FMCG Giant Hindustan Unilever Limited (HUL) Case Study

Devashish Shrivastava , Anik Banerjee

Hindustan Unilever Limited (HUL) is a British-Dutch assembling organization headquartered in Mumbai, India. The items of Hindustan Unilever Ltd incorporate nourishments, drinks, cleaning specialists, individual consideration items, water purifiers, and purchaser merchandise. HUL was set up in 1933 as Lever Brothers and following the merger of its constituent gatherings in 1956, HUL was renamed Hindustan Lever Limited. The organization was then renamed in June 2007 as "Hindustan Unilever Limited".

At the start of 2019, the Hindustan Unilever Limited portfolio had 35 items marked in 20 classifications and utilized 18,000 representatives with offers of Rs. 34,619 crores in 2017-18. In December 2018, HUL reported its procurement of Glaxo Smithkline's India business for $3.8 billion out of an all value merger manage ratio of 1:4.39.

However, the joining of 3800 representatives of GSK stayed questionable as HUL expressed there was no provision for maintenance of workers in the deal. In January 2019, HUL said that it hopes to finish the merger with Glaxo Smith Kline Consumer Healthcare (GSKCH India) this year.

History And Journey Of Hindustan Unilever Brands And Products Of Hindustan Unilever Business Model of HUL Business Growth In India Expected Future Growth

History And Journey Of Hindustan Unilever

Hindustan Unilever Limited (HUL) is India's biggest quick-moving customer merchandise organization. HUL works in seven business sections.

The cleanser segment incorporates cleansers, cleanser bars, cleanser powders, and scourers. Individual items incorporate items in the classifications of oral consideration, healthy skin (barring cleansers), hair care bath powder, and shading beautifiers. Refreshments incorporate tea and espresso.

Nourishments incorporate staples (atta salt and bread) and culinary items (tomato-based items natural product-based items and soups). Frozen yogurts incorporate frozen yogurts and solidified treats. Others incorporate synthetic substances and water business.

HUL's item portfolio incorporates family unit brands—for example, Lux, Lifebuoy, Surf Excel, Rin, Wheel, Fair and Lovely, Pond's, Vaseline, Lakme, Dove, Clinic Plus, Sunsilk, Pepsodent, Closeup, Axe, Brooke Bond, and Bru, Knorr, Kissan, and Kwality Wall's. HUL is a backup of Unilever, one of the world's driving providers of food products , home care, personal care, and refreshment items with deals in more than 190 nations and a yearly turnover of $6.08 billion in 2020.

Hindustan Unilever Limited traces its origins to Unilever, a British-Dutch multinational company, which is the parent of HUL. William Hesketh Lever was a popular social reformer and is regarded as one of the main propagators of several significant employee benefits options like benefits of health, savings, and more. Thus, his ideologies largely seeped into Unilver and resulted in developing its strong sense of corporate responsibility and leadership. This culture was invariably passed on to the Hindustan Unilever Limited (HUL).

The British-Dutch company Unilever, which emerged as a result of the merger of the operations of Dutch Margarine Unie and British soapmaker Lever Brothers, when it first came to India, discovered the rich and largely unexplored potential of the Indian market. Soon after, the establishment of Hindustan Vanaspati Mfg. Co. Ltd. followed in 1931, which was succeeded by the foundation of Lever Brothers India Limited (1933) and United Traders Limited (1935). The Indian subcontinent had only been importing FMCG products, branded under Lever Brothers since then, the first of which were spotted as early as 1888. Following this, brands like Lifebuoy stepped in 1895, along with other famous companies like Pears, Lux, and Vim. Vanaspati was launched in 1918 and the famous Dalda brand came to the market in 1937.

The 3 Unilever companies - Hindustan Vanaspati Manufacturing Company, Lever Brothers India Limited, and United Traders Limited eventually merged together to form HUL in November 1956. HUL offered 10% of its equity to the Indians and soon swooped into the news, being the first foreign subsidiary to do so.

The organization obtained Lipton in 1972, and Lipton Tea (India) Ltd was consolidated in 1977. Brooke Bond joined the Unilever overlap in 1984 through a global obtaining. Lake's (India) Ltd joined the Unilever overlap through a worldwide securing of Chesebrough Pond's USA in 1986.

The progression of the Indian economy, which began in 1991, denoted an enunciation in the organization's development bend. The expulsion of the administrative structure enabled the organization to investigate every item and open-door section with no imperatives on the creation limit. At the same time, deregulation allowed acquisitions and mergers .

The Tata Oil Mills Company (TOMCO) converged with the organization with effect from April 1, 1993. In 1996, Unilever and Lakme Ltd framed a 50:50 joint endeavor, Lakme Unilever Ltd, to advertise Lakme's market-driven beautifiers and other suitable results. In 1998, Lakme Ltd offered its brands to Unilever and stripped its half stake in the joint venture.

In 1994, the organization and US-based Kimberly Clark Corporation framed a 50:50 joint endeavor—Kimberly-Clark Lever Ltd—which markets Huggies Diapers and Kotex Sanitary Pads. The organization likewise set up a backup in Nepal called Unilever Nepal Limited (UNL). UNL's production line speaks to the biggest assembling interest in the Himalayan kingdom. In the1992, Brooke Bond gained Kothari General Foods with critical interests in instant coffee.

In 1993, HUL acquired Kissan from the UB Group and the Dollops ice-cream business from Cadbury India. Tea Estates and Doom Dooma, two major organizations of Unilever, were converged with Brooke Bond. At that point, in 1994, Brooke Bond India and Lipton India converged to shape Brooke Bond Lipton India Ltd (BBLIL) to empower more noteworthy concentration and guarantee collaboration in the customary beverages business. BBL converged with Unilever with effect from January 1, 1996.

The internal rebuilding finished with the merger of Pond's (India) Limited (PIL) with HUL in 1998. The two organizations had huge covers in personal products, specialty chemicals, and export organizations; other than a typical appropriation framework since 1993 for personal products. The two additionally had a typical administration pool and an innovation base.

In January 2000, the administration chose to grant 74% value in Modern Foods to Unilever. This started the divestment of government value in open division endeavors (PSU) to private area accomplices. The organization's entrance into bread production is a key augmentation of the organization's wheat business. In 2002, the organization procured the administration's residual stake in Modern Foods.

In 2002, the organization made its entry into Ayurvedic well-being with its Ayush item range and Ayush therapy centers. In 2003, the organization procured the Cooked Shrimp and Pasteurized Crabmeat business of the Amalgam Group of Companies, an innovator in marine products trades. Additionally, the organization propelled Hindustan Unilever Network Direct to home business. In 2004, the organization launched the 'Pureit' water purifier.

In 2005, Lever India Exports, Lipton India Exports Ltd, Merry climate Food Products, Toc Disinfectants Ltd, and International Fisheries Ltd were amalgamated within Unilever. In February 2006, Vasishti Detergents Ltd (VDL) converged with Unilever. In September 2006, Modern Foods Industries (India) Ltd & Modern Foods and Nutrition Industries Ltd were included. In October 2006, Unilever stripped its 51% controlling stake in Unilever India Shared Services Ltd, currently known as Capgemini Business Services Pvt. Ltd., to Cap Gemini SA.

In March 2007, Sangam Direct, a non-store home conveyance retail business managed by Unilever India Exports Ltd (UIEL) and a completely possessed auxiliary, was moved to Wadhavan Foods Retail Pvt Ltd (WFRPL) in a droop deal business. Likewise, Unilever completed the demerger of its operational offices in Shamnagar, Jamnagar, and Janmam and shaped three autonomous organizations —Shamnagar Estates Ltd., Jamnagar Properties Ltd, and Hindustan Kwality Walls Foods Ltd. In June 2007, the organization changed its name from Hindustan Lever Ltd to Hindustan Unilever Limited.

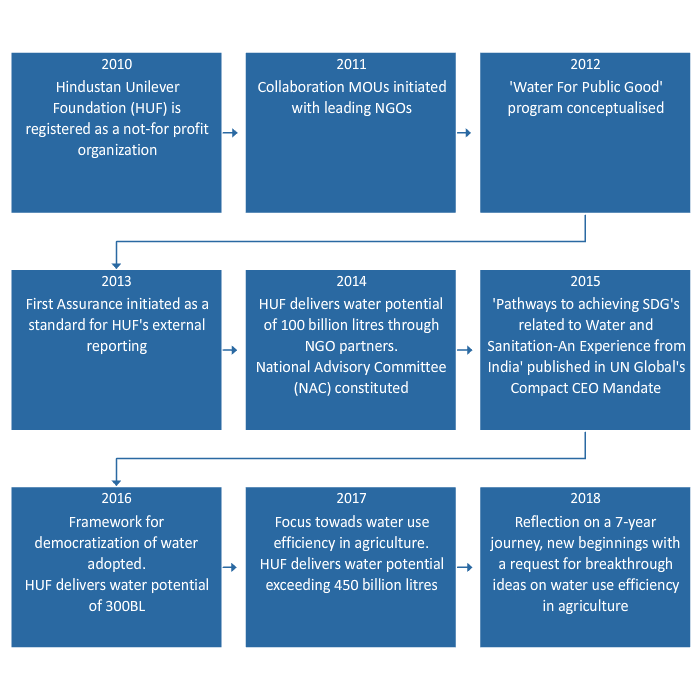

In 2008, the organization reported its coordinated efforts with the Indian Dental Association (IDA) related to World Dental Federation (FDI) through the Pepsodent brand to help improve the oral well-being and cleanliness benchmarks in India. In April 2008, the organization demerged and moved certain immovable properties to Brooke Bond Real Estates Pvt Ltd. In January 2010, the organization introduced its new corporate office.

In April 2010, Unilever affirmed the plan of amalgamation of Bon Ltd, an entirely possessed backup of Hindustan Unilever Limited, with it. The selected date for the previously mentioned plan was 1 April 2009 and the plan was made viable from April 28, 2010. Ensuing to the amalgamation, Bon Ltd stopped being an auxiliary of the company.

During 2010-11, Kissan forayed into a new market fragment in three major classifications. It propelled Kissan Fruit and Soya, a delightful mix of organic product juice and soya milk, which appreciated a separated suggestion in this market. The brand likewise went into the Indian (non-sweet) spreads showcase with the dispatch of Kissan Creamy Spread over key towns. In the bakery division, the organization propelled two new items—Chapi and Cream Rolls. The organization stripped 43.31% stake in Hindustan Field Services Pvt Ltd for Smollan Group (the JV accomplice).

Along these lines, Hindustan Field Services Pvt. Ltd. stopped being a backup organization. Lakme Lever Pvt Ltd, a completely claimed auxiliary of HUL, extended the system of Lakme Beauty Salons in that year with the opening of 11 franchises and oversaw salons alongside 18 franchisees' salons.

In December 2011, the organization demerged the FMCG sends-out business, including explicit fares related to assembling units of the organization, into its entirely claimed backup Unilever India Exports Ltd (UIEL). The plan wound up successful on January 1, 2012.

In 2012, the organization went into a concurrence with Unilever to showcase Brylcreem in India. During the year under audit, Unilever and elements of Piramal Realty (Ajay Piramal Group) consented to an arrangement for the task of HUL's leasehold privileges of the land and building named Gulita arranged at Worli Sea Face Mumbai for an exchange estimation of Rs. 452.5 Crore.

On 22 January 2013, the Board of Directors of HUL affirmed a proposition to consent to another arrangement with its parent organization Unilever for the arrangement of innovation exchange imprint permit, trademark registration, and other services on 1 February 2013. This new understanding underlined that the loyalty cost of 1.4% of turnover payable by HUL to Unilever will increment in a staged way to an eminence cost of 3.15% of turnover, no later than the money-related year finishing 31 March 2018.

The expansion in eminence cost in the period from 1 February 2013 to 31 March 2014 is assessed to be 0.5% of turnover and from there on in the scope of 0.3% to 0.7% of turnover in each money related year, paving the way to a complete evaluated sovereignty cost increment of 1.75% of turnover contrasted with existing courses of action no later than the monetary year finishing 31 March 2018.

In 2014, Unilever reported an organization with Internet.org, a Facebook-directed coalition of accomplices to see how web access can be expanded to contact millions of individuals crosswise over India. The organization additionally dispatched Prabhat activity for network improvement in towns around its industrial facilities during the year under survey. Furthermore, the organization also went into association with MTV to embrace its brands during the year under review. In 2015, the organization propelled The Unilever Foundry.

During the year under audit, the organization was perceived as the most inventive advertiser at the Mobile Marketing Association (MMA). The organization additionally resuscitated Ayush with e-dispatch during the year. Besides, it also propelled the 'Swachh Aadat Swachh Bharat' program in India during the year under review. On 8 September 2015, HUL reported that it has further consented to bring forth an arrangement for the deal and the transfer of its bread and pastry shop business under the brand Modern to Nimman Foods Private Limited, an investee organization of the Everstone Group, for an undisclosed amount.

Brands And Products Of Hindustan Unilever

HUL is the market chief in Indian buyer items with products in more than 20 purchaser classes (for example, cleansers, tea, cleansers, and shampoos among others). Sixteen of HUL's brands were included in the ACNielsen Brand Equity rundown of 100 Most Trusted Brands Annual Survey (2014) which was completed by Brand Equity, an enhancement of The Economic Times. There are many brands and products owned by Hindustan Uniliver:

Food Products

- Annapurna salt and Atta (once known as Kissan Annapurna)

- Brooke Bond 3 Roses, Taj Mahal, Taaza and Red Label tea

- Kissan squashes, kinds of ketchup, squeezes and sticks

- Lipton ice tea

- Knorr soups and supper creators and soupy noodles

- Kwality Wall's solidified treat

- Modern Bread, prepared to eat chapattis and other pastry shop things (presently offered to Everstone Capital)

- Magnum (ice cream)

Homecare Brands

- Wheel cleaner

- Cif Cream Cleaner

- comfort cleansing agents

- Domex disinfectant/toilet and bathroom cleaner

- Rin detergent products

- sunlight cleanser and shading care

- Surf Excel cleanser and delicate wash

- Vim dishwash

- magic – Water Saver

Personal Care Brands

- Aviance Beauty Solutions and products

- Axe deodorant and aftershave lotion and soap and accessories

- Lever Ayush Therapy ayurvedic health care and personal care products and items

- International breeze

- Brylcreem hair cream, hair gel and hair products

- Clear anti-dandruff hair products

- Clinic Plus shampoo and oil

- Close Up toothpaste

- Dove skin cleansing & hair care range: bar, lotions, creams, and antiperspirant deodorants

- Denim shaving products

- Fair and Lovely, skin lightening cream

- Indulekha ayurvedic hair oil

- Lakmé beauty products and salons

- Lifebuoy soaps and handwash range

- Liril 2000 soap

- Lux soap, body wash, and deodorant

- Pears soap, body wash

- Pepsodent toothpaste

- Pond's talcs and creams

- Sunsilk shampoo

- Sure antiperspirant

- Vaseline petroleum jelly, skincare lotions

- Vaseline and relevant products

Water Purifier Products

- Pureit water purifier

Business Model of HUL

Hindustan Unilever is an FMCG company that leverages its Direct to Consumer (D2C) business model and has made over 50 billion in revenue, as discovered in 2017. The company has crossed INR 50,000 cr ($6.55 bn) in turnover during FY21, as per the reports on April 2022. HUL is the first pure FMCG brand to hit such a milestone.

The business model of Hindustan Unilever is propelled with the idea of making living sustainable feasible for the masses. With sustainable living, HUL wants to bring about:

- Bettering the future of the children

- A future full of confidence

- A future full of health

- A future that is better for the planet

- A future that is better for the farming and farmers of India

The beauty and personal care segment of Hindustan Unilever helps the company see the most profit, while the food and refreshments segment is declared as the fastest-growing segment of the company. Home care is another segment of the company among its 3 primary segments.

The Hindustan Unilever company gets its competitive advantage from the global footprint it has and the track record of the company for enhancing value for its consumers around the globe.

Some of the prominent patterns that are noticeable in the business model of HUL are:

Reverse Innovation

Reverse innovation refers to the process of building products for industrial countries and then adapting them to the emerging markets. The technique of reverse innovation is what is truly wielded by HUL, which has been a prominent inspiration for many other big brands. The 'Knorr Stock Pot’ that the brand came up with is an excellent example of leveraging reverse innovation. This technique was mastered by HUL by taking references from the famous ‘Dense Soup treasure,’ which was the first major example of reverse innovation, launched in China in 2007.

Focussing on the financially weak

In contrast to the other foreign subsidiaries, HUL ideated to focus on the financially weaker sections of the country, which led them to focus on the majority of the Indian people. Citing the discovery of Wheel detergent powder is one of the examples where Hindustan Unilever created products for the majority of the Indian consumers. Wheel had lower oil-to-water ratio, which enabled Indian to wash textiles even in rivers with hands. Wheel was then made available cleverly by the brand in the local corner shops as well as via door-to-door representatives.

Staying keen on the Triple Bottom Line

While most of the companies solely focus on the profit part of the follow the Triple Bottom Line with only a little focus on the other segments, HUL has a new approach where the brand decided aimed for the other segments, thereby caring for people and the planet.

HUL largely focuses on the people, including its consumers and others. For instance, the company changed the name of one of its popular products "Fair and Lovely" to "Glow and Lovely", following the All Black Lives Matter movement that raged globally. This instantly made HUL a favourite!

Significant Distribution Strategy

The distribution strategy that Hindustan Unilever follows is exemplary! It focuses on hyperlocal markets, retail stores, wholesalers, hypermarkets convenience stores, ecommerce, and more. This hugely helps in the promotion of the HUL products and moving them fast to the consumers!

Business Growth In India

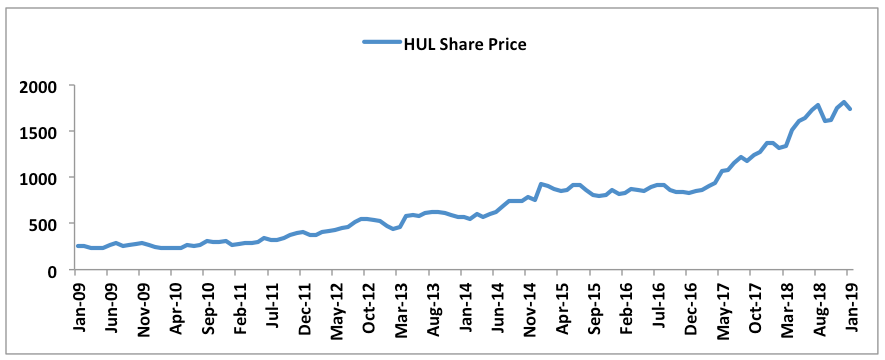

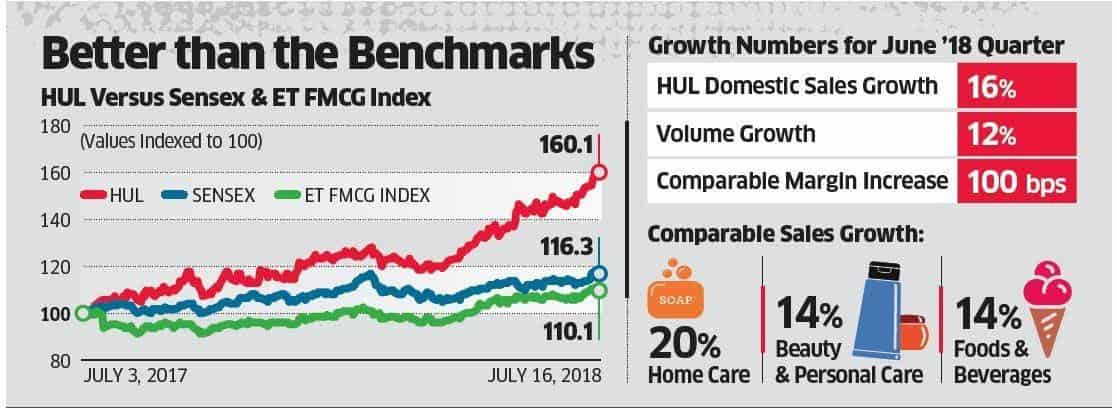

FMCG giant Hindustan Unilever Limited (HUL) announced a 15.98% development in solidified net benefit at Rs 6,060 crore for the monetary year finished March 31, 2019, when contrasted with Rs 5,225 crore in 2018. The net profit that HUL witnessed in FY21 rose by 18% YoY at Rs 7,954 crore.

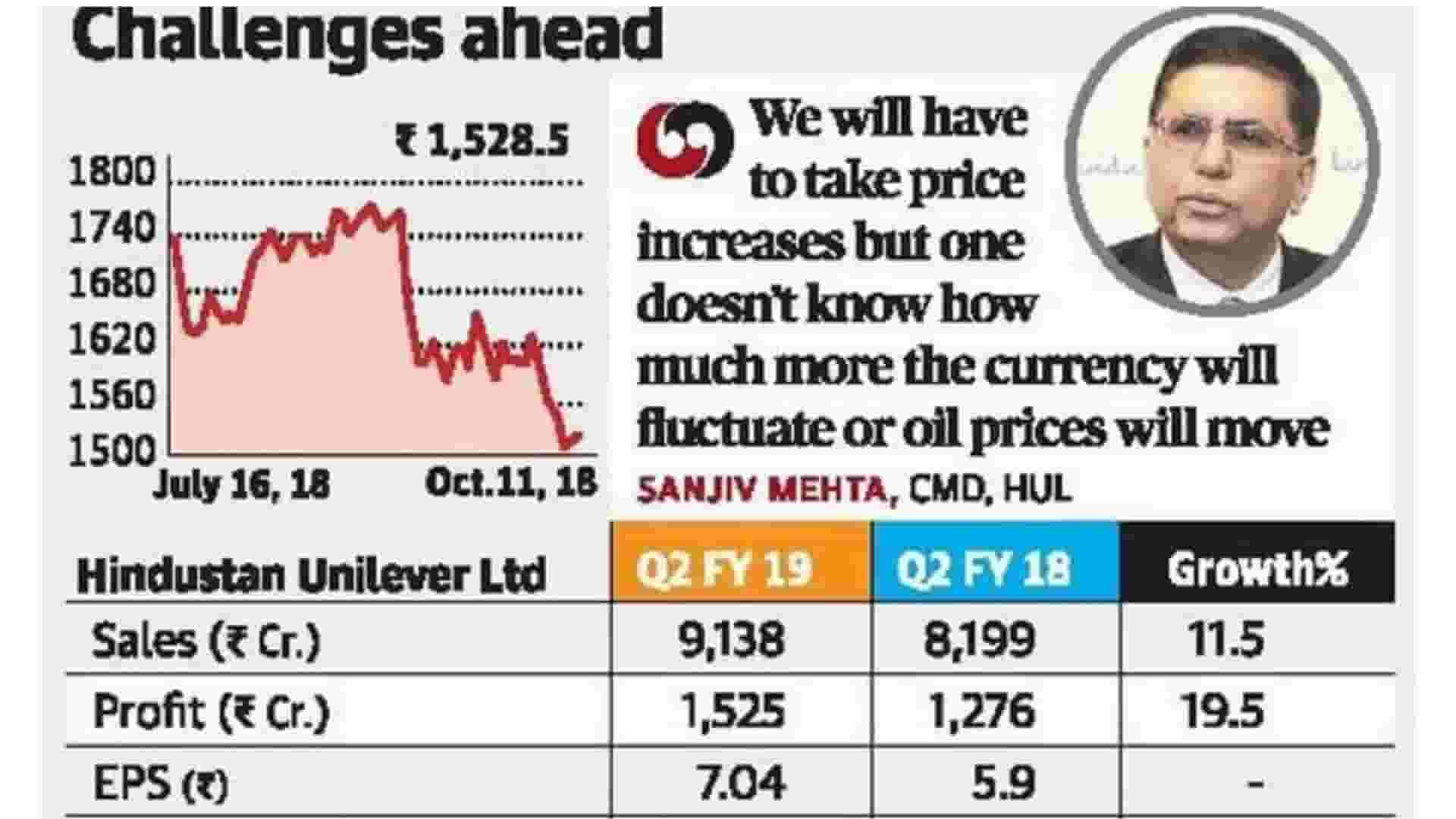

Remarking on the profit, HUL Chairman and Managing Director Sanjiv Mehta stated, "We have conveyed a solid execution for the quarter regardless of some balance in rustic market development. Our attention to fortifying the center and driving business sector advancement has been reliably conveying great outcomes. We have now developed top line and primary concern for the eighth continuous year and our 2019 outcomes were a demonstration of both our technique and execution."

"Given the large-scale monetary pointers, close term advertise development has directed. Notwithstanding, the medium-term viewpoint remains positive. As an association, we are well-situated to react with speed and nimbleness to address the issues of our shoppers. We stay concentrated on our vital plan of conveying predictable, focused, beneficial, and dependable development," he included.

"Together with the between time profit of Rs 9 for each offer, the all-out profit for the money-related year closure March 31, 2019, adds up to Rs. 22 for every offer," the organization said. "Combined income for 2018-19 remained at Rs 39,860 crore, up from Rs 36,622 crore a year sooner," HUL said in a document to the Bombay Stock Exchange.

HUL's business in India developed by 12%, driven by 10% volume development in the household advertise. In the January-March quarter, the organization posted 13.84% development in its independent net benefit at Rs 1,538 crore when contrasted with Rs 1,351 crore in a similar quarter a year ago. The offers of the organization remained at Rs 9,809 crore in Q4FY19 from Rs 9,003 crore in Q4FY18, enrolling a development of 8.95%. The working benefit (EBITDA) for the March quarter was up 13% year-on-year at Rs 2,321 crore and the EBITDA edge was up 90 bps.

The organization said that the edge improved because of judicious administration of instability in costs (unrefined and money driven) alongside improved blend and working influence.

HUL reported that its Earnings before interest, tax, depreciation and amortisation (EBITDA) stood at Rs 11,324 crore, while the EBITDA margin was reported to be 25% during FY21.

Also read : Unknown Facts About Famous Brands | A Case Study

Expected Future Growth

Hindustan Unilever NSE 0.01 % (HUL) may clock 9-10% development in June quarter benefit despite a slight balance in volumes because of value climbs crosswise over classes. IIFL Institutional Equities expects the FMCG major to report a 6% volume development, a slight control from the 7% volume development recorded in the past quarter.

"Our channel checks give us a feeling that the organization has started value climbs crosswise over classes, (for example, cleansers, espresso), among others. We along these lines gauge a business development of 9%, like the past quarter level. We expect the slight withdrawal in gross edge to be counterbalanced by influence in promotion spending and different costs. In general, EBITDA and PAT are relied upon to develop at 13% and 12%, individually," IIFL said. IDFC Securities expects HUL to report 10.3% to ascend in benefit at Rs 1,728 crore. It sees deals developing at 8% to Rs 10,250 crore.

"We expect 6% volume development and factor in deals development of 11% in home consideration and 7% in close to home consideration portions. Lower advertisement spends (down 80 bps YoY) and commands over different overheads will help EBITDA edges," it stated while proposing edge at 24.3% against 23.7% the previous year. Edelweiss sees income, Ebitda, and benefit development at 7.3%, 8.6%, and 7.7% YoY.

"We anticipate that HUL's volume should grow 5% YoY on a high base of 12% YoY development. Q1FY18 was affected by GST dispatch thus the best approach to take a gander at volume development is three years' normal, which will be 5.6%. Delicate quality in the second 50% of Q4FY19 proceeded for the full quarter in Q1FY20. Provincial development is presently at a similar level as urban development. A mixed value climb of 2.5% has been taken. On EBITDA edge front, we expect 20-30 bps YoY development," the business said.

What is Hindustan Unilever origin?

Hindustan Unilever or Hindustan Unilever Limited (HUL) is an Indian subsidiary of Unilever, which sprung from its Dutch-British roots. HUL is headquartered in Mumbai.

Who is the owner of Hindustan Unilever Limited?

HUL is owned by Unilever, its British multinational parent, headquartered in London.

What is HUL?

HUL is the acronym for Hindustan Unilever Limited.

Who are Hindustan Unilever founders?

Hindustan Unilever founders can be cited as 3 parent companies - Hindustan Vanaspati Mfg. Co. Ltd., Lever Brothers India Limited, and United Traders Limited, which were merged to form HUL.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace

The Top Tech Gadgets You Need for Presentations and Meetings

In the current corporate landscape, where time is of the essence, the power to deliver captivating and influential presentations and meetings is crucial to gain an edge over the competition. Whether presenting a new product or service to potential investors, training your workforce, or collaborating with your team, having access

KreditBee - Instant Personal Loan Platform

For many, getting big amounts of money frequently necessitates going to the bank. But until recently, you had to turn to friends or family if you needed a small loan for regular necessities like bills, shopping, or travel. This was mostly because borrowing money from banks may be difficult, especially

8 Ways the Indian Premier League (IPL) Franchises Make Money

The 15th edition of the Indian Premier League (IPL) is here now in 2024, and naturally, we are in the midst of the cricket frenzy with players set in action, the religious fans of the game all thrilled and waiting for their favourite matches, and the franchise owners and other

Nveda: Revolutionizing Healthcare with Nutraceutical Solutions

India's Nutritional Supplements Market was valued at U$ 11.85 billion in 2023 and is projected to hit the market valuation of US$ 28.70 billion by 2032 at a CAGR of 10.7% during the forecast period 2024–2032. Nveda is a fast-growing brand engaged in bringing high quality

- Stock Compare

- Superstar Portfolio

- Stock Buckets

- Corporate Actions

- Nifty Heatmap

- *Now Available in Hindi

Hindustan Unilever Limited (HUL) Case Study 2021 – Industry, SWOT, Financials & Shareholding

by Team Trade Brains | Mar 3, 2021 | Case Study , Stocks | 0 comments

HUL Case Study and analysis 2021: Hindustan Unilever Limited (HUL) is India’s biggest fast-moving consumer goods company . In this article, we will look into the fundamentals of HUL, focusing on both qualitative and quantitative aspects. Here, we will perform the SWOT Analysis of HUL, Michael Porter’s 5 Force Analysis, followed by looking into HUL key financials. We hope you will find the Hindustan Unilever Limited (HUL) case study helpful.

Disclaimer: This article is only for informational purposes and should not be considered any kind of advisory/advice. Please perform your independent analysis before investing in stocks, or take the help of your investment advisor. The data is collected from Trade Brains Portal .

Table of Contents

About HUL and its Business Model

With a legacy of over 80 years, Hindustan Unilever Limited (HUL) is India’s biggest fast-moving consumer goods company. Actually, the very first product of the company was launched in 1888 named Sunlight Soap. In 1931 Unilever set up its subsidiary in India and in 1956, its subsidiaries consolidated to form Hindustan Leer Limited.

In 2007, the name was renamed Hindustan Unilever Limited. In 2013, the parent company Unilever increased the market stake in HUL to 67% and in 2018, the market cap of HUL passed $50bn.

HUL primarily has three divisions:

- Beauty and Personal Care

- Food and Refreshment

Hindustan Unilever has a pan India access and it is found that more than 9 out of 10 households in India use a brand of HUL. Currently, the company has 14 brands in 44 different categories including Skin Cleansing, Tea, Deodrants, HFD, etc. Famous Brands like Surf Excel, Rin, Wheel, Vaseline, Pepsodent, Clinic Plus are included in the portfolio of the company.

On April 1, 2020, HUL also acquired leading brands like Horlicks and Boost. The company has 21,000 employees working under it with 31 factories, more than 1150 suppliers, and the products are available at more than 8million outlets in India.

HUL Case Study – Industry Analysis

FMCG sector is the fourth largest sector in India, which has surged from 840 Billion USD in 2017 to 1.1 Trillion USD in FY20 and is expected to grow at 10% a year. Personal Care and Household dominates with 50% of FMCG sales in India. Rapid urbanisation, increasing disposable incomes and better lifestyles have been the main growth drivers for the FMCG sector.

55% of the sales come from the urban segment, however, for the last few years, it has witnessed faster growth in the rural segment as compared to the urban segment. In rural India, the sector grew at 10.6% in the Q3 FY20, majorly due to better agricultural output.

It is expected that the rural FMCG market will rise to USD 220 billion by the end of 2025, at the same time, the market share of the unorganised market is expected to fall rapidly.

Michael Porter’s 5 Force Analysis of HUL

1. rivalry amongst competitors.

- FMCG industry is a very competitive one with many brands available, and new products coming in each quarter make innovation very important. FMCG business is highly dependent on advertisement and companies spent a big percentage on it.

- The switching costs for the customers are very low in this sector as the product differentiation is moderately low, which intensifies the competition.

2. A Threat by Substitutes

- Substitute in the FMCG sector is highly dependent on the particular product. For example, it is way easier to find Colgate toothpaste at a local shop than a homemade organic dentifrice. On the other hand, the substitute product for biscuits is rusk which is easily available. Since switching costs are very less, the threat of substitutes is relatively on the higher side.

3. Barriers to Entry

- Barriers to entry in the FMCG sector are far less as compared to the others. FMCG business is majorly dependent on brand identification and this can be developed with unique qualities, logo, advertisement; basically, proper market strategy.

- The distribution network is very large and branched in the FMCG sector, which further eases out barriers of entry.

4. Bargaining Power of Suppliers

- In FMCG business, companies have long term business with the suppliers, which helps them to negotiate the price. Moreover, the number of suppliers is ample; hence, decreasing the bargaining power of suppliers. However, companies need to make sure that they are getting the supplies at the cheapest possible prices as the industry is a high-volume, low-margin business.

5. Bargaining Power of Customers

- Factors like a high number of similar product companies available, very low switching costs and similar products available at similar quality and in almost the same price range increase the bargaining power of customers. The only thing that can make them stay is brand loyalty for a product.

HUL Case Study – SWOT Analysis

Now, moving forward in our HUL case study, we will perform the SWOT analysis.

1. Strengths

- HUL has a strong brand equity and a large legacy as it is a very old and well-rooted company with a variety of popular brands and products.

- The company has its presence across the length and breadth of India with over 8 million+ retail stores where its products are available.

2. Weaknesses

- HUL runs in a very competitive environment and there are highly established and rising companies that are little product-focused and hence, eat up the market share of the company.

- HUL currently doesn’t have any ayurvedic or natural products in their portfolio, which is a negative aspect of the company as the current population’s trend is shifting to herbal products and many focused companies are making the best use of it.

3. Opportunities

- With increasing disposable incomes, education and youth population, the FMCG sector in rural and semi-urban areas is expected to grow very rapidly as compared to urban areas. The company can use this very well as it already has a brand image and a wide chain of distributors.

- The company can use its healthy cash reserve position and brand image legacy to acquire various products to diversify its portfolio.

- HUL runs in a highly competitive environment, with 100% FDI allowed by the Govt. of India and new multinational companies setting their feet, the company faces a high threat from its competitors.

- The company is highly dependent on raw material prices. Inflation can shrink the margins for the company as it runs in a sector that is a high-volume, low-margin one.

- Population’s shift to organic and healthy products can help some unorganized and small companies to increase their market share, which can be a threat to HUL.

Asian Paints Case Study 2021 – Industry, SWOT, Financials & Shareholding

HUL’s Management

There are 9 members in the board of directors committee of the company, out of which 6 are Independent Directors including one female member.

Mr Sanjiv Mehta has been serving as the Chairman and Managing Director of the company since 2018. Chartered Accountant by degree, Sanjiv Mehta is also the President of Unilever South Asia (Pakistan, Bangladesh, Sri Lanka and Nepal). In 2019, he was awarded the “Business Leader of The Year” award by the All India Management Association.

Mr Willem Uijen is the Executive Director, Supply Chain of Hindustan Unilever Limited. He has been with the company since 1999 and was a part of various demographical projects of the company, especially in Latin America. In January 2020, he joined his current position.

Financial Analysis of HUL

- 44% of the company’s revenue comes from Beauty and Personal Care, followed by Home Care (34%). Foods & Refreshment contributes 19% and only 3% comes from others.

- In terms of Operating profit, Beauty and Personal care products contribute the maximum (55%), 29% comes from Home Care, 14% and 3% from Foods and others respectively.

- The company has a 54% market share in the Skin Care Segment, which makes it the market leader. In Dishwashing Detergents, 55% of the market share is dominated by the company. 47% and 37% is the respective market share which company owns in Shampoo and Personal Care Segment.

- As of Sept’20, the company spent 9.79% on advertisements as a % of total sales, which has shown a good rise from 7.46 of June’20.

- Net Profit Margin for the company is 14.77% as of FY20, which has surged from 13.59% as that of FY19. Current NPM is the highest of that in the last 5 financial years and the 3 Yrs. Avg. Net Profit Margin is 14.26%. Source: Trade Brains Portal ]

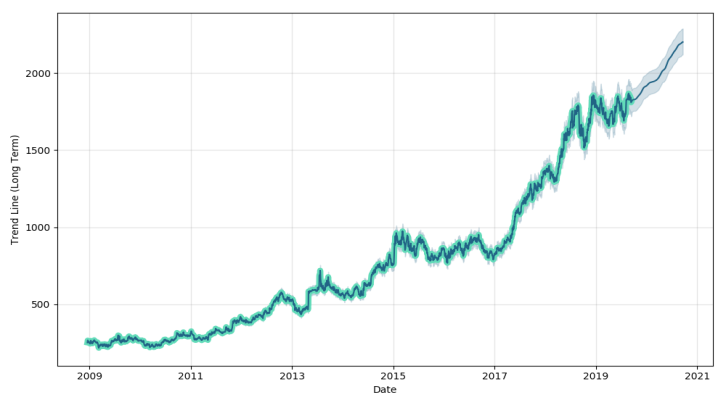

- In FY20, HUL showed a Revenue Growth of 1.2% from the previous FY. 3-year CAGR is 6.16%, which means that in recent years, the revenue growth has been subdued. A similar trend is visible from Net Profit Growth, 1-year CAGR is 11.46% whereas 3-year CAGR (14.66%) is higher.

- The company has a very healthy and consistent cash flow from Operating Activities. Outflow in cash flow from financing activities surged in FY20 as the company paid a higher dividend than the previous year.

HUL Case Study Financial Ratios

1. profitability ratios.

- EBITA Margin for the company has been increasing for the last 5 financial years except for FY19, in which it witnessed a small dip from 20.7 to 19.91. As of FY20, EBITDA Margin is 21.54%.

- Hindustan Unilever has the premium RoE of 84.15 (FY20), and a consistent rise in the same has been visible for the last 4 years. The 3 years avg RoE is 79.76%.

- The company enjoys 3-digit RoCE, which is very well respected by the market and a similar rising trend is visible in RoCE as that of RoE. As of FY20, RoCE is 114.67% and the Avg ROCE for 3 years is 110.16%.

2. Leverage Ratios

- As of FY20, Quick Ratio and Current Ratio for the company are 1.02 and 1.32 respectively, which indicated its good liquidity position. These levels have been more or less the same for the last 5 financial years, which is a positive sign for the company.

- HUL is a 100% debt-free company and its Interest Coverage Ratio is 48.69% as of FY20. Although this level is very good currently, it was 261.73 in FY19.

3. Efficiency Ratios

- Currently, the asset turnover ratio for the company is 2.4, which is slightly lower than the previous year but this figure has been almost constant in the recent financial years.

- The inventory turnover ratio witnessed a continuous rise from FY16 (12.04%) to FY19(17.53%), which later dipped to 17.18 in FY20 due to virus outbreak disruptions.

- The number of receivable days has decreased (12.79% in FY19 to 11.83% in FY20) and the number of payable days has increased (90.77% in FY19 to 92.86% in FY20), indicating the company’s increased bargaining power over the buyers and suppliers.

Shareholding Pattern of HUL

- Promoters own 61.9% of the company as of December quarter 2020. Although it has been the same for the last 3 quarters, a fall was seen from the level of 67.18% in March 2020. The best part is that promoters do not pledge a single share.

- FIIs hold 14.92% of shares of the company as of December 2020, which has surged from the level of 12.32% in the same period the previous year.

- DIIs own nearly 10.72% shares of the company, which was around 6.68% a year back. Both FIIs and DIIs have increased their shareholding in the previous years.

- Public shareholding has witnessed a fall in the recent quarters, from the level of 14.95% in Jun2020 to 12.46% in Dec 2020.

Closing Thoughts

In this article, we tried to perform a quick Hindustan Unilever Limited (HUL) case study. Although there are still many other prospects to look into, however, this guide would have given you a basic idea about HUL.

What do you think about HUL fundamentals from the long-term investment point of view? Do let us know in the comment section below. Take care and happy investing!

Start Your Stock Market Journey Today!

Want to learn Stock Market trading and Investing? Make sure to check out exclusive Stock Market courses by FinGrad, the learning initiative by Trade Brains. You can enroll in FREE courses and webinars available on FinGrad today and get ahead in your trading career. Join now!!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Search Topic or Keyword

Trending articles.

Recent IPO’s

- Bharti Hexacom IPO Review 2024 – GMP, Financials And More

- SRM Contractors IPO Review 2024 – GMP, Financials And More

- Krystal Integrated Services IPO Review 2024 – GMP, Financials & More

- Popular Vehicles IPO Review – GMP, Financials & More

- Gopal Namkeen IPO Review – Financials, GMP And More

Easiest Stock Screener Tool!

Best stock discovery tool with +130 filters, built for fundamental analysis. Profitability, Growth, Valuation, Liquidity, and many more filters. Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters.

- — Stock Screener

- — Compare Stocks

- — Stock Buckets

- — Portfolio Backtesting

Start your stock analysis journey with Trade Brains Portal today. Launch here !

Keep the Learning On!

Subscribe to Youtube to watch our latest stock market videos. Subscribe here .

Unilever Foundation School 2024

Hindustan Unilever's Foundation School is a unique opportunity to immerse yourself into the world of business and brands before kickstarting your B-school journey. Not only will you build a strong foundation for your management studies, but also get a chance to secure an early offer for HUL's coveted summer internship program (ULIP'24) much ahead of placement season on campus.

About Hindustan Unilever Foundation School

- Ace your dream B-School interview by preparing with us

- Early access to India's largest B-school case study competitions - Lessons in Marketing Excellence (LIME) and FinAce

- Chance to secure a direct summer internship offer with Hindustan Unilever for ULIP'24

- An exclusive window into India's largest FMCG company and a house of iconic brands

- Be a part of Foundation School immersive sessions at the HUL head office to learn fundamentals of Sales & Marketing, Finance and Human Resources

- Build a strong network with managers at HUL and fellow Unilever Foundation School

Get a chance to be a part of Unilever Leadership Internship Program'24

Customise your summer internship project as per your skillset and inclination to learn

Selection process for hindustan unilever foundation school 2024.

Fill An Application Form

You are required to fill out the Hindustan Unilever Foundation School 2024 Application Form

Shortlisted students prepare with HUL

Basis the application form, shortlisted students get an opportunity to prepare with HUL to ace their dream B-School admission process. The parameters for evaluation will be:

- Academic performance (including CAT/XAT score)

- Work experience or live projects undertaken

- Certifications/specialisation in specific skill sets

- Areas of passion substantiated with strong evidence

- Any other diverse experiences unique to you

Unilever Foundation School

Unilever Foundation School is a 3-day immersive workshop, filled with sessions where you get coached, challenged and tested on your knowledge of key managerial domains like Marketing, Finance and HR. At the end of the workshop, participants would have developed a deep insight into HUL, the world of FMCG and its workings.

Personal Interviews with senior managers from HUL

Testimonials

Sukrithi sood.

My experience as HUL Foundation School was a truly enriching one. I still remember when I first came across the opportunity on InsideIIM and wanted to make it! The learning journey began from the selection process itself, with its unique and thought-provoking format.

Khushboo Rao

The entire process was smooth and flawless. I am a marketing enthusiast, and Foundation School allowed me to intern with my dream firm and made my life much easier in IIM A!

Kushagra Agarwal

If anyone wants an introduction to marketing before you enter B-school, HUL Foundation School is the best opportunity out there. I thoroughly enjoyed the 3-day program, made friends, worked all night on our project, understood the basics of marketing, and got much more clarity on my future goals before joining IIMA.

What a fantastic experience it was! Foundation School is an opportunity to witness branding, sales, marketing, finance, etc., from the same people who have landed into HUL after their MBA. The program’s rich exposure to learning and engaging with senior leaders is unparalleled and a definite plus point.

Unilever, being India's largest FMCG company, is a dream company for marketing enthusiasts like me. HUL Foundation School program provides a chance to receive PPI and summer internship at HUL. Along with this, it helps understand industry insights and career as a marketer, which benefits in b-school journey ahead.

Ayushi Rawat

The entire experience was ecstatic. The thrill of meeting people would be joining various b-schools, participating in stage 0 of LIME case study competition, and attending the informative and engaging sessions kept my stay at the HUL office engaged.

Early Careers @ HUL

An internship at Hindustan Unilever Limited under Unilever Leadership Internship Programme is an enriching and challenging experience. Interns get an opportunity to work on exciting live projects, with clear deliverables and identified targets. These projects are of critical importance to the specific business and interns will be expected to apply their technical knowledge to the tasks at hand. In the process, they shall develop a business perspective while getting a hands-on experience. During the internship, they will be assigned a tutor, buddy and mentor who will guide them throughout the stint and help in building a larger functional and business perspective.

Unilever Future Leaders Programme (UFLP) is HUL's flagship management training programme and is one of the most respected as well as recognized corporate learning programmes in the country. As part of the programme, UFLPs would traverse the length and breadth of the Unilever world and be posted to any one of the locations/ units during training and thereafter. The objective of the programme is to build a larger functional and business perspective while getting a hands-on experience.

Competitions

L.I.M.E. (Lessons in Marketing Excellence) is the country's biggest and most keenly contested B-school challenge which is televised on CNBC-TV18 in association with HUL. Every year, top B-schools in India take part in a marketing case-study competition for management students. In a very short span of time, L.I.M.E has become one of the most sought after and keenly fought competitions L.I.M.E gives students the chance to grapple with real, live and compelling business challenges from a variety of sectors. Unilever Foundation school students get an early advantage to LIME Season 15!

FinAce is HUL's inter B-School finance and business challenge to give students an opportunity to stretch their imagination and write the future! The objective of FinAce is to provide a real-life perspective of how the Finance function operates in an FMCG major in terms of business partnering roles as well as the business strategy decisions made in the company. Unilever Foundation school students get an early advantage to FinAce Season 7!

To know more about Finace Season 6, please click here.

Registration Form

Personal Details

Undergraduation Details

Entrance Exam Details

Work Experience

Top B-Schools

Write a Story

InsideIIM Gold

InsideIIM.com is India's largest community of India's top talent that pursues or aspires to pursue a career in Management.

Follow Us Here

Konversations By InsideIIM

TestPrep By InsideIIM

- NMAT by GMAC

- Score Vs Percentile

- Free CAT Course

- Exam Preparation

- Explainer Concepts

- Free Mock Tests

- RTI Data Analysis

- Selection Criteria

- CAT Toppers Interview

- Profile Evaluation

- Study Planner

- Preparedness Level

- Admission Statistics

- Interview Experiences

- Explore B-Schools

- Compare B-Schools

- B-School Rankings

- Life In A B-School

- B-School Placements

- Certification Programs

- Self-Paced Upskilling

- Klub AltUni

Placement Preparation

- Summer Placements Guide

- Final Placements Guide

Career Guide

- Career Explorer

- The Top 0.5% League

- Konversations Cafe

- The AltUni Career Show

- Employer Rankings

- Alumni Reports

- Salary Reports

Copyright 2024 - Kira9 Edumedia Pvt Ltd. All rights reserved.

- Harvard Business School →

- Faculty & Research →

- August 2019 (Revised April 2020)

- HBS Case Collection

Transforming Hindustan Unilever

- Format: Print

- | Language: English

- | Pages: 18

About The Author

Krishna G. Palepu

Related work.

- September 2019

- Faculty Research

Transforming Hindustan Unilever, Video Supplement

- Transforming Hindustan Unilever, Video Supplement By: Krishna G. Palepu and Rachna Tahilyani

- Transforming Hindustan Unilever By: Krishna G. Palepu

- Transforming Hindustan Unilever By: Krishna G. Palepu and Rachna Tahilyani

- Global Finance

- Personal Finance

- Youth Finance

- Entrepreneur Case Studies

- Entrepreneur Interviews

- Success Stories

- Softwares & Reviews

- Advertisements

- Digital Marketing

- Social Media

- Health & Wellness

- Home & Decor

- Infotainment

- Recreation & Entertainment

- Shopping Trends

- Travel & Tourism

- Career Tips

- Entrepreneurship

- Ethics & Social Responsibility

- BU eMagazine Editions

- Entrepreneur Stories

- Case Study Centre

Unveiling Airtel Business Login: A Comprehensive Guide

Businessman read- guide to integrating term insurance into corporate risk management, what makes epos transactions essential for a successful business, tata steel amalgamation: a strategic move to strengthen market position, uniparts share price – future growth and key aspects, analysing easy trip share price: a comprehensive guide, analysing the trends: tata elxsi share price movements, budgeting 101: how to allocate funds for stock market investments, navigating entrepreneurship, finance, and technology: the inspiring journey of vinod menon, empowering businesses through legal brilliance: the inspiring journey of nitika khanna, revolutionizing human capital management: tymeline’s incredible journey with shrikar nag, igniting creativity and redefining animation – the inspiring journey of sanjana bhatia with cinevire, aws console login – what is it, features, and how to get started, oneplus watch 2 – features, review, and price, the vivo v26 pro: a perfect blend of style and substance, bksmartphone: the ultimate virtual store for smartphones, best google ads agency in india – transforming clicks into conversions, leverage benefits by hiring the best seo company in india, best press release distribution platforms, digital marketing in the tech age: trends and tactics, different millets types: the ultimate superfood, hdhub4u.in: the best place to watch any movies, denver perfume: men’s prestigious fragrance brand, exploring the national zoological park delhi: a wildlife haven, navigating the world of moocs: top platforms for data science learning, time management techniques for a productive life, sql for business analysts – potential of drive informed decision-making, e-challan: a step towards smart cities and traffic management, enrich your music listening experience with spotify.com/pair, how to unlist from truecaller from www.truecaller.unlisting, use bsnl number check code to know bsnl mobile number, a useful guide to your whatsapp status download, allmovieshub in 2023: a case study on the popularity and legality of movie download platforms, soaring through the skies: a comprehensive case study on drone camera and their impact on photography and videography, the health benefits of olives, nutrition facts, and side effects: a comprehensive case study, know the entrepreneurial journey of shark tank india judge namita thapar.

A Case Study on Hindustan Unilever Limited (HUL)

Article Overview

Introduction

Hindustan Unilever Limited (HUL) is one of India’s wide-ranging consumer goods companies, spreading with two out of three people of Indian with above 20 wonderful categories in personal care products, home as well as meals & beverages. They provide the Company with combined volumes of an estimated four million tones and income of more than Rs. 13,000 crores. The HUL is likewise the U.S.A.’s Major exporting country; through the participation of the Indian authorities, it is recognized as a very famous gold trading center. The Anglo-Dutch company’s junior leverage holds a 52% majority stake in Hindustan Unilever Co. Ltd. In 1888, when the box was picked up during the day, the Lever Brothers started their royal business in India, cleaning soap bars enchase with the phrases like “ Made in England with the aid of Lever Brothers ” had been transferred to the Port of Kolkata and is the beginning of a generation of fast-paced product advertising and marketing of FMCG in HUL which When the Leverage Brothers India was suspended in 1933 and established in 1956, its shape changed to Hindustan Lever restrained with a combination of Lever Brothers, United buyers Ltd and Hindustan Vanaspati Mfg. Co. Ltd. The company is headquartered in Mumbai, India, powers more than 15,000 workers, and indirectly employs more than 52,000 employees. In the months of June 2007, the company changed its name to Hindustan Unilever Co. Ltd. The main motive of carrying out the case research changed into to seriously examine various characteristics of operating of these companies in popular and methods followed for accomplishing strategic pliability . These studies are carried out in stages based on evolution to Pursue strategic agility through the dynamic talents of excellent manufacturing companies. In addition, it examines popular popularity, general performance indicators, and economic indicators, as well as dynamic skill systems. an in-depth evaluation of the research has been completed and their consequences have portrayed the industrial framework concerning the research objective.

Business Strategy of HUL

HUL’s nutrients strategy specializes in better products, better diets, better lives, and better products. Here Good products have a long history in HUL. They have got a protracted background in contributing definitely to humans’ diets. Their brands which include Knorr and Lipton have supplied healthful and terrific-tasting merchandise for over 100 years. They have got set ambitious vitamins goals which might be embedded into the enterprise and R&D approach.

Related Article: Deepinder Goyal: Delving into the Business Strategies of Indian Food Delivery King

Nutrition Strategy of HUL

Better merchandise :.

They usually enhance the nutritional nice of our merchandise even as now they can not compromise on taste. The Lipton tea and Brooke Bond Purple Label are delicious, healthy drinks that refresh and moisturize. kids’ fit to be eaten Frozen or Ice Dessert products have strict vitamins standards. They also are gradually reducing the sodium content material of Kissan ketchup/sauces and Knorr Soups portfolio to get the sodium benchmarks in line with Unilever’s maximum nutrition standards.

Better Nutrition :

Through their advertising, they inspire more nutritious cuisine. They sell wholesome recipes on the product % and online. They have constantly supported and keep lending our support to mothers in making scrumptious yet wholesome food for his or her youngsters.

Better Lives :

Their campaigns inspire human beings to undertake more healthy diets and existence, for instance, the Lipton green Tea ‘domestic to domestic, The facts of fats’ marketing campaign .

Company facilities of HUL

Hindustan Unilever owns 45 foremost units and has over 50 1/3 birthday celebration gadgets in India with quite a number 65 brands crossing 20 awesome classes inclusive of food and healthcare , skincare, soaps, shampoos, detergents and pores, kinds of toothpaste, tea, cosmetics, coffee , water purifiers, and deodorants, etc. Its principal portfolio consists of main household manufacturers including Lux, Surf Excel, Lifebuoy, Rin, fair & cute, Wheel, Pond’s, Lakmé, Vaseline, Dove, Sunsilk, hospital Plus, Pepsodent, Closeup, Brooke Bond, Bru, Kissan, Kwality Walls, Knorr, Pureit and awl. The organization has over 16,000 personnel and has an annual turnover of around Rs.21.736 crore (FY 2011-2012). HUL is a subsidiary of Unilever, one of the global’s leading providers of rapid-moving consumer items with sturdy nearby as the company is rooted in more than 100 countries around the world, with annual sales in 2011 of approximately 46.5 billion euros. Unilever owns approximately 52% of HUL.

Financial Growth of HUL

It is observed that 44% of the organization’s sales come from beauty and personal care , accompanied by using domestic Care (34%). foods & Refreshment contributes 19% and handiest three% comes from others. In terms of working income, beauty and personal care products make a contribution the most (55%), 29% get home care, and 14% and 3% from food and other things. In the skincare phase, employers occupy 54% of the market, making it the market leader. In Dishwashing Detergents, 55% of the marketplace proportion is dominated by using the agency. 47% and 37% is the respective marketplace proportion which agency owns in Shampoo and private Care phase. As of September 20, the company has issued 9.79% of the total income which has shown an increased spike in total sales as of 20th June. Internet profit Margin for the business enterprise is 14.77% in FY20, up from 13.59% in FY2019 contemporary NPM is the best of that inside the remaining 5 financial years and the 3 Yrs. Avg. internet earnings Margin is 14.26%. HUL net earnings Margin In FY20, HUL confirmed a sales increase of 1.2% from the preceding FY. 3-year CAGR is 6.16%, which means that sales growth this year is moderate. A comparable fashion is visible from the internet earnings boom, 1-12 months CAGR is eleven.46% whereas 3-yr CAGR (14.66%) is higher. HUL as a fall, look at sales profit and bottom line. The employer has completely healthy and regular coins that go with the flow from working sports. Outflow in coins waft from financing sports surged in FY20 as the agency paid a better dividend than the preceding 12 months.

The SWOT Analysis of HUL

HUL has a strong logo equity and a huge legacy as it’s miles a very antique and properly-rooted organization with a selection of famous brands and products. The organization has its presence across the duration and breadth of India with over 8 million+ retail stores in which its merchandise is to be had.

HUL runs in a completely competitive environment and there are noticeably hooked up and rising agencies that might be little product-centered and consequently, consume up the market proportion of the organization. HUL presently doesn’t have any ayurvedic or herbal merchandise in their portfolio, that’s a bad element of the business enterprise because the modern populace’s fashion is transferring to natural merchandise and lots of targeted companies are making fine use of it.

Opportunities

With increasing disposable incomes, education, and kids population, the FMCG quarter in rural and semi-urban areas is predicted to develop very rapidly compared to city regions. The agency can use this very well as it already has a brand image and an extensive chain of vendors. The organization can use its healthful cash reserve position and emblem picture legacy to acquire various merchandise to diversify its portfolio.

HUL runs in a rather aggressive surrounding, with 100% FDI allowed via the government of India and new multinational corporations placing their toes, the organization faces an excessive danger from its competitors. The agency is exceptionally dependent on uncooked cloth charges. Inflation can cut back the margins for the business enterprise because it runs in a zone that may be an excessive-quantity, low-margin one. Populace’s shift to natural and healthful products can help a few unorganized and small agencies to grow their marketplace share, which may be a risk to HUL.

Unilever has pursued this advertising and marketing approach since the consumers in developing enterprise sectors are profoundly targeted around value. it could give close-by contenders the brink, besides if an organization can find out a technique to tug in clients with deal costs just as better items. Unilever accepts the reality that productivity improvement should likewise be chargeable for improvement. Unilever’s effective picture advancement program is upheld with a huge degree of showcasing and publicizing physical games which includes a maximum of the media structures. As there are various open doors in the unfamiliar commercial enterprise sectors, yet the inclination of danger is similar to circumstances. The brilliant studies and development (R&D) wing, improved and separate product offerings, and marketplace research are terrific large additives that reason an organization to make the maximum of its latent capacity and extremely good piece of the general enterprise inside the unusual market. To keep up a more fruitful brand an incentive there should be first-rate coordination and incorporation among the emblem chiefs inside the showcasing department.

Also Read : Soaring Through the Skies: A Comprehensive Case Study on Drone Camera and Their Impact on Photography and Videography

- business case studies

- business case study

- business case study examples

- business story

- case study of company

- case study on international business

- company history

- company timeline

- consumer goods

Latest news

What are the benefits of wearing tinted sunscreen, related news, business upside.

Business Upside has established itself as a rapidly growing news research and analysis website. It offers invaluable information and updates related to several genres that include in-depth analysis of crucial sectors of the economy. Visit Business Upside for updated and unique information related to every thing that is happening under the sun with inputs from business, finance, industrial verticals, entrepreneurship, lifestyle, science, healthcare, personal financial growth, technology, and the latest developments from across the globe.

Email For Newsletter

How to refer amazon pay know the step by step process, what happens when you force stop an app – an overview, cozy & cute thesparkshop.in:product/baby-girl-long-sleeve-thermal-jumpsuit, meesho online shopping: a great online shopping option, a comprehensive guide on kuttymovies.com 2023, why should you use techy hit tools for free, wellhealthorganic.com:ayurveda-dinner, a case study on infosys, thesparkshop.in:product/bear-design-long-sleeve-baby-jumpsuit, every whatsapp text tricks you need to know, how to resolve the iphone error “last line no longer available”, a case study on britannia, a case study on swiggy: the path to its success, a comprehensive guide on meesho online shopping all products, tilak mehta – the youngest entrepreneur of india 2021, popular categories.

- Write for Us

- Collaboration Inquiry

- Privacy Policy

- Cookie Policy

- Terms & Condition

© Business Upside India | All rights reserved

- Brand Connect

HUL FinAce Season 7: Master the rules for business growth in the ultimate finance challenge

Hul finace, is back with its season 7. an opportunity for the students of india's prestigious business institutes to gain insights into the corporate world.

- " class="general-icons icon-sq-whatsapp">

- " class="general-icons icon-sq-googleplus popup">

- All semi-finalists will be granted the opportunity for a pre-placement interview (PPI) with Unilever as a part of the Summer Internship Process (ULIP 2024).

- All winners will be featured on Forbesindia.com.

- The grand finale winner will be awarded a substantial cash prize of 3 lakh rupees.

- Runners-up will secure a noteworthy cash prize of 2 lakh rupees.

- " class="general-icons icon-sq-youtube">

Summer of 2024: Sizzling temperature, heat wave to hit food prices, water, polls too

Internationalisation of the rupee: Baby steps taken, a long road ahead

Why Dolf van den Brink, the Heineken CEO, refuses to be guided by mere profit

US spot Bitcoin ETFs continue upward trajectory, gain $111 billion in trading volume in March

Totality ready: US braces for April 8 solar eclipse frenzy

Seventeen, NCT Dream, IVE: Global interest in K-pop continues unabated

How Madan Mohanka built Tega Industries into a stakeholders' dream

Photo of the day: Aftermath of earthquake

It's performance review time. Which ranking system is best for your team?

How Vistara, India's best airline, flew into turbulent air?

A bunny at a media briefing and fifteen questions in photos: Eyecatchers of the week

Australia battles to save last 11 wild 'earless dragons'

New Japanese whisky rules aim to deter imposters

KFC, Pizza Hut, and Costa Coffee: Ravi Jaipuria's Devyani International and its insatiable appetite for growth

Forbes India IPO litmus test: Survival of the fittest

Hindustan Unilever Limited Change location

Case studies

IMAGES

VIDEO

COMMENTS

Hindustan Unilever Limited (HUL) is a British-Dutch assembling organization headquartered in Mumbai, India. The items of Hindustan Unilever Ltd incorporate nourishments, drinks, cleaning specialists, individual consideration items, water purifiers, and purchaser merchandise. HUL was set up in 1933 as Lever Brothers and following the merger of ...

Add Benefits. Glassdoor has millions of jobs plus salary information, company reviews, and interview questions from people on the inside making it easy to find a job that's right for you. Unilever interview details: 3,967 interview questions and 3,720 interview reviews posted anonymously by Unilever interview candidates.

Experience: First Round: (Group Discussion) - A Marketing Case Study for one of HUL's food and beverages brand was given to the group. Innovation, ahead of aggression was valued. The discussion moved to repetitive points towards the end, and the interviewer was clearly interested in looking at people's thought process and understanding of ...

HUL Case Study - Industry Analysis. FMCG sector is the fourth largest sector in India, which has surged from 840 Billion USD in 2017 to 1.1 Trillion USD in FY20 and is expected to grow at 10% a year. Personal Care and Household dominates with 50% of FMCG sales in India. Rapid urbanisation, increasing disposable incomes and better lifestyles ...

HUL was established in 1933 as Lever Brothers, following the merger of constituent groups in 1956 and renamed as Hindustan Lever Limited. ... Each member will be fast-tracked to the prelim interview round of the: ... INR 10,00,000; The winning team would also win a ticket to the global Unilever case study competition- Unilever Future Leaders ...

Commonly asked questions, as reported by candidates. Normal calculation market knowledge. Shared on October 9, 2023 - Filed Executive - Thane, Maharashtra. Why should we hire etc. Shared on August 22, 2023 - Accountant - Gwalior, Madhya Pradesh. Read more interview questions at HUL Hindustan Unilever.

I interviewed at Unilever. Interview. The questions asked were on random cases given to you, to try to evaluate your analytical thinking and your ability to solve problems on the spot. The last case study is the longest one. You cannot prepare for the interview beforehand as the cases are random, however you can train yourself by actively ...

Unilever Foundation. School 2024. Hindustan Unilever's Foundation School is a unique opportunity to immerse yourself into the world of business and brands before kickstarting your B-school journey. Not only will you build a strong foundation for your management studies, but also get a chance to secure an early offer for HUL's coveted summer ...

Abstract. In October 2013, when Sanjiv Mehta had taken over the reins of Unilever's business in India and the larger South Asia region, Hindustan Unilever (HUL) had been going through a difficult time. Caught in the midst of a weakening economy, falling consumer spending, and increasing competition, growth at the firm had slowed.

Prepare at least two technologies or languages in depth if you are appearing for a technical interview at Hindustan Unilever . The most common topics and skills that interviewers at Hindustan Unilever expect are Leasing, Logistics, Procurement, Senior Level and Senior Management. What are the top questions asked in Hindustan Unilever Supply ...

Introduction. Hindustan Unilever Limited (HUL) is one of India's wide-ranging consumer goods companies, spreading with two out of three people of Indian with above 20 wonderful categories in personal care products, home as well as meals & beverages. They provide the Company with combined volumes of an estimated four million tones and income ...

Hul's Work-Life Balance Policies. HUL was generally referred to as the 'CEO Factory of India', considering the fact that it had over 440 CEOs on different Boards across India and the globe. It was also considered a 'Dream Employer' by aspiring talent across India that included some of the best B-Schools in India.

Round: FORM SUBMISSION Tips: Be true in the answers and stick to the word limit. Round: GROUP DISCUSSION Experience: Students are shortlisted on the basis of form (HUL doesn't ask for resumes). Then, GDs are conducted in a group of 8-10. The topics are like case-studies which highlight some problem being faced by an organization and you need to come up with some solution for the same.

The case study was launched virtually & included an overview of HUL Finance function, insights from the South Asia Unilever CFO - Ritesh Tiwari, followed by the unveiling of the case study, and ...

HireVue Interview Questions and answers Unilever is a British-Dutch transnational consumer goods company co-headquartered in London, England, and Rotterdam, ...

Running any business successfully involves tackling numerous challenges which are often quite unpredictable. In this video we will look at how Unilever overc...

Hindustan Unilever (HUL) Success Story | FMCG Products | $ 70 Billion company HUL's Pureit Water purifier, launched in 2008, targeted at millions of low-in...

Contact us. Get in touch with our specialist teams in Hindustan Unilever Limited headquarters, the Unilever PLC team, or find contacts around the world. Contact us. Case studies of HUL sustainability and corporate responsibility initiatives.

Unilever's new Global Brand VP must not only revitalize Lifebuoy soap's sagging market performance, but simultaneously impact the health of one billion peopl...

Hindustan Unilever Ltd Case Study, SWAT Analysis| Business Model & HUL History| Hindi| Startup Point.About the Video- In this video we are talking about Hind...

A 'Desi' Multinational -A Case Study of Hindustan. Unilever Limited. Keerthan Raj, 1 & P. S. Aithal2. 1, 2 Srinivas Institute of Management Studies, Srinivas University, Mangalore - 575 ...

This case documents Unilever's journey to revitalize Lipton brand through sourcing all its tea from Rainforest Alliance Certified (TM) farms. Commodity value...