- Español – América Latina

- Português – Brasil

Zerodha: Improving the retail investment experience with seamless collaboration on Google Workspace

About Zerodha

Founded in 2010, Zerodha is one of India's largest stock brokers, serving millions of users. The company offers investors attractive brokerage rates for all types of investments, including stocks, mutual funds, and commodities. The name Zerodha borrows from the English word, Zero, and Rodha, which means barrier in Sanskrit. Zerodha removes barriers for traders by charging a flat fee of 20 Indian Rupee, the equivalent of 27 cents, rather than a percentage commission in investment size. The company donates a portion of its profits to the Rainmatter Foundation, an NGO dedicated to combating climate change.

Tell us your challenge. We're here to help.

Zerodha enables employees to work remotely during the covid-19 lockdown with google workspace, enabling secure access to enterprise apps, while enabling real-time meetings anywhere with google meet..

- Collaborating on Docs for quicker development of blogs and company newsletters

- Transitioned 1,000+ staff with minimal effort to full remote work overnight using Google SSO with 2FA

- Onboards millions of users in 4 weeks Automate document verification with Vision AI to speed up application process

Enables new account opening in minutes instead of days

The rise of smartphone ownership in India in recent years alongside the pandemic has brought about a surge in retail investing. More people are choosing to enter the stock market through their mobile devices due to the ease of access. In fact, the Indian National Stock Exchange (NSE) reported that mobile trading jumped from less than 7% in 2019 to more than 19% in 2021. Zerodha , one of the largest online brokerages in India, experienced a double-digit growth in customers every month since the outbreak in 2019.

Featuring low brokerage fees and easy-to-use apps, Zerodha simplifies trading for anyone with a smartphone. By reducing manual tasks, the company keeps margins low and invests in developing digital solutions such as its flagship trading platform, Kite, and its mutual fund investing platform, Coin.

When Zerodha began operations in 2010, the team was eager to eliminate cumbersome tasks related to legacy solutions, such as managing mail servers. According to Vishnu Sudhakaran, full-stack developer at Zerodha, Google Workspace was the obvious choice. This was because Google Workspace was easy to set up for employees as they were already familiar with the Google ecosystem and did not require any training.

“Zerodha's guiding principle is scalability. Our trading platform grew to millions of users with the help of a small tech team,” says Vinay Kumar, AVP Technology at Zerodha. “Rather than managing email accounts and servers, we want engineers to focus on building digital solutions that our customers need.”

Team collaboration in the new normal with Google Workspace

Google Meet is now an integral part of life at Zerodha to help colleagues stay connected. Virtual meetings are a fairly new practice at Zerodha, as it only started to become a norm since the COVID-19 pandemic. Before, everyone would go into the office to work, so meetings were often face-to-face.

Employees use Meet for daily project meetings, monthly catch-ups, and even use them for social events, such as playing multiplayer games with team members. With the seamless integration of Meet with Google Chat , employees can also choose to start a meeting instantly through the Chat platform. This allows impromptu meetings to take place, whether it is a one-on-one or group meeting.

One of the value propositions that Zerodha provides is to empower traders through financial literacy. The marketing team does this by creating blog posts around topics like business valuation and option trading, that aim to educate customers, as well as generate new leads.

Using Docs , employees can view, edit, and share articles that are a work in progress internally in real time, so that they can get immediate feedback and input from each other all in the same document. They also use Docs to share meeting notes where necessary.

“Zerodha's guiding principle is scalability. Our trading platform grew to millions of users with the help of a small tech team. Rather than managing email accounts and servers, we want engineers to focus on building digital solutions that our customers need.”

Improving security and ease of access management with Google SSO

Protecting company and customer data is a top priority for Zerodha. For data protection beyond passwords, the company implemented Google Single Sign-On (SSO) with Two-Factor Authentication (2FA) in compliance with Securities and Exchange Board of India (SEBI) cybersecurity guidelines.

Employees now access enterprise apps with a single login using Google SSO and 2FA. To reduce security risks, employees who leave the company would have their Google account suspended, which in turn automatically disables access to all enterprise applications.

"Employees have access to different systems depending on their roles. SSO with 2FA from Google simplifies user authentication and access from any location and device,” says Sudhakaran. “Due to this architecture, we could move to work from home practically overnight with minimal impact on customers.” Even though pandemic restrictions are easing, Zerodha continues to support work from home as the default working arrangement.

As of November 2021, Zerodha upgraded its 1,000+ employees to the Enterprise plan to enhance security with features such as data loss protection (DLP), which prevents users from sharing sensitive data, and alerts administrators when users log in from unfamiliar devices.

"Employees have access to different systems depending on their roles. SSO with 2FA from Google simplifies user authentication and access from any location and device. Due to this architecture, we could move to work from home practically overnight with minimal impact on customers.”

Scaling up digital onboarding to meet regulatory changes

Each day, Zerodha receives around 25,000 account opening applications, all of which undergo a Know-Your-Customer (KYC) process as required by SEBI in order to minimize fraudulent activities such as identity theft and money laundering. Customers must provide KYC documents such as their Permanent Account Numbers (PAN) cards, to verify their identities. Pre-pandemic, there were about 2,500 accounts opened in a day, currently, we see around 15,000 accounts opened per day.

To simplify the KYC process, Zerodha deployed Vision AI in April 2020, which analyzes scanned copies of PAN cards submitted by users as proof of identity. Using optical character recognition, the system detects text in the images, extracts the PAN names and numbers and compares them to the information the clients themselves provided in their application forms. If their PAN cards don't match the information they provided, users receive an alert and will need to submit the correct documentation in order to open their accounts.

"Google Vision API helps us to validate the PAN card uploaded by the user in real-time, thereby avoiding a manual intervention from the support agent and this helps to significantly reduce the time spent on account opening for new users. By eliminating 80% of the manual process, we continue to improve the customer experience as we grow."

Zerodha Case Study & Strategies That Made Them Billion Dollar Company

Introduction .

The Indian stock market has been booming since the post-pandemic era, and Zerodha has played an important role in the growth of the Indian stock market by creating a hassle-free solution to trade and invest in the share market with less brokerage. Headquartered in Bangaluru, Zerodha is an Indian stock trading app and financial service company that is registered with the Securities and Exchange Board of India and a member of prominent stock exchanges in India like the NSE and BSE.

So, if you are a trader or investor, then you must be aware of what Zerodha is and how it works. However, have you ever thought about the success story of Zerodha or how it became a billion-dollar company without raising a single round of funding or burning millions of dollars on advertising?

In today’s blog post, I will walk you through the Zerodha case study and some of the strategies that have helped them become a billion-dollar brand.

Overview of Zerodha

The name Zerodha has been derived from the Sanskrit word Rodha, which means barrier in Sanskrit. And zero is just a number. So Zerodha means zero barriers to the people who are looking to invest. The company was founded by two brothers with a knack for trading and investing in the stock market, namely Nithin and Nikhil Kamath, on August 15, 2010. Since then, they have disrupted the Indian trading market with low-cost pricing, flat-fee brokerage, and zero brokerage on investment in mutual funds. Today, Zerodha contributes 5% of daily market turnover across various stock exchanges in India, making it the biggest and most used stock trading app in India.

Zerodha is a completely bootstrapped startup, meaning they don’t have any backing or raised funding. Today, they are valued at $2 billion and have clocked Rs 1000 crore in revenue with a profit of 440 crore rupees. That’s truly insane. There are several factors that led to their exponential growth in the Indian financial market. One of them is that they treat all clients with the same deal, and their brokerage calculator is completely transparent, making them different from their competitors. Zerodha’s Membership Information:

Zerodha NSE Member ID:Capital Market (CM): INB231390627 Future & Options (F&O): INF231390627 Currency Derivatives (CDS): INE231390627

Zerodha BSE Member ID:Capital Market (CM) – INB011390623Future & Options (F&O) – INF011390623

CDSL: IN-DP-CDSL-00278209

NSDL: IN-DP-NSDL-11496000

Zerodha NSE Registration Date: June 30, 2010

Zerodha BSE Registration Date: May 17, 2012

Background on Zerodha

The story started in 2005, when Nithin Kamath was a full-time trader and one HNI was impressed with his trading skills and portfolio. The HNI immediately wrote a check for Rs. 25 lakh and told Nithing to manage his demate account. Later on, Nithin left his job and stated that he was managing clients on a full-time basis and helping them with their investments in the stock market. This was the time when Nithin realized there was no single platform where he could switch different accounts seamlessly. To cope with this problem, Nithing joined Reliance Money as a sub-broker, which allowed him to buy and sell stocks on one single platform.

Over all these years, Nithin realized there was a huge gap between the commission charged by the brokers and the actual amount clients received after every trade. He also realized that many young people in India are interested in investing in the stock market, but they aren’t able to find one single platform for investing in the share market. That’s because of high brokerage charges and complex trading processes.

So, after working for almost more than 10 years in trading and the stock market, Nithin decides to become a broker himself. And not just an ordinary broker, but the one who decided to revolutionize the broking industry in India. Nithin, along with his brother Nikhil, who was a better trader, decided to start Zerodha.

The reason to start Zerodha was simple: to create a seamless trading platform at an affordable rate by charging a flat fee commission rather than charging brokerage based on the volume of trades. The aim was to remove all the barriers and eliminate the hurdles faced by investors and traders by paying a huge brokerage. Zerodha’s actual operation began in 2010. Prior to 2010, Nithin was looking to raise funding when the Indian financial market was going through a crisis. Also, none of the investors and VCs were confident enough in the idea of an online trading platform back then.

Nithin decided to use his savings to get things moving and bought refundable deposits to set up a small office space. It is show time now. In 2010, the business operations started growing with Zerodha’s user-friendly trading platform and technology. They only charged a flat fee of Rs 20 per trader, irrespective of the volume and size. This attracted many traders to get on Zerodha’s platform. In the first year of their operations, Zerodha managed to open 3000 demat accounts.

And they achieved all these without any funding or burning millions of marketing campaigns. At the beginning, they opted for community outreach, as Nithin was part of several online trading communities. This worked in favor of Zerodha. They also opted for a door-to-door marketing policy, and a combination of these strategies helped them acquire the initial customers.

The year 2015 was the major year for business operations, where things started taking more pace. The founders decided to make delivery on equity investments free of charge from a fee of Rs 20 to zero. This gave Zerodha growth, and in just 5 years, the customer base went from 30,000 to 14,00,000 lakh accounts in 2020. In the year 2019, Zerodha also becomes a market leader by leaving behind ICICI Securities, the then-market leader.

But tremendous growth was yet to come.

In the year 2020, COVID-19 fueled interest among individuals in stock investing and trading. This surge led to the massive growth of online trading platforms in India, including Zerodha. As a result, Zerodha surpassed its customer base by one crore, with 62 lakh active customers placing millions of orders per day. In the same year, after 10 years of operations, Zerodha became a profitable unicorn startup. In fact, it is one of the few profitable unicorn startups in India.

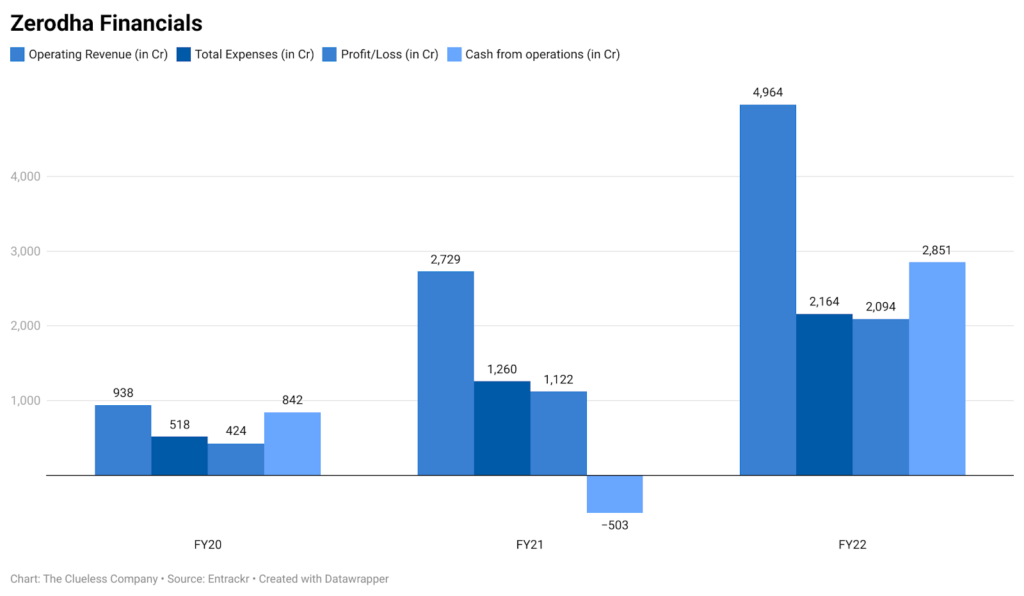

In FY22, the startup reported ₹4,964 crore in revenue and ₹2,094 crore in profits. And they achieved all this without VC funding and advertising.

One of the key reasons for Zerodha’s success is its customer-centric approach. Zerodha has always focused on providing excellent customer service and support.

One of the main reasons for Zerodha’s success is its customer-centric policy and approach, which gave it an edge in the market. Zerodha provides amazing customer service and support, which helps them retain customers and acquire new clients quickly. Plus, word-of-mouth marketing has helped them a lot. They have a dedicated customer support team that is always ready to go the extra mile to solve every query of their clients.

They have an active online community where clients can share their experiences and provide feedback.

Founding and History

Zerodha kicked off their operations in 2010 with the aim of breaking all the barriers that traders and investors faced while trading in the Indian stock market. Their aim was to tackle the high brokerage rate, provide better support, and leverage technology to create a seamless trading platform in India.

Today, they have disrupted the online stock market industry in India with their flat-fee pricing model and in-house technology. They have over 1 crore clients that place millions of orders every day on Zerodha, which is close to 15% of all the Indian retail trading volume.

Mission and Vision

Zerodha’s mission is to offer high-quality services through technology, innovation, and capacity enhancement in the domain of trading and investment, while their vision is to follow the standards of ethics and compliance fairly and transparently.

Growth and market presence

Zerodha’s triumph wasn’t solely attributed to its emphasis on technology and education; it also revolutionized the conventional brokerage model through the implementation of a flat fee structure. Instead of levying a percentage-based brokerage fee on the trade value, Zerodha opted for a groundbreaking flat fee of Rs. 20 per trade. This innovative fee structure proved to be a game-changer for the industry, drawing in a substantial number of investors seeking cost-effective trading services.

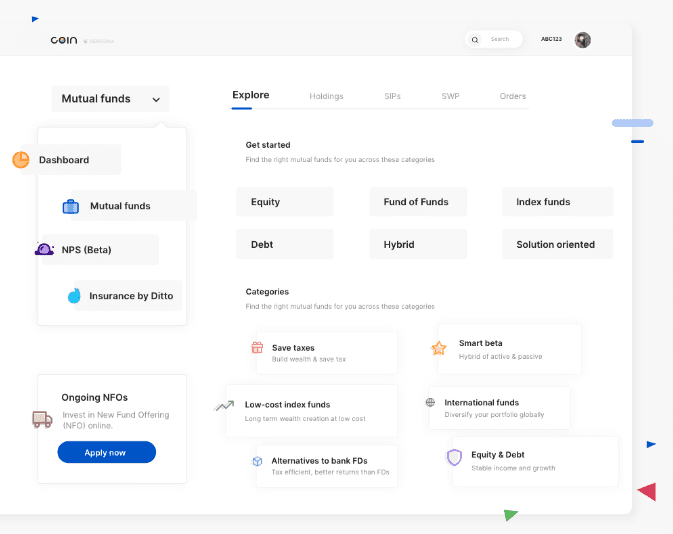

Another pivotal stride by Zerodha was the introduction of direct mutual funds, marking the company as the pioneer in India to provide such a service to its clients. This move not only enabled clients to save on fees but also enhanced their overall returns. Zerodha continued its streak of innovation with the introduction of discount brokerage services, the integration of UPI payments, and the launch of its proprietary mutual fund platform, Coin.

Business Model

Zerodha’s business model is based on low-margin and high-volume targets. They charge a flat fee rate of Rs 20 per trade for equalities and derivatives trading, irrespective of the volume of trade. For commodity trading, they charge 0.03% of the value of the transaction. This minimal pricing model has helped them to stand out in the market and be profitable. Besides, they also charge a certain fee annually for demand account maintenance.

Another thing that adds to their profitability is their business operation, which is mostly online. They have only one office, rather than having multiple offices across India.

This reduces the cost of running the business and adds to its profitability. Besides, they don’t burn money on marketing and advertising. All their customers and client bases have grown organically and with word-of-mouth marketing over the years.

Features of Zerodha

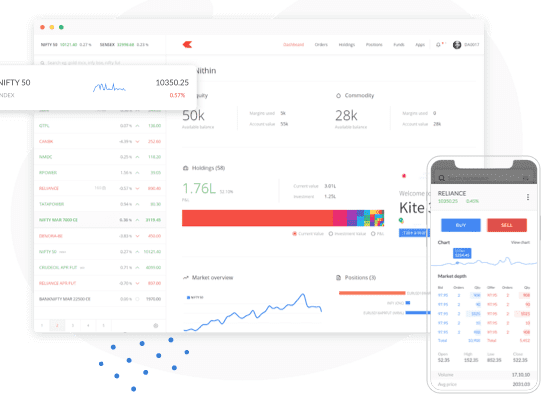

1. zerodha kite.

The most popular and widely used feature of Zerodha is its Kite trading platform , which is built with modern features and sensibilities to give investors a seamless trading experience. It has a user-friendly interface and more than 90,000 stocks to search from. You can also search for futures and options contracts across multiple exchanges quickly and without any hassle. To further make your trading process easy, Zerodha Kite has level 3 data, or 20 market depth. Level 3 data gives you deeper insights about the market and helps to curate the best trading strategies.

There is also an advanced charting system and tools with historical data for stocks, futures, and options contracts. You can use and make profitable traders.

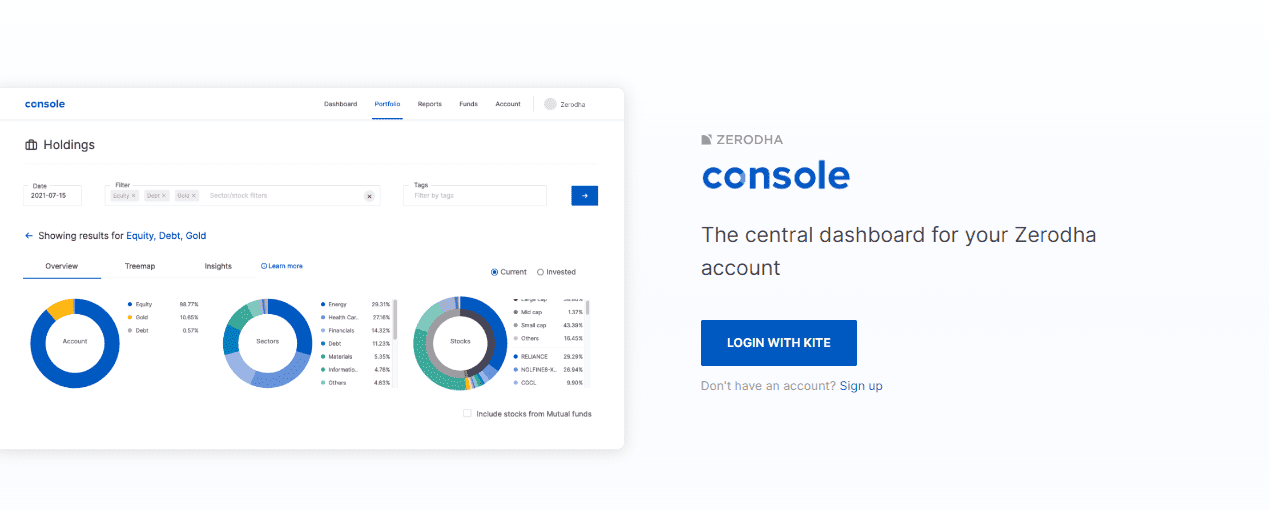

2. Zerodha Console

Zerodha Console is an in-depth analytics and reporting dashboard where you can see all your investments and portfolios in one place. You can check your investments in equity, mutual funds, debt, and gold from one single place. It gives you multi-dimensional insights on your trades and portfolio in pictorial format, allowing you to easily understand everything.

You can also check the complete history of your stocks right from the day of acquisition and understand your trades better with a per-trade charge breakdown. Console also gives you tax-ready reports for a full financial year, completely ready to be submitted to your chartered accountant.

3. Zerodha Coin

For those who want to directly invest in mutual funds, government securities, or gold bonds, Zerodha Coin is the place to be. You can buy mutual funds via coin with no commission passed back, directly from the asset management companies. You can either invest once or start your SIP with a set-up feature that will allow you to automatically increase the SIP amounts by your preferred percentage. You can start your SIP, stop it, or pause it as needed. SIP values can be increased and decreased at your own will.

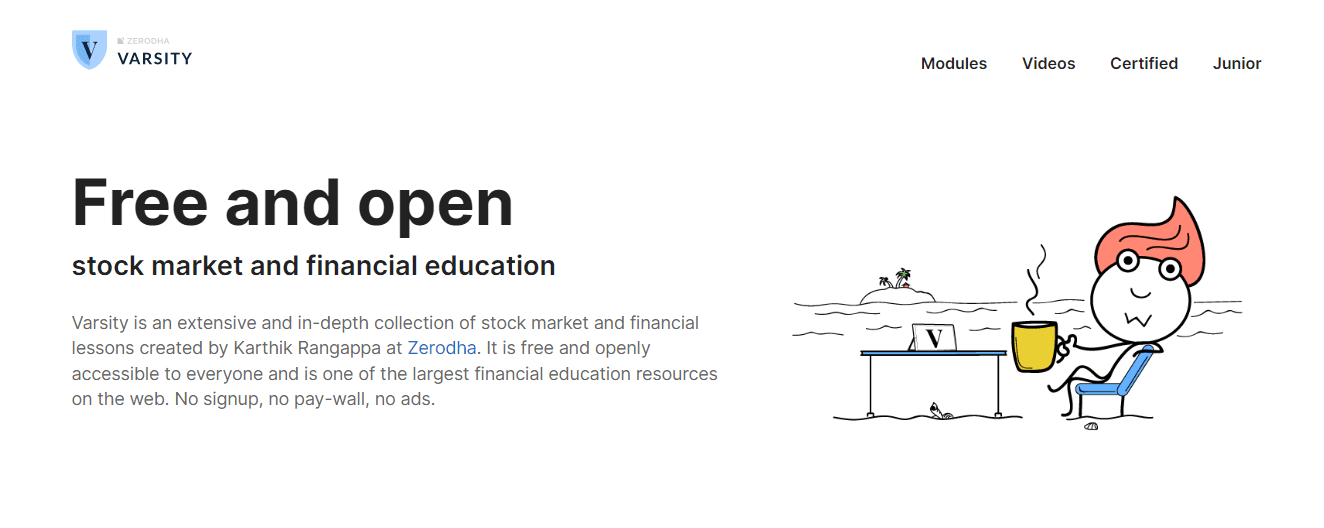

4. Zerodha varsity

Do you want to learn about stock marketing? Are you interested in trading but confused about where to start? If your answer to the above two questions is yes, then Zerodha Varsity is the place to be.

Zerodha Varsity is an online educational platform created by Zerodha, which is one of the largest retail stockbrokers in India. Zerodha Varsity provides comprehensive and free educational content related to various aspects of trading, investing, and financial markets. The platform is designed to help both beginners and experienced traders understand the complexities of the stock market, derivatives, technical analysis, fundamental analysis, and other related topics.

Zerodha Varsity offers courses in the form of modules, chapters, and lessons, covering a wide range of subjects in a structured manner. It includes text-based content, illustrations, and practical examples to make learning about the financial markets more accessible and engaging. Users can access Zerodha Varsity for free, making it a valuable resource for anyone looking to enhance their knowledge of the stock market and improve their trading or investment skills.

5. Zerodha API Connect

Are you a startup keen on building a trading platform? If yes, then you can surely use Zerodha’s API Connect to build a trading platform, execute real orders, get live market data, manage portfolios, and much more. You can make your own platform within a few minutes without the hassle of becoming a registered stockbroker.

Once you create your platform with Zerodha’s API Connect, it will become immediately accessible to the 4+ million customers of Zerodha, who can use it to place orders and execute trades within a few clicks.

Kite Connect provides a comprehensive broking-as-a-service solution, managing everything from onboarding and KYC to account opening and customer support. By utilizing our APIs, you can concentrate on developing your investment platforms while we handle the operational and regulatory aspects.

Challenges Faced by Zerodha

1. onboarding customers.

One of the major challenges that Zeordha faced was onboarding new clients during the initial days of its business operations. Zerodha did not have any funding or backing from a venture capital firm, so it was tough to get the customers on board with the platform. They decided to get a few customers on board with the help of community outreach and door-to-door marketing. By leveraging these two strategies, they gained the first 1,000 customers.

2. Credibility

Another reason that Zerodha faced was the credibility issue. Back in 2010, nobody believed in the concept of online trading. There is not a single trading platform or portal that traders and investors could use for investing. In fact, investing money via online portals would have sounded like a scam back then. However, by harnessing the power of technology and simplifying the trading process, Zerodha gained popularity and retained its existing customers.

In fact, the existing customers found the platform so useful that they recommended it to others.

Strategies for growth

1. trading communities.

During the initial days of their business, Zerodha’s founder, Nithin Kamath, leveraged the power of trading communities, which he was part of, to grow the business. Back then, there were no online platforms or social media. Nithin Kamath had good networking in the trading and stock market communities, which is used positively for marketing Zerodha.

2. Door-to-door marketing

Zerodha also did door-to-door marketing in their neighborhood during the initial days by distributing pamphlets and marketing materials. Back then, their team was small, so both the Kamath brothers used to knock on the doors of people and encourage them to use Zerodha for trading and investment.

3. Referral Program

The next top-rated strategy that Zerodha leveraged for scaling its business was the launch of the referral program. This strategy helped them grow their customer base to the next level. Through the referral program, Zerodha’s existing customers were enticed to refer the platform to their friends and family, and they would get a commission in return for every person who opened a Demat account via their referral link.

4. Word-of-mouth marketing

Zerodha’s platform was so good that it created hype in the trading communities, and people started loving the platform for its affordable services, seamless interface, and everything online. The majority of the customers that started using Zerodha did so because of word-of-mouth strategies and referrals from friends and family.

5. Technological leverage

Zerodha is also known for their technological advancements, which make them stand out from the crowd. Besides, they have curated an amazing user interface and an easy-to-use platform, which makes it easy for beginners to trade and invest.

Who can use Zerodha?

Zerodha is a financial services company based in India that primarily operates as a stock brokerage firm. It provides a platform for trading in stocks, commodities, and currencies. Zerodha’s services are available to:

Retail Investors: Individuals who want to invest or trade in the stock market can open an account with Zerodha. Whether you are a beginner or an experienced investor, Zerodha caters to a wide range of users.

Traders: Active traders who engage in frequent buying and selling of stocks, commodities, or currencies can use Zerodha’s platform for their trading activities.

Investors: Those who prefer long-term investments and want to buy and hold stocks for an extended period can also use Zerodha’s services.

Intraday Traders: Zerodha is popular among intraday traders who take advantage of short-term price movements to make quick profits.

Derivatives Traders: Zerodha provides facilities for trading in derivatives such as futures and options.

Small and Medium Enterprises (SMEs): Zerodha offers services to small and medium-sized enterprises for investing and managing their capital.

To use Zerodha, individuals need to open a trading and demat account with the company. It’s important to note that, as of my last knowledge update in January 2022, the information might have changed, and it’s advisable to check the latest terms and conditions on the official Zerodha website or contact their customer support for the most up-to-date information.

FAQs about the Zerodha Case Study

Zerodha is a leading Indian stock brokerage firm that offers online trading and investment services. It is known for its discount brokerage model and user-friendly trading platforms.

Zerodha case studies are in-depth analyses of specific scenarios or experiences related to Zerodha’s platform, services, or user interactions. These studies often highlight challenges, solutions, and outcomes, providing insights into the brokerage industry.

Zerodha case studies offer users valuable insights into real-life trading situations. By examining these cases, users can learn about effective strategies, risk management, and common pitfalls, helping them make informed decisions in their own trading activities.

Yes, Zerodha case studies can be beneficial for beginners. They provide practical examples and lessons that help novice traders understand the dynamics of the stock market, learn from others’ experiences, and enhance their trading skills.

Zerodha often shares case studies on its official blog, social media channels, or other platforms. Users can access these studies to gain insights into various aspects of trading, investment, and the use of Zerodha’s tools.

Zerodha case studies cover a wide range of topics, including but not limited to trading strategies, market analysis, technical analysis, platform features, customer experiences, and innovations within the brokerage industry.

Users can access Zerodha case studies on the official Zerodha website, blog, or other online platforms where the company shares information. Additionally, these case studies may be featured in educational materials, newsletters, or community forums associated with Zerodha.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

A Startup that Revolutionised the Indian Broking Industry | Success Story of Zerodha

Every year on January 16, India celebrates National Startup Day.

India now has over 72,000 startups, including 100+ unicorns.

But there are only a handful of bootstrapped startups that went on to become unicorn startups.

So, I decided to share the success story of a startup I admire, a bootstrapped one – Zerodha.

Let’s get to know this startup that made our investing and trading journey smooth like butter (Amul one 😋).

Table of Contents

About zerodha startup, the kamath brothers, how and when did zerodha start, growth of zerodha, what did zerodha do special, challenges and competition.

Before we move on to the story, check out these amazing startup stats for 2023.

I am pretty sure you must have heard this name a lot over the last 2-3 years.

And I can’t believe I was just 10 when two brothers, Nithin Kamath and Nikhil Kamath, founded Zerodha in 2010.

Zerodha is a financial services company offering discount brokerage services to retail Indian investors and traders.

They offer investing and trading services in the stock market, currency and commodities markets, mutual funds, and bonds.

And you won’t believe this, Zerodha is India’s largest brokerage firm in terms of active customers.

Wow! A bootstrapped startup without spending a penny on advertising has over 1 crore customers with 62 lakh+ active customers.

So, how did this happen?

Well, let’s get the ball rolling.

Nithin Kamath, the founder and CEO of Zerodha, started stock trading at the age of 17.

Having been introduced to the stock market by his friends, he started trading in penny stocks and made a good amount of money. But in the 2001-02 market crash, he lost it all.

This prompted Nithin to work in a call center at night, while he traded during the day.

Later, he joined Reliance Money as a sub-broker, and he made a lot of money by handling big client accounts.

Nikhil Kamath, co-founder and CTO of Zerodha, followed in his brother’s footsteps.

Nikhil dropped out of school after the 10th standard to play chess. (Quite a bold decision!)

But at the age of 17, he started working full-time at a call center. He also started stock trading after following his brother and friends.

As Nikhil got more experienced in trading, he started managing the assets of his friends and colleagues. Later, he joined Way2Wealth as a sub-broker.

So, how did these two brothers stumble upon the idea of establishing Zerodha?

Let’s find out.

In 2005, a foreign HNI was impressed with Nithin’s trading portfolio. So, he gave Nithin a ₹25 lakh cheque to manage his Demat account.

Later, he left his call center job as he started handling more accounts.

But, there was a problem.

There was no single platform where Nithin could switch between different accounts seamlessly.

To tackle this situation, in 2006 he joined Reliance Money as a sub-broker. This allowed him to buy and sell stocks from a single platform.

But in all this, he realised one thing. There was a huge gap between the commissions charged by the brokers and the actual amount clients got after the transaction.

He also figured out why many young people are not interested in stock trading. The reason was simple – high brokerage charges and a complex trading process.

As Nithin had worked with many brokerage firms, he recognized the challenges faced by traders.

So, after trading for almost a decade, Nithin decided to become a broker. And not just an ordinary broker; he also decided to revolutionise the broking industry.

Then both the brothers quit their jobs and started building Zerodha. But the journey ahead was going to be tough.

The reason behind starting Zerodha was to empower traders by providing a simple-to-use and affordable trading platform.

They simply wanted to eliminate all the hurdles faced by the traders and make their trading experience a walk in the park.

And that’s how they came up with the name Zerodha. ‘Rodha’ is a Sanskrit word for hurdle or barrier. Now, do I need to tell you what Zero means? 😁

When the two words are combined, it means “no hurdles” or “zero hurdles”.

So, how did they remove the obstacles and went on to become the largest brokerage company in India?

Well, here’s the story.

Just before Zerodha was founded, financial markets went through a crisis in 2008-09.

Nithin was looking for VC funding, but VCs were reluctant to fund an online brokerage startup after the market crash. Rather, they were not interested in investing money in any startup.

So, he decided to use his savings to get things moving. And most of the savings went into purchasing exchange refundable deposits and setting up an office space.

Everything was set, and now it was show time.

Zerodha’s operations began on August 15, 2010. And this made them India’s first discount brokerage firm.

They launched a user-friendly and easy-to-use trading platform using the latest technology.

On top of that, they only charged a flat fee of ₹20 on every trade, irrespective of its size, with zero brokerage fees and an annual maintenance fee of ₹300.

This disrupted the whole brokerage industry. Zerodha did what other traditional brokers couldn’t do.

But they had to tackle some challenges.

One of the major issues was to onboard traders on Zerodha’s platform.

Since they didn’t get any VC funding and had fewer savings, doing a marketing campaign was out of the question.

So, they decided to do community outreach, and Nithin was already part of some online trading communities. This worked in their favour for distributing the early version of Zerodha.

And they didn’t just stop at community building; they also did door-to-door marketing.

Both of these strategies helped them onboard their first 1,000 customers. (Yay!)

Zerodha did this without spending money on advertising, and they still don’t spend money on it. (No kidding)

In the first year of their operations, they managed to open 3000 Demat accounts.

Now, you must be thinking, “Just 3000 accounts!”

Yeah. Look, serving in a market like India is not easy. People become suspicious if you do something different from everyone else.

And most traders were reluctant to use Zerodha’s services as they did not offer any research services.

This was their second issue – less credibility.

Unlike full-service brokers, they didn’t offer any stock buy or sell recommendations.

To overcome this, they launched Varsity, a collection of stock market lessons and terms.

Again, they used technology to simplify the stock investing and trading processes. And to retain the customers, they created a superior trading platform.

After resolving these issues, Zerodha had 17,500 clients investing and trading on Indian stock exchanges. But things were about to go upward.

In 2015, the founders decided to make the delivery of equity investments free of charge. From a fee of ₹20 per order to ZERO fee.

This resulted in the first wave of Zerodha’s growth. In just 5 years, the customer base went from 30,000 accounts (2015) to 14 lakh accounts (2020).

When all this was happening, in 2019, Zerodha became the market leader by toppling ICICI Securities.

But this was just the tip of the iceberg.

In 2020, two things happened.

First, the Covid-19 lockdown fueled the interest of Indians towards stock investing and trading.

This surge in interest led to massive growth as many new customers opened Demat accounts through Zerodha.

As a result, their user base surpassed one crore, with over 62 lakh active customers placing millions of orders per day.

Second, after 10 years of operations, Zerodha became a profitable unicorn startup. One of the few profitable unicorns!

And this spectacular growth is also reflected in Zerodha’s revenue and profits.

In FY22, the startup reported ₹4,964 crore in revenue and ₹2,094 crore in profits. And they achieved all this without VC funding and advertising.

So, how did they achieve this?

The Kamath brothers were well aware of the challenges faced by the traders. And they offered a simple solution by building Zerodha’s online trading platform.

As I said earlier, the founders tried to remove obstacles like high brokerage fees, lack of transparency, and complex trading processes.

And traders were introduced to a smart trading platform at a low cost, which made their trading journey easier.

Also, Zerodha’s business model was based on low margins and high volume. This model, coupled with zero brokerage, led to good revenue generation.

During this period, they also introduced a flat fee model by challenging the percentage brokerage fee model.

Now, what is the percentage brokerage fee model?

Let me explain this with an example.

Back in the day, traditional brokers would charge brokerage based on your trading value.

Let’s say a broker charged 1% per trade.

So, if your traded value is ₹1,000, your brokerage fee would be ₹10.

Now, imagine your trade value is ₹1 lakh, so your brokerage fee would be ₹1,000.

But Zerodha played a masterstroke by charging only 20 rupees. This was possible because the trade size didn’t affect the operational cost.

And they also showed all the charges transparently by adding a brokerage calculator to their website. This enabled traders and investors to know all the charges with a click.

By doing this, Zerodha earned a reputation among the trading community. And this helped them gain a market share of approximately 17%, closely followed by another discount broker, Upstox (14%).

Let me know if you want a case study on Upstox.

Now, let’s talk about the challenges and competition faced by Zerodha.

No doubt, Zerodha is a pioneer in the brokerage industry, but they also face a few challenges that they need to overcome.

Due to a huge number of transactions, the platform experiences technical glitches. This disrupts the trading and investing experience of the users.

Now, Zerodha doesn’t have any offline branches as most of the operations are performed online.

So, if any customer faces any difficulty, they need to reach their online customer support team. And it is likely that the customer support team might fail to address the customer’s concerns.

Even the founders admitted this by saying that their customer support is the weakest link of Zerodha. I am sure they will sort this out pretty soon.

And like most discount brokers, they don’t provide any stock advisory services or market-related calls.

All of this may result in customer loss.

Now, let’s look at Zerodha’s competition.

Since the Covid-19 lockdown, the financial services industry has seen a tremendous boom. Now, more people are interested in investing and trading in stocks.

And Zerodha faces stiff competition from many traditional brokers as well as discount brokers.

The traditional brokers include big players like ICICI Direct, HDFC Securities, Motilal Oswal, and Sharekhan.

And the discount brokers include VC-backed Upstox, Groww, and Angel One. These discount brokers are gaining a strong foothold in the market.

But the only thing that differentiates Zerodha from other brokers is zero advertising and marketing.

They built a community that helped them acquire new customers through word-of-mouth marketing.

In which year Zerodha started?

Zerodha started on 15th of August in 2010.

What does Zerodha company do?

Zerodha is a financial services company based in India that provides a range of investment services, including retail and institutional broking, equity investments, and trading in currencies and commodities.

As a member of NSE, BSE, and MCX, Zerodha offers a reliable and trustworthy platform for investors to manage their portfolios. Most notably, Zerodha is known for its unique offering of brokerage-free equity investments.

Is Zerodha startup profitable?

Yes, Zerodha’s FY22 net profit was Rs 2,094 crore, up 87% YoY from Rs 1,122 crore in FY21. Operating revenue surged 82% to Rs 4,963 crore YoY. Notably, Zerodha has not raised any external funding to date.

What is the meaning of Zerodha?

Zerodha, a combination of “Zero” and the Sanskrit word “Rodha,” meaning barrier, reflects the company’s dedication to providing affordable brokerage services to Indian investors while removing obstacles and barriers.

Both the founders, Nithin and Nikhil, used their experience and knowledge to build a product that solved the problems faced by traders.

And solving a burning problem is the main aspect of building a startup.

Serving in a price-sensitive market like India is not easy. They identified it early on and took some bold decisions that eventually worked in Zerodha’s favour.

Comment down your views on Zerodha’s success.

With that, it’s time to say goodbye!

How cloud native is driving Zerodha, the world’s largest retail stock investment platform

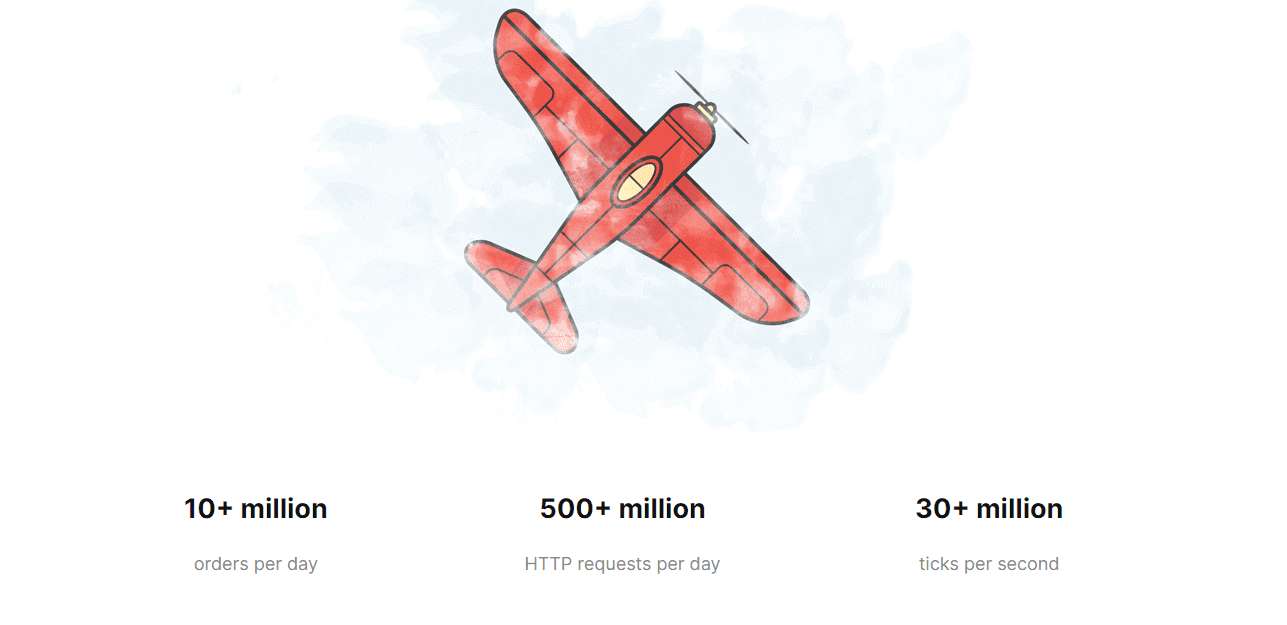

The Indian stock brokerage Zerodha handles 8 million trades a day, making it the largest retail stock investment platform in the world. With a complex, hybrid infrastructure, a heavily regulated technology stack, and end-user applications and internal systems with disparate external dependencies, the company needed “a centralized, uniform monitoring infrastructure that worked across a wide variety of complex environments,” says CTO Kailash Nadh.

Zerodha adopted Prometheus for monitoring, then migrated many of its services from VMs to containers, and then to Kubernetes.

“Prometheus gave us powerful monitoring for critical, low-latency financial systems,” says Nadh. With Kubernetes, “we’ve gained scale and modularity, especially in an environment where sweeping regulatory changes often demand significant changes to systems. In addition, we are able to utilize cloud resources more efficiently.”

Projects used

By the numbers

Cost of compute instances

Reduced by at least 50%

1 billion retail trades processed in 2019

Complete environments with all the dependencies can be brought up in minutes instead of hours

The Indian stock brokerage Zerodha handles 8 million trades a day, making it the largest retail stock investment platform in the world.

“Our mission is to make trading and investing easy and accessible to the masses,” says CTO Kailash Nadh.

Given its industry and scale, Zerodha requires infrastructure that spans a public cloud (AWS for most in-house applications) and physical machines in multiple data centers, with specific regulatory and technical requirements for capital market connectivity via leased lines and adapters from various stock exchanges.

That complexity— along with a heavily regulated technology stack and end-user applications and internal systems with disparate external dependencies- led the company to embrace cloud native technologies.

“We needed a centralized, uniform monitoring infrastructure that worked across a wide variety of environments,” Nadh says. “Prometheus gave us powerful monitoring for critical, low-latency financial systems . It helped us aggregate and monitor metrics infra-wide. The large number of existing exporters and the ease of writing custom exporters enabled us to attain wide coverage in a short period of time.”

Additionally, Zerodha began moving its services from VMs to containers, and gradually to Kubernetes in 2020. Because all of its apps had already been developed with a service-oriented architecture and 12-factor approach, the migration was straightforward. The infrastructure team began by creating CI pipelines with GitLab as the company has a well-defined process of pushing changes to production with its CI/CD process. With a focus on infrastructure-as-code practices, Zerodha uses a mix of Terraform, Packer, and eksctl to create its Kubernetes infrastructure on AWS and hosts container artifacts on an internal registry powered by AWS (ECR).

“We have been conscious of not creating an ops vs. dev divide,” says Nadh. “Developers are responsible for the entire lifecycle of their projects, including deployments. We created a standard template for deployments with Kubernetes that allows developers to craft their own deployments with minimal scaffolding or direct involvement of DevOps engineers.”

“Kubernetes has helped us standardize the deployment process of applications built on many different kinds of stacks across teams.” — KAILASH NADH, CTO AT ZERODHA

As a result, deployment rollouts are faster and more frequent: Complete environments with all the dependencies can be brought up in minutes, rather than hours, with very little manual intervention. “Kubernetes has helped us standardize the deployment process of applications built on many different kinds of stacks across teams,” he says. “We’ve gained scale and modularity, especially in an environment where sweeping regulatory changes often demand significant changes to systems. Kubernetes also allows us fine-grained resource allocation for workloads, reducing cost of compute instances by at least 50%.”

Zerodha is using a CNCF incubating project, NATS, “for transmitting large volumes of real time-market data across infrastructures across applications at high throughputs,” says Nadh. “Many of our components depend on the ease of subscriptions and instant and ‘automagical’ failovers NATS offers. We had at least three other technologies that we had tried over the years before stumbling upon NATS. It pretty much solved all the issues we had faced with other message streams and PubSub systems.”

Other CNCF projects are in the pipeline at Zerodha, such as Envoy as an edge proxy for inter-application networking. “We use Kong as an API Gateway internally. However, we are looking for a service mesh that can gracefully handle retries and failures, load balancing, cross-infra discovery, etc. Envoy seems to fit the bill,” he says. “We are looking at Istio as the control plane, and Jaeger, which comes bundled with it, for enabling tracing across services.”

“Cloud native enables companies to do faster iterations and deployments and have well defined moving parts that are easily managed.” — KAILASH NADH, CTO AT ZERODHA

For Zerodha, the impact of cloud native has been clear: “Thanks to our lean, modern, and scalable infrastructure and architecture, we have been able to focus on high quality technology and products that have catapulted us to the #1 position in the industry, trumping large stock brokers operated by megabanks,” Nadh says. “We have been able to achieve unprecedented scale with our stack, handling a million concurrent users who receive tens of millions of streaming market quotes per second, and place millions of low-latency trades. In 2019, we processed a billion retail trades, possibly the highest for any stock broker in the world. Our daily volumes amount to about 20% of all retail stock market volumes in India.”

In the near future, the Zerodha team plans to focus on migrating most stateless workloads to Kubernetes, implement a service mesh, and adopt more cloud native observability tools. The company has seen the benefits of cloud native, and is continuing on the journey.

“Cloud native enables companies to do faster iterations and deployments and have well defined moving parts that are easily managed,” says Nadh. “Running applications in a cloud native stack also helps companies save on infrastructure costs as they are able to better utilize the cloud resources and scale up/down dynamically. Cloud native technologies have proven to be a great way of running, managing, and monitoring complex application stacks.”

- Stock Compare

- Superstar Portfolio

- Stock Buckets

- Corporate Actions

- Nifty Heatmap

- *Now Available in Hindi

Zerodha Success Story: Journey to Biggest Stockbroking in India!

by Team Trade Brains | Oct 5, 2021 | Online Brokers | 18 comments

Zerodha Success Story in Stockbroking Industry in India : Trading and Investments are the two terms everyone wishes to experiment with but is reluctant to step in due to many reasons like lack of knowledge, hefty commission and brokerage charges, uncertainties in the market and so on.

2008-2010 were the years when the biggest global financial crisis happened and the world was facing a trading hush. In India, the stockbroking companies that existed also experienced a downfall and were using old technologies to provide stockbroking services. Many young generation people were not educated enough to even think of trading at a very young age.

While all of these were encountered by almost every broker in India, Bangalore based discount broking firm, Zerodha was founded in 2010 by Mr. Nithin Kamath that provides trading services at discounted brokerage fees and a user-friendly interface with reliability. This firm enjoys a massive client base of over 2.5 million users.

Let us deep dive into the journey of how Zerodha success story and discuss how it became the biggest discount broker in India in this article.

Quick Note: Nithin Kamath and Nikhil Kamath are the founders of Zerodha, India’s biggest stock brokerage company in terms of volume of trade. According to the IIFL Wealth Hurun India Rich List 2021 Kamath and his family are ranked as the 63rd richest Indians. Their net worth is estimated to be above $3.1 billion.

Table of Contents

The founding of Zerodha: How did it start?

The Co-founder of Zerodha “Nithin Kamath”, before establishing Zerodha, was working in the call center at the night and he used to trade during the morning hours. At the age of 17, he got introduced to the stock markets by his friend and since then he started trading.

Although he made a good chunk of money by trading in stocks, he lost all the money during 2001 and 2002 when the markets crashed. Over a period of time, he was landed a cheque from a foreign HNI to manage his money. Eventually, he joined Reliance Money as a sub-broker and made a lot of money by adding big clients to Reliance money.

Quick Note: If you want to open a FREE Demat account with Zerodha, here’s the direct link !

Nevertheless, again lost a significant amount of money in the second market crash in the middle of the global financial crisis in 2008-09. After trading full-time for over 10 years, this Maverick decided to become a broker when he thought that the time has come to provide a different kind of stockbroking services that he never came across during the 10 years span of his trading.

He felt digitization and online user-friendly platform are the need of an hour when he first thought of starting Zerodha. Nitin Kamath also observed that the reason why the young generation is not willing to start trading is that there are high brokerage charges implemented on the transactions. His aim was to become an online broker using the latest technologies that is more people-first than profit-first.

Zerodha is derived from the Sanskrit word Rodha which means Obstructions. The name Zerodha means ‘No Obstructions’. Hence, the founder aimed at providing a hassle-free, low brokerage trading platform. He targeted clients who are young and more tech-savvy to contribute to the capital market ecosystem.

According to him, he wanted more of a Google-like platform with simple to use rather than a Yahoo-like platform. When he felt the need to change the system, he along with his younger brother, Nikhil, started Zerodha and the rest is the history or rather a case study for everyone.

Also read: 8 Best Discount Brokers in India – Stockbrokers List 2021

The Secret Formula of Zerodha’s Success

It is indeed a fact that there is no shortcut to success. However, Nithin Kamath, when founded this discount broking firm, decided to provide technology-efficient and cost-efficient services to its customers. He observed that there is a huge lag between the commissions charged by the other brokerage firms and the amount of money actually received by the customers.

In addition to that, the technology that was used was too old and Nithin felt the need to introduce a smart platform that enables users to trade online comfortably. He thought of providing services at a low cost where the idea of charging low commission clicked into his mind.

He also wanted to attract more young customers who often do not enter into trading due to high commission charges. With this aim, he started his firm and today it has become the biggest discount broking firm. He believes if we do not depend too much on foreign capital and invest in our own companies, the day is not far when India will become an economically strong country.

Surprisingly, the firm hardly spent any money on advertising or marketing for its own firm. They do not run any advertisements. The founder believes in ‘the word of mouth is your true marketing’. Thus, with a very low operating cost Zerodha was able to capture a large number of customers.

Interestingly, trading is provided free of cost at his stockbroking firm if the period of holding for shares is longer than a day. They make money by charging a flat fee of Rs. 20 for futures, options, and intraday trading.

While other competitors charge much more than this which is based on the percentage of a transaction traded. Its business model on which it works is ‘low margin – high volume’.

Innovation and New Additions

In order to stay competitive, the firm launched many products to expand its reach and to overcome some challenges they were facing. Below is a brief on what each product provides:

— Console: It is a central dashboard of a customer’s account with Zerodha that will provide in-depth reports and visualizations to get more insightful ideas.

— Kite: It is a sleek trading and investment platform using the latest technologies. It eases the customer’s experience to trade and transact in the stock market.

— Kite Connect API: This is mainly focused on independent traders and startups to enable them to build an innovative trading and investment platform. Using algorithms, retail traders can automate their trades.

— Sentinel: A platform that enables you to create market alerts. The alerts can be customized based on price, trade quantity, and open interest. The interesting aspect of this product is that you do not need to be a Zerodha customer in order to use Sentinel.

— Z Connect: This is a blog facility regarding stocks, trading, and investment with Zerodha. They publish articles and information on this blog and any user is allowed to ask questions and post comments.

— Varsity: One of the challenges faced by this firm was that it lacked in providing research services to its customers who are sometimes clueless about what and when to buy or sell. To overcome this, they come up with Varsity that gives a vast collection of stock market lessons on the go.

— Coin: It provides a commission-free purchase of mutual funds directly delivered into the customer’s Demat account.

— Rainmatter: It is an incubator that provides funding as well as mentorship to startup companies in capital markets and gives a minority stake in the exchange.

Source: Product information from Zerodha.com

In addition, Zerodha has also partnered with a lot of leading stock market platforms and portals like Streak, Sensibull, etc to create more value for their clients.

Let us Talk about Challenges

Despite the tremendous success and huge customer base, Zerodha also had to confront a few challenges as described below:

- First of all, Zerodha does not provide stock advisory or any market-related calls that would enable its customers to decide on what to buy and sell.

- They also suffered from a lack of delivery of valuable advisory reports and analysis of one’s investments and trading activities be it either weekly or quarterly. Most of the big full-service brokers provide research reports.

- As Zerodha is mostly online and no offline support branches, inefficient customer support, and lack of quick customer service are the biggest challenges that this firm faces.

- Technical errors like app down for a few minutes or charting errors were reported previously which was basically because of the high market traffic situations.

Closing Thoughts

To sum up, competing with big players like HDFC and ICICI is indeed a daunting task that the genius was able to cope up. However, there are other competitors too such as Upstox, Groww, SAS Online, Angle Broking, TradingBells, etc. However, the founder wishes to continue with his low-margin strategy.

This firm also developed a strategy to start selling Treasury bills, Government Securities, and Sovereign Gold Bonds which is everyone’s preference while the markets are facing a downfall.

Nithin strongly believes in not running after the money but doing the right things for a long period of time. This is what is the reason his firm has become one of the top-most broking firms in the country over the eight to nine years of time.

To add to that, after facing so many challenges, the firm has made its way to persistently increase its customer base year by year. To get more insights you can read Zerodha review 2021.

That’s all for this post. I hope this Zerodha success story is inspiring for all the budding entrepreneurs and business enthusiasts who are planning to make something big in the stock market industry. Stay safe and happy investing.

Start Your Stock Market Journey Today!

Want to learn Stock Market trading and Investing? Make sure to check out exclusive Stock Market courses by FinGrad, the learning initiative by Trade Brains. You can enroll in FREE courses and webinars available on FinGrad today and get ahead in your trading career. Join now!!

I want join the zerodha so please call back

I’ve been trying to open an online account in Zerodha since last week but I get a message that my no and email are already registered. Even unable to get support from customer care. Can Zerodha help me in opening an account.

Good to hear zerodha blog

whn u say 20 rs is it for each lot whch includes buy and sell qtys.can u giv a mob no whr a human can giv a reply to my query

Sir, I newly entered marker by Zerodha and feel well. Here my sincere request is that We feel more convinient when we enter NIFTY options we should get all NIFTY CALL/PUT list In single column with present strike prices in a single column then we can select easily whichever we feel good.

Sir, It is very convenient to us if get all CALL/PUT options with running strike prices in a single column whenever we enter NIFTY in search in watch list. Thanking you.

Sir I am newly in share and zerodha …plz give me some tips ….I want ..plz tell me ..few queries sloved it

मला आपल्या ग्रुपमध्ये सामील करून घ्यावा

Hello sir I dont buy bank NIFTY n NFO IN MY ACCOUNT

Good afternoon sir

Today I had not buy 5lot of A stock , but zerodha buy this himself ,without my permission , What was this ?????

Already i signup yesterday. I paid rs 300rs also. But i can t finish the signup. Because i cant understand. Step by step process. Then i have not bank check leaf. So what can i do. Can i get rs 300.

Since last 3yrs with zerodha my observation is this prosperity of Kamath Brothers is outcome of dirty and cheap games of malpractices in pricing chart show lowest price,then console show higher than that but after square off position the pricing will be totally different.2.They manipulate the system for fiction of seconds just to hit stop loss but when you cross check the price you hit stop loss with competitors charts there would be certainly marginal price difference. Eagerly waiting for the day when God decide enough is enough it is time to pay the price.

Hi Rajesh. Sorry to hear about these issues. Didn’t know about it and will cross check. Anyways, you should definitely file a complain on Zerodha’s support regarding this one.

What would have been nice is if people at Zerodha took a little more ownership about customer issues and followed through. Been with Zerodha for 4 years now and have not been impressed by their customer service and the lack of it.

Thanks for the valuable information. Some of them were unknown. Keep your article flooded with such true information

I find Zerodha platform too good compared to Icicidirect or axis direct or Indiabullls. Trading is seamless. Absolutely no problem. Dashboard too informative. Never seen such a fantastic platform. Don’t know why some customers are facing problem. Could be due to ignorance or not being tech savvy.

As regards customer care, they call back if busy when one calls them. Their answers are to the point and not like other brokerages who don’t even understand the queries.

Trackbacks/Pingbacks

- List of India's Successful Entrepreneurs list|Young|Famous - […] Source: Trade Brains […]

- WHAT IS A UNICORN STARTUP? - TOP 10 STARTUPS – WATW - […] ZERODHA founders Nithin Kamath and Nikhil Kamath (Source: TradeBrains) […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Search Topic or Keyword

Trending articles.

Recent IPO’s

- Bharti Hexacom IPO Review 2024 – GMP, Financials And More

- SRM Contractors IPO Review 2024 – GMP, Financials And More

- Krystal Integrated Services IPO Review 2024 – GMP, Financials & More

- Popular Vehicles IPO Review – GMP, Financials & More

- Gopal Namkeen IPO Review – Financials, GMP And More

Easiest Stock Screener Tool!

Best stock discovery tool with +130 filters, built for fundamental analysis. Profitability, Growth, Valuation, Liquidity, and many more filters. Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters.

- — Stock Screener

- — Compare Stocks

- — Stock Buckets

- — Portfolio Backtesting

Start your stock analysis journey with Trade Brains Portal today. Launch here !

Keep the Learning On!

Subscribe to Youtube to watch our latest stock market videos. Subscribe here .

- Take One: Big story of the day

Groww took the growth out of Zerodha. But can it really take it on?

The seven-year-old financial services platform usurped the bootstrapped startup to become the largest brokerage in india in terms of the number of active investors. the change in pecking order is significant, but zerodha is still miles ahead when it comes to revenues.

- " class="general-icons icon-sq-whatsapp">

- " class="general-icons icon-sq-googleplus popup">

Related stories

How four ex-Flipsters built Groww into a unicorn

Shrini Viswanath at Upstox on going from a small proprietary trading outfit to an investment platform for 7 million users

When Nithin Kamath doubled up as Zerodha's social media manager

Taking on the challenge , where can it go from here .

- " class="general-icons icon-sq-youtube">

Legendary restaurant elBulli will host two guests for one special night

India has what it takes to become a global semiconductor powerhouse: Qualcomm's Rahul Patel

Circle Introduces Smart Contract Functionality for BlackRock's BUIDL

Photo of the day: Ready for Lok Sabha Elections 2024

Estimating the value of intangible investments: A new approach

All We Imagine As Light: Indian film to compete for Palme d'Or at the Cannes Film Festival

Through the IPL, brands have started to speak to the many Indias: Nikhil Bardia

Inside Vasant 'Vas' Narasimhan's transformation of Novartis, and more

Why Adidas is betting big on Indian cricket

Video games top source for TV inspiration, says Jonathan Nolan

Photo of the day: Eid Mubarak

5G expansion: Sluggish and silent

Millions of Indonesians take part in exodus for Eid celebration

China and the US reshaping their semiconductor supply chains present both challenges and opportunities for India: Chris Miller

3 things industrial control system enterprises should do to boost cyber-resilience

- Bahasa Indonesia

- Sign out of AWS Builder ID

- AWS Management Console

- Account Settings

- Billing & Cost Management

- Security Credentials

- AWS Personal Health Dashboard

- Support Center

- Expert Help

- Knowledge Center

- AWS Support Overview

- AWS re:Post

Helping Zerodha Handle the Volatility of Financial Markets

Zerodha is the leading discount brokerage in India, providing online trading services in stock, commodities, mutual funds, bonds, and currency.

India’s Largest Stock Broker by Active Clients

Indian fintech company Zerodha offers online trading services in stock, commodities, mutual funds, bonds, and currency. Launched in 2010, the company has more than 1 million clients placing millions of trades each day. Zerodha was one of the first discount brokerages in India. It charges 20 rupees (US$0.29) per trade or 0.01% of the trade’s value, whichever is lower, and does not take brokering fees. In 2018, the company became the largest retail stock brokerage in India, according to the National Stock Exchange of India.

The Cost of On-Premises Servers Gets Too High

While Zerodha handles 2 to 3 million trades a day on average, this figure can easily double on the back of breaking financial news. Because Zerodha leased on-premises servers at a hosted data center, the company experienced issues scaling its architecture to meet trading highs and lows, and, as a result, it had to overprovision its IT. Kailash Nadh, chief technology officer at Zerodha, says, “Most of our capacity could go unused for days or weeks during non-peak periods. It was like a very expensive insurance policy.”

An Opportunity Presents Itself in Mumbai

When Zerodha learned that AWS was expanding its Asia-Pacific Region to Mumbai, it gave the company the opportunity to use the AWS Cloud. In 2016, Zerodha moved its IT infrastructure from on-premises to the Amazon Web Services (AWS) Cloud to scale to its fluctuating trading volumes and comply with India financial regulations that limit data sharing across geographic locations. At this point, Zerodha was using Amazon Simple Storage Service (Amazon S3) to store large documents. Says Nadh, “We were very satisfied with Amazon S3, which was eight times more cost-effective than our on-premises storage. Furthermore, the relationship we had built with AWS around Amazon S3 gave us a lot of confidence to carry out a full migration.”

Modularity Makes Cloud Migration Simpler

Zerodha managed its migration internally—building applications for its website, mobile app, and backend processing by using a modular design. This modularity was also what made it easier to migrate to the AWS Cloud. “Because our software is stateless [where data travels independently of other data], it was easy to run on an internet-based cloud environment,” says Nadh. In total, Zerodha migrated all its IT onto the AWS Cloud except for a few on-premises servers used for live feeds from India’s stock exchanges. “If the Indian regulations had allowed us to, we would have migrated those servers too,” adds Nadh.

Auto Scaling Soaks Up the Surges

Apart from Zerodha’s website and mobile app, the company’s business-critical trading and post-trading platforms are also running on the AWS Cloud. Amazon Elastic Compute Cloud Auto Scaling (Amazon EC2 Auto Scaling) dynamically scales up and down the number of Amazon Elastic Compute Cloud (Amazon EC2) instances supporting the platforms, based on parameters such as central processing unit (CPU) utilization.

Approximately 500,000 customers log on to Zerodha concurrently when the Indian Stock Exchange opens in the morning. Currently, Amazon EC2 Auto Scaling ramps up the number of Amazon EC2 instances supporting the trading platform during this period. The number of supporting instances is automatically scaled back down when trading traffic decreases.

Post-Trade Processing from Hours to Minutes

Once the stock exchange closes, Zerodha runs all accounting and settlement processes on its post-trading platform. This involves checking and updating files for about 500,000 customers overnight. “The work requires processing more than 10 billion data points and presenting the information back to customers, as well as financial authorities, in specific formats,” says Nadh. “At the same time, we’re updating analytical reports for our customers, which show their trading performance over weeks, months, and years. That requires recomputing their historical data with that day’s results.”

Before using AWS, Zerodha used a proprietary system designed for post-trade processing. The system, which processed data sequentially, took around 10 hours to complete the job. This is now done using AWS Lambda , which lets Zerodha run its software without provisioning or managing servers and completes processing tasks in parallel. “We’ve reduced post-trade processing times from between 6 and10 hours to 2 or 3 minutes with AWS Lambda,” says Nadh.

50% Reduction in IT Costs

The company has reduced the costs of its IT by 50 percent by migrating to AWS. It no longer has to overprovision because it can align processing power with trading activity. Zerodha has also cut the time and expense of managing its IT because much of the AWS infrastructure comes as a managed service. The administration required is done much faster. Says Nadh, “It could take two days to install a firewall at the on-premises site, but now it takes 2 minutes with AWS.”

Quicker Access To Information

Zerodha is now able to deliver a better level of service to its customers. The company has reduced network latency by 65 percent—from 200 milliseconds to 70 milliseconds. Furthermore, it has increased the availability of its services, reducing the risk of interruptions to trading while the stock exchange is open. Comments Nadh, “We can provide faster and more resilient services to our customers, helping us retain our leading position in the market.”

To learn more, visit https://aws.amazon.com/financial-services/ .

Ending Support for Internet Explorer

Article | Foundr MAGAZINE

How Zerodha is making money? - Zerodha case study

Zerodha, a leading player in the Indian broking industry, has garnered widespread attention for its innovative approach to financial investments and online trading. The company’s flagship product, the Zerodha Kite app, has revolutionized the way investors engage in stock trading and investing. In this comprehensive case study, we will delve into the various facets of Zerodha’s business model, including its revenue streams, valuation, and pricing strategies, to understand how the company has achieved remarkable success in the Indian financial sector.

Zerodha has disrupted the traditional brokerage model with its user-friendly and cost-effective online trading platform. The company’s emphasis on transparency, technology-driven solutions, and a customer-centric approach has positioned it as a preferred choice for both seasoned and novice investors. Zerodha’s commitment to democratizing finance and making investing accessible to all has been a key driver of its success.

Zerodha’s Revenue Streams

Zerodha generates revenue through various channels, including brokerage charges, subscription fees for premium services, and interest income from its clients’ margin trading accounts. By offering competitive pricing and a range of value-added services such as research and analytics tools, Zerodha has successfully monetized its platform while providing a compelling proposition to its user base. Additionally, the company’s focus on promoting direct mutual fund investments has also contributed to its revenue generation.

Valuation and Growth

The market has recognized Zerodha’s potential, leading to a substantial increase in its valuation over the years. The company’s exponential growth trajectory, innovative approach to technology, and its ability to attract a large customer base have contributed to its impressive valuation within the Indian broking industry. Zerodha’s disruptive business model and its consistent focus on enhancing the customer experience have been pivotal in driving its valuation and growth.

How Zerodha Makes Money

How Zerodha Makes Money Zerodha’s revenue model is intricately tied to the volume of trades executed on its platform. As a discount broker, the company charges nominal fees per trade, attracting a high volume of users. Zerodha generates its revenue primarily from brokerage charges. The company follows a revenue model centered around its minimal brokerage fees, set at 0.03% or Rs. 20 per trade, whichever is less. This unique feature adds an appealing dimension to the platform for its users. Additionally, Zerodha offers margin trading facilities, generating interest income from the funds leveraged by its clients. The company’s innovative approach to pricing and its focus on leveraging technology to streamline operations have been instrumental in driving its revenue generation. Zerodha’s ability to scale its revenue model while maintaining cost efficiency has been a key factor in its sustained profitability and growth.

Zerodha’s disruptive approach to the Indian broking industry has not only transformed the way individuals engage in stock investing but has also redefined the revenue potential within the online trading space. By offering a seamless and cost-effective platform, Zerodha has effectively capitalized on the burgeoning interest in financial investments among Indian investors. The company’s commitment to innovation, transparency, and customer empowerment has solidified its position as a key player in the Indian financial sector. Zerodha’s ability to adapt to market dynamics and its relentless focus on delivering value to its customers have been instrumental in its success. Zerodha’s affordable trading services have enabled the platform to capture a significant market share, establishing itself as a prominent player in the Indian brokerage industry.

By incorporating the focus keyword “Zerodha Case Study” and related terms such as “Zerodha Kite app,” “financial investments,” “Indian Broking Industry,” “investors,” “ Zerodha valuation ,” “Zerodha charges,” “How Zerodha makes money,” “online trading platform,” and “stock investing” throughout the content in a natural manner, this article aims to provide an insightful and comprehensive understanding of how Zerodha has established itself as a key player in the financial sector. This well-organized and engaging case study will not only offer valuable insights to readers but also enable them to easily navigate through the content to find the information they seek, ensuring that it remains relevant and up-to-date.

Also Read : Social Media Marketing Case Study

Zerodha Marketing Strategy - How Zerodha Succeeded Without Advertisements?

Poonam Chauhan

If you have a little bit of interest in the equity or stock market, you must have come across the name Zerodha. It is one of the dominant brokerage platforms that facilitate five million+ orders daily.

To be very honest, after the 2008 financial crisis, many big corporate houses have faced colossal losses. The stock market was at its worst, and many people have lost their faith in investment.

The 2008 market collapse was the most significant single-day decrease in modern history. The fallout from this disastrous financial catastrophe washed away large portions of retirement savings and had a long-term impact on business, even after the share market had stabilized.

The recession was the black phase for every country, but then in 2009, the Kamath brothers came up with the idea of Zerodha, which is the online brokerage platform. At that instant, there were many share marketing platforms like Sharekhan, ICICI was available in the market, and launching Zerodha seems to be a foolish move. Because how can you beat the legends but with hope in their heart they launched Zerodha in 2010 with a small budget of 10 lakhs.

Let's know all about Zerodha and its marketing strategy in detail.

The Story Behind Zerodha Zerodha Marketing Strategy Zerodha Success Factors Why Doesn't Zerodha Believe in Advertising? Things That Make Zerodha Stand Out in the Market

The Story Behind Zerodha

Zerodha is a brokerage company situated in Bengaluru, Karnataka . Nitin Kamath created it on August 15, 2010. It is India's first cheap broker, ushering in a new era in the brokerage sector. In India, Zerodha is the biggest and one of the finest stock brokers. The ultimate aim was to make the investing barrier-free which is why they came up with the name Zerodha.

Do you know that both the brothers are listed in the Forbes list of India's 100 most prosperous 2020? You might be aware of that, but what makes us awe is how they become the most substantial brokerage company in India, with around 2.5 million users.

Before founding Zerodha, the company's co-founder " Nithin Kamath " worked at customer service at night and traded in the day. He was exposed to the financial markets by a companion when he was 17 years old, and he has been investing ever since.

After working full-time for over ten years, he chose to be a broker because he felt the moment had come to offer a distinct type of structured finance service that he had never encountered throughout his trading career . When he initially considered creating Zerodha, he believed that digitalization and a user-friendly platform were highly required. Nitin Kamath further noted that the hefty brokerage costs imposed on trades are one of the reasons why young people are hesitant to begin trading. His goal was to be an internet broker who prioritized people before profits by utilizing cutting-edge technology. That's the incarnation of Zerodha.

Zerodha Marketing Strategy

Coming to our next section where we will shed light on how Zerodha became so popular among people, what was their marketing strategy. Zerodha was launched with the aim to give consumers technology-efficient and cost-effective services. Many young users were afraid to try stock investment because of the brokerage charges. Furthermore, the technology used was old and can be a bummer for many of us. Kamath's brother knew that it is time to change and allure young minds with service that doesn't require any technological expertise.