AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup or small business, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

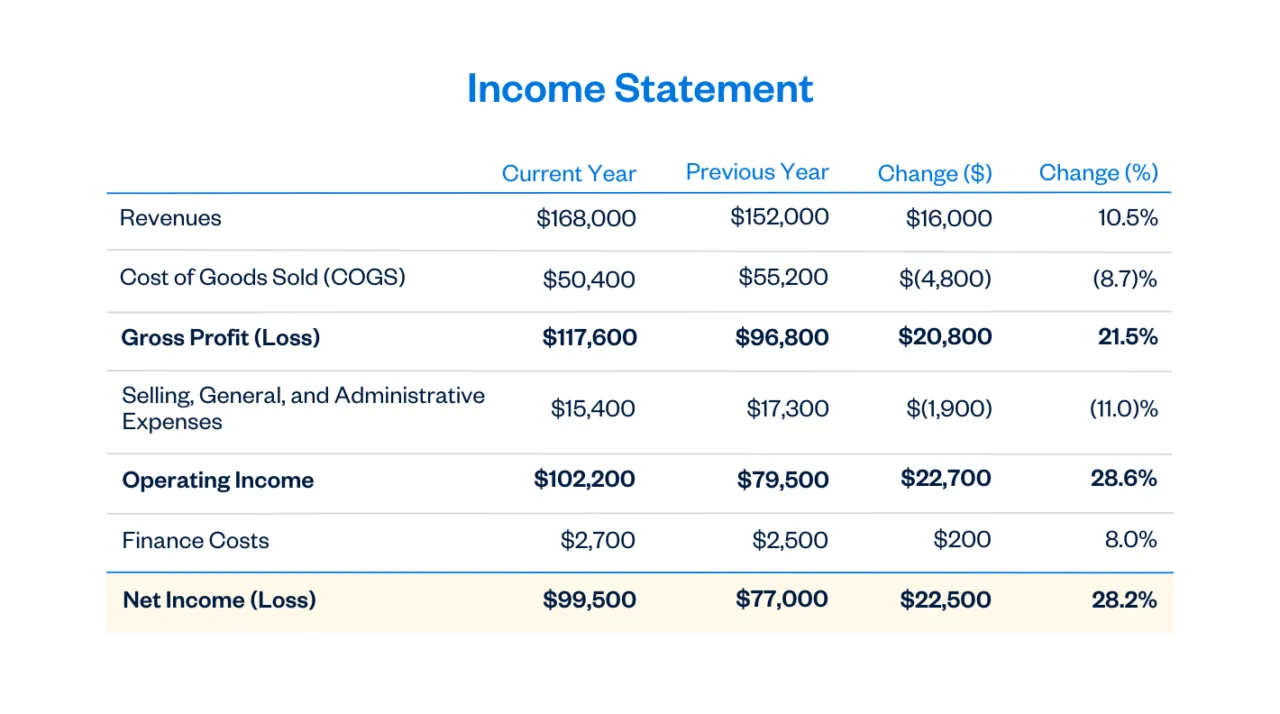

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

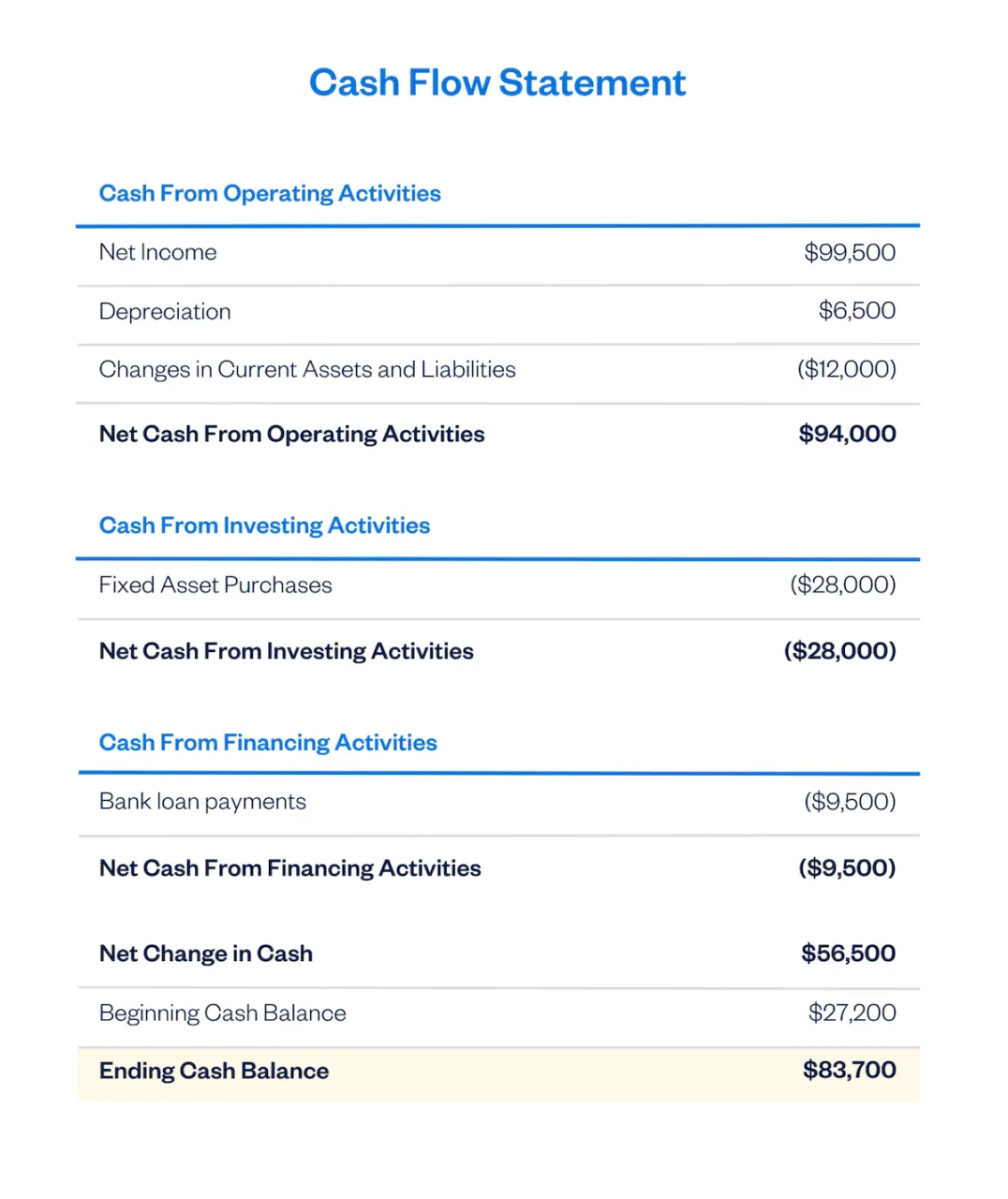

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

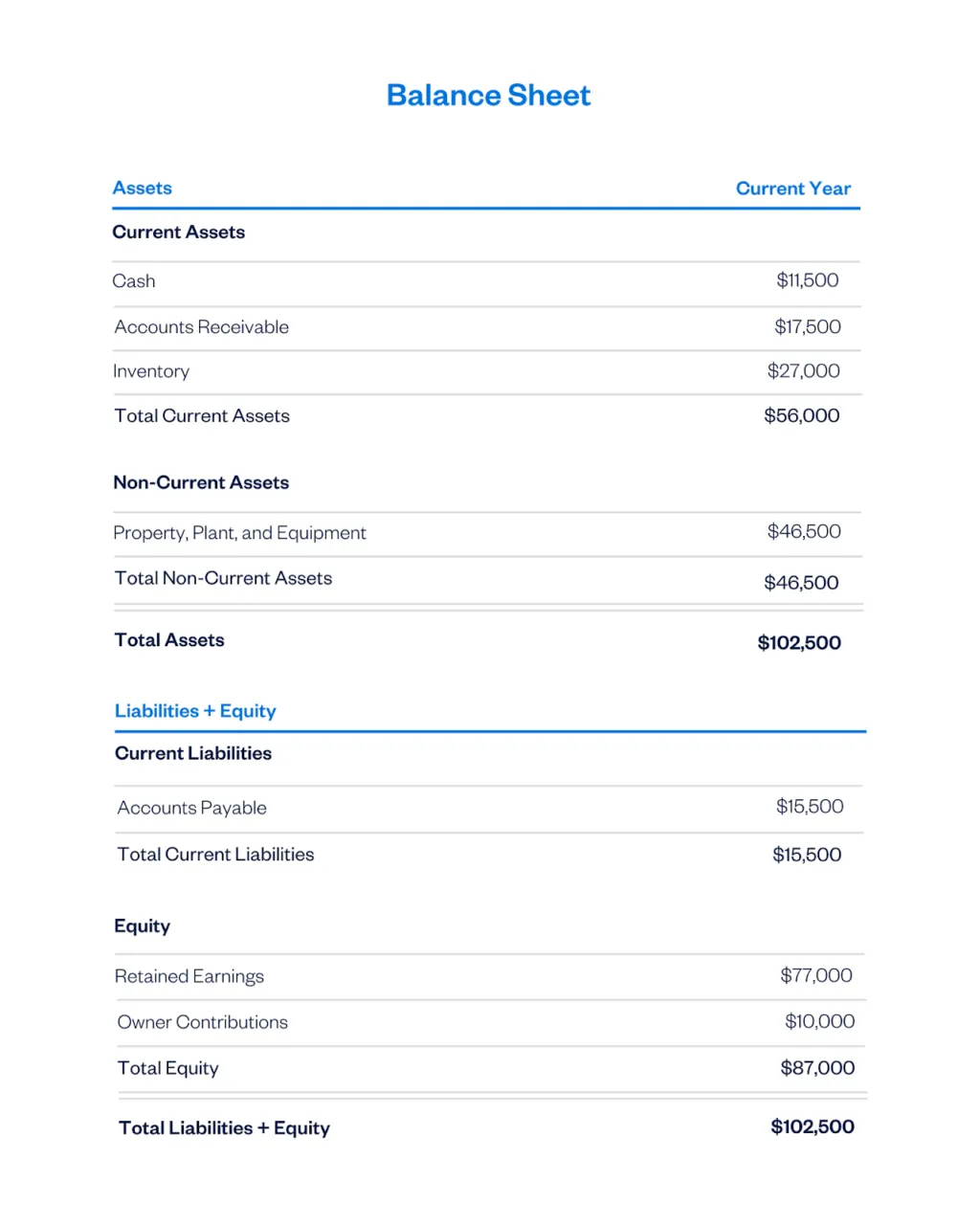

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup or small business.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your small business and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan for your business plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

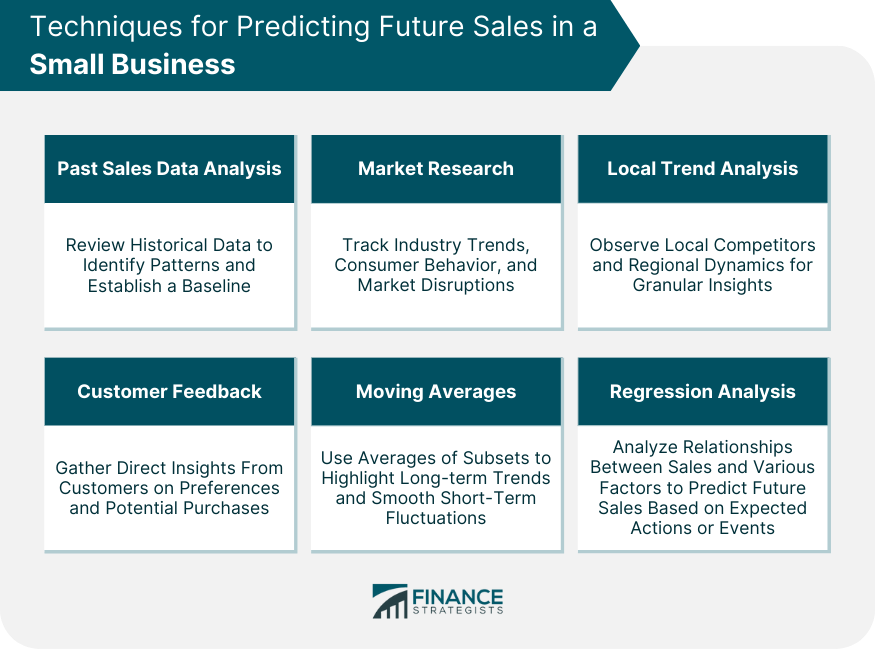

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

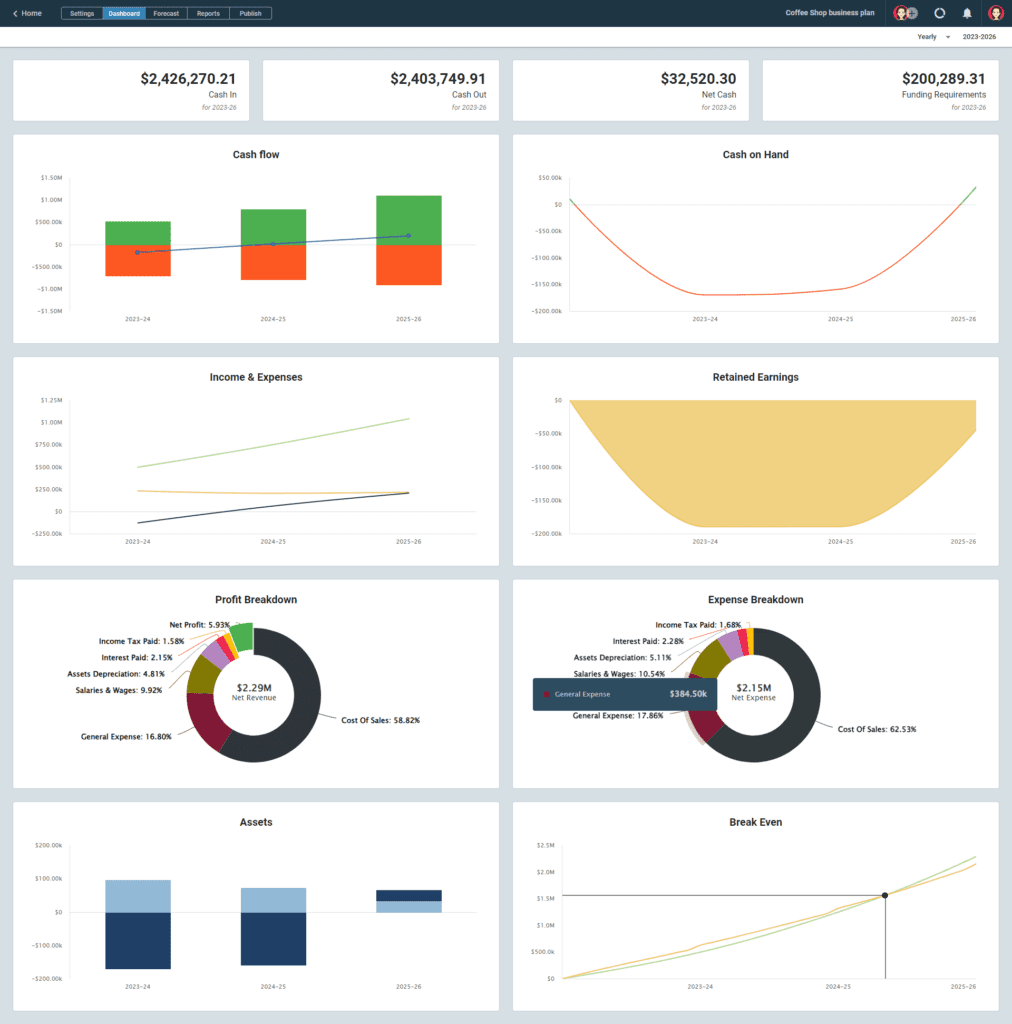

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan for your small business, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

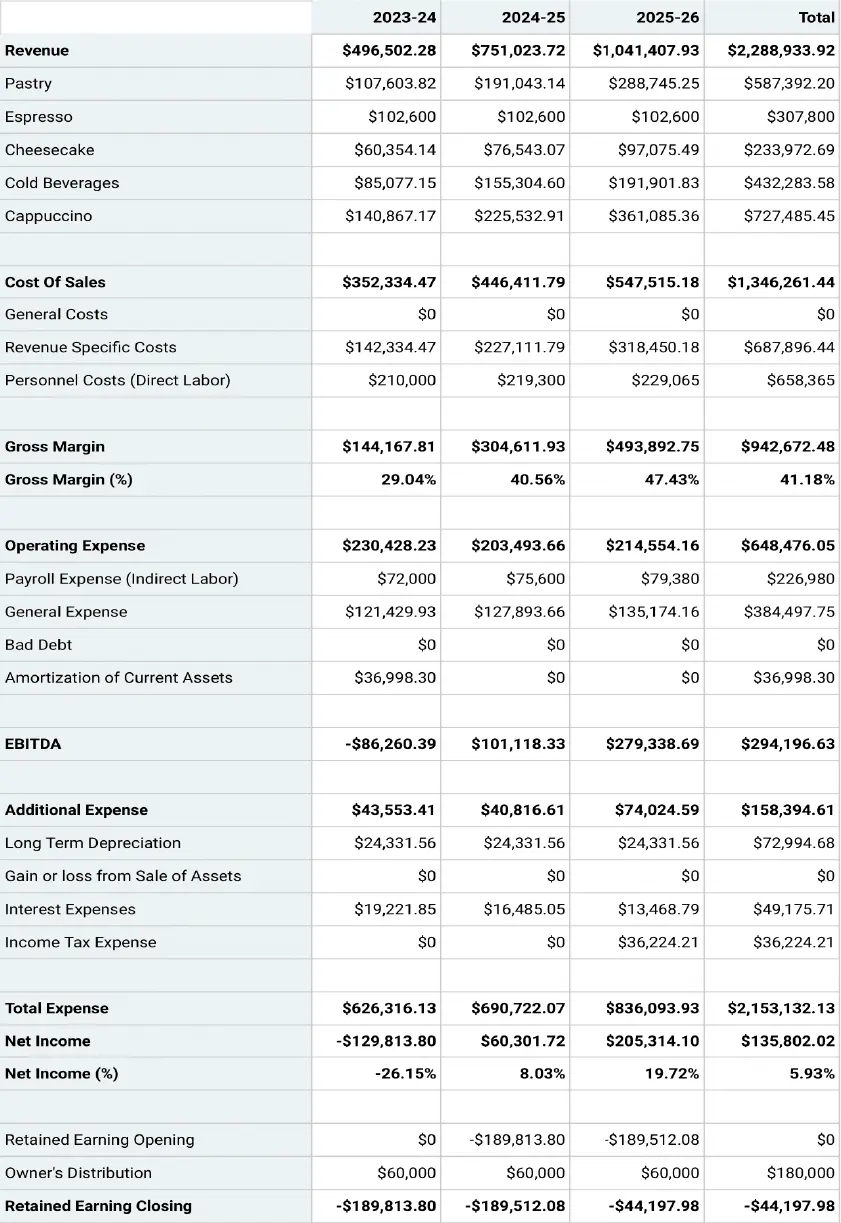

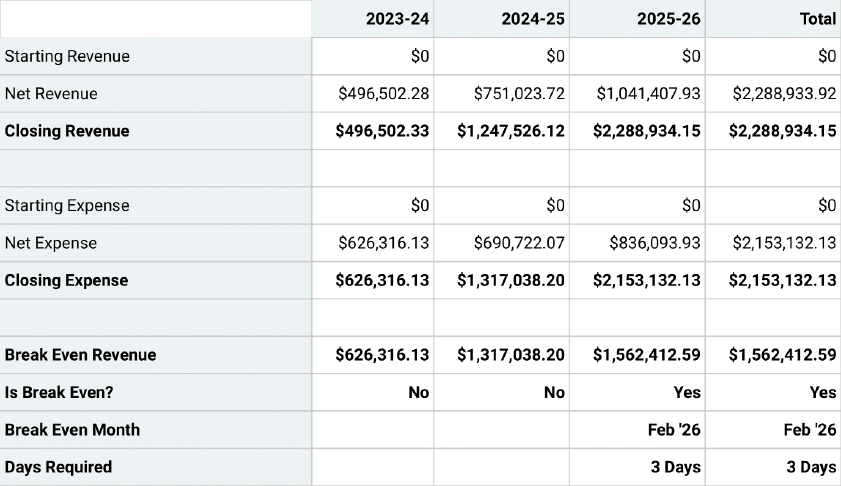

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or small businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More tips for your startup

How to choose a legal entity for your startup, 5 steps to use social media to launch your business, 5 alternatives to writing a traditional business plan.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to Write a Financial Plan for a Business Plan

Noah Parsons

4 min. read

Updated July 11, 2024

Creating a financial plan for a business plan is often the most intimidating part for small business owners.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan in business plans

A sound financial plan for a business plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, you’ll need to include a few additional pieces of information as part of your business plan’s financial plan example.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your financial plan for a business plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan’s financial plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

10 Min. Read

How to Write the Company Overview for a Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial statements for small businesses.

Information is power. As long as you can make sense of that information. As a business owner, you’ll want to track your financial progress to make informed business decisions about your future. And that involves understanding cash flows, operating expenses, and net profit, all found in your financial statements.

Even if you delegate the bookkeeping to a professional, and don’t prepare financial statements yourself, you’ll need to know what your CPA is talking about when they walk you through your balance sheet.

In this article, you’ll learn about the 3 principal financial statements—income statements, balance sheets, and cash flow statements—and how to interpret them.

Here’s what we’ll cover: Income Statement (Profit and Loss Statement) Balance Sheet Difference Between an Income Statement and a Balance Sheet Cash Flow Statement Financial Statements Are Fundamental

Income Statement (Profit and Loss Statement)

An income statement shows a company’s financial performance by revealing whether it’s made a profit or a loss.

Without an income statement, you’d be in the dark about the profitability of your business. An income statement is also known as a profit and loss statement, profit and loss account, or P&L.

The reporting period for an income statement is typically one fiscal year.

What Goes on an Income Statement?

Let’s now jump to the format of an income statement.

In most cases, it will look something like this:

Now, let’s dig into what an income statement covers.

Revenues (or Sales)

This is the top line on your income statement. It’s the total amount for the year of all the things or services you sold. But if you’ve given any discounts, you’ll reduce your sales by the discount amount.

For example, if you sold $100 in t-shirts but offered a 10% discount as a Black Friday incentive, you would record $90 as your net sales amount .

Cost of Goods Sold (or Cost of Sales)

These are the expenses directly related to the sales you’ve made. Suppose you’re selling electronics. The cost of goods sold is the cost of the electronics you sell within a financial year. And this is important. It’s not the cost of the electronics you bought in the year.

In a service-related business, a consultancy, for example, the cost of sales is often termed direct costs. Hence, you’ll include costs directly related to your service.

Gross Profit

Gross profit is the profit that results directly and specifically from the trading activity of buying and selling. You calculate the gross profit by subtracting the cost of goods sold from revenues.

Selling, General, and Administrative Expenses

All other expenses like salaries, rent, or travel merely facilitate the main trading activity of your business and are often categorized under selling, general, or administrative (SG&A) expenses.

You can have as many categories of SG&A expense as is necessary and helpful for running your business. Some of the common ones are:

- Office supplies

- Salaries and wages

- Marketing and advertising

Operating Income

Next is operating income. As the name implies, it’s the profit your business has earned from its operations when considering all the revenue and expenses necessary to run your business.

Finance Costs

Finance costs represent the costs of financing arrangements, such as interest on bank loans. You’ll want to strip financing costs away from SG&A expenses because they don’t represent the costs necessary for producing the goods or services you sell.

Net Income

After factoring in finance costs, you’re left with net income (or net loss). This is the much-talked-about bottom line. Your net income is how much your company has earned throughout the year.

What About Income Taxes?

You may ask yourself, why didn’t we include taxes? A small business isn’t burdened with income tax unless it’s structured as a C-corporation (which few small businesses are due to their complexity and maintenance costs). Instead, the business profits pass through to the owner and get taxed on the individual Form 1040.

Balance Sheet

Also known as the statement of financial position, the balance is an organization’s most important financial report because it shows the company’s financial health.

A balance sheet reports data for a specific point in time, often the last day of a fiscal year.

What Goes on a Balance Sheet?

Balance sheets contain 3 sections: assets, liabilities, and equity.

These are the resources your company owns that have a current or future economic value. These include cash, equipment (such as computers), and vehicles.

Assets can be broken down into:

- Current assets: This is anything you own that can be converted to cash within one year (e.g., accounts receivable and inventory). Also called short-term assets.

- Non-current assets: These are assets that can’t be quickly converted into cash, like computers, equipment, and vehicles, or intangible assets, like trademarks and copyrights. Also called fixed assets or long-term assets.

2. Business Liabilities

These are amounts your business owes other entities such as banks, employees, and suppliers.

- Current liabilities: Amounts you owe that are due within one year (e.g., accounts payable and payroll liabilities)

- Non-current (long-term) liabilities: Debts that will be repaid in more than one year

3. Owner Equity or Shareholder Equity

This is the value of the owner’s or shareholders’ investment in the business after liabilities are subtracted from assets. It may also be called owner’s or shareholders’ capital.

Purpose of a Balance Sheet

The balance sheet shows anyone what your business is worth. Lenders, investors, partners, and potential buyers will want to review your balance sheet.

The overall worth of your business can be measured or estimated by the total value of its assets, which are recorded and presented on the balance sheet.

But even more important, your balance sheet shows your business’s net worth , which is the owner’s equity (or shareholder’s equity). This is a business’s residual value after removing its liabilities . It’s what ultimately belongs to the business owner.

Format of a Balance Sheet

Balance sheets are prepared based on the accounting equation, which is:

Traditionally, before accounting software was developed and bookkeeping was done with pencil and paper, assets were put on the left side of the balance sheet, while equity and liabilities went to the right side.

Today, however, a balance sheet will almost always look like this:

Now here’s something to remember.

The net income (your income statement bottom line) is annually transferred to your balance sheet, where it will appear as retained earnings. So retained earnings are a running total of your company’s profitability from day 1.

Difference Between an Income Statement and a Balance Sheet

If you want to know how your business has performed over a span of time (a year, month, or quarter), you’ll want to refer to your income statement.

On the flip side, if you want to know your business’s financial health, to know its value or worth at a particular point since it was established, the balance sheet is the report you’ll want to refer to.

Cash Flow Statement

A cash flow statement shows the movement of cash, the cash inflows and outflows within the business, based on 3 cash sources and cash expenditure categories: operations, investing, and financing.

This is an extremely important financial statement because, ultimately, cash is the best indicator of the financial health of an enterprise.

The reporting period for a cash flow statement is often one fiscal year but could be a quarter, month, or any reporting period that makes sense for your business.

Why Do You Need a Cash Flow Statement?

You already have an income statement that shows you the profits you’ve made. Why do you still need a cash flow statement?

An income statement is prepared based on the accrual method of accounting . This means your sales are recorded when you earn them, not when your business receives the actual cash.

This creates a timing difference. A sales amount of $10,000 on your income statement, for example, doesn’t always mean this amount is in your bank account. It may be an invoice you sent to your customer, and you’re still awaiting payment.

The same goes for expenses. In accrual-basis accounting, expenses are recorded when your business incurs them and not when you pay out the cash.

But what about the cash figure on the balance sheet? While the balance sheet captures the cash balance, which can be meaningful, this balance sheet figure doesn’t tell us the source of the cash.

The cash could be from a windfall, like an insurance claim, which is a one-time event and unsustainable. Or it could be from normal day-to-day business operations, which are more sustainable.

Sections of a Cash Flow Statement

A cash flow statement has 3 sections:

- Cash from operations (or from operating activities)

- Cash from investing activities

- Cash from financing activities

And this is what a typical cash flow statement looks like:

Cash From Operating Activities

Cash from operations is the first section of a cash flow statement, revealing its relative importance in the cash flow statement hierarchy. Cash from operating activities is the most meaningful because this is cash from your day-to-day trading activities.

These include cash received from sales, set off against cash expenses like the cost of goods sold, utility expenses, and rent.

It also takes into account non-cash items, like depreciation , that are included in net income but don’t involve any actual cash movement. And it considers any changes in your assets and liabilities during the time period, like an increase in accounts receivable .

Since operating activities are the mainstay of a business, a company with positive cash flow from operating activities will be more sustainable.

Cash From Investing Activities

The main source and use of cash from investing activities are purchasing and selling fixed assets. Common examples of fixed asset items are things like buildings, vehicles, computer equipment, or machinery.

But other investment items can appear in the investing activity section, such as buying stocks and bonds for investment purposes.

Cash From Financing Activities

All cash inflows and outflows from financing activities will be captured in this last section of cash flow statements.

If you’ve taken out a bank loan to purchase equipment, the cash the bank provided you will show up in this section. And when you begin making loan payments, these will be included here. To learn more about this follow our guide on Loan Repayment Entry , which provide you with the right steps.

Financial Statements Are Fundamental

In Sam Walton’s autobiography Made In America , here’s what Al Johnson, the CEO of Walmart at one time, revealed about Walmart’s owner and founder:

“Every Friday morning for six years, I would take my columnar pad with all the numbers on it into Sam’s office for him to review. Sam would jot them down on his own pad and work through the calculations himself. I always knew I could not just go in there and lay a sheet of numbers in front of him and expect him to just accept it.”

As a small business owner, you should be able to make sense of your financial statements. It will ensure you ask the right questions and follow important clues and cues.

You can make financial statements manually in a spreadsheet, but accounting software automates everything, so it’s faster and easier and leaves less room for error. With all your financial information in one place, you can immediately access your financial data whenever you or your accountant needs it.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

More From Forbes

Basics of a business plan financials section.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

A good business plan is an entrepreneur’s best friend. It’s an indispensable document, and every section matters, from the executive summary to the market analysis to the appendix; however, no section matters as much as the financials section. You’re in business to make money, after all, and your business plan has to clearly, numerically reflect a lucrative business pursuit, preferably with visuals, especially if you want funding.

The financials section of your business plan tells you and your potential investors, loan providers or partners whether your business idea makes economic sense. Without an impressive financials section, you’re looking at an uphill battle when it comes to scoring capital; underwhelming financials may indicate a need to make some revisions to your approach.

Basic Financials

So, how to build an impressive financials section? As with all things in small business, there’s no one-size-fits-all approach; it varies by business and field. But there are some general guidelines that can give you a clear idea of where to start and what kind of data you’ll need to gather.

You need to include at least three documents in the financials section of your business plan:

1. Income statement: Are you profitable?

2. Cash flow statement: How much cash do you have on hand?

3. Balance sheet: What’s your net worth?

There’s other financial information you can — and often should — add to your business plan, like sales forecasts and personnel plans. But the income statement, cash flow projections and balance sheet are the ones you can’t leave out.

Here's a brief run-down of the three major data sets.

Income Statement

Also called a profit/loss statement, here’s where your reader can see if your business is profitable. If you’re not operating the business yet, this will be a projected income statement, based on a well-informed analysis of your business’s first year.

The income statement is broken down by month and shows revenue (sales), expenses (costs of operating) and the resulting profit or loss for one fiscal year. (Revenue - expenses = profit/loss.)

Cash Flow Statements

Here’s where your reader can see how much money you’re going to need in the first year of operations. If you’re not yet up and running, you’ll only have projections.

For cash flow projections, you’ll predict the cash money that will flow into and out of your business in a particular month. You’ll need a year’s worth of monthly projections. If you’re already operating, also include cash flow statements for past months showing actual numbers.

Cash flow statements have three basic components: cash revenues, cash disbursements and reconciliation of revenues to disbursements. For each month, you start with your previous month’s balance, add revenues and subtract disbursements. The final balance becomes the opening balance for the following month.

Balance Sheet

Here’s where your reader sees your business’s net worth. It breaks down into monthly balance sheets and a final net worth at the end of the fiscal year. There are three parts to a balance sheet:

• Accounts receivable

• Inventory, equipment

• Real estate

2. Liabilities

• Accounts payable

• Loan debts

3. Equity: Total assets minus total liabilities (Assets = liabilities + equity.)

It’s good to offer readers an analysis of the three basic financial statements — how they fit together and what they mean for the future of your business. It doesn’t have to be in depth; focus is good. Just interpret the data from each statement, putting it in context and indicating what the reader should take away from the financials section of your business plan.

Other Financial Documents

These are the basics of your financials, but you’ll need to fill out the section with other data based on the specifics of your business and your capital needs. Other financial information you might provide includes:

• Sales forecast: Estimates of future sales volumes

• Personnel plan: Who you plan to recruit/hire and how much it will cost

• Breakeven analysis: Projected point at which your sales will match your expenses

• Financial history: Summary of your business finances from the start of operations to the present time

Make It Easy

A lot of this can be made easier with business planning software, which can not only guide you through the process and make sure you don’t leave anything else but may also generate graphs, charts and other visuals to accompany the data in your financials section. Those types of visuals are highly recommended because some readers will skim. Anything you can do to convey information in a glance imparts a benefit.

Revisit Monthly

Once in operation, don’t forget to go back into your financials every month to update your projections with actual numbers and then adjust any future projections accordingly. Regular updates will tell you if you’re on track with your predictions and hitting your goals, as well as whether you need to make adjustments. Don’t forget this part — when you’re starting out, planning really is your best friend.

- Editorial Standards

- Reprints & Permissions

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

- How to Write a Great Business Plan: Financial Analysis

The last article in a comprehensive series to help you craft the perfect business plan for your startup.

This article is part of a series on how to write a great business plan .

Numbers tell the story. Bottom line results indicate the success or failure of any business.

Financial projections and estimates help entrepreneurs, lenders, and investors or lenders objectively evaluate a company's potential for success. If a business seeks outside funding, providing comprehensive financial reports and analysis is critical.

But most importantly, financial projections tell you whether your business has a chance of being viable--and if not let you know you have more work to do.

Most business plans include at least five basic reports or projections:

- Balance Sheet: Describes the company cash position including assets, liabilities, shareholders, and earnings retained to fund future operations or to serve as funding for expansion and growth. It indicates the financial health of a business.

- Income Statement: Also called a Profit and Loss statement, this report lists projected revenue and expenses. It shows whether a company will be profitable during a given time period.

- Cash Flow Statement: A projection of cash receipts and expense payments. It shows how and when cash will flow through the business; without cash, payments (including salaries) cannot be made.

- Operating Budget: A detailed breakdown of income and expenses; provides a guide for how the company will operate from a "dollars" point of view.

- Break-Even Analysis: A projection of the revenue required to cover all fixed and variable expenses. Shows when, under specific conditions, a business can expect to become profitable.

It's easy to find examples of all of the above. Even the most basic accounting software packages include templates and samples. You can also find templates in Excel and Google Docs. (A quick search like "google docs profit and loss statement" yields plenty of examples.)

Or you can work with an accountant to create the necessary financial projections and documents. Certainly feel free to do so... but I'd first recommend playing around with the reports yourself. While you don't need to be an accountant to run a business, you do need to understand your numbers... and the best way to understand your numbers is usually to actually work with your numbers.

But ultimately the tools you use to develop your numbers are not as important as whether those numbers are as accurate as possible--and whether those numbers help you decide whether to take the next step and put your business plan into action.

Then Financial Analysis can help you answer the most important business question: "Can we make a profit?"

Some business plans include less essential but potentially important information in an Appendix section. You may decide to include, as backup or additional information:

- Resumes of key leaders

- Additional descriptions of products and services

- Legal agreements

- Organizational charts

- Examples of marketing and advertising collateral

- Photographs of potential facilities, products, etc

- Backup for market research or competitive analysis

- Additional financial documents or projections

Keep in mind creating an Appendix is usually only necessary if you're seeking financing or hoping to bring in partners or investors. Initially the people reading your business plan don't wish to plow through reams and reams of charts, numbers, and backup information. If one does want to dig deeper, fine--he or she can check out the documents in the Appendix.

That way your business plan can share your story clearly and concisely.

Otherwise, since you created your business plan... you should already have the backup.

And one last thing: always remember the goal of your business plan is to convince you that your idea makes sense--because it's your time, your money, and your effort on the line.

More in this series:

- How to Write a Great Business Plan: Key Concepts

- How to Write a Great Business Plan: the Executive Summary

- How to Write a Great Business Plan: Overview and Objectives

- How to Write a Great Business Plan: Products and Services

- How to Write a Great Business Plan: Market Opportunities

- How to Write a Great Business Plan: Sales and Marketing

- How to Write a Great Business Plan: Competitive Analysis

- How to Write a Great Business Plan: Operations

- How to Write a Great Business Plan: Management Team

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

Call Us (877) 968-7147 Login

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

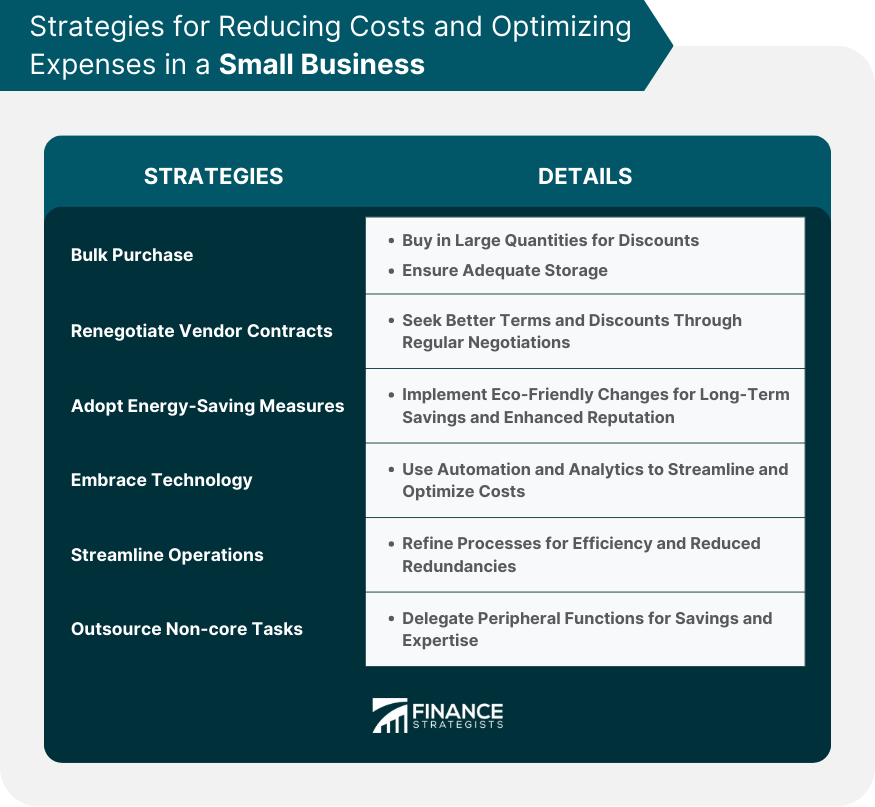

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.