Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

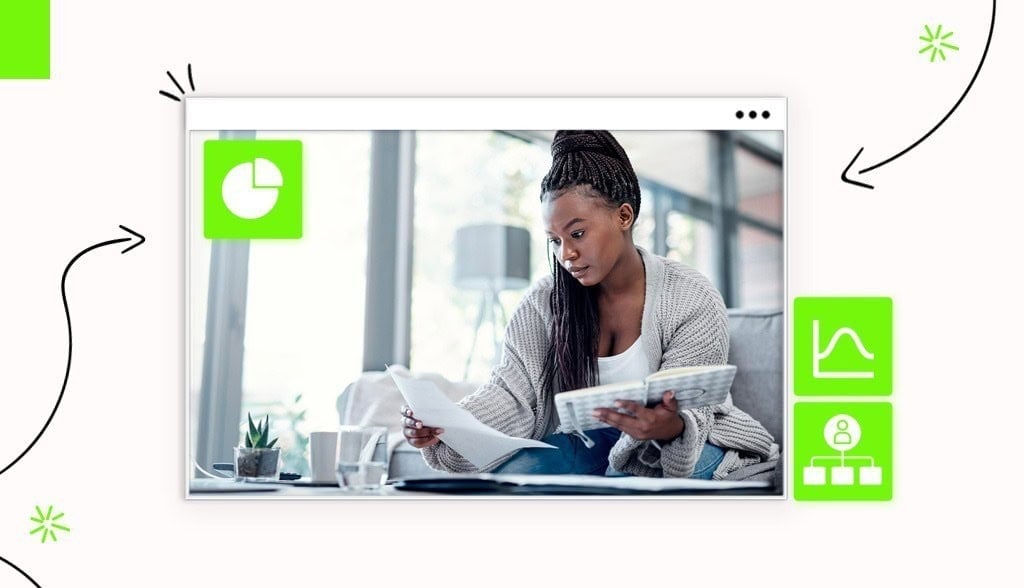

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

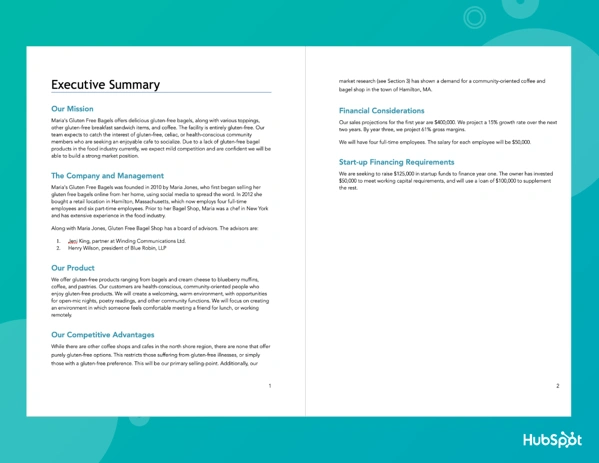

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

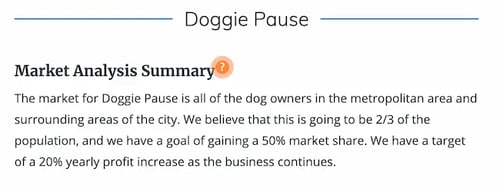

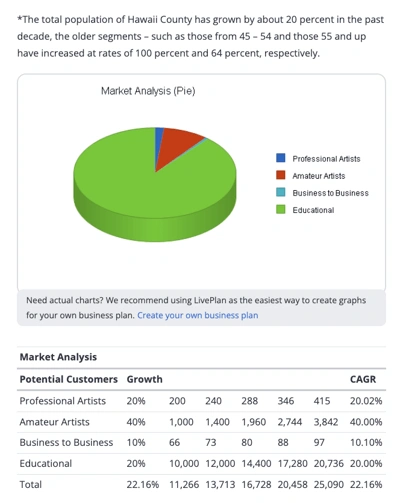

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

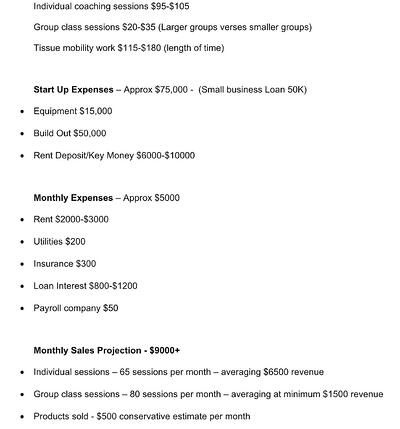

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

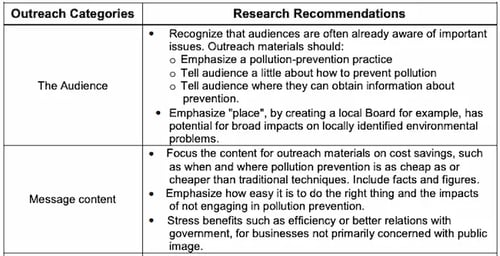

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

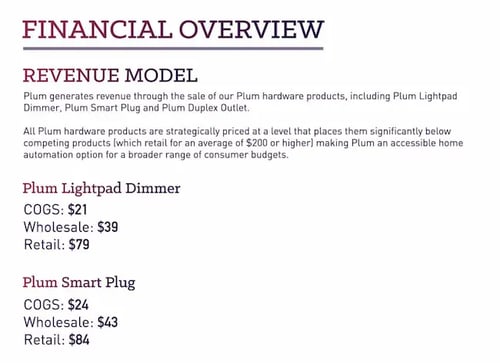

Step 10: Financial Projections

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

Download Business Plan Template

Microsoft Excel | Smartsheet

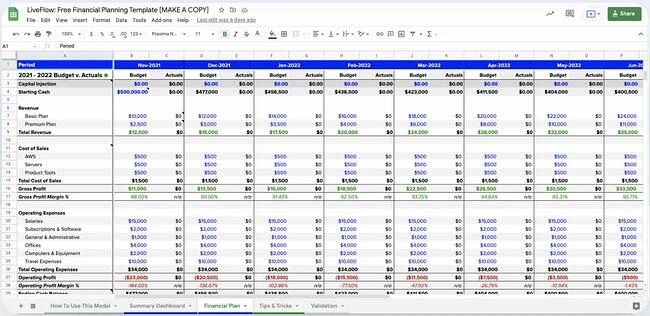

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

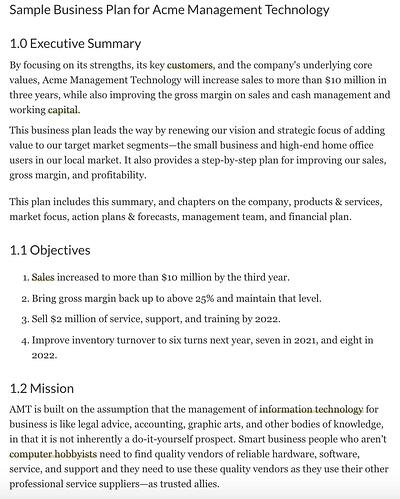

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Starting a Business | How To

How to Write a Business Plan in 7 Steps

Published February 2, 2024

Published Feb 2, 2024

WRITTEN BY: Mary King

Get Your Free Ebook

Your Privacy is important to us.

This article is part of a larger series on Starting a Business .

Starting A Business?

Step 1: Gather Your Information

Step 2: outline your business plan, step 3: write each section, step 4: organize your appendix, step 5: add final details, step 6: add a table of contents, step 7: get feedback, bottom line.

A solid business plan helps you forecast your future business and is a critical tool for raising money or attracting key employees or business partners. A business plan is also an opportunity to show why and how your business will become a success. Learning how to write a business plan successfully requires planning ahead and conducting financial and market research.

How to write a business plan step-by-step:

- Gather your information

- Outline your business plan

- Write each section

- Organize your appendix

- Add final details

- Add a table of contents

- Get feedback.

Your first step is to get organized by gathering all your relevant business information. This will save you time completing the various sections of your business plan. At a minimum, you’ll want to have the following handy:

- Business name, contact information, and address

- Owner(s) names, contact information, and addresses

- Names, contact information, and addresses of any business partners (if you will be working with partners)

- Resume and relevant work history for yourself and any key partners or employees

- Any significant sales, commerce, traffic, and financial data and forecasts

- Customer data (if applicable)

- Any significant data about your nearest competitors’ commerce, traffic, or finances

Now it’s time to outline your business plan, making note of the sections you need to include and what data you want to include in each section. You can create an outline on your own or use a business plan template to help. Whichever route you choose, it is common to include these sections in your business plan outline:

- Introduction

- Executive summary

- Company overview

- Products and services

- Market and industry analysis

- Marketing strategy

- Sales strategy

- Management and organization

- Financial data, analysis, and forecasts

Connect the data you gathered in step one to specific sections of your outline. Make a note if you need to convert some information into charts or images to make them more compelling for potential investors. For example, you’ll want to include relevant work history in your management section and convert your sales forecasts into charts for your financial data section.

Now it’s time to write your business plan. Attack this one section at a time, adding the relevant data as you go.

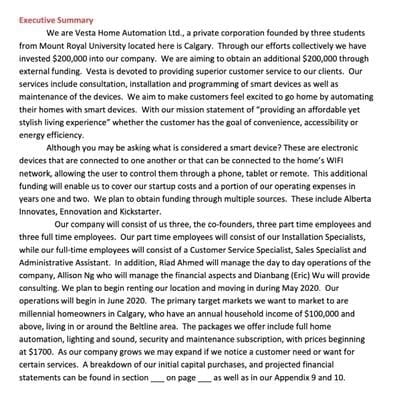

Executive Summary

The executive summary is an overview of the business plan and should ideally be one, but no more than two, pages in length. Some investors actually only request the executive summary. So make it an informative, persuasive, and concise version of your business plan.

It can be easier to write the executive summary last, after the other sections. Then you can more clearly understand which sections of your business plan are the most important to highlight in the executive summary.

When learning how to write an executive summary for a business plan, remember to include the following:

- Business objectives : Your business objectives are specific and attainable goals for your business. Create at least four business objectives organized by bullet point. If you’re not sure how to phrase your objectives, read our SMART goals examples to understand how to do so.

- Mission statement: The mission statement discusses the aim, purpose, and values of your business. It’s typically a short statement from one sentence to several sentences in length. You may find that your mission statement evolves as your business grows. Learn more on how to write your mission statement in our guide.

Consider also including the following in your executive summary:

- Business description : Similar to a 30-second pitch, describing your business and what makes it unique

- Products and services : The type of products and services you’re providing and their costs

- Competitors : Your biggest competitors and why your business will succeed despite them

- Management and organization : The owners’ backgrounds and how they will help the business succeed; management structure within the business

- Business location (or facility) : Location benefits and the surrounding area

- Target market and ideal customer : Who your ideal customers are and why they’re going to purchase your products or services

- Financial data and projections : Provide brief financial data and projections relevant to your business, such as startup costs, at what month the business will be profitable, and forecasted sales data

- Financing needed : Explanation of the startup funding sources and the amount of financing being requested

The bullets above can be combined into several paragraphs. You can add or remove sections based on your business’ needs. For example, if you don’t have a physical location, you might remove that piece of information. Or, if a web presence is crucial to your success, include two to three sentences about your online strategy .

Company Overview

The company overview (sometimes also called a “business overview”) section highlights your company successes (if you’re already in business) or why it will be successful (if you’re a startup). In the opening paragraph or paragraphs, provide information like location, owners, hours of operation, products, and services.

How you structure this section depends on whether you’re a startup or an established business. A startup will discuss the general expenses and steps needed to open the business, such as permits, build-outs, rent, and marketing. An established business will briefly discuss the company’s financial performance over the past three years.

If you’re trying to raise capital from an investor or bank, include a chart listing the items your business will acquire with the capital. For example, if you’re purchasing equipment with the additional funding, list each piece of equipment and the associated cost. At the bottom of the chart, show the total of all expenses, which should be the requested amount of funding.

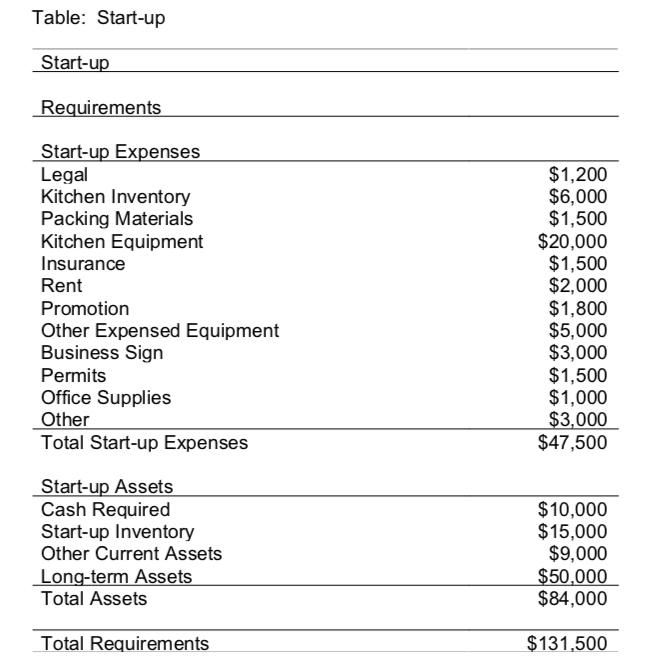

This startup cost table for a pizza restaurant separates startup expenses from startup assets.

Your company overview should cover the following:

- Location & Facilities : If you have a brick-and-mortar location or a facility, like a warehouse, describe it here. Detail the benefits of your location and the surrounding areas. Write about square footage, leases or ownership, the surrounding area, and a brief description of the population.

- Ownership : Briefly mention the company ownership team and their backgrounds. Show why these owners are likely to be successful in operating this business by providing certain details, such as each owner’s industry experience, previous employers, education, and awards. This will be discussed more in-depth in the management and organization section below.

- Competitive advantage : Ideally, your competitive advantage is what your business can do that your competitors cannot. It’s the one big differentiator that will make your company successful. Many investors are looking for specific competitive advantages, such as patents, proprietary tech, data, and industry relationships. If you don’t have these, describe the top aspect in which your business will do better than competitors, such as quality of products, quality of services, relationships with vendors, or marketing strategy.

Products & Services

The products and services section is the most flexible section because its structure depends on what your business sells. Regardless of what you’re selling, include a description of your business model to explain how your business makes money. Also include future products or services your business could provide one, two, or five years down the road.

List and describe all physical and digital products you plan to sell, as well as any services the business provides. Services don’t necessarily have to be sold for a cost—your business might offer entertainment, like live music or bar games as a free service.

Whether you’re selling products, services, or both, it’s important to discuss fulfillment, or how each will be delivered. If you make or sell physical products, describe how products will be sold, assembled, packed, and shipped. If your business is service-based, describe how a service, such as a window installation, will be ordered and completed. Where will the glass be purchased from and acquired, how will customers place orders, and how will the window be installed?

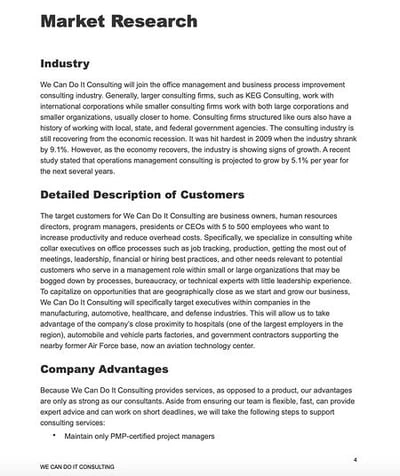

Market & Industry Analysis

The market and industry analysis section is where you analyze potential customers and the forces that influence your industry. This section is where you make the case as to why your business should succeed, ideally backed by data. You’ll want to do a deep dive into your competitors and discuss their challenges and successes. Learn more about sales targeting to improve how you approach your sales strategy.

Market Segmentation

Market segmentation, or your target market, consists of the customers who are most likely to purchase your products or services. Describe these groups of customers based on demographics, including attributes like age, income, location, and buying habits. Additionally, if you’ll be operating with a business-to-business (B2B) model, use characteristics to describe the ideal businesses to which you’ll sell.

Once your target market is segmented into groups, use market research data to show that those customers are physically located near your business (or are likely to do business with you if you’re online). If you’re opening a daycare, for example, you’ll want to show the data on how many families are in a certain mile radius around your business. You can obtain this kind of data from a free resource, like the U.S. Census and ReferenceUSA .

Once you have at least three segments, briefly outline the strategy you’ll use to reach them. Most likely it will be a combination of marketing, pricing, networking, and sales.

Learn the best approach to product pricing in our guide.

Industry Analysis

Take a look at your business’s industry and explain why it’s a great idea to start a business in that niche. If you’re in a growing industry, a bank is more likely to lend your business capital because it’s predicted to be in demand and have additional customers. Learn about how to find a niche market .

Find industry statistics from a free tool, like the Bureau of Labor Statistics , or a paid tool like the Hoovers Industry Research , which provides professionally curated reports for over 1,000 industries.

Competitor Research

Wrap up the market and industry analysis section by analyzing at least five competitors within a five-mile radius (expand the radius, if needed). Create a table with the five competitors and mention their distance from your business (if applicable), along with their challenges, and successes.

During your analysis, you’ll want to frame their challenges as something you can improve upon. Persuade your reader that your business will provide superior products and services than the competitors.

Marketing Strategy & Implementation Summary

In the opening paragraphs of your marketing strategy and implementation summary, give an overview of the subsections below.

Include any industry trends you may take advantage of. If applicable, include the advertising strategy and budget, stating specific channels. Mention who in the business will be responsible for overseeing the marketing.

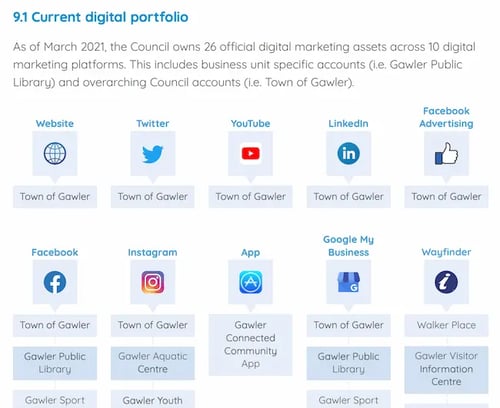

Include any platforms and tools the business will use, like your website, social media, email marketing, and video. If you’re hiring a company to do any online work, like creating a website or managing social media, briefly describe them and the overall cost (you can elaborate more on costs in the financial data section ).

Don’t forget to include a subsection for your traditional marketing plan. Traditional marketing encompasses anything not online, such as business cards, flyers, local media, direct mail, magazine advertising, and signage.

Sales Strategy

If sales is an important component of your business, include a section about your sales strategy. Describe the role of the salesperson (or persons), strategies they’ll use to close the deal with clients, lead follow-up procedures, and networking they’ll attend. Also, list any training your sales staff will attend.

Sales Forecast Table

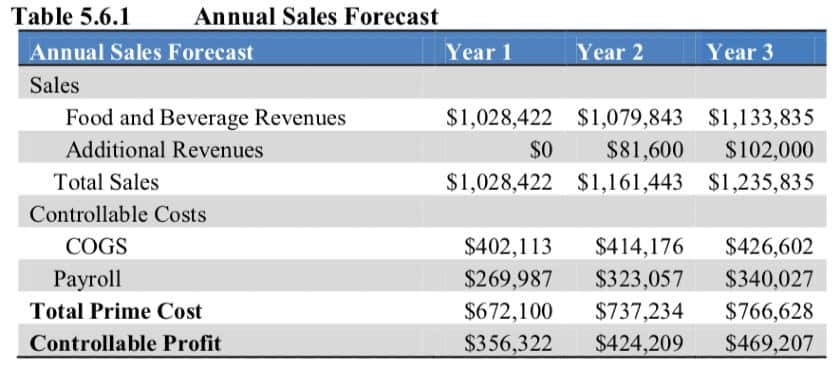

A sales forecast table gives a high-level summary of where you expect your sales and expenses to occur for each of the next three years in business. In the paragraph before the table, state where you expect growth to come from and include a growth percentage rate. The annual sales forecast chart will be broken down further in the financial projections section below.

The annual sales forecast for this restaurant summarizes sales, cost, and profit for the first three years in business.

Pricing Strategy

In the pricing strategy section, discuss product/service pricing, competitor pricing, sales promotions , and discounts—basically anything related to the pricing of what you sell. You should discuss pricing in relation to product and service quality as well. Consider including an overview of pricing for specific products, e.g., pizza price discounts when ordering a specific number of pizzas for catering.

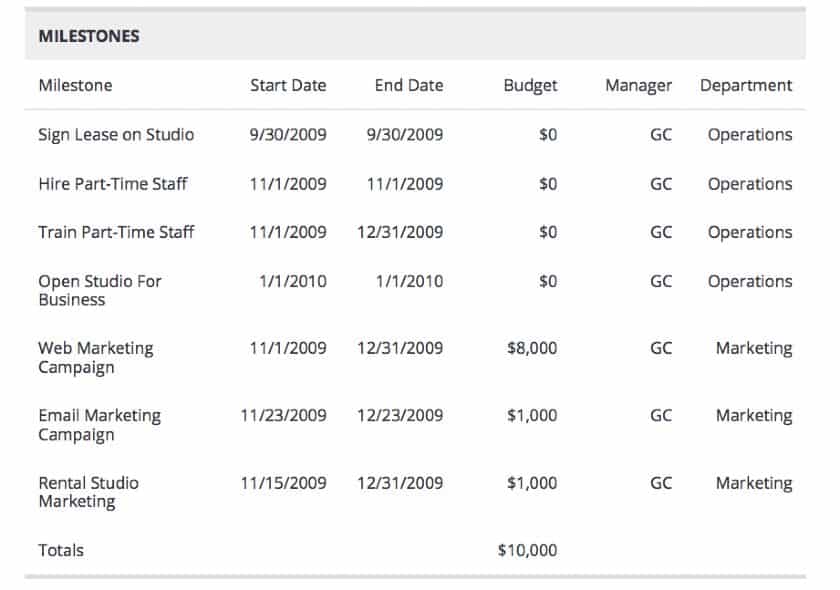

Milestones in a business plan are typically displayed in a table. They outline important tasks to do before the business opens (or expands, if already in business). For each milestone, include the name, estimated start and completion date, cost, person responsible, and department responsible (or outside company responsible). List at least seven milestones.

Milestones for this commercial photography business include hiring staff and completing marketing campaigns.

Management & Organization Summary

The management and organization summary is an in-depth look at the ownership background and key personnel. This is an important section because many investors say they don’t invest in companies, they invest in people. In this section, make the case why you and your team have the experience and knowledge to make this business a success.

Ownership Background

Discuss the owners’ backgrounds and place an emphasis on why that background will ensure the business succeeds. If you don’t have experience managing a retail business, consider finding a co-owner who does. Typically, banks won’t lend to someone who doesn’t have experience in the type of business they’re trying to open.

Management Team Gaps

If there are any experience or knowledge gaps within the management team, state them. List the consultants or employees you will hire to cover the gaps. Investors who know your industry well may recognize gaps within your business plan, and it’s important to state the gaps without waiting for the investor to bring it up. This makes it appear that you know the industry well.

Personnel Plan

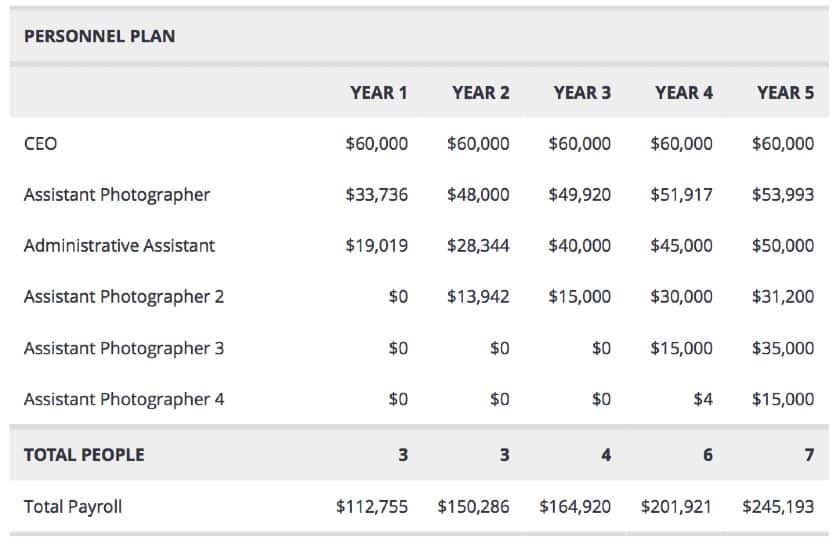

The personnel plan outlines every position within your business for at least the next three years. In the opening paragraph, discuss the roles within the company and who will report to whom. Include a table with at least three years of salary projections for each employee in your business. Include a total salary figure at the bottom. This table may be broken down further into salaries for each month in the financial projections or appendix.

This commercial photography business has the CEO at the same salary every year, with their employees’ salaries increasing year over year.

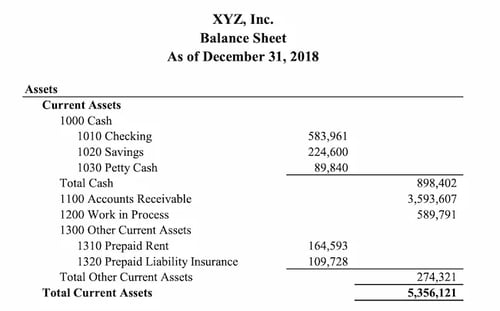

Financial Data & Analysis

The financial data and analysis section is the most difficult part of a business plan. This section requires you to forecast income and expenses for the next three years. You’ll need a working knowledge of common financial statements, like the profit and loss statement, balance sheet, and cash flow statement.

In the opening paragraphs of the financial data and analysis section, give an overview of the sections below. Discuss the break-even point and the projected profit at the first, second, and third year in business. State the assets and liabilities from the projected balance sheet as well.

If you’re getting a loan from a bank, say how long and from what source the loan will be repaid. One of the main pieces of information bankers want to ascertain from financial forecasting is if they will be paid back and how likely that is to happen.

You might also include the following financial reports:

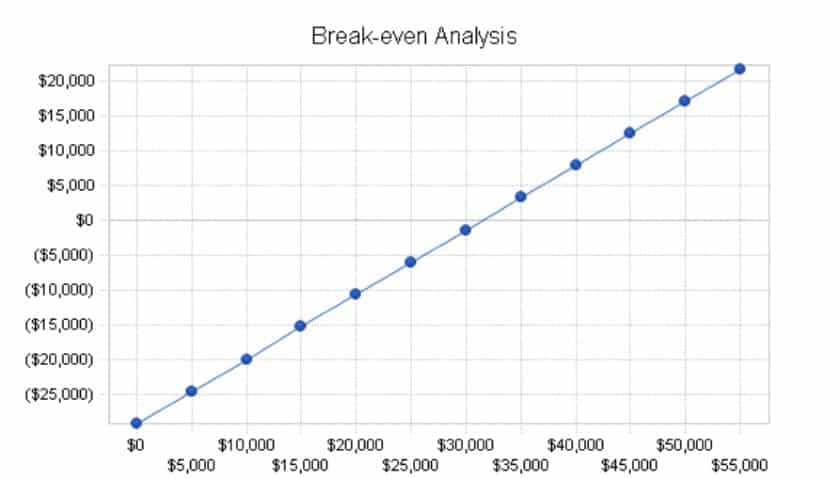

- Break-even analysis : Break-even is when your business starts to make money. Break-even analysis is where you illustrate the point at which your revenue exceeds expenses and a profit occurs. In this section’s opening paragraph, state your monthly fixed costs and average percent variable costs (cost that changes with output, like labor or cost of goods). In the example below, variable costs increase 8% for every additional dollar made.

The break-even point for this document shredding business is $31,500 in a month.

- Projected profit & loss: The profit and loss table is a month-by-month breakdown of income and expenses (including startup expenses). Typically, you should expect your business to show a profit within the first year of operating and increase in years two and three. Be sure to show income and expenses month-by-month for the first two years in operation. Create a separate chart that shows income and expenses year-by-year for the first three years.

- Projected cash flow : The cash flow section shows your business’s monthly incoming and outgoing cash. It should cover the first two years in business. Mention what you plan to do with excess cash. See how to run a statement cash flow in QuickBooks Online .

- Projected balance sheet: The balance sheet shows the net worth of the business and the financial position of the company on a specific date. It focuses on the assets and liabilities of the business. Ideally, the balance sheet should show that the net worth of your business increases. Prepare a projected year-by-year balance sheet for the first three years.

- Business ratios: Also called financial ratios, these are a way to evaluate business performance. It’s helpful to compare your projected business ratios to the industry standard. Project your business ratios by year for the first three years.

The appendix is where you put information about the business that doesn’t fit in the above categories. What you put here largely depends on the type of business you’re creating. It’s a good idea to put any visual components in the appendix. A restaurant might add an image of the menu and an artist rendering of the interior and exterior, for example.

Consider including the following items in your business plan appendix:

- Artist mock-up of interior

- Building permits

- Equipment documentation

- Incorporation documents

- Leases and agreements

- Letters of recommendation

- Licenses and permits

- Marketing materials

- Media coverage

- Supplier agreements

An appendix isn’t required in a business plan, but it’s highly recommended for additional persuasion. Documents like media coverage, agreements, and equipment documentation show the investor and banker you’re serious about the business. If your appendix is more than 10 pages, consider creating a second table of contents just for the appendix.

Detailed Financial Projections

Put the more detailed projections in the appendix. The financial projections in the previous section is typically a year-by-year breakdown for three years in the future. But many bankers and investors want to see the first two years broken down month-by-month for at least the profit and loss statement, balance sheet, cash flow, and personnel plan.

Typically, you can print out the spreadsheet in smaller font and include it in the appendix. You don’t need to create additional charts for the appendix.

With all of your information organized, now it’s time to add the final details, like cover pages and a nondisclosure agreement (NDA).

- Cover Page: The cover page provides contact information about the business and its owner. The cover page should have the business name and who prepared it, including your name, address, phone number, and email address. Additionally, if the registered company name with the state is different from the business name, you may want to add that as a “company name.”

- Nondisclosure Agreement: An NDA ((also called a confidentiality agreement) is a legal document that safeguards business information. You’d want someone to sign it before reading your business plan if you believe they could use the information to their advantage and your disadvantage, such as to steal your business idea or marketing strategy.

Fit Small Business provides a free non-disclosure agreement.

Once your final details are added, proofread all the sections of your business plan, ensuring that the information is accurate and that all spelling and grammar are correct. If there are any illustrations, projections, or additional information you forgot to include, now is the time to add it.

The final step is adding a table of contents so that bankers and potential investors can easily navigate your business plan. A table of contents lists the sections and subsections of your business plan. All of the headers above (Executive Summary, Business Objectives, Company Overview, Products and Services, and so on) are considered sections of a business plan. You can number the sections for additional organization. For example, 1.0 is the executive summary, 1.1 is the business objectives, and 1.2 is the mission statement.

Editing and formatting can change the pagination of your business plan. So you’ll save yourself work if you finalize the business plan content first, then arrange the table of contents at the end.

Congratulations! You’ve captured your business idea and plan for profitability on paper. Before you send this business plan to loan officers and potential investors, ask friends, family, and other supportive business owners to read it and provide feedback. They may notice typos or other errors that you missed. They may also identify details you can add to make your business plan more persuasive.

Frequently Asked Questions (FAQs) About How to Write a Business Plan

These are the most common questions I hear about writing a business plan.

What needs to be in a business plan?

What you should put in a business plan depends on its purpose and your industry. If you’re seeking funding from a bank or investor, you’re going to need most of the sections above, with a strong focus on your financial projections. If you are using your business plan to attract key employees (like a chef for your restaurant), mock-ups and vendor agreements will be more useful. Think about the information that will help your target reader make a decision about whether to get involved with your business—whether that is a location, a business model, or product idea—and be sure your business plan includes that information.

How do you write a business plan for a startup?

The business plan for a startup is similar to a business plan for an established business. The startup business plan will include startup costs, which will be listed by item and factored into the financial projections. Additionally, since your business hasn’t proven it can be successful yet, you may need additional information about the ownership, business model, market, and industry to convince the reader your business will succeed.

How long does it take to write a business plan?

A simple business plan may only take a couple of hours. However, for the business plan provided with this template, which includes financial projections, it may take over 60 hours to research the income and costs associated with running your business. You also have to format those costs into a chart, because it’s best to showcase the data with easy-to-understand charts.

Is writing a business plan hard?

Creating a business plan for funding from a bank or investor is a detailed process. Unless you have a background in financial statements, the financial projections may be difficult for the average business owner. But you can ask for help; it is common to hire a bookkeeper or accountant to assist you with financial projects to ensure your math is correct. Outside of the projections, most other business plan sections are simple, though you’ll want to give yourself time to make each section persuasive.

Every type of business, whether it’s a side hustle or a multimillion-dollar business, should have a business plan. The industry analysis and market segmentation sections validate your business idea. Researching and forecasting financial projections helps you logically think through income and expenses, which lessens the risk of business failure. Remember to get feedback on your business plan from business employees and associates. If necessary, have them sign an NDA before they review the plan.

About the Author

Find Mary On LinkedIn Twitter

Mary King is an expert restaurant and small business contributor at Fit Small Business. With more than a decade of small business experience, Mary has worked with some of the best restaurants in the world, and some of the most forward-thinking hospitality programs in the country. Mary’s firsthand operational experience ranges from independent food trucks to the grand scale of Michelin-starred restaurants, from small trades-based businesses to cutting-edge co-working spaces.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

BRAND NEW Two-Day LIVE Summit with 20+ Ecommerce Trailblazers.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, how to write a business plan (tips, templates, examples).

Written by Jesse Sumrak | May 14, 2023

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Business plans might seem like an old-school stiff-collared practice, but they deserve a place in the startup realm, too. It’s probably not going to be the frame-worthy document you hang in the office—yet, it may one day be deserving of the privilege.

Whether you’re looking to win the heart of an angel investor or convince a bank to lend you money, you’ll need a business plan. And not just any ol’ notes and scribble on the back of a pizza box or napkin—you’ll need a professional, standardized report.

Bah. Sounds like homework, right?

Yes. Yes, it does.

However, just like bookkeeping, loan applications, and 404 redirects, business plans are an essential step in cementing your business foundation.

Don’t worry. We’ll show you how to write a business plan without boring you to tears. We’ve jam-packed this article with all the business plan examples, templates, and tips you need to take your non-existent proposal from concept to completion.

Table of Contents

What Is a Business Plan?

Tips to Make Your Small Business Plan Ironclad

How to Write a Business Plan in 6 Steps

Startup Business Plan Template

Business Plan Examples

Work on Making Your Business Plan

How to Write a Business Plan FAQs

What is a business plan why do you desperately need one.

A business plan is a roadmap that outlines:

- Who your business is, what it does, and who it serves

- Where your business is now

- Where you want it to go

- How you’re going to make it happen

- What might stop you from taking your business from Point A to Point B

- How you’ll overcome the predicted obstacles

While it’s not required when starting a business, having a business plan is helpful for a few reasons:

- Secure a Bank Loan: Before approving you for a business loan, banks will want to see that your business is legitimate and can repay the loan. They want to know how you’re going to use the loan and how you’ll make monthly payments on your debt. Lenders want to see a sound business strategy that doesn’t end in loan default.

- Win Over Investors: Like lenders, investors want to know they’re going to make a return on their investment. They need to see your business plan to have the confidence to hand you money.

- Stay Focused: It’s easy to get lost chasing the next big thing. Your business plan keeps you on track and focused on the big picture. Your business plan can prevent you from wasting time and resources on something that isn’t aligned with your business goals.

Beyond the reasoning, let’s look at what the data says:

- Simply writing a business plan can boost your average annual growth by 30%

- Entrepreneurs who create a formal business plan are 16% more likely to succeed than those who don’t

- A study looking at 65 fast-growth companies found that 71% had small business plans

- The process and output of creating a business plan have shown to improve business performance

Convinced yet? If those numbers and reasons don’t have you scrambling for pen and paper, who knows what will.

Don’t Skip: Business Startup Costs Checklist

Before we get into the nitty-gritty steps of how to write a business plan, let’s look at some high-level tips to get you started in the right direction:

Be Professional and Legit

You might be tempted to get cutesy or revolutionary with your business plan—resist the urge. While you should let your brand and creativity shine with everything you produce, business plans fall more into the realm of professional documents.

Think of your business plan the same way as your terms and conditions, employee contracts, or financial statements. You want your plan to be as uniform as possible so investors, lenders, partners, and prospective employees can find the information they need to make important decisions.

If you want to create a fun summary business plan for internal consumption, then, by all means, go right ahead. However, for the purpose of writing this external-facing document, keep it legit.

Know Your Audience

Your official business plan document is for lenders, investors, partners, and big-time prospective employees. Keep these names and faces in your mind as you draft your plan.

Think about what they might be interested in seeing, what questions they’ll ask, and what might convince (or scare) them. Cut the jargon and tailor your language so these individuals can understand.

Remember, these are busy people. They’re likely looking at hundreds of applicants and startup investments every month. Keep your business plan succinct and to the point. Include the most pertinent information and omit the sections that won’t impact their decision-making.

Invest Time Researching

You might not have answers to all the sections you should include in your business plan. Don’t skip over these!

Your audience will want:

- Detailed information about your customers

- Numbers and solid math to back up your financial claims and estimates

- Deep insights about your competitors and potential threats

- Data to support market opportunities and strategy

Your answers can’t be hypothetical or opinionated. You need research to back up your claims. If you don’t have that data yet, then invest time and money in collecting it. That information isn’t just critical for your business plan—it’s essential for owning, operating, and growing your company.

Stay Realistic

Your business may be ambitious, but reign in the enthusiasm just a teeny-tiny bit. The last thing you want to do is have an angel investor call BS and say “I’m out” before even giving you a chance.

The folks looking at your business and evaluating your plan have been around the block—they know a thing or two about fact and fiction. Your plan should be a blueprint for success. It should be the step-by-step roadmap for how you’re going from Point A to Point B.

How to Write a Business Plan—6 Essential Elements

Not every business plan looks the same, but most share a few common elements. Here’s what they typically include:

- Executive Summary

- Business Overview

- Products and Services

- Market Analysis

- Competitive Analysis

- Financial Strategy

Below, we’ll break down each of these sections in more detail.

1. Executive Summary

While your executive summary is the first page of your business plan, it’s the section you’ll write last. That’s because it summarizes your entire business plan into a succinct one-pager.

Begin with an executive summary that introduces the reader to your business and gives them an overview of what’s inside the business plan.

Your executive summary highlights key points of your plan. Consider this your elevator pitch. You want to put all your juiciest strengths and opportunities strategically in this section.

2. Business Overview

In this section, you can dive deeper into the elements of your business, including answering:

- What’s your business structure? Sole proprietorship, LLC, corporation, etc.

- Where is it located?

- Who owns the business? Does it have employees?

- What problem does it solve, and how?

- What’s your mission statement? Your mission statement briefly describes why you are in business. To write a proper mission statement, brainstorm your business’s core values and who you serve.

Don’t overlook your mission statement. This powerful sentence or paragraph could be the inspiration that drives an investor to take an interest in your business. Here are a few examples of powerful mission statements that just might give you the goosebumps:

- Patagonia: Build the best product, cause no unnecessary harm, use business to inspire and implement solutions to the environmental crisis.

- Tesla: To accelerate the world’s transition to sustainable energy.

- InvisionApp : Question Assumptions. Think Deeply. Iterate as a Lifestyle. Details, Details. Design is Everywhere. Integrity.

- TED : Spread ideas.

- Warby Parker : To offer designer eyewear at a revolutionary price while leading the way for socially conscious businesses.

3. Products and Services

As the owner, you know your business and the industry inside and out. However, whoever’s reading your document might not. You’re going to need to break down your products and services in minute detail.

For example, if you own a SaaS business, you’re going to need to explain how this business model works and what you’re selling.

You’ll need to include:

- What services you sell: Describe the services you provide and how these will help your target audience.

- What products you sell: Describe your products (and types if applicable) and how they will solve a need for your target and provide value.

- How much you charge: If you’re selling services, will you charge hourly, per project, retainer, or a mixture of all of these? If you’re selling products, what are the price ranges?

4. Market Analysis

Your market analysis essentially explains how your products and services address customer concerns and pain points. This section will include research and data on the state and direction of your industry and target market.

This research should reveal lucrative opportunities and how your business is uniquely positioned to seize the advantage. You’ll also want to touch on your marketing strategy and how it will (or does) work for your audience.

Include a detailed analysis of your target customers. This describes the people you serve and sell your product to. Be careful not to go too broad here—you don’t want to fall into the common entrepreneurial trap of trying to sell to everyone and thereby not differentiating yourself enough to survive the competition.

The market analysis section will include your unique value proposition. Your unique value proposition (UVP) is the thing that makes you stand out from your competitors. This is your key to success.

If you don’t have a UVP, you don’t have a way to take on competitors who are already in this space. Here’s an example of an ecommerce internet business plan outlining their competitive edge:

FireStarters’ competitive advantage is offering product lines that make a statement but won’t leave you broke. The major brands are expensive and not distinctive enough to satisfy the changing taste of our target customers. FireStarters offers products that are just ahead of the curve and so affordable that our customers will return to the website often to check out what’s new.

5. Competitive Analysis

Your competitive analysis examines the strengths and weaknesses of competing businesses in your market or industry. This will include direct and indirect competitors. It can also include threats and opportunities, like economic concerns or legal restraints.

The best way to sum up this section is with a classic SWOT analysis. This will explain your company’s position in relation to your competitors.

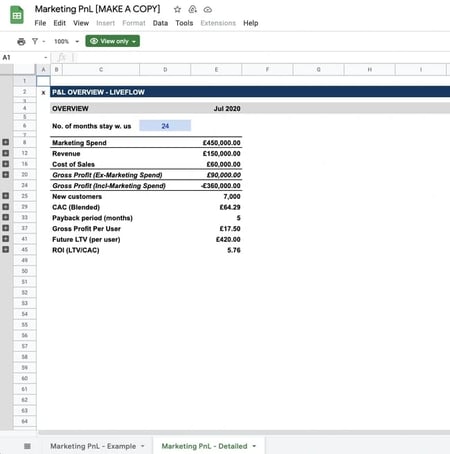

6. Financial Strategy

Your financial strategy will sum up your revenue, expenses, profit (or loss), and financial plan for the future. It’ll explain how you make money, where your cash flow goes, and how you’ll become profitable or stay profitable.

This is one of the most important sections for lenders and investors. Have you ever watched Shark Tank? They always ask about the company’s financial situation. How has it performed in the past? What’s the ongoing outlook moving forward? How does the business plan to make it happen?

Answer all of these questions in your financial strategy so that your audience doesn’t have to ask. Go ahead and include forecasts and graphs in your plan, too:

- Balance sheet: This includes your assets, liabilities, and equity.

- Profit & Loss (P&L) statement: This details your income and expenses over a given period.

- Cash flow statement: Similar to the P&L, this one will show all cash flowing into and out of the business each month.

It takes cash to change the world—lenders and investors get it. If you’re short on funding, explain how much money you’ll need and how you’ll use the capital. Where are you looking for financing? Are you looking to take out a business loan, or would you rather trade equity for capital instead?

Read More: 16 Financial Concepts Every Entrepreneur Needs to Know

Startup Business Plan Template (Copy/Paste Outline)

Ready to write your own business plan? Copy/paste the startup business plan template below and fill in the blanks.

Executive Summary Remember, do this last. Summarize who you are and your business plan in one page.

Business Overview Describe your business. What’s it do? Who owns it? How’s it structured? What’s the mission statement?

Products and Services Detail the products and services you offer. How do they work? What do you charge?

Market Analysis Write about the state of the market and opportunities. Use date. Describe your customers. Include your UVP.

Competitive Analysis Outline the competitors in your market and industry. Include threats and opportunities. Add a SWOT analysis of your business.

Financial Strategy Sum up your revenue, expenses, profit (or loss), and financial plan for the future. If you’re applying for a loan, include how you’ll use the funding to progress the business.

5 Frame-Worthy Business Plan Examples

Want to explore other templates and examples? We got you covered. Check out these 5 business plan examples you can use as inspiration when writing your plan:

- SBA Wooden Grain Toy Company

- SBA We Can Do It Consulting

- OrcaSmart Business Plan Sample

- Plum Business Plan Template

- PandaDoc Free Business Plan Templates

Get to Work on Making Your Business Plan

If you find you’re getting stuck on perfecting your document, opt for a simple one-page business plan —and then get to work. You can always polish up your official plan later as you learn more about your business and the industry.

Remember, business plans are not a requirement for starting a business—they’re only truly essential if a bank or investor is asking for it.

Ask others to review your business plan. Get feedback from other startups and successful business owners. They’ll likely be able to see holes in your planning or undetected opportunities—just make sure these individuals aren’t your competitors (or potential competitors).

Your business plan isn’t a one-and-done report—it’s a living, breathing document. You’ll make changes to it as you grow and evolve. When the market or your customers change, your plan will need to change to adapt.

That means when you’re finished with this exercise, it’s not time to print your plan out and stuff it in a file cabinet somewhere. No, it should sit on your desk as a day-to-day reference. Use it (and update it) as you make decisions about your product, customers, and financial plan.

Review your business plan frequently, update it routinely, and follow the path you’ve developed to the future you’re building.

Keep Learning: New Product Development Process in 8 Easy Steps

What financial information should be included in a business plan?

Be as detailed as you can without assuming too much. For example, include your expected revenue, expenses, profit, and growth for the future.

What are some common mistakes to avoid when writing a business plan?

The most common mistake is turning your business plan into a textbook. A business plan is an internal guide and an external pitching tool. Cut the fat and only include the most relevant information to start and run your business.

Who should review my business plan before I submit it?

Co-founders, investors, or a board of advisors. Otherwise, reach out to a trusted mentor, your local chamber of commerce, or someone you know that runs a business.

Ready to Write Your Business Plan?

Don’t let creating a business plan hold you back from starting your business. Writing documents might not be your thing—that doesn’t mean your business is a bad idea.

Let us help you get started.

Join our free training to learn how to start an online side hustle in 30 days or less. We’ll provide you with a proven roadmap for how to find, validate, and pursue a profitable business idea (even if you have zero entrepreneurial experience).

Stuck on the ideas part? No problem. When you attend the masterclass, we’ll send you a free ebook with 100 of the hottest side hustle trends right now. It’s chock full of brilliant business ideas to get you up and running in the right direction.

About Jesse Sumrak

Jesse Sumrak is a writing zealot focused on creating killer content. He’s spent almost a decade writing about startup, marketing, and entrepreneurship topics, having built and sold his own post-apocalyptic fitness bootstrapped business. A writer by day and a peak bagger by night (and early early morning), you can usually find Jesse preparing for the apocalypse on a precipitous peak somewhere in the Rocky Mountains of Colorado.

Related Posts

Shopping Cart Abandonment: Why It Matters and What to Do for Recovery

How To Develop a Million-Dollar Pitch Deck For Potential Investors

How Shipt Founder Bill Smith Had Three Exits Before 40

What to Sell on eBay: 5 Reliable Product Categories for Your eBay Store

How to Sell on eBay: A Detailed Step-by-Step Guide

Product Testing: It’s Worth Investing

How to Manufacture a Product: A Detailed Breakdown

How to Find USA Suppliers

How to Find Chinese Manufacturers to Bring Your Product to Life

AI Tools For Business: 6 Tools to Start from Scratch With

Business Not Making Money? Here’s the Reason(s) Why

What Is MOQ (Minimum Order Quantity)? Learn How It Impacts Your Business.

What Is a Wholesaler? Everything You Need To Know

What Is ROI? And How Can You Calculate It like a Pro?

Jessica Rolph Says Your Subscription Product Needs Purpose

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

BUILD SOMETHING FOR YOU

Gretta van riel will help create your ecomm brand from scratch..

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Write a Professional Business Plan in 10 Easy Steps

Home » Blog » How to Write a Business Plan in 10 Easy Steps

During financial uncertainty, many of us press pause on our entrepreneurial aspirations.

Wondering if now’s the right time to start our business . Doubting our ideas and worrying about the what-ifs and maybes!

A business plan removes the uncertainty and what-ifs from the equation. It validates our business ideas, confirms our marketing strategies, and identifies potential problems before they arise.

Replacing our doubts with positivity, ensuring we see the complete picture, and increasing our chances of success.