- Search Search Please fill out this field.

Getting Started

Strategy 1: value investing, strategy 2: growth investing, strategy 3: momentum investing, strategy 4: dollar-cost averaging.

- Do You Have Your Strategy?

- Investing Strategy FAQs

The Bottom Line

4 key investment strategies to learn before trading.

Choose a strategy that fits your profit objectives and skills

:max_bytes(150000):strip_icc():format(webp)/Dr.JeFredaR.Brownheadshot-JeFredaBrown-1e8af368a1ea4533a21868d8a951895a.jpg)

An investment strategy is a set of principles that guide investment decisions. There are several different investing plans you can follow depending on your risk tolerance, investing style, long-term financial goals, and access to capital,

Investing strategies are flexible. If you choose one and it doesn’t suit your risk tolerance or schedule, you can certainly make changes. However, changing investment strategies come at a cost. Each time you buy or sell securities—especially in the short-term in non-sheltered accounts—may create taxable events. You may also realize your portfolio is riskier than you'd prefer after your investments have dropped in value.

Here, we look at four common investing strategies that suit most investors . By taking the time to understand the characteristics of each, you will be in a better position to choose one that’s right for you over the long term without the need to incur the expense of changing course.

Key Takeaways

- Before you figure out your strategy, take some notes about your financial situation and goals.

- Value investing requires investors to remain in it for the long term and to apply effort and research to their stock selection.

- Investors who follow growth strategies should be watchful of executive teams and news about the economy.

- Momentum investors buy stocks experiencing an uptrend and may choose to short sell those securities.

- Dollar-cost averaging is the practice of making regular investments in the market over time.

Before you begin to research your investment strategy , it's important to gather some basic information about your financial situation. Ask yourself these key questions:

- What is your current financial situation?

- What is your cost of living including monthly expenses and debts?

- How much can you afford to invest—both initially and on an ongoing basis?

Even though you don't need a lot of money to get started, you shouldn't start investing until you can afford to do so. If you have debts or other obligations, consider the impact investing will have on your short-term cash flow before you start putting money into your portfolio.

Make sure you can afford to invest before you actually start putting money away. Prioritize your current obligations before setting money aside for the future.

Next, set out your goals. Everyone has different needs, so you should determine what yours are. Are you saving for retirement ? Are you looking to make big purchases like a home or car in the future? Are you saving for your or your children's education? This will help you narrow down a strategy as different investment approaches have different levels of liquidity, opportunity, and risk.

Next, figure out what your risk tolerance is. Your risk tolerance is determined by two things. First, this is normally determined by several key factors including your age, income, and how long you have until you retire. Investors who are younger have time on their side to recuperate losses, so it's often recommended that younger investors hold more risk than those who are older.

Risk tolerance is also a highly-psychological aspect to investing largely determined by your emotions. How would you feel if your investments dropped 30% overnight? How would you react if your portfolio is worth $1,000 less today than yesterday? Sometimes, the best strategy for making money makes people emotionally uncomfortable. If you're constantly worrying about the state of possibly losing money, chances are your portfolio has too much risk.

Risk-Reward Relationship

Risk isn't necessarily bad in investing. Higher risk investments are often rewarded with higher returns. While lower risk investments are more likely to preserve their value, they also don't have the upside potential.

Finally, learn the basics of investing. Learn how to read stock charts, and begin by picking some of your favorite companies and analyzing their financial statements. Keep in touch with recent news about industries you're interested in investing in. It's a good idea to have a basic understanding of what you're getting into so you're not investing blindly.

Value investors are bargain shoppers. They seek stocks they believe are undervalued. They look for stocks with prices they believe don’t fully reflect the intrinsic value of the security. Value investing is predicated, in part, on the idea that some degree of irrationality exists in the market. This irrationality, in theory, presents opportunities to get a stock at a discounted price and make money from it .

It’s not necessary for value investors to comb through volumes of financial data to find deals. Thousands of value mutual funds give investors the chance to own a basket of stocks thought to be undervalued. The Russell 1000 Value Index , for example, is a popular benchmark for value investors and several mutual funds mimic this index.

For those who don’t have time to perform exhaustive research, the price-earnings ratio (P/E) has become the primary tool for quickly identifying undervalued or cheap stocks. This is a single number that comes from dividing a stock’s share price by its earnings per share (EPS). A lower P/E ratio signifies you’re paying less per $1 of current earnings. Value investors seek companies with a low P/E ratio.

Who Should Use Value Investing?

Value investing is best for investors looking to hold their securities long-term. If you're investing in value companies, it may take years (or longer) for their businesses to scale. Value investing focuses on the big picture and often attempts to approach investing with a gradual growth mindset.

People often cite legendary investor Warren Buffett as the epitome of a value investor. Consider Buffett’s words when he made a substantial investment in the airline industry . He explained that airlines "had a bad first century." Then he said, "And they got that century out of the way, I hope." This thinking exemplifies much of the value investing approach: choices are based on decades of trends and with decades of future performance in mind.

Over the long-run, value investing has produced superior returns. However, value investing has seen prolonged periods where it has underperformed growth investing. One study from Dodge & Cox determined that value strategies have lagged behind growth strategies for a 10-year period during three periods over the last 90 years. Those periods were the Great Depression (1929-1939/40), the Technology Stock Bubble (1989-1999), and the period 2004-2014/15. Indeed, value investing, has consistently underperformed growth investing since 2007, producing a drawdown of more than 50% through 2020. It remains to be seen whether value stocks will regain their luster in the near future.

Pros and Cons - Value Investing

There's long-term opportunity for large gains as the market fully realizes a value company's true intrinsic value.

Value companies often have stronger risk/reward relationships.

Value investing is rooted in fundamental analysis and often supported by financial metrics.

Value companies are more likely to issue dividends as they aren't as reliant on cash for growth.

Value companies are often hard to find especially considering how earnings can be inflated due to accounting practices.

Successful value investments take time, and investors must be more patient.

Even after holding long-term, there's no guarantee of success - the company may even be in worse shape than before.

Investing only in sectors that are underperforming decreases your portfolio's diversification.

Rather than look for low-cost deals, growth investors want investments that offer strong upside potential when it comes to the future earnings of stocks. It could be said that a growth investor is often looking for the “next big thing.” Growth investing, however, is not a reckless embrace of speculative investing . Rather, it involves evaluating a stock’s current health as well as its potential to grow.

A drawback to growth investing is a lack of dividends . If a company is in growth mode, it often needs capital to sustain its expansion. This doesn’t leave much (or any) cash left for dividend payments. Moreover, with faster earnings growth comes higher valuations, which are, for most investors, a higher risk proposition.

While there is no definitive list of hard metrics to guide a growth strategy, there are a few factors an investor should consider. Growth stocks do tend to outperform during periods of falling interest rates, as newer companies can find it less expensive to borrow in order to fuel innovation and expansion. It's important to keep in mind, however, that at the first sign of a downturn in the economy, growth stocks are often the first to get hit.

Growth investors also need to carefully consider the management prowess of a business’s executive team . Achieving growth is among the most difficult challenges for a firm. Therefore, a stellar leadership team is required. At the same time, investors should evaluate the competition. A company may enjoy stellar growth, but if its primary product is easily replicated, the long-term prospects are dim.

Who Should Use Growth Investing?

Growth investing is inherently riskier and generally only thrives during certain economic conditions. Investors looking for shorter investing horizons with greater potential than value companies are best suited for growth investing. Growth investing is also ideal for investors that are not concerned with investment cashflow or dividends.

According to a study from New York University’s Stern School of Business, “While growth investing underperforms value investing, especially over long time periods, it is also true that there are sub-periods, where growth investing dominates.” The challenge, of course, is determining when these “sub-periods” will occur. While it's inadvisable to try and time the market, growth investing is most suitable for investors who believe strong market conditions lay ahead.

Because growth companies are generally smaller and younger with less market presence, they are more likely to go bankrupt than value companies. It could be argued that growth investing is better for investors with greater disposable income as there is greater downside for the loss of capital compared to other investing strategies.

Pros and Cons - Growth Investing

Growth stocks and funds aim for shorter-term capital appreciation. If you make profits, it'll usually be quicker than compared to value stocks.

Once growth companies begin to grow, they often experience the sharpest and greatest stock price increases.

Growth investing doesn't rely as heavily on technical analysis and can be easier to begin investing in.

Growth companies can often be boosted by momentum; once growth begins, future periods of continued growth (and stock appreciation) are more likely.

Growth stocks are often more volatile. Good times are good, but if a company isn't growing, its stock price will suffer.

Depending on macroeconomic conditions, growth stocks may be long-term holds. For example, increasing interest rates works against growth companies.

Growth companies rely on capital for expansion, so don't expect dividends.

Growth companies often trade at high multiple of earnings; entry into growth stocks may be higher than entry into other types of stocks.

Momentum investors ride the wave. They believe winners keep winning and losers keep losing. They look to buy stocks experiencing an uptrend. Because they believe losers continue to drop, they may choose to short-sell those securities.

Momentum investors are heavily reliant on technical analysts . They use a strictly data-driven approach to trading and look for patterns in stock prices to guide their purchasing decisions. This adds additional weight to how a security has been trading in the short term.

Momentum investors act in defiance of the efficient-market hypothesis (EMH). This hypothesis states that asset prices fully reflect all information available to the public. A momentum investor believes that given all the publicly-disclosed information, there are still material short-term price movements to happen as the markets aren't fully recognizing recent changes to the company.

Despite some of its shortcomings, momentum investing has its appeal. Consider, for example, that The MSCI World Momentum Index, which has averaged annual gains of 10.75% since its inception (in 1994) through June 2022, compared to 7.59% for its benchmark over the same period.

Who Should Use Momentum Investing?

Traders who adhere to a momentum strategy need to be at the switch, and ready to buy and sell at all times. Profits build over months, not years. This is in contrast to simple buy-and-hold strategies that take a "set it and forget it" approach.

In addition to being heavily active with trading, momentum investing often calls for continual technical analysis. Momentum investing relies on data for proper entry and exit points, and these points are continually changing based on market sentiment. For those will little interest in watching the market every day, there are momentum-style exchange-traded funds (ETFs).

Due to its highly-speculative nature, momentum investing is among the riskiest strategies. It's more suitable for investors that have capital they are okay with potentially losing, as this style of investing most closely resembles day trading and has the greatest downside potential.

Pros and Cons - Momentum Trading

Higher risk means higher reward, and there's greater potential short-term gains using momentum trading.

Momentum trading is done in the short-term, and there's no need to tie up capital for long periods of time.

This style of trading can be seen as simpler as it doesn't rely on bigger picture elements.

Momentum trading is often the most exciting style of trading. With quick price action changes, it is a much more engaging style than strategies that require long-term holding.

Momentum trading requires a high degree of skill to properly gauge entry and exit points.

Momentum trading relies on market volatility; without prices quickly rising or dropping, there may not be suitable trades to be had.

Depending on your investment vehicles, there's increased risk for short-term capital gains.

Invalidation can happen very quickly; without notice, an entry and exit point may not longer exist and the opportunity is lost.

Dollar-cost averaging (DCA) is the practice of making regular investments in the market over time and is not mutually exclusive to the other methods described above. Rather, it is a means of executing whatever strategy you chose. With DCA, you may choose to put $300 in an investment account every month.

This disciplined approach becomes particularly powerful when you use automated features that invest for you. The benefit of the DCA strategy is that it avoids the painful and ill-fated strategy of market timing. Even seasoned investors occasionally feel the temptation to buy when they think prices are low only to discover, to their dismay, they have a longer way to drop.

When investments happen in regular increments, the investor captures prices at all levels, from high to low. These periodic investments effectively lower the average per-share cost of the purchases and reduces the potential taxable basis of future shares sold.

Who Should Use Dollar-Cost Averaging?

Dollar-cost averaging is a wise choice for most investors. It keeps you committed to saving while reducing the level of risk and the effects of volatility . Most investors are not in a position to make a single, large investment. A DCA approach is an effective countermeasure to the cognitive bias inherent to humans. New and experienced investors alike are susceptible to hard-wired flaws in judgment.

Loss aversion bias, for example, causes us to view the gain or loss of an amount of money asymmetrically. Additionally, confirmation bias leads us to focus on and remember information that confirms our long-held beliefs while ignoring contradictory information that may be important. Dollar-cost averaging circumvents these common problems by removing human frailties from the equation.

In order to establish an effective DCA strategy, you must have ongoing cashflow and reoccurring disposable income. Many online brokers have options to set up reoccurring deposits during a specific cadence. This feature can then be adjusted based on changes in your personal cashflow or investment preference.

Pros and Cons - DCA

DCA can be combined with the other strategies mentioned above.

During periods of declining prices, your average cost basis will decrease, increasing potential future gains.

DCA removes the emotional element of investing, requiring reoccurring investments regardless of how markets are performing.

Once set up, DCA can be incredibly passive and require minimal maintenance.

DCA can be difficult to automate especially if you are not familiar with your broker's platform.

During periods of declining prices, your average cost basis will decrease, increasing your future tax liability.

You must have steady, stable cashflow to invest to DCA.

Investors may be tempted to not monitor DCA strategies; however, investments - even ones automated - should be reviewed periodically.

Once You've Identified Your Strategy

If you've narrowed down a strategy, great! There are still a few things you'll need to do before you make the first deposit into your investment account. First, figure out how much money you need start investing. This includes your upfront investment as well as how much you can continue to invest going forward.

You'll also need to decide the best way for you to invest. Do you intend to go to a traditional financial advisor or broker, or is a passive, worry-free approach more appropriate for you? If you choose the latter, consider signing up with a robo-advisor .

Consider your investment vehicles. Cash accounts can be immediately withdrawn but often have the greatest consequences. 401ks can't be touched until you retire and have limited options, but your company may match your investment. Different types of IRAs have different levels of flexibility as well.

It also pays to remain diversified. To reduce the risk of one type of asset bringing down your entire portfolio, consider spreading your investments across stocks, bonds , mutual funds, ETFs, and alternative assets. If you're someone who is socially conscious, you may consider responsible investing . Now is the time to figure out what you want your investment portfolio to be made of and what it will look like.

Establishing Your Investing Principles

When choosing your investment strategy, answer each of these questions:

- Do you want to invest for the short-term or long-term?

- Do you want your investments to be easily accessible or illiquid?

- Do you want to chase risk for higher returns or avoid risk for stability?

- Do you want to manage your own investments or pay an advisor?

- Do you want to actively monitoring your portfolio or be more passive?

- Do you want to invest a little amount over time or a lot all at once?

What Is the Best Investment Strategy?

The best investment strategy is the one that helps you achieve your financial goals. A review of some of the top investors will show that for every investor, the best strategy will be different. For example, if you're looking for the quickest profit with the highest risk, momentum trading is for you. Alternatively, if you're planning for the long-term, value stocks are probably better.

How Do I Set Up an Investment Strategy?

A general investment strategy is formed based on your long-term goals. How much are you trying to save? What is your timeline for saving? What are you trying to achieve? Once you have your financial goals in place, you can set target performance on returns and savings, then find assets that mesh with that plan.

For example, your goal may be to save $1,000,000. To achieve this goal, you must invest $10,000 per year for 29 years and achieve 8% annual returns. Armed with this information, you can analyze various historical investment performance to try and find an asset class that achieves your strategic target.

How Do Beginners Invest in Stocks?

Beginners can get started with stocks by depositing funds in a low-fee or no-fee brokerage firm. These brokerage companies will not charge (or issue small charges) when the investor deposits, trades, or withdraws funds. In addition to getting started with a brokerage firm, you can leverage information on the broker's website to begin researching which asset classes and securities you're interested in.

The decision to choose a strategy is more important than the strategy itself. Indeed, any of these strategies can generate a significant return as long as the investor makes a choice and commits to it. The reason it is important to choose is that the sooner you start, the greater the effects of compounding .

Remember, don’t focus exclusively on annual returns when choosing a strategy. Engage the approach that suits your schedule and risk tolerance . With a plan in place and goal set, you'll be well on your way to a long and successful investing future!

CNBC. " Warren Buffett: I Like Airlines Because They Just 'Got a Bad Century Out of the Way .'"

Dodge & Cox. " Staying the Course in Value Investing ," Page 1.

Arnott, Robert D., et al. "Reports of value’s death may be greatly exaggerated." Financial Analysts Journal, vol. 77, no. 1, 2021, pp. 44-67.

Maloney, Thomas, and Tobias J. Moskowitz. "Value and Interest Rates: Are Rates to Blame for Value’s Torments?." The Journal of Portfolio Management, vol. 47, no. 6, 2021, pp. 65-87.

New York University, Stern School of Business. " Growth Investing: Betting on the Future? ," Page 2.

MSCI. " MSCI World Momentum Index (USD) ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1470025568-667065ed5a39451da01f3543f9d1bcc9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Making Smart Investments: A Beginner’s Guide

- Matthew Blume

Reduce the risk factor, increase the reward factor, and generate meaningful returns.

If you make smart decisions and invest in the right places, you can reduce the risk factor, increase the reward factor, and generate meaningful returns. Here are a few questions to consider as you get started.

- Why should you invest? At a minimum, investing allows you to keep pace with cost-of-living increases created by inflation. At a maximum, the major benefit of a long-term investment strategy is the possibility of compounding interest, or growth earned on growth.

- How much should you save vs. invest? As a guideline, save 20% of your income to to build an emergency fund equal to roughly three to six months’ worth of ordinary expenses. Invest additional funds that aren’t being put toward specific near-term expenses.

- How do investments work? In the finance world, the market is a term used to describe the place where you can buy and sell shares of stocks, bonds, and other assets. You need to open an investment account, like a brokerage account, which you fund with cash that you can then use to buy stocks, bonds, and other investable assets.

- How do you make (or lose) money? In the market, you make or lose money depending on the purchase and sale price of whatever you buy. If you buy a stock at $10 and sell it at $15, you make $5. If you buy at $15 and sell at $10, you lose $5.

Where your work meets your life. See more from Ascend here .

Are you a saver or spender?

- MB Matthew Blume is a portfolio manager of private client accounts at Pekin Hardy Strauss Wealth Management . He also manages the firm’s ESG research and shareholder advocacy efforts. He earned a B.S. in electrical engineering from Valparaiso University and an MBA from Northwestern University’s Kellogg School of Management. Matthew is a CFA charterholder.

Partner Center

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

9 Investment Strategies for New Investors

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

The best investment strategies increase the money investors make and decrease their exposure to risk.

The strategy will vary depending on your end investment goal and its timeframe, your risk tolerance and how involved you want to be in choosing individual investments.

Many investors combine multiple strategies to find the best personalized strategy to fit their situation.

What's an investment strategy?

An investment strategy is a way of thinking that shapes how you select the investments in your portfolio. The best strategies should help you meet your financial goals and grow your wealth while maintaining a level of risk that lets you sleep at night. The strategy you choose may influence everything from what types of assets you have to how you approach buying and selling those assets.

If you're ready to start investing, a good rule of thumb is to ask yourself some basic questions: What are your goals? How much time until you retire? How comfortable are you with risk? Do you know how much you want to invest in stocks, bonds or an alternative?

This is where investment strategies come into play.

9 popular investment strategies

There are numerous ways to approach investing, and here are some of the more popular investing strategies to consider.

1. Start with a new or existing retirement account

One way to begin investing is through a retirement account. Open or access an individual retirement account, or IRA , through a brokerage account. Then choose investments that are aligned with your goals.

If you already have a retirement account through your employer, it's generally a good idea to contribute to that 401(k) first — and qualify for the company match — before you start funding your IRA. Employer match programs are free money you don't want to leave on the table.

However, you should know that most 401(k)s offer relatively few investment choices, so the options for strategy within those vehicles are usually limited. Whereas IRAs give you access to a more expansive world of investments than your 401(k) may offer.

You can also trade through a brokerage account for long-term goals other than retirement.

» Need more direction? Read How to Invest at Any Life Stage

2. Buy-and-hold investing

It’s always nice when things have a clear label, and you can’t get much clearer than “buy and hold.” Buy-and-hold strategists seek investments they believe will perform well over many years. The idea is to not get rattled when the market dips or drops in the short term, but to hold onto your investments and stay the course. Buy-and-hold works only if investors believe in their investment’s long-term potential through those short-term declines.

This strategy requires investors to carefully evaluate their investments — whether they are broad index funds or a rising young stock — for their long-term growth prospects upfront. But once this initial work is done, holding investments saves time you would have spent trading, and often beats the returns of more-active trading strategies.

» Want to know more? Dive into details on buy-and-hold investment strategy

3. Active investing

Active investors prefer trading more frequently and opportunistically to capitalize on market fluctuations. Stock traders may use technical analysis, the study of past market data such as trading volume or price trends, to help anticipate where market prices might go.

Active trading includes different strategies based upon pricing, such as swing or spread trading, and can also include momentum and event-driven strategies. Momentum investing seeks to identify and follow trends currently in favor to profit off of market sentiment. Event-driven investing strategies attempt to capture pricing differences during corporate changes and events, such as during mergers and acquisitions, or a distressed company filing for bankruptcy.

» To time or not to time? Learn more about market timing

4. Dollar-cost averaging

The biggest challenge to timing the markets is getting it right on a consistent basis. For those investors wary of trying their luck on market timing but still wanting a good entry point into the market, the strategy of dollar-cost averaging may appeal.

Investors who dollar-cost average their way into the market spread their stock or fund purchases out over time, buying the same amount at regular intervals. Doing so helps to "smooth" out the purchase price over time as you purchase more shares when the stock price is down and buy less shares when the stock price is up. Over time, you gain a better average entry price and reduce the impact of market volatility on your portfolio.

5. Index investing

While there are active and passive approaches to investing , there are also active and passive investments themselves when deciding between various types of funds. Investors frequently use mutual funds , index funds and exchange-traded funds (ETFs) to populate their investment portfolio because funds provide access to a collection of securities, generally stocks and bonds, through one vehicle. Funds allow investors to benefit from diversification , spreading investment risk across many securities to help balance volatility.

» Learn more: What are ETFs ?

Active funds employ a portfolio or fund manager to handpick certain investments to populate the fund based upon proprietary research, analysis and forecasts. The manager's goal is to outperform the fund's corresponding index or benchmark. Passive funds, such as index funds and most ETFs, simply mimic an underlying index, providing the investor with similar performance to that particular index.

Some mutual funds have high expense ratios or high minimum investments (or both). But investors can often sidestep the highest of such costs by comparison shopping among mutual funds, or by favoring index funds and ETFs, which tend to offer lower expense ratios than actively managed funds. Given the lower cost of passive funds and the arduous task of beating the benchmark facing portfolio managers, index or passive investing often delivers better overall returns over time .

6. Growth investing

Growth investing involves buying shares of emerging companies that appear poised to grow at an above-average pace in the future. Companies like this often offer a unique product or service that competitors can't easily duplicate. While growth stocks are far from a sure thing, their allure is that they might grow in value much faster than established stocks if the underlying business takes off. Growth investors are willing to pay a premium price for these stocks in exchange for their robust future growth potential.

New technologies often fall into this category. For example, if someone believes that home buyers are going to shift increasingly from banks to online mortgage lenders with a streamlined application process, they might invest in the lender they believe will become dominant in that market.

Investors can also look toward burgeoning geographies or companies to find growth. As they industrialize, emerging markets or developing economies usually are more volatile but also grow at a faster pace compared to their more-developed peers. Companies are valued by market capitalization, or market cap, which is calculated by their total outstanding shares available times the market price of the shares. Small-cap stocks, shares of companies usually valued at $2 billion in market cap or less, provide investors with greater potential risk but also greater potential return due to their faster growth trajectory.

7. Value investing

Made famous by investors such as Warren Buffett, value investing is the bargain shopping of investment strategies. By purchasing what they believe to be undervalued stocks with strong long-term prospects, value investors aim to reap the rewards when the companies achieve their true potential in the years ahead. Value investing usually requires a pretty active hand, someone who is willing to watch the market and news for clues on which stocks are undervalued at any given time.

Think about it like this: A value investor might scoop up shares of a historically successful car company when its stock price drops following the release of an awful new model, so long as the investor feels the new model was a fluke and that the company will bounce back over time.

» Grow your investment. Compare and contrast growth and value investing

Value investing is considered a contrarian strategy because investors are going against the grain or investing in stocks or sectors currently out of favor. A subset of investors take value investing a step further by not just investing in cheaper stocks and sectors but purposely seeking out the cheapest ones out there to invest in so-called deep value.

8. Income investing

Investment strategies can help investors achieve a particular aim; for instance, producing a steady income stream. Many investors use income investing to help cover their living expenses particularly when transitioning into retirement.

There are different investments that can produce income, from dividend-paying stocks to bond and CD ladders to real estate .

» Learn more: What is a bond

9. Socially responsible investing

Social issues such as climate change and racial justice impact lives on a day-to-day basis. Socially responsible investing (SRI) aims to create positive change in society while also generating positive returns. In addition to investment performance, SRI investors look into a company’s business practices and revenue sources to ensure they're aligned with their personal values.

Some investors employ SRI by excluding stocks of companies that go against their moral compass; for instance, they might exclude investments in “sin” stocks or tobacco- and alcohol-related companies. Others intentionally direct their investment dollars toward issues they care about, such as into renewable energy companies.

» Want an ethical portfolio? Learn more about socially responsible investing

Principles of investment strategies

Whatever investment strategy you choose, it’s important to consider your investing goals. Where your investment style will fall in the following categories depends on many factors: Everything from your age to your finances and even your comfort level doing it yourself will help determine what your portfolio will look like.

Long-term goals vs. short-term goals

When investing for long-term goals — those five years or more in the future — it may make sense to choose higher-yielding (but more volatile) instruments like stocks and stock funds. But there are smart ways to pursue short-term savings goals, too. If you’re saving for a down payment on a house, you may want to place those savings in a more stable environment, like CDs or a high-yield savings account. Since you have a shorter time frame for your money to grow with a goal like this, there is less time to weather the volatility of the stock market.

» Saving for the short term? Read about the best short-term investment accounts

Long-term savings goals, such as retirement, can handle the fluctuations of the market. Since those investments will be in the market for longer — provided the investor can stay the course when there are major changes in the short term — there is less need to worry about those shorter-term dips. These long-term investments are better served by a mix of stocks and bonds or stock mutual funds.

Low-risk vs. high-risk investing strategy

Investment strategies always come with some amount of risk, and in almost every way risk and reward are linked. Investors who pursue higher rewards are usually taking bigger risks. For example, a bank CD is insured by the Federal Deposit Insurance Corp. and has virtually no risk. It also pays very little in return. A young tech startup’s stock, on the other hand, is likely higher-risk, but there is a chance it could explode in value.

There are many shades of risk in between, but whatever path you choose, make sure you’re prepared to deal with them.

Do-it-yourself vs. hiring professional help

Investors have many choices when it comes to managing their investment portfolio. How involved do you want to be in the investing process? How much do you already know about investing? Beginner investors may prefer to hand their savings off to a robo-advisor — an automated, low-cost investing service — rather than take on the challenge of making all the choices themselves.

More advanced investors or avid DIYers might opt to take a more active role, whether that means trading every day or just keeping tabs on their portfolios. Active investing can be a lot of work and may not give you higher returns than passive investing strategies.

On a similar note...

Find a better broker

View NerdWallet's picks for the best brokers.

on Robinhood's website

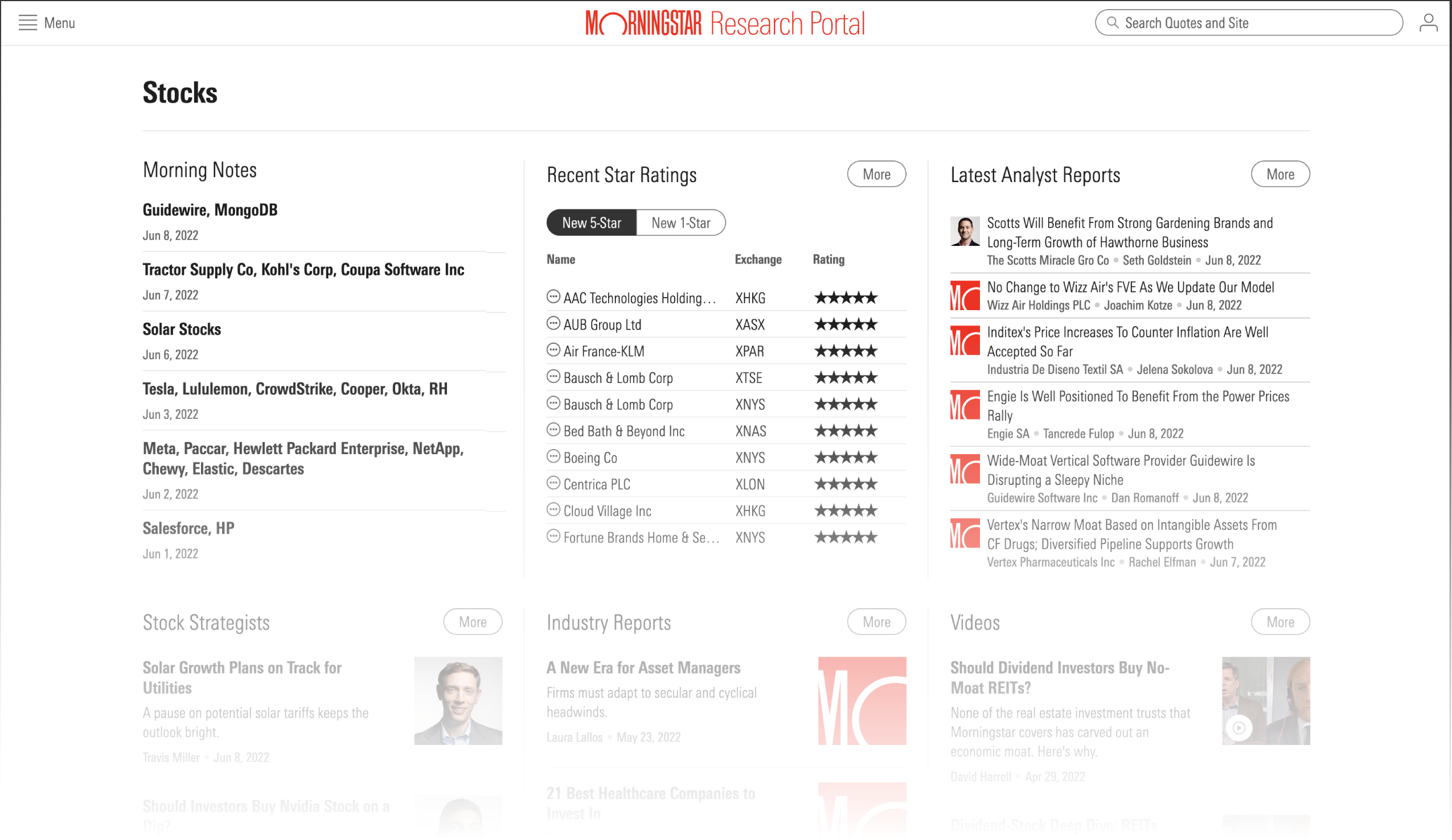

Licensed Research

Powering Confident Decisions

Tap into independent investment research with global consistency, built on a singular framework, the independent, global insights of our research analysts and quantitative models form the gold standard for analyzing investment options. our commitment to transparency and demonstrated performance fuel the strongest outcomes..

Equity Research

Make confident investment decisions powered by our commitment to fundamental research and a consistent methodology across our qualitative and quantitative universes.

Manager Research

Empower investors to make the most suitable choices with analyst-driven insights into funds’ sustainable advantages, along with forward-looking perspective into how they might behave in a variety of market environments, across all asset classes.

Direct Compass

Gain actionable insights from Morningstar's independent research to make building a comprehensive investment strategy for your clients easier than ever.

Manager Due Diligence and Selection Services

A list of managers and investments selected by our award-winning global manager selection team to drive better outcomes and help address compliance risk.

Institutional Equity Research

Research on companies, deals, funds, investors, and service providers across the entire public and private investment lifecycle. Powered by PitchBook.

Close the Gap Between Complexity and Communication

Morningstar rating for stocks and funds.

Uncover the true value of stocks and find buying and selling opportunities with our forward-looking star rating for stocks. For funds, our star rating illuminates historical performance relative to peers.

Morningstar Medalist Rating

A forward-looking, analyst- and quantitatively-driven rating system that is expressed with Gold, Silver, Bronze, Neutral, and Negative indicators. The Medalist Rating unifies Morningstar analyst insights and processes with scalable machine learning models.

Morningstar Economic Moat Rating

Understand how a company's sustainable competitive advantages impact its ability to generate economic profits over the long term. We use a signature methodology focused on evaluating a firm’s Economic Moat.

Morningstar Quantitative Rating for Stocks

Help investors identify a broader set of investment opportunities across geographies, sectors, and styles. We use a forward-looking machine-learning approach that mimics our analyst-driven ratings process.

Morningstar Sustainability Rating

Show investors how the companies in their portfolios manage ESG risks relative to their peers. A refined design aims to establish systematic, reliable measures for this growing area of interest.

Harness Consistent Insights for Multiple Uses

EQUITY RESEARCH AT SCALE

Expand your reach to fuel competitive equity recommendations

Empower financial professionals to evaluate a broader set of equities and validate their assumptions against a trusted source for proven research and ratings.

Key financial professional activities:

Provide actionable buy-and-sell signals for investment selection Identify and communicate equity investment ideas for client portfolios Efficiently deploy a uniform equity recommendation solution Improve investor outcomes by delivering recommendations with the greatest impact Mitigate risks and contribute to regulatory compliance requirements

ESG INSIGHTS

Customize for Sustainable Suitability

Build a custom list of suitable funds and ETFs with a single market standard for assessing ESG risks and opportunities.

Get educated on sustainability trends and how to position your firm for policy changes Directly compare funds and managed investments across parent firms and categories Use company- and fund-level metrics to develop new investments and vet exclusions Build custom lists of suitable funds to capture upside performance versus peers Reach a new generation of investors with differentiated products

DUE DILIGENCE & SUPPORT

Meet Evolving Regulatory Standards

Establish a curated product shelf and help investors evaluate suitability, separate cost from commission, and surface reasonably available alternatives to ensure best interest decisions.

Develop investment lineups that serve the best interest of clients Enhance your firm’s product shelf with our objective research and ratings Review your product shelf to ensure every fund has a purpose Guide your fund selection process to determine reasonable recommendations Empower financial professionals to perform their own analysis using data and insights

Power Actionable Decisions with Consistent Frameworks

Learn more about Morningstar research methodologies.

Economic Moat

Our equity analysts use a long-term approach to valuation, based on a signature methodology that contextualizes and conveys investing insights simply and clearly.

Analyst Rating for Funds

Our manager analysts assign this forward-looking, qualitative rating based on their assessment of a fund's investment merits using a five-tier scale for active and passive managed investments.

Quantitative Rating for Stocks

Our quantitative equity star ratings expand the universe of forward-looking insights to a large universe of more than 50,000 global stocks.

See Our Research in Action

Global Sustainable Fund Flows Report

Sustainable funds represent a substantial and growing portion of the fund universe—in part due to the launches of new funds, and in part due to existing funds adding ESG factors to their prospectuses. This report explores activity in the global sustainable funds universe within the past quarter, detailing regional flows, assets, and launches.

Morningstar's Cryptocurrency Landscape

Cryptocurrencies have become increasingly popular over the past seven years and at $1.7 trillion in total market capitalization, this volatile asset class can no longer hide in the shadows. In our inaugural Cryptocurrency Landscape, we shed light on the risks associated with digital currencies and share what we’ve learned about the future of the space.

Sustainable Funds U.S. Landscape Report

Sustainable investing has gained considerable traction and attention over the last five years. These funds are varied in nature, offering investors exposure across geographies, asset classes, and investment strategies. In our annual Landscape Report, Morningstar’s ESG research team examines the growth, performance, and changing nature of this emerging fund group.

Ready to See for Yourself?

See how morningstar’s research can help you help investors build a better financial future..

- No services available for your region.

Quantitative Investment Strategies

2021 key themes in review, key phrase usage in global earnings calls.

QIS looks at over 25,000 global earnings calls across 60+ countries in order to understand what phrases companies are communicating to the public and what topics are being discussed. In 2021, we observed increases in phrases such as “pandemic”, “social media”, “inflation”, “emission”, “retail investors”, “higher cost”, and “climate change.”

Leveraging machine learning techniques lets us monitor what companies are saying and helps us make data-driven investment decisions.

Source: Goldman Sachs Asset Management. Based on data released as of December 31, 2021.

PRIMARY FACTOR PERFORMANCE IN 2021

The QIS Proprietary Value and QIS Quality factors performed positively in 2021, surpassing pre-pandemic levels. Although both traditional Quality and traditional Value exhibited positive performance in 2021, only traditional Quality has surpassed pre-pandemic levels. While performance for traditional Momentum was negative in 2021, performance for the QIS Proprietary version was relatively flat. Additionally, 2021 was a year with high factor dispersion within Value, with cheaper stocks trading at a 42% discount compared to more expensive stocks. This discount is higher than the ten-year average discount of 28%.

Traditional

Quality: 12-month ROE and debt to equity ratio

Momentum: 12 month historical price return

Value: 12-month operating cash flow to price ratio, projected EPS to price ratio, and B/P.

QIS Proprietary

QIS incorporates traditional versions of factors augmented with proprietary signals that leverage machine learning techniques to synthesize vast amounts of nontraditional, unstructured data.

Sources: Goldman Sachs Asset Management. Based on data released as of December 31, 2021. S&P Dow Jones Indices LLC.

Past performance does not guarantee future results, which may vary.

REOPENING THE WORLD

Consumers massively altered their habits in response to the pandemic and associated lockdowns. The QIS team aggregates geolocation data, credit card transaction data, web traffic data, point-of-sale data and other metrics to help us understand which companies may be the beneficiaries of increased consumer attention. We believe that our alternative data signals have been valuable in navigating this evolving market environment.

Source: Goldman Sachs Asset Management. Based on data as of December 31, 2021.

Past correlations are not indicative of future correlations, which may vary.

RISE OF RETAIL TRADING

During the course of the pandemic, individuals poured money into equities and options trading partly due to 1) pandemic factors, such as work from home & reduction in traditional entertainment options and 2) secular causes, such as reduced friction from zero commission trading & expansion of stock ownership. We monitor retail trading activity for alpha opportunities because we believe that retail trading exhibits patterns of short-term persistency due to autocorrelation of flows but medium-to-long-term reversal.

Sources: Bloomberg. Goldman Sachs Asset Management. Goldman Sachs Global Markets Division. CNBC. Subredditstats.com. Statista.com

With the recently increasing inflationary pressures, the QIS team actively monitors different components of inflation in order to create a holistic investment view. Among other considerations, we look at which industries should expect to be impacted by inflation and use natural language processing to identify which industries mention inflation more frequently. Our analysis has found that these and other metrics measure very different features of inflation.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG)

Investors poured a record $649 billion into ESG-focused funds worldwide through Nov. 30, up from $542 billion in 2020 and $285 billion in 2019. Additionally, support for environmental and social proposals at US shareholder meetings rose to 32%, a 5% increase from 2020 1 . In order to manage the potential paradigm shift of a transition to a low carbon economy, the QIS team has applied a strategic climate-aware tilt to all its equity alpha portfolios, with the objective of reducing the carbon footprint of our portfolios by at least 25% relative to benchmark.

The track record information and operational commitments on this page also relate to Goldman Sachs’s sustainability practices and track record at an organizational and investment team level, which may not be reflected in the portfolio of the product(s).

Sources: Goldman Sachs Asset Management. Based on data as of December 31, 2021. Goldman Sachs Asset Management, ESG Considerations in the Equity Alpha Investment Process, December 2020. Goldman Sachs, Carbonomics, November 2021

1 Reuters. How 2021 became the year of ESG investing. November 4, 2021

Related Insights

Investment Ideas 2022

FE 2022 Top Equity Ideas

Fixed Income Outlook 1Q 2022: Goldilocks and The Three Bulls or Bears?

Our Clients

- Central Banks

- Consultants

- Corporate Pension Plans

- Defined Contribution

- Endowments and Foundations

- Public Pension Plans

- Sovereign Institutions

- Taft-Hartley

- Explore by Asset Class

- Fixed Income

- Liquidity Solutions

- Alternatives

- Multi-Asset

- Explore by Solution

- ESG & Impact Investing

- Outsourced CIO

- Pension Solutions

- Workplace Retirement Solution

- Perspectives

- GSAM Connect

- All Insights

- Goldman Sachs Global Investment Research

- News and Media

- Stewardship

Disclosures

Please refer to the full report for important risks additional disclosures.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security. Views and opinions are current as of the date of this material and may be subject to change, they should not be construed as investment advice.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. It should not be assumed that investment decisions made in the future will be profitable or will equal the performance of the securities discussed.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

Foreign securities may be more volatile than investments in U.S. securities and will be subject to a number of additional risks, including but not limited to currency fluctuations and political developments.

Emerging markets securities may be less liquid and more volatile and are subject to a number of additional risks, including but not limited to currency fluctuations and political instability.

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by GSAM and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and GSAM has no obligation to provide any updates or changes.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This financial promotion is provided by Goldman Sachs Bank Europe SE. This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches ("GSBE"). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Bank AG, Zürich. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Bank AG, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia Pacific: Please note that neither Goldman Sachs Asset Management International nor any other entities involved in the Goldman Sachs Asset Management (GSAM) business maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore and Malaysia. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited, in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H) and in or from Malaysia by Goldman Sachs (Malaysia) Sdn Berhad (880767W).

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), Goldman Sachs Asset Management, LP (GSAMLP) or Goldman Sachs & Co. LLC (GSCo). Both GSCo and GSAMLP are regulated by the US Securities and Exchange Commission under US laws, which differ from Australian laws. Both GSI and GSAMI are regulated by the Financial Conduct Authority and GSI is authorized by the Prudential Regulation Authority under UK laws, which differ from Australian laws. GSI, GSAMI, GSCo, and GSAMLP are all exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences. Any financial services given to any person by GSI, GSAMI, GSCo or GSAMLP by distributing this document in Australia are provided to such persons pursuant to ASIC Class Orders 03/1099 and 03/1100. No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

Canada: This presentation has been communicated in Canada by GSAM LP, which is registered as a portfolio manager under securities legislation in all provinces of Canada and as a commodity trading manager under the commodity futures legislation of Ontario and as a derivatives adviser under the derivatives legislation of Quebec. GSAM LP is not registered to provide investment advisory or portfolio management services in respect of exchange-traded futures or options contracts in Manitoba and is not offering to provide such investment advisory or portfolio management services in Manitoba by delivery of this material.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law by Goldman Sachs Asset Management Co., Ltd.

East Timor: Please note: the attached information has been provided at your request for informational purposes only and is not intended as a solicitation in respect of the purchase or sale of instruments or securities (including funds), or the provision of services. Neither Goldman Sachs Asset Management (Singapore) Pte. Ltd. nor any of its affiliates is licensed under any laws or regulations of Timor-Leste. The information has been provided to you solely for your own purposes and must not be copied or redistributed to any person or institution without the prior consent of Goldman Sachs Asset Management.

Vietnam: Please note: the attached information has been provided at your request for informational purposes only. The attached materials are not, and any authors who contribute to these materials are not, providing advice to any person. The attached materials are not, and should not be construed as an offering of any securities or any services to any person. Neither Goldman Sachs Asset Management (Singapore) Pte. Ltd. nor any of its affiliates is licensed as a dealer under the laws of Vietnam. The information has been provided to you solely for your own purposes and must not be copied or redistributed to any person without the prior consent of Goldman Sachs Asset Management.

Cambodia: Please note: the attached information has been provided at your request for informational purposes only and is not intended as a solicitation in respect of the purchase or sale of instruments or securities (including funds) or the provision of services. Neither Goldman Sachs Asset Management (Singapore) Pte. Ltd. nor any of its affiliates is licensed as a dealer or investment advisor under The Securities and Exchange Commission of Cambodia. The information has been provided to you solely for your own purposes and must not be copied or redistributed to any person without the prior consent of Goldman Sachs Asset Management.

© 2021 Goldman Sachs. All rights reserved.

267010-OTU-1548292

- See our Privacy Policy

- Learn More About Security

- Terms of Use

© 2022 Goldman Sachs. All rights reserved.

Please enter your email address to continue reading.

Confirm your access.

An email has been sent to you to verify ownership of your email address. Please verify the link in the email by clicking the confirmation button. Once completed, you will gain instant access to our insights. If you did not receive the email from us please check your spam folder or try again .

Improving your experience

We noticed that you have not opted into the Cookies that improve your experience. If you would like to receive insights and information which are more relevant to you, you can click the link below and opt-in to Cookies that improve your experience. Set your preferences here We use these cookies to understand website behaviour and to tailor the information we share with you.

At Morgan Stanley, we lead with exceptional ideas. Across all our businesses, we offer keen insight on today's most critical issues.

Personal Finance

Learn from our industry leaders about how to manage your wealth and help meet your personal financial goals.

Market Trends

From volatility and geopolitics to economic trends and investment outlooks, stay informed on the key developments shaping today's markets.

Technology & Disruption

Whether it’s hardware, software or age-old businesses, everything today is ripe for disruption. Stay abreast of the latest trends and developments.

Sustainability

Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics.

Diversity & Inclusion

Multicultural and women entrepreneurs are the cutting-edge leaders of businesses that power markets. Hear their stories and learn about how they are redefining the terms of success.

Wealth Management

Investment Banking & Capital Markets

Sales & Trading

Investment Management

Morgan Stanley at Work

Sustainable Investing

Inclusive Ventures Group

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals.

We have global expertise in market analysis and in advisory and capital-raising services for corporations, institutions and governments.

Global institutions, leading hedge funds and industry innovators turn to Morgan Stanley for sales, trading and market-making services.

We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions.

We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

We provide comprehensive workplace financial solutions for organizations and their employees, combining personalized advice with modern technology.

We offer scalable investment products, foster innovative solutions and provide actionable insights across sustainability issues.

From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success.

Core Values

Giving Back

Sponsorships

Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Underpinning all that we do are five core values.

Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back.

Morgan Stanley leadership is dedicated to conducting first-class business in a first-class way. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years.

The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

Morgan Stanley is differentiated by the caliber of our diverse team. Our culture of access and inclusion has built our legacy and shapes our future, helping to strengthen our business and bring value to clients.

Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research.

At Morgan Stanley, giving back is a core value—a central part of our culture globally. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best asset—Morgan Stanley employees.

As a global financial services firm, Morgan Stanley is committed to technological innovation. We rely on our technologists around the world to create leading-edge, secure platforms for all our businesses.

At Morgan Stanley, we believe creating a more equitable society begins with investing in access, knowledge and resources to foster potential for all. We are committed to supporting the next generation of leaders and ensuring that they reflect the diversity of the world they inherit.

Why Morgan Stanley

How We Can Help

Building a Future We Believe In

Get Started

Stay in the Know

For 88 years, we’ve had a passion for what’s possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

At Morgan Stanley, we focus the expertise of the entire firm—our advice, data, strategies and insights—on creating solutions for our clients, large and small.

We have the experience and agility to partner with clients from individual investors to global CEOs. See how we can help you work toward your goals—even as they evolve over years or generations.

At Morgan Stanley, we put our beliefs to work. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give back—all to contribute to a future that benefits our clients and communities.

Meet one of our Financial Advisors and see how we can help you.

Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

- Opportunities

- Technology Professionals

Experienced Financial Advisors

We believe our greatest asset is our people. We value our commitment to diverse perspectives and a culture of inclusion across the firm. Discover who we are and the right opportunity for you.

Students & Graduates

A career at Morgan Stanley means belonging to an ideas-driven culture that embraces new perspectives to solve complex problems. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

Experienced Professionals

At Morgan Stanley, you’ll find trusted colleagues, committed mentors and a culture that values diverse perspectives, individual intellect and cross-collaboration. See how you can continue your career journey at Morgan Stanley.

At Morgan Stanley, our premier brand, robust resources and market leadership can offer you a new opportunity to grow your practice and continue to fulfill on your commitment to deliver tailored wealth management advice that helps your clients reach their financial goals.

- Dec 1, 2017

Will Big Data Be Increasingly Fundamental to Stock Picking?

After a record year of inflows, factor- and quant-based investing is a $1.5 trillion market that is only gaining influence. should fundamental investors be paying attention.

Proponents of bottom-up stock picking say that dispassionate numbers alone cannot predict the success of a stock or asset class; a spreadsheet doesn't capture the talent of a management team or the power of a cyclical trend.

Proponents of quantitative investing—using complex mathematical models to pinpoint opportunities—contend that human emotions, biases and limitations handicap performance. Instead, it’s better to identify the factors associated with superior returns and build models around them.

With data more widespread and complex, the lines between fundamental investing and quantitative investing are blurring.

- Share this on LinkedIn

- Share this on Facebook

But while both styles have their champions, a new Morgan Stanley Research report finds that a combination of the two approaches could be advantageous for investors in either camp.

In fact, according to Martin Leibowitz, Vice Chairman of Morgan Stanley Research and Chair of the firm’s Quantitative Council, there will likely be a broader convergence of fundamental and quantitative investment processes over the next five years.

“Fundamental investors will need to pay greater attention to quant and factor investing, whether as a driver of markets or a complement to their investment process. By extension, for quant investors, combining fundamental and factor approaches—what’s called quantamental—could produce superior returns.”

Quant and Factor: A Rapidly Growing Market

Rise of the machines: automating the future, ready. set. hedge., why advice matters.

Assets in factor and quant-based strategies have increased at a compound annual growth rate of 17% over the past six years, with an estimated $1.5 trillion just in retail funds and hedge funds alone.

While the growth has been impressive, Leibowitz says there is still room to run. “Just a 1% shift in global assets under management each year away from traditional assets—which is not hard to imagine in the current yield-starved environment—translates into a 12% compound annual growth rate for factor assets.”

Investors are paying attention. The Quantitative Council that Leibowitz chairs at Morgan Stanley is comprised of senior quantitative specialists from across the firm with the goal of ensuring that the Morgan Stanley’s quant resources are aligned with the needs of clients and the fundamental strategists and analysts in the Research Department.

Total Smart Beta/Quant/Factor Based AuM ($B)

Quant and Factor Investing Explained

Although investors are becoming more educated on quant and factor investing, it’s worth taking a moment to distinguish between them. Quantitative investing can be defined as a form of active management. Instead of legacy fundamental stock-picking, quant uses complex mathematical models to detect investment opportunities. Like fundamental human analysts, quant can utilize a multitude of strategies under its umbrella, including event-driven, trend-following (momentum), economic data-driven or price inefficiency seeking.

One form of quantitative investing, factor investing, is an investment strategy that seeks to enhance returns, improve portfolio diversification or reduce risk by targeting exposure to specific drivers of risk and return. These drivers, or factors, are based on valuation, momentum, volatility, quality, and other traits of stocks that investors have traditionally scrutinized.

In factor investing, stocks with favorable combinations of factor exposures, as determined by statistical tests, receive higher weights than do stocks with disfavored combinations of factor exposures. Investment managers can parse and weigh these factors any number of ways to achieve desired investment outcomes, depending on their universe of stocks, investment horizon or other criteria.

So in simplest terms, quant and factor strategies use vast amounts of data to discern the relationships between stock characteristics and overall returns.

The Rise of Quantamental

While factor investing is often associated with rule-based index investing (aka smart beta), active managers are increasingly using factor-based algorithms to reduce risk and maximize returns in the fundamental arena. “We see evidence that combining fundamental and factor approaches—or 'quantamental' investing—can produce superior returns," says Brian Hayes, Global Head of Quantitative Equity Research.

This is particularly true in the era of big data, where public companies can be evaluated not just through company and economic specific data, but also non-traditional data sources like satellite images, internet traffic and logistics data . Fundamental investors must grapple with how to systematically collect, analyze and garner insights from all of this data, while quantitative investors may need fundamental sector expertise to identify reliable patterns.

The upshot: “We see fields of opportunity to boost returns by bridging the fundamental and quantitative divide and combining the investment processes," Hayes says. “This could yield new and greater insights, and enhance alpha generation for those with the technology, tools and process to harness and make sense of it."

Quantamental investing can also improve cross-asset investment decisions. “Factor investing is the next iteration in the evolution of asset allocation, as diversity of return drivers becomes increasingly important in a low-return world," Leibowitz says.

Surprise Results

To test the validity of factor investing—and quantamental investing—the report’s authors systematically constructed factor strategies, both at the individual stock level (micro) and asset class level (macro), globally.

For individual stocks, they created global models for forecasting single-stock performance for 5,400 stocks across developing markets and emerging countries; they studied more than 70 factors classified into four broad categories: valuation, growth and investor sentiment, capital use and profitability, and capital structure and financial leverage.

They then paired those models with Morgan Stanley fundamental analyst ratings. Between 2003 and 2010, a period that included a major equity rally, a quant crisis and one of the worst bear markets in decades, stocks that screened well on the factor-based model and analyst ratings had better historical performance than either approach on a stand-alone basis.

Performance of Various Approaches to Investing (2003 to 2010)

Late Stage or Early Stage?

One question some investors have is that although the growth in factor and quant-based strategies is impressive, how much runway is left? According to the report, quite a bit.

The report finds that as investor education grows, articulating the advantages of solutions-based investing combined with the shift towards AI and big data techniques to enhance alpha generation versus legacy stock-pickers, the trend will boost factor/quant strategies and accelerate growth into the end of the decade and beyond.