Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

1.3 The Economists’ Tool Kit

Learning objectives.

- Explain how economists test hypotheses, develop economic theories, and use models in their analyses.

- Explain how the all-other-things unchanged (ceteris paribus) problem and the fallacy of false cause affect the testing of economic hypotheses and how economists try to overcome these problems.

- Distinguish between normative and positive statements.

Economics differs from other social sciences because of its emphasis on opportunity cost, the assumption of maximization in terms of one’s own self-interest, and the analysis of choices at the margin. But certainly much of the basic methodology of economics and many of its difficulties are common to every social science—indeed, to every science. This section explores the application of the scientific method to economics.

Researchers often examine relationships between variables. A variable is something whose value can change. By contrast, a constant is something whose value does not change. The speed at which a car is traveling is an example of a variable. The number of minutes in an hour is an example of a constant.

Research is generally conducted within a framework called the scientific method , a systematic set of procedures through which knowledge is created. In the scientific method, hypotheses are suggested and then tested. A hypothesis is an assertion of a relationship between two or more variables that could be proven to be false. A statement is not a hypothesis if no conceivable test could show it to be false. The statement “Plants like sunshine” is not a hypothesis; there is no way to test whether plants like sunshine or not, so it is impossible to prove the statement false. The statement “Increased solar radiation increases the rate of plant growth” is a hypothesis; experiments could be done to show the relationship between solar radiation and plant growth. If solar radiation were shown to be unrelated to plant growth or to retard plant growth, then the hypothesis would be demonstrated to be false.

If a test reveals that a particular hypothesis is false, then the hypothesis is rejected or modified. In the case of the hypothesis about solar radiation and plant growth, we would probably find that more sunlight increases plant growth over some range but that too much can actually retard plant growth. Such results would lead us to modify our hypothesis about the relationship between solar radiation and plant growth.

If the tests of a hypothesis yield results consistent with it, then further tests are conducted. A hypothesis that has not been rejected after widespread testing and that wins general acceptance is commonly called a theory . A theory that has been subjected to even more testing and that has won virtually universal acceptance becomes a law . We will examine two economic laws in the next two chapters.

Even a hypothesis that has achieved the status of a law cannot be proven true. There is always a possibility that someone may find a case that invalidates the hypothesis. That possibility means that nothing in economics, or in any other social science, or in any science, can ever be proven true. We can have great confidence in a particular proposition, but it is always a mistake to assert that it is “proven.”

Models in Economics

All scientific thought involves simplifications of reality. The real world is far too complex for the human mind—or the most powerful computer—to consider. Scientists use models instead. A model is a set of simplifying assumptions about some aspect of the real world. Models are always based on assumed conditions that are simpler than those of the real world, assumptions that are necessarily false. A model of the real world cannot be the real world.

We will encounter our first economic model in Chapter 35 “Appendix A: Graphs in Economics” . For that model, we will assume that an economy can produce only two goods. Then we will explore the model of demand and supply. One of the assumptions we will make there is that all the goods produced by firms in a particular market are identical. Of course, real economies and real markets are not that simple. Reality is never as simple as a model; one point of a model is to simplify the world to improve our understanding of it.

Economists often use graphs to represent economic models. The appendix to this chapter provides a quick, refresher course, if you think you need one, on understanding, building, and using graphs.

Models in economics also help us to generate hypotheses about the real world. In the next section, we will examine some of the problems we encounter in testing those hypotheses.

Testing Hypotheses in Economics

Here is a hypothesis suggested by the model of demand and supply: an increase in the price of gasoline will reduce the quantity of gasoline consumers demand. How might we test such a hypothesis?

Economists try to test hypotheses such as this one by observing actual behavior and using empirical (that is, real-world) data. The average retail price of gasoline in the United States rose from an average of $2.12 per gallon on May 22, 2005 to $2.88 per gallon on May 22, 2006. The number of gallons of gasoline consumed by U.S. motorists rose 0.3% during that period.

The small increase in the quantity of gasoline consumed by motorists as its price rose is inconsistent with the hypothesis that an increased price will lead to an reduction in the quantity demanded. Does that mean that we should dismiss the original hypothesis? On the contrary, we must be cautious in assessing this evidence. Several problems exist in interpreting any set of economic data. One problem is that several things may be changing at once; another is that the initial event may be unrelated to the event that follows. The next two sections examine these problems in detail.

The All-Other-Things-Unchanged Problem

The hypothesis that an increase in the price of gasoline produces a reduction in the quantity demanded by consumers carries with it the assumption that there are no other changes that might also affect consumer demand. A better statement of the hypothesis would be: An increase in the price of gasoline will reduce the quantity consumers demand, ceteris paribus. Ceteris paribus is a Latin phrase that means “all other things unchanged.”

But things changed between May 2005 and May 2006. Economic activity and incomes rose both in the United States and in many other countries, particularly China, and people with higher incomes are likely to buy more gasoline. Employment rose as well, and people with jobs use more gasoline as they drive to work. Population in the United States grew during the period. In short, many things happened during the period, all of which tended to increase the quantity of gasoline people purchased.

Our observation of the gasoline market between May 2005 and May 2006 did not offer a conclusive test of the hypothesis that an increase in the price of gasoline would lead to a reduction in the quantity demanded by consumers. Other things changed and affected gasoline consumption. Such problems are likely to affect any analysis of economic events. We cannot ask the world to stand still while we conduct experiments in economic phenomena. Economists employ a variety of statistical methods to allow them to isolate the impact of single events such as price changes, but they can never be certain that they have accurately isolated the impact of a single event in a world in which virtually everything is changing all the time.

In laboratory sciences such as chemistry and biology, it is relatively easy to conduct experiments in which only selected things change and all other factors are held constant. The economists’ laboratory is the real world; thus, economists do not generally have the luxury of conducting controlled experiments.

The Fallacy of False Cause

Hypotheses in economics typically specify a relationship in which a change in one variable causes another to change. We call the variable that responds to the change the dependent variable ; the variable that induces a change is called the independent variable . Sometimes the fact that two variables move together can suggest the false conclusion that one of the variables has acted as an independent variable that has caused the change we observe in the dependent variable.

Consider the following hypothesis: People wearing shorts cause warm weather. Certainly, we observe that more people wear shorts when the weather is warm. Presumably, though, it is the warm weather that causes people to wear shorts rather than the wearing of shorts that causes warm weather; it would be incorrect to infer from this that people cause warm weather by wearing shorts.

Reaching the incorrect conclusion that one event causes another because the two events tend to occur together is called the fallacy of false cause . The accompanying essay on baldness and heart disease suggests an example of this fallacy.

Because of the danger of the fallacy of false cause, economists use special statistical tests that are designed to determine whether changes in one thing actually do cause changes observed in another. Given the inability to perform controlled experiments, however, these tests do not always offer convincing evidence that persuades all economists that one thing does, in fact, cause changes in another.

In the case of gasoline prices and consumption between May 2005 and May 2006, there is good theoretical reason to believe the price increase should lead to a reduction in the quantity consumers demand. And economists have tested the hypothesis about price and the quantity demanded quite extensively. They have developed elaborate statistical tests aimed at ruling out problems of the fallacy of false cause. While we cannot prove that an increase in price will, ceteris paribus, lead to a reduction in the quantity consumers demand, we can have considerable confidence in the proposition.

Normative and Positive Statements

Two kinds of assertions in economics can be subjected to testing. We have already examined one, the hypothesis. Another testable assertion is a statement of fact, such as “It is raining outside” or “Microsoft is the largest producer of operating systems for personal computers in the world.” Like hypotheses, such assertions can be demonstrated to be false. Unlike hypotheses, they can also be shown to be correct. A statement of fact or a hypothesis is a positive statement .

Although people often disagree about positive statements, such disagreements can ultimately be resolved through investigation. There is another category of assertions, however, for which investigation can never resolve differences. A normative statement is one that makes a value judgment. Such a judgment is the opinion of the speaker; no one can “prove” that the statement is or is not correct. Here are some examples of normative statements in economics: “We ought to do more to help the poor.” “People in the United States should save more.” “Corporate profits are too high.” The statements are based on the values of the person who makes them. They cannot be proven false.

Because people have different values, normative statements often provoke disagreement. An economist whose values lead him or her to conclude that we should provide more help for the poor will disagree with one whose values lead to a conclusion that we should not. Because no test exists for these values, these two economists will continue to disagree, unless one persuades the other to adopt a different set of values. Many of the disagreements among economists are based on such differences in values and therefore are unlikely to be resolved.

Key Takeaways

- Economists try to employ the scientific method in their research.

- Scientists cannot prove a hypothesis to be true; they can only fail to prove it false.

- Economists, like other social scientists and scientists, use models to assist them in their analyses.

- Two problems inherent in tests of hypotheses in economics are the all-other-things-unchanged problem and the fallacy of false cause.

- Positive statements are factual and can be tested. Normative statements are value judgments that cannot be tested. Many of the disagreements among economists stem from differences in values.

Look again at the data in Table 1.1 “LSAT Scores and Undergraduate Majors” . Now consider the hypothesis: “Majoring in economics will result in a higher LSAT score.” Are the data given consistent with this hypothesis? Do the data prove that this hypothesis is correct? What fallacy might be involved in accepting the hypothesis?

Case in Point: Does Baldness Cause Heart Disease?

Mark Hunter – bald – CC BY-NC-ND 2.0.

A website called embarrassingproblems.com received the following email:

What did Dr. Margaret answer? Most importantly, she did not recommend that the questioner take drugs to treat his baldness, because doctors do not think that the baldness causes the heart disease. A more likely explanation for the association between baldness and heart disease is that both conditions are affected by an underlying factor. While noting that more research needs to be done, one hypothesis that Dr. Margaret offers is that higher testosterone levels might be triggering both the hair loss and the heart disease. The good news for people with early balding (which is really where the association with increased risk of heart disease has been observed) is that they have a signal that might lead them to be checked early on for heart disease.

Source: http://www.embarrassingproblems.com/problems/problempage230701.htm .

Answer to Try It! Problem

The data are consistent with the hypothesis, but it is never possible to prove that a hypothesis is correct. Accepting the hypothesis could involve the fallacy of false cause; students who major in economics may already have the analytical skills needed to do well on the exam.

Principles of Economics Copyright © 2016 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

1.3 How Economists Use Theories and Models to Understand Economic Issues

Learning objectives.

By the end of this section, you will be able to:

- Interpret a circular flow diagram

- Explain the importance of economic theories and models

- Describe goods and services markets and labor markets

John Maynard Keynes (1883–1946), one of the greatest economists of the twentieth century, pointed out that economics is not just a subject area but also a way of thinking. Keynes ( Figure 1.6 ) famously wrote in the introduction to a fellow economist’s book: “[Economics] is a method rather than a doctrine, an apparatus of the mind, a technique of thinking, which helps its possessor to draw correct conclusions.” In other words, economics teaches you how to think, not what to think.

Watch this video about John Maynard Keynes and his influence on economics.

Economists see the world through a different lens than anthropologists, biologists, classicists, or practitioners of any other discipline. They analyze issues and problems using economic theories that are based on particular assumptions about human behavior. These assumptions tend to be different than the assumptions an anthropologist or psychologist might use. A theory is a simplified representation of how two or more variables interact with each other. The purpose of a theory is to take a complex, real-world issue and simplify it down to its essentials. If done well, this enables the analyst to understand the issue and any problems around it. A good theory is simple enough to understand, while complex enough to capture the key features of the object or situation you are studying.

Sometimes economists use the term model instead of theory. Strictly speaking, a theory is a more abstract representation, while a model is a more applied or empirical representation. We use models to test theories, but for this course we will use the terms interchangeably.

For example, an architect who is planning a major office building will often build a physical model that sits on a tabletop to show how the entire city block will look after the new building is constructed. Companies often build models of their new products, which are more rough and unfinished than the final product, but can still demonstrate how the new product will work.

A good model to start with in economics is the circular flow diagram ( Figure 1.7 ). It pictures the economy as consisting of two groups—households and firms—that interact in two markets: the goods and services market in which firms sell and households buy and the labor market in which households sell labor to business firms or other employees.

Firms produce and sell goods and services to households in the market for goods and services (or product market). Arrow “A” indicates this. Households pay for goods and services, which becomes the revenues to firms. Arrow “B” indicates this. Arrows A and B represent the two sides of the product market. Where do households obtain the income to buy goods and services? They provide the labor and other resources (e.g., land, capital, raw materials) firms need to produce goods and services in the market for inputs (or factors of production). Arrow “C” indicates this. In return, firms pay for the inputs (or resources) they use in the form of wages and other factor payments. Arrow “D” indicates this. Arrows “C” and “D” represent the two sides of the factor market.

Of course, in the real world, there are many different markets for goods and services and markets for many different types of labor. The circular flow diagram simplifies this to make the picture easier to grasp. In the diagram, firms produce goods and services, which they sell to households in return for revenues. The outer circle shows this, and represents the two sides of the product market (for example, the market for goods and services) in which households demand and firms supply. Households sell their labor as workers to firms in return for wages, salaries, and benefits. The inner circle shows this and represents the two sides of the labor market in which households supply and firms demand.

This version of the circular flow model is stripped down to the essentials, but it has enough features to explain how the product and labor markets work in the economy. We could easily add details to this basic model if we wanted to introduce more real-world elements, like financial markets, governments, and interactions with the rest of the globe (imports and exports).

Economists carry a set of theories in their heads like a carpenter carries around a toolkit. When they see an economic issue or problem, they go through the theories they know to see if they can find one that fits. Then they use the theory to derive insights about the issue or problem. Economists express theories as diagrams, graphs, or even as mathematical equations. (Do not worry. In this course, we will mostly use graphs.) Economists do not figure out the answer to the problem first and then draw the graph to illustrate. Rather, they use the graph of the theory to help them figure out the answer. Although at the introductory level, you can sometimes figure out the right answer without applying a model, if you keep studying economics, before too long you will run into issues and problems that you will need to graph to solve. We explain both micro and macroeconomics in terms of theories and models. The most well-known theories are probably those of supply and demand, but you will learn a number of others.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Authors: Steven A. Greenlaw, David Shapiro, Daniel MacDonald

- Publisher/website: OpenStax

- Book title: Principles of Economics 3e

- Publication date: Dec 14, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Section URL: https://openstax.org/books/principles-economics-3e/pages/1-3-how-economists-use-theories-and-models-to-understand-economic-issues

© Jan 23, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- More from M-W

- To save this word, you'll need to log in. Log In

Definition of hypothesis

Did you know.

The Difference Between Hypothesis and Theory

A hypothesis is an assumption, an idea that is proposed for the sake of argument so that it can be tested to see if it might be true.

In the scientific method, the hypothesis is constructed before any applicable research has been done, apart from a basic background review. You ask a question, read up on what has been studied before, and then form a hypothesis.

A hypothesis is usually tentative; it's an assumption or suggestion made strictly for the objective of being tested.

A theory , in contrast, is a principle that has been formed as an attempt to explain things that have already been substantiated by data. It is used in the names of a number of principles accepted in the scientific community, such as the Big Bang Theory . Because of the rigors of experimentation and control, it is understood to be more likely to be true than a hypothesis is.

In non-scientific use, however, hypothesis and theory are often used interchangeably to mean simply an idea, speculation, or hunch, with theory being the more common choice.

Since this casual use does away with the distinctions upheld by the scientific community, hypothesis and theory are prone to being wrongly interpreted even when they are encountered in scientific contexts—or at least, contexts that allude to scientific study without making the critical distinction that scientists employ when weighing hypotheses and theories.

The most common occurrence is when theory is interpreted—and sometimes even gleefully seized upon—to mean something having less truth value than other scientific principles. (The word law applies to principles so firmly established that they are almost never questioned, such as the law of gravity.)

This mistake is one of projection: since we use theory in general to mean something lightly speculated, then it's implied that scientists must be talking about the same level of uncertainty when they use theory to refer to their well-tested and reasoned principles.

The distinction has come to the forefront particularly on occasions when the content of science curricula in schools has been challenged—notably, when a school board in Georgia put stickers on textbooks stating that evolution was "a theory, not a fact, regarding the origin of living things." As Kenneth R. Miller, a cell biologist at Brown University, has said , a theory "doesn’t mean a hunch or a guess. A theory is a system of explanations that ties together a whole bunch of facts. It not only explains those facts, but predicts what you ought to find from other observations and experiments.”

While theories are never completely infallible, they form the basis of scientific reasoning because, as Miller said "to the best of our ability, we’ve tested them, and they’ve held up."

- proposition

- supposition

hypothesis , theory , law mean a formula derived by inference from scientific data that explains a principle operating in nature.

hypothesis implies insufficient evidence to provide more than a tentative explanation.

theory implies a greater range of evidence and greater likelihood of truth.

law implies a statement of order and relation in nature that has been found to be invariable under the same conditions.

Examples of hypothesis in a Sentence

These examples are programmatically compiled from various online sources to illustrate current usage of the word 'hypothesis.' Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Send us feedback about these examples.

Word History

Greek, from hypotithenai to put under, suppose, from hypo- + tithenai to put — more at do

1641, in the meaning defined at sense 1a

Phrases Containing hypothesis

- counter - hypothesis

- nebular hypothesis

- null hypothesis

- planetesimal hypothesis

- Whorfian hypothesis

Articles Related to hypothesis

This is the Difference Between a...

This is the Difference Between a Hypothesis and a Theory

In scientific reasoning, they're two completely different things

Dictionary Entries Near hypothesis

hypothermia

hypothesize

Cite this Entry

“Hypothesis.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/hypothesis. Accessed 4 May. 2024.

Kids Definition

Kids definition of hypothesis, medical definition, medical definition of hypothesis, more from merriam-webster on hypothesis.

Nglish: Translation of hypothesis for Spanish Speakers

Britannica English: Translation of hypothesis for Arabic Speakers

Britannica.com: Encyclopedia article about hypothesis

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

More commonly misspelled words, commonly misspelled words, how to use em dashes (—), en dashes (–) , and hyphens (-), absent letters that are heard anyway, how to use accents and diacritical marks, popular in wordplay, 12 star wars words, the words of the week - may 3, 9 superb owl words, 10 words for lesser-known games and sports, your favorite band is in the dictionary, games & quizzes.

- Economic Glossary

- Depression Defined

- Introduction to Economics

- Microeconomics

- Macroeconomics

Economic Definition of hypothesis . Defined.

Offline Version : PDF

Term hypothesis Definition : A reasonable proposition about the workings of the world that's inspired or implied by a theory and which may or may not be true. An hypothesis is essentially a prediction made by a theory that can be compared with observations in the real world. Hypotheses usually take the form: "If A, the also B." The essence of the scientific method is to test, or verify, hypotheses against real world data. If supported by data over and over again, hypotheses become principles.

« hyperinflation | hysteresis »

Permalink : https://glossary.econguru.com/economic-term/hypothesis

Alphabetical Reference to Over 2,000 Economic Terms

© 2007, 2008 Glossary.EconGuru.com . All rights reserved. Privacy Policy | Terms of Use | Disclaimer | Contact Us

Definition of a Hypothesis

What it is and how it's used in sociology

- Key Concepts

- Major Sociologists

- News & Issues

- Research, Samples, and Statistics

- Recommended Reading

- Archaeology

A hypothesis is a prediction of what will be found at the outcome of a research project and is typically focused on the relationship between two different variables studied in the research. It is usually based on both theoretical expectations about how things work and already existing scientific evidence.

Within social science, a hypothesis can take two forms. It can predict that there is no relationship between two variables, in which case it is a null hypothesis . Or, it can predict the existence of a relationship between variables, which is known as an alternative hypothesis.

In either case, the variable that is thought to either affect or not affect the outcome is known as the independent variable, and the variable that is thought to either be affected or not is the dependent variable.

Researchers seek to determine whether or not their hypothesis, or hypotheses if they have more than one, will prove true. Sometimes they do, and sometimes they do not. Either way, the research is considered successful if one can conclude whether or not a hypothesis is true.

Null Hypothesis

A researcher has a null hypothesis when she or he believes, based on theory and existing scientific evidence, that there will not be a relationship between two variables. For example, when examining what factors influence a person's highest level of education within the U.S., a researcher might expect that place of birth, number of siblings, and religion would not have an impact on the level of education. This would mean the researcher has stated three null hypotheses.

Alternative Hypothesis

Taking the same example, a researcher might expect that the economic class and educational attainment of one's parents, and the race of the person in question are likely to have an effect on one's educational attainment. Existing evidence and social theories that recognize the connections between wealth and cultural resources , and how race affects access to rights and resources in the U.S. , would suggest that both economic class and educational attainment of the one's parents would have a positive effect on educational attainment. In this case, economic class and educational attainment of one's parents are independent variables, and one's educational attainment is the dependent variable—it is hypothesized to be dependent on the other two.

Conversely, an informed researcher would expect that being a race other than white in the U.S. is likely to have a negative impact on a person's educational attainment. This would be characterized as a negative relationship, wherein being a person of color has a negative effect on one's educational attainment. In reality, this hypothesis proves true, with the exception of Asian Americans , who go to college at a higher rate than whites do. However, Blacks and Hispanics and Latinos are far less likely than whites and Asian Americans to go to college.

Formulating a Hypothesis

Formulating a hypothesis can take place at the very beginning of a research project , or after a bit of research has already been done. Sometimes a researcher knows right from the start which variables she is interested in studying, and she may already have a hunch about their relationships. Other times, a researcher may have an interest in a particular topic, trend, or phenomenon, but he may not know enough about it to identify variables or formulate a hypothesis.

Whenever a hypothesis is formulated, the most important thing is to be precise about what one's variables are, what the nature of the relationship between them might be, and how one can go about conducting a study of them.

Updated by Nicki Lisa Cole, Ph.D

- What Is a Hypothesis? (Science)

- Understanding Path Analysis

- Null Hypothesis Examples

- What Are the Elements of a Good Hypothesis?

- What It Means When a Variable Is Spurious

- What 'Fail to Reject' Means in a Hypothesis Test

- How Intervening Variables Work in Sociology

- Null Hypothesis Definition and Examples

- Understanding Simple vs Controlled Experiments

- Scientific Method Vocabulary Terms

- Null Hypothesis and Alternative Hypothesis

- Six Steps of the Scientific Method

- What Are Examples of a Hypothesis?

- Structural Equation Modeling

- Scientific Method Flow Chart

- Lambda and Gamma as Defined in Sociology

Life-Cycle Hypothesis

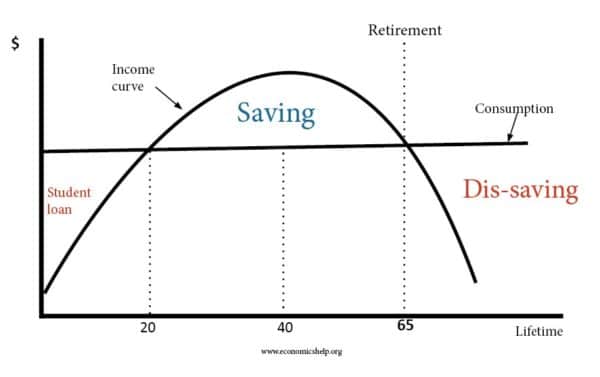

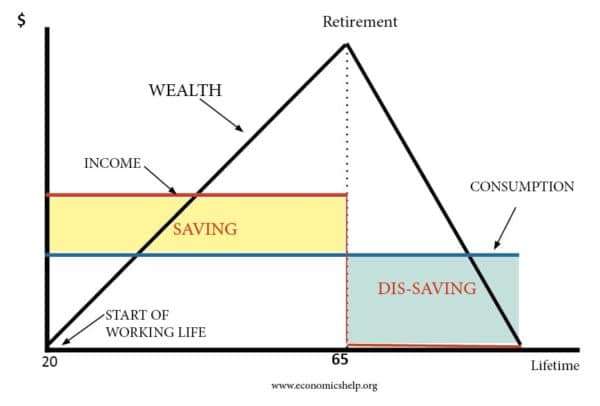

Definition: The Life-cycle hypothesis was developed by Franco Modigliani in 1957. The theory states that individuals seek to smooth consumption over the course of a lifetime – borrowing in times of low-income and saving during periods of high income.

- As a student, it is rational to borrow to fund education.

- Then during your working life, you pay off student loans and begin saving for your retirement.

- This saving during working life enables you to maintain similar levels of income during your retirement.

It suggests wealth will build up in working age, but then fall in retirement.

Wealth in the Life-Cycle Hypothesis

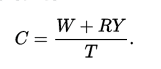

The theory states consumption will be a function of wealth, expected lifetime earnings and the number of years until retirement.

Consumption will depend on

- C= consumption

- R = Years until retirement. Remaining years of work

- T= Remaining years of life

It suggests for the whole economy consumption will be a function of both wealth and income.

Prior to life-cycle theories, it was assumed that consumption was a function of income. For example, the Keynesian consumption function saw a more direct link between income and spending.

However, this failed to account for how consumption may vary depending on the position in life-cycle.

Motivation for life-cycle consumption patterns

- Diminishing marginal utility of income. If income is high during working life, there is a diminishing marginal utility of spending extra money at that particular time.

- Harder to work and earn money, in old age. Life Cycle enables people to work hard and spend less.

Does the Life-cycle theory happen in reality?

Mervyn King suggests life-cycle consumption patterns can be found in approx 75% of the population. However, 20-25% don’t plan in the long term. (NBER paper on economics of saving )

Reasons for why people don’t smooth consumption over a lifetime.

- Present focus bias – People can find it hard to value income a long time in the future

- Inertia and status quo bias . Planning for retirement requires effort, forward thinking and knowledge of financial instruments such as pensions. People may prefer to procrastinate – even though they know they should save more – and so saving gets put off.

Criticisms of Life Cycle Theory

- It assumes people run down wealth in old age, but often this doesn’t happen as people would like to pass on inherited wealth to children. Also, there can be an attachment to wealth and an unwillingness to run it down. See: Prospect theory and the endowment effect.

- It assumes people are rational and forward planning. Behavioural economics suggests many people have motivations to avoid planning.

- People may lack the self-control to reduce spending now and save more for future.

- Life-cycle is easier for people on high incomes. They are more likely to have financial knowledge, also they have the ‘luxury’ of being able to save. People on low-incomes, with high credit card debts, may feel there is no disposable income to save.

- Leisure. Rather than smoothing out consumption, individuals may prefer to smooth out leisure – working fewer hours during working age, and continuing to work part-time in retirement.

- Government means-tested benefits for old-age people may provide an incentive not to save because lower savings will lead to more social security payments.

Other theories

- Permanent income hypothesis of Milton Friedman – This states people only spend more when they see it as an increase in permanent income.

- Ricardian Equivalence – consumers may see tax cuts as only a temporary rise in income so will not alter spending.

- Autonomous consumption – In Keynesian consumption function, the level of consumption that is independent of income.

- Marginal propensity to consume – how much of extra income is spent.

15 thoughts on “Life-Cycle Hypothesis”

Thanks for the reminder of the theory… Am a moi university Economic student in Nairobi Kenya.

Thanks for the most summarised note ever. it will help me with presentation. Gulu university. JALON

prof premraj pushpakaran writes — 2018 marks the 100th birth year of Franco Modigliani!!!

Thanks for the analysis on the hypothesis

Nice piece of work for economist. Been applicable in my presentation at Kyambogo university Uganda

This piece of paper is very important as far as consumption is concerned…

This piece is the best I have seen so far, this is a great work

Thanks for this work.it Will help me in my presentation at metropolitan international University

Very coincise and well articulated. This work reconnects me with themechanics of consumption theories. I appreaciate for a job well done.

Very nice and comprensive information. It will help me in my exams at university of jos Nigeria, studying economics

thank u for the summarized notes,it will help me in my exam at Kibabii university

Great job. Thanks for this masterpiece.

Good job. Thanks for this masterpiece. It reconnects me with the consumption theories.

A good summarised piece of work on life cycle hypothesis, it will help me in my group presentation. Kenyatta University economics student.

Comments are closed.

What is Hypothesis? Definition, Meaning, Characteristics, Sources

- Post last modified: 10 January 2022

- Reading time: 18 mins read

- Post category: Research Methodology

- What is Hypothesis?

Hypothesis is a prediction of the outcome of a study. Hypotheses are drawn from theories and research questions or from direct observations. In fact, a research problem can be formulated as a hypothesis. To test the hypothesis we need to formulate it in terms that can actually be analysed with statistical tools.

As an example, if we want to explore whether using a specific teaching method at school will result in better school marks (research question), the hypothesis could be that the mean school marks of students being taught with that specific teaching method will be higher than of those being taught using other methods.

In this example, we stated a hypothesis about the expected differences between groups. Other hypotheses may refer to correlations between variables.

Table of Content

- 1 What is Hypothesis?

- 2 Hypothesis Definition

- 3 Meaning of Hypothesis

- 4.1 Conceptual Clarity

- 4.2 Need of empirical referents

- 4.3 Hypothesis should be specific

- 4.4 Hypothesis should be within the ambit of the available research techniques

- 4.5 Hypothesis should be consistent with the theory

- 4.6 Hypothesis should be concerned with observable facts and empirical events

- 4.7 Hypothesis should be simple

- 5.1 Observation

- 5.2 Analogies

- 5.4 State of Knowledge

- 5.5 Culture

- 5.6 Continuity of Research

- 6.1 Null Hypothesis

- 6.2 Alternative Hypothesis

Thus, to formulate a hypothesis, we need to refer to the descriptive statistics (such as the mean final marks), and specify a set of conditions about these statistics (such as a difference between the means, or in a different example, a positive or negative correlation). The hypothesis we formulate applies to the population of interest.

The null hypothesis makes a statement that no difference exists (see Pyrczak, 1995, pp. 75-84).

Hypothesis Definition

A hypothesis is ‘a guess or supposition as to the existence of some fact or law which will serve to explain a connection of facts already known to exist.’ – J. E. Creighton & H. R. Smart

Hypothesis is ‘a proposition not known to be definitely true or false, examined for the sake of determining the consequences which would follow from its truth.’ – Max Black

Hypothesis is ‘a proposition which can be put to a test to determine validity and is useful for further research.’ – W. J. Goode and P. K. Hatt

A hypothesis is a proposition, condition or principle which is assumed, perhaps without belief, in order to draw out its logical consequences and by this method to test its accord with facts which are known or may be determined. – Webster’s New International Dictionary of the English Language (1956)

Meaning of Hypothesis

From the above mentioned definitions of hypothesis, its meaning can be explained in the following ways.

- At the primary level, a hypothesis is the possible and probable explanation of the sequence of happenings or data.

- Sometimes, hypothesis may emerge from an imagination, common sense or a sudden event.

- Hypothesis can be a probable answer to the research problem undertaken for study. 4. Hypothesis may not always be true. It can get disproven. In other words, hypothesis need not always be a true proposition.

- Hypothesis, in a sense, is an attempt to present the interrelations that exist in the available data or information.

- Hypothesis is not an individual opinion or community thought. Instead, it is a philosophical means which is to be used for research purpose. Hypothesis is not to be considered as the ultimate objective; rather it is to be taken as the means of explaining scientifically the prevailing situation.

The concept of hypothesis can further be explained with the help of some examples. Lord Keynes, in his theory of national income determination, made a hypothesis about the consumption function. He stated that the consumption expenditure of an individual or an economy as a whole is dependent on the level of income and changes in a certain proportion.

Later, this proposition was proved in the statistical research carried out by Prof. Simon Kuznets. Matthus, while studying the population, formulated a hypothesis that population increases faster than the supply of food grains. Population studies of several countries revealed that this hypothesis is true.

Validation of the Malthus’ hypothesis turned it into a theory and when it was tested in many other countries it became the famous Malthus’ Law of Population. It thus emerges that when a hypothesis is tested and proven, it becomes a theory. The theory, when found true in different times and at different places, becomes the law. Having understood the concept of hypothesis, few hypotheses can be formulated in the areas of commerce and economics.

- Population growth moderates with the rise in per capita income.

- Sales growth is positively linked with the availability of credit.

- Commerce education increases the employability of the graduate students.

- High rates of direct taxes prompt people to evade taxes.

- Good working conditions improve the productivity of employees.

- Advertising is the most effecting way of promoting sales than any other scheme.

- Higher Debt-Equity Ratio increases the probability of insolvency.

- Economic reforms in India have made the public sector banks more efficient and competent.

- Foreign direct investment in India has moved in those sectors which offer higher rate of profit.

- There is no significant association between credit rating and investment of fund.

Characteristics of Hypothesis

Not all the hypotheses are good and useful from the point of view of research. It is only a few hypotheses satisfying certain criteria that are good, useful and directive in the research work undertaken. The characteristics of such a useful hypothesis can be listed as below:

Conceptual Clarity

Need of empirical referents, hypothesis should be specific, hypothesis should be within the ambit of the available research techniques, hypothesis should be consistent with the theory, hypothesis should be concerned with observable facts and empirical events, hypothesis should be simple.

The concepts used while framing hypothesis should be crystal clear and unambiguous. Such concepts must be clearly defined so that they become lucid and acceptable to everyone. How are the newly developed concepts interrelated and how are they linked with the old one is to be very clear so that the hypothesis framed on their basis also carries the same clarity.

A hypothesis embodying unclear and ambiguous concepts can to a great extent undermine the successful completion of the research work.

A hypothesis can be useful in the research work undertaken only when it has links with some empirical referents. Hypothesis based on moral values and ideals are useless as they cannot be tested. Similarly, hypothesis containing opinions as good and bad or expectation with respect to something are not testable and therefore useless.

For example, ‘current account deficit can be lowered if people change their attitude towards gold’ is a hypothesis encompassing expectation. In case of such a hypothesis, the attitude towards gold is something which cannot clearly be described and therefore a hypothesis which embodies such an unclean thing cannot be tested and proved or disproved. In short, the hypothesis should be linked with some testable referents.

For the successful conduction of research, it is necessary that the hypothesis is specific and presented in a precise manner. Hypothesis which is general, too ambitious and grandiose in scope is not to be made as such hypothesis cannot be easily put to test. A hypothesis is to be based on such concepts which are precise and empirical in nature. A hypothesis should give a clear idea about the indicators which are to be used.

For example, a hypothesis that economic power is increasingly getting concentrated in a few hands in India should enable us to define the concept of economic power. It should be explicated in terms of measurable indicator like income, wealth, etc. Such specificity in the formulation of a hypothesis ensures that the research is practicable and significant.

While framing the hypothesis, the researcher should be aware of the available research techniques and should see that the hypothesis framed is testable on the basis of them. In other words, a hypothesis should be researchable and for this it is important that a due thought has been given to the methods and techniques which can be used to measure the concepts and variables embodied in the hypothesis.

It does not however mean that hypotheses which are not testable with the available techniques of research are not to be made. If the problem is too significant and therefore the hypothesis framed becomes too ambitious and complex, it’s testing becomes possible with the development of new research techniques or the hypothesis itself leads to the development of new research techniques.

A hypothesis must be related to the existing theory or should have a theoretical orientation. The growth of knowledge takes place in the sequence of facts, hypothesis, theory and law or principles. It means the hypothesis should have a correspondence with the existing facts and theory.

If the hypothesis is related to some theory, the research work will enable us to support, modify or refute the existing theory. Theoretical orientation of the hypothesis ensures that it becomes scientifically useful. According to Prof. Goode and Prof. Hatt, research work can contribute to the existing knowledge only when the hypothesis is related with some theory.

This enables us to explain the observed facts and situations and also verify the framed hypothesis. In the words of Prof. Cohen and Prof. Nagel, “hypothesis must be formulated in such a manner that deduction can be made from it and that consequently a decision can be reached as to whether it does or does not explain the facts considered.”

If the research work based on a hypothesis is to be successful, it is necessary that the later is as simple and easy as possible. An ambition of finding out something new may lead the researcher to frame an unrealistic and unclear hypothesis. Such a temptation is to be avoided. Framing a simple, easy and testable hypothesis requires that the researcher is well acquainted with the related concepts.

Sources of Hypothesis

Hypotheses can be derived from various sources. Some of the sources is given below:

Observation

State of knowledge, continuity of research.

Hypotheses can be derived from observation from the observation of price behavior in a market. For example the relationship between the price and demand for an article is hypothesized.

Analogies are another source of useful hypotheses. Julian Huxley has pointed out that casual observations in nature or in the framework of another science may be a fertile source of hypotheses. For example, the hypotheses that similar human types or activities may be found in similar geophysical regions come from plant ecology.

This is one of the main sources of hypotheses. It gives direction to research by stating what is known logical deduction from theory lead to new hypotheses. For example, profit / wealth maximization is considered as the goal of private enterprises. From this assumption various hypotheses are derived’.

An important source of hypotheses is the state of knowledge in any particular science where formal theories exist hypotheses can be deduced. If the hypotheses are rejected theories are scarce hypotheses are generated from conception frameworks.

Another source of hypotheses is the culture on which the researcher was nurtured. Western culture has induced the emergence of sociology as an academic discipline over the past decade, a large part of the hypotheses on American society examined by researchers were connected with violence. This interest is related to the considerable increase in the level of violence in America.

The continuity of research in a field itself constitutes an important source of hypotheses. The rejection of some hypotheses leads to the formulation of new ones capable of explaining dependent variables in subsequent research on the same subject.

Null and Alternative Hypothesis

Null hypothesis.

The hypothesis that are proposed with the intent of receiving a rejection for them are called Null Hypothesis . This requires that we hypothesize the opposite of what is desired to be proved. For example, if we want to show that sales and advertisement expenditure are related, we formulate the null hypothesis that they are not related.

Similarly, if we want to conclude that the new sales training programme is effective, we formulate the null hypothesis that the new training programme is not effective, and if we want to prove that the average wages of skilled workers in town 1 is greater than that of town 2, we formulate the null hypotheses that there is no difference in the average wages of the skilled workers in both the towns.

Since we hypothesize that sales and advertisement are not related, new training programme is not effective and the average wages of skilled workers in both the towns are equal, we call such hypotheses null hypotheses and denote them as H 0 .

Alternative Hypothesis

Rejection of null hypotheses leads to the acceptance of alternative hypothesis . The rejection of null hypothesis indicates that the relationship between variables (e.g., sales and advertisement expenditure) or the difference between means (e.g., wages of skilled workers in town 1 and town 2) or the difference between proportions have statistical significance and the acceptance of the null hypotheses indicates that these differences are due to chance.

As already mentioned, the alternative hypotheses specify that values/relation which the researcher believes hold true. The alternative hypotheses can cover a whole range of values rather than a single point. The alternative hypotheses are denoted by H 1 .

Business Ethics

( Click on Topic to Read )

- What is Ethics?

- What is Business Ethics?

- Values, Norms, Beliefs and Standards in Business Ethics

- Indian Ethos in Management

- Ethical Issues in Marketing

- Ethical Issues in HRM

- Ethical Issues in IT

- Ethical Issues in Production and Operations Management

- Ethical Issues in Finance and Accounting

- What is Corporate Governance?

- What is Ownership Concentration?

- What is Ownership Composition?

- Types of Companies in India

- Internal Corporate Governance

- External Corporate Governance

- Corporate Governance in India

- What is Enterprise Risk Management (ERM)?

- What is Assessment of Risk?

- What is Risk Register?

- Risk Management Committee

Corporate social responsibility (CSR)

- Theories of CSR

- Arguments Against CSR

- Business Case for CSR

- Importance of CSR in India

- Drivers of Corporate Social Responsibility

- Developing a CSR Strategy

- Implement CSR Commitments

- CSR Marketplace

- CSR at Workplace

- Environmental CSR

- CSR with Communities and in Supply Chain

- Community Interventions

- CSR Monitoring

- CSR Reporting

- Voluntary Codes in CSR

- What is Corporate Ethics?

Lean Six Sigma

- What is Six Sigma?

- What is Lean Six Sigma?

- Value and Waste in Lean Six Sigma

- Six Sigma Team

- MAIC Six Sigma

- Six Sigma in Supply Chains

- What is Binomial, Poisson, Normal Distribution?

- What is Sigma Level?

- What is DMAIC in Six Sigma?

- What is DMADV in Six Sigma?

- Six Sigma Project Charter

- Project Decomposition in Six Sigma

- Critical to Quality (CTQ) Six Sigma

- Process Mapping Six Sigma

- Flowchart and SIPOC

- Gage Repeatability and Reproducibility

- Statistical Diagram

- Lean Techniques for Optimisation Flow

- Failure Modes and Effects Analysis (FMEA)

- What is Process Audits?

- Six Sigma Implementation at Ford

- IBM Uses Six Sigma to Drive Behaviour Change

- Research Methodology

- What is Research?

Sampling Method

Research methods.

- Data Collection in Research

- Methods of Collecting Data

- Application of Business Research

- Levels of Measurement

- What is Sampling?

Hypothesis Testing

Research report.

- What is Management?

- Planning in Management

- Decision Making in Management

- What is Controlling?

- What is Coordination?

- What is Staffing?

- Organization Structure

- What is Departmentation?

- Span of Control

- What is Authority?

- Centralization vs Decentralization

- Organizing in Management

- Schools of Management Thought

- Classical Management Approach

- Is Management an Art or Science?

- Who is a Manager?

Operations Research

- What is Operations Research?

- Operation Research Models

- Linear Programming

- Linear Programming Graphic Solution

- Linear Programming Simplex Method

- Linear Programming Artificial Variable Technique

- Duality in Linear Programming

- Transportation Problem Initial Basic Feasible Solution

- Transportation Problem Finding Optimal Solution

- Project Network Analysis with Critical Path Method

- Project Network Analysis Methods

- Project Evaluation and Review Technique (PERT)

- Simulation in Operation Research

- Replacement Models in Operation Research

Operation Management

- What is Strategy?

- What is Operations Strategy?

- Operations Competitive Dimensions

- Operations Strategy Formulation Process

- What is Strategic Fit?

- Strategic Design Process

- Focused Operations Strategy

- Corporate Level Strategy

- Expansion Strategies

- Stability Strategies

- Retrenchment Strategies

- Competitive Advantage

- Strategic Choice and Strategic Alternatives

- What is Production Process?

- What is Process Technology?

- What is Process Improvement?

- Strategic Capacity Management

- Production and Logistics Strategy

- Taxonomy of Supply Chain Strategies

- Factors Considered in Supply Chain Planning

- Operational and Strategic Issues in Global Logistics

- Logistics Outsourcing Strategy

- What is Supply Chain Mapping?

- Supply Chain Process Restructuring

- Points of Differentiation

- Re-engineering Improvement in SCM

- What is Supply Chain Drivers?

- Supply Chain Operations Reference (SCOR) Model

- Customer Service and Cost Trade Off

- Internal and External Performance Measures

- Linking Supply Chain and Business Performance

- Netflix’s Niche Focused Strategy

- Disney and Pixar Merger

- Process Planning at Mcdonald’s

Service Operations Management

- What is Service?

- What is Service Operations Management?

- What is Service Design?

- Service Design Process

- Service Delivery

- What is Service Quality?

- Gap Model of Service Quality

- Juran Trilogy

- Service Performance Measurement

- Service Decoupling

- IT Service Operation

- Service Operations Management in Different Sector

Procurement Management

- What is Procurement Management?

- Procurement Negotiation

- Types of Requisition

- RFX in Procurement

- What is Purchasing Cycle?

- Vendor Managed Inventory

- Internal Conflict During Purchasing Operation

- Spend Analysis in Procurement

- Sourcing in Procurement

- Supplier Evaluation and Selection in Procurement

- Blacklisting of Suppliers in Procurement

- Total Cost of Ownership in Procurement

- Incoterms in Procurement

- Documents Used in International Procurement

- Transportation and Logistics Strategy

- What is Capital Equipment?

- Procurement Process of Capital Equipment

- Acquisition of Technology in Procurement

- What is E-Procurement?

- E-marketplace and Online Catalogues

- Fixed Price and Cost Reimbursement Contracts

- Contract Cancellation in Procurement

- Ethics in Procurement

- Legal Aspects of Procurement

- Global Sourcing in Procurement

- Intermediaries and Countertrade in Procurement

Strategic Management

- What is Strategic Management?

- What is Value Chain Analysis?

- Mission Statement

- Business Level Strategy

- What is SWOT Analysis?

- What is Competitive Advantage?

- What is Vision?

- What is Ansoff Matrix?

- Prahalad and Gary Hammel

- Strategic Management In Global Environment

- Competitor Analysis Framework

- Competitive Rivalry Analysis

- Competitive Dynamics

- What is Competitive Rivalry?

- Five Competitive Forces That Shape Strategy

- What is PESTLE Analysis?

- Fragmentation and Consolidation Of Industries

- What is Technology Life Cycle?

- What is Diversification Strategy?

- What is Corporate Restructuring Strategy?

- Resources and Capabilities of Organization

- Role of Leaders In Functional-Level Strategic Management

- Functional Structure In Functional Level Strategy Formulation

- Information And Control System

- What is Strategy Gap Analysis?

- Issues In Strategy Implementation

- Matrix Organizational Structure

- What is Strategic Management Process?

Supply Chain

- What is Supply Chain Management?

- Supply Chain Planning and Measuring Strategy Performance

- What is Warehousing?

- What is Packaging?

- What is Inventory Management?

- What is Material Handling?

- What is Order Picking?

- Receiving and Dispatch, Processes

- What is Warehouse Design?

- What is Warehousing Costs?

You Might Also Like

What is measure of skewness, data analysis in research, what is research design features, components, types of hypotheses, measures of relationship, what is sampling need, advantages, limitations, sampling process and characteristics of good sample design, data processing in research, leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

- Dictionaries home

- American English

- Collocations

- German-English

- Grammar home

- Practical English Usage

- Learn & Practise Grammar (Beta)

- Word Lists home

- My Word Lists

- Recent additions

- Resources home

- Text Checker

Definition of hypothesis noun from the Oxford Advanced Learner's Dictionary

- to formulate/confirm a hypothesis

- a hypothesis about the function of dreams

- There is little evidence to support these hypotheses.

- formulate/advance a theory/hypothesis

- build/construct/create/develop a simple/theoretical/mathematical model

- develop/establish/provide/use a theoretical/conceptual framework

- advance/argue/develop the thesis that…

- explore an idea/a concept/a hypothesis

- make a prediction/an inference

- base a prediction/your calculations on something

- investigate/evaluate/accept/challenge/reject a theory/hypothesis/model

- design an experiment/a questionnaire/a study/a test

- do research/an experiment/an analysis

- make observations/measurements/calculations

- carry out/conduct/perform an experiment/a test/a longitudinal study/observations/clinical trials

- run an experiment/a simulation/clinical trials

- repeat an experiment/a test/an analysis

- replicate a study/the results/the findings

- observe/study/examine/investigate/assess a pattern/a process/a behaviour

- fund/support the research/project/study

- seek/provide/get/secure funding for research

- collect/gather/extract data/information

- yield data/evidence/similar findings/the same results

- analyse/examine the data/soil samples/a specimen

- consider/compare/interpret the results/findings

- fit the data/model

- confirm/support/verify a prediction/a hypothesis/the results/the findings

- prove a conjecture/hypothesis/theorem

- draw/make/reach the same conclusions

- read/review the records/literature

- describe/report an experiment/a study

- present/publish/summarize the results/findings

- present/publish/read/review/cite a paper in a scientific journal

- Her hypothesis concerns the role of electromagnetic radiation.

- Her study is based on the hypothesis that language simplification is possible.

- It is possible to make a hypothesis on the basis of this graph.

- None of the hypotheses can be rejected at this stage.

- Scientists have proposed a bold hypothesis.

- She used this data to test her hypothesis

- The hypothesis predicts that children will perform better on task A than on task B.

- The results confirmed his hypothesis on the use of modal verbs.

- These observations appear to support our working hypothesis.

- a speculative hypothesis concerning the nature of matter

- an interesting hypothesis about the development of language

- Advances in genetics seem to confirm these hypotheses.

- His hypothesis about what dreams mean provoked a lot of debate.

- Research supports the hypothesis that language skills are centred in the left side of the brain.

- The survey will be used to test the hypothesis that people who work outside the home are fitter and happier.

- This economic model is really a working hypothesis.

- speculative

- concern something

- be based on something

- predict something

- on a/the hypothesis

- hypothesis about

- hypothesis concerning

Questions about grammar and vocabulary?

Find the answers with Practical English Usage online, your indispensable guide to problems in English.

- It would be pointless to engage in hypothesis before we have the facts.

Other results

Nearby words.

Quickonomics

Natural-Rate Hypothesis

Definition of natural-rate hypothesis.

The natural-rate hypothesis (NRH) is an economic theory that states that the unemployment rate in an economy will eventually return to its natural rate, regardless of the level of economic activity. That means it describes the rate of unemployment that exists when the labor market is in equilibrium. This rate is determined by the structure and dynamics of the labor market and is independent of the level of aggregate demand.

To illustrate the natural-rate hypothesis, let’s look at the economy of a small imaginary country. In this country, the natural rate of unemployment is 5%. That means when the economy is in equilibrium, the unemployment rate will be 5%. Now, assume the government decides to stimulate the economy by increasing aggregate demand. As a result, the unemployment rate drops to 3%. However, according to the NRH, this decrease in unemployment is only temporary. Eventually, the unemployment rate will return to its natural rate of 5%.

Why Natural-Rate Hypothesis Matters

The natural-rate hypothesis is an important concept in macroeconomics. It helps economists to understand the dynamics of the labor market and the effects of government policies on unemployment. In addition to that, it is also used to evaluate the effectiveness of government policies. That is, if the government implements a policy to reduce unemployment, but the unemployment rate does not decrease, then it is likely that the policy has not been effective.

Related Terms

- Macroeconomics

Baltic Dry Index

Bretton woods agreement, ad valorem tax.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

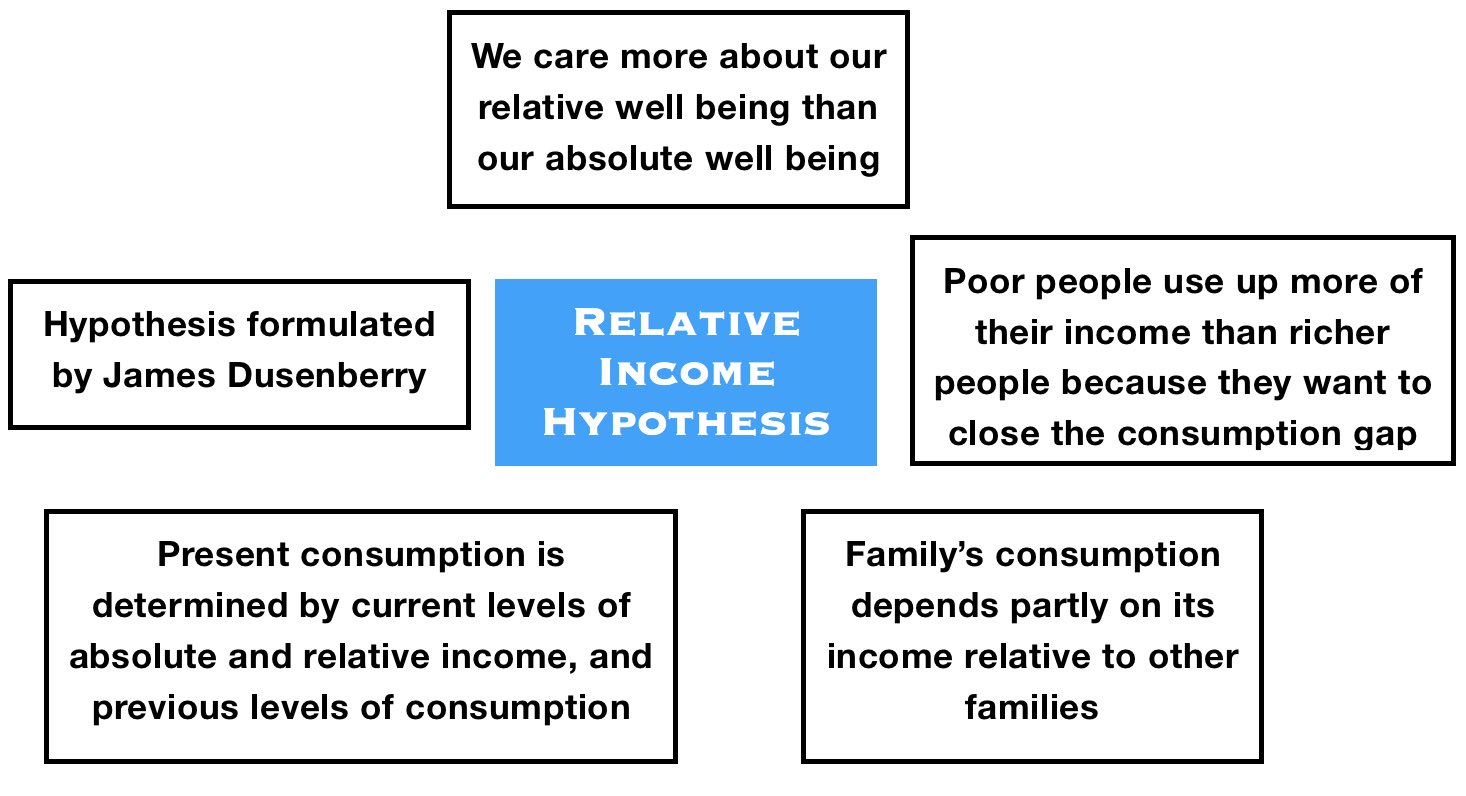

What is the relative income hypothesis? Definition and meaning

The Relative Income Hypothesis says that we care more about how much we earn and consume in relation to how other people around us do than our absolute well-being or our own earnings and consumption in isolation or comparison to a moment in the past.

According to relative income supposition, a typical person is happier if he or she got a $100 weekly wage rise if others only got $50 than receiving a $150 increase while everybody else received the same increase.

This concept also extends to the psychological impact of income perception, where individuals assess their economic position not just by their financial well-being, but by how they perceive their prosperity relative to their community or social circle

People on lower incomes may consume more of their earnings than their better-off counterparts because they would like to reduce the gap in their standards of living – consumption levels.

James Duesenberry

James Duesenberry (1918-2009), an American economist who made a considerable contribution to the Keynesian analysis of income and employment, first set out the relative income conjecture in 1949 when his book – Income, Saving and the Theory of Consumer Behavior – was published.

According to Duesenberry, the weekly consumption of a household depends in part on its income relative to other families.

There are several versions of this hypothesis. The one formulated by Duesenberry has received the most attention, and is the main focus of this article.

We don’t like to consume less than before

Supporters of the relative income hypothesis say that current consumption is not influenced just by current levels of relative and absolute income, but also by levels of consumption reached in previous period. As soon as a household reaches a level of consumption, it is difficult for it to consume less afterwards.

In other words, the relative income rationale has three components:

- Our attitude to consumption and saving is dictated more by our situation in relation to others than by abstract living standards.

- Poorer people spend more of their income than wealthier individuals because they want to close the consumption gap.

- We don’t like to consume less than we used to.

The relative income hypothesis suggests that conspicuous consumption, the purchase of goods or services for the direct purpose of displaying one’s wealth, is a direct consequence of individuals striving to signal their economic status relative to others.

Permanent and relative income hypothesis

Relative income hypothesis contrasts with Permanent Income Hypothesis , a consumer spending theory which states that we will spend money at a level that is consistent with our expected long-term average income.

Our level of expected long-term income is then thought of as our level of ‘permanent’ income that can be spent safely.

We all save only if our current income is greater than our anticipated level of permanent income – we do this to guard against future reductions in income, so the permanent income hypothesis states.

Rich households save more

Other hypotheses that followed Duesenberry’s relative income hypothesis, including the permanent income hypothesis, were also able to explain why rich households tended to save more than those further down the socioeconomic ladder – and in a less controversial way.

In an article published in the Quarterly Journal of Business and Economics – ‘ The Relative Income Hypothesis: A Review of the Cross Section Evidence’ – George Kosicki wrote:

“Early models of household saving postulated that poor households acted in a way fundamentally diffrent from rich households. Duesenberry argues that effects in consumption weighed less heavily on rich households, and so savings rates should rise with position in the income distribution.”

“Although Duesenberry’s relative income hypothesis held up well under cross section empirical tests, it was supplanted by the life cycle and permanent income models that followed.”

“These models seemed capable of explaining the same empirical evidence in a less controversial manner.”

Absolute Income vs. Relative Income

Imagine two people, one earns $100,000 per year and the other $50,000 – this information is on their absolute incomes; one earns twice as much as the other.

However, if I now add some more information – the $100,000 per year person works 80 hours per week by 51 weeks of the year, while the $50,000 per year individual works just 4 hours per week by 30 weeks of the year, we are now looking at things differently.

In absolute terms the $100,000 per year person earns more, but in relative terms the $50,000 per year individual is way, way better off… In order to understand what the relative income hypothesis is, you first need to know what relative income means.

Video – What is Relative Income Hypothesis?

This educational video, from our sister channel on YouTube – Marketing Business Network , explains what ‘ Relative Income Hypothesis ‘ means using simple and easy-to-understand language and examples.

Share this:

- Renewable Energy

- Artificial Intelligence

- 3D Printing

- Financial Glossary

- Maths Notes Class 12

- NCERT Solutions Class 12

- RD Sharma Solutions Class 12

- Maths Formulas Class 12

- Maths Previous Year Paper Class 12

- Class 12 Syllabus

- Class 12 Revision Notes

- Physics Notes Class 12

- Chemistry Notes Class 12

- Biology Notes Class 12

- Null Hypothesis

- Hypothesis Testing Formula

- Difference Between Hypothesis And Theory

- Real-life Applications of Hypothesis Testing

- Permutation Hypothesis Test in R Programming

- Bayes' Theorem

- How do you define and measure your product hypothesis?

- How to Perform an F-Test in Python

- How to Perform a Kruskal-Wallis Test in Python

- Type II Error in Hypothesis Testing with R Programming

- Multiplication Theorem

- How to Perform the Nemenyi Test in Python

- Hypothesis in Machine Learning

- Current Best Hypothesis Search

- Understanding Hypothesis Testing

- Hypothesis Testing in R Programming

- Jobathon | Stats | Question 10

- Jobathon | Stats | Question 17

- Testing | Question 1

- Difference between Null and Alternate Hypothesis

- ML | Find S Algorithm

- Python - Pearson's Chi-Square Test

- Arithmetic Mean

- MuSigma Aptitude Test - Round I

- Aptitude | Syllogism | Question 1

Hypothesis is a testable statement that explains what is happening or observed. It proposes the relation between the various participating variables. Hypothesis is also called Theory, Thesis, Guess, Assumption, or Suggestion. Hypothesis creates a structure that guides the search for knowledge.

In this article, we will learn what is hypothesis, its characteristics, types, and examples. We will also learn how hypothesis helps in scientific research.

What is Hypothesis?

A hypothesis is a suggested idea or plan that has little proof, meant to lead to more study. It’s mainly a smart guess or suggested answer to a problem that can be checked through study and trial. In science work, we make guesses called hypotheses to try and figure out what will happen in tests or watching. These are not sure things but rather ideas that can be proved or disproved based on real-life proofs. A good theory is clear and can be tested and found wrong if the proof doesn’t support it.

Hypothesis Meaning

A hypothesis is a proposed statement that is testable and is given for something that happens or observed.

- It is made using what we already know and have seen, and it’s the basis for scientific research.

- A clear guess tells us what we think will happen in an experiment or study.

- It’s a testable clue that can be proven true or wrong with real-life facts and checking it out carefully.

- It usually looks like a “if-then” rule, showing the expected cause and effect relationship between what’s being studied.

Characteristics of Hypothesis

Here are some key characteristics of a hypothesis:

- Testable: An idea (hypothesis) should be made so it can be tested and proven true through doing experiments or watching. It should show a clear connection between things.

- Specific: It needs to be easy and on target, talking about a certain part or connection between things in a study.

- Falsifiable: A good guess should be able to show it’s wrong. This means there must be a chance for proof or seeing something that goes against the guess.

- Logical and Rational: It should be based on things we know now or have seen, giving a reasonable reason that fits with what we already know.

- Predictive: A guess often tells what to expect from an experiment or observation. It gives a guide for what someone might see if the guess is right.

- Concise: It should be short and clear, showing the suggested link or explanation simply without extra confusion.

- Grounded in Research: A guess is usually made from before studies, ideas or watching things. It comes from a deep understanding of what is already known in that area.

- Flexible: A guess helps in the research but it needs to change or fix when new information comes up.

- Relevant: It should be related to the question or problem being studied, helping to direct what the research is about.

- Empirical: Hypotheses come from observations and can be tested using methods based on real-world experiences.

Sources of Hypothesis

Hypotheses can come from different places based on what you’re studying and the kind of research. Here are some common sources from which hypotheses may originate:

- Existing Theories: Often, guesses come from well-known science ideas. These ideas may show connections between things or occurrences that scientists can look into more.

- Observation and Experience: Watching something happen or having personal experiences can lead to guesses. We notice odd things or repeat events in everyday life and experiments. This can make us think of guesses called hypotheses.

- Previous Research: Using old studies or discoveries can help come up with new ideas. Scientists might try to expand or question current findings, making guesses that further study old results.

- Literature Review: Looking at books and research in a subject can help make guesses. Noticing missing parts or mismatches in previous studies might make researchers think up guesses to deal with these spots.

- Problem Statement or Research Question: Often, ideas come from questions or problems in the study. Making clear what needs to be looked into can help create ideas that tackle certain parts of the issue.

- Analogies or Comparisons: Making comparisons between similar things or finding connections from related areas can lead to theories. Understanding from other fields could create new guesses in a different situation.

- Hunches and Speculation: Sometimes, scientists might get a gut feeling or make guesses that help create ideas to test. Though these may not have proof at first, they can be a beginning for looking deeper.

- Technology and Innovations: New technology or tools might make guesses by letting us look at things that were hard to study before.

- Personal Interest and Curiosity: People’s curiosity and personal interests in a topic can help create guesses. Scientists could make guesses based on their own likes or love for a subject.

Types of Hypothesis

Here are some common types of hypotheses:

Simple Hypothesis

Complex hypothesis, directional hypothesis.

- Non-directional Hypothesis

Null Hypothesis (H0)

Alternative hypothesis (h1 or ha), statistical hypothesis, research hypothesis, associative hypothesis, causal hypothesis.