- International edition

- Australia edition

- Europe edition

Why do physicists gravitate towards jobs in finance?

O f those who will be graduating with degrees in physics this year, around a half will go on to further study (doing a PhD is the most popular option). Perhaps surprisingly, of the other half, around one-fifth will soon be starting work in the financial sector. According to a report published last year by the Institute of Physics , of those in employment one year after graduation, a job in "finance" was second only in popularity to a job in "education". Trailing behind those two are jobs in "scientific and technical industries", in "government" and in "energy and the environment". Furthermore, many of those who stay on to PhD level and beyond eventually leave academia to work in the financial sector, often at senior levels in investment banks.

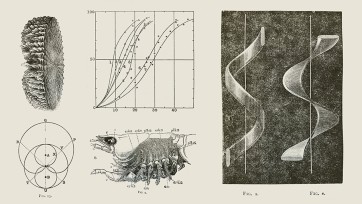

Then again, perhaps it is not surprising that so many physicists wind up working in finance. After all, they are good at using mathematics to solve real-world problems and the money is good. There is more to it than that though. There are mathematical links between physics and finance that go back at least to 1900, when Frenchman Louis Bachelier wrote his Theory of Speculation , in which he used the mathematics of a random walk to analyse fluctuations on the Paris stock exchange. Five years later, the same ideas were used by a young Albert Einstein to explain why pollen grains zigzag when they are suspended in water. His explanation invoked the idea that very large numbers of tiny molecules, much smaller than the pollen grains, are responsible for kicking the grains around. This was a crucial insight and provided one of the earliest convincing confirmations of the existence of atoms. To make the parallel with the financial markets, we might say that stock prices are kicked around by myriad unknown factors in the marketplace. Today, these ideas have been developed into a means of computing the value of sophisticated financial instruments and the management of risk.

As a particle physicist, I work with systems containing just a few particles and because the number of particles is not too great I can keep track of the ways they can interact with one another. Things rapidly spiral out of control whenever we try to study systems with a large number of components because it is then impossible to keep track of everything. Notice the generality of the language – we speak of "systems" and their "components". A simple system might be a gas, in which case the components would be the constituent molecules. Although we do not know what the individual molecules are doing, we can make statistical statements; we can speak of the average speed of a molecule or the average distance between a pair of molecules. Thinking about large collections of particles like this led the physicists of the 19th century to the field of statistical mechanics and to a precise understanding of what is meant by concepts such as "temperature" and "pressure". In the 1950s, understanding the statistical properties of electrons in semiconductors was exploited by physicists at Bell Telephone laboratories to invent the transistor, the tiny switch that is used to build the logic circuitry that underpins the operation of the microchip.

By backing away from the near-impossible challenge of understanding a complicated system in every detail, the strategy is instead to focus on the more modest goal of computing the odds that the system will behave in a particular way. Precisely the same ideas are used to model the financial markets, in which case the "system" could be the price of an asset and the "components" would then be the range of things that can influence its price. The most famous equation in finance was published in 1972 and is named after American economists Fischer Black and Myron Scholes. The Black-Scholes equation provided a means to value "European options", which is the right to buy or sell an asset at a specified time in the future. Remarkably, it is identical to the equation in physics that determines how pollen grains diffuse through water.

Intellectual connections such as these are why so many physicists are interested in problems in finance and, in part, why so many have been recruited into the financial sector. It also helps that physicists tend to be good at computer modelling and working with large data sets.

The March 2013 edition of Nature Physics was devoted to the latest academic research into the links between physics and finance. Much of this is in the emerging area of "complex networks", which aims to describe the behaviour of systems containing a number of interconnected discrete elements. Complex networks are known to have a very wide range of applicability: a biological cell can be viewed as a network of chemicals linked through chemical reactions; the world wide web is a network of webpages connected by hyperlinks; and food webs are used by ecologists to model the relationships between different species. Financial institutions collectively form a network and, by understanding the global properties of the network, it is possible to gain key insights into its function.

One such insight is that the greater diversification of risk might actually increase systemic risk, not decrease it, as one might naively think. The idea dates back to a short paper published in Nature way back in 1972 by former chief scientific adviser to the government Robert May, entitled "Will a large complex system be stable?". The paper was set in the context of population stability in ecological networks and, in simple terms, it is the idea that by complicating matters we increase the numbers of ways something can go wrong. Using networks, it also becomes possible to understand how the use of leverage by competing institutions can push a market network towards financial collapse and to assess which institutions are systemically important. It isn't just a case of being "too big to fail" – an institute's position within the network matters too.

The network idea brings together the analysis of many superficially very different systems. In the words of Andy Haldane, the executive director for financial stability at the Bank of England, speaking in 2009: "Seizures in the electricity grid, degradation of ecosystems, the spread of epidemics and the disintegration of the financial system – each is essentially a different branch of the same network family tree."

The recent financial crisis has highlighted the need to better understand how the global markets work. Theoretical developments in statistical physics and complex systems may be able to help.

- ... on science

- Financial sector

Comments (…)

Most viewed.

- Diversity & Inclusion

- Community Values

- Visiting MIT Physics

- People Directory

- Faculty Awards

- History of MIT Physics

- Policies and Procedures

- Departmental Committees

- Academic Programs Team

- Finance Team

- Meet the Academic Programs Team

- Prospective Students

- Requirements

- Employment Opportunities

- Research Opportunities

- Graduate Admissions

- Doctoral Guidelines

- Financial Support

- Graduate Student Resources

PhD in Physics, Statistics, and Data Science

- MIT LEAPS Program

- for Undergraduate Students

- for Graduate Students

- Mentoring Programs Info for Faculty

- Non-degree Programs

- Student Awards & Honors

- Astrophysics Observation, Instrumentation, and Experiment

- Astrophysics Theory

- Atomic Physics

- Condensed Matter Experiment

- Condensed Matter Theory

- High Energy and Particle Theory

- Nuclear Physics Experiment

- Particle Physics Experiment

- Quantum Gravity and Field Theory

- Quantum Information Science

- Strong Interactions and Nuclear Theory

- Center for Theoretical Physics

- Affiliated Labs & Centers

- Program Founder

- Competition

- Donor Profiles

- Patrons of Physics Fellows Society

- Giving Opportunties

- physics@mit Journal: Fall 2023 Edition

- Events Calendar

- Physics Colloquia

- Search for: Search

Many PhD students in the MIT Physics Department incorporate probability, statistics, computation, and data analysis into their research. These techniques are becoming increasingly important for both experimental and theoretical Physics research, with ever-growing datasets, more sophisticated physics simulations, and the development of cutting-edge machine learning tools. The Interdisciplinary Doctoral Program in Statistics (IDPS) is designed to provide students with the highest level of competency in 21st century statistics, enabling doctoral students across MIT to better integrate computation and data analysis into their PhD thesis research.

Admission to this program is restricted to students currently enrolled in the Physics doctoral program or another participating MIT doctoral program. In addition to satisfying all of the requirements of the Physics PhD, students take one subject each in probability, statistics, computation and statistics, and data analysis, as well as the Doctoral Seminar in Statistics, and they write a dissertation in Physics utilizing statistical methods. Graduates of the program will receive their doctoral degree in the field of “Physics, Statistics, and Data Science.”

Doctoral students in Physics may submit an Interdisciplinary PhD in Statistics Form between the end of their second semester and penultimate semester in their Physics program. The application must include an endorsement from the student’s advisor, an up-to-date CV, current transcript, and a 1-2 page statement of interest in Statistics and Data Science.

The statement of interest can be based on the student’s thesis proposal for the Physics Department, but it must demonstrate that statistical methods will be used in a substantial way in the proposed research. In their statement, applicants are encouraged to explain how specific statistical techniques would be applied in their research. Applicants should further highlight ways that their proposed research might advance the use of statistics and data science, both in their physics subfield and potentially in other disciplines. If the work is part of a larger collaborative effort, the applicant should focus on their personal contributions.

For access to the selection form or for further information, please contact the IDSS Academic Office at [email protected] .

Required Courses

Courses in this list that satisfy the Physics PhD degree requirements can count for both programs. Other similar or more advanced courses can count towards the “Computation & Statistics” and “Data Analysis” requirements, with permission from the program co-chairs. The IDS.190 requirement may be satisfied instead by IDS.955 Practical Experience in Data, Systems, and Society, if that experience exposes the student to a diverse set of topics in statistics and data science. Making this substitution requires permission from the program co-chairs prior to doing the practical experience.

- IDS.190 – Doctoral Seminar in Statistics and Data Science ( may be substituted by IDS.955 Practical Experience in Data, Systems and Society )

- 6.7700[J] Fundamentals of Probability or

- 18.675 – Theory of Probability

- 18.655 – Mathematical Statistics or

- 18.6501 – Fundamentals of Statistics or

- IDS.160[J] – Mathematical Statistics: A Non-Asymptotic Approach

- 6.C01/6.C51 – Modeling with Machine Learning: From Algorithms to Applications or

- 6.7810 Algorithms for Inference or

- 6.8610 (6.864) Advanced Natural Language Processing or

- 6.7900 (6.867) Machine Learning or

- 6.8710 (6.874) Computational Systems Biology: Deep Learning in the Life Sciences or

- 9.520[J] – Statistical Learning Theory and Applications or

- 16.940 – Numerical Methods for Stochastic Modeling and Inference or

- 18.337 – Numerical Computing and Interactive Software

- 8.316 – Data Science in Physics or

- 6.8300 (6.869) Advances in Computer Vision or

- 8.334 – Statistical Mechanics II or

- 8.371[J] – Quantum Information Science or

- 8.591[J] – Systems Biology or

- 8.592[J] – Statistical Physics in Biology or

- 8.942 – Cosmology or

- 9.583 – Functional MRI: Data Acquisition and Analysis or

- 16.456[J] – Biomedical Signal and Image Processing or

- 18.367 – Waves and Imaging or

- IDS.131[J] – Statistics, Computation, and Applications

Grade Policy

C, D, F, and O grades are unacceptable. Students should not earn more B grades than A grades, reflected by a PhysSDS GPA of ≥ 4.5. Students may be required to retake subjects graded B or lower, although generally one B grade will be tolerated.

Unless approved by the PhysSDS co-chairs, a minimum grade of B+ is required in all 12 unit courses, except IDS.190 (3 units) which requires a P grade.

Though not required, it is strongly encouraged for a member of the MIT Statistics and Data Science Center (SDSC) to serve on a student’s doctoral committee. This could be an SDSC member from the Physics department or from another field relevant to the proposed thesis research.

Thesis Proposal

All students must submit a thesis proposal using the standard Physics format. Dissertation research must involve the utilization of statistical methods in a substantial way.

PhysSDS Committee

- Jesse Thaler (co-chair)

- Mike Williams (co-chair)

- Isaac Chuang

- Janet Conrad

- William Detmold

- Philip Harris

- Jacqueline Hewitt

- Kiyoshi Masui

- Leonid Mirny

- Christoph Paus

- Phiala Shanahan

- Marin Soljačić

- Washington Taylor

- Max Tegmark

Can I satisfy the requirements with courses taken at Harvard?

Harvard CompSci 181 will count as the equivalent of MIT’s 6.867. For the status of other courses, please contact the program co-chairs.

Can a course count both for the Physics degree requirements and the PhysSDS requirements?

Yes, this is possible, as long as the courses are already on the approved list of requirements. E.g. 8.592 can count as a breadth requirement for a NUPAX student as well as a Data Analysis requirement for the PhysSDS degree.

If I have previous experience in Probability and/or Statistics, can I test out of these requirements?

These courses are required by all of the IDPS degrees. They are meant to ensure that all students obtaining an IDPS degree share the same solid grounding in these fundamentals, and to help build a community of IDPS students across the various disciplines. Only in exceptional cases might it be possible to substitute more advanced courses in these areas.

Can I substitute a similar or more advanced course for the PhysSDS requirements?

Yes, this is possible for the “computation and statistics” and “data analysis” requirements, with permission of program co-chairs. Substitutions for the “probability” and “statistics” requirements will only be granted in exceptional cases.

For Spring 2021, the following course has been approved as a substitution for the “computation and statistics” requirement: 18.408 (Theoretical Foundations for Deep Learning) .

The following course has been approved as a substitution for the “data analysis” requirement: 6.481 (Introduction to Statistical Data Analysis) .

Can I apply for the PhysSDS degree in my last semester at MIT?

No, you must apply no later than your penultimate semester.

What does it mean to use statistical methods in a “substantial way” in one’s thesis?

The ideal case is that one’s thesis advances statistics research independent of the Physics applications. Advancing the use of statistical methods in one’s subfield of Physics would also qualify. Applying well-established statistical methods in one’s thesis could qualify, if the application is central to the Physics result. In all cases, we expect the student to demonstrate mastery of statistics and data science.

- Follow us on Facebook

- Follow us on Twitter

- Follow us on LinkedIn

- Watch us on Youtube

- Latest Explore all the latest news and information on Physics World

- Research updates Keep track of the most exciting research breakthroughs and technology innovations

- News Stay informed about the latest developments that affect scientists in all parts of the world

- Features Take a deeper look at the emerging trends and key issues within the global scientific community

- Opinion and reviews Find out whether you agree with our expert commentators

- Interviews Discover the views of leading figures in the scientific community

- Analysis Discover the stories behind the headlines

- Blog Enjoy a more personal take on the key events in and around science

- Physics World Live

- Impact Explore the value of scientific research for industry, the economy and society

- Events Plan the meetings and conferences you want to attend with our comprehensive events calendar

- Innovation showcases A round-up of the latest innovation from our corporate partners

- Collections Explore special collections that bring together our best content on trending topics

- Artificial intelligence Explore the ways in which today’s world relies on AI, and ponder how this technology might shape the world of tomorrow

- #BlackInPhysics Celebrating Black physicists and revealing a more complete picture of what a physicist looks like

- Nanotechnology in action The challenges and opportunities of turning advances in nanotechnology into commercial products

- The Nobel Prize for Physics Explore the work of recent Nobel laureates, find out what happens behind the scenes, and discover some who were overlooked for the prize

- Revolutions in computing Find out how scientists are exploiting digital technologies to understand online behaviour and drive research progress

- The science and business of space Explore the latest trends and opportunities associated with designing, building, launching and exploiting space-based technologies

- Supercool physics Experiments that probe the exotic behaviour of matter at ultralow temperatures depend on the latest cryogenics technology

- Women in physics Celebrating women in physics and their contributions to the field

- Audio and video Explore the sights and sounds of the scientific world

- Podcasts Our regular conversations with inspiring figures from the scientific community

- Video Watch our specially filmed videos to get a different slant on the latest science

- Webinars Tune into online presentations that allow expert speakers to explain novel tools and applications

- IOP Publishing

- Enter e-mail address

- Show Enter password

- Remember me Forgot your password?

- Access more than 20 years of online content

- Manage which e-mail newsletters you want to receive

- Read about the big breakthroughs and innovations across 13 scientific topics

- Explore the key issues and trends within the global scientific community

- Choose which e-mail newsletters you want to receive

Reset your password

Please enter the e-mail address you used to register to reset your password

Registration complete

Thank you for registering with Physics World If you'd like to change your details at any time, please visit My account

- Environment and energy

Green jobs for physics graduates: finance and economics

With their mix of technical knowledge and problem-solving skills, physics graduates are ideally placed to tackle the world’s environmental challenges. In the fourth of a series of articles, Laura Hiscott speaks to three physicists who are doing their bit to build a greener, more sustainable future in the field of finance and economics

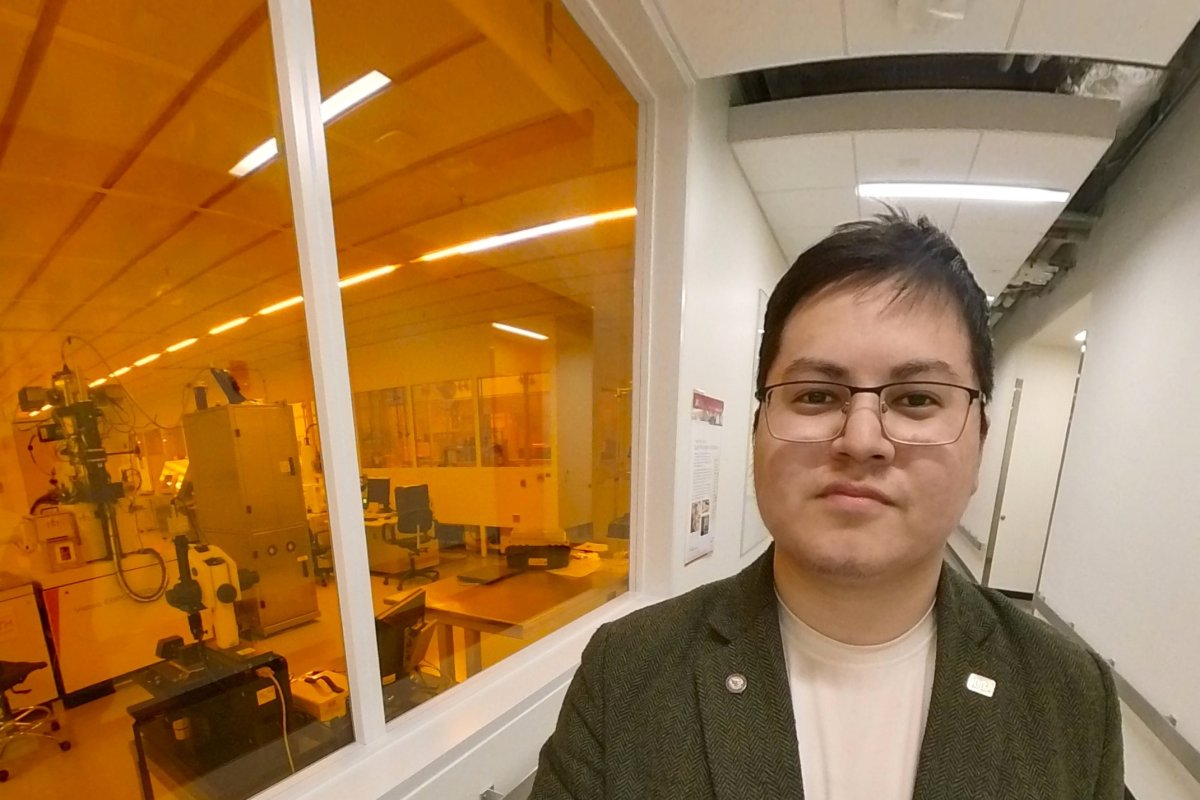

Rustam Majainah , senior pricing analyst, OVO

Green energy might appear to be all about feats of engineering, but integrating those breakthroughs into society involves many other challenges too, not least from a financial and economic point of view. This is another area where physicists can play a key role. Just ask Rustam Majainah, a physics graduate who now works as a pricing analyst at OVO , the UK’s largest independent energy supplier.

After studying physics at Royal Holloway , Majainah did a Master’s in renewable energy and sustainability at the University of Reading , UK. In the summer between his BSc and Master’s programme, he did a placement at the Chippenham-based renewable-energy company Good Energy , which he found through the South East Physics Network (SEPnet).

In his job at OVO, Majainah uses numerical models to determine the cost of energy. This involves considering many factors, including the cost of generation, the use of cables that bring the energy to people’s homes, and social levies such as the warm home discount, which supports vulnerable customers. “I think energy supply is often a forgotten part of the green transition,” says Majainah. “You’ve got the energy generators and networks on one side, and everyday people on the other, and energy suppliers sit in the middle and try to match them up.”

Majainah points out that it’s a time of change in the industry. “With the innovation of smart meters, we’re moving from a system where you give your supplier one reading per quarter to one where we can get that data at a half-hourly level,” he says. In moving to more granular charges, OVO can use that data to pass on savings to their customers if, for example, the wind is blowing and turbines are generating energy, or if electricity is cheap at certain times. More granular charges can also be used to “flatten” energy usage peaks by charging customers less for energy at quieter times, and part of Majainah’s role is looking at the wider policy around that.

“It’s a prickly point,” he explains, “because if energy is cheaper at some times and more expensive at others, how do you encourage customers to change their consumption patterns without unfairly impacting people who don’t have the flexibility to do that?” OVO also looks at kitting people’s homes out with electric vehicle chargers, using vehicle-to-grid technology that allows cars to export energy back into the grid when local demand increases.

All of these challenges require people with numerical and analytical skills, which a physics degree gives you a strong grounding in. Additionally, Majainah says that skills in data-analysis programming languages such as Python , which many physics degrees teach, are highly sought-after in the energy sector. “We’re going through big systems transitions,” he says, “so there are plenty of opportunities at OVO and in the industry in general.”

Flora Biggins , PhD student, University of Sheffield, UK

Since wind and solar energy depend on the weather, and are not necessarily being generated most at the times when consumers are using the most electricity, energy storage is a key component of embedding them in our networks. But developing this capacity requires financial investment.

Flora Biggins, a PhD student at the University of Sheffield , is working on incentivizing companies to make these investments. After graduating with a physics degree from Imperial College London , she decided she wanted to do research relating to sustainability. “I wanted to use my problem-solving skills to work on solutions to climate change, which is the biggest challenge we face,” she says, “and energy storage is really important for decarbonizing electricity.”

Biggins’ research involves creating computational models that use machine learning to predict how prices of energy-storage technologies such as batteries and green hydrogen will evolve over time. She can then use these predictions to advise companies on how to invest in order to maximize their profits, for example by buying the right kind of batteries, or by using batteries to store energy and then sell it on when prices are higher.

I wanted to use my problem-solving skills to work on solutions to climate change, which is the biggest challenge we face Flora Biggins

In addition to advising companies, Biggins’ work also informs policy. “If I find that energy storage is not very profitable, then it’s important for government organizations to know that,” she explains. “They might respond by introducing subsidies to encourage investment until prices drop to an affordable level.” Predicting future prices is very difficult, as there are numerous factors to consider that are constantly fluctuating. Future prices of green hydrogen are especially tricky to forecast, as it is relatively new, so doesn’t have much historical data to use as a starting point.

To tackle these challenges, the mathematical and computational skills Biggins developed during her physics degree are essential. Besides these technical skills, she says resilience is also necessary to keep going when things don’t go as planned, and she finds that having a positive solutions-focused project helps to motivate her. “It feels good to be working on something that is going to benefit society.”

Lewis Ashworth , programme manager, Institutional Investors Group on Climate Change

Many physics graduates go into careers in finance, which are another way of influencing how money is invested, and there are green options within this sector too. Lewis Ashworth, for example, is a programme manager at the Institutional Investors Group on Climate Change (IIGCC) – a membership body that supports shareholders to drive forward sustainability in the companies they invest in.

As part of his physics degree at the University of Sheffield, Ashworth did a year abroad at Monash University in Melbourne, Australia, during which he took courses in climate dynamics of the atmosphere and oceans alongside pure physics. “That opened my eyes to climate change,” he says, “so when I graduated I decided to do a sustainability-focused Master’s degree.”

Ashworth did an MSc course on environmental technology and energy policy at Imperial College London before starting his role at IIGCC. He now works on several projects, including an initiative called Climate Action 100+ , which seeks to ensure that the 167 largest greenhouse-gas-emitting companies in the world reduce their emissions to be in line with the goals of the Paris Agreement .

Other programmes that Ashworth works on include educating shareholders on how they can influence the companies they invest in, for example by filing shareholder resolutions or voting against directors. He is also helping to develop a benchmarking process to assess companies’ progress towards the goals of the Paris Agreement. This uses various indicators, such as whether the companies have set net-zero targets.

Green jobs for physics graduates: opportunities to help build a sustainable future

Ashworth regularly does presentations to colleagues and investors as part of his job, so communication skills are essential, alongside an understanding of the statistics and data that he is presenting. He finds his physics background gives him confidence in understanding the various topics he speaks about, from electric vehicles to using hydrogen to decarbonize the steel industry. “As a physicist, these are not alien concepts,” he says, “so it’s nice to feel confident in your ability to decipher what’s going on.”

One common challenge facing people like Ashworth who work in sustainability is that they have high aspirations for making change, but often face barriers and find progress to be slower than they would like. “But when something big happens,” he says, “like a company announcing that they are going to commit to a target that you have been pushing for, and you know you were part of it, that’s when you know you are really making a difference.”

Want to read more?

- E-mail Address

Getting physical with the climate crisis

- Medical physics

Proton arc therapy: do we need it; can we deliver it?

Discover more from physics world.

- Opinion and reviews

Why we still need a CERN for climate change

- Particle and nuclear

Peter Higgs: Nobel-prize-winning particle theorist dies aged 94

- Personalities

Keith Burnett: ‘I have this absolute commitment that the broader we are, the more powerful physics will be’

Related jobs, atmospheric earth and energy division leader, science program officer, heising-simons foundation, postdoctoral position: impacts of terrestrial climate change on the lunar orbit, univ of michigan, related events.

- Biophysics and bioengineering | Workshop Interdisciplinary challenges in non-equilibrium physics: from soft to active, biological and complex matter (IntCha24) 22—26 April 2024 | Dresden, Germany

- Quantum | Conference Quantum.Tech USA 24—26 April 2024 | Washington DC, US

- Medical physics | Virtual event Hybrid Symposium on "Radioresistance" 25 April 2024

The Science of Investment Banking: How to Use Your Physics Degree to Your Advantage

Discover how your physics degree can be an advantage in the world of investment banking.

Posted May 11, 2023

Table of Contents

Investment banking is rapidly growing as one of the most lucrative career paths for students in the field of science and mathematics. In particular, physics graduates have proved to be valuable assets to investment banks. In this article, we will explore why physics graduates are in demand in investment banking, and how you can use your knowledge of physics to your advantage in this industry.

Why Physics Graduates Are In-Demand in Investment Banking

Physics is a highly analytical and data-driven field. Physics graduates possess a unique skill set that includes advanced mathematical skills, an aptitude for problem solving, and a strong foundation in statistical analysis. These skills are highly sought after in the world of investment banking, where data is at the center of every decision that is made. Investment bankers use large sets of data to assess risks and make informed investment decisions. Physics graduates are well-versed in handling and analyzing data, which makes them valuable assets in investment banking.

Furthermore, physics graduates also have a strong understanding of complex systems and how they interact with each other. This knowledge is crucial in investment banking, where understanding the interconnectedness of various financial markets and industries is essential for making informed decisions. Physics graduates are able to apply their knowledge of complex systems to financial models and simulations, which helps investment bankers to better understand the potential outcomes of their decisions.

The Role of Mathematics in Investment Banking

Mathematics plays a crucial role in investment banking, and physics graduates have a strong background in this field. Physics majors take advanced courses in calculus, linear algebra, and differential equations, which puts them in a unique position to analyze and solve complex mathematical problems in the finance industry. In investment banking, mathematics is widely used to price new securities, develop financial models, and perform risk analysis. Physics graduates possess the knowledge and skills to carry out these tasks with precision and accuracy.

Furthermore, mathematics is also used in investment banking to optimize trading strategies and portfolio management. By using mathematical models and algorithms, investment bankers can identify profitable trades and minimize risk. This requires a deep understanding of mathematical concepts such as probability theory, stochastic calculus, and optimization techniques. Physics graduates are well-equipped to handle these complex mathematical problems, making them highly sought after in the investment banking industry.

Understanding the Principles of Quantum Mechanics in Investment Banking

Quantum mechanics refers to the branch of physics that deals with the behavior of matter and energy at the smallest scales. While it may seem that quantum mechanics has no place in investment banking, the truth is that this field can help investment bankers make better decisions. The principles of quantum mechanics, such as superposition and entanglement, can be applied to analyzing financial markets. For example, superposition can help investors evaluate different scenarios when making investment decisions. Physics graduates who are familiar with quantum mechanics can use these principles to gain a unique perspective on the finance industry.

Moreover, quantum computing is becoming increasingly relevant in investment banking. Quantum computers can perform complex calculations at a much faster rate than classical computers, which can be useful in analyzing large amounts of financial data. Investment banks are already exploring the potential of quantum computing in areas such as risk management and portfolio optimization. As quantum computing technology continues to advance, it is likely that investment banks will increasingly incorporate it into their operations.

How to Apply Your Knowledge of Thermodynamics in Investment Banking

Thermodynamics is the branch of physics that deals with the relationship between heat, energy, and work. While it may seem like an unlikely subject in finance, the principles of thermodynamics can be applied to analyzing financial systems. For example, thermodynamics can be used to analyze the performance of stock portfolios over time. By treating investment portfolios as thermodynamic systems, physics graduates can use their knowledge of thermodynamics to better understand the performance of investments, and make informed decisions based on that understanding.

Furthermore, thermodynamics can also be applied to risk management in investment banking. By analyzing the flow of energy and heat within a financial system, physicists can identify potential areas of risk and develop strategies to mitigate them. This can include analyzing the flow of money within a financial system, identifying potential points of failure, and developing contingency plans to minimize losses in the event of a market downturn. By applying their knowledge of thermodynamics to risk management, physicists can help investment banks make more informed decisions and reduce their exposure to risk.

Using Statistical Analysis to Make Informed Investment Decisions

Statistical analysis is a key skill in investment banking, and physics graduates have a strong foundation in this area. Physics students take courses in probability theory and statistics. They are trained to analyze and interpret complex data sets, and to identify patterns and trends that can help make informed decisions. In investment banking, statistical analysis is used extensively to evaluate the performance of investments, identify potential risks, and make recommendations for future investments. Physics graduates with a strong background in statistical analysis are highly prized in this industry.

The Importance of Data Analytics in Investment Banking

Data analytics is a key aspect of investment banking. It allows investors to work with large sets of data and identify patterns that are difficult to discern with the naked eye. Data analytics helps investment bankers identify investment opportunities, assess risks, and make informed decisions. Physics graduates who are skilled in data analytics can be highly sought after, because they possess the unique ability to take large sets of data and make meaningful insights that can help shape the direction of an investment portfolio.

Exploring the Relationship Between Physics and Finance

The connection between physics and finance may not be immediately apparent, but there are many links between these two industries. Physics provides the foundational knowledge and skills that are necessary for success in investment banking. The analytical mindset, problem-solving skills, and mathematical competence that are developed through a physics education are highly valued in the finance industry. Furthermore, many of the principles of physics, such as the laws of motion and the principles of thermodynamics, can be applied to finance in meaningful ways.

The Future of Investment Banking: Trends and Predictions for Physics Graduates

The finance industry is constantly evolving and adapting to new trends and technologies. As technology continues to advance, it is expected that data analytics and automation will play an increasingly important role in investment banking. Physics graduates who have a strong background in data analytics and computer science will be well-positioned to take advantage of these trends. Furthermore, with the growing demand for sustainable and socially responsible investments, physics graduates who are interested in renewable energy and other green technologies will have opportunities to make an impact in the finance industry.

Top Skills Needed for Success as an Investment Banker with a Physics Degree

While physics graduates possess a unique set of skills that make them valuable assets in investment banking, there are some specific skills that are particularly important for success. These skills include:

- Strong analytical thinking and problem-solving skills

- Excellent mathematical skills, including advanced calculus, linear algebra, and differential equations

- Strong skills in statistical analysis and data management

- Excellent communication skills, including the ability to communicate complex ideas to a non-technical audience

- Proficiency in programming languages suitable for data analysis and machine learning such as Python

- Sound understanding of financial markets and modeling including derivatives pricing and market risk management

- Understanding of accounting and financial reporting requirements

Transitioning from Physics to Finance: A Guide for Recent Graduates

Making the transition from physics to finance can be a daunting task for recent graduates. However, with the right preparation and approach, this transition can be highly successful. The first step is to gain a basic understanding of finance and investment banking by reading relevant books and taking courses about finance and markets. Building a professional network by attending events and conferences is also highly recommended. Relevant internships or co-op programs can also help you to gain practical experience in finance. Finally, seeking the guidance of a career coach can help tailor your CV towards the finance sector and equip you with relevant interview skills.

Tips for Networking and Building a Career in Investment Banking with a Physics Background

Networking is a key component of building a career in investment banking. Making connections with professionals in the industry can help you discover job openings, gain insights into the industry, and advance your career. Here are some tips for networking and building a career in investment banking:

- Attend relevant industry events and conferences.

- Join relevant industry groups and associations.

- Establish strong relationships with mentors, peers, and professors.

- Develop skills in areas such as data analytics and computer science that are important in investment banking.

- Consider joining a professional networking group or seeking the guidance of career coaches and headhunters.

Overcoming Challenges Faced by Physics Graduates in the Investment Banking Industry

While physics graduates bring many valuable skills to the finance industry, they may also face some challenges in terms of adapting to the corporate culture and communication styles within the industry. As a physics student, coursework tends to be more structured and individualistic which is contrary to being effective in large, team-oriented environments. Investment banks also value a high level of professionalism, communication, and social skills. Overcoming these challenges requires that physics graduates actively seek feedback from their colleagues and adopt a willingness to learn during their transition period.

How to Develop Soft Skills as a Physics Graduate for a Career in Finance

Soft skills refer to the personal qualities and communication abilities that are necessary for success in any professional environment. To develop soft skills as a physics graduate, it is recommended to cultivate your networking abilities, presentation skills, and communication skills. It is also important to be adaptable and receptive to feedback, as well as be able to work collaboratively and cohesively within in a team environment. Practicing these skills in professional and social situations will help you to leverage your physics background and excel in finance industry roles.

Navigating the Corporate Culture of Investment Banks as a Science Graduate

Investment banking has a unique corporate culture that can be challenging for science graduates to navigate. It is important to understand the corporate culture of investment banks and to adapt accordingly. Investment banks place a strong emphasis on professionalism, communication, punctuality, and attention to detail. Science graduates can benefit from observing the dress code and the standards of etiquette while on the job, while ensuring their work is organized, well-documented, and timely. It is also important to take a proactive approach in seeking feedback and clarification. By doing so, you ensure open communication and accountability which are important for success in the industry.

In conclusion, physics graduates are in high demand in investment banking due to their analytical and problem-solving skills, mathematical abilities, and data-driven thinking. Given the skills-gap and demand in the industry, transitioning from physics to investment banking offers high opportunities in financial modeling, data analytics, quantitative research, and market intelligence.

Browse hundreds of expert coaches

Leland coaches have helped thousands of people achieve their goals. A dedicated mentor can make all the difference.

Browse Related Articles

May 19, 2023

From Internship to Full-Time: Secure Your Investment Banking Dream Job

If you're aspiring to land a full-time investment banking job after your internship, this article is a must-read.

May 11, 2023

Career Transition: How to Break Into Investment Banking from Another Industry

Are you looking to make a career transition into investment banking from another industry? This article provides valuable insights and actionable tips on how to successfully break into the world of investment banking.

January 10, 2024

Tech-Savvy Finance: How to Become an Investment Banker with a Degree in Computer Science

Discover how you can leverage your computer science degree to break into the world of investment banking.

The Perfect Combination: How to Leverage Your STEM Degree for a Career in Investment Banking

Discover how to use your STEM degree to break into the world of investment banking.

Unlocking Your Potential: How to Become an Investment Banker with a Degree in Mathematics

Discover the secrets to unlocking your potential and becoming an investment banker with a degree in mathematics.

Crunching the Numbers: How to Break Into Investment Banking with a Degree in Statistics

Discover the secrets to breaking into investment banking with a degree in statistics.

Building a Strong Foundation: How to Become an Investment Banker with a Degree in Engineering

Discover how to leverage your engineering degree to break into the world of investment banking.

College to Wall Street: Break Into Investment Banking Post-Graduation

Learn how to break into the competitive world of investment banking after college graduation.

December 14, 2023

Making the Leap: How to Become an Investment Banker with a Degree in Political Science

If you have a degree in political science and are interested in a career in investment banking, this article is for you.

May 18, 2023

Making the Move: How to Transition from the Automotive Industry to Management Consulting

Are you considering a career change from the automotive industry to management consulting? This article provides valuable insights and tips on how to successfully make the transition.

March 12, 2024

How to Answer the "Why Investment Banking?" Interview Question

Though one of the most common banking questions, most applicants struggle to answer it convincingly. Here are our tips for nailing the response, complete with examples.

June 6, 2023

Crafting the Perfect Investment Banking Resume: Best Practices

Looking to break into the world of investment banking? Crafting a tailored and strategic resume is crucial to landing your dream job! Learn the essential tips and strategies for preparing an outstanding resume that will captivate investment banking recruiters and propel you towards your goals.

Physics and Finance

- © 2021

- Volker Ziemann ORCID: https://orcid.org/0000-0002-6229-5620 0

Department of Physics and Astronomy, Uppsala University, Uppsala, Sweden

You can also search for this author in PubMed Google Scholar

- Provides a compact introduction to common concepts of physics and finance

- Offers cross-disciplinary view which deepens understanding of underlying concepts

- Exhibits try-yourself MATLAB/Octave scripts which provide hands-on experience

- Includes end-of-chapter exercises which foster practical working knowledge

- Presents explicit derivations and worked examples in MATLAB which extend the readers’ “toolbox” of mathematical and computational methods

Part of the book series: Undergraduate Lecture Notes in Physics (ULNP)

25k Accesses

2 Citations

9 Altmetric

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents (13 chapters)

Front matter, introduction.

Volker Ziemann

Concepts of Finance

Portfolio theory and capm, stochastic processes, black-scholes differential equation, the greeks and risk management, regression models and hypothesis testing, time series, bubbles, crashes, fat tails and lévy-stable distributions, quantum finance and path integrals, optimal control theory, cryptocurrencies, solutions for selected exercises, back matter.

- Econophysics textbook

- Physics and finance

- Wall Street physics

- Langevin and Fokker-Planck equation

- Noise in physics and finance

- Stochastic processes in physics and finance

- Application of path integrals

- Entanglement/Entropy and Cryptocurrencies

- cryptocurrencies

- Blockchain and DAOs

About this book

This book introduces physics students to concepts and methods of finance. Despite being perceived as quite distant from physics, finance shares a number of common methods and ideas, usually related to noise and uncertainties. Juxtaposing the key methods to applications in both physics and finance articulates both differences and common features, this gives students a deeper understanding of the underlying ideas. Moreover, they acquire a number of useful mathematical and computational tools, such as stochastic differential equations, path integrals, Monte-Carlo methods, and basic cryptology. Each chapter ends with a set of carefully designed exercises enabling readers to test their comprehension.

Authors and Affiliations

About the author.

Volker Ziemann obtained his Ph.D. in accelerator physics from Dortmund University in 1990. After postdoctoral positions in Stanford at SLAC and in Geneva at CERN, where he worked on the design of the LHC, in 1995, he moved to Uppsala where he worked at the electron-cooler storage ring CELSIUS. In 2005, he moved to the physics department where he has since taught physics. He was responsible for several accelerator physics projects at CERN, DESY, and XFEL. In 2014, he received the Thuréus prize from the Royal Society of Sciences in Uppsala.

Bibliographic Information

Book Title : Physics and Finance

Authors : Volker Ziemann

Series Title : Undergraduate Lecture Notes in Physics

DOI : https://doi.org/10.1007/978-3-030-63643-2

Publisher : Springer Cham

eBook Packages : Physics and Astronomy , Physics and Astronomy (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2021

Hardcover ISBN : 978-3-030-63642-5 Published: 19 January 2021

Softcover ISBN : 978-3-030-63645-6 Published: 19 January 2022

eBook ISBN : 978-3-030-63643-2 Published: 18 January 2021

Series ISSN : 2192-4791

Series E-ISSN : 2192-4805

Edition Number : 1

Number of Pages : X, 286

Number of Illustrations : 22 b/w illustrations, 43 illustrations in colour

Topics : Theoretical, Mathematical and Computational Physics , Finance, general , Applications of Mathematics , Probability Theory and Stochastic Processes , Professional Computing , Capital Markets

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Utility Menu

Apply | Contact Us | Carol Davis Fund Anonymous Feedback to the Physics Chair

Graduate studies, commencement 2019.

The Harvard Department of Physics offers students innovative educational and research opportunities with renowned faculty in state-of-the-art facilities, exploring fundamental problems involving physics at all scales. Our primary areas of experimental and theoretical research are atomic and molecular physics, astrophysics and cosmology, biophysics, chemical physics, computational physics, condensed-matter physics, materials science, mathematical physics, particle physics, quantum optics, quantum field theory, quantum information, string theory, and relativity.

Our talented and hardworking students participate in exciting discoveries and cutting-edge inventions such as the ATLAS experiment, which discovered the Higgs boson; building the first 51-cubit quantum computer; measuring entanglement entropy; discovering new phases of matter; and peering into the ‘soft hair’ of black holes.

Our students come from all over the world and from varied educational backgrounds. We are committed to fostering an inclusive environment and attracting the widest possible range of talents.

We have a flexible and highly responsive advising structure for our PhD students that shepherds them through every stage of their education, providing assistance and counseling along the way, helping resolve problems and academic impasses, and making sure that everyone has the most enriching experience possible.The graduate advising team also sponsors alumni talks, panels, and advice sessions to help students along their academic and career paths in physics and beyond, such as “Getting Started in Research,” “Applying to Fellowships,” “Preparing for Qualifying Exams,” “Securing a Post-Doc Position,” and other career events (both academic and industry-related).

We offer many resources, services, and on-site facilities to the physics community, including our electronic instrument design lab and our fabrication machine shop. Our historic Jefferson Laboratory, the first physics laboratory of its kind in the nation and the heart of the physics department, has been redesigned and renovated to facilitate study and collaboration among our students.

Members of the Harvard Physics community participate in initiatives that bring together scientists from institutions across the world and from different fields of inquiry. For example, the Harvard-MIT Center for Ultracold Atoms unites a community of scientists from both institutions to pursue research in the new fields opened up by the creation of ultracold atoms and quantum gases. The Center for Integrated Quantum Materials , a collaboration between Harvard University, Howard University, MIT, and the Museum of Science, Boston, is dedicated to the study of extraordinary new quantum materials that hold promise for transforming signal processing and computation. The Harvard Materials Science and Engineering Center is home to an interdisciplinary group of physicists, chemists, and researchers from the School of Engineering and Applied Sciences working on fundamental questions in materials science and applications such as soft robotics and 3D printing. The Black Hole Initiative , the first center worldwide to focus on the study of black holes, is an interdisciplinary collaboration between principal investigators from the fields of astronomy, physics, mathematics, and philosophy. The quantitative biology initiative https://quantbio.harvard.edu/ aims to bring together physicists, biologists, engineers, and applied mathematicians to understand life itself. And, most recently, the new program in Quantum Science and Engineering (QSE) , which lies at the interface of physics, chemistry, and engineering, will admit its first cohort of PhD students in Fall 2022.

We support and encourage interdisciplinary research and simultaneous applications to two departments is permissible. Prospective students may thus wish to apply to the following departments and programs in addition to Physics:

- Department of Astronomy

- Department of Chemistry

- Department of Mathematics

- John A. Paulson School of Engineering and Applied Sciences (SEAS)

- Biophysics Program

- Molecules, Cells and Organisms Program (MCO)

If you are a prospective graduate student and have questions for us, or if you’re interested in visiting our department, please contact [email protected] .

- GRADUATE STUDIES

- Admissions & Financial Aid

- Admissions FAQs

- Advising Team

- Advising Portal (Graduate)

- Course Requirements

- Other PhD Tracks

- Griffin Graduate School of Arts and Sciences

- GSAS Student Council

- PhD Thesis Help

- Tax Information

- Undergraduate

- Master of Accounting

- Full Time MBA

- Evening Executive MBA

- Weekend Executive MBA

- Charlotte Executive MBA

News & Stories

Physics + finance = career opportunities.

A joint venture between UNC’s Department of Physics and Astronomy and UNC Kenan-Flagler, the new major combines physics classes – such as mechanics and electromagnetism – with business and math courses – such as applied derivatives and differential equations.

Finance professor Alexander Arapoglou and physics professor Reyco Henning are collaborating to offer the new major.

“Physics is an intellectually interesting subject,” said Arapoglou. “This major creates an opportunity for students to prepare themselves for future employment in such areas as quantitative finance, risk analysis and management, and portfolio management.”

The numerical methods developed for solving problems in physics have direct applications in finance. Top financial institutions regularly employ students with math and physics backgrounds – known as “quants.”

There is strong demand for people who can understand complex mathematical models and solve hard quantitative business problems, according to Arapoglou. “This is a great time to enter the finance job market.”

A physics major lends itself well to a career in finance because students learn quantitative analysis and how to handle real world data and uncertainties, Henning said. “In finance, a lot of times there are hard problems for which there is no text book or class. In physics, students learn to handle real-world data and uncertainties.”

Henning said that many of his physicist colleagues now work in finance, and when Arapoglou (MBA ’80) worked at J.P. Morgan his colleagues often had PhDs in physics. Finance professors Jacob Sagi and Greg Brown studied physics before they embarked their academic careers – Brown worked for the Board of Governors of the Federal Reserve System.

Many analytical models used in financial engineering are derived from mathematical models used in physics, including the Nobel-Prize-winning Black-Scholes options pricing model, which is based on the heat equation in physics. Economists Fischer Black and Myron Scholes both studied physics prior to making their mark in finance.

The program was specifically designed as a BA rather than a BS to give students the freedom to choose the classes that interested them, Henning said. “It gives you flexibility. You can fill up your BA with as much math and science as you want or you can fill it up with business classes. This makes it appealing to a wide audience.”

The major is available for current and incoming students with no separate application. Henning and Arapoglou encourage students interested in combining math and problem solving with business to consider the degree.

“If you’re a student who likes to do quantitative problems and you like business, this is the degree for you,” said Henning.

This website uses cookies and similar technologies to understand visitor experiences. By using this website, you consent to UNC-Chapel Hill's cookie usage in accordance with their Privacy Notice .

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Job Search Advice Forum JOB

Physics PhD trying to get into finance industry

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

Hello everyone, I just found out about this website. I am currently a physics PhD candidate from Rice university doing theoretical physics (mostly modeling). As you all know, getting into academia is like needle in a haystack. I am planning to break into finance industry (either investment banking, quant or corporate finance). I have taken some financial modeling class from Rice and planning to take more near future. I have some concerns about getting a job since I don't have any background in finance. 1) Should I take CFA or Series 79? Does that weigh a lot on my resume? 2) Should I get a master of finance from my local non-target school in addition to my PhD. 3) Should I even wait to get my PhD or just quit with my master and try to find a job?

Thank you very much. Please give me any comments or advice. I am really kind of lost here.

What year of your PhD are you in? Or more specifically, what year did you enroll in the PhD, and what year are you anticipated to finish? To answer your questions:

- no. if you're able to do theoretical physics, people will expect you to be able to pick up on financial concepts pretty quickly, regardless of past training.

- no. waste of time since your PhD is more pedigree anyway.

- absolutely get your PhD. you have 0 leverage without it. plus, academia will always be a back up in case you can't make it in to finance. in addition, people may think you are a quitter if you do this.

I think a number of quant-type firms will be open to you... also, you might like that kind of a job better.

Make sure you take a look at the options you laid out, pick one and then go after that. People will want to see that you know exactly what you want - i.e. quant HF , banking, corp fin for a company that works in an area related to your research.... Saying "I'm open to anything" or sounding unsure won't help with recruiting... that said, when starting to network you can be a little more open about that as you try to zero in on what you want. Asking about peoples' jobs, their day, what they see in their future, etc will help you decide.

Also, a friend's husband has a PhD in theoretical physics and was doing post-doctoral research (something on string theory, but he never liked to talk about his work... I wish he had as I stopped a physics undergrad degree when I decided I didn't want to teach/do something like med school but still enjoy the topics even though I can't keep up) while traveling the world from uni to uni... seemed like a nice gig to me. Really fit my friend's lifestyle as well... she liked languages and speaks at least 4 academically.

Anyway, he has since moved to a quant HF in I think London. He had no background in finance, just networked and had good reasons for making the move. So it is definitely possible!

Physics PhD candidate trying to get into finance industry ( Originally Posted: 04/20/2015 )

Hello everyone, I just found out about this website. I am currently a physics PhD candidate from Rice university doing theoretical physics (mostly modeling). As you all know, getting into academia is like needle in a haystack. I am planning to break into finance industry (either investment banking, quant or corporate finance ). I have taken some financial modeling class from Rice and planning to take more near future. I have some concerns about getting a job since I don't have any background in finance. 1) Should I take CFA or Series 79 ? Does that weigh a lot on my resume? 2) Should I get a master of finance from my local non-target school in addition to my PhD. 3) Should I even wait to get my PhD or just quit with my master and try to find a job?

I have some friends in similar situations (STEM Ph.D) going into finance ( IBD ).

Promise you, first question you will get: "Why did you waste your time doing a Ph.D if you want to be an analyst?" Also, the most common feedback to candidates was: "I'm sure you're a smart guy, but nothing on your resume says 'Finance'".

CFA helped answer that comment. CFA is almost a pre-req in Toronto (highest CFA's per capita in the world I hear), less important in the U.S.

You can't write the the Series 79 without sponsored (employed) by a FINRA member firm. In Canada, you can write the Canadian Securities Course (CSC, similar type of qualification) without being sponsored, but it is hardly considered a prestigious credential.

Subscribed.

Any physics phds? ( Originally Posted: 09/13/2010 )

Anyone else a Physics PhD?

It is my understanding that the sole reason an expungement exists is for situations like yours. My brother was in a similar situation and said 'no' with no repercussions. (This may very well be a state by state thing though).

^^ And that was for a security clearance which, I would hope, is a much more intense background check.

Consequatur amet voluptatem quas dolor. Voluptatem dolorem natus aspernatur rerum reiciendis dolorem est. Et atque assumenda blanditiis animi quaerat ipsa. Ratione illum qui placeat reiciendis. Vel ut mollitia sint voluptatum.

Aliquid et explicabo sit voluptas nobis. Optio velit repellat delectus nisi qui voluptate occaecati. Ea accusantium corrupti explicabo hic. Saepe non ipsum vel consequatur qui delectus rem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Want to Vote on this Content?! No WSO Credits?

Already a member? Login

Trending Content

Career Resources

- Financial Modeling Resources

- Excel Resources

- Download Templates Library

- Salaries by Industry

- Investment Banking Interview Prep

- Private Equity Interview Prep

- Hedge Fund Interview Prep

- Consulting Case Interview Prep

- Resume Reviews by Professionals

- Mock Interviews with Pros

- WSO Company Database

WSO Virtual Bootcamps

- Apr 27 Foundations Bootcamp 10:00AM EDT

- May 04 Venture Capital Bootcamp 10:00AM EDT

- May 11 Financial Modeling & Valuation Bootcamp May 11 - 12 10:00AM EDT

- May 18 Investment Banking Interview Bootcamp 10:00AM EDT

- Jun 01 Private Equity Interview Bootcamp 10:00AM EDT

Career Advancement Opportunities

April 2024 Investment Banking

Overall Employee Satisfaction

Professional Growth Opportunities

Total Avg Compensation

“... there’s no excuse to not take advantage of the resources out there available to you. Best value for your $ are the...”

Leaderboard

- Silver Banana

- Banana Points

“... I believe it was the single biggest reason why I ended up with an offer...”

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

How To Get A Quant Job Once You Have A PhD

In this article we are going to discuss an issue that repeatedly crops up via the QuantStart mailbox, namely how to get a quant job once you have a PhD . There's a lot of confusion around this topic because quite a few people who currently work in academia and want to make the shift believe that it is quite straightforward to "walk into" a high-paying financial role. While this may have been true 10-15 years ago, the reality of the current job market is such that quant roles are now highly competitive and candidates need to stand out if they are to get the best jobs.

Firstly we'll discuss what sort of candidates you will be competing against when considering going for interview. Secondly, we'll discuss how to make an honest assessment of your PhD and what you got out of it that might be relevant to quantitative finance roles. Finally, we'll consider whether it is necessary to return to school in order to train up in a quant-specific qualification.

The Competition

I've made it rather clear on QuantStart that the competition for some of the top quantitative trading researcher roles can be extremely tough. In the UK the best roles tend to be filled well upstream of any "front door" interview process. Usually extremely bright academics in mathematics, physics, computer science, economics or mathematical finance are head-hunted for a particular skill set, such as deep expertise on market microstructure, insight into high-frequency trading algorithms, novel stochastic calculus techniques for certain derivatives pricing regimes or extensive statistical machine learning knowledge that applies to datasets used by such funds.

When such quant researcher roles ARE opened up to the public they will often state that they are looking for "only the best and brightest", which in the UK usually means "Top Five" universities (Cambridge, Oxford, Imperial College, LSE and UCL). In the US this will mean high-end Ivy League institutions. The adverts will often state that they want to see evidence of consistent Mathematical Olympiad prizes and an extensive publication list in a relevant field.

While this is certainly true of the top roles, there are plenty of other (very well paying and prestigious) jobs that also need filling. Bear in mind that there are only so many Mathematical Olympiad winners, after all! Thus one should not be disheartened when seeing numerous adverts asking for such qualifications. There are plenty of smaller funds and boutique outfits that do not have the resources to aggressively hunt for the ultimate talent and so will be more than willing to employ bright PhDs who might not necessarily have an Olympiad track record.

Honestly Assess Your PhD

The first task to carry out when applying for quant roles is an honest assessment of your PhD and what you achieved with it . Primarily you need to consider the level of mathematical ability you were able to attain as well as your computational programming skill.

Quant roles in the derivative pricing space, known traditionally as the "quant analyst" or "financial engineer", require a reasonable amount of mathematical sophistication. Specifically, expertise in stochastic calculus, probability and measure theory. These are topics usually taught in an undergraduate mathematics course, but can form a component of taught graduate school PhDs. In addition they require a good understanding of scientific programming usually in C++, Python or MatLab. Since the role of a quant analyst is often to code up an implementation of a particular algorithm from a research paper, under heavy deadlines, it is quite naturally suited to those with PhDs of this type.

Quant roles in the algorithmic trading and quant hedge fund world are almost exclusively going to require novel methods for generating "alpha" (i.e. excess return above a benchmark). Usually this is accomplished via time series analysis and econometrics, but more recently statistical machine learning techniques have been applied, as have methods related to sentiment analysis. Some of the best quant funds make extensive use of even more advanced graduate level mathematics in the realms of algebraic geometry, number theory and information theory. Hence anything highly mathematically, statistically or physically oriented is likely to be of interest to a top quant hedge fund.

As for computer scientists and strong scientific software developers, generally there is always work available for quantitative developer roles. Although you will be competing against those with industry experience in rigourous software engineering. Hence "academic code" of the "20,000 line single-file of Fortran" variety might be a bit of a hindrance! Make sure to brush up on the more modern software development methodologies such as OOP , Agile , etc.

I want to discuss specific PhD fields as well, to give you an idea of where you might consider focusing your efforts based on what you have previously studied:

- Pure Mathematics - The top funds generally hire the pure mathematicians from esoteric realms such as algebraic geometry and information theory. Banks will also take individuals who study stochastic calculus to a high level for their derivatives research teams.

- Mathematical Finance - Portfolio optimisation and derivatives pricing are two common themes studied in mathematical finance PhDs. You will often have collaborated with banks during your PhD, so it is unlikely your job prospects will be slim! If you are struggling, it can be very helpful to contact department heads as they will often have a strong network.

- Theoretical Physics - Funds will be very interested in your ability to model physical phenomena, either through direct or statistical approaches. Some theoretical physics areas are highly mathematical (Cosmology, String Theory, Quantum Field Theory etc) and so the advice given to theoretical physics PhDs is similar to pure mathematicians.

- Computational Physics/Engineering - The main skillset taught here is how to take an algorithm and produce a robust scientific computing implementation, perhaps in a parallelised fashion. This is an extremely useful skill for quant work both in banks and funds, especially for developing infrastructure. Make sure however to brush up on core topics such as statistics and stochastic calculus prior to interview.

- Statistics/Econometrics - Statisticians and theoretical econometricians will be in good demand from technical quant funds, especially in the Commodity Trading Advisor (CTA)/Managed Futures space. The time series modelling will be highly appropriate here.

- Computer Science/Machine Learning - Many funds are now making extensive use of machine learning and optimisation tools, which are the natural domain of the theoretical computer scientist and, more recently, the "data scientist". Familiarity with statistical machine learning and Bayesian methods will be highly attractive.

- Bioinformatics - Bioinformaticians also make extensive use of machine learning tools on "big data" sets. For interview you will want to emphasise your familiarity with such tools and your programming capability. Depending upon your background you may need to brush up on your (pure) mathematics for interview questions.

- Economics/Finance - Economics and Finance PhDs do not always teach you the mathematical maturity necessary for pure quant work, but it really depends on the project. You will need to be honest with yourself about where you lie on the mathematical spectrum. In addition you will need to consider your programming ability.

Heading Back To School

An extremely common question that I receive in the QuantStart mailbag is whether to return to school for finance-specific training subsequent to a PhD.

I've previously documented my views on Masters in Financial Engineering (MFE) programs as related to quantitative trading . In essence I believe that MFEs are not hugely suitable for quantitative trading research work, but they are a good entry point into investment banking quant work.

If your PhD was not heavy on quantitative or programming work, but you have a sufficiently mature mathematical background, then it can make good sense to take a MFE assuming that you can afford to fund the course. A MFE at a top-tier school will provide you with a solid network of other candidates (and thus people who might later help you secure a role), a relatively healthy recruitment position upon graduation and a useful skillset for investment banking derivatives pricing work.

I would advise against returning to school if you have a strong quantitative PhD as you simply won't need the additional qualifications and you should be able to pick up the necessary interview material yourself, albeit with a lot of study.

If you have a PhD in a non-quantitative field and your background is not sufficiently mathematical, then you should definitely consider that you will likely need to return to school if you truly want to work in quantitative finance. In particular you will need to study an undergraduate degree that has a strong quantitative component such as Mathematics or Physics as these two degrees will generally let you transition into other quantitative fields easily.

Join the QSAlpha research platform that helps fill your strategy research pipeline, diversifies your portfolio and improves your risk-adjusted returns for increased profitability.

The Quantcademy

Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability.

Successful Algorithmic Trading

How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine.

Advanced Algorithmic Trading

How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python.

- Search forums

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

- Career Advice

Theoretical Physics PhD going into Quant. Finance

- Thread starter Dr. Ricky

- Start date 12/6/12

Hello All, I'm a recent PhD in theoretical physics (in fact, got it last year) and now I'm working as a post-doc researcher. As the title suggests I'm planning to break into the finance world. I just want to know what the odds are for me and that's why I'm posting here. This is my first post as you can see but I wish I had discovered this forum earlier. Without further ado let me briefly describe what pertinent skills and knowledge I have: - Seven years of quantitative research experience (undergrad + grad school and postdoc). - Intuitive understanding of stochastic calculus and its application to finance. - Numerical calculation and simulations with C++ - Probability theory, pricing and hedging withing the Black-Scholes framework. So, I told my boss the idea of leaving physics recently, and he gave me a project that has implications to finance (I have a lot of respect for him since). Part of the project involves writing a Markov Chain Monte Carlo algorithm to estimate the distribution of the return of an asset with arbitrage modeled as quantum fluctuations. This has been shown to produce the "fat tail" distribution produced in real markets. I have already written most of the code in two weeks using C++ giving expected results. So my question is, how do I maximize my chances from here?

Andy Nguyen

Hey Ricky, Welcome to QN. The trickiest part is to find direction as finance is a changing field. Whatever you read 2 years ago may no longer apply. You will always facing the question, why finance and what you want to do in finance. Until then, it's hard to know the next steps. Take a look at this QuantNet Guide https://www.quantnet.com/threads/how-to-get-a-quant-job-advice-from-wall-street-executives.4537/

Ah! Thanks for the reply. I guess I left out what I wanted to to do in Finance. I have my eyes on risk management, quantitative research in a hedge fund, algorithmic trading and FX. This answers the 'What finance' question. From what I understand so far these areas involve a fair amount of number crunching and programming, which I love. And this answers the 'why finance'. Given this, how should I proceed? I'm working through "Stochastic Processes" by Ross right now. I would recommend it to everyone. A lot of challenging problems!

For risk management, read everything that Ken Abbott posts on here. https://www.quantnet.com/tags/risk+management/

Apply - Hoping to get interview in current market - Beating other Ivy league or Oxbridge folks to get offer There are two books I feel useful 1. Quant Job Interview Questions & Answers 2. Heard on the Street I have been applying Quant jobs for 3 months now, what I found is in the current situation, it is even difficult to get interviews in the first place; So be well prepared for the 'Quants questions' & be sure you can answer them well in those interviews; cos those 2 or 3 interviews are possibly all the interviews you could get this year.

zxilver: Thank you sir. I just ordered 'Heard on the Street', it was recommended by another person as well.