Earnings Release Q2 FY 2024: Siemens Energy benefits from positive market environment and delivers another solid quarter. Adjusted outlook reflects stronger growth and positive cash development.

- During the second quarter of the fiscal year, Siemens Energy’s relevant markets and demand for electricity continued to develop strongly.

- As expected, orders decreased year-over-year from a high level of comparison mainly due to a lower volume of large orders. Growth at Grid Technologies and Transformation of Industry could not offset lower orders in the other segments, mainly Siemens Gamesa. Overall, the decline was 21.8% on a comparable basis (excluding currency translation and portfolio effects) and orders came in with €9.5bn. The book-to-bill ratio (ratio of orders to revenue) was again above 1, driving the order backlog to a new high of €119bn.

- Revenue grew by 3.7% on a comparable basis to €8.3bn with substantial and significant growth at Grid Technologies and Transformation of Industry, respectively.

- Siemens Energy’s Profit before special items sharply increased to €170m (Q2 FY 2023: €41m) in part benefiting from positive currency effects. Special items amounted to positive €331m (Q2 FY 2023: positive €23m), driven by pre-tax gains from the sale of businesses related to the ongoing progress on disposals and accelerated portfolio transformation. As a result, Profit for Siemens Energy came in at €501m (Q2 FY 2023: €64m).

- Siemens Energy reported a Net income of €108m (Q2 FY 2023: Net loss €189m). Corresponding basic earnings per share (EPS) were positive €0.08 (Q2 FY 2023: negative €0.25).

- Free cash flow pre tax was positive with €483m (Q2 FY 2023: negative €294m). The improvement to prior-year quarter was primarily due to strong cash conversion across all business areas and shifts in timing from Siemens Gamesa.

- Due to the strong business performance in the first half-year, Siemens Energy raised its outlook for fiscal year 2024. Management now expects for the Siemens Energy Group a comparable revenue growth between 10% and 12% (previously between 3% and 7%) and a Profit margin before special items between negative 1% and positive 1% (previously between negative 2% and positive 1%). Free cash flow pre tax is now expected to be up to positive €1.0bn (previously around negative €1.0bn). The outlook for Siemens Energy’s Net income remains unchanged at up to €1bn.

Christian Bruch, President and CEO of Siemens Energy AG: “Our strong development in the second quarter underscores the continued strong demand for our technology to power the energy transition and our success in stabilizing the wind business. We have raised our outlook to reflect this positive development. The turnaround of our wind business is still our focus. To this end, we are taking steps to reduce complexity and create a more focused business.”

Earnings Release Q2 FY 2024: Siemens Energy benefits from positive market environment and delivers another solid quarter. Adjusted outlook reflects stronger growth and positive cash development.

Due to the business performance in the first half-year, we raised the outlook for the fiscal year 2024 for Siemens Energy. The new forecast is based on adjusted revenue growth assumptions for all segments and higher Profit assumptions for Grid Technologies. In the first half of the fiscal year, the product and service businesses in the Grid Technologies and Transformation of Industry segments performed better than expected driven by strong market demand. For Siemens Gamesa, we expect a revenue development in the second half of the fiscal year substantially exceeding the first half-year, especially driven by the continuous ramp-up in the offshore area. In terms of Free cash flow pre tax, we expect all segments to exceed original expectations excluding Siemens Gamesa. This is particularly applicable for Gas Services and Grid Technologies, which both are to experience strong cash inflows driven by customer payments related to a continuing orders momentum.

Therefore, we now expect Siemens Energy to achieve a comparable revenue growth (excluding currency translation and portfolio effects) in a range of 10% to 12% (previously between 3% and 7%). Profit margin before special items is now expected between negative 1% and positive 1% (previously between negative 2% and positive 1%). Unchanged, we expect a Net income of up to €1bn including impacts from disposals and the acceleration of the portfolio transformation. Furthermore, we now expect a positive Free cash flow pre tax up to €1.0bn (previously a negative Free cash flow pre tax of around €1.0bn). We now expect proceeds for the whole fiscal year around positive €3.0bn (previously in a range of positive €2.5bn to €3.0bn) from disposals and the acceleration of the portfolio transformation.

The outlook for Siemens Energy does not include charges related to legal and regulatory matters.

Amended overall assumptions per business area

- Gas Services now assumes a comparable revenue growth of negative 2% to 0% (previously negative 4% to 0%) and a Profit margin before special items of 9% to 11% (unchanged).

- Grid Technologies now plans to achieve a comparable revenue growth of 32% to 34% (previously 18% to 22%) and a Profit margin before special items between 8% and 10% (previously between 7% and 9%).

- Transformation of Industry now expects a comparable revenue growth of 14% to 16% (previously 8% to 12%) and a Profit margin before special items of 5% to 7% (unchanged).

- Siemens Gamesa now assumes a comparable revenue growth of 10% to 12% (previously 0% to positive 4%) and a negative Profit before special items of around €2bn (unchanged).

This document contains statements related to our future business and financial performance, and future events or developments involving Siemens Energy that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project,” or words of similar meaning. We may also make forward-looking statements in other reports, prospectuses, in presentations, in material delivered to shareholders, and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Siemens Energy´s management, of which many are beyond Siemens Energy´s control. These are subject to a number of risks, uncertainties, and other factors, including, but not limited to, those described in disclosures, in particular in the chapter “Report on expected developments and associated material opportunities and risks” in the Annual Report. Should one or more of these risks or uncertainties materialize, should acts of force majeure, such as pandemics, occur, or should underlying expectations including future events occur at a later date or not at all, or should assumptions not be met, Siemens Energy´s actual results, performance, or achievements may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forward-looking statement. Siemens Energy neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated. This document includes supplemental financial measures – that are not clearly defined in the applicable financial reporting framework – and that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Siemens Energy´s net assets and financial position or results of operations as presented in accordance with the applicable financial reporting framework in its consolidated financial statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently. Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Tim Proll-Gerwe

Siemens Energy

Oliver Sachgau

Siemens Energy

Siemens Energy is one of the world’s leading energy technology companies. The company works with its customers and partners on energy systems for the future, thus supporting the transition to a more sustainable world. With its portfolio of products, solutions and services, Siemens Energy covers almost the entire energy value chain – from power and heat generation and transmission to storage. The portfolio includes conventional and renewable energy technology, such as gas and steam turbines, hybrid power plants operated with hydrogen, and power generators and transformers. Its wind power subsidiary Siemens Gamesa makes Siemens Energy a global market leader for renewable energies. An estimated one-sixth of the electricity generated worldwide is based on technologies from Siemens Energy. Siemens Energy employs around 97,000 people worldwide in more than 90 countries and generated revenue of €31 billion in fiscal year 2023. www.siemens-energy.com

Please use another Browser

It looks like you are using a browser that is not fully supported. Please note that there might be constraints on site display and usability. For the best experience we suggest that you download the newest version of a supported browser:

Internet Explorer , Chrome Browser , Firefox Browser , Safari Browser

Please allow JavaScript

This page requires JavaScript in order to be fully functional and displayed correctly. Please enable JavaScript and reload the site.

Siemens drives implementation of Vision 2020 with Mentor Graphics acquisition and Gamesa merger

- Gamesa and Mentor Graphics transactions successfully closed

- Major portfolio steps in orientation toward growth fields in electrification, automation and digitalization

- Key milestones for customers, employees and shareholders

For this press release

- PDF Download

Press Events

- Read more about the Merger of Siemens Wind Power and Gamesa

- Siemens closes acquisition of Mentor Graphics

Alexander Becker

+49 (89) 636-36558

Contact Siemens

Follow our global channels, change region.

Siemens Energy: Awaiting Q4 Results Keenly

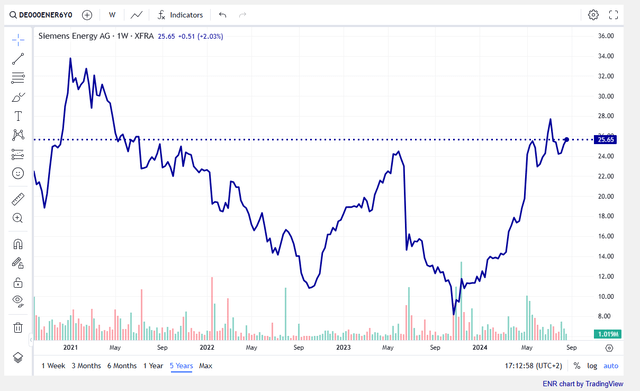

- Siemens Energy AG has seen an 88% rise over 12 months, driven by energy transition excitement and improvements in its wind business.

- Operational improvements and strategic priorities like "deliver, fix, maintain" are aimed at enhancing shareholder returns and tackling challenges in Siemens Gamesa.

- Valuation scenarios suggest the stock is fairly priced, with optimism in gas and power but caution in clean energy segments.

- The Q4 earnings release on November 13th is a crucial catalyst, especially for updates on the Gamesa turnaround.

Karsten Leineke

Siemens Energy AG ( OTCPK:SMEGF ) at the time of writing is up 88% in the past 12 months. That makes it the top-performing Eurozone energy stock, and beats every stock in the Euro Stoxx 50 index, too. The story is a combination of energy transition excitement about Grid Technologies - rapid growth in data center power demand meaning demands on power grids - and the general investor interest in the electrification megatrend, and the turnaround happening in the Wind business.

Yet, the stock is still only up slightly since its spin-off from Siemens in 2020 and in recent weeks the momentum has stalled somewhat, so what's the deal?

ENR chart by TradingView

Siemens Energy AG was spun-off from German industrial conglomerate Siemens AG ( OTCPK:SIEGY ) in September 2020. The stock is perhaps the ultimate “picks and shovels” type stock to play the energy transition, as the company manufactures the equipment needed for a wide range of low carbon and clean energy production methods.

Since the spin-off, operational improvements have been introduced, including a new group structure, and this has been playing out across its Gas Services, Grid Technologies and Transformation of Industry segments, and it is also in a huge turnaround situation at Siemens Gamesa, which Siemens Energy formerly a majority shareholder in, took full control of in February last year, after engineering problems at the wind turbine manufacturer. This was done to be able to fully integrate the wind businesses of Siemens Energy and Siemens Gamesa.

At the Capital Markets Day at the end of 2023, management fleshed out the strategic priorities of “deliver, fix, maintain” Siemens Energy with several action points promised to deliver shareholder returns.

- Executing on a record backlog with healthy margins

- Project execution excellence driven across Siemens Energy by new Global Functions division

- Expanding capacities and competencies with efficient use of capital resources

- Progress on Onshore wind quality issues and Offshore wind ramp-up trajectory

- Action plan to get profitability back to a sustainable level

- Active portfolio management to eliminate distractions from strategic core

- Strict capital discipline, supported by stringent capital allocation principles

Challenges impacting Siemens Gamesa

At the that Capital Markets Day, management was explicit about the problems the wind business faced: lower prices, cost increases, problematic contract terms and conditions, quality issues and operational challenges all created the perfect storm for the profitability of the company’s backlog, which caused huge write-downs to be taken in the 2023 fiscal year.

Despite the significant price improvements, we achieved in recent quarters, unsustainable competition among wind turbine manufacturers in recent years has resulted in market pricing below healthy levels. Significant increase in wind turbine manufacturers’ direct cost base, mainly driven by raw materials and logistics, has deteriorated project profitability. Previous inadequate market-standard terms and conditions forced wind turbine manufacturers to assume unbalanced risks and impeded them from passing cost increases on to customers. Fast development cycles among wind turbine manufacturers in recent years affected quality levels of new platforms. Rapid growth of offshore demand has posed operational challenges in ramping up production simultaneously in multiple locations.

Source: Siemens Energy 2023 Capital Markets Day, November 21, 2023 in Hamburg.

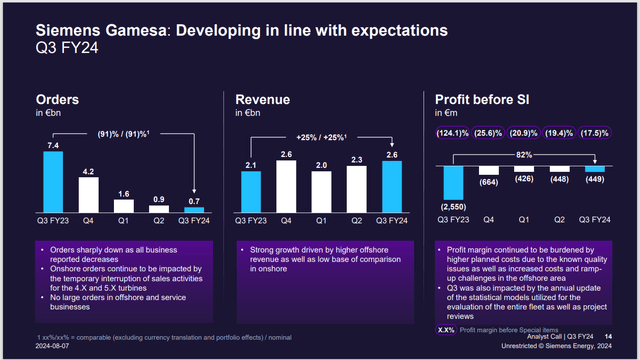

Fast forward a year and progress has been made at Gamesa, as noted by the improving quarterly margins.

Gamesa improving (Siemens Energy Q3 FY24 presentation)

At the Q3 FY24 earnings call earlier this month, management noted that there would be an update on Gamesa operations in the Q4 earnings release in November. This, I believe, will be a crucial catalyst for the stock. In the Q3 earnings call, it was mentioned that the company was on track for the reintroduction of the 4x turbine model in 2024 and the 5x turbine model in 2025. The Q4 call in November will hopefully go into more detail on this.

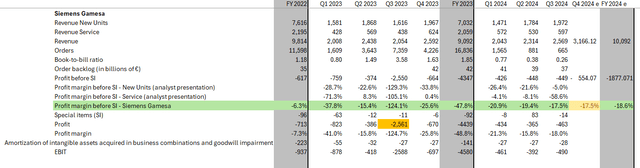

The Global Investor

We can see that over the last seven quarters, profit margins have been highly negative both for the New Units (turbine manufacturing) and the Services unit at Gamesa. The company has been reducing its order intake to focus on quality improvement and to work off its backlog in an efficient way. At the capital markets day last year, management said it aimed to break even by fiscal year 2026 at Gamesa. This is because many contracts which still need to be fulfilled had locked in losses, and profits are only recognised on completion and delivery of product to customer. I will discuss what this means for future EBIT forecasts and the company's valuation later on.

Ultimately, the wind business has been a problem child for Siemens Energy. The company has provided fairly good data at the end of earnings presentation slides on Gamesa. In September, the company is attending several investor conferences, so there may be some more updates announced soon.

A narrowed focus on only attractive markets is likely going to mean that Europe will be the core market for Siemens Gamesa, thanks to an attractive policy framework provided by the EU Wind Power Package, launched last year.

It does seem however that the stock price rally has priced in some recovery in profitability at Gamesa, as I will discuss.

A note on accounting

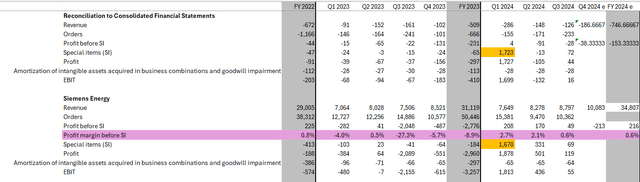

When you first look at Siemens Energy's financial reporting, you notice a focus on "Profit before Special Items". This is essentially what we often see as "adjusted profits". Profit after special items is then before "Amortization of intangible assets acquired in business combinations and goodwill impairment". Only after both these adjustments do we get to the IFRS Earnings Before Interest and Tax, also seen as operating income (loss). Adding up the segments to get to group numbers, you also have to include "Reconciliation to Consolidated Financial Statements".

I'm often sceptical of adjustments, but it's all there at the segment level and the group level, and the adjustments, in the grand scheme of things, are not that big, typically in the tens of millions in segments on sales of multiple billions.

In Q1 FY24, a chunky special item was reported, but that was explained as driven by a pre-tax gain related to the sale of an 18 percent stake in Siemens Limited, India, of €1,729 million.

SE earnings and adjustments (The Global Investor)

Gas Services

Five underlying trends driving the gas market until 2030

At last year's Capital Market's Day, Siemens Energy modelled the gas market and predicted the following:

In conventional gas, China will add about 200 Gigawatts, and Saudi Arabia will add about 40 Gigawatts. The Coal-/Oil-to-Gas Shift will create about 35 Gigawatts of new capacity in the European Union and 15 Gigawatts in South Korea. Hydrogen and Green Fuels Turbines will create 15-20 Gigawatts of hydrogen ready gas-fired power plants to support coal and nuclear exit in Germany’s “Energiewende” and in the UK the “Decarbonization Readiness Program” requiring 100% hydrogen ready turbines will support flexible power generation. Renewables Integration will drive demand for gas peaker plants. In the US, rising demand for peakers to ensure grid stability and security of supply will demand about 25 gas turbines per annum and in Europe, gas peakers will be demanded to provide dedicated grid services and cover “dark doldrums” (e.g., in the UK, Germany, Ireland). Finally, all these trends will create an increasing backlog for Siemens Energy and mean its Service business will have a longer reach.

Siemens Energy also appears to be quite cautious on gas, as they have flat revenue guidance for the Gas Services segment out to FY 2026, and guidance for revenue growth of about negative 1% for FY 2024. I feel, however, that with the importance of electricity for data centres, electric vehicles, renewables can't support this alone. Hence, gas will take a larger market share of electricity production, as we have been seeing in the US in recent years, so gas turbines and gas services should have tailwinds in the coming years.

Gas Services has a profit margin before special items on track for 10% in 2024, with management guiding to 11% by 2026.

Grid Technologies - the profitable growth engine for the global energy transition

This segment is likely the segment the market is bullish about. It's on track for 33% revenue growth this year and through 2026 "mid-double digit" compound annual growth. Profit margin before special interests is on track to reach 9% this year, up from 7.5% in 2023. Going forward, management is guiding towards about 10% margin. While Gas Services is driven by orders in services, more than new units, Grid Technologies is driven by revenues and orders in new units over services. New units today, will lead to service business in the future.

Management's double-digit market growth is being supported by global policy packages:

- In Europe the EU Green Deal/Fit for 55, Net Zero Industry Act and REPower EU

- In the US, the Inflation Reduction Act substantiating market growth

- In Asia, China is committed to be carbon-neutral by 2060 and India by 2070

The business is all about connecting renewable power to the grid, enabling power grid resilience, and managing increasing grid complexity. Products include Transformers, Switchgears, Converter towers and battery energy storage.

Transformation of Industry

The business aims to decarbonize industrial processes by three main levers: Energy Efficiency (increasing the efficiency of existing assets), Electrification (converting industrial processes from fossil fuels to electricity) and Hydrogen (producing and transporting green hydrogen and clean fuels). The segment has four businesses: Industrial Steam Turbines and Generators (providing process steam and converting heat to electricity), Electrification, Automation and Digitalization (electrifying industrial processes) Compression (compressing, transporting and storing fuels across all decarbonization offerings, including carbon capture) and Sustainable Energy Systems (manufacturing electrolyzer systems for hydrogen production). In short, this is the “clean tech” division.

In the longer term, the Electrification, Automation and Digitalization business which helps customers in converting industrial processes from fossil fuels to electricity, is in prime position to capture the electrification megatrend, as 50% of world primary energy will come from electricity in 2050 vs. 22% in 2020.

Management has guided low-single digit revenue growth through 2026, and is on track for a 6% profit margin before special items in 2024 growing to about 7% by 2026.

Earnings are distorted by the losses in Gamesa and the ongoing improvements across the business. Management has guided for Gamesa breakeven in 2026, so I have forecast a range of segment EBITs for 2027. For Gas Services, Grid Technologies and Transformation of Industry I am using profit margins of 11%, 10% and 7% respectively to get to 2027 EBITs. For Gamesa I have a range of margins depending on the case. I use the sector medium EV / EBIT multiple of 17x as a base case. Reconciliation to Consolidated Financial Statements stay constant at negative EUR 200m in each case.

From 2024 levels, Gas Services revenues stay flat, Grid Technologies grow cumulatively by 45%, Transformation of Industry grow cumulatively by 24%, and Gamesa revenues grow cumulatively by 9%. Gamesa achieves a 4% profit margin before special items. Taken together, this produces a group EBIT of EUR 3.2 billion. At 17x multiple, that gives us an enterprise value of EUR 54.4 billion. Subtract net debt of EUR 35 billion (assuming no cash from sales of non-core assets), gives us a market capitalisation of EUR 19.4 billion, slightly below today's market capitalisation of just over EUR 20 billion. In other words, my base case suggests Siemens Energy is roughly fairly valued now. This has priced in rapid growth in Grid Tech, a slow recovery in Gamesa, and flat Gas Services, with margins only about 1% point above where they are today, excluding Gamesa.

From 2024 levels, Gas Services revenues grow cumulatively by 15%, Grid Technologies grow cumulatively by 50%, Transformation of Industry grow cumulatively by 27%, and Gamesa revenues grow cumulatively by 12%. Gamesa achieves a 5% profit margin before special items. Taken together, this produces a group EBIT of EUR 3.7 billion. At a slightly better 18x multiple, that gives us an enterprise value of EUR 66.6 billion. Subtract net debt of EUR 33 billion (assuming two billion Euros cash raised from sales of non-core assets), gives us a market capitalisation of EUR 33.6 billion, which is about 68% above today's market capitalisation. This bull case assumes a stronger recovery in Gamesa by 2027, and stronger revenue growth in the other three segments.

From 2024 levels, Gas Services revenues drop cumulatively by 5%, Grid Technologies grow cumulatively by 36%, Transformation of Industry grow cumulatively by 20%, and Gamesa revenues stay flat to 2024 levels. Gamesa achieves a zero profit margin before special items, i.e. breakeven a year later than management forecasts. Taken together, this produces a group EBIT of EUR 2.6 billion. At a slightly worse 16x multiple, that gives us an enterprise value of EUR 41.1 billion. Subtract net debt of EUR 35 billion (assuming no cash from sales of non-core assets), gives us a market capitalisation of just EUR 6.6 billion, which is about 67% below today's market capitalisation. This bear case assumes continued problems with Gamesa, and slower or declining revenue growth in the other three segments.

My base case is the one that is most realistic to me. But the bull and bear cases are also somewhat realistic, and the risk reward to bear and bull case is about 1:1. However, I have not factored in any conglomerate discount, and it is also possible that Siemens Energy could warrant a higher multiple as its group of businesses are likely to be in a faster growing market than the medium industrial stock. A discounted cash flow valuation also would reduce the risk around the forecasts for 2027 earnings and multiples.

An alternative valuation approach would be to compare against direct competitor GE Vernova ( GEV ) as the businesses are very similar and figure out which one is cheaper, or which one is likely to fix its struggling wind business faster and/or better. It's also important to note that Siemens Energy gets around 20% of its business from the United States alone, making it a strong competitor to GEV.

I have made a number of assumptions after carefully reviewing each segment's quarterly performance over the last two years. The stock seems fairly priced, with likely optimism priced in to the gas and power businesses, and likely pessimism or at least less enthusiasm for the new/clean energies segments Transformation of Industry and Gamesa Wind. With an Altman Z Score of just 0.57 means the company's financial strength isn't great, which is a concern, although management is aware of this and is looking to sell non-core assets. The stock's momentum is also fading now. If you think my bull case is scenario is more likely, then the stock is a buy, but otherwise the stock is a hold for now. The key catalyst comes at the Q4 earnings release on 13th November, when we should get a better picture of the Gamesa turnaround.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About smegf stock.

| Symbol | Last Price | % Chg |

|---|

More on SMEGF

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| SMEGF | - | - |

Trending Analysis

Trending news.

Siemens Energy takes full control of Siemens Gamesa

- Medium Text

- Siemens Energy AG Follow

- Siemens Gamesa Renewable Energy SA Follow

Sign up here.

Reporting by Christoph Steitz Editing by Miranda Murray

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

US lenders not on insolvency panel of India's Byju's, sources say

U.S.-based Glas Trust is not part of a key panel overseeing the insolvency proceedings of Indian education-technology giant Byju's, and will need to substantiate the $1 billion claim of lenders it represents, according to documents and three sources.

- Election 2024

- Entertainment

- Newsletters

- Photography

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election results

- Google trends

- AP & Elections

- U.S. Open Tennis

- Paralympic Games

- College football

- Auto Racing

- Movie reviews

- Book reviews

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Another New Jersey offshore wind project runs into turbulence as Leading Light seeks pause

Land-based wind turbines spin in Atlantic City, N.J., April 28, 2022. (AP Photo/Wayne Parry)

- Copy Link copied

Another offshore wind project in New Jersey is encountering turbulence.

Leading Light Wind is asking the New Jersey Board of Public Utilities to give it a pause through late December on its plan to build an offshore wind farm off the coast of Long Beach Island.

In a filing with the utilities board made in July but not posted on the board’s web site until Tuesday, the company said it has had difficulty securing a manufacturer for turbine blades for the project and is currently without a supplier.

It asked the board to pause the project through Dec. 20 while a new source of blades is sought.

Wes Jacobs, the project director and vice president of Offshore Wind Development at Invenergy — one of the project’s partners — said it is seeking to hit the pause button “in light of industry-wide shifts in market conditions.”

It seeks more time for discussions with the board and supply chain partners, he said.

“As one of the largest American-led offshore wind projects in the country, we remain committed to delivering this critically important energy project, as well as its significant economic and environmental benefits, to the Garden State,” he said in a statement Tuesday night.

The statement added that the company, during a pause, would continue moving its project ahead with such developmental activities as an “ongoing survey program and preparation of its construction and operations plan.”

The request was hailed by opponents of offshore wind, who are particularly vocal in New Jersey.

“Yet another offshore wind developer is finding out for themselves that building massive power installations in the ocean is a fool’s errand, especially off the coast of New Jersey,” said Protect Our Coast NJ. “We hope Leading Light follows the example of Orsted and leaves New Jersey before any further degradation of the marine and coastal environment can take place.”

Nearly a year ago, Danish wind energy giant Orsted scrapped two offshore wind farms planned off New Jersey’s coast, saying they were no longer financially feasible to build.

Atlantic Shores, another project with preliminary approval in New Jersey, is seeking to rebid the financial terms of its project.

And opponents of offshore wind have seized on the disintegration of a wind turbine blade off Martha’s Vineyard in Massachusetts in July that sent crumbled pieces of it washing ashore on the popular island vacation destination.

Leading Light was one of two projects chosen in January by the state utilities board. But just three weeks after that approval, one of three major turbine manufacturers, GE Vernova, said it would not announce the kind of turbine Invenergy planned to use in the Leading Light Project, according to the filing with the utilities board.

A turbine made by manufacturer Vestas was deemed unsuitable for the project, and the lone remaining manufacturer, Siemens Gamesa Renewable Energy, told Invenergy in June “that it was substantially increasing the cost of its turbine offering.”

“As a result of these actions, Invenergy is currently without a viable turbine supplier,” it wrote in its filing.

The project, from Chicago-based Invenergy and New York-based energyRE, would be built 40 miles (65 kilometers) off Long Beach Island and would consist of up to 100 turbines, enough to power 1 million homes.

New Jersey has become the epicenter of resident and political opposition to offshore wind, with numerous community groups and elected officials — most of them Republicans — saying the industry is harmful to the environment and inherently unprofitable.

Supporters, many of them Democrats, say that offshore wind is crucial to move the planet away from the burning of fossil fuels and the changing climate that results from it.

New Jersey has set ambitious goals to become the East Coast hub of the offshore wind industry. It built a manufacturing facility for wind turbine components in the southern part of the state to help achieve that aim.

Follow Wayne Parry on X at www.twitter.com/WayneParryAC

Another New Jersey offshore wind project runs into turbulence as Leading Light seeks pause

Another offshore wind project in New Jersey is encountering turbulence

Another offshore wind project in New Jersey is encountering turbulence.

Leading Light Wind is asking the New Jersey Board of Public Utilities to give it a pause through late December on its plan to build an offshore wind farm off the coast of Long Beach Island.

In a filing with the utilities board made in July but not posted on the board's web site until Tuesday, the company said it has had difficulty securing a manufacturer for turbine blades for the project and is currently without a supplier.

It asked the board to pause the project through Dec. 20 while a new source of blades is sought.

Wes Jacobs, the project director and vice president of Offshore Wind Development at Invenergy — one of the project's partners — said it is seeking to hit the pause button “in light of industry-wide shifts in market conditions.”

It seeks more time for discussions with the board and supply chain partners, he said.

“As one of the largest American-led offshore wind projects in the country, we remain committed to delivering this critically important energy project, as well as its significant economic and environmental benefits, to the Garden State,” he said in a statement Tuesday night.

The statement added that the company, during a pause, would continue moving its project ahead with such developmental activities as an "ongoing survey program and preparation of its construction and operations plan.”

The request was hailed by opponents of offshore wind, who are particularly vocal in New Jersey.

“Yet another offshore wind developer is finding out for themselves that building massive power installations in the ocean is a fool’s errand, especially off the coast of New Jersey,” said Protect Our Coast NJ. “We hope Leading Light follows the example of Orsted and leaves New Jersey before any further degradation of the marine and coastal environment can take place.”

Nearly a year ago, Danish wind energy giant Orsted scrapped two offshore wind farms planned off New Jersey's coast, saying they were no longer financially feasible to build.

Atlantic Shores, another project with preliminary approval in New Jersey, is seeking to rebid the financial terms of its project.

And opponents of offshore wind have seized on the disintegration of a wind turbine blade off Martha's Vineyard in Massachusetts in July that sent crumbled pieces of it washing ashore on the popular island vacation destination.

Leading Light was one of two projects chosen in January by the state utilities board. But just three weeks after that approval, one of three major turbine manufacturers, GE Vernova, said it would not announce the kind of turbine Invenergy planned to use in the Leading Light Project, according to the filing with the utilities board.

A turbine made by manufacturer Vestas was deemed unsuitable for the project, and the lone remaining manufacturer, Siemens Gamesa Renewable Energy, told Invenergy in June “that it was substantially increasing the cost of its turbine offering.”

“As a result of these actions, Invenergy is currently without a viable turbine supplier,” it wrote in its filing.

The project, from Chicago-based Invenergy and New York-based energyRE, would be built 40 miles (65 kilometers) off Long Beach Island and would consist of up to 100 turbines, enough to power 1 million homes.

New Jersey has become the epicenter of resident and political opposition to offshore wind, with numerous community groups and elected officials — most of them Republicans — saying the industry is harmful to the environment and inherently unprofitable.

Supporters, many of them Democrats, say that offshore wind is crucial to move the planet away from the burning of fossil fuels and the changing climate that results from it.

New Jersey has set ambitious goals to become the East Coast hub of the offshore wind industry. It built a manufacturing facility for wind turbine components in the southern part of the state to help achieve that aim.

Follow Wayne Parry on X at www.twitter.com/WayneParryAC

Popular Reads

15 ISIS members killed in US raid: Officials

- Aug 31, 11:00 AM

11-year-old confesses to fatally shooting 2 people

- Sep 3, 3:27 PM

49ers' Ricky Pearsall shot in attempted robbery

- Sep 2, 6:26 PM

What I learned after being groomed online as a kid

- Sep 3, 4:01 AM

Trump charged in Jan. 6 superseding indictment

- Aug 27, 6:25 PM

ABC News Live

24/7 coverage of breaking news and live events

Wind energy primes its wings for takeoff in South Korea

Wind energy plays an indispensable role in our society, and this is evident in the efforts of our Asia-Pacific team. They are rapidly fast laying the groundwork for an expected surge in offshore installations in South Korea in the coming years, even if challenges remain and for now it’s onshore that continues to make steady progress.

SG 14-236 DD series: Our largest ever wind turbine is now fully operational

We have witnessed the journey of the installation of Siemens Gamesa's largest offshore wind turbine: from the beginning, when the nacelle left the factory in Brande, all the way to the installation of the rotor with its 115-meter-long blades. With a capacity of up to 15 MW with Power Boost, this massive turbine will provide an increase of more than 30% in Annual Energy Production (AEP) compared to its predecessor.

Uncharted waters - how floating wind opens up new possibilities

A recent survey in the UK revealed that between 79% and 88% of people questioned support wind power, the level of support dependent upon their stated political allegiance; they recognize that it is the most effective way to decarbonize energy generation, to bring us towards net zero. But do they know that floating offshore wind offers a way further to speed the process and bring offshore wind to areas where it currently is not viable?

Minority shareholders of Siemens Gamesa approve capital reduction, paving way for complete integration into Siemens Energy

Tuesday, 13 June 2023,

Pioneering technology

Siemens Gamesa is leading the way for a sustainable future with the RecyclableBlade, the first product to offer a comprehensive recyclable solution that is ready for commercial use both offshore and onshore.

The wind industry is still relatively young and is aware of the responsibility it holds of finding a sustainable way to deal with wind turbine components at the end of their life cycle. Increasing the recyclability of the wind components is high on our agenda, and we are committed to producing 100% recyclable turbines by 2040.

Your trusted technology partner

Operating in around 90 countries, Siemens Gamesa offers an extensive range of onshore wind turbine technologies to cover all wind classes and site conditions. By listening to our customers - and backed up by over 40 years of experience - we know just what it takes to develop and manage a successful onshore project.

Powerful performance

Leading the way forward, our engineers and technicians pioneered the offshore sector back in 1991, with the world’s first wind power plant in Denmark. Since then, Siemens Gamesa has grown to become the global leader in offshore power generation. Offering full-scope solutions and services, our people and products will guarantee the success of your next offshore project.

World-class maintenance

Siemens Gamesa has a proven track record of excellence in operation and maintenance. Leveraging scale and global reach, we offer a flexible service portfolio that can be tailored to our customers’ diverse operating models. We also provide advanced diagnostics and digitalization capabilities, as well as customized offshore offerings.

It takes the brightest minds to be a technology leader. It takes imagination to create green energy for the generations to come. At Siemens Gamesa we make real what matters.

This decade will be judged on our ability to take the steps needed to keep global temperature rises this century to between 1.5 and 2.0 degrees Celsius, as well as deliver a fairer and more equal world. That is why as part of our Sustainability Vision 2040, we are focused not just on the targets we set, but instead on the actions that are needed to deliver on them.

Taking innovation offshore: the Kaskasi wind energy project, a world first. And why policymakers should care

Sustainability

We are 35 kilometers off the coast of the German island of Heligoland in the North Sea. For the last few years, Daniel and his crew of engineers and technicians have been working on a world first for the industry. They installed the first commercial recyclable wind turbine blades here, and in July 2022 these turbines generated their first green energy output. The Kaskasi wind project, along with two other offshore sites Amrumbank West and Nordsee Ost, forms part of RWE’s Heligoland Cluster.

The FOD4Wind project estimates a reduction of 13,000 tons of CO2 in 2030

We must innovate in the use of drones to service offshore wind farms cheaper, faster and more efficiently. The research project FOD4Wind between Energy Cluster Denmark, ESVAGT, Upteko, University of Southern Denmark (SDU) and Siemens Gamesa can reduce downtime and eliminate fixed costs for servicing offshore wind. Based on estimations of the project team, with 70 installed charging stations with drones, the annual effect in 2030 will be reduced downtime of 12,250 hours, 13,000 tons of CO2 reduction, increased energy production by 39,200 MWh, reduced costs for service by 57 million Euros and additional employment of 180 employees.

You might be interested in

Siemens Gamesa 5.X

As a part of our Siemens Gamesa 5.X onshore platform, the SG 6.6-170 comes with high performance and proven reliability at medium and low wind.

- Rotor diameter: 170 m

- Nominal power: Up to 6.6 MW

- Technology: Geared

- Special features: OptimaFlex

Spares and repairs for wind turbines

Siemens Gamesa has the global scale and operational experience to support you wherever you need us, and a comprehensive portfolio of spares (new and refurbished), repairs, reconditioning services as well as advance main component exchange processes – all built on the highest safety and quality standards. A repairs expert you can rely on to deliver a solution long before it might become necessary. Get the most out of your turbines, all the time.

SG 14-222 DD

Strong winds of change

The SG 14-222 DD is based on proven technology and will deliver safe and clean energy for a sustainable future.

- Wind class: I, S

- Rotor diameter: 222m

- Serial production: 2024

- Nominal power: 14 MW

Khabarovsk Krai

| Хабаровский край | |

| Coordinates: 136°50′E / 54.800°N 136.833°E / 54.800; 136.833 | |

| Country | |

| Administrative center | |

| Government | |

| • Body | |

| • | (acting) |

| Area | |

| • Total | 787,633 km (304,107 sq mi) |

| • Rank | |

| Population ( ) | |

| • Total | 1,292,944 |

| • Estimate | 1,328,302 |

| • Rank | |

| • Density | 1.6/km (4.3/sq mi) |

| • | 83.4% |

| • | 16.6% |

| ( ) | |

| RU-KHA | |

| 27 | |

| ID | 08000000 |

| Official languages | |

| Website | |

Administrative divisions

Heavy industry, demographics, ethnic groups, settlements, sister relations, external links.

Being dominated by the Siberian High winter cold, the continental climates of the krai see extreme freezing for an area adjacent to the sea near the mid-latitudes, but also warm summers in the interior. The southern region lies mostly in the basin of the lower Amur River , with the mouth of the river located at Nikolaevsk-on-Amur draining into the Strait of Tartary , which separates Khabarovsk Krai from the island of Sakhalin . The north occupies a vast mountainous area along the coastline of the Sea of Okhotsk , a marginal sea of the Pacific Ocean . Khabarovsk Krai is bordered by Magadan Oblast to the north; Amur Oblast , Jewish Autonomous Oblast , and the Sakha Republic to the west; Primorsky Krai to the south; and Sakhalin Oblast to the east.

The population consists of mostly ethnic Russians , but indigenous people of the area are numerous, such as the Tungusic peoples ( Evenks , Negidals , Ulchs , Nanai , Oroch , Udege ), Amur Nivkhs , and Ainu . [10]

Khabarovsk Krai shares its borders with Magadan Oblast in the north; with the Sakha Republic and Amur Oblast in the west; with the Jewish Autonomous Oblast , China ( Heilongjiang ), and Primorsky Krai in the south; and is limited by the Sea of Okhotsk in the east. In terms of area, it is the fourth-largest federal subject within Russia. Major islands include the Shantar Islands .

Taiga and tundra in the north, swampy forest in the central depression, and deciduous forest in the south are the natural vegetation in the area. The main rivers are the Amur , Amgun , Uda , and Tugur , among others. There are also lakes such as Bokon , Bolon , Chukchagir , Evoron , Kizi , Khummi , Orel , and Udyl , among others. [11]

Khabarovsk Krai has a severely continental climate with its northern areas being subarctic with stronger maritime summer moderation in the north. In its southerly areas, especially inland, annual swings are extremely strong, with Khabarovsk itself having hot, wet, and humid summers which rapidly transform into severely cold and long winters, where temperatures hardly ever go above freezing. This is because of the influence of the East Asian monsoon in summer and the bitterly cold Siberian High in winter. The second-largest city of Komsomolsk-on-Amur has even more violent temperature swings than Khabarovsk, with winter average lows below −30 °C (−22 °F) , but in spite of this, avoiding being subarctic because of the significant heat in summer.

The main mountain ranges in the region are the Bureya Range , the Badzhal Range (highest point 2,221 metres (7,287 ft) high, the Gora Ulun ), the Yam-Alin , the Dusse-Alin , the Sikhote-Alin , the Dzhugdzhur Mountains , the Kondyor Massif , as well as a small section of the Suntar-Khayata Range , the Yudoma-Maya Highlands , and the Sette-Daban in the western border regions. The highest point is 2,933 metres (9,623 ft) high, Berill Mountain . [12] [13]

There are a number of peninsulas along the krai's extensive coast, the main ones being (north to south) the Lisyansky Peninsula , Nurki Peninsula , Tugurskiy Peninsula , and the Tokhareu Peninsula .

The main islands of Khabarovsk Krai (north to south) are Malminskiye Island , the Shantar Islands , Menshikov Island , Reyneke Island (Sea of Okhotsk) , Chkalov Island , Baydukov Island , and the Chastye Islands . The island of Sakhalin (Russia's largest) is administered separately as Sakhalin Oblast , along with the Kuril Islands .

The charts below detail climate averages from various locations in the krai. Khabarovsk is set near the Chinese border at a lower latitude far inland, while Komsomolsk-on-Amur being further downstream on the Amur river at a higher latitude. Sovetskaya Gavan and Okhotsk are coastal settlements in the deep south and far north, respectively.

| Climate data for (1991–2020, extremes 1878–2023) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

| Record high °C (°F) | 0.6 (33.1) | 6.3 (43.3) | 17.0 (62.6) | 28.6 (83.5) | 31.5 (88.7) | 36.4 (97.5) | 35.7 (96.3) | 35.6 (96.1) | 29.8 (85.6) | 26.4 (79.5) | 15.5 (59.9) | 6.6 (43.9) | 36.4 (97.5) |

| Mean daily maximum °C (°F) | −14.9 (5.2) | −9.9 (14.2) | −1.0 (30.2) | 10.5 (50.9) | 19.2 (66.6) | 23.8 (74.8) | 26.8 (80.2) | 24.9 (76.8) | 19.7 (67.5) | 10.6 (51.1) | −2.8 (27.0) | −13.6 (7.5) | 7.8 (46.0) |

| Daily mean °C (°F) | −19.2 (−2.6) | −14.9 (5.2) | −5.9 (21.4) | 4.8 (40.6) | 12.9 (55.2) | 18.0 (64.4) | 21.4 (70.5) | 19.9 (67.8) | 14.1 (57.4) | 5.4 (41.7) | −6.9 (19.6) | −17.4 (0.7) | 2.7 (36.9) |

| Mean daily minimum °C (°F) | −23.1 (−9.6) | −19.6 (−3.3) | −10.7 (12.7) | −0.1 (31.8) | 7.3 (45.1) | 12.8 (55.0) | 16.8 (62.2) | 15.7 (60.3) | 9.4 (48.9) | 1.0 (33.8) | −10.4 (13.3) | −20.9 (−5.6) | −1.8 (28.8) |

| Record low °C (°F) | −40.0 (−40.0) | −35.1 (−31.2) | −28.9 (−20.0) | −15.1 (4.8) | −3.1 (26.4) | 2.2 (36.0) | 6.8 (44.2) | 4.9 (40.8) | −3.3 (26.1) | −15.6 (3.9) | −27.7 (−17.9) | −38.1 (−36.6) | −40.0 (−40.0) |

| Average mm (inches) | 13 (0.5) | 12 (0.5) | 22 (0.9) | 37 (1.5) | 70 (2.8) | 84 (3.3) | 137 (5.4) | 143 (5.6) | 85 (3.3) | 48 (1.9) | 26 (1.0) | 19 (0.7) | 696 (27.4) |

| Average extreme snow depth cm (inches) | 14 (5.5) | 16 (6.3) | 12 (4.7) | 1 (0.4) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 1 (0.4) | 5 (2.0) | 10 (3.9) | 16 (6.3) |

| Average rainy days | 0 | 0 | 1 | 10 | 16 | 15 | 15 | 17 | 15 | 11 | 2 | 0 | 102 |

| Average snowy days | 14 | 11 | 11 | 6 | 1 | 0 | 0 | 0 | 0.1 | 4 | 12 | 14 | 73 |

| Average (%) | 75 | 72 | 68 | 63 | 65 | 74 | 79 | 83 | 78 | 67 | 69 | 73 | 72 |

| Mean monthly | 147 | 181 | 231 | 213 | 242 | 262 | 248 | 217 | 212 | 189 | 159 | 145 | 2,446 |

| Source 1: Pogoda.ru.net | |||||||||||||

| Source 2: NOAA (sun, 1961–1990) | |||||||||||||

| Climate data for | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

| Record high °C (°F) | 0.7 (33.3) | 0.0 (32.0) | 13.6 (56.5) | 23.9 (75.0) | 31.0 (87.8) | 33.2 (91.8) | 36.2 (97.2) | 38.0 (100.4) | 30.0 (86.0) | 20.5 (68.9) | 8.3 (46.9) | 1.0 (33.8) | 38.0 (100.4) |

| Mean daily maximum °C (°F) | −19.6 (−3.3) | −13.9 (7.0) | −4.0 (24.8) | 7.5 (45.5) | 16.1 (61.0) | 22.8 (73.0) | 25.1 (77.2) | 23.4 (74.1) | 17.1 (62.8) | 7.4 (45.3) | −6.4 (20.5) | −17.2 (1.0) | 4.6 (40.3) |

| Daily mean °C (°F) | −24.7 (−12.5) | −19.8 (−3.6) | −9.5 (14.9) | 2.3 (36.1) | 10.4 (50.7) | 17.3 (63.1) | 20.3 (68.5) | 18.5 (65.3) | 11.9 (53.4) | 2.5 (36.5) | −10.5 (13.1) | −21.8 (−7.2) | −0.6 (30.9) |

| Mean daily minimum °C (°F) | −30.8 (−23.4) | −27.2 (−17.0) | −17.1 (1.2) | −3.4 (25.9) | 3.7 (38.7) | 10.8 (51.4) | 15.2 (59.4) | 13.5 (56.3) | 6.4 (43.5) | −2.9 (26.8) | −16.1 (3.0) | −27.4 (−17.3) | −6.6 (20.1) |

| Record low °C (°F) | −47.0 (−52.6) | −42.0 (−43.6) | −33.9 (−29.0) | −20.8 (−5.4) | −7.5 (18.5) | −2.2 (28.0) | 0.0 (32.0) | −8.9 (16.0) | −6.0 (21.2) | −22.0 (−7.6) | −34.0 (−29.2) | −42.0 (−43.6) | −47.0 (−52.6) |

| Average mm (inches) | 30 (1.2) | 19 (0.7) | 30 (1.2) | 43 (1.7) | 63 (2.5) | 65 (2.6) | 95 (3.7) | 110 (4.3) | 74 (2.9) | 62 (2.4) | 49 (1.9) | 32 (1.3) | 672 (26.4) |

| Average precipitation days | 14 | 12 | 13 | 15 | 15 | 13 | 15 | 14 | 14 | 13 | 16 | 15 | 169 |

| Average rainy days | 0 | 0 | 1 | 7 | 14 | 13 | 15 | 14 | 14 | 8 | 1 | 0 | 87 |

| Average snowy days | 14 | 12 | 13 | 11 | 3 | 0 | 0 | 0 | 0 | 8 | 15 | 15 | 91 |

| Source 1: climatebase.ru | |||||||||||||

| Source 2: Weatherbase | |||||||||||||

| Climate data for (1914–2012) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

| Record high °C (°F) | 2.6 (36.7) | 12.2 (54.0) | 18.9 (66.0) | 25.1 (77.2) | 31.8 (89.2) | 35.1 (95.2) | 34.2 (93.6) | 35.8 (96.4) | 30.2 (86.4) | 26.8 (80.2) | 16.5 (61.7) | 9.4 (48.9) | 35.8 (96.4) |

| Mean daily maximum °C (°F) | −11.4 (11.5) | −8.3 (17.1) | −1.8 (28.8) | 5.6 (42.1) | 11.6 (52.9) | 16.8 (62.2) | 20.5 (68.9) | 21.9 (71.4) | 18.2 (64.8) | 10.9 (51.6) | 0.0 (32.0) | −8.7 (16.3) | 6.3 (43.3) |

| Daily mean °C (°F) | −16.8 (1.8) | −14.2 (6.4) | −7.4 (18.7) | 1.1 (34.0) | 6.6 (43.9) | 11.5 (52.7) | 15.6 (60.1) | 17.4 (63.3) | 13.3 (55.9) | 6.0 (42.8) | −4.7 (23.5) | −13.5 (7.7) | 1.3 (34.3) |

| Mean daily minimum °C (°F) | −22.2 (−8.0) | −20.1 (−4.2) | −12.9 (8.8) | −3.5 (25.7) | 1.5 (34.7) | 6.2 (43.2) | 10.7 (51.3) | 12.9 (55.2) | 8.4 (47.1) | 1.0 (33.8) | −9.3 (15.3) | −18.3 (−0.9) | −3.8 (25.2) |

| Record low °C (°F) | −40.0 (−40.0) | −38.6 (−37.5) | −30.3 (−22.5) | −26.4 (−15.5) | −9.5 (14.9) | −3.0 (26.6) | 2.4 (36.3) | 4.0 (39.2) | −1.7 (28.9) | −14.7 (5.5) | −31.3 (−24.3) | −38.4 (−37.1) | −40.0 (−40.0) |

| Average mm (inches) | 19.9 (0.78) | 20.7 (0.81) | 42.9 (1.69) | 47.5 (1.87) | 73.9 (2.91) | 70.1 (2.76) | 82.1 (3.23) | 109.6 (4.31) | 117.2 (4.61) | 87.7 (3.45) | 43.4 (1.71) | 32.7 (1.29) | 747.7 (29.42) |

| Average precipitation days | 6.8 | 7.0 | 9.6 | 10.3 | 13.2 | 12.9 | 13.4 | 14.7 | 13.1 | 9.2 | 6.1 | 6.6 | 122.9 |

| Source: | |||||||||||||

| Climate data for (1991−2020 normals, extremes 1891–present) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

| Record high °C (°F) | 5.5 (41.9) | 2.0 (35.6) | 6.4 (43.5) | 16.0 (60.8) | 26.2 (79.2) | 31.3 (88.3) | 31.0 (87.8) | 32.1 (89.8) | 24.8 (76.6) | 15.7 (60.3) | 6.2 (43.2) | 2.8 (37.0) | 32.1 (89.8) |

| Mean daily maximum °C (°F) | −16.8 (1.8) | −14.2 (6.4) | −6.3 (20.7) | 0.4 (32.7) | 6.2 (43.2) | 11.4 (52.5) | 15.7 (60.3) | 17.1 (62.8) | 12.9 (55.2) | 2.7 (36.9) | −9.7 (14.5) | −16.4 (2.5) | 0.3 (32.5) |

| Daily mean °C (°F) | −19.9 (−3.8) | −18.5 (−1.3) | −12.1 (10.2) | −3.8 (25.2) | 2.6 (36.7) | 8.1 (46.6) | 12.9 (55.2) | 13.7 (56.7) | 8.9 (48.0) | −1.2 (29.8) | −12.7 (9.1) | −19.0 (−2.2) | −3.4 (25.9) |

| Mean daily minimum °C (°F) | −22.7 (−8.9) | −22.2 (−8.0) | −17.8 (0.0) | −8.2 (17.2) | −0.2 (31.6) | 5.7 (42.3) | 10.6 (51.1) | 10.6 (51.1) | 4.9 (40.8) | −4.6 (23.7) | −15.3 (4.5) | −21.4 (−6.5) | −6.7 (19.9) |

| Record low °C (°F) | −41.3 (−42.3) | −45.7 (−50.3) | −36.9 (−34.4) | −29.2 (−20.6) | −16.0 (3.2) | −2.6 (27.3) | 1.7 (35.1) | −0.1 (31.8) | −6.6 (20.1) | −27.5 (−17.5) | −37.4 (−35.3) | −37.7 (−35.9) | −45.7 (−50.3) |

| Average mm (inches) | 15 (0.6) | 7 (0.3) | 16 (0.6) | 24 (0.9) | 40 (1.6) | 55 (2.2) | 85 (3.3) | 94 (3.7) | 92 (3.6) | 66 (2.6) | 32 (1.3) | 14 (0.6) | 540 (21.3) |

| Average rainy days | 0.1 | 0.2 | 0.3 | 2 | 11 | 16 | 18 | 15 | 16 | 7 | 1 | 0.2 | 87 |

| Average snowy days | 9 | 9 | 11 | 13 | 10 | 0.4 | 0 | 0 | 0.3 | 9 | 11 | 8 | 81 |

| Average (%) | 63 | 63 | 68 | 77 | 84 | 88 | 89 | 86 | 80 | 70 | 66 | 63 | 75 |

| Mean monthly | 86 | 147 | 241 | 230 | 195 | 200 | 179 | 182 | 172 | 157 | 107 | 54 | 1,950 |

| Source 1: Pogoda.ru.net | |||||||||||||

| Source 2: (sun 1961–1990) | |||||||||||||

According to various Chinese and Korean records, the southern part of Khabarovsk Krai was originally occupied by one of the five semi-nomadic Shiwei , the Bo Shiwei tribes, and the Black Water Mohe tribes living, respectively, on the west and the east of the Bureya and the Lesser Khingan ranges.

In 1643, Vassili Poyarkov 's boats descended the Amur , returning to Yakutsk by the Sea of Okhotsk and the Aldan River , and in 1649–1650, Yerofey Khabarov occupied the banks of the Amur. The resistance of the Chinese, however, obliged the Cossacks to quit their forts, and by the Treaty of Nerchinsk (1689), Russia abandoned its advance into the basin of the river.

Although the Russians were thus deprived of the right to navigate the Amur River, the territorial claim over the lower courses of the river was not settled in the Treaty of Nerchinsk of 1689. The area between the Uda River and the Greater Khingan mountain range (i.e. most of Lower Amuria) was left undemarcated and the Sino-Russian border was allowed to fluctuate. [20] [21]

Later in the nineteenth century, Nikolay Muravyov conducted an aggressive policy with China by claiming that the lower reaches of the Amur River belonged to Russia . In 1852, a Russian military expedition under Muravyov explored the Amur, and by 1857, a chain of Russian Cossacks and peasants had been settled along the whole course of the river. In 1858, in the Treaty of Aigun , China recognized the Amur River downstream as far as the Ussuri River as the boundary between Russia and the Qing Empire, and granted Russia free access to the Pacific Ocean. [22] The Sino-Russian border was later further delineated in the Treaty of Peking of 1860 when the Ussuri Territory (the Maritime Territory ), which was previously a joint possession, became Russian. [23]

Khabarovsk Krai was established on 20 October 1938, when the Far Eastern Krai was split into the Khabarovsk and Primorsky Krais . [24] Kamchatka Oblast , which was originally subordinated to the Far Eastern Krai, fell under the Jurisdiction of Khabarovsk Krai, along with its two National Okrugs, Chukotka and Koryak . In 1947, the northern part of Sakhalin was removed from the Krai to join the southern part and form Sakhalin Oblast . In 1948, parts of its southwestern territories were removed from the Krai to form Amur Oblast . In 1953, Magadan Oblast was established from the northern parts of the Krai and was given jurisdiction over Chukotka National Okrug, which was originally under the jurisdiction of Kamchatka oblast. In 1956, Kamchatka Oblast became its own region and took Koryak National Okrug with it. The Krai took its modern form in 1991, just before the USSR's collapse when the Jewish Autonomous Oblast was created within its territory. On 24 April 1996, Khabarovsk signed a power-sharing agreement with the federal government, granting it autonomy. [25] This agreement would be abolished on 12 August 2002. [26]

During the Soviet period, the high authority in the oblast was shared between three persons: The first secretary of the Khabarovsk CPSU Committee (who, in reality, had the biggest authority), the chairman of the oblast Soviet (legislative power), and the Chairman of the oblast Executive Committee (executive power). Since 1991, CPSU lost all the power, and the head of the Oblast administration, and eventually the governor, was appointed/elected alongside elected regional parliament .

The Charter of Khabarovsk Krai is the fundamental law of the krai. The Legislative Duma of Khabarovsk Krai is the regional standing legislative (representative) body. The Legislative Duma exercises its authority by passing laws, resolutions, and other legal acts and by supervising the implementation and observance of the laws and other legal acts passed by it. The highest executive body is the Krai Government, which includes territorial executive bodies, such as district administrations, committees, and commissions that facilitate development and run the day to day matters of the province. The Krai Administration supports the activities of the Governor , who is the highest official and acts as guarantor of the observance of the Charter in accordance with the Constitution of Russia .

On 9 July 2020, the governor of the region, Sergei Furgal , was arrested and flown to Moscow. The 2020 Khabarovsk Krai protests began on 11 July 2020, in support of Furgal. [27]

Khabarovsk Krai is the most industrialized territory of the Far East of Russia, producing 30% of the total industrial products in the Far Eastern Economic Region.

The machine construction industry consists primarily of a highly developed military–industrial complex of large-scale aircraft- and shipbuilding enterprises. [28] The Komsomolsk-on-Amur Aircraft Production Association is currently among the krai's most successful enterprises, and for years has been the largest taxpayer of the territory. [28] Other major industries include timber-working and fishing , along with metallurgy in the main cities. Komsomolsk-on-Amur is the iron and steel centre of the Far East; a pipeline from northern Sakhalin supplies the petroleum-refining industry in the city of Khabarovsk . In the Amur basin, there is also some cultivation of wheat and soybeans . The administrative centre , Khabarovsk, is at the junction of the Amur River and the Trans-Siberian Railway .

The region's mineral resources are relatively underdeveloped. Khabarovsk Krai contains large gold mining operations (Highland Gold, Polus Gold), a major but low-grade copper deposit being explored by IG Integro Group , and a world-class tin district which was a major contributor to the Soviet industrial complex and is currently being revitalised by Far Eastern Tin (Festivalnoye mine) and by Sable Tin Resources Archived March 13, 2017, at the Wayback Machine , which is developing the Sable Tin Deposit (Sobolinoye) , a large high-grade deposit, 25 km from Solnechny town.

| Year | ||

|---|---|---|

| 1926 | 184,700 | — |

| 1939 | 657,400 | +255.9% |

| 1959 | 979,679 | +49.0% |

| 1970 | 1,173,458 | +19.8% |

| 1979 | 1,369,277 | +16.7% |

| 1989 | 1,597,373 | +16.7% |

| 2002 | 1,436,570 | −10.1% |

| 2010 | 1,343,869 | −6.5% |

| 2021 | 1,292,944 | −3.8% |

| Source: Census data | ||

Population : 1,292,944 ( 2021 Census ) ; [29] 1,343,869 ( 2010 Russian census ) ; [9] 1,436,570 ( 2002 Census ) ; [30] 1,824,506 ( 1989 Soviet census ) . [31]

| Ethnicity | Population | Percentage |

|---|---|---|

| 1,047,221 | 92.9% | |

| 10,813 | 1.0% | |

| 7,170 | 0.6% | |

| 4,332 | 0.4% | |

| 3,740 | 0.3% | |

| 3,709 | 0.3% | |

| Other Ethnicities | 50,780 | 3.9% |

| Ethnicity not stated | 165,179 | – |

Vital statistics for 2022: [33] [34]

- Births: 12,404 (9.6 per 1,000)

- Deaths: 18,209 (14.0 per 1,000)

Total fertility rate (2022): [35] 1.50 children per woman

Life expectancy (2021): [36] Total — 67.85 years (male — 62.91, female — 72.94)

| | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Rank | Pop. | ||||||||

| | 1 | 577,441 | | ||||||

| 2 | 263,906 | ||||||||

| 3 | 42,970 | ||||||||

| 4 | 22,752 | ||||||||

| 5 | 27,712 | ||||||||

| 6 | 17,154 | ||||||||

| 7 | 17,001 | ||||||||

| 8 | 14,555 | ||||||||

| 9 | 13,306 | ||||||||

| 10 | 13,048 | ||||||||

| Religion in Krai Oblast as of 2012 (Sreda Arena Atlas) | ||||

|---|---|---|---|---|

| 26.2% | ||||

| Other | 1.3% | |||

| 0.5% | ||||

| Other | 3.7% | |||

| 1.1% | ||||

| and other native faiths | 0.5% | |||

| 27.9% | ||||

| and | 23.1% | |||

| Other and undeclared | 15.7% | |||

According to a 2012 survey, [37] 26.2% of the population of Khabarovsk Krai adheres to the Russian Orthodox Church , 4% are unaffiliated generic Christians , 1% adhere to other Orthodox churches or are believers in Orthodox Christianity who do not belong to any church, while 1% are adherents of Islam . In addition, 28% of the population declared to be "spiritual but not religious", 23% are atheist , and 16.8% follow other religions or did not give an answer to the question. [37]

There are the following institutions of higher education in Khabarovsk Krai. [39] [40]

- Pacific National University

- Far Eastern State University of Humanities

- Far Eastern State Medical University

- Khabarovsk State Academy of Economics and Law [ ru ]

- Far Eastern State Transport University

- Far Eastern Academy of Government Services

- Far Eastern State Physical Education University

- Khabarovsk State Institute of Arts and Culture

- Komsomolsk-on-Amur State Technical University

- Komsomolsk-on-Amur State Pedagogical institute

- Amur Khabarovsk , a professional hockey club of the international Kontinental Hockey League and plays its home games at the Platinum Arena .

- FC SKA-Energiya Khabarovsk is a professional association football team playing in the Russian Football National League , the second tier of Russian association football.

- SKA-Neftyanik is a professional bandy club which plays in the top-tier Russian Bandy Super League at its own indoor venue Arena Yerofey . In the 2016–17 season , the club became Russian champion for the first time. [41]

The city was a host to the 1981 Bandy World Championship as well as to the 2015 Bandy World Championship . For the 2015 games, twenty-one teams originally were expected, which would have been four more than the record-making seventeen from the 2014 tournament , but eventually, only sixteen teams came. The A Division of the 2018 Bandy World Championship was again to be played in Khabarovsk. [42]

- List of Chairmen of the Legislative Duma of Khabarovsk Krai

- Tourism in Khabarovsk Krai

Related Research Articles

Amur Oblast is a federal subject of Russia, located on the banks of the Amur and Zeya rivers in the Russian Far East. Amur Oblast borders Heilongjiang province of the People's Republic of China (PRC) to the south.

Okha is a town and the administrative center of Okhinsky District of Sakhalin Oblast, Russia. Population: 23,008 (2010 Russian census) ; 27,963 (2002 Census) ; 36,104 (1989 Soviet census) .

Sakhalin Oblast is a federal subject of Russia comprising the island of Sakhalin and the Kuril Islands in the Russian Far East. The oblast has an area of 87,100 square kilometers (33,600 sq mi). Its administrative center and largest city is Yuzhno-Sakhalinsk. As of the 2021 Census, the oblast has a population of 466,609.

Magadan Oblast is a federal subject of Russia. It is geographically located in the Far East region of the country, and is administratively part of the Far Eastern Federal District. Magadan Oblast has a population of 136,085, making it the least populated oblast and the third-least populated federal subject in Russia.

Komsomolsk-on-Amur is a city in Khabarovsk Krai, Russia, located on the west bank of the Amur River in the Russian Far East. It is located on the Baikal-Amur Mainline, 356 kilometers (221 mi) northeast of Khabarovsk. Population: 238,505 (2021 Census) ; 263,906 (2010 Russian census) ; 281,035 (2002 Census) ; 315,325 (1989 Soviet census) .

Nikolayevsk-on-Amur is a town in Khabarovsk Krai, Russia located on the Amur River close to its liman in the Pacific Ocean. Population: 22,752 (2010 Russian census) ; 28,492 (2002 Census) ; 36,296 (1989 Soviet census) .

Sovetskaya Gavan is a town in Khabarovsk Krai, Russia, and a port on the Strait of Tartary which connects the Sea of Okhotsk in the north with the Sea of Japan in the south. Population: 27,712 (2010 Russian census) ; 30,480 (2002 Census) ; 34,915 (1989 Soviet census) .

Kamchatka Krai is a federal subject of Russia, situated in the Russian Far East. It is administratively part of the Far Eastern Federal District. Its administrative center and largest city is Petropavlovsk-Kamchatsky, home to over half of its population of 291,705.

Amursk is a town in Khabarovsk Krai, Russia, located on the left bank of the Amur River 45 kilometers (28 mi) south of Komsomolsk-on-Amur. Population: 42,970 (2010 Russian census) ; 47,759 (2002 Census) ; 58,395 (1989 Soviet census) .

Poronaysk is a town and the administrative center of Poronaysky District of Sakhalin Oblast, Russia, located on the Poronay River 288 kilometers (179 mi) north of Yuzhno-Sakhalinsk. Population: 16,120 (2010 Russian census) ; 17,954 (2002 Census) ; 25,971 (1989 Soviet census) .

Ayano-Maysky District is an administrative and municipal district (raion), one of the seventeen in Khabarovsk Krai, Russia. It is located in the north of the krai. The area of the district is 167,200 square kilometers (64,600 sq mi). Its administrative center is the rural locality of Ayan. Population: 2,292 (2010 Russian census) ; 3,271 (2002 Census) ; 4,802 (1989 Soviet census) . The population of Ayan accounts for 42.2% of the district's total population.

Zabaykalsky Krai is a federal subject of Russia, located in the Russian Far East. Its administrative center is Chita. As of the 2010 Census, the population was 1,107,107.

Fevralsk is an urban locality in Selemdzhinsky District of Amur Oblast, Russia, located between the Selemdzha River and its tributary the Byssa, about 340 kilometers (210 mi) northeast of Blagoveshchensk, the oblast's administrative center, and 204 kilometers (127 mi) southwest of Ekimchan, the administrative center of the district. Population: 5,128 (2010 Russian census) ; 4,690 (2002 Census) ; 8,816 (1989 Soviet census) .

Novy Urgal is an urban locality in Verkhnebureinsky District of Khabarovsk Krai, Russia, located in the valley of the Bureya River, close to its confluence with the Urgal River, about 340 kilometers (210 mi) northwest of the krai's administrative center of Khabarovsk and 28 kilometers (17 mi) west of the district's administrative center of Chegdomyn. Population: 6,803 (2010 Russian census) ; 7,274 (2002 Census) ; 9,126 (1989 Soviet census) .

Komsomolsky District is an administrative and municipal district (raion), one of the seventeen in Khabarovsk Krai, Russia. It is located in the southern central part of the krai. The area of the district is 25,167 square kilometers (9,717 sq mi). Its administrative center is the city of Komsomolsk-on-Amur. Population: 29,072 (2010 Russian census) ; 31,563 (2002 Census) ; 33,649 (1989 Soviet census) .

Nikolayevsky District is an administrative and municipal district (raion), one of the seventeen in Khabarovsk Krai, Russia. It is located in the east of the krai. The area of the district is 17,188 square kilometers (6,636 sq mi). Its administrative center is the town of Nikolayevsk-on-Amur. Population: 9,942 (2010 Russian census) ; 13,850 (2002 Census) ; 19,683 (1989 Soviet census) .

Okhotsky District is an administrative and municipal district (raion), one of the seventeen in Khabarovsk Krai, Russia. It is located in the north of the krai. The area of the district is 158,517.8 square kilometers (61,204.1 sq mi). Its administrative center is the urban locality of Okhotsk. Population: 8,197 (2010 Russian census) ; 12,017 (2002 Census) ; 19,183 (1989 Soviet census) . The population of Okhotsk accounts for 51.4% of the district's total population.

Tuguro-Chumikansky District is an administrative and municipal district (raion), one of the seventeen in Khabarovsk Krai, Russia. It is located in the center of the krai. The area of the district is 96,069 square kilometers (37,092 sq mi). Its administrative center is the rural locality of Chumikan. Population: 2,255 (2010 Russian census) ; 2,860 (2002 Census) ; 3,610 (1989 Soviet census) . The population of Chumikan accounts for 47.0% of the district's total population.

Smidovichsky District is an administrative and municipal district (raion), one of the five in the Jewish Autonomous Oblast, Russia. It is located in the east of the autonomous oblast and borders Khabarovsk Krai in the north and east, China in the south, and Birobidzhansky District in the west. The area of the district is 5,900 square kilometers (2,300 sq mi). Its administrative center is the urban locality of Smidovich. As of the 2010 Census, the total population of the district was 28,165, with the population of Smidovich accounting for 18.2% of that number.

Selikhino is a rural locality in Komsomolsky District of Khabarovsk Krai, Russia. Population: 4,255 (2010 Russian census) ; 4,865 (2002 Census) .

- ↑ Президент Российской Федерации. Указ №849 от 13 мая 2000 г. «О полномочном представителе Президента Российской Федерации в федеральном округе». Вступил в силу 13 мая 2000 г. Опубликован: "Собрание законодательства РФ", No. 20, ст. 2112, 15 мая 2000 г. (President of the Russian Federation. Decree # 849 of May 13, 2000 On the Plenipotentiary Representative of the President of the Russian Federation in a Federal District . Effective as of May 13, 2000.).

- ↑ Госстандарт Российской Федерации. №ОК 024-95 27 декабря 1995 г. «Общероссийский классификатор экономических регионов. 2. Экономические районы», в ред. Изменения №5/2001 ОКЭР. ( Gosstandart of the Russian Federation. # OK 024-95 December 27, 1995 Russian Classification of Economic Regions. 2. Economic Regions , as amended by the Amendment # 5/2001 OKER. ).

- 1 2 Charter of Khabarovsk Krai, Article 4

- ↑ "Оценка численности постоянного населения по субъектам Российской Федерации" . Federal State Statistics Service . Retrieved September 1, 2022 .

- ↑ "26. Численность постоянного населения Российской Федерации по муниципальным образованиям на 1 января 2018 года" . Federal State Statistics Service . Retrieved January 23, 2019 .

- ↑ "Об исчислении времени" . Официальный интернет-портал правовой информации (in Russian). June 3, 2011 . Retrieved January 19, 2019 .

- ↑ Official throughout the Russian Federation according to Article 68.1 of the Constitution of Russia .

- 1 2 Russian Federal State Statistics Service (2011). Всероссийская перепись населения 2010 года. Том 1 [ 2010 All-Russian Population Census, vol. 1 ] . Всероссийская перепись населения 2010 года [2010 All-Russia Population Census] (in Russian). Federal State Statistics Service .

- ↑ Chaussonnet, p.109

- ↑ Topographic map N-53; M 1: 1,000,00

- ↑ Khabarovsk Krai Mountains - PeakVisor

- ↑ Google Earth

- ↑ "Pogoda.ru.net" (in Russian) . Retrieved November 8, 2021 .

- ↑ "Habarovsk/Novy (Khabarovsk) Climate Normals 1961–1990" . National Oceanic and Atmospheric Administration . Retrieved November 2, 2021 .

- ↑ "climatebase.ru (1948-2011)" . Retrieved April 28, 2012 .

- ↑ "Weatherbase: Historical Weather for Komsomolsk-on-Amur, Russia" . Weatherbase. 2012. Retrieved on November 24, 2011.

- ↑ "Weather and Climate-The Climate of Okhotsk" (in Russian). Weather and Climate (Погода и климат). Archived from the original on December 3, 2019 . Retrieved December 3, 2019 .

- ↑ "Ohotsk (Okhotsk) Climate Normals 1961–1990" . National Oceanic and Atmospheric Administration . Retrieved December 3, 2019 .

- ↑ "1689, Nerchinsk – Russia" . China's External Relations .

- ↑ Alexei D. Voskressenski (2002). Russia and China: A Theory of Inter-State Relations . Routledge. pp. 107–108. ISBN 978-0700714957 .

- ↑ "1858, Aigun – Russia" . China's External Relations .

- ↑ Alexei D. Voskressenski (2002). Russia and China: A Theory of Inter-State Relations . Routledge. pp. 112–113. ISBN 978-0700714957 .

- ↑ Decree of October 20, 1938

- ↑ Solnick, Steven (May 29, 1996). "Asymmetries in Russian Federation Bargaining" (PDF) . The National Council for Soviet and East European Research : 12. Archived (PDF) from the original on October 9, 2022.

- ↑ Chuman, Mizuki. "The Rise and Fall of Power-Sharing Treaties Between Center and Regions in Post-Soviet Russia" (PDF) . Demokratizatsiya : 146. Archived (PDF) from the original on October 9, 2022.

- ↑ "Anger at Kremlin Grows in Latest Massive Russian Far East Protest" . The Moscow Times . July 25, 2020.

- 1 2 "KNAAPO Komsomolsk na Amure Aviation Industrial Association named after Gagarin - Russian" . www.globalsecurity.org .

- ↑ Russian Federal State Statistics Service. Всероссийская перепись населения 2020 года. Том 1 [ 2020 All-Russian Population Census, vol. 1 ] (XLS) (in Russian). Federal State Statistics Service .

- ↑ Federal State Statistics Service (May 21, 2004). Численность населения России, субъектов Российской Федерации в составе федеральных округов, районов, городских поселений, сельских населённых пунктов – районных центров и сельских населённых пунктов с населением 3 тысячи и более человек [ Population of Russia, Its Federal Districts, Federal Subjects, Districts, Urban Localities, Rural Localities—Administrative Centers, and Rural Localities with Population of Over 3,000 ] (XLS) . Всероссийская перепись населения 2002 года [All-Russia Population Census of 2002] (in Russian).

- ↑ Всесоюзная перепись населения 1989 г. Численность наличного населения союзных и автономных республик, автономных областей и округов, краёв, областей, районов, городских поселений и сёл-райцентров [ All Union Population Census of 1989: Present Population of Union and Autonomous Republics, Autonomous Oblasts and Okrugs, Krais, Oblasts, Districts, Urban Settlements, and Villages Serving as District Administrative Centers ] . Всесоюзная перепись населения 1989 года [All-Union Population Census of 1989] (in Russian). Институт демографии Национального исследовательского университета: Высшая школа экономики [Institute of Demography at the National Research University: Higher School of Economics]. 1989 – via Demoscope Weekly .

- ↑ "Национальный состав населения" . Federal State Statistics Service . Retrieved December 30, 2022 .

- ↑ "Information on the number of registered births, deaths, marriages and divorces for January to December 2022" . ROSSTAT . Archived from the original on March 2, 2023 . Retrieved February 21, 2023 .

- ↑ "Birth rate, mortality rate, natural increase, marriage rate, divorce rate for January to December 2022" . ROSSTAT . Archived from the original on March 2, 2023 . Retrieved February 21, 2023 .