Amazon Com Inc (AMZN) SEC Filing 10-K Annual Report for the fiscal year ending Friday, December 31, 2021

Sec filings, amzn valuations.

- Select PDF Feature:

- Include Exhibits

- Highlight YoY Changes

- Highlight Sentiment

February 2024

November 2023

October 2023

September 2023

August 2023

February 2023

Last10K.com | 10-K Annual Report Fri Feb 04 2022

Amazon com inc.

Please wait while we load the requested 10-K report or click the link below:

https://last10k.com/sec-filings/report/1018724/000101872422000005/amzn-20211231.htm

View differences made from one year to another to evaluate Amazon Com Inc's financial trajectory

Compare this 10-K Annual Report to its predecessor by reading our highlights to see what text and tables were removed , added and changed by Amazon Com Inc.

Assess how Amazon Com Inc's management team is paid from their Annual Proxy

- Voting Procedures

- Board Members

- Executive Team

- Salaries, Bonuses, Perks

- Peers / Competitors

SEC Filing Tools

Read 10-K Annual Reports Better Last10K.com and Stocksnips.net computationally analyzes management discussions inside annual and quarterly reports to determine if they are bullish , bearish or neutral on the company's finances and operations. View Rating for FREE "> Rating Learn More

We provide 5 of these remarks for FREE. To see all the remarks without having to find them in the 10-K Annual Report, become a member of Last10K.com

Our variable costs include product and content costs, payment processing and related transaction costs, picking, packaging, and preparing orders for shipment, transportation, customer service support, costs necessary to run AWS, and a portion of our marketing costs.

Free cash flows are driven primarily by increasing operating income and efficiently managing accounts receivable, inventory, accounts payable, and cash capital expenditures, including our decision to purchase or lease property and equipment.

We had no borrowings outstanding under the unsecured revolving credit facility, $725 million of borrowings outstanding under the commercial paper programs, and $803 million of borrowings outstanding under our secured revolving credit facility (the "Credit Facility") as of December 31, 2021.

Fulfillment costs as a percentage of net sales may vary due to several factors, such as payment processing and related transaction costs, our level of productivity and accuracy, changes in volume, size, and weight of units received and fulfilled, the extent to which third party sellers utilize Fulfillment by Amazon services, timing of fulfillment network and physical store expansion, the extent we utilize fulfillment services provided by third parties, mix of products and services sold, and our ability to affect customer service contacts per unit by implementing improvements in our operations and enhancements to our customer self-service features.

While costs associated with Amazon Prime membership benefits and other shipping offers are not included in marketing expense, we view these offers as effective worldwide marketing tools, and intend to continue offering them indefinitely.

We expect our cost of... Read more

Likewise, if the U.S. Dollar... Read more

U.S. tax rules provide for... Read more

The increase in AWS operating... Read more

We seek to expand our... Read more

Our results are inherently unpredictable... Read more

To increase sales of products... Read more

Technology and Content Technology and... Read more

Our fixed costs include the... Read more

General and Administrative The increase... Read more

The increase in fulfillment costs... Read more

The decrease in operating cash... Read more

Increases in operating income primarily... Read more

Income Taxes Our effective tax... Read more

Cash capital expenditures were $35.0... Read more

Cash provided by (used in)... Read more

We seek to invest efficiently... Read more

Operating Expenses Information about operating... Read more

Increased unit sales were driven... Read more

The International operating loss in... Read more

For a discussion of the... Read more

Additionally, sales by our sellers... Read more

Developments in an audit, investigation,... Read more

We seek to reduce our... Read more

The sales growth primarily reflects... Read more

See "Results of Operations -... Read more

Our interest income corresponds with... Read more

Included in other income (expense),... Read more

To best take advantage of... Read more

This guidance includes approximately $1.0... Read more

Variable costs generally change directly... Read more

Infrastructure costs include servers, networking... Read more

Our operating cash flows result... Read more

Net sales information is as... Read more

North America sales increased 18%... Read more

International sales increased 22% in... Read more

AWS sales increased 37% in... Read more

Shipping costs to receive products... Read more

We provide multiple measures of... Read more

We seek to increase unit... Read more

Our financial focus is on... Read more

Our measures of free cash... Read more

The increase in technology and... Read more

Cash inflows from financing activities... Read more

On average, our high inventory... Read more

First Quarter 2022 Guidance Net... Read more

The following is a reconciliation... Read more

We seek to mitigate costs... Read more

For example, if the U.S.... Read more

We believe that our increasing... Read more

Financial Statements, Disclosures and Schedules Inside this 10-K Annual Report

Material Contracts, Statements, Certifications & more Amazon Com Inc provided additional information to their SEC Filing as exhibits

Ticker: AMZN CIK: 1018724 Form Type: 10-K Annual Report Accession Number: 0001018724-22-000005 Submitted to the SEC: Thu Feb 03 2022 6:46:51 PM EST Accepted by the SEC: Fri Feb 04 2022 Period: Friday, December 31, 2021 Industry: Retail Catalog And Mail Order Houses

Intrinsic Value Calculator

Our Intrinsic Value calculator estimates what an entire company is worth using up to 10 years of financial ratios to determine if a stock is overvalued or not

Never Miss A New SEC Filing Again

Receive an e-mail as soon as a company files an Annual Report, Quarterly Report or has new 8-K corporate news

We Highlighted This SEC Filing For You

Read positive and negative remarks made by management in their entirety without having to find them in a 10-K/Q

Widen Your SEC Filing Reading Experience

Remove data columns and navigations in order to see much more filing content and tables in one view

Uncover Actionable Information Inside SEC Filings

Read both hidden opportunities and early signs of potential problems without having to find them in a 10-K/Q

Adobe PDF, Microsoft Word, Excel and CSV Downloads

Export Annual and Quarterly Reports to Adobe Acrobat (PDF), Microsoft Word (DOCX), Excel (XLSX) and Comma-Delimited (CSV) files for offline viewing, annotations and analysis

Financial Stability Report

Our Financial Stability reports uses up to 10 years of financial ratios to determine the health of a company's EPS, Dividends, Book Value, Return on Equity, Current Ratio and Debt-to-Equity

Get a Better Picture of a Company's Performance

See how over 70 Growth, Profitability and Financial Ratios perform over 10 Years

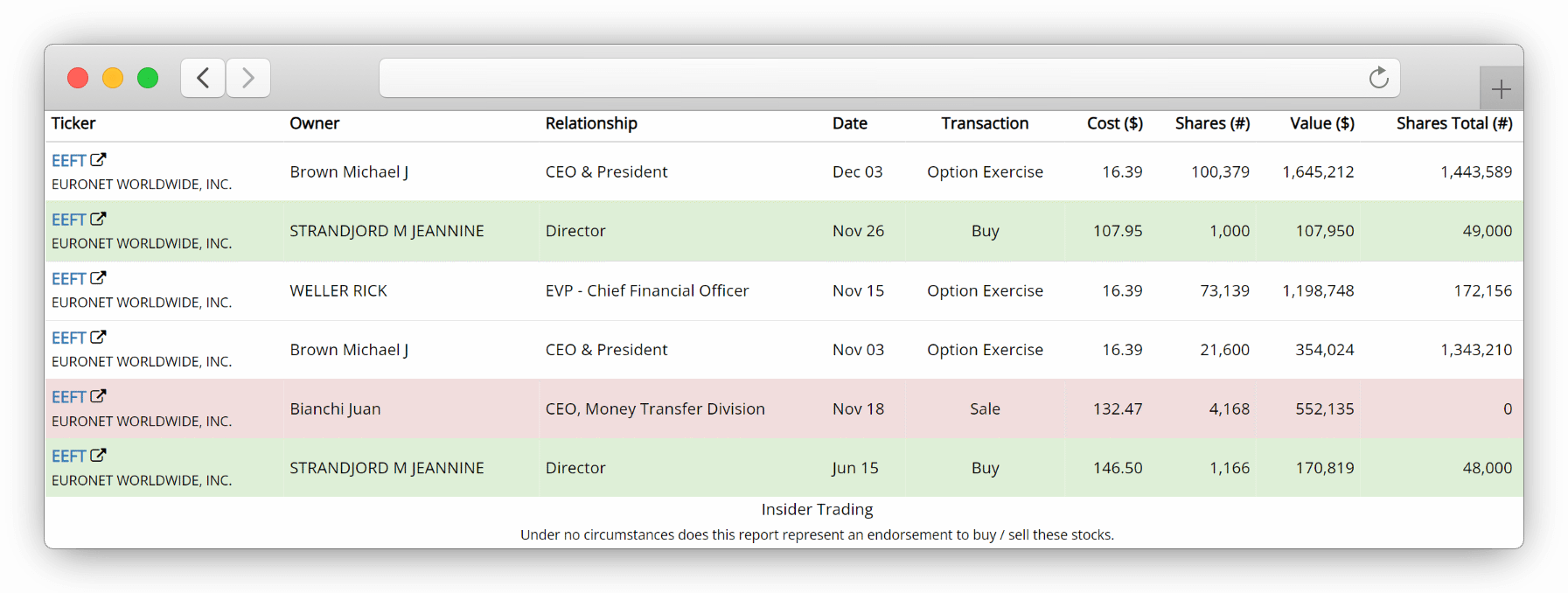

See when company executives buy or sell their own stock

Use our calculated cost dollar values to discover when and how much registered owners BUY , SELL or excercise their company stock OPTIONS aggregated from Form 4 Insider Transactions SEC Filings

See how institutional managers trade a stock

View which hedge funds, pension / retirement funds, endowments, banks and insurance companies have increased or decreased their positions in a particular stock. Includes Ownership Percent, Buy versus Sell comparison, Put-Call ratio and more

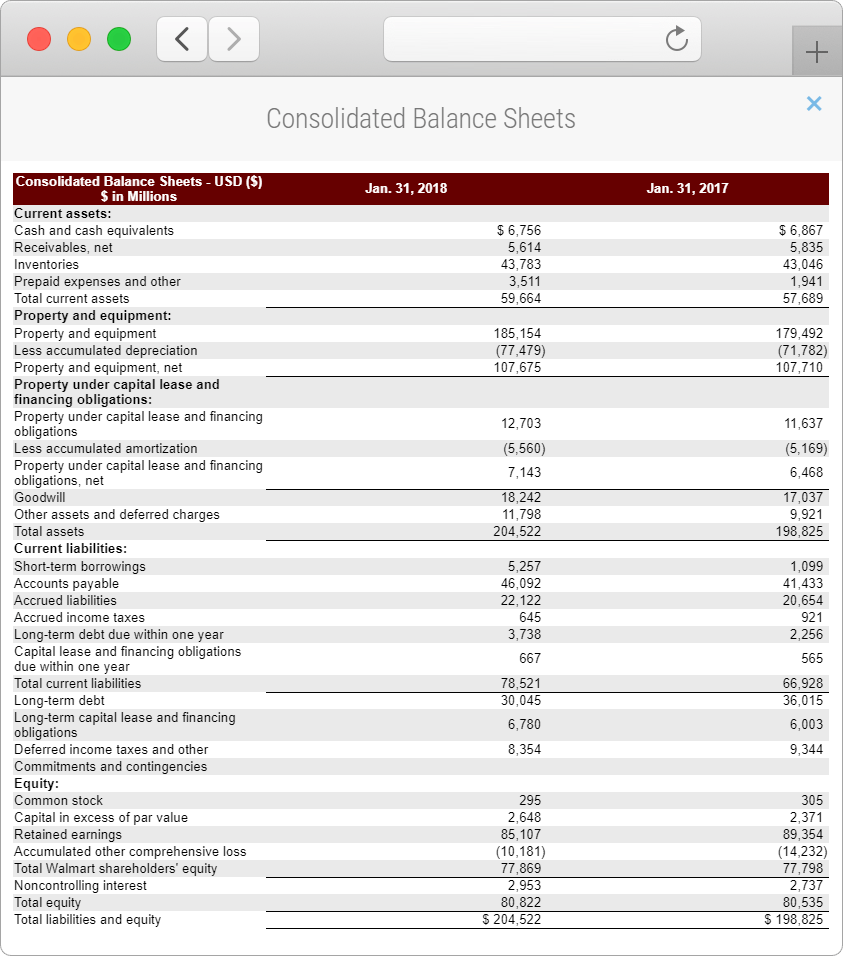

FREE Financial Statements

Get one-click access to balance sheets, income, operations and cash flow statements without having to find them in Annual and Quarterly Reports

SEC Filing Exhibit

Loading SEC Filing Exhibit...

SEC Filing Financial Summary

Loading SEC Filing Financial Summary...

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

Top Research Reports for Amazon.com, Berkshire Hathaway & Thermo Fisher

August 01, 2022 — 02:58 pm EDT

Written by Santanu Roy for Zacks ->

Monday, August 1, 2022 The Zacks Research Daily presents the best research output of our analyst team. Today's Research Daily features new research reports on 16 major stocks, including Amazon.com, Inc. (AMZN), Berkshire Hathaway Inc. (BRK.B) and Thermo Fisher Scientific Inc. (TMO). These research reports have been hand-picked from the roughly 70 reports published by our analyst team today. You can see all of today’s research reports here >>>

Amazon shares have declined -19.0% over the past year against the Zacks Internet - Commerce industry’s decline of -33.4%. The company’s growing expenses due to supply-chain constraints and inflationary pressure remain concerns. Nevertheless, second quarter results were driven by Prime and AWS momentum. Strengthening AWS services portfolio and its growing adoption rate contributed well.

Ultrafast delivery services and expanding content portfolio were beneficial. Strong momentum across Amazon Music was a tailwind. Strengthening relationship with third-party sellers was a positive. Robust advertising business contributed well. Improving Alexa skills along with robust smart home products offerings were tailwinds.

Amazon’s strong global presence and solid momentum among the small and medium businesses remain positives. Growing capabilities in grocery, pharmacy, Amazon Care, Kuiper and Zoox are other positives.

(You can read the full research report on Amazon here >>> )

Berkshire Hathaway shares have outperformed the Zacks Insurance - Property and Casualty industry over the past year (+8.1% vs. -0.4%). The company is one of the largest property and casualty insurance companies measured by premium volume. Berkshire's inorganic growth story remains impressive with strategic acquisitions.

A strong cash position supports earnings-accretive bolt-on buyouts and indicates the company's financial flexibility. Continued insurance business growth fuels increase in float, drive earnings and generates maximum return on equity. The non-insurance businesses are delivering improved results with increased revenues over the past few years. A sturdy capital level provides further impetus.

However, exposure to catastrophe loss induces earnings volatility and also affects the property and casualty underwriting results of Berkshire. Huge capital expenditure remains a headwind for the company.

(You can read the full research report on Berkshire Hathaway here >>> )

Thermo Fisher shares have outperformed the Zacks Medical - Instruments industry over the past year (+12.3% vs. -21.9%). The company’s robust year-over-year revenue growth in the Analytical Instruments and the Laboratory Products and Biopharma Services segments appears promising.

Thermo Fisher’s strategic acquisitions of PPD, Inc. and PeproTech raise investors’ confidence. Thermo Fisher’s accelerated investments to expand bioproduction capacity also buoy optimism. The upbeat guidance for 2022 is indicative that this growth momentum will continue.

However, the year-over-year decline in revenues in the Specialty Diagnostics segment is disappointing. The contraction of both margins does not bode well either.

(You can read the full research report on Thermo Fisher here >>> )

Other noteworthy reports we are featuring today include Verizon Communications Inc. (VZ), Advanced Micro Devices, Inc. (AMD), and Anheuser-Busch InBev SA/NV (BUD).

Sheraz Mian Director of Research

Note: Sheraz Mian heads the Zacks Equity Research department and is a well-regarded expert of aggregate earnings. He is frequently quoted in the print and electronic media and publishes the weekly Earnings Trends and Earnings Preview reports. If you want an email notification each time Sheraz publishes a new article, please click here>>>

Today's Must Read

Amazon (AMZN) Banks on Growing AWS Adoption & Prime Momentum

Solid Insurance Business Aid Berkshire (BRK.B), Cat Loss Ail

Thermo Fisher (TMO) Advances in Bioprocess, End Markets Grow

Featured Reports

Verizon (VZ) Aims to Deter Margin Woes With Attractive Plans Per the Zacks analyst, Verizon is offering various mix-and-match pricing in both wireless and home broadband plans for customer additions as it is forced to lower guidance on macroeconomic woes.

Robust Product Portfolio & Partnerships Aid AMD's Prospects Per the Zacks analyst, Advanced Micro Devices is benefiting from strong adoption of EPYC, Ryzen and Radeon processors. Moreover, alliances with Baidu, Amazon and Microsoft, bode well.

Digital Investments Brighten AB InBev's (BUD) Growth Prospects Per the Zacks analyst, AB InBev's investments in B2B platforms, e-commerce and digital marketing have been aiding growth. It is likely to rapidly grow its digital platform, like BEES and Ze Delivery.

Southern Company (SO) Buoyed by Regulated Customer Growth The Zacks analyst believes that an increase in Southern's regulated business customer base will support its revenue growth but is concerned over timing and cost overrun of the Vogtle project.

Moderna's (MRNA) Dependence on COVID Vaccine Revenues A Woe Moderna has boosted its cash resources on the back of robust sales of its COVID vaccine. However, the Zacks Analyst is concerned that lower cases of COVID infections fuel uncertainty for vaccine deman

Infrastructure Investment, Clean Assets Aid Xcel Energy (XEL) Per the Zacks analyst, Xcel Energy's investment of $26 billion through 2026 to enhance clean electricity generation and strengthen its infrastructure will boost its profitability.

Operating Skills Up Waste Connections (WCN), Liquidity Dips Per the Zacks analyst, Waste Connections' low-overhead , highly efficient operational structure allows it to penetrate contiguous markets for geographical expansion. Low liquidity remains a concern.

New Upgrades

Range Resources (RRC) Banks On Marcellus Shale Play Assets The Zacks analyst is impressed by Range Resources' 3,000 undrilled wells in the Marcellus formation of the Appalachian Basin. The wells are likely to provide production for several decades.

Solid Loan Demand, Rising Rates, Fee Income Aid Zions (ZION) Per the Zacks analyst, robust loan demand, higher interest rates, solid balance sheet and rise in fee income will aid Zions' financials. Its capital deployments seem sustainable on earnings strength.

Plexus (PLXS) Gains from Demand Environment, Program Ramps Per the Zacks analyst, Plexus will continue to benefit from robust demand environment and new program ramps. Enhanced exposure to newer markets like commercial space and factory automation bode well

New Downgrades

Higher Input Costs, Soft Demand Hurt Sherwin-Williams (SHW) Per the Zacks analyst, higher raw material costs due to supply disruptions will weigh on the company's sales and margins. Weak demand in Europe and China is also a concern.

Softness in Fitness & Marine Segments Hurts Garmin (GRMN) Per the Zacks analyst, Garmin is suffering from sluggishness in fitness segment due to weak demand for cycling products and advanced wearables. Also, supply constraints are hurting its marine segment.

Virtu Financial (VIRT) Continues to Grapple With High Costs Per the Zacks Analyst, Virtu Financial's elevated expenses have been putting pressure on its margins. Also, a decline in market volatility offers it lesser trading and profit opportunities.

Want to Know the #1 Semiconductor Stock for 2022?

Few people know how promising the semiconductor market is. Over the last couple of years, disruptions to the supply chain have caused shortages in several industries. The absence of one single semiconductor can stop all operations in certain industries.

This year, companies that create and produce this essential material will have incredible pricing power. For a limited time, Zacks is revealing the top semiconductor stock for 2022. You'll find it in our new Special Report, One Semiconductor Stock Stands to Gain the Most .

Today, it's yours free with no obligation.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

- About Amazon (English)

- About Amazon (日本語)

- About Amazon (Français)

- About Amazon (Deutsch)

- Newsroom (Deutsch)

- About Amazon (Italiano)

- About Amazon (Polski)

- About Amazon (Español)

- Press Center (English)

- Press Center

- About Amazon (Português)

- Press Release Archive

- Images & Videos

- Investor Relations

Amazon.com Announces Third Quarter Results

- North America segment sales increased 20% year-over-year to $78.8 billion.

- International segment sales decreased 5% year-over-year to $27.7 billion, but increased 12% excluding changes in foreign exchange rates.

- AWS segment sales increased 27% year-over-year to $20.5 billion, or increased 28% excluding changes in foreign exchange rates.

- North America segment operating loss was $0.4 billion, compared with operating income of $0.9 billion in third quarter 2021.

- International segment operating loss was $2.5 billion, compared with operating loss of $0.9 billion in third quarter 2021.

- AWS segment operating income was $5.4 billion, compared with operating income of $4.9 billion in third quarter 2021.

- Third quarter 2022 net income includes a pre-tax valuation gain of $1.1 billion included in non-operating income from the common stock investment in Rivian Automotive, Inc.

- Operating cash flow decreased 27% to $39.7 billion for the trailing twelve months, compared with $54.7 billion for the trailing twelve months ended September 30, 2021.

- Free cash flow decreased to an outflow of $19.7 billion for the trailing twelve months, compared with an inflow of $2.6 billion for the trailing twelve months ended September 30, 2021.

- Free cash flow less principal repayments of finance leases and financing obligations decreased to an outflow of $28.5 billion for the trailing twelve months, compared with an outflow of $8.8 billion for the trailing twelve months ended September 30, 2021.

- Free cash flow less equipment finance leases and principal repayments of all other finance leases and financing obligations decreased to an outflow of $21.5 billion for the trailing twelve months, compared with an outflow of $3.9 billion for the trailing twelve months ended September 30, 2021.

“In the past four months, employees across our consumer businesses have worked relentlessly to put together compelling Prime Member Deal Events with our eighth annual Prime Day and the brand new Prime Early Access Sale in early October. The customer response to both events was quite positive, and it’s clear that particularly during these uncertain economic times, customers appreciate Amazon’s continued focus on value and convenience,” said Andy Jassy, Amazon CEO. “We’re also encouraged by the steady progress we’re making on lowering costs in our stores fulfillment network, and have a set of initiatives that we’re methodically working through that we believe will yield a stronger cost structure for the business moving forward. There is obviously a lot happening in the macroeconomic environment, and we’ll balance our investments to be more streamlined without compromising our key long-term, strategic bets. What won’t change is our maniacal focus on the customer experience, and we feel confident that we’re ready to deliver a great experience for customers this holiday shopping season.”

Obsessing over the customer experience

Amazon obsesses over how to make customers’ lives better and easier every day. This is true for consumers, sellers, brands, developers, enterprises, and creators. For example, in the past quarter, Amazon:

- Premiered several new entertainment series, including The Lord of the Rings: The Rings of Power , which attracted more than 25 million global viewers on its first day, the biggest debut in Prime Video history, and closing in on 100 million viewers to date. The company also premiered three new Original and three returning series, including Heidi Klum and Tim Gunn’s Making the Cut ; The Outlaws , starring Christopher Walken and Stephen Merchant; and thriller The Peripheral , starring Chloë Grace Moretz.

- Kicked off the inaugural season of Prime Video as the exclusive home of NFL Thursday Night Football with more than 15 million viewers for its first game. Live sports also returned to Prime Video across Europe with new seasons of UEFA Champions League soccer in Germany and Italy, Ligue 1 soccer in France, and exclusive coverage of US Open tennis in the UK.

- Introduced the first-ever Prime Early Access Sale, a two-day shopping event on October 11-12 exclusively for Prime members in 15 countries. Customers could choose from hundreds of thousands of deals across all best-selling categories, such as apparel, home, toys and Amazon devices. Amazon’s selling partners, most of which are small and medium-sized businesses, also took part in the event, and customers responded by ordering more than 100 million items from these businesses.

- Opened a dozen new fulfillment centers globally in order to serve more customers even more quickly. New sites were opened in the U.S., Mexico, Canada, Ireland, and Turkey.

- Expanded to Belgium with the launch of Amazon.com.be and a Prime program for local customers, providing faster access to more than 180 million products across more than 30 product categories. As part of the launch, Amazon introduced the “Brands of Belgium” storefront to showcase products from Belgian entrepreneurs.

- Partnered with new brands and retailers to make their products available on Amazon with same-day delivery for Prime members in select ZIP codes across over 10 U.S. cities. Examples of these partners include GNC, PacSun, SuperDry, Sur La Table, and 100% Pure.

- Continued working to protect customers from fake reviews through legal action against fake review brokers, filing its first criminal complaint in Italy and its first lawsuit in Spain. These two legal proceedings, plus 10 other new lawsuits recently launched in the U.S., target bad actors that operate more than 11,000 websites and social media groups that attempt to orchestrate fake reviews on Amazon and other stores. Amazon stops millions of suspicious reviews before customers ever see them, and these legal actions help uncover perpetrators and stop the abuse where it starts.

- Rolled out Venmo as a new payment option in the U.S., giving customers more choice during the checkout experience.

- Hosted Amazon Accelerate, an annual conference dedicated to seller success where numerous new tools were introduced, including new email marketing capabilities, free-to-use shipping software that offers discounted shipping rates, and new features and analytics on conversion-driving content.

- Announced new commitments and migrations from AWS customers across many industries and geographies, such as BMW Group, which extended its work to help BMW’s developers derive insights from the data their vehicles produce; grocery delivery service Schwan’s Home Delivery, which is optimizing delivery times across its routes, building and scaling its technology infrastructure to support evolving consumer preferences, and personalizing product recommendations; online grocery platform Pick n Pay, which migrated its entire on-premises SAP environment to AWS to automate operations and deliver real-time insights; German national football league Bundesliga, which debuted two new Bundesliga Match Facts powered by AWS to help fans better understand team performance and game strategy; and South Korea-based wireless telecommunications operator SK Telecom (SKT), which is making it easier and more cost-effective for customers to build, use, and scale computer vision applications.

- Continued to expand AWS’s infrastructure footprint to support customers, announcing plans to launch the AWS Asia Pacific (Bangkok) Region in Thailand and opening the second Region in the Middle East, the AWS Middle East (UAE) Region.

- Received CrowdStrike’s 2022 Ecosystem Partner of the year award for AWS. Together, CrowdStrike and AWS delivered end-to-end comprehensive protection that enables AWS customers to build, run, and secure applications with speed and confidence.

Inventing on behalf of customers

Amazon is driven by a passion for invention across all of its business areas. The company builds new products and services that customers ask for, and also invents new ones that customers didn’t know they wanted but make their lives or businesses better in some meaningful way. For example, this past quarter, Amazon:

- Introduced a range of new Fire TV devices and entertainment experiences, including the Omni QLED Series smart TV with hands-free Alexa controls and new ambient features that turn the TV into an always-smart device when not streaming; and the all-new Fire TV Cube streaming media player with a faster processor for increased app launch speeds, an industry-first HDMI input port, and Wi-Fi 6E support for smoother 4K streaming.

- Introduced the next generation of Echo Dot and Echo Auto, as well as upgrades to Echo Studio. The all-new Echo Dot and Echo Dot with Clock feature a redesigned audio architecture, and the Echo Dot Kids now comes in Owl and Dragon designs. The next generation Echo Auto is designed to hear requests over music, the air conditioner, and road noise, and the new Echo Studio features bass extension and custom-built spatial audio processing technology.

- Launched three new Kindle devices: Kindle Scribe, the first Kindle that makes it possible for customers to both read and write as naturally as they do on paper but with the convenience of Kindle’s glare-free Paperwhite display; the next-generation Kindle, Amazon’s lightest and most compact Kindle yet; and the next-generation Kindle Kids.

- Expanded the Ring lineup with new security devices and features: Ring Intercom allows customers living in apartment buildings to use their phone to talk to and buzz in visitors; Spotlight Cam Pro and Spotlight Cam Plus use radar sensors to detect motion and send more precise alerts; Ring Alarm Panic Button enables customers to get help at the push of a button in an emergency; and a new integration of Ring Virtual Security Guard and the Amazon Astro robot for businesses offers expanded security options.

- Announced the Blink Wired Floodlight Camera, which features person detection for the first time in a Blink device, and Blink Mini Pan Tilt accessory, which extends the functionality of the popular Blink Mini with additional viewpoint capabilities.

- Launched a new Alexa feature called Customers ask Alexa that enables brands and selling partners to answer common customer questions through Alexa and better inform purchase decisions.

- Continued to collaborate with leading retailers and stadiums to equip their locations with Just Walk Out technology for checkout-free shopping and Amazon One for palm recognition and payment. One or both of these technologies are now available at Texas A&M’s Kyle Field, Lumen Field in Seattle, Crypto.com Arena in Los Angeles, and a Hudson Nonstop at Dallas Fort Worth International Airport. Amazon also continued to roll out Amazon One at Whole Foods Market stores with the technology now available at over 65 stores in California.

- Announced the general availability of new AWS EC2 machine learning training instances (Trn1), which make it possible to build more accurate machine learning models and reduce training times. AWS-designed Trainium chips are purpose-built for high-performance machine learning training in the cloud. With Trainium-powered Trn1 instances, AWS customers can save up to 50% on deep learning training costs over equivalent GPU-based instances.

- Announced the general availability of AWS IoT FleetWise, which makes it easier to collect, transform, and transfer vehicle data to the cloud in near real time. Automakers, suppliers, fleet operators, and technology solution vendors can use the data to analyze vehicle fleet health and more quickly identify potential recalls or safety issues, make in-vehicle infotainment systems smarter, and improve advanced technologies like autonomous driving and advanced driver-assistance systems with analytics and machine learning.

- Announced a new alliance and investment with Harvard University to advance fundamental research and innovation in quantum networking, which will explore applications to combat privacy and security threats. AWS also announced the AWS Generation Q Fund at the Harvard Quantum Initiative to train the next-generation of quantum scientists and engineers.

Empowering employees and delivery service partners

In addition to its focus on customers, Amazon strives to make every day better for its employees and delivery service providers. There is a long list of initiatives the company continues to pursue. For example, in the third quarter, the company:

- Announced it is investing nearly $1 billion in pay increases for its fulfillment network employees over the next year in the U.S., bringing average pay to more than $19 per hour.

- Expanded Anytime Pay to provide hourly employees with instant access to up to 70% of their pay at any time during the month.

- Celebrated the 10-year anniversary of Career Choice, an education benefit that empowers employees to learn new skills for career success and has seen over 90,000 employees participate so far.

- Announced it is investing more than $450 million over the next year to help Delivery Service Partners (DSPs) support their teams with access to new and improved benefits, and additional rate increases. One new benefits provider, Next Mile, offers drivers employed by participating DSPs access to more than 1,700 academic programs with tuition assistance from their DSP. Participating DSPs are eligible to receive up to $5,250 per driver per year from Amazon to help cover the costs of tuition assistance.

- Expanded career advancement and development programs for front-line employees, such as offering the Amazon Intelligence Initiative to enhance technical skills and place employees in engineering roles within AWS.

- Announced plans to hire 150,000 people for open seasonal, full-time, and part-time roles across its operations network in the U.S. to help deliver for customers during the holidays.

- Introduced an additional, free mental wellness program for employees and their families in the U.S., the UK, and Brazil. Offered through Twill Therapeutics, the tools and services to improve mental health are available 24/7 and can be used to address in-the-moment concerns or as part of a daily mental health and well-being routine.

Supporting communities and protecting the environment

Amazon believes that success and scale bring broad responsibility to help the planet, future generations, and local communities in which the company has a significant presence. Amazon employees have passion for investing in these areas, and a small sampling of the many efforts from this past quarter include Amazon:

- Supporting people affected by Hurricane Fiona in Puerto Rico and Hurricane Ian in Florida by providing hundreds of thousands of essential products such as water filters and medical supplies; sending more than 320,000 bottles of water to residents of Jackson, Mississippi, suffering from a shortage of clean water; and donating items such as blankets and flashlights after the magnitude 6.8 earthquake in Sichuan Luding, China.

- Continuing to support people impacted by the war in Ukraine with product donations to refugees, financial support to more than 150 nonprofits on the ground in Eastern Europe, and cloud credits and technological assistance through AWS. As part of the support for the Ukrainian government, AWS sent Snowball devices—ruggedized compute and storage hardware—into Ukraine to help secure, store, and transfer over 10 petabytes (10 million gigabytes) of essential data to the cloud. These Snowball devices were the foundation for the effort to preserve Ukraine’s data—including state registries, education records, and other essential databases—which are critical in rebuilding the country. Amazon has donated more than $45 million in assistance since the start of the war and waived the referral fee for all Ukrainian small and medium-sized businesses selling in Amazon’s European stores. In addition, AWS launched IT Skills 4U, a free workforce-development initiative to provide Ukrainians around the world with access to skills training.

- Committing to hire at least 5,000 refugees in the U.S. by the end of 2024. The company is also providing support and resources through its Welcome Door program, which launched in April 2022 to help refugee employees navigate the immigration process.

- Committing $147 million to create and preserve 1,260 affordable homes across the Washington, D.C., metro area in partnership with minority-led organizations. This investment is the latest initiative by the Amazon Housing Equity Fund, a $2 billion commitment to create and preserve affordable homes in Amazon’s hometown communities.

- Announcing plans to invest more than €1 billion over the next five years to further electrify and decarbonize its transportation network across Europe. This includes investments in electric trucks, vans, and micro mobility solutions like e-cargo bikes, as well as charging infrastructure.

- Announcing agreements with Plug Power to supply 10,950 tons of green hydrogen per year for Amazon’s transportation and building operations, and with Infinium to bring clean-burning electrofuels to Amazon’s middle mile transportation fleet starting next year.

- Announcing 71 new renewable energy projects globally, including its first project in Brazil and its first solar farms in India and Poland, building on Amazon’s position as the leading corporate buyer of renewable energy in the world.

- Extending its partnership with Water.org, donating $10 million to help launch the Water.org Water & Climate Fund. The fund is focused on climate-resilient water and sanitation solutions that will result in lasting access for 100 million people across Asia, Africa, and Latin America. In addition, Amazon’s funding will help provide 1 million people with access to clean water by 2025.

- Launching Amazon Catalytic Capital to invest $150 million in venture capital funds, accelerators, incubators, and venture studios that provide funding to entrepreneurs from underrepresented backgrounds.

- Announcing AWS has now helped more than 13 million people globally gain access to free cloud computing skills training since 2020 as part of Amazon’s commitment to provide free training to 29 million people around the world by 2025.

Financial Guidance

The following forward-looking statements reflect Amazon.com’s expectations as of October 27, 2022, and are subject to substantial uncertainty. Our results are inherently unpredictable and may be materially affected by many factors, such as uncertainty regarding the impacts of the COVID-19 pandemic, fluctuations in foreign exchange rates, changes in global economic and geopolitical conditions and customer demand and spending (including the impact of recessionary fears), inflation, interest rates, regional labor market and global supply chain constraints, world events, the rate of growth of the Internet, online commerce, and cloud services, and the various factors detailed below. This guidance reflects our estimates as of October 27, 2022 regarding the impacts of the COVID-19 pandemic on our operations as well as the effect of other factors discussed above.

Fourth Quarter 2022 Guidance

- Net sales are expected to be between $140.0 billion and $148.0 billion, or to grow between 2% and 8% compared with fourth quarter 2021. This guidance anticipates an unfavorable impact of approximately 460 basis points from foreign exchange rates.

- Operating income is expected to be between $0 and $4.0 billion, compared with $3.5 billion in fourth quarter 2021.

- This guidance assumes, among other things, that no additional business acquisitions, restructurings, or legal settlements are concluded.

A conference call will be webcast live today at 2:30 p.m. PT/5:30 p.m. ET, and will be available for at least three months at amazon.com/ir. This call will contain forward-looking statements and other material information regarding the Company’s financial and operating results.

These forward-looking statements are inherently difficult to predict. Actual results and outcomes could differ materially for a variety of reasons, including, in addition to the factors discussed above, the amount that Amazon.com invests in new business opportunities and the timing of those investments, the mix of products and services sold to customers, the mix of net sales derived from products as compared with services, the extent to which we owe income or other taxes, competition, management of growth, potential fluctuations in operating results, international growth and expansion, the outcomes of claims, litigation, government investigations, and other proceedings, fulfillment, sortation, delivery, and data center optimization, risks of inventory management, variability in demand, the degree to which the Company enters into, maintains, and develops commercial agreements, proposed and completed acquisitions and strategic transactions, payments risks, and risks of fulfillment throughput and productivity. Other risks and uncertainties include, among others, risks related to new products, services, and technologies, system interruptions, government regulation and taxation, and fraud. In addition, global economic and geopolitical conditions and additional or unforeseen effects from the COVID-19 pandemic amplify many of these risks. More information about factors that potentially could affect Amazon.com’s financial results is included in Amazon.com’s filings with the Securities and Exchange Commission (“SEC”), including its most recent Annual Report on Form 10-K and subsequent filings.

Our investor relations website is amazon.com/ir and we encourage investors to use it as a way of easily finding information about us. We promptly make available on this website, free of charge, the reports that we file or furnish with the SEC, corporate governance information (including our Code of Business Conduct and Ethics), and select press releases, which may contain material information about us, and you may subscribe to be notified of new information posted to this site.

About Amazon

Amazon is guided by four principles: customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking. Amazon strives to be Earth’s Most Customer-Centric Company, Earth’s Best Employer, and Earth’s Safest Place to Work. Customer reviews, 1-Click shopping, personalized recommendations, Prime, Fulfillment by Amazon, AWS, Kindle Direct Publishing, Kindle, Career Choice, Fire tablets, Fire TV, Amazon Echo, Alexa, Just Walk Out technology, Amazon Studios, and The Climate Pledge are some of the things pioneered by Amazon. For more information, visit amazon.com/about and follow @AmazonNews.

Amazon.com, Inc. Certain Definitions

Customer Accounts

- References to customers mean customer accounts established when a customer places an order through one of our stores. Customer accounts exclude certain customers, including customers associated with certain of our acquisitions, Amazon Payments customers, AWS customers, and the customers of select companies with whom we have a technology alliance or marketing and promotional relationship. Customers are considered active when they have placed an order during the preceding twelve-month period.

Seller Accounts

- References to sellers means seller accounts, which are established when a seller receives an order from a customer account. Sellers are considered active when they have received an order from a customer during the preceding twelve-month period.

AWS Customers

- References to AWS customers mean unique AWS customer accounts, which are unique customer account IDs that are eligible to use AWS services. This includes AWS accounts in the AWS free tier. Multiple users accessing AWS services via one account ID are counted as a single account. Customers are considered active when they have had AWS usage activity during the preceding one-month period.

- References to units mean physical and digital units sold (net of returns and cancellations) by us and sellers in our stores as well as Amazon-owned items sold in other stores. Units sold are paid units and do not include units associated with AWS, certain acquisitions, certain subscriptions, rental businesses, or advertising businesses, or Amazon gift cards.

Amazon Investor Relations Dave Fildes, [email protected] amazon.com/ir

Amazon Public Relations Dan Perlet, [email protected] amazon.com/pr

Source: Amazon.com, Inc.

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

Amazon (AMZN) to Report Q3 Earnings: What's in the Offing?

Amazon ( AMZN Quick Quote AMZN - Free Report ) is scheduled to report third-quarter 2022 results on Oct 27. For the third quarter, Amazon expects net sales between $125 billion and $130 billion. Net sales are expected to grow 13-17% from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for net sales is pegged at $128.05 billion, indicating growth of 15.6% from the prior-year quarter’s reported figure. The Zacks Consensus Estimate for third-quarter earnings is pegged at 24 cents per share, suggesting a decline of 22.6% from the year-ago quarter’s reported figure. The figure has moved up 4.3% over the past 30 days.

Amazon.com, Inc. Price and EPS Surprise

Amazon.com, Inc. price-eps-surprise | Amazon.com, Inc. Quote

Prime, Retail & Streaming Momentum to Note

Growing inflationary pressure on fuel, energy and transportation costs might have negatively impacted AMZN’s third-quarter performance. A slowdown in online shopping activities, elevated staffing costs, foreign-currency headwinds and supply-chain disruptions are likely to have been a concern. Nevertheless, Amazon’s strong performance during its mega shopping event Prime Day, conducted at the beginning of the third quarter, is likely to have driven its sales in the to-be-reported quarter. Its robust distribution network, and Prime-enabled fast delivery and strengthening grocery services are expected to have aided the performance of its online retail business in the third quarter. Prime benefits, including a strong loyalty system, customer-friendly offers, quick grocery delivery services, and robust Prime Free One-Day and Prime Free Same-Day Delivery services, are expected to have aided Amazon’s customer momentum in the quarter under review. AMZN’s aggressive stance on the core retail industry, especially grocery retail, is expected to have benefited the quarterly performance. An expanding footprint of Amazon Fresh grocery stores across the United States is anticipated to have contributed well to AMZN’s grocery sales in the third quarter. Amazon’s strengthening footprint in countries like India, Canada, the U.K. and Australia is expected to have bolstered its efforts in expanding its footprint in the global retail market. This apart, strengthening relationships with third-party sellers on the back of strong solution offerings might have remained a positive. In the third quarter, Amazon rolled out a solution named Amazon Warehousing & Distribution for sellers to solve their supply-chain issues. It also introduced marketing solutions like advertising, social media ads and Buy with Prime marketing toolkits for sellers, especially direct-to-consumer merchants. Coming to streaming services, a solid momentum across Prime Video is expected to have remained a major tailwind in the soon-to-be-reported quarter. Expanding original content, regional content and the overall content portfolio on Prime Video are expected to have driven the Prime subscription in the to-be-reported quarter. Gains from the growing momentum across Amazon Music are expected to get reflected in the upcoming third-quarter results.

AWS Portfolio Momentum to Consider

Amazon’s expanding Amazon Web Services (AWS) portfolio is expected to have benefited the third-quarter performance. In the third quarter, AWS announced the general availability of AWS IoT FleetWise, which aids in seamlessly collecting and transferring data from millions of vehicles to the cloud in real time with cost efficiency. AWS made its managed wide area network (WAN) service, namely AWS Cloud WAN, generally available. It also announced the general availability of three serverless analytics options for Amazon EMR, Amazon MSK and Amazon Redshift. We expect all these initiatives to have helped Amazon win customers. This, in turn, is expected to have boosted AWS’s third-quarter revenues.

Smart Device Portfolio Strength

Amazon’s expanding tablet offerings with the introduction of the all-new Kindle and Kindle Kids, and Kindle Scribe might have contributed well. AMZN’s expanding portfolio of Echo smart speakers might have been a positive for its third-quarter performance. Amazon unveiled next-generation Echo Dot and Echo Auto, Echo Dot Kids and Echo Studio in the third quarter. Its strengthening portfolio of Fire devices is anticipated to have been beneficial. Amazon unveiled next-generation Fire TV Cube and the new Alexa Voice Remote Pro in the to-be-reported quarter. AMZN’s expanding smart security camera offering with the introduction of the Blink Wired Floodlight Camera and the new Blink Mini Pan Tilt might have been a positive. Strengthening Alexa features is likely to have aided Amazon in delivering a better user experience. All these factors are expected to have aided AMZN’s quarterly performance.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Amazon this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here as you see below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter . Amazon has an Earnings ESP of -27.66% and a Zacks Rank #4 (Sell) at present.

Stocks to Consider

Here are some stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this season. Cognizant Technology Solutions ( CTSH Quick Quote CTSH - Free Report ) has an Earnings ESP of +0.19% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here . Cognizant is set to report third-quarter 2022 results on Nov 2. The Zacks Consensus Estimate for CTSH’s earnings is pegged at $1.17 per share, suggesting an increase of 10.4% from the prior-year quarter’s reported figure. Benefitfocus has an Earnings ESP of +2.32% and a Zacks Rank of 3 at present. Benefitfocus is scheduled to release third-quarter fiscal 2022 results on Nov 2. The Zacks Consensus Estimate for BNFT’s loss is pegged at 14 cents per share, which is narrower than the prior-year quarter’s reported loss of 19 cents. CDW ( CDW Quick Quote CDW - Free Report ) has an Earnings ESP of +0.31% and is Zacks #3 Ranked at present. CDW is expected to release third-quarter 2022 results on Nov 2. The Zacks Consensus Estimate for CDW’s earnings is pegged at $2.52 per share, suggesting an increase of 18.3% from the year-ago quarter’s reported figure. Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar .

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report free:.

Amazon.com, Inc. (AMZN) - free report >>

Cognizant Technology Solutions Corporation (CTSH) - free report >>

CDW Corporation (CDW) - free report >>

Published in

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Stock Market

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Investment Ideas

- Research Reports

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Here’s why amazon.com (amzn) declined in 2022.

Investment management company First Pacific Advisors recently released its “FPA Crescent Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here . In the fourth quarter, the fund returned 8.42% compared to a 7.56% return for the S&P 500 Index. The fund delivered a -9.20% return in 2022 compared to a -18.11% return for the S&P 500 Index. In addition, you can check the top 5 holdings of the fund to know its best picks in 2022

FPA Crescent Fund highlighted stocks like Amazon.com, Inc. (NASDAQ: AMZN ) in the fourth quarter investor letter. Headquartered in Seattle, Washington, Amazon.com, Inc. (NASDAQ:AMZN) provides consumer products and subscriptions. On February 9, 2023, Amazon.com, Inc. (NASDAQ:AMZN) stock closed at $98.24 per share. One-month return of Amazon.com, Inc. (NASDAQ:AMZN) was 3.12%, and its shares lost 38.22% of their value over the last 52 weeks. Amazon.com, Inc. (NASDAQ:AMZN) has a market capitalization of $1.007 trillion.

FPA Crescent Fund made the following comment about Amazon.com, Inc. (NASDAQ:AMZN) in its Q4 2022 investor letter:

“ Amazon.com, Inc. (NASDAQ:AMZN) declined in price during the year as it became apparent that, having doubled the footprint of the company's retail infrastructure coming out of Covid, the company had expanded too aggressively. The investment community is similarly concerned that the company's cloud business, AWS, is likely to be negatively impacted by general economic malaise, which would result in a growth rate lower than that of the recent past. Taking a long-term view, we envision both AWS and retail growing over the coming years, complemented by a high margin advertising business. Looking forward, we expect the company to benefit from positive operating leverage under the keen eye of CEO Andy Jassy, who has proven himself as a results-oriented leader in his former position as head of AWS. Though the valuation looks rather rich at the moment on near-term results, if we are correct in our thesis, the valuation at present prices will look to have been a bargain in hindsight.”

christian-wiediger-rymh7EZPqRs-unsplash

Amazon.com, Inc. (NASDAQ:AMZN) is in 2nd position on our list of 30 Most Popular Stocks Among Hedge Funds . As per our database, 269 hedge fund portfolios held Amazon.com, Inc. (NASDAQ:AMZN) at the end of the third quarter, which was 252 in the previous quarter.

We discussed Amazon.com, Inc. (NASDAQ:AMZN) in another article and shared RGA Investment Advisors' views on the company. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Supply Chain Management Definition and Biggest Companies

16 Most Valuable Beverage Brands in the World

15 Most Valuable Russian Companies

Disclosure: None. This article is originally published at Insider Monkey .

IMAGES

COMMENTS

Amazon.com Inc. analyst ratings, historical stock prices, earnings estimates & actuals. AMZN updated stock price target summary.

Unlimited, Prime Video, and Amazon Music Unlimited, as growing faster within the mix. Source: Morningstar Equity Research Source: Morningstar Undervalued Fairly Valued Overvalued Quantitative Valuation t USA AMZN Morningstar Equity Analyst Report | Report as of 01 Jul 2021 03:46, UTC | Page 1 of 7 Amazon.com Inc AMZN (XNAS)

Amazon.com Inc. research and ratings by Barron's. View AMZN revenue estimates and earnings estimates, as well as in-depth analyst breakdowns. ... AMZN will report FY 2024 earnings on 01/30/2025 ...

Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its fourth quarter ended December 31, 2022. Fourth Quarter 2022 Net sales increased 9% to $149.2 billion in the fourth quarter, compared with $137.4 billion in fourth quarter 2021. Excluding the $5.0 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased ...

AMAZON.COM, INC. PART I Item 1. Business This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements based on expectations, estimates, and projections as of the date of this filing. Actual results and outcomes may differ materially from those expressed in forward-looking statements.

See the latest Amazon stock price (NASDAQ:AMZN), related news, valuation, dividends and more to help you make your investing decisions.

Net income also saw a dramatic increase to $10.6 billion, or $1.00 per diluted share, compared to just $0.3 billion, or $0.03 per diluted share, in the fourth quarter of 2022. For the full year of ...

Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its third quarter ended September 30, 2022. Net sales increased 15% to $127.1 billion in the third quarter, compared with $110.8 billion in third quarter 2021. Excluding the $5.0 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 19% compared with ...

Find out all the key statistics for Amazon.com, Inc. (AMZN), including valuation measures, fiscal year financial statistics, trading record, share statistics and more.

Amazon share holder equity for 2023 was $201.875B, a 38.23% increase from 2022. Amazon share holder equity for 2022 was $146.043B, a 5.64% increase from 2021. Amazon share holder equity for 2021 was $138.245B, a 48.01% increase from 2020. Amazon.com is one of the largest e-commerce providers, with sprawling operations spreading across the globe.

Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its fourth quarter ended December 31, 2023. Fourth Quarter 2023 Net sales increased 14% to $170.0 billion in the fourth quarter, compared with $149.2 billion in fourth quarter 2022. Excluding the $1.3 billion favorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 13 ...

SEATTLE—(BUSINESS WIRE) February 3, 2022—Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its fourth quarter ended December 31, 2021. ... (Form DEF 14A) filed after their 2022 10-K Annual Report includes: Voting Procedures; Board Members; Executive Team; Salaries, Bonuses, Perks ... Book Value, Return on Equity, Current ...

KO The Coca-Cola Company. 60.64. +0.15%. Find the latest Amazon.com, Inc. (AMZN) stock quote, history, news and other vital information to help you with your stock trading and investing.

SEATTLE-- (BUSINESS WIRE)--Jul. 28, 2022-- Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its second quarter ended June 30, 2022. Operating cash flow decreased 40% to $35.6 billion for the trailing twelve months, compared with $59.3 billion for the trailing twelve months ended June 30, 2021.

The Amazon Housing Equity Fund Impact Report YEAR IN REVIEW 20 22. Corporate America plays a vital role in enriching its communities. Amazon's belief is that all people should have ... As of March 2022, Amazon has announced total commitments of more than $1.2 billion1 in affordable housing initiatives in our hometown communities - Arlington ...

SEC Filings Details. Document Details. Form: 10-K

Today's Research Daily features new research reports on 16 major stocks, including Amazon.com, Inc. (AMZN), Berkshire Hathaway Inc. (BRK.B) and Thermo Fisher Scientific Inc. (TMO). These research ...

SEATTLE--(BUSINESS WIRE)-- Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its third quarter ended September 30, 2022. Net sales increased 15% to $127.1 billion in the third quarter, compared with $110.8 billion in third quarter 2021.Excluding the $5.0 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales ...

In this article: AMZN. For the quarter ended December 2022, Amazon (AMZN) reported revenue of $149.2 billion, up 8.6% over the same period last year. EPS came in at $0.21, compared to $1.39 in the ...

Zacks Equity Research October 24, 2022. Better trading starts here. AMZN - Free Report) is scheduled to report third-quarter 2022 results on Oct 27. For the third quarter, Amazon expects net sales ...

Amazon.com Analyst EPS Estimates. Amazon.com last issued its quarterly earnings data on February 1st, 2024. The e-commerce giant reported $1.00 earnings per share for the quarter, beating analysts' consensus estimates of $0.81 by $0.19. The firm had revenue of $169.96 billion for the quarter, compared to analysts' expectations of $165.96 billion.

Amazon.com, Inc. - Annual reports, proxies and shareholder letters. About Amazon Investor Relations Annual reports, proxies and shareholder letters.

Investment management company First Pacific Advisors recently released its "FPA Crescent Fund" fourth quarter 2022 investor letter. A copy of the same can be downloaded here. In the fourth ...