11.4 The Business Plan

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Business Description

This section describes the industry, your product, and the business and success factors. It should provide a current outlook as well as future trends and developments. You also should address your company’s mission, vision, goals, and objectives. Summarize your overall strategic direction, your reasons for starting the business, a description of your products and services, your business model, and your company’s value proposition. Consider including the Standard Industrial Classification/North American Industry Classification System (SIC/NAICS) code to specify the industry and insure correct identification. The industry extends beyond where the business is located and operates, and should include national and global dynamics. Table 11.4 shows a sample business description for La Vida Lola.

Industry Analysis and Market Strategies

Here you should define your market in terms of size, structure, growth prospects, trends, and sales potential. You’ll want to include your TAM and forecast the SAM . (Both these terms are discussed in Conducting a Feasibility Analysis .) This is a place to address market segmentation strategies by geography, customer attributes, or product orientation. Describe your positioning relative to your competitors’ in terms of pricing, distribution, promotion plan, and sales potential. Table 11.5 shows an example industry analysis and market strategy for La Vida Lola.

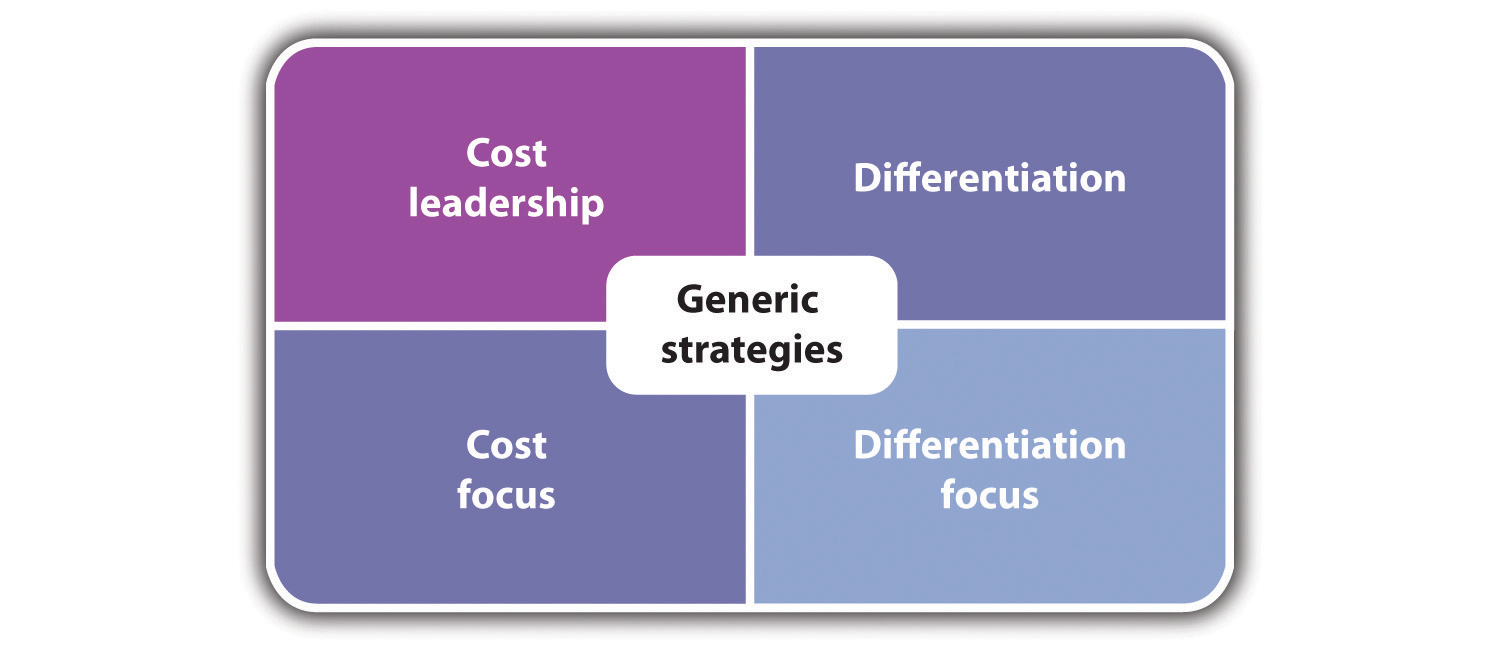

Competitive Analysis

The competitive analysis is a statement of the business strategy as it relates to the competition. You want to be able to identify who are your major competitors and assess what are their market shares, markets served, strategies employed, and expected response to entry? You likely want to conduct a classic SWOT analysis (Strengths Weaknesses Opportunities Threats) and complete a competitive-strength grid or competitive matrix. Outline your company’s competitive strengths relative to those of the competition in regard to product, distribution, pricing, promotion, and advertising. What are your company’s competitive advantages and their likely impacts on its success? The key is to construct it properly for the relevant features/benefits (by weight, according to customers) and how the startup compares to incumbents. The competitive matrix should show clearly how and why the startup has a clear (if not currently measurable) competitive advantage. Some common features in the example include price, benefits, quality, type of features, locations, and distribution/sales. Sample templates are shown in Figure 11.17 and Figure 11.18 . A competitive analysis helps you create a marketing strategy that will identify assets or skills that your competitors are lacking so you can plan to fill those gaps, giving you a distinct competitive advantage. When creating a competitor analysis, it is important to focus on the key features and elements that matter to customers, rather than focusing too heavily on the entrepreneur’s idea and desires.

Operations and Management Plan

In this section, outline how you will manage your company. Describe its organizational structure. Here you can address the form of ownership and, if warranted, include an organizational chart/structure. Highlight the backgrounds, experiences, qualifications, areas of expertise, and roles of members of the management team. This is also the place to mention any other stakeholders, such as a board of directors or advisory board(s), and their relevant relationship to the founder, experience and value to help make the venture successful, and professional service firms providing management support, such as accounting services and legal counsel.

Table 11.6 shows a sample operations and management plan for La Vida Lola.

Marketing Plan

Here you should outline and describe an effective overall marketing strategy for your venture, providing details regarding pricing, promotion, advertising, distribution, media usage, public relations, and a digital presence. Fully describe your sales management plan and the composition of your sales force, along with a comprehensive and detailed budget for the marketing plan. Table 11.7 shows a sample marketing plan for La Vida Lola.

Financial Plan

A financial plan seeks to forecast revenue and expenses; project a financial narrative; and estimate project costs, valuations, and cash flow projections. This section should present an accurate, realistic, and achievable financial plan for your venture (see Entrepreneurial Finance and Accounting for detailed discussions about conducting these projections). Include sales forecasts and income projections, pro forma financial statements ( Building the Entrepreneurial Dream Team , a breakeven analysis, and a capital budget. Identify your possible sources of financing (discussed in Conducting a Feasibility Analysis ). Figure 11.19 shows a template of cash-flow needs for La Vida Lola.

Entrepreneur In Action

Laughing man coffee.

Hugh Jackman ( Figure 11.20 ) may best be known for portraying a comic-book superhero who used his mutant abilities to protect the world from villains. But the Wolverine actor is also working to make the planet a better place for real, not through adamantium claws but through social entrepreneurship.

A love of java jolted Jackman into action in 2009, when he traveled to Ethiopia with a Christian humanitarian group to shoot a documentary about the impact of fair-trade certification on coffee growers there. He decided to launch a business and follow in the footsteps of the late Paul Newman, another famous actor turned philanthropist via food ventures.

Jackman launched Laughing Man Coffee two years later; he sold the line to Keurig in 2015. One Laughing Man Coffee café in New York continues to operate independently, investing its proceeds into charitable programs that support better housing, health, and educational initiatives within fair-trade farming communities. 55 Although the New York location is the only café, the coffee brand is still distributed, with Keurig donating an undisclosed portion of Laughing Man proceeds to those causes (whereas Jackman donates all his profits). The company initially donated its profits to World Vision, the Christian humanitarian group Jackman accompanied in 2009. In 2017, it created the Laughing Man Foundation to be more active with its money management and distribution.

- You be the entrepreneur. If you were Jackman, would you have sold the company to Keurig? Why or why not?

- Would you have started the Laughing Man Foundation?

- What else can Jackman do to aid fair-trade practices for coffee growers?

What Can You Do?

Textbooks for change.

Founded in 2014, Textbooks for Change uses a cross-compensation model, in which one customer segment pays for a product or service, and the profit from that revenue is used to provide the same product or service to another, underserved segment. Textbooks for Change partners with student organizations to collect used college textbooks, some of which are re-sold while others are donated to students in need at underserved universities across the globe. The organization has reused or recycled 250,000 textbooks, providing 220,000 students with access through seven campus partners in East Africa. This B-corp social enterprise tackles a problem and offers a solution that is directly relevant to college students like yourself. Have you observed a problem on your college campus or other campuses that is not being served properly? Could it result in a social enterprise?

Work It Out

Franchisee set out.

A franchisee of East Coast Wings, a chain with dozens of restaurants in the United States, has decided to part ways with the chain. The new store will feature the same basic sports-bar-and-restaurant concept and serve the same basic foods: chicken wings, burgers, sandwiches, and the like. The new restaurant can’t rely on the same distributors and suppliers. A new business plan is needed.

- What steps should the new restaurant take to create a new business plan?

- Should it attempt to serve the same customers? Why or why not?

This New York Times video, “An Unlikely Business Plan,” describes entrepreneurial resurgence in Detroit, Michigan.

- 48 Chris Guillebeau. The $100 Startup: Reinvent the Way You Make a Living, Do What You Love, and Create a New Future . New York: Crown Business/Random House, 2012.

- 49 Jonathan Chan. “What These 4 Startup Case Studies Can Teach You about Failure.” Foundr.com . July 12, 2015. https://foundr.com/4-startup-case-studies-failure/

- 50 Amy Feldman. “Inventor of the Cut Buddy Paid YouTubers to Spark Sales. He Wasn’t Ready for a Video to Go Viral.” Forbes. February 15, 2017. https://www.forbes.com/sites/forbestreptalks/2017/02/15/inventor-of-the-cut-buddy-paid-youtubers-to-spark-sales-he-wasnt-ready-for-a-video-to-go-viral/#3eb540ce798a

- 51 Jennifer Post. “National Business Plan Competitions for Entrepreneurs.” Business News Daily . August 30, 2018. https://www.businessnewsdaily.com/6902-business-plan-competitions-entrepreneurs.html

- 52 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition . March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf

- 53 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition. March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf; Based on 2019 RBPC Competition Rules and Format April 4–6, 2019. https://rbpc.rice.edu/sites/g/files/bxs806/f/2019-RBPC-Competition-Rules%20-Format.pdf

- 54 Foodstart. http://foodstart.com

- 55 “Hugh Jackman Journey to Starting a Social Enterprise Coffee Company.” Giving Compass. April 8, 2018. https://givingcompass.org/article/hugh-jackman-journey-to-starting-a-social-enterprise-coffee-company/

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-4-the-business-plan

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-14343635291-33bf053f368c43f6a792e94775285bbd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

8.6: Business Plans

- Last updated

- Save as PDF

- Page ID 3642

What you’ll learn to do: list and describe the key components of a business plan

Business planning forces an entrepreneur to develop a detailed understanding of the market—including their unique value proposition, competitive strategy, and what it will take to succeed. This understanding includes specific operating and financial statement terms, which often take a significant amount of research and time to discover.

In this section, we will focus in on the business plan, which pulls together the research, analysis and self-assessment of prior sections.

Learning Objectives

- Briefly describe the components of a business plan

Create Your Business Plan

Executive Summary

Company Description

Market Analysis

Organization & Management

Service or Product Line

Marketing & Sales

- Funding Request

Financial Projections

The SBA provides two example business plans for reference: consulting firm and toy manufacturer.

Note that the length and depth of business plans vary depending on the audience and objective. For example, a business owner(s) seeking a traditional bank loan will likely need a more detailed plan. An alternative is the lean business plan, which PaloAlto Software and BPlan founder and CEO Tim Berry claims can be completed in an hour. The process and timeframe is probably more applicable to a seasoned entrepreneur, but it may be worth reading Berry’s Fundamentals of Lean Business Planning blog post to see if it’s a fit. There are a number of one page business plan templates freely available online; to view a range of options, conduct an image search on “one page business plan template.” A final approach for consideration is venture capitalist Guy Kawasaki’s 10/20/30 formula: 10 slides, 20 minutes, 30 point font. In those 10 slides, Kawasaki recommends eliminating pitch-speak and focusing on the topics that matter to a VC:

- Your solution

- Business model

- Underlying magic/technology

- Marketing and sales

- Competition

- Projections and milestones

- Status and timeline

- Summary and call to action

practice question \(\PageIndex{1}\)

The SBA recommends that a business plan addresses the following major elements EXCEPT:

- Funding request

- Company description

- Market analysis

- IT analysis

D. Correct. IT strategy is not a major element addressed in a business plan.

Understanding the Components of Business Plans

Although terminology and formats differ, most business plans include the same key ingredients. Let’s drill down into the elements SBA recommends:

Briefly summarize what you do (Product or Service) for whom (Target Market) and what will make you successful. Elements to include: mission statement, management and organizational structure highlights, intended location and scale of operation. If you’re seeking financing, include summary-level financial information and growth projections.

In this section, provide a more detailed description of your company, including the opportunity (aka market problem addressed) and your solution. Be specific in identifying your target market, including a description of the consumer profile or list of target businesses or organizations. This is where detail your competitive advantage, including management expertise and/or product, process, or other differentiators.

This is where the rigor of your research pays off. Use this section to summarize your understanding of the economy, industry, your target market and related trends and developments. This is also where you would incorporate competitive research, including success factors and what your positioning and value proposition will be relative to competitors. For perspective on competitive mapping, see the links to sample analyses below:

- Business News Daily.com: Porter’s Five Forces: Analyzing the Competition

- Simplicable’s 3 Examples of a Competitive Map

- Harvard Business Review’s Mapping Your Competitive Position

In this section, describe your legal structure (e.g., sole proprietor, partnership, corporation) and introduce yourself and management team or advisors, if applicable. You may also want to elaborate on any related points or motivations such as a social impact or sustainability orientation. If applicable, include an organizational chart so readers can visualize who’s in charge of what functions.

You may also want to include key accomplishments to illustrate what specific expertise each person brings to the team. Key management resumes can be included in the Appendix.

Use the product or service section to detail your offerings and any market differentiators such as copyrights or patents. Explain what benefit your product or service delivers to your customers, in particular relative to competitive offerings. If applicable, highlight quality and/or process or material supply certifications and any other points that influence purchase decisions or reduce business risk.

Cliff Bar is a case study in using sustainability as a business strategy and competitive differentiator. For perspective, read UC Davis’ Clif Bar: Raises the Bar on Sustainability write-up of Clif Bar President and Chief Operating Officer Kevin Cleary’s Dean’s Distinguished Speaker presentation. Research and development activities and any related funding should also be detailed in this section.

In a world where consumers are overwhelmed by choices, you can’t expect a better product or service to win on merit alone. Your task in this section is to describe your plan to bring your product or service to market. You should also detail how the sales will happen so related costs and technology can be factored into your financials. The complexity of your marketing activities and sales process (and corresponding sales lead time) will depend on your product or service.

For a general perspective, see Fitsmallbusiness.com’s Sales Funnel Templates, Definition & Stages article. The approach that works for you will depend on your business and your nature. The good news is technology has made a range of low cost options available.

For a dose of marketing perspective and creative inspiration, read Creative Guerilla Marketing’s What is Guerilla Marketing article.

Funding Request (if applicable)

If you’re using your business plan to request funding, this section is where you’ll detail your funding requirements and the intended use of those funds over the next five years. The SBA recommends specifying whether you’re asking for debt or equity financing and your desired terms, including interest rate and time period. Provide an explanation of the funding need—for example, to cover operating expenses while building a revenue pipeline. Finally, state your future strategic plan, whether it’s paying off debt or selling the business.

A business plan is nothing without numbers and financial statements should be prepared regardless of whether you’re requesting funding or using your business plan as proof of concept. Projections should cover a five year period and include a financial outlook summary as well as forecasted income statements, balance sheets, cash flow statements and capital expenditure budgets.

The SBA advises using more detailed (quarterly or monthly) projections for the first year. This level of detail also serves as a reality check and early warning for you as a business manager as you implement your plan. If your business is an ongoing concern, include actual income statements, balance sheets, and cash flow statements for the last three to five years. If you have other assets you’re prepared to offer as collateral, list them in this section. Review your projections and funding request details to make sure the narrative and numbers are in synch. This section runs the risk of becoming a blur of numbers without significance. Be thoughtful and creative (with your design, not the numbers) in order to present your financials in a clear and compelling manner.

The Appendix is used to provide supporting detail and provide any other relevant or requested documentation. The SBA lists the following common items to include: credit histories, resumes, product pictures, letters of reference, licenses, permits, or patents, legal documents, permits, and other contracts.

SBA’s Business Plan Tool (registration required)

practice question \(\PageIndex{2}\)

In the components of a business plan, what section contains a detailed description of the company, the problem/opportunity, proposed solution to be offered, and your competitive advantage?

- Service and Product Line

- Organization and Management

c . The Company description offers a detailed view of those factors.

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- Subscribers For Subscribers

- ELN Write for Entrepreneur

- Store Entrepreneur Store

- Spotlight Spotlight

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

An Introduction to Business Plans Why is a business plan so vital to the health of your business? Read the first section of our tutorial on How to Build a Business Plan to find out.

A business plan is a written description of your business's future. That's all there is to it--a document that desribes what you plan to do and how you plan to do it. If you jot down a paragraph on the back of an envelope describing your business strategy, you've written a plan, or at least the germ of a plan.

Business plans can help perform a number of tasks for those who write and read them. They're used by investment-seeking entrepreneurs to convey their vision to potential investors. They may also be used by firms that are trying to attract key employees, prospect for new business, deal with suppliers or simply to understand how to manage their companies better.

So what's included in a business plan, and how do you put one together? Simply stated, a business plan conveys your business goals, the strategies you'll use to meet them, potential problems that may confront your business and ways to solve them, the organizational structure of your business (including titles and responsibilities), and finally, the amount of capital required to finance your venture and keep it going until it breaks even.

Sound impressive? It can be, if put together properly. A good business plan follows generally accepted guidelines for both form and content. There are three primary parts to a business plan:

- The first is the business concept , where you discuss the industry, your business structure, your particular product or service, and how you plan to make your business a success.

- The second is the marketplace section , in which you describe and analyze potential customers: who and where they are, what makes them buy and so on. Here, you also describe the competition and how you'll position yourself to beat it.

- Finally, the financial section contains your income and cash flow statement, balance sheet and other financial ratios, such as break-even analyses. This part may require help from your accountant and a good spreadsheet software program.

Breaking these three major sections down even further, a business plan consists of seven key components:

- Executive summary

- Business description

- Market strategies

- Competitive analysis

- Design and development plan

- Operations and management plan

- Financial factors

In addition to these sections, a business plan should also have a cover, title page and table of contents.

How Long Should Your Business Plan Be? Depending on what you're using it for, a useful business plan can be any length, from a scrawl on the back of an envelope to, in the case of an especially detailed plan describing a complex enterprise, more than 100 pages. A typical business plan runs 15 to 20 pages, but there's room for wide variation from that norm. Much will depend on the nature of your business. If you have a simple concept, you may be able to express it in very few words. On the other hand, if you're proposing a new kind of business or even a new industry, it may require quite a bit of explanation to get the message across.

The purpose of your plan also determines its length. If you want to use your plan to seek millions of dollars in seed capital to start a risky venture, you may have to do a lot of explaining and convincing. If you're just going to use your plan for internal purposes to manage an ongoing business, a much more abbreviated version should be fine.

Who Needs a Business Plan?

About the only person who doesn't need a business plan is one who's not going into business. You don't need a plan to start a hobby or to moonlight from your regular job. But anybody beginning or extending a venture that will consume significant resources of money, energy or time, and that is expected to return a profit, should take the time to draft some kind of plan.

Startups. The classic business plan writer is an entrepreneur seeking funds to help start a new venture. Many, many great companies had their starts on paper, in the form of a plan that was used to convince investors to put up the capital necessary to get them under way.

Most books on business planning seem to be aimed at these startup business owners. There's one good reason for that: As the least experienced of the potential plan writers, they're probably most appreciative of the guidance. However, it's a mistake to think that only cash-starved startups need business plans. Business owners find plans useful at all stages of their companies' existence, whether they're seeking financing or trying to figure out how to invest a surplus.

Established firms seeking help. Not all business plans are written by starry-eyed entrepreneurs. Many are written by and for companies that are long past the startup stage. WalkerGroup/Designs, for instance, was already well-established as a designer of stores for major retailers when founder Ken Walker got the idea of trademarking and licensing to apparel makers and others the symbols 01-01-00 as a sort of numeric shorthand for the approaching millennium. Before beginning the arduous and costly task of trademarking it worldwide, Walker used a business plan complete with sales forecasts to convince big retailers it would be a good idea to promise to carry the 01-01-00 goods. It helped make the new venture a winner long before the big day arrived. "As a result of the retail support up front," Walker says, "we had over 45 licensees running the gamut of product lines almost from the beginning."

These middle-stage enterprises may draft plans to help them find funding for growth just as the startups do, although the amounts they seek may be larger and the investors more willing. They may feel the need for a written plan to help manage an already rapidly growing business. Or a plan may be seen as a valuable tool to be used to convey the mission and prospects of the business to customers, suppliers or others.

Plan an Updating Checklist Here are seven reasons to think about updating your business plan. If even just one applies to you, it's time for an update.

- A new financial period is about to begin. You may update your plan annually, quarterly or even monthly if your industry is a fast-changing one.

- You need financing , or additional financing. Lenders and other financiers need an updated plan to help them make financing decisions.

- There's been a significant market change . Shifting client tastes, consolidation trends among customers and altered regulatory climates can trigger a need for plan updates.

- Your firm develops or is about to develop a new product , technology , service or skill. If your business has changed a lot since you wrote your plan the first time around, it's time for an update.

- You have had a change in management . New managers should get fresh information about your business and your goals.

- Your company has crossed a threshold, such as moving out of your home office, crossing the $1 million sales mark or employing your 100th employee .

- Your old plan doesn't seem to reflect reality any more. Maybe you did a poor job last time; maybe things have just changed faster than you expected. But if your plan seems irrelevant, redo it.

Finding the Right Plan for You

Business plans tend to have a lot of elements in common, like cash flow projections and marketing plans. And many of them share certain objectives as well, such as raising money or persuading a partner to join the firm. But business plans are not all the same any more than all businesses are.

Depending on your business and what you intend to use your plan for, you may need a very different type of business plan from another entrepreneur. Plans differ widely in their length, their appearance, the detail of their contents, and the varying emphases they place on different aspects of the business.

The reason that plan selection is so important is that it has a powerful effect on the overall impact of your plan. You want your plan to present you and your business in the best, most accurate light. That's true no matter what you intend to use your plan for, whether it's destined for presentation at a venture capital conference, or will never leave your own office or be seen outside internal strategy sessions.

When you select clothing for an important occasion, odds are you try to pick items that will play up your best features. Think about your plan the same way. You want to reveal any positives that your business may have and make sure they receive due consideration.

Types of Plans Business plans can be divided roughly into four separate types. There are very short plans, or miniplans. There are working plans, presentation plans and even electronic plans. They require very different amounts of labor and not always with proportionately different results. That is to say, a more elaborate plan is not guaranteed to be superior to an abbreviated one, depending on what you want to use it for.

- The Miniplan. A miniplan may consist of one to 10 pages and should include at least cursory attention to such key matters as business concept, financing needs, marketing plan and financial statements, especially cash flow, income projection and balance sheet. It's a great way to quickly test a business concept or measure the interest of a potential partner or minor investor. It can also serve as a valuable prelude to a full-length plan later on.

Be careful about misusing a miniplan. It's not intended to substitute for a full-length plan. If you send a miniplan to an investor who's looking for a comprehensive one, you're only going to look foolish.

- The Working Plan. A working plan is a tool to be used to operate your business. It has to be long on detail but may be short on presentation. As with a miniplan, you can probably afford a somewhat higher degree of candor and informality when preparing a working plan.

A plan intended strictly for internal use may also omit some elements that would be important in one aimed at someone outside the firm. You probably don't need to include an appendix with resumes of key executives, for example. Nor would a working plan especially benefit from, say, product photos.

Fit and finish are liable to be quite different in a working plan. It's not essential that a working plan be printed on high-quality paper and enclosed in a fancy binder. An old three-ring binder with "Plan" scrawled across it with a felt-tip marker will serve quite well.

Internal consistency of facts and figures is just as crucial with a working plan as with one aimed at outsiders. You don't have to be as careful, however, about such things as typos in the text, perfectly conforming to business style, being consistent with date formats and so on. This document is like an old pair of khakis you wear into the office on Saturdays or that one ancient delivery truck that never seems to break down. It's there to be used, not admired.

- The Presentation Plan. If you take a working plan, with its low stress on cosmetics and impression, and twist the knob to boost the amount of attention paid to its looks, you'll wind up with a presentation plan. This plan is suitable for showing to bankers, investors and others outside the company.

Almost all the information in a presentation plan is going to be the same as your working plan, although it may be styled somewhat differently. For instance, you should use standard business vocabulary, omitting the informal jargon, slang and shorthand that's so useful in the workplace and is appropriate in a working plan. Remember, these readers won't be familiar with your operation. Unlike the working plan, this plan isn't being used as a reminder but as an introduction.

You'll also have to include some added elements. Among investors' requirements for due diligence is information on all competitive threats and risks. Even if you consider some of only peripheral significance, you need to address these concerns by providing the information.

The big difference between the presentation and working plans is in the details of appearance and polish. A working plan may be run off on the office printer and stapled together at one corner. A presentation plan should be printed by a high-quality printer, probably using color. It must be bound expertly into a booklet that is durable and easy to read. It should include graphics such as charts, graphs, tables and illustrations.

It's essential that a presentation plan be accurate and internally consistent. A mistake here could be construed as a misrepresentation by an unsympathetic outsider. At best, it will make you look less than careful. If the plan's summary describes a need for $40,000 in financing, but the cash flow projection shows $50,000 in financing coming in during the first year, you might think, "Oops! Forgot to update that summary to show the new numbers." The investor you're asking to pony up the cash, however, is unlikely to be so charitable.

- The Electronic Plan. The majority of business plans are composed on a computer of some kind, then printed out and presented in hard copy. But more and more business information that once was transferred between parties only on paper is now sent electronically. So you may find it appropriate to have an electronic version of your plan available. An electronic plan can be handy for presentations to a group using a computer-driven overhead projector, for example, or for satisfying the demands of a discriminating investor who wants to be able to delve deeply into the underpinnings of complex spreadsheets.

Source: The Small Business Encyclopedia , Business Plans Made Easy , Start Your Own Business and Entrepreneur magazine .

Continue on to the next section of our Business Plan How-To >> Plan Your Plan

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- She Started a Side Hustle While Working 2 Jobs as a Line Cook for $22 an Hour Combined — Now It's an 8-Figure Brand You've Probably Seen on TV

- Lock I Moved My 80-Person Company to a 4-Day Workweek Even Though It's Against the Industry Norm. Here's Why We'll Never Go Back .

- These Women-Founded Franchises Surpassed a Major Milestone — Against the Odds. Here's How They Did It .

- Lock Always Waiting for the Best Option Is Holding You Back . Here's Why.

- If You Want to Be Successful, Become a Better Speaker — Follow This 7-Step Process for Effective Speaking

- Lock How to Turn Your Side Hustle Into a Full Business While Working a 9-to-5 , From 3 Founders Who Did It

Most Popular Red Arrow

The remote side hustle a 43-year-old musician works on for 1 hour a day earns nearly $3,000 a month: 'all from the comfort of home'.

Sam Ziegler wanted to supplement his income as a professional drummer — then his tech skills and desire to help people came together.

'Elon Is Mad at Me': Don Lemon Says Elon Musk Canceled His New Talk Show After Controversial Interview

"The Don Lemon Show" was set to air exclusively on X.

Under Armour Founder Kevin Plank Returns as CEO After Controversial Exit, Shares Plummet 12% Upon the News

Plank will step into his role effective April 1.

Ever Wonder Why Certain Websites Rank Higher Than Yours? This SEO Expert Reveals The Secret to Dominating Search Results

It's often the smart use of SEO, now supercharged with AI, particularly in keyword optimization.

AI Is Impacting Jobs. Here Are the Gigs Affected the Most, According to an Analysis of 5 Million Upwork Postings

The researcher said in the report that freelance jobs were analyzed first because that market will likely see AI's immediate impact.

The Top Franchise Brands Growing Globally

While our main Fastest-Growing Franchises list focuses on North American growth, more and more brands are looking to grow worldwide. These are the 25 that had the greatest franchise growth outside the U.S. and Canada from July 2022 to July 2023.

Successfully copied link

7 Different Types of Business Plans Explained

11 min. read

Updated November 30, 2023

Business plans go by many names: Strategic plans, traditional plans , operational plans, feasibility plans, internal plans, growth plans, and more.

Different situations call for different types of plans.

But what makes each type of plan unique? And why should you consider one type over another?

In this article, we’ll uncover a quick process to find the right type of business plan, along with an overview of each option.

Let’s help you find the right planning format.

- What type of business plan do you need?

The short answer is… it depends.

Your current business stage, intended audience, and how you’ll use the plan will all impact what format works best.

Remember, just the act of planning will improve your chances of success . It’s important to land on an option that will support your needs. Don’t get too hung up on making the right choice and delay writing your plan.

So, how do you choose?

1. Know why you need a business plan

What are you creating a business plan for ? Are you pitching to potential investors? Applying for a loan? Trying to understand if your business idea is feasible?

You may need a business plan for one or multiple reasons. What you intend to do with it will inform what type of plan you need.

For example: A more robust and detailed plan may be necessary if you seek investment . But a shorter format could be more useful and less time-consuming if you’re just testing an idea.

2. Become familiar with your options

You don’t need to become a planning expert and understand every detail about every type of plan. You just need to know the basics:

- What makes this type of plan unique?

- What are its benefits?

- What are its drawbacks?

- Which types of businesses typically use it?

By taking the time to review, you’ll understand what you’re getting into and be more likely to complete your plan. Plus, you’ll come away with a document built with your use case(s) in mind—meaning you won’t have to restart to make it a valuable tool.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Start small and grow

When choosing a business plan format, a good tactic is to opt for a shorter option and build from there. You’ll save time and effort and still come away with a working business plan.

Plus, you’ll better understand what further planning you may need to do. And you won’t be starting from scratch.

Read More: How to identify the right type of plan for your business

Again, the type of business plan you need fully depends on your situation and use case. But running through this quick exercise will help you narrow down your options.

Now let’s look at the common business plan types you can choose from.

- Traditional business plan

The traditional (or standard) business plan is an in-depth document covering every aspect of your business. It’s the most common plan type you’ll come across.

A traditional business plan is broken up into 10 sections:

- Executive summary

- Description of products and services

- Market analysis

- Competitive analysis

- Marketing and sales plan

- Business operations

- Key milestones and metrics

- Organization and management team

- Financial plan

- Appendix

Why use this type of plan?

A traditional business plan is best for anyone approaching specific business planning events—such as presenting a business plan to a bank or investor for funding.

A traditional plan can also be useful if you need to add more details around specific business areas.

For example: You start as a solopreneur and don’t immediately need to define your team structure. But eventually you hit a threshold where you need more staff in order to keep growing. A great way to explore which roles you need and how they will function is by fleshing out the organization and management section .

That’s the unseen value of a more detailed plan like this. While you can follow the structure outlined above and create an in-depth plan ready for funding, you can also choose which sections to prioritize.

Read More: How to write a traditional business plan

- One-page plan

The one-page business plan is a simplified (but just as useful) version of a traditional business plan. It follows the same structure, but is far easier to create. It can even be used as a pitch document.

Here’s how you’ll organize information when using a one-page plan:

- Value proposition

- Market need

- Your solution

- Competition

- Target market

- Sales and marketing

- Budget and sales goals

- Team summary

- Key partners

- Funding needs

A one-page plan is faster and easier to assemble than a traditional plan. You can write a one-page plan in as little as 30 minutes .

You’ll still cover the crucial details found in a traditional plan, but in a more manageable format.

So, if you’re exploring a business idea for the first time or updating your strategy—a one-page plan is ideal. You can review and update your entire plan in just a few minutes.

Applying for a loan with this type of plan probably wouldn’t make sense. Lenders typically want to see a more detailed plan to accurately assess potential risk.

However, it is a great option to send to investors.

“Investors these days are much less likely to look at a detailed plan,” says Palo Alto Software COO Noah Parsons. “An executive summary or one-page plan, pitch presentation, and financials are all a VC is likely to look at.”

Creating a more detailed plan is as much about being prepared as anything else. If you don’t dig into everything a traditional plan covers, you’ll struggle to land your pitch .

If you don’t intend to seek funding, a one-page plan is often all you need. The key is regularly revisiting it to stay on top of your business.

Let’s explore two unique processes to help you do that:

Read More: How to write a one-page business plan

Lean planning process

Lean planning is a process that uses your one-page plan as a testing tool. The goal is to create a plan and immediately put it into action to see if your ideas actually work. You’ll typically be focusing on one (or all) of the following areas:

- Strategy – What you will do

- Tactics – How you will do it

- Business Model – How you make money

- Schedule – Who is responsible and when will it happen

Why use this process?

Lean planning is best for businesses that need to move fast, test assumptions, revise, and get moving again. It’s short and simple, and meant to get everyone on the same page as quickly as possible.

That’s why it’s so popular for startups. They don’t necessarily need a detailed plan, since they’re mostly focused on determining whether or not they have a viable business idea .

The only drawback is that this planning process is built primarily around early-stage businesses. It can be a useful tool for established businesses looking to test a strategy, but it may not be as helpful for ongoing management.

Read More: The fundamentals of lean planning

Growth planning

Growth planning is a financials-focused planning process designed to help you make quick and strategic decisions.