How to Write the Management Team Section of a Business Plan + Examples

Written by Dave Lavinsky

Over the last 20+ years, we’ve written business plans for over 4,000 companies and hundreds of thousands of others have used our business plan template and other business planning materials.

From this vast experience, we’ve gained valuable insights on how to write a business plan effectively , specifically in the management section.

What is a Management Team Business Plan?

A management team business plan is a section in a comprehensive business plan that introduces and highlights the key members of the company’s management team. This part provides essential details about the individuals responsible for leading and running the business, including their backgrounds, skills, and experience.

It’s crucial for potential investors and stakeholders to evaluate the management team’s competence and qualifications, as a strong team can instill confidence in the company’s ability to succeed.

Why is the Management Team Section of a Business Plan Important?

Your management team plan has 3 goals:

- To prove to you that you have the right team to execute on the opportunity you have defined, and if not, to identify who you must hire to round out your current team

- To convince lenders and investors (e.g., angel investors, venture capitalists) to fund your company (if needed)

- To document how your Board (if applicable) can best help your team succeed

What to Include in Your Management Team Section

There are two key elements to include in your management team business plan as follows:

Management Team Members

For each key member of your team, document their name, title, and background.

Their backgrounds are most important in telling you and investors they are qualified to execute. Describe what positions each member has held in the past and what they accomplished in those positions. For example, if your VP of Sales was formerly the VP of Sales for another company in which they grew sales from zero to $10 million, that would be an important and compelling accomplishment to document.

Importantly, try to relate your team members’ past job experience with what you need them to accomplish at your company. For example, if a former high school principal was on your team, you could state that their vast experience working with both teenagers and their parents will help them succeed in their current position (particularly if the current position required them to work with both customer segments).

This is true for a management team for a small business, a medium-sized or large business.

Management Team Gaps

In this section, detail if your management team currently has any gaps or missing individuals. Not having a complete team at the time you develop your business plan. But, you must show your plan to complete your team.

As such, describe what positions are missing and who will fill the positions. For example, if you know you need to hire a VP of Marketing, state this. Further, state the job description of this person. For example, you might say that this hire will have 10 years of experience managing a marketing team, establishing new accounts, working with social media marketing, have startup experience, etc.

To give you a “checklist” of the employees you might want to include in your Management Team Members and/or Gaps sections, below are the most common management titles at a growing startup (note that many are specific to tech startups):

- Founder, CEO, and/or President

- Chief Operating Officer

- Chief Financial Officer

- VP of Sales

- VP of Marketing

- VP of Web Development and/or Engineering

- UX Designer/Manager

- Product Manager

- Digital Marketing Manager

- Business Development Manager

- Account Management/Customer Service Manager

- Sales Managers/Sales Staff

- Board Members

If you have a Board of Directors or Board of Advisors, you would include the bios of the members of your board in this section.

A Board of Directors is a paid group of individuals who help guide your company. Typically startups do not have such a board until they raise VC funding.

If your company is not at this stage, consider forming a Board of Advisors. Such a board is ideal particularly if your team is missing expertise and/or experience in certain areas. An advisory board includes 2 to 8 individuals who act as mentors to your business. Usually, you meet with them monthly or quarterly and they help answer questions and provide strategic guidance. You typically do not pay advisory board members with cash, but offering them options in your company is a best practice as it allows you to attract better board members and better motivate them.

Management Team Business Plan Example

Below are examples of how to include your management section in your business plan.

Key Team Members

Jim Smith, Founder & CEO

Jim has 15 years of experience in online software development, having co-founded two previous successful online businesses. His first company specialized in developing workflow automation software for government agencies and was sold to a public company in 2003. Jim’s second company developed a mobile app for parents to manage their children’s activities, which was sold to a large public company in 2014. Jim has a B.S. in computer science from MIT and an M.B.A from the University of Chicago

Bill Jones, COO

Bill has 20 years of sales and business development experience from working with several startups that he helped grow into large businesses. He has a B.S. in mechanical engineering from M.I.T., where he also played Division I lacrosse for four years.

We currently have no gaps in our management team, but we plan to expand our team by hiring a Vice President of Marketing to be responsible for all digital marketing efforts.

Vance Williamson, Founder & CEO

Prior to founding GoDoIt, Vance was the CIO of a major corporation with more than 100 retail locations. He oversaw all IT initiatives including software development, sales technology, mobile apps for customers and employees, security systems, customer databases/CRM platforms, etc. He has a B.S in computer science and an MBA in operations management from UCLA.

We currently have two gaps in our Management Team:

A VP of Sales with 10 years of experience managing sales teams, overseeing sales processes, working with manufacturers, establishing new accounts, working with digital marketing/advertising agencies to build brand awareness, etc.

In addition, we need to hire a VP of Marketing with experience creating online marketing campaigns that attract new customers to our site.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- Financial Assumptions and Your Business Plan

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

Business Plan Management Team Section

An overview of your founders, key employees, and advisors, management team.

The purpose of including the management team in a business plan is that it provides an overview of your founders and key employees. Yet, in the beginning, that might be just one person. You can increase your plan’s credibility by establishing a supporting cast of key mentors and advisors and including them in this section.

This article provides information about how to present your management team, including examples and a management team template you can use for your business plan.

Important Considerations for Presenting Your Management Team

Venture capitalists will often say, “We don’t invest in ideas. We invest in people.” Their rationale is that, over time, the idea will have to evolve. The right team will develop the idea into a winner. But the wrong team can ruin even what was initially an outstanding idea. So the question to be answered by this section is, “What experience and achievements in this team’s past demonstrate that they will succeed in this new business?”

Business Plan Outline for your Management Team:

The structure for the management team section of your business plan is straightforward. For each bullet point item below, expand on the experience and value brought to your company by their participation. The following sections will recommend best practices for presenting your management team in a way that investors and lenders will appreciate.

- Key Employees

Hiring Plans

Board members.

- Professional Advisors

Founders and CEOs

Most startup businesses will be led by the founder as the Chief Executive Officer or CEO. For a startup, the title of President is equally suitable.

If Your Founder is also the CEO

Assuming your President or CEO is also the founder, begin your Management Team section with a description of the individual who will be the CEO or senior person in charge of running the company.

Under the heading of Founder and CEO, include a mini-bio relevant to the credibility of this person leading the firm to success. A lender or investor will go to LinkedIn to get the full bio, so stick to the essential elements.

The best thing you can say about the founder is that he or she has CEO-level experience running a similar business or one in a similar space. Realistically, you’re only sometimes going to be able to say that. What can you say?

First, present the most relevant experience that makes the CEO “investable.” That could be technical expertise, sales experience, or management skills from another company. By stating the most relevant experience to the new business right up front, you’ll help the reader see the transferable skills. If there is no CEO experience, don’t worry. In the following sections, we’ll show you how to build a bridge of confidence to cover that gap.

If Your Founder is not the CEO

If the founder is not the CEO, two questions must be answered in this lead-off sub-section of your business plan management team. First, why is the founder not leading the company as its CEO? Next, what role will the founder play in the business?

Hopefully, the first question answers itself by presenting the outstanding qualifications of the CEO, such that the reader would be impressed by the fact that you were able to get this person to come on board to grow your business. A simple example would be:

Robert Nelson has 20 years of experience in our industry, 10 of that as a CEO. Robert will lead MyCo as our CEO. Robert is known and respected in the field and will surely accelerate our growth.

Dana Elders, our founder, worked under Robert as the head of sales, where he flourished. Dana will be MyCo’s President and will also be responsible for driving revenue.

Whatever the circumstances are that led to your founder not being the CEO, one would expect that there is an advantage with an upside. Otherwise, why would the founder abdicate this role? Be sure to identify the upside in your business plan.

Key Management Team Members

Highlight the relevant experience and accomplishments your team brings to the table. You can include the resumes of your key management team members as appendices in your business plan and refer to them in this section.

Whom should you include?

Include as many of the following roles in your management team as you have filled. Adapt these to align more closely with the important roles in your industry.

- Any VP-level person

- Chief Operating Officer

- Chief Financial Officer

- Chief Product Officer

- Chief Technology Officer

- Head of Sales

- Head of Marketing

- Head of Operations

- Any outstanding contributor with experience that will obviously contribute to the success of your business.

What to Say about Each Person on Your Management Team

For each individual you list, include their relevant experience, transferable skills, and key accomplishments, emphasizing factors that will contribute to your business’ success. Avoid making readers “connect the dots” on their own. Rather, make the connection for them.

For example:

Jose Rodero, VP of Product and Marketing.

In Jose’s previous role as Chief Product Officer of LikeMine Company, he expanded into new markets and tripled the size of the business in three years. This experience is ideal for MyCo as we move beyond a single market to expand into adjacent markets.

Highlight Relevant Accomplishments

For each person you list in the key management section, it’s helpful to convey a pattern of accomplishments, such as, “At her last company, Ms. Johnson was named Employee of the Year for the past two years. During that time, she was twice promoted. First to VP of Sales and then to COO.

Leave out admirable but “sideline” accolades such as, “Ms. Johnson is a two-time winner of the La Jolla Triathlon.” Unless an accolade relates to the success of your business, you’re better off mentioning it in the biography (included as an appendix) or leaving it out altogether.

At the early stages of your company, you might be missing some key people on your management team—this is normal and acceptable. Usually, this has a lot to do with why you are seeking funding. If you haven’t yet hired all your key people, you can address this in your business plan in two ways.

First, if you have lined up some individuals who will come on board when you bring in your funding, you can identify them in your business plan. If this information is not ready to be disclosed, you can allude to it in generalized terms without divulging the person’s name or current company.

“We have identified an individual with ten years of experience in a similar company to fill the Director of Marketing role. Pending the timing of our funding, we expect this person to join our team.

Next, address any gaps in your management team that need to be filled. Identify key hires that remain and the order in which you expect to fill the positions. Doing so shows that you’re thinking ahead and shields you from any criticism about holes in your current team.

While you may think these gaps are a weakness in your plan, your potential investors or lenders become a source of free candidate referrals!

Board of Directors versus Board of Advisors

There are two types of boards: a board of directors and a board of advisors, sometimes called an advisory board. A board of directors can have specific legal responsibilities and authority. For that reason, some individuals would prefer to join a board of advisors.

A board of advisors generally has fewer or no formal responsibilities but can be just as beneficial to the company through the guidance they provide. It’s never too early, and your business is never too small to have a board of advisors.

Whether it’s a board of directors or a board of advisors, it is important to surround yourself with experienced advisors who will provide sound advice that you will be willing to follow. Anything less will waste your time and theirs.

One founder we met with had this to say about a particular board member:

“I selected him to be on the board of my first company because he was strongly recommended by two successful business people I knew. I found him to be someone who pushed back on many of my ideas, asked lots of tough questions, and always held me to task on everything I said we would accomplish. We were not friends outside of the business.

When I started my next business, and we needed to set up a board–he was the first person I called.”

Your best board members may not be your best friends, and hopefully, they won’t be people who think just like you. A board brings a diversity of thought and critical thinking. They help you be a better version of yourself.

Having a board of directors or board of advisors tells lenders and investors that you value the input of outside thinking and have the skills to build relationships with people who can help your business succeed. That bodes well for the future success of your business!

Board of Directors

Your initial board of directors will almost certainly be led by the founder as its Chair. Typically, a co-founder, angel investor, or key employee with very senior executive experience might also be on the board. A small board of directors is fine, especially if you’ll be adding a board of advisors.

Depending on the state where you start your business and your corporate structure, a minimum number of board members may be prescribed.

Advisory Board

If you still need to get a board of directors beyond the minimum required roles, consider putting together a board of advisors. Chances are you have mentors and people with relevant experience who are giving you input on your business idea. Perhaps one of them is even a customer or potential customer.

Consider asking these people to agree to be on your board of advisors, a group that would meet quarterly to hear updates on your business and to provide input. With their consent, you can list members of your board of advisors in your business plan. You’ll find that accomplished people are often happy to join your board of advisors for little or no compensation.

What to Show in Your Business Plan for Board Members (Directors and Advisors)

For each board member in your board of directors and board of advisors, list their name, current or most recent position, and company. If members have special experience that pertains strongly to your business, naturally, you would also want to include that information. Include up to two or three sentences of narrative about each board member.

Using the format above, first list your Board of Directors and then your Board of Advisors.

Professional Services Advisors

If you have worked with an attorney to establish your business, an accountant to help prepare your financial forecasts, or an advertising or PR firm to help prepare some promotional materials—include these organizations in your business plan’s management section under the heading “Professional Advisors.”

Bankers and investors are often well-connected to area professional service providers. Knowing that you are working with recognized names in the business community can boost your credibility. It also tells the reader that you’re being advised by professionals.

Be sure to let your advisors know in advance that you’ve listed them in your business plan since oftentimes, they’ll get a phone call asking for their impressions of the business. Better still, seek and obtain their permission.

In this section, include the type of services provided, the name of the firm, and your primary contact.

Legal Advisors: Dewey and Howe. Jerry Mander, Partner.

Management Team Example Summary

Most startup businesses have a lean management team. A savvy founder will find a way to surround him or herself with individuals who will help the business get started, grow and thrive as non-executive contributors.

Use our provided information and management team examples to present a well-rounded management team section in your business plan.

If you still need to get some of the ancillary advisors we’ve recommended, now is the time to expand your influence circle. You’ll find that there are highly qualified individuals who are willing and even enthusiastic to be a part of your success.

Ready to complete your business plan in just 1 day?

Click GET STARTED to learn more about our fill-in-the-blank business plan template. We’ll step you through all the details you need to develop a professional business plan in just one day!

Successfully used by thousands of people starting a business and writing a business plan. It will work for you too!

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- Subscribers For Subscribers

- ELN Write for Entrepreneur

- Store Entrepreneur Store

- Spotlight Spotlight

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- How to Use Your Business Plan Most Effectively

- The Basics of Writing a Business Plan

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 12 Ways to Set Realistic Business Goals and Objectives

- 3 Key Things You Need to Know About Financing Your Business

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

How to Write the Management Team Section to Your Business Plan Think you've got an all-star lineup? These are the key characteristics to showcase.

By Eric Butow • Oct 27, 2023

Key Takeaways

- Who to include in your org chart

- The key traits to highlight

Opinions expressed by Entrepreneur contributors are their own.

This is part 1 / 8 of Write Your Business Plan: Section 3: Selling Your Product and Team series.

One crucial aspect of any business plan is the management team slide, which outlines the key employees in the organization. Here are some things to keep in mind when putting together your all-star lineup.

Put Yourself First

Don't be modest. If you're the head of the business, you should feature yourself first. After all, you are the entrepreneur behind the business venture, and you will have to put your neck on the line, answer the hard questions, and take the criticism— as well as the praise and acclaim, should there be some.

If you want to impress people with your management team, it's essential to let your readers know who is at the helm and who is selecting the management team. Explain your background, including your vision, your credentials, and why you chose the management team you did.

A business follows the lead of the founder, and as such, you need to briefly explain what is expected of this management team and the role you see it, as a group, playing in the future of this business.

Related: Does Your Team Have the Right Stuff to Attract Venture Capital?

Highlight These Characteristics

Identifying your managers is about presenting what they bring to the table. You can provide this by describing them in terms of the following characteristics:

Education Impressive educational credentials among company managers provide strong reasons for an investor or other plan reader to feel good about your company. Use your judgment in deciding what educational background to include and how to emphasize it. If you're starting a fine restaurant, for example, and your chef graduated at the top of her class from the Culinary Institute of America, play that front and center. If you're starting a courier service and your partner has an anthropology degree from a little-known school, mention it, but don't make a big deal out of it.

Employment Prior work experience in a related field is something many investors look for. If you've spent ten years in management in the retail men's apparel business before opening a tuxedo outlet, an investor can feel confident that you know what you're doing. Likewise, you'll want to explain your team members' key, appropriate positions. Describe any relevant jobs in terms of job title, years of experience, names of employers, and so on. But remember, this isn't a resume. You can feel free to skim over or omit any irrelevant experience. You do not have to provide exact dates of employment.

Related: How to Craft a Business Plan That Will Turn Investors' Heads

Skills A title is one thing, but what you learn while holding it is another. In addition to pointing out that you were a district sales manager for a stereo equipment wholesaler, you should describe your responsibilities and the skills you honed while fulfilling them. Again, list your management team's skills that pertain to this business. A great cook may have incredible accounting skills, but that doesn't matter in the new restaurant's kitchen.

Each time you mention skills that you or a management team member has spent years acquiring at another company, it will be another reason for an investor to believe you can do it at your own company.

Accomplishments Dust off your plaques and trot out your calculator for this one. If you or one of your team members has been awarded patents, achieved record sales gains, or once opened an unbelievable number of new stores in the space of a year, now's the time to talk about it. Don't brag. Just be factual and remember to quantify. If, for example, you have twelve patents, your sales manager had five years of thirty percent annual sales gains, and you oversaw the grand openings of forty-two stores in eleven months, this is the stuff investors and others reading your business plan will want to see. Investors are looking to back impressive winners, and quantifiable results speak strongly to businesspeople of all stripes.

Personal information Investors want to know with whom they're dealing in terms of the personal side. Personal information on each member of your management team may include age, city of residence, notable charitable or community activities, and, last but not least, personal motivation for joining the company. Investors like to see vigorous, committed, and involved people in the companies they back. Mentioning one or two of the relevant personal details of your key managers may help investors feel they know what they're getting into, especially in today's increasingly transparent business climate.

Related: How to Evaluate Your Startup Like a VC

Who to Include in Your Plan

Should you mention everyone in your organization down to shop foremen or stop with the people on your executive committee? The answer is probably neither. Instead, think about your managers in terms of the crucial functions of your business.

In deciding the scope of the management section of your plan, consider the following business functions, and make sure you've explained who will handle those that are important to your enterprise:

- Advertising

- Distribution

- Human Resources

- Technical Operations

Related: How To Build a Team of Outside Experts for Your Business

What Does Each Person Do?

There's more to a job than a title. A director in one organization is a high and mighty individual, whereas a director is practically nobody in another company. Many industries have unique job titles, such as managing editor, creative director, and junior accountant level II, with no counterparts in other industries.

In a longer plan, when you give your management team's background and describe their titles, don't stop there. Go on and tell the reader exactly what each management team member will be expected to do in the company. This may be especially important in a startup, where not every position is filled. If the CFO will handle your marketing work until you get further down the road, let readers know this upfront. You certainly can't expect them to figure that out on their own.

In a shorter business plan, or mini-plan , choose those people most vital to your business. If you are opening a martial arts studio, the instructors, or lead instructors, are significant, as is the software developer in a new software company. While you have room to describe these people in more detail in a longer plan, in the shorter miniplans, use one defining sentence for your top five people.

Related: 6 Tips for Making a Winning Business Presentation

Future Hires

If you do have significant holes in your management team, you'll want to describe your plans for filling them. You may say, for example, "Marketing duties are being handled temporarily by the vice president for finance. Once sales have reached the $500,000 per month level, approximately six months after startup, a dedicated vice president of marketing will be retained to fulfill that function."

In some cases, particularly if you're in a really shaky startup and need solid talent, you may have to describe in some detail your plans for luring a hotshot industry expert to your fledgling enterprise. Then, briefly describe your ideal candidate. For a mini-plan, you may write, "We plan to hire a marketing VP who excels in reaching our 20–29 target market."

Related: Vusi Thembekwayo's 7 Rules of Pitching

More in Write Your Business Plan

Section 1: the foundation of a business plan, section 2: putting your business plan to work, section 3: selling your product and team, section 4: marketing your business plan, section 5: organizing operations and finances, section 6: getting your business plan to investors.

Successfully copied link

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing the Organization and Management Section of Your Business Plan

What is the organization and management section in a business plan.

- What to Put in the Organization and Management Section

Organization

The management team, helpful tips to write this section, frequently asked questions (faqs).

vm / E+ / Getty Images

Every business plan needs an organization and management section. This document will help you convey your vision for how your business will be structured. Here's how to write a good one.

Key Takeaways

- This section of your business plan details your corporate structure.

- It should explain the hierarchy of management, including details about the owners, the board of directors, and any professional partners.

- The point of this section is to clarify who will be in charge of each aspect of your business, as well as how those individuals will help the business succeed.

The organization and management section of your business plan should summarize information about your business structure and team. It usually comes after the market analysis section in a business plan . It's especially important to include this section if you have a partnership or a multi-member limited liability company (LLC). However, if you're starting a home business or are writing a business plan for one that's already operating, and you're the only person involved, then you don't need to include this section.

What To Put in the Organization and Management Section

You can separate the two terms to better understand how to write this section of the business plan.

The "organization" in this section refers to how your business is structured and the people involved. "Management" refers to the responsibilities different managers have and what those individuals bring to the company.

In the opening of the section, you want to give a summary of your management team, including size, composition, and a bit about each member's experience.

For example, you might write something like "Our management team of five has more than 20 years of experience in the industry."

The organization section sets up the hierarchy of the people involved in your business. It's often set up in a chart form. If you have a partnership or multi-member LLC, this is where you indicate who is president or CEO, the CFO, director of marketing, and any other roles you have in your business. If you're a single-person home business, this becomes easy as you're the only one on the chart.

Technically, this part of the plan is about owner members, but if you plan to outsource work or hire a virtual assistant, you can include them here, as well. For example, you might have a freelance webmaster, marketing assistant, and copywriter. You might even have a virtual assistant whose job it is to work with your other freelancers. These people aren't owners but have significant duties in your business.

Some common types of business structures include sole proprietorships, partnerships, LLCs, and corporations.

Sole Proprietorship

This type of business isn't a separate entity. Instead, business assets and liabilities are entwined with your personal finances. You're the sole person in charge, and you won't be allowed to sell stock or bring in new owners. If you don't register as any other kind of business, you'll automatically be considered a sole proprietorship.

Partnership

Partnerships can be either limited (LP) or limited liability (LLP). LPs have one general partner who takes on the bulk of the liability for the company, while all other partner owners have limited liability (and limited control over the business). LLPs are like an LP without a general partner; all partners have limited liability from debts as well as the actions of other partners.

Limited Liability Company

A limited liability company (LLC) combines elements of partnership and corporate structures. Your personal liability is limited, and profits are passed through to your personal returns.

Corporation

There are many variations of corporate structure that an organization might choose. These include C corps, which allow companies to issue stock shares, pay corporate taxes (rather than passing profits through to personal returns), and offer the highest level of personal protection from business activities. There are also nonprofit corporations, which are similar to C corps, but they don't seek profits and don't pay state or federal income taxes.

This section highlights what you and the others involved in the running of your business bring to the table. This not only includes owners and managers but also your board of directors (if you have one) and support professionals. Start by indicating your business structure, and then list the team members.

Owner/Manager/Members

Provide the following information on each owner/manager/member:

- Percentage of ownership (LLC, corporation, etc.)

- Extent of involvement (active or silent partner)

- Type of ownership (stock options, general partner, etc.)

- Position in the business (CEO, CFO, etc.)

- Duties and responsibilities

- Educational background

- Experience or skills that are relevant to the business and the duties

- Past employment

- Skills will benefit the business

- Awards and recognition

- Compensation (how paid)

- How each person's skills and experience will complement you and each other

Board of Directors

A board of directors is another part of your management team. If you don't have a board of directors, you don't need this information. This section provides much of the same information as in the ownership and management team sub-section.

- Position (if there are positions)

- Involvement with the company

Even a one-person business could benefit from a small group of other business owners providing feedback, support, and accountability as an advisory board.

Support Professionals

Especially if you're seeking funding, let potential investors know you're on the ball with a lawyer, accountant, and other professionals that are involved in your business. This is the place to list any freelancers or contractors you're using. Like the other sections, you'll want to include:

- Background information such as education or certificates

- Services provided to your business

- Relationship information (retainer, as-needed, regular, etc.)

- Skills and experience making them ideal for the work you need

- Anything else that makes them stand out as quality professionals (awards, etc.)

Writing a business plan seems like an overwhelming activity, especially if you're starting a small, one-person business. But writing a business plan can be fairly simple.

Like other parts of the business plan, this is a section you'll want to update if you have team member changes, or if you and your team members receive any additional training, awards, or other resume changes that benefit the business.

Because it highlights the skills and experience you and your team offer, it can be a great resource to refer to when seeking publicity and marketing opportunities. You can refer to it when creating your media kit or pitching for publicity.

Why are organization and management important to a business plan?

The point of this section is to clarify who's in charge of what. This document can clarify these roles for yourself, as well as investors and employees.

What should you cover in the organization and management section of a business plan?

The organization and management section should explain the chain of command , roles, and responsibilities. It should also explain a bit about what makes each person particularly well-suited to take charge of their area of the business.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Write Your Business Plan ."

City of Eagle, Idaho. " Step 2—Write Your Business Plan ."

Small Business Administration. " Choose a Business Structure ."

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

Tips on Writing the Management Team Section of a Business Plan

Free Ultimate Guide On Writing A Business Plan

- December 21, 2023

10 Min Read

A business is as efficient as its team and its management. It, therefore, becomes important for business owners to build a structured management team that achieves the objectives and goals set by the organization. Thus, making the management section of a business plan the most essential component.

Andrew Carnegie , an American steel magnate, beautifully summarized it –

Teamwork is the ability to work together toward a common vision. The ability to direct individual accomplishments toward organizational objectives. It is the fuel that allows common people to attain uncommon results.

A business management plan helps build an efficient team and formalize business operations . This helps businesses streamline strategies to achieve their goals.

It, therefore, becomes imperative that business owners pay utmost importance while writing the management section of a business plan.

So, if you are a business owner who is looking to formalize their business structure and write the management team section in their business plan , this guide is for you.

Here’s a sneak peek into what you’ll learn:

Table of Contents

- What Is the Management Section?

- Importance of the Management Section

- What to Include in the Management Section?

- Example of a Management Section Plan

- Ensure That the Management Section Is Fool-proof?

Sounds good? Let’s dive in.

What Is The Management Section Of A Business Plan?

The management section of a business plan is an in-depth description of a business’s team, its structure, and the ownership of a business.

The section discusses in detail who is on the management team – internal and external- their skill sets, experiences, and how meaningfully they would contribute to an organization’s goals and outcomes.

Now that we have defined what is the management section of a business plan, let’s understand why it is so important.

The Importance Of The Management Section Of A Business Plan

The management section helps you to:

1. Convince your investors (banks and government agencies) to disburse loans and grants for your business idea

2. Prove that your management team can execute your idea and if not, help hire the right fit for a position

3. Share how your advisory board can help your team succeed

What To Include In the Management Section Of A Business Plan?

The management section of a business plan helps in formalizing and structuring the management team plan and is comprised of

- The Management Team

- The Management Team Gaps

- The Management Structure

Let’s understand them in detail.

1. The Management Team

An organization’s entire management team can be divided into parts – the internal team and the external team.

The Internal Management Team

A business team consists of several departments. The most common departments are – Marketing, Sales, IT, Customer Service, Operations, Finance, and HR.

These departments may or may not be required. It purely depends on the nature and functioning of your business. For example, a dental clinic may not require a sales department per se.

The entire management team is compartmentalized according to their responsibility. This helps the business owners and investors be aware of the roles, benefits, ESOPs (if applicable), profit sharing (for sales), work contracts, NDAs (Non-Disclosure Agreements), and Non-Competition Agreements of the entire team.

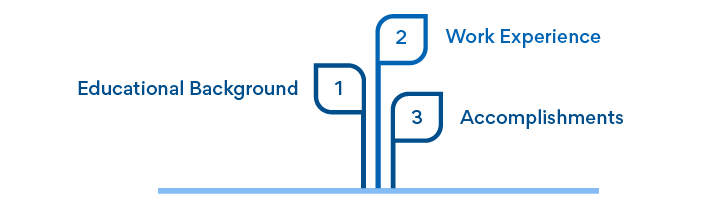

It is recommended that business owners collect and document the following information about their team:

- Educational Background

- Work Experience

- Accomplishments

For example, your present VP of Marketing helped their previous company grow its bottom line from $3 million to $10 million over 18 months.

The External Management Team

The external management team is usually composed of – Advisory Board Members and Professional Services.

Advisory board members help by :

- Establishing trust, showing results, and experiencing the table.

- Increasing the confidence of investors and consumers.

This helps attract talented employees to the team. Credible advisory board members show great commitment to a company’s growth. Therefore, it becomes important to document their experience and specialization in the business management plan. The advisory board members can help give valuable advice that internal team members need or lack.

If your business has not or will not have VC funding, you may not require board members on your team.

Usually, board members meet quarterly or monthly to provide strategic guidance in place of stock options in your company. This helps attract the best advisors and motivates them to invest in your business.

For example, founders and business owners coming to raise funds in Shark Tank , a business television series, are looking for advisory members who would invest money and provide guidance on necessary steps.

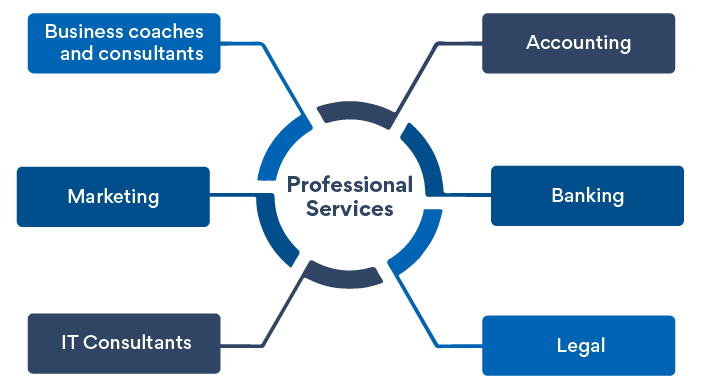

On the other hand, Professional Service helps by

- Offering highly specialized advice and sharing knowledge.

- Business owners make key strategic management decisions.

Such services help businesses leverage skills that would be difficult to build and acquire over a short period.

Examples of such professional services are

- IT Consultants

- Business coaches and consultants

After a brief overview of the Management Team of an organization, let’s dive into what to include in Management Team Gaps.

2. The Management Team Gaps

The management team gap is an important part of the management section. Primarily because it helps document if your management team currently has gaps or missing skills. Your team may lack a few required skills while starting. The management team gaps help you to be aware and make efforts to close this gap.

As a business owner, you must document what positions are missing and who ought to fill that positions or take responsibility.

For example, if you need a VP of Sales, clearly document this in the section.

Also, write down the job description and key responsibilities to be undertaken,

Example – You might mention that role required 10 years of experience in the sales domain. The applicant must have experience handling a sales team, closing new accounts, working in tandem with the marketing team, and having relevant startup experience.

Be as detailed as possible. This will help you build a checklist while interviewing the right candidate and also win investor confidence in your managerial skills.

Following are a few key positions you would want to include in your management team:

- Founder and/or, CEO

- Chief Technical Officer (CTO)

- Chief Marketing Officer (CMO)

- Chief Operating Officer (COO)

- Chief Financial Officer (CFO)

- Chief Human Resources Officer (CHRO)

- Head of Product Management (PM)

- VP of Sales

- VP of Marketing

- UX Designer

- Digital Marketing Manager

- Business Development Manager

- Customer Service Manager

- Customer Success Manager

- Sales Managers/Sales Staff

- Advisory Board Members

Let’s dive into the nitty-gritty of the management structure.

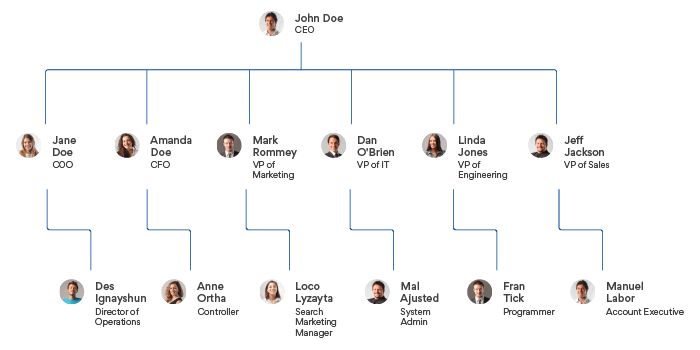

3. The Management Structure

The management structure defines how a business organizes its management hierarchy. A hierarchy helps determine the roles, positions, power, and responsibilities of all team members.

The management structure also depends upon the type of business ownership. Business ownership can be – a sole proprietorship, partnership, or simply an LLC.

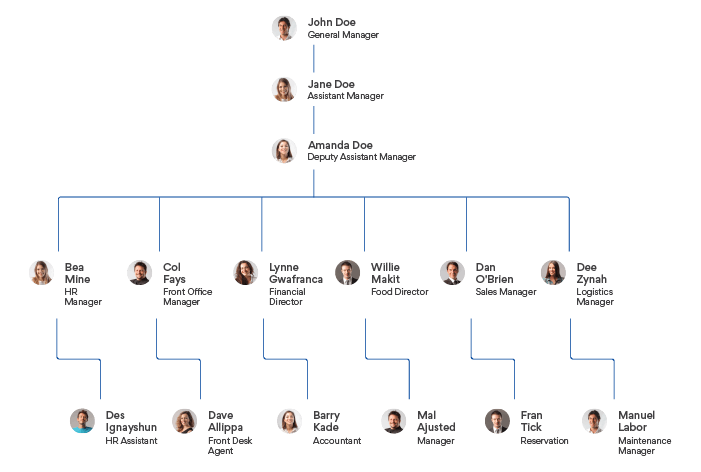

Following is a sample management structure of an organization.

Now that we understand what details we need to document in the business management plan, let’s look at a few examples of the management plan.

Example Of A Management Section Plan

[management section of a hotel], [management team], internal team members.

Name: Charles Fargo Role: Owner Responsibility: Formulating key strategies, defining budgets, and building a business plan Experience: 35 years of owning multiple hotels in Las Vegas Educational Background: B.Sc in Hospitality Management from South Dakota State University.

Name: Michael Clark Role: General Manager Responsibility: Overall hotel operations – guest interactions, revenue management, brand ambassador of the hotel, customer satisfaction, and experience, leadership to all departments Experience: 25 years working with several technology hotels as the general manager. Educational Background: MBA from Wharton School

Name: George Trump Role: Department Manager Responsibility: Manage employees, smooth coordination amongst employees, plan daily affairs of the department, strategize, prepare reports, and deal with complaints and suggestions. Lead team members to function as a team Experience: 15 years working as a department manager Educational Background: BSc in Hotel Management from Texas University

Note: There can be multiple Department Managers depending on the nature of your business. In the case of hotels, departments can include – housekeeping, logistics, security, food, and banquets.

Name: Donald Clooney Role: Marketing and Sales Manager Responsibility: Increase occupancy and generate revenue. Position the hotel as an option for leisure activities, relaxation, and holidays. Experience: 11 years working as the marketing and sales manager for hotels Educational Background: MBA in Tourism and Hospitality from Midway University

External Team Members

Advisory Board Member

#1 Richard Branson Responsibility: Strategic advisory for sustainable growth and expansion Experience: Founder of Virgin Group

Professional Services

[management structure].

There is a gap in one key position in our startup.

#1 Chief Finance Officer (CFO) Responsibilities: Finance, Accounting, Tracking Profit and Loss, and overseeing FP&A (Financial Planning and Analysis)

How To Ensure That The Management Section Of Your Business Plan Is Fool-Proof?

“In preparing for battle I have always found that plans are useless, but planning is indispensable.” ― Dwight D. Eisenhower

By building a fool-proof management plan and ensuring that all the intricate details are accounted for, we can ensure that your business has a greater chance of succeeding.

Business planning software like Upmetrics ensures that business owners, like you, get the management section planning correct on the first attempt itself.

You can also get started with a free demo today to discover how Upmetrics can help you plan your business in a breeze.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Related Articles

How to Write an Operations Plan Section of your Business Plan

What to Include in Your Business Plan Appendix Section

How to Prepare a Financial Plan for Startup Business (w/ example)

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Personnel Management Business Plan

Start your own personnel management business plan

OutReSources

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

OutReSources, Inc. will be a consulting company specializing in the design and delivery of training products and services in statewide and regional markets. The company offers health care providers a reliable, high-quality alternative to in-house resources for business development, market development, training, and quality assurance.

OutReSources will initially be created as a Greenstate DBA company under the umbrella of Flowstone, Inc., based in the Central County area of Greenstate, the heart of Greenstate’s population and growth.

Within the state, OutReSources plans to target health care service providers, tailoring our services to their needs. One of OutReSources’ challenges will be establishing itself as a real consulting and training company, positioned as a relatively risk-free purchase.

Industry competition comes in several forms, the most significant being companies and agencies that choose to do business development and training in-house rather than outsourcing. There are also State and independent organizations providing training and development resources. Many of these companies are generalist in nature and do not focus on a niche market. Furthermore, they are often hampered by a flawed organizational structure that does not provide the most experienced people for the client’s projects. OutReSources’ advantage over such companies is that it provides high-level consulting to help integrate practice with theory and in concert with the client companies’ goals.

OutReSources will be priced at the upper edge of what the market will bear. The pricing will fit with the general positioning of OutReSources as providing high-level expertise. Sales are estimated to be substantial and an excellent cash balance in the first year.

The company’s founders are former and current health care service providers, all in the “fee-for-service” provider markets we will target. They are founding OutReSources to formalize the consulting services they already offer. OutReSources will be managed by working partners, in a structure taken mainly from Flowstone, Inc. In the beginning we assume three partners, Khallie Locharnold and Soren Aboukir (from Flowstone Inc.) and Yuriatin Guadalquivir.

The firm estimates healthy profits by the first year with a commensurate net profit margin. The company does not anticipate any cash flow problems arising.

1.1 Objectives

OutReSources has set several objectives for the first year.

- Develop and implement a training service that targets both for-profit and non-profit health care providers that provide fee-for-services and which are required to meet standards set by state and federal regulations, and/or private associations.

- Raise the standards for quality of care while breaking free of the confines of the “fee-for-service that is Medicaid” by developing a service to support those health care providers who still operate within those confines.

- Develop a company with low overhead and liability to optimize net profit margins.

1.2 Mission

Our mission is to raise the standards of health care services by improving the skills, abilities, and efficiencies of those who provide such services. We wish to educate and train those who provide health care services and are reimbursed and regulated by the state governing agencies. We aim to be transitional educators and trainers to those with the education but without the experience.

1.3 Keys to Success

Quality and Credibility

Employing trainers within the appropriate disciplines who have

- Credentials: Education, Licenses, Certifications

- Proven successful track record

- Continuing Education Units

Strong Formal Methodology

Developing strong formalized training methodologies for all services

- Policy and Procedures

- Hierarchy roles in the Organizational Structure: Qualifications and Duties

- Confidentiality control

- Feedback Reporting: Finished Product

Promotion and Marketing

- Starting with what we know: Our first offerings are based on our expertise

- Reaching a large targeted population: Expanding our offerings

- Spring boarding off current credentials

Operations and Liability

Maintaining low overhead and liability by:

- Maximizing abilities and simplifying roles

- Assessing the market and initiating with “High End” targets (large providers, high fee-for-service rate services)

- Strong investments in quality equipment vs cost by including

- Mobility vs Center or combinations

- Space and supplies

- Finished products (manuals, pamphlets, protocols)

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

OutReSources, Inc. is a new company providing high-level expertise consulting to health care providers, including business development, training development, quality assurance strategies, and marketing of additional training services. It will focus initially on:

- Providing “How-to’s of Best Practice” with development and training for Developmental Disability, Service Coordination, and a multitude of Mental Health Service providers.

- Audit Preparation reviews to enable companies and agencies to avoid costly recoupment or pay backs, and avoid damaging citations.

As OutReSources grows it will take on people and consulting work in related markets becoming more diversified, such as supportive training services like First Aid/CPR, Cultural Diversity, Health and Wellness in the workplace, Research Resource Center, Mobility, Business Practices in the Business System, and so on. It will also look for additional leverage by developing partnerships with key advocacy organizations and state officials.

2.1 Company Ownership

OutReSources, Inc. is projected as a Limited Partnership in conjunction with Flowstone, Inc., but may switch the preferred structure to a “C” Corporation or Limited Liability Corporation, for purposes of investment structuring.

OPERATING PARTNERS (initial)

- General Managing Partners, with 62% ownership by Flowstone, Inc.

- Vice Managing Partner for Programmatic Development and Operations, with 28% ownership.

INVESTMENT PARTNERS

- Flowstone, Inc. with 95% ownership from start-up date.

- Limited Partner Yuriatin Guadalquivir, with 5% ownership from start date.

Structure of Partnership

Flowstone, Inc. will provide the initial starting capital investment necessary to begin OutReSources, Inc., making them the primary stock holder. Yuriatin Guadalquivir will begin as the General Operating Manager responsible for development and implementation, receiving compensation through salary and stock acquisition. First year salary of $41,000 will be paid by Flowstone, Inc. An appropriate profit percentage may be paid at each year end. If a loss is realized at the end of any year then Yuriatin Guadalquivir receives no payout of stock in the company.

- Following first calander year, Flowstone, Inc. will reimburse Yuriatin Guadalquivir for service by turning 5% of stock ownership of OutReSources, Inc. over to him.

- Each additional year Flowstone will increase Yuriatin Guadalquivir’s stock ownership by 5% to a maximum of 33% ownership in OutReSources, Inc.

- Once equal partnership between Flowstone, Inc. and Yuriatin Guadalquivir has been reached then Guadalquivir becomes a full partner, assuming equal voting rights, and liability.

- Liability will include equal share in all legal and financial obligations.

2.2 Start-up Summary

Total start-up expenses includae legal costs, logo design, stationery and related expenses.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

OutReSources, Inc. will begin by providing multiple training services for health care providers and public agencies in the areas of Developmental Therapy, and Service Coordination, but will later progress and diversify into Psychosocial Rehabilitation, Case Management, Clinical Therapies, and a multitude of supportive and more specific concepts. These concepts may range from Health Care Business Practices, Health and Wellness Promotion, Specific Disabilities and Treatments.

The initial service training categories for Developmental Therapy and Service Coordination are:

- Standard DS training (DS for Children and Adults) and state certification

- Paraprofessional Supervision by a Developmental Disabilities Professional

- Quality Assurance practices and implementation of the “Best Practice/Client 1st” concept

- Audit simulation in conjunction with training and assistance.

- First Aid/CPR Certifications

- Business analysis and restructuring consultations

- Specific acute “Hot Topic” analysis (treatment/therapy methods, disorders, customer service, adult transition to include Medicaid/SSI, guardianship, community resource)

Market Analysis Summary how to do a market analysis for your business plan.">

OutReSources, Inc. is a business that has become necessary because of today’s ever increasing demand on the need for community health care. There are an increasing number of providers who have become dependent on Medicaid reimbursement, which has created the need for training resources. There are 100s of agencies providing fee-for-services reimbursed by Medicaid. Combine this with regional Medicaid units being severely understaffed and underbudgeted and you have a declining system unable to meet the huge need for support. OutReSources is therefore, ideally positioned to deliver these support and training services to provider companies and agencies.

4.1 Market Segmentation

The are many Medicaid providers. There are 79 listed in the Centerville Yellow Pages under the Mental Health and Developmental Disability categories, most of which provide a variety of service treatments or therapies. Several are either incorporated or franchised across the state. All of them provide at least one Medicaid reimbursed service (most offer several) and are required to maintain certain standards, self regulate, and educate. This creates the prime market for our services:

- Pre-Audit preparation which would be on a sliding scale from finding, fixing, and training.

- Certification Training (Specialist Certifications, CPR/First Aid, etc…)

- Supportive training options (Diversity, Language, Parenting, “Best Practice”, Business and HR in Health Care, etc…)

The segmentation of the market is a new concept within the Mental Health and Developmental Disabilities fields of service but is not new to the general health care industry, and other service fields leaving a strong need for specific services:

- Developmental Disabilities: Largest population in target with even larger body of regulations.

- Service Coordination: Little regulation but severe lack of quality service.

- Psychology/Social Rehabilitation: Smaller population but strong need for improvements in both quality and quantity.

It makes logical sense for OutReSources, Inc. to primarily direct its marketing approach at these three segments. In 2000, the market potential for the disabled service population is estimated to be around 200,498 people reporting some disability in Greenstate (Census 2000). Nationally the number was nearly 50 million. At the same time, the market potential for the need of bilingual services was estimated to be around 127,609 people speaking another language other than English at home of which 85% speak Spanish. Each of these populations are expected to grow at a steady rate of 5.6% per year.

In the table and chart below:

- Agency Group 1 = State Licensed Developmental Disabilities Agencies

- Agency Group 2 = State Licensed Service Coordination Agencies

- Agency Group 3 = Other Medicaid Providers in Need of Cross Training and Continuing Education Units

4.2 Target Market Segment Strategy

OutReSources, Inc. chooses to make the above segments its targeted market is because we have the applied first hand experience and the credentials having provided these services for significant periods of time, earning credibility with substantial marks in quality. Through our experiences as providers we have developed a strong knowledge of what services would be greatly needed, appreciated and valued.

We have and are continually increasing our credentials as providers to improve our current services allowing us to utilize those gained credentials in support of our new offerings. Through the years we have developed a reputation of providing high-quality services among state regulators, providers, and the community.

4.3 Service Business Analysis

Consulting participants range from major international name-brand consultants to tens of thousands of individuals. One of OutReSources’ challenges will be establishing itself as a real consulting company, positioned as a relatively risk-free organizational purchase.

There really is not much local competition specific to the field of Mental Health and Developmental Disabilities, only small private entities that are usually sole proprietors consulting from the basis of that one individual’s own knowledge and/or theories, and their own interpretations but with varying levels of practical application experience.

Our program will minimize its starting cost and have almost no overall risk by developing our new offerings based on the services services Flowstone, Inc. currently provides. This allows us to minimize up front cost and overhead while improving services within OutReSources. Flowstone will provide the inial start-up expenses in return for partial ownership, profit, and free access to services rendered.

4.3.1 Competition and Buying Patterns

The key element in purchase decisions made at the OutReSources’ client level is trust in the professional reputation and reliability of the consulting firm.

Strategy and Implementation Summary

OutReSources, Inc. will primarily focus on three service markets, Developmental Disability, Service Coordination, and Mental Health Providers, and in limited product segments: Pre-audit Review, Training, and Certifications.

5.1 Competitive Edge

Clearly, our competitive edge is the customer service experience and approach that our management team will bring to the table. Our “Best Practice” and “Client First” approach to all of our services is evident, and highly appreciated.

5.2 Marketing Strategy

An overview of the marketing plan includes:

- Networking via word of mouth

- Joining Associations of potential clients

- Evolve Flowstone’s services to optimized levels to maximize profit and quality

- Community involvement through volunteering, providing free seminars or scholarships to families in need to attend seminars

- Symposium and Conferences

- Website

- Calling on connections within key state departments, agencies, and other affiliates

- High profile interaction between our managers, and the customers

- Excellent service and high quality results

5.3 Sales Strategy

The Team Supervisor needs and expects close contact and cooperation with the client agency’s staff. The General Operational Manger is under pressure to get a quotation together. The GOM and Trainers must be armed with quick reference guide to pricing. The important caller should be told that the GOM will “call right back.” The more successful the marketing strategy is in making in-roads into the foundation of a market, the more important this communication response will become.

In respect to the prospect list of clients, it is essential that a “salesman’s” approach be adopted to insure an organized, orderly approach to each prospect. Notes need to be kept on each client. Follow-up and persistence will pay off.

5.3.1 Sales Forecast

OutReSources, Inc. is a start-up and a relatively new concept in the field within a fairly common concept of consultation and training services. It is difficult to forecast without any benchmarks. However, since our overhead and start-up cost will be minimal we are able to use basic forecast principles by estimating our primary cost of salary (what it cost us to provide the service) which includes staffs estimated operating costs of lodging, meals and travel expenses to forecast our cost.

We want a 50% profit margin (to allow room for adjustments as needed) and so will double operating expenses to project revenue. This results in a Net profit of 50% on the dollar or 2-1 on our money. Of course, as services are implemented adjustments will be made based on total sales, realized cost, accessibility, feasibility, etc.

5.4 Milestones

Set forth below are the main milestones in the schedule of proposed development. We have carefully reviewed the timelines for start-up and firmly believe that once we are completely funded we can construct and open our initial services within less than one month of external implementation.

- Development of Formalized Methodology of all services provided by May 2005 (GOM)

- Purchase of High-end Presentation equipment by May 2005 (FLowstone, Inc.)

- Preliminary dry run of internal mock services by June 2005 (General Operations Manager)

- Approval of final product by July 2005 (Flowstone, Inc. GOM and Training Supervisors)

- Marketing for potential clients By July 2005 (Flowstone, Inc. and GOM)

- Training Packets, manuals, and documents by May 2005 (GOM, Training Supervisors)

- Develop internal operation protocols and employee manual By June 2005 (Flowstone, Inc. and GOM)

- Prepare and finalize marketing campaign (pamphlets, advertisements, etc) by June 2005 (Flowstone, Inc. and GOM)

- Train staff by June 2005 (GOM and Training Supervisors)

- Soft open (training period 30 to 45 days) by July 2005 (GOM and Training Supervisors)

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

The three managers, Flowstone, Inc. owners Khallie Locharnold and Soren Aboukir and General Operations Manager Yuriatin Guadalquivir, have impeccable credentials in this industry. This will benefit OutReSources, Inc. in three ways:

- Clients will be brought from existing professional relationships

- Respect and recognition by associated organizations and state departments

- The experience each has will attract new clients in the area of finance and administration,

The Training Supervisors and Trainers have yet to be formalized but would primarily consist of the Program Managers and Professionals from within Flowstone. Their extensive experience and education in service, and management within the industry will provide a foundation for success for OutReSources, Inc.

6.1 Personnel Plan

All work is, at the moment, produced by Yuriatin Guadalquivir and Flowstone, Inc. Since OutReSources, Inc. still remains in its formative stage and all stock holders’ compensation is purely based on net profit, and currently there is no revenue being generated, there are no salary expenses. There will be added where and when necessary and in line with success in penetrating the plan’s targeted markets. These salary expenses will absorbed by Flowstone, Inc.

By the end of June 2005, it is assumed that increased business volume will require the first Training Supervisor to be brought on board. By the end of August 2005, increased volume will require hiring the first trainer.

In FY2007, OutReSources will have 4 Training Supervisors and 4 trainers working, with the increasing amount of less sensitive work being farmed out to paraprofessionals and administrative support staff of Flowstone. It is assumed that OutReSources will become completely independent of Flowstone’s financial and staff support in year FY2008 or FY2009, depending on demand volume.

As stated earlier the salaries of the owner/consultants, training supervisors and trainers is included in the Cost of Sales. Only those costs for the hourly paraprofessional and administrative staff are shown in the Personnel table below.

Financial Plan investor-ready personnel plan .">

Our main concerns will be aggressive time management, so that our labor costs stay under control, and proper purchasing, keeping costs down. Secondarily, hiring the best team, training them properly and retaining them will be a critical component to good costs. A good trainer does not sacrifice quality for quantity, but rather they optimize their time spent. Growth will be sustained through a contribution to a “roll-over” plan, and from potential future clients.

7.1 Start-up Funding

Total start-up expenses include legal costs, logo design, stationery and related expenses.

Expensed presentation and office equipment include computers and projectors. Start-up assets include initial cash to handle the first few months of consulting operations as accounts receivable play through the cash flow. Flowstone, Inc. is providing some of their used office furniture, chairs, as Other Current Assets.

Flowstone, Inc. will provide seed capital. Soren Aboukir and Khallie Locharnold will each invest at start-up, and anticipate loaning the company additional funds during the year.

7.2 Important Assumptions

- We are assuming steady growth from good management, barring any unforseen local, or state disasters, economic slowdown, or Medicaid budget cuts.

- We are assuming adequate funding by Flowstone, Inc. and the partners to sustain us during start-up.

- We are assuming that health care providers will respond to the new concept of outsourced training and value it enough to pay for it.

- We are assuming that the state will support us by referring health care provider clients.

- We are assuming that we will be able to market our offerings as high-end services, allowing us to have a large profit potential.

- We are assuming that this endeavor will not negatively affect those services already provided by Flowstone, Inc.

7.3 Projected Profit and Loss

Initially, OutReSources will be housed in the Flowstone office spaces and and benefit from the established administrative support system. In January 2006, we anticipate that OutReSources will move to it’s own office when an adjacent suite is due to become available.

As noted earlier, salaries for owner/consultants, training supervisors and trainers are included in Cost of Sales. To correctly calculate the necessary payroll tax withholding, a formula was entered into the P&L table for a percentage of the combined salaried and hourly wages.

7.4 Break-even Analysis

Our monthly break even figure is based on our anticipated cost of sales, and in-kind administrative support from Flowstone. Break even currently requires an average monthly sales as shown below. This will vary if cost of sales increases or decreases, and if overhead expenses such as administrative support is transferred from Flowstone to us sooner than expected.

7.5 Projected Cash Flow

The Cash Flow table is based on ideal numbers. The numbers where set as explained previously by basic business principles to permit room for adjustment as the company grows. As seen in the chart as the months go by the Cash Balance remains positive. This is dependent upon reaching sales forecasts each month and keeping our expenses in line. Over time we are assured to make adjustments as stated in the explanation of the forecasting. The key components we will need to monitor that will adjust the overall true numbers are:

- The Demand for Service

- Cost of Service (The service may be desired, but must be priced right for clients to see the benefit)

- Quality of Service (A fine balance of quality vs quantity)

- Quality Cost (Salaries will be the primary factor. Can we hire quality trainers and charge a quality price while still receiving a quality profit)

The founding partners anticipate loaning the company additional monies as a short-term loan in mid-year. If sales exceed forecast this may not be necessary. Additional computers and presentation equipment will need to be purchased as new trainers and supervisors are hired.

7.6 Projected Balance Sheet