Advertisement

Greening the Financial Sector: Evidence from Bank Green Bonds

- Original Paper

- Published: 07 December 2022

- Volume 188 , pages 259–279, ( 2023 )

Cite this article

- Mascia Bedendo ORCID: orcid.org/0000-0003-0611-0860 1 ,

- Giacomo Nocera 2 &

- Linus Siming 3

2113 Accesses

5 Citations

1 Altmetric

Explore all metrics

Turn green or lose ‘licence to operate’—Deutsche Bank CEO Christian Sewing (Olaf Storbeck, “Turn green or lose ‘licence to operate’, says Deutsche Bank chief,” Financial Times , May 20, 2021).

Banks are expected to play a key role in assisting the real economy with the green transition process. One of the tools used for this purpose is the issuance of green bonds. We analyze the characteristics of banks that issue green bonds to understand: (i) which banks are more likely to resort to these funding instruments, and (ii) if the issuance of green bonds leads to an improvement in a bank’s environmental footprint. We find that large banks and banks that had already publicly expressed their support for a green transition are more likely to issue green bonds. Conditional on being a green bond issuer, smaller banks tend to resort to green bonds in a more persistent manner and for relatively larger amounts, while larger banks issue green bonds on a more occasional basis and for smaller amounts. This heterogeneity is also reflected in our findings that only banks that issue green bonds more intensively improve their emissions and reduce lending to polluting sectors, thus contributing to the decarbonization of the financial sector.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Green bonds as an instrument to finance low carbon transition

Eftichios S. Sartzetakis

Utilising Green Finance for Sustainability: Empirical Analysis of the Characteristics of Green Bond Markets

Green bonds issuance: insights in low- and middle-income countries

Ursule Yvanna Otek Ntsama, Chen Yan, … Abdel Hamid Mbouombouo Mboungam

Authors’ calculations based on Bloomberg data.

The banking sector accounted for 43% of all corporate bonds issued globally in 2020. Authors’ calculations based on Bloomberg data.

The number of green bond issuers reported in Table 3 (120) is smaller than the one reported in Table 2 (177), since Table 3 only refers to banks that have financial data available at year-end 2012, while Table 2 includes all green bond issuers that have financial data available at any point during the sample period.

The correlation between bank size and presence of an ESG rating is equal to 48% in our sample.

Statement available at: https://www.unepfi.org/about/unep-fi-statement/ .

Our specifications in Columns III–VI do not include country fixed effects since the multinomial logit models suffer from the curse of dimensionality issue when dealing with a large number of fixed effects for these sample sizes, and fail to converge to a solution. This is also the reason why we are unable to include bank fixed effects or country-year fixed effects in our specifications, which could otherwise have served as effective controls for any time-varying environmental policies in different countries. However, the inclusion of country EPI and NDC already contains key information on the countries’ environmental and regulatory specificities.

In an unreported robustness check, we replaced country EPI with country fixed effects, and the results are essentially unchanged.

We exclude from the pool of potential control banks those that never issue green bonds but belong to the same banking group of the treated banks and, as such, share the same environmental measures. Those banks would otherwise be classified as non-issuers even though they could potentially benefit, at a group level, from the green bond issuance of other institutions in the group.

Guidance on how to measure and disclose emissions from lending and investment activities has been detailed in the Global GHG Accounting and Reporting Standard for the Financial Industry only in November 2020. In February 2021, the European Banking Authority proposed the disclosure of banks’ green asset ratio, that is the share of a credit institution’s environmentally sustainable balance sheet exposures versus its total eligible exposures.

Some sample banks report the proportion of loans granted to green companies in their sustainability reports. We decide against using this information mainly because information on green lending has been provided for a sufficient number of years only by very few sample banks. Additionally, sustainability reports are a key input used by rating agencies to derive ESG ratings, hence any information on green lending included in sustainability reports is most likely embedded in the environmental measures used in the “ Does Green Bond Issuance Improve Environmental Performance? ” section.

We use bank fixed effects instead of country fixed effects to better control for any bank specific feature that may have not been captured by the matching.

For brevity, we proxy the intensity of green bond issuance only with this measure, given that all measures are positively and significantly (at 1% level) correlated and, as shown in Table 5 , share the same explanatory factors.

See the Climate Bonds Standard and Certification Scheme at the Climate Bonds Initiative: https://www.climatebonds.net/certification . The list of green bonds that have obtained CBI certification is retrieved from https://www.climatebonds.net/certification/certified-bonds .

Baker, M., Bergstresser, D., Serafeim, G., & Wurgler, J. (2022). The pricing and ownership of U.S. green bonds. Annual Review of Financial Economics, 14 (415), 437.

Google Scholar

Bauckloh, T., Schaltegger, S., Utz, S., Zeile, S., & Zwergel, B. (2021). Active first movers vs late free-riders? An empirical analysis of UN PRI signatories’ commitment. Journal of Business Ethics, 1 , 35.

Berg, F., Fabisik, K., & Sautner, Z. (2020). Is history repeating itself? The (un)predictable past of ESG ratings. ECGI Finance Working Paper No. 708–2020.

Berg, F., Kölbel, J. F., & Rigobon, R. (2022). Aggregate confusion: The divergence of ESG ratings. Review of Finance, 26 (6), 1315–1344.

Article Google Scholar

Bloomberg (2020). Guide to green bonds on the terminal. New York, USA: Bloomberg L.P.

Bolton, P., & Kacperczyk, M. (2021). Firm commitments. Working Paper.

Chen, I. J., Hasan, I., Lin, C.-Y., & Nguyen, T. (2021). Do banks value borrowers’ environmental record? Evidence from financial contracts. Journal of Business Ethics, 174 , 687–713.

Choi, D., Gao, Z., & Jiang, W. (2020). Attention to global warming. Review of Financial Studies, 33 , 1112–1145.

Daubanes, J.X., Mitali, S.F., & Rochet, J.-C. (2022). Why do firms issue green bonds? Swiss Finance Institute Research Paper No. 21–97.

Degryse H., Roukny T., & Tielens J. (2020). Banking barriers to the green economy. Working paper.

Degryse H., Goncharenko R., Theunisz C., & Vadasz, T. (2021). When green meets green. Working paper.

Delis, M., de Greiff, K., Iosifidi, M., & Ongena, S. (2021). Being stranded with fossil fuel reserves? Climate policy risk and the pricing of bank loans. Swiss Finance Institute Research Paper Series No 18–10.

Dyck, A., Lins, K. V., Roth, L., & Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. Journal of Financial Economics, 131 , 693–714.

Ehlers, T., Packer, F., & de Greiff, K. (2021). The pricing of carbon risk in syndicated loans: Which risks are priced and why? Journal of Banking and Finance, 136 , 106180.

Emerson, J. W., Hsu, A., Levy, M. A., de Sherbinin, A., Mara, V., Esty, D. C., & Jaiteh, M. (2012). 2012 Environmental Performance Index and Pilot Trend Environmental Performance Index . Yale Center for Environmental Law & Policy.

European Banking Authority (2021). Advice to the Commission on KPIs and methodology for disclosure by credit institutions and investment firms under the NFRD on how and to what extent their activities qualify as environmentally sustainable according to the EU taxonomy regulation. EBA/Rep/2021/03.

European Central Bank (2019). Financial Stability Review: Climate risk-related disclosures of banks and insurers and their market impact. November.

Fatica, S., Panzica, R., & Rancan, M. (2021). The pricing of green bonds: Are financial institutions special? Journal of Financial Stability, 54 , 100873.

Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 12 , 499–516.

Gianfrate, G., & Peri, M. (2019). The green advantage: Exploring the convenience of issuing green bonds. Journal of Cleaner Production, 219 , 127–135.

Hachenberg, B., & Schiereck, D. (2018). Are green bonds priced differently from conventional bonds? Journal of Asset Management, 19 , 371–383.

Hsu, A., Emerson, J. W., Levy, M. A., de Sherbinin, A., Johnson, L., Malik, O. A., Schwartz, J. D., & Jaiteh, M. (2014). 2014 Environmental Performance Index . Yale Center for Environmental Law & Policy.

Hsu, A., Esty, D. C., de Sherbinin, A., & Levy, M. A. (2016). 2016 Environmental Performance Index: Global Metrics for the Environment . Yale Center for Environmental Law & Policy.

Iovino, L., Martin, T., & Sauvagnat, J. (2021) Corporate taxation and carbon emissions. Working paper.

Krey, V., Masera, O., Blanford, G., Bruckner, T., Cooke, R., Fisher-Vanden, K., Haberl, H., Hertwich, E., Kriegler, E., Mueller, D., Paltsev, S., Price, L., Schlömer, S., Ürge-Vorsatz, D., van Vuuren, D., & Zwickel, T. (2014). Annex II: Metrics & methodology. In O. Edenhofer, R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel, & J. C. Minx (Eds.), Climate change 2014: Mitigation of climate change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press.

Kothari, S. P., & Warner, J. B. (2007). Econometrics of event studies. In E. Eckbo (Ed.), Handbook of corporate finance (pp. 3–36). Elsevier.

Chapter Google Scholar

Krüger, P., Sautner, Z., & Starks, L. T. (2020). The importance of climate risks for institutional investors. Review of Financial Studies, 33 , 1067–1111.

Mésonnier, J.-S. (2022). Banks’ climate commitments and credit to carbon-intensive industries: New evidence for France. Climate Policy, 22 , 389–400.

Müller, I. and Sfrappini, E. (2021) Climate change-related regulatory risks and bank lending. Working paper.

Panetta, F. (2021). A global accord for sustainable finance. The ECB Blog, Frankfurt am Main, 11 May 2021.

Reghezza, A., Altunbas, Y., Marques-Ibanez, D., Rodriguez d’Acri, C., & Spaggiari, M. (2022). Do banks fuel climate change? Journal of Financial Stability, 62 , 101049.

Sangiorgi, I., & Schopohl, L. (2021). Explaining green bond issuance using survey evidence: Beyond the greenium. British Accounting Review . https://doi.org/10.1016/j.bar.2021.101071

Spence, M. (1973). Job market signaling. Quarterly Journal of Economics, 87 , 355–374.

Tang, D. Y., & Zhang, Y. (2020). Do shareholders benefit from green bonds? Journal of Corporate Finance, 61 , 101427.

Wendling, Z. A., Emerson, J. W., Esty, D. C., Levy, M. A., & de Sherbinin, A. (2018). 2018 Environmental performance index . Yale Center for Environmental Law & Policy.

Wendling, Z. A., Emerson, J. W., de Sherbinin, A., & Esty, D. C. (2020). 2020 Environmental performance index . Yale Center for Environmental Law & Policy.

Zerbib, O. D. (2019). The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking and Finance, 98 , 39–60.

Zerbini, F. (2017). CSR initiatives as market signals: A review and research agenda. Journal of Business Ethics, 146 , 1–23.

Download references

Acknowledgements

We are grateful to the editor, two anonymous reviewers, Özlem Dursun-de Neef and seminar participants at the University of Zurich, WHU Otto Beisheim School of Management, the Free University of Bozen-Bolzano, and conference attendants at the CGRM Conference in Rome, the FEBS Conference in Portsmouth, and the FMA European Conference in Lyon, for their helpful comments and useful suggestions. We thank Letizia Ricchiardi for excellent research assistance.

This study is funded by a CRC2021 Sustainability Grant from the Free University of Bozen-Bolzano.

Author information

Authors and affiliations.

Department of Management, University of Bologna, Via Capo di Lucca 34, 40126, Bologna, Italy

Mascia Bedendo

Department of Finance, Audencia Business School, 8 Route de la Jonelière, 44300, Nantes, France

Giacomo Nocera

Faculty of Economics and Management, Free University of Bozen-Bolzano, Universitätsplatz 1, 39100, Bozen, Italy

Linus Siming

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Mascia Bedendo .

Ethics declarations

Conflict of interest.

All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1: Event study around green bond announcements

In this appendix we perform an event study to test the stock price reaction of green bond issuers around the announcement of the issuance of green bonds. Our sample covers all green bonds issued by publicly listed banks worldwide between January 1, 2013 and October 31, 2020. The announcement dates of green bond issuances as well as the issuers’ daily stock prices are retrieved from Bloomberg. We use a one-factor market model to estimate the “normal” relation between stock and market returns since previous literature has shown that short-horizon event studies are not sensitive to the benchmark specification (Kothari and Warner, 2007 ):

where \({R}_{it}\) is the daily return on the common share of bank i on day t and \({R}_{mt}\) is the daily return on the MSCI World total return index on the same day. In line with Tang and Zhang ( 2020 ), the market model is estimated from 300 calendar days to 50 calendar days prior to the event date \(t=0\) , which coincides with the announcement date. We derive daily abnormal stock returns \({AR}_{it}\) as the difference between raw returns and returns estimated from the market model:

As in Tang and Zhang (2020) and Flammer ( 2021 ), we then compute cumulative abnormal returns \({CAR}_{i}\) for bank i around each event date by aggregating \({AR}_{it}\) from 5 days before to 10 days after (5 days before to 5 days after) the announcement date. The table reports the average CARs computed across the two event windows separately for first-time issues and subsequent issues, with t -statistics in parenthesis. Consistently with the findings from previous studies on corporate green bonds in general, we document, also in banks: (i) a positive stock price response following the announcement of the first green bond issuance; (ii) no stock price response following the announcement of subsequent green bond issuances. This is in line with the signaling argument, as the market learns about the bank’s commitment to green lending with the first-time issue, while the information content of subsequent issues is likely to resemble that of conventional bond issues (see the discussion in Tang and Zhang, 2020 , and Flammer, 2021 ).

- ∗, ∗∗, and ∗∗∗ denotes significance at the 10, 5, and 1% level

Appendix 2: Variable definitions

Appendix 3: t -tests on treated and control samples.

- This table reports summary statistics and t -tests for difference in means for treated (green bond issuers) and control (non-green bond issuers) banks from a matched sample. The matching is based on bank characteristics of bond issuers at year-end before the first green bond was issued. All variables are described in Appendix 2.

- ∗, ∗∗, and ∗∗∗ denotes significance at the 10, 5, and 1% level, respectively.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Bedendo, M., Nocera, G. & Siming, L. Greening the Financial Sector: Evidence from Bank Green Bonds. J Bus Ethics 188 , 259–279 (2023). https://doi.org/10.1007/s10551-022-05305-9

Download citation

Received : 01 May 2022

Accepted : 28 November 2022

Published : 07 December 2022

Issue Date : November 2023

DOI : https://doi.org/10.1007/s10551-022-05305-9

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Green banking

- Green bonds

- Decarbonization

- Sustainable finance

- Find a journal

- Publish with us

- Track your research

Financial Management. Green Bonds – Success or Failure?

Hammer, Thomas and Siegfried, Patrick (2021): Financial Management. Green Bonds – Success or Failure? Published in: Expert Journal of Finance , Vol. 9, (31 December 2021): pp. 1-8.

This text will explain which role “Green Bonds” play in financing projects and how the green factor is weighted. It will be discussed on how the term “green” can change the price of the bond, if there is a “green premium” and for which group of investors this type of bond is interesting. We will discuss ways to reduce their cost of capital, also considering the risks and on ways on how to improve their conditions. The sustainable and eco-friendly aspects are also highlighted in this text and they might become crucial in future investing, which gives the bond an interesting role.

All papers reproduced by permission. Reproduction and distribution subject to the approval of the copyright owners.

Contact us: [email protected]

This repository has been built using EPrints software .

IMAGES

COMMENTS

MBA Master's Thesis The Emergence of Green Bonds as Innovative Financial Instruments: A Bibliometrics Analysis from 2008 to 2020 Munich Business School Working Paper 2021-04 Nicolas Penuela, MBA Email: [email protected] Munich Business School Working Paper Series, ISSN 2367-3869

Green bonds issued by firms to meet the objectives of sustainable development, so investor attention plays its role in green bonds development: The green bonds are weakly correlated with other form of financial instruments so it provides diversification benefits and growth of this market helps in promoting environments friendly finance:

A Thesis submitted to the Faculty of the Graduate School of Arts and Sciences of Georgetown University in partial fulfillment of the requirements for the degree of Master of Public Policy ... Green bonds were first issued in 2007 by the European Investment Bank (Rosembuj & Bottio, 2016). They are the most common denomination for a pool of fixed ...

The green bond market develops rapidly and aims to contribute to climate mitigation and adaptation significantly. Green bonds as any asset are subject to transition climate risk, namely, regulatory risk. This paper investigates the impact of unexpected political events on the risk and returns of green bonds and their correlation with other assets. We apply a traditional and regression-based ...

research. Herein, through a systematic literature review on the green bond market, our ultimate goal. is to provide investors, main markets actors, and policymakers with some helpful insight on ...

The explosive growth in the corporate green bond market since 2013 is shown in Table 1, based on the sample dataset drawn. The new issue amounts registered per year in Datastream rose by more than one hundredfold over the seven year period after the market's launch, from $1.42 billion in 2013 to $188 billion in 2020.

green bonds situated in the context of green finance as a vehicle for mobilizing capital to support renewable energy integration efforts. The research also examines the use of green bonds as a ... 1.6 Thesis Structure ..... 16 Chapter Two: Examining Existing Literature on Green Bonds: Using The Purposive Sample of Literature ...

Green bonds (or climate bonds) are one of the most used sustainable investment instruments, and under the Paris Climate Agreement of 2015, the climate bond market is expected to thrive in the near future. Green bonds are gaining increasing popularity between environmentally responsible investors, as well as investors who "simply" attempt to benefit from portfolio diversification, including ...

The purpose of this thesis is to understand the impact of sovereign green bonds issuance on the growth of the market as well as to understand what lies beneath the decision to issue green bonds. To that end, two case studies will be presented, namely the Italian and German sovereign green bond issuance.

Issuing a green bond can thus help to consolidate internally the sustainability work the company is already doing. In a similar way, issuing a green bond is also viewed as a good means to communicate this work externally. Being able to issue a green bond is also perceived as a stamp of quality for the organisation.

Despite the European green bond market having the most growth in the past years, studies exclusively focusing on Europe have not been conducted. This paper aims to contribute to the existing green bond literature, by filling the gap by answering the following research question: Does the market react positively to the announcement of green bonds?

Environmental policy formulation, implementation, and evaluation represent crucial steps in striking a harmonious balance between the economy and the environment. Market-oriented green bonds have emerged as a notable instrument within environmental policy expression. In China, the adoption of green bonds reflects a shared commitment to dual carbon objectives and sustainable development, with ...

Green bonds are associated with a significant discount in the issuance spread. This evidence is rather robust, irrespective of the matching method employed, as can be seen from the standard errors and the statistical significance levels of the estimates. The ATT ranges from −28.9 bps to −40.8 bps.

Green bond is a rather new financial instrument that aims towards more sustainable use of pro-ceeds. In this thesis, I examine the stock market reaction a green bond issuance creates by using a data sample from 2013 to March 2021 consisting of 154 US corporate green bonds from 44 companies and 7 different industries.

The authors found that the green bonds issued by ESG rated the issuer's experience as a higher negative premium (between 9 and. 19 bps) compared with the un-rated green bond issuances (between 8 and 14 bps). Moreover, the authors denoted that a higher ESG rating follows a higher negative green bond premium.

In regression (1) of Table 8, we add the second lag of the volume of outstanding green bonds ( O u t V o l u m e). The coefficient of O u t V o l u m e i, t − 2 is -2.38, significant at the 1 % level. Therefore, a higher cumulated green bond issue volume is associated with lower future carbon intensity.

Of the sustainable debt instruments discussed earlier, green bonds are by far the most popular and subject to particular attention and, thus, the main topic of this thesis. In 2021, they accounted for 49% of the total sustainable debt market, with a market size of USD 522.7 billion (CBI 2022b).

Title: Green bonds - A beneficial financing form? Purpose: The purpose of this master thesis was to examine housing companies reasoning behind issuing green bonds for financing their projects. What advantages and disadvantages that are currently connected to green bonds and if the green bond market can motivate companies to build more ...

This investigation conducts the rst comparative analysis of the nancial performance of Green Bonds and their conventional peers. Based on a dataset of 359 Green Bonds and 1291 conventional bonds, the analysis is conducted over the period between 2011 and 2017 and uses an extended Fama-French model in a Fama-Macbeth regression procedure.

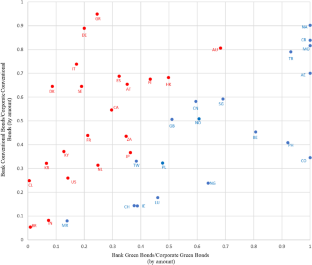

Bank bonds and corporate bonds. This figure compares the market share of green bonds (x-axis) and conventional bonds (y-axis) issued by banks (out of green and conventional bonds issued by banks and non-financial corporates) at country level.Sample period: January 2013-October 2020. Entries in blue (red) denote countries where the market share of bank green bonds is higher (lower) than that ...

transparency. Both of the Active Monitors require a detailed green bond plan (usually in the form of a Green Bond Framework), a pre-issuance external review that verifies the legitimacy (i.e., whether the green bond plan aligns with selected guidelines or standards) and feasibility (i.e., whether the issuer has the internal

This master thesis is dedicated to all of them. To my supervisor, Professor Szabolcs, I would like to express my gratitude for the assistance, the advice and the patience to lead someone who at times found herself lost. Thank you for all the help. ... Green bonds appeared in financial markets as a way to materialize both issuers' and ...

Abstract. This text will explain which role "Green Bonds" play in financing projects and how the green factor is weighted. It will be discussed on how the term "green" can change the price of the bond, if there is a "green premium" and for which group of investors this type of bond is interesting. We will discuss ways to reduce ...

Green bond and green growth possibility. Green bond (GB) is the concept of World Bank primarily introduced in late 2010, raised to reverse high carbon emission and o mitigate the climate changes (Zhou and Cui, 2019).According to GB fundmentals, projects are keenly assessed and are financed through green bonds to commence green energy (Maltais and Nykvist, 2020), boost green energy intensity ...