Philippine Legal Forms

Deed of assignment of shares of stock sample.

Philippine Legal Forms Tags: Deed of Assignment , Deed of Assignment of Shares of Stock , Deed of Assignment Sample

HOW ARE SHARES OF STOCKS TRANSFERRED?

After reading How are shares of stocks transferred? , read also Administrative Sanctions and Criminal Penalties under the Pre-Need Code of the Philippines

For shares of stocks with a stock certificate, there must be delivery of the stock certificate, indorsement and recording in the stock and transfer book of the corporation.

For shares of stocks without a stock certificate, transfer must be done by means of a deed of assignment and recording in the stock and transfer book of the corporation.

The Corporation is not a party to the transfer of shares of stocks through any form of conveyance.

S hares of stocks in a corporation are treated as personal property under our existing laws. Like any other personal property, an owner of shares of stocks can sell, assign, transfer or convey his property to another person as an attribute of ownership. However, the law may regulate shares of stocks since by its nature, it is considered as intangible personal properties. As such, any manner of conveyance or transfer must also be regulated.

The law says:

Section 62 of the Revised Corporation Code of the Philippines states that:

SEC. 62 . Certificate of Stock and Transfer of Shares . – The capital stock of corporations shall be divided into shares for which certificates signed by the president or vice president, countersigned by the secretary or assistant secretary, and sealed with the seal of the corporation shall be issued in accordance with the bylaws. Shares of stock so issued are personal property and may be transferred by delivery of the certificate or certificates indorsed by the owner, his attorney in-fact, or any other person legally authorized to make the transfer. No transfer, however, shall be valid, except as between the parties, until the transfer is recorded in the books of the corporation showing the names of the parties to the transaction, the date of the transfer, the number of the certificate or certificates, and the number of shares transferred. The Commission may require corporations whose securities are traded in trading markets and which can reasonably demonstrate their capability to do so to issue their securities or shares of stocks in uncertificated or scripless form in accordance with the rules of the Commission. No shares of stock against which the corporation holds any unpaid claim shall be transferable in the books of the corporation. (Emphasis supplied.)

What are the requirements of a valid transfer of shares of stocks?

For shares of stocks that are represented by a stock certificate, the following must be strictly complied with:

- delivery of the stock certificate;

- indorsement by the owner or his agent;

- recording in the books of the corporation. (Sec. 62, Revised Corporation Code)

However, if the shares of stocks are not represented by a stock certificate, such as when the certificate has not yet been issued or when such certificate is not in the possession of the stockholder, the transfer must be:

- by means of a deed of assignment; and

- such is duly recorded in the books of the corporation.

Jurisprudence says:

For the delivery of the stock certificate, the Supreme Court ruled that the term delivery means delivery to the assignee or the transferee and not delivery to the corporation. (Teng v. Securities and Exchange Commission, G.R. No. 184332, 17 February 2016)

In the case of Rural Bank of Lipa v. Court of Appeals (G.R. No. 124535, 28 September 2001) , the Supreme Court has held that for the transfer of shares of stocks to be valid and binding to third parties, such transfer must be recorded in the books of the corporation.

It must be noted that the registration in the stock and transfer book is not necessary if the conveyance is by way of chattel mortgage. However, there must be due registration with the Register of Deeds . (Chua Guan v. Samahang Magsasaka, G.R. No. L-42091, 2 November 1935)

Registration is likewise necessary if the heirs of the deceased shareholder acquire the latter’s shares of stocks. (Reyes v. RTC and Zenith Insurance Corporation, G.R. No. 165744, 11 August 2008)

The corporation whose shares of stock are the subject of a transfer through sale, donation, or any mode of conveyance, is not a party to the transaction. (Forest Hill Golf & Country Club v. Vertex Sales and Trading, G.R. No. 202205, 6 March 2013)

May a stockholder bring a suit to compel the corporate secretary to register valid transfer of stocks?

Yes, a stockholder may compel the corporate secretary to register a valid transfer of stocks. It is the duty and obligation of the corporate secretary to register the transfer of stocks.

Is the attachment or mortgage of shares of stocks required to be registered in the corporation’s stock and transfer books to be valid and binding on the corporation and third parties?

No, an attachment or mortgage of shares of stocks need not be registered in the corporation’s stock and transfer books inasmuch as a chattel mortgage over shares of stocks does not involve a transfer of shares.

Only absolute transfers of shares of stocks are required to be registered in the corporation’s stocks and transfer book in order to have the force and effect against third persons. (Chemphil Export and Import Corporation v. Court of Appeals, G.R. No. 112438-39, 12 December 1995)

Alburo Alburo and Associates Law Offices specializes in business law and labor law consulting. For inquiries, you may reach us at [email protected], or dial us at (02)7745-4391/0917-5772207.

All rights reserved.

[email-subscribers-form id=”4″]

Philippine Legal Resources

Philippine Legal Forms and Resources: Affidavit, Deed, Contract, Memorandum

Tuesday, July 14, 2020

Deed of assignment (shares of stock), popular posts.

- MOA on Sale of Lot

- Affidavit of Damage to Vehicle

- Contract of Lease of Commercial Building

- Affidavit of No Rental

- Deed of Assignment and Transfer of Rights

- Affidavit of Consented Land Use

- Deed of Absolute Sale of Business

- Demand to Vacate

- Affidavit of Loss of High School Diploma

- Download Free Legal Forms

Privacy Policy

This privacy policy tells you how we use personal information collected at this site. Please read this privacy policy before using the site or submitting any personal information. By using the site, you accept the practices described here. Collection of Information We collect personally identifiable information, like names, email addresses, etc., when voluntarily submitted by our visitors. The information you provide is used to fulfill your specific request, unless you give us permission to use it in another manner, for example, to add you to one of our mailing lists. Cookie/Tracking Technology Our site may use cookies and tracking technology which are useful for gathering information such as browser type and operating system, tracking the number of visitors to the site, and understanding how visitors use the Site. Personal information cannot be collected via cookies and other tracking technology, however, if you previously provided personally identifiable information, cookies may be tied to such information. Third parties such as our advertisers may also use cookies to collect information in the course of serving ads to you. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. Distribution of Information We do not share your personally identifiable information to any third party for marketing purposes. However, we may share information with governmental agencies or other companies assisting us in fraud prevention or investigation. We may do so when: (1) permitted or required by law; or, (2) trying to protect against or prevent actual or potential fraud or unauthorized transactions; or, (3) investigating fraud which has already taken place. Commitment to Data Security Your personally identifiable information is kept secure. Only authorized staff of this site (who have agreed to keep information secure and confidential) have access to this information. All emails and newsletters from this site allow you to opt out of further mailings. Privacy Contact Information If you have any questions, concerns, or comments about our privacy policy you may contact us by email at [email protected]. We reserve the right to make changes to this policy. You are encouraged to review the privacy policy whenever you visit the site to make sure that you understand how any personal information you provide will be used.

Blog Archive

Featured post, minimum wage and rights of kasambahays (domestic workers in the philippines), affidavit, deed, acknowledgment & waiver, power of attorney, sale of personal property, corporation, real estate, donation & extrajudicial settlement, family law and annulment/nullity of marriage, credit and loan, other forms & pleadings, pageviews all time.

Transfer of stock shares

It must be noted that whether or not the shares of stock are evidenced by a stock certificate, the transfer must be recorded or registered in the books of the corporation to be valid against third parties and the corporation

Published in Daily Tribune on October 20, 2022 by: Mary Jasmin Zennaia M. Balasolla

- Share on Facebook

- Share on Twitter

- Share on Pinterest

- Share on LinkedIn

- Share on Reddit

- Share by Mail

Shares of stock in a corporation are classified as personal property. As a general rule, the owner of the stocks may dispose of them as he sees fit as an inherent attribute of his ownership thereof. However, because these are intangible personal properties, the manner of their transfer and conveyance is regulated by particular laws.

Section 63 of the Corporation Code specifies how a share of stock may be transferred. The provision on the transfer of shares of stock makes no restrictions as to whom they may be sold or transferred.

As the owner of personal property, a shareholder is free to dispose of it in favor of whomever he wishes, subject only to the general provisions of the law and the bylaws of the corporation to which it pertains.

SECTION 62. Certificate of Stock and Transfer of Shares. — The capital stock of corporations shall be divided into shares for which certificates signed by the president or vice president, countersigned by the secretary or assistant secretary, and sealed with the seal of the corporation shall be issued in accordance with the bylaws. Shares of stock so issued are personal property and may be transferred by delivery of the certificate or certificates endorsed by the owner, his attorney-in-fact, or any other person legally authorized to make the transfer. No transfer, however, shall be valid, except as between the parties, until the transfer is recorded in the books of the corporation showing the names of the parties to the transaction, the date of the transfer, the number of the certificate or certificates, and the number of shares transferred. The Commission may require corporations whose securities are traded in trading markets and which can reasonably demonstrate their capability to do so to issue their securities or shares of stocks in uncertificated or scripless form in accordance with the rules of the Commission.

No shares of stock against which the corporation holds any unpaid claim shall be transferable in the books of the corporation.

Under the above-mentioned provision, if the shares of stock are represented by a stock certificate, the following must be complied with for there to be a valid transfer of stocks:

(a) There must be the delivery of the stock certificates;

(b) The certificate must be endorsed by the owner or his attorney-in-fact or other persons legally authorized to make the transfer; and

(c) To be valid against third parties, the transfer must be recorded in the books of the corporation. (Teng v. Securities and Exchange Commission, G.R. No. 184332, (17 February 2016).

From the foregoing, it is the delivery of the certificate, coupled with the endorsement by the owner or his duly authorized representative that is the operative act of transfer of shares from the original owner to the transferee. The delivery contemplated herein pertains to the physical delivery of the certificate of shares by the transferor to the transferee and not delivery to the corporation. It is also worth mentioning that surrendering the original certificate of stock is necessary before the issuance of a new one so that the old certificate may be canceled.

On the other hand, if the shares of stock are not represented by a certificate, they may be transferred as follows:

1. By means of a deed of assignment; and

2. Such is duly recorded in the books of the corporation.

It must be noted that whether or not the shares of stock are evidenced by a stock certificate, the transfer must be recorded or registered in the books of the corporation to be valid against third parties and the corporation. There are several reasons why such registration is necessary: (1) to enable the transferee to exercise all the rights of a stockholder; (2) to inform the corporation of any change in share ownership so that it can ascertain the persons entitled to the rights and subject to the liabilities of a stockholder; and (3) to avoid fictitious or fraudulent transfers, among others.

Read more: https://tribune.net.ph/2022/10/20/transfer-of-stock-shares/

Read more Daily Tribune stories at: https://tribune.net.ph/

Follow us on our social media Facebook: @tribunephl Youtube: TribuneNow Twitter: @tribunephl Instagram: @tribunephl TikTok: @dailytribuneofficial

Share this entry

Any questions email us.

Manila Office: Unit 203 Le Metropole Building 155 H.V. Dela Costa cor. Tordesillas Sts. Salcedo Village, 1227 Makati City, Philippines Tel. Nos. (02) 8817-9704 to 07 Email: [email protected] [email protected]

Bacolod Office:

Unit 2Q, Paseo Verde Complex Lacson St., Mandalagan 6100 Bacolod City, Philippines Tel. No. (034) 458-9941 Email: [email protected] [email protected]

Privacy Policy

Copyright © 2020 Aranas Cruz Araneta Parker & Faustino Law Offices. All rights reserved.

Deed of Assignment of Stock Subscription

Choose whether the seller is an individual person, partnership, or corporation. The seller is the one transferring the shares.

Select " Corporation " if the employer is registered as a corporation whether stock or non-stock, or one-person corporation, or any other type of corporation with the Securities and Exchange Commission.

Select " Partnership " if the employer is a partnership that may be registered with the Securities and Exchange Commission.

Select " Individual person " if the employer is a natural person such as a sole proprietorship.

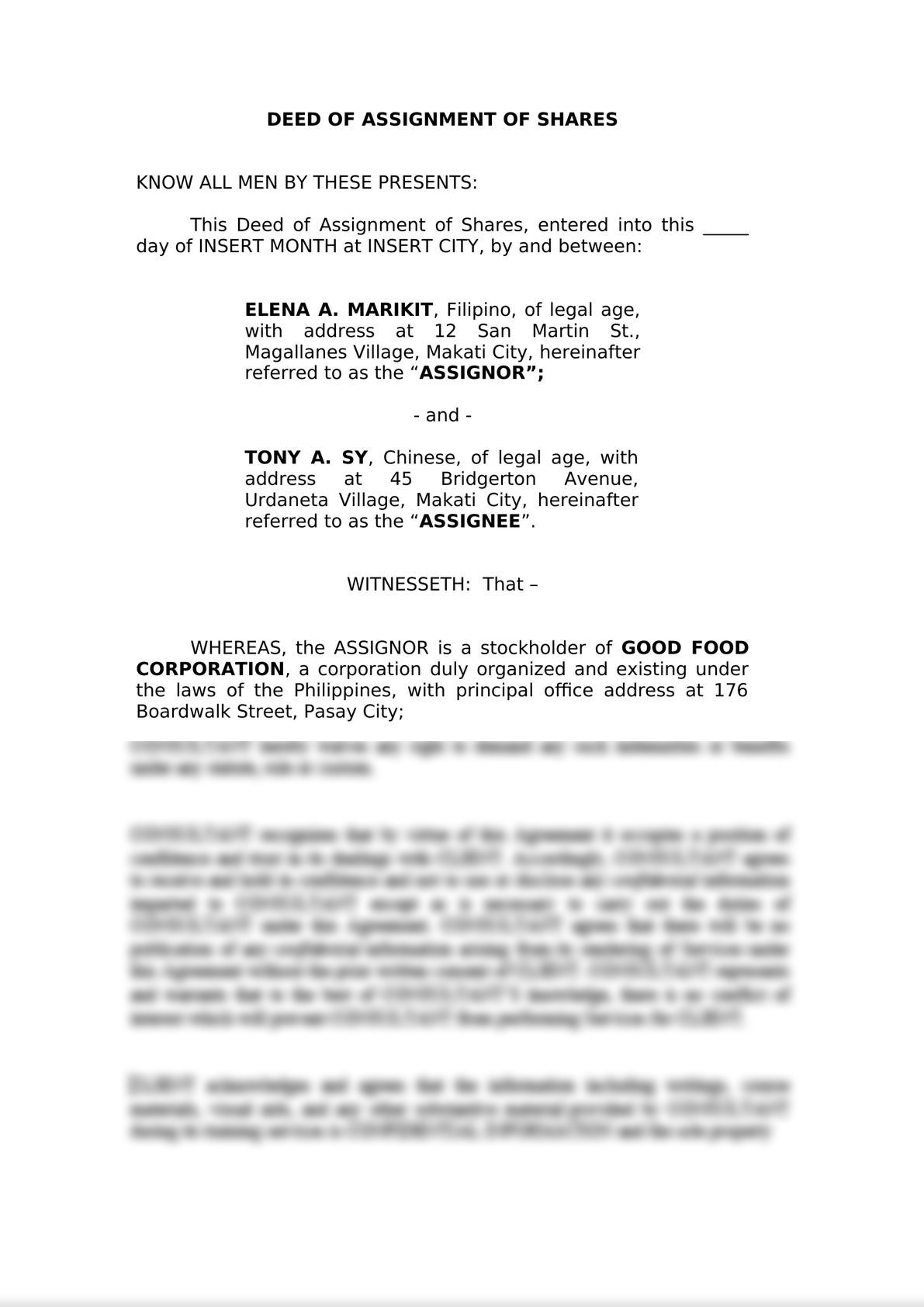

DEED OF ASSIGNMENT

KNOW ALL MEN BY THESE PRESENTS:

________ , of legal age, Filipino , residing at ________ hereinafter referred to as the ASSIGNOR

________ , of legal age, Filipino , residing at ________ , hereinafter referred to as the ASSIGNEE

WITNESSETH:

WHEREAS, ________ is a corporation organized and existing under and by virtue of the laws of the Philippines with principal address at ________ ;

WHEREAS, the ASSIGNOR is the legal and beneficial owner and holder of Stock Certificate No. ________ (the "Stock Certificate") representing ________ ( ________ ) Shares (the "Shares"), with a par value of ________ (Php________) per share, of ________ ;

WHEREAS, the ASSIGNOR has fully paid their total subscription of ________ (Php________);

WHEREAS, the ASSIGNOR desires to assign and convey ________ ( ________ ) Shares (the "Conveyed Shares") to the ASSIGNEE;

WHEREAS, the ASSIGNEE is willing to accept ASSIGNOR's aforementioned shares;

NOW, THEREFORE, for and in consideration of the foregoing premises and the sum of ________ (Php________), the receipt of which is hereby acknowledged by the ASSIGNOR in full, the ASSIGNOR hereby absolutely cedes, transfers, and conveys all the rights and title to and in the aforementioned ________ ( ________ ) Shares of ________ in favor of the ASSIGNEE and the ASSSIGNEE hereby accepts the same.

ASSIGNOR shall indorse, if necessary, and deliver all available documents necessary for the registration of the Shares in the name of the ASSIGNEE upon the signing of this Agreement. All other documents shall be delivered with any necessary indorsements within Five (5) Days from their availability.

ASSIGNOR shall file and pay the Documentary Stamp Tax ("DST") within Five (5) Days after the the close of the month when the Shares were transferred. For purposes of this Agreement, the Shares shall be considered transferred upon the indorsement of the Stock Certificate.

The ASSIGNOR hereby represents and warrants that:

1. the ASSIGNOR is the sole legal and beneficial owner of the Conveyed Shares;

2. 252 82282225 555528 88 2522 525 88255 22 522 525 588 885828, 88228, 8555228, 525 228528552828; 525

3. the ASSIGNOR has the full power and authority to assign, sell, cede, transfer, and convey the Conveyed Shares

IN WITNESS WHEREOF, we have hereunto set our hands this ____________________, in the City/Municipality of ____________________, Province of ____________________, Republic of the Philippines.

________ Assignor TIN - ________

________ Assignee TIN - ________

Signed in the presence of:

____________________

ACKNOWLEDGEMENT

REPUBLIC OF THE PHILIPPINES ) PROVINCE OF ________________________ ) CITY OR MUNICIPALITY OF ________________________ )S.S.

BEFORE ME, a Notary Public, for and in the CITY OR MUNICIPALITY OF ________________________, ________________________, this _______ day of ________________________, 20______, personally appeared the following persons:

1. ________ , with the following competent proof of identification: Driver's License with number ________ which expires on ________

2. ________ , with the following competent proof of identification: Driver's License with number ________ which expires on ________

all known to me 525 22 22 22282 22 82 252 8522 2258228 852 25285225 252 225222822 8225 22 8888222222 822828252822 22 _________ 25228, 828855822 2588 2522 85252 252 882228825222222 88 8582222, 525 2522 582228825225 22 22 2552 252 8522 88 25285 2522 525 828522552 582 525 5225.

WITNESS MY HAND AND SEAL on the day and place first written above.

Doc No. ________; Page No. ________; Book No. ________; Series of ________.

HOW TO CUSTOMIZE THE TEMPLATE

Answer the question and then click on "Next".

The document is written according to your responses - clauses are added or removed, paragraphs are customised, words are changed, etc.

At the end, you will immediately receive the document in Word and PDF formats. You can then open the Word document to modify it and reuse it however you wish.

Create your Deed of Trust and Assignment (for shares of stock) in minutes.

Step-by-step assistance.

Click the "Begin Here" button at the top of this page to start creating your document. Answer questions and download your customized document once finished.

Look for the following icons as you answer the Q&A to know more about the question and our suggested answer.

What is this?

Click this icon for information about the question.

Suggested Answer

Click this icon to know what is the recommended answer based on similar documents.

Things you need to know about Deed of Trust and Assignment (for shares of stock).

1. what is a deed of trust and assignment.

In a Deed of Trust and Assignment, the signor (the trustee) confirms that he/she is holding certain shares of stock in a corporation only in trust for the benefit of another person (the trustor).

The signor also appoints the Corporate Secretary of the corporation that issued the shares of stock as his/her attorney-in-fact to sell, assign and transfer the shares of stock in favor of the trustor or any person designated by the trustor.

2. What information do you need to create the Deed of Trust and Assignment?

To create your Deed of Trust and Assignment, you’ll need the following minimum information:

- The name and details (i.e. nationality and address) of the trustee

- The name of the trustor

- The number of shares held in trust

- The corporation which issued the shares of stock

3. How much is the document?

The document costs PhP 350 for a one-time purchase.

You can also avail of Premium subscription at PhP 1,000 and get (a) unlimited use of our growing library of documents, from affidavits to contracts; and (b) unlimited use of our “ Ask an Attorney ” service which lets you consult an expert lawyer anytime for any legal concern you have.

Document Name

Cancel Save

9 Eymard Drive, New Manila Quezon City Owned and operated by JCArteche’s Online Documentation & Referral Services

Back to Top

- Terms of Service

- Privacy Policy

- Create Documents

- Ask An Attorney

- How It Works

- Customer Support

By providing an email address. I agree to the Terms of Use and acknowledge that I have read the Privacy Policy .

Transfers of shares held in trust are not subject to tax

MANILA -In corporate law, it is common practice for lawyers to handle transfers of shares of stock from nominees to their principals, or to new nominees. Prior to the Revised Corporation Code, which came into effect in February 2019, corporations were required to have at least five stockholders and directors, each holding a minimum of one share of stock in the company.

When establishing a corporation, business owners would often seek out nominees to hold a qualifying share in order to meet the requirement of five shareholders. Typically, these nominees are the trusted officers of the principal stockholder who, since they do not own the company, eventually move on to other employment opportunities, thereby severing their connection with the company.

In such cases, the nominees would execute a deed of assignment of the shares to return them to the principal or to the new nominee who will be taking their place.

Even with the introduction of the Revised Corporation Code which allows for less than five stockholders in a corporation, many companies still prefer to maintain several board seats in their board for various reasons, one of which is for good governance.

Accordingly, transfers of shares of stock from nominees to new nominees are quite common. Oftentimes, the transfer of shares is done by the execution of a deed of assignment by the nominee to the principal or new nominee. However, issues concerning actual consideration for the transfer and the taxes that may be due may arise. Moreover, the relevant laws and regulation provide that before registering a transfer of share to the new shareholder, the corporation’s corporate secretary must satisfy itself that proper taxes have been paid to the Bureau of Internal Revenue (BIR). This is done by the submission of the tax returns and the tax clearance or certificate of authority to register issued by the BIR.

In terms of taxation, currently, the sale of shares of stock is subject to a flat rate of 15 percent on capital gains taxes (CGT). There is also the Documentary Stamp Tax (DST) which is P1.50 for every P200 on the sale or transfers of shares of stocks. It also used to be the practice of the BIR examiners to assess Donor’s Tax on the transaction when the declared consideration for the transfer of shares was below the book or market value.

The taxes that may be imposed could be substantial, as some nominees may hold thousands of shares in their names. This practice is not prohibited nor uncommon, as the only requirement is that the shareholder and director hold at least one share of stock.

Accordingly, are these transfers of shares of stock by nominees back to their principal or to the new nominees subject to the CGT, DST, or Donor’s Taxes ?

The answer is: No.

In a tax ruling dated Nov. 8, 2021, Sun Life of Canada (Philippines), Inc. (Sun Life), requested the BIR for an exemption from the payment of taxes on the transfer of their Manila Polo Club shares.

Sun Life’s shares were registered in the name of and assigned to its officers who were allowed to make use of the facilities of the Polo Club in building their business network. It sought a transfer of the shares to a new set of officers as the previous officers were no longer connected with the company.

The company representatives all executed Declarations of Trust where they declared that Sun Life is the true and beneficial owner of the shares, that the shares were registered in their names because the articles of incorporation of the Manila Polo Club provides that no institutional members shall be admitted as a shareholder, that they have no title, right, claim or interest whatsoever over the shares, and Sun Life may designate another company officer as the new holder and user of the shares.

The BIR confirmed that:

1. The transfer of shares from the nominee-officers to the new nominee-officers were not subject to Capital Gains Taxes 2. The transfers are also not subject to the Documentary Stamp Taxes; 3. The transaction is not a Donation 4. The tax that is due is the Documentary Stamp Taxes on the Deeds of Declaration of Trust

(BIR Ruling No. OT – 0653-2020, November 8, 2021)

Sun Life’s shares of stock in the Manila Polo Club in the name of its nominees were covered by Declarations of Trust executed by the nominees all of whom acknowledged that the transfer did not give them any kind of right, claim or interest whatsoever in the shares and that they are holding only legal ownership of the same where the beneficial ownership belongs to the Company.

It was established that Sun Life was the one who purchased the shares and had registered the same in the officers’ names, who were its nominees, since the Articles of Incorporation and By-laws of the Manila Polo Club provided that only natural persons may become registered members.

Sec. 24 (C) of the National Internal Revenue Code provides that a final tax rate of fifteen percent is imposed upon the net capital gains realized during the taxable year from the sale, barter, exchange, or other disposition of shares of stock in a domestic corporation, except shares sold or disposed of through the stock exchange.

Accordingly, CGT is only imposed upon the “net capital gains” realized during the taxable year which means the tax is on gain or profit from the sale of capital assets.

Since the transfer of the Manila Polo Club shares only involves legal title and not beneficial ownership, which remains with Sun Life, then there is no gain or profit and consequently, no capital gains taxes are due.

The BIR found that no capital gains taxes are due considering that:

(1) the shares are actually owned by Sun Life, and the transferors and transferees are mere nominees and/or trustees of Sun Life who only hold legal title (2) There is no actual transfer of ownership and beneficial title (3) no monetary consideration is involved, no gain or profit resulted in the transfer which is merely by virtue of an assignment as evidenced by the Declaration of Trust.

In the matter of DST, the BIR declared that a mere transfer of a share from one trustee to another, without a change in the beneficial ownership of the share is, therefore not the taxable transaction being contemplated under the Tax Code provision on DST. There being no new conveyance to speak of in this case, there is no new exercise of a privilege upon which DST may be imposed.

DST on trust document

DST is however due on the Declaration of Trust.

Not a donation

There is a lack of any intention on the part of the transferors to donate to the transferee the Manila Polo Club shares. Moreover, the transaction was found to be purely for a legitimate business purpose. Accordingly, there is no donation and no donor’s tax due.

The BIR confirmed that in a trust relationship covered by a declaration of trust, transfers by the nominee of shares of stock held by it back to the principal or to a new a nominee is not subject to CGT and DST. It is also not a donation subject to donor’s taxes.

Lastly, just a final word on trust for our readers.

A trust is a legal relationship where one person has equitable ownership of property and another person owns the legal title to the property. Trusts are distinguished by the separation of legal title and equitable ownership of the property, with the fiduciary (trustee) holding legal title and the trustor holding equitable title. (Soledad Caezo vs. Rojas, G.R. No. 148788, November 23, 2007)

A trust may be expressed or implied. In this case, the Declaration of Trust referred to in BIR Ruling No. OT – 0653-2020 is an express trust. It is a document whereby a person acknowledges that they hold the property title for the use of another.

Subscribe to our daily newsletter

(The author, Atty. John Philip C. Siao, is a practicing lawyer and founding Partner of Tiongco Siao Bello & Associates Law Offices, teaches law at the MLQU School of Law, and an Arbitrator of the Construction Industry Arbitration Commission of the Philippines. He may be contacted at [email protected] . The views expressed in this article belong to the author alone.)

Subscribe to our business news

Disclaimer: Comments do not represent the views of INQUIRER.net. We reserve the right to exclude comments which are inconsistent with our editorial standards. FULL DISCLAIMER

© copyright 1997-2024 inquirer.net | all rights reserved.

We use cookies to ensure you get the best experience on our website. By continuing, you are agreeing to our use of cookies. To find out more, please click this link.

8:30 AM – 5:30 PM, MON – FRI

Legal Heads Up

Basic Tax Consequences of Transfers of Shares Not Traded in the Stock Exchange under the Tax Code, as amended by TRAIN 1

In general, the sale, barter, exchange or other disposition of shares of stock in a Philippine corporation not traded in the stock exchange is subject to the following:

- Capital Gains Tax (CGT) is imposed on the net capital gains realized during the taxable year from the sale, exchange or other disposition of shares of stock in a domestic corporation.

- Documentary Stamp Tax (DST) is imposed on all sales, or agreements to sell, or memoranda of sales, or deliveries, or transfer of shares or certificates of stock in any association, company, or corporation.

- If the fair market value (FMV) of the shares of stock exceeds the selling price, the difference may be subject to donor’s tax

Failure to timely file the returns and pay the taxes due shall subject the basic tax to a 25% surcharge, 12% interest per annum, plus graduated compromise penalties of up to Php50,000.

Share This Article

Disclaimer: The information in this website is provided for general informational purposes only. No information contained in this post should be construed as legal advice from Platon Martinez or the individual author, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting on the basis of any information included in, or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances.

Read These Next

The apostille convention, now in effect., entitlement to compensation for a work-related injury must be proven by substantial evidence, data privacy rights remain despite covid-19 crisis, compliance with the data privacy act of 2012: the dpo.

6th & 7th Floors Tuscan Building 114 V.A. Rufino Street, Legaspi Village, 1229 Makati City, Philippines

Telephone: +63 2 88674696 Fax: +63 2 88671304

© 2024 Platon Martinez. All rights reserved. Powered by Passion.

Legal & Tax Updates [Back to list]

Sec opinion 21-03: deed of trust and assignment over share of stock.

In SEC-OGC Opinion No. 21-03 dated February 18, 2021, the Securities and Exchange Commission ( “SEC” ) resolved the following issues:

- Whether a company with nominee shareholder can register in its Stock and Transfer Book ( “STB” ) and General Information Sheet ( “GIS” ) the changes in nominee shareholders pursuant to an existing Deed of Trust and Assignment without the need of an actual sale; and

- Whether there is a need to report to the SEC, through the company’s GIS, the said new nominee director.

Sysmex Philippines, Inc. ( “Sysmex” ) has five (5) nominee shareholders who also constitute the Board of Directors. One nominee shareholder/director is no longer connected with Sysmex; thus, the latter intends to appoint a new shareholder/director. However, Sysmex is in quandary on whether to execute a Deed of Trust and Assignment or Deed of Absolute Sale to effect such change.

Since the contemplated transfer of share/s to the new nominee shareholder is for purposes of qualifying the said nominee shareholder to be a member of the Board, and to complete the number of directors composing the same, the SEC cited its previous opinions where it held that:

“ For purposes of complying with the statutory minimum number of stockholders/directors, the owner may transfer one (1) qualifying share to each nominee stockholders for purposes of qualifying them to become members of the Board, without giving them the beneficial ownership of the shares. Said transfer would be more of a “trust” and not a transfer of “ownership,” hence, the beneficial interest in such shares will remain with the assignor while the assignee will hold only the legal title to the stock. In such case, the transferee should be described in the Deed of Assignment, corporate books and certificate of stock merely as a qualifying shareholder or nominee of the transferor. The fact that the stock standing on the corporate books is in the name of the person only as a qualifying shareholder or that the holder of the stock certificate is described merely as a nominee serves as a notice to the corporation and third parties that the holder thereof does not hold the share in his own right but holds it only as a nominee for the benefit of the real owner.” [emphasis supplied]

Thus, the SEC opined that Sysmex can validly report in its GIS changes in nominee shareholders pursuant to a validly executed Deed of Trust and Assignment.

With respect to the second issue, the SEC held that Section 25 of the Revised Corporation Code (“ RCC ”), which categorically mandates the submission of information relating to the election of directors, trustees and officers, is intended to timely apprise the SEC of any relevant changes in the submitted information on file with the latter as they arise. Section 25 of the RCC thus provides:

“Section 25. Within thirty (30) days after the election of the directors, trustees and officers of the corporation, the secretary , or any other officer of the corporation, shall submit to the Commission, the names, nationalities, shareholdings, and residence addresses of the directors, trustees, and officers elected. x x x” [Emphasis supplied]

The election or appointment of a new director is a circumstance of Sysmex’s governance structure that needs to be reported to the SEC through its GIS as it involves a material change in the Board’s composition.

Track updates

339 downloads

Click to preview

Deed of Assignment of Shares

Updated: May 17, 2022

Accepted payment methods

Key description

- This document is a Deed of Assignment of Corporate Shares. Since these are only a few clauses, I am sharing this for free. If you are interested in corporate documents, let me know. I can draft these for you.

- Corporate documents

Shares sale

Business sale, sale & purchase.

Please read our Terms of service and Privacy Policy carefully before using Lexub. By using Lexub, you agree to be bound by these documents.

Other documents from the author

# Corporate documents # Labor law # Others # Legal # English

# Corporate documents # Term sheets # Business sale # Court # English # Filipino

# Sale & Purchase # Business sale # Affidavits # Family law # Court Forms # Forms # Real estate # Legal # General # Court # English

Similar documents

# Labor law # Terms & Conditions # Service contracts # Outsourcing & Contracting # Corporate documents # General # Media # Wholesale and retail # Other industries # Manufacturing # Hospitality # Logistics # English

# Partnership agreements # Terms & Conditions # Legal # Real estate # English

# Sale & Purchase # Terms & Conditions # Partnership agreements # Real estate # Legal # Real estate # Infrastructure # English

# Affidavits # Real estate # Sale & Purchase # Business sale # Others # Terms & Conditions # General # Legal # Real estate # English

Write review

- Privacy Policy

- Terms of Service

- Ambassador Programme FAQs

Popular jurisdictions

- Philippines

- Banking & Finance

- Construction

- Digital technology

- Electronics

All industries »

- Antitrust & Fair Competition

- Bankruptcy, Restructuring & Insolvency

- Business formation

- Capital markets

- Confidentiality & Non-Disclosure

All categories »

IMAGES

VIDEO

COMMENTS

Account No. 111-222-333. Type of Shares: Common Shares. Number of Shares: 1000. Par Value: 1 peso/share. The ASSIGNEE hereby accepts the assignment. IN WITNESS WHEREOF, the parties have signed this deed on 7 July 2014 at Pasay City, Philippines. MARIA S. SANTOS MARIO C. CRUZ. ASSIGNOR ASSIGNEE. SIGNED IN THE PRESENCE OF:

Size 2 to 3 pages. 4.5 - 2 votes. Fill out the template. A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties, the date of the transfer, the number of the stock ...

Only absolute transfers of shares of stocks are required to be registered in the corporation's stocks and transfer book in order to have the force and effect against third persons. (Chemphil Export and Import Corporation v. Court of Appeals, G.R. No. 112438-39, 12 December 1995) Alburo Alburo and Associates Law Offices specializes in business ...

Deed of Assignment (Shares of Stock) DEED OF ASSIGNMENT OF SHARES OF STOCK. KNOW ALL MEN BY THESE PRESENTS: This Deed of Assignment, made and executed this (Date) at ( Place), by and between: (NAME OF ASSIGNOR), of legal age, Filipino, single/married, and resident of (Place of Residence), and hereinafter referred to as the "ASSIGNOR"; - in ...

On the other hand, if the shares of stock are not represented by a certificate, they may be transferred as follows: 1. By means of a deed of assignment; and. 2. Such is duly recorded in the books of the corporation. It must be noted that whether or not the shares of stock are evidenced by a stock certificate, the transfer must be recorded or ...

Choose whether the seller is an individual person, partnership, or corporation. The seller is the one transferring the shares. Select "Corporation" if the employer is registered as a corporation whether stock or non-stock, or one-person corporation, or any other type of corporation with the Securities and Exchange Commission.Select "Partnership" if the employer is a partnership that may be ...

Philippine law treats shares of stock in a corporation as personal property. Similar to other personalty, the owner of the property can ... assignment or any other conveyance) in the Philippines and probably in any jurisdiction, that the parties to any contract must be aware of the subject matter - what is being sold, transferred or otherwise ...

Learn more about the Philippine government, its structure, how goverment works and the people behind it.

hence, the beneficial interest in such shares will remain with the assignor while the assignee will hold only the legal title to the stock. In such case, the transferee should be described in the Deed of Assignment, corporate books and certificate of stock merely as a qualifying shareholder or nominee of the transferor. The fact that the stock ...

The document costs PhP 350 for a one-time purchase. You can also avail of Premium subscription at PhP 1,000 and get (a) unlimited use of our growing library of documents, from affidavits to contracts; and (b) unlimited use of our " Ask an Attorney " service which lets you consult an expert lawyer anytime for any legal concern you have.

Deed of Assignment of Shares - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. The document is a Deed of Assignment of Shares whereby an Assignor transfers and conveys 500 shares of common stock in a corporation to an Assignee for 500 Philippine pesos. The Assignor authorizes the corporate secretary to transfer the shares to the Assignee in the ...

DEED OF SALE OF SHARES OF STOCK KNOW ALL MEN BY THESE PRESENTS: I, _____, of legal age, Filipino, single/married, and resident of ... and by virtue of the laws of the Republic of the Philippines, with SEC Registration No. _____, and with principal office address at _____, free from any and all liens and encumbrances whatsoever. ...

DEED OF ASSIGNMENT . KNOW ALL MEN BY THESE PRESENTS: This DEED, ... WHEREAS, the ASSIGNOR is a stockholder and holds certain shares of stock of MBS Tek Corporation, a corporation organized and existing under and virtue of the laws of the Republic of the Philippines with office address at Astillero Building, Oro Site, Legazpi City, Philippines ...

Accordingly, transfers of shares of stock from nominees to new nominees are quite common. Oftentimes, the transfer of shares is done by the execution of a deed of assignment by the nominee to the ...

In Rural Bank of Salinas,46 the Court ruled that the right of a transferee/assignee to have stocks transferred to his name is an inherent right flowing from his ownership of the stocks.47 In said case, the private respondent presented to the bank the deeds of assignment for registration, transfer of the shares assigned in the bank's books ...

Documentary Stamp Tax (DST) is imposed on all sales, or agreements to sell, or memoranda of sales, or deliveries, or transfer of shares or certificates of stock in any association, company, or corporation. The CGT rate for non-resident foreign corporations remains unchanged at 5% for the first Php100,000 of net gain and 10% on amounts in excess ...

The complaint was amended for the second time on October 17, 1990. The amendment consisted of dropping Zalamea as defendant in view of the Deed of Assignment dated October 15, 1987 which he executed, assigning, transferring and ceding to the Government the 121,178 Bulletin shares registered in his name.

3. Deed of Assignment e. Shares of Stock 1. Detailed schedule of the shares of stock showing the name of stockholder, stock certificate number, number of shares and the basis of transfer value whether market or book value certified by the treasurer 2. Audited financial statements of the investee co mpany as of the last fiscal year

Deed of Assignment of Shares Template - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Sample Template for Assignment of Shares of stocks from a corporation

In SEC-OGC Opinion No. 21-03 dated February 18, 2021, the Securities and Exchange Commission ( "SEC") resolved the following issues: Whether there is a need to report to the SEC, through the company's GIS, the said new nominee director. Sysmex Philippines, Inc. ( "Sysmex") has five (5) nominee shareholders who also constitute the ...

Learn more about the Philippine government, its structure, how goverment works and the people behind it.

7 clauses. Shareholder's Agreement Term Sheet. # Corporate documents # Term sheets # Business sale # Court # English # Filipino. $21.10. Updated: May 17, 2022. 17 clauses. Extra-judicial Settlement of Estate with Deed of Absolute Sale.

Deposit Act of the Philippines of 1974), as amended, and other laws/regulations relative to the confidentiality or secrecy of bank deposits. To effectively carry out the powers herein granted, the DEBTOR and/or ASSIGNOR hereby unconditionally and irrevocably names and constitutes the ASSIGNEE and each of the BDO Subsidiaries and Affiliates its true and lawful attorney-in-