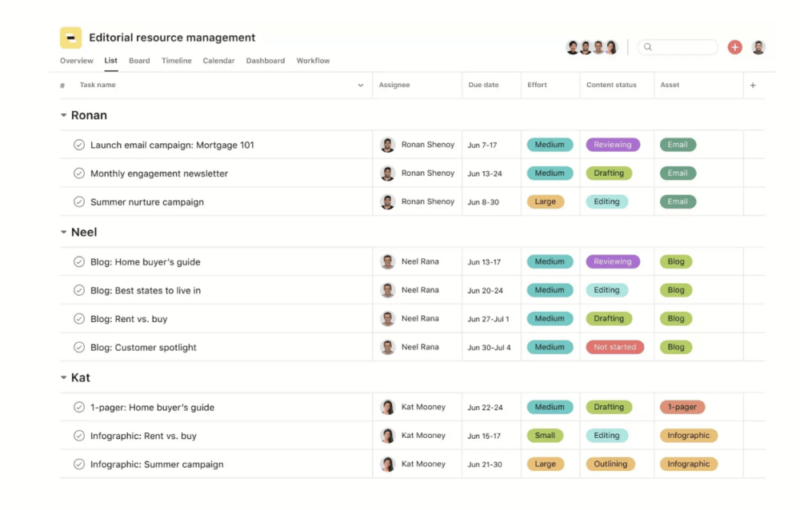

This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

12 Types of Business Risks and How to Manage Them

Description

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

90% of startups fail .

Thanks to the explosion of the digital economy, business founders have plenty of opportunities that they can tap into to build a winning business.

Unfortunately, there is a myriad of challenges your new business has to navigate through. These risks are inevitable, and they are a part of life in the business world.

However, without the right plan, strategy, and instruments, your business might be drowned by these challenges.

Therefore, we have created this guide to show you how can your business utilize risk management to succeed in 2022.

There are many types of startup and business risks that entrepreneurs can expect to encounter in 2022. Most of these threats are prevalent in the infancy stages of a business.

To know what you’ll be up against, here is a breakdown of the 12 most common threats.

12 Business Risks to Plan For

1) economic risks.

Failure to acquire adequate funding for your business can damage the chances of your business succeeding.

Before a new business starts making profits, it needs to be kept afloat with money. Bills will pile up, suppliers will need payments, and your employees will be expecting their salaries.

To avoid running into financial problems sooner or later, you need to acquire enough funds to shore up your business until it can support itself.

On the side, world and business country's economic situation can change either positively or negatively, leading to a boom in purchases and opportunities or to a reduction in sales and growth.

If your business is up and running, a great way to limit the effect of negative economic changes is to maintain steady cash flow and operate under the lean business method.

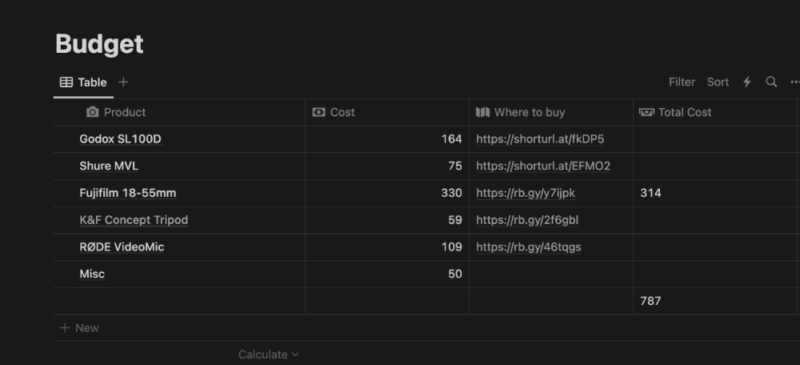

Here's an article from a founder explaining how he set up a lean budget on his $400k/year online business.

2) Market Risks

Misjudging market demand is one of the primary reasons businesses fail .

To avoid falling into this trap, conduct detailed research to understand whether you will find a ready market for what you want to sell at the price you have set.

Ensure your business has a unique selling point, and make sure what you offer brings value to the buyers.

To know whether your product will suit the market, do a survey, or get opinions from friends and potential customers.

Building a Minimum Viable Product of that business idea you've had is the recommendations made by most entrepreneurs.

This site, for example, was built in just 3 weeks and launched into the market to see if there was any interest in the type of content we offered.

The site was ugly, had little content and lacked many features. Yet, +7,700 users visited it within the first week, which made us realize we should keep working on this.

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

3) Competitive Risks

Competition is a major business killer that you should be wary of.

Before you even start planning, ask yourself whether you are venturing into an oversaturated market.

Are there gaps in the market that you can exploit and make good money?

If you have an idea that can give you an edge, register it. This will prevent others from copying your product, re-innovating it, and locking you out of what you started.

Competitive risks are also those actions made by competitors that prevent a business from earning more revenue or having higher margins.

4) Execution Risks

Having an idea, a business plan, and an eager market isn’t enough to make your startup successful.

Most new companies put a lot of effort into the initial preparation and forget that the execution phase is equally important.

First, test whether you can develop your products within budget and on time. Also, check whether your product will function as intended and whether it’s possible to distribute it without taking losses.

5) Strategic Risks

Business strategies can lead to the growth or decline of a company.

Every strategy involves some risk, as time & resources are generally involved to put them into practice.

Strategic risk in the chance that an implemented strategy, therefore, results in losses.

If, for example, the Marketing Department of a company implements a content marketing strategy and a lot of months, time & money later the business doesn't see any ROI, this becomes a strategic risk.

6) Compliance Risks

Compliance risks are those losses and penalties that a business suffers for not complying with countries' and states' regulations & laws.

There are some industries that are highly-regulated so the compliance risks of businesses within them are super high.

For example, in May 2018, the EU Commission implemented the General Data Protection Regulation (GDPR), a law in privacy and data protection in the EU, which affected millions of websites.

Those websites that weren't adapted to comply with this new rule, were fined.

7) Operational Risks

Operational risks arise when the day-to-day running of a company fail to perform.

When processes fail or are insufficient, businesses lose customers and revenue and their reputation gets ruined.

One example can be customer service processes. Customers are becoming every day less willing to wait for support (not to mention, receive bad quality one).

If a business customer service team fails or delays to solve customer's issues, these might find their solution in the business competitors.

8) Reputational Risks

Reputational risks arise when a business acts in an immoral and discourteous way.

This led to customer complaints and distrust towards the business, which means for the company a big loss of sales and revenue.

With the rise of social networks, reputational risks have become one of the main concerns for businesses.

Virality is super easy among Twitter so a simple unhappy customer can lead to a huge bad press movement for the company.

A recent example is the Away issue with their toxic work environment, as a former employee reported in The Verge .

The issue brought lots of critics within social networks which eventually led the CEO, Steph Korey, to step aside from the startup ( she seems to be back, anyway 🤷♂️! ).

9) Country Risks

When a business invests in a new country, there is a high probability it won't work.

A product that is successful in one market won't necessarily be in another one, especially when people within them are so different in cultures, climates, tastes backgrounds, etc.

Country risk is the existing failure probability businesses investing in new countries have to deal with.

Changes in exchange rates, unstable economic situations and moving politics are three factors that make these country risks be even more delicate.

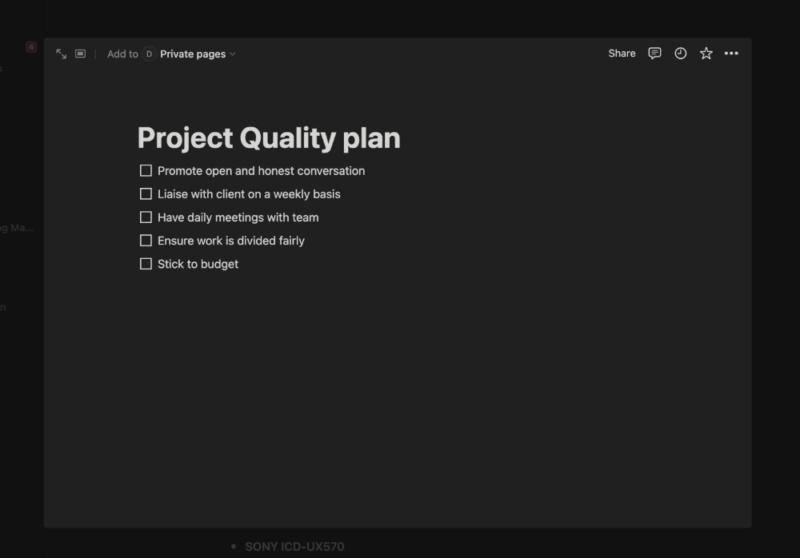

10) Quality Risks

When a business develops a product or service that fails to meet customers' needs and quality expectations, the chance these customers will ever buy again is low.

In this way, the business loses future sales and revenue. Not to mention that some customers will ask for refunds, increasing business costs, as well as publicly criticize the company's products, leading to bad reputation (and a viral cycle that means even less $$ for the business).

11) Human Risk

Hiring has its benefits but also its risks.

Employees themselves involve a huge risk for a business, as they become to represent the company through how they work, mistakes committed, the public says and interactions with customers & suppliers,

A way to deal with human risk is to train employees and keep a motivated workforce. Yet, the risk will continue to exist.

12) Technology Risk

Security attacks, power outrage, discontinued hardware, and software, among other technology issues, are the events that form part of the technology risk.

These issues can lead to a loss of money, time and data, which has many connections with the previously mentioned risks.

Back-ups, antivirus, control processes, and data breach plans are some of the ways to deal with this risk.

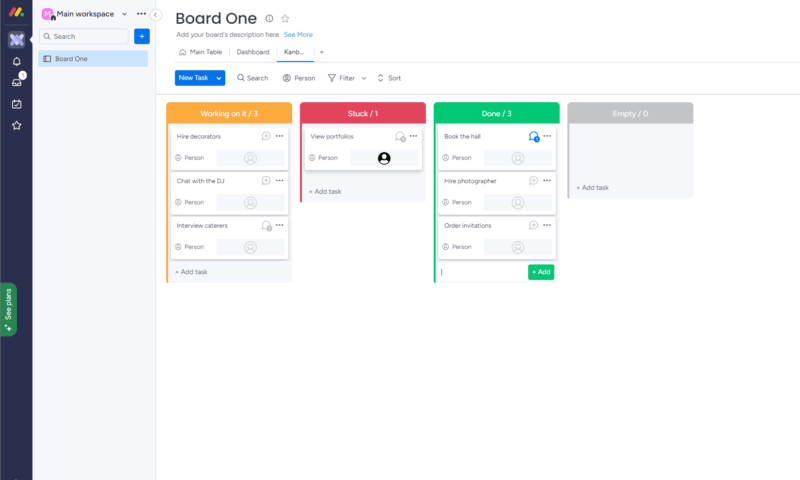

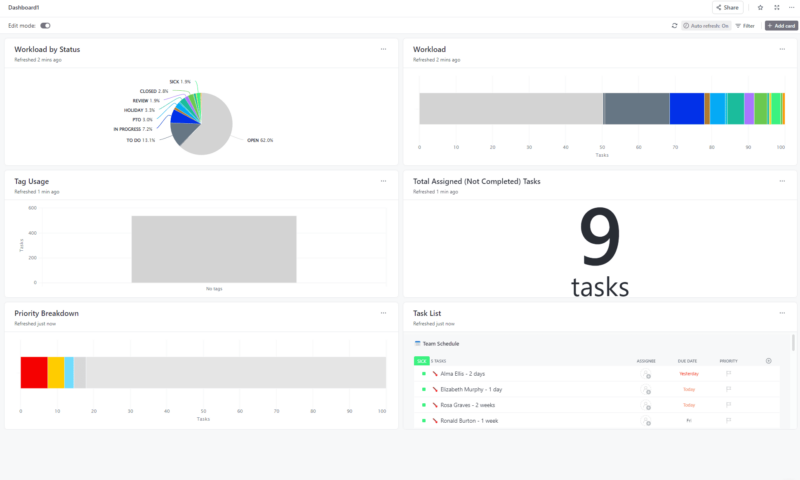

How Businesses Can Use Risk Management To Grow Business

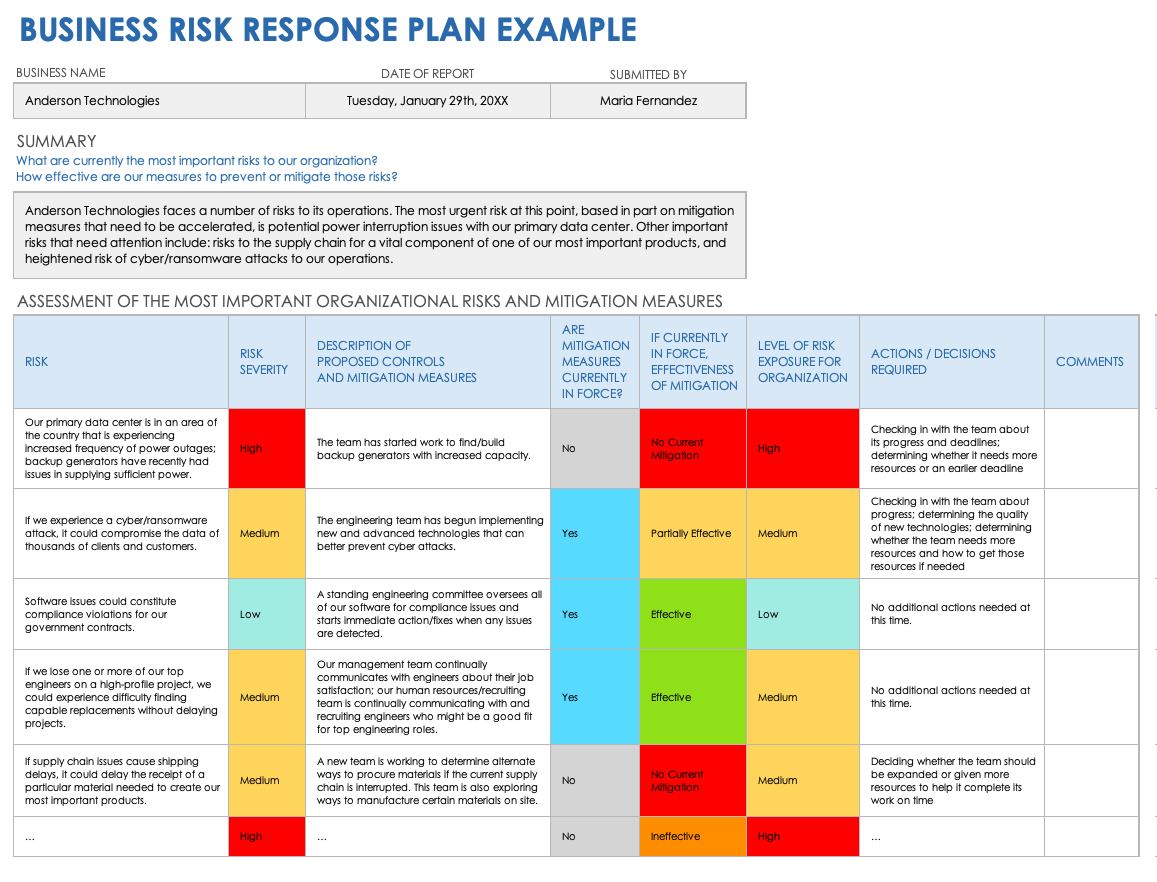

To mitigate any future threats, you need to prepare a comprehensive risk management plan.

This plan should detail the strategy you will use to deal with the specific challenges your business will encounter. Here’s what to do.

1) Identify Risks

Every business encounters a different set of challenges.

Before mapping the risks, analyze your business and note down its key components such as critical resources, important services or products, and top talent.

2) Record Risks

Once risks have been identified, you need to assess and document the threats that can affect each component.

Identify any warning signs or triggers of that recorded risk, also.

3) Anticipate

The best way to beat a threat is to detect and prepare for it in advance.

Once you know your business can be affected by a certain scenario, develop steps that you will take to stop the risk or to blunt its effects.

4) Prioritize Risks

Not all types of business risk have the same effect. Some can bring your startup to its knees, while others will only cause minimal effects.

To keep your business alive, start by putting in place measures that protect the vital functions from the most severe and most probable risks.

5) Have a Backup Plan

For every risk scenario, have at least two plans for countering the threat before it arrives.

The strategy you put in place should be in line with the current technology and trends.

Ensure your communicate these measures with all your team members.

6) Assign Responsibilities

When communicating measures with the team, assign responsibilities for each member in case any of the recorded risks affect the business.

These members should also be responsible for controlling the risks every certain time and maintaining records about them.

What is a Business Risk?

The term "business risk" refers to the exposure businesses have to factors that can prevent them from achieving their set financial goals.

This exposure can come from a variety of situations, but they can be classified into two:

- Internal factors: The risk comes from sources within the company, and they tend to be related to human, technological, physical or operational factors, among others.

- External factors: The risk comes from regulations/changes affecting the whole country/economy.

Any of these factors led to the business being unable to return investors and stakeholders the adequate amounts.

What Is Risk Management?

Risk management is a practice where an entrepreneur looks for potential risks that their business may face, analyzes them, and takes action to counter them.

The steps you take can eliminate the threat, control it, or limit the effects.

A risk is any scenario that harms your business. Risks can emanate from a wide variety of sources such as financial problems, management errors, lawsuits, data loss, cyber-attacks, natural calamities, and theft.

The risk landscape changes constantly, therefore you need to know the latest threats.

By setting up a risk management plan, your business can save money and time, which in some cases can be the determinant to keep your startup in business.

Not to mention, on the side, that risk management plans tend to make managers feel more confident to carry out business decisions, especially the risky ones, which can put their startups in a huge competitive advantage.

Wrapping Up

Becoming your own boss is one of the most rewarding things you can do.

However, launching a business is not a walk in the park; risks and challenges lurk around every corner.

If you are planning to establish a new business come 2022, make sure you secure its future by creating a broad risk management plan.

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

How to Highlight Risks in Your Business Plan

Tallat Mahmood

5 min. read

Updated October 25, 2023

One of the areas constantly dismissed by business owners in their business plan is an articulation of the risks in the business.

This either suggests you don’t believe there to be any risks in your business (not true), or are intentionally avoiding disclosing them.

Either way, it is not the best start to have with a potential funding partner. In fact, by dismissing the risks in your business, you actually make the job of a lender or investor that much more difficult.

Why a funder needs to understand your business’s risks:

Funding businesses is all about risk and reward.

Whether it’s a lender or an investor, their key concern will be trying to balance the risks inherent in your business, versus the likelihood of a reward, typically increasing business value. An imbalance occurs when entrepreneurs talk extensively about the opportunities inherent in their business, but ignore the risks.

The fact is, all funders understand that risks exist in every business. This is just a fact of running a business. There are risks that exist with your products, customers, suppliers, and your team. From a funder’s perspective, it is important to understand the nature and size of risks that exist.

- There are two main reasons why funders want to understand business risks:

Firstly, they want to understand whether or not the key risks in your business are so fundamental to the investment proposition that it would prevent them from funding you.

Some businesses are not at the right stage to receive external funding and placate funder concerns. These businesses are best off dealing with key risk factors prior to seeking funding.

The second reason why lenders and investors want to understand the risk in your business is so that they can structure a funding package that works best overall, despite the risk.

In my experience, this is an opportunity that many business owners are wasting, as they are not giving funders an opportunity to structure deals suitable for them.

Here’s an example:

Assume your business is seeking equity funding, but has a key management role that needs to be filled. This could be a key business risk for a funder.

Highlighting this risk shows that you are aware of the appointment need, and are putting plans in place to help with this key recruit. An investor may reasonably decide to proceed with funding, but the funding will be released in stages. Some will be released immediately and the remainder will be after the key position has been filled.

The benefit of highlighting your risks is that it demonstrates to investors that you understand the danger the risks pose to your company, and are aware that it needs to be dealt with. This allows for a frank discussion to take place, which is more difficult to do if you don’t acknowledge this as a problem in the first place.

Ultimately, the starting point for most funders is that they want to invest in you, and want to validate their initial interest in you.

Highlighting your business risks will allow the funder to get to the nub of the problem, and give them a better idea of how they may structure their investment in order to make it work for both parties. If they are unsure of the risks or cannot get clear explanations from the team, it is unlikely they will be forthcoming when it comes to finding ways to make a potential deal work.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The right way to address business risks:

The main reason many business owners don’t talk about business risks with potential funders is because they don’t want to highlight the weaknesses in their business.

This is a fair concern to have. However, there is a right way to address business risk with funders, without turning lenders and investors off.

The solution is to focus on how you mitigate the risks.

In other words, what are the steps you are taking in your business as a direct reaction to the risks that you have identified? This is very powerful in easing funder fears, and in positioning you as someone who has a handle on their business.

For example, if a business risk you had identified was a high level of customer concentration, then a suitable mitigation plan would be to market your products or services targeting new clients, as opposed to focusing all efforts on one client.

Having net profit margins that are lower than average for your market would raise eyebrows and be considered a risk. In this instance, you could demonstrate to funders the steps you are putting in place over a period of time to help increase those margins to at least market norms for your niche.

The process of highlighting risks—and, more importantly, outlining key mitigating actions—not only demonstrates honesty, but also a leadership quality in solving the problems in your business. Lenders and investors want to see both traits.

- The impact on your credibility:

Any lender or investor backs the leadership team of a business first, and the business itself second.

This is because they realize that it is you, the management team, who will ultimately deliver value and grow the business for the benefit for all. As such, it is imperative that they have the right impression about you.

The consequence of highlighting business risks in your business plan with mitigations is that it provides funders a real insight into you as a business leader. It demonstrates that not only do you have an understanding of their need to understand risk in your business, but you also appreciate that minimizing that risk is your job.

This will have a massive impact on your credibility as a business owner and management team. This impact is more acute when compared to the hundreds of businesses they will meet that omit discussing the risks in their business.

The fact is, funders have seen enough businesses and business plans in all sectors to instinctively know what risks to expect. It’s just more telling if they hear it from you first.

- What does this mean for you going forward?

Funders rely on you to deliver on your inherent promise to add value to your business for all stakeholders. The weight of this promise becomes much stronger if they can believe in the character of the team, and that comes from your credibility.

A business plan that discusses business risks and mitigations is a much more complete plan, and will increase your chances of securing funding.

Not only that, but highlighting the risks your business faces also has a long-term impact on your character and credibility as a business leader.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tallat Mahmood is founder of The Smart Business Plan Academy, his flagship online course on building powerful business plans for small and medium-sized businesses to help them grow and raise capital. Tallat has worked for over 10 years as a small and medium-sized business advisor and investor, and in this period has helped dozens of businesses raise hundreds of millions of dollars for growth. He has also worked as an investor and sat on boards of companies.

.png?format=auto)

Table of Contents

- Why a funder needs to understand your business’s risks:

Related Articles

6 Min. Read

How to Forecast Sales for a Subscription Business

2 Min. Read

How to Use These Common Business Ratios

1 Min. Read

How to Calculate Return on Investment (ROI)

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Business Plan Risk Analysis - What You Need to Know

The business plan risk analysis is a crucial and often overlooked part of a robust business plan. In the ever-changing world of business knowing potential pitfalls and how to mitigate them could be the difference between success and failure. A well-crafted business plan acts as a guiding star for every venture, be it a startup finding its footing or a multinational corporation planning an expansion. However, amidst financial forecasts, marketing strategies, and operational logistics, the element of risk analysis frequently gets relegated to the back burner. In this blog, we will dissect the anatomy of the risk analysis section, show you exactly why it is important and provide you with guidelines and tips. We will also delve into real-life case studies to bring to life your learning your learning.

Table of Contents

- Risk Analysis - What is it?

- Types of Risks

- Components of Risk Analysis

- Real-Life Case Studies

- Tips & Best Practices

- Final Thoughts

Business Plan Risk Analysis - What Exactly Is It?

Risk analysis is like the radar system of a ship, scanning the unseen waters ahead for potential obstacles. It can forecast possible challenges that may occur in the business landscape and plan for their eventuality. Ignoring this can be equivalent to sailing blind into a storm. The business plan risk analysis section is a strategic tool used in business planning to identify and assess potential threats that could negatively impact the organisation's operations or assets. Taking the time to properly think about the risks your business faces or may face in the future will enable you to identify strategies to mitigate these issues.

Types of Business Risks

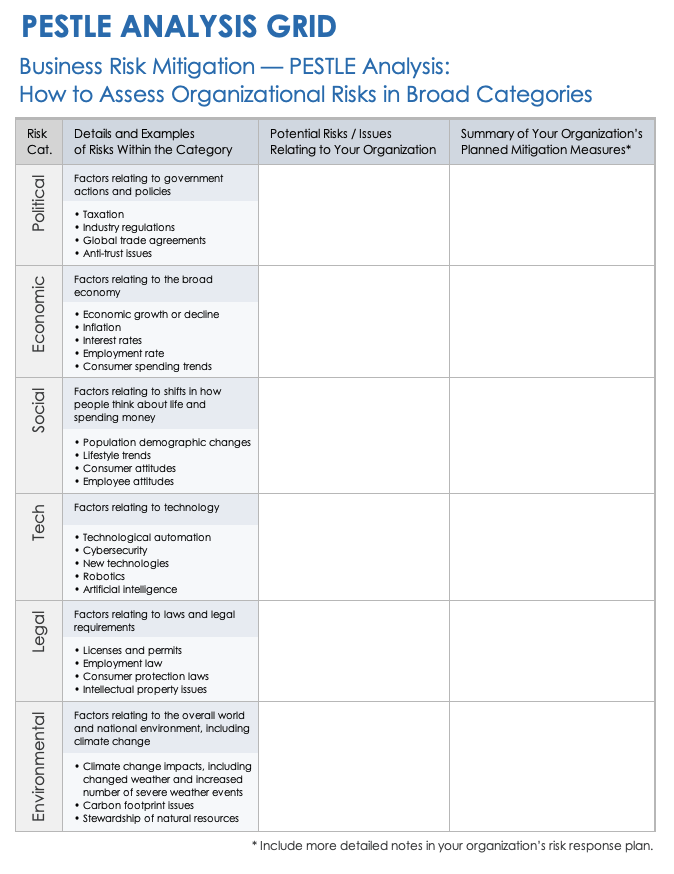

There are various types of risks that a business may face, which can be categorised into some broader groups:

- Operational Risks: These risks involve loss due to inadequate or failed internal processes, people, or systems. Examples could include equipment failure, theft, or employee misconduct.

- Financial Risks: These risks are associated with the financial structure of the company, transactions the company makes, and the company's ability to meet its financial obligations. For instance, currency fluctuations, increase in costs, or a decline in cash flow.

- Market Risks: These risks are external to the company and involve changes in the market. For example, new competitors entering the market changes in customer preferences, or regulatory changes.

- Strategic Risks: These risks relate to the strategic decisions made by the management team. Examples include the entry into a new market, the launch of a new product, or mergers and acquisitions.

- Compliance Risks: These risks occur when a company must comply with laws and regulations to stay in operation. They could involve changes in laws and regulations or non-compliance with existing ones.

The business risk analysis section is not a crystal ball predicting the future with absolute certainty, but it provides a foresighted approach that enables businesses to navigate a world full of uncertainties with informed confidence. In the next section, we will dissect the integral components of risk analysis in a business plan.

Components of a Risk Analysis Section

Risk analysis, while a critical component of a business plan, is not a one-size-fits-all approach. Each business has unique risks tied to its operations, industry, market, and even geographical location. A thorough risk analysis process, however, typically involves four main steps:

- Identification of Potential Risks: The first step in risk analysis is to identify potential risks that your business may face. This process should be exhaustive, including risks from various categories mentioned in the section above. You might use brainstorming sessions, expert consultations, industry research, or tools like a SWOT analysis to help identify these risks.

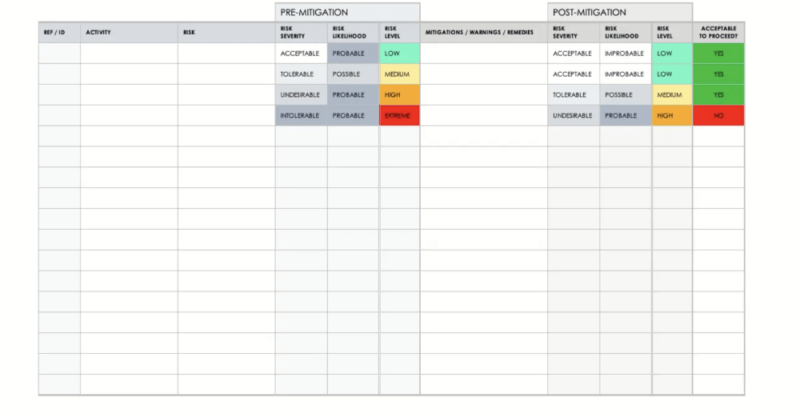

- Risk Assessment: Once you've identified potential risks, the next step is to assess them. This involves evaluating the likelihood of each risk occurring and the potential impact it could have on your business. Some risks might be unlikely but would have a significant impact if they did occur, while others might be likely but with a minor impact. Tools like a risk matrix can be helpful here to visualise and prioritise your risks.

- Risk Mitigation Strategies: After assessing the risks, you need to develop strategies to manage them. This could involve preventing the risk, reducing the impact or likelihood of the risk, transferring the risk, or accepting the risk and developing a contingency plan. Your strategies will be highly dependent on the nature of the risk and your business's ability to absorb or mitigate it.

- Monitoring and Review: Risk analysis is not a one-time task, but an ongoing process. The business landscape is dynamic, and new risks can emerge while old ones can change or even disappear. Regular monitoring and review of your risks and the effectiveness of your mitigation strategies is crucial. This should be an integral part of your business planning process.

Through these four steps, you can create a risk analysis section in your business plan that not only identifies and assesses potential threats but also outlines clear strategies to manage and mitigate these risks. This will demonstrate to stakeholders that your business is prepared and resilient, able to handle whatever challenges come its way.

Business Plan Risk Analysis - Real-Life Examples

To fully grasp the importance of risk analysis, it can be beneficial to examine some real-life scenarios. The following are two contrasting case studies - one demonstrating a successful risk analysis and another highlighting the repercussions when risk analysis fails.

Case Study 1: Google's Strategic Risk Mitigation

Consider Google's entry into the mobile operating system market with Android. Google identified a strategic risk : the growth of mobile internet use might outpace traditional desktop use, and if they didn't have a presence in the mobile market, they risked losing out on search traffic. They also recognised the risk of being too dependent on another company's (Apple's) platform for mobile traffic. Google mitigated this risk by developing and distributing its mobile operating system, Android. They offered it as an open-source platform, which encouraged adoption by various smartphone manufacturers and quickly expanded their mobile presence. This risk mitigation strategy helped Google maintain its dominance in the search market as internet usage shifted towards mobile.

Case Study 2: The Fallout of Lehman Brothers

On the flip side, Lehman Brothers, a global financial services firm, failed to adequately analyse and manage its risks, leading to its downfall during the 2008 financial crisis. The company had significant exposure to subprime mortgages and had failed to recognise the potential risk these risky loans posed. When the housing market collapsed, the value of these subprime mortgages plummeted, leading to significant financial losses. The company's failure to conduct a robust risk analysis and develop appropriate risk mitigation strategies eventually led to its bankruptcy. The takeaway from these case studies is clear - effective risk analysis can serve as an essential tool to navigate through uncertainty and secure a competitive advantage, while failure to analyse and mitigate potential risks can have dire consequences. As we move forward, we'll share some valuable tips and best practices to ensure your risk analysis is comprehensive and effective.

Business Plan Risk Analysis Tips and Best Practices

While the concept of risk analysis can seem overwhelming, following these tips and best practices can streamline the process and ensure that your risk management plan is both comprehensive and effective.

- Be Thorough: When identifying potential risks, aim to be as thorough as possible. It’s crucial not to ignore risk because it seems minor or unlikely; even small risks can have significant impacts if not managed properly.

- Involve the Right People: Diverse perspectives can help identify potential risks that might otherwise be overlooked. Include people from different departments or areas of expertise in your risk identification and assessment process. They will bring different perspectives and insights, leading to a more comprehensive risk analysis.

- Keep it Dynamic: The business environment is continually changing, and so are the risks. Hence, risk analysis should be an ongoing process, not a one-time event. Regularly review and update your risk analysis to account for new risks and changes in previously identified risks.

- Be Proactive, Not Reactive: Use your risk analysis to develop mitigation strategies in advance, rather than reacting to crises as they occur. Proactive risk management can help prevent crises, reduce their impact, and ensure that you're prepared when they do occur.

- Quantify When Possible: Wherever possible, use statistical analysis and financial projections to evaluate the potential impact of a risk. While not all risks can be quantified, putting numbers to the potential costs can provide a clearer picture of the risk and help prioritise your mitigation efforts.

Implementing these tips and best practices will strengthen your risk analysis, providing a more accurate picture of the potential risks and more effective strategies to manage them. Remember, the goal of risk analysis isn't to eliminate all risks—that's impossible—but to understand them better so you can manage them effectively and build a more resilient business.

In the ever-changing landscape of business, where uncertainty is a constant companion, the risk analysis section of a business plan serves as a guiding compass, illuminating potential threats and charting a course toward success. Throughout this blog, we have explored the critical role of risk analysis and the key components involved in its implementation. We learned that risk analysis is not just about identifying risks but also about assessing their potential impact and likelihood. It involves developing proactive strategies to manage and mitigate those risks, thereby safeguarding the business against potential pitfalls. In conclusion, a well-crafted business plan risk analysis section is not just a formality but a strategic asset that empowers your business to thrive in an unpredictable world. As you finalise your business plan, keep in mind that risk analysis is not a one-time task but an ongoing practice. Revisit and update your risk analysis regularly to stay ahead of changing business conditions. By embracing risk with a thoughtful and proactive approach, you will position your business for growth, resilience, and success in an increasingly dynamic and competitive landscape. Want more help with your business plan? Check out our Learning Zone for more in-depth guides on each specific section of your plan.

How to write the risks and mitigants section of your business plan?

Whilst the risks and mitigants section of your business plan might seem difficult to draft, it’s one of the most important parts of the document.

Neglecting this section can lead potential partners and investors into thinking that you either missed key risks asssociated with your business or that you have something to hide.

Luckily for you, this guide provides a comprehensive overview of the risks and mitigants section of your business plan and what information should be included in it.

Ready? Let’s get started?

In this guide:

What is the objective of the risks and mitigants section of your business plan?

What information should i include in the risks and mitigants section of my business plan.

- How long should the risks and mitigants section of your business plan be?

- Example of risks and mitigants in a business plan

What tools can you use to write your business plan?

It's important to remember that managing risk is key to successful business operations. Stakeholders such as investors and lenders are often interested in assessing both risk and reward before making a final decision about whether to finance a business or not.

Entrepreneurs often create imbalances by focusing predominantly on financial opportunities and neglecting risk. This section of your business plan aims to address that issue by having you clearly state risks that could be of detriment to your business as well as explaining the contingency measures in place to counteract them.

Doing so helps build trust and credibility amongst readers that you will be able to deliver your plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The risks and mitigants subsection is at the end of the strategy section of your business plan, at which point the reader has a fairly clear idea of what your business does, what market you operate in and what your strategy to conquer that market is.

When writing this section, it’s important to be transparent. If you've forgotten to include a common or significant risk, the reader (particularly if it’s an investor), may think that you lack market knowledge.

Ultimately, you should state each business risk clearly, describe its potential impact and the chances of it occurring.You could use specific examples, data, or market trends to support your analysis.

You then need to discuss how you plan to mitigate these risks. This could be as simple as being insured against a particular risk, or more complex depending the circumstances.

For example, if a shortage of skilled labour is seen as a major risk, you could talk about your previous experience in hiring inexperienced workers and training them successfully to do the task at hand.

In any case, it is essential to outline procedures for regularly monitoring, evaluating, and updating your risk management activities. Prospective investors can be reassured that you are determined to manage risks appropriately and to adjust your business strategies by showing that you have a system in place to regularly review and amend your tactics if necessary.

It may prove helpful to categorize business risks based on their probability of occurrence and severity of impact. Common examples of risk categories include:

- Market risks: these risks are related to shifts in the market environment, consumer preferences, or the level of competition.

- Operational risks: these are risks related to the supply chain, personnel churn, or production bottlenecks.

- Financial risks: these risks threaten the stability and sustainability of the business, potentially arising from unfavorable profitability, unsustainable financial structures, or cash flow dilemmas.

How long should the risks and mitigants section of your business plan be?

When it comes to the length of the business plan, the ideal rule of thumb is to write two to three paragraphs per risk.

However, the actual length of the section depends on several factors, such as the number of risks and the extent of information being provided.

When determining the length, remember:

- While it's important to provide information about business risks, not every risk needs to be included. You should focus on including risks that have a high probability or a high impact.

- There should be adequate space for relevant statistics, graphs, and visual comparisons, such as historical trends and forecasts.

- Supporting documents can be included in appendices or reference sections if you have a lot of data, graphs, or other materials relating to the risk analysis.

- The level of detail you need to include depends on the reader’s familiarity with the business and the industry. If your business is in an emerging industry, you may need to provide extensive details as the reader may not be familiar with it.

Example of risks and mitigants in a business plan

Below is an example of what the risks and mitigants section of your business plan might look like.

It lists each risk beforehand and then explains the nature of it, the consequences it could have and discusses methods to counteract it.

This example was taken from one of our business plan templates .

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

In this section, we will review three solutions for writing a professional business plan:

- Using Word and Excel

- Hiring a consultant to write your business plan

- Utilizing an online business plan software

Create your business plan using Word and Excel

Creating a business plan using Word and Excel is old fashion, error prone, and (very) time consuming.

First of all, using Excel to create your financial forecast is only feasible if you have a degree in accounting and experience in financial modelling, because lenders are unlikely to trust the accuracy of your financial forecast otherwise.

Secondly, using Word means starting from scratch and formatting the document yourself once written - a process that is quite tedious. There are also no instructions or examples to guide you through each section making the overall process much longer than it needs to be.

Thirdly, for a business plan to be really useful it needs to be tracked against the company's actual financial performance and regularly updated which is a very manual process if you are using Excel.

Hire a consultant to write your business plan

This is a good option if you have the budget for it - from experience you need to budget at least £1.5k ($2.0k) for a complete business plan, more if you need to make changes after the initial version (which happens frequently after the initial meetings with lenders).

Consultants are experienced in writing business plans and most of them adept at creating financial forecasts without errors. Furthermore, hiring a consultant can save you time and allow you to focus on the day-to-day operations of your business.

Use an online business plan software for your business plan

Another alternative is to use online business plan software .

There are several advantages to using specialized software:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you without errors

- You get a professional document, formatted and ready to be sent to your bank

- The software will enable you to easily track your actual financial performance against your forecast and update your forecast as time goes by

If you're interested in using this type of solution, you can try our software for free by signing up here .

Also on The Business Plan Shop

- How to do a market analysis for a business plan

- What is a business plan and how to create one?

- How to write the milestones section of your business plan

- How to write the suppliers section of your business plan

- What should you include in your business plan appendices

Do you know someone who could use some assistance with their business plan? Help them out by sharing this article!

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

Risk Management, Risk Analysis, Templates and Advice

- #1 Mind Mapping Tool

- Collaborate Anywhere

- Stunning Presentations

- Simple Project Management

- Innovative Project Planning

- Creative Problem Solving

The Top 50 Business Risks And How To Manage them!

Risk is simply uncertainty of outcome whether positive or negative ( PRINCE2, 2002, p239 ). Business risk is uncertainty around strategy, profits, compliance, environment, health and safety and so on. stakeholdermap.com

The Top 50 Business Risks

Download the full list of business risks, word download - the top 50 business risks (word), pdf download - the top 50 business risks (pdf), 20 common project risks - example risk register, checklist of 30 construction risks, overall project risk assessment template, simple risk register - excel template, business risk - references and further reading, read more on risk management.

- Risk Assessment

- Construction Risk Management

- Risk Management Glossary

- Risk Management Guidelines

- Risk Identification

- NHS Risk Register

- Risk Register template

- Risk Management Report

- Risk Responses

- Prince2 Risk Register

- Prince2 Risk Management Strategy

Share this Image

What is business risk?

You know about death and taxes. What about risk? Yes, risk is just as much a part of life as the other two inevitabilities. This became all the more apparent during COVID-19, as each of us had to assess and reassess our personal risk calculations as each new wave of the pandemic— and pandemic-related disruptions —washed over us. It’s the same in business: executives and organizations have different comfort levels with risk and ways to prepare against it.

Where does business risk come from? To start with, external factors can wreak havoc on an organization’s best-laid plans. These can include things like inflation , supply chain disruptions, geopolitical upheavals , unpredictable force majeure events like a global pandemic or climate disaster, competitors, reputational issues, or even cyberattacks .

But sometimes, the call is coming from inside the house. Companies can be imperiled by their own executives’ decisions or by leaks of privileged information, but most damaging of all, perhaps, is the risk of missed opportunities. We’ve seen it often: when companies choose not to adopt disruptive innovation, they risk losing out to more nimble competitors.

The modern era is rife with increasingly frequent sociopolitical, economic, and climate-related shocks. In 2019 alone, for example, 40 weather disasters caused damages exceeding $1 billion each . To stay competitive, organizations should develop dynamic approaches to risk and resilience. That means predicting new threats, perceiving changes in existing threats, and developing comprehensive response plans. There’s no magic formula that can guarantee safe passage through a crisis. But in situations of threat, sometimes only a robust risk-management plan can protect an organization from interruptions to critical business processes. For more on how to assess and prepare for the inevitability of risk, read on.

Learn more about McKinsey’s Risk and Resilience Practice.

What is risk control?

Risk controls are measures taken to identify, manage, and eliminate threats. Companies can create these controls through a range of risk management strategies and exercises. Once a risk is identified and analyzed, risk controls can be designed to reduce the potential consequences. Eliminating a risk—always the preferable solution—is one method of risk control. Loss prevention and reduction are other risk controls that accept the risk but seek to minimize the potential loss (insurance is one method of loss prevention). A final method of risk control is duplication (also called redundancy). Backup servers or generators are a common example of duplication, ensuring that if a power outage occurs no data or productivity is lost.

But in order to develop appropriate risk controls, an organization should first understand the potential threats.

What are the three components to a robust risk management strategy?

A dynamic risk management plan can be broken down into three components : detecting potential new risks and weaknesses in existing risk controls, determining the organization’s appetite for risk taking, and deciding on the appropriate risk management approach. Here’s more information about each step and how to undertake them.

1. Detecting risks and controlling weaknesses

A static approach to risk is not an option, since an organization can be caught unprepared when an unlikely event, like a pandemic, strikes. So it pays to always be proactive. To keep pace with changing environments, companies should answer the following three questions for each of the risks that are relevant to their business.

- How will a risk play out over time? Risks can be slow moving or fast moving. They can be cyclical or permanent. Companies should analyze how known risks are likely to play out and reevaluate them on a regular basis.

- Are we prepared to respond to systemic risks? Increasingly, risks have longer-term reputational or regulatory consequences, with broad implications for an industry, the economy, or society at large. A risk management strategy should incorporate all risks, including systemic ones.

- What new risks lurk in the future? Organizations should develop new methods of identifying future risks. Traditional approaches that rely on reviews and assessments of historical realities are no longer sufficient.

2. Assessing risk appetite

How can companies develop a systematic way of deciding which risks to accept and which to avoid? Companies should set appetites for risk that align with their own values, strategies, capabilities, and competitive environments—as well as those of society as a whole. To that end, here are three questions companies should consider.

- How much risk should we take on? Companies should reevaluate their risk profiles frequently according to shifting customer behaviors, digital capabilities, competitive landscapes, and global trends.

- Are there any risks we should avoid entirely? Some risks are clear: companies should not tolerate criminal activity or sexual harassment. Others are murkier. How companies respond to risks like economic turmoil and climate change depend on their particular business, industry, and levels of risk tolerance.

- Does our risk appetite adequately reflect the effectiveness of our controls? Companies are typically more comfortable taking risks for which they have strong controls in place. But the increased threat of severe risks challenges traditional assumptions about risk control effectiveness. For instance, many businesses have relied on automation to increase speed and reduce manual error. But increased data breaches and privacy concerns can increase the risk of large-scale failures. Organizations, therefore, should evolve their risk profiles accordingly.

3. Deciding on a risk management approach

Finally, organizations should decide how they will respond when a new risk is identified. This decision-making process should be flexible and fast, actively engaging leaders from across the organization and honestly assessing what has and hasn’t worked in past scenarios. Here are three questions organizations should be able to answer.

- How should we mitigate the risks we are taking? Ultimately, people need to make these decisions and assess how their controls are working. But automated control systems should buttress human efforts. Controls guided, for example, by advanced analytics can help guard against quantifiable risks and minimize false positives.

- How would we respond if a risk event or control breakdown happens? If (or more likely, when) a threat occurs, companies should be able to switch to crisis management mode quickly, guided by an established playbook. Companies with well-rehearsed crisis management capabilities weather shocks better, as we saw with the COVID-19 pandemic.

- How can we build true resilience? Resilient companies not only better withstand threats—they emerge stronger. The most resilient firms can turn fallout from crises into a competitive advantage. True resilience stems from a diversity of skills and experience, innovation, creative problem solving, and the basic psychological safety that enables peak performance.

Change is constant. Just because a risk control plan made sense last year doesn’t mean it will next year. In addition to the above points, a good risk management strategy involves not only developing plans based on potential risk scenarios but also evaluating those plans on a regular basis.

Learn more about McKinsey’s Risk and Resilience Practice.

What are five actions organizations can take to build dynamic risk management?

In the past, some organizations have viewed risk management as a dull, dreary topic, uninteresting for the executive looking to create competitive advantage. But when the risk is particularly severe or sudden, a good risk strategy is about more than competitiveness—it can mean survival. Here are five actions leaders can take to establish risk management capabilities .

- Reset the aspiration for risk management. This requires clear objectives and clarity on risk levels and appetite. Risk managers should establish dialogues with business leaders to understand how people across the business think about risk, and share possible strategies to nurture informed risk-versus-return decision making—as well as the capabilities available for implementation.

- Establish agile risk management practices. As the risk environment becomes more unpredictable, the need for agile risk management grows. In practice, that means putting in place cross-functional teams empowered to make quick decisions about innovating and managing risk.

- Harness the power of data and analytics. The tools of the digital revolution can help companies improve risk management. Data streams from traditional and nontraditional sources can broaden and deepen companies’ understandings of risk, and algorithms can boost error detection and drive more accurate predictions.

- Develop risk talent for the future. Risk managers who are equipped to meet the challenges of the future will need new capabilities and expanded domain knowledge in model risk management , data, analytics, and technology. This will help support a true understanding of the changing risk landscape , which risk leaders can use to effectively counsel their organizations.

- Fortify risk culture. Risk culture includes the mindsets and behavioral norms that determine an organization’s relationship with risk. A good risk culture allows an organization to respond quickly when threats emerge.

How do scenarios help business leaders understand uncertainty?

Done properly, scenario planning prompts business leaders to convert abstract hypotheses about uncertainties into narratives about realistic visions of the future. Good scenario planning can help decision makers experience new realities in ways that are intellectual and sensory, as well as rational and emotional. Scenarios have four main features that can help organizations navigate uncertain times.

- Scenarios expand your thinking. By developing a range of possible outcomes, each backed with a sequence of events that could lead to them, it’s possible to broaden our thinking. This helps us become ready for the range of possibilities the future might hold—and accept the possibility that change might come more quickly than we expect.

- Scenarios uncover inevitable or likely futures. A broad scenario-building effort can also point to powerful drivers of change, which can help to predict potential outcomes. In other words, by illuminating critical events from the past, scenario building can point to outcomes that are very likely to happen in the future.

- Scenarios protect against groupthink. In some large corporations, employees can feel unsafe offering contrarian points of view for fear that they’ll be penalized by management. Scenarios can help companies break out of this trap by providing a “safe haven” for opinions that differ from those of senior leadership and that may run counter to established strategy.

- Scenarios allow people to challenge conventional wisdom. In large corporations in particular, there’s frequently a strong bias toward the status quo. Scenarios are a nonthreatening way to lay out alternative futures in which assumptions underpinning today’s strategy can be challenged.

Learn more about McKinsey’s Strategy & Corporate Finance Practice.

What’s the latest thinking on risk for financial institutions?

In late 2021, McKinsey conducted survey-based research with more than 30 chief risk officers (CROs), asking about the current banking environment, risk management practices, and priorities for the future.

According to CROs, banks in the current environment are especially exposed to accelerating market dynamics, climate change, and cybercrime . Sixty-seven percent of CROs surveyed cited the pandemic as having significant impact on employees and in the area of nonfinancial risk. Most believed that these effects would diminish in three years’ time.

Introducing McKinsey Explainers : Direct answers to complex questions

Climate change, on the other hand, is expected to become a larger issue over time. Nearly all respondents cited climate regulation as one of the five most important forces in the financial industry in the coming three years. And 75 percent were concerned about climate-related transition risk: financial and other risks arising from the transformation away from carbon-based energy systems.

And finally, cybercrime was assessed as one of the top risks by most executives, both now and in the future.

Learn more about the risk priorities of banking CROs here .

What is cyber risk?

Cyber risk is a form of business risk. More specifically, it’s the potential for business losses of all kinds in the digital domain—financial, reputational, operational, productivity related, and regulatory related. While cyber risk originates from threats in the digital realm, it can also cause losses in the physical world, such as damage to operational equipment.

Cyber risk is not the same as a cyberthreat. Cyberthreats are the particular dangers that create the potential for cyber risk. These include privilege escalation (the exploitation of a flaw in a system for the purpose of gaining unauthorized access to resources), vulnerability exploitation (an attack that uses detected vulnerabilities to exploit the host system), or phishing. The risk impact of cyberthreats includes loss of confidentiality, integrity, and availability of digital assets, as well as fraud, financial crime, data loss, or loss of system availability.

In the past, organizations have relied on maturity-based cybersecurity approaches to manage cyber risk. These approaches focus on achieving a particular level of cybersecurity maturity by building capabilities, like establishing a security operations center or implementing multifactor authentication across the organization. A maturity-based approach can still be helpful in some situations, such as for brand-new organizations. But for most institutions, a maturity-based approach can turn into an unmanageably large project, demanding that all aspects of an organization be monitored and analyzed. The reality is that, since some applications are more vulnerable than others, organizations would do better to measure and manage only their most critical vulnerabilities.

What is a risk-based cybersecurity approach?

A risk-based approach is a distinct evolution from a maturity-based approach. For one thing, a risk-based approach identifies risk reduction as the primary goal. This means an organization prioritizes investment based on a cybersecurity program’s effectiveness in reducing risk. Also, a risk-based approach breaks down risk-reduction targets into precise implementation programs with clear alignment all the way up and down an organization. Rather than building controls everywhere, a company can focus on building controls for the worst vulnerabilities.

Here are eight actions that comprise a best practice for developing a risk-based cybersecurity approach:

- fully embed cybersecurity in the enterprise-risk-management framework

- define the sources of enterprise value across teams, processes, and technologies

- understand the organization’s enterprise-wide vulnerabilities—among people, processes, and technology—internally and for third parties

- understand the relevant “threat actors,” their capabilities, and their intent

- link the controls in “run” activities and “change” programs to the vulnerabilities that they address and determine what new efforts are needed

- map the enterprise risks from the enterprise-risk-management framework, accounting for the threat actors and their capabilities, the enterprise vulnerabilities they seek to exploit, and the security controls of the organization’s cybersecurity run activities and change program

- plot risks against the enterprise-risk appetite; report on how cyber efforts have reduced enterprise risk

- monitor risks and cyber efforts against risk appetite, key cyber risk indicators, and key performance indicators

How can leaders make the right investments in risk management?

Ignoring high-consequence, low-likelihood risks can be catastrophic to an organization—but preparing for everything is too costly. In the case of the COVID-19 crisis, the danger of a global pandemic on this scale was foreseeable, if unexpected. Nevertheless, the vast majority of companies were unprepared: among billion-dollar companies in the United States, more than 50 filed for bankruptcy in 2020.

McKinsey has described the decisions to act on these high-consequence, low-likelihood risks as “ big bets .” The number of these risks is far too large for decision makers to make big bets on all of them. To narrow the list down, the first thing a company can do is to determine which risks could hurt the business versus the risks that could destroy the company. Decision makers should prioritize the potential threats that would cause an existential crisis for their organization.

To identify these risks, McKinsey recommends using a two-by-two risk grid, situating the potential impact of an event on the whole company against the level of certainty about the impact. This way, risks can be measured against each other, rather than on an absolute scale.

Organizations sometimes survive existential crises. But it can’t be ignored that crises—and missed opportunities—can cause organizations to fail. By measuring the impact of high-impact, low-likelihood risks on core business, leaders can identify and mitigate risks that could imperil the company. What’s more, investing in protecting their value propositions can improve an organization’s overall resilience.

Articles referenced:

- “ Seizing the momentum to build resilience for a future of sustainable inclusive growth ,” February 23, 2023, Børge Brende and Bob Sternfels

- “ Data and analytics innovations to address emerging challenges in credit portfolio management ,” December 23, 2022, Abhishek Anand , Arvind Govindarajan , Luis Nario and Kirtiman Pathak

- “ Risk and resilience priorities, as told by chief risk officers ,” December 8, 2022, Marc Chiapolino , Filippo Mazzetto, Thomas Poppensieker , Cécile Prinsen, and Dan Williams

- “ What matters most? Six priorities for CEOs in turbulent times ,” November 17, 2022, Homayoun Hatami and Liz Hilton Segel

- “ Model risk management 2.0 evolves to address continued uncertainty of risk-related events ,” March 9, 2022, Pankaj Kumar, Marie-Paule Laurent, Christophe Rougeaux, and Maribel Tejada

- “ The disaster you could have stopped: Preparing for extraordinary risks ,” December 15, 2020, Fritz Nauck , Ophelia Usher, and Leigh Weiss

- “ Meeting the future: Dynamic risk management for uncertain times ,” November 17, 2020, Ritesh Jain, Fritz Nauck , Thomas Poppensieker , and Olivia White

- “ Risk, resilience, and rebalancing in global value chains ,” August 6, 2020, Susan Lund, James Manyika , Jonathan Woetzel , Edward Barriball , Mekala Krishnan , Knut Alicke , Michael Birshan , Katy George , Sven Smit , Daniel Swan , and Kyle Hutzler

- “ The risk-based approach to cybersecurity ,” October 8, 2019, Jim Boehm , Nick Curcio, Peter Merrath, Lucy Shenton, and Tobias Stähle

- “ Value and resilience through better risk management ,” October 1, 2018, Daniela Gius, Jean-Christophe Mieszala , Ernestos Panayiotou, and Thomas Poppensieker

Want to know more about business risk?

Related articles.

What matters most? Six priorities for CEOs in turbulent times

Creating a technology risk and cyber risk appetite framework

Risk and resilience priorities, as told by chief risk officers

- Search Search Please fill out this field.

Identifying Risks

Physical risks, location risks, human risks, technology risks, strategic risks, making a risk assessment, insuring against risks, risk prevention, the bottom line.

- Business Essentials

Identifying and Managing Business Risks

:max_bytes(150000):strip_icc():format(webp)/522293_3816099810338_52357726_n1__marc_davis-5bfc2625c9e77c0058760671.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Running a business comes with many types of risk. Some of these potential hazards can destroy a business, while others can cause serious damage that is costly and time-consuming to repair. Despite the risks implicit in doing business, CEOs and risk management officers can anticipate and prepare, regardless of the size of their business.

Key Takeaways

- Some risks have the potential to destroy a business or at least cause serious damage that can be costly to repair.

- Organizations should identify which risks pose a threat to their operations.

- Potential threats include location hazards such as fires and storm damage, a l cohol and drug abuse among personnel, technology risks such as power outages, and strategic risks such as investment in research and development.

- A risk management consultant can recommend a strategy including staff training, safety checks, equipment and space maintenance, and necessary insurance policies.

If and when a risk becomes a reality, a well-prepared business can minimize the impact on earnings, lost time and productivity, and negative impact on customers. For startups and established businesses, the ability to identify risks is a key part of strategic business planning . Risks are identified through a number of ways. Strategies to identify these risks rely on comprehensively analyzing a company's specific business activities. Most organizations face preventable, strategic and external threats that can be managed through acceptance, transfer, reduction, or elimination.

A risk management consultant can help a business determine which risks should be covered by insurance.

Below are the main types of risks that companies face:

Building risks are the most common type of physical risk. Think fires or explosions. To manage building risk, and the risk to employees, it is important that organizations do the following:

- Make sure all employees know the exact street address of the building to give to a 911 operator in case of emergency.

- Make sure all employees know the location of all exits.

- Install fire alarms and smoke detectors.

- Install a sprinkler system to provide additional protection to the physical plant, equipment, documents and, of course, personnel.

- Inform all employees that in the event of emergency their personal safety takes priority over everything else. Employees should be instructed to leave the building and abandon all work-associated documents, equipment and/or products.

Hazardous material risk is present where spills or accidents are possible. The risk from hazardous materials can include:

- Toxic fumes

- Toxic dust or filings

- Poisonous liquids or waste

Fire department hazardous material units are prepared to handle these types of disasters. People who work with these materials, however, should be properly equipped and trained to handle them safely.

Organizations should create a plan to handle the immediate effects of these risks. Government agencies and local fire departments provide information to prevent these accidents. Such agencies can also provide advice on how to control them and minimize their damage if they occur.

Among the location hazards facing a business are nearby fires, storm damage, floods, hurricanes or tornados, earthquakes, and other natural disasters. Employees should be familiar with the streets leading in and out of the neighborhood on all sides of the place of business. Individuals should keep sufficient fuel in their vehicles to drive out of and away from the area. Liability or property and casualty insurance are often used to transfer the financial burden of location risks to a third-party or a business insurance company.

There are other business risks associated with location that are not directly related to hazards, such as city planning. For example, a gas station exists on a major road, and as a result of its location, it receives plenty of business. City planning can eventually restructure the area around the gas station. The city may close the road the gas station is on, build other infrastructure that would make the gas station inaccessible, or overall just not take the gas station into consideration with any redevelopment. This would leave the gas station with no traffic to serve.

Alcohol and drug abuse are major risks to personnel in the workforce. Employees suffering from alcohol or drug abuse should be urged to seek treatment, counseling, and rehabilitation if necessary. Some insurance policies may provide partial coverage for the cost of treatment.

Protection against embezzlement , theft and fraud may be difficult, but these are common crimes in the workplace. A system of double-signature requirements for checks, invoices, and payables verification can help prevent embezzlement and fraud. Stringent accounting procedures may discover embezzlement or fraud. A thorough background check before hiring personnel can uncover previous offenses in an applicant's past. While this may not be grounds for refusing to hire an applicant, it would help HR to avoid placing a new hire in a critical position where the employee is open to temptation.

Illness or injury among the workforce is a potential problem. To prevent loss of productivity, assign and train backup personnel to handle the work of critical employees when they are absent due to a health-related concern. Other human-related risks under public attention could be associated with their behaviors and values. Misbehavior of management related to bias, racism, sexism, harassment, corruption, discrimination, pollutive actions, and carelessness about the environment are all actions that represent risk for the companies where these managers work.

A power outage is perhaps the most common technology risk. Auxiliary gas-driven power generators are a reliable back-up system to provide electricity for lighting and other functions. Manufacturing plants use several large auxiliary generators to keep a factory operational until utility power is restored.

Computers may be kept up and running with high-performance back-up batteries. Power surges may occur during a lightning storm (or randomly), so organizations should furnish critical business systems with surge-protection devices to avoid the loss of documents and the destruction of equipment.

Cloud storage is another source of risks nowadays. The process involves backing up data with Amazon Web Services, for example, using Azure, IBM, and Oracle, for instance. This is a huge undertaking that should be considered given the reliance on cloud-based data to run most businesses now. It is important to establish both offline and online data backup systems to protect critical documents.

Although telephone and communications failure are relatively uncommon, risk managers may consider providing emergency-use company cell phones to personnel whose use of the phone or internet is critical to their business.

Strategy risks are not altogether undesirable. Financial institutions such as banks or credit unions take on strategy risk when lending to consumers, while pharmaceutical companies are exposed to strategy risk through research and development for a new drug. Each of these strategy-related risks is inherent in an organization's business objectives. When structured efficiently, the acceptance of strategy risks can create highly profitable operations.

Companies exposed to substantial strategy risk can mitigate the potential for negative consequences by creating and maintaining infrastructures that support high-risk projects. A system established to control the financial hardship that occurs when a risky venture fails often includes diversification of current projects, healthy cash flow, or the ability to finance new projects in an affordable way, and a comprehensive process to review and analyze potential ventures based on future return on investment .

After the risks have been identified , they must be prioritized in accordance with an assessment of their probability. The first step is to establish a probability scale for the purposes of risk assessment .

For example, risks may:

- Be very likely to occur

- Have some chance of occurring

- Have a small chance of occurring

- Have very little chance of occurring

Other risks must be prioritized and managed in accordance with their likelihood of occurring. Actuarial tables —statistical analysis of the probability of any risk occurring and the potential financial damage ensuing from the occurrence of those risks—may be accessed online and can provide guidance in prioritizing risk.

Insurance is a principle safeguard in managing risk, and many risks are insurable. Fire insurance is a necessity for any business that occupies a physical space, whether owned outright or rented, and should be a top priority. Product liability insurance, as an obvious example, is not necessary for a service business.

Some risks are an inarguably high priority, for example, the risk of fraud or embezzlement where employees handle money or perform accounting duties in accounts payable and receivable. Specialized insurance companies will underwrite a cash bond to provide financial coverage in the event of embezzlement, theft or fraud.

When insuring against potential risks, never assume a best-case scenario. Even if employees have worked for years with no problems and their service has been exemplary, insurance against employee error may be a necessity. The extent of insurance coverage against injury will depend on the nature of your business. A heavy manufacturing plant will, of course, require more extensive coverage for employees. Product liability insurance is also a necessity in this context.

If a business relies heavily on computerized data—customer lists and accounting data, for example—exterior backup and insurance coverage is necessary. Finally, hiring a risk management consultant may be a prudent step in the prevention and management of risks.

The best risk insurance is prevention. Preventing the many risks from occurring in your business is best achieved through employee training, background checks, safety checks, equipment maintenance and maintenance of the physical premises. A single, accountable staff member with managerial authority should be appointed to handle risk management responsibilities. A risk management committee may also be formed with members assigned specific tasks with a requirement to report to the risk manager.

The risk manager, in conjunction with a committee, should formulate plans for emergency situations such as:

- Hazardous materials accidents or the occurrence of other emergencies

Employees must know what to do and where to exit the building or office space in an emergency. A plan for the safety inspection of the physical premises and equipment should be developed and implemented regularly including the training and education of personnel when necessary. A periodic, stringent review of all potential risks should be conducted. Any problems should be immediately addressed. Insurance coverage should also be periodically reviewed and upgraded or downgraded as needed.

Prevention is the best insurance against risk. Employee training, background checks, safety checks, equipment maintenance, and maintenance of physical premises are all crucial risk management strategies for any business.

While business risks abound and their consequences can be destructive, there are ways and means to ensure against them, to prevent them, and to minimize their damage, if and when they occur. Finally, hiring a risk management consultant may be a worthwhile step in the prevention and management of risks.

:max_bytes(150000):strip_icc():format(webp)/BusinessPlanMeeting-570270145f9b5861953a6732.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

GetRiskManager

What Are Examples of Business Risks? The Scary Threats and Great Opportunities!

What are examples of business risks?

Business risks are threats and opportunities that refer to a business’s internal risks and external risks environment and can help or prevent the company from accomplishing goals.

Understanding the benefits of risk management and anticipating risks can help resolve problems, prepare contingencies , and reach the business plan.

This article defines risk management as a proactive process that helps companies assess and manage potential risks.

Let’s Look at Risk Opportunity and Threat Definitions

Opportunities.

Opportunity-based risks materialise when you’re faced with choices and select one option over the others.

The risk is that the option you didn’t choose was potentially better for your organisation, hence a missed opportunity.

For example, you’re considering opening a new business location in another country and narrowing your options to two countries. You decide to expand in the country closest to current operations, risking possible greater success if you had chosen the more remote country instead.

To overcome opportunity-based risk, it might be helpful to increase your confidence in your business decisions and strive to maximise your efficiency in whatever selection you choose.

A threat is an event or circumstance that takes advantage of another vulnerability and could negatively affect the ability to continue operations.

Understanding threats is essential to make appropriate decisions about protecting the business .

Risk Management Actions