Perfect competition

Perfect competition is a market structure where many firms offer a homogeneous product. Because there is freedom of entry and exit and perfect information, firms will make normal profits and prices will be kept low by competitive pressures.

Features of perfect competition

- Many firms.

- Freedom of entry and exit; this will require low sunk costs.

- All firms produce an identical or homogeneous product.

- All firms are price takers, therefore the firm’s demand curve is perfectly elastic.

- There is perfect information and knowledge.

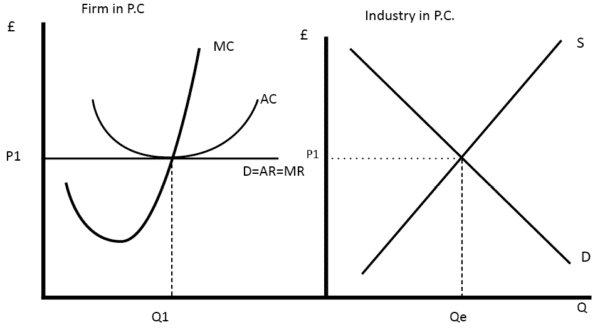

Diagram for perfect competition

- The industry price is determined by the interaction of Supply and Demand, leading to a price of Pe.

- The individual firm will maximise output where MR = MC at Q1

- In the long run firms will make normal profits.

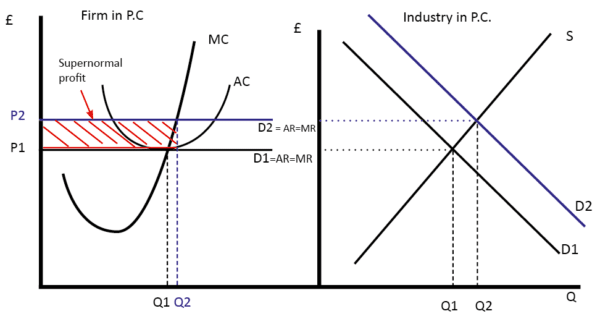

What happens if supernormal profits are made?

If supernormal profits are made new firms will be attracted into the industry causing prices to fall. If firms are making a loss then firms will leave the industry causing price to rise

The features of perfect competition are very rare in the real world. However perfect competition is as important economic model to compare other models. It is often argued that competitive markets have many benefits which stem from this theoretical model.

Changes in long run equilibrium

1. The effect of an increase in demand for the industry.

If there is an increase in demand there will be an increase in price Therefore the demand curve and hence AR will shift upwards. This will cause firms to make supernormal profits.

This will attract new firms into the market causing price to fall back to the equilibrium of Pe

2. An increase in firms costs

- The AC curve will increase therefore AR< AC

- Firms will now start making a loss and therefore firms will go out of business. This will cause supply to fall causing prices to increase.

Efficiency of perfect competition

- Firms will be allocatively efficient P=MC

- Firms will be productively efficient . Lowest point on AC curve.

- Firms have to remain efficient otherwise they will go out of business. ( X-efficiency )

- Firms are unlikely to be dynamically efficient because they have no profits to invest in research and development.

- If there are high fixed costs , firms will not benefit from efficiencies of scale.

- see more: efficiency of perfect competition

Examples of perfect competition

In the real world, it is hard to find examples of industries which fit all the criteria of ‘perfect knowledge’ and ‘perfect information’. However, some industries are close.

- Foreign exchange markets . Here currency is all homogeneous. Also, traders will have access to many different buyers and sellers. There will be good information about relative prices. When buying currency it is easy to compare prices

- Agricultural markets . In some cases, there are several farmers selling identical products to the market, and many buyers. At the market, it is easy to compare prices. Therefore, agricultural markets often get close to perfect competition.

- Internet related industries . The internet has made many markets closer to perfect competition because the internet has made it very easy to compare prices, quickly and efficiently (perfect information). Also, the internet has made barriers to entry lower. For example, selling a popular good on the internet through a service like e-bay is close to perfect competition. It is easy to compare the prices of books and buy from the cheapest. The internet has enabled the price of many books to fall in price so that firms selling books on the internet are only making normal profits.

Related pages

- eBay and perfect competition

- Different types of market structure

1 thought on “Perfect competition”

- Pingback: The problem of rejected / misshaped vegetables | Economics Help

Comments are closed.

Perfect Competition as a Market Structure

Introduction.

A market or an industry is said to be competitive depending on the key market players, that is, suppliers and consumers. The number of suppliers seeking the demand of consumers in the market determines the competition in the market. The other factor that determines the competitiveness of a market is the barriers to entry and exit into the market in the long run.

The nature of competition in the market depends on the number of buyers and sellers in the market such that when both are many, the market assumes a perfect competition nature or monopoly if there is only one seller. The difference between the two extreme market structures is that industries operating in a purely competitive market have no power to set prices, and therefore, they operate at the prevailing price in the market.

On the other hand, a firm operating in a pure monopoly market enjoys full power to determine the price they charge in the market. A perfectly competitive market or perfect monopoly may be nonexistent in real-world markets, but they are very useful in gauging the level of competition in any given market.

The Meaning of Perfect Competition

According to Aumann (1996, 7), Perfect competition is a market structure that assumes the optimum allocation of resources. The market is theoretical and nonexistent in real life. A perfectly competitive market is defined as a market structure in which there are many buyers and sellers such that no one has the power to set or control market prices.

Firms operating in a competitive market are price takers as they operate on the price that is prevailing in the market. There is no competition concerning price. The competition is determined by the quality of the products sold by a particular seller and the preferences of the buyers.

Characteristic of Perfect Competition

A market is considered to have perfect competition if it is characterized by a number of factors. Firstly, all parties in the market have perfect knowledge of the products offered in the market and the prices attached to them. Secondly, there are many buyers and sellers in the market, and therefore no one is obligated to set the prices, but all take the prevailing price (CliffsNotes, 2010, p. 1). Market entry is also free such that firms could join or leave the market any time they decide, depending on the prevailing condition.

The suppliers can sell as much as they can in the market but only at the market price. They have no authority to make prices. There is also a homogeneity of products that are produced by the firms (Aumann, 1996, 7). There is no advertisement in the market because all parties are price takers, and products are perfect substitutes. The perfect knowledge of prices and products also makes advertisement unnecessary.

Normal and Supernormal Profits in Perfect Competition

Normal profits in perfect competition are earned when a firm reaches an economic equilibrium where average cost equals marginal revenue at the point where the firm maximizes profit (Stigler, 1987, 539). Marginal revenue, price, average cost, and marginal cost are always the same when the firms are at their optimum level of production. Normal profit is the profit that is just enough to enable the firm to continue producing and stay in business because it can cover its costs.

In case the average cost falls below the price, the firm earns a supernormal profit. This happens at a profit-maximizing output but does not occur in the long run. Any amount of profit that exceeds the normal profits is categorized under supernormal profits and is earned in the short run.

Short and Long Run Perfect Competitor Price/Output Diagrams

In the short run, there may be high demand for commodities in the market. This causes the increase in the price of the commodities above the average cost making the firm earn supernormal profits. This attracts many firms into the industry/market. This shifts the supply level in the market higher, causing the price to go down (Aumann, 1996, 7).

The profit earned by the new and the existing firms reduces, thus completing away the supernormal profits. The firm can also earn supernormal loss in the short run if the average cost increases above the price. The situation will be corrected when new firms will leave the market, causing supply to go down.

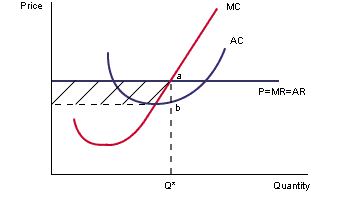

Based on the diagrams above, we see that it is possible for a firm to earn normal and supernormal profits. In the first diagram, the average cost is below the price, meaning that the firm can make a supernormal profit that is equivalent to the shaded region. This can be represented by Q* (a – b) .

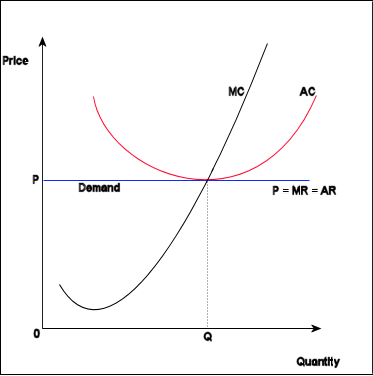

The firm is also earning a normal profit at the point where P=MR=MC . This is the equilibrium level of the firm where normal profits are experienced at the point where marginal cost = marginal revenue at the minimum point of the average cost, as shown in the second diagram.

Perfect Competition and Public Interest

The perfect competition will have a great impact on public interest in some respects. For example, consumers may end up getting poor-quality products or services at high prices.

There is also a lack of product variety, showing that consumers have low sovereignty in choosing what best suits them. This is due to the lack of product differentiation. Poor quality is contributed by the fact that there is no competition concerning commodity design and specification because the price in the market is the same.

Allocative and Productive Efficiency

A firm is said to be efficient if it attains the optimum production level and also the optimum distribution of scarce resources (CliffsNotes, 2010, p. 1). Allocative efficiency in perfect competition occurs when the firm distributes goods and services according to the consumers’ preferences. It occurs at the point where P=MC , that is, price equals marginal cost.

Productive efficiency, on the other hand, occurs when a given amount of inputs produces a maximum volume of commodities. In this case, the output is achieved at minimum average cost and can occur in the long or short run. In this diagram, both allocative and productive efficiency is achieved at the point (Q, P), where P=MC=AC . At this point, AV (average cost is at its minimum) means that productive efficiency is achieved. Allocative efficiency is also achieved at the same point because of P=MC (price = marginal cost)

Perfect competition as a market structure does not exist in a real market situation. However, its characteristics are very useful in measuring the nature of competition in other market structures like an oligopoly, monopsony, et cetera.

Reference List

Aumann, R. J., 1996. Existence of Competitive Equilibrium in Markets with a Continuum of Traders. Econometrical , V. 34, N. 1 (1966): pp. 1-17.

CliffsNotes. 2010. CliffsNotes.com. Conditions for Perfect Competition . USA: Wiley Publishing, Inc. Web.

Stigler, J. G. , 1987. Competition, The New Palgrave: a Dictionary of Economics , First edition, vol. 3, pp. 531–46.

Cite this paper

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2020, April 16). Perfect Competition as a Market Structure. https://studycorgi.com/perfect-competition/

"Perfect Competition as a Market Structure." StudyCorgi , 16 Apr. 2020, studycorgi.com/perfect-competition/.

StudyCorgi . (2020) 'Perfect Competition as a Market Structure'. 16 April.

1. StudyCorgi . "Perfect Competition as a Market Structure." April 16, 2020. https://studycorgi.com/perfect-competition/.

Bibliography

StudyCorgi . "Perfect Competition as a Market Structure." April 16, 2020. https://studycorgi.com/perfect-competition/.

StudyCorgi . 2020. "Perfect Competition as a Market Structure." April 16, 2020. https://studycorgi.com/perfect-competition/.

This paper, “Perfect Competition as a Market Structure”, was written and voluntary submitted to our free essay database by a straight-A student. Please ensure you properly reference the paper if you're using it to write your assignment.

Before publication, the StudyCorgi editorial team proofread and checked the paper to make sure it meets the highest standards in terms of grammar, punctuation, style, fact accuracy, copyright issues, and inclusive language. Last updated: January 24, 2024 .

If you are the author of this paper and no longer wish to have it published on StudyCorgi, request the removal . Please use the “ Donate your paper ” form to submit an essay.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

9.1 Perfect Competition: A Model

Learning objectives.

- Explain what economists mean by perfect competition.

- Identify the basic assumptions of the model of perfect competition and explain why they imply price-taking behavior.

Virtually all firms in a market economy face competition from other firms. In this chapter, we will be working with a model of a highly idealized form of competition called “perfect” by economists.

Perfect competition is a model of the market based on the assumption that a large number of firms produce identical goods consumed by a large number of buyers. The model of perfect competition also assumes that it is easy for new firms to enter the market and for existing ones to leave. And finally, it assumes that buyers and sellers have complete information about market conditions.

As we examine these assumptions in greater detail, we will see that they allow us to work with the model more easily. No market fully meets the conditions set out in these assumptions. As is always the case with models, our purpose is to understand the way things work, not to describe them. And the model of perfect competition will prove enormously useful in understanding the world of markets.

Assumptions of the Model

The assumptions of the model of perfect competition, taken together, imply that individual buyers and sellers in a perfectly competitive market accept the market price as given. No one buyer or seller has any influence over that price. Individuals or firms who must take the market price as given are called price takers . A consumer or firm that takes the market price as given has no ability to influence that price. A price-taking firm or consumer is like an individual who is buying or selling stocks. He or she looks up the market price and buys or sells at that price. The price is determined by demand and supply in the market—not by individual buyers or sellers. In a perfectly competitive market, each firm and each consumer is a price taker. A price-taking consumer assumes that he or she can purchase any quantity at the market price—without affecting that price. Similarly, a price-taking firm assumes it can sell whatever quantity it wishes at the market price without affecting the price.

You are a price taker when you go into a store. You observe the prices listed and make a choice to buy or not. Your choice will not affect that price. Should you sell a textbook back to your campus bookstore at the end of a course, you are a price-taking seller. You are confronted by a market price and you decide whether to sell or not. Your decision will not affect that price.

To see how the assumptions of the model of perfect competition imply price-taking behavior, let us examine each of them in turn.

Identical Goods

In a perfectly competitive market for a good or service, one unit of the good or service cannot be differentiated from any other on any basis. A bushel of, say, hard winter wheat is an example. A bushel produced by one farmer is identical to that produced by another. There are no brand preferences or consumer loyalties.

The assumption that goods are identical is necessary if firms are to be price takers. If one farmer’s wheat were perceived as having special properties that distinguished it from other wheat, then that farmer would have some power over its price. By assuming that all goods and services produced by firms in a perfectly competitive market are identical, we establish a necessary condition for price-taking behavior. Economists sometimes say that the goods or services in a perfectly competitive market are homogeneous , meaning that they are all alike. There are no brand differences in a perfectly competitive market.

A Large Number of Buyers and Sellers

How many buyers and sellers are in our market? The answer rests on our presumption of price-taking behavior. There are so many buyers and sellers that none of them has any influence on the market price regardless of how much any of them purchases or sells. A firm in a perfectly competitive market can react to prices, but cannot affect the prices it pays for the factors of production or the prices it receives for its output.

Ease of Entry and Exit

The assumption that it is easy for other firms to enter a perfectly competitive market implies an even greater degree of competition. Firms in a market must deal not only with the large number of competing firms but also with the possibility that still more firms might enter the market.

Later in this chapter, we will see how ease of entry is related to the sustainability of economic profits. If entry is easy, then the promise of high economic profits will quickly attract new firms. If entry is difficult, it won’t.

The model of perfect competition assumes easy exit as well as easy entry. The assumption of easy exit strengthens the assumption of easy entry. Suppose a firm is considering entering a particular market. Entry may be easy, but suppose that getting out is difficult. For example, suppliers of factors of production to firms in the industry might be happy to accommodate new firms but might require that they sign long-term contracts. Such contracts could make leaving the market difficult and costly. If that were the case, a firm might be hesitant to enter in the first place. Easy exit helps make entry easier.

Complete Information

We assume that all sellers have complete information about prices, technology, and all other knowledge relevant to the operation of the market. No one seller has any information about production methods that is not available to all other sellers. If one seller had an advantage over other sellers, perhaps special information about a lower-cost production method, then that seller could exert some control over market price—the seller would no longer be a price taker.

We assume also that buyers know the prices offered by every seller. If buyers did not know about prices offered by different firms in the market, then a firm might be able to sell a good or service for a price other than the market price and thus could avoid being a price taker.

The availability of information that is assumed in the model of perfect competition implies that information can be obtained at low cost. If consumers and firms can obtain information at low cost, they are likely to do so. Information about the marketplace may come over the internet, over the airways in a television commercial, or over a cup of coffee with a friend. Whatever its source, we assume that its low cost ensures that consumers and firms have enough of it so that everyone buys or sells goods and services at market prices determined by the intersection of demand and supply curves.

The assumptions of the perfectly competitive model ensure that each buyer or seller is a price taker. The market, not individual consumers or firms, determines price in the model of perfect competition. No individual has enough power in a perfectly competitive market to have any impact on that price.

Perfect Competition and the Real World

The assumptions of identical products, a large number of buyers, easy entry and exit, and perfect information are strong assumptions. The notion that firms must sit back and let the market determine price seems to fly in the face of what we know about most real firms, which is that firms customarily do set prices. Yet this is the basis for the model of demand and supply, the power of which you have already seen.

When we use the model of demand and supply, we assume that market forces determine prices. In this model, buyers and sellers respond to the market price. They are price takers. The assumptions of the model of perfect competition underlie the assumption of price-taking behavior. Thus we are using the model of perfect competition whenever we apply the model of demand and supply.

We can understand most markets by applying the model of demand and supply. Even though those markets do not fulfill all the assumptions of the model of perfect competition, the model allows us to understand some key features of these markets.

Changes within your lifetime have made many markets more competitive. Falling costs of transportation, together with dramatic advances in telecommunications, have opened the possibility of entering markets to firms all over the world. A company in South Korea can compete in the market for steel in the United States. A furniture maker in New Mexico can compete in the market for furniture in Japan. A firm can enter the world market simply by creating a web page to advertise its products and to take orders.

In the remaining sections of this chapter, we will learn more about the response of firms to market prices. We will see how firms respond, in the short run and in the long run, to changes in demand and to changes in production costs. In short, we will be examining the forces that constitute the supply side of the model of demand and supply.

We will also see how competitive markets work to serve consumer interests and how competition acts to push economic profits down, sometimes eliminating them entirely. When we have finished we will have a better understanding of the market conditions facing farmers and of the conditions that prevail in any competitive industry.

Key Takeaways

- The central characteristic of the model of perfect competition is the fact that price is determined by the interaction of demand and supply; buyers and sellers are price takers.

- The model assumes: a large number of firms producing identical (homogeneous) goods or services, a large number of buyers and sellers, easy entry and exit in the industry, and complete information about prices in the market.

- The model of perfect competition underlies the model of demand and supply.

Which of the following goods and services are likely produced in a perfectly competitive industry? Relate your answer to the assumptions of the model of perfect competition.

- International express mail service

- Athletic shoes

Case in Point: Entering and Exiting the Burkha Industry

Sandip Debnath – Hyderabad Blues 3 – CC BY-NC-ND 2.0.

Muhammed Ibrahim Islamadin was driving a cab in Kabul, Afghanistan, when the Taliban took over the country. He foresaw the repression that would follow and sensed an opportunity.

He sold his taxicab and set up a shop for sewing and selling burkhas, the garments required of all women under the Taliban’s rule. Mr. Islamadin had an easy task selling, as women caught outdoors with exposed skin were routinely beaten by the Taliban’s religious police. He told The Wall Street Journal , “This was very bad for them, but it was good for me.”

Of course, Mr. Islamadin was not the only producer to get into the industry. Other Afghani merchants, as well as merchants from Pakistan and China, also jumped at the opportunity.

The entry of new firms exemplifies an important characteristic of perfect competition. Whenever there is an opportunity to earn economic profits—even an unexpected opportunity—new firms will enter, provided that entry is easy.

The model of perfect competition also assumes that exit will be easy if and when a firm experiences economic losses. When the Taliban rulers were ousted by the United States and its allies in 2001, Mr. Islamadin expected that the demand for burkhas would begin to fall. It did. The sales fell 50% almost immediately. Prices fell as well, generally by about 20%.

It was simple for Mr. Islamadin to leave the industry. He gave his remaining stock of burkhas to a brother who was producing them in the countryside where women continued to wear them. As for Mr. Islamadin, he has made plans to go into the glassware business. He expects the demand for glass teacups to be strong whatever happens in Afghanistan’s critical future.

Source: Andrew Higgins, “With Islamic Dress, Out Goes the Guy Who Sold Burkhas,” The Wall Street Journal , December 19, 2001, p. A1.

Answers to Try It! Problems

- Not perfectly competitive–There are few sellers in this market (Fedex, UPS, and the United States Postal Services are the main ones in the United States) probably because of the difficulty of entry and exit. To provide these services requires many outlets and a large transportation fleet, for example.

- Perfectly competitive—There are many firms producing a largely homogeneous product and there is good information about prices. Entry and exit is also fairly easy as firms can switch among a variety of crops.

- Not perfectly competitive—The main reason is that goods are not identical.

Principles of Economics Copyright © 2016 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

10.9: Introduction to Perfect Competition

- Last updated

- Save as PDF

- Page ID 48412

What you’ll learn to do: describe the characteristics of perfect competition and calculate costs, including fixed, variable, average, marginal, and total costs

Imagine the 7-year old you had a lemonade stand. It was one of several on the street. Your neighbor, Julie, also had a lemonade stand and she typically sold her lemonade for 25 cents. You figured that in order to make more money, you would charge 50 cents and steal all her customers. Sadly, everyone bought from Julie and you had no customers at all.

Welcome to the world of perfect competition. You will see in this section that because your lemonade stands were essentially identical, in order to remain in business and make any profit, you needed to be a price-taker instead of a price-maker.

Contributors and Attributions

- Introduction to Perfect Competition. Authored by : Steven Greenlaw and Lumen Learning. License : CC BY: Attribution

- lemonade stand. Authored by : ErikaWittlieb. Provided by : Pixabay. Located at : https://pixabay.com/en/lemonade-stand-lemonade-summer-2483297/ . License : CC0: No Rights Reserved

Perfect Competition Notes & Questions (A-Level, IB)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | IB Economics Notes Directory

Perfect Competition Definition: A market with Perfect Competition is defined as having an unlimited number of buyers and sellers, perfect information (eg. with regards to product pricing of all firms), no barriers to entry or exit, and all firms sell homogenous (the same) goods.

Perfect Competition Examples & Explanation: If you are one of many Ebay stores selling the same unbranded masks online during the Coronavirus epidemic , you are likely to charge a very similar market price. This is because if you sell at a higher price, consumers will buy from other stores. Hence, you are a price taker in the market. As a result, you will sell each mask for the same price to the unlimited number of buyers out there, causing your average and marginal revenues to be the same. As consumers have visibility over most stores and their listing prices, they have near perfect information of the market. There are also little to no barriers to entry/exit in the market, as it is extremely easy to set up or close a store on Ebay to sell masks. Perfect competition is the only market structure that has allocative efficiency by default, when compared to monopolistic competition , oligopoly or monopoly , where competition is imperfect. However, this form of market structure is unlikely to exist in reality due to its extreme competition and assumptions. Therefore, it is more of an Economic model for theoretical than practical purposes. Another close example is the currency exchange market where the service provided by firms is highly similar.

Perfect Competition Economics Notes

Perfect competition video explanation – econplusdal.

The left video explains the perfect competition market structure, the right illustrates perfect competition in the short-run.

Receive News on our Free Economics Classes, Notes/Questions Updates, and more

Perfect competition multiple choice questions (a-level), perfect competition essay questions (ib), perfect competition examples in real life.

Related A-Level, IB Economics Resources

Follow us on Facebook , TES and SlideShare for resource updates.

You may also like

Macroeconomic Objectives Notes & Questions (A-Level, IB Economics)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | […]

Edexcel A-Level Economics Past Papers

Download A2 Edexcel Economics past papers for Paper 1 (Microeconomics), Paper 2 (Macroeconomics) and Paper 3 (Synoptic) from 2014 to 2018 below, […]

OCR A-Level Economics Past Papers

Download A2 OCR Economics past papers for Paper 1 (Microeconomics), Paper 2 (Macroeconomics) and Paper 3 (Themes in Economics) for 2017 and […]

AQA AS Economics Past Papers

Download AQA AS Economics past papers for Paper 1 (Microeconomics) and Paper 2 (Macroeconomics) from 2017 to 2019 below. AQA A2 Economics […]

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- International

- Schools directory

- Resources Jobs Schools directory News Search

A-level Economics Model Essay on Perfect Competition

Subject: Economics

Age range: 16+

Resource type: Other

Last updated

22 February 2018

- Share through email

- Share through twitter

- Share through linkedin

- Share through facebook

- Share through pinterest

Tes paid licence How can I reuse this?

Your rating is required to reflect your happiness.

It's good to leave some feedback.

Something went wrong, please try again later.

fantabulous

I am not sure that I would give this full marks or pay 4 pounds for it. I thought that it was a whole essay not part of an essay

junaidahmed01

Hi there, would love to know what was missing from it. If you request a refund I'd be happy to pay it back and you're welcome to keep it for free. It is a 15 mark essay consisting of approximately 425 words. Either way, you're welcome to get in touch either through TES or contacting me directly and I'll fully refund your payment.

Empty reply does not make any sense for the end user

Report this resource to let us know if it violates our terms and conditions. Our customer service team will review your report and will be in touch.

Not quite what you were looking for? Search by keyword to find the right resource:

- Search Search Please fill out this field.

Perfect Competition

Imperfect competition, market structures and competition, the bottom line.

- Guide to Microeconomics

Perfect vs. Imperfect Competition: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/picture-53887-1440627076-5bfc2a8946e0fb0026013e02.jpg)

Perfect competition is a concept in microeconomics that describes a market structure controlled entirely by market forces. If and when these forces are not met, the market is said to have imperfect competition.

While no market has clearly defined perfect competition, all real-world markets are classified as imperfect . That being said, a perfect market is used as a standard by which the effectiveness and efficiency of real-world markets can be measured. Learn the key differences between perfect and imperfect competition and how real-world market structures work.

Key Takeaways

- The market structure is controlled entirely by market forces in perfect competition.

- In perfect competition, identical products are sold, prices are set by supply and demand, market share is spread to all firms, buyers have complete information about products and prices, and there are low or no barriers to entry or exit.

- In the real world, there is no perfect competition but markets are represented by imperfect competition.

- Imperfect competition occurs when at least one condition of a perfect market is not met.

- Examples of imperfect competition include, but aren't limited to, monopolies and oligopolies.

Perfect competition is an abstract concept that occurs in economics textbooks, but not in the real world. That's because it's impossible to attain in real life.

Theoretically, resources would be divided among companies equally and fairly in a market with perfect competition, and no monopoly would exist. Each company would have the same industry knowledge and they would all sell the same products. There would be plenty of buyers and sellers in this market, and demand would help set prices evenly across the board.

In order for a market to have perfect competition, there must be:

- Identical products sold by companies

- An environment in which prices are determined by supply and demand, meaning companies cannot control the market prices of their products

- Equal market share between companies

- Complete information about prices and products available to all buyers

- An industry with low or no barriers to entry or exit

The entry and exit in perfect market competition is not regulated, which means the government has no control over the players in any given industry.

When it comes to their bottom lines, companies typically make just enough profit to stay in business. No one business is more profitable than the next. That's because the dynamics in the market cause them to operate on an equal playing field, thereby canceling out any possible edge one may have over another.

Since perfect competition is merely a theoretical concept, it is difficult to find a real-world example. But there are instances in the market that may appear to have a perfectly competitive environment. A flea market or farmer's market are two examples. Consider the stalls of four crafters or farmers in the market who sell the same products. This market environment is characterized by a small number of buyers and sellers. There may be little to differentiate between the products each crafter or farmer sells, as well as their prices, which are typically set evenly among them.

Imperfect competition occurs in a market when one of the conditions in a perfectly competitive market are left unmet. This type of market is very common. In fact, every industry has some type of imperfect competition. This includes a marketplace with different products and services, prices that are not set by supply and demand, competition for market share, buyers who may not have complete information about products and prices, and high barriers to entry and exit.

Imperfect competition can be found in the following types of market structures: monopolies, oligopolies, monopolistic competition, monopsonies, and oligopsonies.

In monopolies, there is only one (dominant) seller. That company offers a product to the market that has no substitute. Monopolies have high barriers to entry, a single seller which is a price maker. That means the firm sets the price at which its product will be sold regardless of supply or demand. Finally, the firm can change the price at any time, without notice to consumers.

Oligopolies

In an oligopoly, there are many buyers but only a few sellers. Oil companies, grocery stores, cellphone companies, and tire manufacturers are examples of oligopolies. Because there are a few players controlling the market, they may bar others from entering the industry. The firms in this market structure set prices for products and services collectively or, in the case of a cartel, they may do so if one takes the lead.

Monopolistic Competition

Monopolistic competition occurs when there are many sellers who offer similar products that aren't necessarily substituted. Although the barriers to entry are fairly low and the companies in this structure are price makers, the overall business decisions of one company do not affect its competition. Examples include fast food restaurants like McDonald's and Burger King. Although they are in direct competition, they offer similar products that cannot be substituted—think Big Mac vs. Whopper.

Monopsonies and Oligopsonies

Monopsonies and oligopsonies are counterpoints to monopolies and oligopolies. Instead of being made up of many buyers and few sellers, these unique markets have many sellers but few buyers. Many firms create products and services and attempt to sell them to a singular buyer—the U.S. military, which constitutes a monopsony . An example of an oligopsony is the tobacco industry. Almost all of the tobacco grown in the world is purchased by less than five companies, which use it to produce cigarettes and smokeless tobacco products. In a monopsony or an oligopsony, it is the buyer, not the seller, who can manipulate market prices by playing firms against one another.

What's the Difference Between Perfect and Imperfect Competition?

Perfect competition assumes that there are many buyers, many sellers, and identical products. Market forces drive supply and demand, and every company has equal market share. It is purely theoretical. With imperfect competition, at least one element of perfect competition is missing.

What's the Difference Between Market Structure and Perfect Competition?

Different market structures differ from perfect competition in different ways. Monopolies, for example, aren't perfect competition because they are dominated by one seller. Oligopolies are dominated by a few sellers. In perfect competition, there would be no dominant seller, because market share would be divided equally and market forces would drive prices.

What Is an Example of an Imperfect Market?

Every real-world market is an example of an imperfect market because perfect markets don't exist in the real world. Imperfect markets lack perfect competition, such as in the case of monopolies. For example, consider the search engine and digital advertising marketplace. It is an imperfect market because Google is the dominant company, thwarting or buying up competitors. The U.S. Justice Department even filed an antitrust lawsuit, alleging monopolistic practices.

Perfect competition describes a hypothetical market that is purely controlled by market forces. In the real world, perfect competition doesn't exist; some aspect is missing. It may be a difference in products sold, individual companies controlling prices, lopsided market share, consumers with incomplete information, or a high barrier to entry for a particular industry. Whatever the reason, the result is imperfect competition.

Corporate Finance Institute. " Imperfect Competition ."

U.S. Federal Trade Commission. " Competition Counts: How Consumers Win When Businesses Compete ," Page 2.

Council of Economic Advisers Issue Brief. " Benefits of Competition and Indicators of Market Power ," Page 3.

U.S. Department of Justice. " Justice Department Sues Google for Monopolizing Digital Advertising Technologies ."

:max_bytes(150000):strip_icc():format(webp)/imperfectmarket.asp-final-3b126b9789d44042ba6da4534871b759.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Perfect Competition vs Monopoly Essay Guide

10th February 2014

- Share on Facebook

- Share on Twitter

- Share by Email

A quick but informative guide on how to structure an essay evaluating perfect competition and monopoly. For more videos, click here

Perfect competition revision quiz - click here

Jim co-founded tutor2u alongside his twin brother Geoff! Jim is a well-known Business writer and presenter as well as being one of the UK's leading educational technology entrepreneurs.

You might also like

Our subjects.

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

IMAGES

VIDEO

COMMENTS

Perfect competition is a market structure where many firms offer a homogeneous product. Because there is freedom of entry and exit and perfect information, firms will make normal profits and prices will be kept low by competitive pressures. Features of perfect competition. Many firms. Freedom of entry and exit; this will require low sunk costs.

Key points. A perfectly competitive firm is a price taker, which means that it must accept the equilibrium price at which it sells goods. If a perfectly competitive firm attempts to charge even a tiny amount more than the market price, it will be unable to make any sales. Perfect competition occurs when there are many sellers, there is easy ...

The Meaning of Perfect Competition. According to Aumann (1996, 7), Perfect competition is a market structure that assumes the optimum allocation of resources. The market is theoretical and nonexistent in real life. A perfectly competitive market is defined as a market structure in which there are many buyers and sellers such that no one has the ...

Summary. Long-run equilibrium in perfectly competitive markets meets two important conditions: allocative efficiency and productive efficiency. These two conditions have important implications. First, resources are allocated to their best alternative use. Second, they provide the maximum satisfaction attainable by society.

Perfect competition is a model of the market based on the assumption that a large number of firms produce identical goods consumed by a large number of buyers. The model of perfect competition also assumes that it is easy for new firms to enter the market and for existing ones to leave. And finally, it assumes that buyers and sellers have ...

Characteristics Of Perfect Competition Economics Essay. Monopoly is a market structure that is the only sole seller of a product and large number of buyers that have no close substitution and have a high entry and exit barrier. A monopoly markethas no other firms can enter the market and compete with it to produce some good or service.

Perfect competition is a market structure in which the following five criteria are met: 1) All firms sell an identical product; 2) All firms are price takers - they cannot control the market price ...

Perfect competition is a theoretical market structure. It does provide a useful benchmark for evaluating efficiency for real-world market structures, e.g. monopolies and oligopolies. Perfectly competitive markets has an efficient allocation of resources where resources are allocated to their most valued uses.

This AQA Economics study note covers perfect competition. In the bustling marketplace of economic models, perfect competition holds a coveted spot. It represents a utopian world of efficient resource allocation, where firms are mere players following the rules, leading to an optimal outcome for consumers and society. Let's dive into this model, unpacking its features, implications, and ...

It was one of several on the street. Your neighbor, Julie, also had a lemonade stand and she typically sold her lemonade for 25 cents. You figured that in order to make more money, you would charge 50 cents and steal all her customers. Sadly, everyone bought from Julie and you had no customers at all. Welcome to the world of perfect competition.

10 Past Papers with Model Answers on Market Failure. All orders will be delivered within 1-2 weeks. Find FREE model answers in Economics. Model answers for Perfect Competition questions. Prepare and pass your exams. Use our model answers to help you. Hire a specialist private Economics tutor if you need more help.

1950 Words. 8 Pages. Open Document. Perfect Competition. Perfect competition is an idealised market structure theory used in economics to show the market under a high degree of competition given certain conditions. This essay aims to outline the assumptions and distinctive features that form the perfectly competitive model and how this model ...

The general rule is, if MR (Marginal Revenue) is higher than ATC, the firm is making economic profit. If MR is at ATC, the firm is making $0 economic profit and is therefore neutral. If MR is lower than ATC, the firm can still operate in the short run but it will exit the market in the long run. In long-run competitive equilibrium, the ...

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | IB Economics Notes Directory. Perfect Competition Definition: A market with Perfect Competition is defined as having an unlimited number of buyers and sellers, perfect information (eg. with regards to product pricing of all firms), no barriers to ...

A-level Economics Model Essay on Perfect Competition. Subject: Economics. Age range: 16+. Resource type: Other. File previews. docx, 307.96 KB. This is a model A2 economics essay answer to the following question: Explain how a perfectly competitive market is economically efficient. It is suitable for students of all exam board studying business ...

Perfect competition assumes that there are many buyers, many sellers, and identical products. Market forces drive supply and demand, and every company has equal market share. It is purely ...

2.2 Perfect Competition and its characteristics. Perfect competition is referring to the market in which there are many buyers and sellers, the products are homogeneous and the sellers may readily join and leave from the market. 2.3 Large number of buyers and sellers. The amount of a single seller sells in a market is so tiny emulated to the ...

Perfect Competition vs Monopoly Essay Guide. Jim Riley. 10th February 2014. Share : A quick but informative guide on how to structure an essay evaluating perfect competition and monopoly. For more videos, click here. Perfect competition revision quiz - click here. Share :

Perfect Competition Essay - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Perfect competition is a market structure in which firms in an industry are price takers. Producers and consumers have perfect knowledge / are fully aware of the market. Firms as such have the ability to add inviting features to their products with an increased price.

This essay delves into the intricacies of perfect competition, examining its defining features, implications for market dynamics, and its role in shaping economic outcomes. Defining Perfect Competition: Perfect competition is a theoretical market structure characterized by several key features: Large Number of Buyers and Sellers: In a perfectly ...

2.3 Advantages of monopoly. Monopoly avoids duplication and hence wastage of resources. A monopoly enjoys economics of scale as it is the only supplier of product or service in the market. The benefits can be passed on to the consumers. Due to the fact that monopolies make lot of profits, it can be used for research and development and to ...

The third characteristics in perfect competition are freedom entry and exit the market; there are no barriers to them. In the long run business, when the register firm need to exit the market, it needs to show a prove, but in the short run there is no restriction to entry or exit the market. The entire firm in a perfectly competition market ...

In this essay Perfect competition and Monopoly market structures are analysed to understand the nature of a business. Perfect Competition: "A market Structure where there are many firms; where there is freedom of entry into the industry; where all firms produce an identical product; and where all firms are price takers" (Slomon, 2013).