Creating a Representation Letter

Try our AI Legal Assistant - it's free while in beta 🚀

Genie's AI Legal Assistant can draft, risk-review and negotiate 1000s of legal documents

Note: Want to skip the guide and go straight to the free templates? No problem - scroll to the bottom. Also note: This is not legal advice.

Introduction

Drafting a representation letter is an essential step in the legal process. Failure to do so can lead to a misunderstanding between parties, leaving one or both at risk of potential legal repercussions. Representation letters clearly outline the roles and responsibilities of each party involved and ensure that the individual or business being represented understands their rights, obligations and scope of authority. What’s more, these letters also protect against any legally-binding mistakes made by the representative during the course of their work.

At Genie AI, our team have developed a vast community template library which holds millions of data points which inform our AI as to what constitutes a market-standard representation letter. With our library, anyone can quickly draft and customise high quality legal documents without paying for costly lawyer fees - it’s open source! Our simple yet comprehensive guide provides step-by-step guidance on how to create your own representation letter using our template library; so you can trust you’re getting it right every time.

So if you’re looking for free representation letter templates with no strings attached – Genie AI is here for you. Read on below to get started with our step-by-step guide now and access our template library today!

Definitions (feel free to skip)

Legal Binding: A legally binding agreement is an enforceable agreement between two or more parties, which is legally recognized by a court of law.

Notarization: Notarization is a process that ensures the authenticity of a document and is typically done by a notary public.

Informed Consent: Informed consent is a process in which a person voluntarily agrees to participate in something after being fully informed of the risks, benefits, and other details of the activity.

Enforceable: Enforceable means that a legal agreement or contract is legally binding and can be enforced by the courts.

Explain the purpose of a representation letter and why it is important

Outline the key elements that should be included in the representation letter such as an introduction, a description of the agreement, the responsibilities of each party, the signatures of the parties, and any other details that may be necessary, describe the process of how to write and organize a representation letter, taking into account the legal aspects and the desired outcome, provide guidance on the formatting and layout of a representation letter, explain how to sign and date a representation letter, including the requirements for notarization and other legal measures, discuss how to ensure that the representation letter is legally binding and enforceable, such as by using specific language in the letter, list the documents, evidence and information needed to support a representation letter, such as witness statements or other forms of proof, explain when and how to use a representation letter in legal matters, and the types of situations that require a representation letter, detail the responsibilities of the representative and the individual or company represented, such as the obligations of each party and their rights with respect to the agreement, discuss the potential legal implications of not having a representation letter in place, such as the consequences of not meeting legal requirements, provide recommendations for how to ensure that a representation letter meets all legal requirements, summarize the key points of the article, get started.

- Understand what a representation letter is - it is a document that is signed by two parties to confirm the agreement they have made and the rights and responsibilities of each party

- Learn why representation letters are important - they provide a legal and binding agreement between the parties involved, and ensure that all parties are aware of the terms of the agreement

- Understand the consequences of not using a representation letter - without a representation letter, there is no written record of the agreement, which could lead to disputes and misunderstandings between the parties involved.

- Introduction: Introduce the purpose of the representation letter, the parties involved and their roles.

- Description of Agreement: Outline the details of the agreement, including the scope of the representation, the terms, and any other relevant information.

- Responsibilities of Each Party: Describe the duties and responsibilities that each party has in the agreement.

- Signatures of the Parties: Include the signature of each party on the letter.

- Other Details: Include any other details that may be necessary to clarify the agreement, such as timelines, deadlines, or any other special conditions.

When you can check this off your list and move on to the next step:

- Once all of the key elements have been outlined in the representation letter, you can move on to the next step in the guide.

- Start by outlining the scope of the representation. What are the legal rights and responsibilities of each party?

- Include an introduction that outlines the purpose of the representation letter and how it will be used.

- Identify the parties involved in the agreement.

- Provide a full description of the agreement, including any conditions or restrictions.

- Identify any potential risks or liabilities associated with the agreement.

- List out all the responsibilities of each party, including any obligations or duties.

- Include a signature line for each party at the bottom of the letter.

- Proofread the letter and make sure all information is correct and accurate.

When you have completed this step, you should have an organized representation letter that clearly outlines the scope of the agreement and the rights and responsibilities of each party.

- Begin the letter with the date and the recipient’s name and address

- Include a salutation, such as “Dear [Name],”

- Write out the purpose of the letter in the opening sentence

- Explain the purpose and the desired outcome of the letter in detail

- Include any relevant legal information that may be necessary

- Make sure to include all of the pertinent facts and evidence to provide clarity

- End the letter with a formal closing, such as “Sincerely,”

- Sign and date the letter

- Make sure to include any additional information, such as a notarization or other legal measures

When you have completed the formatting and layout of your representation letter and it includes the necessary information, you can check this step off your list and move on to the next step.

- Have all parties signing the letter present at the same time in front of a notary public

- Each party should sign the letter in the presence of the notary

- Every signing party should also provide a valid form of identification

- The notary should also sign and date the letter

- Once all parties have signed and the notary has notarized the letter, it is legally binding

- After completing the steps above, you can be sure that the letter is valid and enforceable

- Now you can move on to the next step in the guide.

- Research the legal requirements and regulations in your jurisdiction to make sure the representation letter is legally binding

- Use precise and unambiguous language when drafting the letter, such as stating the exact obligations of each party

- Ensure the letter clearly outlines the roles, rights, and obligations of each party

- Include a signature line for both parties and make sure each signature is witnessed and notarized

- Check that the letter is dated accurately

- Once you have completed the steps above, you can be sure that the representation letter is legally binding and enforceable

- Gather any documents that will be used as evidence, such as contracts, agreements, or other documents that are relevant to the case.

- Collect any witness statements, including any written or verbal statements from people who can provide proof in the case.

- Assemble any other forms of proof, such as photographs, recordings, or other physical evidence.

- Make sure all information is organized and accessible for use in the representation letter.

Once you have collected all documents, evidence, and information, you can check this step off your list and move on to the next step.

- Understand the purpose of a representation letter. It is a document used to enter into an agreement between an individual or company and their representative.

- Learn the types of legal matters that require a representation letter. These may include negotiations, contract disputes, court proceedings, and more.

- Research the laws and regulations that apply to the specific situation. This will help you know what must be included in the representation letter.

- When you have gathered the necessary information and documents, you can proceed to drafting the representation letter.

- When the letter is written and signed, it is ready to be used in the legal proceeding.

You will know you have completed this step when you have gathered all the necessary information and documents, and have drafted the representation letter.

- Brainstorm and list out all of the responsibilities and obligations that the representative and the individual or company they are representing should fulfill

- Make sure to include the individual or company’s rights with respect to the agreement in the representation letter

- Review the list of responsibilities and obligations and make sure that all parties involved are comfortable with the terms

- Once all parties have agreed to the terms, add the details to the representation letter

- When the representation letter is complete, have all parties involved sign it

- Once all parties have signed the representation letter, it is legally binding and enforceable

- You will know this step is complete when all parties have signed the representation letter and the document is finalized.

- Research and understand the legal requirements for the representation letter, and the potential risks and consequences of not meeting these requirements.

- Consider the potential risks of not having a representation letter in place, such as enforcement of contract terms, liability for damages, or penalties for breach of contract.

- Consult a lawyer or other legal expert to ensure that you are aware of all the potential legal implications of not having a representation letter in place.

- Once you have a thorough understanding of the potential legal implications of not having a representation letter in place, move on to the next step.

• Draft the representation letter with a clear and concise legal language, making sure all the parties involved are named and referenced. • Ensure that the agreement is signed by all the parties involved, or their representatives. • Make sure that the agreement contains a specific and detailed description of the services or goods to be provided, including a timeline and payment structure. • Include clauses that detail the legal consequences of a breach of contract and dispute resolution. • Ensure that the letter is written in accordance with the applicable laws of the jurisdiction where the agreement is to be made. • Check that the agreement is clear and unambiguous, with no room for interpretation. • Check that the agreement is legally binding and that all parties have read and understood the contents.

You can check this off your list and move on to the next step once you have completed the above steps to ensure that the representation letter meets all legal requirements.

• Gather all relevant information needed for the representation letter, including the client’s name, address, and the reasons why legal representation is needed. • Make sure that the representation letter is written in a clear and professional manner, with all legal requirements stated clearly. • Ensure that the representation letter adheres to the laws of the state or jurisdiction where the representation letter is being used. • Include all relevant details that are necessary for the document, such as names, signatures, dates, and any other relevant information. • Double check that all the necessary information has been included and that the representation letter meets all legal requirements.

Once you have gathered the necessary information and double checked that the representation letter meets all legal requirements, you can check this off your list and move onto the next step.

Q: What is the difference between a representation letter and a legal opinion?

Asked by Sarah on October 1st, 2022. A: A representation letter is an agreement between two parties, while a legal opinion is an interpretation of the law given by a lawyer. A representation letter typically outlines the responsibilities of both parties, confirms the terms of an agreement, and makes any necessary representations about the accuracy of information or the ability of one party to perform its obligations. A legal opinion, on the other hand, is an analysis of applicable law which assesses the legal risks associated with a particular transaction or situation. It is often used to provide guidance on how to proceed in a certain situation.

Q: When do I need a representation letter?

Asked by James on December 12th, 2022. A: Representation letters are typically used to provide written confirmation that certain terms have been agreed upon between two parties. This can be useful when there may be a dispute in the future as to what was agreed upon. Representation letters can also be used to confirm that all necessary information has been disclosed and that all parties understand each other’s responsibilities. Representation letters can be used in many different contexts including contracts, investments, mergers and acquisitions, and joint ventures.

Q: What should be included in a representation letter?

Asked by Elizabeth on April 4th, 2022. A: A representation letter should include all relevant details about the two parties involved in the agreement and their respective roles and responsibilities. It should also include any representations made by either party about the accuracy of information or their ability to perform their obligations. Additionally, it should clearly state all agreed upon terms and conditions.

Q: How do I draft a representation letter for my business?

Asked by Michael on January 14th, 2022. A: Drafting a representation letter for your business should begin with understanding your specific needs and what you are trying to achieve with your document. You should then consider what types of representations you need to make, who will be involved in the agreement, and what types of terms and conditions need to be included. Once you have these details determined, you can begin drafting your representation letter using templates or software tools available online.

Q: How do I sign a representation letter?

Asked by Jessica on May 9th, 2022. A: The signing process for a representation letter will depend on the specific document requirements set out by your jurisdiction and applicable laws. Generally speaking, both parties must sign the document in order for it to be legally binding. Depending on your jurisdiction and applicable laws, this may require an original signature by each party or simply an electronic signature via an appropriate software tool or service provider.

Q: What are some common pitfalls when creating a representation letter?

Asked by Joshua on August 22nd, 2022. A: One common pitfall when creating a representation letter is not being clear enough about each party’s obligations or expectations from the agreement. It’s important to ensure that all relevant details are explicitly stated in order to avoid any potential misunderstandings or disputes down the road. Additionally, you should ensure that any representations made by either party are accurate and truthful as this could have legal implications if false information is provided. Finally, you should ensure that all applicable laws are taken into account when drafting your document in order to ensure compliance with those laws and regulations.

Q: What are some best practices when creating a representation letter?

Asked by Emily on November 17th, 2022. A: When creating a representation letter it’s important to ensure that all relevant details are explicitly stated so as to avoid any potential misunderstandings or disputes down the road. Additionally, it’s important to ensure that any representations made by either party are accurate and truthful as this could have legal implications if false information is provided. You should also ensure that all applicable laws are taken into account when drafting your document in order to ensure compliance with those laws and regulations. Finally, it’s important to take into account any potential unforeseen circumstances which could arise from your agreement so as to ensure that these situations are covered in your document if they occur in the future.

Q: Is there a difference between UK vs USA vs EU jurisdictions when creating a representation letter?

Asked by Hannah on February 23rd, 2022. A: Yes – there may be differences between jurisdictions when it comes to creating a representation letter depending on which country’s laws apply to your situation or agreement. Generally speaking though there are some common elements which must be included such as clearly stating each party’s obligations and ensuring that all applicable laws are taken into account when drafting your document in order to ensure compliance with those laws and regulations regardless of jurisdiction. Additionally, it’s important to check if there are any specific requirements under local law which must be taken into account when creating your document as well as ensuring that any representations made by either party are accurate and truthful as this could have legal implications if false information is provided regardless of jurisdiction too.

Q: Is it possible for me to create my own representation letter without involving an attorney?

Asked by Matthew on June 28th, 2022. A: Yes – it is possible for you to create your own representation letter without involving an attorney depending on the complexity of your situation or agreement as well as any specific requirements set out under local law which must be taken into account when creating your document. However it’s important to note that using an attorney may provide additional benefits such as providing advice regarding applicable legal risks associated with your particular transaction or situation as well as ensuring that all necessary information has been disclosed accurately and truthfully before signing off on any agreement or contract .

Q: Are there different types of representation letters I can create?

Asked by John on July 12th, 2022 A: Yes – there are different types of representation letters depending on what type of agreement you need for your particular situation or transaction such as contracts, investments, mergers & acquisitions, joint ventures etc… Each type of agreement will require different elements such as outlining each party’s roles & responsibilities as well as confirming all agreed upon terms & conditions etc… It’s important to understand what type of agreement you need before beginning drafting process so as make sure all necessary elements are included in order for it be legally binding if required later down the line .

Q: Can I use online services or software tools available online help me create my own representation letter?

Asked by David on September 18th 2022 A: Yes – there are online services available which can help you create your own representation letter depending on what type of agreement you need for your particular situation or transaction such as contracts, investments mergers & acquisitions , joint ventures etc… These services typically provide templates which allow you fill out relevant details about both parties involved in agreement such their roles & responsibilities , confirm agreed upon terms & conditions etc… Additionally , some services also allow you sign electronically via appropriate software tool or service provider .

Q: Does every industry have its own specific laws regarding creating a representation letter?

Asked by Ashley on March 8th 2022 A: No - not necessarily - while certain industries may have laws specific to them regarding creating a representation Letter , generally speaking most agreements will require same elements such outlining each party’s roles & responsibilities confirming terms & conditions etc… However , it’s important check whether there are any specific industry requirements need taken into account depending upon business model ( e . g . SaaS , technology , B2B ) , sector , jurisdiction etc… before beginning drafting process .

Example dispute

Suing a company over a representation letter.

- A plaintiff may sue a company for damages if they believe that the company has made false or misleading representations in a representation letter.

- The plaintiff must prove that the representations were false and that the company acted negligently or recklessly.

- The plaintiff must also show that the representations caused them to suffer some kind of financial loss or other harm.

- The plaintiff may be entitled to damages such as lost profits, attorney’s fees, or other costs associated with the lawsuit.

- The plaintiff may also seek an injunction or other equitable relief if the representation letter has caused irreparable harm.

- The court may also require the company to issue a corrective representation letter if the company has made false or misleading representations.

Templates available (free to use)

Rule 144 Seller S Representation Letter Non Affiliate Sale Of Restricted Securities Sas 72 Representation Letter

Helpful? Not as helpful as you were hoping? Message me on Linkedin

Links to get you started

Our AI Legal Assistant (free while in beta) Contract Template Library Legal Clause Library

Try the world's most advanced AI Legal Assistant, today

- Owner’s Profile

- Homeowner’s Association

- Reserve Study Services

- Individuals

- New! Associations & Taxes

- Treasurer’s Handbook

- The Condo Book

Understanding the Representation Letter

Written by David T. Schwindt, CPA

What is a Representation Letter? As a Board member or manager of a community management company, you may be asked to sign a representation letter at the conclusion of an audit or a reviewed financial statement engagement. Although the letter is from the Association/management company to the CPA, the CPA will generally draft the letter on behalf of the Association. The letter includes certain assertions about the Association during the period covered by the financial statements. Those assertions include but are not limited to the following:

- The Association/management company has provided the CPA with all requested financial information.

- The Association/management company has disclosed all related party transactions.

- The Association/management company has disclosed all existing and potential litigation.

- The Association/management company has disclosed any knowledge of fraud or financial irregularities.

- The Association takes responsibility for the design and implementation of a system of internal controls. These controls include but are not limited to safeguarding assets, approving transactions and minimizing the risk of someone perpetrating a theft of money or information and not being discovered in a reasonable amount of time. Although the Board is ultimately responsible for this activity, it is common that Boards rely upon the management company to assist in this responsibility.

In some instances, the management company may sign a different representation letter because the responsibilities are slightly different.

Why is the Representation Letter necessary? The American Institute of Certified Public Accounts has determined that those charged with governance (the board of directors and the community management company) should take responsibility for the assertions in the representation letter. CPAs are mandated to obtain the signed representation letter before issuing the final financial statements.

Who should sign the representation letter? Most often, the Board Chair, Board Treasurer and community manager signs the letter.

When does the Representation Letter need to be signed? The letter needs to be signed at the end of the engagement generally after a draft of the financial statements are issued. Schwindt & Co combines the representation letter with the management letter comments and proposed adjusting journal entries for ease of review. When the signed document is received by our office, we are then able to issue the final financial statements.

Should a new Board member or community manager who was not involved with Association management or governance during the period under audit or review be hesitant about signing the representation letter? This is a common question and the answer is simple. No! The first paragraph of the representation states that whoever signs the letter does so based on the best knowledge and belief of the person signing. This means that even though you may be new to the Board or management company, it is perfectly fine to sign the letter because you will only be asserting to issues that you have knowledge. It is very common for Board members/managers to sign a representation letter even though they were not involved during the period being audited or reviewed.

- Representation letters are normal and required before the issuance of audited/reviewed financial statements.

- Board members are only asserting to issues that they are aware of and new board members and managers frequently are required to sign representation letters.

- The Board Chair, Board Treasurer and community manager are generally required to sign the representation letter.

Questions regarding this article may be directed to David T. Schwindt, CPA at Schwindt & Co. (503) 227-1165.

12300 SE Mallard Way, Suite 275 Milwaukie, OR 97222 (503) 227-1165

OFFICE HOURS

Monday-Thursday, 9 am – 3 pm Friday, By Appointment Only

Copyright 2017-2024 Schwindt & Co. | All Rights Reserved

What is a Representation Letter?

A representation letter is a written statement provided by a company’s management to its auditors as part of the audit process. The representation letter confirms that the information provided to the auditors is complete, accurate, and fairly presented in accordance with the applicable financial reporting framework. The letter also confirms that the management has disclosed to the auditors all relevant information that may be necessary for the auditors to properly understand the company’s financial position, results of operations, and cash flows. The representation letter helps to ensure that the auditors have all the necessary information to conduct an audit in accordance with professional standards.

Why is a Representation Letter Required?

The purpose of the representation letter is to provide the auditor with assurance that the financial statements accurately reflect the company’s financial position and performance. The letter also helps the auditor to identify any potential areas of concern or risk that may need to be addressed during the audit process.

Contents of a Representation Letter

A representation letter typically includes the following:

- A statement that the financial statements being audited are complete and accurate

- A statement that the financial statements are in accordance with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS)

- A statement that the company’s management team is responsible for the preparation and fair presentation of the financial statements

- A statement that the company’s management team has made all necessary disclosures in the financial statements

- A statement that the company’s management team has disclosed all material transactions and events that have occurred during the period being audited

- A statement that the company’s management team has disclosed all material off-balance sheet transactions, arrangements, and obligations

- A statement that the company’s management team has disclosed all material changes in accounting principles that have occurred during the period being audited

- A statement that the company’s management team has disclosed all material related-party transactions that have occurred during the period being audited

- A statement that the company’s management team has disclosed all material contingencies and commitments that have occurred during the period being audited

The representation letter may also include other representations, such as a representation that the company has complied with all relevant laws and regulations, and that there are no pending legal proceedings that could have a material impact on the financial statements.

Importance of the Representation Letter

The representation letter is an important part of the audit process, as it provides the auditor with assurance that the financial statements are accurate and complete. This helps the auditor to form an opinion on the financial statements and to issue an audit report stating whether the financial statements are presented fairly, in all material respects.

Without a representation letter, the auditor may not be able to complete the audit, as they may not have sufficient evidence to form an opinion on the financial statements. This could lead to delays or other issues in the audit process, and may impact the company’s ability to obtain financing or meet other regulatory requirements.

In summary, a representation letter is a written statement signed by the company’s management that confirms the accuracy and completeness of the financial statements. It is an important part of the audit process, as it helps the auditor to form an opinion on the financial statements and to issue an audit report.

Amy is a Certified Public Accountant (CPA), having worked in the accounting industry for 14 years. She is a seasoned finance executive having held various positions both in public accounting and most recently as the Chief Financial Officer of a large manufacturing company based out of Michigan.

Related Posts

Journal entries for deferred tax assets and liabilities, what is an income tax provision, journal entries for withholding tax, capitalization of shareholder loans to equity, capitalization of retained earnings to paid-up capital, journal entries for dividends (declaration and payment).

Type above and press Enter to search. Press Esc to cancel.

What is a Representation Letter?

An auditor’s responsibility is to gather audit evidence regarding a subject matter. This evidence comes from several audit procedures. Based on this evidence, the auditor must conclude whether the subject matter meets specific criteria. In the case of external audits , it includes examining a client’s financial statements to establish whether they are free from material misstatements.

In some cases, however, auditors may not have the option to apply some substantive audit procedures . However, that does not imply the auditor must not consider those areas. It also does not infer that auditors must provide a negative opinion regarding those areas. In these cases, auditors can also obtain a representation letter from the client’s management.

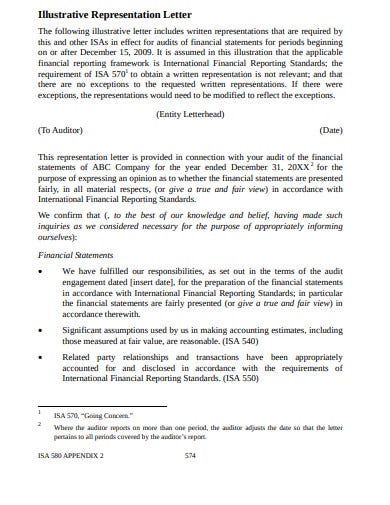

A representation letter is a form of written representation obtain from a client. Written representations are audit evidence that auditors collect. Similarly, they are necessary information that auditors may require related to a specific audit assignment. These are similar to audit inquiries but in a written form. The international auditing standard that deals with written representations are ISA 580 Written Representations.

It is a written statement written by auditors. This statement attests to the accuracy of the financial statements given to the auditors for analysis. Auditors present this letter to the client’s management, who signs the letter constructing a form of audit evidence. While this evidence is necessary, it may not represent sufficient appropriate audit evidence.

Once presented to the management, a senior official will sign the representation letter. Usually, a client’s CEO, CFO, or other higher senior accounting personnel sign the letter. This process must take place before auditors present an audit report regarding the client’s financial statements. The content of the representation letter may vary from one firm to another. However, there are some similar elements or contents that are present in every representation letter.

What are the Contents of the Representation Letter?

A typical representation letter will include various areas to cover the auditors’ liability towards the audit assignment. It will also include areas to ensure the management is aware of its responsibility to prepare accurate financial statements. According to accountingtool.com , representation letters will cover the following areas.

1. The management is responsible for the proper presentation and accurate preparation of the financial statements. It will also include a reference to the applicable accounting framework for this purpose. 2. The auditors have received all the financial records related to the audit. 3. The board of directors meeting minutes are complete. 4. There are no unrecorded transactions. 5. The management has disclosed all related party transactions. 6. The management has provided all letters from regulatory agencies regarding financial reporting noncompliance if required. 7. The net effect of all uncorrected misstatements is immaterial. 8. The financial statements conform to the applicable accounting standards. 9. The management doesn’t have any knowledge of fraud within the company. 10. The financial statements account for all material transactions. 11. The management is responsible for systems designed to detect and prevent fraud. 12. The client has disclosed all liens and other encumbrances on its assets. 13. The management has disclosed all contingent liabilities. 14. The management acknowledges its responsibility for the system of financial controls. 15. The client has disclosed all unasserted claims or assessments.

Overall, the representation letter will consist of all the management’s responsibilities for the financial statements and the audit. This letter will decrease the auditors’ responsibility if there is a future dispute. Similarly, it places responsibility on the management for areas where it must ensure proper accounting and controls. Auditors will not allow the management to make changes to the representation letter before signing.

What Happens If Auditors Cannot Obtain Reliable Representation Letters?

In some cases, auditors cannot obtain a reliable representation letter from the management. These may occur when the auditor has concerns about the competence, integrity, or diligence of the management. In these cases, the standards require auditors to determine the effect that such issues may have on the reliability of the representation letters.

When auditors obtain representation letters that are inconsistent with other audit evidence, they must perform procedures to resolve any discrepancies. If they cannot do so, they will need to reconsider the prior assessment of the client’s management. The auditors must also determine the effects such circumstances will have on the reliability of the representation letter or the audit assignment.

If auditors conclude that the representation letter is not reliable, they must take appropriate actions. These may include establishing the possible effect on the opinion in the auditor’s report. The same cases will apply when the management refuses to provide a representation letter. The auditor must discuss it with the management before taking any actions.

Representation letters are a form of written representation and constitute an essential part of audits. These letters attest to the accuracy of the financial statements presented by the client’s management. There are several areas which representation letters cover. If auditors cannot obtain reliable representation letters, they will need to evaluate the situation and take appropriate actions.

Related Posts:

- Reasonable Assurance Engagement: All You Need to Know!

- Limited Assurance Engagement: All You Need to Know!

- Types of Assurance Engagement: All You Need to Know

- Objectives of an Assurance Engagement

Management Representation Letter: Format, Content, Signature

Home » Bookkeeping » Management Representation Letter: Format, Content, Signature

As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors are required by professional standards to report, in writing, internal control matters that they believe should be brought to the attention of those charged with governance (the board). Generally, if your auditor is going to put an internal control matter in a letter, they have assessed that the matter was the result of a deficiency in internal controls. This is an important part of that audit that the profession does not take lightly.

One common example of a deficiency in internal control that’s severe enough to be considered a material weakness or significant deficiency is when an organization lacks the knowledge and training to prepare its own financial statements, including footnote disclosures. The “SAS 115” letter is usually issued when any significant deficiencies or material weaknesses would have been discussed with management during the audit, but are not required to be communicated in written form. In performing an audit of your Plan’s internal controls and plan financials, your auditors are required to obtain an understanding of the Plan’s operations and internal controls.

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually required to sign the letter. The letter is signed following the completion of audit fieldwork, and before the financial statements are issued along with the auditor’s opinion. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

In doing so, they may become aware of matters related to your Plan’s internal control that may be considered deficiencies, significant deficiencies, or material weaknesses. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited.

The representation should reaffirm your client’s understanding of all significant terms in the engagement letter. A relevant assertion is a financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

Depending on materiality and other qualitative factors, the auditors will consider the deficiency to be an “other” matter, significant deficiency, or material weakness. The auditor has discretion on which category the deficiency falls into, but are otherwise required to use the standard wording and definitions in the letter.

It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements. The definition of good internal controls is that they allow errors and other misstatements to be prevented or detected and corrected by (the nonprofit’s) employees in the normal course of performing their duties.

Material weaknesses or significant deficiencies may exist that were not identified during the audit, and auditors are required to disclose this in their written communication. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls.

What is a management representation letter?

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

A control objective provides a specific target against which to evaluate the effectiveness of controls. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

These types of auditors are used when an organization doesn’t have the in-house resources to audit certain parts of their own operations. The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. The compilation standards do not require practitioners to obtain a management representation letter, but this does not mean that it’s not a prudent thing to do. Obtaining a representation letter helps to ensure your client understands the services that you have provided, the limitations on the work you have completed, and that they are ultimately responsible for their financial statements.

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Auditors evaluate each internal control deficiency noted during the audit to determine whether the deficiency, or a combination of deficiencies, is severe enough to be considered a material weakness or significant deficiency. In assessing the deficiency, auditors consider the magnitude of potential misstatements of your financial statements as well as the likelihood that internal controls would not prevent or detect and correct the misstatements.

Representation to Management

- In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit.

- written confirmation from management to the auditor about the fairness of various financial statement elements.

- Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk.

The idea behind a management representation letter is to take away some of the legal burdens of delivering wrong financial statements from the auditor to the company. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. Internal auditors are employed by the company or organization for whom they are performing an audit, and the resulting audit report is given directly to management and the board of directors. Consultant auditors, while not employed internally, use the standards of the company they are auditing as opposed to a separate set of standards.

If the auditors detect an unexpected material misstatement during your audit, it could indicate that your internal controls are not functioning properly. Conversely, lack of an actual misstatement doesn’t necessarily mean that your internal controls are working.

The determination of whether an assertion is a relevant assertion is based on inherent risk, without regard to the effect of controls. Financial statements and related disclosures refers to a company’s financial statements and notes to the financial statements as presented in accordance with generally accepted accounting principles (“GAAP”). References to financial statements and related disclosures do not extend to the preparation of management’s discussion and analysis or other similar financial information presented outside a company’s GAAP-basis financial statements and notes.

External audits can include a review of both financial statements and a company’s internal controls. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions. In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements.

In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit. Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk. written confirmation from management to the auditor about the fairness of various financial statement elements. The purpose of the letter is to emphasize that the financial statements are management’s representations, and thus management has the primary responsibility for their accuracy.

Expert Social Media Tips to Help Your Small Business Succeed

This letter is useful for setting the expectations of both parties to the arrangement. Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud.

Management representation letter

As long as there’s a reasonable possibility for material misstatement of account balances or financial statement disclosures, your internal controls are considered to be deficient. An auditor typically will not issue an opinion on a company’s financial statements without first receiving a signed management representation letter. An audit engagement is an arrangement that an auditor has with a client to perform an audit of the client’s accounting records and financial statements. The term usually applies to the contractual arrangement between the two parties, rather than the full set of auditing tasks that the auditor will perform. To create an engagement, the two parties meet to discuss the services needed by the client.

As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. As noted above, an internal control letter is usually the result of a deficiency in internal controls discovered during the audit, most commonly from a material audit adjustment. The letter includes required language regarding the severity of the deficiency.

Real Business Owners,

The parties then agree on the services to be provided, along with a price and the period during which the audit will be conducted. This information is stated in an engagement letter, which is prepared by the auditor and sent to the client. If the client agrees with the terms of the letter, a person authorized to do so signs the letter and returns a copy to the auditor. By doing so, the parties indicate that an audit engagement has been initiated.

Also, the letter provides supplementary audit evidence of an internal nature by giving formal management replies to auditor questions regarding matters that did not come to the auditor’s attention in performing audit procedures. Some auditors request written representations of all financial statement items. All auditors require representations regarding receivables, inventories, plant and equipment, liabilities, and subsequent events. The letter is required at the completion of the audit fieldwork and prior to issuance of the financial statements with the auditor’s opinion.

Auditors spend a lot of time assessing how material audit adjustments and immaterial adjustments that have the potential to be material will be communicated in the internal control letter. The Representation Letter is issued with the draft audit and is required by auditing standards to finalize the audit. The Representation Letter is a letter from the Association to our firm confirming responsibilities of the board and management for the financial statements, as well as confirming information provided to us during the audit. The President or Treasurer and Management need to sign the Representation Letter and return it back to our office within 60 days from the date the draft audit was issued. Representation Letters received after the 60-day mark may result in additional auditing procedures in order to finalize the audit and comply with auditing standards at an additional expense to the Association.

14+ Management Representation Letter Format, What is It, Examples

- Letter Format

- January 24, 2024

- Business Letters , Contract Letters , Legal Letters

Management Representation Letter Format : A management representation letter format is a formal document used by auditors to obtain written confirmation from management about certain financial and non-financial matters . The Business letter is an important part of the audit process as it helps auditors gain a better understanding of the client’s business operations, accounting policies, and financial reporting practices .

- Business Inauguration Invitation Letter

- Business Proposal Acceptance Letter Format

- Business Invitation Letter Format

- Business Agreement Letter Format

- Business Contract Letter Format

Management Representation Letter Format

Content in this article

The management representation letter format is typically including the following components:

- Opening Paragraph: The Legal letter begins with a formal greeting and an explanation of the purpose of the letter. It may also include the date of the audit and the reporting period.

- Responsibilities of Management: This section outlines the responsibilities of management in relation to the financial statements and the audit process. It confirms that management is responsible for the preparation and presentation of the financial statements in accordance with accounting principles, maintaining adequate internal controls, and providing the auditor with access to all relevant information.

- Representations: This is the main body of the letter, where management makes specific representations about various financial and non-financial matters. These may include statements about the completeness and accuracy of financial statements, compliance with laws and regulations, the absence of fraud, and the adequacy of internal controls.

- Closing Paragraph: The Contract letter concludes with a statement confirming that management has disclosed all relevant information to the auditor and that the representations made in the letter are true and accurate.

It is important to note that the management representation letter Format is a legal document and should be drafted with care. Management should review the letter carefully before signing it, as they are legally responsible for the accuracy of the information provided.

In addition to providing auditors with important information about the client’s business, the management representation letter can also serve as a valuable communication tool between management and the auditor . It can help to identify potential issues early in the audit process and facilitate a smoother and more efficient audit.

Management Representation Letter Format – Sample Format

Below is a Sample Format of Management Representation Letter Format:

[Your Company Letterhead]

[External Auditor’s Name]

[External Auditor’s Firm]

[Address Line 1]

[Address Line 2]

[City, State, ZIP Code]

Dear [External Auditor’s Name],

Re: Management Representation Letter

We appreciate the opportunity to work with your firm in connection with the audit of the financial statements of [Your Company Name] for the fiscal year ended [Date]. In connection with your audit, we are providing you with this representation letter.

We, the management of [Your Company Name], confirm the following representations:

- The financial statements have been prepared in conformity with the generally accepted accounting principles (GAAP) and present fairly the financial position, results of operations, and cash flows of the company.

- Management is responsible for establishing and maintaining effective internal control over financial reporting, and there have been no significant changes in the internal control over financial reporting that could have a material effect on the company’s ability to record, process, summarize, and report financial data.

- To the best of our knowledge, there has been no fraud or illegal acts that have materially affected or are reasonably likely to materially affect the financial statements.

- Except as disclosed in the financial statements or in the notes thereto, there are no pending or threatened legal actions, claims, or assessments that could have a material effect on the financial statements.

- All significant information and documentation related to the company’s operations and financial transactions have been made available to your firm.

- We have disclosed all significant events occurring after the balance sheet date that would require adjustment to, or disclosure in, the financial statements.

This representation letter is provided to you in connection with your audit of the financial statements of [Your Company Name] and should be read in conjunction with the auditor’s report. We acknowledge our responsibility for the design and implementation of internal controls to prevent and detect fraud, as well as the preparation of financial statements.

Please let us know if you need any further information or clarification. We appreciate your professional services and look forward to a successful audit.

[Your Name]

[Your Title]

[Your Company Name]

[Your Contact Information]

This is a general template for a management representation letter. Specific content may vary based on the company’s circumstances and the requirements of the external auditor. It is advisable to consult with legal and accounting professionals when preparing such letters.

Email Ideas about Management Representation Letter Format

Here’s an Email Ideas for Management Representation Letter Format:

Subject: Request for Management Representation Letter

Dear [Manager’s Name],

I am writing to request your assistance in providing a management representation letter format to complete our audit process. As you are aware, the management representation letter is a crucial document that provides written confirmation from management on the accuracy and completeness of financial statements and related disclosures.

The representation letter helps our auditors to obtain evidence in support of the financial statements and to obtain assurance that management has fulfilled its responsibilities. It also serves as a tool for our auditors to document the representations made by management during the course of the audit.

We would appreciate it if you could provide the management representation letter as soon as possible, but no later than [date]. We understand that the process of preparing this letter can take some time and we are available to discuss any questions or concerns you may have.

Please let us know if you need any further information or assistance in preparing the letter. We appreciate your cooperation and look forward to completing the audit process.

Thank you for your attention to this matter.

Management Representation Letter Format to Auditor

This letter, presented to auditors, formalizes the company’s commitments, affirming the accuracy of financial data, adherence to accounting standards, and cooperation with auditors to ensure a transparent and accurate audit process.

We appreciate the opportunity to collaborate with your firm for the audit of the financial statements of [Your Company Name] for the fiscal year ended [Date]. In connection with the audit, we are pleased to provide you with the following representations:

- The management of [Your Company Name] is responsible for the preparation and fair presentation of the financial statements in conformity with the generally accepted accounting principles (GAAP).

Should you require any further information or clarification, please do not hesitate to contact us. We appreciate your professional services and look forward to a successful audit.

This letter is a general format for a management representation letter to an auditor. Specific content may vary based on the company’s circumstances and the requirements of the external auditor. Always consult with legal and accounting professionals when preparing such letters.

Management Representation Letter Format to Bank

This Management Representation Letter Format serves to affirm the accuracy of financial information, adherence to credit terms, and compliance with agreements, fostering transparency in the company’s dealings with the bank.

[Bank Name]

[Bank Address Line 1]

[Bank Address Line 2]

Dear [Bank Manager’s Name],

Re: Management Representation Letter for Banking Purposes

We hereby provide this Management Representation Letter in connection with our banking relationship with [Bank Name]. This letter is to confirm certain representations to assist the bank in its assessment of our financial standing and creditworthiness.

- We confirm that the financial statements provided to the bank are prepared in accordance with generally accepted accounting principles (GAAP) and present fairly our financial position as of [Date].

- All information provided regarding our credit facilities, loans, and guarantees is accurate, complete, and reflective of our current financial obligations to the best of our knowledge.

- We confirm that we are in compliance with all terms and conditions outlined in our loan agreements, credit facilities, and any other financial arrangements with the bank.

- We have disclosed any material changes in our financial condition, business operations, or other relevant matters that may impact our ability to meet our financial obligations to the bank.

- There are no pending or threatened legal proceedings, disputes, or litigation that could materially affect our ability to fulfill our financial commitments to the bank.

- The undersigned individuals have the authority to provide these representations on behalf of the company, and all necessary corporate approvals have been obtained.

This Management Representation Letter is provided solely for the purpose of supporting our banking relationship with [Bank Name]. We acknowledge our responsibility to promptly inform the bank of any material changes that may affect the accuracy of these representations.

If you require any additional information or documentation, please do not hesitate to contact us. We appreciate your continued support and understanding.

This Management Representation Letter to the bank is a formal document confirming key financial and operational details. Customize it as needed based on your specific banking relationship and requirements.

Management Representation Letter Format – Template

Here’s a Template of Management Representation Letter Format:

[Company Letterhead]

[External Auditor Name] [External Auditor Address] [External Auditor City, State ZIP Code]

Dear [External Auditor Name],

We are pleased to provide you with this management representation letter in connection with the audit of our financial statements for the year ended [Date]. As management of [Company Name], we acknowledge our responsibility for the preparation and presentation of the financial statements in accordance with generally accepted accounting principles.

We confirm that we have provided you with all relevant information necessary for the audit and that we have disclosed all known or suspected fraud, illegal acts, or non-compliance with laws and regulations that may have a material effect on the financial statements.

We represent that the financial statements are complete and accurate, and that they fairly present, in all material respects, the financial position of [Company Name] as of [Date], and the results of its operations and cash flows for the year then ended.

We also confirm that the representations made in this letter are true and accurate as of the date of this letter.

[Your Name] [Your Title] [Your Company Name]

Management Representation Letter for External Audit

This letter reinforces the company’s commitment to transparency, providing essential assurances to external auditors regarding the accuracy of financial information and cooperation throughout the audit, crucial for ensuring the integrity of the audit process.

[Audit Firm Name]

[Audit Firm Address]

Re: Management Representation for the External Audit of [Company Name]

We, the undersigned management of [Your Company Name], hereby provide this letter to confirm certain representations in connection with the external audit of our financial statements for the fiscal year ending [Date].

- We confirm that the financial statements, including the balance sheet, income statement, and cash flow statement, present a true and fair view of the financial position of [Your Company Name] as of [Date].

- The financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) [or International Financial Reporting Standards (IFRS)].

- We have established and maintained effective internal controls to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with applicable accounting standards.

- All significant information and disclosures related to our operations, financial position, and business transactions that may affect the understanding and interpretation of the financial statements have been disclosed to the best of our knowledge.

- All assets and liabilities, including contingent liabilities, have been properly recorded and disclosed in the financial statements.

- We have disclosed to you all known and potential legal claims, disputes, and litigations that may have a material impact on the financial statements.

- We acknowledge our responsibility to provide you and your team with complete access to all information and documents requested during the audit process.

- We confirm that there have been no changes in accounting policies or practices that materially affect the financial statements without appropriate disclosure.

This letter is provided solely for the purpose of supporting the external audit of our financial statements. We understand the importance of your audit in providing assurance to our stakeholders, and we commit to providing all necessary cooperation throughout the audit process.

If you require any additional information or clarification, please do not hesitate to contact us.

This Management Representation Letter for an external audit assures the auditor of the accuracy and completeness of financial statements, compliance with accounting standards, and cooperation during the audit process. Customize it as per your specific company and audit requirements.

Management Representation Letter to Investors

This letter serves as a transparent communication tool, instilling confidence among investors by affirming the company’s commitment to sound financial practices, compliance, and overall business stability.

[Investor’s Name]

[Investor’s Company/Organization]

[Investor’s Address]

Dear [Investor’s Name],

Re: Management Representation Letter to Investors

We, the undersigned management of [Your Company Name], are pleased to provide this letter to investors to affirm certain key aspects of our operations and financial position. This representation is made as of [Date] in connection with your investment in our company.

- We confirm that the financial statements provided to investors accurately represent the financial position of [Your Company Name] as of [Date]. The statements have been prepared in accordance with generally accepted accounting principles (GAAP) [or International Financial Reporting Standards (IFRS)].

- The management assures investors that the operational performance of the company is in line with the disclosed business plans and strategies. Any material changes have been duly communicated.

- We confirm that the company is in compliance with all applicable laws and regulations relevant to its operations. Any deviations have been appropriately addressed or disclosed.

- All material contracts and agreements that may impact the company’s financial position have been accurately disclosed to investors. There have been no material breaches of these contracts.

- The management has disclosed all known risk factors that may materially affect the company’s financial position or future prospects. We are committed to proactive risk management.

- Funds invested by our esteemed investors have been utilized in accordance with the stated purposes and business plans as communicated during the investment process.

- Any forward-looking statements made by the management are based on reasonable assumptions. However, actual results may vary, and the company is not obligated to update these statements.

- The management is dedicated to maintaining open lines of communication with investors. Any significant developments or changes in the company’s status will be promptly communicated.

This letter is intended to provide additional assurance and transparency to our valued investors. We appreciate your trust in [Your Company Name] and remain committed to creating value and fostering a mutually beneficial partnership.

If you have any questions or require further clarification, please do not hesitate to contact us.

This Management Representation Letter to Investors affirms key aspects of the company’s financial position, operational performance, and commitment to transparency, providing reassurance to investors about their investment in the company. Customize it as per your specific company and investor relations.

Management Representation Letter to Regulators

This letter serves as a formal commitment from the company’s management to regulatory bodies, ensuring transparency, accountability, and adherence to regulatory requirements, thereby fostering trust and regulatory compliance.

[Regulatory Authority Name]

Subject: Management Representation Letter

Dear [Regulatory Authority Name],

Re: Management Representation for Compliance with [Applicable Laws/Regulations]

We, the undersigned management of [Your Company Name], hereby provide this letter to confirm our commitment to compliance with all applicable laws, regulations, and industry standards under the jurisdiction of [Regulatory Authority Name].

- We affirm that our company operates in full compliance with all relevant laws and regulations governing our industry and business operations.

- The financial statements of [Your Company Name], including the balance sheet, income statement, and cash flow statement, have been prepared in accordance with applicable accounting standards, providing a true and fair view of the company’s financial position.

- We have established and maintained effective internal controls to ensure the accuracy and reliability of financial reporting and compliance with regulatory requirements.

- All material information, events, and transactions that may affect the company’s compliance status or financial position have been transparently disclosed.

- We commit to timely and accurate filing of all required reports, statements, and documentation as per the regulations enforced by [Regulatory Authority Name].

- We acknowledge our responsibility to fully cooperate with any regulatory inspections or inquiries that may arise, providing all necessary information and documentation as requested.

- Our management is dedicated to continuous improvement in our compliance practices, ensuring that we stay abreast of any changes in laws or regulations that may impact our business.

This letter is provided for the purpose of assuring [Regulatory Authority Name] of our dedication to compliance and transparent business practices. We understand the importance of regulatory oversight in maintaining market integrity and protecting the interests of stakeholders.

This Management Representation Letter to Regulators emphasizes the company’s commitment to compliance with applicable laws and regulations, providing assurance to regulatory authorities and fostering transparency in business operations. Customize it based on your specific company and regulatory requirements.

Management Representation Letter Format – Example

Here’s an Example of Management Representation Letter Format:

As management of [Company Name], we acknowledge our responsibility for the preparation and presentation of the financial statements in accordance with generally accepted accounting principles. We understand that you will be conducting an audit of our financial statements for the year ended [Date].

We confirm that we have disclosed all known or suspected fraud, illegal acts, or non-compliance with laws and regulations that may have a material effect on the financial statements. We also confirm that we have provided you with access to all relevant information necessary for the audit.

We understand that this letter is a legal document and that we are responsible for the accuracy of the information provided. We confirm that the representations made in this letter are true and accurate as of the date of this letter.

Management Representation Letter Format – Example

Formal Management Representation Letter Format

This Management Representation Letter Format serves to provide external auditors with essential assurances from management regarding the accuracy and completeness of financial information, adherence to legal and regulatory requirements, and the effectiveness of internal controls.

Re: Management Representation for [Year/Period] Ended [End Date]

We, the undersigned management of [Your Company Name], are providing this letter to confirm certain representations made to you during the audit of our financial statements for the [Year/Period] ended [End Date].

- We acknowledge our responsibility for the preparation and fair presentation of the financial statements in accordance with the applicable financial reporting framework.

- To the best of our knowledge and belief, the company has complied with all relevant laws and regulations that may materially affect the financial statements.

- We have established and maintained effective internal control over financial reporting, and any identified deficiencies have been disclosed to you.

- We have made you aware of any known or suspected instances of fraud or illegal acts affecting the company.

- All related party transactions have been accurately identified, disclosed, and recorded in accordance with the applicable financial reporting framework.

- We have disclosed to you all known actual or potential litigation and claims that may have a material effect on the financial statements.

- We have assessed the company’s ability to continue as a going concern and disclosed any uncertainties related to going concern appropriately.

- The information provided to you during the audit is complete and accurate, and we have disclosed all significant matters relevant to the financial statements.

This representation is provided to assist you in obtaining reasonable assurance that the financial statements are free from material misstatement. If there are any additional matters or information you require, please contact us promptly.

We appreciate your professional services and look forward to a successful completion of the audit.

This Formal Management Representation Letter Format is designed to provide external auditors with assurances on various aspects related to financial statements, compliance, internal controls, and more. Customize it based on your specific company and audit requirements.

Fraud and Illegal Acts Representation Letter

This letter underscores the company’s dedication to integrity and transparency, outlining measures taken to prevent and address fraudulent activities, and providing assurances to external auditors regarding compliance with legal and ethical standards.

Subject: Representation Regarding Fraud and Illegal Acts

Re: Fraud and Illegal Acts Representation

We, the undersigned management of [Your Company Name], hereby provide this representation regarding the prevention, detection, and reporting of fraud and illegal acts within the organization for the [Year/Period] ended [End Date].

- We acknowledge our responsibility for the prevention and detection of fraud and illegal acts within the organization.

- We have established and maintained internal controls and procedures designed to prevent and detect fraud and illegal acts.

- Employees are provided with adequate training and awareness programs to understand the risks associated with fraud and illegal acts and are encouraged to report any concerns through appropriate channels.

- We have communicated ethical standards and expectations to all employees, emphasizing our commitment to conducting business with integrity and in compliance with applicable laws and regulations.

- Any known or suspected instances of fraud or illegal acts are promptly reported to the appropriate levels of management and, if necessary, to the board of directors.

- In the event of identified fraud or illegal acts, we conduct thorough investigations and implement remedial actions, including disciplinary measures and corrective measures to prevent recurrence.

- We have established mechanisms to protect whistleblowers from retaliation and encourage the reporting of concerns without fear of reprisal.

- We commit to cooperating fully with external authorities, including law enforcement agencies and regulatory bodies, in the investigation of fraud or illegal acts.

- All representations made to you regarding the prevention, detection, and reporting of fraud and illegal acts are accurate and complete.

This representation is provided to assist you in obtaining reasonable assurance that the financial statements are free from material misstatement, including those resulting from fraud or illegal acts.

If you have any questions or require further clarification on any matters related to fraud and illegal acts, please do not hesitate to contact us.

This Fraud and Illegal Acts Representation Letter is designed to assure external auditors of the company’s commitment to preventing, detecting, and reporting fraud and illegal acts. Customize it based on your specific company policies and procedures.

FAQS About Management Representation Letter Format, What is It, Examples

What is a management representation letter format.

A Management Representation Letter Format is a formal document issued by a company’s management to external auditors, confirming certain representations related to financial statements, compliance, internal controls, and other crucial aspects during an audit.

What is the Purpose of a Management Representation Letter Format?

The primary purpose is to provide external auditors with written representations from management regarding various aspects of the company’s operations. Management Representation Letter Format helps auditors obtain assurance on the accuracy and completeness of financial information and other relevant matters.

What Information is Typically Included in a Management Representation Letter Format?