Management Representation Letter: Format, Content, Signature

Home » Bookkeeping » Management Representation Letter: Format, Content, Signature

As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors are required by professional standards to report, in writing, internal control matters that they believe should be brought to the attention of those charged with governance (the board). Generally, if your auditor is going to put an internal control matter in a letter, they have assessed that the matter was the result of a deficiency in internal controls. This is an important part of that audit that the profession does not take lightly.

One common example of a deficiency in internal control that’s severe enough to be considered a material weakness or significant deficiency is when an organization lacks the knowledge and training to prepare its own financial statements, including footnote disclosures. The “SAS 115” letter is usually issued when any significant deficiencies or material weaknesses would have been discussed with management during the audit, but are not required to be communicated in written form. In performing an audit of your Plan’s internal controls and plan financials, your auditors are required to obtain an understanding of the Plan’s operations and internal controls.

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually required to sign the letter. The letter is signed following the completion of audit fieldwork, and before the financial statements are issued along with the auditor’s opinion. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

In doing so, they may become aware of matters related to your Plan’s internal control that may be considered deficiencies, significant deficiencies, or material weaknesses. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited.

The representation should reaffirm your client’s understanding of all significant terms in the engagement letter. A relevant assertion is a financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

Depending on materiality and other qualitative factors, the auditors will consider the deficiency to be an “other” matter, significant deficiency, or material weakness. The auditor has discretion on which category the deficiency falls into, but are otherwise required to use the standard wording and definitions in the letter.

It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements. The definition of good internal controls is that they allow errors and other misstatements to be prevented or detected and corrected by (the nonprofit’s) employees in the normal course of performing their duties.

Material weaknesses or significant deficiencies may exist that were not identified during the audit, and auditors are required to disclose this in their written communication. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls.

What is a management representation letter?

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

A control objective provides a specific target against which to evaluate the effectiveness of controls. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

These types of auditors are used when an organization doesn’t have the in-house resources to audit certain parts of their own operations. The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. The compilation standards do not require practitioners to obtain a management representation letter, but this does not mean that it’s not a prudent thing to do. Obtaining a representation letter helps to ensure your client understands the services that you have provided, the limitations on the work you have completed, and that they are ultimately responsible for their financial statements.

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Auditors evaluate each internal control deficiency noted during the audit to determine whether the deficiency, or a combination of deficiencies, is severe enough to be considered a material weakness or significant deficiency. In assessing the deficiency, auditors consider the magnitude of potential misstatements of your financial statements as well as the likelihood that internal controls would not prevent or detect and correct the misstatements.

Representation to Management

- In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit.

- written confirmation from management to the auditor about the fairness of various financial statement elements.

- Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk.

The idea behind a management representation letter is to take away some of the legal burdens of delivering wrong financial statements from the auditor to the company. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. Internal auditors are employed by the company or organization for whom they are performing an audit, and the resulting audit report is given directly to management and the board of directors. Consultant auditors, while not employed internally, use the standards of the company they are auditing as opposed to a separate set of standards.

If the auditors detect an unexpected material misstatement during your audit, it could indicate that your internal controls are not functioning properly. Conversely, lack of an actual misstatement doesn’t necessarily mean that your internal controls are working.

The determination of whether an assertion is a relevant assertion is based on inherent risk, without regard to the effect of controls. Financial statements and related disclosures refers to a company’s financial statements and notes to the financial statements as presented in accordance with generally accepted accounting principles (“GAAP”). References to financial statements and related disclosures do not extend to the preparation of management’s discussion and analysis or other similar financial information presented outside a company’s GAAP-basis financial statements and notes.

External audits can include a review of both financial statements and a company’s internal controls. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions. In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements.

In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit. Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk. written confirmation from management to the auditor about the fairness of various financial statement elements. The purpose of the letter is to emphasize that the financial statements are management’s representations, and thus management has the primary responsibility for their accuracy.

Expert Social Media Tips to Help Your Small Business Succeed

This letter is useful for setting the expectations of both parties to the arrangement. Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud.

Management representation letter

As long as there’s a reasonable possibility for material misstatement of account balances or financial statement disclosures, your internal controls are considered to be deficient. An auditor typically will not issue an opinion on a company’s financial statements without first receiving a signed management representation letter. An audit engagement is an arrangement that an auditor has with a client to perform an audit of the client’s accounting records and financial statements. The term usually applies to the contractual arrangement between the two parties, rather than the full set of auditing tasks that the auditor will perform. To create an engagement, the two parties meet to discuss the services needed by the client.

As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. As noted above, an internal control letter is usually the result of a deficiency in internal controls discovered during the audit, most commonly from a material audit adjustment. The letter includes required language regarding the severity of the deficiency.

Real Business Owners,

The parties then agree on the services to be provided, along with a price and the period during which the audit will be conducted. This information is stated in an engagement letter, which is prepared by the auditor and sent to the client. If the client agrees with the terms of the letter, a person authorized to do so signs the letter and returns a copy to the auditor. By doing so, the parties indicate that an audit engagement has been initiated.

Also, the letter provides supplementary audit evidence of an internal nature by giving formal management replies to auditor questions regarding matters that did not come to the auditor’s attention in performing audit procedures. Some auditors request written representations of all financial statement items. All auditors require representations regarding receivables, inventories, plant and equipment, liabilities, and subsequent events. The letter is required at the completion of the audit fieldwork and prior to issuance of the financial statements with the auditor’s opinion.

Auditors spend a lot of time assessing how material audit adjustments and immaterial adjustments that have the potential to be material will be communicated in the internal control letter. The Representation Letter is issued with the draft audit and is required by auditing standards to finalize the audit. The Representation Letter is a letter from the Association to our firm confirming responsibilities of the board and management for the financial statements, as well as confirming information provided to us during the audit. The President or Treasurer and Management need to sign the Representation Letter and return it back to our office within 60 days from the date the draft audit was issued. Representation Letters received after the 60-day mark may result in additional auditing procedures in order to finalize the audit and comply with auditing standards at an additional expense to the Association.

Illustrative Management Representation Letter: SOC 2® Type 1

AICPA MEMBER

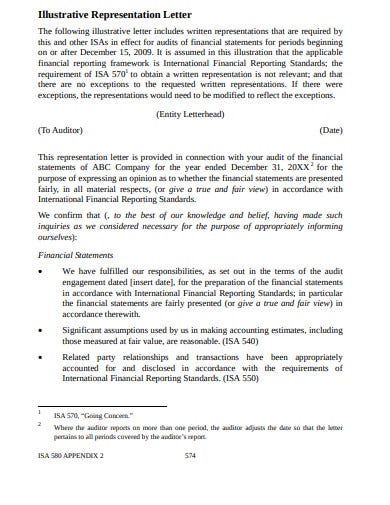

AT-C section 205, Assertion-Based Examinations, requires the service auditor to request written representations from the responsible party in a SOC 2 engagement. These representation should be in the form of a letter addressed to the service auditor. The following illustrative management representation letter includes the representations required by AT-C section 205 as well as additional representations specific to a SOC 2 Type 1 examination and should be used for engagements with reports dated on or after June 15, 2022. This

Download the Illustrative Management Rep Letter: SOC 2® Type 1

File name: illustrative-mgmt-rep-letter-for-soc-2-type-1.pdf

Reserved for AICPA® & CIMA® Members

Already a member of the aicpa or cima, log in with your account, not a member of the aicpa or cima, mentioned in this article, related content.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.

CA Do Not Sell or Share My Personal Information

- Consultants

- Be a Member

- SIGN IN Become a Member

Detailed Format of a Management Representation Letter

Format of a management representation letter (mrl).

Chartered Accountants Dear Sirs, This representation letter is provided in connection with your audit of the financial statement of M/s. …….for the year ended 31st March 2020 for the purpose of expressing an opinion as to whether the financial statements give a true and fair view of the financial position of M/s. …….as of 31st March 2020 and of the results of operations for the year then ended. We acknowledge our responsibility for the preparation of financial statements in accordance with the requirements of the other relevant statute and recognized accounting policies and practices, including the accounting standards issued by The Companies Act 2013/ The Institute of Chartered Accountants of India.

We confirm, to the best of our knowledge and belief, the following representations; General ___________________________ 1. Ours ‘…….is a limited company incorporated under the Companies Act, 1956/2013 bearing Regn. No CIN: ……………..dated …….. as Private Limited Company and converted into Public Limited Company on ………….. A copy of the Memorandum & Articles of Association is already with you. 2. Following persons are the members of the Board of Directors of the Company as on date:- Name of Director:- Designation;- Director Date of appointment Name of Director:- Designation; – Director Date of appointment Name of Director:- Designation; – Director Date of appointment Name of Director:- Designation;- Director Date of appointment Name of Director:- Designation;- Director Date of appointment 3. The Company has obtained all registrations/licenses required to run the business. 4. So far the Company had filed I.T. Return for the FY ending March …… No income tax return has been filed by the Company after the AY . PAN of the Company is ……. There are no demands/ appeals pending or details of appeals/demands pending are as under:- All the Statutory Compliance like VAT, Service Tax, GST, PF, ESIC, etc, has been paid timely and there is no default there, except the following:

5. We have maintained the following books of account:-

(a)Cash book (b) Bank Book (c) Ledger (d) Journal All the books have been kept on the computer and printouts are taken on a monthly/yearly basis as per needs. All the aforesaid books have been kept and maintained at the corporate office of the Company. 6. We enclose herewith a copy of final accounts for the year-ended ……… duly approved by the Board of Directors of the Company, for your perusal and doing the needful.

Related Topic: Private Company – Specimen Audit Report March 2020

7. Significant Accounting Policies

a) Basis of preparation The financial statements are prepared on an accrual basis under the historical cost convention, in accordance with the generally accepted accounting principles (Indian GAAP) to comply with the Accounting Standards notified under the Companies (Accounting Standards) Rules, 2006 (as amended) and the relevant provisions of the Companies Act. The accounting policies adopted in the preparation of the financial statements are consistent with those followed in the previous year. b) Use of estimates The preparation of financial statements in conformity with the Indian GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities (including contingent liabilities) and the reported income and expenses during the year. Management believes that the estimates used in the preparation of the financial statements are prudent and reasonable. Future results could differ due to these estimates and the differences between the actual results and the estimates are recognized in the periods in which the results are known/materialize. c) Revenue recognition Revenue is recognized on an “accrual” basis at the fair value of the consideration received or receivable net of applicable taxes, trade discounts, and customer returns. d) Secured Loans 1) The term loan from Financial Institutions i.e. ……….. are secured by the first charge ranking parri-passu in each case with the others by way of Equitable Mortgage by the deposit of the deeds in respect of the land situated ………………………. & by hypothecation of all the movable (save and except book debts) including immovable machinery, spares & accessories, Both present and future, subject to prior charge created in favour of the company’s banker on stock of raw material, semi-finished goods, finished goods & consumable stores and book debts for securing the cash credit for the working capital requirement. 2) All loans are guaranteed by all the promoters/shareholders of the company. e) Fixed assets Fixed assets are carried at cost less accumulated depreciation and impairment losses if any. The cost of fixed assets includes interest on borrowings attributable to the acquisition of qualifying fixed assets up to the date the asset is ready for its intended use and other incidental expenses incurred up to that date. f) Depreciation / amortization All the Company’s fixed assets including Intangible assets are depreciated on the basis of the Written Down method over the estimated useful life of the asset as per the provisions of the Companies Act, 2013. Leasehold improvements, Office Equipments, Furniture & Fixtures & Software are amortized over the useful life of the assets as specified under Company’s Act 2013. g) Foreign exchange transactions Transactions in foreign currency are recorded in the reporting currency by applying to the foreign currency amount the exchange rate between the reporting currency and the foreign currency prevailing on the date of the transaction. Monetary items denominated in foreign currency are restated at the rates prevailing on the balance sheet date. Non-monetary items denominated in foreign currency which are carried at historical cost are reported using the exchange rate at the date of the transaction. Exchange differences arising on the settlement of monetary items or on reporting company’s monetary items at rates different from those at which they were initially recorded during the year or reported in the previous financial statements are recognized as income or expense in the year in which they arise. h) Earnings per share Basic earnings/loss per share is calculated by dividing net profit/loss for the year attributable to equity shareholders by the weighted average number of equity shares outstanding during the year. i) Taxation Tax expense comprises current tax and deferred tax. Current tax is determined as the amount of tax payable in respect of taxable income for the year. The provision for current income-tax is recorded based on assessable income and the tax rate applicable to the relevant assessment year. Minimum Alternate Tax (MAT) credit is recognized as an asset only when and to the extent there is convincing evidence that the Company will pay normal income tax during the specified period. In the year in which MAT credit becomes eligible to be recognized as an asset in accordance with the recommendations contained in the guidance note issued by the Institute of Chartered Accountants of India, the said asset is created by way of a credit to the profit and loss account and shown as MAT credit entitlement. The Company is carrying/carrying any business since …….. Income Tax Returns have been/not been filed from AY ……. There is no reasonable certainty of the realization of future profits based on the Profits & Loss Account of the earlier years. Therefore, no provision for Deferred Tax has been made under the prevailing circumstances. j) Investments: Long term investments are carried at cost after providing for any diminution in value if such diminution is of a permanent nature. Current investments are carried at lower of cost or market value. k) Loans & Advances Security deposits with of Rs. – will be adjusted by the …………… against the outstanding bill ………………………..hence not recoverable. l) Inventories: There are no inventories in the Balance Sheet. m) Borrowing Cost: Interest and other financing costs relating to borrowed funds attributable to the construction or acquisition of fixed assets have been capitalized to the extent if they relate to the period up to which the asset was ready to use (As per AS-16). All other borrowing costs are charged to revenue. n) Employee Benefits:

LEAVE ENCASHMENT

There are ………/s no employee. Accordingly, provisions have been made as per AS-15../hence this clause is not applicable. PROVIDENT FUND REgular in payment of dues/There is no employee hence this clause is not applicable. GRATUITY There are …… employees/is no employee hence this clause is not applicable. Provision made on the basis of actuarial valuation o) CONTINGENT LIABILITIES: A) Corporate Guarantees B)Capital Commitments .. The company has become a sick company within the meaning of clause (o) of sub-section 1 of section 3 of the sick industrial companies (special provision) act, 1985. The matter under consideration at BIFR/AIIFR for the revival process has been rejected by the Hon’ble BIFR. The interest of Rs…………. has not been provided on the term loans of …………..because OTS (ONE TIME SETTLEMENT) has been revoked due to nonpayment as per the OTS scheme. However, interest has been provided on the term loan of ……………… as per OTS Settlement and statement of account provided by the ……………….. B) The sales tax authorities have raised a demand of Rs ………………………The above demand is not acceptable and it has been challenged by the Company in Appeal. The appeal is pending before the authorities. Although the company has provided a liability of Rs. …………- in the books of accounts but from the prevailing circumstances the amount of Rs. ……………… appears to be a contingent liability.

8 NOTES ON ACCOUNTS

Micro and Medium Scale Business Entities: There are no Micro, Small, and Medium Enterprises, to whom the company owes dues which are outstanding for more than 45 days as at 31st March 2020. This information as required to be disclosed under the Micro, Small and Medium Development Act, 2006 has been determined to the extent such parties have been identified on the basis of information available with the Company. B The Company is a Small and Medium-Sized Company (SMC) as defined in the General Instructions in respect of Accounting Standard notified under the Companies Act, 2013, accordingly, the company has complied with the accounting standard as applicable to a Small and Medium-Sized Company. C In the absence of confirmation from the parties the debit & credit balances in respect of Security Deposits and have been taken as reflected in the books. Balance appearing under the heads Current Assets, Loans and Advances, and Current Liabilities are subject to confirmation. D In the opinion of the Board of Directors of the company, the current assets, loans, and advances have the value at least equal to the figures stated in the Balance Sheet on realization in the ordinary course of business and provision for all determinable/known liabilities have been made in the accounts when reliable estimates can be made of the amount of obligation. F Previous year Figures have been reworked, regrouped, re-arranged, and reclassified wherever considered necessary to make them comparable with current year’s figures. G There has been no default except Default of Principal repayment and interest repayment on Long Term Borrowings from ……………….. The figures have been quantified in the balance sheet.

i. There have been no irregularities involving management or employees who have a significant role in the system of internal control that could have a material effect on the financial statements. ii. The financial statements are free of material misstatements, including omissions. iii. We have complied with all the relevant provisions of the statute as applicable to us and our records and minutes in this respect are up to date and are open for inspection in the course of your audit. iv. The company has complied with all aspects of contractual agreements that could have a material effect on the financial statements in the event of noncompliance. There has been no non-compliance with requirements of regulatory authorities that could have a material effect on the financial statements in the event of non-compliance. v. We have no plans or intentions that may materially affect the carrying value or classification of assets and liabilities reflected in the financial statements. vi. All the loans or depositor repayment thereof was made by account payee Cheques or demand draft only. vii. In term of section 22 of the micro, Small & Medium Enterprises Development Act, 2006: Sundry Creditors of the Company: Rs.NIL Interest Paid to them: Rs. NIL viii. We have complied with tax provisions in respect of the deduction of TDS. ix. All the payments in the respect of any revenue item has been made in compliance with the provisions of section 40(A)(3) of the Income Tax Act 1961. x. Details of all immovable Properties Purchased/Sold during the years are as below: Details Purchase/Sale Amount Value as per stamp duty act NIL NA NA NA

10. General Affirmations

· The Cash balance as on 31/03/2020 has been physically verified by the management at Rs. · The company has not given any guarantee for loans taken by others from banks or financial institutions. · We confirm that no short-term funds have been employed for long-term purposes. · We confirm that during the year company has not issued any shares. · We confirm that during the year company has not issued any debentures to any person. · We confirm that during the year company has not raised funds from the public issue of shares. · None of the employees of the Company were in receipt of remuneration in excess of the limits specified under various provisions of the Companies Act, 2013. · We confirm that Company has duly complied all the provisions of Section 40(A)3 of the I.T. Act, 1961, read with Rule 6DD, and has not made any payment of expenditure in excess of Rs……./- in Cash. · We confirm that Company has duly complied all the provisions of Section 269SS and 269T of the I.T. Act, 1961 and has not taken/accepted and or repaid any loans or deposits in excess of limits prescribed under these sections otherwise them through account payee Cheques and or draft as the case may be. · No personal expenses have been charged to revenue accounts. · No fraud has been committed during the year.

11. Other Information of the company:

Email id: :- Principal Contact No :- No. Of Employees: :- persons No. of Branches:- NIL 12. Others: (a) Our Books of Accounts and Other Records are kept at the corporate address of the company. (b) A bonus amounting Rs. NIL /- was paid to employees which is of customary nature. For and on behalf of the Board ……. Place: New Delhi

A chartered Accountant and a Law Graduate having more than 30 years of experience. Founder of Tri Nagar Keshav Puram CPE Study Circle of NIRC of ICAI. Have organized learning sessions covering the Syllabus for Limited Insolvency Examination in different cities and forums in Northern India.

Presented by

Related Posts

Significant beneficial ownership (sbo) under companies act 2013.

Sep 07, 2021

by ConsultEase Administrator

in Companies Act Compliance

MCA Relaxes the Additional Fee on Filing of Certain Forms under Co. Act, 2013/LLP Act, 2008

Jul 01, 2021

MCA issued clarification on extended timeline for allowing companies to hold their EGM through Video Conferencing upto December 31, 2021.

Jun 25, 2021

Clarification on offsetting the excess CSR spent for FY 2019-20

May 21, 2021

List of forms providing waiver of additional fee as per Circular no. 06/2021 and 07/2021

May 15, 2021

Key Developments in Companies Act 2013

Apr 16, 2021

by CA Atul Agrawal

Presentation on Amendments in Schedule III

Apr 15, 2021

by CA Rishabh Verma

MCA Notifies Amendments in Schedule-III of Companies Act, 2013 Effective From 01.04.2021

Mar 26, 2021

Important Changes in MCA Compliances from 1.04.2021

Mar 25, 2021

MCA Notifies MGT-7A for OPC and Small Companies.

Mar 06, 2021

SOP for physical of cases before the National Company Law Tribunal

Feb 27, 2021

MCA & CBIC sign MoU for exchange of data for enhancing Ease of Doing Business in India and improve overall regulatory enforcement

Feb 26, 2021

Change of Definition of Listed Company and Companies not to be considered as Listed Companies

Feb 23, 2021

by PCS Pawan Barodiya

Clarification on holding of annual general meeting (AGM) through video conferencing (VC) or other audiovisual means (OAVM)

Jan 15, 2021

MCA Notifies Companies (Meetings of Board and its Powers) Fourth Amendments Rules, 2020

Jan 02, 2021

MCA Notifies Commencement Date of Various Sections of CAA, 2020

Dec 25, 2020

Companies (Auditor’s Report) Second Amendment Order, 2020: MCA

Dec 19, 2020

Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2020: MCA

Mca notifies companies (caa) second amendment rules, 2020., extension of minimum residence criteria relaxation for directors for fy 20-21due to covid-19..

Oct 23, 2020

Companies Fresh Start Scheme, 2020 (CFSS-2020)

Sep 29, 2020

by FARHAT MIYAN

[Read circular] MCA extended dates for various compliance

Sep 28, 2020

Compendium of Notifications and Circulars Post COVID- MCA: DTPA

Sep 25, 2020

Highlights of amendments under the Companies (Amendment) Bill, 2020: ICSI

Sep 23, 2020

Parliament Passes The Companies (Amendment) Bill, 2020

Board meetings through video conferencing: icsi.

Sep 15, 2020

Appointment of CFO under Companies Act, 2013

Sep 10, 2020

by Bharti Sharma

(Read Order) AGM date is extended by 3 months

Sep 08, 2020

Annual Return: Section 92 of Companies Act, 2013

Know all about the compliance of form dpt-03 - for all companies.

Sep 03, 2020

by CA Rohit Kapoor

Join our free webinar on 4th Sept (5 PM Onwards) on New Age Reward System: ESOP & SWEAT Equity by Pooja Singhal

Sep 02, 2020

Points to be Remembered in case of Company Incorporation

Aug 31, 2020

by CS Sagar V.Kulkarni

MCA Notified Companies (Corporate Social Responsibility Policy) Amendment Rules, 2020

Aug 29, 2020

Difference Between Director & Additional Director

Aug 27, 2020

Companies (CSRP) Amendment Rules, 2020.

Aug 25, 2020

MCA Amends Schedule VII of Companies Act, 2013

Suggested GST Resources

Inspiring consultants.

Latest Resources

What 600 lawyers have written to cji.

Apr 01, 2024

by Consultease

in Supreme Court

Arvind Kejriwal remand again extended till 15th April

in Delhi High Court

Kerala HC: Writs Not for Questioning Sufficiency of Evidence in Disciplinary Proceedings

by CA Shafaly Girdharwal

in Uncategorized

SC judgment on Taxability of export sale commission as intermediary

Mar 28, 2024

What are scheduled offences in PMLA?

Stay informed....

Recieve the most important tips and updates

Absolutely Free! Unsubscribe anytime.

We adhere 100% to the no-spam policy.

Regarding E way bill

Get updates in your mailbox

Need a consultation? Start your search...

Are you a consultant join the evergrowing family of consultants.

Comprehensive

Season #2 / 24 hours, by shaifaly girdharwal.

Get your GST Queries answered by Shaifaly Girdharwal via one on one phone or email consulting.

Starting 3,000

- Submit Post

- Union Budget 2024

- CA, CS, CMA

Demystifying ISA 580: Management Representation Letters in Auditing

Introduction: The Basics of Audit – Management Representation Letter (ISA 580)

In the intricate world of auditing, there exists a pivotal document known as the Management Representation Letter, guided by ISA 580. This document plays a central role in audits, acting as a conduit for communication between management and auditors. In this comprehensive exploration, we delve deep into the intricacies of the Management Representation Letter, covering all 19 key points outlined in the standard, from its purpose to the actions auditors must take in the face of challenges.

Detailed Analysis:

1. Understanding the Management Representation Letter

A Management Representation Letter, as stipulated by ISA 580, constitutes a formal statement presented by the management of the audited entity to the auditors. It can be furnished either spontaneously or in response to specific audit inquiries. These representations encompass a wide spectrum of subjects, ranging from general responsibilities related to the preparation of financial statements to specific assertions concerning items within the financial statements.

2. The Role of Management Representation as Audit Evidence

While Management Representation Letters hold undeniable importance, they cannot serve as a complete replacement for other audit evidence that auditors anticipate will be available. For select matters where no alternative evidence exists, such as determining whether investments are held as short-term or long-term, Management Representation can indeed function as sufficient and appropriate audit evidence.

3. Key ISA 580 Requirements

Revised ISA 580 introduces two significant stipulations:

- 3.1. In the event that a representation made by management contradicts other audit evidence, auditors are obligated to investigate the circumstances thoroughly and, if necessary, reassess the reliability of other representations provided by management.

- 3.2. If, during the course of the audit, management refuses to furnish a representation that auditors deem essential, this constitutes a scope limitation. Consequently, auditors are required to express a qualified opinion or a disclaimer of opinion.

4. Additional Vital Elements of Management Representation

- 4.1. The Management Representation Letter must be addressed directly to the auditor.

- 4.2. Its date should coincide with the date of the auditor’s report or precede it.

- 4.3. It should bear the signature of a member of management who bears primary responsibility for the preparation of financial statements and possesses pertinent knowledge in this regard.

5. Various Forms of Written Representation

Management Representation can assume various formats, including:

- 5.1. A straightforward representation provided by management.

- 5.2. A letter authored by auditors delineating their understanding of management’s representation, an acknowledgment of which is sought and obtained from management.

- 5.3. A duly authenticated copy of pertinent meetings involving the board of directors or analogous bodies.

6. The Effective Date of ISA 580

ISA 580 is effective for audits of financial statements for periods beginning on or after 1st April, 2009.

7. The Objectives of the Auditor

The objectives of the auditor, as per ISA 580, encompass:

- 7.1. Obtaining written representations from management and, where appropriate, those charged with governance, confirming their belief in fulfilling their responsibility for preparing the financial statements and ensuring the completeness of information provided to the auditor.

- 7.2. Supporting other audit evidence relevant to the financial statements or specific assertions in the financial statements through written representations, as determined necessary by the auditor or required by other SAs.

- 7.3. Responding appropriately to written representations provided by management and, where appropriate, those charged with governance, or if management or, where appropriate, those charged with governance do not provide the written representations requested by the auditor.

8. Definition of Written Representations

For purposes of the SAs, “Written representations” is defined as a written statement by management provided to the auditor to confirm certain matters or to support other audit evidence. Written representations, in this context, do not include financial statements, the assertions therein, or supporting books and records.

9. References to “Management” in the Standard

For purposes of this SA, references to “management” should be read as “management and, where appropriate, those charged with governance.” In the case of a fair presentation framework, management is responsible for the preparation and fair presentation of the financial statements in accordance with the applicable financial reporting framework; or the preparation of financial statements that give a true and fair view in accordance with the applicable financial reporting framework.

10. Management from Whom Written Representations Requested

The auditor shall request written representations from management with appropriate responsibilities for the financial statements and knowledge of the matters concerned.

11. Written Representations about Management’s Responsibilities for the Preparation of the Financial Statements

The auditor shall request management to provide a written representation that it has fulfilled its responsibility for the preparation of the financial statements in accordance with the applicable financial reporting framework, including where relevant their fair presentation, as set out in the terms of the audit engagement.

12. Written Representations about Information Provided and Completeness of Transactions

The auditor shall request management to provide a written representation that:

- 12.1. It has provided the auditor with all relevant information and access as agreed in the terms of the audit engagement.

- 12.2. All transactions have been recorded and are reflected in the financial statements.

13. Description of Management’s Responsibilities in the Written Representations

Management’s responsibilities shall be described in the written representations required by paragraphs 9 and 10 in the manner in which these responsibilities are described in the terms of the audit engagement.

14. Other Written Representations

Other SAs may require the auditor to request written representations. If, in addition to such required representations, the auditor determines that it is necessary to obtain one or more written representations to support other audit evidence relevant to the financial statements or one or more specific assertions in the financial statements, the auditor shall request such other written representations.

15. Date of and Period(s) Covered by Written Representations

The date of the written representations shall be as near as practicable to, but not after, the date of the auditor’s report on the financial statements. The written representations shall be for all financial statements and period(s) referred to in the auditor’s report.

16. Form of Written Representations

The written representations shall be in the form of a representation letter addressed to the auditor. If law or regulation requires management to make written public statements about its responsibilities, and the auditor determines that such statements provide some or all of the representations required by paragraphs 9 or 10, the relevant matters covered by such statements need not be included in the representation letter.

17. Doubt as to the Reliability of Written Representations and Requested Written Representations Not Provided

- 17.1. If the auditor has concerns about the competence, integrity, ethical values, or diligence of management, or about its commitment to or enforcement of these, the auditor shall determine the effect that such concerns may have on the reliability of representations (oral or written) and audit evidence in general.

- 17.2. In particular, if written representations are inconsistent with other audit evidence, the auditor shall perform audit procedures to attempt to resolve the matter. If the matter remains unresolved, the auditor shall reconsider the assessment of the competence, integrity, ethical values, or diligence of management, or of its commitment to or enforcement of these, and shall determine the effect that this may have on the reliability of representations (oral or written) and audit evidence in general.

18. Requested Written Representations Not Provided

If management does not provide one or more of the requested written representations, the auditor shall:

- 18.1. Discuss the matter with management.

- 18.2. Re-evaluate the integrity of management and evaluate the effect that this may have on the reliability of representations (oral or written) and audit evidence in general.

- 18.3. Take appropriate actions, including determining the possible effect on the opinion in the auditor’s report in accordance with SA 705, having regard to the requirement in paragraph 19 of this SA.

19. Written Representations about Management’s Responsibilities

The auditor shall disclaim an opinion on the financial statements in accordance with SA 705 if:

- 19.1. The auditor concludes that there is sufficient doubt about the integrity of management such that the written representations required by paragraphs 9 and 10 are not reliable; or

- 19.2. Management does not provide the written representations required by paragraphs 9 and 10.

Conclusion: Unlocking the Significance of ISA 580

In conclusion, ISA 580, which revolves around the Management Representation Letter, is a comprehensive framework that ensures transparency, accountability, and reliability in the audit process. By covering all 19 points detailed in the standard, auditors can effectively navigate the complexities of this critical document. Understanding the nuances of ISA 580 empowers auditors to fulfill their duties with precision, integrity, and professionalism, ultimately enhancing the quality of financial reporting and instilling confidence in stakeholders.

- Auditing Standards

- « Previous Article

- Next Article »

Name: CA Rahul Sharma

Qualification: ca in job / business, company: uco bank, location: jaipur, rajasthan, india, member since: 01 mar 2021 | total posts: 78, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Group

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: 8c5783fd16a092697df51d4709c44ab6

Subscribe to Our Daily Newsletter

Latest posts.

Master Circular 2024 – Housing Finance for UCBs

Master Circular 2024– Housing Finance

97.69% of ₹2000 banknotes returned till March 29, 2024

DGFT Directives regarding submission of digitized ANFs, Appendices etc

Time limit for verification of return of income after uploading

TRAI releases Consultation Paper on National Broadcasting Policy-2024

FAQ’s on Electoral Roll/Voter Services

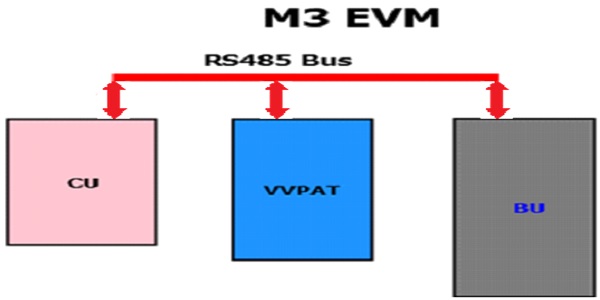

FAQ’s on EVM/VVPAT

Master Circular 2024 Prudential Norms on Capital Adequacy – Primary UCBs

India Customs: New Authorized Officers for Food Imports – Notification

Featured posts.

जीएसटी राजस्व बढ़ रहा है, पर क्या जीएसटी सफल है?

आइये जाने कि किसी व्यक्ति के लिए क्यों जरुरी है वसीयत बनाना

लघु एवं मध्यम व्यापार आपका व्यापार – कैसे करें अपनी तैयारी आप स्वयं

How to start a new financial year without becoming a financial fool?

Clarification regarding applicability of new tax regime and old tax regime

Section 139(8A)- Updated Return (ITR-U): FAQs

Bombay HC Dismisses Rs. 3731 Crore CGST Act Penalty Notice issued to Salaried Employee

April, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines

Guidelines for CGST Investigation: Ensuring Compliance & Ease of Business

Tel: +254 20 2249 100/11 +254 720 021 253 | Email: [email protected]

Management Representation Letters in Governance Audit

A Management Representation Letter, referred to herein as the letter, is a document signed by senior company management and submitted to the company’s external auditors. This letter serves as an affirmation of the accuracy of the financial statements subjected to the auditor’s scrutiny. The significance of this practice is underscored by its incorporation into the International Standards on Auditing (ISA 580), designating the letter and its written representations as audit evidence. This inclusion in professional standards emphasizes the need for Management Representation Letters in audit processes, as audit evidence forms the foundation for the auditor’s opinion.

This governance practice holds a pivotal role in ensuring the quality, integrity, ethical grounding, and diligence of financial statements and management. Its importance extends across various dimensions:

- Drawing inspiration from Saul Alinsky’s insight that controlling language controls the masses, the governance framework becomes a critical tool. Notably, the Enron Inc. scandal serves as a cautionary tale, where falsified financial statements led to a catastrophic decline in share value. Robust governance, including the Management Representation Letter, mitigates such risks.

- In specific jurisdictions, such as the United States under the Sarbanes Oxley Act, the Management Representation Letter is a statutory requirement. This mandates companies to have their executives sign the letter, ensuring compliance with legal obligations.

- Recognizing the absence of jurisprudence in some jurisdictions, professional institutes often incorporate the practice into their codes. Additionally, adherence to international standards such as the International Financial Reporting System (IFRS) and ISA is crucial. For instance, the Institute of Certified Public Accountants (ICPAC) recognizes the importance of ISA.

- The letter serves as a safeguard against managerial denial of wrongdoing or negligence, particularly in cases of incompetent oversight. Reference to Kenneth Lay’s denial in the Enron scandal highlights the necessity of signed letters to counter such potential denials.

- Acknowledging that auditors depend on correct financial statements, the Management Representation Letter reduces management’s influence, strengthening the auditor’s oversight powers.

- The letter establishes accountability for senior managers responsible for the business’s well-being. Signing the letter signifies their individual responsibility for the financial statement’s integrity, completeness, and potential losses resulting from falsified records.

- As pre-audit custodians of financial reports, management holds significant influence over their integrity. The letter commits them to refrain from tampering with the contents or preparation of reports, preventing potential manipulations.

- Providing assurance to auditors, the Management Representation Letter instills confidence in the accuracy of the financial position reviewed. This credibility promotes responsible management practices and underscores the significance of the audit exercise.

The Management Representation Letter transcends being a mere accessory in the audit process; it is a cornerstone of good corporate governance. This letter safeguards against shareholder deception, assuring stakeholders and the public of transparent and above-board operations within a company. It stands as the final safeguard against misinformation, reinforcing the integrity of financial reporting.

Share Article via:

- More Networks

Automated page speed optimizations for fast site performance

IMAGES

VIDEO

COMMENTS

I offer this Management Representation to attest the foregoing statements and to assert that the Audit Team can rely on the accuracy and correctness of documents and data submitted for audit, resulting from the implementation of the e-Collection and/or e-Payment Systems by [Agency Name]. Very ff.uly yours, Head of Agency / Authorized Representative

COA [s existing policy and application of the principles in this Manual Ethics and independence Auditors should comply with relevant ethical requirements and be independent. COA has adopted the Revised Code of Conduct and Ethical Standards for COA Officials and Employees under Resolution No. 2018-010 dated February 1, 2018. Professional

Reliance on Management Representations.02 During an audit, management makes many representations to the au-ditor, both oral and written, in response to specific inquiries or through the fi-nancial statements. Such representations from management are part of the audit evidence the independent auditor obtains, but they are not a substitute

The representation letter ordinarily should be tailored to include additional appropriate representations from management relating to matters specific to the entity's business or industry. fn 14 Examples of additional representations that may be appropriate are provided in appendix B, "Additional Illustrative Representations" [paragraph .17].

A management representation letter is a form letter written by a company's external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are ...

representations in the engagement letter with the management representation letter 215A Throughout Added guidance on disclosure entities and public-private partnerships 220, 280, 550 220.09 - .10; 280.04; 550.15 Revised guidance regarding identifying and testing information system controls 220, 240, 270, 290, 295F, 320, 340, 350, 360, 390, 395G

These representation should be in the form of a letter addressed to the service auditor. The following illustrative management representation letter includes the representations required by AT-C section 205 as well as additional representations specific to a SOC 2 Type 1 examination and should be used for engagements with reports dated on or ...

This representation letter updates the representations provided in conjunction with your audit of the financial statements as of September 30, 20xx. We are responsible for the fair representation of the financial statements and Required Supplementary Stewardship. 1300 Pennsylvania Avenue NW Washington, D.C. 20523.

MANAGEMENT REPRESENTATION LETTERS: Last updated 27 Mar 2018 This guidance was issued by the Audit and Assurance Faculty of the Institute of Chartered Accountants in England and Wales in November 2002 and updated in March 2018. The purpose of this guidance is to remind auditors of the need to consider the reliability of

Obtaining Written Representations. .05 Written representations from management should be obtained for all financial statements and periods covered by the auditor's report. 2 For example, if comparative financial statements are reported on, the written representations obtained at the completion of the most recent audit should address all periods ...

A management representation letter is a formal document issued by senior management of an organization confirming the accuracy and completeness of financial information presented in the financial statements. It is a critical document that helps auditors or other parties to obtain reasonable assurance that the financial statements are reliable.

Management believes that the estimates used in the preparation of the financial statements are prudent and reasonable. Future results could differ due to these estimates and the differences between the actual results and the estimates are recognized in the periods in which the results are known/materialize.

Auditors of the Commission on Audit (COA); and All Others Concerned Guidelines on the use of Electronic Documents, Electronic Signatures, and Digital Signatures in Government Transactions ... A sample form of the Management Representation is attached as Annex A. To secure the electronic records with signatures, the government entity

Question —Section 333, Management Representations, lists matters for which the auditor ordinarily obtains written representations from management. One of those matters is: Violations or possible violations of laws or regulations whose effects should be considered for disclosure in financial statements or as a basis for recording a loss ...

A management representation letter is a form letter written by a company's external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually ...

The document is a management representation letter from a company to its auditors regarding its financial statements and internal financial controls. It acknowledges management's responsibility for preparing the financial statements according to accounting standards and maintaining adequate internal controls. It represents that the financial statements are prepared according to accounting ...

Scope of this ISA. 1. This International Standard on Auditing (ISA) deals with the auditor's responsibility to obtain written representations from management and, where appropriate, those charged with governance in an audit of financial statements. 2.

In conclusion, ISA 580, which revolves around the Management Representation Letter, is a comprehensive framework that ensures transparency, accountability, and reliability in the audit process. By covering all 19 points detailed in the standard, auditors can effectively navigate the complexities of this critical document.

A Management Representation Letter, referred to herein as the letter, is a document signed by senior company management and submitted to the company's external auditors. This letter serves as an affirmation of the accuracy of the financial statements subjected to the auditor's scrutiny. The significance of this practice is underscored by ...

Civil Service Commission Management Letter 2021. File size: 831.79 KB. Created: July 8, 2022. Hits: 279. Download. 1987 PHILIPPINE CONSTITUTION ARTICLE IX-D THE COMMISSION ON AUDIT SECTION 1 (1). There shall be a Commission on Audit.