- Undergraduate

- Master of Accounting

- Full Time MBA

- Evening Executive MBA

- Weekend Executive MBA

- Charlotte Executive MBA

PhD in Accounting

Accounting and UNC Kenan-Flagler’s international reputation makes us one of world’s top academic centers of innovative accounting thought and research. We are widely recognized as a leading center of research on financial reporting, tax, international accounting, accounting standard setting, managerial accounting, and the role of accounting information in decision making.

We pride ourselves on frequent and successful student-faculty collaboration and encourage our students to work with, and seek advice, from every one of our faculty. We believe this frequent interaction with our faculty, who themselves work in many diverse areas, creates well-rounded graduates who can think creatively and deeply about important problems.

Typical Course Schedule by Year

- Seminar in Empirical Accounting Research

- Seminar in Corporate Governance

- Students in Accounting are required to complete two semesters of Statistics/Econometrics and select the level at which they qualify.

- Many Accounting students select Corporate Finance Theory I & II taught by our Finance faculty.

- Microeconomics

- Capital Markets – your first and second year

- A research paper is required for presentation and critique during the fall semester of your second year.

- Seminar in Corporate Finance: Financial Economics and Asset Pricing

- Seminar in Managerial Accounting (may be completed your first or second year.)

- Investment Finance

- Game Theory

- Econometrics

- Professional Communication Skills

- Seminar in Executing Research

- Comprehensive written examination which covers all of the Accounting courses you take in your first two years of the PhD Program

- An oral presentation of your current research

- Secure an advisor prior to your third year. Historically, students and advisors have gravitated towards one another naturally as we ensure students and faculty frequently interact. However, we will assign an advisor based on student and faculty preferences and interest, if necessary.

- Full-time research

- With consent of your advisor, you may attend/participate or present at external national or international conferences after your second year, which are frequently done by our PhD students.

- Your Dissertation and Oral Defense are expected prior to the end of your fifth year.

- Preparing for the job market

- You may take any elective course offered by UNC Kenan-Flagler or other UNC (or Duke) departments with guidance from your advisor.

View our current Accounting PhD students .

Related Research

Audit firms benefit from pcaob hires.

Federal prosecutors made headlines when they charged six accountants with conspiracy and other charges in January 2018. They said five accountants conspire...

How to nip and tuck costs

For hospitals, a corollary to the popular adage “what gets measured gets managed” could be “measure more accurately to manage costs better.” That seems to ...

Evasive maneuvers

“Round-Tripping” – How U.S. investors route their income through offshore tax havens As long as there have been taxes, there has been tax evasion. ...

This website uses cookies and similar technologies to understand visitor experiences. By using this website, you consent to UNC-Chapel Hill's cookie usage in accordance with their Privacy Notice .

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

Our doctoral program in the accounting field offers broadly based, interdisciplinary training that develops the student’s skills in conducting both analytical and empirical research.

Emphasis is placed on developing a conceptual framework and set of skills for addressing questions broadly related to accounting information. While issues of financial reporting, managerial accounting, corporate governance and taxation are the ultimate concern, special emphasis is given to applying basic knowledge of economics, decision theory, and statistical inference to accounting issues.

Spectrum of Interests and Research Methods

Faculty research represents a broad spectrum of interests and research methods:

- Empirical and analytical research on the relation between accounting information and capital market behavior examines the characteristics of accounting amounts, the effect of accounting disclosures on the capital market, the role of analysts as information intermediaries, and the effects of management discretion. Issues examined also include the impact of financial information on stock and option prices, earnings response coefficients, market microstructure, earnings management, voluntary disclosures, and the effect of changes in accounting standards and disclosure requirements.

- Problems of information asymmetries among management, investors, and others are currently under study. This research investigates, analytically and empirically, the structure of incentive systems and monitoring systems under conditions of information asymmetry. Research on moral hazard, adverse selection, risk sharing, and signaling is incorporated into this work.

- Other ongoing projects include research on the economic effects of auditing and regulation of accounting information, and analysis of tax-induced incentive problems in organizations.

- Additional topics of faculty interest include analytical and empirical research on productivity measurement, accounting for quality, activity-based costing for operations and marketing, and strategic costing and pricing.

Preparation and Qualifications

It is desirable for students to have a solid understanding of applied microeconomic theory, econometrics and mathematics (linear algebra, real analysis, optimization, probability theory) prior to the start of the program. Adequate computer programming skills (e.g. Matlab, SAS, STAT, Python) are necessary in coursework. A traditional accounting background such as CPA is not required.

Faculty in Accounting

Christopher s. armstrong, jung ho choi, george foster, brandon gipper, ron kasznik, john d. kepler, jinhwan kim, rebecca lester, iván marinovic, maureen mcnichols, joseph d. piotroski, kevin smith, emeriti faculty, mary e. barth, william h. beaver, david f. larcker, charles m. c. lee, stefan j. reichelstein, recent publications in accounting, elpr: a new measure of capital adequacy for commercial banks, fraudulent financial reporting and the consequences for employees, board diversity and shareholder voting, recent insights by stanford business, nine stories to get you through tax season, tax cuts in the uk gave an unexpected boost to african economies, the hidden costs of clicking the “buy now, pay later” button.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

PhD in Accounting

Be more than a PhD. Be an accounting powerhouse.

Request Information

It all adds up: incomparable faculty, top research publication rankings, excellent teaching opportunities and a history of great post-graduation placements.

The Eller Doctoral Program in Accounting stands out as a leader with its high concentration of bright minds and collaborative research.

Graduate Program Coordinator Denise Burruel

520-621-2697 [email protected]

The Program

Program essentials.

This accounting doctoral program’s aim is to prepare you to excel as an accounting educator or researcher at a top-50 research institution. As you near completion of your Eller program, our goal is to help you gain notice from excellent schools and prospective employers.

Explore the program

Plan of Study

You’ll spend your first two years learning about research areas, disciplines and methods. Years three and four are spent producing a quality dissertation and research pipeline. Your fifth year is dedicated to progressing your dissertation and research, preparing for a final oral defense and job recruiting.

Explore The Plan of Study

Accounting PhD program for archival-tax research BYU Accounting Rankings

Accounting PhD program for archival-auditing research BYU Accounting Rankings

Accounting PhD program for graduates' publication record BYU Accounting Rankings

Studying Accounting at Eller

We know it can be challenging to evaluate a doctoral program. Current doctoral students were in your shoes not too long ago. Here, Eller accounting doctoral students share their perspectives: from living in Tucson to what they’ve experienced so far.

Student Spotlight

The American Accounting Association (AAA) 2021 Auditing Section Virtual Midyear Meeting has chosen our PhD Alumni'20, Jacob Jaggi's dissertation titled, "When Does the Internal Audit Function Enhance Audit Committee Effectiveness?" for the 2021 Outstanding Auditing Dissertation Award . This award is given to the author of the dissertation who makes the most outstanding contribution to auditing knowledge. Additionally, Professor Preeti Choudhary and Professor Jayanthi Sunder (co-chairs for Jacob’s dissertation) were chosen to receive the Dissertation Committee Chair Award. Jacob dissertation idea received several recognition and awards, such as the 2019 AAA Western Region Conference Best Doctoral Student Paper Award and the 2018 Institute of Internal Auditors (IIA) Michael J. Barrett Doctoral Dissertation Grant for his dissertation idea, which provided him with financial support. Jacob was placed as an Assistant Professor at Washington State University in May 2020.

Doctoral Admissions Process

Applicants must have a four-year bachelor’s degree, a minimum 3.0 GPA and a minimum 675 GMAT score (taken within the last five years). You’ll need to compile transcripts and test scores, then submit an online application to the University of Arizona Graduate College.

View Admissions PRocess

All of our PhD students are awarded a generous financial package that covers full tuition plus a stipend for living expenses. You may be able to supplement that stipend by teaching extra courses (such as over the summer). Additional scholarships and fellowships are also available.

View Funding Information

Application Deadline

January 15, 2024 : Next Application Deadline for Fall 2024 Admission (Domestic and International)

Doctoral students are admitted only in the fall semester, and all application materials must be submitted online.

Your coursework will prepare you for cutting-edge research on substantive accounting issues in the areas of managerial accounting, financial accounting, auditing and tax. You can take advantage of the many resources available to you as a doctoral student and sustain our track record of publishing in the top accounting journals.

Explore Research

Our doctoral program strives to prepare our students for competitive faculty positions at Tier-1 accounting research universities. Our past graduates have earned positions at institutions including the University of Chicago, Ohio State University, University of Notre Dame and University of Southern California.

Explore Placement

Accounting Faculty

Our esteemed faculty work closely with doctoral students throughout their coursework and research, mentoring students and guiding them to become successful researchers and teachers. With research ranging from auditing and tax to financial reporting and behavioral and cost accounting, they are a great resource.

Explore Faculty

Start Your Journey to the Top of Your Field

Small class sizes. A great faculty-to-doctoral-student ratio. Incredible research resources. A stellar track record. And you.

Contact us with any questions , or if you're ready to apply to the Eller Doctoral Program in Accounting, just click below. We look forward to making breakthroughs together.

About / Departments

Department of Accounting | Ph.D. Overview

Ph.d. overview.

- Stern’s accounting faculty has a wide range of research interests and continuously publishes works in all major academic accounting research journals such as the Journal of Accounting Research, Journal of Accounting and Economics, the Accounting Review, the Review of Accounting Studies, and Contemporary Accounting Research. Furthermore, Stern’s accounting faculty has published in such major Finance journals as the Journal of Finance, the Journal of Financial Economics, and the Journal of Financial and Quantitative Analysis.

- The Department boasts a large and diverse body of Ph.D. students, who assist faculty with research projects early on in their doctoral program and often become co-authors to papers published in prestigious accounting journals.

- The admissions process is a rigorous one and important criteria are: an interest in doing research and teaching in accounting, strong quantitative skills, and an ability to communicate effectively. There are no formal education requirements other than possession of a bachelor's degree - an MBA is not required.

- The quality of our Ph.D. program (ranked 7th in the United States by U.S. News and World Report) manifests itself by, among other things, our success in placing our graduates.

Click here to learn more about the PhD admissions process.

Accounting, Ph.D. Program Coordinators

NYU Stern Henry Kaufman Management Center 44 West 4th Street Suite No. 10-77 Phone: 212-998-0025 Email: [email protected]

Xiaojing Meng

NYU Stern Henry Kaufman Management Center 44 West 4th Street Suite No. 10-84 Phone: 212-992-6812 Email: [email protected]

Explore Stern PhD

- Meet with Us

ACCOUNTING PhD

The nation’s top accounting program.

Texas McCombs boasts the most prestigious accounting doctoral program in the country and has graduated more than 300 PhD students since its inception in 1934. Are you ready for the best?

Your Future In Accounting

- PhD Program

- Why McCombs

- Department of Accounting

ACADEMIC LIFE AT McCOMBS

Mentorship and practice, application deadline.

The application deadline for the Accounting Doctoral Program is December 15.

AREAS OF SPECIALIZATION

If you are a practicing accountant, these topical areas will be familiar to you. However, we welcome students with backgrounds in Mathematics, Economics, Engineering, Finance, Psychology, or other disciplines to apply. We can remedy any lack of accounting knowledge through additional coursework. Most students enter our accounting doctoral program with some knowledge in these areas:

Financial Accounting

Financial accounting researchers are interested in the use of accounting information by investors, creditors, analysts, and other decision-makers. We are also interested in the preparation of accounting information by managers who may respond to economic incentives and use discretion to manage earnings. Finally, we are also interested in the regulation of accounting information by standard setters and other regulators who are evaluating the relevance and reliability of current and potential accounting information.

Auditing researchers are interested in questions of independence, governance, compliance, auditing processes, and biases. This research helps global standard-setters and regulators adopt standards and policies that protect the integrity of our accounting information.

Managerial accounting research topics include optimal employee compensation and governance, using information for efficiency management, motivating creativity, etc.

Taxation research covers economic incentives, transfer pricing, compliance with tax enforcement, multistate taxation, and numerous topics about accounting for income taxation, where tax rules overlap with financial reporting standards.

RANKINGS & RESEARCH

Academic leadership, research methodologies.

When you earn a doctorate, most of your time is spent developing deep expertise in research methods. Accounting researchers use three main approaches. In all cases, your doctoral studies will involve a firm grounding in statistics and typically a choice of either economics or psychology as an additional foundation.

Archival research involves the statistical analysis of historical data to examine relevant research questions based on economic theory for its predictions. Thus, archival research requires a strong background in statistics and economics, which we provide through rigorous coursework in the business school and the economics department.

Experimental

Experimental or survey methods are commonly used to obtain data to conduct what is broadly known as behavioral research. Behavioral research relies on psychology for its theories. Because this research is interested in what people do and why they do it, it is often necessary to conduct controlled experiments or survey participants. Using experiment or survey methods, researchers in accounting and finance have provided compelling alternative explanations where economic theories fall short.

Analytical research uses quantitative mathematical models to explain and predict behavior. This research is grounded in game theory from economics. Students wanting to conduct analytical research should have even stronger mathematical backgrounds than other applicants. We will design a program of study that builds on those initial strengths with additional coursework in mathematics and economics.

GET READY TO APPLY

Preparation and qualifications, career placement, the world needs you, career destinations.

The primary goal of the Texas McCombs PhD program is to prepare students for exceptional academic careers. Over the last five years, McCombs Accounting PhD alumni have excelled at top institutions globally.

Recent Graduate Placements

Jesse Chan | 2022 | Boston University

Cassie Mongold | 2022 | University of Illinois Urbana-Champaign

Ryan Hess | 2021 | Stanford University (postdoc); Oklahoma State University

Ryan Ballestero | 2021 | Kent State University

Dan Rimkus | 2021 | University of Florida (October 2021 graduation)

Shannon Garavaglia | 2020 | University of Pittsburgh

Jakob Infuehr | 2019 | University of Southern Denmark

Antonis Kartapanis | 2019 | Texas A&M University

Kristen Valentine | 2019 | University of Georgia

Colin Koutney | 2018 | George Mason University

Zheng Leitter | 2018 | Nanyang Technological University

Brian Monsen | 2018 | The Ohio State University

Xinyu Zhang | 2018 | Cornell University

Jeanmarie Lord | 2017 | University of Montana

Ben Van Landuyt | 2017 | University of Arizona

Shannon Chen | 2017 | University of Arizona

Prasart Jongjaroenkamol | 2017 | Singapore Management University

Ying Huang | 2017 | University of Texas - Dallas

Current Students and *Job Market Candidates

Mary adenle, yiying chen, dorothy dickmann, mandy ellison*, kenzie feinberg, michael gonari, nathan herrmann, sean kemsley, minjae kim*, kaitlyn kroeger, jingpei shi, albert wang, are you ready to change the world.

The Texas McCombs Doctoral Program is seeking individuals who are interested in transforming the global marketplace. Are you one of these future thought leaders?

G. Brint Ryan College of Business

Search form.

- EagleConnect

- UNT Directory

- Jobs at UNT

- College Outcomes

- Strategic Plan

- Corporate Partners

- Map & Directions

- Educational Partners

- Office of the Dean

- Business Leadership Building

- Welcome Book

- Faculty Support Center

- Expertise Directory Form

- Business Information Technology Services

- Center for Logistics & Supply Chain Management

- Center for Energy Accounting and Sustainability

- The Murphy Center

- The People Center

- Academic Programs

- Undergraduate Programs

- Master's Degree Programs

- Ph.D. Degree Program

- Doctor of Business Administration

- Academic Departments

- Logistics & Operations Management

- Why Study Business?

- Take a Tour

- Paying for College

- How to Apply

- Request More Information

- Virtual Lab

- Scholarships

- Wilson Jones Career Center

- Professional Leadership Program

- Newsletters

- Events Calendar

- Distinguished Speaker Series

- Eagle Business Network

- Hall of Fame

- UNT Alumni Association

- Real Estate Alumni Association

- North Texan Magazine

- Dallas Business Club

- 2022 Awards

- 2021 Awards

- 2020 Awards

- 2019 Awards

- 2018 Awards

- 2017 Awards

- 2016 Awards

- 2015 Awards

- 2006-2009 Awards

- Adjunct Faculty

- Advisory Boards

- Information

- Future Students

- Current Students

You are here

- Ph.D. Concentrations

Accounting Ph.D. Program

- Business Information Assurance

- Management Science

- Information Systems

The University of North Texas's G. Brint Ryan College of Business offers a rigorous four-year Ph.D. program in business with an accounting concentration designed to prepare students for successful careers as academic scholars. Students are trained to conduct independent research in a wide range of areas, including tax, financial, managerial, systems, and audit. Our faculty and doctoral students use both archival and behavioral approaches.

Our program is demanding, broad in scope, and provides opportunities for close interaction between students and faculty. Students are required to demonstrate a high level of proficiency in quantitative areas (such as mathematics and statistics), and scholarly writing. Our program has been changing rapidly, reflecting the growing emphasis on rigorous research at the University of North Texas.

UNT is an ambitious, growing university that is making a strong commitment to expanding and improving its doctoral programs. Accounting doctoral students at UNT now benefit from working with nationally recognized faculty in a wide variety of specialties in a new, exceptionally well-equipped building with cutting edge technology.

UNT is the largest university in the fast-growing Dallas/Fort Worth region. The G. Brint Ryan College of Business enjoys strong alumni support and close relationships with a dynamic business community. Our Institute of Petroleum Accounting is one of the leading academic centers specializing in the oil and gas industry.

The UNT Department of Accounting offers an exceptionally collegial environment with a strong tradition of close student-faculty collaboration. The accounting faculty and administrators are committed to strongly supporting doctoral students and doing everything possible to enable their success.

Doctoral Program Coordinator Contact Information

Frequently asked questions, 1) what is the desired educational background of the students entering your ph.d. program.

A master's degree in accounting, an MBA with an accounting concentration, or the equivalent is generally required. Students must demonstrate proficiency in calculus 1 and microeconomics (master's level) before they begin their doctoral studies.

2) What type of work experience, if any, is required or recommended before admittance into your program? Are you willing to consider well prepared students who have little or no prior work experience?

Professional work experience is strongly recommended. We will sometimes consider exceptionally strong students who have little prior full-time professional work experience.

3) What is the average GMAT score for your entering Ph.D. students? What minimum criteria do you specify for a Ph.D. student? What are your English language proficiency requirements?

We require all applicants to submit GMAT scores. The mean GMAT score of our current Ph.D. students is 695.

We consider only those students who demonstrate excellent English language writing and speaking skills.

4) What qualities do you look for in students that are applying to your school?

We look for a very strong academic background with a record that suggests the ability to become a successful scholar. Intellectual curiosity, enthusiasm, and a very strong work ethic are essential for success in our program.

5) Do you invite/require applicants in for campus or phone interviews?

We invite the strongest applicants to visit our campus for personal interviews. With some applicants we may conduct phone interviews instead of personal interviews.

6) How many new Ph.D. students have you admitted and plan to admit from 2014 to 2018?

7) what is your annual tuition and the typical financial package made available to new ph.d. students in terms of cash stipends, tuition breaks, and any other benefit provided.

Annual tuition and fees : Roughly $7,500 per year during the first two years, and about $3,200 per year in later years. These items are waived for almost all students.

Average annual cash stipends : At least $28,000.

Other financial assistance provided : Variable.

8) How many full-time (FT) and part-time (PT) Ph.D. students do you currently have in your program in each of the following years of study?

9) over the past years, how many ph.d. students have graduated from your program annually, 10) what percentage of your entering ph.d. students graduate and how many years of study does it take on average to complete your ph.d. program based on recent graduates.

95% Graduate. It takes an average of four years to complete the program.

11) Do you expect your students to teach during their Ph.D. program? If so, what is the expected number of classes per year?

Yes, most students teach one section per semester, one preparation during most of the student's Ph.D. program, typically not starting until after comprehensive exams. We offer flexibility in teaching assignments.

12) List the schools where recent Ph.D. graduates from your institution accepted employment.

Bentley University, Clemson University, San Francisco State University, University of Nevada-Reno, TCU, Babson College, Monmouth University, University of South Dakota, University of Texas Permian Basin, Clark University, Ohio University, Penn State University – Behrend, University of Wisconsin - La Crosse, University of North Carolina Wilmington, St. Norbert College, and Xi'an Jiaotong-Liverpool University (China).

13) Of your current Ph.D. students, how many anticipate graduating with a research focus on each of the following areas?

14) of your current accounting faculty, how many are directly involved in supporting your ph.d. students in research in each of the following areas, 15) what is the url to your web site.

http://www.cob.unt.edu/phd/

16) What is your application deadline?

Students should submit their applications as early as possible. Jan. 15 is the formal deadline for admission in the following fall, but students should apply sooner. The program might become full before the deadline. International applicants are especially urged to apply early, since application processing at the university level for international students can require many weeks.

17) Do you offer a part-time program?

Prerequisites, g. brint ryan college of business prerequisites.

The UNT G. Brint Ryan College of Business PhD Handbook for Doctoral Students states that a student entering the doctoral program upon completion of a bachelor's degree must complete the MBA core requirements and take 12 additional hours in the major and/or minor areas. (This statement assumes that the entering student does not already hold an MBA.)

A student who holds a master's degree that does not contain courses equivalent to the MBA background courses must take these courses as "deficiencies" outside the doctoral program. The Accounting Department can make exceptions to the above requirements on a case-by-case basis.

Accounting Department prerequisites

- Two semesters of calculus for behavioral track students. Three semesters of calculus up to and including vector-valued functions, multi-variable functions, partial derivatives, and multiple integrals for archival track students (This is the equivalent of UNT's three semester calculus sequence (Calc I [Math 1710], Calc II [Math 1720], and Calc III [Math 2730]).

- Intermediate microeconomics – 3 credits. (upper level undergraduate or master's level).

- Linear algebra – strongly recommended but not required.

Although we generally require that incoming accounting doctoral students have the equivalent of an MS in Accounting, we evaluate incoming students' academic backgrounds on a case-by-case basis. We generally require the equivalent of the following UNT G. Brint Ryan College of Business accounting background courses:

- ACCT 3110 - Intermediate Accounting I

- ACCT 3120 - Intermediate Accounting II

- ACCT 3270 - Cost Accounting

- ACCT 4100 - Accounting Systems

- ACCT 4300 - Federal Income Taxation

- ACCT 4400 - Auditing – Professional Responsibilities

Example Course Plans

Course plan for behavioral students, course plan for archival students, research interests of unt accounting faculty, richard cazier.

The information content of frms’ narrative disclosures; the relation between disclosure and litigation risk; how the fnancial press infuences market participants. SSRN : https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=391166 Google Scholar : https://scholar.google.com/citations?user=iukM0AkAAAAJ&hl=en

Jared Eutsler

Auditing; Audit Regulation (including PCAOB); Audit Inputs (including hiring and training of individual auditors); and Fraud. Google Scholar : https://scholar.google.com/citations?hl=en&user=y63c-V0AAAAJ

Paul D. Hutchison

Governmental accounting, environmental accounting, disclosures, research methods, cash flow management, and accounting systems. BYU : https://www.byuaccounting.net/rankings/indrank/per_ind_cnt.php?authorid=1245&authorname=Hutchison,%20Paul%20D . Google Scholar : https://scholar.google.com/citations?view_op=list_works&hl=en&user=2A5Z9i4AAAAJ ORCID : https://orcid.org/0000-0001-8629-022

Govind Iyer

Tax policy analysis, tax compliance, and behavioral research on the role of affect and biases on actions and decisions.

Peggy Jimenez

Judgment and decision-making of tax preparers and individual taxpayers

Information Systems and Audit.

Jose Lineros

Smart Contracts, Permissioned Blockchains, and Generative AI

Blair Marquardt

Corporate governance and financial reporting. Google Scholar : https://scholar.google.com/citations?user=7KHNAHUAAAAJ&hl=en

Michael Neel

Financial reporting, with a focus on international differences and reporting incentives. Google Scholar : https://scholar.google.com/citations?user=CR9oDP4AAAAJ&hl=en&oi=sra SSRN : https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=821405

Chad A. Proell

Research is behavioral and currently focused on how social psychological factors affect audit quality via their influence on audit team upward communication, turnover, and decision-making. BYU : https://www.byuaccounting.net/rankings/indrank/per_ind_cnt.php?authorid=5409&authorname=Proell,%20Chad%20A .

Jesse Robertson

Auditor liability; Auditor JDM; Professional Skepticism. Google Scholar : https://scholar.google.com/citations?user=dtMZe-AAAAAJ&hl=en

Pradeep Sapkota

Corporate taxation, financial reporting (including reliability, disclosure, and timeliness), and auditing (including audit quality, audit pricing, and auditor-provided tax services)

Casey Schwab

Dr. Schwab’s tax research focuses on the determinants and consequences of corporate tax behavior; his financial accounting research focuses on the quality of financial reporting. For more information and links to his publications, visit https://sites.google.com/view/caseymschwab/home .

Ananth Seetharaman

Tax policy analysis, executive compensation and incentives, corporate governance. Google Scholar : https://scholar.google.com/citations?user=3JRUk7UAAAAJ

Dr. Sun conducts archival research in auditing and financial accounting. Her audit research focuses on audit standards, audit quality, audit opinions, audit fees, audit delays, and auditor-client relationships. Her financial accounting research focuses on corporate disclosure, financial reporting quality, and the impact of executives on corporate disclosure and reporting. Google Scholar : https://scholar.google.com/citations?user=7-s1KukAAAAJ&hl=en&oi=sra SSRN : https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=513696

1 Two semesters of calculus and an upper-level microeconomics course are required for the behavioral track, and three semesters of calculus and an upper-level microeconomics course are required for the capital markets (archival) track. Prerequisite coursework must be completed before the start of fall classes.

- Caption text 1

- Caption text 2

- Youth Program

- Wharton Online

PhD Program

Wharton’s Ph.D. program in Accounting trains students to be successful academic researchers. To this end, the program is designed to provide students with opportunities to learn to develop their own research ideas and to learn to implement appropriate research methods. Students learn these skills through rigorous coursework, as well as mentoring relationships and often research projects with faculty members that provide “on-the-job” training. When a student completes the program, he or she will have a dissertation and other publishable research in progress that can credibly communicate to the academic community the student’s skills and potential for future success as a researcher.

For examples of joint work between students and faculty, Click here . For student placements since 1999, Click here .

About the Program Find out more about the Accounting admission requirements.

Course Information View the Accounting course requirements.

Course Schedule View the Accounting course schedules.

Current Students View a list of our current Accounting PhD students.

Sample Plan of Study

PhD Accounting Program Coordinator Luzi Hail Stephen J. Heyman Professor, Professor of Accounting 1319 Steinberg Hall-Dietrich Hall Philadelphia, PA 19104-6365 Phone: (215) 898-8205 E-mail: [email protected]

Additional PhD Information

- Apply to Wharton

- Doctoral Inside: Resources for Current PhD Students

- Welcome to Philadelphia Video

- Policies and Procedures

- Harvard Business School →

- Doctoral Programs →

- PhD Programs

Accounting & Management

- Business Economics

- Health Policy (Management)

- Organizational Behavior

- Technology & Operations Management

- Program Requirements

Accounting & Management

Curriculum & coursework.

Our programs are full-time degree programs which officially begin in August. Students are expected to complete their program in five years. Typically, the first two years are spent on coursework, at the end of which students take a field exam, and then another three years on dissertation research and writing.

Students in the Accounting and Management program must complete a minimum of 13 semester-long doctoral courses in the areas of business management theory, economic theory, quantitative research methods, academic field seminars, and two MBA elective curriculum courses. In addition to HBS courses, students may take courses at other Harvard Schools and MIT.

Research & Dissertation

Students in accounting and management begin research in their first year typically by working with a faculty member. By their third and fourth years, most students are launched on a solid research and publication stream. In Accounting and Management, the dissertation may take the form of three publishable papers or one longer dissertation.

Recent questions students have explored include: the ways in which managers use retail-level marketing actions to influence the timing of consumer purchases in relation to their firms’ fiscal calendars and financial performance as well as those of their competitors; the role of accounting information in strategic human resource decisions; the evolution, consequences and institutional determinants of unregulated financial reporting practices; the effects of adopting rolling forecasts on forecast quality.

Elliot Tobin

“ I’m constantly inspired to look into new research angles by the brilliant people I run into on campus every day. ”

Current HBS Faculty

- Brian K. Baik

- Dennis Campbell

- Srikant M. Datar

- Aiyesha Dey

- Susanna Gallani

- Gunther Glenk

- Brian J. Hall

- Jonas Heese

- Robert S. Kaplan

- V.G. Narayanan

- Trung Nguyen

- Joseph Pacelli

- Lynn S. Paine

- Krishna G. Palepu

- Ananth Raman

- Edward J. Riedl

- Clayton S. Rose

- Ethan C. Rouen

- Tatiana Sandino

- David S. Scharfstein

- George Serafeim

- Anywhere Sikochi

- Robert Simons

- Eugene F. Soltes

- Suraj Srinivasan

- Adi Sunderam

- Charles C.Y. Wang

- Emily Williams

Current Accounting & Management Students

- Yaxuan Chen

- Ji Ho Kim

- Botir Kobilov

- Yiwei Li

- Trang Nguyen

- Konstantin Pavlenkov

- Ria Sen

- Terrence Shi

- Albert Shin

- Elliot Tobin

- Wenxin Wang

- Yina Yang

- Siyu Zhang

Current HBS Faculty & Students by Interest

Recent placement, wilbur chen, 2022, alexandra scherf, 2021, jody grewal, 2019, andrew jing liu, 2018, hashim zaman, 2022, wei cai, 2020, matthew shaffer, 2019, jee eun shin, 2018, patrick ferguson, 2021, jihwon park, 2020, carolyn deller, 2018, aaron yoon, 2018.

- Current Students

- Faculty + Staff

- Alumni + Friends

- Parents + Family

- Community + Visitors

- Bachelor's Degrees

- Master's Degrees

- Doctorate Degrees

- Certificates

- Arts & Design

- Business & Industry

- Communications & Media

- Data Analytics & Information

- Health & Wellness

- Humanities & Social Sciences

- Music & Performing Arts

- Public Service

- Multidisciplinary

- Still Exploring & Undetermined

- International

- Bienvenidos

- Featured Videos

- College Tour

- Tuition & Aid

- Student Life

- Search Type Search Search

- Quicklinks:

- STUDENT EMAIL

- UNT DIRECTORY

- INFO FOR CURRENT STUDENTS

- INFO FOR FACULTY + STAFF

- INFO FOR ALUMNI + FRIENDS

- INFO FOR PARENTS + FAMILY

- INFO FOR COMMUNITY + VISITORS

- UNT LIBRARIES

- UNT CALENDAR

- JOBS AT UNT

Accounting Ph.D.

Want more info.

We're so glad you're interested in UNT! Let us know if you'd like more information and we'll get you everything you need.

Why Earn an Accounting Ph.D.?

Students are trained to conduct independent research in a wide range of areas, including tax, financial, managerial, systems and audit. Our faculty and doctoral students use both archival and behavioral approaches.

Our program is demanding, broad in scope and provides opportunities for close interaction between students and faculty. Students are required to demonstrate a high level of proficiency in quantitative areas (such as mathematics and statistics) and scholarly writing. Our program has been changing rapidly, reflecting the growing emphasis on rigorous research at the University of North Texas.

- Application of standard research methods

- Conduct and report business research

- Knowledge of core business disciplines

- Pedagogical practices

- Business research communication

Accounting Ph.D. Highlights

Career outlook.

Recent Ph.D. graduates have accepted employment at Clemson University, San Francisco State University, University of Nevada-Reno, TCU, Babson College, Monmouth University and University of South Dakota.

Accounting Ph.D. Courses You Could Take

Learn More About UNT

Explore more options.

It’s easy to apply online. Join us and discover why we’re the choice of nearly 47,000 students.

15 Best PhD in Accounting Online Programs [2024 Guide]

Explore Online PhD in Accounting Programs. Compare doctoral programs, specializations, careers, and salaries.

Whether you’re a seasoned veteran of the financial world or fresh out of your master’s degree program, you may find plenty of appeal in getting your PhD in Accounting online.

Editorial Listing ShortCode:

Online accounting degree programs offer the same level of education as their traditional on-campus counterparts but are often more convenient and less expensive.

Universities Offering Online PhD in Accounting Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

1. Capella University

Capella University is located in Minneapolis, Minnesota and is owned by Strategy Education, INC. This university delivers most of its programs online. It was founded in 1993 as The Graduate School of America.

Approximately 23% of the 38,000 students enrolled in Capella classes are doctoral candidates. Capella University works to make sure that students experience great support as they join a community of professionals. Their programs are designed to help students gain skills and knowledge that are relevant to their career goals.

- PhD in Accounting

- DBA in Accounting

Capella is accredited by the Higher Learning Commission.

2. City University of Seattle

City University of Seattle is a private university located in Seattle, Washington. It offers both campus and online classes, so you can find your preferred learning method. It all started back in 1973 when Dr. Michael A. Pastore founded City University to provide higher education for working adults.

Over the years, the school has increased its locations and student count. You can choose different degrees you want to study starting from certificate to Doctorate. There are different areas of study you can choose: Business and Management, Computer and Info Systems, Teaching and Education.

- DBA in Business Administration (Finance concentration)

CityU is accredited by the Northwest Commission on Colleges and Universities.

3. Drexel University

Drexel University, located in Philadelphia, Pennsylvania is a private research university founded by Anthony Drexel in 1891. It offers approximately 70 bachelor degree programs and 100 graduate degrees. Out of the nearly 25,000 students enrolled per year, one-third of them are grad students.

The Drexel Dragons play in the NCAA Division I, and there are many other student organizations to participate in.

Drexel’s LeBow College of Business is among the elite 20 percent of business schools to be accredited by AACSB International.

4. Franklin University

Franklin University’s 100% online DBA with optional accounting focus areas that can be finished in as few as 3 years. This 58 credit hours program will prepare students to be problem solvers in their own businesses, can be a consultant to a business organizations, or a business teacher

- DBA (Accounting concentration)

Franklin University is accredited by the Higher Learning Commission.

5. George Fox University

This is a Christian university located in Newberg, Oregon and founded as a school for Quakers in 1891. The private university has over 4,000 students and offers classes in psychology, social work, business, counseling, and accounting.

The university was called Friends Pacific Academy for a few years before it became a college in 1891. Also, have you ever heard of the athletic team named the Bruins? George Fox University has over 21 different sports – 11 for women and 10 for men. Attending this university is a great chance to grow professionally, spiritually, and academically.

George Fox is accredited by the Northwest Commission on Colleges and Universities.

6. Indiana Wesleyan University

Indiana Wesleyan University, located in Marion, Indiana, is a private university affiliated with the United Methodist Church. It is also the largest private college in Indiana.

Most of the school’s 13,000 students are online, enrolled through IWU-National & Global. Through IWU, you can earn your pick of 80 bachelor degrees, 57 master’s, and 9 doctorates.

The Global campus includes a seminary for theologians and pastors.

The Wildcats play in the NCCAA Division I.

Indiana Wesleyan University is accredited by The Higher Learning Commission and is a member of the North Central Association of Colleges and Schools.

7. Kansas State University

Kansas State University, or K-State, is a public research university. Its main campus is located in Manhattan, Kansas. It first opened in 1863 and was the first institution of higher education in the state.

Originally, the university was named Kansas State Agricultural College. Nowadays, it is a popular university. Furthermore, it offers a great active student life. Kansas State University has sports teams that play as the Wildcats in the NCAA Division I.

- Hybrid PhD in Personal Financial Planning

Kansas State is accredited by the Higher Learning Commission.

8. Liberty University

Liberty University is one of the largest Christian universities in the world, and it is also one of the largest non-profit universities in the U.S. The school consists of 17 colleges in total, including the medical school and a school of law.

The university has a traditional Christian orientation with three Bible-classes for undergraduate students. Liberty University was founded in 1971 by Jerry Falwell and Elmer L. Towns, and at first, it was a Lynchburg Baptist College.

However, it is not all about education and religion. The university is a member of the Atlantic Sun Conference for 17 of its 20 different sports. If you are looking for a great place to get an education in a Christian setting, Liberty University could be a good fit.

Liberty is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

9. National University

If you are looking for an acclaimed non-profit university for your online studies, you may wish to look into National University. NU is a continually growing network of nonprofit educational institutions dedicated to supporting students through career-driven education and services that aim to help them succeed in their educational, work, and personal lives.

National University was founded by US Navy Captain David Chigos in 1971. Since then, it has created a community of over 30,000 students and 220,000 alumni from around the world. It is a top educator of US military students and the largest non-profit in San Diego.

The school offers over 190 degrees at all levels of higher education, including the following:

- PhD in Business Administration – Advanced Accounting

- DBA in Financial Management

- DBA in Advanced Accounting

National University is accredited by the WASC Senior College and University Commission.

10. Rutgers University

Rutgers University is an American public research university located in New Jersey. It is the largest higher education institution in the state.

Originally, the university was created as Queen’s College in 1766. It is the 8th oldest college in the U.S. The institution was renamed as Rutgers College in 1825.

Rutgers is known as the “birthplace of college football,” so you know it places a lot of importance on athletics.

Rutgers is accredited by the Middle States Commission on Higher Education.

11. Saint Leo University

Saint Leo University was founded in 1889 and is a private Roman Catholic liberal arts university in St. Leo, Florida. It was the first Roman Catholic college in Florida and is one of the 5 largest Catholic colleges in the U.S.

Saint Leo University was also one of the first universities in the country that provided online education. Students that enroll in Saint Leo University have a great and active student life through a variety of organizations, clubs, and societies.

Saint Leo University athletic teams, named the Lions, participate in baseball, basketball, and golf for men, and swimming, softball, tennis, and volleyball for women.

Saint Leo is accredited by the Southern Association of Colleges and Schools.

12. Trident University

Trident University is a private online university in California. The university offers associate’s , bachelor’s, master’s, and doctoral degree programs. Also, you can get certificates in education, business, and information systems.

Trident University was founded in 1988 with headquarters was in Cypress, California. It is a great way to get an education for veterans and the military, as the university is online, though Trident University is a flexible university for everybody.

- PhD in Business Administration – Accounting

Trident is accredited by the WASC Senior College and University Commission.

13. University of Dallas

The University of Dallas is a private Catholic school founded in 1956 in Irving, Texas. Since then, the university has been ranked as a leading university for both Catholic and traditional academic students, ranked 6th in both best regional universities in the west and best value schools by U.S. News & World Report .

Today, the University of Dallas enrolls 3,000 students from all over the world, 1,000 of which are graduate students. It continues to provide higher education with a Catholic perspective. On-campus students will enjoy the 744-acre property.

UD is accredited by the Southern Association of Colleges and Schools.

14. University of South Carolina

The University of South Carolina is a public research institution in Columbia, South Carolina. It has been listed as an up-and-coming university by U.S. News & World Report . It was established in 1801 and is one of the oldest universities in South Carolina.

There are approximately 50,000 students enrolled in the university, which makes it one of the largest educational institutions in Carolina.

The school‘s 19 sports teams are competing in the Southeastern Conference and are known as Gamecocks. The university has a rich history of 200+ years of leadership in education.

- Hybrid DBA in Business Administration – Finance

USC is accredited by the Southern Association of Colleges and Schools.

15. Walden University

Walden University is an online university headquartered in Minneapolis, Minnesota. This university is a part of a global network managed by Laureate Education, Inc. Originally, it was established in 1970 by two teachers from New York City.

Walden University receives more than 75% of its funds from the US government and guarantees you that it can offer you a student loan. It offers plenty of degree programs, starting from bachelor’s to doctoral. It has nearly 50,000 students enrolled, most of who are online.

Walden is accredited by the Higher Learning Commission.

Online PhD in Accounting Degrees

Some of the most popular doctoral accounting degrees include the following. Click on the one that most interests you to jump to that section of the guide.

Financial Accounting

Managerial accounting.

Choosing a specialty can help prepare you for an interesting and rewarding career.

A PhD in Auditing can help you become an in-depth investigator for many types of businesses. Taking Auditing classes can give you the opportunities to learn economic principles, accounting, taxation, some government system types, and business policies.

Additionally, auditing is commonly used in the insurance field. Graduating with this degree can help you pursue a highly paid job and make yourself a great career.

The most common position for Auditing professionals is working for a large corporation or regulatory agency. If you like accounting, are responsible, and detail-accurate, then you probably already know how much you enjoy auditing.

Finance is a little broader than Accounting but encompasses the topic. If you enjoy looking at the big picture of a company’s, organization’s, or even a person’s finances, this might be the doctoral program for you.

From accounting to investing to planning and advising on other financial strategies, you may be able to play an important role in managing the funds of a company or for your clients. You might work for an investment company, a large corporation, a non-profit, or even a government entity.

From financial analyst to investment specialist to CFO, you’ll have many career options available to pursue. Many degree holders teach Finance and/or Accounting subjects at the university level.

A PhD in Financial Accounting may be a great start for those who are looking for a career in academic or research organizations. Taking classes in Financial Accounting can help you learn about business and economics in general and gain statistical and research skills.

Many students study Financial Accounting for the possibility of personal growth and higher earnings.

After graduation, you may work in government agencies, educational institutes, and non-profit organizations, as well as big business.

Managerial Accounting forms most of the accounting departments in many businesses. Earning a PhD in Managerial Accounting can help students learn economic principles and gain leadership and management skills.

Studies in this degree can help you learn about investment and risk, cash flow valuation, and treasury risk management. After graduation, you may find yourself a career as an investment advisor, lead accountant, senior auditor, or department head.

A Managerial Accountant PhD is often in the top position in their sphere. A person who loves numbers, is accurate, and has a great eye for the details may find a great fit for any type of Managerial Accounting career.

A PhD in Taxation can help provide you with the knowledge to assist businesses and individuals to navigate tax law. It can help you gain the skills for addressing current and future issues of taxation.

You should be interested in economics, accounting, and finance if you want to get a PhD in taxation. After graduation, you may find a job as a government researcher, financial analyst, or corporate accountant.

What Is an Online PhD in Accounting?

Often requiring between 72 and 90 credit hours to complete, securing a PhD in Accounting may serve as the perfect platform to display your expertise in the inner workings of generally accepted accounting principles (GAAP), as well as other facets of the modern accounting industry.

Additionally, focusing on this kind of graduate degree also allows for academic research and theoretical discussion, leading plenty of PhD candidates to remain in academia.

The “online” part simply means that you get a similar education as you would attending class in person, but you get to complete your classes in a more flexible manner and often on a more flexible timeline.

Online PhD in Accounting Curriculum

As far as your actual coursework goes, you will likely touch on a wide array of topics, including:

- Accounting Research Methods

- Econometric Theory

- Math Tools for Accounting

- Small Group Theory

- Teaching Best Practices

Most PhD programs in accounting require a dissertation, but there are a number of online DBA programs with no dissertation required. Concentrations are available in accounting, finance, and related fields.

Learning what to expect now can give you a better idea of how to schedule courses and properly prepare for this learning experience later on down the road.

Career Outlook for a PhD in Accounting vs. PhD in Finance

In reality, these two disciplines are different sides of the same coin. Earning a PhD in Accounting revolves around auditing and recording past fiscal matters, while going the finance route focuses on leveraging this information to generate future projections and support sound business decisions.

According to the Bureau of Labor Statistics (BLS), earning a PhD in Accounting and taking on a position as an economist can potentially net you an average annual salary of $105,020. As for professors in the business and finance field, expecting compensation that falls somewhere between $80,300 and $191,760 during the same timeframe is a potentially realistic outlook.

Here are some other career options to consider.

- Financial Analyst

- Financial Consultant

- Investment Researcher

- Department Manager

You might work for large corporations, investment firms, non-profit organizations, or the various levels of government. Every entity in every sector deals with finances.

How Do You Get a PhD in Accounting Online?

When it comes to actually working through your coursework and ending up on the big stage with this kind of post-graduate degree in hand, you have two primary paths to success: taking classes on campus or completing your PhD program via a digital classroom setting.

Depending on your current professional and personal situations, splitting your time between flexible online learning and the real-world interaction (dissertation defenses, counselor meetings, fieldwork, etc.) could be the key to avoiding unnecessary burnout and scheduling stress.

The first step to earning your terminal Accounting degree online is to narrow down your selection of schools and apply.

PhD Admission Requirements

To enter into a PhD in Accounting program, you’ll most likely have to jump through a few admissions hoops to beat out the rest of the applicant field. Submitting official transcripts of your bachelor’s and accounting master’s degree , as well as maintaining a GPA of at least 3.0, often serves as the first few steps of the process.

From this point, providing three letters of recommendation – usually via supporting faculty members – comes next. Finally, don’t be surprised if submitting your professional resume or achieving certain scores on the Graduate Management Admission Test (GMAT) or the Graduate Record Examination (GRE) also enters the picture.

Accreditation

Just like everything needs to line up in the ledger, so everything needs to line up regarding a university’s credentials. It’s best if a regional board periodically audits the school and validates the educational programs it offers with official accreditation.

Make sure the universities you apply to are accredited by one of these boards:

- Higher Learning Commission (HLC)

- Middle States Commission on Higher Education (MSCHE)

- New England Commission of Higher Education (NECHE)

- Northwest Commission on Colleges and Universities (NWCCU)

- Southern Association of Colleges and Schools Commission on Colleges (SACSCOC)

- WASC Senior College and University Commission (WSCUC)

If the university you attend isn’t accredited, other schools and potential employers may not respect your degree.

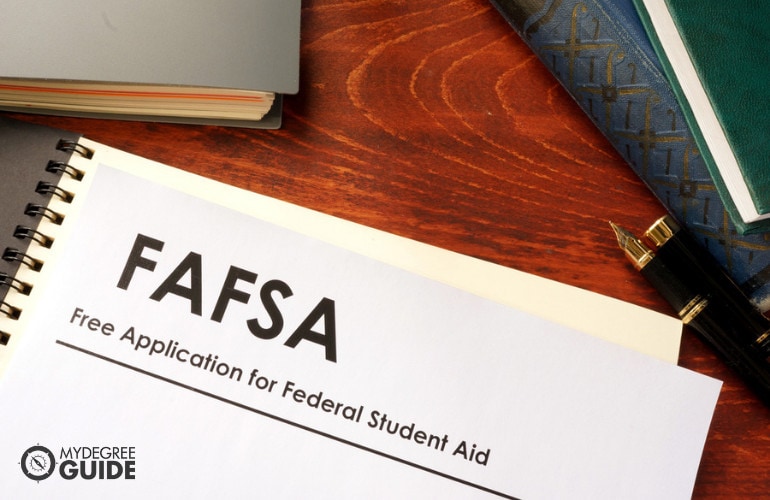

Financial Aid

Speaking of money, earning your next degree will probably be quite an investment. Look for these opportunities to lighten your expenses.

- Scholarships

- Fellowships

- Employer Tuition Assistance

You may also qualify for deferred loans to help you get through school and back into the workforce before you need to pay too much out of pocket. Start your search by looking into the federal student aid available for graduate students .

Is a PhD in Accounting Worth It?

Yes, a PhD in accounting is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include financial analyst, economist, investment researcher, and financial consultant.

The salary statistics says that earning the highest degree in your field is may be worth it considering the potential increased pay you’ll likely receive over the life of your career compared to the investment in education.

Of course, not every PhD student takes on this learning experience to move into a new position. This means that determining the worth of your time in the classroom can rest upon intangible considerations.

It will take a heavy commitment of time for the next couple of years. Is becoming an expert in your field something you want to spend the time on?

If so, you can start the process now, conveniently, online.

Doctoral study of tax policy

Start your ph.d. in accounting with a focus on tax research.

The Hoops Institute of Taxation Research and Policy and the Carson College of Business Department of Accounting in Pullman invite exceptionally qualified individuals to apply for admission to the Ph.D. program in accounting to study tax policy. An accepted candidate will be eligible to apply for both a Hoops Graduate Fellowship in Accounting and a graduate assistantship from the Carson College of Business and Washington State University.

Required qualifications

Qualified candidates will demonstrate previous tax education, multiple years of professional tax experience, and an interest in pursuing a career of academic tax research.

About the fellowship and assistantship

A WSU Carson College graduate assistantship includes a tuition waiver and a stipend, and this will be supplemented with special support to be provided by the endowment of the Howard D. and B. Phyllis Hoops Graduate Fellowships in Accounting.

Total annual compensation during the course of a typical four-year Ph.D. program will likely be in the $25,000-$30,000 range, assuming consistent degree progress and satisfactory work required by the terms of the assistantship (approximately 20 hours per week).