- ComplyAdvantage Mesh

- Customer Screening

- Company Screening

- Ongoing Monitoring

- Transaction Monitoring

- Payment Screening

- Fraud Detection

- Politically Exposed Persons (PEPs)

- Adverse Media

- ComplyLaunch™

- Cryptocurrency

- Early Stage Start-Ups

- WealthTech and Investments

- Latest News

- Events & Webinars

- Reports & Guides

- Knowledge & Training

- Customer Stories

- All Insights

- Press and Media

- Partner with us

- Open Positions

- Careers in Product

- Careers in Technology

The State of Financial Crime 2024: Download our latest research

23 September 2022

Customer risk assessment: what you need to know.

Insights Customer risk assessment: What you need to know

A customer risk assessment is a necessity when onboarding new customers . It ensures that high-risk individuals are identified, and appropriate anti-money laundering (AML) measures are put in place.

But what elements should firms consider as part of an AML customer risk assessment? And how do they determine what to prioritize?

What is a customer risk assessment?

In order to understand the money laundering risks each customer poses, a customer risk assessment should consider a number of factors. These include verifying the identity of a customer , considering how to engage with them – the products and services they access, the type of transactions they carry out, and how often – and the geographical locations to which the customer is linked.

In addition, firms should ensure they comply with national and international sanctions by screening customer and beneficial owner names against United Nations and other relevant sanctions lists.

Firms will have different levels of risk appetite regarding the customers they are willing to work with. However, it is important that a consistent customer risk assessment methodology is implemented, setting out the criteria for customer risk scoring weighting mechanisms, and the rationale behind these.

The main purpose of the assessment is to identify the risks to which a firm may be exposed, either in the course of a business relationship, or for an occasional transaction. The more complex this interaction is, the more rigorous a customer risk assessment needs to be.

By being well informed, firms will be better placed to determine the correct level of customer due diligence (CDD). Ongoing reviews should be completed, particularly if a customer starts to act in a manner that deviates from their risk profile. The Financial Action Task Force (FATF) recommends that where firms cannot apply the appropriate level of CDD, they should not enter into the business relationship, or should terminate the business relationship.

What factors should be included in a customer due diligence risk assessment?

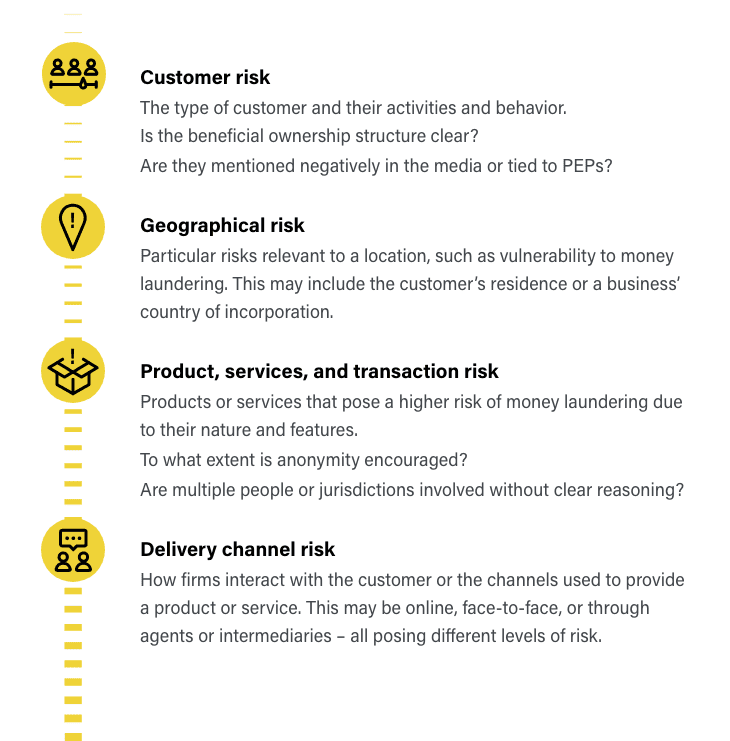

There are four main pillars to consider in a customer risk assessment:

In the US, the Financial Crimes Enforcement Network’s (FinCEN) CDD Final Rule clarifies and strengthens customer due diligence requirements. It requires applicable financial institutions to establish and maintain written policies and procedures that are designed to:

- Identify and verify the identity of customers

- Identify and verify the identity of the beneficial owners of companies opening accounts

- Understand the nature and purpose of customer relationships to develop customer risk profiles

- Conduct ongoing monitoring to identify and report suspicious transactions and, on a risk basis, to maintain and update customer information

Dynamic AML customer risk assessment

Ongoing due diligence of customers is needed to help firms mitigate money laundering risk , but what is suspicious for one customer won’t be for another.

Some general behaviors that may raise a red flag, or prompt a re-evaluation of a customer risk assessment include:

- Changing banks a number of times in a short space of time

- Attempts to disguise the real owner of the business

- Requests for short-cuts or unusual speed in transactions

- Involvement of a third-party funder with no connection to the business

- A large amount of private funding from an individual running a cash-intensive business

- False or suspicious documents used

- A large amount of cash transactions inconsistent with the profile of the customer

- Business transactions involve countries with a high risk of money laundering and/or funding of terrorism

- Overly complicated ownership structures

- Inconsistent level of business activity

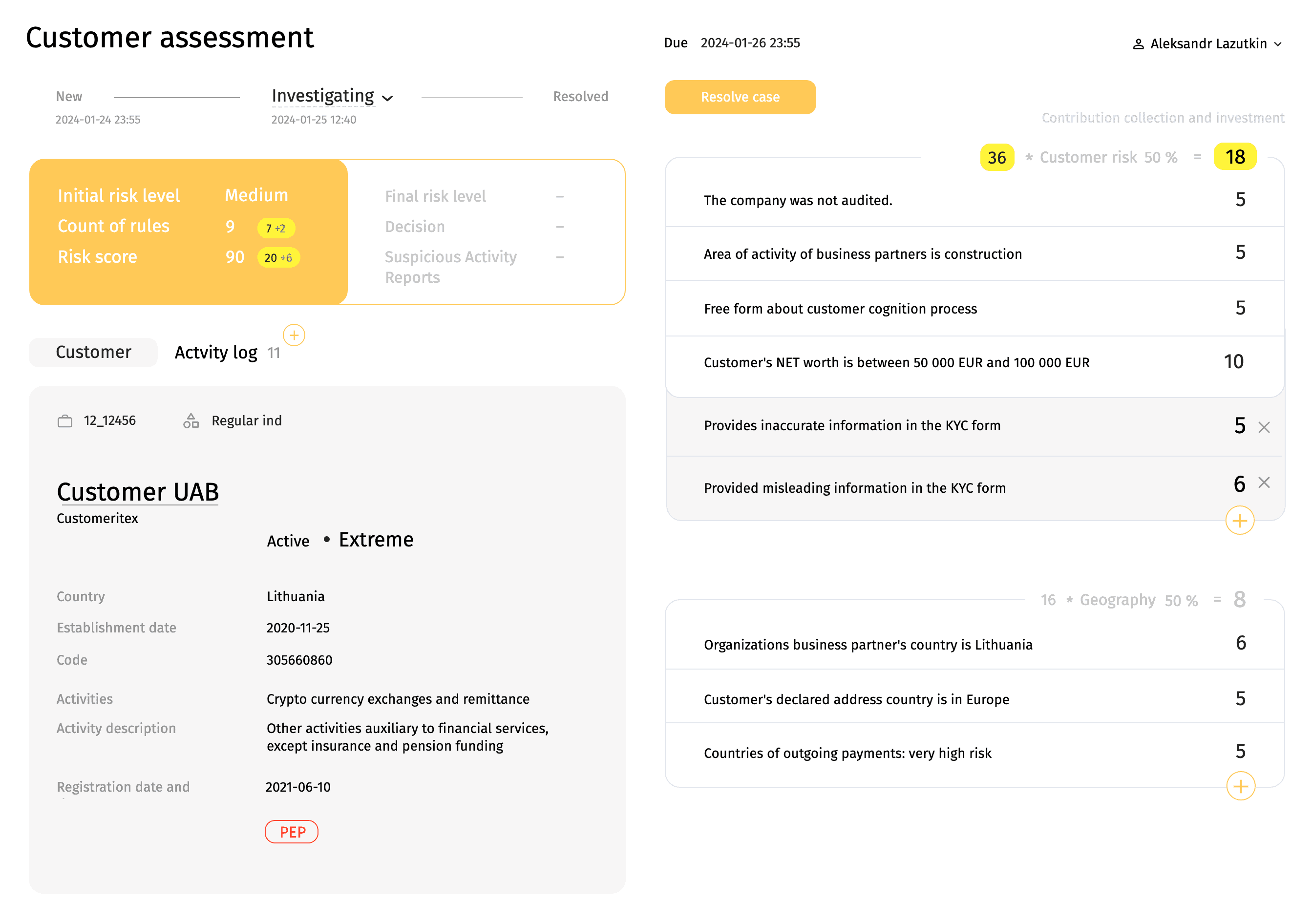

Firms need to more accurately flag suspicious actors and activities . To do so, they need to understand the importance of dynamic risk assessments and have the data and technology to enable this.

Misclassification of low-risk customers as high risk, and inaccurate or insubstantial KYC information gathering, can dilute the effectiveness of AML measures – and a wholly manual and complex process may not be enough to guarantee the results needed.

Firms should consider simplifying the architecture of their risk models and introducing statistical analysis to complement expert judgment. Machine learning algorithms can improve the quality of data and help continuously update customer profiles, while considering behavior and additional factors.

Scale your business with a robust AML KYC solution

Automate customer onboarding and monitoring with a real-time AML risk database & an effective AML KYC solution.

Originally published 23 September 2022, updated 15 April 2024

Related Content

Recent KYC/KYB Articles

- 3 common data test mistakes when evaluating an AML vendor

- Top 10 AML software for banks

- The biggest AML fines in 2023

- What is the KYC process in banking?

View Knowledge & Training

- 12 types of financial fraud

- Top 5 fraud trends in 2024 and how to mitigate them

- 5 steps to implement an effective sanctions screening process

- What is payment screening? A complete guide

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).

Flushing out the money launderers with better customer risk-rating models

Money laundering is a serious problem for the global economy, with the sums involved variously estimated at between 2 and 5 percent of global GDP. 1 “Money-laundering and globalization,” United Nations Office on Drugs and Crime, unodc.org. Financial institutions are required by regulators to help combat money laundering and have invested billions of dollars to comply. Nevertheless, the penalties these institutions incur for compliance failure continue to rise: in 2017, fines were widely reported as having totaled $321 billion since 2008 and $42 billion in 2016 alone. 2 Gavin Finch, “World’s biggest banks fined $321 billion since financial crisis,” Bloomberg , March 2, 2017, bloomberg.com. This suggests that regulators are determined to crack down but also that criminals are becoming increasingly sophisticated.

Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. The models deployed by most institutions today are based on an assessment of risk factors such as the customer’s occupation, salary, and the banking products used. The information is collected when an account is opened, but it is infrequently updated. These inputs, along with the weighting each is given, are used to calculate a risk-rating score. But the scores are notoriously inaccurate, not only failing to detect some high-risk customers, but often misclassifying thousands of low-risk customers as high risk. This forces institutions to review vast numbers of cases unnecessarily, which in turn drives up their costs, annoys many low-risk customers because of the extra scrutiny, and dilutes the effectiveness of anti–money laundering (AML) efforts as resources are concentrated in the wrong place.

In the past, financial institutions have hesitated to do things differently, uncertain how regulators might respond . Yet regulators around the world are now encouraging innovative approaches to combat money laundering and leading banks are responding by testing prototype versions of new processes and practices. 3 The US Treasury and banking agencies have together encouraged innovative anti–money laundering (AML) practices; see “Agencies issue a joint statement on innovative industry approaches,” US Office of the Comptroller of the Currency, December 3, 2018, occ.gov. In China, the Hong Kong Monetary Authority has backed the wider use of regulatory technology, and in the United Kingdom, the financial regulator has established a fintech sandbox to test AML innovations. Some of those leaders have adopted the approach to customer risk rating described in this article, which integrates aspects of two other important AML tools: transaction monitoring and customer screening. The approach identifies high-risk customers far more effectively than the method used by most financial institutions today, in some cases reducing the number of incorrectly labeled high-risk customers by between 25 and 50 percent. It also uses AML resources far more efficiently.

Best practice in customer risk rating

To adopt the new generation of customer risk-rating models, financial institutions are applying five best practices: they simplify the architecture of their models, improve the quality of their data, introduce statistical analysis to complement expert judgment, continuously update customer profiles while also considering customer behavior, and deploy machine learning and network science tools.

1. Simplify the model architecture

Most AML models are overly complex. The factors used to measure customer risk have evolved and multiplied in response to regulatory requirements and perceptions of customer risk but still are not comprehensive. Models often contain risk factors that fail to distinguish between high- and low-risk countries, for example. In addition, methodologies for assessing risk vary by line of business and model. Different risk factors might be used for different customer segments, and even when the same factor is used it is often in name only. Different lines of business might use different occupational risk-rating scales, for instance. All this impairs the accuracy of risk scores and raises the cost of maintaining the models. Furthermore, a web of legacy and overlapping factors can make it difficult to ensure that important rules are effectively implemented. A person exposed to political risk might slip through screening processes if different business units use different checklists, for example.

Under the new approach, leading institutions examine their AML programs holistically, first aligning all models to a consistent set of risk factors, then determining the specific inputs that are relevant for each line of business (Exhibit 1). The approach not only identifies risk more effectively but does so more efficiently, as different businesses can share the investments needed to develop tools, approaches, standards, and data pipelines.

2. Improve data quality

Poor data quality is the single biggest contributor to the poor performance of customer risk-rating models. Incorrect know-your-customer (KYC) information, missing information on company suppliers, and erroneous business descriptions impair the effectiveness of screening tools and needlessly raise the workload of investigation teams. In many institutions, over half the cases reviewed have been labeled high risk simply due to poor data quality.

The problem can be a hard one to solve as the source of poor data is often unclear. Any one of the systems that data passes through, including the process for collecting data, could account for identifying occupations incorrectly, for example. However, machine-learning algorithms can search exhaustively through subsegments of the data to identify where quality issues are concentrated, helping investigators identify and resolve them. Sometimes, natural-language processing (NLP) can help. One bank discovered that a great many cases were flagged as high risk and had to be reviewed because customers described themselves as a doctor or MD, when the system only recognized “physician” as an occupation. NLP algorithms were used to conduct semantic analysis and quickly fix the problem, helping to reduce the enhanced due-diligence backlog by more than 10 percent. In the longer term, however, better-quality data is the solution.

3. Complement expert judgment with statistical analysis

Financial institutions have traditionally relied on experts, as well as regulatory guidance, to identify the inputs used in risk-rating-score models and decide how to weight them. But different inputs from different experts contribute to unnecessary complexity and many bespoke rules. Moreover, because risk scores depend in large measure on the experts’ professional experience, checking their relevance or accuracy can be difficult. Statistically calibrated models tend to be simpler. And, importantly, they are more accurate, generating significantly fewer false-positive high-risk cases.

Building a statistically calibrated model might seem a difficult task given the limited amount of data available concerning actual money-laundering cases. In the United States, suspicious cases are passed to government authorities that will not confirm whether the customer has laundered money. But high-risk cases can be used to train a model instead. A file review by investigators can help label an appropriate number of cases—perhaps 1,000—as high or low risk based on their own risk assessment. This data set can then be used to calibrate the parameters in a model by using statistical techniques such as regression. It is critical that the sample reviewed by investigators contains enough high-risk cases and that the rating is peer-reviewed to mitigate any bias.

Experts still play an important role in model development, therefore. They are best qualified to identify the risk factors that a model requires as a starting point. And they can spot spurious inputs that might result from statistical analysis alone. However, statistical algorithms specify optimal weightings for each risk factor, provide a fact base for removing inputs that are not informative, and simplify the model by, for example, removing correlated model inputs.

Would you like to learn more about our Risk Practice ?

4. continuously update customer profiles while also considering behavior.

Most customer risk-rating models today take a static view of a customer’s profile—his or her current residence or occupation, for example. However, the information in a profile can become quickly outdated: most banks rely on customers to update their own information, which they do infrequently at best. A more effective risk-rating model updates customer information continuously, flagging a change of address to a high-risk country, for example. A further issue with profiles in general is that they are of limited value unless institutions are considering a person’s behavior as well. We have found that simply knowing a customer’s occupation or the banking products they use, for example, does not necessarily add predictive value to a model. More telling is whether the customer’s transaction behavior is in line with what would be expected given a stated occupation, or how the customer uses a product.

Take checking accounts. These are regarded as a risk factor, as they are used for cash deposits. But most banking customers have a checking account. So, while product risk is an important factor to consider, so too are behavioral variables. Evidence shows that customers with deeper banking relationships tend to be lower risk, which means customers with a checking account as well as other products are less likely to be high risk. The number of in-person visits to a bank might also help determine more accurately whether a customer with a checking account posed a high risk, as would his or her transaction behavior—the number and value of cash transactions and any cross-border activity. Connecting the insights from transaction-monitoring models with customer risk-rating models can significantly improve the effectiveness of the latter.

While statistically calibrated risk-rating models perform better than manually calibrated ones, machine learning and network science can further improve performance.

5. Deploy machine learning and network science tools

The list of possible model inputs is long, and many on the list are highly correlated and correspond to risk in varying degrees. Machine-learning tools can analyze all this. Feature-selection algorithms that are assumption-free can review thousands of potential model inputs to help identify the most relevant features, while variable clustering can remove redundant model inputs. Predictive algorithms (decision trees and adaptive boosting, for example) can help reveal the most predictive risk factors and combined indicators of high-risk customers—perhaps those with just one product, who do not pay bills but who transfer round-figure dollar sums internationally. In addition, machine-learning approaches can build competitive benchmark models to test model accuracy, and, as mentioned above, they can help fix data-quality issues.

Network science is also emerging as a powerful tool. Here, internal and external data are combined to reveal networks that, when aligned to known high-risk typologies, can be used as model inputs. For example, a bank’s usual AML-monitoring process would not pick up connections between four or five accounts steadily accruing small, irregular deposits that are then wired to a merchant account for the purchase of an asset—a boat perhaps. The individual activity does not raise alarm bells. Different customers could simply be purchasing boats from the same merchant. Add in more data however—GPS coordinates of commonly used ATMs for instance—and the transactions start to look suspicious because of the connections between the accounts (Exhibit 2). This type of analysis could discover new, important inputs for risk-rating models. In this instance, it might be a network risk score that measures the risk of transaction structuring—that is, the regular transfer of small amounts intended to avoid transaction-monitoring thresholds.

Although such approaches can be powerful, it is important that models remain transparent. Investigators need to understand the reasoning behind a model’s decisions and ensure it is not biased against certain groups of customers. Many institutions are experimenting with machine-based approaches combined with transparency techniques such as LIME or Shapley values that explain why the model classifies customers as high risk.

Moving ahead

Some banks have already introduced many of the five best practices. Others have further to go. We see three horizons in the maturity of customer risk-rating models and, hence, their effectiveness and efficiency (Exhibit 3).

The journey toward sophisticated risk-rating models

Getting started: how to move from horizon one to two.

Assemble a team of experts from compliance, business, data science, and technology and data.

Establish a common hierarchy of risk factors informed by regulatory guidance, experts, and risks identified in the past.

Start in bite-size chunks: pick an important model to recalibrate that the team can use to develop a repeatable process.

Assemble a file-review team to label a sample of cases as high or low risk based on their own risk assessment. Bias the sample to ensure that high-risk cases are present in sufficient numbers to train a model.

Use a fast-paced and iterative approach to cycle through model inputs quickly and identify those that align best with the overarching risk factors. Be sure there are several inputs for each factor.

Engage model risk-management and technology teams early and set up checkpoints to avoid any surprises.

Becoming an industry leader: How to move from horizon two to three

Begin to build capabilities in machine learning, network science, and natural-language processing by hiring new experts or identifying potential internal transfers.

Construct a network view of all customers, initially building links based on internal data and then creating inferred links. This will become a core data asset.

Set up a working group to identify technology changes that can be deployed on existing technology (classical machine learning may be easier to deploy than deep learning, for example) and those that will require longer-term planning.

Design and implement customer journeys in a way that facilitates quick updates to customer data. An in-person visit to a branch should always prompt a profile update, for example. Set up an innovation team to continuously monitor model performance and identify emerging high-risk typologies to incorporate into model calibration.

Most banks are currently on horizon one, using models that are manually calibrated and give a periodic snapshot of the customer’s profile. On horizon two, statistical models use customer information that is regularly updated to rate customer risk more accurately. Horizon three is more sophisticated still. To complement information from customers’ profiles, institutions use network analytics to construct a behavioral view of how money moves around their customers’ accounts. Customer risk scores are computed via machine-learning approaches utilizing transparency techniques to explain the scores and accelerate investigations. And customer data are updated continuously while external data, such as property records, are used to flag potential data-quality issues and prioritize remediation.

Financial institutions can take practical steps to start their journey toward horizon three, a process that may take anywhere from 12 to 36 months to complete (see sidebar, “The journey toward sophisticated risk-rating models”).

As the modus operandi for money launderers becomes more sophisticated and their crimes more costly, financial institutions must fight back with innovative countermeasures. Among the most effective weapons available are advanced risk-rating models. These more accurately flag suspicious actors and activities, applying machine learning and statistical analysis to better-quality data and dynamic profiles of customers and their behavior. Such models can dramatically reduce false positives and enable the concentration of resources where they will have the greatest AML effect. Financial institutions undertaking to develop these models to maturity will need to devote the time and resources needed for an effort of one to three years, depending on each institution’s starting point. However, this is a journey that most institutions and their employees will be keen to embark upon, given that it will make it harder for criminals to launder money.

Stay current on your favorite topics

Daniel Mikkelsen is a senior partner in McKinsey’s London office, Azra Pravdic is an associate partner in the Brussels office, and Bryan Richardson is a senior expert in the Vancouver office.

Explore a career with us

Related articles.

Derisking machine learning and artificial intelligence

The new frontier in anti–money laundering

What Is AML Customer Risk Assessment: Its Importance and How to Do It

Last Updated: March 25, 2024 by Tamas Kadar

Understanding and mitigating customer risk is pivotal to sustaining growth and maintaining a competitive edge. Customer risk assessment serves as a critical tool, enabling organizations to decipher the complexities of customer behavior, financial stability, and potential for fraud or default. This process not only safeguards a company’s assets but also fortifies its reputation, ensuring a trust-based relationship with its clientele.

While customer risk assessment tools are mandatory for financial institutions, it is essential for all businesses. Failing to perform an adequate risk assessment can cost a lot in fines and leave organizations vulnerable to financial criminals.

Let’s look more closely at what AML customer risk assessment is, how to do it, and what to consider before implementing it.

What Is AML Customer Risk Assessment?

In the realm of anti-money laundering (AML), customer risk assessment is a critical process where financial institutions evaluate the potential risks posed by customers to prevent money laundering and terrorist financing.

This comprehensive evaluation includes verifying customer identities, checking customer details against various sanctions lists and analyzing transaction patterns, the services they use and their geographical connections. Conducting a customer risk assessment is a vital part of adhering to AML standards, as it enables financial institutions to pinpoint, comprehend, and lessen the potential risks that might emanate from their client base.

The assessment’s goal is to find out whether a customer poses a money laundering threat, is involved in financing terrorism, is a politically exposed person or appears on any criminal or sanctions lists.

Implementing standardized AML customer risk assessment ensures that financial organizations can identify potential threats effectively, allowing them to decide on the appropriate level of due diligence. Such measures are vital for safeguarding the integrity of financial systems and maintaining compliance with national and international regulatory standards, ultimately ensuring secure and lawful business operations.

What Does Customer Risk Assessment in AML Involve?

Customer risk assessment is a cornerstone of AML compliance, involving several key steps:

- Customer identification and verification: Institutions must verify the identity of their customers using reliable, independent source documents, data, or information. This process, known as Know Your Customer (KYC), is crucial for establishing the customer’s identity and the legitimacy of their activities.

- AML customer risk scoring: This process involves assigning a numerical score to a customer or transaction based on various risk indicators, which helps in determining the level of scrutiny and monitoring required. This score is calculated using an AML risk scoring model, a tool that helps businesses measure how risky their customers are in terms of money laundering. It looks at things like what customers do for a living, where they live, and how they use their money. The model gives scores to different risk factors, adds them up, and uses this total score to decide how closely to watch a customer’s activities. If the score is high, the bank may need to look more closely at the customer’s transactions. The model is regularly updated to stay effective and to keep up with new laws and emerging risks.

- Enhanced Due Diligence (EDD): For customers classified as higher risk throughout AML customer risk profiling and found to be politically exposed persons (PEPs) or those from high-risk countries, enhanced due diligence measures are applied. This involves a deeper investigation into the customer’s background, source of funds, and the nature of their transactions.

- Ongoing monitoring: Customer risk assessment is not a one-time process. Continuous monitoring of transactions is essential to detect any unusual or suspicious behavior that could indicate money laundering or terrorist financing.

- Sanction screening: Regularly screening customers against national and international sanctions lists ensures that the institution is not inadvertently facilitating illegal activities.

- Transaction review and reporting: Institutions must review transactions to identify patterns consistent with money laundering. Suspicious activities are reported to relevant authorities as per the regulatory requirements.

By rigorously assessing and monitoring customer risks, financial institutions can detect and prevent illicit activities, ensuring compliance with AML regulations and safeguarding the integrity of the financial system.

The Importance of Assessing Customer Risk

Assessing customer risk is vital across industries, especially in finance, to safeguard against illegal activities and maintain trust. It’s not just about following rules; it’s about being a responsible player in the global financial system.

Financial institutions use AML customer risk assessment to prevent money laundering and terrorism financing, protecting themselves and their customers. These assessments pinpoint suspicious activities, helping to avert fraud and financial crimes. Moreover, they ensure that resources are focused where they’re most needed, enhancing operational efficiency.

By understanding the risk each customer poses, institutions can offer tailored services, maintaining compliance and building stronger customer relationships. In a world where financial transactions cross borders with ease, customer risk assessment is the anchor for navigating international regulations and managing global risks.

Ultimately, it’s about making informed, data-driven decisions to continuously refine risk management strategies, ensuring the financial sector remains robust and trustworthy.

Utilize SEON’s identification technology and advanced APIs to create an onboarding process that is low-friction and high-compliance.

Main Elements of an AML Customer Risk Assessment

AML customer risk assessment is pivotal for financial organizations, ensuring compliance and mitigating risks associated with financial crimes. The two key components of customer risk assessment are risk identification, i.e. reviewing all available information to verify the customer’s identity and detect potential risk factors, and customer fraud scoring to categorize customers based on how great of a risk they pose to the business.

Customer Risk Identification

Initially, financial institutions need identification proofing documentation to assess a customer’s risk profile. These are some of the main components of identifying customers and spotting potential risk factors:

- Differentiating between individuals vs. entities: Differentiating between individual consumers and legal entities is vital, as each has distinct risk factors associated with their activities.

- Reviewing customer affiliations and profiles: Understanding a customer’s background, including employment history, social connections, and financial behaviors, is crucial. Unusual financial activities, like a jobless individual making substantial deposits, can indicate potential risk.

- Geographic considerations: The risk level can vary based on a customer’s geographic connections. Special attention is needed for transactions in locations that don’t align with a customer’s residence or workplace. Money mules, who carry substantial amounts of cash, often establish accounts in various places to sidestep the requirement of declaring these cash transactions.

- Reviewing services requested by customers: The nature of services a customer seeks can be indicative of risk. For example, frequent inquiries about cash deposit processes or international transfers might warrant closer scrutiny.

Customer Risk Scoring

After evaluating the risk factors, a risk score is assigned to each customer in order to categorize them into different risk levels:

- Low-risk customers: These are individuals or entities with transparent financial activities and clear sources of income whose past transactions align with their profiles.

- Medium-risk customers: This category includes customers with slightly elevated risk levels, possibly due to connections to regions or industries known for financial discrepancies.

- High-risk customers: Customers requiring in-depth due diligence, possibly due to unclear funding sources or significant political connections, fall under this category.

- Prohibited category: Individuals or organizations with a history of financial crimes are barred from engaging with financial institutions.

Understanding and implementing these elements to your customer risk assessment enables you to manage customer risk effectively, ensuring a stable and secure financial environment.

How Long Does It Take to Assess a Customer?

Navigating the digital landscape, businesses, especially non-financial ones, are faced with a critical dilemma: the need to accelerate user actions, like signing up or making purchases, while also mitigating risks and ensuring security. This delicate balance is pivotal as companies strive to eliminate churn, friction and barriers, enhancing user experience.

Traditionally, acquiring financial services like bank accounts or insurance required submitting extensive personal data for customer risk assessment, often resulting in prolonged wait times. However, with modern advancements, these processes can now be nearly instantaneous, provided you’ve set up the right system in place.

SEON’s 5 Steps To Customer Risk Assessment

Identifying and mitigating risks is paramount for businesses seeking to safeguard their operations and adhere to regulatory standards. SEON offers a comprehensive solution designed to enhance your AML customer risk assessment processes.

Initial data gathering

The moment a visitor lands on your site, SEON springs into action and starts gathering vital information.

- IP analysis: Examine and analyze the user’s IP address to discern their geographic location, detect any use of Tor or VPNs and identify attempts to mask their connection.

- Device fingerprinting : A robust method that unveils the unique combination of software and hardware your visitors use to access your site. By understanding the intricacies of their device configuration, browser specifics, and more, SEON not only recognizes returning users but also detects impersonators.

- Digital footprinting: An additional layer of verification which involves collecting and analyzing information generated by an individual’s entire online presence, utilizing real-time data and checking for a broad range of social and digital signals.

Analyzing the gathered data

SEON also does email analysis, which can unravel significant insights – from the age of the email account and its domain provider to any previous blacklist instances. Similarly, phone number analysis helps determine the type of line, the accuracy of the geographic match, and the authenticity of the network.

Combining all the above data points, SEON helps you find correlations and anomalies and turn all the gathered information into meaningful insights that lead to faster and more accurate risk assessment.

PEPs & Sanction Screening

SEON’s AML API enables businesses to screen their customers’ names against a broad and regularly refreshed array of relevant watchlists. These lists cover all key compliance areas, encompassing checks for politically exposed persons (PEPs), sanctions, and criminal watchlists.

Monitoring transaction for AML

SEON’s transaction monitoring proactively safeguards transactions like transfers and withdrawals by analyzing customer data and behaviors to spot potential money laundering signs. It helps you manage transaction volumes and escalate high-risk cases to your fraud teams for further examination. Combining machine learning and human analysis, you can notice patterns in vast data sets, enabling prompt, informed decisions. Enhanced with proprietary data and a user-friendly interface, this approach streamlines compliance and accelerates response to potential risks.

Evaluating risk

The culmination of the assessment is deciding on the risk level associated with a user. In the past, this decision heavily relied on the acumen and intuition of fraud managers. However, with the right risk assessment tool, the process is significantly refined through the use of sophisticated risk scores. These scores are derived from various rules – some pre-established for specific industries, others custom-made or even AI-recommended.

Ultimately, the power lies in your hands. You decide on the balance between stringent security measures, which might increase false positives and a more lenient approach that could allow some fraud risks. SEON empowers you with the flexibility to tailor your fraud and risk prevention strategy to your business’s unique needs, ensuring you maintain control over how you mitigate risk.

Frequently Asked Questions

Customer risk assessment is crucial not only for banks but for any business involved in online transactions, including fintechs, crypto exchanges, online casinos, loan companies, and traditional financial institutions, as it helps differentiate between profitable customers and those who pose potential risks.

To conduct an AML risk assessment, first, individuals and entities must be differentiated to identify distinct risk factors. Review customer affiliations, financial behaviors, and geographic connections for potential risks. Then, evaluate the nature of the services customers seek, like frequent cash transactions or international transfers. Finally, assign a risk score to categorize customers into low, medium, high, or prohibited risk levels based on their profiles and activities. This process ensures effective risk management and compliance in the financial sector.

If your business is involved in financial transactions or services where there’s a risk of money laundering, you’re required to comply with AML regulations, your customers engage in high-risk transactions, or if you operate in sectors or regions prone to financial crimes, a risk assessment tool is essential to identify, evaluate, and mitigate potential risks effectively.

You might be interested in:

- SEON: Guide to Transaction Monitoring Software | Tools & Tips

- SEON: 10 Best-Rated Banking Fraud Detection Software in 2024

Share article

Showing all with ` ` tag

Financial Fraud Detection and Prevention: Best Approaches in 2023

Aml watchlists screening: how to check crime and sanctions lists, how anti-fraud tools can help your business prevent chargebacks, online insurance fraud: how it works and how to prevent it.

Speak with a fraud fighter.

Tamas kadar.

Tamás Kádár is the Chief Executive Officer and co-founder of SEON. His mission to create a fraud-free world began after he founded the CEE’s first crypto exchange in 2017 and found it under constant attack. The solution he built now reduces fraud for 5,000+ companies worldwide, including global leaders such as KLM, Avis, and Patreon. In his spare time, he’s devouring data visualizations and injuring himself while doing basic DIY around his London pad.

SEON Resources

Case studies, comparisons, sign up for our newsletter.

The top stories of the month delivered straight to your inbox

.png?width=250&height=104&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)

- AFC Network

- Customer Support

- Compliance Chronicles

-1.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White)-1.png)

- AFC Ecosystem

- Onboarding Suite

- Smart Screening

- Dynamic Risk Scoring

- Smart Alert Management

- Case Manager

- Compliance-as-a-Service

- Digital Banks

- Compliance Hub

- Regulations

- Thought Leadership

- Infographics

- Life@Tookitaki

The Essential Guide to Customer Risk Assessment

When you bring in new customers, it's essential to do a customer risk assessment. This helps pinpoint people who might pose a higher risk, and it allows us to take the right steps to prevent money laundering through appropriate measures. In today's fast-changing business environment, it's crucial to understand and manage these risks to ensure ongoing success. This guide delves into the broader concept of risk assessment, emphasizing its significance and the specific factors that impact customer risk.

What Is a Risk Assessment?

Customer risk assessment in the context of Anti-Money Laundering (AML) refers to the process of evaluating the level of risk associated with a particular customer or client within the financial system. AML is a set of regulations and practices designed to prevent the illegal generation of income through activities such as money laundering and terrorism financing. Customer risk assessment is a crucial component of AML compliance and is undertaken by financial institutions to identify, understand, and mitigate potential risks associated with their customers.

Here are key aspects to consider when discussing customer risk assessment in terms of AML:

1. Customer Due Diligence (CDD):

Financial institutions are required to conduct thorough due diligence on their customers to assess the risk they pose. This involves collecting and verifying information about a customer's identity, purpose of the account, nature of the business relationship, and the source of funds.

2. Risk Factors:

Various risk factors contribute to the overall risk assessment of a customer. These factors include the customer's geographical location, type of business, transaction volume, and the complexity of the financial transactions. Customers engaging in high-risk activities or residing in high-risk jurisdictions are subject to more scrutiny.

3. Enhanced Due Diligence (EDD):

In cases where the risk is deemed higher, financial institutions may need to apply enhanced due diligence measures. This could involve obtaining additional information about the customer, monitoring transactions more closely, and assessing the potential exposure to money laundering or other illicit activities.

4. Transaction Monitoring:

Continuous monitoring of customer transactions is essential to detect unusual or suspicious activities. Automated systems are often employed to analyze transaction patterns and identify deviations from the norm, triggering further investigation.

5. Politically Exposed Persons (PEPs):

Individuals holding prominent public positions, known as politically exposed persons, are considered higher risk due to the potential for corruption and misuse of their positions. Financial institutions are required to subject PEPs to enhanced scrutiny and monitoring.

6. Customer Risk Profiles:

Financial institutions categorize customers into different risk profiles based on their assessment. These profiles help determine the level of monitoring and due diligence required. Low-risk customers may undergo standard procedures, while high-risk customers may require more rigorous scrutiny.

7. Documentation and Record-Keeping:

AML regulations mandate the maintenance of comprehensive records of customer due diligence, risk assessments, and monitoring activities. Proper documentation is crucial for regulatory compliance and serves as evidence of the institution's efforts to mitigate AML risks.

8. Ongoing Monitoring:

Customer risk analysis is not a one-time process; it is an ongoing activity. Financial institutions must continuously monitor their customers, regularly update customer information, and reassess risk levels to ensure the effectiveness of their AML compliance programs.

Importance of Assessing Customer Risk

Assessing customer risk is of paramount importance in various industries, particularly in the financial sector, and it serves several crucial purposes. Here's an expansion on the importance of assessing customer risk:

1. Compliance with Regulatory Requirements:

Anti-Money Laundering (AML) regulations require financial institutions to implement robust customer risk assessment processes. Failure to comply with these regulations can result in severe penalties, legal consequences, and reputational damage. By assessing customer risk, institutions demonstrate their commitment to complying with regulatory standards.

2. Prevention of Money Laundering and Terrorism Financing:

Customer risk assessment is a key component in detecting and preventing money laundering and terrorism financing. By evaluating the risk associated with each customer, financial institutions can identify unusual or suspicious transactions that may indicate illicit activities.

3. Protection of Financial Institutions' Reputation:

Inadequate risk assessment can expose financial institutions to reputational risks. If a customer engages in illicit activities, it can tarnish the institution's reputation and erode the trust of clients, investors, and regulatory bodies. Effective risk assessment measures help protect the integrity and standing of the financial institution.

4. Enhanced Operational Efficiency:

Consumer risk management allows financial institutions to allocate resources efficiently. By focusing more on higher-risk customers, institutions can optimize their monitoring efforts and investigative resources, ensuring that resources are deployed where they are most needed.

5. Prevention of Fraud and Financial Crimes:

Assessing customer risk aids in the early identification of potential fraudulent activities. This includes not only money laundering but also other financial crimes such as identity theft, credit card fraud, and cybercrime. Timely detection helps prevent financial losses and protects the interests of both the institution and its customers.

6. Strengthening National Security:

Customer risk assessment plays a crucial role in preventing the financing of terrorism. By identifying and monitoring customers who may be involved in or funding terrorist activities, financial institutions contribute to national and international security efforts.

7. Customer Relationship Management:

Understanding customer risk allows financial institutions to tailor their services based on the risk profile of each customer. This ensures that higher-risk customers receive the appropriate level of scrutiny and that services are provided in a manner that aligns with regulatory requirements.

8. Global Risk Management:

In an interconnected global financial system, assessing customer risk is essential for managing cross-border transactions. It helps financial institutions navigate the complexities of international regulations, cultural differences, and diverse risk environments.

9. Data-Driven Decision-Making:

Customer risk assessments provide valuable data that can inform strategic decision-making within financial institutions. This data-driven approach allows for the continuous improvement of risk management strategies and the adaptation of policies to evolving threats.

10. Prevention of Regulatory Sanctions:

Regular customer risk assessments contribute to ongoing compliance with changing regulatory requirements. This proactive approach helps financial institutions avoid regulatory penalties and sanctions, ensuring a smoother operational environment.

Customer Risk Factors

Customer risk factors encompass various elements that financial institutions consider when evaluating the level of risk associated with a particular customer. These factors help in determining the likelihood of a customer being involved in money laundering, fraud, or other illicit activities.

1. Geographic Location:

Customers residing in jurisdictions known for high levels of corruption, weak regulatory frameworks, or a history of financial crimes may pose a higher risk. Financial institutions often assess the risk associated with a customer based on their geographic location.

2. Business Type and Industry:

Certain industries are inherently more susceptible to money laundering and other financial crimes. Businesses involved in cash-intensive activities, high-value transactions, or those lacking transparent financial structures may be considered higher risk.

3. Transaction Patterns:

Unusual or complex transaction patterns, particularly those inconsistent with a customer's known business activities, may raise red flags. Rapid and significant changes in transaction volumes, frequency, or size can indicate potential risks.

4. Source of Wealth and Income:

Understanding the legitimate source of a customer's wealth is crucial. If the source of income or wealth is unclear, unverifiable, or inconsistent with the customer's profile, it can be indicative of higher risk. Financial institutions often scrutinize large, unexpected inflows of funds.

5. Customer Behavior:

Unusual behavior, such as frequent changes in account information, reluctance to provide necessary documentation, or attempts to avoid regulatory scrutiny, may signal potential risk. Behavioral analysis is a crucial component of customer risk assessment.

Customer Risk Levels

Customer risk levels refer to the categorization of customers based on the assessment of factors that may expose them to potential financial crimes, such as money laundering, fraud, or terrorism financing. The goal is to stratify customers according to their risk profiles, allowing financial institutions to allocate resources and implement appropriate risk mitigation measures.

1. Low-Risk Customers:

Characteristics : Customers with transparent and verifiable sources of income, a clear business purpose, and a history of compliance with regulatory requirements are typically considered low risk.

Risk Mitigation : Low-risk customers may undergo standard due diligence procedures. Transaction monitoring is conducted with a standard level of scrutiny, and routine reviews of customer profiles are performed periodically.

2. Medium-Risk Customers

Characteristics : Customers with moderate risk may have some factors that warrant closer attention, such as involvement in industries prone to money laundering or transactions with certain risk indicators.

Risk Mitigation : Enhanced Due Diligence (EDD) measures are applied to medium-risk customers. This may involve more in-depth verification of identity, additional documentation requirements, and increased transaction monitoring.

3. High-Risk Customers:

Characteristics : High-risk customers exhibit multiple risk factors, such as complex ownership structures, involvement in high-risk industries, or transactions that deviate significantly from established patterns.

Risk Mitigation : High-risk customers are subject to rigorous scrutiny and monitoring. Enhanced Due Diligence (EDD) is applied extensively, involving thorough background checks, source of funds verification, and continuous transaction monitoring. These customers may require senior management approval for onboarding or continued engagement.

4. Politically Exposed Persons (PEPs):

Characteristics: PEPs, due to their public positions, are considered inherently high risk. This includes government officials, diplomats, and individuals with close associations to such positions.

Risk Mitigation: PEPs are subject to the highest level of scrutiny. Enhanced Due Diligence measures are mandatory, and transactions are monitored with extreme diligence. Regular reviews and reporting obligations are intensified for PEPs.

5. Emerging Risk or Changing Risk Levels:

Characteristics : Customers may experience changes in their risk profile due to evolving business activities, regulatory changes, or shifts in ownership.

Risk Mitigation : Financial institutions must proactively monitor and reassess customer risk levels. If there are changes in a customer's circumstances, appropriate measures are taken, such as updating due diligence information, conducting additional investigations, and adjusting risk mitigation strategies accordingly.

6. Automated Risk Scoring:

Characteristics : Some financial institutions employ automated risk-scoring systems that use algorithms to assess various risk factors and assign a numerical score to customers.

Risk Mitigation : Based on the automated risk score, customers are categorized into risk levels. Higher scores may trigger additional scrutiny, while lower scores may result in standard due diligence procedures.

7. Dynamic Risk Assessment:

Characteristics : Risk levels are not static and can change over time based on customer behavior, market conditions, or regulatory developments.

Risk Mitigation : Regular and ongoing monitoring allows for dynamic risk assessment. Financial institutions continuously update customer profiles, reassess risk levels, and adjust risk mitigation measures as needed.

Dynamic AML Customer Risk Assessment

Dynamic AML customer risk assessment refers to an approach where the evaluation of a customer's risk is not a one-time activity but an ongoing and adaptable process. It involves continuously monitoring and reassessing the risk associated with customers based on evolving factors, such as changes in customer behavior, market conditions, regulatory developments, and other relevant circumstances. Here's an expansion on the concept of dynamic AML customer risk assessment:

1. Continuous Monitoring:

Dynamic AML customer risk assessment involves the continuous monitoring of customer transactions, behavior, and other relevant activities. Automated systems and analytics are often employed to detect patterns and anomalies in real-time or near-real-time.

2. Real-Time Data Analysis:

The use of advanced data analytics allows financial institutions to analyze vast amounts of data in real-time. This includes transaction data, customer information, and external data sources to identify unusual patterns or behaviors that may indicate increased risk.

3. Behavioral Analysis:

Dynamic risk assessment places a strong emphasis on behavioral analysis. By establishing a baseline of normal customer behavior, financial institutions can quickly identify deviations that may signal potential risks. Unusual transaction patterns, changes in account activity, or unexpected shifts in behavior trigger further scrutiny.

4. Trigger Events:

Trigger events, predefined indicators or thresholds, are set to automatically prompt a reassessment of customer risk. These triggers can be based on transaction amounts, frequency, geographic locations, or other relevant factors. For example, a sudden increase in transaction volume may trigger a reevaluation.

5. Event-Driven Updates:

Changes in a customer's profile or external events, such as regulatory updates or sanctions, trigger automatic updates to the customer's risk assessment. This ensures that risk levels are promptly adjusted in response to changes in the customer's circumstances or the external environment.

Tookitaki's Dynamic Risk Scoring Solution

Tookitaki's Dynamic Risk Scoring solution is a game-changer in the world of risk management for financial institutions. By adopting a data-driven approach, this solution allows for continuous improvement and adaptation of risk management strategies in response to evolving threats. One of the key benefits of this solution is the prevention of regulatory sanctions. By conducting regular customer risk assessments, financial institutions can ensure ongoing compliance with changing regulatory requirements.

This proactive approach helps them avoid penalties and sanctions, creating a smoother operational environment. The solution takes into account various customer risk factors, such as geographic location, business type and industry, transaction patterns, source of wealth and income, and customer behavior. By analyzing these factors, financial institutions can categorize customers into different risk levels, from low-risk to high-risk customers and politically exposed persons (PEPs). This allows them to allocate resources and implement appropriate risk mitigation measures based on each customer's risk profile.

Additionally, the solution incorporates automated risk scoring systems and dynamic risk assessment to ensure that risk levels are continuously monitored and adjusted as needed. With its focus on continuous monitoring, real-time data analysis, behavioral analysis, trigger events, and event-driven updates, Tookitaki's Dynamic Risk Scoring solution provides financial institutions with the tools they need to effectively manage customer risk and stay compliant in an ever-changing regulatory landscape.

Customer risk assessment is a cornerstone of effective risk management for businesses. By understanding and evaluating the potential risks associated with individual customers, businesses can protect their financial interests, comply with regulations, and foster a secure and trustworthy environment. Embracing a dynamic approach to customer risk assessment ensures that businesses stay ahead of evolving risks, contributing to long-term success.

1. What is a customer risk assessment?

A customer risk assessment is the process of evaluating and analyzing the potential risks associated with engaging with a particular customer.

2. How to identify the need for customer risk assessment?

The need for customer risk assessment arises from the desire to safeguard financial interests, comply with regulatory requirements, and create a secure business environment.

3. How can technology assist in customer risk assessment?

Technological tools, such as data analytics, artificial intelligence, and machine learning, play a crucial role in customer risk assessment.

Anti-Financial Crime Compliance with Tookitaki?

Content that might peak your interest

What is correspondent banking AML risk?

The Benefits of Implementing AML Software

AML Compliance Risks and Mitigation Strategies for UAE Businesses

©️2024 Tookitaki Holding Pte. Ltd

- Customer Risk Scoring

- Privacy Policy

- Recognitions

- real-time payments

- payments infrastructure

How can you elevate your AML risk assessment?

In our ever-evolving digital world, technology has changed the way that we make payments, as well as our ability to send money at any time, anywhere in the world. It has also made it easier for fraudsters to conceal the origins of illegally obtained funds, making them appear to come from a legitimate source. Indeed, with money laundering schemes costing some 2-5% of the global GDP – up to 30% of that figure originating in the US alone (costing upwards of $300B a year) – it’s pertinent that businesses respond appropriately to the guidance of authoritative and regulatory bodies worldwide. This is where the anti-money laundering (AML) risk assessment comes in.

Let’s take a deep dive into why an AML risk assessment is necessary and the best practices for conducting an effective AML risk assessment as part of a larger AML compliance program.

What is an AML risk assessment?

An AML risk assessment is a key component of any AML tool kit, enabling businesses to measure the likelihood that a customer or client is involved with money laundering or terrorist financing. An AML risk assessment will measure the risk level of each client, performing due diligence to minimize any potential involvement in a money laundering scheme.

Who conducts an AML risk assessment?

Ultimately, an AML risk assessment is a worthwhile process for any organization that conducts financial transactions. Regulators worldwide have made it mandatory for financial institutions under the AML and Counter-Terrorism Financing (CTF) laws and regulations to take the appropriate preventative measures against such financial crimes, or else risk serious penalties and regulatory audits.

How is AML regulated?

To combat AML worldwide, the Financial Action Task Force (FATF), an inter-governmental body that sets standards to guide countries to develop and update their AML and CTF laws, has been created. The FATF includes 39 members and 37 member jurisdictions , as well as the European Commission and the Gulf Cooperation Council.

Specifically (and for example), the USA has the Bank Secrecy Act ( BSA ) and the US Patriot Act , Canada has the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, Australia has the AML/CTF Act , while Europe is guided by a series of legislative directives, including the most recently released Sixth AML Directive ( 6AMLD ).

The five steps to performing an AML risk assessment

While completing an AML risk assessment is necessary to comply with regulations, understanding the risk level of each client and transaction also protects your business and your reputation. Below are five steps to follow to ensure compliance and protection.

1. Document key risk indicators

The first step for conducting an AML risk assessment is to create the appropriate documentation regarding key risk indicators (KRIs) and, in turn, how they relate to your business. This documentation will outline the support for the risk analysis. Remember – document everything, including your thought processes. As information changes and evolves, it helps to have everything cataloged to be sure your processes stay up-to-date and relevant.

Common categories of KRIs that should be documented include:

Clients/Customers/Business entities: Which type of individuals do you do business with? Are they who they say they are? Some will have a higher risk, such as:

- Politically Exposed Persons (PEPs)

- Non-Resident Aliens

- Professional Service Providers

Be sure to complete a sanction screening to confirm that any individual you are working with is not on any sanction lists. And remember, doing business with PEPs is not necessarily banned, it is simply deemed high risk.

Meanwhile, if your client is a business entity, ask yourself who ultimately controls or benefits from their activities? Be sure to cross-reference any information on file with records kept at the company’s house and other beneficial ownership registers.

Products/Services: It’s important to understand and analyze the risks associated with the products and services you offer. For example, the following comes with higher risk:

- Remote deposits

- Probate services

- Gambling services

- Cryptocurrency services

- ATM and cash services

- Foreign correspondent accounts

- Loan portfolios

- Online account opening and access

When providing a higher-risk service, keep a lookout for any red flags associated with your customer’s behavior. For example, ask yourself: Are the services they require consistent with their business rationale?

Delivery channels: It’s a good idea to remember that some delivery channels can increase money laundering risk, especially if they can disguise the true identity of the client’s activity. Remember to consider whether the service/product will be delivered in person or remotely or provided directly or via an intermediary.

Geographic location: A core component of any AML risk assessment is identifying the geographic locations that pose a higher risk. For example, do you operate in an area where there are higher rates of drug trafficking? To be thorough, confirm geographic risk through a list from the FATF or other such organizations.

And don’t forget, your customer doesn’t need to be in a foreign land to set off a red flag. If they are in a different city or province, enquire as to why they are coming to you instead of seeking a similar service closer to them, geographically.

Transactions: Naturally, an AML risk assessment will involve the evaluation of the type of transactions your business engages in. For example, how does the number of international wire transfers compare to domestic ones? Or what is the volume of loan transactions and private ATM customers?

2. Employ dedicated staff

No matter the size of your organization, ensuring adequate staff is employed to dedicate time to compliance is essential when conducting your AML risk assessment.

3. Identify the inherent risk

Inherent risk represents the exposure your business will have to money laundering risk should you not put any processes in place to mitigate them. This step of identifying the inherent risk builds upon your documentation process in step one.

Once you have identified the inherent risks to your organization, you need to implement controls to reduce them. These can be broken down simply into three categories: weak, adequate and strong.

4. Determine the residual risk

Once you have identified the inherent risk to your organization and, in turn, the effectiveness of the internal control environment you have in place, you can move on to determining the residual risk. This category of risk is defined as the risk that remains once controls have been put in place to mitigate the inherent risk. In other words, what gaps in your controls are present that could enable money laundering?

5. Rate the risk

Best practice involves applying a three-tier rating scale to assess the risk of money laundering or terrorism funding occurring, identified as high risk, moderate risk or low risk. Should the risk be rated high, your mitigation efforts are not effective enough and additional risk management measures should be implemented immediately. Ultimately, the strength of your controls can help determine the risk score. For example, when there are adequate controls in place, risk ratings might reduce from a three to a two.

Furthermore, best practice dictates one assess the risk at all levels of AML-regulated business. This means that a risk assessment should be conducted at the following levels:

- The transaction level (by whomever is dealing with the transaction)

- The customer/client level (by whomever is dealing with the customer)

- The business level (by the appropriate individual in senior management/legal/compliance)

Finally, when appropriate, it never hurts to go one step further and perform a risk assessment at the sectoral level, the national level and the international level.

Cultivate a culture of compliance

Remember, the AML risk assessment process is an ongoing one. By cultivating a culture of compliance and conducting regular audits of your processes, you can be sure your organization remains aligned with regulatory changes and minimizes the likelihood of risk affecting your business and reputation.

Unfortunately, despite the risk assessments, controls and strict processes we implement, financial fraud is evolving faster than ever. In fact, in 2022, financial services businesses saw a 79% increase in document fraud compared to the previous year. Given the state of the current economic climate, this situation isn’t predicted to settle anytime soon.

Therefore, in an environment so fraught with fraud, going beyond the regulated assessment requirements is recommended. As we have discussed in previous blogs dedicated to KYC compliance , embracing a digital transformation strategy is a must. What this means is balancing your obligations to AML assessments and compliance with innovative, digital identity verification that can help protect your business against the latest sophisticated fraud trends without impacting the customer experience.

In fact, by enhancing your approach to AML (and KYC) compliance with comprehensive online capabilities like digital identity verification pre-AML risk assessment, you will not only better mitigate sophisticated fraud attacks, such as synthetic identities , but also provide an even more seamless customer experience from the very first touchpoint – account creation.

Want to discover how you can go beyond best practices for conducting your AML risk assessment with digital identity verification? Contact us today.

- News and insights

- From risk to compliance: the five steps to performing an AML risk assessment

Mastercard sites

- Mastercard.com

- Mastercard Data & Services

- Mastercard Brand Center

- Mastercard Developers

- Priceless.com

Fill in the form bellow to contact us

Phone number (optional)

I have read and accepted the Privacy Policy I consent to the processing of my personal data for marketing purposes.

Managing AML risk assessment: tools for customer evaluation

As technology continues to advance, the financial and crypto-asset sectors have become more complex, and crimes have become more sophisticated and technologically advanced, making detection and AML risk assessment ahead with AML risk scoring more difficult.

This leaves firms vulnerable to criminal activity. The question of how to “separate the wheat from the chaff” and find the bad actors among a bunch of perfectly legitimate customers is more important than ever. The risk-based approach and perfectly working AML risk assessment could be the answer, but only if it is applied correctly: you could be prepared to stay on the safe side with the regulator while ensuring uninterrupted service to your customers.

This blog explores tools and techniques for evaluating anti-money laundering (AML) risk management solutions. It considers regulatory requirements and the need to prevent criminal use. Also, it addresses the business need for the best customer experience. Operating profitably is another crucial aspect to consider.

Understanding the importance of AML risk assessment in AML/CFT compliance programs

In simple terms, the risk-based approach is just a fancy term for segmenting your customer portfolio into groups. It filters out potential wrongdoers from those without concerns, helping to identify any links to criminal activity.

AML risk assessment is another word combination used by the regulator that indicates the same approach – don’t be chaotic, use your resources wisely, don’t bother customers who are not risky and focus your efforts on customers who are possible criminals or associated with criminal activity.

A risk-based approach is at the heart of any AML/CFT compliance programme and rests on two pillars: holistic (enterprise-wide or business-wide) risk assessment and targeted (individual customer) risk assessment. ML/TF risk assessment should be an integral part of the firm’s overall risk management framework and target the basic steps of risk management: risk identification, risk assessment, risk control, and risk mitigation or avoidance (the latter should be used carefully and should not lead to de-risking of the entire client group).

Sounds simple? In theory it is but putting it into practice raises a number of issues. The wrong risk-based approach can result in unhappy customers burdened with unnecessary due diligence. It can also waste resources and miss criminal activity.

Here are some tips from our experts on how to approach risk assessment.

Holistic customer segmentation or Enterprise-Wide Risk Assessment (EWRA)

If you have a ‘chicken or the egg’ conundrum, the answer is simple – enterprise-wide risk assessment always comes first. If you are a start-up, the holistic view of your ML/TF risks should be based on your business plan, which should be updated later with actual data.

Enterprise-wide risk assessment (or EWRA) is not a standalone exercise undertaken simply to satisfy the regulator. If done properly, EWRA could give you an answer on your target customer profile based on “peer grouping” and this already sets some thresholds for further individual customer risk scoring and transaction monitoring . EWRA could give you some insight into:

- The ML/TF risks of your target customers and the weaknesses in the AML/CFT controls applied to these customers (or possible risks and possible controls if you are in the start-up phase);

- How to establish individual customer ML/TF risk assessment criteria, including criteria for triggering enhanced due diligence;

- How to tailor your transaction monitoring model: setting thresholds and limits for certain rules, customizing the frequency and intensity of transaction monitoring for certain customer groups;

- Determine the basis for calculating the actual resources required to implement the necessary AML/CFT controls.

Importance of quantitative data

Quantitative data should form the basis of the assessment of inherent ML/TF risks (either actual data over the selected business period or business plan), so data quality must be ensured, including data accuracy, so that the company can be confident that it is implementing the necessary AML/CFT controls:

Accuracy, so that the company can be confident that material distortions of the actual AML/TF results are avoided;

Completeness (including data from all business units).

The larger companies are using more sophisticated tools to obtain statistics from their internal databases, but so far it is still a challenge to ensure that accurate and complete data would feed into the EWRA results.

To ensure that the residual ML/TF risk is properly assessed, an overview of AML/CFT controls is required. Compliance reports, audit reports, reports on the results of monitoring back-testing, reports on operational risk incidents could be the source that the firm would be willing to examine before deciding whether the controls are adequate.

The assessment of residual risk is subject to the risk assessment model used by the entity. As with all risk assessment models, the risk assessment model used for EWRA should be validated.

Targeted risk assessment or individual customer risk assessment

The data collected from customers (Know Your Customer, or KYC data) forms the basis for the individual customer risk assessment. When developing KYC questionnaires, the firm should use the results of the EWRA and consider having more comprehensive questionnaires for those customer segments that are exposed to higher risks and possibly simplified KYC questionnaires for those that do not raise concerns.

However, an individual client poses an individual risk relative to his or her peer group, and this should also be considered. For example, a corporate customer domiciled in a low-risk country and using only domestic payment initiation services may pose a different risk to the same customer that expands its services to include cross-border payments to and from high-risk countries.

The higher risk clients will be subject to enhanced due diligence procedures, which will include not only additional data collection (e.g., on source of funds and assets), but also enhanced monitoring and senior management involvement in the client onboarding decision process. Therefore, to avoid overburdening the business with additional processes, you may be willing to have an accurate client AML risk scoring tool that addresses ML/TF risks in a way that satisfies the regulator and keeps the process as burdensome as possible for the business and, later, its clients.

Things to consider when developing AML risk scoring model

In developing a AML risk scoring model, you may wish to consider:

whether the AML risk scoring model meets all the mandatory criteria set by the regulator (client, geography, product, channel);

whether the AML risk scoring model takes into account the mandatory high-risk situations set by the regulator (e.g. an automatic high-risk score could be applied if the customer is a politically exposed person, registered in the high-risk country, etc.);

if the weighting of the risk criteria is not unduly influenced by a single factor and/or does not lead to a situation where it is impossible to classify any business relationship as high risk;

if it is possible to override the automatically generated risk score if necessary;

where the individual customer risk score is reviewed on a regular basis or when trigger events occur (e.g. when the customer wishes to take out a new product or service, when a certain transaction threshold is reached, etc.);

where the customer re-scoring is applied when there are significant changes to the AML risk scoring model or when there are significant changes to components of the AML risk scoring model (e.g. significant changes to the geographical risk score due to external factors such as inclusion of the country on the FATF grey or black list).

Although KYC data is an important part of the risk assessment, the company should consider including internal and external data sources as additional information that could be evaluated as additional customer risk criteria, such as customer behavior, transaction history, internal investigation data, adverse media screening information, regulatory or law enforcement inquiries.

Validation of risk assessment models

Assessing the risk of money laundering in a business or financial institution. By analyzing customer and transaction data, AML risk assessment helps organizations determine the likelihood of money laundering activities and implement effective risk management strategies to mitigate these risks.

The primary objective of AML risk assessment is to identify potential risks and vulnerabilities in an organization’s operations, systems and processes. This process enables organizations to develop risk management plans that address any weaknesses and vulnerabilities and prevent or mitigate money laundering risks. Effective AML risk assessment and management plans can help organizations avoid hefty fines, reputational damage and legal repercussions.

Risk assessment tools

To effectively manage AML risks, organizations can use a variety of tools. One of the most common techniques is risk scoring, which involves assigning scores to customers based on their risk level. By analyzing data such as transaction history, location and occupation, organizations can identify customers who pose a higher risk of money laundering.

Transaction monitoring is another tool that enables businesses to assess and flag suspicious transactions in real time. This can be achieved using algorithms that look for patterns and anomalies that may indicate money laundering activity.

Risk management techniques

Once organizations identify money laundering risks, they must implement effective risk management techniques. These techniques are crucial for mitigating the identified risks effectively. Rules-based monitoring is one such technique that organizations can use to identify suspicious transactions. This involves creating specific rules to help identify suspicious transactions based on pre-defined criteria.