- Jira Service Management

- Atlassian Guard

- Company News

- Continuous Delivery

- Inside Atlassian

- IT Service Management

- Work Management

- Project Management

Our State of Teams 2024 report is live! Check it out here .

We read 100 data breach notifications to make this guide (which we hope you’ll never need)

Product Marketing Manager

Nothing fills out the “worst-case scenario” column quite like a data breach. For the countless teams out there who work hard to protect their customers’ data, the idea of compromising that trust is a nightmare.

Data breaches are on a lot of minds lately with the 2017 Equifax data breach , which exposed personal data from 143 million American consumers. The company, security industry, and regulators have a huge task of working out the details on how something like this happens.

At Statuspage, we talk a lot about transparency, trust, and letting the right people know when things go wrong. Transparency around crises is a core part of our philosophy here at Atlassian and Statuspage. While we’re typically talking about these thing in relation to outages and downtime instead of data breaches, there are a lot of overlapping themes. The benchmarks of a great downtime response strategy aren’t all that different from a great data breach response strategy. We fancy ourselves experts at incident response best practices, we figured it would be interesting to take a look at data breach response best practices and see where we can notice some overlap.

A brief look at incident response vs. data breach response

For the most part, downtime is more tolerable and less troubling than a data breach. A few minutes of an unscheduled outage is usually more palatable than even a hint of a data breach. Teams will even purposefully take their service offline to prevent a breach from spreading in some cases. Because of this, most systems are built to prioritize data safety over perfect uptime . We’ve talked plenty about how downtime is inevitable and shooting for 100% uptime shouldn’t be the goal. That’s partly because 100% data protection should be the goal. Think about it. Would you rather your bank’s mobile app went down for a day or lost your transaction history for a day? It’s pretty clear that in the web service hierarchy of needs, data protection trumps uptime. And that’s OK.

Because of the heightened sensitivity to data, we see a lot more regulatory activity around data breaches. Regulators mostly leave it up to organizations on how they’ll announce downtime and service interruptions. But they have a lot to say, understandably so, about how teams should respond to data breaches.

Data breach response regulatory summary (slightly less boring than it sounds)

The Equifax breach has a lot of folks calling for updates to how regulators patrol breach response. Although there are varying opinion on whether the current rules go far enough, it’s worth taking stock of where things stand now.

Right now, there is little national oversight on how companies handle data privacy. When it comes to notifying consumers that their data has been stolen, laws vary state to state and differ in how much time and how much information companies are required to divulge. Equifax is based in Georgia, a state where there is no timeline specified for when a company must notify customers about a breach.

California’s law, enacted in 2002, was the first in the country and became the template for most other states whose lawmakers adopted similar regulations. The main paragraph of California’s law is here (note: if you’re like us and the legal-ese makes your brain hurt, fear not, we break it down in plain English in the next section).

“(a) Any agency that owns or licenses computerized data that includes personal information shall disclose any breach of the security of the system following discovery or notification of the breach in the security of the data to any resident of California (1) whose unencrypted personal information was, or is reasonably believed to have been, acquired by an unauthorized person, or, (2) whose encrypted personal information was, or is reasonably believed to have been, acquired by an unauthorized person and the encryption key or security credential was, or is reasonably believed to have been, acquired by an unauthorized person and the agency that owns or licenses the encrypted information has a reasonable belief that the encryption key or security credential could render that personal information readable or useable. The disclosure shall be made in the most expedient time possible and without unreasonable delay, consistent with the legitimate needs of law enforcement, as provided in subdivision (c), or any measures necessary to determine the scope of the breach and restore the reasonable integrity of the data system.”

Now, in English:

Who this applies to? Any person or group who owns or licenses computerized data that includes personal information.

Which has undergone what? Any breach of the security of the system.

Has to do what? Disclose the breach to any resident of California whose unencrypted personal information was, or is reasonably believed to have been, acquired by an unauthorized person. The same applies if this is encrypted information if there is a known or reasonable belief that the encryption key was also compromised. Basically, if there’s any sort of proof — or reasonable belief — that someone unauthorized was ever able to view private info, they need to notify them.

By when? The most expedient time possible and without unreasonable delay. By now you should be working with law enforcement, who may advise you on when to send the announcement.

Sounds simple enough. But how do these notifications need to be sent? And what should they say? Thankfully, the legislation includes a template which advises the following information be included:

- What happened

- What information was involved

- What’s being done

- What you can do

- Other important information

- Where to find more information

It’s important that these are the regulations for California. While other states drew inspiration from these guidelines, it’s worth noting that these change for users in different states and countries. Please do your own research and contact your own experts and lawyers if you need to put any of this into practice.

The research: 100 breach notifications

Now that we have a handle on what constitutes a breach and what a breach response looks like, let’s have a look at how organizations approach these announcements.

To get a better idea of how teams draft these response letters, we downloaded 100 of the most recent sample responses that were filed recently with the State of California. Filed breach response samples are public record and posted on the state’s Department of Justice website.

Reading these hundreds of pages of breach notification was eye-opening (and a little eye-straining). It’s surprising how much good breach response measures have in common with incident response strategies. It’s also interesting how much variety there was in both the type of organization affected (hospitals, hotels, insurance companies, law offices) and the catalyst of the breach (phishing scams, lost devices, break-ins).

In no particular order, here are a handful of our observations from this research:

- Some teams added a nice plain-English FAQ to the response. This seems helpful. It’s good to keep in mind that your customers aren’t lawyers, and they’ll be quickly skimming for answers to immediate questions.

- Many companies mention they they’ve retained the services of a forensic investigation firm. Some say the name of the firm, others are vague: “a leading cybersecurity firm” “well-respected forensics firms.” If possible, it’s nice to let people know who is working on their behalf.

- Many also note they’re working with law enforcement, but it’s not always clear if they are and/or what the status of any investigation is. Law enforcement can give guidelines on how much transparency you can deliver about what’s happening and how to give periodic updates.

- A handful of the breaches stem from a breach in third-party vendors. This underscores what we’ve always talked about regarding incidents with third-party service providers: if it affects your customers, it’s your responsibility. Your customers don’t care if it technically wasn’t your fault. It’s important to vet your vendors ahead of time. But if there is an incident, take responsibility without throwing your vendor under the but and dodging the blame.

- In some cases, one third-party outage triggered several breach notifications across other companies who used that service.

- Some teams do a nice job of specifically relaying what happened (phishing, malware, etc.). Others are pretty vague, printing statements like “individual obtained access to our system” or “sophisticated cyber-attack” It’s easy to see how this would be frustrating to a customer. How did they get access?How did you learn about the incident? What was so sophisticated about it? What are the steps you took to make sure it doesn’t happen again? To be fair, a lot of these teams are working with law enforcement, lawyers, and private investigators; all of whom might have really good reasons for keeping things on the vague side. As a customer, we would hope for more details than this eventually. In incident response, we always advocate being as specific as possible without compromising trust or finger-pointing.

- One interesting notice stemmed from an over-the-phone scam. Basically someone called the company’s IT office impostering employees. They somehow had enough info to get login credentials reset then access the system. A good reminder to keep your guard up even when you aren’t dealing with keyboards and screens.

- It’s not all sophisticated cyber-attacks. Several companies had data breaches due to physical break-ins or on-person robberies. Good reminder to keep your physical security up to par.

- One organization went above and beyond, filing a detailed, and helpful, breach response when an employee’s cell phone was stolen. Even though the phone was password protected and the company immediately wiped the data on the phone (and there was no other evidence the data had been accessed) the company did the right thing and notified its customers the proper way. We can see how easy it would be to say “it’s just a missing phone, they didn’t even have my pin, what’s the big deal?” This is a good example of taking it on the chin and putting the customer first.

Closing thoughts

Obviously this is a complicated topic, and you should talk to real experts if a data breach happens to your company. It’s important let the lawyers and law enforcement do their jobs.

If you’re interested in learning more, here are some helpful links:

- The Equifax Data Breach: What to Do

- Security Breach Notification Laws

- Comparison of US State and Federal Security Breach Notification Laws

- Cybersecurity Incident & Important Consumer Information

As people trust cloud companies to keep more and more of their info online, it’s going to be easy to take that trust for granted. Just like smart incident communication, smart data breach communication means putting yourself in the customer’s shoes. It’s about trying to make the best experience possible for the customer. Even if it’s a worst-case scenario kind of day.

Advice, stories, and expertise about work life today.

- CCI Magazine

- Writing for CCI

- Career Connection

- NEW: CCI Press – Book Publishing

- Advertise With Us

- See All Articles

- Internal Audit

- HR Compliance

- Cybersecurity

- Data Privacy

- Financial Services

- Well-Being at Work

- Leadership and Career

- Vendor News

- Submit an Event

- Download Whitepapers & Reports

- Download eBooks

- New: Living Your Best Compliance Life by Mary Shirley

- New: Ethics and Compliance for Humans by Adam Balfour

- 2021: Raise Your Game, Not Your Voice by Lentini-Walker & Tschida

- CCI Press & Compliance Bookshelf

- On-Demand Webinars: Earn CEUs

- Leadership & Career

- Getting Governance Right

- Adam Balfour

- Jim DeLoach

- Mary Shirley

Executive Responsibilities and Consequences: A Case Study of Uber’s Data Breaches

Individuals potentially face criminal charges for failing to disclose a data breach.

Organizations at risk of a data breach (that’s every organization, by the way) can learn something from Uber’s data privacy missteps. Squire Patton Boggs attorneys Colin Jennings, Ericka Johnson and Dylan Yépez offer key takeaways from the company’s high-profile data breaches.

On August 19, 2020, the former Chief Security Officer (CSO) for Uber Technologies Inc. (Uber) was charged with obstruction of justice and misprision of felony for allegedly trying to conceal from federal investigators a cyberattack that occurred in 2016, exposing the data of 57 million riders and drivers. Although an extreme case, it is a good reminder for companies and executives to take data breach disclosure obligations seriously.

The criminal complaint, filed in the U.S. District Court for the Northern District of California (“the Complaint”), appears to claim that Uber, through its former CSO, Joseph Sullivan, should have reported the 2016 data breach to federal investigators. But a business’s duty to disclose a data breach is not always clear, and there are often a myriad of laws, regulatory practices and consumer expectations when navigating a breach. Using Uber’s 2016 breach as a case study, company executives must be aware of and recognize the business and personal consequences associated with breach response, and specifically with intentionally concealing a breach.

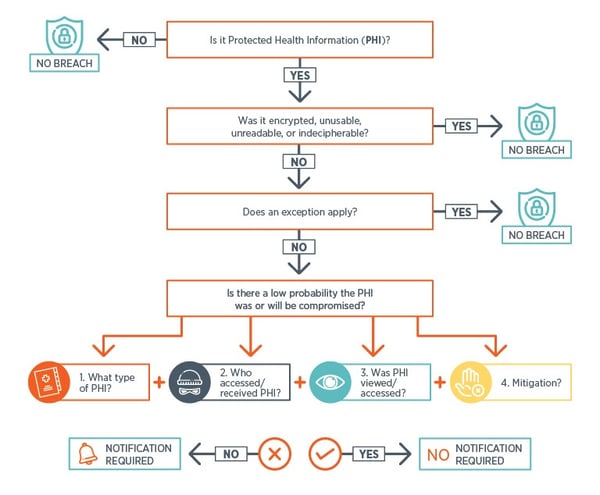

The Obligation to Report a Data Breach is Often Not Straightforward

Across the world, countries have widely varying laws related to the protection of personal information and even greater variance on the requirements to disclose a breach of such information. Even within the United States, the definitions of “personal information” and “data breach” differ greatly from state to state, with no two state laws being identical, so businesses, particularly those operating on a national or global scale, must conduct multijurisdictional analyses to determine whether an obligation to disclose a given breach exists and, if so, the scope of the obligation. Often there are inconsistent laws and obligations, and regulatory and consumer expectations can vary greatly based on the nature, scope and context of the breach.

Many laws require disclosure of a data breach only if there is a “reasonable risk of harm” to the individual(s) whose personal information was unlawfully accessed and/or exfiltrated. This requires businesses to determine whether, based on the totality of circumstances, it is reasonably likely that a breach of personal information will harm affected individuals. On the other hand, some laws do not require any risk of harm. Further, given that the forensic review of a data breach evolves over time, it is not uncommon for the initial findings to change dramatically over the course of a breach response. What often appears to be a limited attack can become a wholesale loss of sensitive consumer or business data – and oftentimes both simultaneously.

The legal analysis is then complex, fact-specific and ever changing. Perhaps, for example, only a portion of the sensitive data was exposed (e.g., only the last four digits of a social security number or only an individual’s last name). Maybe, due to insufficient logs, forensic investigators cannot rule out the possibility that an unauthorized third party accessed the sensitive data or moved laterally into human resources data or databases containing consumer financial information. Or perhaps evidence suggests that the cybercriminals appear to be staging sensitive data for exfiltration, but have destroyed any evidence that data was actually taken. These are but a few examples of factors that can make the obligation to report far from straightforward.

As Uber’s 2016 breach response indicates, the difficulty of ascertaining a business’s breach notification obligations is not a defense to those company executives who intentionally conceal a breach. As discussed below, company executives who ultimately have to decide whether to disclose a breach should take notice of the potential consequences of making the wrong decision.

A Case Study in Intentionally Failing to Report a Breach

The Complaint alleges that, in response to Uber’s 2016 breach, former CSO Joseph Sullivan “engaged in a scheme to withhold and conceal from the [Federal Trade Commission] both the hack itself and the fact that that data breach had resulted in the hackers obtaining millions of records associated with Uber’s users and drivers.”

At the time of the breach, Sullivan was helping oversee Uber’s response to a Federal Trade Commission (FTC) investigation into Uber’s data security practices, which had been triggered, in part, by another Uber data breach that occurred in or around 2014. Sullivan was “intimately familiar with the nature and scope of the FTC’s investigation.”

About 10 days after providing sworn testimony to the FTC, however, Sullivan received an email from “[email protected],” claiming to have found a “major vulnerability in uber [ sic ],” and threatening that the hacker “was able to dump uber [ sic ] database and many other things.” Within days, Sullivan’s security team realized that an unauthorized person or persons had accessed Uber’s data and obtained, among other things, a copy of a database containing approximately 600,000 driver’s license numbers for Uber drivers.

Based on available information, this massive data breach likely triggered Uber’s duty to notify under numerous jurisdictions’ data breach laws. By contrast, the 2016 breach appeared significantly more expansive than the 2014 breach, in which a cybercriminal accessed over 100,000 individuals’ personal information on a cloud-based data warehouse.

Based on the Complaint, Sullivan allegedly took affirmative measures to conceal the data breach and the resulting exposure of data. Among other things, he allegedly:

- negotiated with the cybercriminals to pay $100,000 in exchange for the hackers to sign a nondisclosure agreement (NDA), “falsely represent[ing] that the hackers had not obtained or stored any data during their intrusion,” even though “[b]oth the hackers and Sullivan knew at the time that this representation in the NDA was false;”

- “instructed his team to keep knowledge of the 2016 breach tightly controlled;”

- “never informed the FTC of the 2016 data breach, even though he was aware that the FTC’s investigation focused on data security, data breaches and protection of [Personally Identifiable Information];” and

- “removed certain details … that would have illustrated the true scope of the [2016] breach” from a prepared summary for the new Uber CEO – changes which “resulted in both affirmative misrepresentations and misleading omissions of fact.”

Sullivan’s alleged motives to cover up the 2016 hack and data breach are the concerns that all companies must assess in connection with their breach notification responsibilities.

First , the Complaint appears to allege that one motive to conceal the breach was to prevent further reputational harm to the company. Like Uber’s customers, individuals entrust their data to companies on a daily basis, from making purchases to requesting services. Companies know, therefore, that they risk losing revenue if their customers lose confidence in the protection of their data.

Understanding this dynamic, he “became aware the attackers had accessed [the cloud] in almost the identical manner the 2014 attacker had used,” according to the Complaint. “That is, the attackers were able to access Uber’s source code on GitHub (this time by using stolen credentials), locate [a cloud] credential and use that credential to download Uber’s data.” As such, the Complaint appears to allege that both the embarrassment of falling victim to the same attack vector and the associated reputational consequences may have motivated Sullivan to conceal the breach.

Second , the Complaint appears to allege that another motive for concealing the breach was to prevent additional regulatory scrutiny. In the United States, companies like Uber are subject to many state- and industry-specific regulators (e.g., state Attorneys General, the Securities and Exchange Commission, FTC) — often simultaneously. Additionally, outside of the United States there are numerous laws and data protection or other authorities that govern data breaches.

At the time of the breach, Sullivan was actively responding to the FTC’s inquiries to assist in reaching a settlement related to the 2014 breach. For example, he approved language to the FTC representing that “‘all new database backup files’ had been encrypted since August 2014,” when in fact, they had not. Sullivan’s fears may not have been misplaced. In light of the new information regarding the 2016 breach, the FTC effectively withdrew its previous settlement terms and added requirements to the resolution with Uber.

Ultimately, it appears that such attempts to rationalize and avoid Uber’s breach notification responsibilities may have led Sullivan to engage in the actions he did.

Lesson Learned

In a public statement, the FBI advised that, “[w]hile this case is an extreme example of a prolonged attempt to subvert law enforcement, we hope companies stand up and take notice.” In effect, the consequences of failing to disclose a data breach are the most extreme in cases where a notification obligation clearly exists and the company and its officers consciously decide to circumvent that obligation during the course of an ongoing investigation. While companies have incentives to rationalize and avoid their disclosure obligations (e.g., reputational harm, regulatory oversight, expense), this incident highlights the potential consequences executives should be aware of when weighing the business decision to disclose a breach. Disclosure and direct individual notification of a data breach is now the expectation, and the decision to not disclose must be very carefully weighed – taking into account law, regulatory practice and consumer/customer expectations. One size does not fit all, and the nature, scope and circumstance of the specific breach must be carefully assessed in real time.

Ultimately, the legal analysis to determine whether an obligation exists and the business decision to disclose the same are nuanced and complex. If you experience a data breach, it is best to retain counsel who is highly experienced in the nuances of data breaches and the complexities of data breach notification laws for help determining whether and how to disclose a given breach.

How COVID-19 is Shifting Tax Reporting Regulations

Cci media group launches book publishing division targeting global audience in compliance, ethics, risk, internal audit.

Colin Jennings, Ericka Johnson and Dylan Yépez

Related Posts

News Roundup: 90% of Businesses Face Elevated Risk Levels Over Technology

Business email compromise remains key threat, while online payments industry most frequent ID theft target

News Roundup: SEC Finalizes New Cybersecurity Rules for Broker-Dealers, Others

OFAC launches public-facing sanctions database

In Crisis or In Control? Evolving Threat Actor Tactics Illustrate the Need for Clear Cybersecurity Communications Strategies

Preparing for the unexpected goes beyond IT expertise

Navigating Personal Liability: Post–Data Breach Recommendations for Officers

Executives may be on the hook if info is compromised

Privacy Policy

Founded in 2010, CCI is the web’s premier global independent news source for compliance, ethics, risk and information security.

Got a news tip? Get in touch . Want a weekly round-up in your inbox? Sign up for free. No subscription fees, no paywalls.

Browse Topics:

- Compliance Podcasts

- eBooks Published by CCI

- GRC Vendor News

- On Demand Webinars

- Resource Library

- Uncategorized

- Whitepapers

© 2024 Corporate Compliance Insights

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Take action

- Report an antitrust violation

- File adjudicative documents

- Find banned debt collectors

- View competition guidance

- Competition Matters Blog

Slow the Roll-up: Help Shine a Light on Serial Acquisitions

View all Competition Matters Blog posts

We work to advance government policies that protect consumers and promote competition.

View Policy

Search or browse the Legal Library

Find legal resources and guidance to understand your business responsibilities and comply with the law.

Browse legal resources

- Find policy statements

- Submit a public comment

Vision and Priorities

Memo from Chair Lina M. Khan to commission staff and commissioners regarding the vision and priorities for the FTC.

Technology Blog

Global perspectives from the international competition network tech forum.

View all Technology Blog posts

Advice and Guidance

Learn more about your rights as a consumer and how to spot and avoid scams. Find the resources you need to understand how consumer protection law impacts your business.

- Report fraud

- Report identity theft

- Register for Do Not Call

- Sign up for consumer alerts

Get Business Blog updates

- Get your free credit report

- Find refund cases

- Order bulk publications

- Consumer Advice

- Shopping and Donating

- Credit, Loans, and Debt

- Jobs and Making Money

- Unwanted Calls, Emails, and Texts

- Identity Theft and Online Security

- Business Guidance

- Advertising and Marketing

- Credit and Finance

- Privacy and Security

- By Industry

- For Small Businesses

- Browse Business Guidance Resources

- Business Blog

Servicemembers: Your tool for financial readiness

Visit militaryconsumer.gov

Get consumer protection basics, plain and simple

Visit consumer.gov

Learn how the FTC protects free enterprise and consumers

Visit Competition Counts

Looking for competition guidance?

- Competition Guidance

News and Events

Latest news, ftc acts to stop student loan debt relief scheme that took millions from consumers in first case under the impersonation rule.

View News and Events

Upcoming Event

Closed commission meeting - july 1, 2024.

View more Events

Sign up for the latest news

Follow us on social media

--> --> --> --> -->

Playing it Safe: Explore the FTC's Top Video Game Cases

Learn about the FTC's notable video game cases and what our agency is doing to keep the public safe.

Latest Data Visualization

FTC Refunds to Consumers

Explore refund statistics including where refunds were sent and the dollar amounts refunded with this visualization.

About the FTC

Our mission is protecting the public from deceptive or unfair business practices and from unfair methods of competition through law enforcement, advocacy, research, and education.

Learn more about the FTC

Meet the Chair

Lina M. Khan was sworn in as Chair of the Federal Trade Commission on June 15, 2021.

Chair Lina M. Khan

Looking for legal documents or records? Search the Legal Library instead.

- Cases and Proceedings

- Premerger Notification Program

- Merger Review

- Anticompetitive Practices

- Competition and Consumer Protection Guidance Documents

- Warning Letters

- Consumer Sentinel Network

- Criminal Liaison Unit

- FTC Refund Programs

- Notices of Penalty Offenses

- Advocacy and Research

- Advisory Opinions

- Cooperation Agreements

- Federal Register Notices

- Public Comments

- Policy Statements

- International

- Office of Technology Blog

- Military Consumer

- Consumer.gov

- Bulk Publications

- Data and Visualizations

- Stay Connected

- Commissioners and Staff

- Bureaus and Offices

- Budget and Strategy

- Office of Inspector General

- Careers at the FTC

Data breach prevention and response: Lessons from the CafePress case

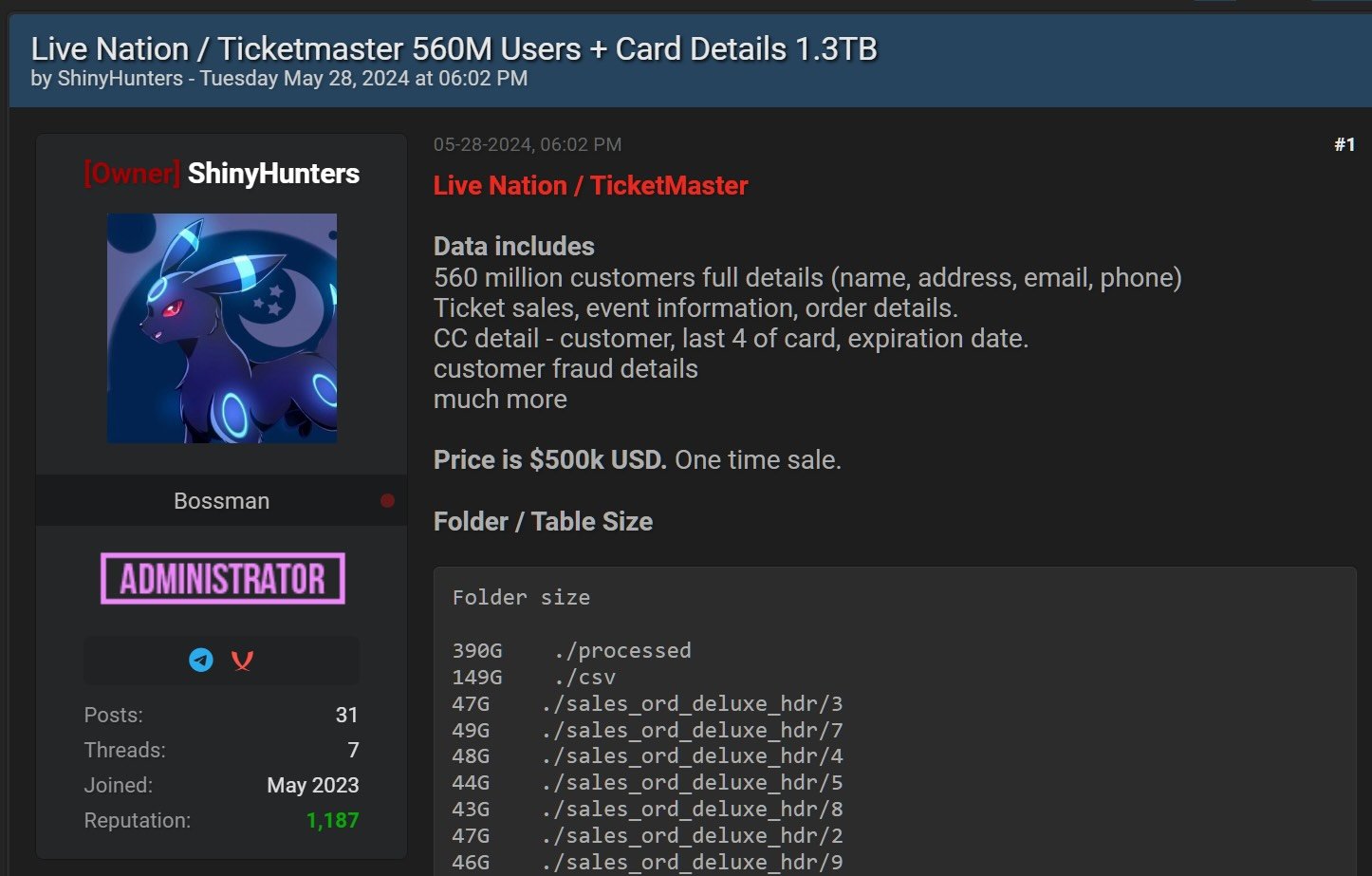

M any small businesses go to online retailing platform CafePress when they want to buy or sell customized items. However, according to a proposed FTC settlement , the company’s lax security practices allowed data thieves to take the idea of “personalization” in a disturbingly different direction. The complaint alleges that hackers exploited the company’s security failures to access personal information about millions of CafePress users – including home addresses, email addresses, passwords, security questions and answers, more than 180,000 unencrypted Social Security numbers, and partial payment card data from thousands of people. It’s particularly troubling that some of that information was later found for sale on a far more nefarious online platform – the Dark Web.

Although CafePress told customers that “100% complete security does not presently exist anywhere online or offline,” the company also touted that “our servers are secure” and that it “pledges to use the best and most accepted methods and technologies to insure your personal information is safe and secure.” On the checkout pages, it went so far as to say “Safe and Secure Shopping. Guaranteed.”

Where does the FTC say CafePress went wrong? According to the complaint, here are just some examples of the company’s questionable data practices:

- CafePress stored Social Security numbers and security Q&As in clear, readable text, and kept personal information indefinitely on its network without a business need;

- CafePress didn’t put readily-available protections in place against well-known vulnerabilities like Structured Query Language (SQL) injection attacks;

- CafePress failed to take reasonable steps to protect passwords and didn’t require users to create complex ones that would be harder to guess;

- CafePress failed to implement reasonable procedures to prevent, detect, or investigate intrusions on its network; and

- When CafePress experienced security episodes, it failed to respond reasonably.

You’ll want to read the complaint for details about multiple security incidents. But here’s the backstory about just one such episode – and the timeline is important here. According to the FTC, a person contacted CafePress in March 2019, revealing that the company had been hacked the month before and that its customer data “is currently for sale in certain circles.” The company confirmed the breach and installed a security patch, but remained mum about the matter. It required returning customers to reset their passwords, but chalked it up to an updated password policy.

In the ensuing months, the company received multiple alerts from individuals and a foreign government, including a warning that its customer data was for sale on the Dark Web. In addition, third-party monitoring services began to alert CafePress customers that their data had been hacked. It wasn’t until September 2019 – six months after CafePress was first told of the breach – that the company sent breach notifications to government agencies and affected customers.

In addition to the typical injuries that breaches impose on people, this breach took a particularly nasty turn when scammers used passwords in extortion attempts. Crooks sent emails to consumers, claiming they had obtained damaging personal information by hacking into the person’s computer and would release it unless paid in bitcoin. To add credibility to their claims, the scammers included the consumer’s recovered password in the extortion message.

The complaint alleges additional ways that small businesses and consumers were harmed by that breach and other security episodes. For example, in an earlier incident, the company learned that the accounts of certain “shopkeepers” – small businesses or individuals who sold items on CafePress – had been hacked. In a response that may define the phrase “adding insult to injury,” the company shut down those accounts and then charged each account holder a $25 closure fee. In other instances, the FTC alleges that the company withheld payable commissions from shopkeepers who accounts were closed due to a security breach.

The six-count complaint names Residual Pumpkin Entity, LLC, the former owner of CafePress, and PlanetArt, LLC, which bought CafePress in 2020. Among other things, the lawsuit alleges that the company misrepresented its data security practices, engaged in unfair security practices, and failed to take appropriate steps to secure accounts following security incidents.

The proposed settlement required the company to pay $500,000 in redress and to send notices to consumers telling them about the breach and the FTC settlement. The proposed order includes a number of other provisions that merit careful attention. For example, the order requires the company to replace any authentication methods that use security questions and answers with multi-factor authentication methods. The order also mandates that the company put in place and maintain an Information Security Program that includes (among other things) policies and procedures for data minimization and data deletion. That program must require the encryption of all Social Security numbers on the company’s networks – a particularly important protection because the company collects SSNs from small businesses for tax reporting purposes. And in addition to submitting third-party security assessments with the FTC, the company must provide redacted versions suitable for public disclosure. Once the proposed order is published in the Federal Register, the FTC will receive public comments for 30 days.

The case suggests more compliance nuggets than can be summarized here, but these may be the top three.

Don’t make it easy for data thieves to steal customer information. Hack happens, but there are numerous, cost-effective steps companies can take so their networks aren’t low-hanging fruit. The FTC offers to-the-point guidance on data security fundamentals , with special cybersecurity resources for small businesses .

Take security warnings seriously. If customers, government agencies, or others are telling you that you may have been hacked, investigate immediately.

Respond to security episodes honestly, transparently – and quickly. If your company has experienced a breach, respond with candor and speed. Move swiftly to implement a rapid response plan that honors your obligations under federal and state law. Read Data Breach Response: A Guide for Business for advice on how to secure your operations, fix vulnerabilities, and contact the people who need to know.

- Consumer Protection

- Bureau of Consumer Protection

- Data Security

- Small Business

Read Our Privacy Act Statement

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices . For more information on how the FTC handles information that we collect, please read our privacy policy .

Read Our Comment Policy

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

- We won’t post off-topic comments, repeated identical comments, or comments that include sales pitches or promotions.

- We won’t post comments that include vulgar messages, personal attacks by name, or offensive terms that target specific people or groups.

- We won’t post threats, defamatory statements, or suggestions or encouragement of illegal activity.

- We won’t post comments that include personal information, like Social Security numbers, account numbers, home addresses, and email addresses. To file a detailed report about a scam, go to ReportFraud.ftc.gov.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

More from the Business Blog

First ftc impersonation rule case: why it matters to 43 million consumers – and to your business, the specs on specs: what eye doctors need to know about the ftc’s revised eyeglass rule, ftc says adobe hid key terms of “annual paid monthly” subscription plan and set up roadblocks to deter customer cancellations, succor borne every minute.

- Data Analytics and Insights

- Forensics and Collections

- Document Review

- Managed Services

- Investigations

- Securities Litigation

- Regulatory Risk Insights

- Information Governance

- Cyber Incident Response

- Antitrust and Competition Services

- Divestiture Services

- Contracts Review and Analysis

- Drafting and Negotiation

- CLM Selection and Optimization

- Contracts Process Advisory

- CLM Implementation and Integration

- Epiq Counsel

- Legal Business Advisory

- Legal Spend Management

- Knowledge Management

- Class Action Administration

- Mass Tort Solutions

- Regulatory and Voluntary Remediation

- Document Processing & Admin Support

- Shared Services: Marketing, Billing, AP/AR

- Office Services

- Print & Mail Fulfillment

- Records Management & Information Governance

- Hospitality & Concierge

- Bankruptcy Services

- Corporate Restructuring

- Trustee Services

- Epiq Bankruptcy Analytics

- Financial Services

- Pharmaceuticals

Technologies

- Epiq Case Power

- Epiq Notify

- Digital Mailroom

- Epiq Reporting & Analytics

- Smart Lockers

- Workspace Management & Hoteling

- Epiq Facilitator

- Epiq Discovery

- Epiq Processing

- Epiq Chat Connector

- AI Practice Group

- Client Portal

- Data, AI, and Analytics Platform

- Application and Services

- Infrastructure

- Amazon Web Services

Epiq Access

- Epiq Access Login

- About Epiq Access

- Meet the Experts

- The Epiq Difference

- Epiq Legal Service Management

- Corporate Social Responsibility

- Diversity, Equity, and Inclusion

- Environment, Social, and Governance

- Search Case Studies

- Blog | The Epiq Angle

- Blog | Epiq Advice

- Newsletters

- Podcasts | Cyberside Chats

- Whitepapers

Case Study: Epiq Uniquely Equipped to Administer Claims Process in Data Breach Affecting Millions

Capital One, an American Bank Holding company

United States

Client need

In July 2019, Capital One announced that it had been the victim of a criminal cyberattack on its systems. The attacker gained unauthorized access to the personal information of approximately 98 million U.S. consumers.

Client solution

With decades of experience as a class action claims administrator, Epiq was uniquely equipped to handle this case. Epiq assigned its Complex Claims Team to the project because it specializes in accurately and efficiently administering complicated data.

Notably, the sheer size of the notifications required for the breach presented unique logistical considerations. Epiq rose to the challenge by implementing an extensive notification campaign that was distributed to millions of email addresses and physical addresses, making it one of the largest datasets it has handled.

Epiq has handled some of the largest data breach settlement administrations in the U.S., and offers a scalable, global infrastructure for providing related services.

Results and Benefits

Skillful administration.

by Epiq’s Complex Claims Team yielded an efficient and accurate resolution

settlement administration

claims processed

website visits

Beyond Headlines: Case Study- The Equifax Data Breach and Lessons Learned

The Equifax data breach in 2017 stands as a stark reminder of the critical importance of robust cybersecurity measures in an era of escalating digital threats. In this case Beyond Headlines: Case Study- The Equifax Data Breach and Lessons Learned guide, we analyze the intricate details of the breach, examining the vulnerabilities that led to the compromise of the sensitive personal information of millions of individuals. By dissecting the Equifax incident, we aim to extract valuable lessons that can guide organizations in fortifying their defenses and implementing proactive strategies to safeguard against similar cyber threats in the future.

What Is Equifax?

Equifax is a consumer credit reporting agency that gathers and maintains financial and personal information on individuals. As one of the three major credit bureaus in the United States, Equifax plays a crucial role in assessing creditworthiness for lenders and financial institutions by providing a comprehensive credit report, offering a snapshot of an individual’s credit history and financial behavior.

The Background of the Equifax Breach

The background of the Equifax breach can be traced back to a series of cybersecurity vulnerabilities and failures within the company’s infrastructure. Equifax, one of the largest credit reporting agencies in the United States, suffered a massive data breach in 2017, exposing sensitive personal information of approximately 147 million consumers. This breach had far-reaching consequences, as the stolen data included names, social security numbers, birth dates, addresses, and in some cases, driver’s license numbers. The breach not only compromised the privacy of millions of individuals but also put them at risk of identity theft .

The Equifax breach highlighted the severe consequences of data breaches and the vulnerabilities that exist within credit reporting agencies. In this case, the breach was caused by a failure to patch a known vulnerability in a software application that was used to handle consumer disputes. Additionally, Equifax failed to implement adequate security controls, allowing the attackers to gain access to sensitive data. This incident served as a wake-up call for both organizations and individuals regarding the importance of protecting personal information and the potential risks associated with data breaches.

Scope and Impact of the Data Breach

Equifax’s data breach incident compromised the personally identifiable information (PII) of approximately 147 million consumers, making it one of the largest data breaches in history. The scope of the Equifax data breach was staggering. The stolen information included names, Social Security numbers, birth dates, addresses, and in some cases, driver’s license numbers. This treasure trove of sensitive data provided cyber criminals with the means to commit identity theft, fraud, and other malicious activities. The impact was felt not only by the affected individuals but also by the financial industry and the overall economy.

The consequences of this breach were severe. Individuals faced the risk of financial loss, damaged credit scores, and the arduous task of mitigating the potential damage caused by identity theft. Moreover, the breach eroded public trust in Equifax and raised concerns about the security practices of credit reporting agencies. The incident prompted regulatory scrutiny, and lawsuits, and calls for stronger data protection and breach notification laws.

Vulnerabilities in Equifax’s Security Infrastructure

One of the key vulnerabilities was Equifax’s failure to patch a known vulnerability in the Apache Struts web application framework. The vulnerability, which was disclosed months before the breach, allowed attackers to execute arbitrary code and gain remote access to Equifax’s systems. Equifax’s failure to apply this critical patch demonstrated a lack of effective vulnerability management, leaving their systems exposed to exploitation.

Additionally, Equifax’s security breaches were further exacerbated by poor data security practices. For example, the breach was facilitated by the use of weak passwords and outdated security certificates, which made it easier for attackers to infiltrate the company’s network undetected.

Poor data governance serves as a stark reminder of the importance of proactive vulnerability management and robust data security practices. Failure to do so can have severe consequences, both for the organization and the individuals whose sensitive information is at risk.

Timeline of Events Leading Up to the Equifax Data Breach

The sequence of events leading up to the Equifax data breach unveiled key insights into the weaknesses present in the company’s security infrastructure.

In March 2017, the United States Computer Emergency Readiness Team (US-CERT) alerted Equifax about a critical vulnerability in Apache Struts, a widely used web application framework. Equifax, unfortunately, failed to patch the vulnerability promptly, leaving their systems exposed to potential attacks.

Fast forward to May 2017, cybercriminals began exploiting the unpatched vulnerability and gained unauthorized access to multiple Equifax databases. For over two months, the attackers clandestinely navigated through Equifax’s network, undetected.

On July 29, 2017, Equifax discovered the breach but failed to contain it immediately. It took the company another six weeks before publicly disclosing the incident on September 7, 2017. It revealed that sensitive information of 143 million consumers, including names, Social Security numbers, birth dates, addresses, and in some cases, driver’s license numbers, was compromised.

On September 15, 2017, Equifax revised the number of affected individuals to 147 million and acknowledged that additional personal information, such as credit card details for over 200,000 people, was also exposed.

The aftermath triggered intense scrutiny from regulatory bodies, Congress, and the public. Equifax faces legal actions, investigations, and a significant decline in its stock value. The incident underscores the urgency for companies to prioritize cybersecurity and prompt disclosure in the face of data breaches.

Response and Handling of the Breach by Equifax

In response to the Equifax data breach, the company’s handling of the incident was marked by delays and a lack of effective containment measures. This mismanagement further exacerbated the impact of the breach, resulting in significant damage to Equifax’s reputation and customer trust .

Several key issues emerged during the company’s response and handling of the breach:

Slow Response Time

Equifax took six weeks to disclose the breach publicly, which allowed hackers ample time to exploit the stolen data. This delay hindered the company’s ability to mitigate the breach’s consequences effectively.

Inadequate Containment Measures

Equifax failed to implement immediate containment measures, such as isolating compromised systems and disabling unauthorized access. This oversight allowed hackers to continue accessing sensitive information, prolonging the breach’s duration.

Poor Communication

Equifax’s initial response lacked transparency and clarity, leaving affected individuals and stakeholders in the dark. The company’s communication efforts were widely criticized for being vague, generic, and lacking empathy towards those impacted.

Legal and Regulatory Implications for Equifax

One of the key regulatory agencies involved was the Securities and Exchange Commission (SEC). The SEC launched an investigation into Equifax’s cybersecurity practices and potential breaches of securities laws. This scrutiny highlighted the importance of data governance and the need for companies to have robust systems in place to protect sensitive information.

The Equifax data breach had profound legal and regulatory implications, prompting investigations and legal actions from various fronts. Following the breach, Equifax also faced scrutiny from federal and state regulatory bodies, including the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB). These agencies examined whether Equifax had taken appropriate measures to secure consumer data and if the company had complied with data protection laws and regulations. The breach also sparked numerous class-action lawsuits from affected individuals seeking compensation for the mishandling of their personal information. Equifax ultimately agreed to settle these lawsuits, leading to one of the largest data breach settlements in history, with a fund of over $575 million established to compensate victims and enhance cybersecurity measures. The Equifax settlement team, ensured only affected individuals got compensated.

Furthermore, the Equifax incident contributed to a broader conversation around the need for enhanced data protection legislation. In its aftermath, lawmakers and regulators called for more stringent regulations to safeguard consumer data and hold companies accountable for data breaches. This momentum led to discussions about updating existing data protection laws and introducing new regulations to ensure that companies, particularly those handling sensitive consumer information, implement robust cybersecurity measures. The Equifax data breach, therefore, had a lasting impact on the legal and regulatory landscape, influencing policies aimed at fortifying cybersecurity practices and protecting individuals’ privacy in the digital age.

Lessons on the Importance of Proactive Security Measures

Equifax’s data breach serves as a stark reminder of the necessity for implementing proactive security measures. The incident highlighted the critical importance of patch management and the timely application of software patches and security updates.

The following lessons can be drawn from this breach:

Importance of Employee Training in Preventing Data Breaches

Employee training plays a crucial role in preventing data breaches by creating a culture of security awareness within an organization. It empowers employees to understand the potential consequences of their actions and make informed decisions when handling sensitive data. Through training programs, employees can learn about best practices for data protection, such as strong password management, recognizing phishing attempts, and securely handling customer information.

Lessons learned from the Equifax data breach highlight the need for continuous training efforts. Organizations should regularly update their training programs to address emerging threats and evolving technologies. Additionally, training should not be limited to IT staff alone; all employees, regardless of their role, should receive training on data security practices.

Best Practices for Secure Storage and Encryption of Data

Effective data security requires the implementation of best practices for secure storage and encryption of data. In the wake of the Equifax data breach, it has become even more crucial for organizations to adopt robust strategies to protect their confidential data.

Here are best practices for secure storage and encryption of data:

Utilize Encryption at Rest

Encrypting data at rest ensures that even if the physical storage medium is compromised, the data remains unreadable and unusable. Employing strong encryption algorithms and secure key management systems is essential to prevent unauthorized access.

Implement Strong Access Controls

Limiting access to sensitive data through role-based access controls and multifactor authentication can significantly reduce the risk of data breaches. Regularly reviewing and updating access privileges, and promptly revoking access for terminated employees, is crucial.

Regularly Backup Data

Maintaining regular backups of data is essential to mitigate the impact of data breaches. Backups should be stored securely, preferably in an offsite location, and regularly tested to ensure their integrity and availability.

By adhering to these best practices, organizations can enhance their data security posture, minimize the risk of data breaches, and protect the confidentiality and integrity of sensitive information.

The Significance of Regular Security Audits and Updates

The Equifax data breach highlighted the significant risks faced by organizations when it comes to protecting corporate data. Security audits play a crucial role in identifying vulnerabilities and weaknesses within an organization’s systems and processes. By conducting regular audits, organizations can proactively identify potential security gaps and take necessary steps to address them. These audits can assess the effectiveness of existing security measures, identify potential areas of improvement, and ensure compliance with industry standards and regulations.

Updates are equally important in maintaining data security. As cyber threats evolve rapidly, organizations must stay one step ahead by implementing the latest security patches and updates. This includes updating operating systems, software, and firmware to address any known vulnerabilities. Regular updates can help protect against emerging threats and ensure that systems are equipped with the latest security features. The absence of regular audits is what allows human error to deviate from the intended course.

Building a Culture of Cybersecurity Awareness

Creating a culture of cybersecurity awareness is imperative for organizations to mitigate the risks of data breaches and protect sensitive information.

To build a culture of cybersecurity awareness, organizations should consider the following:

Education and Training

Implement comprehensive cybersecurity training programs for employees at all levels. This should include regular updates on emerging threats, best practices for data protection, and how to identify and report suspicious activities.

Strong Leadership

Foster a culture where cybersecurity is seen as a top priority by leadership. This includes establishing clear policies and procedures, enforcing accountability, and promoting a proactive approach to cybersecurity.

Continuous Monitoring and Assessment

Regularly assess the organization’s cybersecurity posture through audits, vulnerability scans, and penetration testing. This will help identify any weaknesses or gaps in existing security measures and allow for timely remediation.

The Need for Transparency and Timely Communication

When the breach occurred in 2017, Equifax initially failed to disclose the incident promptly, delaying the provision of crucial information to affected individuals. This lack of transparency not only hindered the victims’ ability to take immediate action to protect themselves but also eroded public trust in the company’s ability to handle the situation responsibly.

Timely communication is equally critical in a data breach scenario. Delayed or inadequate communication can exacerbate the consequences of the breach, allowing hackers more time to exploit stolen information and leaving affected individuals vulnerable to further harm. Equifax’s delayed response meant that millions of consumers were left in the dark for an extended period, unaware that their data had been compromised.

Collaboration and Information Sharing Among Organizations

Effective collaboration and information sharing among stakeholders is vital in addressing the aftermath of a data breach and minimizing its impact. Organizations must recognize the importance of working together to combat cyber threats and protect sensitive information.

Here are aspects to consider when it comes to collaboration and information sharing among organizations:

Establishing Partnerships

Organizations should foster relationships with industry peers, government agencies, and cybersecurity experts to share best practices, threat intelligence, and incident response strategies. By collaborating with others, organizations can gain valuable insights and enhance their overall security posture.

Creating Information – Sharing Platforms

It is crucial to establish platforms that facilitate the sharing of threat intelligence and incident data among organizations. These platforms enable real-time information exchange, allowing organizations to stay updated on emerging threats and take proactive measures to protect their systems and data.

Building a Culture of Trust

Collaboration requires trust among organizations. To foster this trust, it is essential to promote a culture of transparency, openness, and accountability. Organizations should be willing to share information about breaches and vulnerabilities without fear of reputational damage. By doing so, they can collectively learn from each other’s experiences and strengthen their defenses against cyber threats.

The Impact of the Equifax Breach on Consumer Trust

The impact of the Equifax breach on consumer trust cannot be overstated. It has shaken the confidence of individuals in the ability of organizations to safeguard their information. Consumers now question the security measures implemented by companies, demanding more transparency and accountability. This breach has underscored the importance of data protection and the need for stringent cybersecurity measures.

Lessons learned from the Equifax breach have prompted organizations to reevaluate their security practices and invest in robust systems to protect consumer data. Companies are now recognizing the critical role of trust in maintaining customer loyalty and are taking steps to regain that trust. This breach has also prompted regulatory bodies to strengthen data protection laws, imposing stricter penalties for negligence and non-compliance.

In the aftermath of the Equifax breach, consumers are more cautious about sharing personal information and are more likely to scrutinize the security measures employed by organizations. The impact of this breach has extended beyond Equifax, affecting the broader landscape of data security. Restoring consumer trust requires organizations to prioritize data protection and adopt proactive measures to secure sensitive information.

Steps Individuals Can Take to Protect Their Personal Information

As individuals navigate the aftermath of the Equifax breach and its impact on consumer trust, it is crucial to understand the steps they can take to protect their personal information. In a world where data breaches have become increasingly common, individuals need to be proactive in safeguarding their sensitive data.

Here are important steps individuals can take to protect their personal information:

Enroll in Credit Monitoring Services

Credit monitoring services can provide individuals with real-time alerts regarding any suspicious activity on their credit reports. This allows individuals to detect potential identity theft or fraudulent activity early on and take necessary actions to mitigate the damage.

Strengthen Password Security

One of the most common ways hackers gain access to personal information is through weak passwords. Individuals should create strong, unique passwords for each online account they use and consider using a password manager to securely store and manage their passwords.

Regularly Review Credit Reports

It is important for individuals to regularly review their credit reports from all three major credit bureaus. By monitoring their credit reports, individuals can quickly identify any unauthorized accounts or discrepancies and take appropriate actions to rectify the situation.

Frequently Asked Questions

What recommendations emerged for other companies from the equifax case study.

Other companies can learn from the Equifax case study by prioritizing regular security audits, promptly addressing software vulnerabilities, and ensuring transparent communication in the event of a data breach. Establishing robust incident response plans and investing in advanced cybersecurity measures are crucial to mitigating the risks associated with handling sensitive consumer information.

What Changes Did Equifax Make in Response to the Data Breach?

Equifax implemented various changes in response to the data breach, including enhancing its cybersecurity measures, investing in technology upgrades, and appointing new executives with a focus on security. The company also settled legal actions and established a fund for compensating affected individuals. The incident prompted a reevaluation of Equifax’s practices and a commitment to prioritizing data security.

How Did Equifax Handle the Breach, and What Criticisms Did It Face?

Equifax faced criticism for its delayed response in detecting and disclosing the breach. The company took several weeks to notify the public after discovering the intrusion, leading to concerns about the effectiveness of its cybersecurity measures and transparency in communication.

Was There Inside Trading in the Equifax Data Breach?

There were suspicions of insider trading in the Equifax data breach. Several executives, including the Chief Financial Officer, sold shares worth millions of dollars shortly after the breach was discovered but before it was publicly disclosed, leading to investigations by regulatory authorities to determine if any insider trading laws were violated.

The Equifax data breach serves as a stark reminder of the far-reaching consequences that can arise from lapses in cybersecurity. Beyond the headlines, this case study illuminates the critical importance of proactive measures to safeguard sensitive consumer information, emphasizing the need for rapid response, transparent communication, and robust data protection practices. As businesses continue to navigate the digital landscape, the lessons learned from the Equifax incident underscore the imperative to prioritize cybersecurity, foster a culture of vigilance, and enact comprehensive measures to fortify defenses against ever-evolving cyber threats.

Leave a Comment Cancel reply

Be better prepared for breaches by understanding their causes and the factors that increase or reduce costs. Explore the comprehensive findings from the Cost of a Data Breach Report 2023. Learn from the experiences of more than 550 organizations that were hit by a data breach.

This report provides valuable insights into the threats that you face, along with practical recommendations to upgrade your cybersecurity and minimize losses. Take a deep dive into the report and find out what your organization is up against and how to mitigate the risks.

The global average cost of a data breach in 2023 was USD 4.45 million, a 15% increase over 3 years.

51% of organizations are planning to increase security investments as a result of a breach, including incident response (IR) planning and testing, employee training, and threat detection and response tools.

The average savings for organizations that use security AI and automation extensively is USD 1.76 million compared to organizations that don’t.

Gain insights from IBM X-Force experts

Get the most up-to-date information on the financial implications of data breaches. Learn how to safeguard your organization’s reputation and bottom line.

Check out the recommendations based on the findings of the Cost of a Data Breach Report and learn how to better secure your organization.

Only 28% of organizations used security AI extensively, which reduces costs and speeds up containment.

Innovative technologies such as IBM Security® QRadar® SIEM use AI to rapidly investigate and prioritize high-fidelity alerts based on credibility, relevance and severity of the risk. IBM Security® Guardium® features built-in AI outlier detection that enables organizations to quickly identify abnormalities in data access.

If you need to strengthen your defenses, IBM Security® Managed Detection and Response (MDR) Services use automated and human-initiated actions to provide visibility and stop threats across networks and endpoints. With a unified, AI-powered approach, threat hunters can take decisive actions and respond to threats faster.

Explore QRadar SIEM

Explore Managed Detection and Response Services

82% of breaches involved data stored in the cloud. Organizations must look for solutions that provide visibility across hybrid environments and protect data as it moves across clouds, databases, apps and services. IBM Security Guardium helps you uncover, encrypt, monitor and protect sensitive data across more than 19 hybrid cloud environments to give you a better security posture. IBM data security services provide you with advisory, planning and execution capabilities to secure your data, whether you’re migrating to the cloud or need to secure data already in the cloud. Services include data discovery and classification, data loss prevention, data-centric threat monitoring, encryption services and more.

Explore the Guardium data security portfolio

Learn about data security services

Build security into every stage of software and hardware development. Employing a DevSecOps approach and conducting penetration and application testing are top cost-saving factors in the report. X-Force® Red is a global team of hackers hired to break into organizations and uncover risky vulnerabilities that attackers may use for personal gain. The team's offensive security services—including penetration testing, application testing, vulnerability management and adversary simulation—can help identify, prioritize and remediate security flaws covering your digital and physical ecosystem.

Discover X-Force Red offensive security services

Explore our mobile security solution

Knowing your attack surface isn’t enough. You also need an incident response (IR) plan to protect it. The IBM Security® Randori platform uses a continuous, accurate discovery process to uncover known and unknown IT assets, getting you on target quickly with correlated, factual findings based on adversarial temptation. With X-Force® IR emergency support and proactive services, teams can test your cyberattack readiness plan and minimize the impact of a breach by preparing your IR teams, processes and controls.

Get IBM Security Randori

Explore X-Force for incident response

IBM Security helps protect enterprises with an integrated portfolio of products and services, infused with security AI and automation capabilities. The portfolio enables organizations to predict threats, protect data as it moves, and respond with speed and precision while allowing for innovation.

- Data Breach Response

- Privacy Audit

- Review & LSPs

- Hospital PHI Breach Case Study

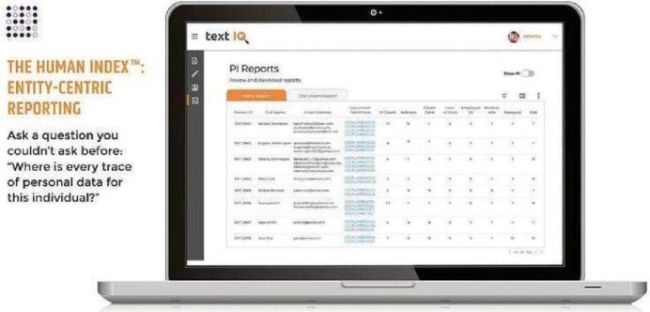

Canopy Achieves “Impossible” Data Breach Response for Hospital Network

The challenge.

A large hospital network experienced a protected health information (PHI) breach, with over 6,600 compromised PDFs — some containing up to 180,000 rows of information and over 150,000 individuals — and densely packed with PHI. Patients’ information was frequently duplicated with different PHI each time. The hospital network needed to work quickly in order to comply with the HIPAA Breach Notification Rule.

The Solution

Canopy’s algorithms recognized the information inside the PDF tables, extracting each data element and transforming them to a structured format. Then, Canopy’s advanced PHI detection algorithms identified each element of PHI. Our machine learning models deduplicated the entities into a list of unique patients and all their PHI, maintaining links to source documents.

"It was not humanly possible for our team to do this — it would have taken a couple hundred reviewers years to complete this project. We can’t even fathom the cost savings."

Project Lead

- Automated data extraction from tables in over 6,600 lengthy Crystal Reports (PDFs), some containing over 180,000 rows

- Deduplicated 4.28 billion entities to just 3 million unique patients, reducing entity list by 99%

- Enabled hospital network to comply with HIPAA Breach Notification Rule

- Saved team millions of man hours & completed "impossible" project in 15 days

By the Numbers

Crystal Reports (lengthy PDFs)

4.28 billion

entities, often frequently duplicated

for Canopy to complete the entire project

Request Case Study

See how Canopy saved one team millions of man hours with automated PDF data extraction and machine learning-powered deduplication.

Request a Demo

See how Canopy's Data Breach Response software leverages machine learning at every step, from PII detection through to generating a notification list .

Get These Results for Your Data Breach Response

Request your personalized demo to see how Canopy's AI-powered solution can transform your workflow.

Pell Center

The Pell Center for International Relations and Public Policy at Salve Regina is a multidisciplinary research center focused at the intersection of politics, policies and ideas.

The Equifax Breach is a Case Study in Why We Need a National Data Notification and Protection Law: Picks of the Week

“The Time is Now for Congress to Act of a National Data Breach Notification Law” | The Hill

“Equifax Breach Prompts Scrutiny, but New Rules May Not Follow” | The New York Times

“The single most depressing thing about the Equifax breach” | The Washington Post

It took over six weeks for credit bureau Equifax – one of the three major credit reporting firms in the U.S. – to disclose the massive data breach that potentially compromised confidential information of 143 million customers – or nearly half of the U.S. population. Aside from the reports on the company’s sloppy cybersecurity measures that made it a low-hanging fruit for hackers and its subsequent handling of what appears to one of the worst data breaches in recorded history, the fact that the company took so long to notify customers is appalling – but given the patchwork of data breach notification laws in the US and the still-too-common disregard for industry-wide cybersecurity standards, it was not all that surprising.

Breached companies often choose to delay notification of hacks, putting customers at risk while avoiding consequences. While there may be legitimate reasons to delay informing consumers about a data breach, such as an ongoing criminal investigation by law enforcement or the need to assess the full scope of the hack and extent of the damage before letting consumers know and possibly causing panic, companies often wait to go public about a data breach because they fear the damages a hack will have on their reputation, customer trust, stock value, and overall revenues.

In the case of Equifax, the company’s slowness first in patching a known vulnerability and then in effectively responding to the hack and notifying customers, combined with its high-level executives who apparently sold off almost $2 million worth of stocks days after the breach was discovered, shows a complete lack of leadership and real concern about customers’ privacy and security. Equifax has yet to disclose why it waited so long to inform customers about the breach and, in the meantime, two top executives have stepped down , the legal team and the Board are bracing for probes by the federal and state authorities and a slew of class-action lawsuits, and the CEO is preparing to testify before the U.S. Congress.

What sets Equifax’s breach apart, however, has less to do with their undue delays or with the numbers of records breached – Yahoo’s data breach last year affected as many as one billion accounts – than with the high-value of the data exposed. The data that was accessed by still-unknown hackers includes a trove of names, birth dates, Social Security numbers, addresses, driver’s license numbers, and even credit card and bank account numbers. Even individuals that never used Equifax were affected. Indeed, consumers have almost no control over whether their information is absorbed into credit bureaus like Equifax , Experian , and Trans Union , and do not have to provide consent for them to use and process their personal data. If you ever applied for a mortgage, a credit card, a cellphone plan, or to buy a car, Equifax, or a similar company likely has your information which is used to rate your credit-worthiness to banks, home sellers, auto sellers and others.

With so much personal information, criminals can easily impersonate you, take out new lines of credit in your name, file fraudulent tax returns, take out prescriptions, and craft even more sophisticated phishing emails and scams. This type of cyber risks are not isolated to Equifax, but this massive data breach revealed another inherent flaw in the U.S .: the over-reliance on Social Security numbers and the skewed credit reporting system that is in urgent need of reform. The wide use of SSNs in both government and private sectors, and the ease of using it to access highly-sensitive accounts, has made hacking systems such as credit reporting agencies even more appealing to cyber criminals.

Unfortunately, companies are not incentivized to prioritize security, resiliency, and privacy, and there is little national oversight on how companies handle data. Indeed, most companies constantly collect and store data even just because they might want to use it sometime in the future – there is no law that forces them to only collect the bare minimum of data necessary, or that limits how long a company can store data, or that requires to encrypt everything they collect, or that imposes regular security audits. When it comes to notifying consumers that their data has been stolen, laws in the U.S. vary state to state and differ in how much time and how much information companies are required to divulge, and whether to notify other parties beside the affected people (such as state attorney generals, credit bureaus or regulators). Past calls in Congress to establish a nationwide standard have repeatedly fizzled . The result is a muddled patchwork of 48 different state laws governing data breach notification, and timing is only specified in eight states and varies anywhere from 10 to 90 days. Rhode Island’s law , for instance, requires notification to be made within 45 days from the discovery of a breach. Georgia – where Equifax is based – has no timeline specified for when a company must notify customers about a breach. Alabama and South Dakota don’t even have a data breach notification law on the books. For comparison, the European Union ’s new General Data Protection Regulation, which comes into effect next year, requires that any data breach be reported within 72 hours.

Big hacks like the Equifax fiasco put into context just how much control organizations have over our personal information, how much information is regularly collected, and how valuable (and vulnerable) that information is. But as the digital world increasingly dictates where we work, play, and live our lives, we need to have control — or at the very least, basic knowledge — over what data is being collected about each one of us, where it is stored, who has access to it, and how it is being protected.

While Congress debates the merits of the various proposals to establish a national data notification and protection law , if you were a victim of this latest enormous breach (assume you were!), here are a few things you should do to protect yourself:

- Check your credit accounts immediately and regularly for any suspicious activity, and continue to monitor your credit card and bank accounts for the foreseeable future;