- Global (EN)

- Albania (en)

- Algeria (fr)

- Argentina (es)

- Armenia (en)

- Australia (en)

- Austria (de)

- Austria (en)

- Azerbaijan (en)

- Bahamas (en)

- Bahrain (en)

- Bangladesh (en)

- Barbados (en)

- Belgium (en)

- Belgium (nl)

- Bermuda (en)

- Bosnia and Herzegovina (en)

- Brasil (pt)

- Brazil (en)

- British Virgin Islands (en)

- Bulgaria (en)

- Cambodia (en)

- Cameroon (fr)

- Canada (en)

- Canada (fr)

- Cayman Islands (en)

- Channel Islands (en)

- Colombia (es)

- Costa Rica (es)

- Croatia (en)

- Cyprus (en)

- Czech Republic (cs)

- Czech Republic (en)

- DR Congo (fr)

- Denmark (da)

- Denmark (en)

- Ecuador (es)

- Estonia (en)

- Estonia (et)

- Finland (fi)

- France (fr)

- Georgia (en)

- Germany (de)

- Germany (en)

- Gibraltar (en)

- Greece (el)

- Greece (en)

- Hong Kong SAR (en)

- Hungary (en)

- Hungary (hu)

- Iceland (is)

- Indonesia (en)

- Ireland (en)

- Isle of Man (en)

- Israel (en)

- Ivory Coast (fr)

- Jamaica (en)

- Jordan (en)

- Kazakhstan (en)

- Kazakhstan (kk)

- Kazakhstan (ru)

- Kuwait (en)

- Latvia (en)

- Latvia (lv)

- Lebanon (en)

- Lithuania (en)

- Lithuania (lt)

- Luxembourg (en)

- Macau SAR (en)

- Malaysia (en)

- Mauritius (en)

- Mexico (es)

- Moldova (en)

- Monaco (en)

- Monaco (fr)

- Mongolia (en)

- Montenegro (en)

- Mozambique (en)

- Myanmar (en)

- Namibia (en)

- Netherlands (en)

- Netherlands (nl)

- New Zealand (en)

- Nigeria (en)

- North Macedonia (en)

- Norway (nb)

- Pakistan (en)

- Panama (es)

- Philippines (en)

- Poland (en)

- Poland (pl)

- Portugal (en)

- Portugal (pt)

- Romania (en)

- Romania (ro)

- Saudi Arabia (en)

- Serbia (en)

- Singapore (en)

- Slovakia (en)

- Slovakia (sk)

- Slovenia (en)

- South Africa (en)

- Sri Lanka (en)

- Sweden (sv)

- Switzerland (de)

- Switzerland (en)

- Switzerland (fr)

- Taiwan (en)

- Taiwan (zh)

- Thailand (en)

- Trinidad and Tobago (en)

- Tunisia (en)

- Tunisia (fr)

- Turkey (en)

- Turkey (tr)

- Ukraine (en)

- Ukraine (ru)

- Ukraine (uk)

- United Arab Emirates (en)

- United Kingdom (en)

- United States (en)

- Uruguay (es)

- Uzbekistan (en)

- Uzbekistan (ru)

- Venezuela (es)

- Vietnam (en)

- Vietnam (vi)

- Zambia (en)

- Zimbabwe (en)

- Financial Reporting View

- Women's Leadership

- Corporate Finance

- Board Leadership

- Executive Education

Fresh thinking and actionable insights that address critical issues your organization faces.

- Insights by Industry

- Insights by Topic

KPMG's multi-disciplinary approach and deep, practical industry knowledge help clients meet challenges and respond to opportunities.

- Advisory Services

- Audit Services

- Tax Services

Services to meet your business goals

Technology Alliances

KPMG has market-leading alliances with many of the world's leading software and services vendors.

Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. That’s why KPMG LLP established its industry-driven structure. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients.

- Our Industries

How We Work

We bring together passionate problem-solvers, innovative technologies, and full-service capabilities to create opportunity with every insight.

- What sets us apart

Careers & Culture

What is culture? Culture is how we do things around here. It is the combination of a predominant mindset, actions (both big and small) that we all commit to every day, and the underlying processes, programs and systems supporting how work gets done.

Relevant Results

Sorry, there are no results matching your search..

- Topic Areas

- Reference Library

Handbook: Accounting changes and error corrections

Handbooks | November 2023

Latest edition: Our in-depth guide to the accounting and presentation requirements of ASC 250.

Using Q&As and examples, this in-depth guide explains how to identify, account for and present the different types of accounting changes and error corrections – with new and revised guidance and interpretations in this edition.

Applicability

- All entities

Relevant dates

- Effective immediately

Key impacts

Principles, methods, estimates – and errors

Sometimes mandated and sometimes self-selected, an entity’s accounting principles, methods and estimates set the scene for the accounting that follows – directing how assets, liabilities, revenues, expenses, gains and losses are recognized and measured. Applied consistently, they provide structure to the financial statements and give financial statement users confidence in interpreting the information.

ASC 250, Accounting Changes and Error Corrections, doesn’t prescribe specific accounting principles or methods or estimates, but it does provide guidance on when and how they are changed. And if an entity stumbles in applying its accounting principles and methods, or in forming estimates, ASC 250 provides guidance on how that error is corrected.

As such, ASC 250 is the companion standard to all others.

Report contents

- Scope and materiality

- Accounting changes

- Error corrections

- Interim reporting

- SEC registrants

Download the document:

Accounting changes and error corrections

Explore more

FASB issues final ASU on disclosure changes

ASU 2023-06 updates US GAAP disclosures in response to the SEC’s disclosure update and simplification initiative.

Answers to issuers' clawback implementation questions

Issuers face questions as they look to apply their new recovery policies under the SEC’s compensation clawback rules.

Meet our team

Subscribe to stay informed

Receive the latest financial reporting and accounting updates with our newsletters and more delivered to your inbox.

Choose your subscription (select all that apply)

By submitting, you agree that KPMG LLP may process any personal information you provide pursuant to KPMG LLP's Privacy Statement .

Accounting Research Online

Access our accounting research website for additional resources for your financial reporting needs.

Thank you for contacting KPMG. We will respond to you as soon as possible.

Contact KPMG

Job seekers

Visit our careers section or search our jobs database.

Use the RFP submission form to detail the services KPMG can help assist you with.

Office locations

International hotline

You can confidentially report concerns to the KPMG International hotline

Press contacts

Do you need to speak with our Press Office? Here's how to get in touch.

- Correction of an Error in Financial Statements

By Charles Hall | Accounting and Auditing

- You are here:

- Accounting and Auditing

A correction of an error--also referred to as a prior period adjustment--is sometimes necessary. But when should such a correction be made? And are there situations where a prior period adjustment is improper?

Below I explain what a correction of an error is, when it's appropriate, disclosure requirements, and implications for auditors.

Correction of an Error

In comparative statements (when two or more years are presented), the correction of a prior period error affects the prior period financial statements and opening balances in the current year. In single-year statements, the correction affects opening balances. Here's an example.

If Mountain Bikes, Inc. failed to accrue it's last two weeks’ payables in the prior year, a correction might be needed. Why do I say might ? Well, if the amount is not material, then the correction of the error may not be required. If the amount is material, then a correction is necessary.

Suppose you are auditing the financial statements of Mountain Bikes, Inc. for the year ended December 31, 2019, and you discover an error made in the December 31, 2018 financial statements. December 31, 2018 payables of $1 million were not accrued (and the amount is material). In this example, the invoices supporting the $1 million error existed and were on hand during last year’s audit, but, for whatever reason, the amount was not accrued. And the misstatement was not detected by the audit. Now, it's necessary to make a prior period adjustment.

If Mountain Bikes, Inc. provides comparative financial statements, the restated 2018 numbers must reflect the additional $1 million in payables and expenses. This adjustment will of course decrease net income for 2018 and retained earnings. So opening retained earnings (January 1, 2019) will decrease $1 million. The adjustment should not affect net income in 2019.

Before suggesting any corrections, discuss them with your audit client.

Discuss the Error with Management

It’s time to discuss the error with management or the owners. Why? You want to make sure the error is real. If management disagrees, they will tell you, and they will provide an explanation. But if management agrees, it’s time to propose a prior period adjustment (technically referred to as a restatement in the FASB Codification).

Correction of Error Defined

FASB defines a correction of an error as follows:

An error in recognition, measurement, presentation, or disclosure in financial statements resulting from:

- mathematical mistakes,

- mistakes in the application of generally accepted accounting principles (GAAP), or

- oversight or misuse of facts that existed at the time the financial statements were prepared.

Correction of an Error Disclosures

If Mountain Bikes, Inc. presents single year financial statements, the prior period adjustment affects just the opening balance of retained earnings (January 1, 2019, in this example). The company should still provide a disclosure explaining the prior period adjustment.

What should be in the note?

Provide a description of the nature of the error. For example, "The Company failed to record $1 million in payables as of December 31, 2018."

When comparative statements are provided, disclose the prior year numbers compared to the corrected numbers for each affected financial statement line items. (Consider displaying three columns: the uncorrected numbers as stated previously, the corrected numbers, and the difference.) FASB specifically requires disclosure of changes to retained earnings or other equity accounts for each prior period presented.

If a single period financial statement is issued, disclose the effects of the restatement on beginning retained earnings and net income from the preceding period.

Correction of Errors and Auditing

If you are the auditor, consider whether the error was intentional (fraudulent). What if, for example, the recording of the 2018 payables would have adversely affected the company's compliance with debt covenants? Then the understatement of payables may have been intentional.

Regardless, now that the misstatement is known, a prior period adjustment is necessary. Either management makes (accepts) the adjustment or you will need to qualify your opinion. Or, depending on the facts, withdrawal might be necessary. If the prior period adjustment is not made, you may need to contact your attorney and insurance company.

Additionally, if fraud is suspected in the prior period (2018, for example), it will have a bearing on the current year planning and risk assessment. You may be thinking, “But what if I discovered the error while performing the 2019 audit?” In other words, this potential fraud was not known during your 2019 audit planning . What then? Return to your audit plan and adjust accordingly. The audit plan is not static. It is living. The plan should reflect the facts, regardless of when they are discovered—in the early stage of the engagement or later.

If you believe the prior year misstatement was intentional (fraudulent), then incorporate this element in your current year audit planning and responses.

When a Prior Period Adjustment is not Merited

Sometimes an error in a prior period does not merit a prior period adjustment. For example, suppose the allowance for uncollectibles as of December 31, 2018 was adequate based on the facts that existed when the financial statements were created . However, in August 2019 (after the issuance of the 2018 statements) the company realizes it will not collect a material 2018 receivable, one that was previously believed to be collectible. Now what? Well, the allowance for uncollectibles should be adjusted in August 2019. A prior period adjustment should not be made. Changes in estimates are prospective.

Sometimes a company might desire a prior period adjustment though one is not merited. Why? It’s a way to sweep problems under the rug. Consider the example in the prior paragraph. If the company incorrectly records the bad debt as a restatement of the January 1, 2019 retained earnings, the expense does not appear in the 2019 income statement. Now, if a single-year presentation is provided, the bad debt expense does not appear in the 2018 or 2019 income statements. Consider that bonuses may be based on net income. If so, this slight of hand could result in extra (fraudulent) compensation.

A prior period adjustment might be desired for other reasons as well. Maybe the owners are sensitive to net income or management doesn’t want the embarrassment of declining net income.

Whatever the reason, a correction of error should be made only when required by generally accepted accounting principles.

About the Author

Charles Hall is a practicing CPA and Certified Fraud Examiner. For the last thirty-five years, he has primarily audited governments, nonprofits, and small businesses. He is the author of The Little Book of Local Government Fraud Prevention, The Why and How of Auditing, Audit Risk Assessment Made Easy, and Preparation of Financial Statements & Compilation Engagements. He frequently speaks at continuing education events. Charles consults with other CPA firms, assisting them with auditing and accounting issues.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Get The Why and How of Auditing on Amazon

Understand auditing like a boss.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

21.4 Correction of Errors

Given the complex nature of some accounting transactions, it is inevitable that errors in reported amounts will sometimes occur. IAS 8 defines errors as both omissions and misstatements, and suggests that errors result from the failure to use or misuse of reliable information that was available and could have reasonably been expected to be obtained when the financial statements were issued. Thus, management cannot claim that a misstatement is simply a change in estimate if they did not take reasonable steps to verify the original amount recorded. IAS 8 also suggests that errors can include mathematical mistakes, mistakes in application of accounting policies, oversights, misinterpretations of facts, and fraud. We can see that there is quite a range of potential causes of financial misstatements. However, regardless of the cause, errors need to be corrected once they are discovered.

If the error is discovered before the financial statements are issued, then the solution is simple: correct the error. This is a normal part of the accounting and audit cycle of a business, and the procedure of correcting errors with year-end adjusting journal entries is quite common. However, if the error is not discovered until after the financial statements have been published, then the company faces a much larger problem. If the error is discovered soon after the financial statements are published, it may be possible to recall the documents and republish a corrected version. However, it is more likely that the error will not be discovered until financial statements are being prepared for a subsequent year. In this case, the error will appear in the amounts presented as comparative figures, and will likely also have an effect on the current year. In this case, the error should be corrected through a process of retrospective restatement , similar to the procedures used for accounting policy changes. Note that a subtle difference in terminology is used: accounting policy changes are retrospectively applied , while error corrections result in retrospective restatements . Despite the difference in terms, the basic principle is the same: a retrospective restatement results in financial statements that present the comparative and current amounts as if the error had never occurred.

Consider the following example. In preparing its 2022 financial statements, management of Manaugh Ltd. discovered that a delivery truck purchased early in 2020 had been incorrectly reported as a repair and maintenance expense in that year rather than being capitalized. The vehicle’s cost was $50,000 and was expected to have a useful life of five years with no residual value. Assume that depreciation for tax purposes is calculated in the same way as for accounting purposes, and that the company’s tax rate is 20%. Also assume that prior year tax returns will be refilled to reflect the correction of the error.

Prior to the discovery of the error, the company reported the following results on its 2022 draft financial statements:

| Revenue | $900,000 | $850,000 |

| Expenses | 690,000 | 625,000 |

| Income before tax | 210,000 | 225,000 |

| Income tax | 42,000 | 45,000 |

| Net income | 168,000 | 180,000 |

| Opening retained earnings | 1,230,000 | 1,050,000 |

| Closing retained earnings | $1,398,000 | $1,230,000 |

In order to correct the error, we need to understand the balances of the relevant accounts prior to the error correction, and what they should be after the error is corrected. This analysis will need to be applied to all years affected by the error. Although there is no prescribed format for evaluating the effects of errors, a tabular analysis, as shown below, is often useful:

| Repair expense incorrectly included | 50,000 | ||

| Depreciation expense, incorrectly excluded | (10,000) | (10,000) | (10,000) |

| Net effect on income before tax | (10,000) | (10,000) | 40,000 |

| Income tax expense over-(under) stated | 2,000 | 2,000 | (8,000) |

| Adjustment required to net income | (8,000) | (8,000) | 32,000 |

| Adjustment required to vehicle account | 50,000 | 50,000 | 50,000 |

| Adjustment required to accumulated depreciation | 30,000 | 20,000 | 10,000 |

| Adjustment required to income taxes payable | (2,000) | (2,000) | 8,000 |

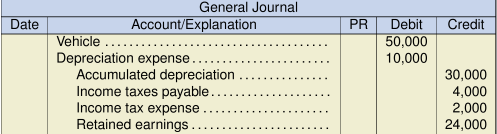

After analyzing the effects of the error, the following journal entry should be made in 2022 in order to correct the error:

After correcting the error, the financial statements will be presented as follows:

| Revenue | $900,000 | $850,000 |

| Expenses | 700,000 | 635,000 |

| Income before tax | 200,000 | 215,000 |

| Income tax | 40,000 | 43,000 |

| Net income | $160,000 | $172,000 |

The retained earnings portion of the statement of shareholders’ equity will include the following information:

| Opening balance, as previously stated | $1,050,000 | |

| Effect of error correction, net of taxes of $8,000 | 32,000 | |

| Opening balance, restated | $1,254,000 | 1,082,000 |

| Net income for the year | 160,000 | 172,000 |

| Closing balance | $1,414,000 | $1,254,000 |

Analyzing and correcting errors is one of the most important skills an accountant can possess. This skill requires not only judgment, but also a very solid understanding of the operation of the accounting cycle, as the sources and effects of the errors may not always be obvious. Additionally, the accountant needs to be aware of the causes of the errors, as some parties may prefer that the accountant not detect or correct the error. In such cases of fraud or inappropriate earnings management, managers may deliberately try to hide the error or prevent correction of it. In other cases, management may try to offer explanations that suggest the error is just a change in estimate, not requiring retrospective restatement. Sometimes these justifications may be motivated by factors that don’t reflect sound accounting principles. As such, the accountant must be prudent and exhibit good judgment when examining the causes of errors to ensure the final disclosures fairly present the economic reality of the situation.

Intermediate Financial Accounting 2 Copyright © 2022 by Michael Van Roestel is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Share This Book

- Search Search Please fill out this field.

- Corporate Finance

Accounting Changes and Error Correction: What it is, How it Works

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Investopedia / Eliana Rodgers

What Is Accounting Changes and Error Correction?

Accounting changes and error correction refers to guidance on reflecting accounting changes and errors in financial statements . It outlines the rules for correcting and applying changes to financial statements, which includes requirements for the accounting for, and reporting of, a change in accounting principle, a change in accounting estimate, a change in reporting entity, or the correction of an error.

Accounting changes and error correction is a pronouncement made by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB).

Key Takeaways

- Accounting changes and error correction refers to the guidance on reflecting accounting changes and errors in financial statements.

- Accounting changes and error corrections are overseen by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) in their jurisdictions.

- Accounting changes are classified as a change in accounting principle, a change in accounting estimate, and a change in reporting entity.

Understanding Accounting Changes and Error Correction

It is imperative for financial markets to have accurate and trustworthy financial reporting. Many businesses, investors, and analysts rely on financial reporting for their decisions and opinions. Financial reports need to be free of errors, misstatements, and completely reliable. Any changes or errors in previous financial statements impair the comparability of financial statements and therefore must be addressed appropriately.

Accounting changes and error correction guidance is laid out by the two primary accounting standards bodies: the FASB and the IASB. The two have different interpretations of accounting rules and principles but do work together to create some uniformity when possible.

The FASB’s Statement No. 154 addresses dealing with accounting changes and error correction, while the IASB’s International Accounting Standard 8, Accounting Policies, Changes in Accounting Estimates and Errors offers similar guidance.

The areas that the regulations focus on are:

- Change in accounting principle

- Change in accounting estimate

- Change in reporting entity

- Correction of an error in previously issued financial statements

The first three items fall under "accounting changes" while the latter falls under "accounting error."

Accounting Changes

Change in accounting principle.

The first accounting change, a change in accounting principle, for example, a change in when and how revenue is recognized, is a change from one generally accepted accounting principle (GAAP) to another. Companies can generally choose between two accounting principles, such as the last in, first out (LIFO) inventory valuation method versus the first in, first out (FIFO) method.

This is a retroactive change that requires the restatement of previous financial statements. Previous financials must be restated to be calculated as if the new principle were used. The only time that financial statements are allowed to not be restated is when every possible effort to address the change has been made and such a calculation is deemed impractical.

Change in Accounting Estimate

The second accounting change, a change in accounting estimate, is a valuation change. This means a material change in estimates is noted in the financial statements and the change is made going forward. An example would be a change in the depreciation method.

Change in Reporting Entity

The third accounting change is a change in financial statements, which in effect, result in a different reporting entity. This would include a change in reporting financial statements as consolidated as opposed to that of individual entities or changing subsidiaries that make up the consolidated financial statements. This is also a retroactive change that requires the restatement of financial statements.

Accounting Errors

Accounting errors are mistakes that are made in previous financial statements. This can include the misclassification of an expense, not depreciating an asset, miscounting inventory , a mistake in the application of accounting principles, or oversight. Errors are retrospective and must include a restatement of financials.

Financial Accounting Standards Board. " Summary of Statement No. 154 ." Accessed Aug. 22, 2020.

International Financial Reporting Standards Foundation. " IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors ." Accessed Aug. 22, 2020.

Financial Accounting Standards Board. " Statement of Financial Accounting Standards No. 154 ," pages 4-18. Accessed Aug. 22, 2020.

Financial Accounting Standards Board. " Statement of Financial Accounting Standards No. 154 ," pages 19-22. Accessed Aug. 22, 2020.

Financial Accounting Standards Board. " Statement of Financial Accounting Standards No. 154 ," pages 23-24. Accessed Aug. 22, 2020.

Financial Accounting Standards Board. " Statement of Financial Accounting Standards No. 154 ," pages 25-26. Accessed Aug. 22, 2020.

:max_bytes(150000):strip_icc():format(webp)/Suspense-Account_Final-Resized-a6d07d2641f34a8c9e9564dc2c2d2304.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Changes in Accounting Estimates and Errors

Published by Elwin Richard Modified over 6 years ago

Similar presentations

Presentation on theme: "Changes in Accounting Estimates and Errors"— Presentation transcript:

Chapter 4 Income Statement.

Nadeeshani Dissanayake B.Sc. Accounting (Sp), First Class, ACA, ACMA, CPA (Aust)

Accounting Policies, Changes in Accounting Estimates and Errors: IAS 8 Wiecek and Young IFRS Primer Chapter 21.

SFRS FOR SMALL ENTITIES

Prepared by: Dragan Stojanovic, CA Rotman School of Management, University of Toronto Chapter 21 Accounting Changes and Error Analysis Chapter 21 Accounting.

IAS 8 - Accounting changes and errors. Academic Resource Center Accounting changes and errors Page 2 Executive summary ► Both IFRS and US GAAP have similar.

PowerPoint Authors: Susan Coomer Galbreath, Ph.D., CPA Charles W. Caldwell, D.B.A., CMA Jon A. Booker, Ph.D., CPA, CIA Cynthia J. Rooney, Ph.D., CPA Copyright.

International Accounting Standard (IAS-8)

Accounting Policies, Changes in Accounting Estimates and Errors General Ledger Division -UHWI Presented By: Onika Clarke-Gordon Presented On: October 17,

Accounting Changes and Error Analysis

Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved. Accounting Changes and Error Corrections 20 Insert Book Cover Picture.

Accounting Changes and Error Corrections

© 2004 The McGraw-Hill Companies, Inc. McGraw-Hill/Irwin Chapter 21 Accounting Changes and Error Corrections.

1 Accounting Policies, Estimates and Errors. 2 Scope of this section This section provides guidance for selecting and applying the accounting policies.

Reporting Accounting Changes and Error Analysis Pertemuan 22, 23 dan 24 Matakuliah: F0054/Akuntansi Keuangan 2 Tahun : 2007.

Accounting Changes and Errors C hapter 23 An electronic presentation by Norman Sunderman Angelo State University An electronic presentation by Norman Sunderman.

TENTH CANADIAN EDITION INTERMEDIATE ACCOUNTING Prepared by: Lisa Harvey, CPA, CA Rotman School of Management, University of Toronto 21 CHAPTER 21 Accounting.

Intermediate Accounting

Accounting changes and errors

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

CORRECTION OF ERRORS

Aug 09, 2014

320 likes | 775 Views

CORRECTION OF ERRORS. An ERROR. is an unintentional mistake. it is generally discovered months after the cut-off (accounts preparation) date. it cannot be simply erased [rub out] or torn out when it (the ERROR) has been discovered. ERRORS.

Share Presentation

- suspense account

- correct what

- trial balance

- entry process

Presentation Transcript

An ERROR • is an unintentional mistake. • it is generally discovered months after the cut-off (accounts preparation) date. • it cannot be simply erased [rub out] or torn out when it (the ERROR) has been discovered

ERRORS • must be corrected via the double-entry process • [1st ] The correction is to be recorded in the JOURNAL • [2nd ] The correction is to be posted in the LEDGERS

ERRORS There are TWO types which may occur in the recording of accounting information: • those which DO NOT AFFECT the Trial Balance. • those which DO AFFECT the Trial Balance.

ERRORS WHICH DO NOT AFFECT THE TRIAL BALANCE

Correcting an error that DNATTB • Have the general journal at hand • analyze the mistake that was made • Determine action required to cancel the mistake • correct what is wrong! • Journalize the required action • Add the explanatory narrative

ERRORS WHICH DO AFFECT THE TRIAL BALANCE

The Suspense Account • ERRORS that do affect the trial balance require the services of the Suspense account. • It holds the cancelling half of the transaction, so as to prevent the clerk from changing the part of the posting that was already correct. • It follows the same rules for double-entry posting

EXAMPLES (DNATTB)

EXAMPLES (DATTB)

- More by User

GLOBAL POSITINING SYSTEM WORKING,ERRORS AND CORRECTION USING DGPS

GLOBAL POSITINING SYSTEM WORKING,ERRORS AND CORRECTION USING DGPS. Department Of Electronics and Communication Engineering. OBJECTIVE: To overcome the drawbacks in Global positioning system by implementing Differential global positioning system. INTRODUCTION :

204 views • 18 slides

BADM 750 – Case Writeups Common Errors and Correction Strategies

BADM 750 – Case Writeups Common Errors and Correction Strategies. Not reading the material fully or not reading and directly addressing all assigned material How does he know? (Very obvious and significant points are never discussed, while the paper rambles on obviously groping to fill space.)

139 views • 5 slides

Correction of Errors one approach

Sequence of topics. Double Entry including accruals/prepayments to simple P

408 views • 21 slides

Coding for the Correction of Synchronization Errors

Coding for the Correction of Synchronization Errors. ASJ Helberg CUHK Oct 2010. Content. Background Synchronization errors and their effects Previous approaches Resynchronization Concatenation Error correction Algebraic insertion/deletion correction Single error correcting

476 views • 27 slides

Transmission Errors Error Detection and Correction

Computer Networks Spring 2013. Transmission Errors Error Detection and Correction . Transmission Errors Outline. Error Detection versus Error Correction Hamming Distances and Codes Linear Codes - Parity Internet Checksum Polynomial Codes Cyclic Redundancy Checking (CRC)

700 views • 29 slides

Advanced Computer Networks D 12 Term C10. Transmission Errors Error Detection and Correction . Transmission Errors Outline. Error Detection versus Error Correction Hamming Distances and Codes Linear Codes - Parity Internet Checksum Polynomial Codes Cyclic Redundancy Checking (CRC)

603 views • 29 slides

CORRECTION OF SENTENCES

CORRECTION OF SENTENCES. UHAS 100. EXERCISE ONE. The budget is froze until next quarter. If he was your manager will you attend the conference. George will have saw him the other day if he was there We do not give that information to no one John and I completed the project yesterday.

1.34k views • 4 slides

Advanced Computer Networks C13 Term C10. Transmission Errors Error Detection and Correction . Transmission Errors Outline. Error Detection versus Error Correction Hamming Distances and Codes Linear Codes - Parity Internet Checksum Polynomial Codes Cyclic Redundancy Checking (CRC)

547 views • 29 slides

Transmission Errors Error Detection and Correction. Transmission Errors Outline. Error Detection V.S. Error Correction Hamming Distances and Codes Parity Checksum Polynomial Codes Cyclic Redundancy Checking (CRC) Properties for Detecting Errors with Generating Polynomials. Error Control.

2.22k views • 46 slides

Correction of resonances driven by random errors

Correction of resonances driven by random errors. Previously, we successfully demonstrated that we can correct nonlinear resonance for high-intensity operation where space charge effects are important. All previous studies were done using lumped errors:

239 views • 9 slides

LINEAR LATTICE ERRORS AT THE ESRF: MODELING AND CORRECTION

LINEAR LATTICE ERRORS AT THE ESRF: MODELING AND CORRECTION. A. Franchi, L. Farvacque, T. Perron. SUMMARY:. Which errors and why correct them. Special focus on beta beating and coupling correction using RDTs Correction sequence and resulting vertical emittance.

318 views • 15 slides

Techniques for automated localization and correction of design errors

Techniques for automated localization and correction of design errors. Jaan Raik Tallinn University of Technology. Design error debug. “There has never been an unexpectedly short debugging period in the history of computers.” Steven Levy. 2. Designs are getting bigger.

801 views • 72 slides

Computer Networks Spring 2012 Term C10. Transmission Errors Error Detection and Correction. Transmission Errors Outline. Error Detection versus Error Correction Hamming Distances and Codes Parity Internet Checksum Polynomial Codes Cyclic Redundancy Checking (CRC)

479 views • 29 slides

Field errors correction strategies

Field errors correction strategies. Marek Strzelczyk Mike Lamont. Agenda. Sources of errors Correction methods Implemented Planned Questions & discussion. Sources of errors. MB Static b2, b3 , b4, b5 a1, a2, a3 Dynamic (b1) , b3 , b5 MQ Static ( b6) Dynamic b2

234 views • 6 slides

Correction of Errors one approach. Gabrielle Moran 17th April 2010. Sequence of topics. Double Entry including accruals/prepayments to simple P&L and Balance Sheet Incomplete Records Control Accounts – Subsidiary Books Depreciation and Disposal Clubs, Service, Farm Manufacturing

348 views • 20 slides

Diagnosis and Correction of Logic Design Errors in Circuits

Diagnosis and Correction of Logic Design Errors in Circuits. Student: Yu-Lin Hsiao Advisor: Chun-Yao Wang 2006.9.1 Department of Computer Science National Tsing Hua University, Taiwan. Outline. Introduction Previous work Problem description Our method Future work. Introduction.

569 views • 45 slides

Diagnosis and Correction of Logic Errors in Circuits based on probability

Diagnosis and Correction of Logic Errors in Circuits based on probability. Student: Yu-Lin Hsiao Advisor: Chun-Yao Wang 2006.3.08 Department of Computer Science National Tsing Hua University, Taiwan. Outline. Problem Description Diagnosis Preliminary idea Correction Future work.

302 views • 14 slides

Errors & Source of Errors

Errors & Source of Errors. Several causes for malfunction in computer systems. Hardware fails Critical data entered incorrectly Software errors Bugs Roundoff Truncation. Errors in Computing. Particular to numerical computation unavoidable.

418 views • 19 slides

Diagnosis and Correction of Logic Design Errors in Circuits. Student: Yu-Lin Hsiao Advisor: Chun-Yao Wang 2006.5.24 Department of Computer Science National Tsing Hua University, Taiwan. Outline. Introduction Previous work Problem description Diagnosis method Future work. Introduction.

293 views • 18 slides

CORRECTION OF ERRORS THAT OCCURRED IN PREVIOUS PERIODS

CORRECTION OF ERRORS THAT OCCURRED IN PREVIOUS PERIODS. Prior-Period Adjustments (Financial Reporting) and Prior-Year Adjustments (Budgetary Reporting). Overview.

336 views • 11 slides

Correction of mistakes

mistakes correction how to deal with enlish for students grammatik

185 views • 10 slides

Correction of Adversarial Errors in Networks

Correction of Adversarial Errors in Networks. Sidharth Jaggi Michael Langberg Tracey Ho Michelle Effros Submitted to ISIT 2005. Greater throughput Robust against random errors. Aha! Network Coding!!!. ?. ?. ?. ?. ?. ?. Xavier. Yvonne. Zorba. Background.

389 views • 38 slides

IMAGES

VIDEO

COMMENTS

For an SEC registrant, the correction of a material misstatement is ordinarily accomplished by performing both of the following: Filing an Item 4.02 Form 8-K to indicate that the previously issued financial statements should no longer be relied upon. The reporting entity should consult with its counsel to determine the appropriate steps and timing for providing notice that the financial ...

[3] The specific disclosures and requirements to report non-reliance on previously issued financial statements can be found directly within Item 4.02 of Form 8-K and depend, in part, on which party (the registrant or auditor) determined that action should be taken to prevent reliance on the financial statements. Registrants, the audit committee and/or board or directors, and the auditors will ...

Principles, methods, estimates - and errors Sometimes mandated and sometimes self-selected, an entity's accounting principles, methods and estimates set the scene for the accounting that follows - directing how assets, liabilities, revenues, expenses, gains and losses are recognized and measured.

A correction of an error--also referred to as a prior period adjustment--is sometimes necessary. But when should such a correction be made? ... 2019 retained earnings, the expense does not appear in the 2019 income statement. Now, if a single-year presentation is provided, the bad debt expense does not appear in the 2018 or 2019 income ...

An error correction fixes an error in previously issued financial statements. This can be an error in recognition, measurement, presentation, or disclosure.

In contrast, as defined in ASC 250-10-20, a change in accounting estimate results from incorporating new information or modifying the estimating techniques affecting the carrying amount of assets or liabilities as of the date the change is made.Changing inputs for estimating uncollectible receivables based on new information is an example of a change in the estimating technique.

Financial reporting developments And 2

21.4 Correction of Errors. Given the complex nature of some accounting transactions, it is inevitable that errors in reported amounts will sometimes occur. IAS 8 defines errors as both omissions and misstatements, and suggests that errors result from the failure to use or misuse of reliable information that was available and could have ...

22.4: Corrections of Errors. Page ID. Table of contents. No headers. Given the complex nature of some accounting transactions, it is inevitable that errors in reported amounts will sometimes occur. IAS 8 defines errors as both omissions and misstatements, and suggests that errors result from the failure to use or misuse of reliable information ...

CHANGE IN ACCOUNTING ESTIMATE A change in accounting estimate is: "A change that has the effect of adjusting the carrying amount of an existing asset or liability or altering the

Accounting Changes Change in Accounting Principle . The first accounting change, a change in accounting principle, for example, a change in when and how revenue is recognized, is a change from one ...

24 Correcting Accounting Errors. Transposition Errors To find an amount that has been transposed: Find the difference between total debits and total credits and add 1 to the first digit Example: You find a difference between the totals of 180. The first digit is 1. Add 1 and you get 2.

AC120 lecture 36 Errors in books of account Correction of errors Use of suspense accounts Source: Thomas, chapter 18. September 15, 2014 What are we doing today? Correct Pg. 26 #2 - 42 evens 1.6 - Combining Like Terms -Lecture and Vocabulary HW - 1.6 - Pg. 30 #3-45.

IAS 8 is applied in selecting and applying accounting policies, accounting for changes in estimates and reflecting corrections of prior period errors. The standard requires compliance with any specific IFRS applying to a transaction, event or condition, and provides guidance on developing accounting policies for other items that result in relevant and reliable information.

An error correction is the correction of an error in previously issued financial statements. It is not an accounting change.

40 Correction of Errors Types of Accounting Errors: A change from an accounting principle that is not generally accepted to an accounting policy that is acceptable. Mathematical mistakes. Changes in estimates that occur because a company did not prepare the estimates in good faith.

CORRECTION OF ERRORS.pptx - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. The document discusses types of errors in financial statements and their correction. It defines errors as unintentional misstatements, including mathematical mistakes, incorrect estimates, and misapplications of accounting principles.

Presentation of Financial Statements. Scope. This Standard shall be applied in selecting and applying accounting policies, and accounting for changes in accounting policies, changes in accounting estimates and corrections of prior period errors. The tax effects of corrections of prior period errors and of retrospective

Presentation Transcript. CORRECTION OF ERRORS. An ERROR • is an unintentional mistake. • it is generally discovered months after the cut-off (accounts preparation) date. • it cannot be simply erased [rub out] or torn out when it (the ERROR) has been discovered. ERRORS • must be corrected via the double-entry process • [1st ] The ...

Application reliability is critical. Service interruptions result in a negative customer experience, thereby reducing customer trust and business value. One best practice that we have learned at Amazon, is to have a standard mechanism for post-incident analysis. This lets us analyze a system after an incident in order to avoid reoccurrences in the future. These […]

Various types of errors in writing and speaking are listed, along with common causes. Techniques for correcting written errors include peer review and collective practice of common mistakes. For spoken errors, techniques involve prompting self-correction through intonation and clues or expansion on partial answers before direct teacher correction.

GIPS compliant presentations, "compliant presentation(s)" or "presentation(s)". This Guidance Statement does not address errors discovered in advertisements prepared

A powerpoint to train teachers in correcting errors in the classroom. Also includes the difference between errors and mistakes.