COMMERCIAL LAW BLOG

Research & Updates

Sub-contracting and Assignment : Resolving the Legal Conundrum

The performance of a contract may require third party involvement towards the fulfilment of obligations under a contract. In certain specific circumstances, the contracting parties may decide to “sub-contract” or “assign” their rights and obligations to a third party depending upon the nature of the contract.

In common parlance, sub-contracting and assignment are used interchangeably, however, a significant difference lies between the two when one examines the terms from a legal stand point. This post aims to discuss the concept of Sub-Contracting and Assignment and explains the key difference between the two concepts.

Sub-contracting

Sub-contracting refers to the delegation of certain duties and obligations by contracting parties to a third party, i.e. a sub-contractor who aids in the performance of the contract. According to the Black’s Law Dictionary, a sub-contract is “where a person has contracted for the performance of certain work and he, in turn, engages a third party to perform the whole or part of that which is included in the original contract, his agreement with such third person is called a subcontract and such person is called a subcontractor .” [1] A subcontractor could be a company, self-employed professionals or an agency undertaking to fulfil obligations under a contract.

Sub-contracting is generally undertaken in complex projects where the contract has a prolonged life cycle or multiple components for completion of a project, for instance, infrastructure contracts, construction contracts, renewable energy contracts or certain information technology-related contracts. However, the rights and duties of the sub-contractor under the sub-contracting agreement are relatively similar to that of the principal contractor in the main agreement.

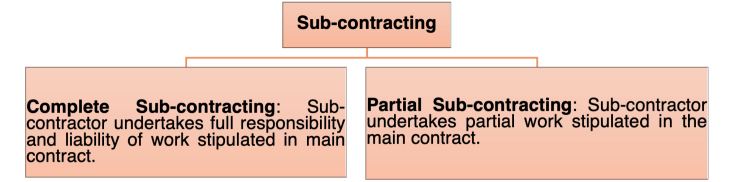

Furthermore, while drafting a contract, one must ensure to incorporate a clause on sub-contracting which clearly spells out that parties to the contract shall sub-contract the rights and obligations only after seeking prior written consent from the other party. The sub-contracting arrangement maybe two-fold, depending upon the nature of the main contract:

Primarily, the basic idea behind delegation of the obligations to a sub-contractor is to ensure greater flexibility in the performance of the contract. However, it is imperative to enter into a sub-contractor’s agreement that specifies all the details of the work to be performed by the subcontractor, including optimum time required to accomplish the task, payment of charges to the subcontractor, termination of the agreement, etc.

While subcontracting is time-saving and cost efficient, it may result into legal issues between the contracting parties. For instance, issues may arise with respect to the payment conditions where the payment to sub-contractor is contingent upon or linked to the principal contractor receiving its payment from the employer. Further, the courts in India have always upheld the principle of privity of contract between employer and the principal contractor on the one hand and between the principal contractor and sub-contractor(s) on the other. The Supreme Court of India in the case of Zonal General Manager, Ircon International Ltd. v. Vinay Heavy Equipments [2] upheld that in the absence of a back-to-back covenant in the main contract, “ the distinct and sole liability of the middle-contractor is presumed and that the rules in relation to privity of contract will mean that the jural relationship between the employer and the main contractor on the one hand and between the sub-contractor and the main contractor on the other will be quite distinct and separate” . Therefore, in order to avoid ambiguities and future legal squabbles, careful consideration must be given while drafting specific terms and obligation that will pass down the contractual chain.

Assignment of contract refers to an act of transferring contractual rights and liabilities under the contract to a third party with other party’s concurrence. Section 37 of the India Contract Act, 1872 (“ Contract Act ”) enables the contracting parties to dispense with the performance of a contract by way of an assignment. While the principle of assignment is well recognized under Indian law, it derives its origin from the English law.

Assignment of rights is a “complete transfer of rights to receive benefits” accruing to one party under a contract. Performance of a contract may be assigned as long as the contracting parties provide their consent towards the assignment. However, the act of assignment needs to be looked at from the perspective of the contracting parties. Essentially, there are three parties involved, namely, the assignor, assignee and obligor.

An important principle affecting assignments is that the burden or liability under a contract cannot be assigned. Essentially, the moot question that often arises is with respect to assignment of “rights” vis à vis assignment of “obligations”. The Supreme Court in the case of Khardah Company Ltd. v. Raymon & Co. (India) Private Limited [3] categorically distinguished between assignment of “rights” and “obligations”. The court upheld that, “ an assignment of a contract might result by transfer either of the rights or of the obligations thereunder. But there is a well-recognised distinction between these two classes of assignments. As a rule, obligations under a contract cannot be assigned except with the consent of the promisee, and when such consent is given, it is really a novation resulting in substitution of liabilities. On the other hand rights under a contract are assignable unless the contract is personal in its nature (or) the rights are incapable of assignment either under the law or under an agreement between the parties” . Primarily, the court clarified that obtaining prior consent to assign “obligations” under a contract would be considered as novation as it will result into substitution of liabilities and obligations to the assignee. Moreover, introduction of a new party into an existing contract will result into novation of a contract i.e. creation of a new contract between original party and new party. As the courts have interpreted that transfer of obligations can be undertaken through novation, the assignment clause in a contract must clearly deal with novation, if the intention is to transfer obligations.

Furthermore, the Supreme Court, in the case of Gopalbhai Manusudhan [4] , reaffirmed that whenever there is a case of assignment or even the transfer of the obligations, it must be acclaimed that there is the presence of the consent of the parties. Without the consent of the parties, the assignment will be not considered valid. In addition to upholding the legal point, this ruling also indicates that before establishing a commercial contract, the parties must consider the different complications of contracts, such as the objective of the contract and the presence of an assignability clause in the agreement.

Therefore, the judicial trend in India has time and again reiterated and laid down that rights under contract can be assigned unless (a) the contract is personal in nature i.e. requires personal engagement of a specific person or (b) the rights are incapable of assignment either under law or under an agreement between the parties. In the case of Robinson v. Davison [5] , the defendant’s wife pledged to perform piano at a concert on a specific date. Due to “her illness”, she was unable to fulfil her obligation, which was to play the piano at an event. The contract in this instance was ruled to be solely dependent on the defendant’s wife’s good health and personal talent, and the defendant’s wife’s illness led the contract to be void. Further, the court ruled that the defendant could not be held liable for damages as a result of the contract’s non-performance. The wife could not assign her right/obligation to a third party because the contract was founded on the “promisor’s expertise” in the aforesaid case.

While assignment is a boiler plate clause, it requires careful consideration on a case-to-case basis. For instance, in real estate transactions, a buyer would insist on retaining the right to assign the “agreement to sell” in favour of a nominee (a company, affiliate or any other third party), in order to facilitate final conveyance in favour of the intended buyer. Similarly, in lending transactions, a borrower will be prohibited from assigning rights under the contract, however, the lender will retain absolute and free right to assign/sell loan portfolios to other lenders or securitisation company.

The apex court has time and again reiterated that the best policy is to unequivocally state the intent with respect to assignment in the agreement to avoid litigation in the future. The contracting parties must expressly specify the rights and obligations stemming from assignment under a contract. Any agreed limitation on such an assignment must be expressly laid down in the contract to avoid adverse consequences.

For a person drafting a contract, it is important to understand these subtle differences, between sub-contracting and assignment. While “sub-contracting” is delegating or outsourcing the liabilities and obligations, “assignment” is literally transferring the obligations. It will be not fallacious to say that an “assignment” transfers the entire legal obligation to perform to the party assigned the obligation whereas, subcontracting leaves the primary responsibility to perform the obligation with the contracting party.

Archana Balasubramanian (Partner), Vaishnavi Vyas (Associate)

[1] Black’s Law Dictionary 4th ed. (St. Paul: West, 1951).

[2] 2006 SCC OnLine Mad 1107

[3] MANU/SC/0428/1962

[4] Kapilaben & Ors. v Ashok Kumar Jayantilal Seth through POA Gopalbhai Manusudhan 2019 (10) SCJ 269

[5] (1871) LR 6 Ex 269

Share this:

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to print (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Leave a comment Cancel reply

- Agama Announcements

- Arbitration

- Commercial Laws

- Covid-19 Updates

- Criminal Law

- Cryptocurrencies and Blockchain

- Data Protection/Privacy

- Environmental Law

- Family Laws

- In the News

- Intellectual Property Laws

- Labour/Employment

- Labour/Employment – Women

- Real Estate

- Securities Law

- Will & Succession

Follow Blog via Email

Enter your email address to follow this blog and receive notifications of new posts by email.

Email Address:

This website does not provide any legal advice and is for information purposes only. Any reliance on information or opinion contained herein would be against the advice of the administrators of this website and entirely at risk and cost of the recipient or user of this information. No attorney-client relationship is formed through this website, directly or indirectly. Opinions are of authors and does not necessarily bind the administrators or owners of the website or the law firm.

Create a website or blog at WordPress.com

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

Assignment vs Novation: Everything You Need to Know

Assignment vs. novation: What's the difference? An assignment agreement transfers one party's rights and obligations under a contract to another party. 4 min read updated on February 01, 2023

Assignment vs. novation: What's the difference? An assignment agreement transfers one party's rights and obligations under a contract to another party. The party transferring their rights and duties is the assignor; the party receiving them is the assignee. Novation is a mechanism where one party transfers all its obligations and rights under a contract to a third party, with the consent of the original counterparty.

The transfer of a benefit or interest from one party to another is referred to as an assignment. While the benefits can be transferred, the obligation or burden behind the contract cannot be. A contract assignment occurs when a party assigns their contractual rights to a third party. The benefit that the issuing party would have received from the contract is now assigned to the third party. The party appointing their rights is referred to as the assignor, while the party obtaining the rights is the assignee.

The assignor continues to carry the burden and can be held liable by the assignee for failing to fulfill their duties under the contract. Purchasing an indemnity clause from the assignee may help protect the assignor from a future liability. Unlike notation, assignment contracts do not annul the initial agreement and do not establish a new agreement. The original or initial contract continues to be enforced.

Assignment contracts generally do not require the authorization from all parties in the agreement. Based on the terms, the assignor will most likely only need to notify the nonassigning party.

In regards to a contract being assignable, if an agreement seems silent or unclear, courts have decided that the contract is typically assignable. However, this does not apply to personal service contracts where consent is mandatory. The Supreme Court of Canada , or SCC, has determined that a personal service contract must be created for the original parties based on the special characteristics, skills, or confidences that are uniquely displayed between them. Many times, the courts need to intervene to determine whether an agreement is indeed a personal service contract.

Overall, assignment is more convenient for the assignor than novation. The assignor is not required to ask for approval from a third party in order to assign their interest in an agreement to the assignee. The assignor should be aware of the potential liability risk if the assignee doesn't perform their duties as stated in the assigned contract.

Novation has the potential to limit future liabilities to an assignor, but it also is usually more burdensome for the parties involved. Additionally, it's not always achievable if a third party refuses to give consent.

It's essential for the two parties in an agreement to appraise their relationship before transitioning to novation. An assignment is preferential for parties that would like to continue performing their obligations, but also transition some of their rights to another party.

A novation occurs when a party would like to transfer both the benefits and the burden within a contract to another party. Similar to assignment, the benefits are transferred, but unlike assignment, the burden is also transferred. When a novation is completed, the original contract is deleted and is replaced with a new one. In this new contract, a third party is now responsible for the obligations and rights. Generally, novation does not cancel any past obligations or rights under the initial contract, although it is possible to novate these as well.

Novation needs to be approved by both parties of the original contract and the new joining third party. Some amount of consideration must also be provided in the new contract in order for it to be novated, unless the novation is cited in a deed that is signed by all parties to the contract. In this situation, consideration is referring to something of value that is being gained through the contract.

Novation occurs when the purchaser to the original agreement is attempting to replace the seller of an original contract. Once novated, the original seller is released from any obligation under the initial contract. The SCC has established a three-point test to implement novation. The asserting party must prove:

- The purchaser accepts complete liability

- The creditor to the original contract accepts the purchaser as the official debtor, and not simply as a guarantor or agent of the seller

- The creditor to the original contract accepts the new contract as the replacement for the old one

Also, the SSC insisted that if a new agreement doesn't exist, the court would not find novation unless the precedence was unusually compelling.

If you need help determining if assignment vs. novation is best for you, you can post your job on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Contract Transfer

- Novation Agreement

- What is Novation of Contract

- Novation of Contract

- Contract Novation Letter

- Deed of Novation

- Contract Novation

- Loan Novation Agreement

- Assignment of Rights Example

- Contract Novation Agreement

ADVOCATES & SOLICITO RS I COMPANY SECRETARY

+ 03 - 78779758

+6012-6582798

- Aug 21, 2023

Deed of Assignment v Deed of Novation - When and how to use them

Updated: Aug 26, 2023

Regarding the transfer of rights and obligations within a contract, two frequently employed legal methods are deeds of assignment novation. Even though both approaches encompass the transfer of rights and responsibilities, they contrast in several ways, such as their effects on the original contract and the requirement of the necessary consent by the parties involved.

Rights and Obligations

In the context of a deed of assignment, the assignor transfers its rights and responsibilities to the assignee, while the initial contract remains valid. Conversely, novation entails establishing a fresh agreement that replaces the original one, forming a new agreement involving the transferor, transferee, and obligor.

Requirement of Consent

To ensure the validity of an assignment deed, the assignor needs to notify the obligor about the assignment, although the obligor’s consent isn't necessary. Conversely, novation demands agreement from all parties—transferor, transferee, and obligor.

Novation in detail

How it works

Novation mandates the approval of every party engaged, including the fresh entrant adopting the responsibilities and rights. The procedure encompasses these stages:

Agreement: All involved parties need to reach a consensus on the novation's terms and the new setup.

Paperwork: A novation agreement needs preparation and endorsement from all parties concerned.

Notification/approvals: All pertinent entities, such as financial institutions or insurers, must be informed of the novation and provide their consent/approval.

Execution: The novation becomes operational once all parties have inked the agreement and the requisite paperwork is finalized.

Novation in action:

· When a fresh contractor assumes control of a construction venture from the original contractor, taking on all the rights and duties specified in the initial agreement.

· In the context of a construction project, if a subcontractor, grappling with financial issues, intends to transfer their responsibilities to another subcontractor, the primary contractor can agree to novate the contract. This process allows the new subcontractor to inherit the obligations and commitments of the original subcontractor.

· An engineering company, commissioned by a municipality to design and build a new road, decides to sell the design and construction contract to another firm. The municipality approves a novation, permitting the new firm to take over the contract and conclude the project

· If a supplier holding a contract with a contractor to deliver construction materials opts to sell their business to another entity, the contractor can consent to a novation. This facilitates the transition of the contract to the new company, ensuring the new entity fulfills the supplier's duties as stipulated in the contract.

Assignment in detail

How an assignment works

The typical procedure for assignment includes these stages:

The initial contracting parties need to reach a consensus on the assignment.

The assignor (the entity transferring rights and obligations) is required to formally inform the other party in writing about the assignment.(typically)

The assignee (the new party assuming rights and obligations) must acknowledge the assignment in written form. (again, typically)

Assignment in action

· A subcontractor transfers their entitlement to payment for their services to a third party, often a lender, as collateral for a loan.

· A contractor delegates their right to receive payment from the project owner to a supplier or vendor, aiming to settle expenses for materials or equipment utilized in the undertaking.

· A property developer relinquishes their right to collect payments from buyers of individual units within a development to a lender, thereby obtaining financing for the venture.

· A contractor relinquishes their right to receive payment from the owner and assigns it to a joint venture partner, distributing the risk and reward of the project.

Grasping the distinctions between assignment deeds and novation is vital for selecting the right method of transferring rights and responsibilities. Prior to making a decision, it's advisable to consult legal experts for guidance on which approach to adopt.

Let's Chat

If you need help in further understanding the distinction between assignment and novation, or require some assistance in transferring certain rights and obligations, feel free to contact us to schedule a complementary consultation.

- law, articles, contract

- legal, articles, business law, comp

Recent Posts

Understanding Legal Retainers in Malaysia: A Comprehensive Guide by Rajvin Gill & Co.

An Overview of Foreign Investment Laws and Policies in Malaysia

What we do: Commercial Law Advisory in Malaysia

India Corporate Law

Rbi’s move to revamp loan transfers in india.

On June 08, 2020, the Reserve Bank of India ( RBI ) released two draft frameworks — one for securitisation of standard assets ( Draft Securitisation Framework ) and the other on sale of loan exposures ( Draft Sale Framework ). In our previous article (available here ), we had dealt with key revisions introduced by the RBI under the Draft Securitisation Framework. This article contains a brief summary of the Draft Sale Framework.

The Draft Sale Framework is addressed to the same constituents as the Draft Securitisation Framework and is expected to operate as an umbrella framework, which will govern all loan transfers (standard and stressed assets).

The Draft Sale Framework is broadly divided into three parts viz., (i) general conditions applicable to all loan transfers; (ii) provisions dealing with sale and purchase of standard assets; and (iii) provisions dealing with sale and transfer of stressed assets (including purchase by ARCs).

The core principles of transfer appear like the previous guidelines on direct assignment. However, the scope of transfer has now been expanded to include various kinds of economic transfers of loan assets, including participation arrangements and transactions in which the loan exposure remains on the books of the transferor even after the said transactions.

Three types of transfers that have been recognised under the Draft Sale Framework viz., (i) assignment; (ii) novation; and (iii) loan participation (which includes both risk participation and funded participation). Whilst loans can be transferred via any of the aforesaid transfer methods, (a) revolver loans and loans with bullet payments of principal and interest can only be transferred through novation and loan participation; and (b) stressed assets can only be transferred through assignment and novation. Transfer by way of novation is exempt from the applicability of the guidelines, except for a diktat that approval of all parties, including the borrower, is required for novation.

RBI has indicated that all these transfers are required to result in immediate legal separation of the transferor from the assets, which are transferred and put beyond the reach of the transferor as well as the creditors of the transferor. RBI has also suggested that these should be bankruptcy remote and a legal opinion should be obtained in this regard.

In line with the position in the 2012 guidelines, transferors are not permitted to offer any credit enhancement or liquidity facility for loan transfers. Diligence requirements continue to be strict and the purchasing lender is required to apply the same standard of care while assessing the asset, as if it were originating the asset directly and cannot outsource its due diligence.

The RBI has also permitted transfer of a single loan asset or part of a single asset to a financial entity through novation or loan participation. Only financial entities carrying on business in India will be eligible to participate. Loans acquired from other entities can also be assigned.

Participation Agreements

The Draft Sale Framework also seeks to permit and regulate participation arrangements. Participation arrangements though popular in certain other jurisdictions were not common here, except inter alia , in accordance with the guidelines issued by the RBI on December 31, 1998. The1998 guidelines permitted two types of participations, inter-bank participations with risk sharing and inter-bank participations without risk sharing. While the assignment agreements that were entered into earlier were akin to participation agreements in spirit, the permissibility of participation is an interesting development and a regulatory headway made in the growth of the loan market. The Draft Sale Framework seeks to allow both risk participation and funded participation in loans. Participation agreements in respect of stressed assets has not been specifically permitted.

The Draft Sale Framework specifically recognizes transfer of external commercial borrowings by ‘eligible lenders’ (as defined under the Master Direction on External Commercial Borrowings, Trade Credits and Structured Obligations), subject to any loss or hair cut being to the account of the transferor.

It is expected that the RBI will provide further clarity on whether all lenders (i.e. overseas branches, onshore branches, etc.) can purchase such assets and whether the exposure must continue to remain in foreign currency, both for standard and stressed assets

The RBI has not stipulated the requirement for a transferor to maintain minimum risk retention for loan transfers. This will enable the transferee to deal with the loan independently. However, transferors will have to comply with the ‘minimum holding period’ requirement.

Transfer of loan accounts at the instance of the borrower, inter-bank participations, trading in bonds, sale of entire portfolio of assets consequent upon a decision to exit the line of business completely, sale of stressed assets and consortium and syndication arrangements continue to remain exempt from the applicability of Chapter III of the Draft Sale Framework (which only applies to transfer of standard assets).

Stressed Assets

Stressed assets have been defined as: ‘ assets that are classified as NPA or as special mention accounts, and generally includes accounts, which are in default, as well as where lenders have given concessions for economic or legal reasons relating to the borrower’s financial difficulty ’.

Currently, the Master Circular on Prudential Norms on Income Recognition, Asset Classification and Provisioning (pertaining to advances), 2015, detail the criteria for standard assets, special mention accounts and non-performing assets. The classification has also been replicated in the Reserve Bank of India (Prudential Framework for Resolution of Stressed Assets) Directions 2019 ( Prudential Stressed Asset Directions ).

The Draft Sale Framework does not replace or limit the application of existing RBI directions (especially the Prudential Stressed Asset Directions). Any regulated entity (that is permitted to take on loan exposures by its statutory or regulatory framework), can purchase stressed assets directly.

Promoters and Similar Persons Not Eligible to Buy Stressed Assets

The transferor is required to ensure that the transferee is not disqualified in terms of Section 29A of the Insolvency and Bankruptcy Code, 2016, and is not otherwise a promoter, associate, subsidiary or related person of the underlying obligor. Therefore, if there is an existing option to put loans on a promoter / similar entity, then the same may not be possible if the loan is a stressed asset.

In case of standard assets, the Draft Sale Framework has stipulated a table for MHP based on tenure of the loan. However, stressed assets are required to be held in the books of the lender for a period of 12 months.

Asset Classification and Provisioning

A purchased stressed asset can be classified as a ‘standard asset’ by the purchasing entity, in cases where the purchasing entity has no existing exposure to the borrower. However, in case, the purchasing entity has an existing exposure to the borrower whose stressed loan account is acquired, the asset classification of the purchased exposure shall be the same as the existing asset classification of the borrower with the transferee.

Transfer of Stressed Assets to ARCs

The Draft Sale Framework also deals with sale of stressed assets to asset reconstruction companies ( ARC ).

While Section 7 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 ( SARFAESI ) always provided that ARCs could issue debt instruments in lieu of the consideration payable for the acquisition of assets, RBI has now specifically provided for the same in the Draft Sale Framework. If such deals are done, it must clearly be established that the sale is effective. However, the Draft Sale Framework also provides that these instruments will have to be considered as debt on the books of the ARC, therefore implying that the ARC has an obligation to repay the debt and such oblgation cannot be linked to realization of the underlying asset. While this enabling provision is useful, ARCs are unlikely to opt for this route given that there is an obligation to repay the debt, the present structure of PTC may be the preferred option.

It is relevant to note that FPI entities continue to have the right to invest in security receipts and will also have the right to invest in the bonds issued by the ARC.

It is specifically clarified that transfer of stressed assets to non-ARCs can only be on a cash-consideration basis.

Swiss Challenge Method

In an attempt to de-regulate price discovery, the mandatory Swiss Challenge Method has been done away with. Lenders are now expected to put in place board approved policies on adoption of an auction-based method for price discovery.

Right of First Refusal

Under the current Guidelines on Sale of Stressed Assets by Banks, issued by the RBI on September 1, 2016, a bank selling a stressed asset is required to offer the right of first refusal to an ARC, which has already acquired the highest and significant share (~25-30%) in the asset. Such ARC is required to be provided the right to match the highest bid. In line with these guidelines, the Draft Sale Framework also provides the right of first refusal to ARCs, which hold a significant stake in the asset. Additionally, the Draft Sale Framework also provides that in the event such ARC does not want to purchase the asset or if no ARC holds a significant portion, then such right of refusal will have to be extended to a ‘financial institution’, if such institution holds a significant stake in the asset.

The Draft Sale Framework is a significant move by the RBI and is expected to streamline loan transfers in the country. This framework reinforces the RBI’s focus on addressing the health of banks and bad debt in the country, whilst remaining committed to a balanced approach on sale of assets. If passed in its current form, it will be a positive move by the regulator in developing a robust market for secondary transfers.

*Authors would like to thank Vidhi Sarin , Associate for her inputs.

- Submission Guidelines

Impact of Assignment and Novation on Arbitration Agreements

[ Kunal Kumar is 4th Year B.A., LL.B. student at National Law University, Jodhpur]

Introduction

In light of the judgment delivered by the Supreme Court in BALCO , Part I of the Indian Arbitration and Conciliation Act, 1996 (the “Act”) has no applicability to foreign-seated arbitration (except in case of agreements concluded prior to the judgment), and the parties shall be referred to arbitration under section 45. The only bar to refer parties to foreign-seated arbitrations are those which are specified in section 45 of the Act, [1] which makes it clear that if there is prima facie evidence of a valid arbitration agreement, the dispute should be referred to arbitration.

In World Sport Group , the Supreme Court held that a judicial authority, when seized of an action in a matter in respect of which the parties have made an agreement referred to in section 44 shall, at the request of one of the parties, refer the parties to arbitration, unless it finds that the said agreement is null and void, inoperative or incapable of being performed.

Determining the validity of the agreement: does the assignment or novation of the agreement make it invalid?

If the agreement entered between the parties does not suffer from any lacuna, there is no fraud or misrepresentation which could have led the agreement to be null and void, and consent given by the appellant therein is qualified consent, the arbitration agreement will be a valid agreement and the parties shall have to be referred to arbitration. The Delhi High Court held in Mcdonalds that if the arbitration agreement is affected by some invalidity since its inception, such as lack of consent due to misrepresentation, duress, fraud or undue influence, then it is said to fall within the meaning of the expression ‘null and void’ under section 45.

The word “inoperative” can be said to cover those cases where the arbitration agreement has ceased to have effect, such as revocation or when an arbitral award has already been passed. The words “incapable of being performed” applies to those cases where the arbitration cannot be effectively set into motion. [2]

Assignment & Novation : Assignment of an arbitration agreement by substituting a third party is a valid procedure. It was observed in Kotak Mahindra Prime Ltd. v. Sanjeev that the assignability depends on the subject matter of the arbitration agreement and the assignment is regulated under the law of assignment of contractual rights and obligations.

But, under section 62 of the Indian Contract Act, 1872 ,when the main agreement is novated, rescinded or altered, it loses its validity and hence the arbitration agreement becomes void. The principle is that if the contract is superseded by another, the arbitration clause, being a component part of the earlier contract, falls with it.

However, courts have relied on the doctrine of severability to refer the dispute to arbitration. As held in Delhi Metro case, an arbitration agreement when assigned to a substituted third party will not novate the agreement and the obligations will flow from the main agreement which would have to be observed.

Severability of the arbitration agreement from the main contract

It is a well accepted jurisprudence that the arbitration agreement can be severed from the main agreement subsequent to its termination. [3] As severability tends to insulate the arbitration clause, it ensures that the arbitration shall be given effect provided severability of the arbitration clause is possible.

It was observed by the Supreme Court in Today Homes and Infrastructure Pvt. Ltd. , the arbitration agreement being a separate agreement does not stand vitiated if the main contract is terminated, frustrated or is voidable at the option of one party. The contrary opinion that the parties should not be referred to arbitration as all rights and liabilities flowing from the agreement get extinguished with termination of the main agreement, and nothing is left for the tribunal to decide, is not sustainable.

Article 6(4) of the ICC Rules of Arbitration permits the arbitral tribunal to continue to exercise jurisdiction and adjudicate the claims even if the main contract is alleged to be null and void or non-existent because the arbitration clause is an independent and distinct agreement.

The crucial test, as laid down in the case of Enercon (India) Limited , places reliance on the intention of the parties to arbitrate. If parties have agreed to resolve all their disputes by arbitration, they cannot at a later stage avoid such an arbitration agreement. In Chatterjee Petroleum Company & Ors . , it was observed that once the parties have agreed for arbitration, the Court should give effect to the arbitration agreement and litigation should not be resorted to.

Thus, in a foreign-seated arbitration, under section 45 of Act the courts shall have to refer the dispute to arbitration unless the arbitration agreement has become null and void , inoperative or incapable of being performed. As discussed above, an assignment and novation of the main agreement shall not be treated as a bar to refer the dispute to arbitration. Even if the main agreement gets terminated because of novation, the arbitration agreement can be severed from the main agreement to give effect to the intention of the parties.

Party autonomy is a foundation stone in the success of building the whole process of arbitration. Intervention by the national courts, if excessive or too intrusive, will defeat the whole arbitration process, destroying its sanctity and benefits; and in the long term may lead to crumbling of the institution of arbitration.

– Kunal Kumar

[1] Shin-Etsu Chemical Co. v Aksh Optifibre , (2005) 7 SCC 234.

[2] Albert Jan Van Den Berg, The New York Convention, 1958: An Overview at p. 11.

[3] Mulheim Pipe coatings GmbH v. Welspun Fintrade Ltd. and Anr. (Bom HC, 2013).

About the author

Add comment

Cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Invoking India’s Money Laundering Regime for Environmental Crimes: Impact on Businesses

Data-protection in the international arbitration regime.

- ‘Beneficial Owner’ is not a ‘Related Party’ under the IBC

The Unavailability of Writ Jurisdiction for Interference with One-Time Settlements

SUBSCRIBE TO BLOG VIA EMAIL Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Top Posts & Pages

- Supreme Court on the Regularization of Temporary Employees

- A Stamp Paper – What Good is it Beyond Six Months?

- SEBI’s Order in the DLF Case: A Summary

- Section 14, SARFAESI Act: Settling A Jurisdictional Conundrum

- Foreign Jurisdiction Clauses in Commercial Contracts: An Indian Perspective

- Creditors with Rejected Claims: Methods to Address Inadequacies under the IBC

- Termination of Worker For ‘Loss of Confidence’ Does Not Amount To Retrenchment

- Validity of Employment Bonds in India

Recent Comments

- Umakanth Varottil on Supreme Court Invokes Article 142 to Permit Withdrawal of CIRP

- Araz Mirbavandi on Supreme Court Invokes Article 142 to Permit Withdrawal of CIRP

- Hari Prakash on Guest Post: Reduction of Provident Fund Contributions to Statutory Limits

- Adv Ragav on Secondment Taxation and the Northern Operating Systems Case

- Suchith on Coffee Plantations under SARFAESI: A Bitter Brew

Social Media

- View @IndiaCorpLaw’s profile on Twitter

UK: Contracts: The Critical Difference Between Assignment and Novation

Introduction.

An assignment of rights under a contract is normally restricted to the benefit of the contract. Where a party wishes to transfer both the benefit and burden of the contract this generally needs to be done by way of a novation. The distinction between assignment and novation was addressed recently in the case of Davies v Jones (2009), whereby the court considered whether a deed of assignment of the rights under a contract could also transfer a positive contractual obligation, which in this instance included the obligation to pay.

Mr Jones (the first defendant) contracted to sell Lidl (the second defendant) a freehold property (the "Lidl Contract"). At that time, the freehold was vested in the claimants as trustees of a retired benefit scheme. Mr Jones contracted to buy the land from the claimants (the " Trustee Contract") and assigned his right, title and interest to the Trustee Contract to Lidl by way of a deed of assignment.

Clause 18 of the Trustee Contract permitted Mr Jones, as purchaser, to retain £100,000 from the purchase monies payable to the claimants until the outstanding works (ground clearance and site preparation) had been completed. Following completion of the works Mr Jones was entitled to retain one half of the proper costs from the retention and release the balance to the claimants. There was a similar clause in the Lidl Contract, which allowed Lidl to retain the proper costs from the retention. Importantly, although similar, under the Lidl Contract Lidl was entitled to retain the whole cost of carrying out the works as against only half in the Trustee Contract.

Lidl retained the sum of £100,000 from the money due by Mr Jones to the claimants on completion of the contract. Once the works were completed Mr Jones failed to pay the claimant the retention monies claiming that the proper cost of the works was over £200,000.

The claimants argued that the benefits granted by way of the assignment were conditional on Lidl performing Mr Jones' obligations under the Trustee Contract. Therefore, the question considered by the court was whether Lidl was bound to observe the terms of the Trustee Contract and in particular clause 18, given that benefit of the contract had been assigned to them.

The court held that the benefit which passed to Lidl by way of the deed of assignment did not require Lidl to perform the obligations of Mr Jones under the Trustee Contract. The assignment did not impose any burden on Lidl. The only person who clause 18 of the Trustee Contract was binding on was Mr Jones. The transfer to Lidl could not impose on Lidl the obligation to perform Mr Jones' obligations and these therefore remained with Mr Jones. This reaffirms the principle that when you take an assignment of a contract, you don't take on the burden (except in limited circumstances where enjoyment of the benefit is conditional on complying with some formality). Therefore, if an owner assigns a building contract to a purchaser of land and the building is still under construction, the obligation to pay the contractor remains with the original owner and does not pass to the new owner.

Assignment and novation in the Construction Industry

Both assignment and novation are common within the construction industry and careful consideration is required as to which mechanism is suitable. Assignments are frequently used in relation to collateral warranties, whereby the benefit of a contract is transferred to a third party. Likewise, an assignment of rights to a third party with an interest in a project may be suitable when the Employer still needs to fulfil certain obligations under the contract, for example, where works are still in progress. A novation is appropriate where the original contracting party wants the obligations under the contract to rest with a third party. This is commonly seen in a design and build scenario whereby the Employer novates the consultants' contracts to the Contractor, so that the benefit and burden of the appointments are transferred, and the Employer benefits from a single point of responsibility in the form of the Contractor.

If the intention is that the assignee is to accept both the benefit and burden of a contract, it is not normally sufficient to rely on a deed of assignment, as the burden of the contract remains with the assignor. In these instances a novation would be a preferable method of transferring obligations, and this allows for both the benefit and burden to be transferred to the new party and leaves no residual liability with the transferor.

Reference: Davies v Jones [2009] EWCA Civ 1164 .

This article was written for Law-Now, CMS Cameron McKenna's free online information service. To register for Law-Now, please go to www.law-now.com/law-now/mondaq

Law-Now information is for general purposes and guidance only. The information and opinions expressed in all Law-Now articles are not necessarily comprehensive and do not purport to give professional or legal advice. All Law-Now information relates to circumstances prevailing at the date of its original publication and may not have been updated to reflect subsequent developments.

The original publication date for this article was 07/06/2010.

© Mondaq® Ltd 1994 - 2024. All Rights Reserved .

Login to Mondaq.com

Password Passwords are Case Sensitive

Forgot your password?

Why Register with Mondaq

Free, unlimited access to more than half a million articles (one-article limit removed) from the diverse perspectives of 5,000 leading law, accountancy and advisory firms

Articles tailored to your interests and optional alerts about important changes

Receive priority invitations to relevant webinars and events

You’ll only need to do it once, and readership information is just for authors and is never sold to third parties.

Your Organisation

We need this to enable us to match you with other users from the same organisation. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use.

Novations in India

Nitin sarin.

Managing Partner

Sitting at the recent Cape Town Convention Academic Project Conference held in Oxford in September 2017, an interesting discussion was taking place between New York law experts on one hand and English Law experts on the other.

The quality of discussions was crisp, immaculate and informative. The panel of the hour was being moderated by Sir Roy Goode (the brainchild of the Cape Town Convention) and Mr. Jeffrey Wool, Secretary General of the Aviation Working Group.

The New York practitioners were representing that under New York law, “ assignments ” of aircraft agreements are recognized while the English Law practitioners were arguing as to how “ novations ” were recognized in their jurisdiction.

Interestingly, the English law specialists highlighted the fact that the term “ novation ” remains undefined ( which is understandable considering the English legal system ). This got me thinking that the closest the British ever got to defining a “ novation ” was through enacting the Indian Contract Act, 1872 (Act No. 9 of 1872).

In 1872, India was still a colony of the British ( it would gain independence only 75 years later in 1947 ) and its laws were still made by England ( the Imperial Legislative Council ).

The Indian Contract Act 1872 contains section 62 which reads as under:

“ Contracts which need not be performed

62. Effect of novation, rescission, and alteration of contract:

If the parties to a contract agree to substitute a new contract for it, or to rescind or alter it, the original contract need not be performed.

Illustrations

(a) A owes money to B under a contract. It is agreed between A, B and C, that B shall thenceforth accept C as his debtor, instead of A. The old debt of A to B is at an end, and a new debt from C to B has been contracted.

(b) A owes B 10,000 rupees. A enters into an agreement with B, and gives B a mortgage of his (A’s) estate for 5,000 rupees in place of the debt of 10,000 rupees. This is a new contract and extinguishes the old.

(c) A owes B 1,000 rupees under a contract, B owes C 1,000 rupees. B orders A to credit C with 1,000 rupees in his books, but C does not assent to the agreement. B still owes C 1, 000 rupees, and no new contract has been entered into.”

The Indian judicial system has, through precedent, certainly built on Section 62 over the last 145 years or so, however, it would still be somewhat of an erroneous statement to state that the British have never defined a “novation”.

Perhaps some food for thought for those English practitioners mentioned above?

Also, it is apt to answer one of the most commonly asked questions by our clients: “Would an Indian court accept a novation of a lease agreement?”

The answer, put succinctly is that Indian law recognizes the concept of a “ novation ” and especially in aircraft transactions, a valid novation of an agreement, which satisfies all the other tests of the Indian Contract Act, 1872 to be a valid contact ( offer, acceptance of offer, consideration and competency to contract, etc. ) would be treated as a valid and binding document in the eyes of law.

Assignment and Novation: Spot the Difference 12 November 2020

- Transfer of rights

- Contribution

- EPC Contract

The English Technology and Construction Court has found that the assignment of a sub-contract from a main contractor to an employer upon termination of an EPC contract will, in the absence of express intention to the contrary, transfer both accrued and future contractual benefits.

In doing so, Mrs Justice O’Farrell has emphasised established principles on assignment and novation, and the clear conceptual distinction between them. While this decision affirms existing authority, it also highlights the inherent risks for construction contractors in step-in assignment arrangements.

"This decision shows the court’s desire to give effect to clear contractual provisions, particularly in complex construction contracts, even where doing so puts a party in a difficult position."

This preliminary issues judgment in the matter of Energy Works (Hull) Ltd v MW High Tech Projects UK Ltd & Others¹ , is the latest in a long series of decisions surrounding the Energy Works plant, a fluidised bed gasification energy-from-waste power plant in Hull². The defendant, MW High Tech Projects UK Ltd (“MW”), was engaged as the main contractor by the claimant and employer, Energy Works (Hull) Ltd (“EWHL”), under an EPC contract entered into in November 2015. Through a sub-contract, MW engaged Outotec (USA) Inc (“Outotec”) to supply key elements for the construction of the plant.

By March 2019, issues had arisen with the project. EWHL terminated the main contract for contractor default and, pursuant to a term in the EPC contract, asked MW to assign to it MW’s sub-contract with Outotec. The sub-contract permitted assignment, but MW and EWHL were unable to agree a deed of assignment. Ultimately, MW wrote to EWHL and Outotec, notifying them both that it was assigning the sub-contract to EWHL. EWHL subsequently brought £133m proceedings against MW, seeking compensation for the cost of defects and delay in completion of the works. The defendant disputed the grounds of the termination, denied EWHL’s claims, and sought to pass on any liability to Outotec through an additional claim under the sub-contract. Outotec disputed MW’s entitlement to bring the additional claim on the grounds that MW no longer had any rights under the sub-contract, because those rights had been assigned to EWHL.

The parties accepted that a valid transfer in respect of the sub-contract had taken place. However, MW maintained that the assignment only transferred future rights under the sub-contract and that all accrued rights – which would include the right to sue Outotec for any failure to perform in accordance with the sub-contract occurring prior to the assignment – remained with MW. In the alternative, MW argued that the transfer had been intended as a novation such that all rights and liabilities had been transferred. As a secondary point, MW also claimed eligibility for a contribution from Outotec under the Civil Liability (Contribution) Act 1978 for their alleged partial liability³.

An assignment is a transfer of a right from one party to another. Usually this is the transfer by one party of its rights and remedies, under a contract with a counterparty, to a third party. However, importantly, the assignor remains liable for any obligations it owes under the contract. As an example, Party A can assign to Party C its right to receive goods under a contract with Party B, but it will remain liable to pay Party B for those goods. Section 136 of the Law of Property Act 1926 requires a valid statutory assignment to be absolute, in writing, and on notice to the contractual counterparty.

Key contacts

Rebecca Williams

Partner London

Mark McAllister-Jones

Counsel London

"In the absence of any clear contrary intention, reference to assignment of the contract by parties is understood to mean assignment of the benefit, that is, accrued and future rights."

In this case, the precise scope of the transferred rights and the purported assignment of contractual obligations were in issue. Mrs Justice O’Farrell looked to the House of Lords’ decision in Linden Gardens⁴ to set out three relevant principles on assignment:

- Subject to any express contractual restrictions, a party to a contract can assign the benefit of a contract, but not the burden, without the consent of the other party to the contract;

- In the absence of any clear contrary intention, reference to assignment of the contract by parties is understood to mean assignment of the benefit, that is, accrued and future rights; and

- It is possible to assign only future rights under a contract (i.e. so that the assignor retains any rights which have already accrued at the date of the assignment), but clear words are needed to give effect to such an intention.

Hence, in relation to MW’s first argument, it is theoretically possible to separate future and accrued rights for assignment, but this can only be achieved through “careful and intricate drafting, spelling out the parties’ intentions”. The judge held that, since such wording was absent here, MW had transferred all its rights, both accrued and future, to EWHL, including its right to sue Outotec.

Whereas assignment only transfers a party’s rights under a contract, novation transfers both a party’s rights and its obligations . Strictly speaking, the original contract is extinguished and a new one formed between the incoming party and the remaining party to the original contract. This new contract has the same terms as the original, unless expressly agreed otherwise by the parties.

Another key difference from assignment is that novation requires the consent of all parties involved, i.e. the transferring party, the counterparty, and the incoming party. With assignment, the transferring party is only required to notify its counterparty of the assignment. Consent to a novation can be given when the original contract is first entered into. However, when giving consent to a future novation, the parties must be clear what the terms of the new contract will be.

"Mrs Justice O’Farrell stressed that “it is a matter for the parties to determine the basis on which they allocate risk within the contractual matrix.”"

A novation need not be in writing. However, the desire to show that all parties have given the required consent, the use of deeds of novation to avoid questions of consideration, and the use of novation to transfer ‘key’ contracts, particularly in asset purchase transactions, means that they often do take written form. A properly drafted novation agreement will usually make clear whether the outgoing party remains responsible for liabilities accrued prior to the transfer, or whether these become the incoming party’s problem.

As with any contractual agreement, the words used by the parties are key. Mrs Justice O’Farrell found that the use of the words “assign the sub-contract” were a strong indication that in this case the transfer was intended to be an assignment, and not a novation.

This decision reaffirms the established principles of assignment and novation and the distinction between them. It also shows the court’s desire to give effect to clear contractual provisions, particularly in complex construction contracts, even where doing so puts a party in a difficult position. Here, it was found that MW had transferred away its right to pursue Outotec for damages under the sub-contract, but MW remained liable to EWHL under the EPC contract. As a result, EWHL had the right to pursue either or both of MW and Outotec for losses arising from defects in the Outotec equipment, but where it chose to pursue only MW, MW had no contractual means of recovering from Outotec any sums it had to pay to EWHL. Mrs Justice O’Farrell stressed that “it is a matter for the parties to determine the basis on which they allocate risk within the contractual matrix.” A contractor in MW’s position can still seek from a sub-contractor a contribution in respect of its liability to the employer under the Civil Liability (Contribution) Act 1978 (as the judge confirmed MW was entitled to do in this case). However, the wording of the Act is very specific, and it may not always be possible to pass down a contractual chain all, or any, of a party’s liability.

Commercially, contractors often assume some risk of liability to the employer without the prospect of recovery from a sub-contractor, such as where the sub-contractor becomes insolvent, or where the sub-contract for some reason cannot be negotiated and agreed on back-to-back terms with the EPC contract. However, contractors need to consider carefully the ramifications of provisions allowing the transfer of sub-contracts to parties further up a contractual chain and take steps to ensure such provisions reflect any agreement as to the allocation of risk on a project.

This article was authored by London Dispute Resolution Co-Head and Partner Rebecca Williams , Senior Associate Mark McAllister-Jones and Gerard Rhodes , a trainee solicitor in the London office.

[1] [2020] EWHC 2537 (TCC)

[2] See, for example, the decisions in Premier Engineering (Lincoln) Ltd v MW High Tech Projects UK Ltd [2020] EWHC 2484, reported in our article here , Engie Fabricom (UK) Ltd v MW High Tech Projects UK Ltd [2020] EWHC 1626 (TCC) and C Spencer Limited v MW High Tech Projects UK Limited [2020] EWCA Civ 331, reported in our article here .

[3] The Civil Liability (Contribution) Act 1978 allows that “ any person liable in respect of any damage suffered by another person may recover contribution from any other person liable in respect of the same damage whether jointly with him or otherwise .”

[4] Linden Gardens Trust Ltd v Lenesta Sludge Disposals Ltd [1994] 1 AC 85

Related stories

Commercial disputes weekly – issue 200, the eu data act: when aviation meets the internet of things, uae case law update – recent dubai court of cassation judgment on recovery of legal costs in arbitration, follow us on.

- X (Twitter)

Aviation Finance & Leasing 2023

Law and practice, trends and developments.

Sarin & Co is one of the oldest firms in India. Originally established in 1932 in Lahore (now in Pakistan), the firm has been in existence for over 90 years. Traditionally a firm of litigators, Sarin & Co branched out into the field of aviation with the joining of Mr Nitin Sarin in 2008. Since then, the aviation team (consisting of six lawyers) and a head of operations have represented some of the largest banks and aircraft leasing companies, handled transactions worth billions of dollars, and also carried out some of the most complex aircraft leasing and financing transactions including aircraft repossessions in the country. In 2022, the firm was offered a position on the Legal Advisory Panel of the Aviation Working Group. The firm primarily advises foreign aircraft lessors, banks and financial institutions. It also represents select foreign airlines in India.

1. Aircraft and Engine Purchase and Sale

1.1 sales agreements, 1.1.1 taxes/duties payable upon execution of the sales agreement.

A sales agreement, if executed while the asset is in India, runs the risk of being levied with several taxes in India, such as goods and services tax and stamp duty. Where an original document (executed outside of India) is not stamped with the requisite stamp duty, it must be affixed with the requisite stamp duty within three months after it has been received in India. Certain states also impose stamp duty on copies of sales agreements.

1.1.2 Enforceability Against Domestic Parties

The enforceability of a sales agreement will not be affected by the language it is written in. However, should a sales agreement need to be submitted to a court or a government entity, it is recommended that it is translated into English and notarised. Furthermore, if a document is not properly stamped, courts in India have the power to detain the document and refuse to admit it into evidence unless and until it is properly stamped.

1.2 Transfer of Ownership

1.2.1 transferring title.

Under Indian law, if there is an offer by one party which is accepted by another for consideration, such an act or series of acts shall constitute "transferring title", and this holds for all installed parts, including an auxiliary power unit (APU).

Under the general applicability of Indian law, the sale of an ownership interest in an entity that owns an aircraft or engine shall be recognised as a sale of that entity only.

1.2.2 Sales Governed by English or New York Law

There is no prohibition on bills of sale in relation to aircraft or engines being governed by any foreign law in India.

A bill of sale should ideally note that a valid contract has been entered into, ie, that there has been an offer by the seller, acceptance by the purchaser, and the seller has received consideration.

1.2.3 Enforceability Against Domestic Parties

If a bill of sale is executed in any language other than English, it is recommended that a translated copy be provided for its proper enforcement. Further, notarisation is also recommended.

1.2.4 Registration, Filing and/or Consent From Government Entities

Generally, a bill of sale is not required to be registered or filed or subject to any consent from any government entity. At the time of registration of an aircraft, the registration authority may require a notarised copy of the bill of sale.

1.2.5 Taxes/Duties Payable Upon Execution of a Bill of Sale

Execution of a bill of sale or the consummation of the sale of the ownership interest may be taxed in India while an aircraft is located in India. Most such transactions are undertaken when the aircraft is flying over international waters or flying over or parked on the territory of another country.

2. Aircraft and Engine Leasing

2.1 overview, 2.1.1 non-permissible leases.

If validly executed, operating/wet/finance leases or leases concerning only engines or parts are permissible and will be recognised under the law of India. Wet and finance leases require specific approval of the regulatory authorities in advance of execution.

2.1.2 Application of Foreign Laws

It is fairly common for a foreign law-governed lease to be recognised in India. A court shall apply such law as long as the parties' rights deriving from such a lease are not opposed to public policy and are not in breach of Indian law.

2.1.3 Restrictions Concerning Payments in US Dollars

India is an exchange-controlled country; therefore, any remittance of foreign exchange (including US dollars) requires the approval of the Reserve Bank of India (RBI) or any authority it prescribes. Most of these approvals have been delegated by the RBI to its commercial banks – known as authorised dealer (or AD) banks, making it easier for a domestic lessee to make rent payments to foreign operating lessors in foreign exchange. Specific approval is required from the RBI in case of remittance of payments under finance leases.

2.1.4 Exchange Controls

Repatriation of foreign exchange as rent payments requires the indirect approval of the RBI. In relation to operating leases, the power to approve is delegated to authorised dealer (AD) banks – however, the remittance of payments for finance leases requires the specific approval of the RBI. Similarly, in cases where a lease is enforced by a foreign lessor (operating or finance), it also would require the RBI's approval before the repatriation of any realised proceeds.

2.1.5 Taxes/Duties Payable for Physical Execution of a Lease

Execution of a lease agreement physically in India would typically attract the levy of stamp duty. Even for lease agreements executed overseas, the stamp duty on them must be paid within three months of such a document’s entry into India.

2.1.6 Licensing/Qualification of Lessors

A lessor does not need to be licensed or otherwise qualified in India to do business with a domestic lessee. However, a foreign lessor based in a prohibited or sanctioned country would not be permitted to do business in India.

2.2 Lease Terms

2.2.1 mandatory terms for leases governed by english or new york law.

No mandatory terms are required to be in a lease; the lease itself must be a valid and binding contract between two parties competent to contract.

2.2.2 Tax and Withholding Gross-Up Provisions

Tax and "grossing up" clauses are permissible and may be enforced by the courts provided they form part of the binding contract entered into between the parties.

2.2.3 Parts Installed or Replaced After a Lease’s Execution

A lease agreement can cover parts installed or replaced on an aircraft or engine after its execution, provided the agreement contemplates such inclusion/coverage. For parts not covered under the lease, the parties may enter a simple side letter or short lease amendment agreement.

2.2.4 Risk of Title Annexation

India will recognise the separate (and distinct) rights of both the owner(s) of the airframe as well as the owner(s) of each engine. As such, with India being a common law jurisdiction, title annexation does not apply.

2.2.5 Recognition of the Concepts of Trust/Trustee

Indian law recognises the concept of a trust and the role of an owner trustee.

2.3 Lease Registration

2.3.1 notation of owner’s/lessor’s interests on aircraft register.

The Directorate General of Civil Aviation (DGCA) is the authority responsible for maintaining the aircraft register in India and records the details of the owner, lessor, operator and mortgagee (if applicable). The effect of such notation on the aircraft register shall amount to notice to all third parties regarding the existence of such an interest in that aircraft.

2.3.2 Registration if the Owner Is Different From the Operator

Registration is possible even if the owner differs from the operator. An aircraft, once registered, is issued a certificate of registration by the DGCA, which contains various details such as name, address and nationality of the owner, lessor, operator and mortgagee (if applicable) of the aircraft.

2.3.3 Aircraft/Engine-Specific Registers

At the time of registration of an aircraft taken on lease, the applicant is required to submit a copy of the lease agreement to the DGCA. DGCA requirements state that any lease amendments or novations must also be filed with the DGCA. There is no engine-specific register nor any requirement to submit a lease in relation to an aircraft engine to any authority in India.

2.3.4 Registration of Leases With the Domestic Aircraft Registry

An aircraft taken on lease by an Indian operator from a foreign lessor cannot be registered in India unless the applicant has submitted a copy of the lease to the DGCA. Leases are not subject to any consent from any government entity.

A copy of the lease agreement, the electronic CA-28 aircraft registration form, and other documents shall be filed for registering aircraft with the DGCA. This process may take anywhere from two to four weeks.

Before a lessee may import an aircraft into India, it must seek the consent of the DGCA. The DGCA first grants "in principle" approval for the import of the aircraft, subject to satisfaction regarding the safety of the aircraft intended to be imported, and then accords its final approval. While no consent is required as a pre-requisite to the execution of a lease, the "no objection" of the DGCA is required before the import of an aircraft on lease will be permitted.

2.3.5 Requirements for a Lease to Be Valid and Registrable

There is no specific form in which a lease must be registered on the aircraft registry. A lease needs to be translated into English, where it is executed in a different language. Further, a notarised copy of the lease would suffice to be valid and registrable on the aircraft registry.

2.3.6 Taxes/Duties Payable for Registering a Lease

There is a fee for registration of an aircraft on the Indian aircraft registry based on the aircraft's weight. Apart from this fee, no other taxes or duties are payable for registering a lease.

2.3.7 Registration of Aircraft in Alternative Countries

Aircraft habitually based in India must be registered in the country. There are very few circumstances in which a foreign-registered aircraft is permitted to operate habitually in India, the most common being in relation to a wet lease (when a foreign-registered aircraft is permitted to operate in India). Wet leases are also only permitted in the country in exceptional circumstances.

2.3.8 Requirements for Documents Concerning Registration

Copies of these documents must be uploaded on the DGCA's online platform, e-GCA, along with the completed CA-28 aircraft registration form (notarisation of the documents is recommended):

- customs clearance certificate/bill of entry of the aircraft;

- certificate of deregistration from the previous registering authority;

- evidence to the effect that the aircraft has been purchased or is wholly owned by the applicant;

- in case of aircraft purchased from a previous owner, then an affidavit to that effect;

- where aircraft is taken on a dry lease, then a copy of the lease agreement is to be annexed;

- where a company or corporation owns the aircraft, then a document of registration of the company and the names, addresses and nationalities of the directors;

- a copy of the import licence issued by the Directorate General of Foreign Trade or permission for the import of aircraft issued by the Ministry of Civil Aviation/DGCA;

- in cases where the aircraft has been mortgaged/hypothecated, the owner/operator shall submit their consent for this and the papers to this effect; and

- letters from the owner, lessor, operator and mortgagee (if applicable) confirming the names and nationality of their directors; and requesting for or consenting to (as the case may be) aircraft registration.

2.4 Lessor’s Liabilities

2.4.1 tax requirements for a foreign lessor.

A foreign lessor may be required to pay income or other taxes upon leasing an aircraft or engine to an Indian lessee depending upon the domicile of the foreign lessor as well as the provisions of the specific double taxation avoidance treaty with the country of domicile of the foreign lessor and India. Ordinarily, where a lessee is required to withhold tax but does not do so, the onus would remain with the lessee, and the responsibility would not shift to the foreign lessor.

2.4.2 Effects of Leasing on the Residence of a Foreign Lessor

A foreign lessor would ordinarily not be deemed to be resident, domiciled in or carrying out any business in India by virtue of being a party to a lease or because of enforcement of a lease. However, it is always prudent to have a tax expert study the relevant double tax avoidance treaty between the country of domicile of the foreign lessor and India.

2.4.3 Engine Maintenance and Operations

Unless the direct involvement and consequent negligence of the foreign lessor are proven in respect of aircraft or engine maintenance and operations, no liabilities would be imposed on the foreign lessor as a result of their being a party to such a lease.

2.4.4 Damage or Loss Caused by an Asset

A lessee under a dry lease remains primarily liable for loss or damage caused by the aircraft to third parties, injuries to the person or property of third parties or passengers, and is responsible for breach of environmental laws - albeit, in the event of a claim, both the lessor and the lessee would generally get sued. Needless to add, both the lessor and the lessee will be liable for negligence in relation to the aircraft arising as a result of their own acts and omissions.

The Indian law on vicarious liability confines the liability of the master only to the torts committed by their servants and agents where these were within the scope of the servant’s/agent’s authority. As the relationship between the lessor and lessee is on a principal-to-principal basis, there will be no vicarious liability either. However, there are four exceptions to the above rule:

- where the lessor retains control over the lessee, and interferes with and/or makes himself a party to the tortious act;

- where the act contracted to be done is wrongful or illegal;

- where a legal or statutory duty is imposed on the lessor; and

- where the act contracted to be done is, by its nature, likely to cause danger to others – in such a case, there is a duty on the part of the lessor to take all reasonable precautions against such a risk.

2.4.5 Attachment by Creditors

Creditors of a domestic lessee may exercise a lien over the aircraft. However, such creditors do not have the right to sell the leased aircraft.

2.4.6 Priority of Third Parties’ Rights

The following third-party rights would take priority over a lessor’s rights under an aircraft or engine lease:

- the Airports Authority of India can exercise a lien on the aircraft for any unpaid dues such as landing and parking charges – this also includes the private airport operators exercising under the powers vested to the Airports Authority of India;

- an unpaid bailee can exercise a mechanics lien;

- similarly, statutory dues such as taxes, workmen's wages, etc, form the first charge on the asset;

- the government or its agencies can confiscate, detain or requisition aircraft (whether foreign-owned or otherwise) under certain circumstances, such as if the central government declares an emergency or if the aircraft is involved in criminal activity.

2.5 Insurance and Reinsurance

2.5.1 requirement to engage domestic insurance companies.

Indian registered aircraft may be insured by an Indian insurer, who in turn would seek reinsurance on the international insurance market – provided, however, that there is a 5% reinsurance retention, ie, obligatory cession, which is mandatorily required to be reinsured with the General Insurance Company of India.

2.5.2 Mandatory Insurance Coverage Requirements

The operator must have insurance coverage for liability towards the hull, crew, passengers and third parties. Insurance is also mandatory for baggage, etc, as may be required under the Carriage by Air Act, 1972.

2.5.3 Placement of Insurances Outside of Jurisdiction

A 5% reinsurance retention is mandatorily required with the General Insurance Company of India.

2.5.4 Enforceability of “Cut-Through” Clauses

"Cut-through" clauses are enforceable in India.

2.5.5 Assignment of Insurance/Reinsurance

Assignments of insurances and reinsurances are routinely carried out in aircraft transactions in India.

2.6 Lease Enforcement

2.6.1 restrictions on lessors’ abilities.

A foreign lessor may terminate an aircraft lease should the lessee be in default of their obligations under the lease. As long as the foreign lessor is acting within the terms of the lease, there are no restrictions on their ability to terminate. A foreign lessor would be required to obtain permission from the customs authorities to re-export the aircraft from India. The sale of the aircraft following such termination is permissible.

2.6.2 Lessor Taking Possession of the Aircraft

There is no procedure for exercising self-help remedies under local laws in India. Peaceful repossession of the aircraft can, of course, be obtained without judicial intervention. Legally, the lessor may terminate the agreement and take possession or control of the aircraft. In cases where there is no cooperation, the lessor has the option to approach the court.

2.6.3 Specific Courts for Aviation Disputes

There are no specific courts that are explicitly competent to decide aviation disputes. The value, facts and circumstances of the aviation dispute would determine the forum.

2.6.4 Summary Judgment or Other Relief

The Code of Civil Procedure, 1908 (CPC) provides for summary procedures under Order XXXVII. Summary procedures may only be effective in cases where a foreign lessor seeks to recover unpaid rent and other monies under the lease and not to enforce the lease. The courts of law are ready to intervene upon proper proceedings being filed.

Interim measures such as the grounding of the aircraft can be obtained fairly quickly and usually within a week or two of the initiation of the legal action. Where there is an arbitration clause, the court and the arbitral tribunal have the power to pass an interim protection order.