- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

- What Is TAB

- Advisory Boards

- Business Coaching

- StratPro Leadership Transformation Program

- Strategic Leadership Tools

- Our Members

- Case Studies

- White Papers

- Business Diagnostic

The Alternative Board Blog

What is a business assessment, and when do you need one.

We’ve already explained the 5 steps in TAB’s strategic business leadership process:

- Vision - Personal and business

- SWOT analysis - Strengths, weaknesses, opportunities, threats

- Plan - Personal and business

- Make it happen - Communication, review, accountability, planning team

- Turn the wheel - continuous review and revision as needed

And we’ve already discussed the importance of having a strategic plan for your business , the kind of plan that will make you remember the big picture: why you started your business in the first place.

But while having a vision for your business and having a strategic business plan to grow it are both keys to success, how do you get from A to B? How do you even know you need a strategic plan?

That’s when a business assessment comes in handy. Business assessments are a crucial aspect of understanding what your business plan should look like, what’s working the way it should, and what isn’t.

Think of your business as a car, and a business assessment as the blueprint for its design. While you might know your vehicle’s exact make, model, and mileage, you probably can’t remember all the details about its construction, such as the exact diameter of each of its hoses. The same goes for small businesses. If you install a hose that’s not the exact fit, the car will come screeching to a halt - and in this particular analogy, there are hundreds of hoses in varying sizes.

So much happens and so many decisions are made on a monthly basis -- without a business assessment it can be incredibly difficult for business owners to remember all of the details that can make huge differences in their operations and bottom line.

We recently interviewed hundreds of small business owners about what they wish they could do differently, if they could build their companies all over again. Out of all the aspects of running a business, the entrepreneurs wish they would’ve spent more time on strategic planning. Only 2% of respondents thought that a better product would have helped their business more than a better strategy.

Want additional insight? Read 4 Step Guide to Strategic Planning now to learn more

That’s why a business assessment is so important. If you have a vision for your business but don’t know where to start when it comes to figuring out a strategic plan for growth, it’s probably time for a business assessment. From there, you can build out your strategic plan and outline specific goals, as well as outline how you’re going to achieve them.

What does “SWOT” stand for?

Different firms offer different business assessments, each with their distinct advantages, but all business assessments are fundamentally lead to a balanced SWOT analysis of the organization.

A SWOT analysis looks at internal and external factors that are helpful or harmful to your business and the way it’s run. This type of assessment is particularly interested in identifying factors in the following 4 categories:

- The strongest parts of your business model and your best selling points. The core competencies of your team and your investments.

W eaknesses

- The weakest parts of your business model and weak spots in the sales funnel. What’s lacking in your team and missing from your investments.

O pportunities

- Potential leads, investors, events, and even new target markets.

- Potential competitors, reasons investors would cut funding, or negative market developments.

At a glance, it’s easy to see where most small business owners (and most business owners in general) like to spend their time - among the tropical shade and white sands of their company’s Strengths and Opportunities.

Rare is the business owner who takes the time to sit down and honestly assess weaknesses in his business model as well as potential threats (which can be difficult to see without another pair of eyes). This is why many small businesses fail -- entrepreneurs often have a vision, but no strategic plan for growth. And they have no strategic plan because they never conducted an honest business assessment.

They thought they were doing just fine when, in reality, weaknesses were eating away at their business model and threats were looming large in their market.

When’s the right time to get a business assessment?

That’s why we offer TAB Business Diagnostic. Our tool that we developed over years of research working with thousands of business owners that lets you comprehensively identify your competitive strengths but also key gaps in your business. Think of it as an MRI for your business that compares your business to others in the same industry. Not only does it identify the gaps but it also helps you prioritize, so you’ll know what challenges and opportunities you need to focus on first.

A business assessment does not take a lot of time but the results are invaluable. The output of the assessment is fed into the SWOT process. This helps identify the key areas of the strategic plan. Taking the first step in this process will put you on a path to running your business more strategically.

No matter of the economic conditions thrown at you and your business, there are steps to help safeguard your business so that you not only survive, but thrive. Download the whitepaper to learn more here

Read our 19 Reasons You Need a Business Owner Advisory Board

Written by The Alternative Board

Subscribe to our blog.

- Sales and marketing (140)

- Strategic Planning (135)

- Business operations (128)

- People management (69)

- Time Management (52)

- tabboards (39)

- Technology (38)

- Customer Service (37)

- Entrepreneurship (35)

- Business Coaching and Peer Boards (24)

- Money management (24)

- company culture (23)

- Work life balance (22)

- employee retention (21)

- Family business (17)

- businessleadership (15)

- leadership (14)

- business strategy (12)

- human resources (12)

- employment (11)

- employee engagement (9)

- communication (8)

- productivity (7)

- adaptability (6)

- businesscoaching (6)

- professional development (6)

- salesstrategy (6)

- strategic planning (6)

- strategy (6)

- innovation (5)

- leadership styles (5)

- marketing (5)

- peeradvisoryboards (5)

- branding (4)

- hiring practices (4)

- socialmedia (4)

- supplychain (4)

- Mentorship (3)

- business vision (3)

- collaboration (3)

- culture (3)

- environment (3)

- future proof (3)

- newnormal (3)

- remote teams (3)

- remote work (3)

- sustainability (3)

- work from home (3)

- worklifebalance (3)

- workplacewellness (3)

- Planning (2)

- businessethics (2)

- ecofriendly (2)

- employeedevelopment (2)

- globalization (2)

- recession management (2)

- salescycle (2)

- salesprocess (2)

- #contentisking (1)

- #customerloyalty (1)

- accountability partners (1)

- artificial intelligence (1)

- blindspots (1)

- businesstrends (1)

- customer appreciation (1)

- customerengagement (1)

- cybersecurity (1)

- data analysis (1)

- digitalpersona (1)

- financials (1)

- globaleconomy (1)

- greenmarketing (1)

- greenwashing (1)

- onlinepresence (1)

- post-covid (1)

- social media (1)

- talent optimization (1)

- transparency (1)

Do you want additional insight?

Download our 19 Reasons Why You Need a Business Advisory Board Now!

TAB helps forward-thinking business owners grow their businesses, increase profitability and improve their lives by leveraging local business advisory boards, private business coaching and proprietary strategic services.

Quick Links

- Find a Local Board

- My TAB Login

keep in touch

- Privacy Policy

- Terms & Conditions

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Write your business plan

Business plans help you run your business.

A good business plan guides you through each stage of starting and managing your business. You’ll use your business plan as a roadmap for how to structure, run, and grow your new business. It’s a way to think through the key elements of your business.

Business plans can help you get funding or bring on new business partners. Investors want to feel confident they’ll see a return on their investment. Your business plan is the tool you’ll use to convince people that working with you — or investing in your company — is a smart choice.

Pick a business plan format that works for you

There’s no right or wrong way to write a business plan. What’s important is that your plan meets your needs.

Most business plans fall into one of two common categories: traditional or lean startup.

Traditional business plans are more common, use a standard structure, and encourage you to go into detail in each section. They tend to require more work upfront and can be dozens of pages long.

Lean startup business plans are less common but still use a standard structure. They focus on summarizing only the most important points of the key elements of your plan. They can take as little as one hour to make and are typically only one page.

Traditional business plan

Lean startup plan

Traditional business plan format

You might prefer a traditional business plan format if you’re very detail-oriented, want a comprehensive plan, or plan to request financing from traditional sources.

When you write your business plan, you don’t have to stick to the exact business plan outline. Instead, use the sections that make the most sense for your business and your needs. Traditional business plans use some combination of these nine sections.

Executive summary

Briefly tell your reader what your company is and why it will be successful. Include your mission statement, your product or service, and basic information about your company’s leadership team, employees, and location. You should also include financial information and high-level growth plans if you plan to ask for financing.

Company description

Use your company description to provide detailed information about your company. Go into detail about the problems your business solves. Be specific, and list out the consumers, organization, or businesses your company plans to serve.

Explain the competitive advantages that will make your business a success. Are there experts on your team? Have you found the perfect location for your store? Your company description is the place to boast about your strengths.

Market analysis

You'll need a good understanding of your industry outlook and target market. Competitive research will show you what other businesses are doing and what their strengths are. In your market research, look for trends and themes. What do successful competitors do? Why does it work? Can you do it better? Now's the time to answer these questions.

Organization and management

Tell your reader how your company will be structured and who will run it.

Describe the legal structure of your business. State whether you have or intend to incorporate your business as a C or an S corporation, form a general or limited partnership, or if you're a sole proprietor or limited liability company (LLC).

Use an organizational chart to lay out who's in charge of what in your company. Show how each person's unique experience will contribute to the success of your venture. Consider including resumes and CVs of key members of your team.

Service or product line

Describe what you sell or what service you offer. Explain how it benefits your customers and what the product lifecycle looks like. Share your plans for intellectual property, like copyright or patent filings. If you're doing research and development for your service or product, explain it in detail.

Marketing and sales

There's no single way to approach a marketing strategy. Your strategy should evolve and change to fit your unique needs.

Your goal in this section is to describe how you'll attract and retain customers. You'll also describe how a sale will actually happen. You'll refer to this section later when you make financial projections, so make sure to thoroughly describe your complete marketing and sales strategies.

Funding request

If you're asking for funding, this is where you'll outline your funding requirements. Your goal is to clearly explain how much funding you’ll need over the next five years and what you'll use it for.

Specify whether you want debt or equity, the terms you'd like applied, and the length of time your request will cover. Give a detailed description of how you'll use your funds. Specify if you need funds to buy equipment or materials, pay salaries, or cover specific bills until revenue increases. Always include a description of your future strategic financial plans, like paying off debt or selling your business.

Financial projections

Supplement your funding request with financial projections. Your goal is to convince the reader that your business is stable and will be a financial success.

If your business is already established, include income statements, balance sheets, and cash flow statements for the last three to five years. If you have other collateral you could put against a loan, make sure to list it now.

Provide a prospective financial outlook for the next five years. Include forecasted income statements, balance sheets, cash flow statements, and capital expenditure budgets. For the first year, be even more specific and use quarterly — or even monthly — projections. Make sure to clearly explain your projections, and match them to your funding requests.

This is a great place to use graphs and charts to tell the financial story of your business.

Use your appendix to provide supporting documents or other materials were specially requested. Common items to include are credit histories, resumes, product pictures, letters of reference, licenses, permits, patents, legal documents, and other contracts.

Example traditional business plans

Before you write your business plan, read the following example business plans written by fictional business owners. Rebecca owns a consulting firm, and Andrew owns a toy company.

Lean startup format

You might prefer a lean startup format if you want to explain or start your business quickly, your business is relatively simple, or you plan to regularly change and refine your business plan.

Lean startup formats are charts that use only a handful of elements to describe your company’s value proposition, infrastructure, customers, and finances. They’re useful for visualizing tradeoffs and fundamental facts about your company.

There are different ways to develop a lean startup template. You can search the web to find free templates to build your business plan. We discuss nine components of a model business plan here:

Key partnerships

Note the other businesses or services you’ll work with to run your business. Think about suppliers, manufacturers, subcontractors, and similar strategic partners.

Key activities

List the ways your business will gain a competitive advantage. Highlight things like selling direct to consumers, or using technology to tap into the sharing economy.

Key resources

List any resource you’ll leverage to create value for your customer. Your most important assets could include staff, capital, or intellectual property. Don’t forget to leverage business resources that might be available to women , veterans , Native Americans , and HUBZone businesses .

Value proposition

Make a clear and compelling statement about the unique value your company brings to the market.

Customer relationships

Describe how customers will interact with your business. Is it automated or personal? In person or online? Think through the customer experience from start to finish.

Customer segments

Be specific when you name your target market. Your business won’t be for everybody, so it’s important to have a clear sense of whom your business will serve.

List the most important ways you’ll talk to your customers. Most businesses use a mix of channels and optimize them over time.

Cost structure

Will your company focus on reducing cost or maximizing value? Define your strategy, then list the most significant costs you’ll face pursuing it.

Revenue streams

Explain how your company will actually make money. Some examples are direct sales, memberships fees, and selling advertising space. If your company has multiple revenue streams, list them all.

Example lean business plan

Before you write your business plan, read this example business plan written by a fictional business owner, Andrew, who owns a toy company.

Need help? Get free business counseling

How To Write A Business Plan: A Comprehensive Guide

A step-by-step guide on writing a business plan to catch an investor's attention & serve as a guiding star for your business..

July 13th, 2022 | By: The Startups Team | Tags: Planning , Model , Pitch Deck

A comprehensive, step-by-step guide - complete with real examples - on writing business plans with just the right amount of panache to catch an investor's attention and serve as a guiding star for your business.

Introduction to Business Plans

So you've got a killer startup idea. Now you need to write a business plan that is equally killer.

You fire up your computer, open a Google doc, and stare at the blank page for several minutes before it suddenly dawns on you that, Hm…maybe I have no idea how to write a business plan from scratch after all.

Don't let it get you down. After all, why would you know anything about business planning? For that very reason we have 4 amazing business plan samples to share with you as inspiration.

For most founders, writing a business plan feels like the startup equivalent of homework. It's the thing you know you have to do, but nobody actually wants to do.

Here's the good news: writing a business plan doesn't have to be this daunting, cumbersome chore.

Once you understand the fundamental questions that your business plan should answer for your readers and how to position everything in a way that compels your them to take action, writing a business plan becomes way more approachable.

Before you set fingers to the keyboard to turn your business idea into written documentation of your organizational structure and business goals, we're going to walk you through the most important things to keep in mind (like company description, financials, and market analysis, etc.) and to help you tackle the writing process confidently — with plenty of real life business plan examples along the way to get you writing a business plan to be proud of!

Keep It Short and Simple.

There's this old-school idea that business plans need to be ultra-dense, complex documents the size of a doorstop because that's how you convey how serious you are about your company.

Not so much.

Complexity and length for complexity and length's sake is almost never a good idea, especially when it comes to writing a business plan. There are a couple of reasons for this.

1. Investors Are Short On Time

If your chief goal is using your business plan to secure funding, then it means you intend on getting it in front of an investor. And if there's one thing investors are, it's busy. So keep this in mind throughout writing a business plan.

Investors wade through hundreds of business plans a year. There's no version of you presenting an 80-page business plan to an investor and they enthusiastically dive in and take hours out of their day to pour over the thing front to back.

Instead, they're looking for you to get your point across as quickly and clearly as possible so they can skim your business plan and get to the most salient parts to determine whether or not they think your opportunity is worth pursuing (or at the very least initiating further discussions).

You should be able to refine all of the key value points that investors look for to 15-20 pages (not including appendices where you will detail your financials). If you find yourself writing beyond that, then it's probably a case of either over explaining, repeating information, or including irrelevant details in your business plan (you don't need to devote 10 pages to how you're going to set up your website, for example).

Bottom line: always be on the lookout for opportunities to “trim the fat" while writing a business plan (and pay special attention to the executive summary section below), and you'll be more likely to secure funding.

2. Know Your Audience

If you fill your business plan with buzzwords, industry-specific jargon or acronyms, and long complicated sentences, it might make sense to a handful of people familiar with your niche and those with superhuman attention spans (not many), but it alienates the vast majority of readers who aren't experts in your particular industry. And if no one can understand so much as your company overview, they won't make it through the rest of your business plan.

Your best bet here is to use simple, straightforward language that's easily understood by anyone — from the most savvy of investor to your Great Aunt Bertha who still uses a landline.

How To Format Your Business Plan

You might be a prodigy in quantum mechanics, but if you show up to your interview rocking cargo shorts and lime green Crocs, you can probably guess what the hiring manager is going to notice first.

In the same way, how you present your business plan to your readers equally as important as what you present to them. So don't go over the top with an extensive executive summary, or get lazy with endless bullet points on your marketing strategy.

If your business plan is laden with inconsistent margins, multiple font types and sizes, missing headings and page numbers, and lacks a table of contents, it's going to create a far less digestible reading experience (and totally take away from your amazing idea and hours of work writing a business plan!)

While there's no one right way to format your business plan, the idea here is to ensure that it presents professionally. Here's some easy formatting tips to help you do just that.

If your margins are too narrow, it makes the page look super cluttered and more difficult to read.

A good rule of thumb is sticking to standard one-inch margins all around.

Your business plan is made up of several key sections, like chapters in a book.

Whenever you begin a section (“Traction” for example) you'll want to signify it using a header so that your reader immediately knows what to expect from the content that follows.

This also helps break up your content and keep everything nice and organized in your business plan.

Subheadings

Subheadings are mini versions of headings meant to break up content within each individual section and capture the attention of your readers to keep them moving down the page.

In fact, we're using sub-headers right now in this section for that very purpose!

Limit your business plan to two typefaces (one for headings and one for body copy and subheadings, for example) that you can find in a standard text editor like Microsoft Word or Google Docs.

Only pick fonts that are easy to read and contain both capital and lowercase letters.

Avoid script-style or jarring fonts that distract from the actual content. Modern, sans-serif fonts like Helvetica, Arial, and Proxima Nova are a good way to go.

Keep your body copy between 11 and 12-point font size to ensure readability (some fonts are more squint-inducing than others).

You can offset your headings from your body copy by simply upping the font size and by bolding your subheadings.

Sometimes it's better to show instead of just tell.

Assume that your readers are going to skim your plan rather than read it word-for-word and treat it as an opportunity to grab their attention with color graphics, tables, and charts (especially with financial forecasts), as well as product images, if applicable.

This will also help your reader better visualize what your business model is all about.

Need some help with this?

Our business planning wizard comes pre-loaded with a modular business plan template that you can complete in any order and makes it ridiculously easy to generate everything you need from your value proposition, mission statement, financial projections, competitive advantage, sales strategy, market research, target market, financial statements, marketing strategy, in a way that clearly communicates your business idea.

Refine Your Business Plans. Then Refine Them Some More.

Your business isn't static, so why should your business plan be?

Your business strategy is always evolving, and so are good business plans. This means that the early versions of your business plans probably won't (and shouldn't be) your last. The details of even even the best business plans are only as good as their last update.

As your business progresses and your ideas about it shift, it's important revisit your business plan from time to time to make sure it reflects those changes, keeping everything as accurate and up-to-date as possible. What good is market analysis if the market has shifted and you have an entirely different set of potential customers? And what good would the business model be if you've recently pivoted? A revised business plan is a solid business plan. It doesn't ensure business success, but it certainly helps to support it.

This rule especially holds true when you go about your market research and learn something that goes against your initial assumptions, impacting everything from your sales strategy to your financial projections.

At the same time, before you begin shopping your business plan around to potential investors or bankers, it's imperative to get a second pair of eyes on it after you've put the final period on your first draft.

After you run your spell check, have someone with strong “English teacher skills” run a fine-tooth comb over your plan for any spelling, punctuation, and grammatical errors you may have glossed over. An updated, detailed business plan (without errors!) should be constantly in your business goals.

More than that, your trusty business plan critic can also give you valuable feedback on how it reads from a stylistic perspective. While different investors prefer different styles, the key here is to remain consistent with your audience and business.

Writing Your Business Plan: A Section-By-Section Breakdown

We devoted an entire article carefully breaking down the key components of a business plan which takes a comprehensive look of what each section entails and why.

If you haven't already, you should check that out, as it will act as the perfect companion piece to what we're about to dive into in a moment.

For our purposes here, we're going to look at a few real world business plan examples (as well as one of our own self-penned “dummy” plans) to give you an inside look at how to position key information on a section-by-section basis.

1. Executive Summary

Quick overview.

After your Title Page — which includes your company name, slogan (if applicable), and contact information — and your Table of Contents, the Executive Summary will be the first section of actual content about your business.

The primary goal of your Executive Summary is to provide your readers with a high level overview of your business plan as a whole by summarizing the most important aspects in a few short sentences. Think of your Executive Summary as a kind of “teaser” for your business concept and the information to follow — information which you will explain in greater detail throughout your plan. This isn't the place for your a deep dive on your competitive advantages, or cash flow statement. It is an appropriate place to share your mission statement and value proposition.

Executive Summary Example

Here's an example of an Executive Summary taken from a sample business plan written by the Startups.com team for a fictional company called Culina. Here, we'll see how the Executive Summary offers brief overviews of the Product , Market Opportunity , Traction , and Next Steps .

Culina Tech specializes in home automation and IoT technology products designed to create the ultimate smart kitchen for modern homeowners.

Our flagship product, the Culina Smart Plug, enables users to make any kitchen appliance or cooking device intelligent. Compatible with all existing brands that plug into standard two or three-prong wall outlets, Culina creates an entire network of Wi-Fi-connected kitchen devices that can be controlled and monitored remotely right from your smartphone.

The majority of US households now spend roughly 35% of their energy consumption on appliances, electronics, and lighting. With the ability to set energy usage caps on a daily, weekly or monthly basis, Culina helps homeowners stay within their monthly utility budget through more efficient use of the dishwasher, refrigerator, freezer, stove, and other common kitchen appliances.

Additionally, 50.8% of house fires are caused in the kitchen — more than any other room in the home — translating to over $5 billion in property damage costs per year. Culina provides the preventative intelligence necessary to dramatically reduce kitchen-related disasters and their associated costs and risk of personal harm.

Our team has already completed the product development and design phase, and we are now ready to begin mass manufacturing. We've also gained a major foothold among consumers and investors alike, with 10,000 pre-ordered units sold and $5 million in investment capital secured to date.

We're currently seeking a $15M Series B capital investment that will give us the financial flexibility to ramp up hardware manufacturing, improve software UX and UI, expand our sales and marketing efforts, and fulfill pre-orders in time for the 2018 holiday season.

2. Company Synopsis

Your Company Synopsis section answers two critically important questions for your readers: What painful PROBLEM are you solving for your customers? And what is your elegant SOLUTION to that problem? The combination of these two components form your value proposition.

Company Synopsis Example

Let's look at a real-life company description example from HolliBlu * — a mobile app that connects healthcare facilities with local skilled nurses — to see how they successfully address both of these key aspects. *Note: Full disclosure; Our team worked directly with this company on their business plan via Fundable.

Notice how we get a crystal clear understanding of why the company exists to begin with when they set up the problem — that traditional nurse recruitment methods are costly, inconvenient, and time-consuming, creating significant barriers to providing quality nursing to patients in need.

Once we understand the painful problem that HolliBlu's customers face, we're then directly told how their solution links back directly to that problem — by creating an entire community of qualified nurses and directly connecting them with local employers more cost-effectively and more efficiently than traditional methods.

3. Market Overview

Your Market Overview provides color around the industry that you will be competing in as it relates to your product/service.

This will include statistics about industry size, [growth](https://www.startups.com/library/expert-advice/the-case-for-growing-slowly) rate, trends, and overall outlook. If this part of your business plan can be summed up in one word, it's research .

The idea is to gather as much raw data as you can to make the case for your readers that:

This is a market big enough to get excited about.

You can capture a big enough share of this market to get excited about.

Target Market Overview Example

Here's an example from HolliBlu's business plan:

HolliBlu's Market Overview hits all of the marks — clearly laying out the industry size ($74.8 billion), the Total Addressable Market or TAM (3 million registered nurses), industry growth rate (581,500 new RN jobs through 2018; $355 billion by 2020), and industry trends (movement toward federally-mandated compliance with nurse/patient ratios, companies offering sign-on bonuses to secure qualified nurses, increasing popularity of home-based healthcare).

4. Product (How it Works)

Where your Company Synopsis is meant to shed light on why the company exists by demonstrating the problem you're setting out to solve and then bolstering that with an impactful solution, your Product or How it Works section allows you to get into the nitty gritty of how it actually delivers that value, and any competitive advantage it provides you.

Product (How it Works) Example

In the below example from our team's Culina sample plan, we've divided the section up using subheadings to call attention to product's key features and how it actually works from a user perspective.

This approach is particularly effective if your product or service has several unique features that you want to highlight.

5. Revenue Model

Quite simply, your Revenue Model gives your readers a framework for how you plan on making money. It identifies which revenue channels you're leveraging, how you're pricing your product or service, and why.

Revenue Model Example

Let's take a look at another real world business plan example with brewpub startup Magic Waters Brewpub .*

It can be easy to get hung up on the financial aspect here, especially if you haven't fully developed your product yet. And that's okay. *Note: Full disclosure; Our team worked directly with this company on their business plan via Fundable.

The thing to remember is that investors will want to see that you've at least made some basic assumptions about your monetization strategy.

6. Operating Model

Your Operating Model quite simply refers to how your company actually runs itself. It's the detailed breakdown of the processes, technologies, and physical requirements (assets) that allow you to deliver the value to your customers that your product or service promises.

Operating Model Example

Let's say you were opening up a local coffee shop, for example. Your Operating Model might detail the following:

Information about your facility (location, indoor and outdoor space features, lease amount, utility costs, etc.)

The equipment you need to purchase (coffee and espresso machines, appliances, shelving and storage, etc.) and their respective costs.

The inventory you plan to order regularly (product, supplies, etc.), how you plan to order it (an online supplier) and how often it gets delivered (Mon-Fri).

Your staffing requirements (including how many part or full time employees you'll need, at what wages, their job descriptions, etc.)

In addition, you can also use your Operating Model to lay out the ways you intend to manage the costs and efficiencies associated with your business, including:

The Critical Costs that make or break your business. In the case of our coffee shop example, you might say something like,

“We're estimating the marketing cost to acquire a customer is going to be $25. Our average sale is $45. So long as we can keep our customer acquisition costs below $25 we will have enough margin to grow with.”

Cost Maturation & Milestones that show how your Critical Costs might fluctuate over time.

“If we sell 50 coffees a day, our average unit cost will be $8 on a sale of $10. At that point we're barely breaking even. However as we scale up to 200 coffees a day, our unit costs drop significantly to $4, creating a 100% increase in net income.”

Investment Costs that highlight strategic uses of capital that will have a big Return on Investment (ROI) later.

“We're investing $100,000 into a revolutionary new coffee brewing system that will allow us to brew twice the amount our current output with the same amount of space and staff.”

Operating Efficiencies explaining your capability of delivering your product or service in the most cost effective manner possible while maintaining the highest standards of quality.

“By using energy efficient Ecoboilers, we're able to keep our water hot while minimizing the amount of energy required. Our machines also feature an energy saving mode. Both of these allow us to dramatically cut energy costs.”

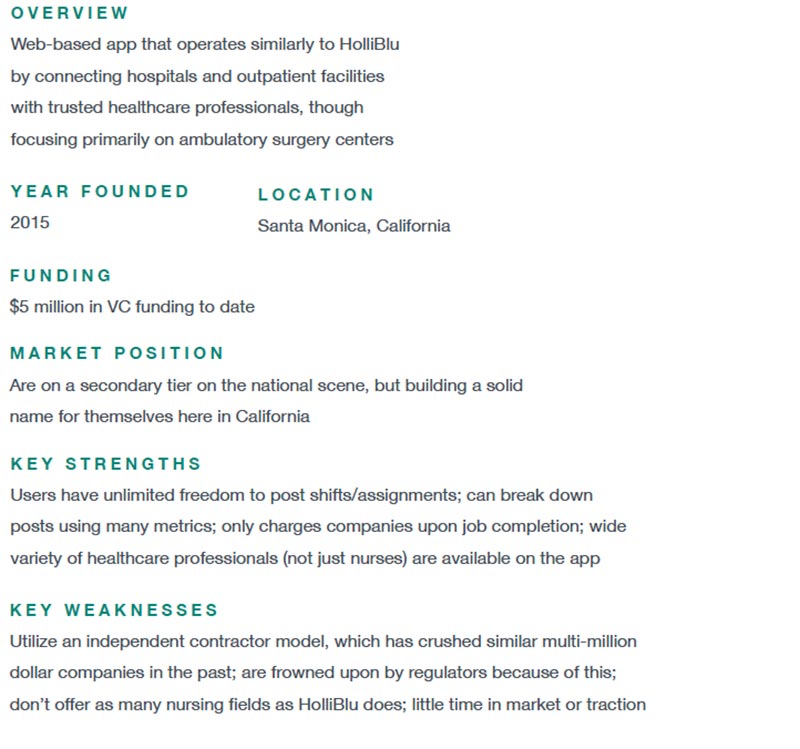

7. Competitive Analysis

Like the Market Overview section, you want to show your readers that you've done your homework and have a crazy high level of awareness about your current competitors or any potential competitors that may crop up down the line for your given business model.

When writing your Competitive Analysis, your overview should cover who your closest competitors are, the chief strengths they bring to the table, and their biggest weaknesses .

You'll want to identify at least 3 competitors — either direct, indirect, or a combination of the two. It's an extremely important aspect of the business planning process.

Competition Analysis Example

Here's an example of how HolliBlu lays out their Competitive Analysis section for just one of their competitors, implementing each of the criteria noted above:

8. Customer Definition

Your Customer Definition section allows you to note which customer segment(s) you're going after, what characteristics and habits each customer segment embodies, how each segment uniquely benefits from your product or service, and how all of this ties together to create the ideal portrait of an actual paying customer, and how you'll cultivate and manage customer relationships.

Customer Definition Example

HolliBlu's Customer Definition section is effective for several reasons. Let's deconstruct their first target market segment, hospitals.

What's particularly successful here is that we are explained why hospitals are optimal buyers.

They accomplish this by harkening back to the central problem at the core of the opportunity (when hospitals can't supply enough staff to meet patient demands, they have to resort on costly staffing agencies).

On top of that, we are also told how big of an opportunity going after this customer segment represents (5,534 hospitals in the US).

This template is followed for each of the company's 3 core customer segments. This provides consistency, but more than that, it emphasizes how diligent research reinforces their assumptions about who their customers are and why they'd open their wallets. Keep all of this in mind when you are write your own business plan.

9. Customer Acquisition

Now that you've defined who your customers are for your readers, your Customer Acquisition section will tell them what marketing and sales strategy and tactics you plan to leverage to actually reach the target market (or target markets) and ultimately convert them into paying customers.

marketing Strategy Example

Similar to the exercise you will go through with your Revenue Model, in addition to identifying which channels you're pursuing, you'll also want to detail all of relevant costs associated with your customer acquisition channels.

Let's say you spent $100 on your marketing plan to acquire 100 customers during 2018. To get your CAC, you simply divide the number of customers acquired by your spend, giving you a $1.00 CAC.

10. Traction

This one's huge. Traction tells investors one important thing: that you're business has momentum. It's evidence that you're making forward progress and hitting milestones. That things are happening. It's one of the most critical components of a successful business plan.

Why is this so important? Financial projections are great and all, but if you can prove to investors that your company's got legs before they've even put a dime into it, then it will get them thinking about all the great things you'll be able to accomplish when they do bankroll you.

Traction Example

In our Culina Traction section, we've called attention to several forms of traction, touching on some of the biggest ones that you'll want to consider when writing your own plan.

Have I built or launched my product or service yet?

Have I reached any customers yet?

Have I generated any revenue yet?

Have I forged any strategic industry relationships that will be instrumental in driving growth?

The key takeaway here: the more traction you can show, the more credibility you build with investors. After all, you can't leave it all on market analysis alone.

11. Management Team

Here's what your Management Team section isn't: it's not an exhaustive rundown of each and every position your team members have held over the course of their lives.

Instead, you should tell investors which aspects of your team's experience and expertise directly translates to the success of this company and this industry.

In other words, what applicable, relevant background do they bring to the table?

Management Team Example

Let's be real. The vast majority of startup teams probably aren't stacked with Harvard and Stanford grads. But the thing to home in on is how the prior experience listed speaks directly to how it qualifies that team member's current position.

The word of the day here is relevancy. If it's not relevant, you probably don't need to include it in your typical business plan.

12. Funding

Funding overview.

The ask! This is where you come out and, you guessed it, ask your investors point blank how much money you need to move your business forward, what specific milestones their investment will allow you to reach, how you'll allocate the capital you secure, and what the investor will get in exchange for their investment.

You can also include information about your exit strategy (IPO, acquisition, merger?).

Funding Example

While we've preached against redundancy in your business plan, an exception to the rule is using the Funding section to offer up a very brief recap that essentially says, “here are the biggest reasons you should invest in my company and why it will ultimately benefit you.”

13. Financials

Spreadsheets and numbers and charts, oh my! Yes, it's everybody's “favorite” business plan section: Financials.

Your Financials section will come last and contain all of the forecasted numbers that say to investors that this is a sound investment. This will include things like your sales forecast, expense budget, and break-even analysis. A lot of this will be assumptions, or estimates.

The key here is keeping those estimates as realistic as humanly possible by breaking your figures into components and looking at each one individually.

Financials Example

The balance sheet above illustrates the business' estimated net worth over a three-year period by summarizing its assets (tangible objects owned by the company), liabilities (debt owed to a creditor of the company), and shareholders' equity (source of financing used to fund the assets).

In plain words, the balance sheet is basically a snapshot of your business' financial status by laying out what you own and owe, helping investors determine the level of risk involved and giving them a good understanding of the financial health of the business.

If you're looking to up your game from those outdated Excel-style spreadsheets, our business planning software will help you create clean, sleek, modern financial reports the modern way. Plus, it's as easy to use as it is attractive to look at. You might even find yourself enjoying financial projections, building a cash flow statement, and business planning overall.

You've Got This!

You've committed to writing your business plan and now you've got some tricks of the trade to help you out along the way. Whether you're applying for a business loan or seeking investors, your well-crafted business plan will act as your Holy Grail in helping take your business goals to the next plateau.

This is a ton of work. It's not a few hours and a free business plan template. It's not just a business plan software. We've been there before. Writing your [business plan](https://www.startups.com/library/expert-advice/top-4-business-plan-examples) is just one small step in startup journey. There's a whole long road ahead of you filled with a marketing plan, investor outreach, chasing venture capitalists, actually getting funded, and growing your business into a successful company.

And guess what? We've got helpful information on all of it — and all at your disposal! We hope this guides you confidently on how to write a business plan worth bragging about.

About the Author

The startups team.

Startups is the world's largest startup platform, helping over 1 million startup companies find customers , funding , mentors , and world-class education .

Discuss this Article

Related articles, timing isn't everything.

The Co-Founder and CEO of Care.com talks about the winding road she took — from a small coconut farm in the Philippines to becoming one of a handful women CEOs leading a publicly traded company.

Expecting Chaos

The prolific internet entrepreneur and investor shares stories about the hard-fought success at PayPal, discusses his failures and what it was like at the very peak of the dot com bubble.

Against Considerable Odds

Founder & CEO of Walker & Company on courage, patience, and building things that solve problems.

Unlock Startups Unlimited

Access 20,000+ Startup Experts, 650+ masterclass videos, 1,000+ in-depth guides, and all the software tools you need to launch and grow quickly.

Already a member? Sign in

Transition to growth mode

with LivePlan Get 40% off now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan