Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- Survey Research | Definition, Examples & Methods

Survey Research | Definition, Examples & Methods

Published on August 20, 2019 by Shona McCombes . Revised on June 22, 2023.

Survey research means collecting information about a group of people by asking them questions and analyzing the results. To conduct an effective survey, follow these six steps:

- Determine who will participate in the survey

- Decide the type of survey (mail, online, or in-person)

- Design the survey questions and layout

- Distribute the survey

- Analyze the responses

- Write up the results

Surveys are a flexible method of data collection that can be used in many different types of research .

Table of contents

What are surveys used for, step 1: define the population and sample, step 2: decide on the type of survey, step 3: design the survey questions, step 4: distribute the survey and collect responses, step 5: analyze the survey results, step 6: write up the survey results, other interesting articles, frequently asked questions about surveys.

Surveys are used as a method of gathering data in many different fields. They are a good choice when you want to find out about the characteristics, preferences, opinions, or beliefs of a group of people.

Common uses of survey research include:

- Social research : investigating the experiences and characteristics of different social groups

- Market research : finding out what customers think about products, services, and companies

- Health research : collecting data from patients about symptoms and treatments

- Politics : measuring public opinion about parties and policies

- Psychology : researching personality traits, preferences and behaviours

Surveys can be used in both cross-sectional studies , where you collect data just once, and in longitudinal studies , where you survey the same sample several times over an extended period.

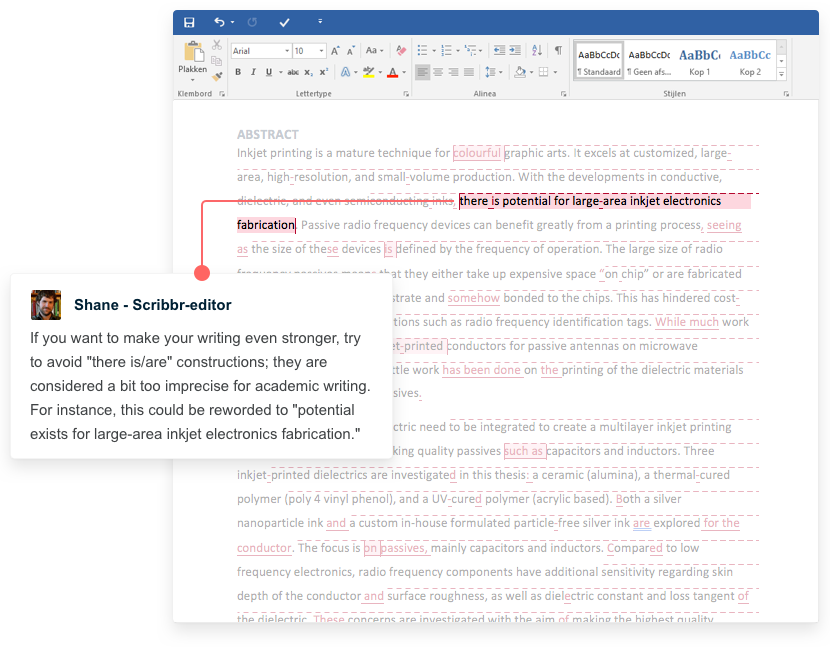

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

Before you start conducting survey research, you should already have a clear research question that defines what you want to find out. Based on this question, you need to determine exactly who you will target to participate in the survey.

Populations

The target population is the specific group of people that you want to find out about. This group can be very broad or relatively narrow. For example:

- The population of Brazil

- US college students

- Second-generation immigrants in the Netherlands

- Customers of a specific company aged 18-24

- British transgender women over the age of 50

Your survey should aim to produce results that can be generalized to the whole population. That means you need to carefully define exactly who you want to draw conclusions about.

Several common research biases can arise if your survey is not generalizable, particularly sampling bias and selection bias . The presence of these biases have serious repercussions for the validity of your results.

It’s rarely possible to survey the entire population of your research – it would be very difficult to get a response from every person in Brazil or every college student in the US. Instead, you will usually survey a sample from the population.

The sample size depends on how big the population is. You can use an online sample calculator to work out how many responses you need.

There are many sampling methods that allow you to generalize to broad populations. In general, though, the sample should aim to be representative of the population as a whole. The larger and more representative your sample, the more valid your conclusions. Again, beware of various types of sampling bias as you design your sample, particularly self-selection bias , nonresponse bias , undercoverage bias , and survivorship bias .

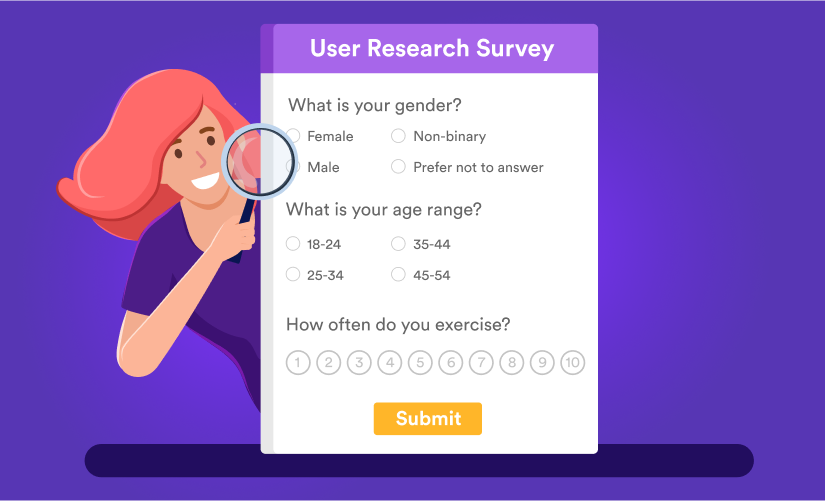

There are two main types of survey:

- A questionnaire , where a list of questions is distributed by mail, online or in person, and respondents fill it out themselves.

- An interview , where the researcher asks a set of questions by phone or in person and records the responses.

Which type you choose depends on the sample size and location, as well as the focus of the research.

Questionnaires

Sending out a paper survey by mail is a common method of gathering demographic information (for example, in a government census of the population).

- You can easily access a large sample.

- You have some control over who is included in the sample (e.g. residents of a specific region).

- The response rate is often low, and at risk for biases like self-selection bias .

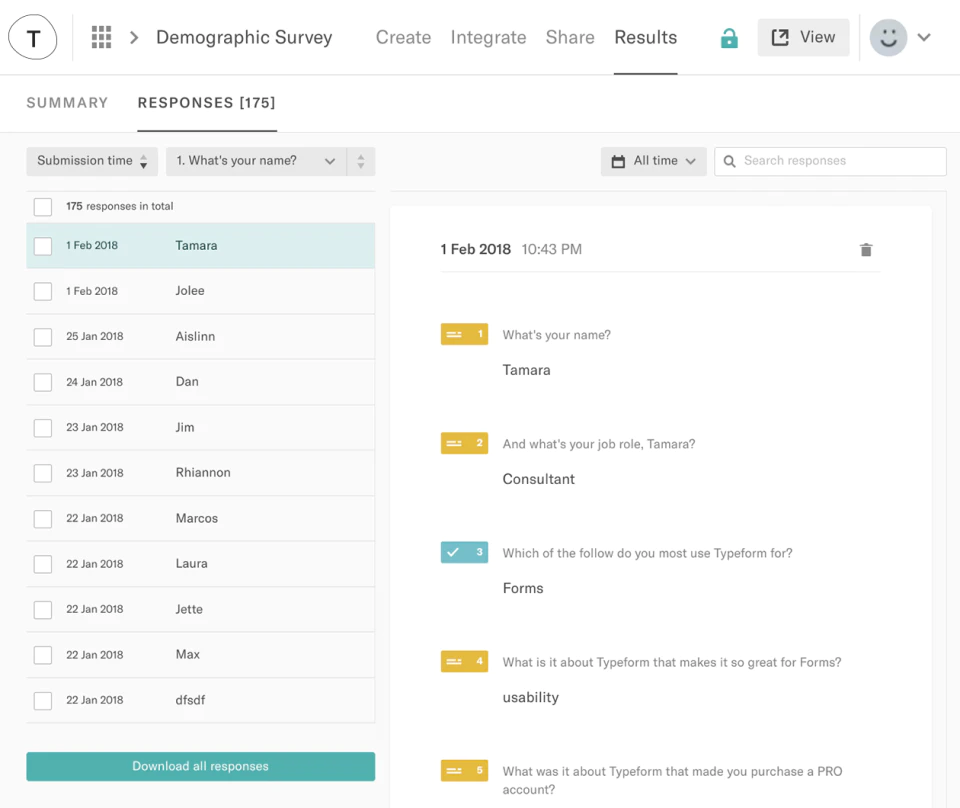

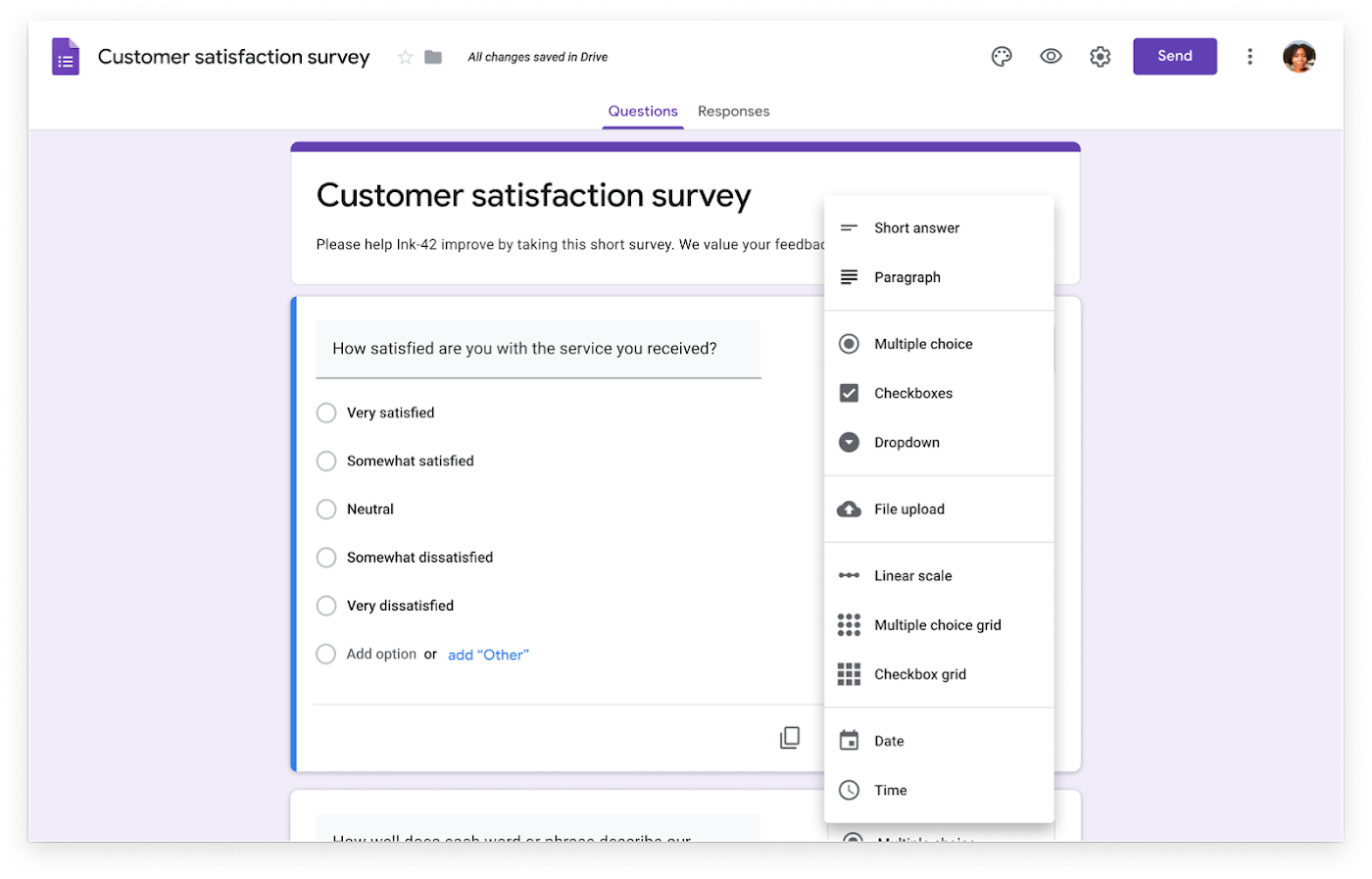

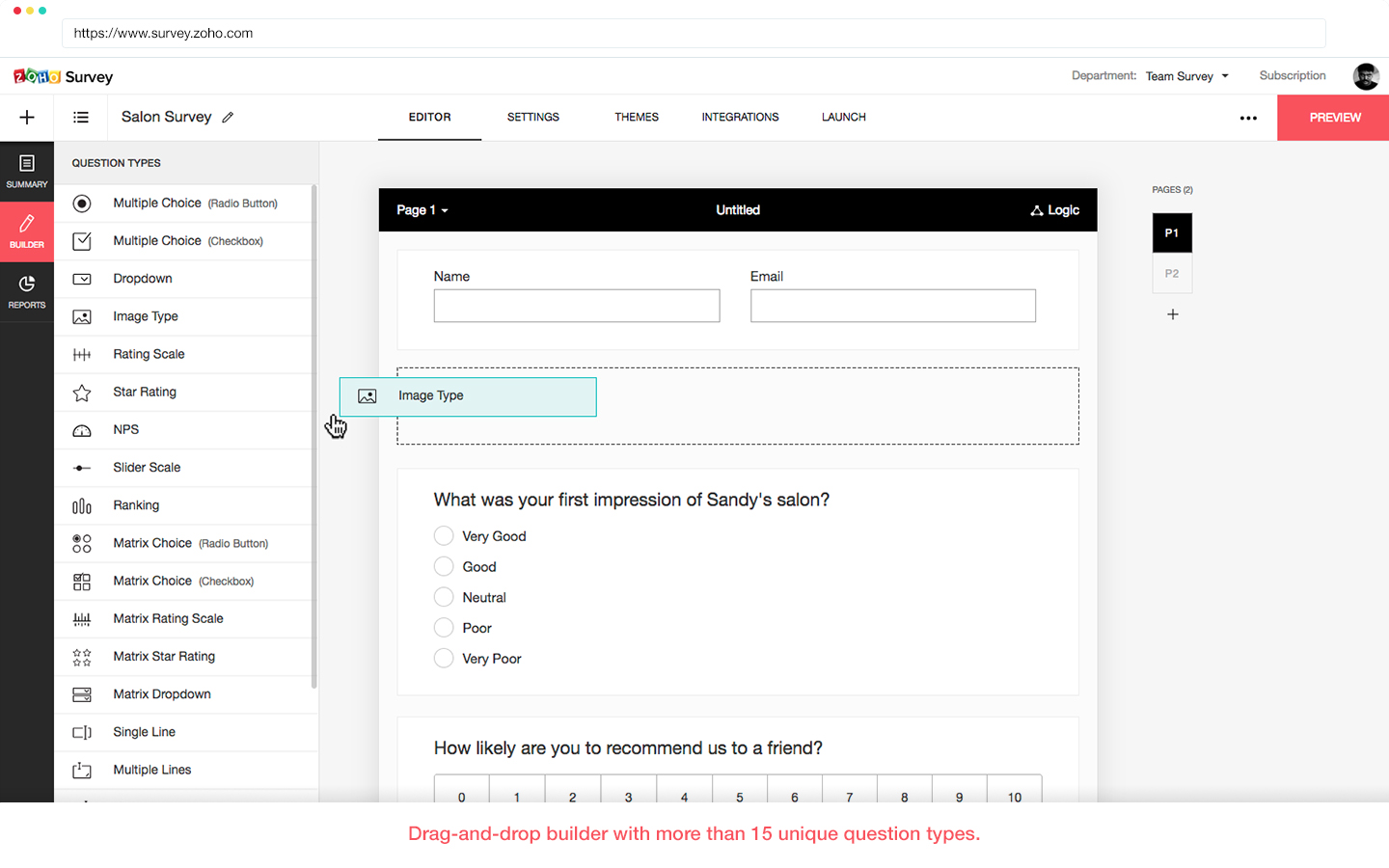

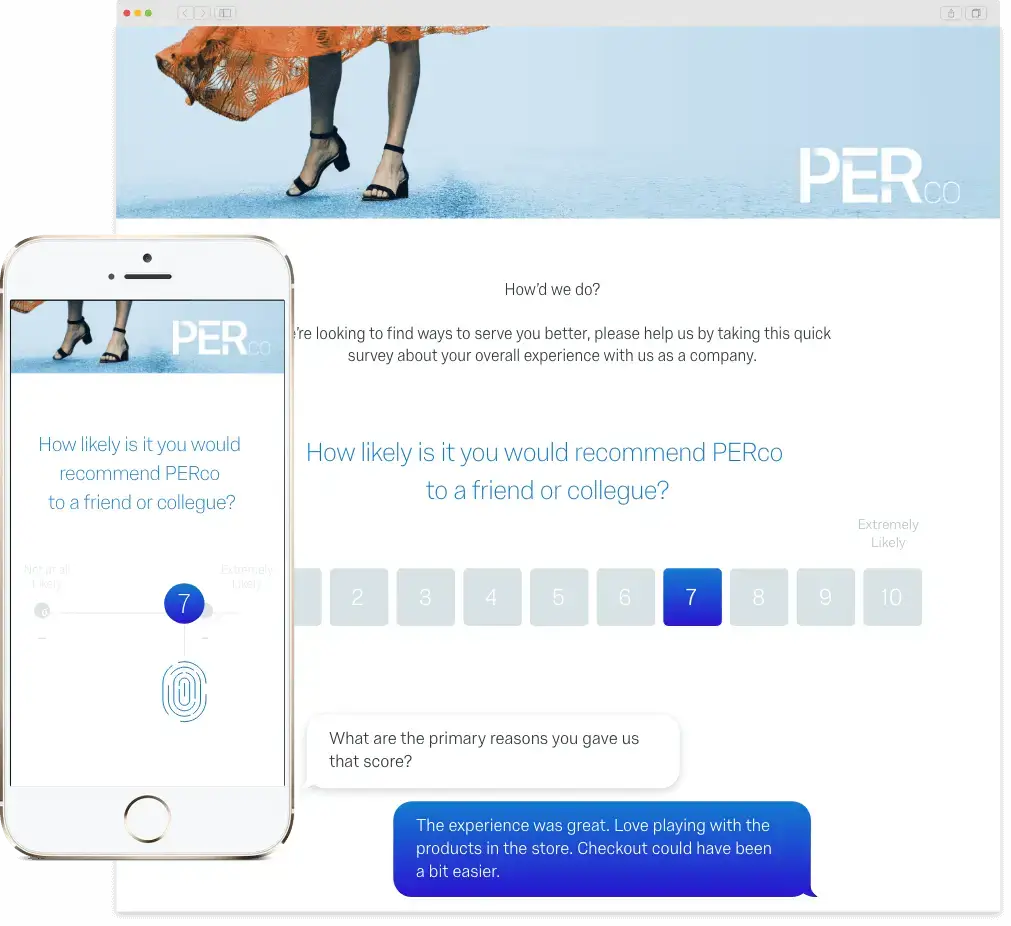

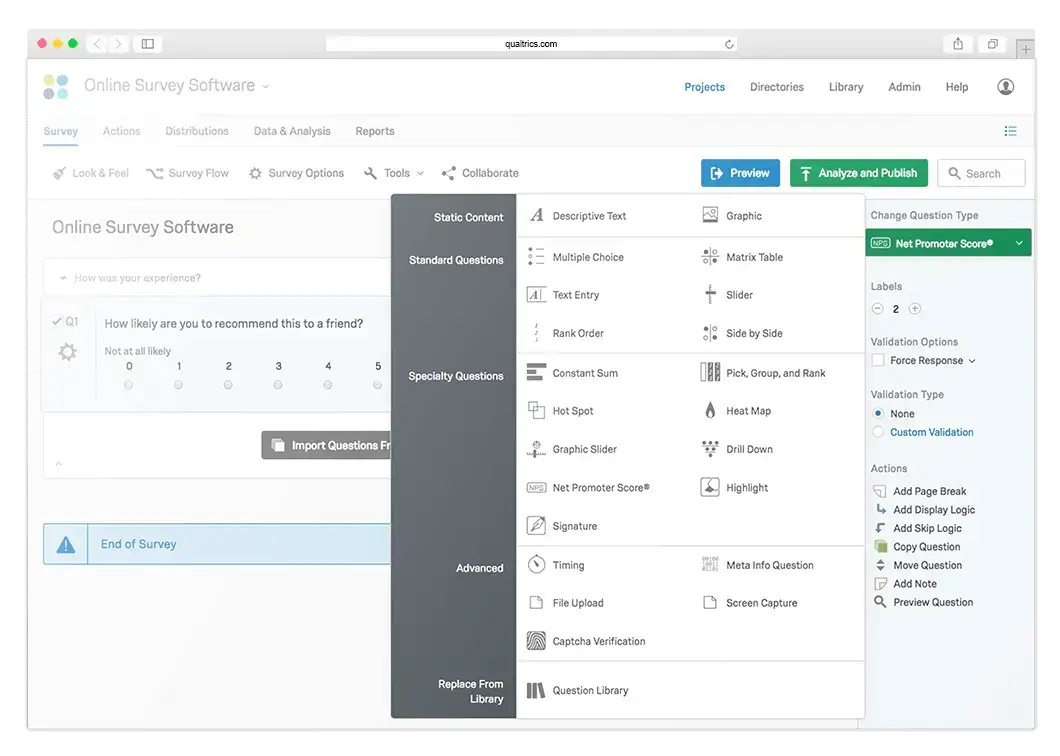

Online surveys are a popular choice for students doing dissertation research , due to the low cost and flexibility of this method. There are many online tools available for constructing surveys, such as SurveyMonkey and Google Forms .

- You can quickly access a large sample without constraints on time or location.

- The data is easy to process and analyze.

- The anonymity and accessibility of online surveys mean you have less control over who responds, which can lead to biases like self-selection bias .

If your research focuses on a specific location, you can distribute a written questionnaire to be completed by respondents on the spot. For example, you could approach the customers of a shopping mall or ask all students to complete a questionnaire at the end of a class.

- You can screen respondents to make sure only people in the target population are included in the sample.

- You can collect time- and location-specific data (e.g. the opinions of a store’s weekday customers).

- The sample size will be smaller, so this method is less suitable for collecting data on broad populations and is at risk for sampling bias .

Oral interviews are a useful method for smaller sample sizes. They allow you to gather more in-depth information on people’s opinions and preferences. You can conduct interviews by phone or in person.

- You have personal contact with respondents, so you know exactly who will be included in the sample in advance.

- You can clarify questions and ask for follow-up information when necessary.

- The lack of anonymity may cause respondents to answer less honestly, and there is more risk of researcher bias.

Like questionnaires, interviews can be used to collect quantitative data: the researcher records each response as a category or rating and statistically analyzes the results. But they are more commonly used to collect qualitative data : the interviewees’ full responses are transcribed and analyzed individually to gain a richer understanding of their opinions and feelings.

Next, you need to decide which questions you will ask and how you will ask them. It’s important to consider:

- The type of questions

- The content of the questions

- The phrasing of the questions

- The ordering and layout of the survey

Open-ended vs closed-ended questions

There are two main forms of survey questions: open-ended and closed-ended. Many surveys use a combination of both.

Closed-ended questions give the respondent a predetermined set of answers to choose from. A closed-ended question can include:

- A binary answer (e.g. yes/no or agree/disagree )

- A scale (e.g. a Likert scale with five points ranging from strongly agree to strongly disagree )

- A list of options with a single answer possible (e.g. age categories)

- A list of options with multiple answers possible (e.g. leisure interests)

Closed-ended questions are best for quantitative research . They provide you with numerical data that can be statistically analyzed to find patterns, trends, and correlations .

Open-ended questions are best for qualitative research. This type of question has no predetermined answers to choose from. Instead, the respondent answers in their own words.

Open questions are most common in interviews, but you can also use them in questionnaires. They are often useful as follow-up questions to ask for more detailed explanations of responses to the closed questions.

The content of the survey questions

To ensure the validity and reliability of your results, you need to carefully consider each question in the survey. All questions should be narrowly focused with enough context for the respondent to answer accurately. Avoid questions that are not directly relevant to the survey’s purpose.

When constructing closed-ended questions, ensure that the options cover all possibilities. If you include a list of options that isn’t exhaustive, you can add an “other” field.

Phrasing the survey questions

In terms of language, the survey questions should be as clear and precise as possible. Tailor the questions to your target population, keeping in mind their level of knowledge of the topic. Avoid jargon or industry-specific terminology.

Survey questions are at risk for biases like social desirability bias , the Hawthorne effect , or demand characteristics . It’s critical to use language that respondents will easily understand, and avoid words with vague or ambiguous meanings. Make sure your questions are phrased neutrally, with no indication that you’d prefer a particular answer or emotion.

Ordering the survey questions

The questions should be arranged in a logical order. Start with easy, non-sensitive, closed-ended questions that will encourage the respondent to continue.

If the survey covers several different topics or themes, group together related questions. You can divide a questionnaire into sections to help respondents understand what is being asked in each part.

If a question refers back to or depends on the answer to a previous question, they should be placed directly next to one another.

Before you start, create a clear plan for where, when, how, and with whom you will conduct the survey. Determine in advance how many responses you require and how you will gain access to the sample.

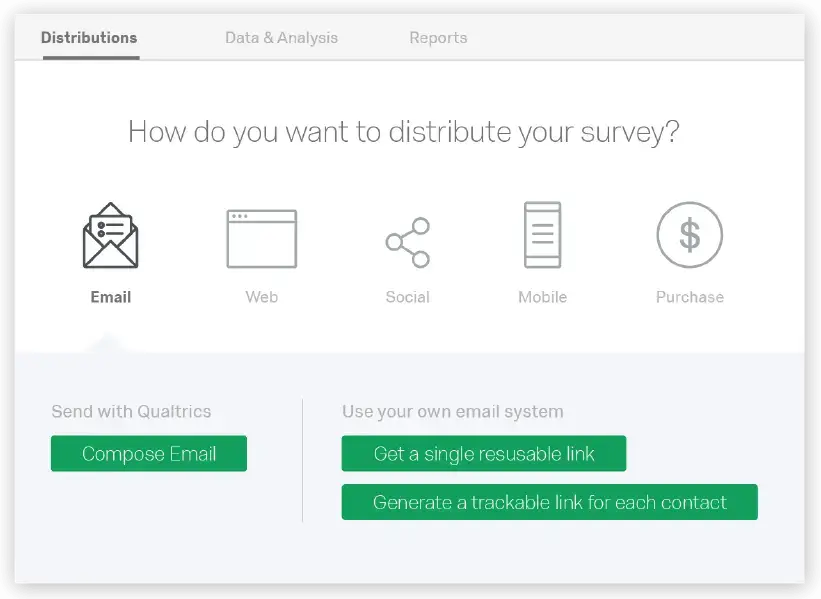

When you are satisfied that you have created a strong research design suitable for answering your research questions, you can conduct the survey through your method of choice – by mail, online, or in person.

There are many methods of analyzing the results of your survey. First you have to process the data, usually with the help of a computer program to sort all the responses. You should also clean the data by removing incomplete or incorrectly completed responses.

If you asked open-ended questions, you will have to code the responses by assigning labels to each response and organizing them into categories or themes. You can also use more qualitative methods, such as thematic analysis , which is especially suitable for analyzing interviews.

Statistical analysis is usually conducted using programs like SPSS or Stata. The same set of survey data can be subject to many analyses.

Finally, when you have collected and analyzed all the necessary data, you will write it up as part of your thesis, dissertation , or research paper .

In the methodology section, you describe exactly how you conducted the survey. You should explain the types of questions you used, the sampling method, when and where the survey took place, and the response rate. You can include the full questionnaire as an appendix and refer to it in the text if relevant.

Then introduce the analysis by describing how you prepared the data and the statistical methods you used to analyze it. In the results section, you summarize the key results from your analysis.

In the discussion and conclusion , you give your explanations and interpretations of these results, answer your research question, and reflect on the implications and limitations of the research.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Student’s t -distribution

- Normal distribution

- Null and Alternative Hypotheses

- Chi square tests

- Confidence interval

- Quartiles & Quantiles

- Cluster sampling

- Stratified sampling

- Data cleansing

- Reproducibility vs Replicability

- Peer review

- Prospective cohort study

Research bias

- Implicit bias

- Cognitive bias

- Placebo effect

- Hawthorne effect

- Hindsight bias

- Affect heuristic

- Social desirability bias

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analyzing data from people using questionnaires.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviors. It is made up of 4 or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with 5 or 7 possible responses, to capture their degree of agreement.

Individual Likert-type questions are generally considered ordinal data , because the items have clear rank order, but don’t have an even distribution.

Overall Likert scale scores are sometimes treated as interval data. These scores are considered to have directionality and even spacing between them.

The type of data determines what statistical tests you should use to analyze your data.

The priorities of a research design can vary depending on the field, but you usually have to specify:

- Your research questions and/or hypotheses

- Your overall approach (e.g., qualitative or quantitative )

- The type of design you’re using (e.g., a survey , experiment , or case study )

- Your sampling methods or criteria for selecting subjects

- Your data collection methods (e.g., questionnaires , observations)

- Your data collection procedures (e.g., operationalization , timing and data management)

- Your data analysis methods (e.g., statistical tests or thematic analysis )

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

McCombes, S. (2023, June 22). Survey Research | Definition, Examples & Methods. Scribbr. Retrieved April 2, 2024, from https://www.scribbr.com/methodology/survey-research/

Is this article helpful?

Shona McCombes

Other students also liked, qualitative vs. quantitative research | differences, examples & methods, questionnaire design | methods, question types & examples, what is a likert scale | guide & examples, "i thought ai proofreading was useless but..".

I've been using Scribbr for years now and I know it's a service that won't disappoint. It does a good job spotting mistakes”

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Survey Research: Definition, Examples and Methods

Survey Research is a quantitative research method used for collecting data from a set of respondents. It has been perhaps one of the most used methodologies in the industry for several years due to the multiple benefits and advantages that it has when collecting and analyzing data.

LEARN ABOUT: Behavioral Research

In this article, you will learn everything about survey research, such as types, methods, and examples.

Survey Research Definition

Survey Research is defined as the process of conducting research using surveys that researchers send to survey respondents. The data collected from surveys is then statistically analyzed to draw meaningful research conclusions. In the 21st century, every organization’s eager to understand what their customers think about their products or services and make better business decisions. Researchers can conduct research in multiple ways, but surveys are proven to be one of the most effective and trustworthy research methods. An online survey is a method for extracting information about a significant business matter from an individual or a group of individuals. It consists of structured survey questions that motivate the participants to respond. Creditable survey research can give these businesses access to a vast information bank. Organizations in media, other companies, and even governments rely on survey research to obtain accurate data.

The traditional definition of survey research is a quantitative method for collecting information from a pool of respondents by asking multiple survey questions. This research type includes the recruitment of individuals collection, and analysis of data. It’s useful for researchers who aim to communicate new features or trends to their respondents.

LEARN ABOUT: Level of Analysis Generally, it’s the primary step towards obtaining quick information about mainstream topics and conducting more rigorous and detailed quantitative research methods like surveys/polls or qualitative research methods like focus groups/on-call interviews can follow. There are many situations where researchers can conduct research using a blend of both qualitative and quantitative strategies.

LEARN ABOUT: Survey Sampling

Survey Research Methods

Survey research methods can be derived based on two critical factors: Survey research tool and time involved in conducting research. There are three main survey research methods, divided based on the medium of conducting survey research:

- Online/ Email: Online survey research is one of the most popular survey research methods today. The survey cost involved in online survey research is extremely minimal, and the responses gathered are highly accurate.

- Phone: Survey research conducted over the telephone ( CATI survey ) can be useful in collecting data from a more extensive section of the target population. There are chances that the money invested in phone surveys will be higher than other mediums, and the time required will be higher.

- Face-to-face: Researchers conduct face-to-face in-depth interviews in situations where there is a complicated problem to solve. The response rate for this method is the highest, but it can be costly.

Further, based on the time taken, survey research can be classified into two methods:

- Longitudinal survey research: Longitudinal survey research involves conducting survey research over a continuum of time and spread across years and decades. The data collected using this survey research method from one time period to another is qualitative or quantitative. Respondent behavior, preferences, and attitudes are continuously observed over time to analyze reasons for a change in behavior or preferences. For example, suppose a researcher intends to learn about the eating habits of teenagers. In that case, he/she will follow a sample of teenagers over a considerable period to ensure that the collected information is reliable. Often, cross-sectional survey research follows a longitudinal study .

- Cross-sectional survey research: Researchers conduct a cross-sectional survey to collect insights from a target audience at a particular time interval. This survey research method is implemented in various sectors such as retail, education, healthcare, SME businesses, etc. Cross-sectional studies can either be descriptive or analytical. It is quick and helps researchers collect information in a brief period. Researchers rely on the cross-sectional survey research method in situations where descriptive analysis of a subject is required.

Survey research also is bifurcated according to the sampling methods used to form samples for research: Probability and Non-probability sampling. Every individual in a population should be considered equally to be a part of the survey research sample. Probability sampling is a sampling method in which the researcher chooses the elements based on probability theory. The are various probability research methods, such as simple random sampling , systematic sampling, cluster sampling, stratified random sampling, etc. Non-probability sampling is a sampling method where the researcher uses his/her knowledge and experience to form samples.

LEARN ABOUT: Survey Sample Sizes

The various non-probability sampling techniques are :

- Convenience sampling

- Snowball sampling

- Consecutive sampling

- Judgemental sampling

- Quota sampling

Process of implementing survey research methods:

- Decide survey questions: Brainstorm and put together valid survey questions that are grammatically and logically appropriate. Understanding the objective and expected outcomes of the survey helps a lot. There are many surveys where details of responses are not as important as gaining insights about what customers prefer from the provided options. In such situations, a researcher can include multiple-choice questions or closed-ended questions . Whereas, if researchers need to obtain details about specific issues, they can consist of open-ended questions in the questionnaire. Ideally, the surveys should include a smart balance of open-ended and closed-ended questions. Use survey questions like Likert Scale , Semantic Scale, Net Promoter Score question, etc., to avoid fence-sitting.

LEARN ABOUT: System Usability Scale

- Finalize a target audience: Send out relevant surveys as per the target audience and filter out irrelevant questions as per the requirement. The survey research will be instrumental in case the target population decides on a sample. This way, results can be according to the desired market and be generalized to the entire population.

LEARN ABOUT: Testimonial Questions

- Send out surveys via decided mediums: Distribute the surveys to the target audience and patiently wait for the feedback and comments- this is the most crucial step of the survey research. The survey needs to be scheduled, keeping in mind the nature of the target audience and its regions. Surveys can be conducted via email, embedded in a website, shared via social media, etc., to gain maximum responses.

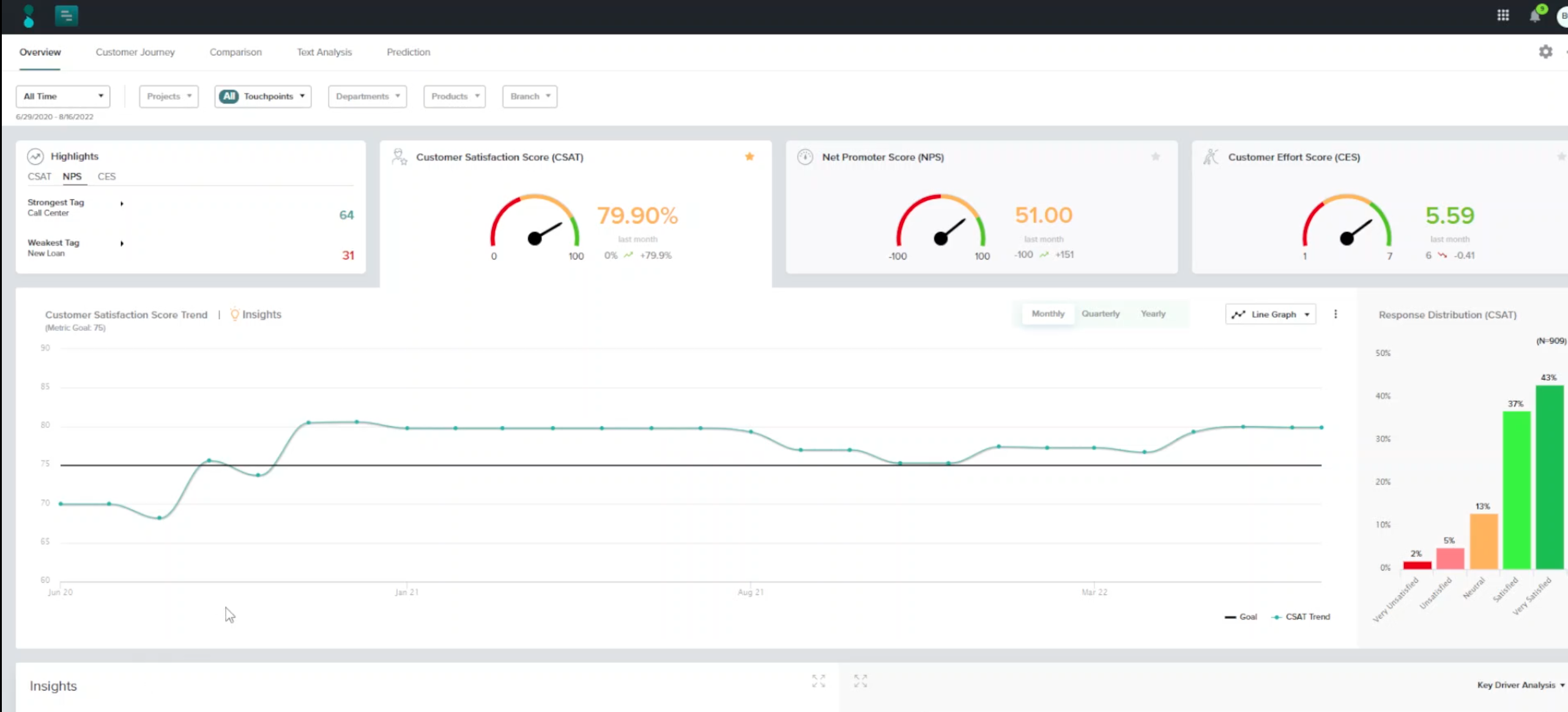

- Analyze survey results: Analyze the feedback in real-time and identify patterns in the responses which might lead to a much-needed breakthrough for your organization. GAP, TURF Analysis , Conjoint analysis, Cross tabulation, and many such survey feedback analysis methods can be used to spot and shed light on respondent behavior. Researchers can use the results to implement corrective measures to improve customer/employee satisfaction.

Reasons to conduct survey research

The most crucial and integral reason for conducting market research using surveys is that you can collect answers regarding specific, essential questions. You can ask these questions in multiple survey formats as per the target audience and the intent of the survey. Before designing a study, every organization must figure out the objective of carrying this out so that the study can be structured, planned, and executed to perfection.

LEARN ABOUT: Research Process Steps

Questions that need to be on your mind while designing a survey are:

- What is the primary aim of conducting the survey?

- How do you plan to utilize the collected survey data?

- What type of decisions do you plan to take based on the points mentioned above?

There are three critical reasons why an organization must conduct survey research.

- Understand respondent behavior to get solutions to your queries: If you’ve carefully curated a survey, the respondents will provide insights about what they like about your organization as well as suggestions for improvement. To motivate them to respond, you must be very vocal about how secure their responses will be and how you will utilize the answers. This will push them to be 100% honest about their feedback, opinions, and comments. Online surveys or mobile surveys have proved their privacy, and due to this, more and more respondents feel free to put forth their feedback through these mediums.

- Present a medium for discussion: A survey can be the perfect platform for respondents to provide criticism or applause for an organization. Important topics like product quality or quality of customer service etc., can be put on the table for discussion. A way you can do it is by including open-ended questions where the respondents can write their thoughts. This will make it easy for you to correlate your survey to what you intend to do with your product or service.

- Strategy for never-ending improvements: An organization can establish the target audience’s attributes from the pilot phase of survey research . Researchers can use the criticism and feedback received from this survey to improve the product/services. Once the company successfully makes the improvements, it can send out another survey to measure the change in feedback keeping the pilot phase the benchmark. By doing this activity, the organization can track what was effectively improved and what still needs improvement.

Survey Research Scales

There are four main scales for the measurement of variables:

- Nominal Scale: A nominal scale associates numbers with variables for mere naming or labeling, and the numbers usually have no other relevance. It is the most basic of the four levels of measurement.

- Ordinal Scale: The ordinal scale has an innate order within the variables along with labels. It establishes the rank between the variables of a scale but not the difference value between the variables.

- Interval Scale: The interval scale is a step ahead in comparison to the other two scales. Along with establishing a rank and name of variables, the scale also makes known the difference between the two variables. The only drawback is that there is no fixed start point of the scale, i.e., the actual zero value is absent.

- Ratio Scale: The ratio scale is the most advanced measurement scale, which has variables that are labeled in order and have a calculated difference between variables. In addition to what interval scale orders, this scale has a fixed starting point, i.e., the actual zero value is present.

Benefits of survey research

In case survey research is used for all the right purposes and is implemented properly, marketers can benefit by gaining useful, trustworthy data that they can use to better the ROI of the organization.

Other benefits of survey research are:

- Minimum investment: Mobile surveys and online surveys have minimal finance invested per respondent. Even with the gifts and other incentives provided to the people who participate in the study, online surveys are extremely economical compared to paper-based surveys.

- Versatile sources for response collection: You can conduct surveys via various mediums like online and mobile surveys. You can further classify them into qualitative mediums like focus groups , and interviews and quantitative mediums like customer-centric surveys. Due to the offline survey response collection option, researchers can conduct surveys in remote areas with limited internet connectivity. This can make data collection and analysis more convenient and extensive.

- Reliable for respondents: Surveys are extremely secure as the respondent details and responses are kept safeguarded. This anonymity makes respondents answer the survey questions candidly and with absolute honesty. An organization seeking to receive explicit responses for its survey research must mention that it will be confidential.

Survey research design

Researchers implement a survey research design in cases where there is a limited cost involved and there is a need to access details easily. This method is often used by small and large organizations to understand and analyze new trends, market demands, and opinions. Collecting information through tactfully designed survey research can be much more effective and productive than a casually conducted survey.

There are five stages of survey research design:

- Decide an aim of the research: There can be multiple reasons for a researcher to conduct a survey, but they need to decide a purpose for the research. This is the primary stage of survey research as it can mold the entire path of a survey, impacting its results.

- Filter the sample from target population: Who to target? is an essential question that a researcher should answer and keep in mind while conducting research. The precision of the results is driven by who the members of a sample are and how useful their opinions are. The quality of respondents in a sample is essential for the results received for research and not the quantity. If a researcher seeks to understand whether a product feature will work well with their target market, he/she can conduct survey research with a group of market experts for that product or technology.

- Zero-in on a survey method: Many qualitative and quantitative research methods can be discussed and decided. Focus groups, online interviews, surveys, polls, questionnaires, etc. can be carried out with a pre-decided sample of individuals.

- Design the questionnaire: What will the content of the survey be? A researcher is required to answer this question to be able to design it effectively. What will the content of the cover letter be? Or what are the survey questions of this questionnaire? Understand the target market thoroughly to create a questionnaire that targets a sample to gain insights about a survey research topic.

- Send out surveys and analyze results: Once the researcher decides on which questions to include in a study, they can send it across to the selected sample . Answers obtained from this survey can be analyzed to make product-related or marketing-related decisions.

Survey examples: 10 tips to design the perfect research survey

Picking the right survey design can be the key to gaining the information you need to make crucial decisions for all your research. It is essential to choose the right topic, choose the right question types, and pick a corresponding design. If this is your first time creating a survey, it can seem like an intimidating task. But with QuestionPro, each step of the process is made simple and easy.

Below are 10 Tips To Design The Perfect Research Survey:

- Set your SMART goals: Before conducting any market research or creating a particular plan, set your SMART Goals . What is that you want to achieve with the survey? How will you measure it promptly, and what are the results you are expecting?

- Choose the right questions: Designing a survey can be a tricky task. Asking the right questions may help you get the answers you are looking for and ease the task of analyzing. So, always choose those specific questions – relevant to your research.

- Begin your survey with a generalized question: Preferably, start your survey with a general question to understand whether the respondent uses the product or not. That also provides an excellent base and intro for your survey.

- Enhance your survey: Choose the best, most relevant, 15-20 questions. Frame each question as a different question type based on the kind of answer you would like to gather from each. Create a survey using different types of questions such as multiple-choice, rating scale, open-ended, etc. Look at more survey examples and four measurement scales every researcher should remember.

- Prepare yes/no questions: You may also want to use yes/no questions to separate people or branch them into groups of those who “have purchased” and those who “have not yet purchased” your products or services. Once you separate them, you can ask them different questions.

- Test all electronic devices: It becomes effortless to distribute your surveys if respondents can answer them on different electronic devices like mobiles, tablets, etc. Once you have created your survey, it’s time to TEST. You can also make any corrections if needed at this stage.

- Distribute your survey: Once your survey is ready, it is time to share and distribute it to the right audience. You can share handouts and share them via email, social media, and other industry-related offline/online communities.

- Collect and analyze responses: After distributing your survey, it is time to gather all responses. Make sure you store your results in a particular document or an Excel sheet with all the necessary categories mentioned so that you don’t lose your data. Remember, this is the most crucial stage. Segregate your responses based on demographics, psychographics, and behavior. This is because, as a researcher, you must know where your responses are coming from. It will help you to analyze, predict decisions, and help write the summary report.

- Prepare your summary report: Now is the time to share your analysis. At this stage, you should mention all the responses gathered from a survey in a fixed format. Also, the reader/customer must get clarity about your goal, which you were trying to gain from the study. Questions such as – whether the product or service has been used/preferred or not. Do respondents prefer some other product to another? Any recommendations?

Having a tool that helps you carry out all the necessary steps to carry out this type of study is a vital part of any project. At QuestionPro, we have helped more than 10,000 clients around the world to carry out data collection in a simple and effective way, in addition to offering a wide range of solutions to take advantage of this data in the best possible way.

From dashboards, advanced analysis tools, automation, and dedicated functions, in QuestionPro, you will find everything you need to execute your research projects effectively. Uncover insights that matter the most!

MORE LIKE THIS

Customer Experience Automation: Benefits and Best Tools

Apr 1, 2024

7 Best Market Segmentation Tools in 2024

In-App Feedback Tools: How to Collect, Uses & 14 Best Tools

Mar 29, 2024

11 Best Customer Journey Analytics Software in 2024

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

- Help Center

- اَلْعَرَبِيَّةُ

- Deutsch (Schweiz)

- Español (Mexico)

- Bahasa Indonesia

- Bahasa Melayu

- Português (Brasil)

- Tiếng việt

Survey Research — Types, Methods and Example Questions

Survey research The world of research is vast and complex, but with the right tools and understanding, it's an open field of discovery. Welcome to a journey into the heart of survey research. What is survey research? Survey research is the lens through which we view the opinions, behaviors, and experiences of a population. Think of it as the research world's detective, cleverly sleuthing out the truths hidden beneath layers of human complexity. Why is survey research important? Survey research is a Swiss Army Knife in a researcher's toolbox. It’s adaptable, reliable, and incredibly versatile, but its real power? It gives voice to the silent majority. Whether it's understanding customer preferences or assessing the impact of a social policy, survey research is the bridge between unanswered questions and insightful data. Let's embark on this exploration, armed with the spirit of openness, a sprinkle of curiosity, and the thirst for making knowledge accessible. As we journey further into the realm of survey research, we'll delve deeper into the diverse types of surveys, innovative data collection methods, and the rewards and challenges that come with them. Types of survey research Survey research is like an artist's palette, offering a variety of types to suit your unique research needs. Each type paints a different picture, giving us fascinating insights into the world around us. Cross-Sectional Surveys: Capture a snapshot of a population at a specific moment in time. They're your trusty Polaroid camera, freezing a moment for analysis and understanding. Longitudinal Surveys: Track changes over time, much like a time-lapse video. They help to identify trends and patterns, offering a dynamic perspective of your subject. Descriptive Surveys: Draw a detailed picture of the current state of affairs. They're your magnifying glass, examining the prevalence of a phenomenon or attitudes within a group. Analytical Surveys: Deep dive into the reasons behind certain outcomes. They're the research world's version of Sherlock Holmes, unraveling the complex web of cause and effect. But, what method should you choose for data collection? The plot thickens, doesn't it? Let's unravel this mystery in our next section. Survey research and data collection methods Data collection in survey research is an art form, and there's no one-size-fits-all method. Think of it as your paintbrush, each stroke represents a different way of capturing data. Online Surveys: In the digital age, online surveys have surged in popularity. They're fast, cost-effective, and can reach a global audience. But like a mysterious online acquaintance, respondents may not always be who they say they are. Mail Surveys: Like a postcard from a distant friend, mail surveys have a certain charm. They're great for reaching respondents without internet access. However, they’re slower and have lower response rates. They’re a test of patience and persistence. Telephone Surveys: With the sound of a ringing phone, the human element enters the picture. Great for reaching a diverse audience, they bring a touch of personal connection. But, remember, not all are fans of unsolicited calls. Face-to-Face Surveys: These are the heart-to-heart conversations of the survey world. While they require more resources, they're the gold standard for in-depth, high-quality data. As we journey further, let’s weigh the pros and cons of survey research. Advantages and disadvantages of survey research Every hero has its strengths and weaknesses, and survey research is no exception. Let's unwrap the gift box of survey research to see what lies inside. Advantages: Versatility: Like a superhero with multiple powers, surveys can be adapted to different topics, audiences, and research needs. Accessibility: With online surveys, geographical boundaries dissolve. We can reach out to the world from our living room. Anonymity: Like a confessional booth, surveys allow respondents to share their views without fear of judgment. Disadvantages: Response Bias: Ever met someone who says what you want to hear? Survey respondents can be like that too. Limited Depth: Like a puddle after a rainstorm, some surveys only skim the surface of complex issues. Nonresponse: Sometimes, potential respondents play hard to get, skewing the data. Survey research may have its challenges, but it also presents opportunities to learn and grow. As we forge ahead on our journey, we dive into the design process of survey research. Limitations of survey research Every research method has its limitations, like bumps on the road to discovery. But don't worry, with the right approach, these challenges become opportunities for growth. Misinterpretation: Sometimes, respondents might misunderstand your questions, like a badly translated novel. To overcome this, keep your questions simple and clear. Social Desirability Bias: People often want to present themselves in the best light. They might answer questions in a way that portrays them positively, even if it's not entirely accurate. Overcome this by ensuring anonymity and emphasizing honesty. Sample Representation: If your survey sample isn't representative of the population you're studying, it can skew your results. Aiming for a diverse sample can mitigate this. Now that we're aware of the limitations let's delve into the world of survey design. {loadmoduleid 430} Survey research design Designing a survey is like crafting a roadmap to discovery. It's an intricate process that involves careful planning, innovative strategies, and a deep understanding of your research goals. Let's get started. Approach and Strategy Your approach and strategy are the compasses guiding your survey research. Clear objectives, defined research questions, and an understanding of your target audience lay the foundation for a successful survey. Panel The panel is the heartbeat of your survey, the respondents who breathe life into your research. Selecting a representative panel ensures your research is accurate and inclusive. 9 Tips on Building the Perfect Survey Research Questionnaire Keep It Simple: Clear and straightforward questions lead to accurate responses. Make It Relevant: Ensure every question ties back to your research objectives. Order Matters: Start with easy questions to build rapport and save sensitive ones for later. Avoid Double-Barreled Questions: Stick to one idea per question. Offer a Balanced Scale: For rating scales, provide an equal number of positive and negative options. Provide a ‘Don't Know’ Option: This prevents guessing and keeps your data accurate. Pretest Your Survey: A pilot run helps you spot any issues before the final launch. Keep It Short: Respect your respondents' time. Make It Engaging: Keep your respondents interested with a mix of question types. Survey research examples and questions Examples serve as a bridge connecting theoretical concepts to real-world scenarios. Let's consider a few practical examples of survey research across various domains. User Experience (UX) Imagine being a UX designer at a budding tech start-up. Your app is gaining traction, but to keep your user base growing and engaged, you must ensure that your app's UX is top-notch. In this case, a well-designed survey could be a beacon, guiding you toward understanding user behavior, preferences, and pain points. Here's an example of how such a survey could look: "On a scale of 1 to 10, how would you rate the ease of navigating our app?" "How often do you encounter difficulties while using our app?" "What features do you use most frequently in our app?" "What improvements would you suggest for our app?" "What features would you like to see in future updates?" This line of questioning, while straightforward, provides invaluable insights. It enables the UX designer to identify strengths to capitalize on and weaknesses to improve, ultimately leading to a product that resonates with users. Psychology and Ethics in survey research The realm of survey research is not just about data and numbers, but it's also about understanding human behavior and treating respondents ethically. Psychology: In-depth understanding of cognitive biases and social dynamics can profoundly influence survey design. Let's take the 'Recency Effect,' a psychological principle stating that people tend to remember recent events more vividly than those in the past. While framing questions about user experiences, this insight could be invaluable. For example, a question like "Can you recall an instance in the past week when our customer service exceeded your expectations?" is likely to fetch more accurate responses than asking about an event several months ago. Ethics: On the other hand, maintaining privacy, confidentiality, and informed consent is more than ethical - it's fundamental to the integrity of the research process. Imagine conducting a sensitive survey about workplace culture. Ensuring respondents that their responses will remain confidential and anonymous can encourage more honest responses. An introductory note stating these assurances, along with a clear outline of the survey's purpose, can help build trust with your respondents. Survey research software In the age of digital information, survey research software has become a trusted ally for researchers. It simplifies complex processes like data collection, analysis, and visualization, democratizing research and making it more accessible to a broad audience. LimeSurvey, our innovative, user-friendly tool, brings this vision to life. It stands at the crossroads of simplicity and power, embodying the essence of accessible survey research. Whether you're a freelancer exploring new market trends, a psychology student curious about human behavior, or an HR officer aiming to improve company culture, LimeSurvey empowers you to conduct efficient, effective research. Its suite of features and intuitive design matches your research pace, allowing your curiosity to take the front seat. For instance, consider you're a researcher studying consumer behavior across different demographics. With LimeSurvey, you can easily design demographic-specific questions, distribute your survey across various channels, collect responses in real-time, and visualize your data through intuitive dashboards. This synergy of tools and functionalities makes LimeSurvey a perfect ally in your quest for knowledge. Conclusion If you've come this far, we can sense your spark of curiosity. Are you eager to take the reins and conduct your own survey research? Are you ready to embrace the simple yet powerful tool that LimeSurvey offers? If so, we can't wait to see where your journey takes you next! In the world of survey research, there's always more to explore, more to learn and more to discover. So, keep your curiosity alive, stay open to new ideas, and remember, your exploration is just beginning! We hope that our exploration has been as enlightening for you as it was exciting for us. Remember, the journey doesn't end here. With the power of knowledge and the right tools in your hands, there's no limit to what you can achieve. So, let your curiosity be your guide and dive into the fascinating world of survey research with LimeSurvey! Try it out for free now! Happy surveying! {loadmoduleid 429}

Table Content

Survey research.

The world of research is vast and complex, but with the right tools and understanding, it's an open field of discovery. Welcome to a journey into the heart of survey research.

What is survey research?

Survey research is the lens through which we view the opinions, behaviors, and experiences of a population. Think of it as the research world's detective, cleverly sleuthing out the truths hidden beneath layers of human complexity.

Why is survey research important?

Survey research is a Swiss Army Knife in a researcher's toolbox. It’s adaptable, reliable, and incredibly versatile, but its real power? It gives voice to the silent majority. Whether it's understanding customer preferences or assessing the impact of a social policy, survey research is the bridge between unanswered questions and insightful data.

Let's embark on this exploration, armed with the spirit of openness, a sprinkle of curiosity, and the thirst for making knowledge accessible. As we journey further into the realm of survey research, we'll delve deeper into the diverse types of surveys, innovative data collection methods, and the rewards and challenges that come with them.

Types of survey research

Survey research is like an artist's palette, offering a variety of types to suit your unique research needs. Each type paints a different picture, giving us fascinating insights into the world around us.

- Cross-Sectional Surveys: Capture a snapshot of a population at a specific moment in time. They're your trusty Polaroid camera, freezing a moment for analysis and understanding.

- Longitudinal Surveys: Track changes over time, much like a time-lapse video. They help to identify trends and patterns, offering a dynamic perspective of your subject.

- Descriptive Surveys: Draw a detailed picture of the current state of affairs. They're your magnifying glass, examining the prevalence of a phenomenon or attitudes within a group.

- Analytical Surveys: Deep dive into the reasons behind certain outcomes. They're the research world's version of Sherlock Holmes, unraveling the complex web of cause and effect.

But, what method should you choose for data collection? The plot thickens, doesn't it? Let's unravel this mystery in our next section.

Survey research and data collection methods

Data collection in survey research is an art form, and there's no one-size-fits-all method. Think of it as your paintbrush, each stroke represents a different way of capturing data.

- Online Surveys: In the digital age, online surveys have surged in popularity. They're fast, cost-effective, and can reach a global audience. But like a mysterious online acquaintance, respondents may not always be who they say they are.

- Mail Surveys: Like a postcard from a distant friend, mail surveys have a certain charm. They're great for reaching respondents without internet access. However, they’re slower and have lower response rates. They’re a test of patience and persistence.

- Telephone Surveys: With the sound of a ringing phone, the human element enters the picture. Great for reaching a diverse audience, they bring a touch of personal connection. But, remember, not all are fans of unsolicited calls.

- Face-to-Face Surveys: These are the heart-to-heart conversations of the survey world. While they require more resources, they're the gold standard for in-depth, high-quality data.

As we journey further, let’s weigh the pros and cons of survey research.

Advantages and disadvantages of survey research

Every hero has its strengths and weaknesses, and survey research is no exception. Let's unwrap the gift box of survey research to see what lies inside.

Advantages:

- Versatility: Like a superhero with multiple powers, surveys can be adapted to different topics, audiences, and research needs.

- Accessibility: With online surveys, geographical boundaries dissolve. We can reach out to the world from our living room.

- Anonymity: Like a confessional booth, surveys allow respondents to share their views without fear of judgment.

Disadvantages:

- Response Bias: Ever met someone who says what you want to hear? Survey respondents can be like that too.

- Limited Depth: Like a puddle after a rainstorm, some surveys only skim the surface of complex issues.

- Nonresponse: Sometimes, potential respondents play hard to get, skewing the data.

Survey research may have its challenges, but it also presents opportunities to learn and grow. As we forge ahead on our journey, we dive into the design process of survey research.

Limitations of survey research

Every research method has its limitations, like bumps on the road to discovery. But don't worry, with the right approach, these challenges become opportunities for growth.

Misinterpretation: Sometimes, respondents might misunderstand your questions, like a badly translated novel. To overcome this, keep your questions simple and clear.

Social Desirability Bias: People often want to present themselves in the best light. They might answer questions in a way that portrays them positively, even if it's not entirely accurate. Overcome this by ensuring anonymity and emphasizing honesty.

Sample Representation: If your survey sample isn't representative of the population you're studying, it can skew your results. Aiming for a diverse sample can mitigate this.

Now that we're aware of the limitations let's delve into the world of survey design.

- Create surveys in 40+ languages

- Unlimited number of users

- Ready-to-go survey templates

- So much more...

Survey research design

Designing a survey is like crafting a roadmap to discovery. It's an intricate process that involves careful planning, innovative strategies, and a deep understanding of your research goals. Let's get started.

Approach and Strategy

Your approach and strategy are the compasses guiding your survey research. Clear objectives, defined research questions, and an understanding of your target audience lay the foundation for a successful survey.

The panel is the heartbeat of your survey, the respondents who breathe life into your research. Selecting a representative panel ensures your research is accurate and inclusive.

9 Tips on Building the Perfect Survey Research Questionnaire

- Keep It Simple: Clear and straightforward questions lead to accurate responses.

- Make It Relevant: Ensure every question ties back to your research objectives.

- Order Matters: Start with easy questions to build rapport and save sensitive ones for later.

- Avoid Double-Barreled Questions: Stick to one idea per question.

- Offer a Balanced Scale: For rating scales, provide an equal number of positive and negative options.

- Provide a ‘Don't Know’ Option: This prevents guessing and keeps your data accurate.

- Pretest Your Survey: A pilot run helps you spot any issues before the final launch.

- Keep It Short: Respect your respondents' time.

- Make It Engaging: Keep your respondents interested with a mix of question types.

Survey research examples and questions

Examples serve as a bridge connecting theoretical concepts to real-world scenarios. Let's consider a few practical examples of survey research across various domains.

User Experience (UX)

Imagine being a UX designer at a budding tech start-up. Your app is gaining traction, but to keep your user base growing and engaged, you must ensure that your app's UX is top-notch. In this case, a well-designed survey could be a beacon, guiding you toward understanding user behavior, preferences, and pain points.

Here's an example of how such a survey could look:

- "On a scale of 1 to 10, how would you rate the ease of navigating our app?"

- "How often do you encounter difficulties while using our app?"

- "What features do you use most frequently in our app?"

- "What improvements would you suggest for our app?"

- "What features would you like to see in future updates?"

This line of questioning, while straightforward, provides invaluable insights. It enables the UX designer to identify strengths to capitalize on and weaknesses to improve, ultimately leading to a product that resonates with users.

Psychology and Ethics in survey research

The realm of survey research is not just about data and numbers, but it's also about understanding human behavior and treating respondents ethically.

Psychology: In-depth understanding of cognitive biases and social dynamics can profoundly influence survey design. Let's take the 'Recency Effect,' a psychological principle stating that people tend to remember recent events more vividly than those in the past. While framing questions about user experiences, this insight could be invaluable.

For example, a question like "Can you recall an instance in the past week when our customer service exceeded your expectations?" is likely to fetch more accurate responses than asking about an event several months ago.

Ethics: On the other hand, maintaining privacy, confidentiality, and informed consent is more than ethical - it's fundamental to the integrity of the research process.

Imagine conducting a sensitive survey about workplace culture. Ensuring respondents that their responses will remain confidential and anonymous can encourage more honest responses. An introductory note stating these assurances, along with a clear outline of the survey's purpose, can help build trust with your respondents.

Survey research software

In the age of digital information, survey research software has become a trusted ally for researchers. It simplifies complex processes like data collection, analysis, and visualization, democratizing research and making it more accessible to a broad audience.

LimeSurvey, our innovative, user-friendly tool, brings this vision to life. It stands at the crossroads of simplicity and power, embodying the essence of accessible survey research.

Whether you're a freelancer exploring new market trends, a psychology student curious about human behavior, or an HR officer aiming to improve company culture, LimeSurvey empowers you to conduct efficient, effective research. Its suite of features and intuitive design matches your research pace, allowing your curiosity to take the front seat.

For instance, consider you're a researcher studying consumer behavior across different demographics. With LimeSurvey, you can easily design demographic-specific questions, distribute your survey across various channels, collect responses in real-time, and visualize your data through intuitive dashboards. This synergy of tools and functionalities makes LimeSurvey a perfect ally in your quest for knowledge.

If you've come this far, we can sense your spark of curiosity. Are you eager to take the reins and conduct your own survey research? Are you ready to embrace the simple yet powerful tool that LimeSurvey offers? If so, we can't wait to see where your journey takes you next!

In the world of survey research, there's always more to explore, more to learn and more to discover. So, keep your curiosity alive, stay open to new ideas, and remember, your exploration is just beginning!

We hope that our exploration has been as enlightening for you as it was exciting for us. Remember, the journey doesn't end here. With the power of knowledge and the right tools in your hands, there's no limit to what you can achieve. So, let your curiosity be your guide and dive into the fascinating world of survey research with LimeSurvey! Try it out for free now!

Happy surveying!

Think one step ahead.

Step into a bright future with our simple online survey tool

Open Source

- Privacy Policy

Buy Me a Coffee

Home » Survey Research – Types, Methods, Examples

Survey Research – Types, Methods, Examples

Table of Contents

Survey Research

Definition:

Survey Research is a quantitative research method that involves collecting standardized data from a sample of individuals or groups through the use of structured questionnaires or interviews. The data collected is then analyzed statistically to identify patterns and relationships between variables, and to draw conclusions about the population being studied.

Survey research can be used to answer a variety of questions, including:

- What are people’s opinions about a certain topic?

- What are people’s experiences with a certain product or service?

- What are people’s beliefs about a certain issue?

Survey Research Methods

Survey Research Methods are as follows:

- Telephone surveys: A survey research method where questions are administered to respondents over the phone, often used in market research or political polling.

- Face-to-face surveys: A survey research method where questions are administered to respondents in person, often used in social or health research.

- Mail surveys: A survey research method where questionnaires are sent to respondents through mail, often used in customer satisfaction or opinion surveys.

- Online surveys: A survey research method where questions are administered to respondents through online platforms, often used in market research or customer feedback.

- Email surveys: A survey research method where questionnaires are sent to respondents through email, often used in customer satisfaction or opinion surveys.

- Mixed-mode surveys: A survey research method that combines two or more survey modes, often used to increase response rates or reach diverse populations.

- Computer-assisted surveys: A survey research method that uses computer technology to administer or collect survey data, often used in large-scale surveys or data collection.

- Interactive voice response surveys: A survey research method where respondents answer questions through a touch-tone telephone system, often used in automated customer satisfaction or opinion surveys.

- Mobile surveys: A survey research method where questions are administered to respondents through mobile devices, often used in market research or customer feedback.

- Group-administered surveys: A survey research method where questions are administered to a group of respondents simultaneously, often used in education or training evaluation.

- Web-intercept surveys: A survey research method where questions are administered to website visitors, often used in website or user experience research.

- In-app surveys: A survey research method where questions are administered to users of a mobile application, often used in mobile app or user experience research.

- Social media surveys: A survey research method where questions are administered to respondents through social media platforms, often used in social media or brand awareness research.

- SMS surveys: A survey research method where questions are administered to respondents through text messaging, often used in customer feedback or opinion surveys.

- IVR surveys: A survey research method where questions are administered to respondents through an interactive voice response system, often used in automated customer feedback or opinion surveys.

- Mixed-method surveys: A survey research method that combines both qualitative and quantitative data collection methods, often used in exploratory or mixed-method research.

- Drop-off surveys: A survey research method where respondents are provided with a survey questionnaire and asked to return it at a later time or through a designated drop-off location.

- Intercept surveys: A survey research method where respondents are approached in public places and asked to participate in a survey, often used in market research or customer feedback.

- Hybrid surveys: A survey research method that combines two or more survey modes, data sources, or research methods, often used in complex or multi-dimensional research questions.

Types of Survey Research

There are several types of survey research that can be used to collect data from a sample of individuals or groups. following are Types of Survey Research:

- Cross-sectional survey: A type of survey research that gathers data from a sample of individuals at a specific point in time, providing a snapshot of the population being studied.

- Longitudinal survey: A type of survey research that gathers data from the same sample of individuals over an extended period of time, allowing researchers to track changes or trends in the population being studied.

- Panel survey: A type of longitudinal survey research that tracks the same sample of individuals over time, typically collecting data at multiple points in time.

- Epidemiological survey: A type of survey research that studies the distribution and determinants of health and disease in a population, often used to identify risk factors and inform public health interventions.

- Observational survey: A type of survey research that collects data through direct observation of individuals or groups, often used in behavioral or social research.

- Correlational survey: A type of survey research that measures the degree of association or relationship between two or more variables, often used to identify patterns or trends in data.

- Experimental survey: A type of survey research that involves manipulating one or more variables to observe the effect on an outcome, often used to test causal hypotheses.

- Descriptive survey: A type of survey research that describes the characteristics or attributes of a population or phenomenon, often used in exploratory research or to summarize existing data.

- Diagnostic survey: A type of survey research that assesses the current state or condition of an individual or system, often used in health or organizational research.

- Explanatory survey: A type of survey research that seeks to explain or understand the causes or mechanisms behind a phenomenon, often used in social or psychological research.

- Process evaluation survey: A type of survey research that measures the implementation and outcomes of a program or intervention, often used in program evaluation or quality improvement.

- Impact evaluation survey: A type of survey research that assesses the effectiveness or impact of a program or intervention, often used to inform policy or decision-making.

- Customer satisfaction survey: A type of survey research that measures the satisfaction or dissatisfaction of customers with a product, service, or experience, often used in marketing or customer service research.

- Market research survey: A type of survey research that collects data on consumer preferences, behaviors, or attitudes, often used in market research or product development.

- Public opinion survey: A type of survey research that measures the attitudes, beliefs, or opinions of a population on a specific issue or topic, often used in political or social research.

- Behavioral survey: A type of survey research that measures actual behavior or actions of individuals, often used in health or social research.

- Attitude survey: A type of survey research that measures the attitudes, beliefs, or opinions of individuals, often used in social or psychological research.

- Opinion poll: A type of survey research that measures the opinions or preferences of a population on a specific issue or topic, often used in political or media research.

- Ad hoc survey: A type of survey research that is conducted for a specific purpose or research question, often used in exploratory research or to answer a specific research question.

Types Based on Methodology

Based on Methodology Survey are divided into two Types:

Quantitative Survey Research

Qualitative survey research.

Quantitative survey research is a method of collecting numerical data from a sample of participants through the use of standardized surveys or questionnaires. The purpose of quantitative survey research is to gather empirical evidence that can be analyzed statistically to draw conclusions about a particular population or phenomenon.

In quantitative survey research, the questions are structured and pre-determined, often utilizing closed-ended questions, where participants are given a limited set of response options to choose from. This approach allows for efficient data collection and analysis, as well as the ability to generalize the findings to a larger population.

Quantitative survey research is often used in market research, social sciences, public health, and other fields where numerical data is needed to make informed decisions and recommendations.

Qualitative survey research is a method of collecting non-numerical data from a sample of participants through the use of open-ended questions or semi-structured interviews. The purpose of qualitative survey research is to gain a deeper understanding of the experiences, perceptions, and attitudes of participants towards a particular phenomenon or topic.

In qualitative survey research, the questions are open-ended, allowing participants to share their thoughts and experiences in their own words. This approach allows for a rich and nuanced understanding of the topic being studied, and can provide insights that are difficult to capture through quantitative methods alone.

Qualitative survey research is often used in social sciences, education, psychology, and other fields where a deeper understanding of human experiences and perceptions is needed to inform policy, practice, or theory.

Data Analysis Methods

There are several Survey Research Data Analysis Methods that researchers may use, including:

- Descriptive statistics: This method is used to summarize and describe the basic features of the survey data, such as the mean, median, mode, and standard deviation. These statistics can help researchers understand the distribution of responses and identify any trends or patterns.

- Inferential statistics: This method is used to make inferences about the larger population based on the data collected in the survey. Common inferential statistical methods include hypothesis testing, regression analysis, and correlation analysis.

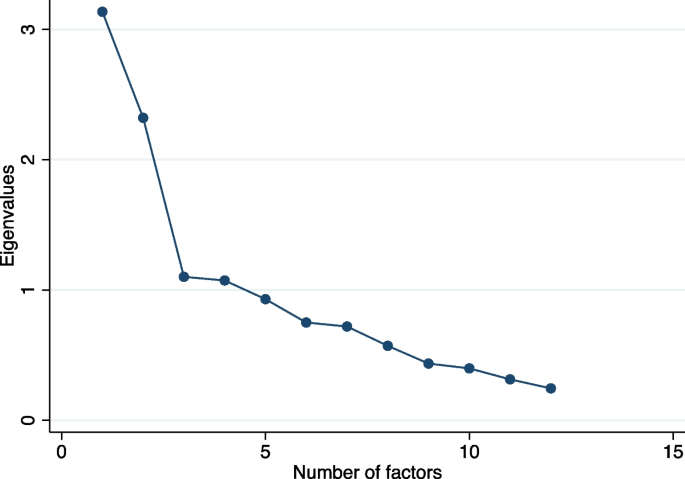

- Factor analysis: This method is used to identify underlying factors or dimensions in the survey data. This can help researchers simplify the data and identify patterns and relationships that may not be immediately apparent.

- Cluster analysis: This method is used to group similar respondents together based on their survey responses. This can help researchers identify subgroups within the larger population and understand how different groups may differ in their attitudes, behaviors, or preferences.

- Structural equation modeling: This method is used to test complex relationships between variables in the survey data. It can help researchers understand how different variables may be related to one another and how they may influence one another.

- Content analysis: This method is used to analyze open-ended responses in the survey data. Researchers may use software to identify themes or categories in the responses, or they may manually review and code the responses.

- Text mining: This method is used to analyze text-based survey data, such as responses to open-ended questions. Researchers may use software to identify patterns and themes in the text, or they may manually review and code the text.

Applications of Survey Research

Here are some common applications of survey research:

- Market Research: Companies use survey research to gather insights about customer needs, preferences, and behavior. These insights are used to create marketing strategies and develop new products.

- Public Opinion Research: Governments and political parties use survey research to understand public opinion on various issues. This information is used to develop policies and make decisions.

- Social Research: Survey research is used in social research to study social trends, attitudes, and behavior. Researchers use survey data to explore topics such as education, health, and social inequality.

- Academic Research: Survey research is used in academic research to study various phenomena. Researchers use survey data to test theories, explore relationships between variables, and draw conclusions.

- Customer Satisfaction Research: Companies use survey research to gather information about customer satisfaction with their products and services. This information is used to improve customer experience and retention.

- Employee Surveys: Employers use survey research to gather feedback from employees about their job satisfaction, working conditions, and organizational culture. This information is used to improve employee retention and productivity.

- Health Research: Survey research is used in health research to study topics such as disease prevalence, health behaviors, and healthcare access. Researchers use survey data to develop interventions and improve healthcare outcomes.

Examples of Survey Research

Here are some real-time examples of survey research:

- COVID-19 Pandemic Surveys: Since the outbreak of the COVID-19 pandemic, surveys have been conducted to gather information about public attitudes, behaviors, and perceptions related to the pandemic. Governments and healthcare organizations have used this data to develop public health strategies and messaging.

- Political Polls During Elections: During election seasons, surveys are used to measure public opinion on political candidates, policies, and issues in real-time. This information is used by political parties to develop campaign strategies and make decisions.

- Customer Feedback Surveys: Companies often use real-time customer feedback surveys to gather insights about customer experience and satisfaction. This information is used to improve products and services quickly.

- Event Surveys: Organizers of events such as conferences and trade shows often use surveys to gather feedback from attendees in real-time. This information can be used to improve future events and make adjustments during the current event.

- Website and App Surveys: Website and app owners use surveys to gather real-time feedback from users about the functionality, user experience, and overall satisfaction with their platforms. This feedback can be used to improve the user experience and retain customers.

- Employee Pulse Surveys: Employers use real-time pulse surveys to gather feedback from employees about their work experience and overall job satisfaction. This feedback is used to make changes in real-time to improve employee retention and productivity.

Survey Sample

Purpose of survey research.

The purpose of survey research is to gather data and insights from a representative sample of individuals. Survey research allows researchers to collect data quickly and efficiently from a large number of people, making it a valuable tool for understanding attitudes, behaviors, and preferences.

Here are some common purposes of survey research:

- Descriptive Research: Survey research is often used to describe characteristics of a population or a phenomenon. For example, a survey could be used to describe the characteristics of a particular demographic group, such as age, gender, or income.

- Exploratory Research: Survey research can be used to explore new topics or areas of research. Exploratory surveys are often used to generate hypotheses or identify potential relationships between variables.

- Explanatory Research: Survey research can be used to explain relationships between variables. For example, a survey could be used to determine whether there is a relationship between educational attainment and income.

- Evaluation Research: Survey research can be used to evaluate the effectiveness of a program or intervention. For example, a survey could be used to evaluate the impact of a health education program on behavior change.

- Monitoring Research: Survey research can be used to monitor trends or changes over time. For example, a survey could be used to monitor changes in attitudes towards climate change or political candidates over time.

When to use Survey Research

there are certain circumstances where survey research is particularly appropriate. Here are some situations where survey research may be useful:

- When the research question involves attitudes, beliefs, or opinions: Survey research is particularly useful for understanding attitudes, beliefs, and opinions on a particular topic. For example, a survey could be used to understand public opinion on a political issue.

- When the research question involves behaviors or experiences: Survey research can also be useful for understanding behaviors and experiences. For example, a survey could be used to understand the prevalence of a particular health behavior.

- When a large sample size is needed: Survey research allows researchers to collect data from a large number of people quickly and efficiently. This makes it a useful method when a large sample size is needed to ensure statistical validity.

- When the research question is time-sensitive: Survey research can be conducted quickly, which makes it a useful method when the research question is time-sensitive. For example, a survey could be used to understand public opinion on a breaking news story.

- When the research question involves a geographically dispersed population: Survey research can be conducted online, which makes it a useful method when the population of interest is geographically dispersed.

How to Conduct Survey Research

Conducting survey research involves several steps that need to be carefully planned and executed. Here is a general overview of the process:

- Define the research question: The first step in conducting survey research is to clearly define the research question. The research question should be specific, measurable, and relevant to the population of interest.

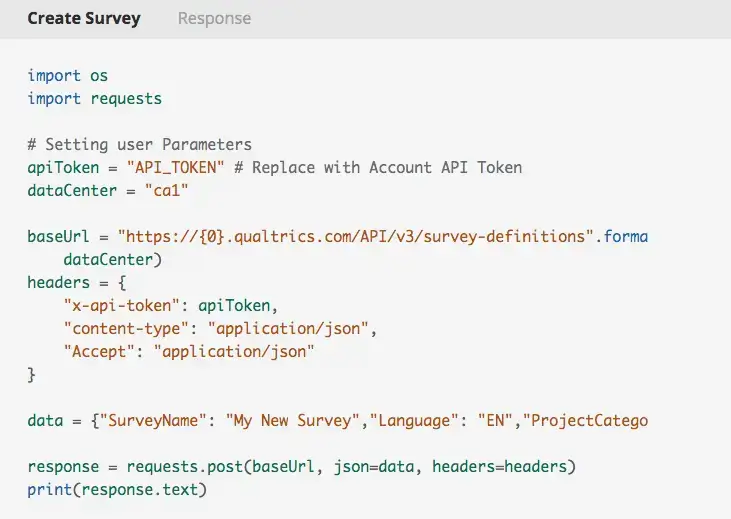

- Develop a survey instrument : The next step is to develop a survey instrument. This can be done using various methods, such as online survey tools or paper surveys. The survey instrument should be designed to elicit the information needed to answer the research question, and should be pre-tested with a small sample of individuals.

- Select a sample : The sample is the group of individuals who will be invited to participate in the survey. The sample should be representative of the population of interest, and the size of the sample should be sufficient to ensure statistical validity.

- Administer the survey: The survey can be administered in various ways, such as online, by mail, or in person. The method of administration should be chosen based on the population of interest and the research question.

- Analyze the data: Once the survey data is collected, it needs to be analyzed. This involves summarizing the data using statistical methods, such as frequency distributions or regression analysis.

- Draw conclusions: The final step is to draw conclusions based on the data analysis. This involves interpreting the results and answering the research question.

Advantages of Survey Research

There are several advantages to using survey research, including: