Call Us (877) 968-7147 Login

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Conduct a Risk Analysis for Your Small Business

Small business owners take risks every day. But if you put too much at stake, your business bottom line could suffer. To make sure your decisions are sound, conduct a risk analysis for your small business.

What is a risk analysis in business?

A risk is a situation that can either have huge benefits or cause serious damage to a small business’s financial health. Sometimes a risk can result in the closure of a business. Before taking risks at your business, you should conduct a risk analysis.

A risk assessment for small business is a strategy that measures the potential outcomes of a risk. The assessment helps you make smart business decisions and avoid financial issues.

Jason Olsen, serial entrepreneur and founder of Studios 360, Prestman Auto, and Automobia, explained in his article :

The key is to not only use optimism for reasons to take action, but also to utilize risk factors you uncover to guide your decisions. Yes, you must have courage to bet on your ideas, but you must also have the ability to take a thoughtful, calculated approach. It’s nearly impossible to remove all risk in any scenario, but what’s important is to make sure these troublesome areas are always considered and understood.”

Internal vs. external risks

Usually, a risk is either internal or external. Internal risks occur inside of your operations, while external risks occur outside of your business.

Internal risks are often more specific to your business and easier to control than external risks. Examples of internal risks include:

- Financial risks

- Marketing risks

- Operational risks

- Workforce risks

Though you can project external risks, they are usually out of your control. You might need to take a reactive approach to managing external risks. These risks include:

- Changing economy

- New competitors

- Natural disasters

- Government regulations

- Consumer demand changes

How to do a risk assessment

There is no one way to assess business risk. The assessment is not 100% accurate when it comes to judging your level of risk. A small business risk analysis gives you a picture of the possible outcomes your business decisions could have. Use the following steps to do a financial risk assessment.

Step 1: Identify risks

The first step to managing business risks is to identify what situations pose a risk to your finances. Consider the damage a risk could have on your business. Then, think about your goals and the rewards that could come out of taking the risk. Depending on your business, location, and industry, risks will vary.

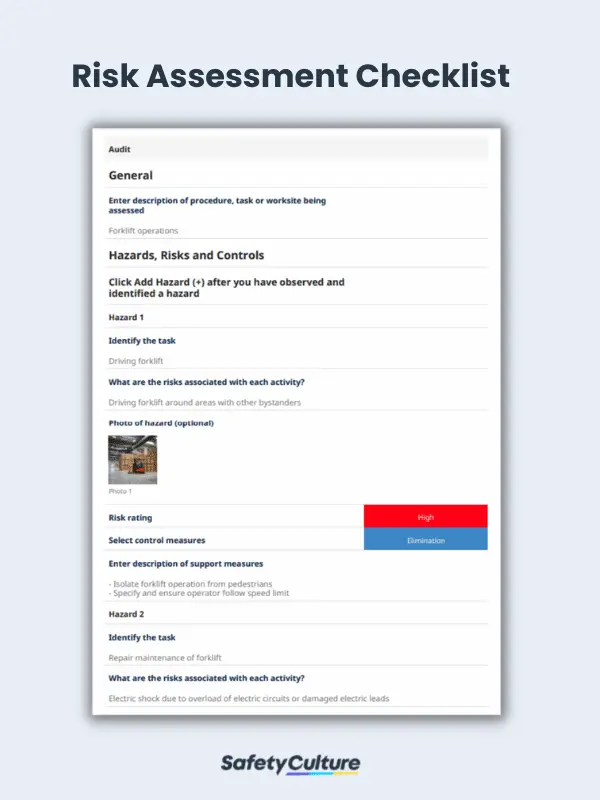

Step 2: Document risks

Once you have a list of potential business risks, define them in a document. Develop a process to weigh the effect of each risk. Look at how much damage the risk could potentially cause and how hard it would be to recover. Set up a scoring system for risks, from mild to severe.

Step 3: Appoint monitors

Identify individuals at your business who will keep an eye on and manage risks. The risk monitor might be you, a partner, or an employee. Decide how risks should be reported and handled. When you have procedures for risk management, issues can be taken care of smoothly.

Step 4: Determine controls

After understanding potential risks, figure out controls you can use to reduce them. Look at patterns over time to predict your income cycle. And, assess the impact risks have on your business. Look at the significance of a risk as well as its likelihood of occurring at your business.

Step 5: Review periodically

Your business risk assessment is not a one-time commitment. Review risk management processes annually to see how you handle risks. Also, look out for new risks that might not have been relevant in the previous assessment.

Use a risk ratio to gauge risk

A risk ratio shows the relationship between your business’s debts and equity. Business debt creates risk. By comparing debt, or leverage, to equity, you get a better understanding of your business’s level of risk. This can help you set more targeted business debt management goals.

Debt-to-equity ratio

There are different kinds of financial leverage ratios. One common leverage ratio formula is the debt-to-equity ratio . For this ratio, divide your total debt by your total equity. Business equity is equal to your assets minus liabilities and shows your ownership in the business.

Debt-to-Equity Ratio = Total Debt / Total Equity

For example, you have $30,000 in debt and $15,000 in equity.

$30,000 / $15,000 = 2 times or 200%

This means for every dollar you have, you owe two dollars to creditors.

By finding the debt-to-equity ratio, you can see how much capital comes from debt. The more debt you have compared to equity, the bigger your risk level.

Purpose of risk assessments

Risk assessments are an important part of running your business. You can use your business risk assessment for making decisions and financing your business .

A simple risk analysis will help you avoid hazards that could damage your finances. The assessment informs you about the steps you need to take to protect your business. You can see what situations you need to address and avoid.

Beyond internal use, a financial risk assessment can help you prepare to talk with lenders. These individuals want to know your business’s level of risk before giving you money. They look at the likelihood of your business growing and how likely you are to pay back the loan.

Need help keeping track of your business debts, income, and expenses? Patriot’s online accounting software is easy to use and made for the non-accountant. We offer free, USA-based support. Try it for free today.

This article is updated from its original publication date of May 9, 2017.

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis

A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

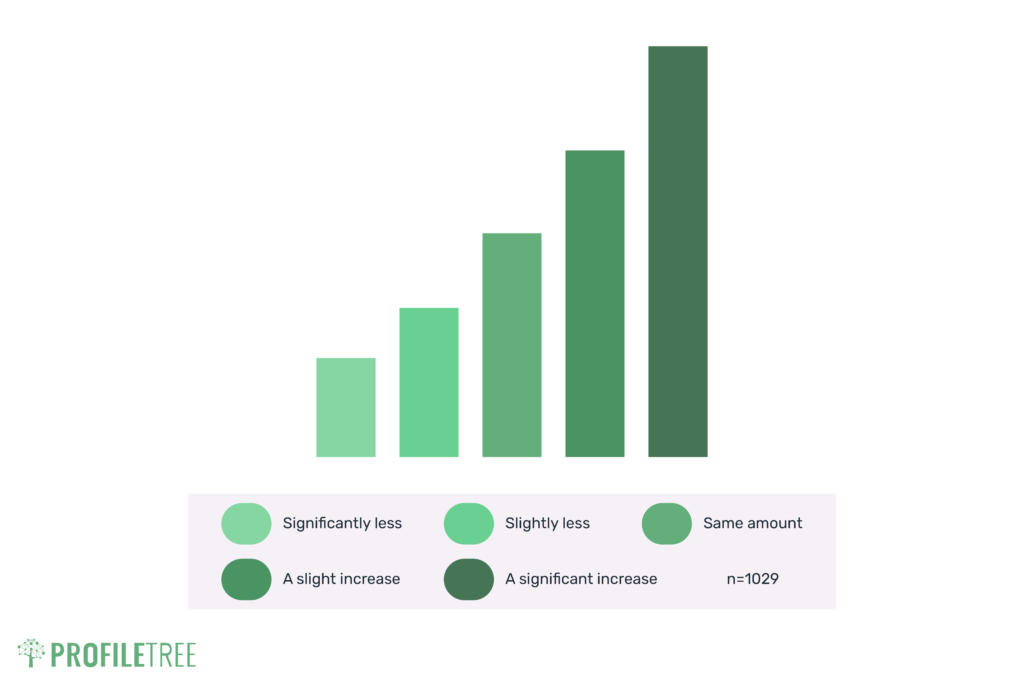

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence . This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks , enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true .

When it comes to businesses, entrepreneurs , or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

Here is how you can write the business plan in 30 steps .

Types of Risks in Business Planning

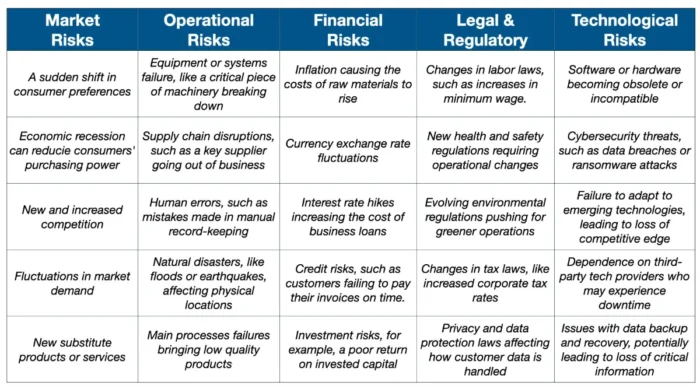

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

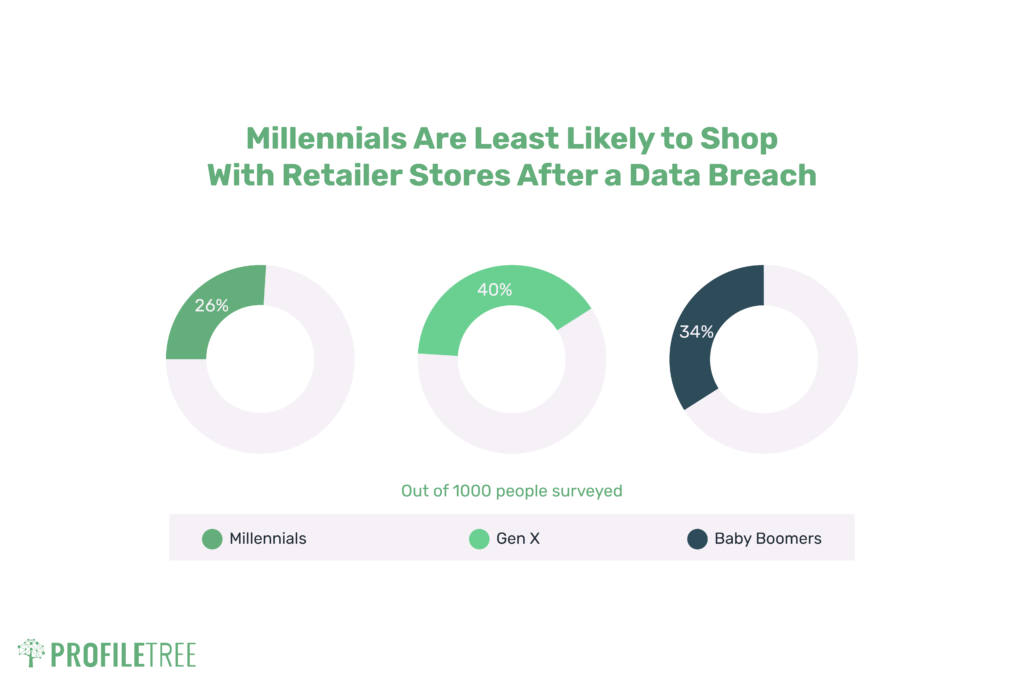

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process . You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas . Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Customers ,

- Customers relationships ,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

Qualitative Risk Analysis

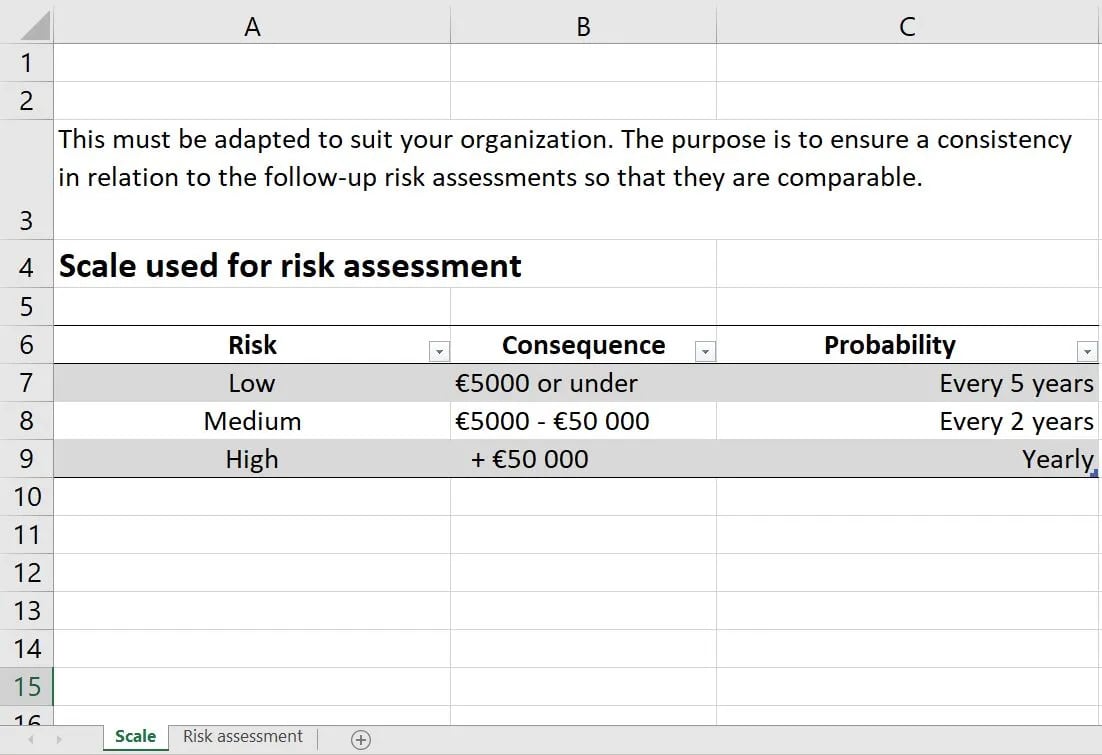

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data .

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example , for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

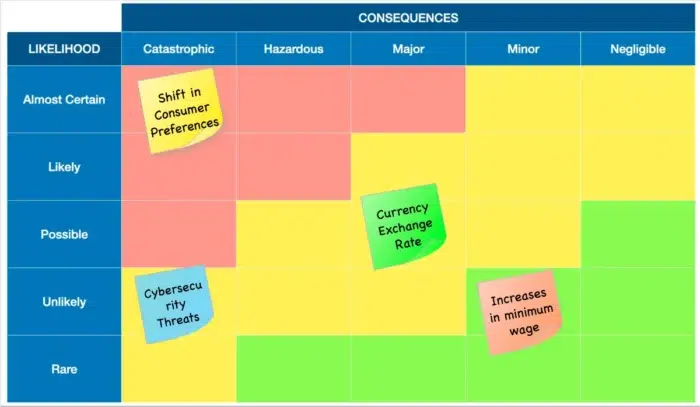

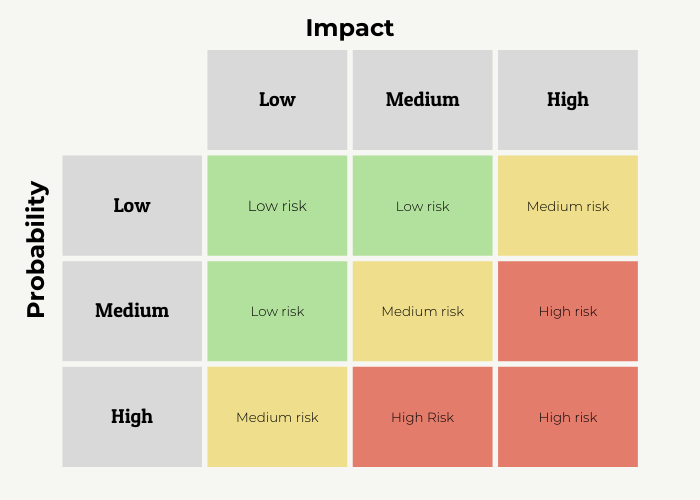

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

- Step 1: Begin by listing out your risks . For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring . In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur . In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix . The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

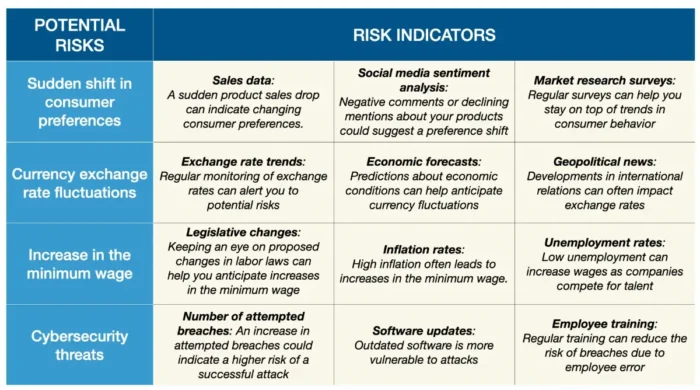

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

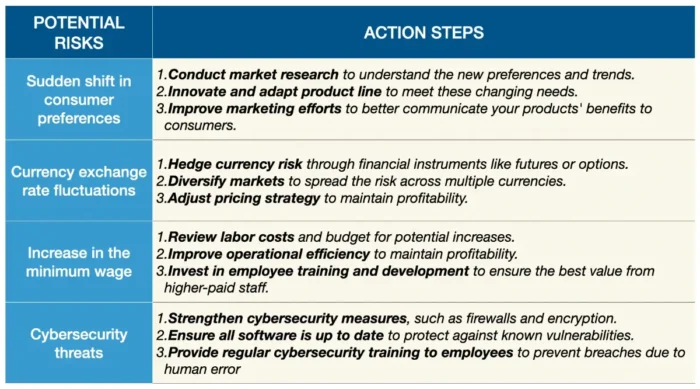

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic , you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

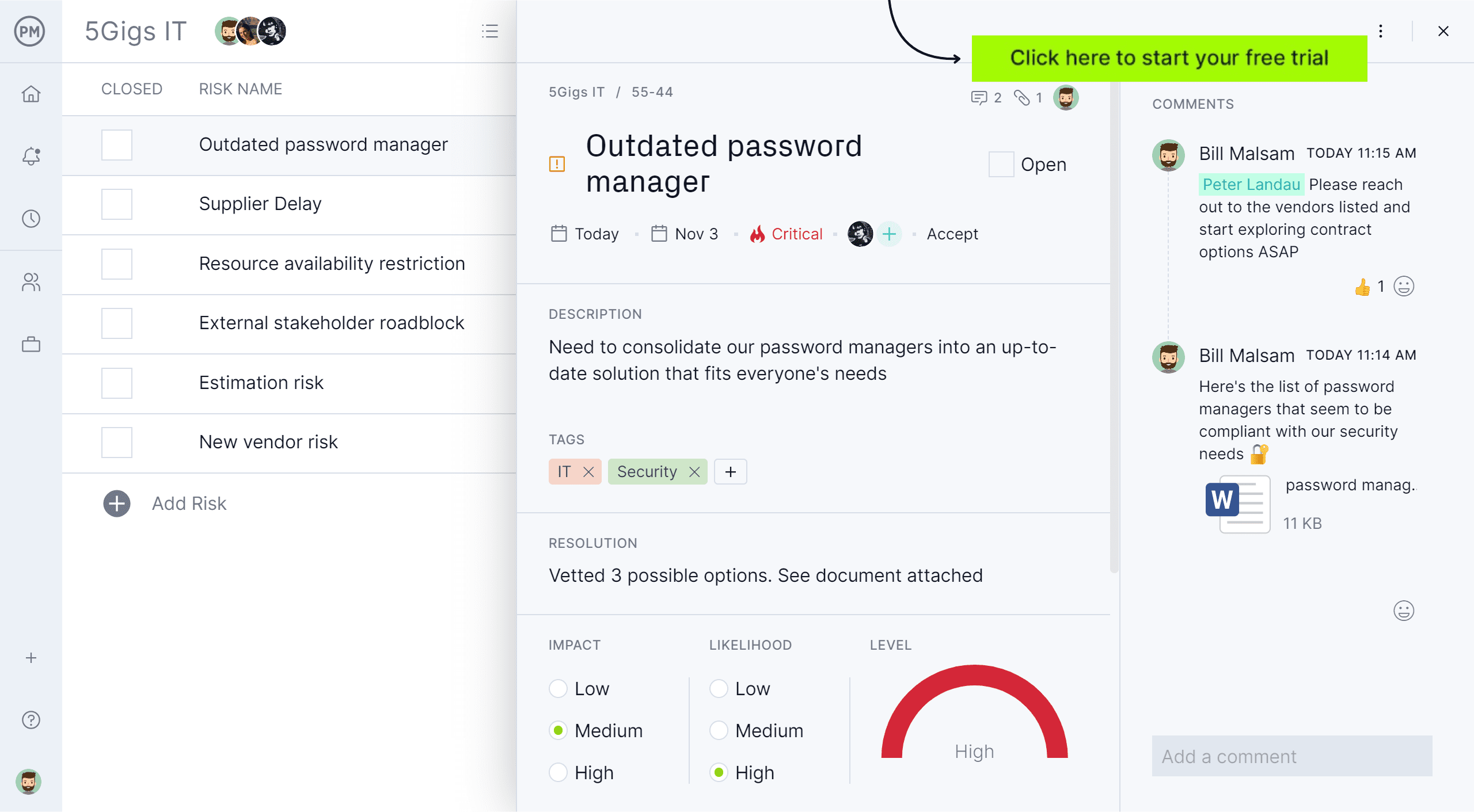

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance : Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer : Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction : Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base .

- Risk acceptance : Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.

Related Posts

How to Write a Business Plan in 36 Steps

Risk Tolerance in Entrepreneurship: A Guide to Successful Business

Business Goals Questions to Develop SMART Goals

Risk Management Guide: Everything You Need to Know About Business Risk

Start typing and press enter to search.

Business Risk Analysis: A Step by Step Guide to Identify and Quantify Risks

1. understanding the importance of business risk analysis, 2. what is risk and why is it relevant to businesses, 3. identifying potential risks in your business operations, 4. assessing the probability and impact of each identified risk, 5. quantifying risks: assigning values and prioritizing based on severity, 6. developing risk mitigation strategies and action plans, 7. implementing risk controls and monitoring progress, 8. evaluating the effectiveness of risk management measures, 9. the value of business risk analysis in driving sustainable growth and success.

business risk analysis is a process of identifying, assessing, and prioritizing the potential threats and opportunities that may affect the performance, profitability, and sustainability of a business. It is an essential tool for any business owner, manager, or investor who wants to make informed decisions, plan ahead, and mitigate the negative impacts of uncertainty. In this section, we will explore the importance of business risk analysis from different perspectives, such as strategic, financial, operational, and reputational. We will also provide some practical steps and examples on how to conduct a business risk analysis for your own business .

Some of the benefits of business risk analysis are:

1. It helps you to align your business goals and strategies with the external and internal environment. By analyzing the strengths, weaknesses, opportunities, and threats (SWOT) of your business, you can identify the gaps and areas for improvement, and devise effective action plans to achieve your desired outcomes . For example, if you are planning to expand your business to a new market, you can use business risk analysis to evaluate the market size, demand, competition, regulations, and cultural factors that may affect your success .

2. It helps you to optimize your resource allocation and budgeting . By estimating the probability and impact of various risks , you can prioritize the most critical and urgent ones, and allocate your resources accordingly. You can also create contingency plans and reserves to cope with unexpected events and minimize losses. For example, if you are running a manufacturing business , you can use business risk analysis to estimate the potential costs and benefits of investing in new equipment, hiring more staff, or outsourcing some processes.

3. It helps you to enhance your operational efficiency and quality . By identifying and monitoring the key performance indicators (KPIs) and risk indicators (KRIs) of your business, you can track your progress and performance , and identify and correct any deviations or errors. You can also implement best practices and standards to ensure the quality and consistency of your products and services. For example, if you are running a restaurant business, you can use business risk analysis to measure and improve the customer satisfaction , food safety, and hygiene of your business.

4. It helps you to protect your reputation and brand image . By anticipating and managing the potential risks that may harm your reputation, such as customer complaints, negative reviews, legal disputes, or ethical issues, you can prevent or mitigate the damage and maintain your trust and loyalty with your stakeholders. You can also use business risk analysis to identify and leverage the opportunities that may enhance your reputation, such as social responsibility, innovation, or awards. For example, if you are running a fashion business, you can use business risk analysis to avoid or address the risks of plagiarism, counterfeiting, or environmental impact of your products .

Stop wasting your time with mass emails when approaching investors!

FasterCapital introduces you to angels and VCs through warm introductions with 90% response rate

Before we dive into the process of business risk analysis, it is important to understand some key terms and concepts related to risk and its relevance to businesses. In this section, we will define what risk is, how it is measured, and why it matters for any organization that wants to achieve its goals and objectives. We will also explore some of the common types and sources of risk that businesses face, and how they can be categorized and prioritized. By the end of this section, you will have a clear and comprehensive understanding of the fundamental aspects of risk and its implications for business decision-making .

1. What is risk? Risk is the possibility of something bad happening that could negatively affect the performance, reputation, or survival of a business. Risk can also be seen as the uncertainty or variability of the outcomes or consequences of an action or event. Risk can be expressed in terms of probability (how likely it is to happen) and impact (how severe it is if it happens).

2. How is risk measured? risk measurement is the process of quantifying the level of risk associated with a particular situation or scenario. There are different methods and tools for measuring risk, depending on the nature and context of the problem. Some of the common risk metrics include expected value, standard deviation, variance, coefficient of variation, value at risk, and risk-adjusted return on capital . These metrics help to compare and evaluate the trade-offs between risk and reward, and to optimize the allocation of resources and capital.

3. Why is risk relevant to businesses? Risk is relevant to businesses because it affects their ability to achieve their strategic goals and objectives , and to create value for their stakeholders. Risk can also create opportunities for innovation, growth, and competitive advantage, if managed properly. Therefore, businesses need to identify, assess, and manage the risks that they face, and to balance them with the potential benefits and rewards. This is the essence of risk management, which is a key component of business strategy and governance.

4. What are the common types and sources of risk that businesses face? Businesses face various types of risk, depending on their industry, size, location, and operations. Some of the common types of risk include market risk, credit risk, operational risk, legal risk, reputational risk, strategic risk, and environmental risk. These risks can arise from different sources, such as changes in customer preferences, competition, regulations, technology, suppliers, employees, natural disasters, or cyberattacks. These risks can also interact and influence each other, creating complex and dynamic risk scenarios.

5. How can risk be categorized and prioritized? Risk categorization and prioritization are the processes of grouping and ranking the risks that a business faces, based on their significance and urgency. There are different criteria and methods for categorizing and prioritizing risk, such as frequency, severity, likelihood, impact, controllability, and exposure. One of the common tools for risk categorization and prioritization is the risk matrix, which plots the risks on a two-dimensional grid, based on their probability and impact. This helps to identify the most critical and relevant risks that require immediate attention and action.

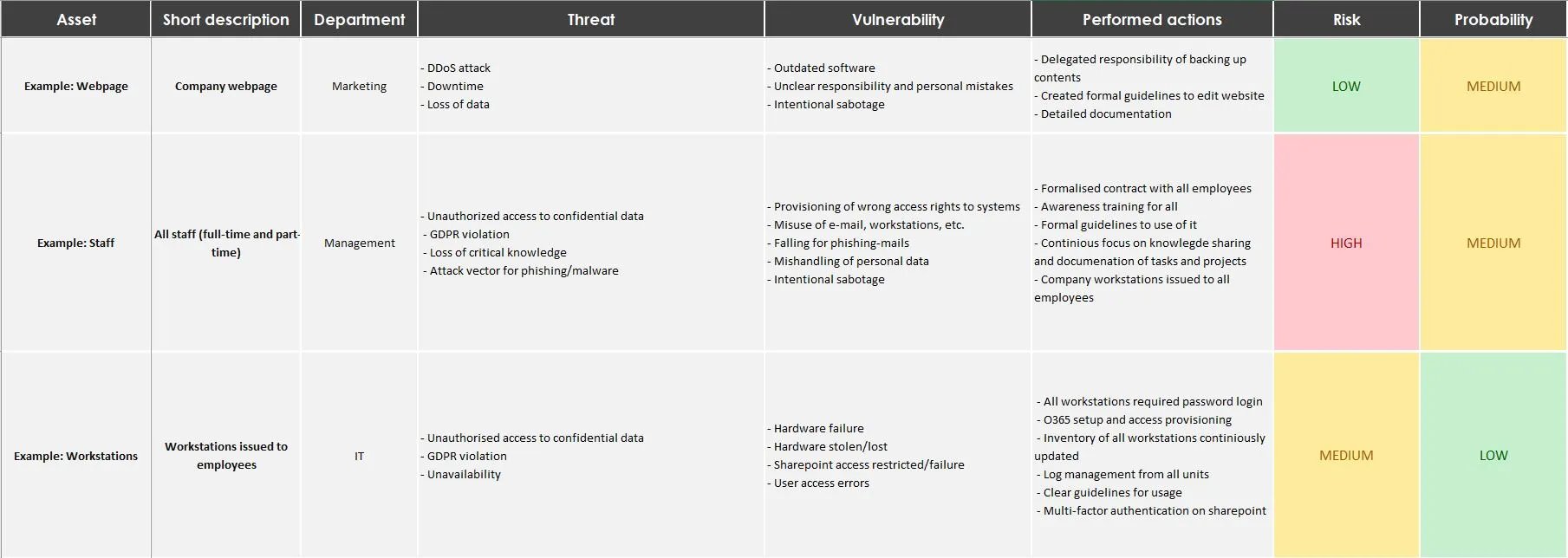

In this section, we will delve into the crucial process of identifying potential risks in your business operations. It is essential to approach this step with a comprehensive perspective, considering insights from various points of view. By doing so, you can gain a deeper understanding of the risks that your business may face and develop effective strategies to mitigate them.

To begin, let's explore the different aspects that need to be considered when identifying potential risks. This includes analyzing internal factors such as operational processes, supply chain vulnerabilities , and employee-related risks. Additionally, external factors like market fluctuations, regulatory changes, and competitive pressures should also be taken into account.

Now, let's move on to the numbered list that provides in-depth information about this section:

1. Conduct a thorough assessment of your business processes: Start by evaluating each operational process within your organization. Identify any potential weaknesses or bottlenecks that could lead to risks. For example, inadequate quality control measures or outdated technology systems.

2. analyze your supply chain : Assess the vulnerabilities in your supply chain , including dependencies on specific suppliers, transportation issues, or potential disruptions. Consider alternative suppliers or contingency plans to minimize the impact of any potential risks .

3. Evaluate human resources risks: Examine potential risks related to your employees, such as skill gaps, turnover rates, or compliance issues. Implement strategies to address these risks, such as training programs, succession planning, or robust HR policies.

4. monitor market trends and changes: stay updated on market trends, customer preferences, and industry regulations. Anticipate potential risks arising from shifts in consumer demand , emerging technologies, or regulatory compliance requirements.

5. Assess competitive pressures: analyze the competitive landscape and identify potential risks posed by competitors. This could include pricing wars, loss of market share , or disruptive innovations. Develop strategies to stay ahead of the competition and mitigate these risks.

6. Consider financial risks: Evaluate financial risks such as cash flow fluctuations, debt management, or economic uncertainties. Implement financial planning and risk management strategies to ensure the stability and resilience of your business.

Remember, these are just a few examples to illustrate the depth of information that can be included in this section. By incorporating insights from different perspectives and providing relevant examples, you can effectively guide readers through the process of identifying potential risks in their business operations.

Identifying Potential Risks in Your Business Operations - Business Risk Analysis: A Step by Step Guide to Identify and Quantify Risks

In the section "Step 2: Assessing the Probability and Impact of Each Identified Risk" of the blog "Business Risk Analysis: A Step-by-Step Guide to Identify and Quantify Risks," we delve into the crucial process of evaluating the likelihood and consequences of each identified risk. This step allows businesses to prioritize and allocate resources effectively.

From various perspectives, it is important to consider the probability of a risk occurring and the potential impact it may have on the organization. By assessing these factors, businesses can make informed decisions and develop appropriate risk mitigation strategies .

To provide a comprehensive understanding, let's explore this section in a numbered list format:

1. Analyzing Probability:

- Assess the likelihood of each identified risk based on historical data , industry trends, and expert opinions.

- Consider external factors such as market conditions , regulatory changes, and technological advancements that may influence the probability of risks.

- Use quantitative methods like statistical analysis or qualitative approaches like expert judgment to estimate the likelihood of each risk.

2. Evaluating Impact:

- Determine the potential consequences of each risk on various aspects of the business, such as financial, operational, reputational, or legal.

- Consider the magnitude and duration of the impact, as well as the likelihood of secondary risks arising from the primary risk event.

- Use past experiences, case studies, or industry benchmarks to gauge the potential impact of each risk.

3. Risk Prioritization:

- Combine the assessed probability and impact to prioritize risks .

- Assign a risk rating or score to each identified risk, considering both the likelihood and consequences.

- Focus on risks with high probability and significant impact, as they pose the greatest threat to the organization.

4. Examples:

- For instance, in the context of a manufacturing company, a potential risk could be a supply chain disruption due to natural disasters. The probability of such an event can be assessed based on historical data of similar incidents in the region.

- Another example could be a cybersecurity breach for an e-commerce business. The impact of such a risk can be evaluated by considering the potential financial losses , customer trust erosion, and legal implications.

Remember, this is a general overview of the section "Step 2: Assessing the Probability and Impact of Each Identified Risk" without referring to the specific blog. If you have any further questions or need more specific information, feel free to ask!

Assessing the Probability and Impact of Each Identified Risk - Business Risk Analysis: A Step by Step Guide to Identify and Quantify Risks

In the section "Step 3: Quantifying Risks: Assigning Values and Prioritizing Based on Severity" of the blog "Business Risk Analysis: A Step-by-Step Guide to Identify and Quantify Risks," we delve into the crucial process of quantifying risks and assigning values to them based on their severity. This step allows businesses to prioritize their risk management efforts effectively.

When quantifying risks, it is essential to consider insights from various perspectives. By gathering input from stakeholders, subject matter experts, and relevant data sources , businesses can gain a comprehensive understanding of the potential risks they face. This holistic approach ensures that no critical risks are overlooked and enables informed decision-making .

To present the information in a structured manner, I will provide a numbered list that offers in-depth insights into this section:

1. Identify and categorize risks: Begin by identifying and categorizing the risks specific to your business. This can include financial risks, operational risks, legal risks, or any other relevant categories. Categorization helps in organizing the risks for further analysis.

2. Assess the impact: Evaluate the potential impact of each identified risk on your business. Consider both the short-term and long-term consequences. This assessment helps in understanding the severity of each risk and its potential implications.

3. Assign values: Assign values to each risk based on its severity. This can be done using a numerical scale or a qualitative assessment. The values assigned should reflect the potential impact on the business, taking into account factors such as financial loss, reputational damage, or operational disruptions.

4. Prioritize risks: Once the risks are quantified and assigned values, prioritize them based on their severity. This involves ranking the risks in order of their potential impact on the business. By prioritizing risks, businesses can allocate resources and develop mitigation strategies accordingly.

5. Provide examples: To illustrate the concepts discussed, let's consider an example. Suppose a manufacturing company identifies a risk of supply chain disruptions due to geopolitical tensions. They assess the potential impact as high, considering the reliance on international suppliers. By assigning a value of 9 out of 10 to this risk, they prioritize it as a top concern and focus their risk management efforts accordingly.

Remember, this is a general overview based on the information provided. For a more detailed and tailored analysis, it is recommended to refer to the complete blog post "Business Risk Analysis: A step-by-Step guide to identify and Quantify risks .

Quantifying Risks: Assigning Values and Prioritizing Based on Severity - Business Risk Analysis: A Step by Step Guide to Identify and Quantify Risks

In the section "Step 4: Developing Risk Mitigation Strategies and Action Plans" of the blog "Business Risk Analysis: A Step-by-Step Guide to Identify and Quantify Risks," we delve into the crucial process of mitigating risks and creating action plans . This step is essential for businesses to proactively address potential risks and minimize their impact on operations.

From various perspectives, it is important to consider different risk mitigation strategies. One approach is to conduct a thorough risk assessment to identify and prioritize potential risks. This involves analyzing internal and external factors that could pose threats to the business, such as market volatility, regulatory changes, or technological disruptions.

Once risks are identified, businesses can develop tailored action plans to address each risk effectively. These plans should outline specific steps, responsibilities, and timelines for implementing risk mitigation measures. It is crucial to involve key stakeholders and subject matter experts in this process to ensure comprehensive coverage and diverse insights.

To provide a comprehensive understanding, let's explore some key points related to risk mitigation strategies and action plans :

1. Risk Identification and Assessment: This involves conducting a comprehensive analysis of potential risks, considering both internal and external factors. By identifying risks early on, businesses can proactively develop strategies to mitigate their impact.

2. Prioritization: Not all risks are equal in terms of their potential impact and likelihood. Prioritizing risks based on their severity and probability allows businesses to allocate resources effectively and focus on the most critical areas.

3. Risk Mitigation Measures: Once risks are identified and prioritized, businesses can develop specific measures to mitigate each risk . These measures may include implementing safeguards, diversifying resources, or establishing contingency plans.

4. Monitoring and Evaluation: Risk mitigation strategies should be continuously monitored and evaluated to ensure their effectiveness. Regular assessments help identify any gaps or emerging risks that require further attention.

5. Communication and Training: Effective communication and training are essential for successful risk mitigation . Ensuring that employees are aware of the risks, understand the action plans, and are equipped with the necessary skills and knowledge enhances the overall risk management process.

Remember, these are general insights into risk mitigation strategies and action plans. It is important to tailor these approaches to the specific needs and context of your business. By implementing robust risk mitigation strategies, businesses can navigate uncertainties more effectively and safeguard their long-term success.

Developing Risk Mitigation Strategies and Action Plans - Business Risk Analysis: A Step by Step Guide to Identify and Quantify Risks

In this section, we will delve into the crucial step of implementing risk controls and monitoring progress. It is essential for businesses to have effective risk controls in place to mitigate potential risks and ensure the smooth operation of their operations. By implementing these controls, businesses can proactively identify and address risks, minimizing their impact on the organization.

1. Establishing risk Management framework : To effectively implement risk controls, businesses need to establish a robust risk management framework . This framework should include clear policies, procedures, and guidelines for identifying, assessing, and managing risks. It provides a structured approach to risk management , ensuring consistency and accountability throughout the organization.

2. Risk Identification and Assessment: The first step in implementing risk controls is to identify and assess potential risks. This involves conducting a comprehensive risk assessment , considering both internal and external factors that may impact the business . By identifying and assessing risks, businesses can prioritize their efforts and allocate resources accordingly.

3. Developing Risk Mitigation Strategies: Once risks are identified and assessed, businesses need to develop appropriate risk mitigation strategies. These strategies aim to reduce the likelihood and impact of identified risks . They can include implementing preventive measures, such as strengthening internal controls , diversifying suppliers, or enhancing cybersecurity measures . Additionally, businesses may consider transferring risks through insurance or contractual agreements.

4. Implementing Controls: After developing risk mitigation strategies, businesses need to implement the necessary controls. This involves putting in place specific measures and procedures to monitor and manage risks effectively. Controls can include regular monitoring and reporting mechanisms, internal audits, and compliance checks. It is crucial to ensure that controls are properly documented and communicated to relevant stakeholders.

5. Monitoring and Reviewing Progress: Implementing risk controls is an ongoing process that requires continuous monitoring and review. Businesses should establish mechanisms to track the effectiveness of implemented controls and identify any emerging risks. Regular reviews and assessments help businesses stay proactive in managing risks and make necessary adjustments to their risk management strategies .

6. Learning from Incidents: In the event of a risk incident or failure, businesses should conduct thorough investigations to understand the root causes and learn from the experience. This feedback loop allows organizations to improve their risk controls and prevent similar incidents in the future. It is essential to foster a culture of continuous improvement and learning from past experiences.

By following these steps and implementing robust risk controls, businesses can effectively manage and mitigate risks , safeguarding their operations and ensuring long-term success .

Evaluating the effectiveness of risk management measures is a crucial step in the business risk analysis process. It helps to determine whether the actions taken to mitigate or avoid the identified risks have been successful or not, and whether they need to be adjusted or improved. Evaluating the effectiveness of risk management measures can be done from different perspectives, such as:

- The stakeholder perspective : This involves assessing how the risk management measures have met the expectations and needs of the stakeholders, such as customers, employees, investors, regulators, suppliers, etc. For example, a customer satisfaction survey can be used to measure how the customers perceive the quality and reliability of the products or services after the implementation of risk management measures.

- The performance perspective : This involves measuring how the risk management measures have affected the key performance indicators (KPIs) of the business, such as revenue, profit, market share, customer retention, employee turnover, etc. For example, a financial analysis can be used to compare the actual results with the projected results after the implementation of risk management measures.

- The process perspective : This involves evaluating how the risk management measures have improved the efficiency and effectiveness of the business processes, such as production, delivery, innovation, communication, etc. For example, a process audit can be used to identify the strengths and weaknesses of the processes after the implementation of risk management measures.

To evaluate the effectiveness of risk management measures, the following steps can be followed:

1. Define the evaluation criteria and methods : The evaluation criteria and methods should be aligned with the objectives and scope of the risk management plan , and should be clearly defined and communicated to all the relevant parties. The evaluation criteria should specify what aspects of the risk management measures will be assessed, and how they will be measured and compared. The evaluation methods should specify how the data will be collected, analyzed, and reported. For example, the evaluation criteria could be the degree of risk reduction, the cost-benefit ratio , the stakeholder satisfaction, etc. The evaluation methods could be surveys, interviews, observations, audits, etc.

2. collect and analyze the data : The data should be collected from various sources and perspectives, and should be relevant, reliable, and valid. The data should be analyzed using appropriate tools and techniques, such as statistical analysis, trend analysis, gap analysis, etc. The data analysis should reveal the strengths and weaknesses of the risk management measures, and the extent to which they have achieved the desired outcomes. For example, the data could show the changes in the risk levels, the costs and benefits of the risk management measures, the feedback from the stakeholders, etc.

3. report and communicate the results : The results of the evaluation should be reported and communicated to all the relevant parties, such as the risk management team , the senior management, the stakeholders, etc. The report should be clear, concise, and comprehensive, and should include the evaluation criteria and methods, the data and analysis, the findings and conclusions, and the recommendations and actions. The report should also highlight the best practices and lessons learned from the evaluation, and the areas for improvement and further development. For example, the report could suggest how to enhance the risk management measures, how to monitor and review them, how to integrate them with the business strategy , etc.

Evaluating the Effectiveness of Risk Management Measures - Business Risk Analysis: A Step by Step Guide to Identify and Quantify Risks

Business risk analysis is a vital process that helps organizations identify and quantify the potential threats and opportunities that may affect their performance, profitability, and reputation. By conducting a systematic and comprehensive assessment of the internal and external factors that influence their business environment, organizations can develop effective strategies to mitigate the negative impacts of risks and capitalize on the positive outcomes of opportunities. In this section, we will discuss the value of business risk analysis in driving sustainable growth and success from different perspectives, such as the strategic, operational, financial, and reputational point of view. We will also provide some examples of how business risk analysis can help organizations achieve their goals and objectives in the long run.

- Strategic value: Business risk analysis can help organizations align their vision, mission, and values with their market conditions, customer needs, and competitive advantages. By identifying the strengths, weaknesses, opportunities, and threats (SWOT) that affect their business, organizations can formulate and implement strategic plans that are realistic, achievable, and adaptable. For example, a company that operates in a highly dynamic and uncertain industry can use business risk analysis to anticipate the changes in customer preferences, technological innovations, and regulatory requirements, and adjust its products, services, and processes accordingly.

- Operational value: Business risk analysis can help organizations optimize their processes, resources, and capabilities to deliver high-quality products and services to their customers. By identifying the sources, causes, and effects of operational risks, such as human errors, equipment failures, supply chain disruptions, and cyberattacks, organizations can implement preventive and corrective measures to reduce the likelihood and impact of these risks . For example, a company that relies on a complex network of suppliers and distributors can use business risk analysis to monitor and evaluate the performance and reliability of its partners, and establish contingency plans in case of any disruptions.

- Financial value: Business risk analysis can help organizations manage their financial resources and obligations in a prudent and efficient manner. By identifying the potential gains and losses that may result from various scenarios, such as changes in market demand, price fluctuations, currency movements, and interest rates, organizations can estimate and budget their revenues , costs, and cash flows. For example, a company that operates in multiple countries can use business risk analysis to hedge its exposure to foreign exchange risks, and diversify its sources of income and funding.

- Reputational value: Business risk analysis can help organizations protect and enhance their reputation and brand image in the eyes of their stakeholders, such as customers, employees, investors, regulators, and the public. By identifying the potential risks that may damage their reputation, such as ethical breaches, legal violations, environmental impacts, and social media backlash , organizations can implement policies and practices that demonstrate their commitment to corporate social responsibility , transparency, and accountability. For example, a company that operates in a highly regulated and scrutinized industry can use business risk analysis to comply with the relevant laws and standards, and communicate its values and achievements to its stakeholders.

Business risk analysis is a valuable tool that can help organizations drive sustainable growth and success in a complex and uncertain world. By conducting a regular and rigorous analysis of the risks and opportunities that affect their business, organizations can improve their decision-making , planning, and execution, and achieve their strategic, operational, financial, and reputational goals. Business risk analysis is not a one-time exercise, but a continuous and iterative process that requires constant monitoring, evaluation, and improvement. By embracing business risk analysis as a core competency, organizations can gain a competitive edge and create long-term value for themselves and their stakeholders.

We make securing loan funding Easy!

FasterCapital's team analyzes your funding needs and matches you with lenders and banks worldwide

Read Other Blogs

Machine learning has revolutionized the way we approach complex decision-making processes, and its...

Credit risk optimization is a crucial aspect of financial decision-making, particularly in the...

As a full-time student, managing your time can be a challenging task. Balancing academic...

In recent years, the resurgence of traditional healing practices has become a focal point in the...

The excitement that surrounds the unveiling of a new product or service is palpable, and it's an...

Understanding the Importance of Loan Origination in Senior Debt Transactions Loan origination...

Price skimming is a pricing strategy that involves setting a high initial price for a new or...

Thermometer charts are a compelling visualization tool used in Excel to display the progress...

In the dynamic landscape of startup growth, the transformation of potential leads into loyal...

ConnectedGRC

Drive a Connected GRC Program for Improved Agility, Performance, and Resilience

BusinessGRC

Power Business Performance and Resilience

- Enterprise Risk

- Operational Risk

- Operational Resilience

- Business Continuity

- Observation

- Regulatory Change

- Regulatory Engagement

- Case and Incident

- Compliance Advisory

- Internal Audit

- SOX Compliance

- Third-Party Risk

Manage IT and Cyber Risk Proactively

- IT & Cyber Risk

- IT & Cyber Compliance

- IT & Cyber Policy

- IT Vendor Risk

Enable Growth with Purpose

AI-based Knowledge Centric GRC

- Integration

- Marketplace

- Developer Portal

Latest Release

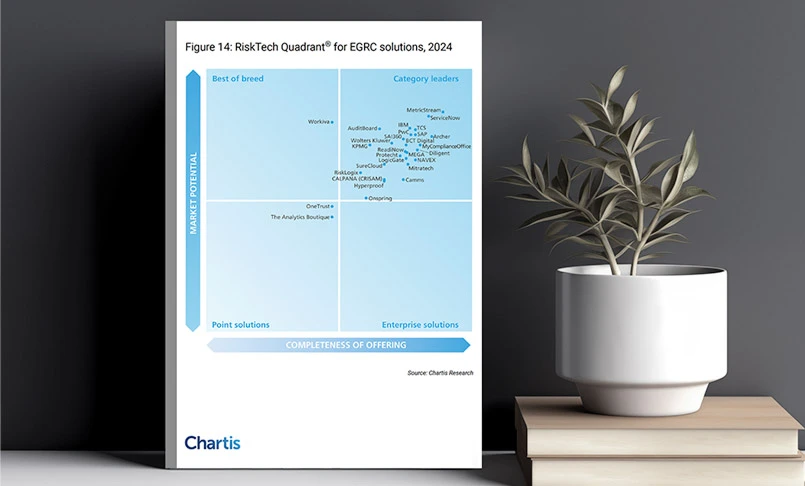

MetricStream Named Category Leader in All Seven Quadrants of the Chartis Research RiskTech Quadrant® for Integrated GRC Solutions, 2024

Discover ConnectedGRC Solutions for Enterprise and Operational Resilience

- Enterprise GRC

- Integrated Risk Management

- Cybersecurity Risk Management

- Corporate Compliance

- Supplier Risk and Performance

- IT and Security Compliance, Policy and Risk

- UK SOX Compliance

- Privacy Compliance

- IDW PS 340 n.F.

- Banking and Financial Services

- Life Sciences

Learn about the EU’s Digital Operational Resilience Act (DORA) and how you can prepare for it.

Explore What Makes MetricStream the Right Choice for Our Customers

- Customer Stories

- GRC Journey

- Training & Certification

- Compliance Online

Robert Taylor from LSEG shares his experience on implementing an integrated GRC program with MetricStream

Discover How Our Collaborative Partnerships Drive Innovation and Success

- Our Partners

- Want to become a Partner?

Watch Lucia Roncakova from Deloitte Central Europe, speak on how the partnership with MetricStream provides collaborative GRC solutions

Find Everything You Need to Build Your GRC Journey and Thrive on Risk

Featured Resources

- Analyst Reports

- Case Studies

- Infographics

- Product Overviews

- Solution Briefs

- Whitepapers

Download this report to explore why cyber risk is rising in significance as a business risk.

Learn about our mission, vision, and core values

Gurjeev Sanghera from Shell explains why they chose MetricStream to advance on the GRC journey

What is Risk Analysis? (Methods, Types, Examples)

Introduction.

In the strategic game of chess, every move is calculated with a keen awareness of potential risks. When transposed onto the business landscape, these calculated risk decisions become even more intricate. This encapsulates the essence of risk analysis.

In this article, we will discuss risk analysis in detail, including its importance, types, benefits, and more.

Key Takeaways

- Risk analysis is a crucial component of risk management. It involves identifying and evaluating potential risks that could obstruct an organization's achievement of its business goals and objectives.

- It is important for organizations to analyze the risks they face to better understand their cascading impact and make better-informed decisions.

- The key difference between risk assessment and risk analysis is that risk assessment is a broader process of identifying and prioritizing risks, while risk analysis is a more focused and detailed examination of specific risks to understand their nature, impact, and mitigation options.

What is Risk Analysis?

Risk analysis is the process of assessing and evaluating potential risks that could hamper business operations, projects, or processes. It involves determining the potential impact of the risks, their, likelihood of occurrence, and the overall level of threat they pose to an organization, project, or activity. Risk analysis helps organizations make informed decisions about how to manage and respond to risks effectively.

It serves as a pivotal mechanism for companies, businesses, or establishments to identify potential hazards and proactively minimize their repercussions. These risks encompass various aspects, including financial operations, safety, health, environmental concerns, legal liabilities, and operational considerations.

However, it's essential to perceive risk analysis not as a pessimistic lens on business strategy but as a necessary tool for preparation and preemptive measures. Through this method, uncertainties surrounding future scenarios are meticulously measured and managed.

Why is Risk Analysis Important?

Risk analysis is important for several reasons, and its criticality extends across various domains, including business, project management, finance, and decision-making processes. Here are some key reasons why risk analysis is important:

Identification of Potential Threats

Risk analysis helps organizations identify potential threats and vulnerabilities that could impact their operations, projects, or objectives. By identifying risks early, organizations can take proactive measures to mitigate or manage them effectively.

Assessment of Impact and Likelihood

Through risk analysis, organizations assess the potential impact of risks and the likelihood of their occurrence. This information is essential for prioritizing risks based on their severity and the level of threat they pose.

Informed Decision Making

Risk analysis provides decision-makers with valuable insights into the risks associated with various options or courses of action. This allows for informed decision-making, as decision-makers can weigh the potential risks against the expected benefits and choose the most suitable strategies or alternatives.

Resource Allocation

By understanding the risks involved, organizations can allocate resources more effectively. Risk analysis helps in identifying areas where resources should be prioritized for risk mitigation efforts, ensuring that resources are utilized efficiently to address high-impact risks.

Risk Mitigation and Management

One of the primary objectives of risk analysis is to develop and implement risk mitigation strategies . These strategies help organizations reduce the impact or likelihood of identified risks, thereby minimizing potential losses, disruptions, or negative consequences.

Compliance and Regulatory Requirements

Many industries have regulatory requirements and compliance standards related to risk management . Risk analysis helps organizations assess their compliance status, identify gaps, and implement necessary measures to meet regulatory obligations.

Enhanced Stakeholder Confidence

Stakeholders, including investors, customers, and partners, often require assurance that risks are being effectively managed. Risk analysis and transparent risk management practices can enhance stakeholder confidence by demonstrating a proactive approach to risk mitigation and protection of interests.

Continuous Improvement

Risk analysis is not a one-time activity but an ongoing process. Regular risk assessments and analyseis help organizations stay vigilant about emerging risks, adapt to changing circumstances, and continuously improve their risk management practices.

Understanding Risk Analysis of Various Types of Risks

Let’s look at various types of risks and how risk analysis helps organizations understand their impact and devise appropriate mitigation strategies.

Market Risks

The global marketplace is a complex space that shifts with consumer trends, tech advancements, socio-political scenarios, and market volatility. A smooth sailing ship today could suddenly find itself amidst turbulent waters tomorrow due to an unexpected shift in market conditions. This is a classic case of market risk. A robust risk analysis strategy helps explore these dynamic shifts in depth and develops adaptable strategies to steer clear of harm or take advantage of the new changes. For example, trend analysis can forecast potential fluctuations and help your business develop resilient marketing strategies that will withstand the storm and thrive even under new circumstances.

Operational Risks

Picture an effective assembly line producing top-notch gadgets. Then, unexpectedly, a machinery failure brings production to a standstill. Or, the supply chain gets disrupted due to unanticipated circumstances like a workers' strike or a global pandemic. These scenarios illustrate risks that could halt business functioning or even spell disaster if not addressed. A good risk analysis drills down into the nitty-gritty of operational processes, foreseeing potential interruptions and setting up robust contingency plans. Regular system checks, having backup suppliers, and providing periodic employee training are examples of proactive strategies derived from sound risk analysis.

Legal Risks

Imagine launching a product, that later becomes subject to a class-action lawsuit for patent infringement or violating certain regulations. The company then stares at considerable fines, reputational risk , and an overall daunting scenario. Through legal risk analysis , businesses can avoid stepping on the regulatory landmines. This systematic evaluation encompasses rigorous scrutiny of local, national, and international laws, enabling businesses to be on the right side of the legal framework, always.

Strategic Risks

Expanding into new territories, developing a new product line, or revamping brand identity, though promising, are significant risk hotspots. Risk analysis works like a well-lit torch on this dark, winding strategic path, bringing to light potential problems, allowing your business to pivot, and adjust strategy as needed.

Types of Risk Analysis Methods

Quantitative analysis.

Quantitative risk analysis methods involve using numerical data and calculations to assess risks, probabilities, and potential impacts. They benefit by assigning a monetary value to risk, which is especially beneficial in cyber risk quantification . Here are some common types of quantitative risk analysis methods:

Statistical Analysis of Historical Data

This method involves analyzing historical data related to risks, such as financial data, market trends, or operational performance metrics. Statistical techniques like regression analysis, time series analysis, and correlation analysis are used to identify patterns, relationships, and trends in the data, providing insights into potential risks and their impacts.

Econometric Models

Econometric models are used to analyze economic data and relationships between various economic variables. These models help in understanding how changes in economic factors can impact risk factors such as interest rates, inflation, exchange rates, and market conditions. Econometric models can be used to forecast future trends and assess the potential risks associated with economic changes.

Backtesting

Backtesting is a method used to evaluate the performance of risk models by comparing their predictions or estimates with actual historical outcomes. It involves applying the risk model to past data and assessing how well it predicts or captures actual risks. Backtesting helps in validating the accuracy and effectiveness of risk models and identifying areas for improvement.

Monte Carlo Simulations

Monte Carlo simulations are probabilistic techniques used to model and analyze complex systems or processes involving uncertainty. By running multiple simulations based on input parameters and probability distributions, Monte Carlo simulations generate a range of possible outcomes and their associated probabilities. This method helps in assessing the likelihood of different risk scenarios and their potential impacts.

Stress Testing

Stress testing involves subjecting a system, portfolio, or financial model to extreme or adverse conditions to assess its resilience and ability to withstand unexpected shocks or stressors. This method helps in identifying vulnerabilities, understanding worst-case scenarios, and evaluating the potential impact of severe events on risk exposure.

FAIR™ Model for Cyber Risk Quantification

Factor Analysis of Information Risk (FAIR™) is a globally recognized quantitative model framework designed to comprehend, evaluate, and measure cyber risks using financial parameters. Through FAIR, one can articulate their security risk exposure in monetary terms, enabling a clear understanding of the financial value at risk. This framework empowers organizations to scrutinize and justify their risk-related decisions utilizing a sophisticated risk model, while also determining the impact of security investments on their risk profile.

Qualitative Analysis

Qualitative risk analysis methods for operational risks involve subjective assessments based on expert judgment, observations, and qualitative data. These methods focus on understanding the nature, characteristics, and potential impacts of risks without using numerical or quantitative measurements. They provide valuable insights, facilitate risk communication, and support decision-making processes by identifying and understanding potential risks based on qualitative criteria and expert judgment.

Here are some common qualitative risk analysis methods for operational risks:

Risk Identification Workshops

Risk identification workshops involve bringing together key stakeholders, subject matter experts, and team members to brainstorm and identify potential risks. These workshops facilitate open discussions, idea sharing, and collective insights into operational risks that may affect the organization.

Risk Registers and Checklists

Risk registers and checklists are tools used to systematically document and categorize identified risks based on their sources, nature, and potential impacts. These tools help in organizing and prioritizing risks for further analysis and management.

Risk Interviews and Surveys

Conducting risk interviews or surveys with relevant stakeholders and personnel can provide qualitative insights into operational risks. These interviews and surveys seek opinions, experiences, and perceptions about potential risks, helping in understanding risk perceptions and concerns within the organization.

Risk Impact and Probability Matrix

This qualitative tool involves creating a matrix that assesses risks based on their potential impact and probability of occurrence. Risks are categorized into high, medium, or low impact and probability levels, helping in prioritizing risks for mitigation efforts.

Risk Scenarios and Storyboarding

Developing risk scenarios and storyboarding involves creating narratives or visual representations of potential risk events, their causes, consequences, and mitigating actions. This method helps in exploring and understanding the sequence of events and interactions associated with operational risks.

SWOT Analysis

SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a strategic planning tool that can be used for qualitative risk analysis. It helps in identifying internal strengths and weaknesses of the organization, along with external opportunities and threats that could pose operational risks.

Root Cause Analysis (RCA)

RCA is a method used to identify the underlying causes or factors contributing to operational risks. By investigating root causes, organizations can develop targeted risk mitigation strategies to address underlying issues and prevent risk recurrence. has context menu

What is the Difference Between Risk Analysis and Risk Assessment?

Risk assessment identifies and explores the range of possible threats and vulnerabilities that an organization may encounter, while risk analysis focuses on identified risks and determining their impact and likelihood.

To a layman, they might appear the same. However, upon digging deeper into the subtleties of these processes, it becomes quite clear that they represent distinctive stages of a larger risk management framework .

Risk assessment acts as the beginning of the journey. Imagine you are about to go on a journey, and risk assessment is the stage where you spread your map on the table and scrutinize the terrain. Risk assessment lays the groundwork. Risk assessment acts as the beginning of the journey. Imagine you are about to go on a journey, and risk assessment is the stage where you spread your map on the table and scrutinize the terrain. Risk assessment lays the groundwork. It is all about identifying what could possibly go wrong and recognizing the potential sources of danger.

However, just recognizing the threats and vulnerabilities isn't enough. You've recognized that a mountain path may be risky, but you're yet to understand how risky, and what consequences it could potentially yield. This is where risk analysis comes into the picture.

Risk analysis follows risk assessment, focusing on the recognized threats, estimating their impact, and how likely they are to occur. Continuing with the journey metaphor, it's like estimating the chances of a storm, or calculating how likely it would be for the path to get slippery.

It takes the data from the assessment, assesses the vulnerabilities, evaluates potential impacts, and describes its effects. By evaluating these consequences, organizations can rank and prioritize risks and formulate strategies accordingly.

Simply put, risk assessment identifies and risk analysis evaluates. Both components are essential in effective risk management, with risk assessment providing the initial overview and prioritization, and risk analysis delving deeper into individual risks for informed decision-making.

Benefits of Risk Analysis

Here are the key benefits of a robust risk analysis process:

The data obtained from risk analysis provides your team with the proverbial map and compass, providing direction on what course of action would best mitigate threats. It adds color to the otherwise blind spots of uncertainty, lending confidence in deciding whether to forge ahead, alter course, or halt your plans.

Mitigation of Unforeseen Impacts

It’s like your organization's built-in radar system, sounding off alarms when trouble is brewing, providing an opportunity to redirect resources or tweak plans to soften any potential blow.

Improved Operational Efficiency

With less time spent tackling sudden disruptions or crises, teams can focus on their core duties, leading to greater operational efficiency.

Increased Stakeholder's Confidence

Customers, shareholders, partners, regulators—they all crave predictability and a sense of security. You can illustrate the precautions you've taken, hence leading to increased trust and credibility among your stakeholders.

How Can MetricStream Help?

Simply put, with a well-rounded, solid, and smart risk analysis, your business gets an additional 'sense' – one that enables it to peer into the future, identify possible threats, and equip it with strategies to circumnavigate them.

Navigating the rocky terrain of risk management may appear overwhelming, but not if you have the right ERM Software partner, like MetricStream.