- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

Fund Your Business

Small business funding is a vital step to start or accelerate the growth of your business. Learn how to get ready for funding, review your options, master the art of pitching, and more.

How to get funding

- Funding options

- Pitch your business

- Manage funding

Explore Topics

40 Proven Ways to Fund Your Business

Angelique O'Rourke

Oct. 27, 2023

Every funding option differs in availability, terms, amount, eligibility criteria, and compatibility with your business needs. Check out our growing list of funding sources to identify the best option for your business.

Apr. 11, 2024

Apr. 9, 2024

Noah Parsons

Spencer Grover

How to Successfully Pitch Your Business Idea

You must know how to pitch your business, even if you don’t plan to pursue funding. Here’s what you need to cover to make any pitch successful.

11 Slides to Include in Your Pitch Deck

Use this proven pitch deck structure to increase your chances of generating interest from potential investors.

Free Download

Investor Pitch Deck Template

Investor Pitch Deck Template Create an engaging, persuasive, and memorable pitch deck with this free template.

Create a business plan that maximizes your chances of securing funding

How to Write a Convincing Business Plan for Investors

Apr. 8, 2024

Did you know that you can fine-tune your business plan to better resonate with investors? Here’s what you should focus on to really show your business is worth investing in.

10 Things the Bank Asks for When Applying for a Loan

7 Key Components of the Perfect Elevator Pitch

Learn the basics of funding

Do you really need funding.

Not every business needs to pursue external funding. To know for sure, you must consider why you want funding, how you’ll manage it, and what you intend to do with it.

How much funding do you need?

Lenders and investors want to know how much money you’re asking for. If you don’t have a clear number in mind—you’ll struggle to get or use any funding.

Is it hard to get funding for a business?

Securing funding can be challenging, as it depends on factors like the business's stage, financial health, and the investor's appetite for risk. A strong pitch, business plan, and network can improve your chances.

What is the best funding option for a business?

The best funding source depends on factors like the stage of your business, creditworthiness, and industry. Typically some combination of self-funding, friends and family financing, and a business loan is your best option.

What questions will investors ask?

You need to prepare for what investors will ask. If you don’t have answers to questions like ‘What problem do you solve?’ or ‘How will you make money’ then you’ll struggle to nail your pitch.

Can you get a business loan with bad credit?

It is possible to get a loan even with bad credit. However, the terms, total, and application process will likely be unfavorable. Luckily, there are things you can do to improve your chances of being approved.

Should you borrow from friends and family?

Friends and family financing is one of the most common funding methods for new businesses. To ensure there are no problems, you need to treat it like a loan or other more formal funding source.

What makes a great pitch?

A great pitch tells a real story, cuts out unnecessary details, demonstrates traction, and is backed up with facts and data.

Small business funding guides

Do you actually need additional funding to start a business? How much do you need? How do you successfully get funding? We have answers to all of these questions, plus additional tips to improve your chances of getting funding.

Funding and financing options

There is a wide variety of funding and financing methods available to small businesses. Learn what makes them unique and how to choose the best option(s) for your business.

How to create your business pitch

When seeking funds, you’ll likely have to pitch your business. Learn what you need to prepare and how to confidently pitch your business.

How to manage funding

An often overlooked part of pursuing funding is how you will track and use it after you receive it. Learn how to get the most from your additional cash and track its use for you and any external stakeholders.

Wow lenders with a professional business plan

Funding your business FAQ

What is the best source of funding for small businesses?

The best source of funding for your specific business depends on numerous factors like the stage of your business, creditworthiness, and industry. Typically some combination of self-funding, friends and family and financing, and eventually some sort of business loan is your best funding source.

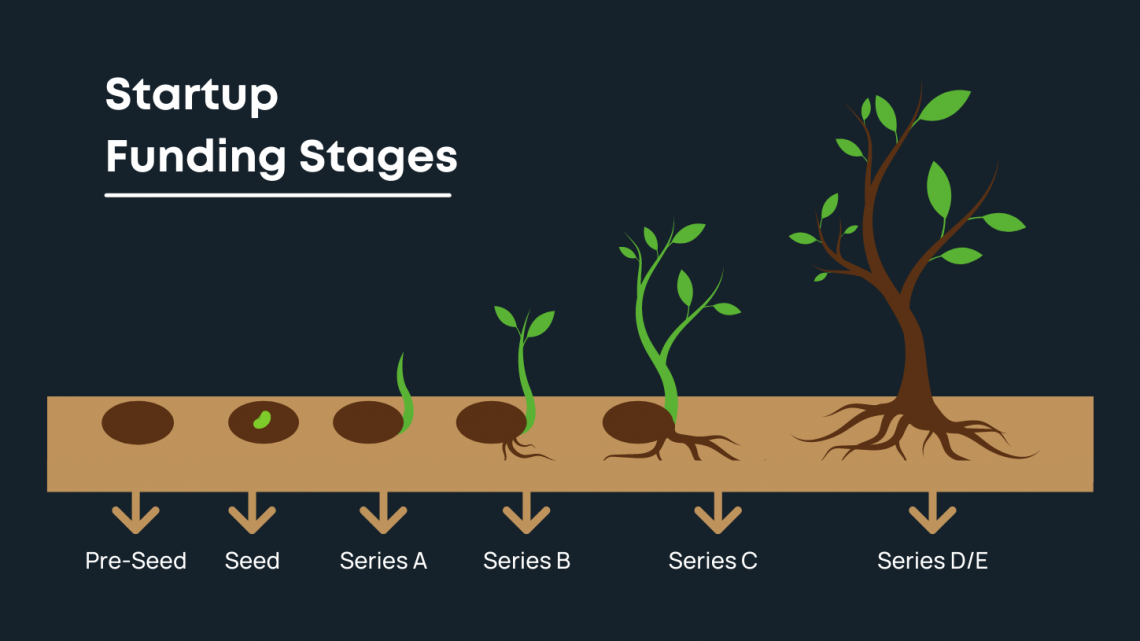

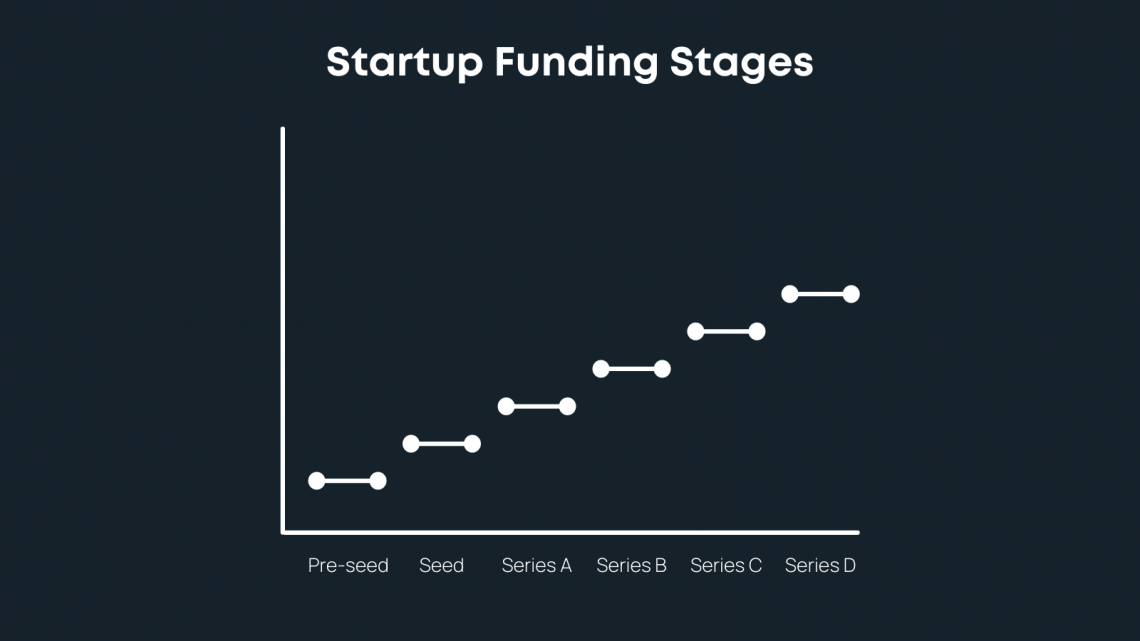

How do startups get funding?

Startups and small businesses typically secure funding through loans, friends and family, angel investors, venture capital, grants, or crowdfunding. To boost your chances you need to be actively networking, craft a compelling pitch, and write a detailed business plan.

How do you get funding for an existing business?

Existing businesses can seek funding through friends and family, loans, lines of credit, investors, grants, or revenue-based financing. To better your chances, it’s crucial to demonstrate financial stability and growth potential.

What is the most common startup funding?

The most common startup funding is often personal savings, friends and family, or loans.

How can you fund a business without a loan?

Businesses can be funded without loans through bootstrapping, crowdfunding, grants, angel investors, venture capital, or investments from friends and family.

Securing funding can be challenging, as it depends on factors like the business’s stage, financial health, and the investor’s appetite for risk. A strong pitch, business plan, and network can improve your chances.

How much should I ask for when funding a startup?

Determine the amount needed by creating a detailed financial plan, considering costs, projected revenues, and growth goals. Be sure to request a realistic amount to justify the use to investors.

Can you get funding with just an idea?

While difficult, it’s possible to secure funding with just an idea, particularly if you have a strong network, industry experience, or an innovative concept. While traditional options like a business loan will require more information and traction, some early-stage investors or incubator programs may be interested.

What are examples of funding?

Examples of funding include self-funding, bank loans, lines of credit, grants, angel investments, venture capital, crowdfunding, and investments from friends and family.

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Understanding the Different Types of Funding for Your Business

By alex ryzhkov, introduction.

Funding sources are an important part of any business plan. They serve as a means to finance the completion of activities, as well as to facilitate new ones. Generally, there are three different types of funding sources, each of which comes with its own advantages and disadvantages.

A funding source can be defined as any type of financial resource that a business can use to embark on or fulfill obligations. It includes, but is not limited to, money from an individual, a government grant, a loan, and/or investments.

The three kinds of funding sources most commonly used in business planning are:

Debt Financing

Equity financing, hybrid financing, debt funding.

Debt funding is a common way for businesses to acquire financing. This involves borrowing money, usually from a bank, to fund a business plan or project. Debt funding typically has to be repaid over a certain period of time and with interest. There are two main types of debt funding: loan or a line of credit.

A Loan or Line of Credit

A loan is when a business takes out a set amount of money from a lender for a predetermined amount of time, usually at an agreed upon interest rate. A line of credit is similar except that it allows a business to draw funds as needed, usually up to a set limit, for a predetermined amount of time. Interest is only charged when money is drawn from the line of credit.

Advantages / Disadvantages

Debt funding has several advantages. One of the main advantages is that a business is able to receive a lump sum of money quickly. Furthermore, a business will not have to surrender any equity or profits in exchange for the loan. On the other hand, debt funding has some disadvantages. The most notable of these is the interest that will be charged, as well as the need to establish a consistent repayment schedule. Additionally, the repayment of the loan or line of credit will create a financial strain on the business.

- Quick access to a lump sum of money

- No need to give up any equity or profits

- Interest charges

- Financial strain from repayments

Equity Funding

Equity funding is one of the most popular sources of funding for businesses. This form of financing involves issuing shares or ownership in your business in exchange for investment money. As the owner, you'll maintain some level of control and will be required to pay dividends to shareholders, depending on the terms of the agreement.

Seeking An Investor

When seeking out an equity investor, there are a few things to consider. First, determine the type of equity investor you wish to attract. Are you seeking angel investors, venture capitalists, or private equity firms? Each type offers its own set of advantages and drawbacks.

Once you have identified your desired equity investor, create a targeted pitch. Make sure to include information about your business and the funding you seek, as well as a realistic timeline and financial projections. Finally, make sure to research potential investors and reach out to them with a well-crafted introduction.

Equity funding has several advantages. For one, you don't have to worry about loan repayments or having to cut ties with your business. You also benefit from the investor's expertise and resources, which can help to grow and expand your business. Additionally, the investor is likely to contribute more money than traditional lenders, so you'll have a greater amount of capital with which to start your business.

One of the downsides of equity funding is that you give up partial control of your enterprise and you may be subject to additional scrutiny. Moreover, the return on your investment may not be realized for years. As such, you'll need to weigh the advantages and disadvantages of equity funding and consider if it is the right fit for your business.

Crowdfunding

Crowdfunding is an increasingly popular method for small businesses or entrepreneurs to acquire funding for their business plans. Fundraising campaigns on crowdfunding platforms have become an attractive, alternative to traditional banking and capital investment.

Online Platforms

One of the largest and best-known crowdfunding platforms is Kickstarter, where a user can set up a page on their website and collect money from website visitors and other investors. They can offer rewards to incentivize larger donations or investments, such as products related to the business. Other popular crowdfunding platforms include: Indiegogo, GoFundMe, Fundly, and Patreon.

Advantages/Disadvantages

The primary benefit of crowdfunding is that it offers the ability to raise significant amounts of capital in a short period of time, which can be attractive for business owners who need to get their ideas off the ground quickly. It also allows for greater exposure for your business idea, and can be a great way to gain public interest or momentum. However, it can be difficult to make your campaign stand out on a platform, and it cannot replace traditional methods of financing, such as debt or equity.

- Raise significant amounts of capital in a short period of time

- Greater exposure for your business idea

- Gain public interest or momentum

- Difficult to make your campaign stand out

- Cannot replace traditional methods of financing

Alternative Funding Sources

Starting a business can be an expensive undertaking, but fortunately, there are many potential funding sources available to entrepreneurs. Knowing the different types of financing available can help entrepreneurs make the best decisions for their business. Here are some of the other alternative funding sources that entrepreneurs may find useful.

Government Grants

Government grants are a type of finance offered to entrepreneurs, usually to support a particular purpose or cause. The specific terms and conditions of government grant availability vary based on country or region. Generally, they are designed to encourage entrepreneurship by providing access to need-based resources. Government grants are appealing as they usually carry no interest, but they also tend to have a lot of restrictions and requirements that need to be met.

Specialized Loans

Specialized loans are available for certain types of businesses, such as small business loans offered by the Small Business Administration. These are tailored to meet the specific needs of particular businesses and the requirements for eligibility can vary based on the loan. Businesses that may be eligible for such loans may include startups, older businesses, and those of particular industries such as agriculture. Specialized loans tend to have better interest rates than other types of finance and may also be easier to apply for.

- Government grants are a type of finance offered to entrepreneurs, usually to support a particular purpose or cause.

- Specialized loans are tailored to meet the specific needs of particular businesses and may offer better interest rates and easier applications.

Strategies for Acquiring Funding

If you want to be successful in launching your own business, understanding all the options available to you regarding funding is of the utmost importance.

An essential part of this process is building your business plan. Your business plan will provide answers to questions that prospective funders may have and can help provide a plan of action that can be followed to reach your business goals and objectives. Additionally, it will help you to identify the types of funding you need to pursue.

When searching for potential funders, it is important to create a detailed list of options that can help support your business. Before doing so, it is important to understand the different types of funding that can be leveraged:

- Equity and Investment

- Crowdfunding Platforms

- Business Incubators and Accelerators

- Family, Friends and Angel Investors

Building Your Business Plan

Creating a solid business plan is one of the most important strategy for acquiring funding for your business. A well-crafted business plan will demonstration to potential investors or lenders that your business will be able to not only sustain but also grow. It should include a mission statement, detailed market research, a list of short and long-term goals, a staffing outline, and your financial projections.

Creating a business plan should also include a “projected use of funds” section. This should detail precisely what each funding source would be used for and how much you would need for each purpose. For example, if you are applying for a loan, this should include a description of how you plan on repaying the loan.

Identifying Your Funders

Once your business plan is complete, the process of identifying funders and the types of funding that make the most sense for your business can begin. Depending on the stage of your business, different types of funders might be more suitable. For example, if you are in the early stages of development, then crowdfunding platforms, angel investors, and venture capital might make the most sense, while if your business is further along, then a bank loan or line of credit might better fit your needs.

These decisions should be based on the amount of money you need, the types of investments you are willing to make, and the repayment methods you are able to commit to. Ultimately, it is important to carefully evaluate each option before deciding on the best fit.

Funding is an essential part of any business plan, and understanding the different types of funding sources available is key to identifying the best option for your business. In this article, we took a comprehensive look at the different types of funding sources, from traditional lenders like banks, to alternative forms like crowdfunding and venture capital. We also discussed the advantages and disadvantages of each type of funding, as well as the steps you should take to make sure you get the best deal possible.

Weighing Your Options

When it comes to funding your business, there are many options to consider, and it can be difficult to know which one is right for you. That’s why it’s important to take the time to research each option, and weigh the pros and cons against your particular business needs. As you do your research, make sure to consider things like interest rates, terms, and the amount of documentation needed.

Continuing to Investigate Funding Options

It's important to remember that the world of business funding is always changing. New options are emerging all the time, so it's important to stay informed about the latest developments. Monitor the business news, and talk to other entrepreneurs and financiers, to get an idea of the latest funding trends. Additionally, consider seeking out professional advice if you need help making the right decisions.

- Monitor business news

- Talk to other entrepreneurs and financiers

- Seek out professional advice

$169.00 $99.00 Get Template

Related Blogs

- Improve Your CAC LTV Ratio and Unlock Your Business's Success with These Tips!

- Presentation Tips - Creating an Effective Pitch Deck

- How to Choose the Right Crowdfunding Platform

- Building a Successful Investment Portfolio

- What to Look for in a Startup’s Product/Market Fit

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Business Capital: Definition and Where to Get It

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Business capital, or small-business capital, commonly refers to lump sums of money that come from external sources and are used to fund business purchases, operations or growth. These sources can include small-business loans , as well as free funding like small-business grants .

The right type of business capital for you depends on how established your business is, as well as other factors like your funding purpose and how fast you need it.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

What is business capital?

Technically speaking, business capital is anything that generates value for your business. That can include financial capital like cash, human capital like employees and personnel or physical capital like real estate and intellectual property.

Business capital, or small-business capital, can also simply refer to external financing, or lump sums your business attains to fund operations or large purchases.

Types of business capital

There are several types of business capital that you can use to fund your business at various stages.

Debt funding

With debt funding — taking out a small-business loan — you borrow money from a third party and repay it, with interest, over a specific period of time. Debt funding can be a good option for a variety of small businesses, especially established companies looking to grow their operations.

Business term loans

With a business term loan , you receive a lump sum of capital upfront from a lender. You then repay the loan, with interest, over a set period of time — usually with fixed, equal payments.

Business term loans are well-suited for specific funding purposes, such as purchasing real estate or renovating your storefront. Some loans, like equipment financing , are designed to accommodate specific business purchases.

You can get business term loans from banks, credit unions and online lenders . Banks and credit unions will offer term loans with the most competitive rates and terms, but you’ll need to meet strict criteria to qualify. Online lenders are typically more flexible and may work with startups or businesses with bad credit. These companies will often charge higher interest rates.

» MORE: Compare the best banks for business loans

SBA loans are partially guaranteed by the U.S. Small Business Administration and issued by participating lenders, typically banks and credit unions. There are several types of SBA loans , but generally, these products are structured as term loans.

These loans usually have low interest rates and long repayment terms and can be used for a range of purposes, such as working capital, equipment purchases and business expansions.

This type of government funding can be a good option if you’re an established business with good credit but you can’t qualify for a bank loan.

>> MORE: Top SBA lenders

Business lines of credit

A business line of credit is one of the most flexible types of business capital — making it well-suited to meet the working capital needs of new and established companies alike.

With a business line of credit, you can draw from a set limit of funds and pay interest on only the money you borrow. After you repay, you can draw from the line as needed. Lines of credit are often used to manage cash flow, buy inventory, cover payroll or serve as an emergency fund.

Like term loans, business lines of credit are available from traditional and online lenders. Traditional lenders typically offer credit lines with the lowest rates but require an excellent credit history and several years in business to qualify.

Online lenders, on the other hand, may charge higher interest rates but generally work with a wider range of businesses. Some online lenders offer startup business lines of credit and/or options for borrowers with fair credit.

Business credit cards

Business credit cards work similarly to personal credit cards, although business cards typically offer rewards for spending on operational expenses, such as gas, internet, software purchases and more.

Business credit cards can be a good option for startups because they offer quick access to capital and most entrepreneurs with good personal credit can qualify. You may not want to completely fund your business with a credit card , however, because overspending can lead to expensive debt that’s difficult to repay.

In general, business credit cards can be useful for all types of entrepreneurs because they allow you to earn rewards (e.g., cash back, miles, points) for everyday spending on your business purchases. Responsible spending on a credit card can also help you establish business credit, which will allow you to qualify for more competitive loan products.

»MORE: Debt vs. equity financing

Equity funding

With equity funding , you receive money from an investor in exchange for partial ownership of your company. If you’re a startup that can’t qualify for a business loan or you want to avoid debt, equity funding may be a suitable option for your needs.

Angel investors and venture capital firms

Angel investors and venture capital firms are common forms of equity financing that involve receiving money in exchange for equity in your company.

With angel investors , you work with individuals who invest their money into your business. These individuals often invest in startups with high growth potential. In addition to the equity they receive, your angel investor may offer business expertise to help your company progress.

A venture capital firm, on the other hand, will be an individual or group that invests from a pool of money. VCs may require a higher amount of equity in your company as well as some operational control, such as a seat on the board of directors. Compared to angel investors, VCs tend to offer larger amounts of money and invest in businesses that are a little more established.

You can find angel investors and venture capitalists through organizations like the Angel Capital Association or the National Venture Capital Association . You can also search online for investors in your area as well as attend industry events and talk to other business owners.

Either of these startup funding options may be a good option for your business if you’re looking to avoid debt. Finding and receiving capital may take time, however, and some businesses may not be able to meet the requirements set out by an angel investor or venture capital firm.

Crowdfunding

With crowdfunding your business , you raise money online through public donations in exchange for equity or rewards, such as an exclusive product or early access to an event.

You can set up a campaign using a crowdfunding platform, which allows you to manage the process through the platform’s website.

With equity crowdfunding , you can use platforms like Fundable, StartEngine and Netcapital to receive capital in exchange for ownership of your business. For rewards-based crowdfunding , you can turn to well-known websites like Kickstarter or Indiegogo .

Crowdfunding can be well-suited for a range of businesses as long as they’re dedicated to managing and promoting a campaign. Rewards-based crowdfunding is usually a better option for small amounts of capital, especially for businesses with a unique product or service.

Equity crowdfunding, on the other hand, may give you access to larger funding amounts, but you may have to meet stricter eligibility requirements to use one of these crowdfunding platforms.

» MORE: How to fund your business idea

Free business capital

On top of these main sources of external financing, entrepreneurs can access free small-business capital through grants. Grants do not have to be repaid and are available from government agencies, corporations and nonprofits.

Small-business grants are available for new and existing businesses. You can get a business grant from a few sources:

Federal and state governments. Government agencies offer a range of small-business grants, including those designed for companies that focus on scientific research and technology innovation. Grants.gov provides a comprehensive list of business grants available from the federal government.

Private corporations. Many corporations offer annual small-business grant programs or competitions, such as the FedEx Small Business Grant Contest . In many cases, you have to meet specific criteria to qualify for one of these grants.

Nonprofits. Certain nonprofits offer grants designed for small-business owners. Among these organizations, some focus on providing business grants for women or business grants for minority groups .

Business grants are a good option for startups as well as companies that can’t qualify for other types of small-business capital. Because grants give you access to free capital, however, applications are competitive — and often time-consuming.

Bootstrapping

In addition to the previous external financing sources, many small-business owners also bootstrap, or self-fund, their business venture. Options for bootstrapping your business include using personal savings or tapping into their retirement account through a Rollover as Business Startup , or ROBS.

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on Nerdwallet's secure site

How to get business capital

The right funding option is different for every small-business owner. And the best type of funding for you now might not be the best choice to meet your needs later.

Consider why you need business capital. Your funding purpose is a key component of which type of business capital is best for you, and how much money you need. Plus, any potential lender or funder will likely ask for this information.

Decide which type of funding is best for your business. Before you start researching, think about which type of business capital is best for you. Consider if you would rather take on debt or give up business equity, how fast you need access to funding and your current resources and qualifications.

Research lenders or funders. Once you’ve decided which type of capital your business needs, you can begin researching providers — either lenders, investors or funding platforms — to determine the best options.

Gather documents. It may vary based on your capital provider, but generally you’ll need documents like your business plan, filing information and financial information like profit and loss statements, tax returns or bank statements.

How you get small-business capital depends on why you need capital and how long you’ve been in business. Startups may consider self-funding, working with angel investors or applying for grants. Businesses with at least a year in operation and solid finances, likely have more options, such as SBA funding and other types of business loans.

Capital in business generally refers to anything the business uses to generate value, including finances, physical assets, human resources and more. It can also refer to external sources of financing, like loans or grants.

If you need money to get your business off the ground, you’ll likely have difficulty qualifying for traditional funding, like a term loan or line of credit. Instead, you might turn to alternative sources, such as friends and family, crowdfunding, small-business grants or angel investors for the startup capital you need.

On a similar note...

More From Forbes

Funding sources for small business owners: understanding your options.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

CEO at Novae , a black-owned fintech serving consumers and small businesses nationwide, providing greater access to underserved communities.

Capital is the lifeblood of a business. It’s necessary for everything else to happen: buying supplies and equipment, paying staff, paying for advertising and marketing, etc. For newer and smaller businesses, raising the capital necessary to start up or survive a rough spot can feel impossible.

Fortunately, in recent years, a number of changes have been made to support small businesses in obtaining business funding. As the founder of a financial technology company that provides business lending services, here are some funding sources you should know about, especially if you’re an entrepreneur or running a small business.

Small Business Administration Lending

In recent years, the Biden-Harris administration has expanded access to Small Business Administration loans. This is especially significant because SBA loans don't exist to profit the lender, and they often have lower interest rates than loans from for-profit lenders.

Recent changes to the SBA loan program include:

• Authorizing new lenders to give SBA loans, including new lenders in previously underserved rural areas and low-income neighborhoods.

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024.

• Relaxing credit requirements by reducing the number of factors a business owner must meet to be deemed creditworthy.

• Eliminating requirements for businesses to put up a 10% equity injection to receive SBA loans larger than $500,000 (except for changes in ownership).

These changes resulted in the SBA making "record gains" in providing small-business loans to veterans, people of color and women entrepreneurs in 2023, according to a statement released by the White House.

Government Contracts

The U.S. federal government is known to be the largest single purchaser of goods and services in the world, and it spent almost $700 billion on contracting in 2023. However, I've found many business owners don’t apply for government contracts because they assume they will not be able to compete with bigger or more experienced businesses applying for the same contracts. In reality, the government aims to provide almost 25% of contract money to small businesses.

If you want to apply for government contracts but have not done so before, researching resources available to you may be a good place to start. For example, improvements have been made to the SBA’s technical assistance program, Empower to Grow, which assists small business owners looking to apply for government contracts. The program has a focus on assisting businesses based in areas with low income or underemployment.

Alternative Financing Options

Over the past few years, I've found much has been made of the availability of new financing options for newer and smaller businesses, including online loans, merchant cash advances and crowdfunding options. When it comes to these options, I urge caution.

Merchant cash advances can be a quick way to obtain business capital. However, these advances can have high interest rates , shorter payback terms than a traditional loan and typically require daily holdback of your transactions. You can consider whether you qualify for other, less expensive types of funding. If you do opt for a merchant cash advance, ensure you have a strategic plan to pay it off. In regards to crowdfunding, while there are potential benefits to this option, businesses without a large, dedicated audience might have trouble reaching their funding goals.

This all makes it especially important for entrepreneurs and new and small business owners to have discerning eyes when seeking financing. While there have been improvements in access to loans and funding for many types of businesses in recent years, I believe the old adage still applies: If it sounds too good to be true, it probably is. Potential borrowers should always review the terms of loans they're considering to pick out the best option for them.

We live in a rapidly changing world, and staying on top of these changes can help entrepreneurs and new and small business owners position themselves for the future. With more options on the table for new and small businesses than ever before, this might be the year to make your big business growth move.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

- Editorial Standards

- Reprints & Permissions

- Line of Credit

- How It Works

- Small Business Resources

- Small Business Blog

- Business Stories

- Our Platform

- Lender and Partner Resources

- Our Company

- Source of Funds Examples in a Business Plan: 8 Suggestions

- Learning Center

- Small Business Loans

A solid business plan is one of the most important documents you’ll need to create for your company. This document provides a roadmap for your company’s future developments. However, no growth can occur without a sufficient amount of working capital. That’s why your business plan should include a source of funds section – it can remind you how to maintain the cash flow your company needs.

There’s another reason this part of your business plan matters. It can show certain lenders how much money you need beyond what the funding sources in your business plan can get you. That said, not all lenders will require you to share a business plan. For example, SmartBiz’s loan approval requirements don’t include business plans among the necessary paperwork. Either way, below are some source of funds examples in business plans.

What is a business plan?

A business plan is a document that guides your company’s growth. It helps define your business goals and provides a clear overview of how you’ll achieve them. You can also use it to plot out your marketing, operational, and sales approaches. Your business plan can be the foundation of a strategy to minimize risk and maximize growth.

Another reason why solid business plans are essential is that you’ll often need to provide them as you apply for business loans. Business plans provide an in-depth look at a company’s plan for profits, so lenders can more easily judge the borrower’s likelihood of repayment. Lenders are much more likely to finance borrowers whom they believe can pay back the loan amount in a reasonable timeframe.

8 source of funds examples

Having a source of funds – sometimes several sources of funding – is vital to growing your business . Common funding options include business loans, and sometimes, to qualify for them, you must show lenders your other funding sources. Understanding the below source of funds examples in business plans can help you better structure yours.

1. Personal savings

When you’re just getting your business off the ground, sometimes, the fastest way to fund it is directly from your current savings. However, entwining your personal savings into a company that could fail is a risky prospect – but it also shows commitment. Lenders and investors often respond well to a borrower who’s ready to go the distance with their ideas.

2. Money from friends and family

Money from family and friends, which you’ll also see called “love money,” is a viable source of funds in your business plan. However, just as it’s risky to get your own money wrapped up in a business, it’s dangerous with other people’s finances too. Plus, accepting money from a loved one can come with drawbacks. For starters, not everyone in your life has much to spare in the first place. Furthermore, if you borrow money from friends or family and you can’t repay it, the relationship could be damaged.

3. Federal and private grants

Occasionally, your business model can put you in line for federal grants. That said, rare is the business that qualifies for federal grants – technically, the government does not provide grants for small businesses growth. However, private companies ranging from FedEx to the NBA offer grants to small businesses that fit certain criteria. If there’s a chance your company could fit these criteria, you can include private grants as sources of funding in your business plan.

4. Share sales and dividends

Selling shares of your company to investors – as in, anyone who buys stocks – falls under a category of funding known as equity financing. This arrangement can be lucrative, which is a main reason why you see so many companies having initial public offerings (IPOs).

However, equity financing has a few drawbacks. For one, you’ll no longer have complete control over your company's future, as stockholders dilute your ownership. Additionally, you’ll have to account for dividends in your financial planning. You pay these sums to your shareholders every quarter.

5. Venture capital

If you need a large amount of cash, venture capitalists can be a viable option. Typically, though, venture capitalists are only interested in funding startup businesses in the tech sector with high growth potential.

Venture capital is a high-reward but high-risk funding source. It often requires you ceding a certain amount of ownership – and thus control – of your business. Furthermore, if your business fails, you may still need to repay any venture capitalists or firms that have funded your operations.

6. Angel investors

An angel investor is a wealthy private individual who invests in small businesses to help them get off the ground. They tend not to offer as much starting capital as a venture capitalist, but they can make up for the smaller amount with experience. Angel investors are often experts within a specific industry and put money back into it by investing in newer businesses within that sphere.

Although you’ll have to give an angel investor some control over your company, their experience and network can help your business grow. Additionally, the word “angel” in their name reflects that they typically don’t ask for their money back if your business fails. That makes them a safer bet than venture capitalists.

7. Business incubators

Unlike the previous funding options, a business incubator doesn’t offer direct monetary support. Instead, incubators help fledgling businesses thrive by allowing them into their workspace and letting them share resources as they get started. This type of funding is indirect – you’ll rarely get direct cash infusions, but you’ll get resources that would otherwise cost you money. It’s common in high-tech industries such as biotechnology, industrial technology, and multimedia.

8. Bank loans

Bank loans probably ring a bell for you. When a current or aspiring small business owner needs additional funds, these loans are often the first thing that comes to mind. They’re among the most in-demand funding options available given their large funding amounts, long-term repayment periods, and low interest rates . However, their high amounts introduce lender risk that can make them difficult to obtain. To minimize risk, most lenders impose strict qualification criteria that you might not make.

Why do you need to provide sources of funds in your business plan?

Providing a source of funds in your business plan paves a path toward obtaining and using your funding. Knowing where your money is coming from and what you’re spending can help with strategic financial planning. It also minimizes the chances of your business partners spending money the company doesn’t actually have.

In a lending context, your sources of funds may help you qualify for any loans you need in the future. Depending on the funding sources you’re using, lenders may view you as someone able to repay the debt financing they offer. For example, using personal savings shows your commitment to your business, meaning you’re likely a reliable borrower who won’t flake on a loan. You’ll show your commitment to your company and your business at the same time.

Parting thoughts

Reliable funding sources are essential to achieving your company’s objectives, and their presence in your business plan can help you obtain more funding. Namely, certain entities that offer small business loans require business plans as part of the borrower approval process. When your approval plan clearly shows why you need the loan money and how else you’re getting funding, lenders may trust you more.

However, certain lenders don’t require business plans. In fact, when you apply for SBA 7(a) loans , bank term loans, or custom financing through SmartBiz ® , you don't need a business plan. Check now to see if you pre-qualify * – the business funding you need might be closer than you think.

Have 5 minutes? Apply online

- Follow SmartBiz

Access to the right loan for right now

- Business Credit

- Business Finances

- Business Marketing

- Business Owners

- Business Technologies

- Emergency Resources

- Employee Management

- SmartBiz University

- More SBA Articles

Related Posts

Smartbiz helps facilitate access to financing for underrepresented entrepreneurs, women-owned business certification: learn about how to get yours, bank term loans 101: understanding the basics for small business, smart growth is smart business.

See if you pre-qualify, without impacting your credit score. 1

*We conduct a soft credit pull that will not affect your credit score. However, in processing your loan application, the lenders with whom we work will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and happens after your application is in the funding process and matched with a lender who is likely to fund your loan.

The SmartBiz® Small Business Blog and other related communications from SmartBiz Loans® are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial processionals for further information.

5 Common Funding Sources For Start-Ups & Growth

Written by Dave Lavinsky

If you want to be successful in business, it is crucial to determine when, where, and how to obtain the startup funding you need. Whether you need $1,000 or $1 million to start or expand your business, if you can’t raise money, you can’t build the business you want.

Before You Look For Funding

Before you look for funding, you need to create a solid business plan. In addition to explaining your business and your strategy for success, your plan must determine how much money you need and how it will be used.

Also, it’s very important for you to understand the timing of the funding. For example, do you need all the funding now (e.g., to build out a location), or can you receive your funding in stages or “tranches.”

The amount of funding you seek will affect the source of funding you approach. For example, if you require $250,000 in funding, angel investors are more applicable than venture capitalists. If you need $5 million, the opposite is true.

Secure Funding Quickly!

The key to securing funding for your business is having the right business plan. With Growthink’s Ultimate Business Plan Template you can complete your plan in just hours and secure funding quickly!

What is The Most Common Source of Funding for Entrepreneurs?

Personal financing is the most common funding source for entrepreneurs. This includes using both your personal savings and personal credit cards to initially fund your business. Other key funding sources, as discussed below, include business loans, friends & family, angel investors and venture capitalists.

What are the Different Ways Businesses can Find Start-up Funds?

While I have identified 41 sources of funding for your business , below are the 5 most common.

1. Funding from Personal Savings

Funding from personal savings is the most common type of funding for small businesses. The two issues with this type of funding are 1) how much personal savings you have and 2) how much personal savings are you willing to risk.

In many cases, entrepreneurs and business owners prefer OPM, or “other people’s money.” The four funding sources below are all OPM sources.

2. Business Loans

Debt financing is a fancy way of saying “ loan .” Credit unions and banks offer funding that you must repay over time with interest. This can come in the form of a personal loan, a traditional business loan, or different loans based on the type of asset you need to purchase (e.g., for equipment, land, or vehicles).

You must prove to the lender that the likelihood of you paying back the bank loans is high, and meet any requirements they have (e.g., having collateral in some cases). With a bank loan, you do not need to give up equity. However, once again, you will have to pay interest along with the principal.

3. Friends & Family

A big source of funding for entrepreneurs is friends and family. They can provide funding in the form of debt (you must pay it back), equity (they get shares in your company), or even a hybrid (e.g., a royalty whereby they get paid back via a percentage of your sales).

Friends and family are a great source of funding since they generally trust you and are easier to convince than strangers. However, there is the risk of losing their money. And you must consider how your relationship with them might suffer if this happens.

4. Angel Investors

Angel investors are generally wealthy individuals like friends and family members; you just don’t know them (yet). At present, there are about 250,000 private angel investors in the United States that fund more than 30,000 small businesses each year.

Most of these angel investors are not members of angel groups. Rather they are business owners, executives and/or other successful individuals that have the means and ability to fund deals that are presented to them and which they find interesting.

Networking is a great way to find an angel investor for your business.

5. Venture Capital

Venture capital funding is a suitable option for businesses that are beyond the startup period, as well as those who need a larger amount of venture capital for expansion and increasing market share. Venture capitalists and VC firms are professional investors that are more involved with business management, and they play a significant role in setting milestones, targets, and giving advice on how to ensure greater success.

Venture capitalists invest in new businesses and medium-sized businesses they believe are likely to go public or be sold for massive future business profits. Specifically, they want to fund companies that have the ability to be valued at $100 million or more within five years. They also go through an expensive and lengthy process of deciding on the best business to invest their venture funds. Hence, the application process and approval usually takes several months.

What Are the Three Major Sources of Funding for New Businesses?

The three major sources of funding for new businesses are personal funds, loans and credit, and venture capital. Personal funds involve using one’s own savings or assets to finance the startup. Loans and credit options are sought from banks, credit unions, or online lenders to obtain the necessary capital. For high-growth potential startups, venture capital firms and angel investors can provide funding in exchange for equity. Other funding options like crowdfunding, grants, or government assistance may also be explored based on the specific business and its needs.

The Bottom Line

As you search for the best funding options for your start-up business or to expand your existing business, you will discover that some sources are more complicated and time-consuming while others may offer a very small amount. While the five sources mentioned above are the most common, there are other ways of obtaining the financing you need including government programs including grants , crowdfunding sites, business credit cards, or a line of credit from a bank just to name a few.

Choosing an inappropriate type of funding can lead to unfavorable outcomes such as feuds between the lender and business owner, shift of control, waste of resources and other negative consequences.

With this in mind, you should study the benefits and drawbacks of each financing option and select the ideal one that will help you meet your business goals. With the right sources of money, the sky’s the limit for your business.

Other Helpful Funding & Business Plan Articles

Small Business Financing Options: Navigating Loans, Grants, And Funding Sources

Small businesses have a crucial impact on many economies. They offer different job opportunities and drive innovation and growth. However, one of the most common issues of small business owners is finances and investment to start and expand. Mang funding companies are available in the market that are available to provide funds for small business startups. The type of funding ranges from traditional methods to alternative forms.

You can be a startup or an established entrepreneur seeking to grow; you need to know different financing options. It will help you make informed decisions about how to fund your business. Securing the right funding for your business is a critical factor. Product production, marketing, and execution require the adequate management of finances. In this guide, we will delve into the finance options for small businesses for your better understanding.

Table of Contents

Importance of Financing Options

Small business owners do not usually have proper finances to invest. They can opt for different funding sources because of the many benefits that they can offer.

Startup Capital

Funding sources can play a crucial role as a starting point for small businesses. They offer the essential initial capital needed to achieve business ideas. These can be securing physical space, getting equipment, or investing in product development. This startup funding is the foundation upon which small businesses are established.

Operational Funds and Growth

John Smith, Founder at pcbitalian , said, “You often need to navigate unexpected cash flows when operating a small business. It is challenging to cover everyday operational expenses. Using funding sources, you can get the required liquidity. In this way, you can manage your financial ebbs and flows, making sure of the uninterrupted flow of business activity.

Moreover, to expand its reach and operations and enter a new market, entrepreneurs need capital. They require an adequate amount to invest in marketing and scaling their infrastructure. Different funding sources offer financial aid necessary to expand businesses and reach new heights.”

Marketing, Brand Building, and Hiring Talent

Effective marketing is a cornerstone to attracting customers and creating brand awareness. Funding supports small businesses to invest in marketing approaches. It includes social media campaigns, advertising, and branding efforts. With these strategies, small businesses expand their reach and solidify their presence in the market.

For such purposes, hiring top-tier talent is crucial. You can take the help of funds to attract and hire skilled employees, offering competitive salaries and benefits. In turn, this will foster business expansion and improve operational efficiency.

Development and Innovation

Innovation is essential to remain competitive in the business realm. Using funding sources, small businesses can help themselves in research and development efforts. It will enable the startups to establish unique products or improve the existing ones. Hence, it will help the businesses to stay relevant in the ever-changing business industry.

For those aiming to expand their innovative ventures globally, registering a company in Hong Kong can be a strategic move. Whether considering setting up operations internationally or seeking a thriving business environment, establishing a presence in Hong Kong can pave the way for sustained growth and success.

Diversification

Bob Smith, Founder at Starlinkzone , said, “Small businesses usually rely solely on one product or revenue source. It is a potential risk that entrepreneurs must consider. To reduce the risks, they need to diversify, which will require more financial support. Funding sources can help in the diversification efforts. It will allow the companies to research new revenue streams or product lines. Thus, they can mitigate the dependence on an individual income source and diversify their revenue.”

Flexible and Contingency Planning

Small businesses typically encounter unpredictable challenges. These may include natural disasters, economic downturns, or market volatility. Business owners can weather these storms with sound financial plans and adequate funding. They can do so by developing contingency strategies and building financial reserves. It will help them to enhance their adaptability, resilience, and survival.

Competitive Advantage

Having funding sources, startups can have a competitive edge over other small businesses. It allows them to grasp the latest opportunities. Moreover, companies can instantly respond to market changes and invest in improvements. It will assist them to avoid competitors having limited access to capital. Financial resilience builds innovation and agility. These factors contribute to the enduring success of the company.

Things to Consider Before Navigating Financing Options

You do not only require funding sources but also practical strategies to manage them.

Build a Strong Business Plan

A well-structured business plan template is the fundamental aspect of successful financing. It offers a detailed roadmap for your business journey. A business plan will include an outline of your goals, competition, market analysis, and financial projections. Investors usually rely on this plan to consider the potential of your business.

Moreover, they also assess how their funds will take part in your success. A transparent and comprehensive business plan shows that you have invested time in your business strategy. With this dedication, you can become a more attractive candidate for funding. A good finance management plan not only attracts possible investors but also helps to meet your goals.

Financial Health

Marom Anaky, marketing manager of Coinscipher , said, “Thoroughly understand the financial health of your business. It is a crucial aspect before you go on seeking financial help. Review the critical financial statements on a regular basis. These may include your balance sheet, cash flows, and income statement. These metrics help investors and lenders measure your ability to manage and repay finances. Present a solid financial foundation to instill confidence in potential investors.”

Tap into Expertise

A group of informed consultants supports every effective financial performance. Seek professional finance assistance to receive additional understanding and security for your economic journey. It will help you to get relevant advice and analysis of your financial arrangements. Moreover, they will also help you to coordinate appropriate strategies according to your finances.

Research Thoroughly

Researching everything about finances and financial funds is essential before you take any loan. It gives you awareness of how you can repay your funds. Furthermore, it also helps you find the right financial aid you require according to your situation and business.

Create a Budget Beforehand

Begin your entrepreneurial journey by creating a budget for your startup expenses. It will entail calculating every dollar required to execute and flourish your business ideas. A detailed budget offers you a clear financial roadmap for everything. You create an estimate of capital needed from product development to marketing.

Financing Options for Small Businesses

There are several financing options available in the market. However, it is necessary to understand what fits you the best as a small business owner.

Self-Funding

Richard Adams, Lead Researcher at WithinHome , said, “Self-funding is utilizing investments, savings, credit cards, or assets for small business funding. Self-funding benefits businesses to have complete access to the finances of the company. The owners do not have to put up with the investor’s demands. It will save both time and effort.

Furthermore, self-funding can also elevate investor confidence in a business. This is so because self-funding indicates the dedication of entrepreneurs toward the project. Moreover, it demonstrates their willingness to accept any financial risks.”

Equity financing is yet another famous financing option for startups. It includes the sale of a portion of the company to the investors in exchange for funds. Equity can be achieved from multiple sources. These may consist of angel investors, venture capitalists, and crowdfunding platforms. Additionally, some businesses may explore opportunities to source proprietary deals , which involve unique agreements with investors or organizations that offer exclusive terms or partnerships, potentially giving them a competitive edge

Crowdfunding

Crowdfunding is an excellent option for small businesses seeking equity capital. These platforms help businesses to raise money from different people. It is usually done through online platforms. Investors may get equity in the company in exchange for their investment. These exchanges can also be done through various rewards like goods or services.

One significant benefit of crowdfunding is that it does not require the business to take on debt. This type of funding can also offer substantial capital. It can also bring valuable knowledge and assets to the industry via investor’s expertise and network.

Non-profit organizations, government entities, or private foundations typically provide grants. They also offer financing for specific initiatives or projects. Grant can be an excellent choice for small businesses since they have limited resources.

Grants are unlike loans, and companies do not need to repay them. Yet, applying for grants can be a competitive and time-consuming task. Also, not all businesses are eligible for grant funding.

For grant eligibility, your business must have a plan outlining the grant’s purpose. You will also need to mention how you will use the funds and the expected results of the initiative or project.

Bank loans are a common finance source for small businesses or firms. Banks provide various types of loans to offer smaller businesses with capital. These loans are often secured by collateral involving an owner guarantee. These collaterals can be real estate or company assets. Examine and compare different loan options. Find the one that suits the best with your objectives and requirements.

Debt-based financing options provide small businesses with an alternative to equity-based funding. These options involve borrowing funds with the obligation to repay over time, typically with interest. This approach can be appealing to businesses looking to access capital quickly without diluting ownership. A prime example are Bridge Loans, which are short-term, asset-backed loans secured against valuable assets like real estate or inventory. Stephen Clark, founder of Finbri , said, “Bridging loans offer speed and flexibility, allowing micro and small businesses (MSMBs) to address urgent financial needs or seize timely opportunities. It’s especially useful to start ups when the mainstream banks don’t want to lend.”

Small business owners usually have insufficient capital to invest in their projects. That is where financing options come to the rescue. There are many funding sources available. Careful evaluation of different small business loans is essential. Research and make strong business and financial planning to find potential funding sources. Find the right financial option for your small business, considering repayment plans. You can also take advice from finance helpers or experts to make a better decision.

Read more: 10 Best Invoicing Software For Textile Shop

Related Posts:

- Branding and Marketing

- Business and Life Planning

- wjr business beat

- Management and Operations

- social media

- Technology and Web

- Inspiration for Entrepreneurs

- Find Funding

- Fund Your Business

- Launch Your Business

- Start a Business

How to Create a Fundable Business Plan

Business plans are created for various reasons. Sometimes a plan is prepared for a strategic partner. In this case, the partner might want to better understand your strategy, milestones and staffing to determine whether to work with you. Sometimes a business plan is created to convince prospective employees to join you. And oftentimes plans are developed to brainstorm and assess strategic options.

As you can imagine, in each of the above cases, your business plan will differ based on the audience. Strategic partners, prospective employees and internal management each have different needs, and each will assess your plan based on how it specifically affects them.

One business plan audience with very specific needs is funding sources such as investors and lenders. Unlike other audiences, funding sources are bombarded with business plans and are only able to fund a small percentage of plans they see. As such, when creating business plans for this highly competitive audience, be sure to do the following.

StartupNation exclusive discounts and savings on Dell products and accessories: Learn more here

Be clear in defining your company.

Rather than starting your plan with the backstory of how you conceived the idea, start with a concise definition. For example, you could say, “Our company is developing X targeting Y .”

By starting with this concise definition, readers quickly understand what you do, and whether they’d like to continue reading. Conversely, oftentimes when you start with a backstory or wordy definition of your business, investors who otherwise might have been interested stop reading. They simply do not have the time to read through business plans, particularly ones which might not fit their sweet spot.

Related: Using Market Research to Create an Actionable Business Plan

Detail your unique success factors.

Funding sources must understand why your company is uniquely qualified to succeed. If you don’t have unique qualifications, then it’s hard for you to be successful.

Think about every aspect of your business in identifying your unique success factors. For instance:

- What is it about your management team (e.g., experience, expertise, relationships) that makes your company uniquely qualified to succeed?

- What is unique about your products and/or services, that ideally can’t easily be replicated?

- Do you have any marketing advantages, such as strategic partnerships or contracts with customers?

- Have you developed operational capabilities that give you competitive advantage?

Detailing your unique success factors gives investors and lenders increased comfort that you’ll be successful, and that they’ll get a return on their investment.

Identify your risk-mitigating funding milestones

Risk-mitigating milestones are those events, that when accomplished, reduce the risk of your company failing.

Let’s go back to the mobile app example. As you can imagine, when you simply have the idea for the mobile app, the risk of failure is high. But, once you build the prototype app, your chance of failure is reduced. And after you gain user feedback and modify the app, risk is further reduced. And clearly, once you gain 1 million users and generate $1 million in revenue, your risk has diminished much further.

Importantly, when developing your business plan for funding sources, detail your risk mitigating milestones. In addition to identifying them, document when you expect each to occur and how much funding you need to accomplish them.

Present a credible financial model

Equity investors want to get a sizable return on their investment in your company, while debt investors/lenders want to be confident you’ll be able to repay your loans with interest.

In both cases, your financial model is a key tool they’ll use in determining whether to invest or not. Of critical importance is that the model you prepare is credible.

To create a credible financial model, research comparable companies as much as you can. How fast have they grown? While it’s possible that your company can grow faster, it’s probably not feasible that your company grows twice as fast as any company ever has.

Likewise, pay attention to costs like human resources. How many staff members do you need? How much will they cost? How long will it take to hire and train new members of your team? While you’ll never answer these questions with 100 percent accuracy, it’s important to think through these questions and include them in your model. If not, investors and lenders will deem your financial projections incredulous and not fund your business.

Sign Up: Receive the StartupNation newsletter!

Key takeaways for creating a fundable business plan

Keep in mind that funding sources want to fund businesses like yours. That’s how they make money. The key is to present your business in a way that compels them to get excited about your business. Once you do, they’ll invite you to meet with them, during which they’ll ask additional questions and determine if there’s a fit between their firm and yours.

Originally published Jan. 16, 2018.

- business plan

Leave a Reply Cancel reply

You must be logged in to post a comment.

Related Posts

The Power of Venture Studios: A Collaborative Approach to Startup Success

Why You Need to Create a Financial Framework for Business Success

How to Start a Loyalty Program in 5 Easy Steps

Level Up Your Digital Skills: Free Right Now with Verizon Small Business

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

- Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

What are the Primary Sources of Funding For Startups

A great startup idea needs money to succeed. Even when you have got everything in order, a lack of financial resources can kill your startup dreams.

The first thing you need to worry about is securing funding for your startup.

We have discussed 14 funding sources available for startup businesses. You’ll surely find a funding source fit for your startup.

Where to get startup funding?