপদেষ্টা অধ্যাপক ইউনূস আজ বৃহস্পতিবার এই সনদে সই করেছেন।

আরও ৫ দিনের রিমান্ডে সালমান এফ রহমান ও আনিসুল হক

Insurance in Bangladesh

Life insurance

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money (the “benefits”) upon the death of the insured person. Depending on the contract, other events such as terminal illness or critical illness may also trigger payment. The policy holder typically pays a premium, either regularly or as a lump sum. Other expenses (such as funeral expenses) are also sometimes included in the benefits.

There is a difference between the insured and the policy owner, although the owner and the insured are often the same person. For example, if Joe buys a policy on his own life, he is both the owner and the insured. But if Jane, his wife, buys a policy on Joe’s life, she is the owner and he is the insured. The policy owner is the guarantor and he will be the person to pay for the policy. The insured is a participant in the contract, but not necessarily a party to it. Also, most companies allow the payer and owner to be different, e. g. a grandparent paying premiums for a policy on a child, owned by a grandchild.

The beneficiary receives policy proceeds upon the insured person’s death. The owner designates the beneficiary, but the beneficiary is not a party to the policy. The owner can change the beneficiary unless the policy has an irrevocable beneficiary designation. If a policy has an irrevocable beneficiary, any beneficiary changes, policy assignments, or cash value borrowing would require the agreement of the original beneficiary.

Death proceeds

Upon the insured’s death, the insurer requires acceptable proof of death before it pays the claim. The normal minimum proof required is a death certificate, and the insurer’s claim form completed, signed (and typically notarized). [ citation needed ] If the insured’s death is suspicious and the policy amount is large, the insurer may investigate the circumstances surrounding the death before deciding whether it has an obligation to pay the claim.

Payment from the policy may be as a lump sum or as an annuity, which is paid in regular installments for either a specified period or for the beneficiary’s lifetime.

- Age and gender of policy holder

- Medical history/pre-existing conditions (you fill in form, but many companies also use database of Medical Information Bureau)

- Family medical history (For instance, did your parents have a history of heart disease or cancer?)

- Results of medical exam (various tests usually required for higher amounts of insurance; the higher the value the more stringent the criteria). Typical tests include:

Property Insurance

Homeowner insurance protects the owner financially from losses and liability.

Homeowners need insurance because it protects them from costly liability lawsuits, covers them in the event of weather- or fire-related damage to their homes, and pays for losses sustained from theft. When a homeowner owes money on his home, he needs to have insurance to protect both himself and the lender. Homeowners whose homes are completely paid for also carry insurance to protect themselves financially.

Personal Property Coverage

While not required by the lender, personal property coverage is frequently part of a policy. Homeowners need to document their possessions, with receipts, video or photographs, and keep the records in a safe place. Making several paper or DVD copies and distributing them among friends or family who do not live in the house is a good way to safeguard the record of personal property. Most hazard insurance policies will not cover expensive jewelry, art, or musical instruments except as riders to the policy. Before many insurance companies will accept the value of the item, they may require an appraisal of the item by a professional. Some homeowners’ insurance policies do not cover business equipment located in the home; just as with jewelry or art, the insurer may require a rider for items that are used in a home office like copiers, faxes and computers.

- Construction type of dwelling (frame, brick, masonry, EIFS, etc.) and size

- Age of dwelling and condition; age or renovation date of systems within structure such as plumbing, electrical, furnace, roof

- Location of dwelling/property

- Proximity to local fire protection

- Presence of safety features (smoke detectors/fire alarm system, security system, sprinklers, etc.)

Factors of Insurance

1. Utmost Good Faith

The Principle of Utmost Good Faith , is a very basic and first primary principle of insurance. According to this principle, the insurance contract must be signed by both parties (i.e insurer and insured) in an absolute good faith or belief or trust.

2. Insurable Interest

The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance. A person has an insurable interest when the physical existence of the insured object gives him some gain but its non-existence will give him a loss. In simple words, the insured person must suffer some financial loss by the damage of the insured object.

3. Indemnity

Indemnity means security, protection and compensation given against damage, loss or injury. According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. Insurance contract is not made for making profit else its sole purpose is to give compensation in case of any damage or loss.

4. Contribution

Principle of Contribution is a corollary of the principle of indemnity. It applies to all contracts of indemnity, if the insured has taken out more than one policy on the same subject matter. According to this principle, the insured can claim the compensation only to the extent of actual loss either from all insurers or from any one insurer. If one insurer pays full compensation then that insurer can claim proportionate claim from the other insurers.

5. Subrogation

Subrogation means substituting one creditor for another. Principle of Subrogation is an extension and another corollary of the principle of indemnity. It also applies to all contracts of indemnity. According to the principle of subrogation, when the insured is compensated for the losses due to damage to his insured property, then the ownership right of such property shifts to the insurer.

6. Loss Minimizatio

According to the Principle of Loss Minimization, insured must always try his level best to minimize the loss of his insured property, in case of uncertain events like a fire outbreak or blast, etc. The insured must take all possible measures and necessary steps to control and reduce the losses in such a scenario. The insured must not neglect and behave irresponsibly during such events just because the property is insured. Hence it is a responsibility of the insured to protect his insured property and avoid further losses.

7. Causa Proxima (Nearest Cause)

Principle of Causa Proxima (a Latin phrase), or in simple english words, the Principle of Proximate (i.e Nearest) Cause, means when a loss is caused by more than one causes, the proximate or the nearest or the closest cause should be taken into consideration to decide the liability of the insurer.

Definition of Reserves Insurance

A stated amount or percent of liquid assets that an insurer must have on hand that will satisfy all claims from in-force insurance policies and other outstanding liabilities. Reserve limits are established by state regulatory agencies which calculate reserves as a percent of the total present value of in-force insurance less the present value of future premiums to be received plus interest.

Definition of Premium Insurance

An insurance premium is the amount of money charged by a company for active coverage. The sum a person pays in premiums, also referred to as the rate, is determined by several factors, including age, health, and the area a person lives in. People pay these rates annually or in smaller payments over the course of the year, and the amount can change over time. When insurance premiums are not paid, the policy is typically considered void and companies will not honor claims against it.

Reinsurance

Reinsurance is insurance that is purchased by an insurance company (the “ceding company” or “cedant” or “cedent” under the arrangement) from one or more other insurance companies (the “reinsurer”) as a means of risk management, sometimes in practice including tax mitigation and other reasons described below. The ceding company and the reinsurer enter into a reinsurance agreement which details the conditions upon which the reinsurer would pay a share of the claims incurred by the ceding company. The reinsurer is paid a “reinsurance premium” by the ceding company, which issues insurance policies to its own policyholders.

The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company.

Evaluation is a systematic determination of a subject’s merit, worth and significance, using criteria governed by a set of standards. It can assist an organization to assess any aim, realizable concept or proposal, or any alternative, to help in decision-making; or to ascertain the degree of achievement or value in regard to the aim and objectives and results of any such action that has been completed.

Bangladesh Insurance Academy

Bangladesh Insurance Academy (BIA) established in 1973 in Dhaka by the government of Bangladesh to impart training to Insurance professionals and others taking up insurance as a career. It is an autonomous body attached to the ministry of commerce. The management of the academy is vested in a board of governors formed by the government. The academy conducts various training programmers for personnel in the insurance industry, arranges seminars, symposiums and conferences on issues relating to the insurance business. The academy started functioning in early 1974 with 12 employees.

In the same year, the academy got affiliated with the Chartered Institute of Insurance in London and started conducting coaching classes for the institute’s ACII programmed at its campus in Dhaka. On behalf of the Chartered Institute of Insurance, the academy conducted examinations for Bangladeshi candidates for ACII certificate. Between 1974 and 1977, the academy offered a total of 17 training courses, of which 8 were on life insurance, while the rest were on general insurance with 437 and 232 participants respectively from Jiban Bima Corporation and Sadharan Bima Corporation. These were the only two state-owned insurance corporations in Bangladesh until 1984, when the government of Bangladesh promulgated the Insurance (Amendment) Ordinance 1984 and Insurance Corporations (Amendment) Ordinance 1984 and allowed private insurance companies to operate with the primary objective of improving the services of insurance and developing a competitive spirit for the benefit of the insuring community. Participants in the academy’s training courses were mainly from those corporations. A few were from Bangladesh shipping corporation and some universities and they came to study for the ACII programmer run by the Chartered Institute of Insurance of London.

Define and Discuss on Consumption

Report on Loan Policies of Standard Bank Limited (Part-3)

Assignment on SWOT Analysis and Target Market Analysis of Radio Foorti

Compare between Investment Appraisal

Annual Report 2008 of MCB Bank Limited

Define and Discuss on Factoring Polynomials

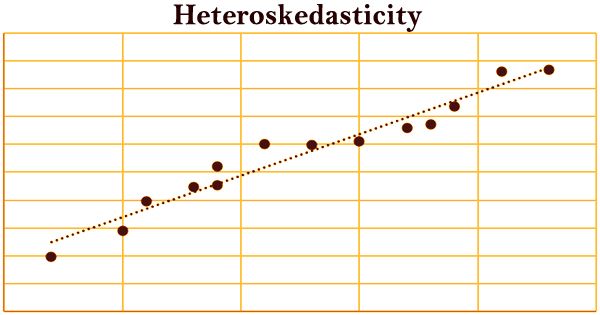

Heteroskedasticity

Scar Tissue is Monitored by an AI-Enabled Soft Robotic Implant so it can Self-Adapt for Individualized Drug Therapy

A Lack of Transparencies Hampers the Inability to Prioritize Funds for Environmental Protection about the Costs of Conservation Projects

Studies Connect COVID-19 to the Sale of Wildlife at Chinese Markets and Find that Alternative Scenarios are Highly Improbable

Latest post.

Terbium Nitride – a binary inorganic compound

Diet and Exercise help prevent type 2 Diabetes, even in persons with a High Genetic Risk

Influenza Viruses can employ two Methods to Infect Cells

Barium Hydride

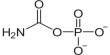

Carbamoyl Phosphate

New Research Set to Change approaches to Recognizing and Treating Acute Leukemia in Children

- Investigative Stories

- Entertainment

- Life & Living

- Tech & Startup

- Rising Star

- Star Literature

- Daily Star Books

- Roundtables

- Star Holiday

- weekend read

- Environment

- Supplements

- Brand Stories

- Law & Our Rights

National Insurance Day 2024

Most Viewed

GTV newsroom editor’s body recovered from Hatirjheel Lake

Enforced disappearance: Govt sets up inquiry commission

Justice Zubayer Rahman Chowdhury appointed BJSC chairman

Modi’s 2021 visit: 200 sued for killing madrasa student in Ctg

Bangladesh’s Insurance Landscape: Progress and Prospects

In 1972, Bangladesh nationalized its insurance industry through the Bangladesh Insurance (Nationalization) Order 1972, excepting postal life and foreign life insurance. All 49 insurance entities were placed under five corporations. Subsequently, the Insurance Corporations Act 1973 restructured this into two entities: Sadharan Bima Corporation for general business and Jiban Bima Corporation for life business. However, in 1984, the Government amended the Insurance Act of 1938 and the Insurance Corporation Act of 1973 to allow private insurance companies to conduct insurance business.

Over time, Bangladesh's insurance sector has witnessed significant growth. According to the latest data from the Insurance Development and Regulatory Authority (IDRA), the country hosts 81 insurance companies, comprising 35 life insurance firms and 46 non-life insurance entities. These insurers collectively provide coverage to approximately 18.97 million individuals across various policies.

For all latest news, follow The Daily Star's Google News channel.

In the life insurance sector, leading companies by market share include MetLife (American Life Insurance Company) at 27.10%, National Life Insurance Company Limited at 14.10%, Delta Life Insurance Company at 7.43%, Jiban Bima Corporation at 6.69%, and Popular Life Insurance Limited at 5.93%.

In the non-life insurance sector, prominent companies with the largest market share are Sadharan Bima Corporation at 11.03%, Green Delta Insurance Company Limited at 9.12%, Reliance Insurance Limited at 7.63%, Pioneer Insurance Company Limited at 6.52%, and Pragati Insurance Limited at 5.60%.

The insurance industry has witnessed a significant increase in the assets of both life and non-life insurance companies. By the end of 2022, the collective total assets of insurance companies rose to Tk 63,629.05 crores, marking a notable increase of 3.34% from the previous year's Tk 61,571.87 crores. Additionally, the investment amount for 2022 reached Tk 46,484.32 crores, reflecting a growth of 1.15% compared to the previous year.

Despite the promising outlook for Bangladesh's insurance sector, driven by economic expansion, rapid industrialization, increased per capita income, and improved life expectancy, overall insurance penetration remains low. Currently, the insurance penetration ratio stands at a mere 0.5 percent, significantly below global standards and trailing behind neighboring countries such as India (4.0), Sri Lanka (1.2), and Pakistan (0.8).

Industry insiders recognize specific reasons for the low penetration of insurance products and sluggish growth of the industry, including trust issues, a shortage of institutionally trained insurance professionals, and a lack of effective awareness programs.

Professor M. Muzahidul Islam from the Department of Banking and Insurance at the University of Dhaka points out, "Many companies show reluctance in settling claims for their customers once their products mature. Consequently, people harbor a lack of trust in genuinely benefiting from any insurance schemes."

He further underscores the critical necessity for modernization in the insurance sector, emphasizing that companies must take proactive measures to address existing issues of distrust. This includes initiatives to attract new policyholders while simultaneously ensuring the satisfaction of current consumers through the provision of dynamic and responsive services.

Shamima Nasrin, Vice President at Prime Insurance Co. Ltd., observes, "People perceive paying premiums over a specific period as an unnecessary expense if they don't experience any casualties in their lives or properties. Consequently, the number of policyholders remains significantly low in Bangladesh. However, people must recognize that insurance ensures economic certainty in the future."

Experts believe that incorporating the importance of insurance into educational curricula can alleviate the existing lack of awareness about it.

"Our curriculum lacks any emphasis on insurance as one of the fundamental services in our lives. We are essentially a nation with low insurance literacy. In our financial culture, insurance is perceived as less significant compared to the banking sector. Workers in insurance companies are often under-remunerated in contrast to those in banks. IDRA is not consistently active in inspecting all private insurance companies." Professor Islam adds.

Furthermore, as Bangladesh undergoes consistent economic and social development, there is a need for a corresponding evolution in risk management planning, predominantly in the insurance sector.

Istiaque Mahmud, Head of Bancassurance at Guardian Life Insurance, notes, "Our previous national economic challenges and ingrained social belief systems contribute to the lag in insurance penetration in Bangladesh. Continuous economic growth is pivotal; it can lead people towards sustainability and enable them to afford insurance products."

Additionally, the absence of a dedicated training center for the proper education of insurers leaves companies reliant on agents, who, in many instances, do not remain faithful to either the policyholders or their respective companies due to their informal and sporadic work arrangements.

Beyond the imperative awareness-building process to extend the reach of insurance to a broader audience, the government must play a crucial role in overseeing the sector. This oversight is essential for establishing transparent monitoring processes that create a win-win situation for both clients and companies.

"There exists a deficiency in transparency within the management of insurance entities, and it is crucial for the regulatory authority in the insurance sector to be active and dynamic," expresses Prof. Dr. Md. Rafiqul Islam from the Department of Banking and Insurance at the Faculty of Business Studies, University of Dhaka. He emphasizes the need for increased awareness among policyholders about the terms and conditions of insurance products, advocating for informed decisions when purchasing from reputable companies to fully understand the benefits of their chosen insurance products.

The government established the Insurance Development and Regulatory Authority (IDRA) in 2011 to oversee the insurance business and protect the interests of policyholders. In case of claim disputes, policyholders now have the option to file complaints with IDRA. In response to such complaints, IDRA has the authority to settle claims, with the limit increased to 5 lakh takas for life insurance customers and up to 20 lakh takas for general insurance (non-life) customers, respectively. This elevated settlement threshold, achieved without resorting to court proceedings, is considered a noteworthy step in favor of customers.

Furthermore, IDRA has recently issued instructions mandating that insurance companies must resolve any customer complaints within a maximum period of 30 days.

In a recent development, the Bangladesh Bank and the Insurance Development Regulatory Authority introduced Bancassurance agreements and accompanying guidelines in December,2023, indicating a potential transformation in the traditional insurance landscape in Bangladesh. Both banking and insurance industry experts foresee that banks, owing to their extensive trust and vast micro-level networks, could bring about substantial positive changes through collaboration with the insurance sector, thereby impacting the overall economy significantly.

গুমবিরোধী আন্তর্জাতিক সনদে যুক্ত হলো বাংলাদেশ

গুমবিরোধী আন্তর্জাতিক সনদে যুক্ত হয়েছে বাংলাদেশ। অন্তর্বর্তী সরকারের প্রধান উপদেষ্টা অধ্যাপক ইউনূস আজ বৃহস্পতিবার এই সনদে সই করেছেন।

আরও ৫ দিনের রিমান্ডে সালমান এফ রহমান ও আনিসুল হক

COMMENTS

Bangladesh's, insurance market is not very large compared to the degree of risk. For a. better functioning of the insurance industry and to attain good growth of this sector, it. is w orthwhil e ...

Insurance in Bangladesh assignment - Free download as PDF File (.pdf), Text File (.txt) or read online for free. This document provides an overview of the insurance industry in Bangladesh. It begins with an introduction to insurance and defines it as a legal contract plus associated services. It then discusses the industry overview including the history of nationalization and privatization.

A person or institution who receives insurance service is called insured or policy holder (Al-amin, 2016). Insurance is an element of monetary part that can be signified play an important role inorder to the growth of economy as well as sharing and caring the burden of a community or country. (Mall, 2018).

According to a sigma report of the Swiss Re Institute, as of 2017, the gross premium volume of life insurance in Bangladesh stands at USD 974 million and that of non-life stands at USD 371 million.3 Figure 1 depicts the year-on-year growth. Life insurance constitutes 73.5% of Bangladesh's insurance market and non-life insurance, 26.5%.4.

Reflecting the rapid growth of the national economy, Bangladesh insurance (both life and general) market continues to make steady growth both in depth and dimension despite reduction in business activities due to global recession coupled with drastic fall in commodity prices. The premium income of all types of insurance companies in 1999 was Tk ...

Insurance Sector of Bangladesh Assignment - Free download as PDF File (.pdf), Text File (.txt) or read online for free. This document provides an overview of the insurance industry in Bangladesh. It begins with definitions of insurance and the insurance industry. It then discusses the historical background of insurance in Bangladesh, including that insurance began under British rule in India ...

Bangladesh Insurance Academy (BIA), and the country's two state-owned insurance corporations—Sadharan Bima Corporation (SBC) and Jiban Bima Corporation (JBC)— through modernizing their systems and business practices. It will also help increase the coverage of insurance to provide protection for people's life and property.

A strong recovery from the COVID-19 pandemic continued in 2022-23, although a recent surge in commodity prices, scarcity of dollar reserves prompting a new financial market crisis have presented new challenges for the government and the economy of Bangladesh. The insurance industry of Bangladesh also had a good start in the beginning of 2023.

Abstract: This paper analyzed the financial performance of the general insurance companies of Bangladesh over the period 2003-2020 by studying 18 general insurance companies out of 46 (including the only government owned company Sadharan Bima Corporation, SBC).

Based on the secondary data, this research critically reviews the previous studies to find the contribution of insurance on economic growth and prospects as well as challenges of insurance sector in the context of Bangladesh. Insurance has significant contribution on economic growth of a country that facilitates to create a strong capital base ...

insurance policy. The main constraint in the development of insurance industry. in Bangladesh is the lack of risk awareness, financial inability etc. In. Bangladesh, there is a greater degree of ...

By the end of 2022, the collective total assets of insurance companies rose to Tk 63,629.05 crores, marking a notable increase of 3.34% from the previous year's Tk 61,571.87 crores. Additionally ...

Therefore, with the motivation to provide a comprehensive overview of the financial health of the general insurance industry in Bangladesh, we have done secondary research on a total of 18 general ...

Prominent among them is the Bangladesh Insurance Association (formed on 25 May 1988) having 30members. It aims at promoting, supporting and protecting the interests and welfare of the member companies. Another example is Bangladesh insurance academy. Surveyors and insurance agents occupy a prominent position in the insurance market of Bangladesh.

So, what are the claim settlement ratios of the insurance companies in Bangladesh? Historical data show that it was about 54 percent in 1973-1990, which rose to nearly 73 percent during 1991-08 ...

The Parliament of Bangladesh on 3 March 2010 has passed two insurance laws in a bid to further strengthen the regulatory framework for the insurance industry. The new laws came into effect on 18 March 2010, are the Insurance Act 2010 and IDRA Act 2010. A total of 81 insurance companies have been operating in the country.

Course Learning Outcomes: CLO 1. Able to have an understanding of major issues related to insurance business. CLO 2. Know about the overview of insurance industry in Bangladesh. CLO 3. Explore about basics of risk management. CLO 4. Know about Life insurance, Fire insurance, Marine Insurance.

However, in the context of Bangladesh, past studies addressed the problems and prospects of the insurance business (e.g., Mamun, 2013; Khan & Uddin, 2013), as well as the ethical standards of the ...

Insurance Act 2010 english version - Free download as PDF File (.pdf), Text File (.txt) or read online for free. This document is a notification from the Government of Bangladesh Ministry of Finance regarding the Insurance Act of 2010. It announces the publication of the authentic English text of the Insurance Act, 2010, which will come into effect on the date specified in the Act.

Bangladesh Insurance Academy (BIA) established in 1973 in Dhaka by the government of Bangladesh to impart training to Insurance professionals and others taking up insurance as a career. It is an autonomous body attached to the ministry of commerce. The management of the academy is vested in a board of governors formed by the government.

Additionally, the investment amount for 2022 reached Tk 46,484.32 crores, reflecting a growth of 1.15% compared to the previous year. Despite the promising outlook for Bangladesh's insurance sector, driven by economic expansion, rapid industrialization, increased per capita income, and improved life expectancy, overall insurance penetration ...

(c) a statutory insurance company formed under the law of any country outside Bangladesh not being of the nature of a private company or a subsidiary of a private company. (2) No mutual insurance company shall transact a non-life insurance business under this Act. 5. Classification of insurance business. (1) For thre purposes of this Act,