The 7 Best Business Plan Examples (2024)

As an aspiring entrepreneur gearing up to start your own business , you likely know the importance of drafting a business plan. However, you might not be entirely sure where to begin or what specific details to include. That’s where examining business plan examples can be beneficial. Sample business plans serve as real-world templates to help you craft your own plan with confidence. They also provide insight into the key sections that make up a business plan, as well as demonstrate how to structure and present your ideas effectively.

Start selling online now with Shopify

Example business plan

To understand how to write a business plan, let’s study an example structured using a seven-part template. Here’s a quick overview of those parts:

- Executive summary: A quick overview of your business and the contents of your business plan.

- Company description: More info about your company, its goals and mission, and why you started it in the first place.

- Market analysis: Research about the market and industry your business will operate in, including a competitive analysis about the companies you’ll be up against.

- Products and services: A detailed description of what you’ll be selling to your customers.

- Marketing plan: A strategic outline of how you plan to market and promote your business before, during, and after your company launches into the market.

- Logistics and operations plan: An explanation of the systems, processes, and tools that are needed to run your business in the background.

- Financial plan: A map of your short-term (and even long-term) financial goals and the costs to run the business. If you’re looking for funding, this is the place to discuss your request and needs.

7 business plan examples (section by section)

In this section, you’ll find hypothetical and real-world examples of each aspect of a business plan to show you how the whole thing comes together.

- Executive summary

Your executive summary offers a high-level overview of the rest of your business plan. You’ll want to include a brief description of your company, market research, competitor analysis, and financial information.

In this free business plan template, the executive summary is three paragraphs and occupies nearly half the page:

- Company description

You might go more in-depth with your company description and include the following sections:

- Nature of the business. Mention the general category of business you fall under. Are you a manufacturer, wholesaler, or retailer of your products?

- Background information. Talk about your past experiences and skills, and how you’ve combined them to fill in the market.

- Business structure. This section outlines how you registered your company —as a corporation, sole proprietorship, LLC, or other business type.

- Industry. Which business sector do you operate in? The answer might be technology, merchandising, or another industry.

- Team. Whether you’re the sole full-time employee of your business or you have contractors to support your daily workflow, this is your chance to put them under the spotlight.

You can also repurpose your company description elsewhere, like on your About page, Instagram page, or other properties that ask for a boilerplate description of your business. Hair extensions brand Luxy Hair has a blurb on it’s About page that could easily be repurposed as a company description for its business plan.

- Market analysis

Market analysis comprises research on product supply and demand, your target market, the competitive landscape, and industry trends. You might do a SWOT analysis to learn where you stand and identify market gaps that you could exploit to establish your footing. Here’s an example of a SWOT analysis for a hypothetical ecommerce business:

You’ll also want to run a competitive analysis as part of the market analysis component of your business plan. This will show you who you’re up against and give you ideas on how to gain an edge over the competition.

- Products and services

This part of your business plan describes your product or service, how it will be priced, and the ways it will compete against similar offerings in the market. Don’t go into too much detail here—a few lines are enough to introduce your item to the reader.

- Marketing plan

Potential investors will want to know how you’ll get the word out about your business. So it’s essential to build a marketing plan that highlights the promotion and customer acquisition strategies you’re planning to adopt.

Most marketing plans focus on the four Ps: product, price, place, and promotion. However, it’s easier when you break it down by the different marketing channels . Mention how you intend to promote your business using blogs, email, social media, and word-of-mouth marketing.

Here’s an example of a hypothetical marketing plan for a real estate website:

Logistics and operations

This section of your business plan provides information about your production, facilities, equipment, shipping and fulfillment, and inventory.

Financial plan

The financial plan (a.k.a. financial statement) offers a breakdown of your sales, revenue, expenses, profit, and other financial metrics. You’ll want to include all the numbers and concrete data to project your current and projected financial state.

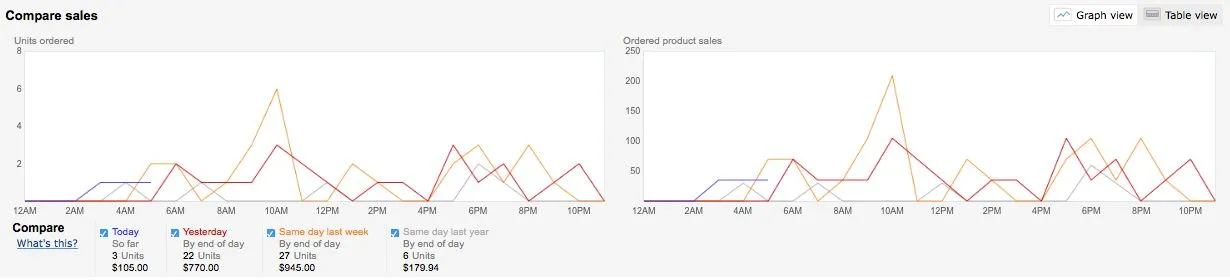

In this business plan example, the financial statement for ecommerce brand Nature’s Candy includes forecasted revenue, expenses, and net profit in graphs.

It then goes deeper into the financials, citing:

- Funding needs

- Project cash-flow statement

- Project profit-and-loss statement

- Projected balance sheet

You can use Shopify’s financial plan template to create your own income statement, cash-flow statement, and balance sheet.

Types of business plans (and what to write for each)

A one-page business plan is a pared down version of a standard business plan that’s easy for potential investors and partners to understand. You’ll want to include all of these sections, but make sure they’re abbreviated and summarized:

- Logistics and operations plan

- Financials

A startup business plan is meant to secure outside funding for a new business. Typically, there’s a big focus on the financials, as well as other sections that help determine the viability of your business idea—market analysis, for example. Shopify has a great business plan template for startups that include all the below points:

- Market research: in depth

- Financials: in depth

Internal

Your internal business plan acts as the enforcer of your company’s vision. It reminds your team of the long-term objective and keeps them strategically aligned toward the same goal. Be sure to include:

- Market research

Feasibility

A feasibility business plan is essentially a feasibility study that helps you evaluate whether your product or idea is worthy of a full business plan. Include the following sections:

A strategic (or growth) business plan lays out your long-term vision and goals. This means your predictions stretch further into the future, and you aim for greater growth and revenue. While crafting this document, you use all the parts of a usual business plan but add more to each one:

- Products and services: for launch and expansion

- Market analysis: detailed analysis

- Marketing plan: detailed strategy

- Logistics and operations plan: detailed plan

- Financials: detailed projections

Free business plan templates

Now that you’re familiar with what’s included and how to format a business plan, let’s go over a few templates you can fill out or draw inspiration from.

Bplans’ free business plan template

Bplans’ free business plan template focuses a lot on the financial side of running a business. It has many pages just for your financial plan and statements. Once you fill it out, you’ll see exactly where your business stands financially and what you need to do to keep it on track or make it better.

PandaDoc’s free business plan template

PandaDoc’s free business plan template is detailed and guides you through every section, so you don’t have to figure everything out on your own. Filling it out, you’ll grasp the ins and outs of your business and how each part fits together. It’s also handy because it connects to PandaDoc’s e-signature for easy signing, ideal for businesses with partners or a board.

Miro’s Business Model Canvas Template

Miro’s Business Model Canvas Template helps you map out the essentials of your business, like partnerships, core activities, and what makes you different. It’s a collaborative tool for you and your team to learn how everything in your business is linked.

Better business planning equals better business outcomes

Building a business plan is key to establishing a clear direction and strategy for your venture. With a solid plan in hand, you’ll know what steps to take for achieving each of your business goals. Kickstart your business planning and set yourself up for success with a defined roadmap—utilizing the sample business plans above to inform your approach.

Business plan FAQ

What are the 3 main points of a business plan.

- Concept. Explain what your business does and the main idea behind it. This is where you tell people what you plan to achieve with your business.

- Contents. Explain what you’re selling or offering. Point out who you’re selling to and who else is selling something similar. This part concerns your products or services, who will buy them, and who you’re up against.

- Cash flow. Explain how money will move in and out of your business. Discuss the money you need to start and keep the business going, the costs of running your business, and how much money you expect to make.

How do I write a simple business plan?

To create a simple business plan, start with an executive summary that details your business vision and objectives. Follow this with a concise description of your company’s structure, your market analysis, and information about your products or services. Conclude your plan with financial projections that outline your expected revenue, expenses, and profitability.

What is the best format to write a business plan?

The optimal format for a business plan arranges your plan in a clear and structured way, helping potential investors get a quick grasp of what your business is about and what you aim to achieve. Always start with a summary of your plan and finish with the financial details or any extra information at the end.

Want to learn more?

- Question: Are You a Business Owner or an Entrepreneur?

- Bootstrapping a Business: 10 Tips to Help You Succeed

- Entrepreneurial Mindset: 20 Ways to Think Like an Entrepreneur

- 101+ Best Small Business Software Programs

Oberlo uses cookies to provide necessary site functionality and improve your experience. By using our website, you agree to our privacy policy.

Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

Step 10: Financial Projections

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

Download Business Plan Template

Microsoft Excel | Smartsheet

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Join thousands of teams using Miro to do their best work yet.

550+ Business Plan Examples to Launch Your Business

Need help writing your business plan? Explore over 550 industry-specific business plan examples for inspiration.

Find your business plan example

Accounting, Insurance & Compliance Business Plans

- View All 25

Children & Pets Business Plans

- Children's Education & Recreation

- View All 33

Cleaning, Repairs & Maintenance Business Plans

- Auto Detail & Repair

- Cleaning Products

- View All 39

Clothing & Fashion Brand Business Plans

- Clothing & Fashion Design

- View All 26

Construction, Architecture & Engineering Business Plans

- Architecture

- Construction

- View All 46

Consulting, Advertising & Marketing Business Plans

- Advertising

- View All 54

Education Business Plans

- Education Consulting

- Education Products

Business plan template: There's an easier way to get your business plan done.

Entertainment & Recreation Business Plans

- Entertainment

- Film & Television

- View All 60

Events Business Plans

- Event Planning

- View All 17

Farm & Agriculture Business Plans

- Agri-tourism

- Agriculture Consulting

- View All 16

Finance & Investing Business Plans

- Financial Planning

- View All 10

Fine Art & Crafts Business Plans

Fitness & Beauty Business Plans

- Salon & Spa

- View All 36

Food and Beverage Business Plans

- Bar & Brewery

- View All 77

Hotel & Lodging Business Plans

- Bed and Breakfast

IT, Staffing & Customer Service Business Plans

- Administrative Services

- Customer Service

- View All 22

Manufacturing & Wholesale Business Plans

- Cleaning & Cosmetics Manufacturing

- View All 68

Medical & Health Business Plans

- Dental Practice

- Health Administration

- View All 41

Nonprofit Business Plans

- Co-op Nonprofit

- Food & Housing Nonprofit

- View All 13

Real Estate & Rentals Business Plans

- Equipment Rental

Retail & Ecommerce Business Plans

- Car Dealership

- View All 116

Technology Business Plans

- Apps & Software

- Communication Technology

Transportation, Travel & Logistics Business Plans

- Airline, Taxi & Shuttle

- View All 62

View all sample business plans

Example business plan format

Before you start exploring our library of business plan examples, it's worth taking the time to understand the traditional business plan format . You'll find that the plans in this library and most investor-approved business plans will include the following sections:

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally only one to two pages. You should also plan to write this section last after you've written your full business plan.

Your executive summary should include a summary of the problem you are solving, a description of your product or service, an overview of your target market, a brief description of your team, a summary of your financials, and your funding requirements (if you are raising money).

Products & services

The products & services chapter of your business plan is where the real meat of your plan lives. It includes information about the problem that you're solving, your solution, and any traction that proves that it truly meets the need you identified.

This is your chance to explain why you're in business and that people care about what you offer. It needs to go beyond a simple product or service description and get to the heart of why your business works and benefits your customers.

Market analysis

Conducting a market analysis ensures that you fully understand the market that you're entering and who you'll be selling to. This section is where you will showcase all of the information about your potential customers. You'll cover your target market as well as information about the growth of your market and your industry. Focus on outlining why the market you're entering is viable and creating a realistic persona for your ideal customer base.

Competition

Part of defining your opportunity is determining what your competitive advantage may be. To do this effectively you need to get to know your competitors just as well as your target customers. Every business will have competition, if you don't then you're either in a very young industry or there's a good reason no one is pursuing this specific venture.

To succeed, you want to be sure you know who your competitors are, how they operate, necessary financial benchmarks, and how you're business will be positioned. Start by identifying who your competitors are or will be during your market research. Then leverage competitive analysis tools like the competitive matrix and positioning map to solidify where your business stands in relation to the competition.

Marketing & sales

The marketing and sales plan section of your business plan details how you plan to reach your target market segments. You'll address how you plan on selling to those target markets, what your pricing plan is, and what types of activities and partnerships you need to make your business a success.

The operations section covers the day-to-day workflows for your business to deliver your product or service. What's included here fully depends on the type of business. Typically you can expect to add details on your business location, sourcing and fulfillment, use of technology, and any partnerships or agreements that are in place.

Milestones & metrics

The milestones section is where you lay out strategic milestones to reach your business goals.

A good milestone clearly lays out the parameters of the task at hand and sets expectations for its execution. You'll want to include a description of the task, a proposed due date, who is responsible, and eventually a budget that's attached. You don't need extensive project planning in this section, just key milestones that you want to hit and when you plan to hit them.

You should also discuss key metrics, which are the numbers you will track to determine your success. Some common data points worth tracking include conversion rates, customer acquisition costs, profit, etc.

Company & team

Use this section to describe your current team and who you need to hire. If you intend to pursue funding, you'll need to highlight the relevant experience of your team members. Basically, this is where you prove that this is the right team to successfully start and grow the business. You will also need to provide a quick overview of your legal structure and history if you're already up and running.

Financial projections

Your financial plan should include a sales and revenue forecast, profit and loss statement, cash flow statement, and a balance sheet. You may not have established financials of any kind at this stage. Not to worry, rather than getting all of the details ironed out, focus on making projections and strategic forecasts for your business. You can always update your financial statements as you begin operations and start bringing in actual accounting data.

Now, if you intend to pitch to investors or submit a loan application, you'll also need a "use of funds" report in this section. This outlines how you intend to leverage any funding for your business and how much you're looking to acquire. Like the rest of your financials, this can always be updated later on.

The appendix isn't a required element of your business plan. However, it is a useful place to add any charts, tables, definitions, legal notes, or other critical information that supports your plan. These are often lengthier or out-of-place information that simply didn't work naturally into the structure of your plan. You'll notice that in these business plan examples, the appendix mainly includes extended financial statements.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. To get the most out of your plan, it's best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you'll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or in any other situation where the full details of your business must be understood by another individual.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear format in favor of a cell-based template. It encourages you to build connections between every element of your business. It's faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan . This format is a simplified version of the traditional plan that focuses on the core aspects of your business.

By starting with a one-page plan , you give yourself a minimal document to build from. You'll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan.

Growth planning

Growth planning is more than a specific type of business plan. It's a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, forecast, review, and refine based on your performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27 minutes . However, it's even easier to convert into a more detailed plan thanks to how heavily it's tied to your financials. The overall goal of growth planning isn't to just produce documents that you use once and shelve. Instead, the growth planning process helps you build a healthier company that thrives in times of growth and remain stable through times of crisis.

It's faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Download a free sample business plan template

Ready to start writing your own plan but aren't sure where to start? Download our free business plan template that's been updated for 2024.

This simple, modern, investor-approved business plan template is designed to make planning easy. It's a proven format that has helped over 1 million businesses write business plans for bank loans, funding pitches, business expansion, and even business sales. It includes additional instructions for how to write each section and is formatted to be SBA-lender approved. All you need to do is fill in the blanks.

How to use an example business plan to help you write your own

How do you know what elements need to be included in your business plan, especially if you've never written one before? Looking at examples can help you visualize what a full, traditional plan looks like, so you know what you're aiming for before you get started. Here's how to get the most out of a sample business plan.

Choose a business plan example from a similar type of company

You don't need to find an example business plan that's an exact fit for your business. Your business location, target market, and even your particular product or service may not match up exactly with the plans in our gallery. But, you don't need an exact match for it to be helpful. Instead, look for a plan that's related to the type of business you're starting.

For example, if you want to start a vegetarian restaurant, a plan for a steakhouse can be a great match. While the specifics of your actual startup will differ, the elements you'd want to include in your restaurant's business plan are likely to be very similar.

Use a business plan example as a guide

Every startup and small business is unique, so you'll want to avoid copying an example business plan word for word. It just won't be as helpful, since each business is unique. You want your plan to be a useful tool for starting a business —and getting funding if you need it.

One of the key benefits of writing a business plan is simply going through the process. When you sit down to write, you'll naturally think through important pieces, like your startup costs, your target market , and any market analysis or research you'll need to do to be successful.

You'll also look at where you stand among your competition (and everyone has competition), and lay out your goals and the milestones you'll need to meet. Looking at an example business plan's financials section can be helpful because you can see what should be included, but take them with a grain of salt. Don't assume that financial projections for a sample company will fit your own small business.

If you're looking for more resources to help you get started, our business planning guide is a good place to start. You can also download our free business plan template .

Think of business planning as a process, instead of a document

Think about business planning as something you do often , rather than a document you create once and never look at again. If you take the time to write a plan that really fits your own company, it will be a better, more useful tool to grow your business. It should also make it easier to share your vision and strategy so everyone on your team is on the same page.

Adjust your plan regularly to use it as a business management tool

Keep in mind that businesses that use their plan as a management tool to help run their business grow 30 percent faster than those businesses that don't. For that to be true for your company, you'll think of a part of your business planning process as tracking your actual results against your financial forecast on a regular basis.

If things are going well, your plan will help you think about how you can re-invest in your business. If you find that you're not meeting goals, you might need to adjust your budgets or your sales forecast. Either way, tracking your progress compared to your plan can help you adjust quickly when you identify challenges and opportunities—it's one of the most powerful things you can do to grow your business.

Prepare to pitch your business

If you're planning to pitch your business to investors or seek out any funding, you'll need a pitch deck to accompany your business plan. A pitch deck is designed to inform people about your business. You want your pitch deck to be short and easy to follow, so it's best to keep your presentation under 20 slides.

Your pitch deck and pitch presentation are likely some of the first things that an investor will see to learn more about your company. So, you need to be informative and pique their interest. Luckily, just like you can leverage an example business plan template to write your plan, we also have a gallery of over 50 pitch decks for you to reference.

With this gallery, you have the option to view specific industry pitches or get inspired by real-world pitch deck examples.

Ready to get started?

Now that you know how to use an example business plan to help you write a plan for your business, it's time to find the right one.

Use the search bar below to get started and find the right match for your business idea.

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

How to Start a Business: A Comprehensive Guide and Essential Steps

- Search Search Please fill out this field.

Conducting Market Research

Crafting a business plan, reviewing funding options, understanding legal requirements, implementing marketing strategies, how much does it cost to start a business, what should i do before starting a business, what types of funding are available to start a business, do you need to write a business plan, the bottom line.

Building an effective business launch plan

:max_bytes(150000):strip_icc():format(webp)/Headshot-4c571aa3d8044192bcbd7647dd137cf1.jpg)

Starting a business in the United States involves a number of different steps, spanning legal considerations, market research, creating a business plan, securing funding, and developing a marketing strategy. It also entails decisions around a business’s location, structure, name, taxation, and registration.

This article covers the key steps involved in starting a business, as well as important aspects of the process for entrepreneurs to consider.

Key Takeaways

- Entrepreneurs seeking to develop their own business should start by conducting market research to understand their industry space and competition, and to target customers.

- The next step is to write a comprehensive business plan, outlining the company’s structure, vision, and strategy. Potential funders and partners may want to review the business plan in advance of signing any agreements.

- Securing funding is crucial in launching a business. Funding can come in the form of grants, loans, venture capital, or crowdfunded money; entrepreneurs may also opt to self-fund instead of or in combination with any of these avenues.

- Choosing a location and business structure can have many implications for legal aspects of business ownership, such as taxation, registration, and permitting, so it’s important to fully understand the regulations and requirements for the jurisdiction in which the business will operate.

- Another key aspect of launching a new business is having a strategic marketing plan that addresses the specifics of the business, industry, and target market.

Before starting a business, entrepreneurs should conduct market research to determine their target audience, competition, and market trends.

The U.S. Small Business Administration (SBA) recommends researching demographic data around potential customers to understand a given consumer base and reduce business risk. It also breaks down common market considerations as follows:

- Demand : Do people want or need this product or service?

- Market size : How many people might be interested?

- Economic indicators : These include income, employment rate, and spending habits of potential customers.

- Location : Where are the target market and the business located?

- Market saturation : How competitive is the business space, and how many similar offerings exist?

- Pricing : What might a customer be willing to pay?

Market research should also include an analysis of the competition (including their strengths and weaknesses compared to those of the proposed business), market opportunities and barriers to entry, industry trends, and competitors’ market share .

There are various methods for conducting market research, and the usefulness of different sources and methodologies will depend on the nature of the industry and potential business. Data can come from a variety of sources: statistical agencies, economic and financial institutions, and industry sources, as well as direct consumer research through focus groups, interviews, surveys, or questionnaires.

A comprehensive business plan is like a blueprint for a business. It will help lay the foundation for business development and can assist in decision making, day-to-day operations, and growth.

Potential investors or business partners may want to review and assess a business plan in advance of agreeing to work together. Financial institutions often request business plans as part of an application for a loan or other forms of capital.

Business plans will differ according to the needs and nature of the company and only need to include what makes sense for the business in question. As such, they can vary in length and structure depending on their intended purpose.

Business plans can generally be divided into two formats: traditional business plans and lean startup business plans. The latter is typically more useful for businesses that will need to adjust their planning quickly and frequently, as they are shorter and provide a higher-level overview of the company.

The process of funding a business can be as unique as the business itself—that is, it will depend on the needs and vision of the business and the current financial situation of the business owner.

The first step in seeking funding is to calculate how much it will cost to start the business. Estimate startup costs by identifying a list of expenses and putting a number to each of them through research and requesting quotes. The SBA has a startup costs calculator for small businesses that includes common types of business expenses.

From there, an entrepreneur will need to determine how to secure the required funding. Common funding methods include:

- Self-funding , also known as bootstrapping

- Seeking funding from investors, also known as venture capital

- Raising money by crowdfunding

- Securing a business loan

- Winning a business grant

Each method will hold advantages and disadvantages depending on the situation of the business. It’s important to consider the obligations associated with any avenue of funding. For example, investors generally provide funding in exchange for a degree of ownership or control in the company, whereas self-funding may allow business owners to maintain complete control (albeit while taking on all of the risk).

The availability of funding sources is another potential consideration. Unlike loans, grants do not have to be paid back—however, as a result, they are a highly competitive form of business funding. The federal government also does not provide grants for the purposes of starting or growing a business, although private organizations may. On the other hand, the SBA guarantees several categories of loans to support small business owners in accessing capital that may not be available through traditional lenders.

Whichever funding method (or methods) an entrepreneur decides to pursue, it’s essential to evaluate in detail how the funding will be used and lay out a future financial plan for the business, including sales projections and loan repayments , as applicable.

Legally, businesses operating in the U.S. are subject to regulations and requirements under many jurisdictions, across local, county, state, and federal levels. Legal business requirements are often tied to the location and structure of the business, which then determine obligations around taxation, business IDs, registration, and permits.

Choosing a Business Location

The location—that is, the neighborhood, city, and state—in which a business operates will have an impact on many different aspects of running the business, such as the applicable taxes, zoning laws (for brick-and-mortar, or physical locations), and regulations.

A business needs to be registered in a certain location; this location then determines the taxes, licenses, and permits required. Other factors to consider when choosing a location might include:

- Human factors : Such as the target audience for your business, and preferences of business owners and partners around convenience, knowledge of the area, and commuting distance

- Regulations and restrictions : Concerning applicable jurisdictions or government agencies, including zoning laws

- Regionally specific expenses : Such as average salaries (including required minimum wages), property or rental prices, insurance rates, utilities, and government fees and licensing

- The tax and financial environment : Including income tax, sales tax, corporate tax, and property tax, or the availability of tax credits, incentives, or loan programs

Picking a Business Structure

The structure of a business should reflect the desired number of owners, liability characteristics, and tax status. Because these have legal and tax compliance implications , it’s important to fully understand and choose a business structure carefully and, if necessary, consult a business counselor, lawyer, and/or accountant.

Common business structures include:

- Sole proprietorship : An unincorporated business that has just one owner, who pays personal income tax on profits

- Partnership : Options include a limited partnership (LP) or a limited liability partnership (LLP)

- Limited liability company (LLC) : A business structure that protects its owners from personal responsibility for its debts or liabilities

- Corporation : Options include a C corp , S corp , B corp , closed corporation , or nonprofit

Getting a Tax ID Number

A tax ID number is like a Social Security number for a business. Whether or not a state and/or federal tax ID number is required for any given business will depend on the nature of the business, as well as the location in which the business is registered.

If a business is required to pay state taxes (such as income taxes and employment taxes), then a state tax ID will be necessary. The process and requirements around state tax IDs vary by state and can be found on individual states’ official websites. In some situations, state tax IDs can also be used for other purposes, such as protecting sole proprietors against identity theft.

A federal tax ID, also known as an employer identification number (EIN) , is required if a business:

- Operates as a corporation or partnership

- Pays federal taxes

- Wants to open a business bank account

- Applies for federal business licenses and permits

- Files employment, excise, alcohol, tobacco, or firearms tax returns

There are further situations in which a business might need a federal tax ID number, specific to income taxation, certain types of pension plans, and working with certain types of organizations. Business owners can check with the Internal Revenue Service (IRS) about whether they need an EIN.

Registering a Business

Registration of a business will depend on its location and business structure, and can look quite different depending on the nature and size of the business.

For example, small businesses may not require any steps beyond registering their business name with local and state governments, and business owners whose business name is their own legal name might not need to register at all. However, registration can include personal liability protection as well as legal and tax benefits, so it can be beneficial even if it’s not strictly required.

Most LLCs, corporations, partnerships, and nonprofits are required to register at the state level and will require a registered agent to file on their behalf. Determining which state to register with can depend on factors such as:

- Whether the business has a physical presence in the state

- If the business often conducts in-person client meetings in the state

- If a large portion of business revenue comes from the state

- Whether the business has employees working in the state

If a business operates in more than one state, it may need to file for foreign qualification in other states in which it conducts business. In this case, the business would register in the state in which it was formed (this would be considered the domestic state), and file for foreign qualification in any additional states.

Some businesses may decide to register with the federal government if they are seeking tax-exempt status or trademark protection, but federal registration is not required for many businesses.

Overall registration requirements, costs, and documentation will vary depending on the governing jurisdictions and business structure.

Obtaining Permits

Filing for the applicable government licenses and permits will depend on the industry and nature of the business, and might include submitting an application to a federal agency, state, county, and/or city. The SBA lists federally regulated business activities alongside the corresponding license-issuing agency, while state, county, and city regulations can be found on the official government websites for each region.

Every business should have a marketing plan that outlines an overall strategy and the day-to-day tactics used to execute it. A successful marketing plan will lay out tactics for how to connect with customers and convince them to buy what the company is selling.

Marketing plans will vary according to the specifics of the industry , target market, and business, but they should aim to include descriptions of and strategies around the following:

- A target customer : Including market size, demographics, traits, and relevant trends

- Unique value propositions or business differentiators : Essentially, an overview of the company’s competitive advantage with regard to employees, certifications, or offerings

- A sales and marketing plan : Including methods, channels, and a customer’s journey through interacting with the business

- Goals : Should cover different aspects of the marketing and sales strategy, such as social media follower growth, public relations opportunities, or sales targets

- An execution plan : Should detail tactics and break down higher-level goals into specific actions

- A budget : Detailing how much different marketing projects and activities will cost

The startup costs for any given business will vary greatly depending on the industry, business activity, and product or service offering. Home-based online businesses will usually cost less than those that require an office setting to meet with customers. The estimated cost can be calculated by first identifying a list of expenses and then researching and requesting quotes for each one. Use the SBA’s startup costs calculator for common types of expenses associated with starting a small business.