Assign Company Code to Chart of Accounts in SAP S4 Hana

After maintaining a chart of accounts in SAP S4 Hana , the next step is the assignment of company code to the chart of accounts.

Assign Company Code to Chart of Accounts in SAP S/4Hana – Scenarios

- In SAP, one chart of accounts can be assigned to one or more company codes

- Only one operational chart of accounts can be assigned to the company code

- Group charts of accounts can be assigned to company code for the consolidation of reports and statements.

How to Assign Company Code to Chart of Accounts in SAP S4 Hana

You can assign a company code to the chart of accounts in SAP S/4 Hana by using transaction code OB62 or IMG menu path.

- IMG Menu Path : SAP Customizing Implementation Guide -> Financial Accounting -> General Ledger (G/L) Accounting -> Master Data -> G/L Accounts -> Preparations > Assign Company Code to Chart of Accounts

- Transaction code : OB62

Refer below step by step procedure how to assign company code AD01 to the chart of account ADCA in the SAP system.

Step 1 : Execute transaction code “ OB62 ” in the command field to assign the company code to the chart of accounts in SAP S4 Hana

Step 2: In the next screen, change the view “ Assign company code” to the chart of accounts overview, click on the position button and enter the company code key in the given entry field.

Now your company displays at top of the list so that you can assign the chart of accounts.

Step 3: Now enter the chart of accounts key “ ADCA ” in field Chrt/Accts and enter to continue,

Click on the save icon to save the assigned company code to a chart of accounts.

Successfully we have assigned company code to chart of accounts in SAP S4 Hana system.

Project Work – Space Work

Now it is the time to practice and learn. Let’s assign your company code to chart of accounts.

Assign Company Code to Chart of Accounts in SAP

IMG Menu Path :- Implementation Guide –> Financial accounting –> G/L Accounting –> GL Accounts –> Master Data–> Preparations –> Assign Company Code to Chart of Account

Transaction Code :- OB62

Step 1 :- Enter transaction Code SPRO in the SAP command field and press enter

Step 2 :- Select SAP Reference IMG

Step 3 :- Follow IMG menu path and select Assign Company Code to Chart of Account

Step 4 :- Click on position and update company code and press enter

Step 5 :- Update chart of account key in the Chrt/Accts field

Step 6 :- Click on Save icon to save the configured data and message will be displayed ” Data was Saved”

Thus Company code is successfully assigned to chart of account

- +91-9556432150

- [email protected]

Chart of Accounts in SAP – Beginners Guide

Published by pradeep on may 25, 2020 may 25, 2020.

Last Updated on September 12, 2022 by Pradeep

Chart of Accounts in SAP – Introduction

The chart of accounts in SAP is a group of GL Accounts that controls the name of the General GL Master, the number of GL Master and some control information. In other words, the grouping of G/L accounts forms the framework for recording accounting transactions in a structured way.

What is Covered in this article?

- Importance of COA for GL Accounts

- List or Types of Chart of Accounts

- How to Create Chart of Accounts

Values to Maintain for defining Chart of Accounts in SAP

- Steps for creation of COA in ECC

- Steps for creation of COA in S/4HANA

- The process to create Group Chart of Accounts

How to Assign Company Code to Chart of Accounts?

- How to display COA?

- Why do you need to create COA?

How it is important for GL Accounts?

Each G/L account is made up of an account number, account name and same control information. The control information decides how an account is created in a company code and posted to.

There are a number of Chart of accounts in SAP that meet the statutory and legal requirements of various countries. Likewise, the international chart of accounts (INT) works in a similar way and any country can use them.

Important: SAP New GL Migration- Overview

(Types) List of Chart of Accounts in SAP

In SAP FICO, We have three types of Chart of Accounts. Let us understand them briefly.

1. Operating Chart of Accounts

The operating chart of accounts in SAP is used for recording the day-to-day transactions in a company code . We also call them the standard chart of accounts. Both FI & CO make use of this element.

Noteworthy, this can be different from the country chart of account. Each company code works with exactly one operating chart of accounts. However, we can assign the same chart to more than one company code.

2. Country Specific Chart of Accounts in SAP

The country chart of accounts in sap helps to meet the country-specific legal requirements. Although it is optional to assign to a company code, you need such a chart when you work with a different operating chart of accounts.

Subsequently, you can establish the linkage by entering the country chart of G/L account number in the alternate Account number field of GL Master Record.

3. Group Chart of Accounts

We use a group chart of accounts in SAP for consolidating all company codes with a dissimilar operating chart of accounts belonging to a company.

However, the assignment of a group chart of accounts to a company code is not mandatory. We also call it the Corporate Chart of Accounts.

You may like to read: Scenarios in SAP General Ledger Accounting

How to create Chart of Accounts in SAP?

After clicking on the “Edit Chart of Accounts List”, to create a new chart of accounts, click on New entry , Fill in the required details and Save.

So, now let’s see how to create COA in two different applications – ECC and S/4HANA.

However, before creating the chart of accounts you must understand that we need to maintain some values which are necessary for the defining process.

- Chart of Accounts – Enter the four-character identifier

- Description – Enter a Description

- Maintenance Language – Select ENGLISH as the maintenance language. Consequently, all the G/L accounts of this chart have their descriptions in this language. We can easily translate the account names to a target language from the maintenance language. However, only if we use the same chart of account in other company code.

- Length of G/L Account Number – Enter (1-10) as the length of the G/L account number.

- SAP Controlling Integration – This field indicates how the system should create cost elements when we create New G/L accounts. Here, the system automatically creates the required cost elements for the option AUTOMATIC Creation of Cost Elements . Provided if you have maintained a default Cost Element Category. ( Remember, you can use Transaction Code OKB2 for this ). You may also set the system to have the cost elements created manually using the appropriate transactions (Transaction KA01 for creating a primary cost element and Transaction Code KA02 for creating a secondary cost element).

- Group of Chart of Accounts in SAP – This chart of account is used for company consolidation.

- Blocked – If you select this indicator, then you are not able to create any New G/L accounts in the company code from this chart of accounts.

Now see the process to define chart of accounts in SAP.

Since we have two applications- ECC and S/4HANA. So there is a slight difference in the steps or path. I have put both here.

Steps to create a new Chart of Accounts in the SAP ECC system

Create COA in SAP FICO with the following process:-

SPRO => SAP IMG-Financial Accounting (New) => General Ledger Accounting (New) => Master Data => G/L Accounts => Preparation => Edit Chart of Accounts List. – [ Transaction Code – OB13 ]

Steps to create Chat of Accounts in the SAP S/4HANA system

SPRO=> SAP IMG => Financial Accounting => General Ledger Accounting => Master Data => G/L Accounts => Preparation => Edit Chart of Accounts List. – [Tcode is same – OB13]

Chart Account can be defined with a maximum 4 digit code. In my example, it is “C160”.

How to create a Group Chart of Account?

The process to create a Group Chart Of Accounts is the same as we create an Operating Chart of Account. Once you create it, assign it to one of the existing operating charts of accounts. Now the earlier one becomes a group chart of accounts.

For example, first, we create a chart of accounts with the name “A”. As mentioned, we will create it in the normal way as an operating chart of accounts. After creation, we assign this “A” chart of account to an already existing COA eg. name “B”.

Finally, after this assignment, the first COA i.e. “A” becomes a Group Chart of Accounts.

Since we create the chart of accounts at the client level, thus, the next logical step is to assign them to company codes.

Steps to Follow:

SPRO => IMG => Financial Accounting (New) => General Ledger Accounting (New) => Master Data => G/L Accounts => Preparation => Assign Company Codes to Chart of Accounts. – [Transaction Code- OB62]

Process for assigning company code:

- Firstly, you need to enter TCode OB62 in the SAP command field area and go ahead.

- Next, you see a screen having Change view Assign company code- chart of accounts – Overview screen.

- Here you select the position option and enter the company code in the box appearing.

- Lastly, after successful completion, you would see the specific company code on the top of your SAP screen.

Would you like to Read:- Accounting vs. Ledger Approach in New Asset Accounting

How to Display Chart of Accounts in SAP

It’s very simple. Just follow the below steps.

Click on the Edit Chart of Account List => Use TCode OB13 => Click on the Position => Search the specific Chart of Accounts.

Same as the image above. The steps are the same as creation. Just enter the specific COA Tcode.

Tcode to display chart of accounts

It is OB13.

You must have known already. Since it is a common question by readers, so I put it here separately. We use it to see a specific Chart of Account.

How to Copy a Chart of Accounts in SAP

The steps are the same as creating a new COA. After which certain things you need to do. Here is the whole process.

- SPRO => SAP IMG-Financial Accounting (New) => General Ledger Accounting (New) => Master Data => G/L Accounts => Preparation => Edit Chart of Accounts List. – Click on COPY Icon (shown in image below) =>

- Here system will ask you to select a Source Chart of Accounts. Eg. 0001. Then, you need to give your target COA.

- Click enter.

- Do the necessary changes (if required).

- Finally Click Save.

(Same Tcode is to use – OB13 ).

Related: List of Top50+ SAP Finance Tcodes and their use

Interestingly, this Chart of Accounts is a feature that SAP introduced in ECC as compared to its R/3 model. This added much functionality here in the SAP functional module.

Why do you need to create Chart of Accounts?

In order to maintain the General Ledgers in SAP properly, you must create the Chart of Accounts in the proper format. Since the general ledger accounts are the backbone of the SAP Financial Management system . This is to say, in FICO and SAP S4 HANA Finance both it has their significance.

Thus, you must consider the chart of accounts as their internal structure.

Importantly, if you would like to understand the General Ledger system in SAP in a deeper way, you must learn the chart of accounts at its best. Also, that should be from a good source.

Know About: Latest Version of S4 HANA Finance 2020

Related Video: How to Chart of Accounts in SAP | Structure & Types

Related Posts

Tax on Sale Purchase in SAP S/4HANA

SAP S/4 HANA covers the business processes like Procure-to-Pay, Order-to-Cash and record-to-report. To understand the functioning of tax on sale purchase in SAP we need to know all tax-relevant steps within the end-to-end scenarios. Additionally, Read more…

SAP New GL Activation & Migration Process

SAP New GL Activation and Migration From Classic GL During a new installation, the New G/L accounting in the standard system is set to active. While the use of classic General Ledger is theoretically also Read more…

SAP Order to Cash & its Process Flow

SAP Order-To-Cash The SAP order to cash process is used for processing the business’s sales orders for goods and services. It manages the company’s receivables and accumulates the relevant payments from its customers. This is Read more…

Explaining G/L Account Settings on Chart of Accounts Level, Company Code Level, and Controlling Area Level

After completing this lesson, you will be able to:

- Explain G/L account settings on chart of accounts level, company code level, and controlling area level

G/L Account Settings on Chart of Accounts Level, Company Code Level, and Controlling Area level

G/l account settings, kevin has had an introduction to the relationship between the chart of accounts, company code, general ledger and the controlling area. he is ready to explore more g/l account settings. choose the play button to discover.

In a G/L Account fields can be defined on these different levels:

- Chart of Accounts

- Company Code

- Controlling Area

Roll over each hotspot on the screenshot below to learn about the most important settings on the Chart of Accounts level of a G/L Account. When you have explored all hotspots, you can use Click Next on this screenshot to go to screenshots of other levels. You can also use the Hamburger Menu icon to select a screenshot.

G/l account: chart of account settings.

Each G/L Account is set up according to a Chart of Accounts which contains the definitions of all G/L Accounts. The following are some of the important fields defined at the Chart of Accounts level:

- Account Number, usually numeric with a fixed number of digits, in our example eight numbers.

- G/L Account Type, e.g. Primary Costs or Revenue, Secondary Costs, Cash account, Balance Sheet, Non-operating Income or Expense.

- Account Group, used to organize and manage groups of similar G/L Accounts.

- Short and Long Text, the description of the G/L Account.

G/L Account: Company Code Settings

Before you can post to a G/L Account in a Company Code, you have to maintain the G/L Account at the Chart of Accounts view. You then create the Company Code-specific settings, which are only valid in the Company Code. An example of a Company Code-specific setting is defining the account currency. Most of the G/L Accounts in Company Code 1010 use the EUR currency, whereas Company Code 1710 uses currency USD. When the account currency is the local currency of the company code one can post to that account in any currency.

G/L Account: Controlling Area settings

The Controlling Area view of the G/L account is only required for G/L Accounts that are setup as a G/L Account Type 'Primary Costs or Revenue' or 'Secondary Costs' accounts. A Cost Element Category needs to be specified, e.g. '01' for Primary costs. This ensures for example when posting to a G/L expense account, you are required to enter a CO assignment which can be a Cost Center which is updated in the Controlling (CO) module from the FI expense posting.

Reconciliation Accounts

The Reconciliation Account field links subledger accounts to the G/L account. This means that a posting to an account in a subledger posts to the corresponding reconciliation account in the general ledger at the same time. We can connect accounts in subledgers such as Accounts Receivable, Accounts Payable and Assets to their own G/L reconciliation account by specifying the type of subledger (D- Customers, K- Vendors, A - Assets). In master data maintenance of the individual accounts in the subledger the G/L reconciliation account is specified.

Roll over each hotspot on the figure below to learn about Reconciliation Accounts.

Log in to track your progress & complete quizzes

Blog about all things SAP

ERProof » SAP FI » SAP FI Training » SAP FI Organizational Structure

SAP FI Organizational Structure

Transaction code: SCC4

Path: SAP Easy Access – Tools – Administration – Administration – Client Administration – Client Maintenance

Relevant table: T000

Client means customer, in SAP Landscape client is an independent information and data. Client means a location in an environment where configuration maintained, master data created and transaction data posts. An environment can have multiple clients for specific purposes like a golden client only for configurations in development environment.

SAP introduced client concept to avoid separate physical system for each customer. Client concept also helps for individual customers to create different clients in one environment. We have different environments, in each environment we can have multiple clients for various activities. There is no obligation to have multiple clients in an environment.

SAP standard provides 3 different clients:

- Client 000 is a master client, it comes by default through SAP ERP software installation.

- Client 001 is a copy of client 000 with Test Company. This client considered as a reference (copy) to create new client.

- Client 066 is called early watch client, it is a diagnosis service for solution monitoring of SAP and NON SAP systems in SAP solution manager.

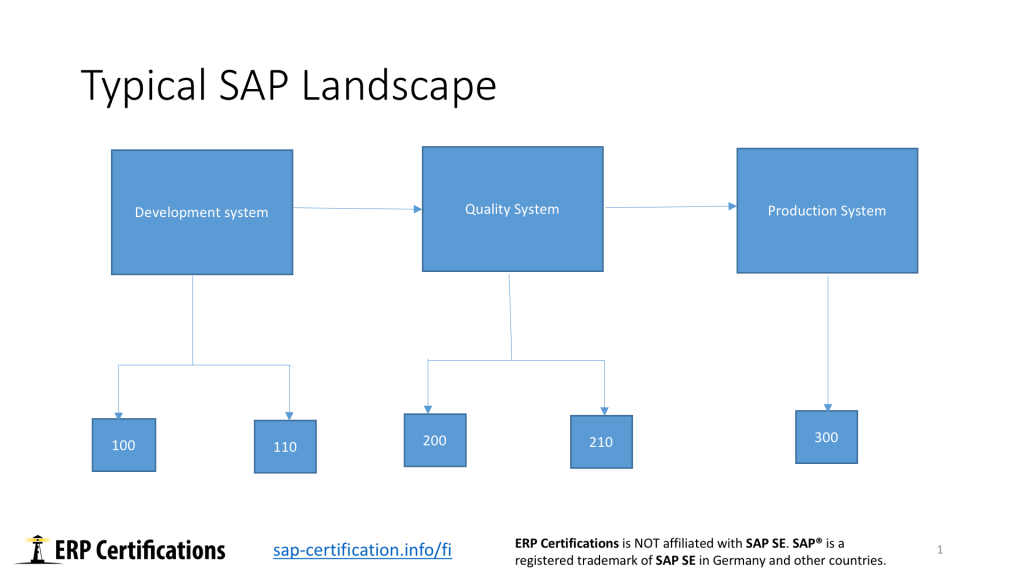

For example SAP landscape enclosed below:

SAP landscape: Development –> Quality –> Production

- Development system has two clients. 100 – Golden client and 110 – Test client. Golden client is meant only for configurations. Test client is meant for testing by consultants/core team to test changes before import in Quality system.

- Quality system has two clients. 200 – Test client and 210 – User testing. Test client is for core team testing. User testing client used by users to perform testing of new changes and client development reports.

- Production system

Production system has one client where we book business transaction of day-to-day activities.

Chart of Depreciation

Relevant tables: T093 (Real and derived depreciation areas), T093C (Company codes in Asset Accounting).

Path: SPRO – SAP reference IMG – Financial Accounting (New) – Financial Accounting Global Settings (New) – Asset Accounting – Asset Accounting (Lean Implementation) – Organizational Structures – Copy Reference Chart of Depreciation/Depreciation Areas – Copy Reference Chart of Depreciation

Transaction code: EC08

Chart of depreciation are used in order to manage various legal requirements for the depreciation and valuation of assets. SAP provided standard chart of depreciation as per the legal requirement of countries. We can create new chart of depreciation by copying the existing chart of depreciation only. It is not possible to create new without copying the existing chart of depreciation.

We can assign one chart of depreciation to many company codes belongs to same country and same functional currency. In SAP new G/L we can have two additional currencies (transaction code OB22), in Asset Accounting we need to assign these currencies to relevant depreciation areas. In classic G/L we have only one currency.

Chart of Accounts

Path: SPRO – SAP reference IMG – Financial Accounting (New) – General Ledger Accounting (New) – Master Data – G/L Accounts – Preparations – Edit Chart of Accounts List

Transaction code: OB13

Relevant tables: T004 (Directory of Charts of Accounts), SKA1 (G/L Account Master (Chart of Accounts))

Chart of accounts consists a list of G/L accounts used by an organization to book the business transactions and day to day activities. It is possible to specify whether cost elements to be create automatically or manual while creating chart of accounts. In SAP configuration like G/L account assignment happened at chart of accounts only. G/L account to be create at chart of accounts level then it is possible to extend at company code level.

Types of Chart of Accounts

We have three types of chart of accounts available in SAP: Operating chart of accounts, Group chart of accounts and country chart of accounts.

Operating Chart of Accounts

GL accounts created under operating chart of accounts are used to book day to day transactions of business. Cost element category maintained for operating chart of accounts. Assignment of operational chart of accounts is obligatory.

Group Chart of Accounts

GL accounts under group chart of accounts are meant for reporting at entire corporate group purpose. In other words we can say reporting of all company codes data. No direct posting allowed to group chart of accounts and the assignment is elective.

Country Chart of Accounts

GL accounts created under country chart of accounts are as per the country legal requirement to provide reporting at per legal requirement of country. Assignment is elective to a company code.

Credit Control Area

Path: SPRO – SAP reference IMG – Enterprise Structure – Definition – Define credit control area

Relevant tables: T014

Transaction code: OB45

Credit control area used to check credit limit for customers. We can assign one credit control areas to one or more company codes.

Credit control area is used for credit management in the applications components for Sales and Distribution and Accounts receivable. Credit management be a centralized or decentralized. If it centralized then all company codes can use one credit control area, in case of decentralized each company code should has individual credit control area.

Credit control area to be assigned to company code and in the customer master data also.

Business Area

Path: SPRO – SAP reference IMG – Enterprise Structure – Definition – Financial Accounting – Define business area

Relevant tables: TGSB (Business Areas), BSEG (Accounting Document Segment)

Transaction code: OX03

Business areas are used to distinguish business transactions of an organization at unit/branch level. For example: A construction company has one company code but it has various projects so each project will be defined as business area.

While booking transactions business area to specify so it is possible to derive reports based on business area. It is not possible to input business area for all the transactions hence business area concept is not much in use.

Business area not assigned to any company code so if an organization has multiple company codes then all can use the same business area. It is also possible to maintain business area as an element in master data like cost center, WBS element, internal order, etc.

Company Code

Path: SPRO- SAP IMG – Enterprise Structure – Definition – Financial Accounting – Edit, Copy, Delete, Check Company Code – Edit Company Code Data

Table: T001

Finally, one of the most important elements of SAP FI organizational structure is a company code . It is a legal independent entity for which general ledger master data extended or created to carry out day to day activities of the business transactions.

Now, you know about organizational structure of SAP FI (Financial Accounting). If you have any questions or comments, you are welcome leave them in the form below.

Related Tutorials:

How to Create a Company Code in SAP ERP?

34 thoughts on “SAP FI Organizational Structure”

its good for learning.

Please tell me, can I get any free SAP software to download for Practice?

Yes it is possible if you re interested down lodge SAP software for practices you can do it

I am interested in SAP and I have a little bit of knowledge about sap. but I don’t have money to go and study for sap, so I would like to know how can I register for the free course and to get certified.

If you want to get SAP certificate you need to check different type of link on site.there is so many option for sap certification. my thinking is that sap certificate is no matter if you know how to do work on it .certificate not show your knowledge but knowledge show your experience and your talent.

Please advise me on how can I take part on the free programme of SAP. I am interested in the programme.

I am interested in SAP FICO. Is there any scenario based training program available?

Can’t read your material on this page as they are blocked by google ads …. please get them removed as they block your material Thanks

Whats the cost of training & certification in sap

Please make FAQ to solve general query for aspirants of sap

It is good and understandable words ..what exactly the sap and it s very helpful to Da beginers.

Please I need to learn SAP for Accounts payable function from a-Z and I don’t have money to pay for course I need free training .

sir i want sap course but i have no money.so how can i resistor free sap couse..

These are free tutorials. You can register here: free SAP FI training .

Hello sir If you really interested learn SAP please open internet and search SAP accounting software you will get a lot of data about it but you need to go with one link (SAP F1 free online training ) and you get full course detail in SAP accounting software it is totally free you need not to pay any cost .

Thanks for all..please help to get if we have a link to download and practise..

please send to me link for lesson 1 in co

Dear Admin,

Thank you for this free training, I am Junior SAP FICO consultant and I would like to study in depth all the concepts of SAP.

I still have confusion about the Local/Parallel currencies and how they work on each one of the organizational structure elements.

Could you please provide a chart of different scenarios of Local/Parallel currencies deployment

Thank you in Advance

This course is very helpful for me. Best traning on online free. Thanku SAP FI traning…. Can I install best SAP FI traning software for practice in my PC.

I found the course very helpful, however there are multiple mistakes in grammar throughout the text, so it would certainly benefit from a proofreading.

Hello, hope doing good Please let me know, is there any chance to get free SAP software to download for Practice?

Hi Where does profit centre feature in SAP FI Org structure?

Good material, thank you

I can see this course from many years, many changes happening in SAP, is this the latest FI training for ECC6 and EHP 7? please let me know if there is any course for SAP s/4 HANA finance (Simple finance).

On this free training, is there a certificate of completion?

Thank you so much for providing such a great platform to prepare oneself for SAP. It is actually very helpful for all of the aspirants who are looking their future as SAP consultant but couldn’t afford the fees that are being charged by any institution.

Thanks a lot for your support on this.

Hi Sir till now i worked on irrelevant field,now if i learn SAP FICO,will they consider me as an consultant?

Any option in android mobile for sap practice

It is very useful for beginners

Dears, Lots of thanks for such valuable information. Simple and short; however, it’s dead useful. Just wondering about any updates with S/4HANA?

Best regards, Ahmad,

You didn’t explain the controlling area in organization structure.

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Chart of accounts company code Table in SAP

- CNV_COA_CCODE Table for Assign 'old - new chart of accounts' per company code Table Type : TRANSP Package : CNV_20100 Module : CA-GTF-BS

- GMCOA Table for Special GL accounts in chart of accounts for grants mgmt Table Type : TRANSP Package : GMMASTERDATA_E Module : PSM-GM-GTE-MD

- GMGAAP Table for Special GL accounts in chart of accounts for GM GAAP Table Type : TRANSP Package : GMMASTERDATA_E Module : PSM-GM-GTE-MD

- TBCA Table for Chart types in bar chart Table Type : TRANSP Package : SGRC Module : BC-FES-GRA

- TBCAT Table for Text on Chart Types in the Bar Chart Table Type : TRANSP Package : SGRC Module : BC-FES-GRA

- /SLOAS/PICCAT Table for Kind of Business graphic like Pie Chart or Line Chart and so Table Type : TRANSP Package : /SLOAS/OUTPUT_ADT Module : SV-SMG-INS

- /SLOAS/PICCATC Table for Kind of Business graphic like Pie Chart or Line Chart and so Table Type : TRANSP Package : /SLOAP/OUTPUT_ADT Module : CA-EUR

- ESERV_C_BUKRS Table for Allocation of Auxilliary Company Code to Company Code Table Type : TRANSP Package : EE_DEREG_INV Module : IS-U-IDE

- PAYAC07 Table for Company Code/Company Code Groups Assignment (FM) Table Type : TRANSP Package : FMFI Module : PSM-FM-PO

- UDM_COMPCODE_MAP Table for Assignment of FI Company Code to Collection Company Code Table Type : TRANSP Package : UDM_COLL_CUSTOMIZING Module : FIN-FSCM-COL

- ACCCHRTACCTS0C Table for Chart of Accounts Table Type : TRANSP Package : FINB_GL_ACCOUNT Module : FIN-FB

- ACCCHRTACCTS0T Table for Chart of Accounts Table Type : TRANSP Package : FINB_GL_ACCOUNT Module : FIN-FB

- CNVA_COA_CONV_CA Table for Chart of Accounts to conversion analysis Table Type : TRANSP Package : CNVA_COA Module : CA-EUR

- CNVA_COA_CONV_VS Table for Chart of Accounts to conversion analysis Table Type : TRANSP Package : CNVA_COA Module : CA-EUR

- CNV_20100_SCEN Table for Elementary scenarios for chart of accounts conversion Table Type : TRANSP Package : CNV_20100 Module : CA-GTF-BS

- CNV_20100_SCENT Table for Elementary scenarios for chart of accounts conv. (descript Table Type : TRANSP Package : CNV_20100 Module : CA-GTF-BS

- CNV_20110_SCEN Table for Elementary scenarios for chart of accounts conversion Table Type : TRANSP Package : CNV_20110 Module : CA-GTF-BS

- CNV_20110_SCENT Table for Elementary scenarios for chart of accounts conv. (descript.) Table Type : TRANSP Package : CNV_20110 Module : CA-GTF-BS

- CSKA Table for Cost Elements (Data Dependent on Chart of Accounts) Table Type : TRANSP Package : KBASCORE Module : CO

- OIUH_RV_COA Table for Chart of Accounts Table Type : TRANSP Package : OIU_H Module : IS-OIL-PRA-REV

- RSBCT_MEC_KP Table for BCT-ME: Chart of Accounts Table Type : TRANSP Package : RS_BCT_ME Module : BW-BCT-ISM

- RSBCT_MEC_KP_T Table for BCT-ME: Texts for Chart of Accounts Table Type : TRANSP Package : RS_BCT_ME Module : BW-BCT-ISM

- RSBCT_MEC_KYFKP Table for BCT-ME: Assignment of InfoObject and Chart of Accounts Table Type : TRANSP Package : RS_BCT_ME Module : BW-BCT-ISM

- SKA1 Table for G/L Account Master (Chart of Accounts) Table Type : TRANSP Package : FBASCORE Module : CRM-ISA

- SKAS Table for G/L account master (chart of accounts: key word list) Table Type : TRANSP Package : FBS Module : CRM

- SKAT Table for G/L Account Master Record (Chart of Accounts: Description) Table Type : TRANSP Package : FBASCORE Module : CRM-ISA

- T850Z Table for Layout: FS chart of accounts Table Type : TRANSP Package : FKUC Module : FI-LC-LC

- TF602 Table for C/I Methods: Cons Chart of Accounts-Based Settings Table Type : TRANSP Package : FC06_UC Module : EC-CS

- TF644 Table for Fair Value Adjustments: Cons Chart of Accounts-Sensitive Table Type : TRANSP Package : FC06_UC Module : EC-CS

- TF692 Table for Global Chart of Accounts-Based Settings for C/I Table Type : TRANSP Package : FC06_UC Module : EC-CS

- TICL831 Table for Entity Table: Collective Account Based on Chart of Accounts Table Type : TRANSP Package : ICL_LAE Module : FS-CM

- TWIC1010A Table for SRSII: Define Grouping Schema and Assign Chart of Accounts Table Type : TRANSP Package : WOST Module : LO-SRS

- CNV_20100_IC_BUK Table for Accounts per company code to be checked for item category Table Type : TRANSP Package : CNV_20100 Module : CA-GTF-BS

- CRMC_BEAVALTYACC Table for IPM: Assignment of Value Types for Accounts in Company Code Table Type : TRANSP Package : CRM_IPM_FI Module : FI

- IDITSR_GLDATA Table for GL accounts for company code and country Table Type : TRANSP Package : ID-FI Module : CA-GTF-CSC

- FBICRC_C_OV Table for ICR: Overview Chart with Single Company Displayed Table Type : TRANSP Package : FB_ICRC_DB Module : FI

- FBICRC_C_OV_ALL Table for ICR: Overview Chart with Multi Company Displayed Table Type : TRANSP Package : FB_ICRC_DB Module : FI

- TFK001GB Table for Company Codes for Company Code Groups Table Type : TRANSP Package : FKKB Module : FI-CA

- ESERVPROVKONT Table for G/L Accounts and Contract Accounts for Service Provider Table Type : TRANSP Package : EE_EDM_IDE_INT Module : IS-U-EDM

- J_1IEWTHKONT Table for Table for for TDS provisions Accounts / Loss Accounts Table Type : TRANSP Package : J1ICIN30A Module : FI-LOC

- TIV80 Table for Allocation of clearing accounts to cost accounts Table Type : POOL Package : FVVI Module : CRM

- TFK001B Table for Company Codes in Contract Accounts Receivable and Payable Table Type : TRANSP Package : FKKB Module : FI-CA

- IDPL_SI_TAX Table for Assign Tax Code for Self Invoices to Company Code Table Type : TRANSP Package : ID-FI-PL Module : FI-LOC

- J_7LC02 Table for REA Company Codes: Common Company Codes Table Type : TRANSP Package : J7LR Module : IS-REA-COR

- T5DP4 Table for Assignment PAISY Company - Superordinate Company Table Type : TRANSP Package : P01Y Module : PY-DE

- J_1ITRNACC Table for Transaction code vs accounts Table Type : TRANSP Package : J1I2 Module : FI-LOC

- CDBC_CODEPROFILG Table for CDB: Code Catalog: Code Groups for Code Group Profile Table Type : TRANSP Package : CDB Module : CRM-MSA

- COMC_CODEPROFILG Table for Code Catalog: Code Groups for Code Group Profile Table Type : TRANSP Package : QSKT Module : CRM-BF-CAT

- ANKP Table for Asset classes: Fld Cont Dpndnt on Chart of Depreciation Table Type : TRANSP Package : AA Module : CRM

- C410 Table for Chart of accts / Account key - acct assign for ED rev Table Type : TRANSP Package : OIH Module : CRM

- CNV_CHART_OF_ACC Table for ChtAccts Conversion: 'Old - New Chart of Accts' assignment Table Type : TRANSP Package : CNV_20100 Module : CA-GTF-BS

- CNV_20100_KONTO_NOT_UNIQUE Table Data element for G/L accounts NOT unique across all charts-of-accounts

- CURRA Table Data element for Planned currency for bank accounts/bank clearing accounts

- ACC_CHRT_ACCTS Table Data element for Chart of Accounts

- FIN_CHOFACCT Table Data element for Chart of Accounts

- LOKKT Table Data element for Account Number in the Local Chart of Accounts

- KTOPL Table Data element for Chart of Accounts

- CNVA_COA_KTOPL_OLD Table Data element for Old Chart of Accounts

- CNVA_COA_KTOPL_NEW Table Data element for New Chart of Accounts

- CNVA_COA_COPY Table Data element for Copy the Chart of Accounts

- CNV_COA_NEW Table Data element for New Chart of Accounts

- CNV_20100_IS_KTOPLFUNC Table Data element for Routine Converts a Chart of Accounts

- CNV_COA_OLD Table Data element for Old Chart of Accounts

Chart of accounts company code related terms

Definitions.

SAP is the short form of Systems, Applications & Products in Data Processing. It is one of the largest business process related software. This software focused on business processes on ERP & CRM.

Like most other software, SAP also using database tables to store the data. In SAP thousands of tables are there to store different data. A table contains several fields and some of the fields will be key fields.

Popular Table Searches

Latest table searches.

- TutorialKart

- SAP Tutorials

- Salesforce Admin

- Salesforce Developer

- Visualforce

- Informatica

- Kafka Tutorial

- Spark Tutorial

- Tomcat Tutorial

- Python Tkinter

Programming

- Bash Script

- Julia Tutorial

- CouchDB Tutorial

- MongoDB Tutorial

- PostgreSQL Tutorial

- Android Compose

- Flutter Tutorial

- Kotlin Android

Web & Server

- Selenium Java

- SAP FICO Training

- SAP FICO Tutorials

- SAP FICO - Introduction

- SAP Financial Accounting

- What is SAP FICO

- What is client in SAP

- SAP FICO - Enterprise Structure

- Define Company in SAP

- Define Company Code in SAP

- Assign company code to company in SAP

- Define business area and consolidation business area in SAP

- Assign business area to consolidated business area in SAP

- Define credit control area in SAP

- Assign company code to credit control area in SAP

- Define functional area in SAP

- Maintain Financial Management Area in SAP

- Assign financial management area to company code in SAP

- How to create segments in SAP

- SAP FICO - Global Parameters

- What is Chart of accounts and how to create COA in SAP?

- Assign company code to chart of accounts

- What is Fiscal year in SAP?

- How to maintain fiscal year variant

- Assign company code to fiscal year variant

- Define account group in SAP

- Define retained earnings account

- Define posting period variant (PPV)

- Assign variants to company code in SAP

- Open and closing posting period variants

- Define field status variant and field status groups in FICO

- Assign company code to field status variant

- Define Tolerance group for G/L accounts

- Define Tolerance group for employees

- Check company code global parameters

- SAP FICO - Foreign Currency Transactions

- Check exchange rate types

- Define translation ratios for currency translation

- How to maintain exchange rates in SAP

- Define accounts for exchange rate differences

- Define foreign currency valuation methods

- Define accounting principles and assign to ledger group

- Define valuation areas and assign to accounting principles

- SAP FICO - New G/L Accounting

- How to activate new G/L accounting?

- Define ledgers for general ledger accounting

- Define currencies for leading currency

- Define & Activate Non-Leading Ledgers

- Define Zero-balance clearing account

- Define interest calculation types

- Define interest indicator

- SAP FICO - Accounts Receivable

- Define account group for customers

- Maintain number ranges for customer account groups

- Assign number ranges to customer account groups

- Define risk categories

- Define tolerance group for Customers

- Create sundry debtors accounts

- Define Customer Master Record

- SAP FICO - Accounts Payable

- What is Accounts Payable in SAP?

- Define vendor account groups

- Maintain number range intervals for vendor accounts

- Assign number ranges to vendor account groups

- Create payment terms

- Define accounts for cash discount taken

- Define Vendor reconciliation account

- Create vendor code

- SAP FICO - Tax on Sales and Purchases

- What is Sales tax and Purchase tax in SAP?

- Define tax calculation procedures

- Assign country to calculation procedure

- Assign tax codes for non taxable transactions

- Maintain tax codes for sales and purchases

- Define tax accounts in SAP

- SAP FICO - Bank Accounting

- What is Bank Accounting in SAP?

- Define bank key

- Define house bank in SAP

- Create check lots

- Automatic payment program

- SAP FICO - Asset Accounting

- What is Asset Accounting in SAP?

- Define Chart of Depreciation

- Assign chart of depreciation to company code

- Specify Account Determination

- Number range intervals for Assets

- Maintain Asset Classes

- ADVERTISEMENT

- SAP Controlling Training

- SAP CO Tutorials

- SAP FI TCodes

- ❯ SAP FICO Tutorials

- ❯ Assign chart of depreciation to company code

How to Assign Chart of Depreciation to Company Code in SAP

In this SAP FICO tutorial you will learn how to assign chart of depreciation to company code in SAP, the link between chart of depreciation and company code is established through the assignment of chart of depreciation “TKCD” to company code “TK01”.’

How many chart of depreciation can be assigned to a company code?

One chart of depreciation can be assigned to only one company code, because chart of depreciation is highest hierarchy level of asset accounting in SAP . But one company code can be assigned to one or more chart of depreciation in asset accounting.

Assign Chart of Depreciation to Company Code

Transaction code: – OAOB SAP IMG Path: – SPRO > SAP Reference IMG > Financial Accounting > Asset Accounting > Organizational Structures > Assign chart of depreciation to company code .

Step 1: – Enter transaction code “ SPRO ” in the SAP command field and press enter to continue.

Step 2: – On customizing execute project screen, click on “SAP Reference IMG”

Step 3: – On display IMG screen, follow the menu path financial accounting – Asset accounting – organizational structures and click on img activity “assign chart of depreciation to company code”

Step 4: – To find out our company code “TK01” in the given list, click on position button and enter company code and press enter to continue.

Step 5: – On change view maintain company code in asset accounting overview screen, our company code TK01 displays on top of the screen. Now enter chart of depreciation key “TKCD” in the given field Chrt dep and press enter.

After assignment of chart of depreciation to company code, click on save button and save the configured details in SAP .

Popular Courses by TutorialKart

App developement, web development, online tools.

IMAGES

VIDEO

COMMENTS

Step 2) On change view "Assign company code -> chart of accounts" overivew screen, select position option and now enter company code in the given field. Now your company code displays on the top of screen. Step 3) Now assign Company code "TK01" to chart of accounts "TKCA" by updating your chart of accounts key in the Chrt/Accts field.

Step 2:- Select SAP Reference IMG. Step 3:- Follow the IMG menu path and select Assign Company Code to Chart of Account. Step 4:- Click on position. and update company code, and press enter to continue. Step 5:- Now, the company code "AD06" displays on top of the list. Update chart of accounts key in the Chrt/Accts field.

and in sub menu (of Preaprations) following options there : 1) Revise Chart of Accounts (only documentation) 2) Edit Chart of Accounts List. 3) Define Account Group. 4) Define Retained Earnings Account. also one more hierarchy is ther name as : Additional Activities , but no option for Assignment of company code to Chart of account (COA) now ...

Change Chart of Accounts Assignment to Company Code. The steps to change the COA of a company code that was created by copying another: Uncheck company code productive in "Company code global data". This can be found via SPRO -> Financial Accounting -> Financial accounting global settings -> Company Code -> Enter global parameters.

Step 1: Execute transaction code " OB62 " in the command field to assign the company code to the chart of accounts in SAP S4 Hana. Step 2: In the next screen, change the view " Assign company code" to the chart of accounts overview, click on the position button and enter the company code key in the given entry field.

The assignment of company code to the chart of accounts can be configured by using one following navigation method. IMG Menu Path :- SPRO > SAP Reference IMG > Implementation Guide -> Financial ...

Assign company code to Chart of Accounts (OB62)SPRO - SAP Reference IMG - Financial Accounting - General Ledger Accounting - GL Accounts - Master Data - Prep...

Chart of Account Assignment. ... Assign Chart of Accounts to Company code; Let us begin with step 1 and 2. COA is a 4 character Alphanumeric code. IMG Path: General Ledger Accounting →Master ...

In the next screen, select New Entries. In the next screen,Enter Following Data : Enter a unique Chart of Accounts Code , maximum length is four. Enter a Description for the Chart of Accounts. Enter Language in which the Chart of Accounts is created.All accounts have a description in this language.Master Data can only be displayed or maintained ...

It contains the parameters (such as the depreciation keys) that are used for calculating asset values in a given country. You have to assign each company code, in which assets are managed, to exactly one chart of depreciation. Assigning Assets. You have to enter a company code when you create an asset. This ensures that each asset is always ...

4. We have to use the chart of accounts for all company codes, if all the company codes are in the same country. 5. If the individual company code requires different COA, We can assign up to 2 COA, in addition to the operational COA. : - If the company codes are in multiple countries. Functions of COA.

Step 1 :-Enter transaction Code SPRO in the SAP command field and press enter. Step 2 :-Select SAP Reference IMG. Step 3 :-Follow IMG menu path and select Assign Company Code to Chart of Account. Step 4 :-Click on position and update company code and press enter. Step 5 :-Update chart of account key in the Chrt/Accts field. Step 6 :-Click on ...

3. Group Chart of Accounts. We use a group chart of accounts in SAP for consolidating all company codes with a dissimilar operating chart of accounts belonging to a company. However, the assignment of a group chart of accounts to a company code is not mandatory. We also call it the Corporate Chart of Accounts. You may like to read: Scenarios in ...

G/L Account: Company Code Settings. Before you can post to a G/L Account in a Company Code, you have to maintain the G/L Account at the Chart of Accounts view. You then create the Company Code-specific settings, which are only valid in the Company Code. An example of a Company Code-specific setting is defining the account currency.

__Assignment control requires that the currency, fiscal year variant, and chart of accounts are all maintained in the company code. At least one of these settings is not maintained in company code 2000.__ __Procedure__ __Complete data maintenance in company code 2000. Only then can you assign company code 2000 to controlling area SG01 possible.__

In SAP configuration like G/L account assignment happened at chart of accounts only. G/L account to be create at chart of accounts level then it is possible to extend at company code level. ... Assignment is elective to a company code. Credit Control Area. Path: SPRO - SAP reference IMG - Enterprise Structure - Definition - Define ...

A table contains several fields and some of the fields will be key fields. List of Chart of accounts company code tables in SAP. CNV_COA_CCODE for Assign 'old - new chart of accounts' per company code. GMCOA for Special GL accounts in chart of accounts for grants mgmt. GMGAAP for Special GL accounts in chart of accounts for GM GAAP.

The assignment of company code to the chart of accounts can be configured by using one following navigation method. IMG Menu Path :- SPRO > SAP Reference IMG > Implementation Guide -> Financial ...

The assignment of Chart of depreciation to a Company Code signals activation. of the asset accounting in that company code. Basic requirements in FI are. being checked at the time of activation and one such check is the tax. indicator. A reason for this check of tax indicator is.

balance of group chart of account. 2. In which scenario business use group chart of account. I know that it is used for group level . reporting, but when is advisable to use out of below scenario. - When there are two company Code with different operating chart of account and different . controlling area.

The company code is assigned to the operating concern indirectly through the assignment of the company to the controlling area ... With block indicator set on the chart of accounts, you can no longers perform postings to the company code assigned. ... The indicator blocks the accounts in the chart of accounts from being assigned to a company ...

One of the first things you learn in accounting 101 is the importance of the chart of accounts. The backbone of your entire business, the chart of accounts is where all of your general ledger ...

Step 2: - On customizing execute project screen, click on "SAP Reference IMG". Step 3: - On display IMG screen, follow the menu path financial accounting - Asset accounting - organizational structures and click on img activity "assign chart of depreciation to company code". Step 4: - To find out our company code "TK01" in ...

Addresses (Business Address Services) Basis - Address Management/Business Address: Transparent Table 22 : TRDIR Generierte Tabelle zu einem View Basis - Syntax, Compiler, Runtime: General View Structure 23 : SKA1 G/L Account Master (chart of accounts) FI - Financial Accounting: Transparent Table 24 : VBRP Billing Document: Item Data SD - Billing