How to Read and Analyze an Income Statement

Heather Liston

7 min. read

Updated November 7, 2023

Ever feel a little left out when people start chatting about P&L’s? How about when the talk turns to income statements, or profit and loss reports, or even a “statement of activities”? The first bit of good news is that all of these refer to the same thing, so you may not have as much to learn as you thought. The second is that an income statement is based on a few very simple concepts, which you already understand.

The basic suite of financial statements a company produces, at least annually, consists of the statement of cash flows, the balance sheet (or statement of financial position), and the income statement.

The ones that people most often look at (and most often pretend to understand), are the latter two. The major difference between them is this: the balance sheet is essentially a snapshot, while the income statement is a movie. In other words, the balance sheet shows what you own (assets) and what you owe (liabilities) at a moment in time (most often as of December 31). The income statement shows what happens over a period of time (usually a year): what comes in, what goes out, and what’s left over at the end.

Here is an example of a basic income statement, covering the period of one month:

Revenue (or Gross Income):

- Allowance $2.00

- Candy ($1.50)

Net Income: $ .50

See how that works? The top section lists money coming in during the period, the middle section lists money going out, and the bottom line is the difference between the two. All the math you need to produce or proofread this statement is a little basic subtraction.

Now flip open the annual report of any Fortune 500 company and find the income statement. What you see, in basic concept and structure, will be exactly like the one above. The only difference is that it has a lot more lines.

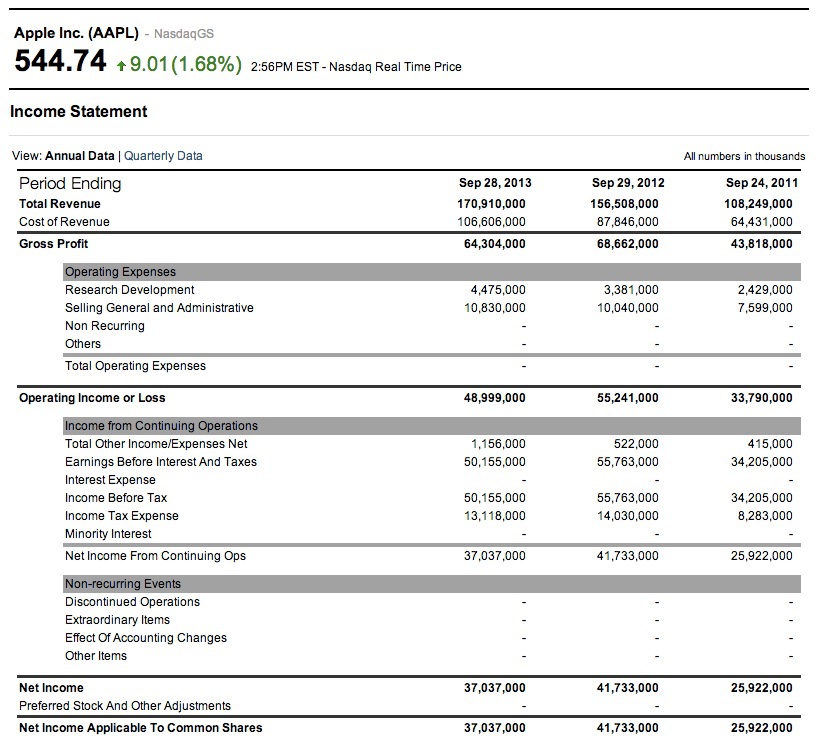

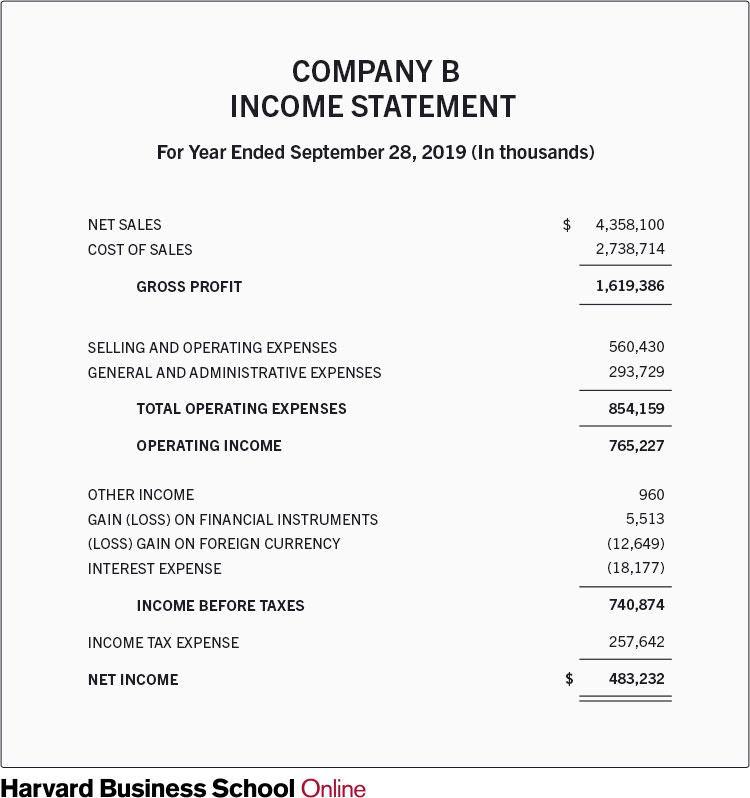

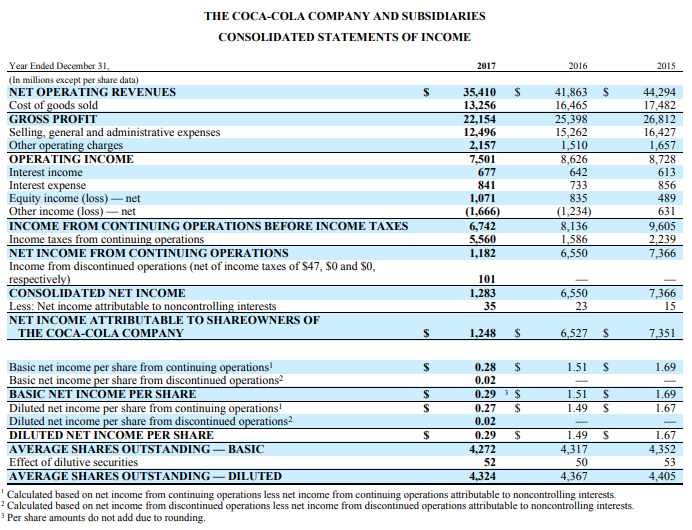

As companies get larger, they start making a few common variations on the structure. Many, for example, have a section at the top that starts with total revenue, then subtracts “cost of revenue” and shows the difference as “gross profit”. The “cost of revenue” line is the total of all expenses the company deems to be directly related to generating the revenue, such as the cost of purchasing inventory. From the gross profit, they then subtract normal operating expenses, like administration and research and development, which leads to another sub-total called, usually, “operating income,” or, more jargonistically, EBIT or EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization). From that, obviously, interest and taxes (and maybe depreciation and amortization) have to be subtracted before the statement shows the final net income line.

All the complexity sketched out in the previous paragraph, though, is nothing more than a little rearrangement of the basic elements—income and expenses—into some sub-categories. The same principles still apply, even when things start to look complicated. No matter what, the income statement includes just income, expenses, and differences between the two. And income is always listed before expense in any group; it’s just that some companies do more sub-grouping before they get to the bottom line.

No matter what twists and turns you take along the way, the last number on the income statement is crucial. It is labeled “Net Income” above, but it also goes by names like “surplus,” “the bottom line,” or maybe “contribution to savings.” If the bottom line is a negative number, it will most often be called the “deficit” or “loss.” The math and the meaning are exactly the same; these are purely terminology issues.

If you’re asked to review an income statement and you’re not sure where to start, here are a few things to do:

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 1. Check all the math

Yes, errors occur even in printed, published statements; even in ones produced by major companies. If you find an error, you look smart—and you might also uncover something that changes the results completely. Also, as you run through the adding and subtracting, you will improve your own understanding of exactly how the numbers fit together.

2. Find the bottom line (Should be easy—it’s at the bottom)

On a very basic level, it’s good to see a positive number there. That means the company earned more than it spent during this period. That means it can pay its employees, keep the lights on, and not be forced to borrow money. But if that bottom line is preceded by a minus sign, or printed in red, or enclosed in parentheses, then expenses exceeded revenue. Find out why. And what the plan is for making the red turn to black.

A net loss once in a while does not necessarily imply disaster. Sometimes new companies have a lot of start-up costs and do not expect to turn a profit in the first year or three. Or maybe the business in question is a cyclical one, like agriculture: if your company grows corn and there was no rain this year you will likely show a loss. Perfectly normal; some years are up; some are down. On the other hand, if net losses become a trend, or if the company does not have enough cash to fund its expenses during the down times, there could be a problem.

- 3. Look at the sources of income

Do they make sense for the business? For example, if you’re in the cotton candy business, then sales income from the county fair sounds right. But if one income line is “gifts from friends” that’s probably not sustainable. What about next year when those friends don’t come through again?

Or say you’re reviewing the statements for a museum. Ten percent of their income came from admission fees last year and 90 percent came from ticket sales for a special blockbuster exhibit that came through town. Fine, as long as there will be a new blockbuster exhibit every year. If that was a non-repeatable event, though, you will want to ask questions about whether the revenue model is sustainable.

- 4. Look at the expense categories

Are they logical? For most businesses, you will see salaries and wages, insurance, rent, supplies, interest, and at least a few other things. Is anything missing that you would expect to see? For example, if the business has a hundred employees and you don’t see rent, or mortgage interest, find out why. Is there an office? If not, why not? If yes, how is it being paid for?

- 5. Now look at the amounts: What are the biggest expenses?

If this is a service business, expect to see a large number for salaries. If it’s a manufacturing business, materials and supplies may logically be a significant total. On the other hand, what if you know the company has only three employees but the salary line is extremely high? Is someone being overpaid? Are there more people working there than you realized? Or what if the president told you the company has been profitable for years but you see high interest expense? Find out why the company is borrowing money, and from whom, and whether they’re paying a reasonable rate.

- 6. Compare year-over-year numbers

Usually, the income statement will have separate column showing the figures for the prior year. If the document doesn’t already show the percentage change in every category, calculate those numbers yourself. Question any significant changes. Like, why is sales income 50 percent lower this year than last? Why is insurance 20 percent lower? Did the entity rack up such a great safety record that the insurer lowered its rates? Maybe. But maybe the reduced insurance number has a negative cause—like one of the policies was canceled and the company is at risk in some way.

- 7. Think about logical relationships between numbers

For example, at most companies these days employee benefits (like health insurance, retirement plan contributions, parking passes) are a significant cost. If the salary line doubled but the benefits number went up by only 10 percent, that should strike you as odd. Is there some reason the new employees do not qualify for benefits? Did the company drop one of its benefit plans?

All these questions may have perfectly reasonable answers, but sorting through them will help you understand what’s going on, and give you confidence that you know what you’re talking about when it comes to income statements.

You do. Revenue minus expenses equals the bottom line. Everything else is details.

Ready to get started? Download our free Profit and Loss Template today.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Heather C. Liston is a San Francisco-based writer, specializing in financial topics.

Table of Contents

- 2. Find the bottom line (Should be easy—it’s at the bottom)

Related Articles

7 Min. Read

Turn What-if to What-Now: The Importance of Scenario Analysis

6 Min. Read

How to Conduct a Plan Vs Actual Analysis With Spreadsheets

10 Min. Read

How Plan Vs Actual Comparison Helps You Manage Your Business

How to Make Sense of Your Small Business Financial Statements

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to Read Income Statement: Expert Guide to Financial Analysis

- Banking & Finance

- Bookkeeping

- Business Operations

- Starting a Business

Income statements are an essential financial document for investors and business owners, providing valuable insights into a company’s financial performance over a specified period, usually a quarter or a year. These statements summarize the financial transactions, including revenues, expenses, and net income, allowing you to assess a company’s profitability and overall financial health. By understanding how to read an income statement, you’ll be equipped with the knowledge to make informed decisions about investments and business operations.

A comprehensive analysis of an income statement involves understanding the income statement structure, breaking down expenses, analyzing revenue streams, and evaluating the enterprise’s profitability. Additionally, you will need to comprehend tax obligations, the role of depreciation and amortization, and how to decipher key income statement metrics. Comparing the income statement to other financial statements, like balance sheets and cash flow statements, will give you a holistic perspective on a company’s financial position.

Key Takeaways

- Income statements help investors and business owners assess a company’s financial performance and profitability over a specified period.

- Analyzing an income statement requires understanding its structure, breaking down expenses, and evaluating revenue streams.

- Comparing income statements to other financial statements provides a comprehensive understanding of an organization’s financial health.

Understanding the Income Statement Structure

Components of an income statement.

An income statement, also known as a profit and loss (P&L) statement, provides an overview of a company’s financial performance over a specific reporting period. The primary components of an income statement are revenue , expenses , and net income . It is structured using the following formula: Net Income = (Revenue – Expenses) + Gains – Losses.

- Revenue : This represents the money earned from sales or services provided during the reporting period. It is calculated as net sales , which is the total sales minus any discounts, allowances, or returns.

- Expenses : These are the costs incurred in carrying out business activities. The most important expense is the cost of goods sold (COGS) , which represents the cost of producing or acquiring the goods being sold.

- Gross Profit : This is calculated as Revenue – COGS and represents the profit made after considering the direct costs associated with producing the goods or providing services.

- Operating Income : This is determined by subtracting operating expenses (e.g., salaries, rent, and utilities) from gross profit.

- Net Income : The final figure represents the company’s profit or loss after accounting for non-operating items such as interest expenses, taxes, and extraordinary gains or losses.

The Difference Between Single-Step and Multi-Step

There are two primary formats for presenting an income statement: single-step and multi-step.

Single-Step Income Statement In the single-step format, all revenues and gains are grouped together, and all expenses and losses are grouped together. This approach displays only the final result, making it easier to read and understand. The single-step method uses the following format:

Multi-Step Income Statement The multi-step format offers a more detailed view of a company’s financial performance by dividing the statement into several sections. This results in the calculation of gross profit, operating income, and net income. A typical multi-step income statement structure is:

In summary, understanding the structure of an income statement is vital for evaluating a company’s financial performance. Familiarize yourself with the components, and pay attention to the format used, whether it’s a single-step or multi-step income statement, to make informed decisions about the company’s profitability and financial health.

Analyzing Revenue Streams

Total revenue.

Total revenue is a crucial figure for any business to consider, as it represents the total amount of money generated from the sale of goods or services. In an income statement , this figure is typically displayed at the top section – ensuring it is one of the first things to be noticed.

To analyze total revenue, start by examining the following components:

- Sales Revenue : The primary source of revenue for most businesses, this refers to the income generated from selling products or services.

- Other Revenues : These can include additional sources of income such as rental income, licensing fees, or royalties.

When looking at total revenue, it is essential to consider the period in question as well, such as quarterly or annual data. Comparing these figures over time will reveal any growth or decline in the company’s revenue-generating ability.

Net Sales Analysis

Net sales, a subsection of total revenue, is arrived at by subtracting any returns, allowances, and discounts from the gross sales figure. To conduct a comprehensive net sales analysis, follow these steps:

- Examine Gross Sales : Begin by reviewing the overall amount generated from sales before any deductions are made.

- Identify Deductions : Investigate the amounts subtracted, such as returns, allowances, and discounts offered to customers. These should be itemized and detailed within the income statement.

- Calculate Net Sales : Finally, subtract the total deductions from the gross sales figure to identify the net sales amount.

Comparing net sales across different financial periods reveals insights into the company’s sales performance, efficiency, and customer satisfaction levels. A continuous increase in returns, for instance, may indicate a product quality issue, while a larger volume of discounts may signal the need for a pricing strategy revision.

By carefully examining both total revenue and net sales, readers can gain valuable insights into a company’s financial health. This information, in turn, can guide future business decisions and strategies.

Breaking Down Expenses

When reading an income statement, it’s essential to understand the different types of expenses a company incurs. This section will cover the main categories of expenses: Cost of Goods Sold (COGS) , Operating Expenses , and Non-operating Expenses .

Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS) represents the direct costs associated with producing the goods or services sold by a company. This includes expenses such as raw materials, labor, and manufacturing overhead. Essentially, COGS demonstrates how much it costs a company to produce its products or services.

Here is a simple table to illustrate the components of COGS:

Operating Expenses

Operating Expenses are the costs a company incurs to run its business operations, excluding production costs. These expenses include Selling, General, and Administrative (SG&A) costs, such as marketing, sales, office rent, utilities expenses, and employee salaries not directly linked to production. They also comprise depreciation and amortization associated with the company’s assets.

To provide better understanding, below is a list of common operating expenses:

- Marketing and Advertising

- Salaries and Wages (not directly tied to production)

- Rent and Utilities

- Office Supplies

- Depreciation and Amortization

Non-operating Expenses

Non-operating Expenses are costs unrelated to a company’s core business operations. They may include interest expense from borrowed funds, one-time expenses such as losses from the sale of assets, and other costs unrelated to the primary business activities of the company.

Here are some examples of non-operating expenses:

- Interest Expense on Debt

- Losses from the Sale of Assets

- Legal Settlements

- Impairment Charges

To summarize, understanding the breakdown of expenses on an income statement is crucial for analyzing a company’s financial health. Grasping the differences between COGS, operating expenses, and non-operating expenses enables you to identify the primary drivers of a company’s profitability and make informed decisions.

Evaluating Profitability

Gross profit margin.

Gross profit margin is the first key element to assess a company’s profitability. It is calculated as gross profit divided by revenue. Gross profit is the difference between the total revenue and the cost of goods sold (COGS). This margin represents the percentage of revenue that a company retains after considering the cost of producing its goods or services.

To compute the gross profit margin, use this formula:

A higher gross profit margin usually indicates better financial health, as it shows that the company can efficiently produce its goods or services and generate a profit.

Operating Income vs. Net Income

Another important aspect of evaluating profitability is comparing operating income with net income . Operating income, also known as operating profit or operating earnings, represents the income generated from the regular business operations, excluding any non-operating income or expenses.

Net income or net profit, on the other hand, is the bottom line of the income statement that considers all revenues and expenses, including financial, operating, and tax expenses. It is essential to understand the difference between operating income and net income to assess how effectively the company is managing its resources and whether it can generate sustainable profitability.

A higher operating income usually implies that the company has effective cost management while a higher net income indicates a better overall financial performance.

Earnings Before Interest and Taxes (EBITDA)

Lastly, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a widely used financial metric to measure a company’s profitability and ability to generate cash flow from its operations. EBITDA is a non-GAAP measure that removes the impact of financial, accounting, and tax-related elements from net income, providing a more accurate comparison of a company’s operational performance across industries and periods.

To compute EBITDA, add back depreciation, amortization, interest, and taxes to the net income:

A higher EBITDA indicates stronger operational performance and suggests that the company is generating sufficient cash flow to fund its growth and meet its financial obligations. Analyzing EBITDA can help identify trends in a company’s profitability and cash flow generation, making it a useful tool for investors and analysts.

Comprehending Tax Obligations

Income before taxes.

When analyzing an income statement, it’s essential to understand the income before taxes . This figure represents the company’s earnings after expenses, such as production costs and operating expenses, are deducted but before tax expenses are applied. In other words, it is the net income before considering tax obligations.

To calculate income before taxes, follow these steps:

- Begin with the gross revenue (or total sales) for the specific period

- Subtract the cost of goods sold (COGS) to obtain the gross profit

- Deduct operating expenses, which include items like rent, salaries, and utilities

- Remove any other non-operating expenses and gains, such as interest or investment income

Tax Expenses

Once the income before taxes is determined, the next step is to consider the tax expenses . This value is the company’s tax obligation on the income earned during the specified period.

Calculating tax expenses involves applying the current applicable tax rate to the income before taxes. Tax rates may vary depending on the company’s jurisdiction, size, and other factors. Keep in mind that tax regulations and rates change over time, so always reference up-to-date information.

By comprehending both income before taxes and tax expenses, you can gain a clear understanding of a company’s financial performance and its tax obligations. Remember to consistently monitor changes in tax regulations, as they may impact your analysis in the future.

Understanding the Role of Depreciation and Amortization

In this section, we will discuss the importance of depreciation and amortization in an income statement and how they impact the financial health of a business. Both depreciation and amortization affect the value of a company’s assets, with depreciation relating to tangible assets and amortization focusing on intangible assets.

Asset Depreciation

Depreciation is an accounting method that allows companies to allocate the cost of tangible assets, such as machinery, vehicles, and equipment, over their useful life. As these assets are used in the company’s operations, their value reduces over time, reflecting the wear and tear or obsolescence. The depreciation expense is recorded on the income statement, reducing the company’s taxable income and providing a more accurate representation of the business’s financial performance.

The most common methods for calculating depreciation are:

- Straight-line method : This method allocates the cost of the asset evenly over its useful life. To calculate annual depreciation, divide the initial cost of the asset by its useful life (in years).

- Double declining balance method : This method accelerates depreciation, resulting in higher depreciation expense in the early years of an asset’s life. It involves applying double the straight-line rate to the remaining asset value each year.

- Units of production method : This method ties the depreciation expense to the actual usage of the asset, such as the number of units produced or the miles driven.

Amortization of Intangibles

Amortization is a similar concept, applied to intangible assets like patents, copyrights, trademarks, or software. These assets do not have a physical form but contribute to a company’s value and revenue-generating potential. As intangible assets are used in the business, their value diminishes over time, which is reflected in the income statement through amortization expenses.

The process of amortization is usually done using the straight-line method, wherein the cost of the intangible asset is divided by its useful life, resulting in an annual amortization expense.

To recap, both depreciation and amortization play an essential role in assessing the financial performance of a company as they allow for a more accurate representation of the value of its assets. By allocating the cost of tangible and intangible assets over their useful life, these methods help provide a clearer picture of the company’s financial health and allow for informed decision-making for stakeholders.

Deciphering Income Statement Metrics

Key ratios and indicators.

When analyzing an income statement, it is essential to examine key financial ratios and performance indicators. These help provide insight into a company’s financial performance, trends, and stability over time. A few important ratios and indicators include:

- Gross Profit Margin : (Revenue - Cost of Goods Sold) / Revenue . This ratio displays the percentage of revenue left after accounting for the direct costs associated with producing goods or providing services.

- Operating Profit Margin : (Operating Income / Revenue) . This ratio indicates how much of the revenue remains after factoring in all operating expenses, excluding interest and taxes.

- Net Profit Margin : (Net Income / Revenue) . This indicator demonstrates the overall profitability of a company, taking into account all expenses, including interest and taxes.

- Earnings per Share (EPS) : (Net Income - Preferred Dividends) / Weighted Average of Common Shares . This metric demonstrates a company’s profitability on a per-share basis.

Profit and Loss Trends

An essential aspect of reading an income statement is identifying any trends regarding a company’s profits and losses. Comparing revenue, operating income, and net income across multiple periods can highlight potential issues or positive developments within a company’s financial performance. Look for the following trends:

- Increases in revenue : A growing top-line could signal the company’s ability to produce products or services that the market demands and its effectiveness in acquiring customers.

- Improvements in gross and operating profit margins : If the company can consistently achieve higher profit margins, it could indicate strong operational efficiency and cost control.

- Divergence between operating and net income : A significant difference between operating income and net income could suggest that the company is carrying a heavy interest or tax burden, which may impact overall profitability.

Financial Health Indicators

Analyzing an income statement also involves reviewing several metrics related to a company’s financial health. These indicators help assess a company’s ability to generate consistent cash flow and manage its debt obligations. Consider the following financial health metrics:

- Cash Flow from Operating Activities : This metric, obtained from the cash flow statement, highlights the company’s ability to generate cash from its core business operations.

- Debt-to-Equity Ratio : (Total Liabilities / Shareholders' Equity) . This ratio, gathered from the balance sheet, reveals a company’s reliance on borrowed capital to finance operations. A higher ratio may signal higher financial risk.

By using the above metrics and indicators, you can confidently read and analyze an income statement, making informed decisions about a company’s financial performance and stability.

Comparing Income Statement to Other Financial Statements

Relation with balance sheet.

The income statement, also known as the P&L (profit and loss) statement, is one of the crucial financial statements businesses use to evaluate their financial performance. When comparing it to the balance sheet, it’s essential to understand the differences and connections between them. The income statement showcases a company’s revenues, expenses, and net income for a specific period, while the balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a particular point in time.

One primary connection between the two statements is the net income , which is reflected in the retained earnings portion of the equity section on the balance sheet. The net income from the income statement flows into the balance sheet, affecting the retained earnings by either increasing it when the company makes a profit, or decreasing it in case of a loss.

Another vital link between the two statements is the cost of goods sold (COGS) on the income statement. COGS represents the cost of producing or acquiring the goods sold by a company. If a company purchases inventory, the balance sheet will reflect the change in inventory value while the income statement recognises the change in COGS, affecting the net income.

Link to Cash Flow Statement

The cash flow statement is another essential financial statement that demonstrates the flow of cash in three primary categories: operating, investing, and financing activities. While income statement shows whether the company is generating a profit, the cash flow statement provides insights into the company’s ability to generate cash.

There is a direct link between the income statement and cash flow statement, especially in the operating activities section. This section starts with the net income from the income statement and adjusts it for non-cash items such as depreciation and changes in working capital, including accounts receivable, accounts payable, and inventory.

It’s worth noting that a profitable company as shown in the income statement may not always have positive cash flow. This situation may arise due to various factors such as slow receivables collection, high inventory turnover, or significant capital expenditures. Therefore, comparing the income statement with the cash flow statement allows a more comprehensive analysis of a company’s financial stability and performance.

Frequently Asked Questions

What are the key components of an income statement.

An income statement consists of three main sections: revenue, expenses, and net income. Revenue represents the money generated by a business through sales and other services, while expenses cover the costs incurred in running the business, such as cost of goods sold, salaries, and overhead. Net income is the result of subtracting expenses from revenue and shows the company’s overall profitability during a specified period of time.

How can you interpret the company’s profitability from an income statement?

To gauge a company’s profitability, one can look at the net income figure on the income statement. If the net income is positive, it indicates that the company is earning more than it spends and is profitable. A negative net income shows that the company is spending more than it earns, resulting in a loss. Additionally, comparing net income figures over multiple periods can provide insights into the company’s financial health and the effectiveness of its strategies.

In what ways does the balance sheet differ from an income statement?

While an income statement displays a company’s financial performance over a specific period (e.g. a quarter or a year), a balance sheet provides a snapshot of a company’s financial position at a given moment in time. The balance sheet consists of assets, liabilities, and owners’ equity, revealing what the company owns, what it owes, and the equity owned by shareholders.

What steps should be followed to analyze an income statement effectively?

To analyze an income statement effectively, follow these steps:

- Examine the revenue trends: Assess whether the company’s revenue is growing, declining, or remaining consistent over time.

- Review the cost structure: Identify the major expenses and analyze how they are changing in relation to the revenue.

- Calculate the profit margins: Determine gross profit, operating profit, and net profit margins to understand how efficiently the company is operating.

- Compare with competitors: Evaluate the company’s performance against industry peers to identify strengths and weaknesses.

- Analyze the tax rate and interest expenses: These factors can have a significant impact on the company’s net income.

How does the profit and loss statement relate to an income statement?

A profit and loss (P&L) statement is another term for an income statement. It presents a company’s revenues, expenses, and net income (or loss) over a specified period, providing insights into the company’s profitability and financial performance.

What financial insights can be gleaned from comparing consecutive income statements?

Comparing consecutive income statements allows for the identification of trends and shifts in a company’s financial performance. By observing changes in revenue, expenses, and net income, one can gain insights into:

- How the company’s sales strategy is performing

- Fluctuations in production costs and their impact on profitability

- The efficiency of the company’s operations

- The effect of external financial factors, such as market changes or new competitors

- The overall financial health of the company over time

- 1-800-711-3307

- Expense management

- Corporate card

- Tax returns & preparation

- Payment processing

- Tax compliance

- Vision & clarity

- Accounting mobile app

- Reduce your accounting expenses

- What does a bookkeeper do

- Why outsource

- Cash vs. Accrual Accounting

- Guides & ebooks

- How Finally works

- Privacy policy

- Terms of service

*Finally is not a CPA firm © 2024 Finally, Backoffice.co , Inc. All rights reserved.

- Income Statement

Home › Accounting › Financial Statements › Income Statement

- What is an Income Statement?

What is an Income Statement Used For?

Who uses an income statement, income statement format, single step income statement, common income statement questions.

The income statement, also called the profit and loss statement , is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. The income statement is the first financial statement typically prepared during the accounting cycle because the net income or loss must be calculated and carried over to the statement of owner’s equity before other financial statements can be prepared.

The income statement calculates the net income of a company by subtracting total expenses from total income . This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues.

The income and expense accounts can also be subdivided to calculate gross profit and the income or loss from operations. These two calculations are best shown on a multi-step income statement. Gross profit is calculated by subtracting cost of goods sold from net sales. Operating income is calculated by subtracting operating expenses from the gross profit.

Unlike the balance sheet, the income statement calculates net income or loss over a range of time. For example annual statements use revenues and expenses over a 12-month period, while quarterly statements focus on revenues and expenses incurred during a 3-month period.

Income Statement Purpose

It’s important to note that there are several different types of income statements that are created for different reasons. For example, the year-end statement that is prepared annually for stockholders and potential investors doesn’t do much good for management while they are trying to run the company throughout the year. Thus, interim financial statements are prepared for management to check the status of operations during the year. Management also typically prepares departmental statements that break down revenue and expense numbers by business segment.

In the end, the main purpose of all profit and loss statements is to communicate the profitability and business activities of the company with end users. Each one of these end users has their own use for this information. Let’s look at who uses the P&L and what they use it for.

There are two different groups of people who use this financial statement: internal users and external users.

Internal users like company management and the board of directors use this statement to analyze the business as a whole and make decisions on how it is run. For example, they use performance numbers to gauge whether they should open new branch, close a department, or increase production of a product.

External users like investors and creditors, on the other hand, are people outside of the company who have no source of financial information about the company except published reports. Investors want to know how profitable a company is and whether it will grow and become more profitable in the future. They are mainly concerned with whether or not investing their money is the company with yield them a positive return.

Creditors, on the other hand, aren’t as concerned about profitability as investors are. Creditors are more concerned with a company’s cash flow and if they are generating enough income to pay back their loans.

Competitors are also external users of financial statements. They use competitors’ P&L to gauge how well other companies are doing in their space and whether or not they should enter new markets and try to compete with other companies.

There are two income statement formats that are generally prepared.

Single-step income statement – the single step statement only shows one category of income and one category of expenses. This format is less useful of external users because they can’t calculate many efficiency and profitability ratios with this limited data.

Multi-step income statement – the multi-step statement separates expense accounts into more relevant and usable accounts based on their function. Cost of goods sold, operating and non-operating expenses are separated out and used to calculate gross profit, operating income, and net income.

In both income statement formats, revenues are always presented before expenses. Expenses can be listed alphabetically or by total dollar amount. Either presentation is acceptable.

P&L expenses can also be formatted by the nature and the function of the expense.

All income statements have a heading that display’s the company name, title of the statement and the time period of the report. For example, an annual income statement issued by Paul’s Guitar Shop, Inc. would have the following heading:

- Paul’s Guitar Shop, Inc.

- For the Year Ended December 31, 2015

Income Statement Example

Here is an example of how to prepare an income statement from Paul’s adjusted trial balance in our earlier accounting cycle examples.

As you can see, this example income statement is a single-step statement because it only lists expenses in one main category. Although this statement might not be extremely useful for investors looking for detailed information, it does accurately calculate the net income for the year.

This net income calculation can be transferred to Paul’s statement of owner’s equity for preparation.

What is considered an expense on the income statement?

Expenses are outlays of resources for goods or services. These costs include wages, depreciation, and interest expense among others. They are reported on several sections of the income statement. Cost of goods sold expenses are reported in the gross profit reporting section while the operating expenses are reported in the operations section. Other expenses are reported further down the statement in the other gains and losses section.

How do you calculate the income statement?

The income statement is used to calculate the net income of a business. The P&L formula is Revenues – Expenses = Net Income. This is a simple equation that shows the profitability of a company. If revenue is higher than expenses, the company is profitable. If revenue is lower than expenses, the company is unprofitable.

What is a multi step income statement?

A multi-step statement splits the business activities into operating and non-operating categories. The operating section includes sales, cost of goods sold, and all selling and admin expenses. The non-operating section includes other income or expenses like interest or insurance proceeds.

How do you make an income statement?

Creating an income statement is fairly easy. Simply follow these steps:

- Determine the Time Period

- Transfer Income Accounts for Trial Balance into our template

- Transfer Expense Accounts for Trial Balance into our template

- Transfer Other Gains and Losses

- Calculate the Net Income

Use one of our templates to list the sales, expenses, and other gains or losses in the correct format. At the bottom of the statement, compute the net income for the company.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Financial Statements

- Multi Step Income Statement

- Other Comprehensive Income

- Extraordinary Items

- Statement of Stockholders Equity

- Balance Sheet

- Classified Balance Sheet

- Statement of Financial Position

- Cash Flow Statement

- Cash Flows – Direct Method

- Cash Flows – Indirect Method

- Statement of Retained Earnings

- Pro Forma Financial Statements

- Financial Ratios

- Call to +1 844 889-9952

Income Statement Analysis Guide & Free Essay Samples

🔝 top-10 examples of income statement analysis, 🎓 income statement explained, 📋 income statement analysis template, 🚫 income statement limits, ✔️ reading an income statement — tips, 📝 income statement analysis research paper examples, 💡 essay ideas on income statement analysis, 👍 good income statement analysis essay examples to write about, 🎓 simple research paper examples with income statement analysis, ✍️ income statement analysis essay examples for college.

An income statement refers to a financial report that analyzes the company’s earnings and expenses over a specific period. This tool helps businesses cope with financial difficulties and inflation. The importance of an income statement lies in its ability to increase the organization’s profitability and avoid the expenditure of excess funds.

- Financial Statements, Contents and Importance

- Etihad Etisalat Company's Marketing Tactics

- Sharjah Islamic Bank Financial Performance

- Apple Company's Financial Performance

- Apple Company's Performance

- Apple Objectives, Goals for the Future, and Mission: Procurement Analysis

- Automotive Fun and Service Company: Business Plan

- Nike Business Strategy Case Study: Industry, Corporate Social Responsibilities, and Strategic Decisions Analysis

- Pepsi Company Problems and Solutions

- Texas Instruments Inc: Financial Planning and Forecasting

Understanding the definition, types, and significance of an income statement is essential to comprehend how a business operates and how money flows in and out of a company.

What Is an Income Statement?

An income statement is one of 3 critical financial statements that a firm uses to report its financial performance over a specific period. The method compares a company’s revenue with its expenses to get the bottom line, which is the net profit or loss. Also, it helps analyze business efficiency and provides helpful insights into a company’s sales.

What Does an Income Statement Look Like?

The income statements can be different for various businesses but with the same set of data: total revenue , total expenses, and net income. These 3 components represent the very minimum of information. Additional details are typically given to help workers better understand the organization’s financial activity.

The income statement consists of the following components:

- Total revenue is the sum of money a company earns during a reporting period.

- Total expenses are the amount a company spends during a reporting period.

- Net income is total revenues minus all business expenses, including taxes, costs, and allowances.

- Costs of goods sold (COGS) are the direct costs of manufacturing the company’s products or services.

- Product-level revenue is the revenue linked to a specific product the company sells.

- Interest expense is the company’s interest payments on any borrowed funds.

- Gross profit is total revenue without COGS.

- Selling, general, and administrative expenses (SG&A) are all non-production costs associated with operating the company and selling the products. They include expenditures on advertising, bonuses, accounting, marketing, travel, etc.

Income statement analysis is the tool used to determine financial ratios that can be utilized to evaluate the company’s performance over time or compare one company with another. This report represents a firm’s financial situation and helps it create a strategic plan to strengthen its weak areas .

There are 2 types of income statement analysis: vertical and horizontal . They differ in how a statement is interpreted and what comparisons one can draw from them.

Vertical analysis is a financial analysis in which each line item in the statement is represented as a percentage of a base figure, namely, gross sales . It involves reading down one column of data and comparing elements with each other. For example, one can determine the relative size of various expenses within operating expenses. Since the company can examine relative proportions, this analysis makes it straightforward to compare financial statements across periods, industries, and firms. Investors use this strategy to delve deeply into a company’s current position regarding such ratios as total assets and working capital .

In contrast, a horizontal analysis looks at the same figure across different reporting periods. The method usually involves comparing absolute values but can also be represented as a percentage of the dollar amount in the base year. Companies use a horizontal analysis to determine their financial performance over time, discover trends , and find factors contributing to their success or failure.

The income statement has several limits, so it is not always the best source of information. For example, it only shows part of the bigger picture since it does not show the purchases made using a credit card or cash. Also, the income report frequently employs estimations rather than exact numbers. That is why making important decisions and analyzing broad concepts can be challenging.

We have prepared several helpful tips on how to read the income statement to receive as many benefits as possible:

- Examine all of the math. Analyzing math data is crucial to uncovering mistakes and better understanding how numbers work.

- Identify the bottom line. The bottom line will aid in creating a strategic plan for saving money in case the company has many extra expenses.

- Take a look at the revenue sources. Analyzing the revenue sources will assist in creating a revenue model suitable for your business.

- Consider the expenses. You need to learn why the business is borrowing money to find a solution to its financial problems.

- Compare numbers for each year. Analyzing performance changes over time will help avoid possible risky situations.

Income statements are essential decision-making tools. Companies turn to them when choosing a growth strategy or deciding to cut expenses. Hopefully, this article has given you some insights into income statement analysis. Don’t miss the examples below!

- GlaxoSmithKline Company Marketing Plan Business essay sample: This paper provides a marketing plan for GlaxoSmithKline Company. It provides an analysis of the forces that prevail in the market for pharmaceutical products.

- Target Corporation Marketing Plan for Clothing Business essay sample: This report presents a marketing proposal for Target Corporation’s new line of clothing product - Ava & Viv dedicated to plus-size women and teens.

- Walmart Company's Marketing Analytics Business essay sample: In this paper, the researcher will analyze marketing strategies used by Wal-Mart and determine the level to which it applies marketing analytics with the view of making recommendations.

- AFDCO Incorporation: Business Plan Business essay sample: AFDCO Incorporation is a private limited company, which was established in 2000 in the UAE. The firm operates in the UAE’s beverage industry, and it is headquartered at Al Quoz, Dubai.

- EasyJet Company's Comprehensive Manner Business essay sample: This study evaluated the current EasyJet Company's operations and availed recommendations on the expected procedures towards profit making.

- New Age Recyclers Company's Business Plan Business essay sample: This is a strategic plan of New Age Recyclers who aim to enter into the waste management business and offer waste collection services, recycling, and market waste consumables.

- Julphar Gulf Pharmaceutical Industries: Financial Analysis Business essay sample: Julphar Gulf Pharmaceutical Industries is a leading pharmaceutical company based in the U.A.E. that carries research, development, and distribution of medicines.

- Wal-Mart Stores' Strategic Management Business essay sample: The article analyses the mission statements, objectives, and values of Wal-Mart, the supermarket store. It suggests the best strategic management practices.

- Green Life Company's Business Financial Plan Business essay sample: Green Life Company will be a new start-up wholesale and distribution of Mosquito killer lamps imported from Taiwan to the United States markets.

- Services in the Banking Sector: Barclays Bank Business essay sample: The paper characterises services in the banking sector: intangibility, inseparability, perishability, variability, and performance and risk management in the Barclays Bank.

- Business Plan: New Age Recyclers Business essay sample: This strategic plan is for the proposed New Age Recyclers located in the UAE within the region of Abu Shagara, Sharjah.

- Islamic Financial Institutions: Accounting Concepts Business essay sample: The main focus is on the analysis of differences in accounting between commercial banks and Islamic financial institutions.

- Lowe’s Companies Inc.’s Consolidated Balance Sheets Business essay sample: This paper analyzes the Lowe’s consolidated balance sheets to perform the trend analysis, including horizontal and vertical analysis and also the financial ratio analysis.

- Dubai Cable Company Financial Performance Business essay sample: This paper examines the Dubai Cable Company, its financial performance and health to give clear information about the company’s series of decision-making.

- Sunoco, Inc. Financial Analysis Report. Business essay sample: Sunoco refines and markets petroleum. Sunoco also manufactures petrochemicals that are used in making fibers, plastics, film and resins.

- We Guess You’re Wrong Company: Financial Plan Business essay sample: A financial plan identifies the current financial condition of a We Guess You’re Wrong business and what the entity wants to achieve in the future.

- Walt Disney World Financial Analysis Business essay sample: There was a significant increase in the values of return on equity for the Walt Disney company. The values were higher than the industry average.

- Financial Statements Definition, Types, & Examples Business essay sample: Three main financial statements of an entity as per GAAP are Balance Sheet, Income Statement (also known as Profit and Loss account), and Cash Flow Statement.

- Companies Financial Statements Overview Business essay sample: The essay describes the purpose of the financial statements for organizations and examines what types of statements are used and their scope of the companies.

- Abbott Laboratories: Company History and Performance Business essay sample: Abbot Laboratory’s performance improved in the three years under consideration as well the stock performed well.

- Management Accounting. World Wrestling Federation Business essay sample: The main strategy of WWE is to capitalise operation leverage and expanding it in the promotional activities of WWE brand in the domestic and international markets.

- RadioShack Company's Operation Analysis Business essay sample: RadioShack “is one of the nations most experienced and trusted consumer electronics specialty retailers, offering innovative products and services from leading brands.”

- Florist Boutique + Café: Business Plan Business essay sample: The business plan is going to be prepared on a combined flower shop and coffee house known as “Florist Boutique + Café”.

- RelaxO Company’s Business Development and Production Plan Business essay sample: RelaxO is focused on providing a comfortable resting place for passengers at Indira Gandhi Airport through the use of high-quality boxes built using high-quality materials.

- Smart Travel Tours Limited: Business Plan Business essay sample: The intended business venture is a private limited company. The firm will deal in the offering of travel services to the market.

- Accounting Fraud: The Bank of America Business essay sample: The bank of America has been the people’s bank for a long time and is preferred due to its quality services. There are a lot of allegations that have been out across and thus costing the bank a lot.

- KSA Financial Market in Saudi Arabia Business essay sample: The report talks about the financial market in Saudi Arabia, the banking system and banks in Saudi, the Saudi insurance system and companies, and the stock market in Saudi.

- Pizza Restaurant: Analysis, Establishment, Teamwork Business essay sample: Pizza’s primary goal should be to provide values to its esteemed customers. The management should focus on the friendly services that will surpass customers’ expectation.

- Managing People, Finance and Marketing Business essay sample: In managerial grid approach, there are five types of leadership practiced by different manager in different organisational arrangement.

- Shangri-La Hotel Group Case Study Business essay sample: The Shangri-La Hotel Group has managed to succeed because of its superior products and services, and a respectable international record of accomplishment.

- Amazon: Financial Analysis Business essay sample: Amazon should focus on its competencies to stay ahead of the competition and leverage its immense skills and experiences to improve the quality of services and goods.

- The Financial Analysis of Coca-Cola Business essay sample: The financial analysis of Coca-Cola is performed in this section, which focuses on the company’s financial performance and its stock price movements in the last five years.

- Fashion Merchandise Management Business essay sample: This paper aims to identify specific incidental risk costs relevant to fashion merchandise management and relate some of the critical accounting tools to business operations.

- Computershare Limited Analysis of Company Business essay sample: The report indicates a subdued performance by the company Computershare during 2009-2010 with a lower level stock price as compared to the year 2008-2009.

- The Home Depot Company: Overview Business essay sample: This paper presents information about Home Depot which is amongst the largest companies in the United States that offer services in home improvements.

- Financial Overview of an Australian Company David Jones Ltd. Business essay sample: The purpose of the paper is to analyze the financial stability of David Jones. After considering all the ratios, an investor would find it valuable to invest in this company.

- Financial Analysis of Procter and Gamble Company Business essay sample: This paper analyzes the income statement, balance sheet, financial ratios, and cash flow of Procter and Gamble Company for the last three years with a focus on examining its economic progress.

- Borders Group Inc.'s Financial Analysis Business essay sample: The profitability of Borders has been declining gradually since 2005. This has been attributed to over-expansion programs witnessed during the years 2006 and 2007.

- Making Stronger Statements: Cash Flow and Income Business essay sample: This paper evaluates the contribution of Bruce Wampler, Harold C., and Timothy Vines towards the possibility of strengthening the cash flows and income statements.

- Analysis of The Candy Company, Inc Business essay sample: The Candy Company Inc can establish their business in a nation like India to expand their global market as India boasts to have the second-highest population after China.

- Ford Motor Company's Income Statement Business essay sample: The analysis of income statements provides reviewers and analysts with the most important information regarding a firm’s profitability.

- CFO Report on Colgate-Palmolive Company Business essay sample: This CFO report is going to focus on the renowned Colgate- Palmolive Company. It is one of the world’s largest cosmetics and toiletries companies.

- Urban Outfitters Inc. and Tiffany & Co.'s Comparative Analysis Business essay sample: This paper seeks to compare Urban Outfitters Inc. with Tiffany & Co. under the retail business industry using their annual reports and other appropriate source materials.

- International Accounting Standards 2 – Inventories Business essay sample: This paper seeks to analyze how the International Accounting Standards or International Financial Reporting Standards handle inventories in the accounting practice.

- The Friendly Card Inc.: Business Case Business essay sample: The main objective of Friendly Card Inc. in purchasing the machine is to increase its profit. The machine will help the company in reduction of lead time, and operations costs.

- David Jones Company Analysis Business essay sample: David Jones is an Australian business entity operating a wide network of department stores in New South Wales, Victoria, Queensland, South and Western Australia.

- Fujairah Building Industry Analysis Business essay sample: Fujairah Building Industry is a public joint-stock company that was set up in Fujairah, which is owned mainly by the government of Fujairah, department of industry and economy.

- GAAP Overview, Benefits, and Alternatives Business essay sample: This report defines GAAP and highlights its history, importance, principles, benefits, limitations, and alternatives.

- Bagpuss Import Ltd: Company Analysis Business essay sample: Bagpuss Import Ltd, a company that is in the business of wholesale of a new brand of ginger ale which is imported from New Zealand for distribution in Australia.

- Westfield Company: Financial Analysis Business essay sample: The Westfield Group has more than 110 shopping centers with more than 4,000 employees around the world, and is the largest retail property group in the world.

- Business Plan Bob’s Fish & Chips Business essay sample: This report makes a market analysis of the fast-food industry in the UK using the PEST model. The internal environment of Bob’s Fish & Chips is analyzed using a SWOT analysis.

- Basic Financial Statements in Accounting Business essay sample: The common financial reports prepared by most organizations include; budgets, cash books, cash flow statements, tax reports, and the balance sheet, just to mention but a few.

- Review of Accounting Process and Financial Statements Business essay sample: Income statements, balance sheets, and cash flow statements each have a distinct role in analyzing the operating performances and presenting the financial position of the entity.

- Cadbury Plc.: Income Statements and Balance Sheets Business essay sample: The first, Cadbury plc, is the second-largest candy maker in the world after Mars of the USA; as well, Cadbury ranks right after global leader Wrigley’s in chewing gum.

- Companies Accounting Principles Business essay sample: Companies prepare financial statements such as the balance sheet, income statement, and cash flow statement so as to determine their financial position.

- Financial Proposal For ‘SILK’ Hair Protection Gel Business essay sample: The business proposal must present an estimated cash flow showing the likely amount of cash that the business can generate during the first year of production.

- Business Plan E & D Hamburger Restaurant Business essay sample: This business plan presents a marketing, financial and operational analysis of the E & D Hamburger Restaurant.

- Financial Analysis and Company Performance Business essay sample: The article argues the importance of drawing and increasing share value versus spending to better support the company by investors.

- Walmart Ltd Financial Analysis Business essay sample: The article presents financial statements with full compliance with GAAP and other accounting principles and gives the true picture of the company Walmart.

- Colgate-Palmolive Company: Financial Research Report Business essay sample: Colgate-Palmolive Company leads in the Personal and Household Products industry; it produces consumer products that are sold in at least 200 different countries and regions.

- Allocation of Fixed Costs Business essay sample: A segmented income statement is an important component in a firm’s financial reporting. This is mainly so concerning firms that have diversified their operation.

- Managing the Allowances for Uncollectible Accounts Business essay sample: The management of cash and accounts, including the notes receivable, is vital to maintaining sufficient liquidity. These assets can also include accounts payable and inventories.

- Morrison’s and Sainsbury’s Comparative Financial Analysis Business essay sample: MRW is a United Kingdom-based company engaged in the operation of retail supermarket stores. Its business is mainly related to food and grocery.

- Income and Cash Flow Statements Business essay sample: Balance sheets, income statements, and cash flow statements are financial statements used by most businesses and practitioners for financial reporting purposes.

- IFRS v. US GAAP: What's the Difference? Business essay sample: The US GAAP and IFRS differ on the presentation and recording of certain financial items, which are investigated in the following paper.

- Du Company: Review Business essay sample: Du telecommunication UAE is an organization that operates in the UAE by providing telecommunication products and services to the entire UAE population.

- Billabong International Limited (BBG): Company Analysis Business essay sample: The negative effects associated with globalization have heavily affected the operations of multinational corporations, Billabong included.

- Financial Management: Barclays Bank Analysis Business essay sample: It will be of great value for Barclays to seek funds by being listed on the London stock exchange because the benefits outweigh the limitations.

- Analysis of Telstra Company Business essay sample: The aim of this report is to give an examination and assessment of the current and potential profitability, and fiscal stability of Telstra Company.

- EBay Inc.'s Financial Health in 1999-2000 Business essay sample: The information from the ratio and the vertical and horizontal analysis clearly shows that the eBay company is very sound,

- Stock Analysis Project for Cat Company Business essay sample: Caterpillar Inc leads globally, by revenue, in the manufacture of construction/mining equipment, diesel/natural gas engines, industrial gas turbines, electric power plants.

- Income and Cash Flows Statements Business essay sample: This paper analyzes the income statement and the cash flows of the business on a monthly, quarterly, and yearly basis using the information provided.

- The Pudong Coffee Shop Analysis Business essay sample: The analysis of the Pudong Coffee Shop company is in three aspects financial performance, projection, and recommendations.

- Microsoft: Financial Statement Analysis Business essay sample: This financial analysis of Microsoft has presented a forward-looking statement in context of the present financial condition of the company.

- Financial Statements: an Income Statement Business essay sample: There are a few principles of income statements that have to be considered when drafting the statement. The principles are namely revenue, losses, gains, and expenses.

- Accounting Report on Queen Limited Business essay sample: The paper will analyze the current financial position of the company. The analysis will be based on the ratios calculated for the financial year ended 30th June 2011 and 2013.

- Corporate Finance: General Motors Company Business essay sample: The good performance is expected to continue for the next five years provided the General Motors Company can predict the changes in the financial market.

- SodaStream’s Capital Structure, Returns, and Growth Business essay sample: The purpose of this paper is to analyze the capital structure that SodaStream would use to lower its cost of capital.

- Rolls Royce’s Financial Performance and Corporate Social Responsibility Business essay sample: Rolls Royce's financial stability has stayed almost stable over the five years. The company has better financial performance than the other two firms, Safran and General Electric.

- The Sustainability of Apple’s Success Business essay sample: This analysis is a case study of two reports by Ireland & Hoskissen (2009) and Ashcroft (2010). Their reports show how market changes have affected Apple’s competitive landscape.

- Deltic Timber Corporation Financial Analysis Business essay sample: This paper shows the financial data use in financial analysis in decision-making for potential investors, by carrying out a broad financial analysis for Deltic Timber Corporation.

- Ocean Commercial Holdings: Accounting Business essay sample: The primary line of business of the company is the production and sale of daily products such as ice cream, milk packing, yoghurt, and chilled dairy products among others.

- Whirlpool Corporation: Analysis of Accounting Principles Business essay sample: The paper describes a publically traded company Whirlpool Corporation that sells inventory products and uses the last-in-first-out (LIFO) method of accounting.

- Herfy Company: Financial Analysis Business essay sample: Herfy’s vision is to develop world-class products and, in the process, to play a leading role in the development of the Saudi food industry.

- Next PLC, Clothing Retail Company Business essay sample: Next PLC is considered among companies in the clothing retail industry with a high growth rate and an increasing market share.

- Abu Dhabi Ship Building Financial Report Business essay sample: The focus of the paper is to establish the operational excellence of the company and the supporting financial capability behind the success of the Abu Dhabi Ship Building Company.

- Financial Analysis: A Case for Coca-Cola and Pepsi Business essay sample: This paper analyzes Pepsi versus Coca-Cola, describes the companys' history, product, major customers, major suppliers, and leadership, and provides a synopsis of each company.

- General Mills and Meiji Holdings Co., Ltd.: Financial Statements Business essay sample: The two companies, General Mills and Meiji Holdings Co., Ltd., disclose different components of stockholders’ equity. The paper aims to analyze and compare them.

- Financial Statement Analysis of Whirlpool Corporation Business essay sample: Whirlpool Corporation is a multinational company that is based in the United States. The corporation operates in the household appliance industry and produces home appliances.

- John Deere & Company: Analysis of Annual Report Business essay sample: This paper seeks to carry out an analytic review of the performance of Deere & Company for the past five years. The results will be compared with those of its competitors.

- The General Mills Ltd. and Meiji Holdings Company: Financial Accounting Business essay sample: There are a number of differences that can be spotted in the financial statements of the two companies. This paper compares financial accounting in these two companies.

- Big Rock and Brick Brewing Financial Position Business essay sample: The purpose of this paper is to discuss the strategies of Big Rock and Brick Brewing Co and their financial position.

- Deere & Company's Authenticity and Financial Performance Business essay sample: This paper is to explicitly review the authenticity of Deere & Company in terms of financial performance to guide the client as a finance manager on the best investment decision.

- Coach Incorporation: Individual Case Analysis Business essay sample: This paper analyzes Coach Incorporation's strategic capabilities, provides company situation analysis, and gives generic and grand strategy recommendations.

- Financial Ratio Analysis of Family Dollar 2010-2013 Financial Statements Business essay sample: Family Dollar uses a large proportion of long-term debt, which causes it to have higher interest expenses than Dollar Tree. A higher degree of leverage increases risk for an investor.

- Abu Dhabi Council in Relation to Volvo Ocean Race Business essay sample: This report seeks to analyze some components of the Abu Dhabi Council in relation to the Volvo Ocean Race. It seeks to determine the factors related to the investments.

- Unilens Vision Incorporation's Company Analysis Business essay sample: This paper demonstrates the use of real financial data in decision-making for potential investors. This analysis attempts to reflect on the financial analysis.

- Hamdan Footwear Start-Up Company's Business Plan Business essay sample: Hamdan Footwear is a start-up company, that planned to start operating in June 2015. The semi-mechanized footwear production unit will focus on footwear for ladies.

- Starbucks Corporation's Accounting Analysis Business essay sample: Starbucks offers an opportunity to shareholders to increase the value of their investment. The firm has high returns on equity and assets, which is a good indication for investors.

- Canadian Tire Corporation: Financial Statements Business essay sample: This paper provides information about the balance sheet, income statement, and statement of cash flow of the Canadian Tire Corporation.

- Financial Analysis and Control System of Ocado Group Business essay sample: The discussion hows a worsening trend of profitability of the Group. It is of greater concern since the firm's objectives are to maximize profitability and shareholders’ wealth.

- Jokkomok Industries Company's Cost Behavior Business essay sample: Based on the calculations shown above, it can be established that Mr. Rosen ensured that the number of units produced during the period increased.

- Islamic Finance: Sharjah Islamic Bank Business essay sample: The Islamic business model is based on shared interests’ policy and it avoids practicing immoral or unethical use of monetary loans as it is prohibited in the Koran.

- Financial Accounting - Losses and Risks Business essay sample: Losses are determined by comparing the running book balance of the asset with a reasonable value, probably the market value, to determine if there are losses.

- Wm Morrison Supermarkets PLC: Financial Analysis Business essay sample: The paper seeks to carry out a financial analysis of Wm Morrison Supermarkets PLC for a period of two years. The gearing ratio of the company increased during the period.

- Profiles of Nestle and Sabic Business essay sample: This report is a proposal to Nestle for a joint venture to package their products. The venture is aimed at shoring up the business prospects of the three companies.

- Jokkmokk Industries: Absorption and Contribution Margin Income Statements Business essay sample: The absorption accounting method involves the generalization of fixed costs and variable costs when calculating gross profit.

- Danish Crown and Panera Bread: Financial Statements Business essay sample: The paper aims to develop an understanding of financial statements by comparing and contrasting the financial statements of two companies, including Danish Crown and Panera Bread.

- The Costa Company: Financial Statement Business essay sample: The profitability of Costa Company is established with the aid of profitability ratios. Some of them include: gross profit margin, net profit margin, and return on assets.

- The XYZ Construction Company: Analysis of Financial and Accounting Processes Business essay sample: This research paper will discuss the financial statements and networking capital of the XYZ Construction Company.

- General Motors: Financial Performance Business essay sample: The paper evaluates the changes in General Motors’ short-term and long-term liquidities, and its profitability between 2011 and 2012.

- Financial Indicators in Income Statements Business essay sample: The research identifies factors that can be added to income statements and auditing reports without leading to changes in the auditing standards.

- Imperial Tobacco Company Analysis Business essay sample: Imperial Tobacco Company is a renowned corporation using its resources to produce quality products that suit users' needs. This report offers an in-depth analysis of ITC.

- Sysco and the Bidvest Group: Financial Management Business essay sample: The Bidvest Group is far more viable as an investment as compared to Sysco based on its financial and stock performance.

- Income Statement: Apple and Samsung Business essay sample: Both Apple and Samsung have provided consistent financial statements that are composed in a convenient manner in terms of comparative analysis.

- Absorption Costing Approach Business essay sample: The article discusses the benefits of the efficiency-based absorption costing approach. Benjamin, Muthaiyah, and Marathamuthu point out the advantages of this approach.

- International Accounting in Comparison Business essay sample: In the United Kingdom, companies have the option of either preparing their accounts by the International Financial Reporting Standards or the local Generally Accepted Accounting Principles.

- Ford Motor Company and Tesla: Financial Statement Analysis Business essay sample: The paper contains a brief overview of Ford Motor Company and Tesla and the financial statement analysis project for both companies.

- Apple Financial Analysis Project Business essay sample: The Apple Inc company is famous for the production of a wide range of smartphones (iPhones), media players (iPod Touch) and tablet computers (iPad)

- Financial Analysis – John Lewis Partnership Plc. Business essay sample: John Lewis Partnership Plc. is one of the leading multichannel stores companies. The company has a long history of corporate success and development in the UK retail sector.

- Company Analysis of Chevron and Economic Factors That Affects

- Financial Projections, the Firm’s Growth Strategy

- Financial Statement Analysis: Saudi Cement Company

- Johnson and Johnson Financial Ratio Analysis

- Museum of Contemporary Art of Georgia Financial Analysis

- Financial Statements: Purpose and Importance

- Noble Ketchup Manufacturing Company Business Plan

- New Footwear Product – Tarco Footwear Company

- Apple Market Position Analysis

- Exxon vs. Chevron: Financial Analysis

- Halliburton Company's Financial Accounting of 2015

- Fashion Clothing Company's Financial Statements

- Aspects of Financial Accounting

- Kellogg Company's Financial Analysis in 2013-2015

- Income Statement: Definition, Explanation and Examples

- Hong Kong Stock Market: The Relationship between Stock Returns and Three Ratio Variables

- Corporate Finance: Equity Financing and Debt Financing

- Panera Bread Company: Financial Performance

- Greene King Plc and Enterprise Inn Plc: Financial Comparison

- Statement of Cash Flows

- Kyle’s Lawns Inc.’s Income Statements Analysis

- The Analysis of Apple Company

- Financial Statements in Accounting

- HAYLO Hair Products Company Analysis

- BP Plc.: Company Analysis

- Case Study: St. Edith Memorial Hospital

- Emirates Airlines' Current Financial Situation Analysis

- Baric Footwear Limited: New Footwear Product

- PepsiCo and the Issue of Its Growth Stock

- Analysis of Multinational Corporations

- Company's Income Statement: Description, Advantages, and Disadvantages

- The Annual Financial Report of Apple Inc.

- PepsiCo Inc. and The Coca Cola Company's Financial Analysis

- The Operational Performance of Lena Sewing Enterprises

- Just for Feet Inc. Financial Analysis

- Kyle’s Lawns Inc.’s Final Accounts Analysis

- KOSS Corporation: Financial and Market Analysis

- Financial Analysis of Koss Corporation

- Financial Analysis of Cavco Industries INC.

- The Role of the CFompany's Financial Statements. Gains and Losses Report

- Analysis of the Harley-Davidson Motorcycles Firm

- Global Accounting Rules: An Unfeasible Aim by Fearnley and Sunder

- Wm Morrison Supermarkets Plc. and J Sainsbury Plc.: Financial Analysis

- Gazprom: Actual Capitalization, Profitability, Threats

- Analyzing Proforma Statements

- XYZ Cleaning Company Business Plan

- AGL Energy Limited Company Making 10-Year Forecast

- Balance Sheet. Components Analysis

- ALFIN Mills Inc.'s Financial Forecasting

- Financial Analysis: Simulation Analysis

- Financial Analysis of Ebay Inc. Company

- Financial Analysis of Lululemon Athletics

- Apple Incorporation Financial Performance

- XYZ Cleaning Company Analysis