Income Statement (By Nature Vs By Function)

Is an income statement presented by nature of expense or by function of expense?

Income Statement by Nature of Expense

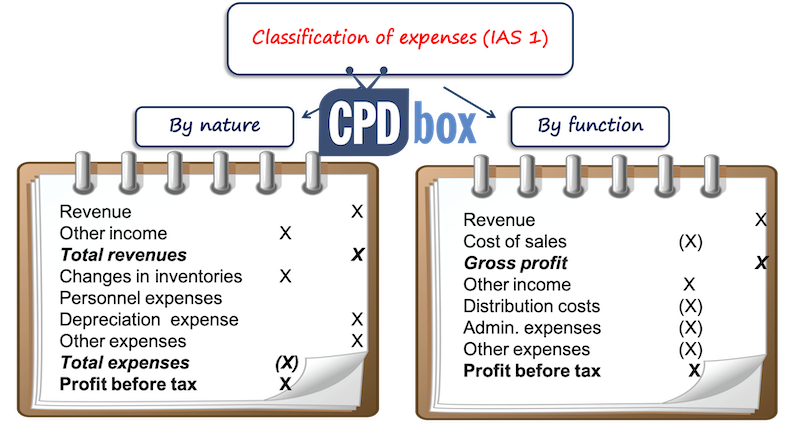

Expenses in an income statement are either classified by their nature or by their function.

An income statement by nature is the one in which expenses are disclosed according to categories they are spent on, such as raw materials, transport costs, staffing costs, depreciation, employee benefit etc. The expenses will not be further classified into their functions (i.e cost of goods sold, selling, administrative, etc).

This method of disclosure of expenses is used in single step income statement, usually employed by small businesses as it is simple and relatively easier to be implemented. However, the drawback of this method is that it cannot be used to calculate gross profit within the income statement.

The following example shows the format of an income statement by nature.

| Sales | 573,610 | |

| Expenses: | ||

| Purchases, delivery charges and other direct costs | (158,401) | |

| Changes in inventory | 69,426 | |

| Depreciation Expense | (3,250) | |

| Rent Expense | (24,000) | |

| Employee benefit expenses | (124,630) | |

| Utilities Expense | (6,900) | |

| Interest Expense | (375) | |

| Total Expenses | (248,130) | |

| Net Income | 325,480 |

Income Statement by Function of Expense

An income statement by function is the one in which expenses are disclosed according to different functions they are spent on (cost of goods sold, selling, administrative, etc.)

This method allows us to calculate gross profit and operating profit within the income statement, and therefore is usually used in the multi-step format of income statement. Most large and medium sized businesses use this method.

The following shows the format of an income statement by function of expense.

| Revenue | 102,716 | |

| Cost of sales | (55,708) | |

| Gross profit | 47,008 | |

| Other income | 1,021 | |

| Selling and distribution expenses | (17,984) | |

| Administrative expenses | (17142) | |

| Research and development expenses | (1,109) | |

| Other expenses | (860) | |

| Results from operating activities | 10,934 | |

| Finance income | 1,161 | |

| Finance costs | (1,707) | |

| Net finance costs | (546) | |

| Share of profit of equity-accounted investees, net of tax | 541 | |

| Profit before tax | 10,929 | |

| Tax expense | (3,371) | |

| Profit from continuing operations | 7,558 |

Have a question?

Give us your email and we'll be in touch..

Vernimmen.com

The reference for professionals and students of finance.

Read // Articles on financials // What is the difference between presenting costs by their nature and by their function on the P&L?

What is the difference between presenting costs by their nature and by their function on the P&L?

There are two main types of profit & loss statement:

- Either they present costs by their nature , e.g. production of goods less purchases of goods or raw materials, changes in inventories, staff costs, taxes and depreciation;

- Or by their function , that is, based on their use in the operating and investment cycle, e.g. turnover less cost of goods sold, sales and marketing expenditure, R&D costs and overheads).

But regardless of how the P&L is presented, the operating profit is still the same!

Presentation of costs by their function This is based on an analytical approach to the company, which classifies costs by major functions within the company

Personnel costs, for example, are broken down in each of these four functions (or three when sales & marketing costs and administrative costs are merged into one item), depending on whether the employee works in production, sales, R&D or administration. Similarly, the depreciation of a tangible fixed asset will be put under production costs if it is a machine, under sales & marketing costs if it is a salesperson's car, under R&D costs if it is laboratory equipment and under administrative costs if it is the accounting department's computers.

Presentation of costs by their nature This is the traditional presentation in France and many continental European countries. Obviously, in this approach, operating income, as in the previous case, is the difference between sales and the cost of these sales. European practice calls for booking costs when they are contracted, not when they are consumed. If the P&L shows, on the one hand, all purchases made during the year and, on the other hand, all invoices sent to clients, then we're comparing apples and oranges. After all, a company can stock some of the purchases it made during the year. This is not value destruction, but, rather, the constitution of an asset that is no doubt temporary, but quite real at a given moment. Meanwhile, it is possible that some of the company's finished products will not be sold during the year and, yet, the costs pertaining to these products appear on the P&L. So to avoid comparing apples and oranges, we have to make some adjustments, i.e.

- Remove the change in raw materials and goods, from purchases. We then book consumptions and not purchases;

- Add the change in inventories of finished goods to sales. We then book production and not sales.

Booking costs by their function starts with revenues and then reconstitutes the costs of these goods or services sold, in order to reach the operating profit. Booking costs by their nature starts from operating purchases and then adjusts them for changes in inventories of raw materials and finished products, in order to reach the operating profit, through subtraction from revenues (1).

A new presentation? A third way of presenting the P&L has emerged, in particular in France and the US. It looks like a presentation by function, except that it does not split up depreciation between various cost items but isolates it on one separate line, as in presentation by nature. Time will tell what becomes of this innovation.

- Global (EN)

- Albania (en)

- Algeria (fr)

- Argentina (es)

- Armenia (en)

- Australia (en)

- Austria (de)

- Austria (en)

- Azerbaijan (en)

- Bahamas (en)

- Bahrain (en)

- Bangladesh (en)

- Barbados (en)

- Belgium (en)

- Belgium (nl)

- Bermuda (en)

- Bosnia and Herzegovina (en)

- Brasil (pt)

- Brazil (en)

- British Virgin Islands (en)

- Bulgaria (en)

- Cambodia (en)

- Cameroon (fr)

- Canada (en)

- Canada (fr)

- Cayman Islands (en)

- Channel Islands (en)

- Colombia (es)

- Costa Rica (es)

- Croatia (en)

- Cyprus (en)

- Czech Republic (cs)

- Czech Republic (en)

- DR Congo (fr)

- Denmark (da)

- Denmark (en)

- Ecuador (es)

- Estonia (en)

- Estonia (et)

- Finland (fi)

- France (fr)

- Georgia (en)

- Germany (de)

- Germany (en)

- Gibraltar (en)

- Greece (el)

- Greece (en)

- Hong Kong SAR (en)

- Hungary (en)

- Hungary (hu)

- Iceland (is)

- Indonesia (en)

- Ireland (en)

- Isle of Man (en)

- Israel (en)

- Ivory Coast (fr)

- Jamaica (en)

- Jordan (en)

- Kazakhstan (en)

- Kazakhstan (kk)

- Kazakhstan (ru)

- Kuwait (en)

- Latvia (en)

- Latvia (lv)

- Lebanon (en)

- Lithuania (en)

- Lithuania (lt)

- Luxembourg (en)

- Macau SAR (en)

- Malaysia (en)

- Mauritius (en)

- Mexico (es)

- Moldova (en)

- Monaco (en)

- Monaco (fr)

- Mongolia (en)

- Montenegro (en)

- Mozambique (en)

- Myanmar (en)

- Namibia (en)

- Netherlands (en)

- Netherlands (nl)

- New Zealand (en)

- Nigeria (en)

- North Macedonia (en)

- Norway (nb)

- Pakistan (en)

- Panama (es)

- Philippines (en)

- Poland (en)

- Poland (pl)

- Portugal (en)

- Portugal (pt)

- Romania (en)

- Romania (ro)

- Saudi Arabia (en)

- Serbia (en)

- Singapore (en)

- Slovakia (en)

- Slovakia (sk)

- Slovenia (en)

- South Africa (en)

- Sri Lanka (en)

- Sweden (sv)

- Switzerland (de)

- Switzerland (en)

- Switzerland (fr)

- Taiwan (en)

- Taiwan (zh)

- Thailand (en)

- Trinidad and Tobago (en)

- Tunisia (en)

- Tunisia (fr)

- Turkey (en)

- Turkey (tr)

- Ukraine (en)

- Ukraine (ru)

- Ukraine (uk)

- United Arab Emirates (en)

- United Kingdom (en)

- United States (en)

- Uruguay (es)

- Uzbekistan (en)

- Uzbekistan (ru)

- Venezuela (es)

- Vietnam (en)

- Vietnam (vi)

- Zambia (en)

- Zimbabwe (en)

- Financial Reporting View

- Women's Leadership

- Corporate Finance

- Board Leadership

- Executive Education

Fresh thinking and actionable insights that address critical issues your organization faces.

- Insights by Industry

- Insights by Topic

KPMG's multi-disciplinary approach and deep, practical industry knowledge help clients meet challenges and respond to opportunities.

- Advisory Services

- Audit Services

- Tax Services

Services to meet your business goals

Technology Alliances

KPMG has market-leading alliances with many of the world's leading software and services vendors.

Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. That’s why KPMG LLP established its industry-driven structure. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients.

- Our Industries

How We Work

We bring together passionate problem-solvers, innovative technologies, and full-service capabilities to create opportunity with every insight.

- What sets us apart

Careers & Culture

What is culture? Culture is how we do things around here. It is the combination of a predominant mindset, actions (both big and small) that we all commit to every day, and the underlying processes, programs and systems supporting how work gets done.

Relevant Results

Sorry, there are no results matching your search., income statement presentation: ifrs compared to us gaap.

The IFRS income statement follows certain formatting requirements and options different from US GAAP.

From the IFRS Institute - Nov 15, 2018

The IFRS presentation guidelines for annual financial statements are generally less prescriptive than SEC regulation, but may still surprise US private companies. IFRS preparers have some flexibility in selecting their income statement format and which line items, headings and subtotals are to be presented on the face of the statement. In this article we highlight key considerations affecting preparers when choosing the structure, format and contents of the income statement and other presentation matters.

Single statement vs. two statements

Under IAS 1[1], the income statement is the primary financial statement used to provide an understanding of a company’s performance and operations over a defined period of time. Because of its importance, its format is often debated and scrutinized by preparers, users, regulators, standard setters and others.

Under IFRS, the income statement is labeled ‘statement of profit or loss’. Like US GAAP, the income statement captures most, but not all, revenues, income and expenses. Other items of comprehensive income (OCI) do not flow through profit and loss. Examples include the fair value remeasurement of certain equity instruments, remeasurements of defined benefit plans, and the effective portion of cash flow hedges change in fair value.

Items of profit and loss and OCI can be presented as:

- a single statement: the ‘statement of comprehensive income’; or

- two separate statements: an income statement displaying profit or loss followed immediately by a separate statement of comprehensive income.

The selected structure is applied consistently.

Format and content of the income statement

Although the format of the income statement is not prescribed, certain items require presentation, if material, either on the face of the income statement or disclosed in the notes to the financial statements. Here we highlight certain items common for commercial or industrial companies and how they should be presented in the income statement.

Common items 'requiring' presentation on the face of the income statement

- Revenue, presenting separately interest revenue

- Finance costs

- Impairment losses related to financial instruments

- Share of the profit or loss of associates and joint ventures

- Tax expense

Common items that may be presented on the face of the income statement 'or' disclosed in the notes to the financial statements

- Writedowns of inventories to net realizable value or property, plant and equipment to recoverable value, as well as reversals of such writedowns

- Restructurings of the activities of an entity and reversals of any provisions for the costs of restructuring

- Gains or losses on disposals of items of property, plant and equipment

- Gains or losses on disposals of investments

- Litigation settlements

Unlike IFRS, SEC regulation prescribes the format and minimum line items to be presented for SEC registrants. For non-SEC registrants, there is limited guidance on the presentation of the income statement or statement of comprehensive income, like IFRS. |

Presentation of expenses by function or nature

Another accounting policy election is the presentation of expenses by either their function or nature. This determination should be based on which approach is most relevant and reliable and often depends on the company, the industry in which it operates and its users’ needs.

When expenses are presented by function they are allocated to, for example, cost of sales, selling or administrative activities. At a minimum, under this method companies present cost of sales separately from other expenses. This election requires the use of IT systems, defined processes and internal controls to make sure the allocations are appropriate. In our experience, most US companies present their expenses by function.

The presentation of expenses by nature is less complex. For example, expenses may be disaggregated as purchases of materials, transport costs, depreciation and amortization, personnel costs and advertising costs. A mixed presentation is not permitted. This means, for instance, that it’s not possible to present impairment losses on nonfinancial assets or amortization and depreciation in separate line items in a presentation by function.

Regardless of the approach used, companies need to ensure the presentation is not misleading and is relevant to the understanding of the financial statements. Lastly, if presenting expenses by function, companies are required to include additional information on the nature of expenses (e.g. depreciation, amortization and staff costs) in the notes to the financial statements.

Unlike IFRS, US GAAP has no requirement for expenses to be classified according to their nature or function. SEC regulations prescribe expense classification requirements, unlike IFRS. |

Presenting additional line items, headings and subtotals

IAS 1 allows companies to use additional line items, headings and subtotals in the income statement “if such presentation is relevant to an understanding of the company’s financial performance.” The standard allows for judgment when determining what to present and how to present it, rather than prescribing a format or specifying all the possible items.

Given that IFRS does not define gross profit, operating results or many other common subtotals, there’s flexibility when adding and defining new line items in the income statement. Many companies disclose ‘operating profit‘ or ’results from operating activities‘ as a subtotal before profit or loss in the income statement. As a general rule, all additional line items and subtotals should be clearly labeled and presented, made up of items recognized and measured using IFRS, and calculated consistently across periods. Further, items shouldn’t be displayed with more prominence than other items required in the income statement.

Unusual or exceptional items

IFRS does not describe events or items of income or expense as ‘unusual’ or ‘exceptional’. However, the presentation, disclosure or characterization of an item as extraordinary is prohibited.

We believe it is possible to characterize items as unusual or exceptional under certain conditions. This should be infrequent and reserved for items that justify a prominence greater than that achieved by separate presentation and disclosure – e.g. a natural disaster. Those items should also be classified by nature or function, in the same way as usual or non-exceptional amounts. Lastly, companies should provide an explanation of the nature of the amount and why the item has been classified in this manner.

Given the significant judgment involved, companies should exercise caution when presenting items as unusual or exceptional. For example, although often infrequent and significant, the costs associated with a restructuring event generally wouldn’t qualify.

Unlike IFRS, transactions of an unusual nature are defined as possessing a high degree of abnormality and of a type clearly unrelated to, or only incidentally related to, the ordinary and typical activities of the entity. Unlike IFRS, significant events or transactions that are unusual and/or occur infrequently are presented separately in the income statement or disclosed in the notes. Like IFRS, extraordinary items classification is prohibited. |

Items of income and expense are only offset when it is required or permitted by IFRS, or when gains, losses and related expenses arise from the same transaction or event or from similar individually immaterial transactions and events. For example, finance costs and finance expenses are generally presented gross; so are other income and expenses.

Like IFRS, items of income and expense are not offset unless it is required or permitted by another Codification topic/subtopic, or when the amounts relate to similar transactions or events that are not significant. However, offsetting is permitted in more circumstances under US GAAP than under IFRS. For example, derivatives executed with the same counterparty under a master netting arrangement may be offset, unlike IFRS. |

Non-GAAP financial measures

Non-GAAP financial measures (NGFMs) – also sometimes referred to outside the United States as alternative performance measures – are not defined in IFRS. In practice, investors are increasingly looking to, and companies are increasingly presenting, NGFMs. These are generally achieved by adding subtotals, such as EBIT or EBITDA, to the income statement. Such measures can be helpful in linking a company’s financial statements to explanations of its business performance.

When NGFMs are presented, companies are expected to:

- identify and define the NGFMs presented and the components included in such measure;

- provide the basis of calculation and how such measures reconcile to the IFRS financial statements; and

- be consistently presented over time.

Read our May 2017 article, Non-GAAP financial measures are thriving .

Unlike IFRS, the presentation of NGFMs in the financial statements by SEC registrants is generally prohibited. There are exceptions to this rule for Foreign Private Issuers applying IFRS. In practice, NGFMs are also not presented in the financial statements by non-SEC registrants, unlike IFRS. Read our . |

Income statement presentation – the takeaway

Most income statement items are consistently presented with little or no ambiguity as to their terminology or order. However, there is flexibility in terms of adding line items, using non-GAAP financial measures and formatting options. Therefore, companies need to be thoughtful when exercising their presentation choices, develop detailed accounting policies and ensure consistent application of such policies with full and transparent disclosures. Companies with the intention of going public should be prepared to respond to future challenges based on these considerations.

The IASB is conducting a standard-setting project on the primary financial statements to provide clarity on subtotals in the income statement, non-GAAP financial measures and unusual or infrequent items. This project is intended to provide guidance so that companies’ alternative performance measures will be more transparent and comparable. The FASB is also conducting a standard-setting project on the presentation of financial statements.

We believe the presentation of items in the income statement will continue to be a heightened area of focus and subject to future change.

- IAS 1, Presentation of Financial Statements

- Regulation S-X Rule 5-03, Income Statements, which applies to commercial or industrial companies

KPMG Executive Education

CPE seminars and customized training

Explore more

Meet our team.

Subscribe to the IFRS® Perspectives Newsletter

Subscribe to receive timely updates on the application of IFRS® Accounting and Sustainability Standards in the United States: our latest thought leadership, articles, webcasts and CPE seminars.

IFRS Perspectives Newsletter

By submitting, you agree that KPMG LLP may process any personal information you provide pursuant to KPMG LLP's Privacy Statement .

Thank you for contacting KPMG. We will respond to you as soon as possible.

Contact KPMG

Job seekers

Visit our careers section or search our jobs database.

Use the RFP submission form to detail the services KPMG can help assist you with.

Office locations

International hotline

You can confidentially report concerns to the KPMG International hotline

Press contacts

Do you need to speak with our Press Office? Here's how to get in touch.

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

CPD technical article

01 February 2011

Presenting financial statements

Multiple-choice questions

Graham Holt

Graham holt explains the changes to financial statements that the iasb and the fasb are proposing, and reviews the possible pitfalls that preparers could encounter, this article was first published in the february 2011 edition of accounting and business magazine. , studying this technical article and answering the related questions can count towards your verifiable cpd if you are following the unit route to cpd and the content is relevant to your learning and development needs. one hour of learning equates to one unit of cpd. we'd suggest that you use this as a guide when allocating yourself cpd units..

In July 2010, the International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB) published a staff exposure draft that proposes changes to the presentation of financial statements under International Financial Reporting Standards (IFRS).

The boards believe the revised format will give users a better understanding of a company's performance by subdividing financial position, comprehensive income and cashflows into core operations and other activities. The publication of the official exposure draft has been delayed until 2011. The boards' plan is to consult with stakeholders and look at the cost benefits of the change and the implications for financial institutions. Only then will the boards consider whether to change any of their tentative decisions.

The key changes proposed are:

- Assets, liabilities, revenues and expenses will be categorised under operating, investing and financing, with separate sections for taxes and discontinued operations.

- The statement of cashflows will be prepared under the direct method, with certain indirect information also presented on the face.

- There will be a 'roll-forward' presentation in the notes for significant line items in the statement of financial position.

- Information will be disaggregated by function (for example, the cost of sales, selling and marketing) in the statement of comprehensive income; and by nature (for example, bad debt, advertising) in the notes.

- Extensive segment disclosures will be made in the notes for the FASB constituents.

The boards' aim is to address concerns that the current rules permit too many alternative presentations and that information in financial statements is confusingly aggregated and inconsistently presented, making it difficult to fully understand the relationship between an entity's financial statements and its financial results. The primary financial statements would be organised around an entity's business activities and separately from its financing activities. Business activities would further distinguish operating activities from investing activities, while financing activities would be separated into debt and equity categories.

An entity would also present separate sections for discontinued operations, income taxes and multi-category transactions. The proposed new categories for the statements of financial position and comprehensive income are shown in the tables below.

New categories for the statement of financial position

- Business Operating Financing arising from operating activities Investing

- Discontinued operations

- Income taxes

- Financing Debt Equity

- Total assets

- Total liabilities

New categories for the statement of comprehensive income

- Business Operating Financing arising from operating activities

- Total operating income

- Total business income

- Net operating from continuing operations

- Other comprehensive income

- Total other comprehensive income

Information would be disaggregated by function in the primary financial statements and by nature in the footnotes. 'Function' refers to an entity's primary activities (for example, the sale of goods or services); 'nature' refers to the economic characteristics that distinguish assets, liabilities, income and expenses (for example, the nature of expenses includes labour and materials).

The proposed standard is based on two core principles: cohesiveness and disaggregation, which the boards believe will aid understanding of the reporting entity's financial information.

Cohesiveness focuses on the relationship between items in the financial statements by consistently linking transactions across statements. For example, while interest is currently reported in current liabilities as a finance cost and as an operating cashflow, in the new presentation it would be consistently reported in the debt category of the financing section across the financial statements.

The aim of disaggregation is to provide enough detail to make clear what the entity's activities and cashflows are, and to ensure that the relationships between assets or liabilities (and the effects of changes in those assets or liabilities) are consistently reflected in the financial statements.

If the economic characteristics of transactions are dissimilar, then separate presentation is required. For example, labour and materials are likely to have different economic characteristics, and so may be presented on a disaggregated basis.

The disaggregation and cohesiveness principles do not apply to the statement of changes in equity.

Accordingly there are common sections and categories in which a reporting entity will classify financial information. An entity will classify items in its financial statements based on how those items relate to its activities across the financial statements. The classification of items could differ based on the sector in which the reporting entity operates.

The structure and appearance of the statement of financial position would change significantly. However, in addition to the subtotals required for each new section, some required subtotals in the statement of financial position, such as total assets and liabilities, would continue to be presented.

Cash would always be classified in the operating category of the business section with the result that cash equivalents will be included in the investing category for most commercial entities.

The proposal no longer allows an entity to treat an operating cycle as longer than 12 months, because an asset or liability would be classified as short term if the shorter of its contractual maturity or its expected date of realisation were within one year of the reporting date.

An entity could present the statement of financial position in order of liquidity within each section and category, rather than classified as short and long term, if the information were considered more useful. This may be the case for financial institutions.

The boards propose to eliminate the option of presenting comprehensive income in two statements, and will require a single, continuous statement of comprehensive income with two distinct sections for profit or loss and other comprehensive income.

As explained above, entities will generally disaggregate income and expense by function and further disaggregate income and expense by nature.

However, if an entity does not consider disaggregation by function to be useful to users, it may disaggregate its income and expense items by nature in the statement of comprehensive income only.

This model will significantly increase the amount of information to be disclosed and so could require changes in systems to capture the information.

Statement of cashflows

The boards have tentatively concluded that cashflows should be presented using the direct method and that a reconciliation from operating income to net cash from operating activities (that is, an indirect reconciliation) should also be presented.

The direct method requires the presentation of gross cash receipts and cash payments classified in the same section and category as the related asset, liability or equity item in the statement of financial position, and the related income or expense item in the statement of comprehensive income.

The boards believe the direct method cashflow statement, together with the indirect reconciliation, provides more transparent and useful cashflow data. It is suggested that cashflow information provided by the direct method could be prepared using information directly from the accounting records or by being derived from changes in assets and liabilities.

Most entities currently use the indirect method, so this requirement would mean changes to systems to collect the information. For example, an entity would have to collect information relating to accounts payable for direct materials and labour to determine cash paid.

Roll-forward analyses

The draft includes a proposal that all companies (except non-public entities) provide a roll-forward presentation of changes in significant assets and liabilities.

This presentation would include an analysis and explanation of the nature of transactions and remeasurements that caused the changes in the account balances.

The reconciliation requires a roll-forward of the start and end balances of the asset or liability, separately presenting the effect of changes resulting from such things as cash inflows and cash outflows, non-cash transactions that are recurring and routine, accounting allocations such as depreciation expense, write-downs or impairment losses, and remeasurements.

The IASB has tentatively concluded that all companies should present, in a single note, the changes in each item of debt, cash, short-term investments and finance leases. The staff draft does not define net debt explicitly but requires presentation of the information needed to determine net debt in a single note.

It is evident that financial statements will be presented differently under the new proposals and more disaggregated information will be required.

Users of financial information may find that the enhanced cohesiveness and disaggregation gives them a better insight into entities' financial position and performance. However, preparers will encounter costs and system challenges, and may feel the increased disclosure is counter-productive.

The move to IFRS has brought a degree of consistency to corporate reporting but there may be some sacrifice of comparability between entities if the principles of the staff draft are carried forward into the final standard.

Graham Holt is an examiner for ACCA and executive head of the accounting and finance division at Manchester Metropolitan University Business School

Related topics.

- Corporate reporting

- ACCA Careers

- ACCA Career Navigator

- ACCA-X online courses

Useful links

- Make a payment

- ACCA Rulebook

- Work for us

- Supporting Ukraine

Using this site

- Accessibility

- Legal & copyright

- Advertising

Send us a message

Planned system updates

View our maintenance windows

INCOME STATEMENT PRESENT BY FUNCTION

Income statement (statement of profit or loss).

The Income Statement of a business shows the owners and other important users how the business has performed in its activities for that period. This performance is judged through two key figures, the Gross Profit and the Net Profit.

Gross Profit

Gross Profit = Revenues – Cost of Sales

Net Profit = Revenues – All Expenses (Cost of Sales + Other expenses)

The Net Profit of a business can also be calculated using the Gross Profit of the business. Instead of deducting all expenses of the business from the revenues of the business, all expenses that are not directly attributable to the revenues of the business (All expenses less Cost of Sales) are subtracted from the Gross Profit.

Net Profit = Gross Profit – Other Expenses (Expenses that are not Cost of Sales)

The above expenses are classified by their nature. These expenses can also be grouped together based on the function of the business where the expenses occur. When grouped by the function of the expense, the presentation is known as functional presentation.

Presenting Expenses in the Income Statement

Presentation by function.

| Raw material consumed | 1,200,000 |

| Production staff salaries | 80,000 |

| Machinery repair and maintenance | 10,000 |

| Administrative staff salaries | 50,000 |

| Legal charges | 10,000 |

| Insurance | 20,000 |

| Marketing staff salaries | 50,000 |

| Advertisements | 15,000 |

| 120,000 | 80,000 | 50,000 | 250,000 |

| 60,000 | 12,000 | 8,000 | 80,000 |

| $ | |

| Revenues | 2,000,000 |

| Less: Cost of Sales | (1,470,000) |

| Administrative Expenses | (172,000) |

| Marketing Expenses | (123,000) |

| Tax | (35,000) |

Related Posts

3 main purposes of financial statements (explained), what is asset definition, explanation, types, classification, formula, and measurement, 5 main elements of financial statements: assets, liabilities, equity, revenues, expenses, income statement: definition, types, templates, examples, and more.

- Financial Statements

- Income Statement

- Single-Step Income Statement

- Multi-Step Income Statement

- Income Statement by Nature

- Income Statement by Function

- Income from Discountinued Operations

- Comprehensive Income

- Earnings per Share

- Statement of Retained Earnings

- Balance Sheet

- Unusual and Infrequent Items

- Statement of Cash Flows

- Cash-Flow Statement: Direct Method

- Cash-Flow Statement: Indirect Method

- Direct vs Indirect Method Cash Flow Statement

- Cash Flows From Investing Activities

- Cash Flows From Financing Activities

- Statement of Changes in Equity

- Notes and Disclosures

- Management Discussion and Analysis

- Changes in Accounting Principles

- Changes in Accounting Estimates

- Accounting Errors

The expenses in an income statement are either classified by their nature or by their function. An income statement by nature method is the one in which expenses are disclosed according to their nature such as depreciation, transports costs, rent expense, wages and salaries etc. There is no reallocation of these expenses to different functions of the entity (i.e. cost of goods sold, selling costs, administrative costs and other expenses).

This method of disclosure of expenses is used in single step income statement and it is usually employed by small businesses due to its simplicity. However there is drawback in this method that it cannot be used to calculate gross profit within the income statement.

The following example shows the format of an income statement by nature.

| Company A | ||

| Income Statement | ||

| For the Year Ended June 31, 2011 | ||

| Sales | $305,610 | |

| Expenses: | ||

| Beginning Inventory | $16,800 | |

| Purchases | 184,100 | |

| Ending Inventory | −21,050 | |

| Depreciation Expense | 14,790 | |

| Rent Expense | 21,000 | |

| Salaries and Wages Expense | 38,320 | |

| Supplies Expense | 3,510 | |

| Utilities Expense | 6,900 | |

| Interest Expense | 375 | |

| Total Expenses | −264,745 | |

| Net Income | $40,865 | |

by Irfanullah Jan, ACCA and last modified on Apr 1, 2020

Related Topics

All chapters in accounting.

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Accounting Systems

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

How to classify expenses in profit or loss statement under IFRS?

How to classify expenses in profit or loss? And, what to do when you have to change this classification?

Where to present depreciation? Salaries?

Let’s see today’s question:

“Dear Silvia, I am auditing a company who owns warehouses in several locations and rents the warehouses to other companies.

Last year, the company’s owners changed and as a result, there was a change in company’s operations.

Before, employees were assigned to the specific warehouse and worked in that warehouse only.

Now, employees rotate and can serve more warehouses over some time period.

On top of it, few administrative employees were fired and warehouse employees work on admin tasks, too.

So, we have a problem with classification of expenses.

Before, all salaries of warehouse employees were classified as cost of sales because they worked in warehouse.

Now, after the change, these salaries are classified simply as personnel expenses and as a result, cost of sales dramatically decreased.

How to solve this situation? Is this OK?”

IFRS Answer: Classification and its change

I like this question, because it deals with two issues:

- Classification of expenses in profit or loss, and

- Change in presentation of your profit or loss.

Classification of expenses in profit or loss

I often receive questions like:

- How to present depreciation expenses?

- How to present insurance of offices? And similar.

Let me say that you have a choice here.

The standard IAS 1 Presentation of financial statements does NOT prescribe how you should present your expenses.

In fact, there is NO mandatory format .

The reason is that every single entity is different in its activities and shows different profile of expenses necessary to achieve revenues.

Therefore, the standard requires the presentation of expenses in profit or loss in a way that provides more reliable and relevant information about your own activities.

- Expenses by nature and

- Expenses by function.

Expenses by nature

When you present by nature , then you simply group the expenses by their nature regardless the role that they play in your company.

You do NOT reallocate them among various functions in your company.

For example, the salary of warehouse employees and the salary of admin employees will be presented as personnel expenses .

Similarly, depreciation of warehouse and depreciation of admin building will be presented as depreciation expenses .

The big advantage of this method is that it is very simple because you don’t have to worry with allocations.

Expenses by function

Here, you group your expenses by the functions in your company.

For example, salary of warehouse employees and depreciation of warehouse are presented as cost of sales .

Salary of admin employees and depreciation of admin building are presented as administrative expenses .

This method is more demanding because it requires certain work and judgment when reallocating your expenses among various functions, but it is probably more relevant for some types of companies.

What classification to use?

And now, let me clarify that IAS 1 DOES NOT require analysis of expense by function or by nature on the face of profit or loss statement – it is a suggestion.

In fact, you are permitted to disclose the classification on the face of the profit or loss statement on some mixed basis .

For example, you present cost of sales as a function, then you present gross profit and then you present depreciation expenses – this is an element from by nature method. That’s the illustration of the mixed basis.

What about the change in presentation?

Let’s get back to the first part of today’s question:

It is OK to present salaries of employees as cost of sales to the extent they relate to their warehouse work.

And, it is also OK to present these salaries as personnel expenses, if this is more relevant for the company’s activities.

But here, the question contains one more element: change in presentation .

One year, the expenses were presented as cost of sales and another year, they were presented as personnel expenses. Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out! Well, this is not permitted .

Instead, you should bear in mind another two requirements of IAS 1:

You can change the presentation, but only when there is a change in entity’s operations and the new way of presenting would be more relevant.

If you make the change in presentation, you need to reclassify your comparative information , too.

It means that if you presented salaries of warehouse employees as cost of sales in the previous period, and now you want to present them as personnel expenses – you can do it, but you need to reclassify these salaries in the previous reporting period to personnel expenses too in order to make previous and current numbers comparable.

Here’s the video summing up the issue:

Any comments or questions? Please let me know below – thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

23 Comments

Thanks so much for Sharing it is so insightful

Well guided

One of your simplest articles you still make it easy …. thank you

Hi Silvia! How to account technical maintance of leasing objects? We are lessor of ships. There is a new agreement (not a part of leasing agreement!) with third party that will maintence ships on regular bases. Is it other expense for us or no? What do you think?

Hi dzirt, well, it depends on what the lease contract says – is maintenance of the ships included in the price of lease? Will lessee refund the maintenance? I cannot really assess based on this short info.

Thank you for the post. To me expenses by nature give clear indication of “trends”. One may have by function classification for management reporting, down to the departments / responsibility accounting. e.g. Fuel prices are increasing will be visible in by nature classification while will be lost in by function classification. However by function classification will required for closing inventory valuation in manufacturing concerns. In Pakistan we have two groups on face of Income Statements; Cost of goods sold and “Selling Admin expenses” with by nature classification in two notes.

I agree with you. When you do “by function”, it is quite judgemental and yes, can hide anything, but the point is to be consistent and fair. Thank you!

Hi Silvia, Thank you for the reply. I appreciate it.

Hi Silvia, thank you so much for sharing the above info. I have a question W maybe you can help me. Why do you think the IASB is considering requiring companies to use either the Nature of expense method or the Function method of expense?

Hi Marjorie, just for the sake of some order in presentation.

Silvia, Thanks for the wonderful explanation.

Hello Silvia, I heard someone mention that you can’t present name expense/(income) non-operating expense/(income) and you can only use operating expense/(income). Is this true ? And if yes how do you disclose income or expense that are not operating ? for example write-off or insurance received ?

Hi Ronald, I think you heard that you cannot use “extra-ordinary” expense/income, because even earthquakes are a part of operations, isn’t it? You can have non-operating expense, for example interest paid can be presented as such.

Thank you very for your explanation. It is very useful!!!

thank you very much!!! it is help me a lot !!!

Hi, Dear Silvia

Many thanks for the nice clarification.

I have a question in this regard. As you said to make consistency in comparison, expenses may be reclassified. In such a situation, if the reclassification becomes material, shouldn’t we apply retrospective accounting or just give a disclosure is enough?

Hi Robiul, I would say that the classification of expenses is more-less disclosure issue, not the recognition itself. Having that said – that’s why you are presenting the comparatives under the new classification, too (it is a kind of restatement).

Dear Silvia, I am a first year business student at university in Australia.

For one of my assessable homework questions it asks us to prepare an income statement. it specifically states to NOT CLASSIFY THE EXPENSES.

i’m a bit lost on what that actually means…..could you please explain a little bit on what that actually means.

Simple but informative. Thank you for making it so

Dear Silvia, It is really helpful, i like the way in u explain the topic very easily,,,, so good. Thanks Best wishes.

Dear Silvia , It’s really helpful thanks for your explanation. Regards, Rana Atif

Hello I really like they youe explain please explain with few example accounting treatment of intangible assets,cash flow statement , partnership and leases

Silvia, Thank you very much for the input, it is very helpful. Stay blessed.

Leave a Reply Cancel reply

Recent Comments

- Jenny on Summary of IAS 40 Investment Property

- Silvia on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Krutin on Accounting for gain or loss on sale of shares classified at FVOCI

- Pramith Siriwardhana on Summary of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

- Tammie on How to account for settlement discounts under IFRS 15?

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

JOIN OUR FREE NEWSLETTER

report “Top 7 IFRS Mistakes” + free IFRS mini-course

1514305265169 -->

We use cookies to offer useful features and measure performance to improve your experience. By clicking "Accept" you agree to the categories of cookies you have selected. You can find further information here .

Nature & Function Through The Eyes Of A Nonprofit

New Guidance Requires Proper Reporting With Statement Of Functional Expenses

Those who know me, know I enjoy spending time in nature – mostly hiking and camping. It helps me function better in my everyday life. And while I’d love to write more about that, this month you get to learn about a different kind of nature and function.

Read Also: Start Engaging With Your Nonprofit’s Leadership

The new nonprofit accounting guidance (ASU 2016-14) directs nonprofit organizations to report expenses by both nature and function within their Generally Accepted Accounting Principles (GAAP) financial statements. While this information can be presented in the footnotes or directly in the statement of activities, many nonprofits are finding that including a statement of functional expenses is the most practical method for complying with this new requirement.

Since most nonprofits were previously not required to present this information or this statement, many are finding that they need to consider new factors in preparation of their 2022 financial statements.

Even if your organization presented a statement of functional expenses in the past or can prepare one based on the information included in the Form 990, now is a good time to fine-tune your understanding and decisions in this area.

Statement of Functional Expenses

A statement of functional expenses presents expenses grouped by nature and function. The natural classification of expenses involves categories such as salaries, rent, supplies, and travel. On the other hand, the functional classification groups expenses according to their purpose. These purposes are typically shown as program services and supporting services, with supporting services being broken down further into management and general, fundraising and membership development (if applicable).

So, why is this information important? These modifications to the nonprofit financial statements are intended to provide more meaningful information to the users of the financial statements. Different users desire different information regarding the breakdown of expenses. With that, management is typically more concerned with the natural classification while the users of the financial statements, such as donors and grantees, are curious about how the money is being used as a functional classification with an eye on efficiency.

How To Build A Statement of Functional Expenses

To build a statement of functional expenses, an organization must allocate costs among the different programs and supporting services categories. Also, all costs can be allocated directly or indirectly.

Direct costs are those that relate to only one classification such as meals provided for an after-school program or rent for a building that is solely used for providing a specific program. However, indirect costs are those that apply to more than one category or would be too cumbersome to allocate directly. These indirect costs can include items such as rent and utilities for general buildings or depreciation and should be allocated through an appropriate basis (such as square footage for occupancy costs or salaries for benefits).

It’s important for the organization to consider each section of expenses, and I recommend developing a written policy that exhibits the intended allocation methods. This should be applied consistently with few exceptions and variations because the new guidance requires disclosure in the footnotes of the methods used for allocating expenses for functional classification.

What To Look Out For

To ensure you’re properly adhering to the new nonprofit accounting guidance, it’s important to understand what to look out for. Take a look at the following considerations:

- Make sure you are actually allocating expenses that should be allocated. Sometimes organizations will lump depreciation, insurance, or interest costs into general and administrative. However, these often represent costs that could be partially applied to the programs that are benefiting from the use of the related property (which is depreciating, is being insured, or has debt associated with it).

- Make sure any expenses that are netted against revenues for GAAP purposes (such as event costs) are included in the statement of functional expenses.

- Consider what fundraising costs you have. If your organization receives donations or grants, it is likely to have costs associated with soliciting the contributions or writing the grant request.

- Use your accounting system to your advantage. Take advantage of ways to allocate expenses within the system to simplify the process. Do not over-complicate your processes. If you have a simple operation, keep it that way!

- Do not get caught in the “overhead myth”. While some donors and grantors compare organizations and award gifts and competitive grants based on efficiency (desiring a low ratio of supporting services to total overall costs), the true measure of an organization’s success should focus on program accomplishments. I’m all for efficiency, but sometimes a bit more administrative work can influence a much greater organizational impact without much cost to the program.

If you want to know more about the new accounting guidance for nonprofits or how to correctly build a statement of functional expenses, email Rea & Associates . Financial reporting for your nonprofit organization should not be overlooked.

After you’ve spent the time learning about and building your statement of functional expenses, go outside and enjoy some real nature (I know that’s my plan).

By Mark Beebe, CPA (Zanesville office)

Check out these resources for more valuable not-for-profit insights:

Take Your Nonprofit To New Heights

Care, Compliance, Loyalty & Financial Accountability

Setting The Bar Higher

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Make a “Good” Presentation “Great”

- Guy Kawasaki

Remember: Less is more.

A strong presentation is so much more than information pasted onto a series of slides with fancy backgrounds. Whether you’re pitching an idea, reporting market research, or sharing something else, a great presentation can give you a competitive advantage, and be a powerful tool when aiming to persuade, educate, or inspire others. Here are some unique elements that make a presentation stand out.

- Fonts: Sans Serif fonts such as Helvetica or Arial are preferred for their clean lines, which make them easy to digest at various sizes and distances. Limit the number of font styles to two: one for headings and another for body text, to avoid visual confusion or distractions.

- Colors: Colors can evoke emotions and highlight critical points, but their overuse can lead to a cluttered and confusing presentation. A limited palette of two to three main colors, complemented by a simple background, can help you draw attention to key elements without overwhelming the audience.

- Pictures: Pictures can communicate complex ideas quickly and memorably but choosing the right images is key. Images or pictures should be big (perhaps 20-25% of the page), bold, and have a clear purpose that complements the slide’s text.

- Layout: Don’t overcrowd your slides with too much information. When in doubt, adhere to the principle of simplicity, and aim for a clean and uncluttered layout with plenty of white space around text and images. Think phrases and bullets, not sentences.

As an intern or early career professional, chances are that you’ll be tasked with making or giving a presentation in the near future. Whether you’re pitching an idea, reporting market research, or sharing something else, a great presentation can give you a competitive advantage, and be a powerful tool when aiming to persuade, educate, or inspire others.

- Guy Kawasaki is the chief evangelist at Canva and was the former chief evangelist at Apple. Guy is the author of 16 books including Think Remarkable : 9 Paths to Transform Your Life and Make a Difference.

Partner Center

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Published: 17 July 2024

Split intein-mediated protein trans -splicing to express large dystrophins

- Hichem Tasfaout ORCID: orcid.org/0000-0003-1902-606X 1 , 2 ,

- Christine L. Halbert 1 , 2 ,

- Timothy S. McMillen 3 ,

- James M. Allen 1 , 2 ,

- Theodore R. Reyes 1 , 2 ,

- Galina V. Flint 3 ,

- Dirk Grimm ORCID: orcid.org/0000-0001-6227-5665 4 , 5 , 6 ,

- Stephen D. Hauschka 2 , 7 ,

- Michael Regnier 2 , 3 , 8 &

- Jeffrey S. Chamberlain ORCID: orcid.org/0000-0001-5299-0059 1 , 2 , 7 , 8

Nature ( 2024 ) Cite this article

Metrics details

- Gene expression

- Gene therapy

Gene replacement using adeno-associated virus (AAV) vectors is a promising therapeutic approach for many diseases 1 , 2 . However, this therapeutic modality is challenged by the packaging capacity of AAVs (approximately 4.7 kilobases) 3 , limiting its application for disorders involving large coding sequences, such as Duchenne muscular dystrophy, with a 14 kilobase messenger RNA. Here we developed a new method for expressing large dystrophins by utilizing the protein trans -splicing mechanism mediated by split inteins. We identified several split intein pairs that efficiently join two or three fragments to generate a large midi-dystrophin or the full-length protein. We show that delivery of two or three AAVs into dystrophic mice results in robust expression of large dystrophins and significant physiological improvements compared with micro-dystrophins. Moreover, using the potent myotropic AAVMYO 4 , we demonstrate that low total doses (2 × 10 13 viral genomes per kg) are sufficient to express large dystrophins in striated muscles body-wide with significant physiological corrections in dystrophic mice. Our data show a clear functional superiority of large dystrophins over micro-dystrophins that are being tested in clinical trials. This method could benefit many patients with Duchenne or Becker muscular dystrophy, regardless of genotype, and could be adapted to numerous other disorders caused by mutations in large genes that exceed the AAV capacity.

This is a preview of subscription content, access via your institution

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

24,99 € / 30 days

cancel any time

Subscribe to this journal

Receive 51 print issues and online access

185,98 € per year

only 3,65 € per issue

Buy this article

- Purchase on Springer Link

- Instant access to full article PDF

Prices may be subject to local taxes which are calculated during checkout

Data availability

The full protein sequences of split inteins are described in Supplementary Table 1. These sequences were found in ‘The Intein Database and Registry’ (InBase: http://www.biocenter.helsinki.fi/bi/iwai/InBase/tools.neb.com/inbase/list.html ). Codon-optimized DNA is described in Supplementary Table 2 . All relevant data that support the findings of this study are available in the Supplementary Information. Source data are provided with this paper.

Li, C. W. & Samulski, R. J. Engineering adeno-associated virus vectors for gene therapy. Nat. Rev. Genet. 21 , 255–272 (2020).

Article CAS PubMed Google Scholar

Issa, S. S., Shaimardanova, A. A., Solovyeva, V. V. & Rizvanov, A. A. Various AAV serotypes and their applications in gene therapy: an overview. Cells 12 , 785 (2023).

Article CAS PubMed PubMed Central Google Scholar

Srivastava, A., Lusby, E. W. & Berns, K. I. Nucleotide sequence and organization of the adeno-associated virus 2 genome. J. Virol. 45 , 555–564 (1983).

Weinmann, J. et al. Identification of a myotropic AAV by massively parallel in vivo evaluation of barcoded capsid variants. Nat. Commun. 11 , 5432 (2020).

Article ADS CAS PubMed PubMed Central Google Scholar

Monaco, A. P. et al. Detection of deletions spanning the Duchenne muscular dystrophy locus using a tightly linked DNA segment. Nature 316 , 842–845 (1985).

Article ADS CAS PubMed Google Scholar

Kunkel, L. M. et al. Analysis of deletions in DNA from patients with Becker and Duchenne muscular dystrophy. Nature 322 , 73–77 (1986).

Danialou, G. et al. Dystrophin-deficient cardiomyocytes are abnormally vulnerable to mechanical stress-induced contractile failure and injury. FASEB J. 15 , 1655–1657 (2001).

Petrof, B. J., Shrager, J. B., Stedman, H. H., Kelly, A. M. & Sweeney, H. L. Dystrophin protects the sarcolemma from stresses developed during muscle contraction. Proc. Natl Acad. Sci. USA 90 , 3710–3714 (1993).

Ervasti, J. M. & Campbell, K. P. Membrane organization of the dystrophin-glycoprotein complex. Cell 66 , 1121–1131 (1991).

Ervasti, J. M. & Campbell, K. P. A role for the dystrophin-glycoprotein complex as a transmembrane linker between laminin and actin. J. Cell Biol. 122 , 809–823 (1993).

Emery, A. E. H. The muscular dystrophies. Lancet 359 , 687–695 (2002).

Banks, G. B., Judge, L. M., Allen, J. M. & Chamberlain, J. S. The polyproline site in hinge 2 influences the functional capacity of truncated dystrophins. PLoS Genet. 6 , e1000958 (2010).

Article PubMed PubMed Central Google Scholar

Gregorevic, P. et al. rAAV6-microdystrophin preserves muscle function and extends lifespan in severely dystrophic mice. Nat. Med. 12 , 787–789 (2006).

Ramos, J. N. et al. Development of novel micro-dystrophins with enhanced functionality. Mol. Ther. 27 , 623–635 (2019).

Bostick, B. et al. AAV micro-dystrophin gene therapy alleviates stress-induced cardiac death but not myocardial fibrosis in >21-m-old mdx mice, an end-stage model of Duchenne muscular dystrophy cardiomyopathy. J. Mol. Cell. Cardiol. 53 , 217–222 (2012).

Harper, S. Q. et al. Modular flexibility of dystrophin: implications for gene therapy of Duchenne muscular dystrophy. Nat. Med. 8 , 253–261 (2002).

Wasala, L. P. et al. The implication of hinge 1 and hinge 4 in micro-dystrophin gene therapy for Duchenne muscular dystrophy. Hum. Gene Ther. https://doi.org/10.1089/hum.2022.180 (2022).

Birch, S. M. et al. Assessment of systemic AAV-microdystrophin gene therapy in the GRMD model of Duchenne muscular dystrophy. Sci. Transl. Med. 15 , eabo1815 (2023).

Koo, T., Popplewell, L., Athanasopoulos, T. & Dickson, G. Triple trans-splicing adeno-associated virus vectors capable of transferring the coding sequence for full-length dystrophin protein into dystrophic mice. Hum. Gene Ther. 25 , 98–108 (2014).

Lai, Y. et al. Efficient in vivo gene expression by trans-splicing adeno-associated viral vectors. Nat. Biotechnol. 23 , 1435–1439 (2005).

Lostal, W., Kodippili, K., Yue, Y. P. & Duan, D. S. Full-length dystrophin reconstitution with adeno-associated viral vectors. Hum. Gene Ther. 25 , 552–562 (2014).

Odom, G. L., Gregorevic, P., Allen, J. M. & Chamberlain, J. S. Gene therapy of mdx mice with large truncated dystrophins generated by recombination using rAAV6. Mol. Ther. 19 , 36–45 (2011).

Shah, N. H. & Muir, T. W. Inteins: nature’s gift to protein chemists. Chem. Sci. 5 , 446–461 (2014).

Esposito, F. et al. Liver gene therapy with intein-mediated F8 trans-splicing corrects mouse haemophilia A. EMBO Mol. Med. 14 , e15199 (2022).

Li, Y. F. Split-inteins and their bioapplications. Biotechnol. Lett 37 , 2121–2137 (2015).

Article PubMed Google Scholar

Padula, A. et al. Full-length ATP7B reconstituted through protein trans-splicing corrects Wilson disease in mice. Mol. Ther. Methods Clin. Dev. 26 , 495–504 (2022).

Tornabene, P. et al. Inclusion of a degron reduces levels of undesired inteins after AAV-mediated protein trans-splicing in the retina. Mol. Ther. Methods Clin. Dev. 23 , 448–459 (2021).

Tornabene, P. et al. Intein-mediated protein trans-splicing expands adeno-associated virus transfer capacity in the retina. Sci. Transl. Med. 11 , eaav4523 (2019).

Li, J., Sun, W. C., Wang, B., Xiao, X. & Liu, X. Q. Protein trans-splicing as a means for viral vector-mediated in vivo gene therapy. Hum. Gene Ther. 19 , 958–964 (2008).

Carvajal-Vallejos, P., Pallissé, R., Mootz, H. D. & Schmidt, S. R. Unprecedented rates and efficiencies revealed for new natural split inteins from metagenomic sources. J. Biol. Chem. 287 , 28686–28696 (2012).

Caspi, J., Amitai, G., Belenkiy, O. & Pietrokovski, S. Distribution of split DnaE inteins in cyanobacteria. Mol. Microbiol. 50 , 1569–1577 (2003).

Shah, N. H., Dann, G. P., Vila-Perelló, M., Liu, Z. H. & Muir, T. W. Ultrafast protein splicing is common among cyanobacterial split inteins: implications for protein engineering. J. Am. Chem. Soc. 134 , 11338–11341 (2012).

Abedi, M. R., Caponigro, G. & Kamb, A. Green fluorescent protein as a scaffold for intracellular presentation of peptides. Nucleic Acids Res. 26 , 623–630 (1998).

Crudele, J. M. & Chamberlain, J. S. AAV-based gene therapies for the muscular dystrophies. Hum. Mol. Genet. 28 , R102–R107 (2019).

Boer, J. M., de Meijer, E. J., Mank, E. M., van Ommen, G. B. & den Dunnen, J. T. Expression profiling in stably regenerating skeletal muscle of dystrophin-deficient mice. Neuromuscul. Disord. 12 , S118–S124 (2002).

Torres, L. F. B. & Duchen, L. W. The mutant mdx: inherited myopathy in the mouse. Morphological studies of nerves, muscles and end-plates. Brain 110 , 269–299 (1987).

Bengtsson, N. E., Tasfaout, H., Hauschka, S. D. & Chamberlain, J. S. Dystrophin gene-editing stability is dependent on dystrophin levels in skeletal but not cardiac muscles. Mol. Ther. 29 , 1070–1085 (2021).

Lynch, G. S., Hinkle, R. T., Chamberlain, J. S., Brooks, S. V. & Faulkner, J. A. Force and power output of fast and slow skeletal muscles from mdx mice 6–28 months old. J. Physiol. 535 , 591–600 (2001).

Pastoret, C. & Sebille, A. Mdx mice show progressive weakness and muscle deterioration with age. J. Neurol. Sci. 129 , 97–105 (1995).

Stedman, H. H. et al. The mdx mouse diaphragm reproduces the degenerative changes of Duchenne muscular dystrophy. Nature 352 , 536–539 (1991).

Lefaucheur, J. P., Pastoret, C. & Sebille, A. Phenotype of dystrophinopathy in old mdx mice. Anat. Rec. 242 , 70–76 (1995).

Chamberlain, J. S., Metzger, J., Reyes, M., Townsend, D. W. & Faulkner, J. A. Dystrophin-deficient mdx mice display a reduced life span and are susceptible to spontaneous rhabdomyosarcoma. FASEB J. 21 , 2195–2204 (2007).

England, S. B. et al. Very mild muscular dystrophy associated with the deletion of 46% of dystrophin. Nature 343 , 180–182 (1990).

El Andari, J. et al. Semirational bioengineering of AAV vectors with increased potency and specificity for systemic gene therapy of muscle disorders. Sci. Adv. 8 , eabn4704 (2022).

Tabebordbar, M. et al. Directed evolution of a family of AAV capsid variants enabling potent muscle-directed gene delivery across species. Cell 184 , 4919–4938.e22 (2021).

Hartigan-O’Connor, D., Kirk, C. J., Crawford, R., Mule, J. J. & Chamberlain, J. S. Immune evasion by muscle-specific gene expression in dystrophic muscle. Mol. Ther. 4 , 525–533 (2001).

Cordier, L. et al. Muscle-specific promoters may be necessary for adeno-associated virus-mediated gene transfer in the treatment of muscular dystrophies. Hum. Gene Ther. 12 , 205–215 (2001).

Boennemann, C. G. et al. Dystrophin immunity after gene therapy for Duchenne’s muscular dystrophy. N. Engl. J. Med. 388 , 2294–2296 (2023).

Article Google Scholar

Halbert, C. L., Allen, J. M. & Chamberlain, J. S. AAV6 vector production and purification for muscle gene therapy. Methods Mol. Biol. 1687 , 257–266 (2018).

Dellorusso, C., Crawford, R. W., Chamberlain, J. S. & Brooks, S. V. Tibialis anterior muscles in mdx mice are highly susceptible to contraction-induced injury. J. Muscle Res. Cell Motil. 22 , 467–475 (2001).

Gregorevic, P., Plant, D. R., Leeding, K. S., Bach, L. A. & Lynch, G. S. Improved contractile function of the mdx dystrophic mouse diaphragm muscle after insulin-like growth factor-I administration. Am. J. Pathol. 161 , 2263–2272 (2002).

Kolwicz, S. C., Jr. & Tian, R. Assessment of cardiac function and energetics in isolated mouse hearts using 31P NMR spectroscopy. J. Vis. Exp. https://doi.org/10.3791/2069 (2010).

Kolwicz, S. C. Jr. et al. Gene therapy rescues cardiac dysfunction in Duchenne muscular dystrophy mice by elevating cardiomyocyte deoxy-adenosine triphosphate. JACC Basic Transl. Sci. 4 , 778–791 (2019).

Rafael, J. A. et al. Forced expression of dystrophin deletion constructs reveals structure-function correlations. J. Cell Biol. 134 , 93–102 (1996).

Download references

Acknowledgements

We thank the Histology and Imaging Core of the University of Washington for the excellent technical assistance. AAV vector production was facilitated by the Viral Vector Core of the Wellstone Muscular Dystrophy Specialized Research Center (grant no. P50AR065139). This work was supported by research grants from the Muscular Dystrophy Association (MDA, USA), the Center for Translational Muscle Research (grant no. P30AR074990), and the Diabetes Research Center (grant no. P30DK017047). H.T. was supported by fellowships from the Bettencourt Schueller Foundation, the Philippe Foundation and Association Française Contre Les Myopathies (AFM-Telethon). D.G. is grateful for funding through the program COMMUTE via the Bundesministerium für Bildung und Forschung.

Author information

Authors and affiliations.

Department of Neurology, University of Washington School of Medicine, Seattle, WA, USA

Hichem Tasfaout, Christine L. Halbert, James M. Allen, Theodore R. Reyes & Jeffrey S. Chamberlain

Senator Paul D. Wellstone Muscular Dystrophy Specialized Research Center, University of Washington School of Medicine, Seattle, WA, USA

Hichem Tasfaout, Christine L. Halbert, James M. Allen, Theodore R. Reyes, Stephen D. Hauschka, Michael Regnier & Jeffrey S. Chamberlain

Department of Bioengineering, College of Engineering and School of Medicine, University of Washington, Seattle, WA, USA

Timothy S. McMillen, Galina V. Flint & Michael Regnier

Department of Infectious Diseases/Virology, Section Viral Vector Technologies, Medical Faculty and Faculty of Engineering Sciences, Center for Integrative Infectious Disease Research (CIID), University of Heidelberg, Heidelberg, Germany

BioQuant, University of Heidelberg, Heidelberg, Germany

German Center for Infection Research (DZIF) and German Center for Cardiovascular Research (DZHK), Heidelberg, Germany

Department of Biochemistry, University of Washington School of Medicine, Seattle, WA, USA

Stephen D. Hauschka & Jeffrey S. Chamberlain

Center for Translational Muscle Research, University of Washington, Seattle, WA, USA

Michael Regnier & Jeffrey S. Chamberlain

You can also search for this author in PubMed Google Scholar

Contributions

H.T. and J.S.C. conceived the project and designed the experiments. J.M.A. generated AAV vectors. C.L.H. purified and titered the AAV preparations. D.G. provided the plasmid containing AAVMYO capsid. S.D.H. provided the CK8e expression cassette. T.R.R. prepared reagents and plasmids, and analysed muscle histology. T.S.M. and G.V.F. analysed the cardiac function. M.R. provided reagents and equipment to analyse the cardiac function. H.T. carried out all other experiments and wrote the manuscript with input from all co-authors. J.S.C. and S.D.H. provided reagents and advice and edited the manuscript.

Corresponding authors

Correspondence to Hichem Tasfaout or Jeffrey S. Chamberlain .

Ethics declarations

Competing interests.

The University of Washington has intellectual property based on the findings of this study. J.S.C. and S.D.H. are inventors of patents covering ∆R4-R23/∆CT µDys, µDys5 and CK8e expression cassettes. D.G. is an inventor of a patent describing the development of the AAVMYO capsid. The other authors declare no competing interests.

Peer review

Peer review information.

Nature thanks Ronald Cohn, Jacques Tremblay and the other, anonymous, reviewer(s) for their contribution to the peer review of this work. Peer reviewer reports are available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Extended data figures and tables

Extended data fig. 1 validation of gfp as a platform for split intein screening..