- Newsletters

Site search

- Israel-Hamas war

- Home Planet

- 2024 election

- Supreme Court

- All explainers

- Future Perfect

Filed under:

- Student Loan Debt

Biden’s student loan forgiveness plan, explained

Do you qualify?

Share this story

- Share this on Facebook

- Share this on Twitter

- Share this on Reddit

- Share All sharing options

Share All sharing options for: Biden’s student loan forgiveness plan, explained

/cdn.vox-cdn.com/uploads/chorus_image/image/73264752/2141954357.0.jpg)

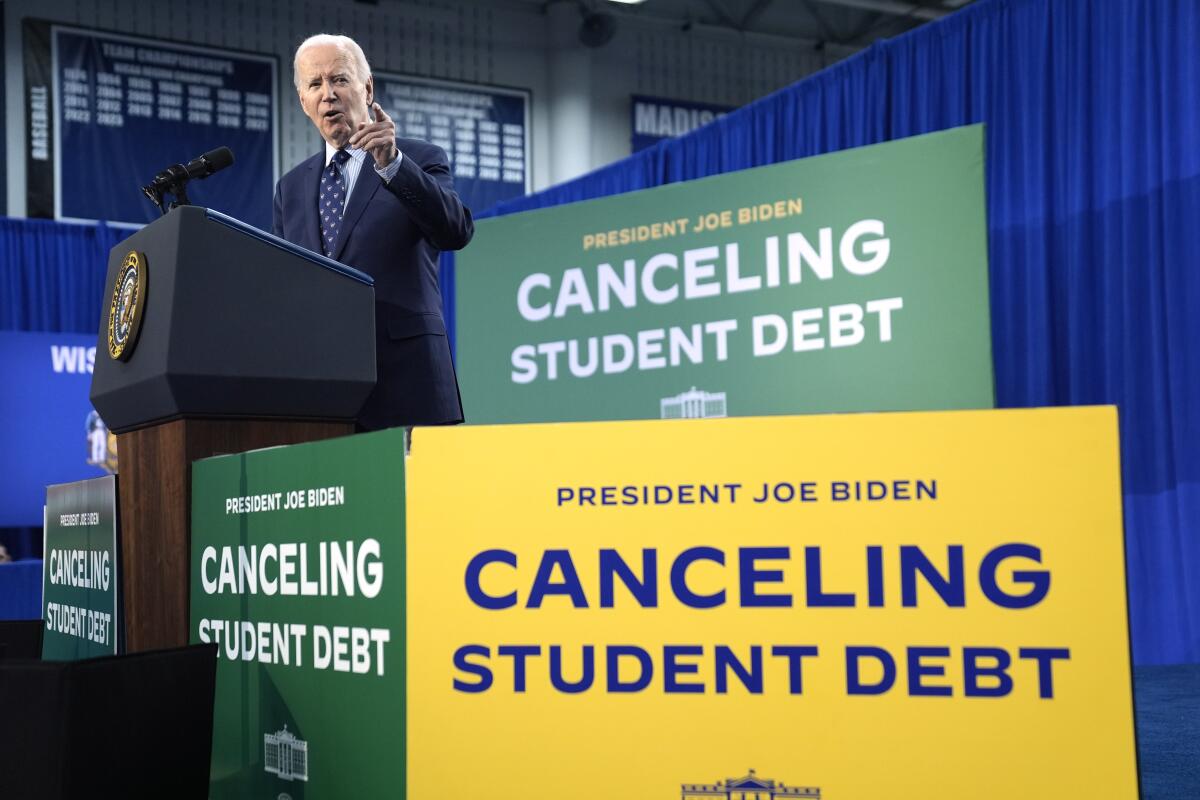

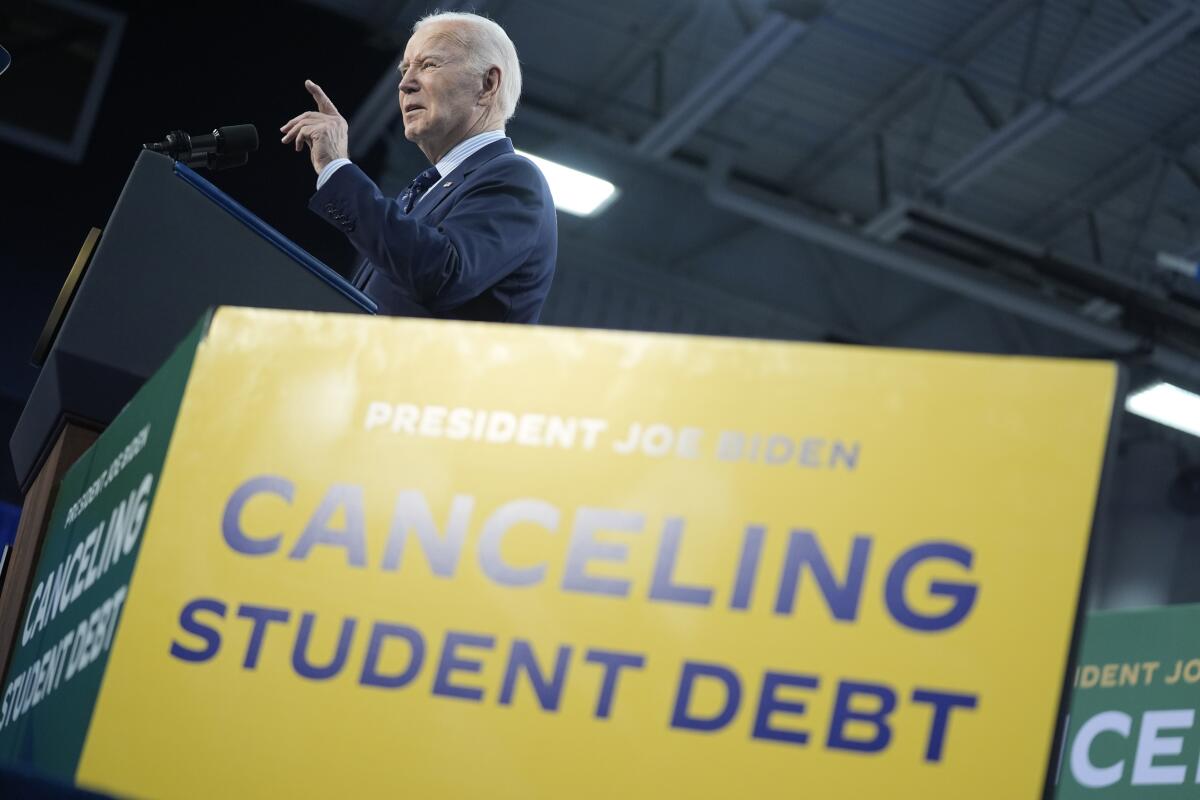

The Biden administration is canceling even more student debt.

On Friday, the White House announced that an additional 277,000 borrowers will see their student loans eliminated, amounting to about $7.4 billion in forgiven debt. Those borrowers qualified for that relief because they were enrolled in one of the loan repayment or forgiveness programs the administration created or revamped while it was also trying to roll out its original plan for broad loan cancellation.

The news comes a few days after Biden announced more specifics on its Plan B for student loan forgiveness, nearly a year since the conservative majority on the Supreme Court struck down their original try.

This second attempt is less all-encompassing than the first, which would have forgiven up to $10,000 in debt for most borrowers, but it’s still pretty ambitious. Plan B invokes a different legal authority than the one used in 2022, builds off existing programs that haven’t faced the same kind of legal pushback, and is much more targeted, all in an attempt to avoid the fate that the first loan forgiveness plan faced at the Supreme Court.

Still, the Biden administration is likely to face opposition from Republicans and conservative critics, who may try to use the federal court system again to derail the plan. It’s also unclear whether voters, especially younger ones, will give Biden credit for this attempt since it largely applies to borrowers who have had debt for a long time, like millennials and Gen X-ers.

Combined with other loan forgiveness plans implemented during President Joe Biden’s term, Plan B would, according to the White House, relieve debt for more than 30 million Americans. Under this new plan, more than 4 million Americans will have their entire debt canceled and 10 million more would see at least $5,000 of relief. Another 23 million would have their accrued interest, the additional debt that borrowers have been saddled with on top of the principal, wiped away.

Any relief is likely at least a few months away. The plan announced Monday is the result of a regulatory process that started a month after the Supreme Court struck down the first plan and it still requires a public comment period before anything can go into effect — meaning that the earliest that debt relief would begin is likely this fall.

Who would get student loan forgiveness under Biden’s plan?

This plan would target five kinds of borrowers, and in most cases it would not require them to fill out an application; the Education Department would use data it has on hand to implement the forgiveness once the plans are finalized.

People who now owe more money on their loans than they originally borrowed . These borrowers would have up to $20,000 of debt from interest erased, regardless of their income. They would still have to repay the original amount they owe. Individuals making less than $120,000 a year, or couples making less than $240,000, would qualify to have full forgiveness of their interest.

People who have owed on loans for at least 20 years . If a borrower entered repayment for undergraduate debt 20 years ago or more, they would qualify for full forgiveness. If a borrower of graduate school debt entered repayment 25 years ago or more, they would also qualify.

People who took out loans to enroll in “low-value” academic programs . These borrowers took out loans for institutions or programs that were deemed by the federal government to have low financial value. The White House defines this as programs or schools that “lost their eligibility to participate in the Federal student aid program” or were deemed to have cheated their students, or left graduates with loan payments on earnings after school that were not better than what someone with a high school diploma could earn.

People who would qualify for a preexisting loan forgiveness program but aren’t enrolled in one right now . This option would automatically enroll borrowers who qualify for forgiveness through the revamped income-driven or public service forgiveness programs.

People experiencing financial hardships . This option is a little vaguer, but it is meant to apply to borrowers for whom other forgiveness and repayment programs don’t apply. Hardships include medical debt, expensive child care , and those at risk of default.

What makes this approach to student loans different is the focus on accrued interest, or what the White House and Department of Education call “runaway interest.” Like all loans, student loan debt consists of a principal (the amount originally borrowed) and interest. When the cost of interest is higher than the amount you’re making in payments, the interest gets added to the balance of the loan. Then you end up with the amount you owe over time, which can keep growing, even if you’re making regular payments.

That additional interest is often added to the principal, making future interest charges even larger. The White House has already implemented changes to the way interest is capitalized — or added to the principal balance and generating even more interest — and this plan builds off those regulatory changes to forgive interest entirely.

Biden and his administration are spending Monday touting this new plan in key cities, including in swing states. The president is in Madison, Wisconsin, while Vice President Kamala Harris is heading to Philadelphia, her husband is traveling to Phoenix, and Miguel Cardona, the secretary of education, is meeting with borrowers in New York City.

Update, April 12, 10:30 am ET: This story was originally published on April 8 and has been updated to include news of the White House’s most recent announcement about loan forgiveness.

Will you support Vox today?

We believe that everyone deserves to understand the world that they live in. That kind of knowledge helps create better citizens, neighbors, friends, parents, and stewards of this planet. Producing deeply researched, explanatory journalism takes resources. You can support this mission by making a financial gift to Vox today. Will you join us?

We accept credit card, Apple Pay, and Google Pay. You can also contribute via

Next Up In Politics

Sign up for the newsletter today, explained.

Understand the world with a daily explainer plus the most compelling stories of the day.

Thanks for signing up!

Check your inbox for a welcome email.

Oops. Something went wrong. Please enter a valid email and try again.

How AI tells Israel who to bomb

Vox podcasts tackle the Israel-Hamas war

Israel’s Rafah operation, explained

Eurovision is supposed to be fun and silly. This year is different.

The Drake vs. Kendrick Lamar feud, explained

Why the Met Gala still matters

- Skip to main content

- Keyboard shortcuts for audio player

Is it fair to forgive student loans? Examining 3 of the arguments of a heated debate

Scott Horsley

Student loan borrowers stage a rally in front of The White House on Aug. 25 to celebrate President Biden cancelling student debt. The plan has sparked heated debate, including about its economic fairness. Paul Morigi/Getty Images for We the 45m hide caption

Student loan borrowers stage a rally in front of The White House on Aug. 25 to celebrate President Biden cancelling student debt. The plan has sparked heated debate, including about its economic fairness.

President Biden's plan to forgive hundreds of billions of dollars in student debt is sparking heated debate.

Biden last week announced plans to forgive up to $20,000 in federal student loan debt for Pell Grant recipients and up to $10,000 for others who qualify.

The news will provide relief for borrowers at a time when the cost of higher education has surged.

Student loan forgiveness is politically popular. But not all Democrats are on board

But critics are questioning the fairness of the plan and warn about the potential impact on inflation should the students with the forgiven loans increase their spending.

Here are three key arguments – for and against the wisdom of Biden's decision.

Raising living standards or adding fuel to inflation?

Undoubtedly, student debt is a big burden for a lot of people.

Under Biden's plan, 43 million people stand to have their loan payments reduced, while 20 million would have their debt forgiven altogether.

People whose payments are cut or eliminated should have more money to spend elsewhere – maybe to buy a car, put a down payment on a house or even put money aside for their own kids' college savings plan. So the debt forgiveness has the potential to raise the living standard for tens of millions of people.

Critics, however, say that additional spending power would just pour more gasoline on the inflationary fire in an economy where businesses are already struggling to keep up with consumer demand.

Inflation remains near its highest rate in 40 years and the Federal Reserve is moving to aggressively raise interest rates in hopes of bringing prices back under control.

Not all economists believe the debt forgiveness will do much to fuel inflation.

Debt forgiveness is not like the $1200 relief checks the government sent out last year, which some experts say added to inflationary pressure. Borrowers won't suddenly have $20,000 deposited in their bank accounts. Instead, they'll be relieved of making loan payments over many years.

President Biden announces student loan relief in the Roosevelt Room of the White House in Washington, D.C. on Aug. 24. Olivier Douliery/AFP via Getty Images hide caption

President Biden announces student loan relief in the Roosevelt Room of the White House in Washington, D.C. on Aug. 24.

Because the relief is dribbled out slowly, Ali Bustamante, who's with left-leaning Roosevelt Institute says Biden's move won't move the needle on inflation very much.

"It's just really a drop in the bucket when it come to just the massive level of consumer spending in our very service- and consumer-driven economy," he says.

The White House also notes that borrowers who still have outstanding student debt will have to start making payments again next year. Those payments have been on hold throughout the pandemic.

Restarting them will take money out of borrower's pockets, offsetting some of the additional spending power that comes from loan forgiveness.

Helping lower income Americans or a sop to the rich?

Another big point of contention has to do with fairness.

Forgiving loans would would effectively transfer hundreds of billions of dollars in debt from individuals and families to the federal government, and ultimately, the taxpayers.

Some believe that transfer effectively penalizes people who scrimped and saved to pay for college, as well as the majority of Americans who don't go to college.

They might not mind subsidizing a newly minted social worker, making $25,000 a year. But they might bristle at underwriting debt relief for a business school graduate who's about to go to Wall Street and earn six figures.

Students from George Washington University wear their graduation gowns outside of the White House in Washington, D.C, on May 18. Economists worry President Biden's plan to forgive student loans could encourage more people to take on debt in the hopes of also being forgiven. Stefani Reynolds/AFP via Getty Images hide caption

Students from George Washington University wear their graduation gowns outside of the White House in Washington, D.C, on May 18. Economists worry President Biden's plan to forgive student loans could encourage more people to take on debt in the hopes of also being forgiven.

The White House estimates 90% of the debt relief would go to people making under $75,000 a year. Lower-income borrowers who qualified for Pell Grants in college are eligible for twice as much debt forgiveness as other borrowers.

But individuals making as much as $125,000 and couples making up to $250,000 are eligible for some debt forgiveness. Subsidizing college for those upper-income borrowers might rub people the wrong way.

"I still think a lot of this benefit is going to go to doctors, lawyers, MBAs, other graduates that have very high earnings potential and may even have very high earnings this year already," says Marc Goldwein senior policy director at the Committee for a Responsible Federal Budget.

Helping those in need or making college tuition worse?

Goldwein also complains that the loan forgiveness doesn't address the larger problem of soaring college tuition costs.

In fact, he suggests, it might make that problem worse — like a Band-Aid that masks a more serious infection underneath.

For years, the cost of college education has risen much faster than inflation, which is one reason student debt has exploded.

And now what? The question that follows Biden's student loan forgiveness plan

By forgiving some of that debt, the government will provide relief to current and former students.

But Goldwein says the government might encourage future students to take on even more debt, while doing little to instill cost discipline at schools.

"People are going to assume there's a likelihood that debt is canceled again and again," Goldwein says. "And if you assume there's a likelihood it's canceled, you're going to be more likely to take out more debt up front. That's going to give colleges more pricing power to raise tuition without pressure and to offer more low-value degrees."

The old rule in economics is when the government subsidizes something, you tend to get more of it. And that includes high tuition and college debt.

- college tuition

- student loan debt

- student loans

- student debt forgiveness

Student debt forgiveness would impact nearly every aspect of people’s lives

Subscribe to global connection, stephen roll , stephen roll research assistant professor, social policy institute, brown school - washington university in st. louis jason jabbari , and jason jabbari research assistant professor - social policy institute at washington university in st. louis michal grinstein-weiss michal grinstein-weiss nonresident senior fellow - economic studies @michalgw.

May 18, 2021

Though the emergency relief measures passed in response to the COVID-19 pandemic allowed student loan borrowers to defer their loan payments, student loan debt burdens still loom large for millions of U.S. households. According to the Federal Reserve , the national student debt level in the fourth quarter of 2020 was $1.7 trillion spread across 45 million borrowers—the highest level on record. Given the size of the debt burden, it is perhaps unsurprising that the possibility of student loan forgiveness has become a major policy discussion.

Most recently, President Joe Biden called for $10,000 in student debt forgiveness, while others, such as Senator Elizabeth Warren, have called for as much as $50,000 in debt forgiveness. Some have even called for total debt forgiveness, which would represent a larger amount of spending than the cumulative spending on unemployment insurance over the last 20 years . In a recent poll from the Center for Responsible Lending, 63 percent of respondents supported permanently reducing student loan debt by $20,000. As policymakers grapple with this question, it is important to explore how debt forgiveness might relate to household behaviors.

A student loan forgiveness experiment

To examine the relationship between student debt forgiveness and household behaviors, researchers at the Social Policy Institute conducted a survey experiment that asked participants with student debt to imagine a scenario in which the federal government forgave some amount of their student debt, and then had these participants report on how this would affect their decisions and behaviors. Participants were randomly assigned to one of four conditions that featured different levels of student debt forgiveness:

- Condition 1: $5,000 of student debt forgiveness

- Condition 2: $10,000 of student debt forgiveness

- Condition 3: $20,000 of student debt forgiveness

- Condition 4: All student debt forgiven

Participants could then select different behaviors they would engage in if their student debt were forgiven. The response options were intended to capture a wide range of experiences like working less, changing purchasing behaviors, having children or getting married, saving for different purposes, or returning to school. In total, 1,009 respondents who reported having student debt participated in the experiment.

The amount of debt forgiven matters

We present the results from this experiment in Figure 1. Generally speaking, the most common ways people reported that they would change their behaviors after student debt forgiveness—regardless of the amount forgiven—concerned their balance sheets. Large proportions of student debt holders reported that they would pay down other debts, save more for emergencies, save for a down payment on a home, or save more for retirement.

Figure 1. The relationship between the amount of student debt forgiven and household behaviors

Source: Social Policy Institute

Note: These results are from a survey experiment in which student debt holders were randomly assigned to receive one of four levels of student debt forgiveness. The impacts of the different levels of debt forgiveness were estimated using logistic regression models that also controlled for the amount of student debt held by participants. N=1,009. The brackets on each bar represent the 95 percent confidence interval of each estimate.

Turning to the differences between experimental conditions, we see interesting patterns in the relationship between the amount of debt forgiven and household behaviors. In particular:

- The amount of student debt forgiven was not strongly associated with either working less or paying down other debts.

- Higher levels of student debt forgiveness were associated with higher reported rates of purchasing more/better food, making large purchases like a car or appliance, returning to school, and saving more for emergencies.

- Student debt holders only say they would save more for retirement if all their student debt were forgiven, which implies that many student debt holders would prioritize other behaviors over the long-term goal of saving for retirement.

- Student debt holders were also twice as likely to report that they would have a child if they received $10,000 of debt forgiveness or complete debt forgiveness as they would if they only received $5,000 of debt forgiveness ($20,000 of debt forgiveness did not produce a statistically significant difference from $5,000).

- Higher amounts of student debt forgiveness were associated with other investment behaviors like starting a business or savings for a down payment on a home, as well as a willingness to spend more on entertainment.

The proportion of debt forgiven matters, too

In Figure 2, we shift our focus away from the amount of debt forgiveness to the proportion of debt forgiveness. For this analysis, we converted the amount of forgiveness in each experimental condition to a percentage based on each participant’s reported amount of student debt. That is, someone with $20,000 of student debt assigned to the $5,000 forgiveness condition would have 25 percent of their student debt forgiven, whereas if that person were assigned to the $10,000 forgiveness condition, they would have 50 percent of their debt forgiven. Everyone assigned to Condition 4, as well as everyone assigned to a condition that offered more student debt forgiveness than the amount of debt they owed, were coded as having 100 percent of their student debt forgiven.

Figure 2. The relationship between the proportion of student debt forgiven and household behaviors

Note: These results are from a survey experiment in which student debt holders were randomly assigned to receive one of four levels of student debt forgiveness. The proportions were calculated by diving the amount of student debt held by the proposed amount of student debt forgiven. The impacts of the different proportions of debt forgiveness were estimated using logistic regression models that also controlled for the amount of student debt held by participants. N=1,009. The brackets on each bar represent the 95 percent confidence interval of each estimate.

Interestingly, Figure 2 shows some interesting differences in response patterns when we shift from considering the amount forgiven to the proportion forgiven.

- There is now a clear relationship between the proportion of student debt forgiven and working less—roughly 10 percent of respondents who had 50 percent or more of their student debt forgiven would work less, compared to almost no one having 25 percent or less of their debt forgiven.

- Respondents having less than half of their student debt forgiven were much more likely to report paying down other debts than those with higher proportions of debt forgiven.

- The bulk of respondents saying they would be more likely to have a child if their student debt were forgiven were those who would have all their debt forgiven.

- Respondents became much more likely to report that they would save for emergencies once the proportion of their student debt forgiven exceeds 25 percent, and were more likely to return to school when the proportion exceeds 50 percent.

- Respondents who had all of their debt forgiven were also much more likely to report starting a business as well.

Student debt forgiveness would benefit both high- and low-income households

As a supplemental analysis, we investigated whether or not student debt holders’ incomes influenced the relationship between student debt forgiveness amounts and hypothetical changes in their behaviors. Interestingly, for the vast majority of possible behaviors, both high- and low-income households reported that different amounts of student debt forgiveness would affect them in similar ways. The one primary exception to this was in terms of savings for emergencies—low-income households were much more likely than high-income households to say that they would increase the amount they saved for emergencies as the amount of student debt forgiveness increased.

Implications

These results show two things. First, they show how extensively student debt affects debt holders. The responses to this experiment indicate that student debt is strongly influencing decisions that can have large implications for household economic stability (e.g., emergency savings) and mobility (e.g., saving for a down payment on a home, starting a business). In addition, student debt may be altering the structure of families themselves. Roughly 7 percent of respondents reported that they would be more likely to get married (results not shown) or have children if their student debt were forgiven, indicating that this debt burden is affecting even fundamental decisions about debt holders’ life trajectories.

Second, these results show that the level of student debt forgiveness matters. In particular, setting a student debt forgiveness target too low may not lead to broad-based changes in households’ economic behaviors. However, setting a student debt forgiveness amount at a point where the average debt holder would have more than a quarter of their debt forgiven may yield large changes in savings behaviors, human capital investments (e.g., returning to school), and business starts, without leading to large changes in labor supply.

As policymakers grapple with whether or not to forgive student debt, how much to forgive, and who gets their debt forgiven, it is important to consider the impact of debt forgiveness on household behaviors and how this might differ by the amount of debt held. Our results suggest that larger amounts of debt forgiveness can improve both family stability and upward mobility—especially when these amounts make up a greater proportion of their overall student debt amounts.

A proportional approach to student loan forgiveness

Among those who are considering student debt forgiveness policies, the debate is often framed as a choice between a universal or a targeted policy approach. In this debate, proponents of targeted approaches suggest that universal approaches tend to be inequitable, as they offer benefits to individuals who don’t necessarily need them, and that these approaches tend to be unfair, as these breaks do not apply to previous debt holders who paid off their student loans. As universal approaches tend to be more expensive, proponents of targeted approaches also note fiscal trade-offs, as the money used to pay off the “luxuries” of higher earners could instead be used to help lower earners meet basic needs, such as food and housing.

While the universal approach often focuses on the dollar amount of debt forgiven and the targeted approach often focuses on the income threshold for who would qualify for debt forgiveness, our results suggest that an approach forgiving a proportion of loans should be considered as an option as well. Here, policies could take into account the actual amount of individuals’ debt and forgive a certain proportion of it. This strategy could be applied to either universal or targeted debt forgiveness, or a combination of both approaches. For example, all individuals could have a proportion of their student debt forgiven, and this proportion could increase for lower-income individuals. This approach would have the benefit of addressing the equity concerns of those advocating for a more targeted approach, while still providing real and substantial benefits to student debt holders across the income spectrum.

Related Content

Adam Looney

February 12, 2021

Jason Jabbari, Olga Kondratjeva, Mathieu Despard, Michal Grinstein-Weiss

August 5, 2020

Sarah Sattelmeyer

April 22, 2021

Federal Fiscal Policy

Global Economy and Development

Vanessa Williamson

April 29, 2024

Richard V. Reeves, Ember Smith

April 26, 2024

Phillip Levine

April 12, 2024

Covering a story? Visit our page for journalists or call (773) 702-8360.

Top Stories

- UChicago political scientist Molly Offer-Westort named Carnegie Fellow

UChicago paleontologist Paul Sereno’s fossil lab moves to Washington Park

- UChicago scientists use machine learning to turn cell snapshots dynamic

A smarter way to solve the student debt problem

Blanket loan forgiveness less effective than helping those who need it most, research suggests.

Editor’s Note: This piece was written by Constantine Yannelis, an assistant professor of finance at the University of Chicago Booth School of Business, and shared by Chicago Booth Review . The essay is based on testimony Yannelis submitted to the U.S. Senate Committee on Banking, Housing, and Urban Affairs’ Subcommittee on Economic Policy in April 2021.

Education is the single highest-return investment most Americans will make, so getting our system of higher-education finance right is fundamentally important for U.S. households and the economy.

A key point in the student-loan debate is that the outcomes of borrowers vary widely. Undeniably, a significant number of borrowers are struggling, and are sympathetic candidates for some kind of relief. Student-loan balances have surged over the past decades. According to the New York Fed, last year student loans had the highest delinquency rate of any form of household debt.

Most student borrowers end up as higher earners who do not have difficulties repaying their loans. A college education is, in the vast majority of cases in America, a ticket to success and a high-paying job. Of those who struggle to repay their loans, a large portion attended a relatively small number of institutions—predominantly for-profit colleges.

The core of the problem in the student-loan market lies in a misalignment of incentives for students, schools, and the government. This misalignment comes from the fact that borrowers use government loans to pay tuition to schools. If borrowers end up getting poor jobs, and they default on their loans, schools are not on the hook—taxpayers pay the costs. How do we address this incentive problem? There are many options, but one of the most commonly proposed solutions is universal loan forgiveness.

Various forms of blanket student-loan cancellation have been suggested, but all are extremely regressive, helping higher-income borrowers more than lower-income ones. This is primarily because people who go to college tend to earn more than those who do not go to college, and people who spend more on their college education—such as those who attend medical and law schools—tend to earn more than those who spend less on their college education, such as dropouts or associate’s degree holders.

My own research with Sylvain Catherine of the University of Pennsylvania demonstrates that most of the benefits of a universal-loan-cancellation policy in the United States would accrue to high-income individuals, those in the top 20 percent of the earnings distribution, who would receive six to eight times as much debt relief as individuals in the bottom 20 percent of the earnings distribution. These basic patterns are true for capped forgiveness policies that limit forgiveness up to $10,000 or $50,000 as well.

Another problem with capped student-loan forgiveness is that many struggling borrowers will still face difficulties. A small number of borrowers have large balances and low incomes. Policies forgiving $10,000 or $50,000 in debt will leave their significant problems unaddressed.

While income phaseouts—policies that limit or cut off relief for people above a certain income threshold—make forgiveness less regressive, they are blunt instruments and lead to many individuals who earn large amounts over their lives, such as medical residents and judicial clerks, receiving substantial loan forgiveness.

A fact that is often missed in the policy debate is that we already have a progressive student-loan forgiveness program, and that is income-driven repayment.

If policy makers want to make sure that funds get into the hands of borrowers at the bottom of the income distribution in a progressive way, blanket student-loan forgiveness does not accomplish this goal. Rather, the policy primarily benefits high earners.

While I am convinced from my own research that student-loan forgiveness is regressive, this is also the consensus of economists. The Initiative on Global Markets at Chicago Booth asked a panel of prominent economists to weigh in on this statement: “Having the government issue additional debt to pay off current outstanding loans would be net regressive.” The panel included economists from leading institutions from both the left and the right. The results of the survey were telling. Not a single economist disagreed with the idea that student-loan forgiveness is regressive. This is because the facts are clear—to borrow a phrase commonly used, “The science is settled”—student-loan forgiveness is a regressive policy that mostly benefits upper-income and upper-middle-class individuals.

Another facet of this policy issue is the effect of student-loan forgiveness on racial inequality. One of the most distressing failures of the federal loan program is the high default rates and significant loan burdens on Black borrowers. And student debt has been implicated as a contributor to the Black-white wealth gap. However, the data show that student debt is not a primary driver of the wealth gap, and student-loan forgiveness would make little progress closing the gap but at great expense. The average wealth of a white family is $171,000, while the average wealth of a Black family is $17,150. The racial wealth gap is thus approximately $153,850. According to our paper, which uses data from the Survey of Consumer Finances, and not taking into account the present value of the loan, the average white family holds $6,157 in student debt, while the average Black family holds $10,630. These numbers are unconditional on holding any student debt.

Thus, if all student loans were forgiven, the racial wealth gap would shrink from $153,850 to $149,377. The loan-cancellation policy would cost about $1.7 trillion and only shrink the racial wealth gap by about 3 percent. Surely there are much more effective ways to invest $1.7 trillion if the goal of policy makers is to close the racial wealth gap. For example, targeted, means-tested social-insurance programs are far more likely to benefit Black Americans relative to student-loan forgiveness. For most American families, their largest asset is their home, so increasing property values and homeownership among Black Americans would also likely do much more to close the racial wealth gap. Still, the racial income gap is the primary driver of the wealth gap; wealth is ultimately driven by earnings and workers’ skills—what economists call human capital. In sum, forgiving student-loan debt is a costly way to close a very small portion of the Black-white wealth gap.

How can we provide relief to borrowers who need it, while avoiding making large payments to well-off individuals? There are a number of policy options for legislators to consider. One is to bring back bankruptcy protection for student-loan borrowers.

Another option is expanding the use of income-driven repayment. A fact that is often missed in the policy debate is that we already have a progressive student-loan forgiveness program, and that is income-driven repayment (IDR). IDR plans link payments to income: borrowers typically pay 10–15 percent of their income above 150 percent of the federal poverty line. Depending on the plan, after 20 or 25 years, remaining balances are forgiven. Thus, if borrowers earn below 150 percent of the poverty line, as low-income individuals, they never pay anything, and the debt is forgiven. If borrowers earn low amounts above 150 percent of the poverty line, they make some payments and receive partial forgiveness. If borrowers earn a high income, they fully repay their loan. Put simply, higher-income people pay more and lower-income people pay less. IDR is thus a progressive policy.

IDR plans provide relief to struggling borrowers who face adverse life events or are otherwise unable to earn high incomes. There have been problems with the implementation of IDR plans in the U.S., but these are fixable, including through recent legislation. Many countries such as the United Kingdom and Australia successfully operate IDR programs that are administered through their respective tax authorities.

Beyond providing relief to borrowers, which is important, we could do more to fix technical problems and incentives. We could give servicers more tools to contact borrowers and inform them of repayment options such as IDR, and we could also incentivize servicers to sign more people up for an IDR plan. But while we may be able to make some technical fixes, servicers are not the root of the problem in the student-loan market: a small number of schools and programs account for a large portion of adverse outcomes.

To fix this, policy makers can also directly align the incentives for schools and borrowers. For example, Brazil, which has had similar problems with its student-loan program, recently gave schools skin in the game by requiring them to pay a fee based on dropout and default rates. This helped align the incentives of the schools and the student borrowers. Making revenues go directly to schools from IDR plans, or implementing income-share agreements in which individuals pay an uncapped portion of their income, could also help align the incentives of schools, students, and taxpayers.

Federal student loans are an important part of college financing and intergenerational mobility. The root of our student-loan crisis is a misalignment of incentives. Since the problem has been so slow moving and continuous, I like the analogy of a frog slowly boiling in a pot of water over a flame. Policies such as student-debt cancellation are not extinguishing the flame—they aren’t fixing the incentive problem. All they do is move the frog into a slightly cooler pot of water. And if we don’t fix the core of the problem, even if we forgive $50,000 of debt for current borrowers, balances will continue to grow, and we will be facing a similar crisis in 10 or 20 years.

Recommended stories

Why a 19th-century bank failure still matters

Household spending swings dramatically in reaction to coronavirus

Get more with UChicago News delivered to your inbox.

Related Topics

Latest news, big brains podcast: how to manifest your future using neuroscience.

Research Speaks

Museum talks give UChicago graduate students’ research a new audience

The College

‘Are we doomed?’ Class debates end of the world—and finds reason for hope

Biological Sciences Division

UChicago scientists tap the power of collaboration to make transformative breakthroughs

Where do breakthrough discoveries and ideas come from?

Explore The Day Tomorrow Began

UChicago scholar wins National Book Critics Circle Award

Office of Civic Engagement

UChicago students help support young migrants at South Side schools

Around uchicago.

Laing Award

UChicago Press awards top honor to Margareta Ingrid Christian for ‘Objects in Air’

Two uchicago scholars elected as 2023 american association for the advancement …, uchicago announces recipients of academic communicators network awards for 2024.

2024 Guggenheim Fellowships

Profs. Sianne Ngai and Robyn Schiff honored for their innovative literary work

Winners of the 2024 UChicago Science as Art competition announced

Six UChicago scholars elected to American Academy of Arts and Sciences in 2024

“you have to be open minded, planning to reinvent yourself every five to seven years.”.

The pros and cons of student loan forgiveness

Examining some of the key arguments on either side of this contentious debate

- Newsletter sign up Newsletter

The Supreme Court has heard arguments both for and against President Biden's controversial student loan forgiveness plan , which, if allowed to proceed, would absolve borrowers of up to $20,000 in federal debt if they earn less than $125,000 a year. Here are some of the key points on either side of this contentious debate:

Con: Forgiving debt isn't fair to people who've already made their payments

Forgiving student debt would be a "great gift" to graduates, argues the Boston Herald editorial board — but so would having your "mortgages, car loans, and … credit card debt" forgiven. "That's not on the table" though, because "adults who assume debt are supposed to be responsible and pay for the things they purchase." For that reason, others have called debt forgiveness a "slap in the face to all who sacrificed and worked extra jobs to pay off their student loans."

Pro: Debt forgiveness is the empathetic solution

But "the argument that 'this is how it was for me, so why should it be any easier for you' is a lazy interpretation of — and solution for — a crisis decades in the making," writes Christina Wyman for NBC News . In fact, harboring such resentment is just "another sinister layer in our country's long-standing problem with empathy ." Ben Burgis puts the counterargument another way to Jacobin : "If a monster lives at the edge of town and makes a regular practice of eating bits and pieces of passersby, and after this goes on for years before the town finally brings in a monster hunter to put an end to it, do the people walking around with missing fingers because of past monster attacks have a legitimate complaint? ... It's not unfair that they're finally taking care of the problem."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Con: Student loan forgiveness could worsen inflation

While student loan forgiveness might have "seemed like a good idea" in November 2020, that time has passed, Matt Yglesias argues at Bloomberg . The "supercharged" demand from the $900 billion stimulus package and the American Rescue Plan was "superdupercharged" due to the sanctions — and resulting high oil prices — following Russia's invasion of Ukraine, meaning the economy "no longer needs stimulus — in fact, it needs to restrain demand." Since a "majority of the public" doesn't have student debt, Yglesias writes, and higher-income individuals tend to be the ones who owe money, restarting collections would come largely at the "expense of a disproportionately high-income minority of the population" while also helping to "reduce the volume of customer demand in the economy," rather than further increase it.

Pro: An imperfect solution is better than nothing

Unburdening student loan borrowers with the sweep of his pen "might not be the best form of stimulus available" to Biden, admits Annie Lowrey in The Atlantic . "Nor would it fix the country's crushing student-loan crisis, or rationalize its higher-education financing structure." But even if debt forgiveness won't instantly solve America's problems with access to higher education, financial equality, or stimulating the economy, "this is a yes-and situation, not an either/or one." While student loan debt would benefit the wealthy too, "giving money to rich people does not erode the benefits of giving money to poor people." People shouldn't get too hung up on the policy being "ideally progressive," either, Lowrey adds, because "the principle matters here too. The fact that higher education should be a public good matters."

Con: Many with student loan debt don't actually need help paying it off

Proponents of canceling student debt say it would help relieve the financial burden on lower-income students who sought higher education. Yet "in 2019, the average graduate of a four-year, non-profit college who took on loans left school with only about $29,000 in debt " while "the average four-year degree holder makes six to seven figures more during their life than someone" who only went to high school, Neal McCluskey, the director of Cato's Center for Educational Freedom, writes . "Student debt is not only often manageable, for many, it is quite profitable." Indeed, "students from families earning more than $114,000 a year borrow at the same rate as the lowest-income students — and they take out loans nearly twice as large," argues Emma Ayers for USA Today , adding that "those who decided to sign 10 years of their future paychecks away on the dotted line at the loan office shouldn't get the most reprieve simply because they spent the most."

Pro: This isn't your father's student loan crisis

People who attended college in the 1968-69 school year paid $1,545 a year, adjusted for inflation, for tuition, fees, room, and board at a public four-year college, Elise Hammond notes at CNN . "If education costs remained in line with inflation, that number would be around $12,000 per year" today — instead of the $29,033 it actually cost in 2020-21. There are students today who cover those costs with loans and manage to pay them after leaving college, "even without starting salaries so high that they invite nosebleed," Erik Sherman writes at Forbes . "Then again, there are people who can run a four-minute mile" and "memorize the first hundred digits of pi." For all the "finger-wagging" about student debt, it's worth remembering that "what was once possible — 'Oh, I put myself through college working for $100 a week during the summer when gas-powered streetlights lit the sidewalks, so why can't kids today?' — no longer is for many, if not most. To pretend that it is becomes a different form of gaslighting."

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Update March 2, 2023 : This article has been updated throughout to reflect recent developments.

Jeva Lange was the executive editor at TheWeek.com. She formerly served as The Week 's deputy editor and culture critic. She is also a contributor to Screen Slate , and her writing has appeared in The New York Daily News , The Awl , Vice, and Gothamist , among other publications. Jeva lives in New York City. Follow her on Twitter .

Speed Read Married people are the least lonely, but report suggests the poorest are priced out

By Arion McNicoll, The Week UK Published 7 May 24

Today's Newspapers A roundup of the headlines from the US front pages

By The Week Staff Published 7 May 24

Speed Read The Ministry of Defence became aware of the breach 'several days ago'

By Theara Coleman Published 14 July 23

By Catherine Garcia Published 4 July 23

In Depth Supreme Court rules against father who took his daughter out of school to go to Florida

By The Week Staff Published 6 April 17

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise With Us

The Week is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

Student Loan Forgiveness, Explained

By Ron Lieber and Tara Siegel Bernard Aug. 24, 2022

- Share full article

President Biden’s move will cancel up to $20,000 worth of federal student loans for millions of people.

Here are some details you should know →

Individuals who are single and earn below $125,000 will qualify for the $10,000 in debt cancellation. If you’re married and file a joint tax return or are a head of household, you qualify if your income is below $250,000.

But you could get more relief. If you received a Pell Grant and meet these income requirements, you could qualify for an extra $10,000 in cancellation. Only federal student loans are eligible.

You can qualify even if you did not earn a degree . Current students may also be eligible, though if you are claimed as a dependent by someone else, your eligibility will be based on that person’s income and not your own.

The move by President Biden also extended the pause on monthly student loan payments , meaning borrowers won’t have to resume payments until at least January.

Another major proposal by the administration would create a new repayment plan that reduces payments on undergraduate loans to 5 percent of discretionary income , down from 10 percent to 15 percent in many existing plans.

Here are more questions and answers about loan forgiveness.

A Guide to Making Better Financial Moves

Making sense of your finances can be complicated. the tips below can help..

The way advisers handle your retirement money is about to change: More investment professionals will be required to act in their customers’ best interest when providing advice about their retirement money.

The I.R.S. estimates that 940,000 people who didn’t file their tax returns in 2020 are due back money. The deadline for filing to get it is May 17.

Credit card debt is rising, and shopping for a card with a lower interest rate can help you save money. Here are some things to know .

Whether you’re looking to make your home more energy-efficient, install solar panels or buy an electric car, this guide can help you save money and fight climate change .

Starting this year, some of the money in 529 college savings accounts can be used for retirement if it’s not needed for education. Here is how it works .

Are you trying to improve your credit profile? You can now choose to have your on-time rent payments reported to the credit bureaus to enhance your score.

Advertisement

66 Forgiveness Essay: Examples, Titles, & Thesis Statement

A forgiveness essay is an exciting yet challenging task. In our article, you can find good forgiveness essay examples in literature, history, religion, and other spheres

📝 Writing a Forgiveness Theme Statement

🏆 best forgiveness essay examples, 🔍 simple forgiveness titles for essay, 💡 interesting forgiveness essay examples.

In your forgiveness essay, focus on different aspects of forgiveness. Some good forgiveness titles for the essay reveal themes of revenge, justice, and personal forgiveness. You can write an excellent reflective or argumentative essay on forgiveness – it is a versatile topic.

Regardless of your forgiveness essay’s specific topic and type, you should develop a strong thesis statement. Below we will provide recommendations on making a good forgiveness theme statement. This will help you come up with a solid base and arguments to prove your position.

Check these tips to make a powerful forgiveness thesis statemen:

- Determine the primary idea. What are you trying to prove? Can anything be forgiven, or are there cases when it’s not possible? Introduce your one main idea and the angle from which you will look at it. You can also include some facts or opinions about the acuteness of the topic.

- Work out your argumentation. It is crucial to have a firm structure in your forgiveness essay. You need to support the thesis statement with several arguments and evidence to demonstrate the consistency of your paper.

- Think of the opposing views. Every argument has a counterargument. When working on your forgiveness theme statement, always keep an opposite thesis statement in mind. Having considered counter positions, you gain additional arguments for your position.

- Don’t quote others in your thesis statement. A thesis statement is the first and foremost chance to introduce your point of view. Use your own strongest words to reach a reader. This is where they get the first impression about the whole work.

We also have lots of other tips on developing A+ thesis statements. Check our free thesis statement generator to discover more information and get a perfect forgiveness theme statement.

- Divine and Human Forgiveness in “Rime of the Ancient Mariner” By Samuel Taylor Coleridge After killing the albatross who was suppose to provide them with wind, all the people in the ship died but he managed to survive because he had asked God to forgive him all the sins […]

- Hamlet and Forgiveness: A Personal Reflection Some of the most prominent themes in the story are the ideas of mutual forgiveness, people’s motivation to be proactive and take risks, and their willingness to forgive and ask for forgiveness.

- Christ’s Atonement and the Concept of Forgiveness This study will connect the atonement of Jesus Christ and attitudes towards forgiveness through the revision of the current church, Love and God’s commandment to forgive.

- Service Recovery and Customer Forgiveness Studies suggest that after apologizing to customers plus taking responsibility for the problem, getting to the root of the problem is very important to prevent such occurrences in the future. Getting to the root of […]

- Racial Inequality Targeted Student Loan Forgiveness Programs The research into this topic seems highly significant as the reduction of racial inequality was one of the most debated topics in the U.S.for the last several decades.

- Forgiveness in the Christian Texts and the World Today The apostle calls upon the church’s people to stop the punishment of the wrongdoer and forgive, comfort, and affirm their love for him. It instructs Muslims to follow God and forgive others instead of following […]

- Philosophy of Forgiveness I believe that if anyone had gone through all the pain and horror that Simon had, and was asked to forgive Karl, the instinct, and most humane reaction at that moment would be to strongly […]

- Forgiveness for Workplace Conflict Resolution The problem with the relationship between the two workers is that Jake feels that Monica is a relatively malicious individual. In the outlined scenario, Jake is doing all that he can to avoid dealing with […]

- The Effects of Forgiveness Therapy After gathering the relevant data, the researchers compared the recovery of the participants to their controls to determine the effects of forgiveness therapy.

- Self-Forgiveness: The Step Child of Forgiveness Research Other than the similarities and the differences, the two types of forgiveness relate to each other as self-forgiveness facilitates interpersonal forgiveness, this is through allowance of one to identify with one’s offender.

- The Amish Philosophy of Forgiveness It is important to note that the immediate forgiveness of the enemy does not mean that the Amish will let the perpetrators of crime go free.

- Review: “Interventions Studies on Forgiveness: A Meta-analysis” by Baskin T. and Enright R. In the church, members come to the pastor with a variety of social and psychological issues. The first step the pastor should undertake is to sympathise with the victims.

- Self-Forgiveness as the Path to Learning to Forgive the Others The key issues that the given research responds to or, at least, attempts to solve, are the definition of self-forgiveness, the relation between self-forgiveness and interpersonal forgiveness, and the means to differentiate between self-forgiveness and […]

- The Effects of Forgiveness Therapy on Depression, Anxiety and Posttraumatic Stress for Women After Spousal Emotional Abuse Enright forgiveness model applied in the study proved effective since it systematically addressed the forgiveness process identified the negative attributes caused by the abuse, and prepared the women for positive responses.

- Forgiveness & Reconciliation: The Differing Perspectives of Psychologists and Christian Theologians Based on the research design there is evidence of measures put in place to control against most of these biases which strengthens the study findings; this is the strength to the study.

- Forgiveness and Reconciliation Critique Availability of literature; as stated in the literature though the area of forgiveness is new in the field of psychology, but there is enough literature to cover the study.

- Forgiveness in Simon Wiesenthal’s Work The Sunflower Taking into account the major themes of the book The Sunflower, one is to make a conclusion that such response to atrocities as forgiveness is considered to be the key aspect of humanity.

- Forgiveness in Martin Luther’s Movement for Rights Blacks The bible teachings tell us that God exists in the holy trinity and the only way to forgive others is for us to be able to forgive our own transgressions.

- The Idea Of Forgiveness Resonates Differently With Every Individual

- Accident Forgiveness in Automobile Insurance

- The Association Of Feathers And Forgiveness

- Christians’ Beliefs About Justice And Forgiveness

- Debt Forgiveness: The Missing Link in Closing Gap with Third World

- Christian Beliefs about Justice, Forgiveness and Reconciliation

- Learning About Forgiveness From the Teachings of the Bible

- Crusades and the Forgiveness of Sins of the Sinners

- Feelings Surrounding the Need for Forgiveness in Emily Bronte’s Wuthering Heights

- Why Forgiveness Is Essential and the Forgiveness Manadala

- The Desirability of Forgiveness in Regulatory Enforcement

- The Styles of Forgiveness Communication in Association with Determinants of Forgiveness in In the Wake of Transgressions, an Article by Andy Merolla

- The Spiritual Principle of Forgiveness in Wes Anderson’s Film The Royal Tenenbaums, Saint Augustine’s Confessions, and the Biblical Story of Adam and Eve

- The Problems With Forgiveness: An Analysis of Literary Works

- The Relationship Between Forgiveness and Sleep Quality

- The Themes of Betrayal and Forgiveness in Paradise Lost by John Milton and A Doll’s House by Henrik Ibsen

- Love, Forgiveness, and Trust: Critical Values of the Modern Leader

- Compassion and Forgiveness: Wilde’s Insincerity

- The Secret Life of Bees An Analysis of Forgiveness and Responsibility

- Themes Of Forgiveness In The Tempest By William Shakespeare

- Resolutions of Forgiveness, Repentance and Reconciliation in Shakespeare

- The Kite Runner: Forgiveness, Loyalty, and the Quest for Redemption

- Why Forgiveness Is Vital In Our Society

- Morals And Forgiveness In Simon Wiesenthal’s The Sunflower

- The Emotional and Physical Benefits of the Act of Forgiveness

- The Monster’s Lack of Forgiveness in Frankenstein, a Book by Mary Shelley

- Conflict Management : Forgiveness And Reconciliation

- Man Alive: A True Story Of Violence, Forgiveness And Becoming

- The Renaissance Figure That Wonders the Lands in Hope of Bring Forgiveness in the Pardoner and His Tale

- The Impact of Acceptance, Tolerance, and Forgiveness in Frankenstein, a Novel by Mary Shelley

- Racism, Redemption, Forgiveness and Hope in Minor Miracle, a Poem by Marilyn Nelson

- Why Perspective in Forgiveness and Redemption is so Important

- The Themes Punishment vs. Forgiveness Present in the Scarlet Letter by Nathaniel Hawthorne

- The Dynamics of Corporate Debt forgiveness and Contract Renegotiation

- Throwing Stones-Resilience and Forgiveness in The Glass Castle

- The Importance of Granting Forgiveness to One’s Enemies in Simon Wiesenthal’s The Sunflower: on Possibilities and Limits of Forgiveness

- The Meaning and Significance for Christians Today of Forgiveness

- Penalties and Exclusion in the Rescheduling and Forgiveness of International Loans

- Gender Differences in the Relationship Between Empathy and Forgiveness

- Conflicts And Forgiveness In Family

- The Importance of Perspectives in Forgiveness and Redemption

- The Economic And Ethical Ambiguities Of African Debt Forgiveness

- Exploring the Themes of Forgiveness and Reconciliation in The Tempest by William Shakespeare

- Vengeance and Forgiveness in Shakespeare’s The Tempest

- The Effects of Forgiveness Therapy on Depression

- Theme Of Betrayal, Revenge, And Forgiveness

- Unbroken A Story Of Redemption And Forgiveness By Laura

- The Christian View On Justice Forgiveness And Reconciliation

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, February 24). 66 Forgiveness Essay: Examples, Titles, & Thesis Statement. https://ivypanda.com/essays/topic/forgiveness-essay-examples/

"66 Forgiveness Essay: Examples, Titles, & Thesis Statement." IvyPanda , 24 Feb. 2024, ivypanda.com/essays/topic/forgiveness-essay-examples/.

IvyPanda . (2024) '66 Forgiveness Essay: Examples, Titles, & Thesis Statement'. 24 February.

IvyPanda . 2024. "66 Forgiveness Essay: Examples, Titles, & Thesis Statement." February 24, 2024. https://ivypanda.com/essays/topic/forgiveness-essay-examples/.

1. IvyPanda . "66 Forgiveness Essay: Examples, Titles, & Thesis Statement." February 24, 2024. https://ivypanda.com/essays/topic/forgiveness-essay-examples/.

Bibliography

IvyPanda . "66 Forgiveness Essay: Examples, Titles, & Thesis Statement." February 24, 2024. https://ivypanda.com/essays/topic/forgiveness-essay-examples/.

- Tolerance Essay Ideas

- Loyalty Essay Ideas

- Personal Ethics Titles

- Friendship Essay Ideas

- Christianity Topics

- Altruism Ideas

- Church Paper Topics

- Positive Psychology Titles

- Consciousness Ideas

- Bible Questions

- Virtue Essay Ideas

- Moral Development Essay Topics

- Belief Questions

- Idealism Paper Topics

- Personal Values Ideas

Home — Essay Samples — Education — Higher Education — Student Loan Debt

Student Loan Debt Essays

Student loan debt essay topics and outline examples, essay title 1: the impact of student loan debt on higher education.

Thesis Statement: The growing burden of student loan debt has far-reaching consequences, affecting not only individual borrowers but also the accessibility and affordability of higher education in the United States.

- Introduction

- Rising Student Loan Debt Levels

- Barriers to Accessing Higher Education

- The Impact on Career Choices and Financial Stability

- Potential Solutions and Policy Reforms

Essay Title 2: The Psychological and Emotional Toll of Student Loan Debt

Thesis Statement: Student loan debt can take a severe psychological and emotional toll on borrowers, affecting their mental health, relationships, and overall well-being.

- The Stress and Anxiety Associated with Debt

- Impact on Personal Relationships and Life Choices

- Strategies for Coping with Student Loan Debt Stress

- The Need for Mental Health Support

Essay Title 3: Exploring Solutions to the Student Loan Debt Crisis

Thesis Statement: Addressing the student loan debt crisis requires a multifaceted approach, including policy reforms, financial literacy education, and innovative repayment options, to provide relief for borrowers and future generations.

- Policies Aimed at Reducing Student Loan Debt

- Empowering Borrowers Through Financial Education

- Innovative Repayment Plans and Loan Forgiveness Programs

- Ensuring Affordability and Accessibility of Higher Education

10 Student Loan Debt Essay Topics

Exploring solutions to the student loan debt crisis is crucial for mitigating the financial burden on graduates and ensuring access to higher education. The following essay topics delve into various facets of this issue, presenting opportunities for problem-solution exploration:

- The Role of Federal Policy in Mitigating Student Loan Debt

- Innovative Repayment Plans.

- Private Sector Solutions for Student Loan Debt

- Educational Reform for Affordable Tuition

- Financial Literacy and Student Loan Debt

- Community and Technical Colleges as a Solution to High Student Loan Debt

- The Impact of Scholarship Expansion on Student Loan Debt

- Bankruptcy Law Reforms to Address Student Loan Debt

- Public Service Loan Forgiveness Program Enhancements

- Technology-Based Solutions for Student Loan Management

Student loan debt in the United States has reached unprecedented levels, with millions of Americans grappling with the financial and emotional strain of repaying their education loans. This crisis not only hampers individual financial growth but also has broader economic implications, restricting consumer spending and contributing to wealth inequality.

Problem-solution essays on student loan debt offer a platform to investigate the roots of this issue and propose innovative solutions. From federal policy reforms to grassroots financial literacy programs, these essays explore multifaceted approaches to alleviate the student loan debt burden. By examining successful case studies and drawing on expert analyses, students can present comprehensive strategies that address both the immediate challenges of loan repayment and the systemic issues of higher education financing. Through such discourse, we can begin to envision a future where higher education is accessible and affordable for all, free from the shackles of debilitating debt. For those looking for problem solution essay examples offered free , ample resources are available to guide and inspire comprehensive solutions.

Apprenticeships as a Solution to Skills Gap, Student Debt, and Career Dead Ends

Student loan debt: the problem and solution, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

The Issue of The Increasing Student-loan Debt in The United States

The issue of student loan debt as a primary reason to the rise of college dropouts in the united states, the problems related to student loan debt, the student loan problem in america and ways to solve it, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Analysis of Forgiving Student Loan Debt by Providing a One-time Bailout as a Solution

Student loan debt struggle in the united states, the origins and future of student loan debt crisis in america, the issue of african american college students loan debt, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

The Need to Manage Student Loan Debt in America

College should be free: student loan debt, the main reasons college should be free for everyone, college should be free: reasons and solutions, the problems with student loans and fees in the uk and the us, pros and cons of government funded college, discharging students' debts through bankrupcy, the burden of college debt: challenges and solutions, the impact of current events on college students, university education can significantly benefit individuals, budgeting: a crucial tool for college students, student loan debt: challenges and solutions, the case for free college education.

Student loan debt refers to the financial obligation incurred by individuals who borrow funds specifically for educational purposes. It is a type of debt that students accumulate to cover the costs of tuition, fees, books, and living expenses during their pursuit of higher education. Student loan debt typically consists of borrowed money from government-based programs or private lending institutions, which students must repay over a specified period of time, often with interest.

Student loan debt in the United States has reached staggering levels and has become a pressing issue in today's society. As of recent data, the total student loan debt in the US exceeds trillions of dollars, making it one of the largest sources of debt for Americans. Many factors contribute to the current state of student loan debt, including rising tuition costs, limited access to grants and scholarships, and the increasing number of students pursuing higher education. The burden of student loan debt has far-reaching consequences for individuals and the economy as a whole. Many borrowers struggle to make timely repayments, leading to financial strain, delayed milestones such as homeownership or starting a family, and limited career choices. The ripple effects extend to the broader economy, affecting consumer spending, saving rates, and overall economic growth. Efforts to address the student loan debt crisis are underway, including income-driven repayment plans, loan forgiveness programs, and increased financial literacy initiatives. However, the magnitude of the problem necessitates further attention and comprehensive solutions to ensure that higher education remains accessible and affordable while mitigating the long-term impact of student loan debt on individuals and society.

Student loan debt has a significant historical context that spans several decades. The roots of the issue can be traced back to the mid-20th century when higher education became increasingly expensive, leading to a surge in the need for student loans. In the United States, the establishment of the Federal Student Aid program in the 1960s aimed to provide financial assistance to students pursuing higher education. However, the situation evolved over time, and the accumulation of student loan debt became a pressing concern. During the 1980s and 1990s, tuition fees continued to rise, and the availability of federal grants decreased. As a result, students increasingly relied on loans to finance their education. The early 2000s witnessed a further expansion of the student loan market, with private lenders entering the scene alongside the government-backed loans. This expansion brought about changes in lending practices and the increasing burden of debt on students.

The influence of student loan debt extends beyond the individual level and has a profound impact on various aspects of society. Firstly, it affects the financial well-being of borrowers, often causing stress, limited financial freedom, and delayed milestones such as homeownership or retirement savings. The burden of debt can also impact mental health, creating anxiety and depression among borrowers. On a broader scale, student loan debt influences the economy. High levels of debt can hinder consumer spending and savings rates, affecting economic growth. Graduates burdened with student loans may delay or forego major life decisions, such as starting a business or pursuing advanced degrees, which can impede innovation and entrepreneurial activities. Moreover, student loan debt exacerbates social and economic inequalities. Those from disadvantaged backgrounds may face additional challenges in accessing higher education due to financial constraints, widening the opportunity gap. The burden of debt can also perpetuate intergenerational poverty, as individuals struggle to accumulate wealth and provide for future generations.

Public opinion on student loan debt is multifaceted and varies among individuals. However, there are some common themes that emerge. Many people acknowledge the growing concern surrounding student loan debt and the challenges it poses for borrowers. There is a general recognition that the rising cost of education and the increasing reliance on loans have created a significant burden for students and graduates. Public opinion is often divided on the responsibility of borrowers versus the role of educational institutions and the government. Some argue that borrowers should take personal responsibility for their loans, while others believe that the education system and policymakers should be held accountable for the affordability and accessibility of higher education. There is growing support for measures aimed at addressing student loan debt, such as loan forgiveness programs, income-based repayment plans, and efforts to lower interest rates. Many individuals believe that these initiatives can provide relief to borrowers and alleviate the financial stress associated with student loans.

1. As of 2021, the total student loan debt in the United States exceeds $1.7 trillion, making it the second-largest consumer debt category after mortgages. 2. Approximately 45 million Americans carry student loan debt, with an average debt per borrower of around $38,000. 3. The average monthly student loan payment for borrowers aged 20 to 30 is $393, which can significantly impact their financial stability and ability to save or invest. 4. Student loan debt is not only prevalent among recent graduates. Around 14% of borrowers are over the age of 50, often carrying debt from their own education or supporting their children's education. 5. Student loan default rates remain a concern. As of 2021, the federal student loan default rate was around 9%, indicating the financial challenges faced by some borrowers. 6. High levels of student loan debt can hinder homeownership rates. Studies suggest that the burden of student loans can delay or deter individuals from purchasing homes, impacting the housing market. 7. Certain professions, such as doctors and lawyers, often accumulate substantial student loan debt due to the extended education required for their careers.

The topic of student loan debt is of paramount importance as it addresses a pressing financial and societal issue that affects millions of individuals in the United States. Writing an essay on student loan debt allows us to delve into the multifaceted consequences it poses on borrowers and the broader economy. The staggering amount of outstanding debt, coupled with rising tuition costs, presents a significant barrier to accessing higher education and achieving economic mobility. Furthermore, the burden of student loan debt impacts borrowers' financial well-being, hindering their ability to save, invest, and contribute to the economy. Exploring the public's opinion, representation in media, and potential policy solutions can provide valuable insights into the urgency of addressing this crisis. By discussing student loan debt, we foster a deeper understanding of the challenges faced by borrowers and encourage dialogues that may lead to effective measures for easing this financial strain and supporting the pursuit of education.

1. Akers, B., & Chingos, M. M. (2014). Is a student loan crisis on the horizon? The Brookings Institution. https://www.brookings.edu/research/is-a-student-loan-crisis-on-the-horizon/ 2. Baum, S., & O'Malley, M. (2003). College on credit: How borrowers perceive their education debt. The College Board. https://files.eric.ed.gov/fulltext/ED494509.pdf 3. Dynarski, S. M. (2014). Building the stock of college-educated labor. Journal of Labor Economics, 32(1), 1-26. https://doi.org/10.1086/674012 4. Houle, J. N. (2014). Disparities in debt: Parents' socioeconomic resources and young adult student loan debt. Sociology of Education, 87(1), 53-69. https://doi.org/10.1177/0038040713514014 5. Jackson, K. M. (2018). The impact of student loan debt on job satisfaction outcomes. Journal of Student Financial Aid, 48(1), 29-52. https://doi.org/10.4148/2572-456X.1018 6. Litten, L. H., & Ackerman, D. B. (2019). A comprehensive approach to student loan debt counseling. Journal of Financial Counseling and Planning, 30(1), 43-57. https://doi.org/10.1891/1052-3073.30.1.43 7. Looney, A., & Yannelis, C. (2015). A crisis in student loans? How changes in the characteristics of borrowers and in the institutions they attended contributed to rising loan defaults. Brookings Papers on Economic Activity, 2015(1), 1-89. https://doi.org/10.1353/eca.2015.0001 8. Lusardi, A., Schneider, D. J., & Tufano, P. (2011). Financially fragile households: Evidence and implications. Brookings Papers on Economic Activity, 2011(2), 83-134. https://doi.org/10.1353/eca.2011.0016 9. Scott-Clayton, J. (2019). The looming student loan default crisis is worse than we thought. Brookings Institution. https://www.brookings.edu/research/the-looming-student-loan-default-crisis-is-worse-than-we-thought/ 10. Zafar, B. (2013). Borrowing constraints and the returns to schooling. Annual Review of Economics, 5(1), 347-365. https://doi.org/10.1146/annurev-economics-072412-133425

Relevant topics

- College Experience

- Bilingual Education

- College Goals

- Plans After High School

- Liberal Arts Education

- Stem Education

- Academic Interests

- Physical Education

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

An important student loan forgiveness deadline is hours away — and it takes under 15 minutes to apply

Some student loan borrowers have until the end of Tuesday to take advantage of an opportunity to get their debt forgiven sooner than they would have otherwise.

- Here's what to know about the Biden administration's temporary student loan consolidation policy.

Borrowers with multiple student loans who request a so-called loan consolidation by the end of the day on April 30 — a move that will combine their federal student loans into one new loan — may benefit from the Biden administration's temporary policy.

Applying for consolidation is a straightforward process: It should take under 15 minutes to fill out the forms, said Jane Fox, the chapter chair of the Legal Aid Society's union.

Here's what borrowers should know ahead of the deadline.

Bundling your loans could bring you closer to relief

Many former students have multiple education loans, either because they borrowed on repeated occasions throughout college or returned to school at some point. If these borrowers are enrolled in an income-driven repayment plan, it can mean that they're also on multiple different timelines to forgiveness. (Depending on the plan, borrowers can get any remaining debt excused after 10, 20 or 25 years.)

Under the temporary policy, borrowers who consolidate will get payment credit on all their loans based on the timeline for the one they've been paying on the longest.

"This will ensure folks get the maximum number of months of credit towards student debt cancellation," Fox said.

More from Personal Finance:

Cash savers still have an opportunity to beat inflation

Here's what's wrong with TikTok's viral savings challenges

The strong U.S. job market is in a 'sweet spot,' economists say

Consolidating while this policy is in place could be an especially good deal for many, experts say.

For example, say a borrower graduated from college in 2004, took out more loans for a graduate degree in 2018, and is now in repayment under an income-driven plan with a 20-year timeline to forgiveness.

Consolidating before May 1 could lead them to quickly qualify for forgiveness on all those loans, experts say, even though they'd normally need to wait at least another 14 years for full relief.

"Many borrowers will get complete debt cancellation, particularly those who have been paying for over twenty years," Fox said.

Usually, a student loan consolidation restarts a borrower's forgiveness timeline to zero, making it a terrible move for those working toward cancellation.

What to know about consolidating your student loans

All federal student loans — including Federal Family Education Loans, Parent Plus loans and Perkins Loans — are eligible for consolidation, said higher education expert Mark Kantrowitz, in a previous interview with CNBC.

You can apply for a Direct Consolidation Loan at StudentAid.gov or with your loan servicer.