Analysis of Carol Geddes’ Growing Up Native

Growing up native, Carol Geddes faces several hardships that she resiliently pushes through; from fearing forced assimilation into Euro-Canadian society to pursuing her dreams while still being in touch with her culture. Carol Geddes’ Growing Up Native illustrates the experiences and hardships of Indigenous people, with a focus on Geddes’ life; starting from her memorable childhood to the excitement she felt getting accepted into university. During this timeframe, Geddes experiences an abundance of setbacks including racism, working menial jobs as a teenager, and the struggles of being Indigenous in a predominantly white community. Geddes highlights that Indigenous people should be treated equally in society and there are no limits to what they can accomplish.

While reading this essay, I was able to make various connections.“It didn’t matter who was carrying me—there was security in every pair of arms” (1). The reliance on extended family is common among many families, including mine. Similar to Geddes, I had an upbringing centered around family. Without my elders’ wisdom, I would be out of touch with my heritage and culture, which Geddes discusses the importance of. Next, in some aspects, this story reminds me of Maternal Ties, a poem by Sable Sweetgrass. Both texts delve into the importance of preserving heritage and culture. In both pieces, the narrator overcomes obstacles and acknowledges that the sky's the limit; Geddes with pursuing post-secondary education at a young age and Sweetgrass with walking across her graduation stage in traditional attire, which was prohibited. Furthermore, in both texts, the narrators pursue post-secondary education and use that knowledge to make a change in Indigenous communities; Geddes with her interest in Indigenous filmmaking and Sweetgrass with her degree in International Indigenous Studies and Film. Lastly, adoption and foster care tends to strip many children from their culture, which Geddes mentions in the essay. In Growing Up Native, Geddes says, “Social workers were scooping up native children and adopting them to white families in the south” (7), which reminds me of the inadequate foster care system, where social workers send children to homes that are not suitable for them (culturally, socially, etc). Some families foster/adopt children from backgrounds they are not familiar with, sometimes resulting in issues such as physical, mental, and sexual abuse. These systems need to be reformed, taking some of the most vulnerable children into consideration (Indigenous, Black, and other minorities). In summation, many connections can be made with this essay, even with non-Indigenous ideas; these connections underline the importance of culture and the inequality minorities face in what we claim is an “equal” society.

Analyzing the essay, Geddes uses a number of stylistic features to get her point across. Her use of idioms makes the writing more evocative and conveys a deep message in an understandable and concise way. Two meaningful idioms I analyzed were, “That was the beginning of the end of the Teslin Tlingit people’s way of life,” (4) and “I was hungry for experiences,” (9). In the first idiom, Geddes talks about how the construction of the Alaska Highway was the beginning of an end for their way of life, that everything they have always grown to know would be changed. Their sacred land was being destroyed before their eyes, which is unjust, tying into the inequality they face. The second idiom conveys the excitement Geddes felt when she moved to Whitehorse; she was ready to experience new things in a large town that was more connected with the outside world. These experiences tie into the idea seen in the essay of Indigenous people venturing out and achieving their goals. Another stylistic feature that makes the essay more effective is the structure of Geddes’ writing. She follows the beginning, middle, and end structure but unlike a traditional essay, there are paragraphs in which she backtracks to her childhood or fast tracks to the present day. This was evident in phrases such as, “But I’m getting ahead of myself” (3), and “Let me tell you a story” (10). I found this to be an entertaining stylistic choice because it made the essay less formal, essentially making it more casual and story-like. Overall, these two stylistic features evoked powerful feelings and made the essay engaging.

Carol Geddes’ Growing Up Native should be studied in school because it teaches people the importance of equality and overcoming obstacles that stop them from achieving their goals, like Geddes and other Indigenous people.

Related Samples

- Online Reviews Essay Example

- The Rising Action in Why I Stopped Babysitting Essay Example

- Choking the Oceans With Plastic by Charles J. Moore Article Analysis

- Lost Tribes of the Amazon by Joshua Hammer Analysis

- Saving the Self in the Age of the Selfie Article Analysis Essay Sample

- The Linkage Between Childhood Bullying Behavior and Future Offending Article Analysis Essay

- Article Analysis of "Creating a Secure Relationship" by Elizabeth Earnshaw (Essay Sample)

- Analysis of Barbara Ehrenreich's “Serving in Florida” (Essay Sample)

- How Credible Are Conspiracy Theories Research Paper

- Analysis Essay of A Personal Mission: Sammy Younge Jr.

Didn't find the perfect sample?

You can order a custom paper by our expert writers

Carol Geddes 'Growing Up Native' Essay by Master Researcher

Description:

Cite this essay:.

- Sign up and get a free ebook!

- Don't miss our $0.99 ebook deals!

My Life: Growing Up Native in America

- Unabridged Audio Download

LIST PRICE $28.99

- Amazon logo

- Bookshop logo

Table of Contents

About the book, product details.

- Publisher: MTV Books (October 1, 2024)

- Length: 224 pages

- ISBN13: 9781668021705

Browse Related Books

- Social Science > Ethnic Studies > American > Native American Studies

- Social Science > Essays

Resources and Downloads

High resolution images.

- Book Cover Image (jpg): My Life: Growing Up Native in America Hardcover 9781668021705

Get a FREE ebook by joining our mailing list today!

Plus, receive recommendations and exclusive offers on all of your favorite books and authors from Simon & Schuster.

You may also like: Thriller and Mystery Staff Picks

More to Explore

Limited Time eBook Deals

Check out this month's discounted reads.

Our Summer Reading Recommendations

Red-hot romances, poolside fiction, and blockbuster picks, oh my! Start reading the hottest books of the summer.

This Month's New Releases

From heart-pounding thrillers to poignant memoirs and everything in between, check out what's new this month.

Tell us what you like and we'll recommend books you'll love.

Growing Up Native American Research Paper

Growing up Native American, I champion the issues of our society. Irene Vernon, a professor at Colorado State University who specializes in Native American health put it simply, “We are the sickest racial, ethnic population in the United States. “ Poverty, unemployment, lack of formal education, domestic violence, incarceration, alcoholism, substance abuse, poor health, and even suicide rates all significantly exceed national rates for any ethnic population. I grew up in a military family and experienced world turmoil, 9-11, and the War on Terrorism from that perspective. My father retired from the Navy in 2011, and we have lived in Mankato, KS since. Lastly, I am serious about my plans to become a Medical Doctor. I have been unwavering

Essay On Native American Society

Current American society is constantly affected by events from the past, but sometimes what society thinks is in the past is not so far behind. The way Native Americans were treated historically continually plays a part in current American society. Due to the racism and stereotypes carried throughout society the Native American cultural circle is constantly under fire.

Native American History Essay

- 7 Works Cited

Popular culture has shaped our understanding and perception of Native American culture. From Disney to literature has given the picture of the “blood thirsty savage” of the beginning colonialism in the new world to the “Noble Savage,” a trait painted by non-native the West (Landsman and Lewis 184) and this has influenced many non native perceptions. What many outsiders do not see is the struggle Native American have on day to day bases. Each generation of Native American is on a struggle to keep their traditions alive, but to function in school and ultimately graduate.

Native American Essay

From as early as the time of the early European settlers, Native Americans have suffered tremendously. Native Americans during the time of the early settlers where treated very badly. Europeans did what they wanted with the Native Americans, and when a group of Native Americans would stand up for themselves, the European would quickly put them down. The Native Americans bow and arrows where no match for the Europeans guns and cannon balls. When the Europeans guns didn’t work for the Europeans, the disease they bought killed the Native Americans even more effectively.

Essay on Native American Issues in Today's Society

What if everyday in America there was not an action someone could take because someone of an opposite race sexually assaulted or domestically abused that person? Often news outlets only focus on major even in cities or towns, but never the reservations. With the lack of awareness of the number of rapes and domestic abuse victims on reservations, at large society is saying America doesn’t care due to reservations having sovereignty. Even with new laws signed into place by President Obama to deal with the rape and abuse problems to Native American women, that come from non Native Americans, the problem with this is it’s a pilot only on three tribes (Culp-Ressler,1).It is said it will expand soon, but how soon? America is not known for being

Dbq Native Americans Research Paper

After the arrival of the Spanish into the New World,the Native Americans lives changed drastically during the 15-16th hundreds. It brought major changes,politically,socially,and economically. The Natives were obviously vulnerable and submissive towards the Spanish.These events that I’m going to talk about shaped and changed the lives of many of Native Americans.It's the most unforgettable history of all times because it was the most unbelievable story.

Native American Education Research Paper

The Bureau of Indian Education (BIE) was formed in 2006. This government agency, previously known as the Office of Indian Education Programs, controls the direction and curriculum for all Indian schools as well as managing the funding. Three legislative acts developed the roles of the BIE. The Indian Reorganization Act of 1934, Indian Self-Determination and Education Assistance Act of 1975 and The Education Amendments Act of 1978. The only more recent legislation was The No Child Left Behind Act of 2001. It is the mission of the BIE to provide quality education to all Native Americans by focusing on the spiritual, mental, physical, and cultural aspects of the individual within his or her family and tribal or village context (U.S. Dept.

Native American Women Research Paper

Deborah Parker, a former member of the Tulalip tribe’s board of directors, now a speaker and activist for social justice for indigenous women, says that there is no domestic violence education in reservation schools. By not teaching what is happening in these kid’s tribes, the cycle of abuse may continue, and more and more generations of Native women will have to endure the abuse. The cycle will be broken if more people are aware of the issue. First, there was the National Domestic Violence Hotline with additional hotlines focused on certain areas of abuse, now there are hotlines specifically aimed at helping Native American women along with Alaskan Natives. These resources help in many ways, whether it’s just communication and therapy, or helping these women out of their situations if needed.

Indian Tribe Research Paper

(Continued from 1832) Andrew Jackson was reelected.Pontotoc removed Chickasaw from their lands.The Wyandots,The Sauk,The Fox,The Prairie Band of Potawatomis,The Shawnees and Delawares,The Kaskaskias and Peorias,The small tribe of Stockbridge,and The Piankeshaws

American Indian Culture Research Paper

The American Indian/Alaskan Native people have a heritage that is rich in culture and history rich in conflict, strife, and triumph (Indians.org, n.d.). The American Indian/Alaskan Native have come a long way compared to their ancestors, however, the culture continues to struggle today with disparities such as poverty, poor health, demographic and social challenges, and a severely limited health care system due in part by lack of funding for health

Native American Indian Children Research Paper

American Indian children face a number of significant challenges. Like many other oppressed populations, many are born into communities that experience widespread of poverty, substance abuse, domestic violence and chronic health problems at much higher rates than non-Native communities. Historically, US government policies have tried for years sought to destroy some characteristic of the American Indian culture, dominion, and way of life contributed greatly to these tragic circumstances.

There are 529 federally recognized Indian Nations in the United States (National Congress of American Indians, 2003). The United States Constitution currently recognizes these Indian Nations as sovereign nations; but this was not always the case, especially regarding education of Native American students. According to PBS, a program of assimilation education began on the reservations. This was in the hopes that the assimilation of the children would translate to assimilation of the parents. However, this didn’t work in the way that was hoped, so education reformers pushed for Native American boarding schools. Children were taken from their parents (with no legal backing other than assimilation) and sent to boarding schools, where they were

Native American Anthropology Research Paper

Archaeologists destroy the sites they excavate. This has been one of the major criticisms that has been lobbed at archaeologists for years. When archaeologists excavate a site, the common practice of digging and removing artifacts is sometimes frowned upon by the communities in the surrounding area. In the 1800’s people’s views of indigenous communities where reprehensible to say the lest “American Indians were held to be inferior to civilized men in order to rationalize the seizure of Indian lands, and that eventually, racial myths grew to supplant any other myths about Indians as a justification for waging war on Indians and violating their treaties.” (Watkins 2000: 6) This trend continued into the 1900’s, but the degradation that indigenous and to some extant non-indigenous communities have experienced is still present to this day, but it is not as prevalent as it was in the past. The things that were decimated where Indigenous graves, sacred places, and cultural materials. The practice of looting grave goods has been a problem since Europeans first came to the Americas “The looting of the Native American past began with the very earliest European presence in North America, starting earlier than many would think.”

English And Native Americans Research Paper

The English acted harsh towards the natives, lying, stealing and killing the natives. Firstly, the English gave the Indians a false gift with small pox killing many of the Indians. This was the first of many harsh acts twords the natives. At first the Indians attacked because the English were invading their land but eventually it became peaceful. Only when the English started to get greedy and lazy did the push the Indians inland and steal and ravage their community's. The Spanish intertwined themselves into the Indians community to remain peaceful, and allowed the Spaniards to spread Christianity throughout the Indian community. The English drove the Indians because they kept wanting more from the new land. They ravaged the Indians stealing

Native American Tribe Essay

The Native American tribe, the Mandan, settled in modern day North and South Dakota where they carried on with their unique cultures and lifestyle. They also share a nation with Hidatsa and Arikara tribes. The Mandan settled in areas with a climate that ranges from very warm summers to extremely cold winters. This tribe was not nomadic and settled in a certain place for their whole life.

Indigenous Community Research Paper

All over the world, there are indigenous people/communities. Many things bar us from being familiar with them, to start with, they are too insecure to associate with other people in the world, they take any attempt to get close to them as an intrusion and end up reacting violently to secure their freedom. These guys usually have their means of protecting themselves from an intruder.

Related Topics

- United States

- World War I

- Native Americans in the United States

- South Vietnam

m&a model case study

Deciphering the m&a case study framework: a comprehensive guide.

Looking to master the art of M&A case study analysis? Look no further than our comprehensive guide! From understanding the key components of a successful framework to analyzing real-world case studies, this article has everything you need to become an expert in M&A strategy.

Posted May 11, 2023

Consulting Week (Apr 15-18)

Monday, april 15.

10:00 PM UTC · 60 minutes

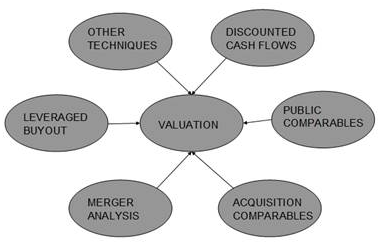

Mergers and acquisitions (M&A) are an essential aspect of the modern business world, where companies are looking for ways to expand their operations, increase their market share, and diversify their product offerings. M&A can take many forms, including mergers, acquisitions, joint ventures, and strategic alliances. This comprehensive guide aims to provide a detailed understanding of the M&A case study framework and the critical factors that influence the success of M&A transactions.

What is M&A and Why is it Important in Today's Business Landscape?

Mergers and acquisitions refer to the process of combining two or more companies or businesses. M&A is typically used as a growth strategy as it enables companies to expand their market share, reduce their costs, gain access to new technologies or products, and achieve economies of scale. M&A is also used as a way for companies to enter new markets, diversify their product offerings or strategic partnerships and collaborations.

M&A is a critical aspect of today's business landscape, as it enables companies to maximize value creation and improve their competitiveness in the global marketplace. Successful M&A transactions can lead to better financial performance, increased shareholder value, and enhanced market position.

However, M&A transactions can also be risky and complex, requiring careful planning, due diligence, and execution. Companies must consider various factors such as cultural differences, regulatory requirements, and potential legal issues that may arise during the process. Poorly executed M&A transactions can result in financial losses, damage to reputation, and even legal consequences.

Moreover, M&A activity is influenced by various external factors such as economic conditions, political instability, and technological advancements. For instance, the COVID-19 pandemic has significantly impacted M&A activity, with many companies delaying or canceling their transactions due to the uncertainty and economic downturn caused by the pandemic.

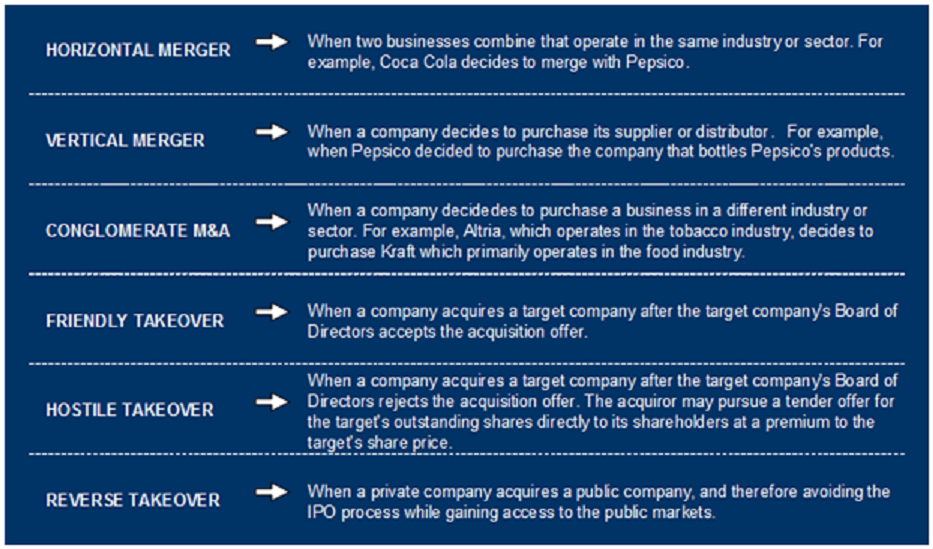

Understanding the Different Types of M&A Transactions

There are several different types of M&A transactions that companies can use as a growth strategy, such as horizontal, vertical, and conglomerate mergers and acquisitions.

Horizontal mergers involve the combination of two companies that operate in the same industry or market. Such mergers aim to increase market share, reduce competition, and achieve economies of scale.

Vertical mergers refer to the combination of two companies that operate in different levels of the value chain of the same industry. Vertical mergers aim to increase efficiency, reduce the cost of raw materials, and improve supply-chain management.

Conglomerate mergers involve the combination of two unrelated companies that operate in different industries or markets. Such mergers aim to diversify the product portfolio, reduce business risk, and achieve economies of scale.

Another type of M&A transaction is a reverse merger, which involves a private company acquiring a public company. This allows the private company to go public without having to go through the lengthy and expensive process of an initial public offering (IPO).

Finally, there are also friendly and hostile takeovers. A friendly takeover is when the target company agrees to be acquired by the acquiring company, while a hostile takeover is when the acquiring company makes an offer to the target company's shareholders without the approval of the target company's management.

Identifying the Key Players in M&A Case Studies

There are several key players involved in M&A transactions, including the acquiring company, the target company, the board of directors, the shareholders, and the investment bankers and advisors. The acquiring company is the buyer of the target company, while the target company is the company that is being acquired. The board of directors plays a crucial role in the approval of the transaction, while shareholders have the power to vote and approve the deal. Investment bankers and advisors are usually responsible for facilitating the transaction and advising on the best strategy for the acquiring company.

It is important to note that the role of each key player can vary depending on the specific M&A case. For example, in a hostile takeover, the target company and its board of directors may resist the acquisition, while the acquiring company may need to work with its investment bankers and advisors to come up with a more aggressive strategy. Additionally, the shareholders may have different opinions on the deal, and it is important for the acquiring company to communicate effectively with them to gain their support. Understanding the unique dynamics of each M&A case is crucial for identifying the key players and their roles.

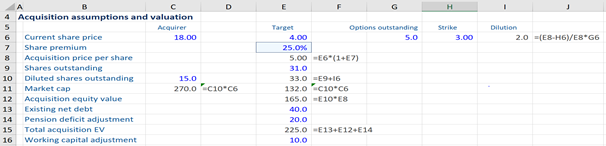

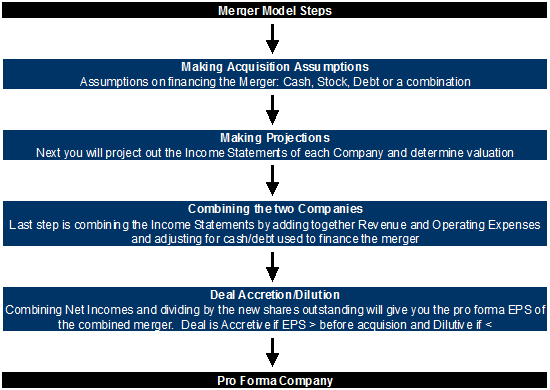

Analyzing the Financial Aspects of a M&A Deal

Financial analysis is a critical step in evaluating M&A transactions. Companies need to conduct a thorough financial analysis to determine the value of the target company and the potential benefits of the acquisition. The financial analysis should consider the financial statements of both the acquiring and target companies, including income statements, balance sheets, and cash flow statements. Additional financial metrics such as net present value (NPV) and internal rate of return (IRR) can also be used to evaluate the financial viability of the transaction.

Another important aspect of financial analysis in M&A deals is the consideration of potential risks and uncertainties. Companies need to assess the potential risks associated with the acquisition, such as changes in market conditions, regulatory changes, and integration challenges. This analysis can help companies develop strategies to mitigate these risks and ensure a successful acquisition.

Furthermore, financial analysis can also help companies identify potential synergies between the acquiring and target companies. Synergies can arise from cost savings, revenue growth, and increased market share. By identifying these synergies, companies can better evaluate the potential benefits of the acquisition and develop a plan to realize these synergies post-merger.

Examining the Legal and Regulatory Implications of M&A Transactions

Legal and regulatory due diligence is a necessary step for any M&A transaction. Companies need to ensure that they comply with legal and regulatory requirements and that their transaction does not violate any antitrust, anti-bribery, or data protection laws. Legal and regulatory due diligence can also include assessing licenses, patents, and intellectual property rights.

Additionally, legal and regulatory due diligence can also involve reviewing the target company's contracts, leases, and other legal agreements to identify any potential liabilities or risks. This can include analyzing the terms of employment contracts, supplier agreements, and customer contracts to ensure that they are favorable and do not pose any legal or financial risks to the acquiring company. It is important for companies to conduct thorough legal and regulatory due diligence to avoid any legal or financial consequences that may arise from a poorly executed M&A transaction.

Assessing the Strategic Motivations for M&A Deals

Companies engage in M&A transactions for various strategic reasons such as increasing market share, diversifying the product portfolio, gaining access to new technologies, reducing costs, or achieving economies of scale. It is essential to assess the strategic motivations behind the transaction to determine if the deal makes sense and will add value to the acquiring company.

One of the most common strategic motivations for M&A deals is to gain access to new markets. By acquiring a company that has a strong presence in a particular market, the acquiring company can quickly establish itself in that market and gain a competitive advantage. This can be particularly beneficial for companies that are looking to expand internationally.

Another strategic motivation for M&A deals is to acquire talent. In some cases, a company may be interested in acquiring another company primarily for its employees. This can be especially true in industries where there is a shortage of skilled workers. By acquiring a company with a talented workforce, the acquiring company can quickly build its own team and gain a competitive advantage.

Evaluating the Risks and Benefits of M&A Transactions for Businesses

M&A transactions are not without risks. These risks include the integration of different corporate cultures and management styles, the potential loss of key employees, legal and regulatory compliance issues, and financial risks. On the other hand, M&A transactions can offer significant benefits such as improved market position, greater economies of scale, access to new technologies, and increased shareholder value. It is essential to evaluate the risks and benefits of M&A transactions for businesses and to mitigate risks to ensure a successful transaction.

Developing a Successful M&A Strategy: Tips and Best Practices

Developing a successful M&A strategy requires careful planning and execution. A well-designed strategy can help companies achieve their financial and strategic goals. Some best practices for developing a successful M&A strategy include conducting thorough due diligence, setting clear objectives, identifying potential risks, and developing a post-merger integration plan.

Real-World Examples of Successful M&A Deals and Lessons Learned

There are many examples of successful M&A transactions, including Disney's acquisition of Marvel Entertainment, Procter & Gamble's acquisition of Gillette, and Facebook's acquisition of WhatsApp. By studying these examples, we can learn valuable lessons about the factors that contribute to successful M&A transactions, including proper due diligence, clear strategic objectives, and effective post-merger integration plans.

Common Pitfalls to Avoid When Engaging in a M&A Transaction

M&A transactions can be complex, and there are several common pitfalls that businesses should avoid. These pitfalls include overvaluing the target company, inadequate due diligence, poor communication with stakeholders, and underestimating integration challenges. Avoiding these common pitfalls can help ensure a successful M&A transaction.

The Role of Due Diligence in M&A Case Studies: A Step-by-Step Guide

Due diligence is a critical component of any M&A transaction. Due diligence involves conducting a comprehensive review of the target company to assess its financial, legal, and operational status. A step-by-step guide to due diligence includes analyzing financial statements, reviewing contract agreements, assessing intellectual property rights, and evaluating employee relations and management processes.

How to Measure the Success of Your M&A Deal: Key Performance Indicators to Track

Measuring the success of an M&A transaction is essential to determine if the deal has added value to the acquiring company. Key performance indicators (KPIs) can help companies assess the success of the transaction. These KPIs include financial performance metrics such as revenue growth and profitability, market share, employee satisfaction, and customer satisfaction.

The Future of M&A: Trends, Innovations, and Challenges

The future of M&A transactions is rapidly evolving, driven by technological advancements, changing market conditions, and global economic shifts. Developments such as big data, artificial intelligence, blockchain, and cloud computing are transforming the way companies approach M&A transactions. As the business landscape continues to evolve, businesses will need to embrace innovation and adapt to new challenges to succeed in today's competitive market.

The M&A case study framework is complex, but by understanding the key factors that contribute to a successful transaction, companies can execute M&A deals that create long-term value. The critical success factors for M&A transactions include a well-designed M&A strategy, due diligence, proper financial analysis, and effective post-merger integration planning. By following best practices and learning from real-world examples, businesses can achieve their strategic and financial goals through M&A transactions.

Browse hundreds of expert coaches

Leland coaches have helped thousands of people achieve their goals. A dedicated mentor can make all the difference.

Browse Related Articles

May 18, 2023

IQVIA Interview Process: A Comprehensive Guide for Success

Looking to ace your IQVIA interview? Our comprehensive guide covers everything you need to know to succeed, from the application process to common interview questions and tips for impressing your interviewer.

May 11, 2023

The Market Sizing Case Framework: A Tool for Success

Discover the Market Sizing Case Framework, a powerful tool that can help you achieve success in your business.

July 31, 2023

Mastering Consulting Case Frameworks: A Comprehensive Guide

Looking to excel in consulting case interviews? Our comprehensive guide to mastering consulting case frameworks is here to help! Learn the essential skills and strategies needed to ace your next case interview and land your dream consulting job.

IQVIA Case Study Interview: A Comprehensive Preparation Guide

If you're preparing for an IQVIA case study interview, this comprehensive guide is a must-read.

Navigating the Shift from Energy Sector to Management Consulting: An Insider's Guide

Are you considering a career shift from the energy sector to management consulting? Look no further than our insider's guide, filled with tips and insights to help you navigate this exciting transition.

Transportation to Management Consulting: An In-depth Look at How to Make the Transition

Are you considering a career change from transportation to management consulting? Look no further! Our in-depth article provides valuable insights and practical tips on how to successfully make the transition.

Transitioning from Media and Entertainment to Management Consulting: Key Considerations

If you're considering a career change from media and entertainment to management consulting, this article is a must-read.

Moving from Telecommunications to Management Consulting: Your Guide to a Successful Transition

Are you considering a career change from telecommunications to management consulting? This guide will provide you with the necessary steps and insights to make a successful transition.

January 9, 2024

BCG Recruiting Timeline for 2023: What Candidates Should Know

If you are considering applying for a position at BCG, it's crucial to familiarize yourself with the recruiting timeline. In this article, we help you understand BCG's stages and deadlines, enabling you to strategize and prepare effectively to increase your chances of securing a job at the firm.

Understanding the Lead Consultant Salary Structure in 2023

Discover the ins and outs of the lead consultant salary structure in 2023 with our comprehensive guide.

Bain Perks at Work: A Comprehensive Overview

Discover the many benefits of working at Bain & Company with our comprehensive overview of the Bain Perks at Work program.

Understanding Exhaustive in a Business Context

Gain a comprehensive understanding of the term "exhaustive" in a business context with our informative article.

M&A case interviews overview

A detailed look at m&a case interviews with a sample approach and example.

M&A motivations | Approaching M&A cases | M&A question bank | Example case walk-through #1 | Example case walk-through #2

Acquisitions are exciting and make for great headlines, but the decision to pursue one is serious business - and makes for a great case interview topic!

For example, consider mega deals like Salesforce acquiring Tableau for $15.7B or Kraft and Heinz merging at a combined valued of $45B. Mergers and acquisitions (often abbreviated as M&A) are some of the splashiest business decisions, often due to the large size of the deals and ability to quickly shake up market share.

Like profitability or market entry cases , M&A questions will often come up during a case interview, either as the primary topic or as a component of a broader case.

Typical motivations for M&A activity (Top)

Before jumping into case interviews, let's talk about why a company might pursue a merger or an acquisition in the first place. There are 3 main factors that drive M&A decisions: growth, competition, and synergies.

M&A for growth purposes

When determining a long-term growth strategy, companies have several options they tend to consider: build, buy, or partner. Amazon's growth into the grocery industry is a great example of a company implementing both build and buy strategies.

Amazon began by leveraging their existing capabilities to build their offering internally, adding food products to their platform and same-day food delivery. However, in 2017 they announced the acquisition of Whole Foods . By purchasing an existing player in the grocery space, they were able to acquire not only the Whole Foods brand, customer base, and retail footprint, but also the employees, supplier relationships, and industry know-how. The acquisition allowed them to grow at a quicker pace than they would have been able to otherwise.

M&A for competitive purposes

Competition can be another big driver behind M&A activity. Consider Uber and Didi's merger in 2016. Both companies were spending enormous amounts of money to gain market share (Uber's losses were estimated at ~$2B), but were still not achieving profitability. By coming to a merger agreement, Uber and Didi were able to end the destructive competition in China and move forward as partners with a shared interest in each other's success.

M&A for synergy gains

Other companies pursue mergers or acquisitions due to the complementary nature of combining two businesses. These complementary aspects are called synergies and might include things like the ability to cut out redundant overhead functions or the ability to cross-sell products to shared customers.

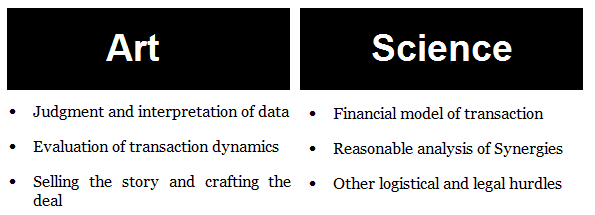

The value of potential synergies is typically estimated prior to doing a deal and would be one of the biggest points of discussion for the buyer. Note that the task of estimating the value of synergies is often more art than science, and many companies overvalue the expected synergies they'll get from a deal. This is just one of the reasons more than 70% of M&A deals fail .

The synergies that can be realized through a merger or acquisition will be different for any given pair of companies and will be one of the primary determining factors in a purchase price. For example, the synergies between a mass retailer buying a smaller clothing company will be much larger than if a restaurant were to buy that same clothing company. Common cost structures and revenue streams often result in greater synergies. For example, two similar businesses that merge will be able to streamline their finance, HR, and legal functions, resulting in a more efficient operation.

M&A framework (Top)

Mergers and acquisitions are not entered into by companies lightly. These are incredibly strategic decisions that are enormously expensive, from both a time and resource perspective, so any leadership team will want to do their due diligence and consider these decisions from multiple angles.

While each M&A scenario will have its own unique factors and considerations, there are some recurring topics you'll most likely want to dive into. We'll cover these in five steps below.

💡 Remember that every case is unique. While these steps can apply to many M&A cases, you should always propose a framework tailored to the specific case question presented!

Step 1: Unpack the motivations

Before recommending a merger or acquisition, the first step is to understand the deeper purpose behind this strategic decision. The motivation might be hinted at in your case prompt, or it might be apparent given general knowledge of a particular industry.

For example, if the question is "Snack Co. is looking to expand into Asia and wants to determine if an acquisition of Candy Co. would be successful", you can tell that the underlying motivation for acquisition is growth through geographic expansion. If the question is about an airline looking to buy another airline, the drivers are likely the competitive nature of the industry and potential synergies in the cost structure.

Once you understand what's driving the M&A desire, you'll know what lens to apply throughout the remainder of the case. You'll also be able to weave in your business acumen in your final recommendation.

Step 2: Evaluate the market

As with many case interviews, a well-rounded market analysis is typically a good place to start. In this scenario, the market we're evaluating is that of the target company. The goal here is to develop a broad understanding of the attractiveness of the market, as the client is essentially investing in this space through M&A activity. For this step, consider:

- Size and forecasted growth of the market

- Barriers to entry such as regulations

- The competitive landscape

- Supplier and buyer dynamics

This step should not be skipped, even in the case of a merger between two companies in the same market. It can't be assumed that the market is attractive just because the buyer is in it already. Rather, if the market evaluation proves unattractive, the buyer should not only avoid the deal, but also address their existing strategy internally.

Step 3: Assess the target company

If the market is deemed to be attractive, the next question is if the target is the optimal company to acquire or merge with in that market. The main points to address here are:

- Is the target financially stable e.g. profitable with growing revenues?

- Does it have a large market share or growing customer base?

- Does it have a capable and experienced team?

- Does it have other intangible assets such as a powerful brand or a valuable patent?

Step 4: Identify potential benefits and risks

Next, consider the pros and cons of doing the deal. Where might the buyer be able to realize synergies with the target? What are the biggest risks to doing the deal? What might derail the integration? For this part, consider these key questions:

- Are there cost or revenue synergies between the two companies?

- What are the primary risks to integrating the two companies?

- Are there concerns around cultural fit (95% of executives say this is vital to a deal's success )?

Step 5: Present your recommendation

Finally, pull all of your findings together and share your final recommendation. Make sure to support your argument with data from the earlier steps and note what you would want to look at if you had more time.

💡 Shameless plug: Our consulting interview prep can help build your skills

M&A question bank (Top)

Below, you'll a see list of M&A case questions sourced from a top candidate - Ana Sousa , an ex-McKinsey Business Analyst currently pursuing her MBA at OSU.

Case A background :

Our client, NewPharma, is a major pharmaceutical company with USD 20 billion in annual revenue. Its corporate headquarters is located in Germany, with sales offices around the world. NewPharma has a long, successful record in researching, developing, and selling “small molecule” drugs. This class represents the majority of drugs today, such as aspirin. They would like to enter a new, fast-growing segment of biological drugs, which are made with large and more complex molecules, and can treat conditions not addressable by conventional drugs. The Research and Development (R&D) associated with biological molecules is completely different from small molecules. In order to acquire these capabilities, a pharma company can build them from scratch, partner with startups, or acquire them. Competition is already many years ahead of NewPharma, so they are looking to jumpstart their own program by acquiring BioAdvance, a leading biologicals startup headquartered in San Francisco. BioAdvance was founded 10 years ago by renowned scientists and now have 200 employees. It is publicly traded, and at current share price, they are worth around USD 2 billion.

Example interview question #1: You are asked to evaluate this potential acquisition and advise on the strategic fit for NewPharma. What would you consider when evaluating whether NewPharma should acquire BioAdvance?

Example interview question #2: let’s explore the setup with bioadvance after a potential acquisition. bioadvance’s existing drug pipeline is relatively limited, however, newpharma is more interested in leveraging bioadvance as a biological research “engine” that, when combined with newpharma’s current r&d assets, would produce a strong drug pipeline over the next 10 years. what are your hypotheses on major risks of integrating the r&d functions of both companies, example interview question #3: in the case of an acquisition, newpharma wants to consolidate all biologicals r&d into one center. there are two options to do so: combine them at newpharma’s headquarters in germany, or at bioadance’s headquarters in san francisco. currently, newpharma does not have any biological facilities or operations in germany, so new ones would need to be built. how would you think about this decision.

Case B background :

Total Energy Inc. (TEI) is a private, medium-sized company with a strong history of drilling and producing natural gas wells in Pennsylvania. They own an ample, and believe valuable, set of land assets where more wells could be drilled. The company is well capitalized but has seen profits decline for the last few years, with a projection of loss for the next year. One of the main drivers is the price of natural gas, which has dropped considerably, mainly because companies like TEI have perfected unconventional drilling techniques, leading to an oversupply of the North American market. Current prices are at a five year low. A larger competition has approached TEI’s leadership about acquiring them for an offer of USD 250 million.

Example interview question #1: TEI’s leadership would like your help in evaluating this offer, as well as identifying alternative strategies. How would you assess this matter?

Example interview question #2: the exploration team at tei has found that there is an oil field in texas that they could acquire, and immediately start drilling. drilling is one of the core competencies and strengths of tei. how would you think about this option in comparison to the selling offer.

Case C background :

Tech Cloud has developed a new research engine designed to increase online retail sales by reshaping customer search results based on real-time customer data analysis. An initial assessment indicates outstanding results in increasing sales, and therefore a tremendous potential for this product. However, Tech Cloud is a small startup, so they do not currently possess the capabilities to sell and install their algorithm in large scale. A major tech company has approached Tech Cloud with a partnership offer: to help them make the new product scalable, offering to pay $150M for it as is, and asking for 50% of profits on all future sales of the new research engine.

Example interview question #1: How would you assess whether Tech Cloud should or should not take this partnership offer?

Example interview question #2: what risks would you outline in this partnership, and how would you recommend tech cloud to mitigate them.

Case D background :

Snack Hack is the fifth largest fast-food chain in the world in number of stores in operation. As most competitors, Snack Hack sells fast-food combo meals for any time of the day. Although Snack Hack owns some of its store, it is mainly operating under a franchising business model, with 85% of its operating stores owned by franchisees. As part of a growth strategy, Snack Hack has been analyzing Creamy Dream as a potential acquisition target. Creamy Dream is a growing ice cream franchise with a global presence. While they also operate by franchising, there is a difference: Snack Hack franchises restaurants (stores), while Creamy Dream franchises areas or regions in which the franchisee is required to open a certain number of stores.

Example interview question #1: What would you explore in order to determine whether Snack Hack should acquire Creamy Dream?

Example interview question #2: what potential synergies can exist between snack hack and creamy dream, example interview question #3: one of the potential synergies that our team believes has great potential is increasing overall profitability by selling creamy dream ice cream at snack hack stores. how would you evaluate the impact of this synergy in profitability, example m&a case #1 (top).

We'll now use our framework to tackle one of the example questions we listed above. Let's focus on Case A and answer the following question:

You are asked to evaluate this potential acquisition and advise on the strategic fit for NewPharma. What would you consider when evaluating whether NewPharma should acquire BioAdvance?

Unpacking: why do they want to acquire.

Following our recommended framework, the first step is to identify the underlying purposes of the acquisition. In this case, you can tell from the context information that their strategic motivation is to enter a new type of drug market. The case has already stated your alternatives outside of this M&A: to build capabilities from scratch or make a partnership/acquisition of a different target.

Evaluating the market: is it an attractive space?

Step 2 in our framework is to evaluate the market. You are told the biological segment is fast-growing, and does not overlap with NewPharma current products, therefore there is no risk of cannibalization. You still need to know who currently competes in this segment, what is the general profitability of these drugs and how it compares to small molecule drugs, and deep dive on the regulation for these drugs, since pharma industry is strongly regulation-driven.

Assessing the target: is it a good company?

Next, we jump into step 3, which is assessing the target. This is where we were given the smallest amount of information, so there is much to cover. R&D is a time-consuming process, and NewPharma will not see profits for drugs they start developing together in case of an acquisition in many years, maybe decades. Therefore, the first thing to look at is the value of BioAdvance’s current drug pipeline, or, in other words, what drugs are they currently developing, their likelihood of success, and their expected revenues and profits.

Another key factor is their capabilities, which is what NewPharma is mostly interested in. What does BioAdvance bring to the table in terms of scientific talent, intellectual property, and research facilities? We also want to look at whether they have current contracts or partnerships with other competitors.

Furthermore, besides their main capability which is research, NewPharma should also learn about their marketing and sales capabilities, to identify any synergies in global sales, and also to understand how they currently promote biologicals, since NewPharma has no experience in this. A great structure would also consider any gaps BioAdvance might have, both in R&D and marketing capabilities. Lastly, NewPharma needs to conduct a due diligence to assess the value of BioAdvance, and therefore the acquisition price.

Identify risks and benefits

Step 4 is identifying the risks and benefits. In a high level, the risks include potential of them having a weak pipeline, which would mean not seeing any profits for years. In addition, NewPharma is a European country, while BioAdvance is from California, which means there is a risk of cultural barriers between both their leaderships and their R&D scientists. In addition, there is the risk that entering this new drug market is not aligned with NewPharma’s strategy or core competencies. The benefits include quickly adding R&D capabilities to catch up with their competitors and addressing a new segment of customers that they currently do not serve.

Example M&A case #2 (Top)

Let's walk through another example M&A case to illustrate how the framework we've introduced might be applied in practice. We'll lay out the thought process a candidate would be expected to demonstrate in a case interview. Here's our prompt:

"Our client, Edu Co., is a publishing company that has historically focused on K-12 curriculum and printed educational materials. They're looking at acquiring a startup that's developed digital classroom materials and assessments. How should they evaluate this opportunity?"

Our first step is to consider why Edu Co. is pursuing an acquisition. From the prompt, we can see that they're an established business looking to acquire a newer entry to the market. Edu Co. has focused on their core capabilities - content and printing - but has not invested in a digital product.

Edu Co. is clearly eyeing the startup target as a way to accelerate their growth into the edtech space. Rather than investing in building a digital product themselves, Edu Co. is looking to buy a company that already has a strong product, customer base, and team.

To begin, we would want to evaluate the digital education market. We might ask for more information on the size and growth rate to start. If we find out the market is large and forecasted to grow at 10% per year, that tells us it's a fairly attractive market.

In terms of barriers to entry, there is limited regulation around K-12 content and assessment. In the edtech space, the main concern is around the secure storage of information having to do with minors.

The competitive landscape is something we would want to ask for more information about. We would want to know how many other companies were pursuing these products and which had the most market share. If the market is highly fragmented, it means there is still room for a clear winner to emerge.

Regarding customer dynamics, we would want to know about any indications of changing preferences. For example, the push towards remote learning during COVID-19 would be relevant, as teachers and students have quickly become more comfortable with digital products.

Once we've determined that the market for digital education is attractive, we'll want to turn our attention to the target company. We would start by asking the interviewer for any information on the company's finances, team, market share, and other assets.

Assume the interviewer gives us revenue, profit, and market share data for the past 3 years. As part of our due diligence, we would want to ensure that all three of these metrics were either stable or growing. If we saw dips in this data, it would be important to dive deeper and understand why their performance had declined.

We would also want to know what their organizational structure looked like. If their staff was primarily sales & marketing (meaning they had outsourced their engineering work), they would be a less attractive target, as acquiring the tech personnel was one of the big reasons Edu Co. was looking to buy the business.

Finally, we would want to understand the technology they had developed. It would be important to understand the strengths and weaknesses of their product as well as any patents or IP.

Next, we would want to lay out any risks or benefits to acquiring the company.

The biggest risk we see is that the two company cultures are very different - Edu Co. is large, slower to make changes, and has an older workforce, whereas the other is much smaller, more agile, and younger. If we tried to integrate these two companies, there may be friction between the two working styles.

On the benefits side, there is potential for both cost and revenue synergies. On the cost side, we would be able to cut redundant administrative roles out, such as HR and finance. On the revenue side, Edu Co. may be able to leverage their customer relationships to cross sell digital products.

Present your final recommendation

Eventually, the interviewer would ask if Edu Co. should pursue the acquisition. Here, we would want to pull all the findings together and lay out our reasoning. Start with the answer first:

Recommendation: "Edu Co. should acquire the edtech startup. It's an attractive market that's growing rapidly and doesn't have a clear leader yet. Furthermore the startup appears to be well-positioned in the market: their revenues, profits, and market share have been growing. As Edu Co. looks to grow into the digital education space, this acquisition will give them a leg-up on competitors. Edu Co. will also be able to leverage their customer relationships to rapidly expand the use of this new digital product. However, Edu Co. will want to develop a robust integration plan to mitigate the risk of culture clash. They may want to consider letting the startup remain in their existing HQ to retain their agile working style."

Summary: putting it all together (Top)

As discussed, M&A cases are fairly common because they have the potential to cover a lot of ground, relevant business challenges.

Realize that in a real M&A case, the due diligence on the target alone could take weeks. It's likely your interviewer will have you dive deeper into one specific step to observe your thought process. In that case, stick with your structure, follow their lead, and always lay out the next steps you would follow if you had more time.

Finally, keep in mind that M&A doesn't just come up because it's fun to analyze; it's also an important source of revenue for the firms - Bain's private equity group does hundreds of due diligence cases annually and BCG's post-merger intergration (PMI) practice makes good money helping firms execute a merger successfully.

Read this next:

- 29 full case interview examples

- Profitability case interviews

- Market entry case interviews

- Weird and unusual case interviews

- Pricing case interviews

- Market sizing case interviews

- PE due diligence interviews

- Supply chain case interviews

- Digital transformation consulting cases

See all RocketBlocks posts .

Get interview insights in your inbox:

New mock interviews, mini-lessons, and career tactics. 1x per week. Written by the Experts of RocketBlocks.

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.

Launch your career.

- For schools

- Expert program

- Testimonials

Free resources

- Behavioral guide

- Consulting guide

- Product management guide

- Product marketing guide

- Strategy & BizOps guide

Interview prep

- Product management

- Product marketing

- Strategy & Biz Ops

Resume advice

- Part I: Master resume

- Part II: Customization

- Focus: PM resumes

- Focus: Consulting resumes

- Focus: BizOps resumes

Ace Your M&A Case Study Using These 5 Key Steps

- Last Updated November, 2022

Mergers and acquisitions (M&A) are high-stakes strategic decisions where a firm(s) decides to acquire or merge with another firm. As M&A transactions can have a huge impact on the financials of a business, consulting firms play a pivotal role in helping to identify M&A opportunities and to project the impact of these decisions.

M&A cases are common case types used in interviews at McKinsey, Bain, BCG, and other top management consulting firms. A typical M&A case study interview would start something like this:

The president of a national drugstore chain is considering acquiring a large, national health insurance provider. The merger would combine one company’s network of pharmacies and pharmacy management business with the health insurance operations of the other, vertically integrating the companies. He would like our help analyzing the potential benefits to customers and shareholders.

M&A cases are easy to tackle once you understand the framework and have practiced good cases. Keep reading for insights to help you ace your next M&A case study interview.

In this article, we’ll discuss:

- Why mergers & acquisitions happen.

- Real-world M&A examples and their implications.

- How to approach an M&A case study interview.

- An end-to-end M&A case study example.

Let’s get started!

Why Do Mergers & Acquisitions Happen?

There are many reasons for corporations to enter M&A transactions. They will vary based on each side of the table.

For the buyer, the reasons can be:

- Driving revenue growth. As companies mature and their organic revenue growth (i.e., from their own business) slows, M&A becomes a key way to increase market share and enter new markets.

- Strengthening market position. With a larger market share, companies can capture more of an industry’s profits through higher sales volumes and/or greater pricing power, while vertical integration (e.g., buying a supplier) allows for faster responses to changes in customer demand.

- Capturing cost synergies. Large businesses can drive down input costs with scale economics as well as consolidate back-office operations to lower overhead costs. (Example of scale economies: larger corporations can negotiate higher discounts on the products and services they buy. Example of consolidated back-office operations: each organization may have 50 people in their finance department, but the combined organization might only need 70, eliminating 30 salaries.)

- Undertaking PE deals. Private equity firms will buy a majority stake in a company to take control and transform the operations of the business (e.g., bring in new top management or fund growth to increase profitability).

- Accessing new technology and top talent. This is especially common in highly competitive and innovation-driven industries such as technology and biotech.

For the seller, the reasons can be:

- Accessing resources. A smaller business can benefit from the capabilities (e.g., product distribution or knowledge) of a larger business in driving growth.

- Gaining needed liquidity. Businesses facing financial difficulties may look for a well-capitalized business to acquire them, alleviating the stress.

- Creating shareholder exit opportunities . This is very common for startups where founders and investors want to liquidate their shares.

There are many other variables in the complex process of merging two companies. That’s why advisors are always needed to help management to make the best long-term decision.

Real-world Merger and Acquisition Examples and Their Implications

Let’s go through a couple recent merger and acquisition examples and briefly explain how they will impact the companies.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

KKR Acquisition of Ocean Yield

KKR, one of the largest private equity firms in the world, bought a 60% stake worth over $800 million in Ocean Yield, a Norwegian company operating in the ship leasing industry. KKR is expected to drive revenue growth (e.g., add-on acquisitions) and improve operational efficiency (e.g., reduce costs by moving some business operations to lower-cost countries) by leveraging its capital, network, and expertise. KKR will ultimately seek to profit from this investment by selling Ocean Yield or selling shares through an IPO.

ConocoPhillips Acquisition of Concho Resources

ConocoPhillips, one of the largest oil and gas companies in the world with a current market cap of $150 billion, acquired Concho Resources which also operates in oil and gas exploration and production in North America. The combination of the companies is expected to generate financial and operational benefits such as:

- Provide access to low-cost oil and gas reserves which should improve investment returns.

- Strengthen the balance sheet (cash position) to improve resilience through economic downturns.

- Generate annual cost savings of $500 million.

- Combine know-how and best practices in oil exploration and production operations and improve focus on ESG commitments (environmental, social, and governance).

How to Approach an M&A Case Study Interview

Like any other case interview, you want to spend the first few moments thinking through all the elements of the problem and structuring your approach. Also, there is no one right way to approach an M&A case but it should include the following:

- Breakdown of value drivers (revenue growth and cost synergies)

- Understanding of the investment cost

- Understanding of the risks. (For example, if the newly formed company would be too large relative to its industry competitors, regulators might block a merger as anti-competitive.)

Example issue tree for an M&A case study:

- Will the deal allow them to expand into new geographies or product categories?

- Will each of the companies be able to cross-sell the others’ products?

- Will they have more leverage over prices?

- Will it lower input costs?

- Decrease overhead costs?

- How much will the investment cost?

- Will the value of incremental revenues and/or cost savings generate incremental profit?

- What is the payback period or IRR (internal rate of return)?

- What are the regulatory risks that could prevent the transaction from occurring?

- How will competitors react to the transaction?

- What will be the impact on the morale of the employees? Is the deal going to impact the turnover rate?

An End-to-end BCG M&A Case Study Example

Case prompt:

Your client is the CEO of a major English soccer team. He’s called you while brimming with excitement after receiving news that Lionel Messi is looking for a new team. Players of Messi’s quality rarely become available and would surely improve any team. However, with COVID-19 restricting budgets, money is tight and the team needs to generate a return. He’d like you to figure out what the right amount of money to offer is.

First, you’ll need to ensure you understand the problem you need to solve in this M&A case by repeating it back to your interviewer. If you need a refresher on the 4 Steps to Solving a Consulting Case Interview , check out our guide.

Second, you’ll outline your approach to the case. Stop reading and consider how you’d structure your analysis of this case. After you outline your approach, read on and see what issues you addressed, and which you didn’t consider. Remember that you want your structure to be MECE and to have a couple of levels in your Issue Tree .

Example M&A Case Study Issue Tree

- Revenue: What are the incremental ticket sales? Jersey sales? TV/ad revenues?

- Costs: What are the acquisition fees and salary costs?

- How will the competitors respond? Will this start a talent arms race?

- Will his goal contribution (the core success metric for a soccer forward) stay high?

- Age / Career Arc? – How many more years will he be able to play?

- Will he want to come to this team?

- Are there cheaper alternatives to recruiting Messi?

- Language barriers?

- Injury risk (could increase with age)

- Could he ask to leave our club in a few years?

- Style of play – Will he work well with the rest of the team?

Analysis of an M&A Case Study

After you outline the structure you’ll use to solve this case, your interviewer hands you an exhibit with information on recent transfers of top forwards.

In soccer transfers, the acquiring team must pay the player’s current team a transfer fee. They then negotiate a contract with the player.

From this exhibit, you see that the average transfer fee for forwards is multiple is about $5 million times the player’s goal contributions. You should also note that older players will trade at lower multiples because they will not continue playing for as long.

Based on this data, you’ll want to ask your interviewer how old Messi is and you’ll find out that he’s 35. We can say that Messi should be trading at 2-3x last season’s goal contributions. Ask for Messi’s goal contribution and will find out that it is 55 goals. We can conclude that Messi should trade at about $140 million.

Now that you understand the up-front costs of bringing Messi onto the team, you need to analyze the incremental revenue the team will gain.

Calculating Incremental Revenue in an M&A Case Example

In your conversation with your interviewer on the value Messi will bring to the team, you learn the following:

- The team plays 25 home matches per year, with an average ticket price of $50. The stadium has 60,000 seats and is 83.33% full.

- Each fan typically spends $10 on food and beverages.

- TV rights are assigned based on popularity – the team currently receives $150 million per year in revenue.

- Sponsors currently pay $50 million a year.

- In the past, the team has sold 1 million jerseys for $100 each, but only receives a 25% margin.

Current Revenue Calculation:

- Ticket revenues: 60,000 seats * 83.33% (5/6) fill rate * $50 ticket * 25 games = $62.5 million.

- Food & beverage revenues: 60,000 seats * 83.33% * $10 food and beverage * 25 games = $12.5 million.

- TV, streaming broadcast, and sponsorship revenues: Broadcast ($150 million) + Sponsorship ($50 million) = $200 million.

- Jersey and merchandise revenues: 1 million jerseys * $100 jersey * 25% margin = $25 million.

- Total revenues = $300 million.

You’ll need to ask questions about how acquiring Messi will change the team’s revenues. When you do, you’ll learn the following:

- Given Messi’s significant commercial draw, the team would expect to sell out every home game, and charge $15 more per ticket.

- Broadcast revenue would increase by 10% and sponsorship would double.

- Last year, Messi had the highest-selling jersey in the world, selling 2 million units. The team expects to sell that many each year of his contract, but it would cannibalize 50% of their current jersey sales. Pricing and margins would remain the same.

- Messi is the second highest-paid player in the world, with a salary of $100 million per year. His agents take a 10% fee annually.

Future Revenue Calculation:

- 60,000 seats * 100% fill rate * $65 ticket * 25 games = $97.5 million.

- 60,000 seats * 100% * $10 food and beverage * 25 games = $15 million.

- Broadcast ($150 million*110% = $165 million) + Sponsorship ($100 million) = $265 million.

- 2 million new jerseys + 1 million old jerseys * (50% cannibalization rate) = 2.5 million total jerseys * $100 * 25% margin = $62.5 million.

- Total revenues = $440 million.

This leads to incremental revenue of $140 million per year.

- Next, we need to know the incremental annual profits. Messi will have a very high salary which is expected to be $110 million per year. This leads to incremental annual profits of $30 million.

- With an upfront cost of $140 million and incremental annual profits of $30 million, the payback period for acquiring Messi is just under 5 years.

Presenting Your Recommendation in an M&A Case

- Messi will require a transfer fee of approximately $140 million. The breakeven period is a little less than 5 years.

- There are probably other financial opportunities that would pay back faster, but a player of the quality of Messi will boost the morale of the club and improve the quality of play, which should build the long-term value of the brand.

- Further due diligence on incremental revenue potential.

- Messi’s ability to play at the highest level for more than 5 years.

- Potential for winning additional sponsorship deals.

5 Tips for Solving M&A Case Study Interviews

In this article, we’ve covered:

- The rationale for M&A.

- Recent M&A transactions and their implications.

- The framework for solving M&A case interviews.

- AnM&A case study example.

Still have questions?

If you have more questions about M&A case study interviews, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for mergers and acquisition cases found the following pages helpful:

- Our Ultimate Guide to Case Interview Prep

- Types of Case Interviews

- Consulting Case Interview Examples

- Market Entry Case Framework

- Consulting Behavioral Interviews

Help with Case Study Interview Prep

Thanks for turning to My Consulting Offer for advice on case study interview prep. My Consulting Offer has helped almost 89.6% of the people we’ve worked with get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how Kathryn Kelleher was able to get her offer at BCG.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

Use Our Resources and Tools to Get Started With Your Preparation!

Mergers & acquisitions (m&a) are often an answer to broader problems during case interviews, merger & acquisition cases are best practiced using mock interviews.

Many growth strategy case studies eventually lead to M&A questions. For instance, companies with excess funds, searching for ways to grow quickly might be interested in acquiring upstream or downstream suppliers (vertical integration), direct competitors (horizontal integration), complementary businesses, or even unrelated businesses to diversify their portfolio. The most important requirement for an M&A is that it must increase the shareholders' value, and it must have a cultural fit even when the decision financially makes sense.

Analogous to making a purchase at a grocery store, M&A can be viewed as a "buying decision". In general, we know that a consumer first determines the "need" to buy a product, followed by analyzing whether he or she can afford the product. After analyzing the first 2 critical factors, the consumer might look at the long/short term benefits of the product. Applying similar logic in M&A cases:

- Why does the company want to acquire?

- How much is the target company asking for its purchase price & is it fair (see cost-benefit analysis )? Can the acquiring company afford to pay the valuation? Financial valuation will generally include industry & company analysis.

- Benefits - potential synergies.

- Feasibility and risks (cultural and economical).

Key areas to analyze: assets, target, industry, and feasibility

When you are sure that it is an M&A case, proceed with the following analyzes after structuring the case as discussed above:

Analyze the client’s company

- (a) Strategic (market position, growth opportunities, diversification of product portfolio)

- (b) Defensive (acquisition by another competitor could make the competitor unconquerable)

- (c) Synergies/value creation (cost-saving opportunities such as economies of scale , cross-selling, brand)

- (d) Undervalued (ineffective management, unfavorable market, and the client has the power to bring the target company to its potential value)

- In which industry does the client operate?

- Which other businesses does the client possess? Look out for synergies ?

- What are the client’s key customer segments?

Analyze the target industry

Once it's clear why the client is interested in acquiring a particular company, start by looking at the industry the client wants to buy. This analysis is crucial since the outlook of the industry might overshadow the target's ability to play in it. For instance, small/unprofitable targets in a growing market can be attractive in the same way as great targets can be unattractive in a dying market.

Potential questions to assess are:

- Can the market be segmented, and does the target only play in one of the segments of the market?

- How big is the market?

- What are the market’s growth figures?

- What is the focus ? Is it a high volume/low margin or a low volume/high margin market?

- Are there barriers to entry ?

- Who are the key competitors in the market?

- How profitable are the competitors ?

- What are possible threats ?

Analyze the target company

After analyzing the target industry, understand the target company. Try to determine its strengths and weaknesses (see SWOT analysis ) and perform a financial valuation to determine the attractiveness of the potential target. You are technically calculating the NPV of the company, but this calculation likely is not going to be asked in the case interview . However, having the knowledge of when it is used (e.g., financial valuation) is crucial. Analyze the following information to determine the market attractiveness:

- The company’s market share

- The company’s growth figures as compared to that of competitors

- The company’s profitability as compared to that of competitors

- Does the company possess any relevant patents or other useful intangibles (see Google purchasing Motorola)?

- Which parts of the company to be acquired can benefit from synergies?

- The company’s key customers

Analyze the feasibility of the M&A

Finally, make sure to investigate the feasibility of the acquisition.

Important questions here are:

- Is the target open for an acquisition or merger in the first place? If not, can the competition acquire it?

- Are there enough funds available (have a look at the balance sheet or cash flow statement )? Is there a chance of raising funds in the case of insufficient funds through loans etc.?

- Is the client experienced in the integration of acquired companies? Could a merger pose organizational/management problems for the client?

- Are there other risks associated with a merger? (For example, think of political implications and risks of failure, like with the failed merger of Daimler and Chrysler.)

Key takeaways

You should now be able to evaluate the venture’s financial and qualitative attractiveness for the client. If you conclude that the client should go on with the M&A, make sure to structure your conclusions in the end. Your suggestions should also include:

- potential upsides of the merger

- potential risks and how are we planning to overcome/mitigate them

Related Cases

Bain Case: Old Winery

TKMC Case: Portfolio optimization of a holding company

General holding, chip equity, paper print.

How to master M&A consulting case studies?

M&A deals can involve huge sums of money. For instance, the beer company AB InBev spent $130bn on SAB Miller, one of its largest competitors, in 2015. As a comparison, South Africa's GDP was ~$300bn the same year.

These situations can be extremely stressful for companies' executives both on the buying and selling sides. Most CEOs only do a handful of acquisitions in their career and are therefore not that familiar with the process. If things go wrong, they could literally lose their job.

As a consequence, management consultants are often brought into these situations to help. Most top firms including McKinsey, BCG and Bain have Partners specialised in helping CEOs and CFOs navigate M&A.

There is therefore a good chance that you will come across an M&A case study at some point in your consulting interviews . Preparing for this situation is important. Let's first step through why companies buy each other in the first place. Second, let's discuss how you should structure your framework in an M&A case interview. And finally, let's practice on an M&A case example.

Click here to practise 1-on-1 with MBB ex-interviewers

Why do companies buy each other.