- Browse All Articles

- Newsletter Sign-Up

- 15 Dec 2020

- Working Paper Summaries

Designing, Not Checking, for Policy Robustness: An Example with Optimal Taxation

The approach used by most economists to check academic research results is flawed for policymaking and evaluation. The authors propose an alternative method for designing economic policy analyses that might be applied to a wide range of economic policies.

- 31 Aug 2020

- Research & Ideas

State and Local Governments Peer Into the Pandemic Abyss

State and local governments that rely heavily on sales tax revenue face an increasing financial burden absent federal aid, says Daniel Green. Open for comment; 0 Comments.

- 12 May 2020

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 01 Apr 2019

- What Do You Think?

Does Our Bias Against Federal Deficits Need Rethinking?

SUMMING UP. Readers lined up to comment on James Heskett's question on whether federal deficit spending as supported by Modern Monetary Theory is good or evil. Open for comment; 0 Comments.

- 20 Mar 2019

In the Shadows? Informal Enterprise in Non-Democracies

With the informal economy representing a third of the GDP in an average Middle East and North African country, why do chronically indebted regimes tolerate such a large and untaxed shadow economy? Among this study’s findings, higher rates of public sector employment correlate with greater permissibility of firm informality.

- 30 Jan 2019

Understanding Different Approaches to Benefit-Based Taxation

Benefit-based taxation—where taxes align with benefits from state activities—enjoys popular support and an illustrious history, but scholars are confused over how it should work, and confusion breeds neglect. To clear up this confusion and demonstrate its appeal, we provide novel graphical explanations of the main approaches to it and show its general applicability.

- 02 Jul 2018

Corporate Tax Cuts Don't Increase Middle Class Incomes

New research by Ethan Rouen and colleagues suggests that corporate tax cuts contribute to income inequality. Open for comment; 0 Comments.

- 13 May 2018

Corporate Tax Cuts Increase Income Inequality

This paper examines corporate tax reform by estimating the causal effect of state corporate tax cuts on top income inequality. Results suggest that, while corporate tax cuts increase investment, the gains from this investment are concentrated on top earners, who may also exploit additional strategies to increase the share of total income that accrues to the top 1 percent.

- 08 Feb 2018

What’s Missing From the Debate About Trump’s Tax Plan

At the end of the day, tax policy is more about values than dollars. And it's still not too late to have a real discussion over the Trump tax plan, says Matthew Weinzierl. Open for comment; 0 Comments.

- 24 Oct 2017

Tax Reform is on the Front Burner Again. Here’s Why You Should Care

As debate begins around the Republican tax reform proposal, Mihir Desai and Matt Weinzierl discuss the first significant tax legislation in 30 years. Open for comment; 0 Comments.

- 08 Aug 2017

The Role of Taxes in the Disconnect Between Corporate Performance and Economic Growth

This paper offers evidence of potential issues with the current United States system of taxation on foreign corporate profits. A reduction in the US tax rate and the move to a territorial tax system from a worldwide system could better align economic growth with growth in corporate profits by encouraging firms to invest domestically and repatriate foreign earnings.

- 07 Nov 2016

Corporate Tax Strategies Mirror Personal Returns of Top Execs

Top executives who are inclined to reduce personal taxes might also benefit shareholders in their companies, concludes research by Gerardo Pérez Cavazos and Andreya M. Silva. Open for comment; 0 Comments.

- 18 Apr 2016

Popular Acceptance of Morally Arbitrary Luck and Widespread Support for Classical Benefit-Based Taxation

This paper presents survey evidence that the normative views of most Americans appear to include ambivalence toward the egalitarianism that has been so influential in contemporary political philosophy and implicitly adopted by modern optimal tax theory. Insofar as this finding is valid, optimal tax theorists ought to consider capturing this ambivalence in their work, as well.

- 20 Nov 2015

Impact Evaluation Methods in Public Economics: A Brief Introduction to Randomized Evaluations and Comparison with Other Methods

Dina Pomeranz examines the use by public agencies of rigorous impact evaluations to test the effectiveness of citizen efforts.

- 07 May 2014

How Should Wealth Be Redistributed?

SUMMING UP James Heskett's readers weigh in on Thomas Piketty and how wealth disparity is burdening society. Closed for comment; 0 Comments.

- 08 Sep 2009

The Height Tax, and Other New Ways to Think about Taxation

The notion of levying higher taxes on tall people—an idea offered largely tongue in cheek—presents an ideal way to highlight the shortcomings of current tax policy and how to make it better. Harvard Business School professor Matthew C. Weinzierl looks at modern trends in taxation. Key concepts include: Studies show that each inch of height is associated with about a 2 percent higher wage among white males in the United States. If we as a society are uncomfortable taxing height, maybe we should reconsider our comfort level for taxing ability (as currently happens with the progressive income tax). For Weinzierl, the key to explaining the apparent disconnect between theory and intuition starts with the particular goal for tax policy assumed in the standard framework. That goal is to minimize the total sacrifice borne by those who pay taxes. Behind the scenes, important trends are evolving in tax policy. Value-added taxes, for example, are generally seen as efficient by tax economists, but such taxes can bear heavily on the poor if not balanced with other changes to the system. Closed for comment; 0 Comments.

- 02 Mar 2007

What Is the Government’s Role in US Health Care?

Healthcare will grab ever more headlines in the U.S. in the coming months, says Jim Heskett. Any service that is on track to consume 40 percent of the gross national product of the world's largest economy by the year 2050 will be hard to ignore. But are we addressing healthcare cost issues with the creativity they deserve? What do you think? Closed for comment; 0 Comments.

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50+ Focused Taxation Research Topics For Your Dissertation

Published by Ellie Cross at December 29th, 2022 , Revised On May 2, 2024

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance on and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper explaining the importance of accounting in the tax department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time.

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK tax studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK.

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, conduct a thorough investigation of enhancing tax benefits among British nationals.

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy.

- The effect and limitations of bilateral and multilateral tax treaties in addressing double taxation and preventing tax evasion.

- Assess solutions: OECD/G20 Base Erosion and Profit Shifting (BEPS) project and explore the implications for multinational corporations.

- The Impact of Tax cuts in Obtaining Social, monetary, and Aesthetic Ends That Benefit the Community.

- Exploring the Effect of Section 1031 of the Tax Code During Transactions on Investors and Business People.

- Investigating the role of environmental taxes and incentives in addressing global environmental challenges.

- Evaluating the impact of increased transparency on multinational enterprises and global efforts to combat tax evasion and illicit financial flows.

- Exploring the health and financial effects of a proposed policy to increase the excise tax on cigarettes.

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyse cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

Here is a list of sports dissertation topics to help you choose the one studies any one as per your requirements.

Need interesting and manageable Twitter Marketing dissertation topics? Here are the trending Twitter Marketing dissertation titles so you can choose the most suitable one.

Physiotherapy is a healthcare profession that deals with movement disorders of the body arising from different conditions. Physiotherapy focuses on performing practices that reduce physical ailments.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

- Search Menu

Sign in through your institution

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Numismatics

- Classical Literature

- Classical Reception

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Papyrology

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Archaeology

- Late Antiquity

- Religion in the Ancient World

- Social History

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Evolution

- Language Reference

- Language Acquisition

- Language Variation

- Language Families

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies (Modernism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Media

- Music and Religion

- Music and Culture

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Science

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Politics

- Law and Society

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Legal System - Costs and Funding

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Restitution

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Clinical Neuroscience

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Medical Ethics

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Security

- Computer Games

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Ethics

- Business Strategy

- Business History

- Business and Technology

- Business and Government

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Social Issues in Business and Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic History

- Economic Systems

- Economic Methodology

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Management of Land and Natural Resources (Social Science)

- Natural Disasters (Environment)

- Pollution and Threats to the Environment (Social Science)

- Social Impact of Environmental Issues (Social Science)

- Sustainability

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- Ethnic Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Behaviour

- Political Economy

- Political Institutions

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Political Theory

- Politics and Law

- Politics of Development

- Public Policy

- Public Administration

- Qualitative Political Methodology

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Disability Studies

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

Taxation: An Interdisciplinary Approach to Research

- Cite Icon Cite

- Permissions Icon Permissions

Taxation involves complex questions of policy, law, and practice. The book offers an innovative introduction to tax research by combining commentary on disciplinary-based and interdisciplinary approaches. Its objective is to guide and encourage researchers how to produce taxation research that is rigorous and relevant. It comments upon how disciplinary-based approaches to tax research have developed in law, economics, accounting, political science, and social policy. Its authors then go to introduce an inter-disciplinary research approach to taxation research. Effective approaches to research problem definition and research method choice are outlined by leading authors in their fields, and topical studies provide bibliographic surveys of specific areas of tax research. The book provides suggestions of topics, readings, and approaches that are intended to help the new researcher choose ways to begin their tax research. Written by a group of international experts, this book will be essential reading for new researchers in the tax field, including PhD students; for existing researchers wishing to broaden their understanding of taxation; for policymakers wanting to gauge where the leading edge of current tax research lies; and for tax practitioners interested in scholarly contributions to their field of practice.

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

- Add your ORCID iD

Institutional access

Sign in with a library card.

- Sign in with username/password

- Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

| Month: | Total Views: |

|---|---|

| August 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

| September 2024 | 1 |

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

Center for Federal Tax Policy

The mission of our federal program is to promote tax and fiscal policy that leads to greater U.S. competitiveness, higher economic growth, and improved quality of life for all taxpayers.

We have several projects, such as the Growth and Opportunity Agenda and Options for Reforming America’s Tax Code , which help us educate taxpayers, journalists, and policymakers on how the U.S. tax system works and the impact of federal tax changes on taxpayers and the economy.

Our Center for Federal Tax Policy hosts Tax Foundation University , a crash course designed to educate congressional staff on the economics of tax policy. Our experts are also a go-to source in the media and are frequently cited in top outlets like The Wall Street Journal , The New York Times , and The Washington Post . See Our Experts

Economic and Tax Modeling

Since 2012, we have used our Taxes and Growth (TAG) macroeconomic model to analyze dozens of legislative and campaign tax proposals, including every major tax plan put forth during the 2016 presidential campaigns, the House GOP’s 2016 Tax Reform Blueprint, the Tax Cuts and Jobs Act, and President Biden’s tax reform agenda. See Our Economic and Tax Modeling

For a look at where tax modeling started, explore the extensive body of work from the Institute for Research on the Economics of Taxation (IRET), the think tank that pioneered dynamic tax modeling. Explore the IRET Archives

Featured Issues

Tax Cuts and Jobs Act President Biden’s Tax Plans 2024 Tax Plans

Cost Recovery | Taxes & Inflation | Taxes on Savers & Investors | Tariffs & Trade | Carbon Taxes

Featured Projects

Options for Navigating the 2025 Tax Cuts and Jobs Act Expirations

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

Tracking 2024 Presidential Tax Plans

Tax policy has become a significant focus of the U.S. 2024 presidential election. Our new interactive tool helps keep track of the tax policies proposed by presidential candidates during their campaigns.

Details and Analysis of a Tax Reform Plan for Growth and Opportunity

The federal tax code remains a major source of frustration and controversy for Americans, and a hindrance to economic growth and opportunity. Other countries, such as Estonia, have proven that sufficient tax revenue can be collected in a less frustrating and more efficient way.

How to Rein in the National Debt

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

Risks to the U.S. Tax Base from Pillar Two

A growing international tax agreement known as Pillar Two presents two new threats to the U.S. tax base: potential lost revenue and limitations on Congress’s ability to set its own tax policy.

How the Moore Supreme Court Case Could Reshape Taxation of Unrealized Income

A major case pending before the U.S. Supreme Court (Moore v. United States) is calling into question provisions on large portions of the U.S. tax base which could quickly become legally uncertain, putting significant revenue at stake.

All Related Articles

Results of a Survey Measuring Business Tax Compliance Costs

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

Expanding User Fees for Transportation: Roads and Beyond

By 2034, the gas tax and other car-related excise taxes are projected to raise less than half of the Highway Trust Fund’s outlays. While broader tax and spending reforms are necessary for overall deficit reduction, improving transportation funding would be a crucial step forward.

Puerto Rican Competitiveness and Pillar Two

Puerto Rico, a US territory with a limited ability to set its own tax policies, will be the first part of the US to be substantially affected by Pillar Two, the global tax agreement that seeks to establish a 15 percent minimum tax rate on corporate income.

Tariff Tracker: Tracking the Economic Impact of the Trump-Biden Tariffs

The Trump administration imposed nearly $80 billion worth of new taxes on Americans by levying tariffs on thousands of products in 2018 and 2019, amounting to one of the largest tax increases in decades. The Biden administration has kept most of the Trump administration tariffs in place

Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposal

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

Reining in America’s $3.3 Trillion Tax-Exempt Economy

For over a century, lawmakers have exempted politically favored organizations and industries from the tax code. As a result, the tax-exempt nonprofit economy now comprises 15 percent of GDP, roughly equal to the fifth-largest economy in the world.

Bibliometric and scientometric analysis of the scientific field in taxation

- Published: 09 January 2023

- Volume 3 , article number 35 , ( 2023 )

Cite this article

- Daniel Fonseca Costa ORCID: orcid.org/0000-0001-6322-5280 1 ,

- Brenda Melissa Fonseca ORCID: orcid.org/0000-0003-2505-3021 1 ,

- Lélis Pedro de Andrade ORCID: orcid.org/0000-0001-6269-6048 1 &

- Bruno César de Melo Moreira ORCID: orcid.org/0000-0003-2265-7217 1

258 Accesses

2 Citations

Explore all metrics

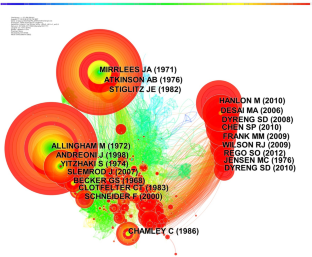

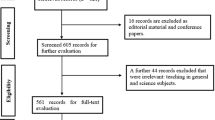

The work aims to conduct a bibliometric and scientometric analysis on the field of research in taxation. Taxation intends to finance and maintain states, whose purpose is to regulate coexistence and social balance. A search was conducted in the web of science—main collection that returned 11,628 articles between the years 1945 and 2019. The results show four trends of studies deemed dominant: tax evasion, bunching properties, government borrowing and tax planning. The tax planning line stands out for having nine works among the twenty most cited and identified in this work. For the whole work, the author who stood out was Joel Slemrod, followed by Anthony Atkinson. Finally, it was found that the tax evasion research line is oriented to behavioral studies, also concluding that the tax planning line has a strong tendency to grow and expand in the taxation field, suggesting that there are research gaps to be filled in this trend. The work contributes in a theoretical and applied way to the scientific field of taxation by emphasizing the main works and the main authors, while showing the main research trends related to the theme and enabling the generation of innovative research on the subject.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Source: Prepared by the authors using the information from the web of science

Source: Prepared by the authors from the CiteSpace output

Similar content being viewed by others

Bibliometric and scientometric analyses on the relation of tax decision and taxpayer behavior

Is analytical tax research alive and kicking? Insights from 2000 until 2022

Analysis of environmental taxes publications: a bibliometric and systematic literature review

Data availability statement.

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Agostini CA, Engel E, Repetto A, Vergara D (2018) Using small businesses for individual tax planning: evidence from special tax regimes in Chile [journal article]. Int Tax Public Financ 25(6):1449–1489. https://doi.org/10.1007/s10797-018-9509-0

Article Google Scholar

Akbulut M, Tonta Y, White HD (2020) Related records retrieval and pennant retrieval: an exploratory case study. Scientometrics 122(2):957–987. https://doi.org/10.1007/s11192-019-03303-9

Allingham MG, Sandmo A (1972) Income tax evasion: a theoretical analysis. J Public Econ 1(3):323–338. https://doi.org/10.1016/0047-2727(72)90010-2

Alm J, Torgler B (2006) Culture differences and tax morale in the United States and in Europe [article]. J Econ Psychol 27(2):224–246. https://doi.org/10.1016/j.joep.2005.09.002

Andreoni J, Erard B, Feinstein J (1998) Tax compliance. J Econ Lit 36(2):818–860. www.jstor.org/stable/2565123 . Accessed 1 Mar 2022

Google Scholar

Armstrong CS, Blouin JL, Larcker DF (2012) The incentives for tax planning. J Account Econ 53(1):391–411. https://doi.org/10.1016/j.jacceco.2011.04.001

Armstrong CS, Blouin JL, Jagolinzer AD, Larcker DF (2015) Corporate governance, incentives, and tax avoidance. J Account Econ 60(1):1–17. https://doi.org/10.1016/j.jacceco.2015.02.003

Atkinson AB, Stiglitz JE (1976) Design of tax structure—direct versus indirect taxation [article]. J Public Econ 6(1–2):55–75. https://doi.org/10.1016/0047-2727(76)90041-4

Atkinson AB, Piketty T, Saez E (2011) Top incomes in the long run of history [article]. J Econ Lit 49(1):3–71. https://doi.org/10.1257/jel.49.1.3

Ayers BC, Call AC, Schwab CM (2018) Do analysts’ cash flow forecasts encourage managers to improve the firm’s cash flows? Evidence from tax planning. Contemp Account Res 35(2):767–793. https://doi.org/10.1111/1911-3846.12403

Barbu L, Mihaiu DM, Serban RA, Opreana A (2022) Knowledge mapping of optimal taxation studies: a bibliometric analysis and network visualization [article]. Sustainability 14(2):36. https://doi.org/10.3390/su14021043

Bashir MF, Ma B, Bilal M, Komal B, Bashir MA (2021) Analysis of environmental taxes publications: a bibliometric and systematic literature review. Enviro Sci Pollut Res 28(16):20700–20716. https://doi.org/10.1007/s11356-020-12123-x

Becker GS (1968) Crime and punishment: an economic approach. J Polit Econ 76(2):169–217. www.jstor.org/stable/1830482 . Accessed 1 Mar 2022

Bradshaw M, Liao G, Ma M (2018) Agency costs and tax planning when the government is a major Shareholder. J Account Econ. https://doi.org/10.1016/j.jacceco.2018.10.002

Chamley C (1986) Optimal taxation of capital income in general equilibrium with infinite lives. Econometrica 54(3):607–622. https://doi.org/10.2307/1911310

Chen C (2004) Searching for intellectual turning points: progressive knowledge domain visualization. Proc Natl Acad Sci 101(suppl 1):5303–5310. https://doi.org/10.1073/pnas.0307513100

Chen C (2006) CiteSpace II: detecting and visualizing emerging trends and transient patterns in scientific literature. J Am Soc Inform Sci Technol 57(3):359–377. https://doi.org/10.1002/asi.20317

Chen C (2016) CiteSpace: a practical guide for mapping scientific literature. Nova Science Publishers Hauppauge, New York

Chen C, Song M (2019) Visualizing a field of research: a methodology of systematic scientometric reviews. PLoS ONE 14(10):e0223994–e0223994. https://doi.org/10.1371/journal.pone.0223994

Chen SP, Chen X, Cheng Q, Shevlin T (2010) Are family firms more tax aggressive than non-family firms? [article]. J Financ Econ 95(1):41–61. https://doi.org/10.1016/j.jfineco.2009.02.003

Chen S, Ye Y, Jebran K (2022) Tax enforcement efforts and stock price crash risk: Evidence from China. J Int Financ Manag Account 33(2):193–218. https://doi.org/10.1111/jifm.12145

Clotfelter CT (1983) Tax evasion and tax rates—an analysis of individual returns [article]. Rev Econ Stat 65(3):363–373. https://doi.org/10.2307/1924181

Costa DF (2014) Utilização do orçamento no planejamento tributário de uma pequena empresa. Revista Brasileira de Contabilidade (206):26–39. http://rbc.cfc.org.br/index.php/rbc/article/view/1147 . Accessed 1 Mar 2022

Costa DF, Chain CP, Carvalho FDM, Moreira BCDM (2016) O custo financeiro dos tributos sobre consumo nas cadeias de suprimento brasileiras: uma proposta metodológica. Revista Contemporânea De Contabilidade 13(29):91–112. https://doi.org/10.5007/2175-8069.2016v13n29p91

Costa DF, Carvalho FDM, Moreira BCDM, Prado JWD (2017) Bibliometric analysis on the association between behavioral finance and decision making with cognitive biases such as overconfidence, anchoring effect and confirmation bias [journal article]. Scientometrics 111(3):1775–1799. https://doi.org/10.1007/s11192-017-2371-5

Costa DF, Silva ACM, Moreira BCDM, Costa MF, Andrade LP (2018) Proposta de um modelo de previsão do resultado para o planejamento tributário de pequenas empresas. Enfoque 37(3):93. https://doi.org/10.4025/enfoque.v37i3.33607

Costa DF, Carvalho FDM, Moreira BCDM (2019) Behavioral economics and behavioral finance: a bibliometric analysis of the scientific fields. J Econ Surv 33(1):3–24. https://doi.org/10.1111/joes.12262

Davidescu AA, Petcu MA, Curea SC, Manta EM (2022) Two faces of the same coin: exploring the multilateral perspective of informality in relation to sustainable development goals based on bibliometric analysis. Econ Anal Policy 73:683–705. https://doi.org/10.1016/j.eap.2021.12.016

Demirbas A (2007) Importance of biodiesel as transportation fuel [article]. Energy Policy 35(9):4661–4670. https://doi.org/10.1016/j.enpol.2007.04.003

Desai MA, Dharmapala D (2006) Corporate tax avoidance and high-powered incentives [article]. J Financ Econ 79(1):145–179. https://doi.org/10.1016/j.jfineco.2005.02.002

Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM (2021) How to conduct a bibliometric analysis: an overview and guidelines [article]. J Bus Res 133:285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

Dyreng SD, Hanlon M, Maydew EL (2008) Long-run corporate tax avoidance [article]. Account Rev 83(1):61–82. https://doi.org/10.2308/accr.2008.83.1.61

Dyreng SD, Hanlon M, Maydew EL (2010) The effects of executives on corporate tax avoidance. Account Rev 85(4):1163–1189. https://doi.org/10.2308/accr.2010.85.4.1163

Early AD (1945) The simpler 1944 income tax. Am J Nurs 45(1):37–39. https://doi.org/10.2307/3417150

Easterly W, Rebelo S (1993) Fiscal-policy and economic-growth—an empirical-investigation [article; Proceedings paper]. J Monet Econ 32(3):417–458. https://doi.org/10.1016/0304-3932(93)90025-b

Feller A, Schanz D (2017) The three hurdles of tax planning: how business context, aims of tax planning, and tax manager power affect tax expense. Contemp Account Res 34(1):494–524. https://doi.org/10.1111/1911-3846.12278

Frank MM, Lynch LJ, Rego SO (2009) Tax reporting aggressiveness and its relation to aggressive financial reporting. Account Rev 84(2):467–496. https://doi.org/10.2308/accr.2009.84.2.467

Genschel P, Schwarz P (2011) Tax competition: a literature review. Soc Econ Rev 9(2):339–370. https://doi.org/10.1093/ser/mwr004

Geofroy V (1890) Riggs, 133 U.S. 258. https://supreme.justia.com/cases/federal/us/133/258/

Graham JR, Hanlon M, Shevlin T, Shroff N (2014) Incentives for tax planning and avoidance: evidence from the field. Account Rev 89(3):991–1023. https://doi.org/10.2308/accr-50678

Haddad M, Harrison A (1993) Are there positive spillovers from direct foreign-investment - evidence from panel-data for Morocco [article]. J Dev Econ 42(1):51–74. https://doi.org/10.1016/0304-3878(93)90072-u

Hanlon M, Heitzman S (2010) A review of tax research [article]. J Account Econ 50(2–3):127–178. https://doi.org/10.1016/j.jacceco.2010.09.002

Harari YN (2014) Sapiens: a brief history of humankind. Random House, London

Harberger AC (1962) The incidence of the corporation income-tax [article]. J Polit Econ 70(3):215–240. https://doi.org/10.1086/258636

Hong Q, Smart M (2010) In praise of tax havens: international tax planning and foreign direct investment. Eur Econ Rev 54(1):82–95. https://doi.org/10.1016/j.euroecorev.2009.06.006

Issah O, Rodrigues LL (2021) Corporate social responsibility and corporate tax aggressiveness: a scientometric analysis of the existing literature to map the future [article]. Sustainability 13(11):23. https://doi.org/10.3390/su13116225 . ( article 6225 )

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3(4):305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Keen M, Lockwood B (2010) The value added tax: its causes and consequences [article]. J Dev Econ 92(2):138–151. https://doi.org/10.1016/j.jdeveco.2009.01.012

Khlif H, Achek I (2015) The determinants of tax evasion: a literature review. Int J Law Manag 57(5):486–497. https://doi.org/10.1108/IJLMA-03-2014-0027

Kirchler E (2007) The economic psychology of tax behaviour. Cambridge University Press, Cambridge. https://doi.org/10.1017/CBO9780511628238

Book Google Scholar

Lin KZ, Shi S, Tang F (2021) Profit–tax relationship, business group affiliation, and external monitoring in china. J Int Financ Manag Account 32(2):182–206. https://doi.org/10.1111/jifm.12128

Liu WS, Gu MD, Hu GY, Li C, Liao HC, Tang L, Shapira P (2014) Profile of developments in biomass-based bioenergy research: a 20-year perspective [article]. Scientometrics 99(2):507–521. https://doi.org/10.1007/s11192-013-1152-z

Macias-Chapula CA (1998) O papel da informetria e da cienciometria e sua perspectiva nacional e internacional. Ciência da Informação, 27. http://www.scielo.br/scielo.php?script=sci_arttext&pid=S0100-19651998000200005&nrm=iso . Accessed 1 Mar 2022

Mirrlees JA (1971) Exploration in theory of optimum income taxation [article]. Rev Econ Stud 38(114):175–208. https://doi.org/10.2307/2296779

Modigliani F, Miller MH (1958) The cost of capital, corporation finance and the theory of investment. Am Econ Rev 48(3):261–297. www.jstor.org/stable/1809766 . Accessed 1 Mar 2022

Nataliia L, Inna Y (2021) Digital innovations in taxation: bibliometric analysis [article]. Mark Manag Innov 3:66–77. https://doi.org/10.21272/mmi.2021.3-06

Nevzorova EN, Kireenko AP, Sklyarov RA (2017) Bibliometric analisis of the literature on tax evasion in russia and foreign countries [article]. J Tax Reform 3(2):115–130. https://doi.org/10.15826/jtr.2017.3.2.035

Olsen J, Kasper M, Kogler C, Muehlbacher S, Kirchler E (2019) Mental accounting of income tax and value added tax among self-employed business owners. J Econ Psychol 70:125–139. https://doi.org/10.1016/j.joep.2018.12.007

Powers K, Robinson JR, Stomberg B (2016) How do CEO incentives affect corporate tax planning and financial reporting of income taxes? [journal article]. Rev Acc Stud 21(2):672–710. https://doi.org/10.1007/s11142-016-9350-6

Prado JW, Alcantara VD, Carvalho FD, Vieira KC, Machado LKC, Tonelli DF (2016) Multivariate analysis of credit risk and bankruptcy research data: a bibliometric study involving different knowledge fields (1968–2014) [article]. Scientometrics 106(3):1007–1029. https://doi.org/10.1007/s11192-015-1829-6

Quinn D (1997) The correlates of change in international financial regulation [article]. Am Polit Sci Rev 91(3):531–551. https://doi.org/10.2307/2952073

Ramsey FP (1927) A contribution to the theory of taxation. Econ J 37(145):47–61. https://doi.org/10.2307/2222721

Ramsey FP (1928) A mathematical theory of saving. Econ J 38(152):543–559. https://doi.org/10.2307/2224098

Rego SO, Wilson R (2012) Equity risk incentives and corporate tax aggressiveness [Article]. J Account Res 50(3):775–810. https://doi.org/10.1111/j.1475-679X.2012.00438.x

Rundquist EA, Sletto RF (1936) Personality in the depression: a study in the measurement of attitudes. University of Minnesota Press, Minneapolis

Samson WD (2002) History of taxation. In: Lymer A, Hasseldine J (eds) The international taxation system. Springer US, New York, pp 21–41. https://doi.org/10.1007/978-1-4615-1071-0_2

Chapter Google Scholar

Sanchez-Riofrio AM, Guerras-Martin LA, Forcadell FJ (2015) Business portfolio restructuring: a comprehensive bibliometric review [Article]. Scientometrics 102(3):1921–1950. https://doi.org/10.1007/s11192-014-1495-0

Schneider F, Enste DH (2000) Shadow economies: size, causes, and consequences. J Econ Lit 38(1):77–114. https://doi.org/10.1257/jel.38.1.77

Slemrod J (2007) Cheating ourselves: the economics of tax evasion [Article]. J Econ Perspect 21(1):25–48. https://doi.org/10.1257/jep.21.1.25

Stiglitz JE (1982) Self-selection and Pareto efficient taxation. J Public Econ 17(2):213–240. https://doi.org/10.1016/0047-2727(82)90020-2

Tague-Sutcliffe J (1992) An introduction to informetrics. Inf Process Manag 28(1):1–3. https://doi.org/10.1016/0306-4573(92)90087-G

Vello A, Martinez AL (2014) Planejamento tributário eficiente: uma análise de sua relação com o risco de mercado. Planejamento Tributário Governança Corporativa Risco De Mercado 11(23):24. https://doi.org/10.5007/2175-8069.2014v11n23p117

White HD (2007a) Combining bibliometrics, information retrieval, and relevance theory, part 1: first examples of a synthesis. J Am Soc Inf Sci Technol 58(4):536–559. https://doi.org/10.1002/asi.20543

White HD (2007b) Combining bibliometrics, information retrieval, and relevance theory, part 2: some implications for information science. J Am Soc Inf Sci Technol 58(4):583–605. https://doi.org/10.1002/asi.20542

White HD (2010) Some new tests of relevance theory in information science. Scientometrics 83(3):653–667. https://doi.org/10.1007/s11192-009-0138-3

White HD (2015) Co-cited author retrieval and relevance theory: examples from the humanities. Scientometrics 102(3):2275–2299. https://doi.org/10.1007/s11192-014-1483-4

Wilson RJ (2009) An examination of corporate tax shelter participants. Account Rev 84(3):969–999. https://doi.org/10.2308/accr.2009.84.3.969

Yitzhaki S (1974) Income tax evasion: a theoretical analysis. J Public Econ 3(2):201–202. https://doi.org/10.1016/0047-2727(74)90037-1

Zhu J, Liu W (2020) A tale of two databases: the use of Web of Science and Scopus in academic papers. Scientometrics 123(1):321–335. https://doi.org/10.1007/s11192-020-03387-8

Zupic I, Cater T (2015) Bibliometric methods in management and organization [Article]. Organ Res Methods 18(3):429–472. https://doi.org/10.1177/1094428114562629

Download references

Acknowledgements

The authors thank the “Federal Institute of Education, Science and Technology of Minas Gerais” for the support given to the development of this article.

The article has no relevant financial support to disclose.

Author information

Authors and affiliations.

Instituto Federal de Educação, Ciência e Tecnologia de Minas Gerais, Formiga, Minas Gerais, Brazil

Daniel Fonseca Costa, Brenda Melissa Fonseca, Lélis Pedro de Andrade & Bruno César de Melo Moreira

You can also search for this author in PubMed Google Scholar

Contributions

All authors contributed to the study’s conception and design. Material preparation, data collection and analysis were performed by DFC, BMF, LPdA and BCdMM. The first draft of the manuscript was written by DFC and BMF and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Correspondence to Daniel Fonseca Costa .

Ethics declarations

Conflict of interest.

The authors have no competing interests to declare that are relevant to the content of this article.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Costa, D.F., Fonseca, B.M., de Andrade, L.P. et al. Bibliometric and scientometric analysis of the scientific field in taxation. SN Bus Econ 3 , 35 (2023). https://doi.org/10.1007/s43546-022-00409-w

Download citation

Received : 30 May 2022

Accepted : 23 December 2022

Published : 09 January 2023

DOI : https://doi.org/10.1007/s43546-022-00409-w

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Tax planning

- Tax evasion

- Tax avoidance

- Find a journal

- Publish with us

- Track your research

The Centre conducts cutting-edge research in economics and law and it is heavily engaged in tax policy debates and tax policy-making across the globe. Research findings are based on rigorous analysis, detailed empirical evidence and in-depth institutional knowledge.

Our own research, as well as selected papers by external contributors, is disseminated in the CBT working paper series .

" Dynamic Spending Responses to Wealth Shocks: Evidence from Quasi Lotteries on the Stock Market " Asger Lau Andersen, Niels Johannesen, Adam Sheridan American Economic Review: Insights, vol. 6, no. 3, September 2024

" Equity and Efficiency When Needs Differ " Kristoffer Berg, Morten Håvarstein, Paolo Piacquadio CESifo Working Paper No. 11310

"Taxing Capital in a Globalized World: The Effects of Automatic Information Exchange" Hjalte Fejerskov Boas, Niels Johannesen, Claus Thustrup Kreiner, Lauge Larsen and Gabriel Zucman. WP 24/08, July 2024

“The EU Public Country-by-Country Reporting Directive: legislative and policy comments” Nicolas Traut British Tax Review, Volume 2024, Issue 3, pages 359–370

Business Tax Roadmap Policy Paper. "An Excess Profits Tax" Michael P. Devereux

"The Offshore World According to FATCA: New Evidence on the Foreign Wealth of US Households" Niels Johannesen Tax Policy and the Economy , Volume 38, 2024, pages 61- 99

"Entity Classification Election Rules in Germany and Beyond: Necessary Tools to Achieve Neutrality of Legal Form or Invitation to Engage in Tax Avoidance?”

"Meritocratic Labor Income Taxation"

“What Is Real and What Is Not in the Global FDI Network?” Niels Johannesen (with Jannick Damgaard and Thomas Elkjaer) Journal of International Money and Finance, 2024

“The End of Bank Secrecy: Implications for Redistribution and Optimal Taxation” Niels Johannesen Oxford Review of Economic Policy , 2023

"Tax Avoidance Networks and the Push for a ’Historic’ Global Tax Reform" Katarzyna Bilicka, Michael P. Devereux and İrem Güçeri Tax Policy and the Economy, 2022, 37, 57-108, August 2023

"Remote Working and the Threshold PE Test" Richard Collier Field Court Tax Chambers Digest, 16 June 2023

"Individual Mobility and the Corporate Tax" Reuven Avi-Yonah and Richard Collier Tax Notes International, 110, 29 May 2023

"The Impact of the Global Minimum Tax on Tax Competition | IBFD" Michael Devereux and John Vella World Tax Journal, 15.3, 323-278, April 2023

"The Evolution of Thinking on Tax and the Digitalisation of Business 1996-2018" Richard Collier World Tax Journal, 15:2, 145-204, 2023

"What Ails Pakistan's Tax System?" Jawad Shah Dissent Today, 1 April 2023

“The Offshore World According to FATCA: New Evidence on the Foreign Wealth of U.S. Households” Niels Johannesen (with Daniel Reck, Max Risch, Joel Slemrod, John Guyton and Patrick Langetieg) NBER Working Paper 31055, March 2023

"Using Computerized Information to Enforce VAT: Evidence from Pakistan" Jawad Shah WP23/03, March 2023

“GILTI and the GloBE” Heydon Wardell-Burrus WP 23/1, February 2023

"GloBE Administrative Guidance – The QDMTT and GILTI Allocation" Heydon Wardell-Burrus Policy Brief , February 2023

"Empirical evidence on the Global Minimum Tax: What is a critical mass and how large is the Substance-Based Income Exclusion?" Michael P. Devereux, Johanna Paraknewitz and Martin Simmler WP22/23, December 2022

“Homes Incorporated: Offshore Ownership of Real Estate in the U.K.” Niels Johannesen (with Jakob Miethe and Daniel Weishaar) CEPR Working Paper 17738, December 2022

"Issues of Fairness in Taxing Corporate Profit" Michael P. Devereux and John Vella LSE Public Policy Review, 24 November 2022

"Introduction of Transfer pricing Measures" Richard Collier Field Court Tax Chamber Digest, 13 November 2022

"International Tax Competition with a Coordinated Minimum Tax" Michael P. Devereux WP22/25, October 2022

"Leveling the Playing Field: Constraints on Multinational Profit Shifting and the Performance of National Firms" Patrick Gauß, Michael Kortenhaus, Nadine Riede, and Martin Simmler, WP22/15, October 2022

"Small Firm Growth and the VAT Threshold: Evidence for the UK" Li Liu, Ben Lockwood, and Eddy Tam WP22/21, October 2022

"MNE Strategic Responses to the GloBE Rules" Haydon Wardell-Burrus WP22/14, September 2022

"Can Pillar Two be Leveraged to Save Pillar One?" Heydon Wardell-Burrus Tax Notes International, July 2022

"Fiscalité environnementale : une construction juridique" Alice Pirlot in Florence George et al. (eds.), Penser, écrire et interpreter le droit, Larcier, 285-294

"GLoBE: Formative Policies and Politics of Pillar 2" Richard Collier and John Vella in Werner Haslehner, Georg Kofler, Katerina Pantazatou, and Alexander Rust, The Global Minimum Tax, Edward Elgar Publishing, forthcoming

"On the Breakdown of the OECD Transfer Pricing Guidelines" Richard Collier Field Court Tax Digest, No. 10, May 2022

"Pillar 2: Rule Order, Incentives, and Tax Competition" Michael P. Devereux, John Vella and Heydon Wardell-Burrus Policy Brief , March 2022

“Tax Evasion and Tax Avoidance” Niels Johannesen (with Annette Alstadsæter, Ségal Le Guern Herry and Gabriel Zucman) Journal of Public Economics, 2022

"Is the shift to taxation at the point of destination inexorable?" Matt Andrew and Richard Collier WP22/03, January 2022

"OECD/International - On the Apparent Widespread Misapplication of the OECD Transfer Pricing Guidelines" Richard Collier and Ian F. Dykes Bulletin for International Taxation, 2022 (Volume 76), No.1

"Pillar 2’s Impact on Tax Competition" Michael P. Devereux, John Vella and Heydon Wardell-Burrus World Tax Journal, forthcoming

Publications by year archive

Cbt tax database.

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

7 facts about Americans and taxes

A majority of U.S. adults say they’re bothered a lot by the feeling that some corporations (61%) and some wealthy people (60%) don’t pay their fair share.

Who pays, and doesn’t pay, federal income taxes in the U.S.?

Since 2000, there has been a downward trend in average effective tax rates for all but the richest taxpayers.

Top tax frustrations for Americans: The feeling that some corporations, wealthy people don’t pay fair share

61% of adults now say that the feeling that some corporations don’t pay their fair share bothers them a lot. 60% say this about some wealthy people.

Growing share of Americans say they want more spending on police in their area