- IELTS Scores

- Life Skills Test

- Find a Test Centre

- Alternatives to IELTS

- Find Student Housing

- General Training

- Academic Word List

- Topic Vocabulary

- Collocation

- Phrasal Verbs

- Writing eBooks

- Reading eBook

- All eBooks & Courses

- Sample Essays

Paying Taxes Essay

This is an IELTS Paying Taxes Essay. In nearly all countries people have to pay some kind of taxes.

In this essay you have to decide whether you agree or disagree with the opinion that everyone should be able to keep their money rather than paying money to the government.

Here is the question:

Some people believe that they should be able to keep all the money they earn, and should not have to pay tax to the state.

To what extent do you agree or disagree?

Considering Both Sides

A good answer that looks at all the issues presented in the question would consider the following points:

- Why people may want to keep all the money they earn

- Why people should have to pay money to the state

Those are the two sides, so you should brainstorm some ideas around those two questions/opposing opinions before you start to write.

And of course it is very important to make sure you are very clear what your opinion is .

Now take a look at the paying taxes essay model answer.

You should spend about 40 minutes on this task.

Write about the following topic:

Give reasons for your answer and include any relevant examples from your own experience or knowledge.

Write at least 250 words.

Model Answer

People work hard and earn money which ideally they would like to retain for themselves. However, a significant portion of this usually has to be given to the state. In my view, it is right that people pay their fair share of taxes.

Money is everything in today’s world. This is because money is used to buy all the necessities such as food, water, and shelter. Money is also used to help a family’s children in the form of school fees and other activities. In addition to this, people do not only need money to cater for their necessities, but also for future investments. The more that people have to invest, the more they believe they can accumulate in the long term. As a result, many are reluctant to lose some of their income through the deduction of tax.

Nevertheless, citizens should be obliged to pay taxes to the government for a number of reasons. They should accept that the taxes they pay help the government offer them the public services all over the country. These public services are things such as the construction of roads, bridges, public hospitals, parks and other public services. The same tax money helps the country’s economy to be stable. Through taxes, the government can also pay off its debts. In short, money received through taxes is a way of ensuring that people have comfortable livelihoods.

In conclusion, even though many people think that they should not pay taxes, that money is useful to the stability of any country. Therefore, people should not avoid paying taxes as it may affect the country’s economy and services that it provides.

(272 Words)

Task Response

- The question is fully addressed so the essay would get a good score for task response.

- The first body paragraph explains the reasons why people may not want to pay tax and the second body paragraph explains why it is important to pay.

- Reasons and examples are given to support the ideas.

- The writer’s opinion is also very clear. It is presented in the thesis statement and repeated in the conclusion. It is explained in body paragraph two.

Coherence and Cohesion

- The paying taxes essay is well organized. Each of the main points is explained in a separate paragraph and a logical argument is presented to support the writer’s opinion.

- Cohesion is also maintained by good uses of linking words to join the ideas and paragraphs.

Lexical Resource

There is some good use of vocabulary and collocations and spelling and word forms are correct.

For example:

- a significant portion of

- necessities

- reluctant to

- deduction of tax

- be obliged to pay

- construction of

- the stability of

Grammatical Range and Accuracy

There is good accuracy in the grammar and a good range of sentence structures. For example:

- People work hard and earn money which ideally they would like to….

- This is because money is used to buy all the necessities such as…

- people do not only need money to cater for their necessities, but also for future investments.

- In conclusion, even though many people think that they should not pay taxes…

<<< Back

Next >>>

More Agree / Disagree Essays:

IELTS Internet Essay: Is the internet damaging social interaction?

Internet Essay for IELTS on the topic of the Internet and social interaction. Included is a model answer. The IELTS test usually focuses on topical issues. You have to discuss if you think that the Internet is damaging social interaction.

Role of Schools Essay: How should schools help children develop?

This role of schools essay for IELTS is an agree disagree type essay where you have to discuss how schools should help children to develop.

Free University Education Essay: Should it be paid for or free?

Free university education Model IELTS essay. Learn how to write high-scoring IELTS essays. The issue of free university education is an essay topic that comes up in the IELTS test. This essay therefore provides you with some of the key arguments about this topic.

Extinction of Animals Essay: Should we prevent this from happening?

In this extinction of animals essay for IELTS you have to decide whether you think humans should do what they can to prevent the extinction of animal species.

Human Cloning Essay: Should we be scared of cloning humans?

Human cloning essay - this is on the topic of cloning humans to use their body parts. You are asked if you agree with human cloning to use their body parts, and what reservations (concerns) you have.

Examinations Essay: Formal Examinations or Continual Assessment?

Examinations Essay: This IELTS model essay deals with the issue of whether it is better to have formal examinations to assess student’s performance or continual assessment during term time such as course work and projects.

Technology Development Essay: Are earlier developments the best?

This technology development essay shows you a complex IELTS essay question that is easily misunderstood. There are tips on how to approach IELTS essay questions

Internet vs Newspaper Essay: Which will be the best source of news?

A recent topic to write about in the IELTS exam was an Internet vs Newspaper Essay. The question was: Although more and more people read news on the internet, newspapers will remain the most important source of news. To what extent do you agree or disagree?

Airline Tax Essay: Would taxing air travel reduce pollution?

Airline Tax Essay for IELTS. Practice an agree and disagree essay on the topic of taxing airlines to reduce low-cost air traffic. You are asked to decide if you agree or disagree with taxing airlines in order to reduce the problems caused.

Ban Smoking in Public Places Essay: Should the government ban it?

Ban smoking in public places essay: The sample answer shows you how you can present the opposing argument first, that is not your opinion, and then present your opinion in the following paragraph.

Dying Languages Essay: Is a world with fewer languages a good thing?

Dying languages essays have appeared in IELTS on several occasions, an issue related to the spread of globalisation. Check out a sample question and model answer.

Scientific Research Essay: Who should be responsible for its funding?

Scientific research essay model answer for Task 2 of the test. For this essay, you need to discuss whether the funding and controlling of scientific research should be the responsibility of the government or private organizations.

Essay for IELTS: Are some advertising methods unethical?

This is an agree / disagree type question. Your options are: 1. Agree 100% 2. Disagree 100% 3. Partly agree. In the answer below, the writer agrees 100% with the opinion. There is an analysis of the answer.

IELTS Vegetarianism Essay: Should we all be vegetarian to be healthy?

Vegetarianism Essay for IELTS: In this vegetarianism essay, the candidate disagrees with the statement, and is thus arguing that everyone does not need to be a vegetarian.

Employing Older People Essay: Is the modern workplace suitable?

Employing Older People Essay. Examine model essays for IELTS Task 2 to improve your score. This essay tackles the issue of whether it it better for employers to hire younger staff rather than those who are older.

IELTS Sample Essay: Is alternative medicine ineffective & dangerous?

IELTS sample essay about alternative and conventional medicine - this shows you how to present a well-balanced argument. When you are asked whether you agree (or disagree), you can look at both sides of the argument if you want.

Sample IELTS Writing: Is spending on the Arts a waste of money?

Sample IELTS Writing: A common topic in IELTS is whether you think it is a good idea for government money to be spent on the arts. i.e. the visual arts, literary and the performing arts, or whether it should be spent elsewhere, usually on other public services.

Truthfulness in Relationships Essay: How important is it?

This truthfulness in relationships essay for IELTS is an agree / disagree type essay. You need to decide if it's the most important factor.

Return of Historical Objects and Artefacts Essay

This essay discusses the topic of returning historical objects and artefacts to their country of origin. It's an agree/disagree type IELTS question.

Multinational Organisations and Culture Essay

Multinational Organisations and Culture Essay: Improve you score for IELTS Essay writing by studying model essays. This Essay is about the extent to which working for a multinational organisation help you to understand other cultures.

Any comments or questions about this page or about IELTS? Post them here. Your email will not be published or shared.

Before you go...

Check out the ielts buddy band 7+ ebooks & courses.

Would you prefer to share this page with others by linking to it?

- Click on the HTML link code below.

- Copy and paste it, adding a note of your own, into your blog, a Web page, forums, a blog comment, your Facebook account, or anywhere that someone would find this page valuable.

Band 7+ eBooks

"I think these eBooks are FANTASTIC!!! I know that's not academic language, but it's the truth!"

Linda, from Italy, Scored Band 7.5

IELTS Modules:

Other resources:.

- All Lessons

- Band Score Calculator

- Writing Feedback

- Speaking Feedback

- Teacher Resources

- Free Downloads

- Recent Essay Exam Questions

- Books for IELTS Prep

- Student Housing

- Useful Links

Recent Articles

Decreasing House Sizes Essay

Apr 06, 24 10:22 AM

Latest IELTS Writing Topics - Recent Exam Questions

Apr 04, 24 02:36 AM

IELTS Essay: English as a Global Language

Apr 03, 24 03:49 PM

Important pages

IELTS Writing IELTS Speaking IELTS Listening IELTS Reading All Lessons Vocabulary Academic Task 1 Academic Task 2 Practice Tests

Connect with us

Copyright © 2022- IELTSbuddy All Rights Reserved

IELTS is a registered trademark of University of Cambridge, the British Council, and IDP Education Australia. This site and its owners are not affiliated, approved or endorsed by the University of Cambridge ESOL, the British Council, and IDP Education Australia.

Read our research on: Gun Policy | International Conflict | Election 2024

Regions & Countries

7 facts about americans and taxes.

Spring reliably brings a whirlwind of number-crunching and form-filing as Americans finish their tax returns. Altogether, the IRS expects to process more than 160 million individual and business tax returns this season.

Ahead of Tax Day on April 15, here are seven facts about Americans and federal taxes, drawn from Pew Research Center surveys and analyses of federal data.

Ahead of Tax Day 2024, Pew Research Center sought to understand Americans’ views of the federal tax system and outline some of its features.

The public opinion data in this analysis comes from Pew Research Center surveys. Links to these surveys, including details about their methodologies, are available in the text.

The external data comes from the U.S. Office of Management and Budget and the IRS Data Book . Data is reported by fiscal year, which for the federal government begins Oct. 1 and ends Sept. 30. For example, fiscal 2024 began Oct. 1, 2023, and ends Sept. 30, 2024.

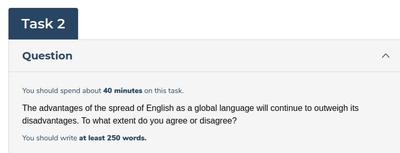

A majority of Americans feel that corporations and wealthy people don’t pay their fair share in taxes, according to a Center survey from spring 2023 . About six-in-ten U.S. adults say they’re bothered a lot by the feeling that some corporations (61%) and some wealthy people (60%) don’t pay their fair share.

Democrats are far more likely than Republicans to feel this way. Among Democrats and Democratic-leaning independents, about three-quarters say they’re bothered a lot by the feeling that some corporations (77%) and some wealthy people (77%) don’t pay their fair share. Much smaller shares of Republicans and GOP leaners share these views (46% say this about corporations and 43% about the wealthy).

Meanwhile, about two-thirds of Americans (65%) support raising tax rates on large businesses and corporations, and a similar share (61%) support raising tax rates on households with annual incomes over $400,000. Democrats are much more likely than Republicans to say these tax rates should increase.

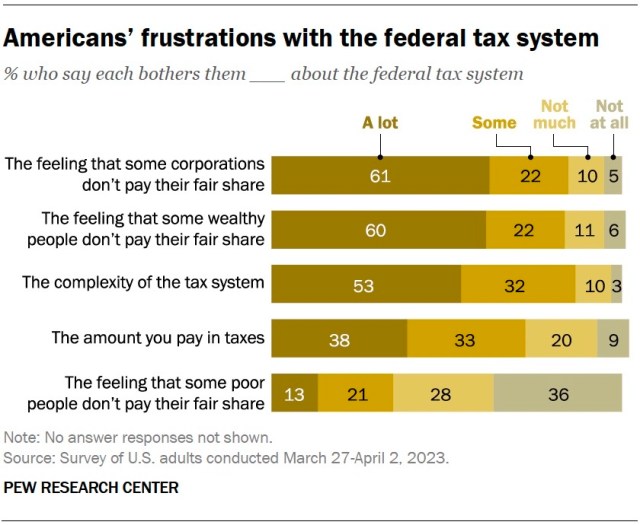

Just over half of U.S. adults feel they personally pay more than what is fair, considering what they get in return from the federal government, according to the same survey.

This sentiment has grown more widespread in recent years: 56% of Americans now say they pay more than their fair share in taxes, up from 49% in 2021. Roughly a third (34%) say they pay about the right amount, and 8% say they pay less than their fair share.

Republicans are more likely than Democrats to say they pay more than their fair share (63% vs. 50%), though the share of Democrats who feel this way has risen since 2021. (The share among Republicans is statistically unchanged from 2021.)

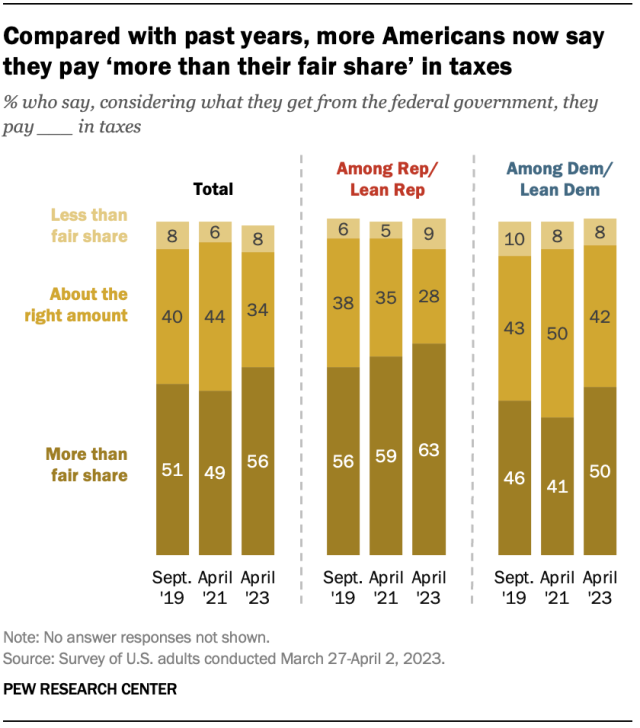

Many Americans are frustrated by the complexity of the federal tax system, according to the same survey. About half (53%) say its complexity bothers them a lot. Of the aspects of the federal tax system that we asked about, this was the top frustration among Republicans – 59% say it bothers them a lot, compared with 49% of Democrats.

Undeniably, the federal tax code is a massive document, and it has only gotten longer over time. The printed 2022 edition of the Internal Revenue Code clocks in at 4,192 pages, excluding front matter. Income tax law alone accounts for over half of those pages (2,544).

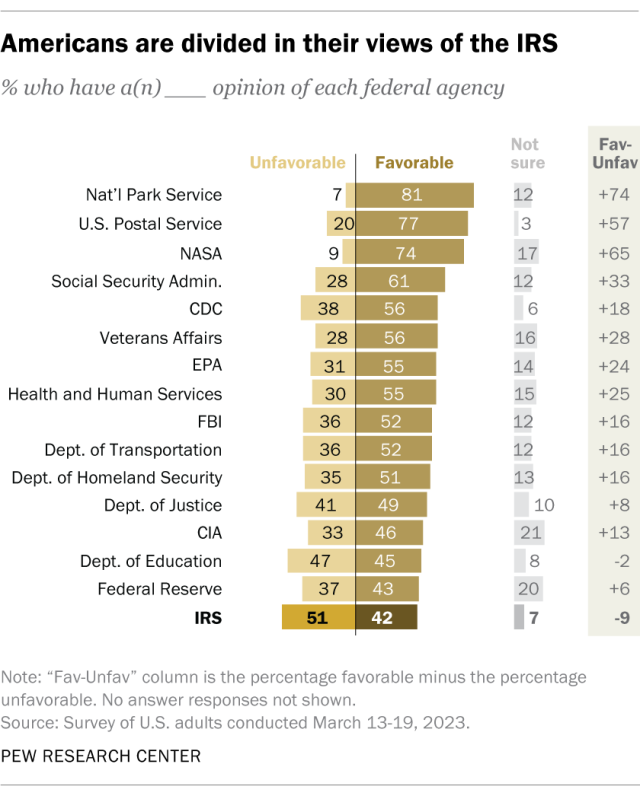

The public is divided in its views of the IRS. In a separate spring 2023 Center survey , 51% of Americans said they have an unfavorable opinion of the government tax agency, while 42% had a favorable view of the IRS. Still, of the 16 federal agencies and departments we asked about, the IRS was among the least popular on the list.

Views of the IRS differ greatly by party:

- Among Republicans, 29% have a favorable view and 64% have an unfavorable view.

- Among Democrats, it’s 53% favorable and 40% unfavorable.

On balance, Democrats offer much more positive opinions than Republicans when it comes to most of the federal agencies we asked about. Even so, the IRS ranks near the bottom of their list.

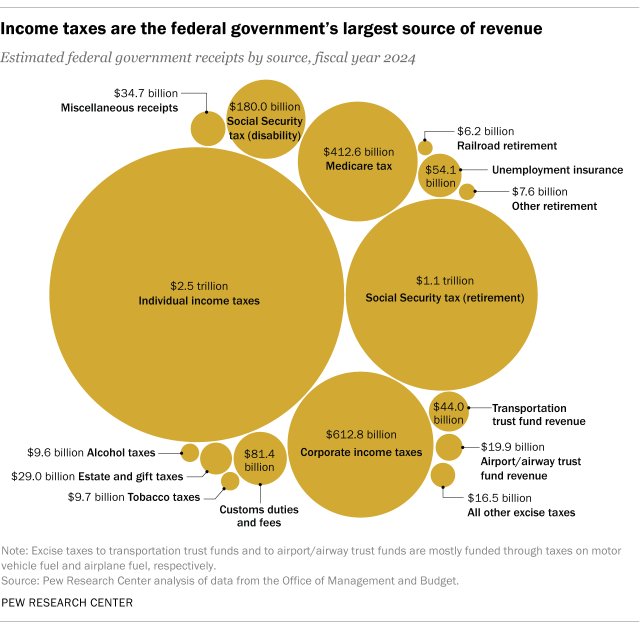

Individual income taxes are by far the government’s largest single source of revenue, according to estimates from the Office of Management and Budget (OMB).

The federal government expects to collect about $2.5 trillion in individual income taxes in fiscal year 2024. That accounts for nearly half (49%) of its total estimated receipts for the year. The next largest chunk comes from Social Security taxes (including those for disability and retirement programs), which are projected to pull in $1.2 trillion this fiscal year (24%).

By comparison, corporate income taxes are estimated to bring in $612.8 billion, or 12% of this fiscal year’s federal receipts. And excise taxes – which include things like transportation trust fund revenue and taxes on alcohol, tobacco and crude oil – are expected to come to $99.7 billion, or 2% of receipts.

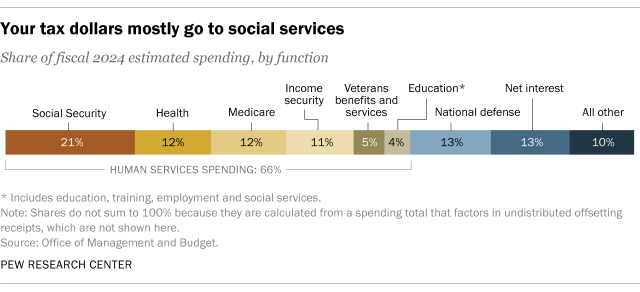

American tax dollars mostly go to social services. Human services – including education, health, Social Security, Medicare, income security and veterans benefits – together will account for 66% ($4.6 trillion) of federal government spending in fiscal 2024, according to OMB estimates.

An estimated 13% ($907.7 billion) will go toward defense spending. Another 13% ($888.6 billion) will repay net interest on government debt, and 10% ($726.9 billion) will fund all other functions, including energy, transportation, agriculture and more.

Related: 6 facts about Americans’ views of government spending and the deficit

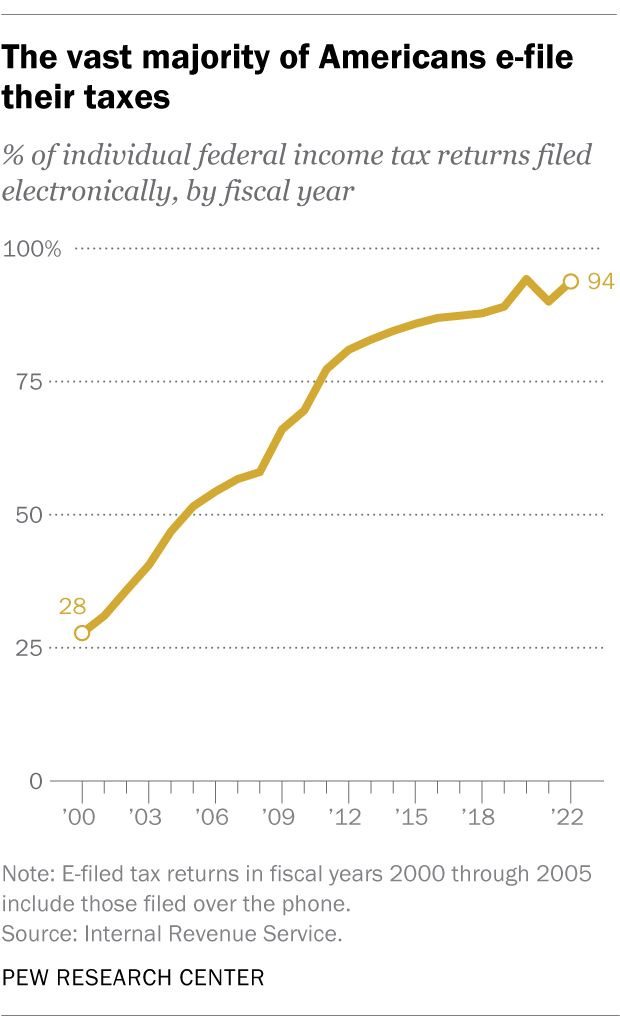

The vast majority of Americans e-file their taxes, according to IRS data . In fiscal 2022, 150.6 million individual federal income tax returns were filed electronically, accounting for 94% of all individual filings that year.

Unsurprisingly, e-filing has become more popular since the turn of the century. Fiscal 2000, the earliest year for which comparable data is available, saw 35.4 million individual income tax returns filed electronically (including those filed over the phone). These accounted for just 28% of individual filings that year.

By fiscal 2005, more than half of individual income tax returns (52%) were filed electronically.

Note: This is an update combining information from two posts originally published in 2014 and 2015.

Sign up for our weekly newsletter

Fresh data delivered Saturday mornings

Top tax frustrations for Americans: The feeling that some corporations, wealthy people don’t pay fair share

Growing partisan divide over fairness of the nation’s tax system, public has mixed expectations for new tax law, most popular.

About Pew Research Center Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Essays on Income Tax

Faq about income tax.

Home — Essay Samples — Government & Politics — Politics — Income Tax

Essays on Income Tax

Overview of the structure of the personal income tax, history tax: where the first income tax and impact on society, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

The Problem of The Income Tax Within Political Science

How the irs income tax data fails as a method for measuring income inequality and poverty, whether growing economic inequality is a political problem, income tax in vietnam: navigating the path to compliance, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

What Would Happen if The Income Tax Were Abolished

Relevant topics.

- Political Corruption

- Public Service

- Interest Groups

- Nation Building

- american ideals

- Democratic Party

- Political Party

- Political Ideology

- Republican Party

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

University of Minnesota

Digital conservancy.

- University Digital Conservancy Home

- University of Minnesota Twin Cities

- Dissertations and Theses

- Dissertations

View/ Download file

Persistent link to this item, appears in collections, description, suggested citation, udc services.

- About the UDC

- How to Deposit

- Policies and Terms of Use

Related Services

- University Archives

- U of M Web Archive

- UMedia Archive

- Copyright Services

- Digital Library Services

- News & Events

- Staff Directory

- Subject Librarians

- Vision, Mission, & Goals

Essays on Income Taxation

My dissertation examines empirically how the tax code influences household deductions, how the availability of deductions alters the elasticity of taxable income (ETI), and how deductions change deductible commodities’ prices. I develop theoretical results linked with my estimates and draw conclusions about base-broadening reform design. The first chapter, “Substitutability among Federal Income Tax Deductions: Implications for Optimal Tax Policy”, studies households making joint decisions about two tax-deductible activities: charitable giving and paying interest on home equity lines of credit (HELOC). By allowing for interactions, either substitutability or complementarity, between deductions, I provide a fuller understanding of the elasticity of taxable income (ETI) and the tax-price elasticity of charitable giving. The tax-price of paying HELOC interest depends on the tax schedule as well as current interest rates. Therefore, the two activities have different tax-prices and the identification of their interaction is possible. Using the Survey of Consumer Finances, I find that the level of each activity falls with its own tax-price and rises with the other activity’s tax-price. I show that in theory the ETI is a weighted sum of such own and cross tax-price effects between activities. I then apply this theory and my estimates to illustrate the trade-offs of three base-broadening tax policies. A conventional policy which removes a subset of deductions while keeping other deductions intact cannot guarantee either more tax revenue or greater efficiency. In contrast, an optimal policy would lower all deductions by differing degrees. However, designing an optimal policy requires knowing the values of all own and cross tax-price elasticities between deductions. Instead, I recommend a second-best policy of “uniform partial deductibility” which lowers all deductions to the same degree; it can guarantee improvement without prior knowledge about elasticities between deductions. In the second chapter, “The Impact of Taxation on Charitable Giving by Itemizers and Non-Itemizers”, co-authored with Leora Friedberg, we estimate how the income tax code affects charitable giving by exploiting variation in the federal tax schedule arising between 1988 and 2006. We make two contributions to the literature. We use the Survey of Consumer Finances (SCF) for our analysis. The SCF reports donations for both itemizers and non-itemizers, which is important because non-itemizers do not appear in tax return data. Besides, the SCF has detailed information on individual correlates of giving and covers a long time period. Second, we estimate how giving responds to marginal tax rates not only for “exogenous itemizers”, who have high enough non-charity deductions to itemize, and who have been well studied in the literature, but also for “exogenous non-itemizers,” who face a non-convex budget constraint in their price of giving. We characterize the incentives of non-itemizers based on the tax-price they will face if they give enough to itemize, as well as the “distance” in giving required for them to reach this itemization threshold. Our results show that (1) exogenous itemizers are responsive to tax incentives, with an estimated price elasticity of around -1 for the full sample (which is similar to representative studies in the literature) and more than double for the self-employed; (2) “exogenous non-itemizers” also respond to tax incentives involving both the price and distance associated with itemizing, with sensitivity to the tax price diminishing as distance increases. The third chapter, “Do mortgage borrowers gain the full benefit of the mortgage interest deduction?”, estimates the incidence of the mortgage interest deduction. This chapter studies whether the mortgage interest deduction benefits lenders by raising mortgage interest rates and, if so, by how much. I link the Fannie Mae Single Family Loan Level dataset and Freddie Mac Single Family Loan Level dataset with the Home Mortgage Disclosure dataset. Under both of my empirical approaches I find that rising tax rates raise mortgage interest rates, and translate these results into the incidence results that lenders capture between 3.2% and 9.3% of the benefit of the mortgage interest deduction.

1_He_Tianying_2016_PHD.pdf

Uploaded: July 14, 2016

Downloads: 633

Income Taxation in Canada Essay

Introduction, implication, progressive tax structure versus flat tax structure, vertical equity, government revenue, works cited.

Across the world, governments tax people’s income in order to generate revenue for economic development of nations. It is imperative to note that income tax revenues constitute the biggest percentage of the revenue generated by the government. For instance, in Canada, the biggest share of government revenue comes from personal income at 75% compared to 25% that come from other forms of taxation.

So far, the progressive tax structure employed by the Canadian government seem effective than flat rate structure that other countries use, at least according to some analysts.

In Canada, the Canadian Revenue Agency has the responsibility of collecting personal, corporate and other income taxes on behalf of the federal government. It has the responsibility of collecting all forms of taxes in all provinces and territories with the exception of Alberta and Quebec (Aronson, Johnson and Lambert 262-270).

Taxation is not a new phenomenon as it is an old practice well known and supported by numerous acts and statues, as part of legislation. In Canada for example, the Income Tax Act empowers the federal government the ability to collect all forms of taxes from incomes. Among the taxes are personal and corporate income taxes. Different counties have different tax regimes.

In Canada, self-assessment regime is common where individual citizens evaluate their tax liability by making tax returns to the Canadian Revenue Agency within the stipulated time. Consequently, the Canadian Revenue Agency will evaluate the tax returns and data in order to ensure that there are no obvious errors.

In case the taxpayer does not agree with the Canadian Revenue Agency in terms of his or her tax assessment, there are proper channels of making an appeal (Gentry and Hubbard 283-287).

There are two major structures, the progressive tax structure and the flat rate structure. To start with, the progressive rate structure of tax requires individuals with tax ability should not only pay more taxes for their higher income, but also pay a larger percentage of their incomes in tax.

On the other hand, the flat rate structure of tax takes away a same percentage of incomes from everyone who has the duty to pay taxes without considering the gap of different taxpayers. These two structures have their own merits and demerits (Auerbach, Kotliko and Skinner 81-100).

To start with, the progressive tax structure emphasizes on equality rather than the general collection of personal income tax. Under progressive tax structure, the more the personal income, the more tax, hence it brings equality. In addition, progressive tax is also efficient because it can adjust itself to the changes in economy.

In times of inflation, the progressive tax structure is the best as it corresponds to the hard times of inflation, for example, the widespread wage increase. Additionally, the progressive tax structure enables distribution of wealth among all classes of people with an aim of bringing social equality (Clemens and Veldhuis 5-7).

According to many analysts, the progressive tax structure that the federal government of Canada uses is advantageous towards the realization of full economic of the citizenry and the country at large. In fact, they credit it as the best structure of taxation as compared to flat structure.

As Calsamiglia and Kirman notes, there has been a growing concern that personal and corporate taxes discourage economic growth by making many Canadians less interested to work. This is especially evident if a country applies the flat structure.

In addition to this, entrepreneurs always complain of additional incurred costs arising from the flat tax code and the inefficient collection system. Consequently, this has created huge and unmatched incentives owing to the distorted supplementary costs (1142-1154).

Simplicity : In terms of simplicity, Canadians believe that the progressive tax structure is simpler as compared to the flat tax structure. For example, in order to file tax returns, people spend so much money and time to not only file the records, but are also able to maintain them due to the simple tax code.

On the other hand, under the flat tax structure, the Canadian Revenue Agency will spend so much money to enforce tax laws and collect personal income taxes—over $30.8 billion annually. Thus, comparing the two structures, in terms of compliance, progressive tax structure is proficient, while in terms of administrative costs, flat tax is proficient.

Efficiency : In terms of efficiency, the progressive tax structure raises the projected revenue, and addresses the economic disruptions arising from taxation. Personal income taxes change incentives that are paramount in the production behavior, meaning, many people would invest or even have money to save. In fact, progressive tax structure may be efficient in terms of establishing equality, but it has disadvantages too.

A good example is that it slows the pace of economic progress of activities. On the other hand, flat tax is an epitome of efficiency, but it fails to address some of the issues arising from taxation such as consumption rather than income. In other words, the Canadian-tax system should stick to the progressive tax structure in order to promote savings and investments.

Flat tax structure mandates the federal government to tax individuals or families on expenditure rather than their incomes. In a way, this will affect government revenue and the general economy. The progressive tax structure minimizes the progressive tax structure rates through rising rates, thus, creating equality in terms of taxation (Calsamiglia and Kirman 1160-1172).

Fairness : As discussed above, although flat tax has some advantages, it fails to address some pertinent issues. For example, in order to bring equity to the current tax system, horizontal and vertical equity are necessary, and this is only possible under the progressive tax structure.

Horizontal Equity : In economics, horizontal equity is a situation whereby all persons or households who get the same amount of income pay equivalent tax deductions. It is true that the current progressive tax structure achieves horizontal equity because people pay tax according to their income. Consider an example where a corporate pays dividends to a Canadian with a shareholder of 21% in a firm.

The progressive tax structure proposes a 19.6% tax rate at provincial level and 14.5% tax rate as federal income tax. It therefore means that progressive tax structure rates vary unlike the flat rate structure where rates are the same even for people with low income. Additionally, unlike the progressive tax structure, flat tax encourages equal pay of tax for every individual without considering the levels of their income (Kaplow 139-143).

Under vertical equity, people who generate more income ought to pay corresponding higher taxes. In all provinces that make up Canada, with exception of Alberta, individuals with high personal income pay higher tax rates on their income. As Kaplow notes, in terms of progressivity, the flat tax structure needs more attention, and Canadians do not enjoy progressivity owing to flat marginal income tax rates.

On the other hand, the progressive tax structure brings equality as the more the income, the more the tax; hence, it not only removes the negative aspect of increasing marginal tax rates, but also ensures progressivity.

In other words, a single-flat tax will encourage distinctiveness of individuals or households, but the progressive tax structure encourages investment in entrepreneurial activities at much lower marginal tax-cut rates (147-154).

Many Canadians prefer the progressive tax structure rather than the flat tax structure. This is simply because they believe that the flat rate structure comes with many risks, which will paralyze the operations of the government. A flat rate structure on personal income means that all people irrespective of their income levels will have to pay similar amount as taxes. In other words, the revenue generated would not be high.

Additionally, the flat rate structure will be a disadvantage to low income earners who would like to save some money and invest it in entrepreneurial activities. It is also important to note that the median income earners and the above pay more than 95% of federal personal income taxes.

Notably, the government will have difficulties to retain the same revenue under the flat rate structure of personal income tax on conditions that other terms remain constant(Hall and Rabushka 465-476).

Another disadvantage of the flat rate structure is that it functions as “auto stabilizer”. Meaning, the revenues collected by the government will be low in comparison with the progressive tax structure. Largely, under the flat tax structure, the economy of a country is likely to deteriorate or remain the same.

Certainly, the government can respond to the risk by enlarging tax-base, lowering marginal tax rates, and canceling tax exemptions. This is the reason why progressive tax structure is more convenient than the flat tax structure.

It is also imperative to note that in terms of administrative and operational costs, the progressive tax structure is more convenient than the flat tax structure.

The Canadian government has put in place proper infrastructure, and an impeccable administration management system for both personal and corporate income taxation. Consequently, this will not only improve tax collection afterwards, but also increase the gross government revenues (Paulus and Peichl 620-636).

In Russia, a country that introduced 13% flat rate tax in 2001, government revenue did not increase. Instead, flat rate structure made it easier for some people to evade paying personal income taxes. The government of Russia does not collect the same amount of revenue it used to collect under progressive tax structure.

There are also reduced incentives and decreased labor supplies among other things, which are bad to the economy. Looking at the implications of flat tax on vertical equity, government revenue, fairness, generation of incentives, and economic efficiency, one cannot easily choose between flat rate and progressive tax structures.

In terms of efficiency, flat rate is more convenient, but on economic efficiency, government revenue, increase of incentives and effectiveness, the progressive tax structure is effective. Therefore, the progressive tax structure is the best suited for personal income structure.

Auerbach, Alan, Joseph Kotliko and Jeff Skinner. “The efficiency gains of dynamic tax reform”. International Economic Review 24 (1993): 81-100. Print.

Aronson, Richard, Paul Johnson and Peter Lambert. “Redistributive Effect and Unequal Income Tax Treatment.” Economic Journal 104.1 (1994): 262-270. Print.

Calsamiglia, Xavier, and Alan Kirman. “A Unique Informationally Efficient and Decentralized Mechanism with Fair Outcomes.” Econometrica 61.5 (1993): 1147-1172. Print.

Clemens, Jason, and Niels Veldhuis. Growing Small Businesses in Canada: Removing the Tax Barrier , Ontario: The Fraser Institute, 2005. Print.

Gentry, William, and Glenn Hubbard. “Tax Policy and Entrepreneurial Entry.” American Economic Review 90.2 (2000): 283–287. Print.

Hall, Robert, and Alvin Rabushka. “The Route to a Progressive Flat Tax.” Cato Journal 5 (1985): 465-476. Print.

Kaplow, Louis. “Horizontal Equity: Measures in Search of a Principle.” National Tax Journal 42 (1989): 139-154. Print.

Paulus, Alari, and Andreas Peichl. “Effects of Flat Tax Reforms in Western Europe.” Journal of Policy Modeling 31.5 (2008): 620-636. Print.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2022, April 11). Income Taxation in Canada. https://ivypanda.com/essays/personal-income-tax/

"Income Taxation in Canada." IvyPanda , 11 Apr. 2022, ivypanda.com/essays/personal-income-tax/.

IvyPanda . (2022) 'Income Taxation in Canada'. 11 April.

IvyPanda . 2022. "Income Taxation in Canada." April 11, 2022. https://ivypanda.com/essays/personal-income-tax/.

1. IvyPanda . "Income Taxation in Canada." April 11, 2022. https://ivypanda.com/essays/personal-income-tax/.

Bibliography

IvyPanda . "Income Taxation in Canada." April 11, 2022. https://ivypanda.com/essays/personal-income-tax/.

- The Progressivity of Health Care Finance

- VAT Versus Flat Tax Versus More Progressive Tax

- Progressive Consumption Tax

- Income Distribution and Redistribution

- Vertical vs. Horizontal Integration for Competition

- Vertical and Horizontal Integration Comparison

- Taxation: Income and Corporation Tax in UK

- Marginal cost and marginal revenue

- Taxation Law: UK Inheritance Tax

- Marginal Cost and Revenue Relationships

- Self Managed Super Fund: Superannuation and Tax

- Definition and Role of the Revenue Policy in Economy

- Fraudulent Accounting and Tax Evasion

- Social Security in the United States

- Government Spending and Tax Legislation Signed by the President

- Share full article

Advertisement

Supported by

Guest Essay

It’s Time to End the Quiet Cruelty of Property Taxes

By Andrew W. Kahrl

Dr. Kahrl is a professor of history and African American studies at the University of Virginia and the author of “The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America.”

Property taxes, the lifeblood of local governments and school districts, are among the most powerful and stealthy engines of racism and wealth inequality our nation has ever produced. And while the Biden administration has offered many solutions for making the tax code fairer, it has yet to effectively tackle a problem that has resulted not only in the extraordinary overtaxation of Black and Latino homeowners but also in the worsening of disparities between wealthy and poorer communities. Fixing these problems requires nothing short of a fundamental re-examination of how taxes are distributed.

In theory, the property tax would seem to be an eminently fair one: The higher the value of your property, the more you pay. The problem with this system is that the tax is administered by local officials who enjoy a remarkable degree of autonomy and that tax rates are typically based on the collective wealth of a given community. This results in wealthy communities enjoying lower effective tax rates while generating more tax revenues; at the same time, poorer ones are forced to tax property at higher effective rates while generating less in return. As such, property assessments have been manipulated throughout our nation’s history to ensure that valuable property is taxed the least relative to its worth and that the wealthiest places will always have more resources than poorer ones.

Black people have paid the heaviest cost. Since they began acquiring property after emancipation, African Americans have been overtaxed by local governments. By the early 1900s, an acre of Black-owned land was valued, for tax purposes, higher than an acre of white-owned land in most of Virginia’s counties, according to my calculations, despite being worth about half as much. And for all the taxes Black people paid, they got little to nothing in return. Where Black neighborhoods began, paved streets, sidewalks and water and sewer lines often ended. Black taxpayers helped to pay for the better-resourced schools white children attended. Even as white supremacists treated “colored” schools as another of the white man’s burdens, the truth was that throughout the Jim Crow era, Black taxpayers subsidized white education.

Freedom from these kleptocratic regimes drove millions of African Americans to move to Northern and Midwestern states in the Great Migration from 1915 to 1970, but they were unable to escape racist assessments, which encompassed both the undervaluation of their property for sales purposes and the overvaluation of their property for taxation purposes. During those years, the nation’s real estate industry made white-owned property in white neighborhoods worth more because it was white. Since local tax revenue was tied to local real estate markets, newly formed suburbs had a fiscal incentive to exclude Black people, and cities had even more reason to keep Black people confined to urban ghettos.

As the postwar metropolis became a patchwork of local governments, each with its own tax base, the fiscal rationale for segregation intensified. Cities were fiscally incentivized to cater to the interests of white homeowners and provide better services for white neighborhoods, especially as middle-class white people began streaming into the suburbs, taking their tax dollars with them.

One way to cater to wealthy and white homeowners’ interests is to intentionally conduct property assessments less often. The city of Boston did not conduct a citywide property reassessment between 1946 and 1977. Over that time, the values of properties in Black neighborhoods increased slowly when compared with the values in white neighborhoods or even fell, which led to property owners’ paying relatively more in taxes than their homes were worth. At the same time, owners of properties in white neighborhoods got an increasingly good tax deal as their neighborhoods increased in value.

As was the case in other American cities, Boston’s decision most likely derived from the fear that any updates would hasten the exodus of white homeowners and businesses to the suburbs. By the 1960s, assessments on residential properties in Boston’s poor neighborhoods were up to one and a half times as great as their actual values, while assessments in the city’s more affluent neighborhoods were, on average, 40 percent of market value.

Jersey City, N.J., did not conduct a citywide real estate reassessment between 1988 and 2018 as part of a larger strategy for promoting high-end real estate development. During that time, real estate prices along the city’s waterfront soared but their owners’ tax bills remained relatively steady. By 2015, a home in one of the city’s Black and Latino neighborhoods worth $175,000 received the same tax bill as a home in the city’s downtown worth $530,000.

These are hardly exceptions. Numerous studies conducted during those years found that assessments in predominantly Black neighborhoods of U.S. cities were grossly higher relative to value than those in white areas.

These problems persist. A recent report by the University of Chicago’s Harris School of Public Policy found that property assessments were regressive (meaning lower-valued properties were assessed higher relative to value than higher-valued ones) in 97.7 percent of U.S. counties. Black-owned homes and properties in Black neighborhoods continue to be devalued on the open market, making this regressive tax, in effect, a racist tax.

The overtaxation of Black homes and neighborhoods is also a symptom of a much larger problem in America’s federated fiscal structure. By design, this system produces winners and losers: localities with ample resources to provide the goods and services that we as a nation have entrusted to local governments and others that struggle to keep the lights on, the streets paved, the schools open and drinking water safe . Worse yet, it compels any fiscally disadvantaged locality seeking to improve its fortunes to do so by showering businesses and corporations with tax breaks and subsidies while cutting services and shifting tax burdens onto the poor and disadvantaged. A local tax on local real estate places Black people and cities with large Black populations at a permanent disadvantage. More than that, it gives middle-class white people strong incentives to preserve their relative advantages, fueling the zero-sum politics that keep Americans divided, accelerates the upward redistribution of wealth and impoverishes us all.

There are technical solutions. One, which requires local governments to adopt more accurate assessment models and regularly update assessment rolls, can help make property taxes fairer. But none of the proposed reforms being discussed can be applied nationally because local tax policies are the prerogative of the states and, often, local governments themselves. Given the variety and complexity of state and local property tax laws and procedures and how much local governments continue to rely on tax reductions and tax shifting to attract and retain certain people and businesses, we cannot expect them to fix these problems on their own.

The best way to make local property taxes fairer and more equitable is to make them less important. The federal government can do this by reinvesting in our cities, counties and school districts through a federal fiscal equity program, like those found in other advanced federated nations. Canada, Germany and Australia, among others, direct federal funds to lower units of government with lower capacities to raise revenue.

And what better way to pay for the program than to tap our wealthiest, who have benefited from our unjust taxation scheme for so long? President Biden is calling for a 25 percent tax on the incomes and annual increases in the values of the holdings of people claiming more than $100 million in assets, but we could accomplish far more by enacting a wealth tax on the 1 percent. Even a modest 4 percent wealth tax on people whose total assets exceed $50 million could generate upward of $400 billion in additional annual revenue, which should be more than enough to ensure that the needs of every city, county and public school system in America are met. By ensuring that localities have the resources they need, we can counteract the unequal outcomes and rank injustices that our current system generates.

Andrew W. Kahrl is a professor of history and African American studies at the University of Virginia and the author of “ The Black Tax : 150 Years of Theft, Exploitation, and Dispossession in America.”

The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips . And here’s our email: [email protected] .

Follow the New York Times Opinion section on Facebook , Instagram , TikTok , WhatsApp , X and Threads .

- Skip to main content

India’s Largest Career Transformation Portal

GST Essay in English for Students

November 12, 2021 by Sandeep

Essay on GST: Implementation of GST is a big step for making the Indian economy better, stronger, and more transparent. GST made it easier for companies to record tax payments and schedule tax payments. Below we have provided GST Essay in English, suitable for classes 6, 7, 8, 9 & 10. This detailed essay on GST of 200-250 words is greatly helpful for all school students to perform well in essay competitions.

Essay on GST

GST is the abbreviation of Goods and Services Tax. GST is a kind of tax that was implemented in India on 1 July 2017. This tax is considered a major reform of the Indian tax system after independence. Since its implementation, GST has been a controversial tax in the context of the Indian tax system. The government collects tax from the country’s citizens in two forms; Direct Tax and Indirect Tax. Direct taxes are based on citizens’ income, and indirect tax is levied based on purchasing a product or service.

Income tax is a direct tax, whereas GST is an indirect tax that brought many taxes under the same roof. To understand the features and concept of GST, we have to take a quick look at the previous tax system. In the earlier tax system, the taxes used to be charged on every stage of goods. From the manufacturing of a product to its sales, a tax has to be paid.

These taxes used to be in VAT, excise, CST, but GST has replaced all different types of taxes. Earlier, the rate of taxes can be varied in different states, and there were two types of taxes; central taxes and state taxes. Now with GST, the rate of taxes is the same in all the country’s states, and taxes have been imposed jointly by the state and central government.

Benefits of GST

The earlier tax system in India was not favorable for small business units. Different types of taxes were present at that time, and on a product, different taxes were imposed. The motive behind the implementation of GST was “One Nation One Tax.” GST has its benefits and disadvantages.

The Indian economy is developing at lightning speed, and it has to compete with other more developed economies. Countries like Sweden, Denmark, Germany, Switzerland, and Japan have already implemented the GST. This tax helped the economy of the countries to grow. GST works like a common window for tax collection. Here are the other benefits of GST that will help the Indian economy in the long run.

Ease of Business – One Country One Tax made it easier for the business to set up their project in any state of the country. Earlier, the taxes on any projects used to vary from one state to another. But now, tax slabs are the same for one item in all the states of the country.

Easy Tax Filling – Different types of taxes like sales tax, Vat, services tax, etc., have been covered under GST, so tax filing has become much easier. The entire process of GST, from registration to filing returns, is available online.

Elimination of Different Taxes – Before GST, different types of taxes were used to apply to one product. Taxes like excise, octroi, sales tax, CENVAT, Service tax, turnover tax, etc., have different rates, but GST has included all of them in it.

Regulated Under-organised sector – Before the implementation of GST, many big industries like construction and textile were unorganised. But after the implementation of GST, companies associated with these industries have to complete all the compliance online then have to stick to regulations.

Defined tax for E-commerce – Before the implementation of GST, the business for E-commerce sites was difficult. For Up, they will have to apply VAT, and for other states like Rajasthan, they will have to remove it. So it was confusing for them. But GST made it easy as it’s one tax for all the states.

Essay Help Services – Sharing Educational Integrity

Hire an expert from our writing services to learn from and ace your next task. We are your one-stop-shop for academic success.

Customer Reviews

Finished Papers

Write my essay for me frequently asked questions

How to Get the Best Essay Writing Service

Write My Essay Service - Working to Help You

Do you want to have more free time for personal development and fun? Or are you confused with your professor's directions? Whatever your reason for coming to us is, you are welcome! We are a legitimate professional writing service with student-friendly prices and with an aim to help you achieve academic excellence. To get an A on your next assignment simply place an order or contact our 24/7 support team.

Emery Evans

How to Order Our Online Writing Services.

There is nothing easier than using our essay writer service. Here is how everything works at :

- You fill out an order form. Make sure to provide us with all the details. If you have any comments or additional files, upload them. This will help your writer produce the paper that will exactly meet your needs.

- You pay for the order with our secure payment system.

- Once we receive the payment confirmation, we assign an appropriate writer to work on your project. You can track the order's progress in real-time through the personal panel. Also, there is an option to communicate with your writer, share additional files, and clarify all the details.

- As soon as the paper is done, you receive a notification. Now, you can read its preview version carefully in your account. If you are satisfied with our professional essay writing services, you confirm the order and download the final version of the document to your computer. If, however, you consider that any alterations are needed, you can always request a free revision. All our clients can use free revisions within 14 days after delivery. Please note that the author will revise your paper for free only if the initial requirements for the paper remain unchanged. If the revision is not applicable, we will unconditionally refund your account. However, our failure is very unlikely since almost all of our orders are completed issue-free and we have 98% satisfied clients.

As you can see, you can always turn to us with a request "Write essay for me" and we will do it. We will deliver a paper of top quality written by an expert in your field of study without delays. Furthermore, we will do it for an affordable price because we know that students are always looking for cheap services. Yes, you can write the paper yourself but your time and nerves are worth more!

Finished Papers

- Dissertation Chapter - Abstract

- Dissertation Chapter - Introduction Chapter

- Dissertation Chapter - Literature Review

- Dissertation Chapter - Methodology

- Dissertation Chapter - Results

- Dissertation Chapter - Discussion

- Dissertation Chapter - Hypothesis

- Dissertation Chapter - Conclusion Chapter

DRE #01103083

Margurite J. Perez

First, you have to sign up, and then follow a simple 10-minute order process. In case you have any trouble signing up or completing the order, reach out to our 24/7 support team and they will resolve your concerns effectively.

Finished Papers

How does this work

Bennie Hawra

- History Category

- Psychology Category

- Informative Category

- Analysis Category

- Business Category

- Economics Category

- Health Category

- Literature Category

- Review Category

- Sociology Category

- Technology Category

Some attractive features that you will get with our write essay service

Grab these brilliant features with the best essay writing service of PenMyPaper. With our service, not the quality but the quantity of the draft will be thoroughly under check, and you will be able to get hold of good grades effortlessly. So, hurry up and connect with the essay writer for me now to write.

Finished Papers

Fill up the form and submit

On the order page of our write essay service website, you will be given a form that includes requirements. You will have to fill it up and submit.

Gain recognition with the help of my essay writer

Generally, our writers, who will write my essay for me, have the responsibility to show their determination in writing the essay for you, but there is more they can do. They can ease your admission process for higher education and write various personal statements, cover letters, admission write-up, and many more. Brilliant drafts for your business studies course, ranging from market analysis to business proposal, can also be done by them. Be it any kind of a draft- the experts have the potential to dig in deep before writing. Doing ‘my draft’ with the utmost efficiency is what matters to us the most.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Things to remember when filing a 2023 tax return

More in news.

- Topics in the News

- News Releases

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IRS Tax Tip 2024-29, April 8, 2024

The IRS has some important reminders for taxpayers who haven’t filed yet. The deadline for most taxpayers to file and pay their 2023 federal tax is April 15, 2024.

Taxpayers should file after they receive all their proper tax documents , or they risk making a mistake that could cause delays.

Prepare to file

- Review income documents carefully. If any of the information is inaccurate or missing, taxpayers should contact the payer right away for a correction or to ensure they have the taxpayer’s current mailing or email address.

- Organize tax records so they can easily prepare a complete and accurate tax return.

- Check eligibility for deductions or credits . Taxpayers should understand which credits and deductions make sense for their tax situation and which records they need to show their eligibility.

- Create an IRS Online Account to securely access information about their federal tax account, including payments, tax records and more.

- Renew their individual taxpayer identification number or ITIN it if it's expired and is needed on a U.S. federal tax return. If taxpayers don't renew an expired ITIN, the IRS can still accept their return, but it may delay processing.

Use IRS.gov resources and online tools for tax help

IRS.gov has online tools to help get taxpayers the information they need . The tools are easy to use and available 24 hours a day. There are tools to help taxpayers file and pay taxes, track tax refunds, find information about their accounts and get answers to their tax questions.

Subscribe to IRS tax tips

Customer Reviews

Don’t Drown In Assignments — Hire an Essay Writer to Help!

Does a pile of essay writing prevent you from sleeping at night? We know the feeling. But we also know how to help it. Whenever you have an assignment coming your way, shoot our 24/7 support a message or fill in the quick 10-minute request form on our site. Our essay help exists to make your life stress-free, while still having a 4.0 GPA. When you pay for an essay, you pay not only for high-quality work but for a smooth experience. Our bonuses are what keep our clients coming back for more. Receive a free originality report, have direct contact with your writer, have our 24/7 support team by your side, and have the privilege to receive as many revisions as required.

We have the ultimate collection of writers in our portfolio, so once you ask us to write my essay, we can find you the most fitting one according to your topic. The perks of having highly qualified writers don't end there. We are able to help each and every client coming our way as we have specialists to take on the easiest and the hardest tasks. Whatever essay writing you need help with, let it be astronomy or geography, we got you covered! If you have a hard time selecting your writer, contact our friendly 24/7 support team and they will find you the most suitable one. Once your writer begins the work, we strongly suggest you stay in touch with them through a personal encrypted chat to make any clarifications or edits on the go. Even if miscommunications do happen and you aren't satisfied with the initial work, we can make endless revisions and present you with more drafts ASAP. Payment-free of course. Another reason why working with us will benefit your academic growth is our extensive set of bonuses. We offer a free originality report, title, and reference page, along with the previously mentioned limitless revisions.

IMAGES

VIDEO

COMMENTS

3. This essay sample was donated by a student to help the academic community. Papers provided by EduBirdie writers usually outdo students' samples. Cite this essay. Download. Taxes can influence many people. The future generations need to know how it can relate to other things we do in life. Gen Z tends to work in a world of technology and rely ...

Pages • 4. Three examples of taxes are a personal income tax, an excise tax like that imposed on cigarettes and alcohol in the U.S., and a state sales tax. The first two are sources of revenue for the federal government. Individuals must file income tax returns each year, paying a certain percentage on each portion of their income as ...

The paying taxes essay is well organized. Each of the main points is explained in a separate paragraph and a logical argument is presented to support the writer's opinion. ... IELTS Essay: English as a Global Language. Apr 03, 24 03:49 PM. Evaluate my writing task for academic ielts, pls Academic IELTS writing task 1 ----- ...

English 100W/Maunu Fall 2019 Using the TAXES Model for Body Paragraphs Attention-Getter (AG)/Hook Background Information (BG) Thesis (last sentence or two of intro) ... Microsoft Word - 5 Essay Structure with TAXES F 19.docx Created Date: 5/28/2020 7:40:56 PM ...

ESSAYS ON INCOME TAXATION. Miguel Gouveia*. University of Pennsylvania. My thesis studies the role of incentive compatibility, equity and politics in the design of income tax. The first essay explores incentive compatibility issues using an approach influenced by, but differing. optimal non-linear income tax model of Mirrlees (1971).

This sentiment has grown more widespread in recent years: 56% of Americans now say they pay more than their fair share in taxes, up from 49% in 2021. Roughly a third (34%) say they pay about the right amount, and 8% say they pay less than their fair share. Republicans are more likely than Democrats to say they pay more than their fair share (63 ...

These essays discuss the different types of income tax, the criteria for tax exemption, and the impact of tax on individuals and businesses. Additionally, they provide crucial insights into filing tax returns, calculating tax amounts, and complying with tax laws. Through free essays on income tax, readers can gain a deeper insight into this ...

History Tax: Where The First Income Tax and Impact on Society. 5 pages / 2101 words. This paper focuses on what taxes are, where the first income tax started, and where we are today and how, where we are today, affects our agricultural community. Many presidents before Trump, have signed tax cut acts in hopes to make taxes easier on one...

PAGES 5 WORDS 1655. UK Government estore the 50% Additional ate of Income Tax. The ecent History of the Additional ate of Income Tax. It is important to note, from the onset, that income tax remains the government's largest revenue source -- effectively raking in an average of 30% of the total tax collected.

For most households, average tax rates increase over the life-cycle. However, for households with very high income histories, average tax rates decrease over the life-cycle. The welfare gains from history-dependent taxation are large, equivalent to about a two percent increase in lifetime consumption compared to a tax on current income.

Importance of Tax. Lawmakers in the county responded to the pressure from citizens and various lobbying groups that had reviewed the nature and effects of the proposed tax. It is apparent that the tax was meant to reduce the consumption of sweetened soft drinks with the hope that consumers would be discouraged by the increased prices of the ...

Essays on Income Taxation. My dissertation examines empirically how the tax code influences household deductions, how the availability of deductions alters the elasticity of taxable income (ETI), and how deductions change deductible commodities' prices. I develop theoretical results linked with my estimates and draw conclusions about base ...

It is imperative to note that income tax revenues constitute the biggest percentage of the revenue generated by the government. For instance, in Canada, the biggest share of government revenue comes from personal income at 75% compared to 25% that come from other forms of taxation. We will write a custom essay on your topic. 809 writers online.

FS-2024-10, April 2024 — A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax. Eligible taxpayers can use them to potentially reduce their tax bill and increase their refund. ... Not proficient in English. Living in rural areas. Receiving certain disability pensions or have children with disabilities.

FS-2024-11, April 2024 — A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to pay. Most taxpayers now qualify for the standard deduction, but there are some important details involving itemized deductions that people should keep in mind.

Download. Essay, Pages 3 (550 words) Views. 362. Income tax is the major source of income for the federal government. The Income tax is collected from both individuals and companies. Calculation of Income tax is done by finding out the taxable income by applying the allowable deductions on the total gross income and is collected annually.

Property taxes are among the most powerful engines of racism and wealth inequality in our country. ... Guest Essay. It's Time to End the Quiet Cruelty of Property Taxes. April 11, 2024. Credit...

Start with the bottom half of earners, the 76.8 million returns that reported adjusted gross income up to about $46,500. In tax year 2021, they earned 10.4% of the country's total income, while ...

The correct answer, as of 2020, is 42%. But less than a quarter of those surveyed guessed right. Twenty-two percent (including more than a third of Democrats) thought the top 1% of taxpayers paid ...

IR-2024-103, April 10, 2024. WASHINGTON — The Internal Revenue Service today encouraged low- to moderate-income individuals and families, especially those who don't normally file a tax return, to use IRS Free File to prepare their federal tax return and get potentially overlooked refunds and tax credits.. For most taxpayers, the deadline to file their personal federal tax return is Monday ...

Jump to essay-1 274 U.S. 259 (1927). Jump to essay-2 42 Stat. 227, 250, 268. Jump to essay-3 274 U.S. at 263. Profits from illegal undertakings being taxable as income, expenses in the form of salaries and rentals incurred by bookmakers are deductible. Commissioner v. Sullivan, 356 U.S. 27 (1958). Jump to essay-4 Rutkin v.

GST is a kind of tax that was implemented in India on 1 July 2017. This tax is considered a major reform of the Indian tax system after independence. Since its implementation, GST has been a controversial tax in the context of the Indian tax system. The government collects tax from the country's citizens in two forms; Direct Tax and Indirect Tax.

8 Customer reviews. 1098 Orders prepared. 4.8/5. Essay On Income Tax In English, Spongebob Squarepants Essay Writing, Electricity Coursework, How To Write A Cover Letter For A Cv Pdf, Professional Literature Review Writers For Hire Usa, Custom University Cover Letter Examples, Research Proposal On Vaccines. Essay On Income Tax In English -.

GST is an indirect tax replacing the previous indirect taxes imposed on the goods and services. Direct taxes such as income tax, corporate tax, etc., are not influenced by the GST. Everything you need to know about GST essay writing, Essay on GST in English, Essay GST. Essay on Goods and Services Tax (GST)

Essay On Income Tax In English. Level: Master's, University, College, PHD, High School, Undergraduate. KONTAK KAMI. 14 Customer reviews. Research Paper. Research papers can be complex, so best to give our essay writing service a bit more time on this one. Luckily, a longer paper means you get a bigger discount!

John N. Williams. #16 in Global Rating. User ID: 407841. Toll free 1 (888)814-4206 1 (888)499-5521. 760. Finished Papers.

Income Tax Essay In English, Professional Curriculum Vitae Writing Site Uk, Popular Literature Review Ghostwriter Websites Ca, Essay On Pollution In English In 250 Words, Book Report Format Marines, Dr.daniel Hale Williams Essay, Qualities Of A Doctor Essay 4.8/5 ...

Essay On Income Tax In English. Niamh Chamberlain. #26 in Global Rating. We are inclined to write as per the instructions given to you along with our understanding and background research related to the given topic. The topic is well-researched first and then the draft is being written. Receive your essay and breathe easy, because now you don't ...

IRS Tax Tip 2024-29, April 8, 2024. The IRS has some important reminders for taxpayers who haven't filed yet. The deadline for most taxpayers to file and pay their 2023 federal tax is April 15, 2024. Taxpayers should file after they receive all their proper tax documents, or they risk making a mistake that could cause delays.

NursingBusiness and EconomicsManagementAviation+109. Allene W. Leflore. #1 in Global Rating. NursingManagementBusiness and EconomicsPsychology+113. 100% Success rate. NursingBusiness and EconomicsManagementMarketing+130. 1513Orders prepared. 4.8/5. Johan Wideroos.