- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![business planning explain How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![business planning explain 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![business planning explain The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

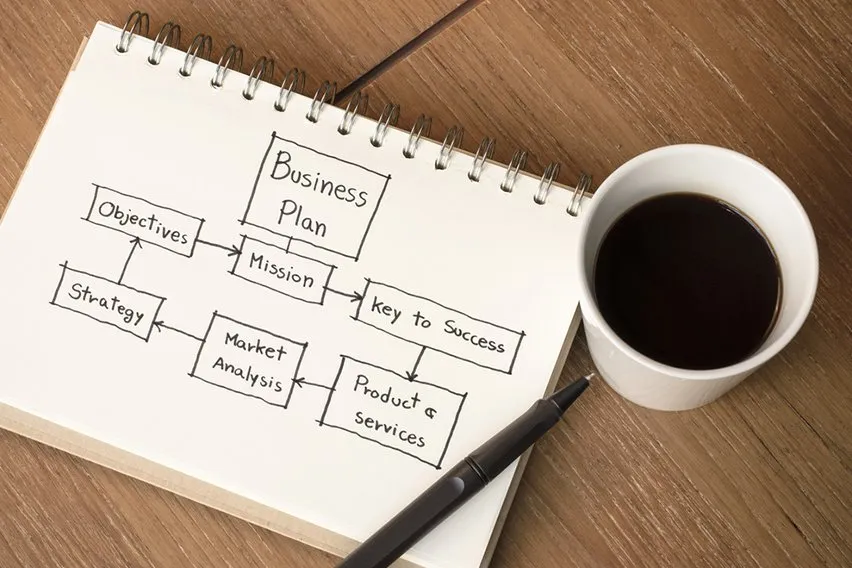

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

What Is Business Planning?

Why Business Planning Isn't Just for Startups

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Morsa Images / Getty Images

Business planning takes place when the key stakeholders in a business sit down and flesh out all the goals , strategies, and actions that they envision taking to ensure the business’s survival, prosperity, and growth.

Here are some strategies for business planning and the ways it can benefit your business.

Business planning can play out in many different ways. Anytime upper management comes together to plan for the success of a business, it is a form of business planning. Business planning commonly involves collecting ideas in a formal business plan that outlines a summary of the business's current state, as well as the state of the broader market, along with detailed steps the business will take to improve performance in the coming period.

Business plans aren't just about money. The business plan outlines the general planning needed to start and run a successful business, and that includes profits, but it also goes beyond that. A plan should account for everything from scoping out the competition and figuring out how your new business will fit into the industry to assessing employee morale and planning for how to retain talent.

How Does Business Planning Work?

Every new business needs a business plan —a blueprint of how you will develop your new business, backed by research, that demonstrates how the business idea is viable. If your new business idea requires investment capital, you will have a better chance of obtaining debt or equity financing from financial institutions, angel investors , or venture capitalists if you have a solid business plan to back up your ideas.

Businesses should prepare a business plan, even if they don't need to attract investors or secure loans.

Post-Startup Business Planning

The business plan isn’t a set-it-and-forget-it planning exercise. It should be a living document that is updated throughout the life cycle of your business.

Once the business has officially started, business planning will shift to setting and meeting goals and targets. Business planning is most effective when it’s done on a consistent schedule that revisits existing goals and projects throughout the year, perhaps even monthly. In addition to reviewing short-term goals throughout the year, it's also important to establish a clear vision and lay the path for your long-term success.

Daily business planning is an incredibly effective way for individuals to focus on achieving both their own goals and the goals of the organization.

Sales Forecasting

The sales forecast is a key section of the business plan that needs to be constantly tracked and updated. The sales forecast is an estimate of the sales of goods and services your business is likely to achieve over the forecasted period, along with the estimated profit from those sales. The forecast should take into account trends in your industry, the general economy, and the projected needs of your primary customers.

Cash Flow Analysis

Another crucial component of business planning is cash flow analysis. Avoiding extended cash flow shortages is vital for businesses, and many business failures can be blamed on cash flow problems.

Your business may have a large, lucrative order on the books, but if it can't be invoiced until the job is completed, then you may run into cash flow problems. That scenario can get even worse if you have to hire staff, purchase inventory, and make other expenditures in the meantime to complete the project.

Performing regular cash flow projections is an important part of business planning. If managed properly, cash flow shortages can be covered by additional financing or equity investment.

Business Contingency Planning

In addition to business planning for profit and growth, your business should have a contingency plan. Contingency business planning (also known as business continuity planning or disaster planning) is the type of business planning that deals with crises and worst-case scenarios. A business contingency plan helps businesses deal with sudden emergencies, unexpected events, and new information that could disrupt your business.

The goals of a contingency plan are to:

- Provide for the safety and security of yourself, your employees, and your customers in the event of a fire, flood, robbery, data breach, illness, or some other disaster

- Ensure that your business can resume operations after an emergency as quickly as possible

Business Succession Planning

If your business is a family enterprise or you have specific plans for who you want to take over in the event of your retirement or illness, then you should have a plan in place to hand over control of the business . The issues of management, ownership, and taxes can cause a great deal of discord within families unless a succession plan is in place that clearly outlines the process.

Key Takeaways

- Business planning is when key stakeholders review the state of their business and plan for how they will improve the business in the future.

- Business planning isn't a one-off event—it should be an ongoing practice of self-assessment and planning.

- Business planning isn't just about improving sales; it can also address safety during natural disasters or the transfer of power after an owner retires.

5 Fundamental Principles of Business Planning

4 min. read

Updated April 19, 2024

I’ve been doing business planning professionally since the 1980s. It’s changed a lot.

These days, I very much advocate the one-page business plan for managing all businesses and all business owners, regardless of whether or not you need the full formal traditional business plan used for seeking investment or business loans.

What I recommend for real business planning has changed a lot over the decades, but these five fundamental business planning principles have remained constant.

1. Do only what you’ll use

Lean business means avoiding waste and doing only what has value.

Therefore, the right form for your business plan is the form that best serves your business purpose. Furthermore, for the vast majority of business owners, the purpose of planning is getting what they want from the business—setting strategy and tactics, executing, reviewing results, and revising as needed.

That purpose is best served with growth planning that starts with a one-page plan and continues with a planning process involving regular review and revision.

You keep it lean because that’s easier, better, and really all you’re going to use.

2. It’s a continuous process, not just a plan

With growth planning, your business plan is always a fresh, current version. You never finish a business plan, heave a sigh of relief, and congratulate yourself that you’ll never have to do that again. You don’t use it once and throw it away.

You don’t store it in a drawer to gather dust.

The PRRR cycle in growth planning

However, this kind of regularly updated planning is clearly better for business than a more static elaborate business plan. With growth planning, the plan is smaller and streamlined, so you can update it easily and often, at least once a month.

Your plan is much more useful than a static plan because it is always current, tracked and reviewed, frequently revised, and a valuable tool for managing.

- You run your business according to priorities.

- Your tactics match your strategy.

- Your specific business activities match your tactics.

- And accountability is part of the process.

The team is aware of the performance metrics, milestones, and progress, or lack thereof. Things get done.

Furthermore, even in the old days of elaborate business plans, it was always true that a good business plan was never done. I’ve been pointing that out in published books, magazine articles, and blog posts since the 1980s.

That’s not new with growth planning. It’s just more important and more obvious than ever before.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 3. It assumes constant change

One of the strongest and most pervasive myths about planning is dead wrong: planning doesn’t reduce flexibility. It builds flexibility. Growth planning manages change. It is not threatened by change.

People say, “ Why would I do a business plan? That just locks me in. It’s a straitjacket.”

And I say: wrong. Never do something just because it’s in the plan. There is no merit whatsoever in sticking to a plan just for the plan’s sake. You never plan to run yourself into a brick wall over and over.

Instead, understand that the plan relates long-term to short-term, sales to costs and expenses and cash flow, marketing to sales, and lots of other interdependencies in the business.

When things change—and they always do—the plan helps you keep track of what affects what else so you can adjust accordingly.

- 4. It empowers accountability

It is easier to be friends with your coworkers than to manage them well. Every small business owner suffers from the problem of management and accountability.

Growth planning sets clear expectations and then follows up on results. It compares results with expectations.

People on a team are held accountable only if management actually tracks results and communicates them to those responsible after the fact.

5. It’s planning, not accounting

One of the most common errors in business planning is confusing planning with accounting. This is true for growth planning too.

Although your projections look like accounting statements, they are just projections. They are always going to be off one way or another, and their purpose isn’t guessing the future exactly right but rather setting expectations and connecting the links between spending and revenue.

Then when you do your monthly reviews, having made the original projection makes adjustments easier.

They are two different dimensions.

Accounting goes from today backward in time in ever-increasing detail. Planning, on the other hand, goes forward into the future in ever-increasing summary and aggregation.

- How these principles apply to growth planning

All five of these principles apply to all business planning, not just growth business planning. However, it’s important to note that growth planning emphasizes all five.

It’s a reflection of the best in business planning.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

.png?format=auto)

Table of Contents

- 1. Do only what you’ll use

- 2. It’s a continuous process, not just a plan

- 5. It’s planning, not accounting

Related Articles

3 Min. Read

How Long Should a Business Plan Be?

12 Min. Read

Do You Need a Business Plan? Scientific Research Says Yes

10 Min. Read

Use This Simple Business Plan Outline to Organize Your Plan

5 Min. Read

Business Plan Vs Strategic Plan Vs Operational Plan—Differences Explained

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

The Business Planning Process: 6 Steps To Creating a New Plan

In this article, we will define and explain the basic business planning process to help your business move in the right direction.

What is Business Planning?

Business planning is the process whereby an organization’s leaders figure out the best roadmap for growth and document their plan for success.

The business planning process includes diagnosing the company’s internal strengths and weaknesses, improving its efficiency, working out how it will compete against rival firms in the future, and setting milestones for progress so they can be measured.

The process includes writing a new business plan. What is a business plan? It is a written document that provides an outline and resources needed to achieve success. Whether you are writing your plan from scratch, from a simple business plan template , or working with an experienced business plan consultant or writer, business planning for startups, small businesses, and existing companies is the same.

Finish Your Business Plan Today!

The best business planning process is to use our business plan template to streamline the creation of your plan: Download Growthink’s Ultimate Business Plan Template and finish your business plan & financial model in hours.

The Better Business Planning Process

The business plan process includes 6 steps as follows:

- Do Your Research

- Calculate Your Financial Forecast

- Draft Your Plan

- Revise & Proofread

- Nail the Business Plan Presentation

We’ve provided more detail for each of these key business plan steps below.

1. Do Your Research

Conduct detailed research into the industry, target market, existing customer base, competitors, and costs of the business begins the process. Consider each new step a new project that requires project planning and execution. You may ask yourself the following questions:

- What are your business goals?

- What is the current state of your business?

- What are the current industry trends?

- What is your competition doing?

There are a variety of resources needed, ranging from databases and articles to direct interviews with other entrepreneurs, potential customers, or industry experts. The information gathered during this process should be documented and organized carefully, including the source as there is a need to cite sources within your business plan.

You may also want to complete a SWOT Analysis for your own business to identify your strengths, weaknesses, opportunities, and potential risks as this will help you develop your strategies to highlight your competitive advantage.

2. Strategize

Now, you will use the research to determine the best strategy for your business. You may choose to develop new strategies or refine existing strategies that have demonstrated success in the industry. Pulling the best practices of the industry provides a foundation, but then you should expand on the different activities that focus on your competitive advantage.

This step of the planning process may include formulating a vision for the company’s future, which can be done by conducting intensive customer interviews and understanding their motivations for purchasing goods and services of interest. Dig deeper into decisions on an appropriate marketing plan, operational processes to execute your plan, and human resources required for the first five years of the company’s life.

3. Calculate Your Financial Forecast

All of the activities you choose for your strategy come at some cost and, hopefully, lead to some revenues. Sketch out the financial situation by looking at whether you can expect revenues to cover all costs and leave room for profit in the long run.

Begin to insert your financial assumptions and startup costs into a financial model which can produce a first-year cash flow statement for you, giving you the best sense of the cash you will need on hand to fund your early operations.

A full set of financial statements provides the details about the company’s operations and performance, including its expenses and profits by accounting period (quarterly or year-to-date). Financial statements also provide a snapshot of the company’s current financial position, including its assets and liabilities.

This is one of the most valued aspects of any business plan as it provides a straightforward summary of what a company does with its money, or how it grows from initial investment to become profitable.

4. Draft Your Plan

With financials more or less settled and a strategy decided, it is time to draft through the narrative of each component of your business plan . With the background work you have completed, the drafting itself should be a relatively painless process.

If you have trouble writing convincing prose, this is a time to seek the help of an experienced business plan writer who can put together the plan from this point.

5. Revise & Proofread

Revisit the entire plan to look for any ideas or wording that may be confusing, redundant, or irrelevant to the points you are making within the plan. You may want to work with other management team members in your business who are familiar with the company’s operations or marketing plan in order to fine-tune the plan.

Finally, proofread thoroughly for spelling, grammar, and formatting, enlisting the help of others to act as additional sets of eyes. You may begin to experience burnout from working on the plan for so long and have a need to set it aside for a bit to look at it again with fresh eyes.

6. Nail the Business Plan Presentation

The presentation of the business plan should succinctly highlight the key points outlined above and include additional material that would be helpful to potential investors such as financial information, resumes of key employees, or samples of marketing materials. It can also be beneficial to provide a report on past sales or financial performance and what the business has done to bring it back into positive territory.

Business Planning Process Conclusion

Every entrepreneur dreams of the day their business becomes wildly successful.

But what does that really mean? How do you know whether your idea is worth pursuing?

And how do you stay motivated when things are not going as planned? The answers to these questions can be found in your business plan. This document helps entrepreneurs make better decisions and avoid common pitfalls along the way.

Business plans are dynamic documents that can be revised and presented to different audiences throughout the course of a company’s life. For example, a business may have one plan for its initial investment proposal, another which focuses more on milestones and objectives for the first several years in existence, and yet one more which is used specifically when raising funds.

Business plans are a critical first step for any company looking to attract investors or receive grant money, as they allow a new organization to better convey its potential and business goals to those able to provide financial resources.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink business plan consultants can create your business plan for you.

Other Helpful Business Plan Articles & Templates

The 7 Steps of the Business Planning Process: A Complete Guide

In this article, we'll provide a comprehensive guide to the seven steps of the business planning process, and discuss the role of Strikingly website builder in creating a professional business plan.

Step 1: Conducting a SWOT Analysis

The first step in the business planning process is to conduct a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. This analysis will help you understand your business's internal and external environment, and it can help you identify areas of improvement and growth.

Strengths and weaknesses refer to internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

You can conduct a SWOT analysis by gathering information from various sources such as market research, financial statements, and feedback from customers and employees. You can also use tools such as a SWOT matrix to visualize your analysis.

What is a SWOT Analysis?

A SWOT analysis is a framework for analyzing a business's internal and external environment. The acronym SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Strengths and weaknesses include internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

A SWOT analysis can help businesses identify areas of improvement and growth, assess their competitive position, and make informed decisions. It can be used for various purposes, such as business planning, product development, marketing strategy, and risk management.

Importance of Conducting a SWOT Analysis

Conducting a SWOT analysis is crucial for businesses to develop a clear understanding of their internal and external environment. It can help businesses identify their strengths and weaknesses and uncover new opportunities and potential threats. By doing so, businesses can make informed decisions about their strategies, resource allocation, and risk management.

A SWOT analysis can also help businesses identify their competitive position in the market and compare themselves to their competitors. This can help businesses differentiate themselves from their competitors and develop a unique value proposition.

Example of a SWOT Analysis

Here is an example of a SWOT analysis for a fictional business that sells handmade jewelry:

- Unique and high-quality products

- Skilled and experienced craftsmen

- Strong brand reputation and customer loyalty

- Strategic partnerships with local boutiques

- Limited production capacity

- High production costs

- Limited online presence

- Limited product variety

Opportunities

- Growing demand for handmade products

- Growing interest in sustainable and eco-friendly products

- Opportunities to expand online presence and reach new customers

- Opportunities to expand product lines

- Increasing competition from online and brick-and-mortar retailers

- Fluctuating consumer trends and preferences

- Economic downturns and uncertainty

- Increased regulations and compliance requirements

This SWOT analysis can help the business identify areas for improvement and growth. For example, the business can invest in expanding its online presence, improving its production efficiency, and diversifying its product lines. The business can also leverage its strengths, such as its skilled craftsmen and strategic partnerships, to differentiate itself from its competitors and attract more customers.

Step 2: Defining Your Business Objectives

Once you have conducted a SWOT analysis, the next step is to define your business objectives. Business objectives are specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your business's mission and vision.

Your business objectives can vary depending on your industry, target audience, and resources. Examples of business objectives include increasing sales revenue, expanding into new markets, improving customer satisfaction, and reducing costs.

You can use tools such as a goal-setting worksheet or a strategic planning framework to define your business objectives. You can also seek input from your employees and stakeholders to ensure your objectives are realistic and achievable.

What is Market Research?

Market research is an integral part of the business planning process. It gathers information about a target market or industry to make informed decisions. It involves collecting and analyzing data on consumer behavior, preferences, and buying habits, as well as competitors, industry trends, and market conditions.

Market research can help businesses identify potential customers, understand their needs and preferences, and develop effective marketing strategies. It can also help businesses identify market opportunities, assess their competitive position, and make informed product development, pricing, and distribution decisions.

Importance of Market Research in Business Planning

Market research is a crucial component of the business planning process. It can help businesses identify market trends and opportunities, assess their competitive position, and make informed decisions about their marketing strategies, product development, and business operations.

By conducting market research, businesses can gain insights into their target audience's behavior and preferences, such as their purchasing habits, brand loyalty, and decision-making process. This can help businesses develop targeted marketing campaigns and create products that meet their customers' needs.